|

|

|

|

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant /x/ |

||

| Filed by a Party other than the Registrant / / | ||

Check the appropriate box: |

||

| / / | Preliminary Proxy Statement | |

| / / | Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| /x/ | Definitive Proxy Statement | |

| / / | Definitive Additional Materials | |

| / / | Soliciting material pursuant to Rule 14a-12 |

|

T.J.T., INC. |

||||

(Name of Registrant as Specified In Its Charter) |

||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| /x/ | No fee required | |||

| / / | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11: |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

| / / | Fee paid previously with preliminary materials. | |||

| / / | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount previously paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing party: |

|||

| (4) | Date filed: |

|||

T.J.T., INC.

843 North Washington

Emmett, Idaho 83617

January 16, 2001

Dear Shareholder:

You are invited to attend T.J.T., Inc.'s 2001 Annual Meeting of Shareholders, which will be held at the Statehouse Inn, in the Majestic Room, on Tuesday, February 20, 2001, at 10:00 a.m. Mountain Standard Time. The Statehouse Inn is located at 981 Grove Street in Boise, Idaho.

In addition to the two items of business identified in the formal notice for the annual meeting on the following page, T.J.T.'s 2000 performance will be discussed and management will respond to your questions. Enclosed with this proxy statement are your proxy card, a postage-paid envelope to return your proxy card, and T.J.T.'s 2000 Annual Report.

Your vote is important to us regardless of the number of shares you own. Please sign and date the enclosed proxy card, and mail it in the envelope provided. If you plan to vote at the annual meeting and your shares are held by a broker, bank, or other person, you must bring two additional items to the annual meeting: (i) a letter from that entity which confirms your beneficial ownership of shares, and (ii) a proxy card issued in your name.

I look forward to seeing you at the meeting.

Sincerely,

TERRENCE

J. SHELDON

Chairman of the Board,

President, and Chief Executive Officer

T.J.T., INC.

NOTICE OF THE 2001

ANNUAL MEETING OF SHAREHOLDERS

FEBRUARY 20, 2001

The Annual Meeting of Shareholders of T.J.T., Inc., a Washington corporation, will be held on Tuesday, February 20, 2001, at 10:00 a.m., Mountain Standard Time, in the Majestic Room of the Statehouse Inn in Boise, Idaho (the "Annual Meeting") for the following purposes:

Shareholders of record at the close of business on Monday, December 18, 2000, are entitled to notice of and to vote at the Annual Meeting and at any adjournments or postponements of the Annual Meeting. If you are unable to attend the Annual Meeting in person, T.J.T. urges you to sign, date and return the enclosed proxy in the self-addressed stamped envelope provided, since it is necessary that a majority of the shareholders' outstanding shares be represented, in person or by proxy, for a quorum at the Annual Meeting.

By Order of the Board of Directors

Julie

Vick

Secretary

Emmett,

Idaho

January 16, 2001

T.J.T.'s 2000 Annual Report is enclosed with this Proxy Statement. The Annual Report contains financial and other information about T.J.T., Inc. not incorporated in the Proxy Statement and is not part of the proxy soliciting material.

TABLE OF CONTENTS

| |

|

||

|---|---|---|---|

| INFORMATION ABOUT T.J.T., INC. | 1 | ||

| INFORMATION ABOUT PROXY SOLICITATION AND VOTING | 1 | ||

| General Information | 1 | ||

| Date, Time and Place of Annual Meeting | 1 | ||

| Record Date; Shares Entitled to Vote | 1 | ||

| Quorum; Required Vote | 2 | ||

| Revocation of Proxies | 2 | ||

| Shareholder Proposals and Nomination of Directors | 2 | ||

| Solicitation of Proxies | 2 | ||

| INFORMATION CONCERNING CHANGES TO THE BOARD OF DIRECTORS | 3 | ||

| BUSINESS AT THE ANNUAL MEETING | 3 | ||

| PROPOSAL 1. ELECTION OF DIRECTORS | 3 | ||

| PROPOSAL 2. RATIFICATION OF APPOINTMENT OF AUDITORS | 6 | ||

| MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS | 7 | ||

| Audit Committee | 7 | ||

| Compensation Committee | 7 | ||

| Executive Committee | 7 | ||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS | 8 | ||

| EXECUTIVE COMPENSATION AND OTHER INFORMATION | 10 | ||

| Summary of Cash and Certain Other Compensation | 10 | ||

| T.J.T., Inc. 1994 Stock Option Plan | 11 | ||

| Stock Option Grants in the Last Fiscal Year | 11 | ||

| Aggregated Stock Options | 12 | ||

| 401(k) Profit Sharing Plan | 12 | ||

| Director Compensation | 13 | ||

| COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION | 14 | ||

| Compensation Policy Applicable to Officers and Key Executives | 14 | ||

| Executive Compensation Policies | 14 | ||

| Employment Agreements | 14 | ||

| CEO's Compensation | 15 | ||

| AUDIT COMMITTEE REPORT | 16 | ||

| Discussion with Management | 16 | ||

| S.A.S. 61 | 16 | ||

| Audited Financial Statements for T.J.T.'s Annual Report | 16 | ||

| PERFORMANCE GRAPH | 17 | ||

| CERTAIN RELATIONSHIPS AND OTHER TRANSACTIONS | 18 | ||

| COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION | 18 | ||

| Compliance With Section 16(a) of the Exchange Act | 18 | ||

| OTHER MATTERS | 19 | ||

| APPENDIX A | 20 | ||

INFORMATION ABOUT T.J.T., INC.

T.J.T., Inc. ("T.J.T." or the "Company") is a purchaser and reconditioner of axles and tires that have been used to transport manufactured homes from the factory to the home site. Federal regulations require that these axles and tires be inspected, refurbished and/or replaced after each trip. T.J.T. also distributes vinyl siding, skirting supplies, and other accessory products to the built-on-site housing market and manufactured housing dealers. T.J.T. is also involved in real estate development on a limited basis. T.J.T. operates in eleven states in the western United States. T.J.T. employs 132 people in this eleven-state region. The Company's executive office is located at 843 North Washington, Emmett, Idaho 83617. The Company's telephone number is (208) 365-5321.

INFORMATION ABOUT PROXY SOLICITATION AND VOTING

General Information

We have sent you the enclosed proxy card because T.J.T.'s Board of Directors is soliciting your proxy to vote your shares at the Annual Meeting. This proxy statement summarizes information that T.J.T. is required to provide to you under the rules of the Securities and Exchange Commission, and is designed to provide you with information to assist you in voting your shares. The purpose of the Annual Meeting is for the shareholders of T.J.T.'s common stock to consider and vote on the following proposals:

Date, Time and Place of Annual Meeting

The Annual Meeting will be held on Tuesday, February 20, 2001, at 10:00 a.m., Mountain Standard Time, in the Majestic Room of the Statehouse Inn at 981 Grove Street in Boise, Idaho. T.J.T. intends to mail this Proxy Statement and accompanying proxy card on or about January 16, 2001, to all shareholders entitled to vote at the Annual Meeting.

Record Date; Shares Entitled to Vote

T.J.T.'s Board of Directors fixed the close of business on Monday, December 18, 2000, as the record date (the "Record Date") for determining T.J.T.'s shareholders entitled to vote at the Annual Meeting. Only the holders of record of T.J.T.'s common stock on the Record Date will be entitled to notice of and to vote at the Annual Meeting. At the close of business on December 18, 2000, there were 4,854,739 shares of common stock outstanding.

Each holder of record of T.J.T.'s common stock on the Record Date is entitled to one vote for each share held on each of the matters to be voted on at the Annual Meeting. On the Record Date, there were approximately 898 holders of record.

1

Quorum; Required Vote

As of the Record Date, there were 4,854,739 shares of outstanding common stock of T.J.T. You are entitled to one vote for each share of T.J.T.'s common stock that you hold as of the Record Date on each of the matters to be voted on at the Annual Meeting. You do not have cumulative voting rights. A quorum consisting of at least 2,427,370 shares is necessary to hold a valid meeting. If at least 2,427,370 shares of the total 4,854,739 shares entitled to vote at the Annual Meeting are cast either in person or by proxy, a quorum will exist.

The inspector of election appointed for the Annual Meeting will tabulate all votes. The inspector of election will separately tabulate affirmative and negative votes, abstentions, and broker non-votes. Abstentions and broker non-votes will be counted toward the quorum requirement. Abstentions will count toward the quorum requirement, and they will have the same effect as negative votes. Broker non-votes will be counted toward a quorum, but will not be counted in determining whether a matter is approved.

If the shares held by the persons present or represented by proxy at the Annual Meeting are less than 2,427,370 shares of T.J.T.'s common stock, the Annual Meeting may be adjourned for the purpose of obtaining additional proxies, votes, or for any other purpose. At any subsequent reconvening of the Annual Meeting, all proxies will be voted in the same manner as the proxies would have been voted at the original Annual Meeting (except for any proxies which have since then effectively been revoked or withdrawn). See "Revocation of Proxies" below.

Revocation of Proxies

You may revoke a proxy at any time before it is voted. You may revoke the proxy by filing a written notice of revocation or a duly executed proxy card with a later date with the Secretary of T.J.T. at 843 North Washington, P.O. Box 278, Emmett, Idaho 83617, or by attending the Annual Meeting and voting in person. Your attendance at the Annual Meeting will not, by itself, revoke a proxy.

Shareholder Proposals and Nomination of Directors

T.J.T.'s bylaws provide that for a shareholder to nominate a candidate for election as a director at an annual meeting of shareholders, or propose business for consideration at such meeting, notice must be given in writing to the Secretary of T.J.T. at T.J.T.'s executive offices not less than 120 days in advance of release of the proxy statement to shareholders in connection with the previous year's annual meeting. Accordingly, a shareholder nomination or proposal intended for consideration at the 2001 annual meeting must have been received by the Secretary prior to September 29, 2000. T.J.T.'s bylaws also provide details about the information that needs to be included in each shareholder's proposal or nomination of a director. No shareholder proposals or nominations have been made for consideration at the Annual Meeting.

Solicitation of Proxies

T.J.T. will pay the entire cost for solicitation of proxies. Copies of the solicitation materials will be sent to banks, brokerage houses, fiduciaries, and custodians holding in their names shares of T.J.T. common stock beneficially owned by others to forward to such beneficial owners. T.J.T. will reimburse persons representing beneficial owners of common stock for their costs of forwarding proxy solicitation materials to the beneficial owners. Solicitation of proxies may be made in person or by mail, telephone, telecopy or telegram. The directors, officers, employees and representatives of T.J.T. may supplement the original proxies. T.J.T. will not pay its directors, officers or employees any additional compensation for this service, but they may be reimbursed for out-of-pocket expenses incurred in connection with the proxy solicitation.

2

INFORMATION CONCERNING CHANGES TO THE BOARD OF DIRECTORS

At the 2000 annual meeting of shareholders, Robert M. Harrison, Patricia I. Bradley and Larry B. Prescott were elected to the Board of Directors to serve as Class I Directors until the year 2003, and Joe Light was elected to the Board of Directors to serve as a Class III director until the year 2002.

Since the 2000 annual meeting, T.J.T.'s Board of Directors has experienced other changes. Patricia I. Bradley resigned as a Director effective September 5, 2000. Robert M. Harrison, T.J.T.'s Chief Operating Officer, was appointed to the Directors Executive Committee in November 1999 and served on the Directors Audit Committee from February 2000 through November 2000. Joe Light was appointed to serve as a member of the Directors Audit and Compensation Committees in February 2000 and as a member of the Directors Executive Committee in August 2000. Larry Prescott, T.J.T.'s Chief Financial Officer and Treasurer, was appointed to the Directors Executive Committee in November 1999 and serves as Secretary of the committee. Mr. Prescott was appointed non-voting Secretary of the Directors Audit Committee in November 2000.

The Board of Directors has nominated Ulysses B. Mori, Scott M. Hayes, and Arthur J. Berry to stand for re-election to the Board as Class II Directors. As a Class II Director, each person will serve until the annual meeting of shareholders in 2004.

BUSINESS AT THE ANNUAL MEETING

PROPOSAL 1. ELECTION OF DIRECTORS

T.J.T.'s Board of Directors is divided into three classes of directors who serve staggered three-year terms. The term of one class of directors expires at each annual meeting of shareholders. Each director serves on the Board of Directors until he or she is succeeded by another qualified elected director.

The current classes of directors or nominated directors are as follows:

The current term for the Class II Directors, Douglas A. Strunk, Ulysses B. Mori, Scott M. Hayes, Arthur J. Berry, and B. Kelly Bradley, expires as of the Annual Meeting. The nominees standing for re-election as Class II Directors are: current directors Arthur J. Berry, Scott M. Hayes and Ulysses B. Mori. These Class II nominees will be elected to hold office until T.J.T.'s annual meeting of shareholders in 2004.

If any nominee is unable to serve as a Director, the proxy holders may substitute a nominee and vote for another person of their choice in that place, or the Board may reduce the size of the Board of Directors prior to the Annual Meeting to eliminate the position of any nominees. T.J.T. intends that the proxy holders named on the enclosed proxy card vote for the three Class II nominees named above. The number of directors on T.J.T.'s Board of Directors is ten. The following information provides biographical information for each nominee and continuing director:

Class II—Nominees for election to serve until the 2004 annual meeting of shareholders:

Arthur J. Berry, 49, was elected to the Board in 1995. For the past six years, Mr. Berry has been the President and principal shareholder of Arthur J. Berry & Company, a real estate development

3

and business brokerage firm located in Boise, Idaho. Arthur J. Berry & Company is not a subsidiary or affiliate of T.J.T. Mr. Berry received a Bachelor's degree in Finance from Boise State University in 1973, a J.D. from the University of Idaho in 1976, and an MBA from Boise State University in 1981. Mr. Berry is a member of the Directors Compensation, Audit, and Executive Committees.

Scott M. Hayes, 53, was elected to the Board in February 1998. Currently, Mr. Hayes is a self-employed private investor and consultant. He previously served as the Executive Vice President and Chief Financial Officer of West One Bancorp from 1987 to 1995. Mr. Hayes is a member of the Directors Compensation and Audit Committees, and serves as Chairman of the Directors Executive Committee.

Ulysses B. Mori, 48, was elected to the Board in February 1998. Mr. Mori was appointed Senior Vice President and Corporate Sales Manager in January 2000. Mr. Mori served as T.J.T.'s Senior Vice President and Manager of New Business Development and O.E.M. Sales from March 1998 through January 2000. Mr. Mori previously served as a Senior Vice President and Manager of T.J.T.'s Woodland, California facility following T.J.T.'s merger with Leg-it Tire Company, Inc. in 1997. Mr. Mori had previously been the President and Chief Executive Officer of Leg-it Tire Company, Inc. since 1980. Mr. Mori is a member of the National Axles and Tires Association and the Transportation Task Force.

Class I—Directors elected to serve until the 2003 annual meeting of shareholders:

Robert M. Harrison, 65, currently serves as Senior Vice President and Chief Operating Officer of T.J.T. Mr. Harrison previously served as Vice President and Area General Manager from March 1999 through December 1999. Mr. Harrison was elected to the Directors Executive Committee in November 1999. Mr. Harrison served on the Audit Committee from February 2000 through November 2000. In November 2000 the Audit Committee Charter was revised and employee directors were no longer eligible to serve on the committee. Mr. Harrison was appointed to the Board of Directors in May of 1999. Previously, Mr. Harrison was employed by Boise Cascade Corporation from 1954 through 1981, the Boise Company from 1981 through 1986, American Real Estate Group, a division of American Savings & Loan from 1986 through 1990, Evergreen Mobile Company from 1990 through 1997, and Modular Building Systems from 1997 through 1998.

Larry B. Prescott, 53, was appointed to the Board in February 1999. Mr. Prescott was appointed Senior Vice President, Chief Financial Officer, and Treasurer of the Company in January 1999. Mr. Prescott was appointed Trustee of the Company's 401(k) Profit Sharing Plan and Chairman of the Directors Audit Committee in February of 1999. Due to revisions to the Audit Charter, Mr. Prescott now serves as a non-voting Secretary for the Audit Committee. Mr. Prescott was elected Secretary of the Directors Executive Committee in November 1999. Previously, Mr. Prescott was Vice President and Portfolio Manager at US Bancorp in Portland. Prior to his banking experience, he spent 15 years with Boise Cascade Corporation in the manufactured housing industry.

Class III—Directors elected to serve until the 2002 annual meeting of Shareholders:

Darren Bradley, 39, was appointed to the Board in January 1997. Mr. Bradley was appointed General Manager of the Company's Salem, Oregon facility in August 2000. Mr. Bradley continues to serve as General Manager of the Centralia, Washington facility, a position he was appointed to in December 1999. Mr. Bradley was employed as Assistant Manager of the Company's Centralia, Washington facility from November 1996 through December 1999. Prior to that, Mr. Bradley was employed by Bradley Enterprises, Inc. from 1984 to 1996. Mr. Bradley served as Assistant Manager

4

of Bradley Enterprises, Inc. from 1989 to 1996. Bradley Enterprises, Inc. was acquired by T.J.T., Inc. in August 1996. Mr. Bradley is the son of Patricia I. Bradley who served as a director of T.J.T. from February 1997 through September 2000, and the brother of B. Kelly Bradley, a member of T.J.T.'s Board of Directors.

Terrence J. Sheldon, 59, co-founded T.J.T., Inc., an Idaho corporation ("TJT-Idaho") in 1977. Mr. Sheldon was elected to the Board of TJT-Idaho in April of 1977. Mr. Sheldon served as President since inception of TJT-Idaho with the exception of the period from January 1986 through October 1986. TJT-Idaho merged into the Company in December of 1994. Mr. Sheldon is a founder and principal stockholder of the Company. Mr. Sheldon has served as President and Chief Executive Officer of the Company since 1994. Mr. Sheldon served as Chief Operating Officer of the Company from December 1998 through December 1999. Mr. Sheldon is Chairman of the Board of Directors, Chairman of the Compensation Committee, serves as a member of the Directors Executive Committee, and serves as a Trustee of T.J.T.'s 401(k) Plan.

Rickie K. Treadwell, 52, was appointed to the Board in August 1998. Mr. Treadwell currently serves as Senior Vice President and General Manager of T.J.T.'s Phoenix Arizona facility. In July 1998, Mr. Treadwell was appointed as a Senior Vice President of T.J.T. and Assistant Manager of O.E.M. Sales. From 1978 to June 1998, Mr. Treadwell served as the President of West States Recycling, Inc. West States Recycling, Inc. is not a subsidiary or an affiliate of the Company.

Joe Light, 61, was appointed to the Board in November 1999. Mr. Light was elected to the Directors Audit and Compensation Committees in February 2000, and to the Directors Executive Committee in August 2000. Mr. Light served as General Manager of Champion Enterprises, Inc. from 1993 until he retired in July 1999. He also served as Senior Vice President of Operations for Champion Enterprises, Inc. from 1992 through 1993, Regional Vice President from 1973 through 1992, and General Manager for Idaho from 1968 through 1973.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS

A VOTE IN FAVOR OF PROPOSAL 1.

5

PROPOSAL 2. RATIFICATION OF APPOINTMENT OF AUDITORS

The Board of Directors has appointed Balukoff, Lindstrom & Co., P.A. to serve as the auditors of T.J.T. and to make an examination of T.J.T.'s consolidated financial statements for the fiscal year ending September 30, 2001. This firm of independent public accountants has served as T.J.T.'s auditors since T.J.T.'s public offering in December 1995.

Representatives of Balukoff, Lindstrom & Co., P.A. will be present at the Annual Meeting to respond to appropriate questions and to make a statement if they desire to do so. In the absence of other instructions, shares represented by properly executed proxies will be voted "For" the ratification of Balukoff, Lindstrom & Co., P.A. as T.J.T.'s auditors for the fiscal year ending September 30, 2001.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR

THE RATIFICATION OF PROPOSAL 2.

6

MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS

During the fiscal year ended September 30, 2000, the Board of Directors met quarterly. In addition to the full Board meetings, some directors also attended meetings of Board committees. The Board of Directors has an Audit Committee, an Executive Committee, and a Compensation Committee.

During the fiscal year ended September 30, 2000, the Board of Directors held four quarterly meetings. With the exception of B. Kelly Bradley who attended 50% of the Board of Directors meetings, all of the directors attended at least 75% of all of the meetings of the Board and those committees on which they served during the fiscal year.

For information regarding compensation received by a director, see "Executive Compensation and Other Information—Compensation of Directors" and "Certain Relationships and Other Transactions."

Audit Committee

The Audit Committee is authorized by the Board of Directors to review and supervise the financial controls of T.J.T. This includes selecting T.J.T.'s independent public accountants, acting upon recommendations of the independent public accountants, reviewing T.J.T.'s proposed budgets, and taking such further actions as the Audit Committee deems necessary. In the November 14, 2000 Board of Directors meeting, the revised written Audit Committee Charter was adopted. The new charter does not allow employee directors to serve on the Audit Committee. The Audit Committee Charter is set forth as Appendix A to this Proxy Statement. Mr. Prescott was appointed by the Audit Committee to serve as a non-voting secretary, he and Mr. Harrison no longer serve on the committee. The Audit Committee, consisting of Messrs. Prescott, Harrison, Berry, Light and Hayes, met four times during the 2000 fiscal year.

Compensation Committee

The Directors Compensation Committee reviews and adjusts the salaries of T.J.T.'s principal officers and key executives, and administers T.J.T.'s executive compensation and benefit plans. The Directors Compensation Committee consisting of Messrs. Sheldon (Chairman), Hayes, Light and Berry met twice during the 2000 fiscal year.

Executive Committee

The Directors Executive Committee was formed in November 1999 to take any and all actions which may be required by T.J.T.'s Board of Directors to facilitate the review and monitoring of monthly financial results of operations of the Company during the months the Board of Directors does not meet, and to aid in overseeing day to day operational issues that arise. The Executive Committee is expressly empowered to authorize distributions by the corporation and the issuance of shares of the corporation to the extent specifically provided by resolution of the Board. The Executive Committee consists of Arthur J. Berry, Robert M. Harrison, Scott M. Hayes (Chairman), Joe Light, Larry B. Prescott, and Terrence J. Sheldon.

7

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

This table details the amount of T.J.T.'s common stock owned as of December 18, 2000, by each person who is known by T.J.T. to beneficially own more than 5% of T.J.T.'s common stock. The table also shows information concerning beneficial ownership by all directors, each executive officer named in the Summary Compensation Table, and by all directors and named executive officers as a group.

| (1) Title of Class: Common Stock |

(2) Name and Address of Beneficial Owner |

(3) Number of Shares and Nature of Beneficial Ownership as of December 18, 2000(1,2) (including Shares in Column (4)) |

(4) Right to Acquire Within 60 Days of December 18, 2000 |

(5) Percent of Class(3) |

|||||

|---|---|---|---|---|---|---|---|---|---|

| Directors and Named Executive Officers: | |||||||||

| Terrence J. Sheldon(4,8,11) | 1,014,856 | 20.9 | % | ||||||

| Ulysses B. Mori(7,11) | 243,999 | 5.0 | % | ||||||

| Rickie K. Treadwell(2,6,7,11) | 4,694 | * | |||||||

| Douglas A. Strunk(11) | 119,236 | 2.4 | % | ||||||

| B. Kelly Bradley(11) | 83,612 | 1.7 | % | ||||||

| Darren M. Bradley(11) | 81,608 | 1.7 | % | ||||||

| Robert M. Harrison(8,9,11) | 13,500 | 8,000 | * | ||||||

| Larry B. Prescott(8,11) | 29,750 | 15,000 | * | ||||||

| Patricia Bradley(5,7,8,11) | 614,700 | 12.76 | % | ||||||

| Michael J. Gilberg(2,11) | 9,556 | * | |||||||

| Arthur J. Berry(9) 960 Broadway Ave., Suite 450, Boise, ID |

74,000 | 4,000 | 1.5 | % | |||||

| Scott M. Hayes 101 S. Capitol Blvd., 11th Floor, Boise, ID |

39,000 | 4,000 | * | ||||||

| Joe Light(11) | 2,000 | 2,000 | * | ||||||

| All directors and executive officers as a group | 2,330,511 | 49,600 | 48 | % | |||||

8

9

EXECUTIVE COMPENSATION AND OTHER INFORMATION

Summary of Cash and Certain Other Compensation

This table indicates all cash compensation T.J.T. paid, as well as certain other compensation paid or accrued to Terrence J. Sheldon, the President, Chief Executive Officer, and Chairman of the Board of T.J.T., and the executive officers of T.J.T. earning more than $100,000/year ("Named Executive Officers"):

Summary Compensation Table

| |

|

|

|

|

Long-Term Compensation |

|

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

|

|

|

|

|

Payouts |

|

||||||||

| |

|

|

|

|

Awards |

LTIP Payouts ($) |

|

|||||||||

| |

Annual Compensation(1) |

|

||||||||||||||

| |

Restricted Stock Award(s) ($) |

|

|

|||||||||||||

| Name and Principal Position |

Year |

Salary ($) |

Bonus ($) |

Other Annual Compensation(2) |

Securities Underlying Options (#) |

Stock Options Granted |

All Other Compensation ($) |

|||||||||

| Terrence J. Sheldon President, Chief Executive Officer, and Chairman of the Board of Directors |

2000 1999 1998 |

$131,538 $172,019 $225,000 |

$15,435 $16,088 $47,036 |

— — |

||||||||||||

| Patricia I. Bradley(5) Former Executive Vice President of Dealer Sales and Former Director |

2000 1999 1998 |

$30,223.05 $169,553 $209,477 |

$3,452 $2,900 |

— — — |

||||||||||||

| Ulysses B. Mori(3, 4) Senior Vice President and Manager of New Business Development and O.E.M. Sales and Director |

2000 1999 1998 |

$104,355 $142,708 $162,162 |

N/A $3,115 $2,596 |

— — — |

||||||||||||

| Rickie K. Treadwell(3, 4) Senior Vice President & General Manager of T.J.T.'s Phoenix facility and Director |

2000 1999 1998 |

$150,000 $150,000 $46,154 |

$4,500 $1,212 N/A |

— — — |

||||||||||||

10

T.J.T., Inc. 1994 Stock Option Plan

At a special meeting held on February 17, 1995, T.J.T.'s shareholders approved the T.J.T., Inc. 1994 Stock Option Plan (the "Plan"). At the Annual Shareholders meeting held February 22, 2000, the Plan was amended to increase the shares from 200,000 to 400,000; with 300,000 shares classified as incentive stock options and 100,000 shares classified as non-qualified stock options.

Two-hundred Thousand (200,000) shares were granted as incentive stock options during the 2000 fiscal year. No optionees have exercised their stock options. The following table provides information as to options granted to each of T.J.T.'s Named Executive Officers during the fiscal year ended September 30, 2000. The value of options held by the Named Executive Officers at fiscal year end is measured in terms of the last reported sale price reported on the OTC Bulletin Board for T.J.T.'s common stock on September 30, 2000. The value of T.J.T.'s stock on September 30, 2000 was $0.281.

Stock Option Grants in the Last Fiscal Year

In 2000, T.J.T. granted Two Hundred Thousand (200,000) shares from the 1994 Stock Option Plan.

Option Grants in Last Fiscal Year

| |

Individual Grants |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name |

Number of Securities Underlying Options Granted (#)(1) |

% of Total Options Granted to Employees in Fiscal Year(2) |

Exercise Price ($/Sh)(3) |

Expiration Date |

Grant Date Present Value ($)(4) |

|||||||

| Larry B. Prescott | 100,000 | 50 | % | $ | .75 | 2/22/2010 | $ | 25,400 | ||||

| Robert M. Harrison | 100,000 | 50 | % | $ | .75 | 2/22/2010 | $ | 25,400 | ||||

11

Aggregated Stock Options

The table below provides information concerning aggregated unexercised stock options held as of September 30, 2000, and the stock options exercised during the 2000 fiscal year by certain Named Executive Officers.

Aggregated Option Exercises in Last Fiscal Year

and FY-End Option Values

| |

|

|

Number of Securities Underlying Unexercised Options at FY-End (#)(1) |

|

||||

|---|---|---|---|---|---|---|---|---|

| |

|

|

Value of Unexercised In-the- Money Options at FY End ($)(1,2) |

|||||

| |

Shares Acquired on Exercise (#) |

|

||||||

| |

Value Realized |

|||||||

| Name |

Exercisable/Unexercisable |

Exercisable/Unexercisable |

||||||

| Robert M. Harrison | — | — | 8,000/112,000 | — / — | ||||

| Larry B. Prescott | — | — | 10,000/115,000 | — / — |

401(k) Profit Sharing Plan

As of September 30, 2000, T.J.T. maintained a 401(k) Profit Sharing Plan (the "401(k) Plan") for its eligible employees. The 401(k) Plan is a profit-sharing plan, including a cash or deferred arrangement according to Section 401(k) of the Internal Revenue Code of 1986, as amended. T.J.T. sponsors the 401(k) Plan to provide its eligible employees with the opportunity to defer compensation and to have these deferred amounts contributed to the 401(k) Plan on a pre-tax basis, subject to certain limitations. Until August 1, 1996, T.J.T. made matching contributions to employee deferrals of 100% of participants' contributions up to 6%. As of August 1, 1996, T.J.T. adjusted its matching contributions to 50% of employees' wage contributions up to a maximum of 6% contributed by the employee.

During the fiscal year ended September 30, 2000, T.J.T. contributed $51,631.00 in matching contributions. Amounts contributed to the 401(k) Plan by executive officers during the 2000 fiscal year totaled $38,160.00.

12

Director Compensation

Directors who are T.J.T. employees do not receive fees for their services as directors. Non-employee directors receive a fee of $500 per meeting plus reasonable out-of-pocket expenses in a manner consistent with past practice for attending Board of Directors meetings. Non-employee directors also receive $100 per Audit and Compensation meeting and $500 per Executive committee meeting they attend. If the Executive Committee meeting is held on the same day as a Board of Directors meeting, an attendance fee is not paid. Non-employee directors receive a $10,000 annual retainer payable in quarterly installments of $2,500 each. As of the date of this Proxy Statement, Messrs. Hayes, Berry and Light are eligible to receive compensation for their services to the Board. For the 2000 fiscal year, Messrs. Hayes received $19,600, Berry received $19,600, and Light received $10,200 for their services as directors. Mrs. Bradley received $13,000 for her service as a non-employee director from December of 1999 through September of 2000.

As of November 18, 1997, the Board of Directors adopted T.J.T.'s 1997 Directors Stock Option Plan ("Directors Plan") and on February 24, 1998, T.J.T.'s shareholders approved the Directors Plan. The Directors Plan authorized the issuance of a total of 50,000 shares of T.J.T.'s stock to directors who are not employed by T.J.T. At the Annual Shareholders meeting on February 22, 2000, the Directors Plan was amended to: (i) increase the number of shares of Common Stock by 150,000 shares to 200,000 shares; (ii) to extend the expiration date of the Directors Plan from November 17, 2007 to the later of February 22, 2010 or 10 years from the date the option is granted, or to such time as there are no longer options available and (iii) to expand the power of the Board of Directors to grant additional options to Non-employee Directors.

The option grants under the Directors Plan are non-discretionary grants which are made when a non-employee director is elected to T.J.T.'s Board of Directors. Each non-employee director elected receives an option grant to purchase 5,000 shares of T.J.T.'s common stock. Twenty percent of the options granted under the Directors Plan become exercisable immediately after the grant is issued. The options then become exercisable at a rate of 20% per year, on the anniversary of the grant date, over a period of four years. The exercise price of the options is 100% of the fair market value of T.J.T.'s common stock on the OTC Bulletin Board on the last trading day prior to the grant date. On November 18, 1997, Messrs. Hayes and Berry were each granted the option to purchase 5,000 shares of T.J.T.'s common stock. On January 3, 2000, Mr. Light was granted the option to purchase 5,000 shares. On February 22, 2000, the options to purchase the following shares were granted: Mr. Berry 20,000 shares and Mr. Hayes 50,000 shares. The total options granted during fiscal year 2000 under the Directors Plan was seventy-five thousand shares. As of the date of this proxy statement, 4,000 of the 55,000 options granted to Mr. Hayes are exercisable; 4,000 of the 25,000 options granted to Mr. Berry are exercisable and 2,000 of the 5,000 options granted to Mr. Light are exercisable. No stock options have been exercised under the Directors Plan. There are 115,000 shares remaining under the Directors Plan.

13

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION(1)

T.J.T.'s Directors Compensation Committee is comprised of Terrence J. Sheldon, Scott M. Hayes, Joe Light and Arthur J. Berry. The Directors Compensation Committee regularly reviews the compensation of its Executive Officers. The most recent review was conducted on August 15, 2000.

Compensation Policy Applicable to Officers and Key Executives

It is the goal of the Directors Compensation Committee to create compensation packages for officers and key executives which will attract, retain and motivate executive personnel who are capable of achieving T.J.T.'s short and long-term financial and strategic goals. Compensation packages are designed to combine a mixture of short-term and long-term incentives tied to T.J.T.'s performance. In exercising its responsibilities, the Directors Compensation Committee also seeks to encourage management to maximize T.J.T.'s stock price to provide a long-term value for its shareholders. Through implementing its compensation policies, the Directors Compensation Committee believes it can motivate T.J.T.'s management to strive to obtain T.J.T.'s objectives of strong financial performance and stock price appreciation. The Directors Compensation Committee has not adopted a policy in response to federal tax laws that limit the deductibility by T.J.T. of compensation in excess of $1 million per employee per year for each of T.J.T.'s most highly compensated executives. The total compensation paid to any individual executive officer of T.J.T. does not now exceed the deductibility levels. T.J.T. does not anticipate exceeding the deductibility levels in the foreseeable future.

Executive Compensation Policies

T.J.T.'s executive compensation is made up of two elements: (i) base salary and (ii) grants of equity-based compensation (e.g., stock options).

Base Salary. T.J.T. set base salary for officers and executives prior to its initial public offering in December 1995. Consideration was given to each person's job responsibilities, and the salaries paid to officers and executives in comparable positions in similar-sized companies in the Emmett, Idaho area. Effective January 1, 1995, the Directors Compensation Committee established base salaries for all of T.J.T.'s executive officers.

Stock Options. In addition to compensation through salary and bonuses, T.J.T. adopted the T.J.T., Inc. 1994 Stock Option Plan (the "Plan"), which provides long-term compensation to officers and key employees depending upon T.J.T.'s financial performance. Under the Plan, officers, directors and key employees are eligible to receive stock option grants. The number of stock options granted to each executive officer is determined by a competitive compensation analysis and each individual's salary and responsibilities. The Directors Compensation Committee also considers the number and exercise price of options and shares of restricted stock previously granted to individuals.

Employment Agreements

T.J.T. had two employment agreements with Named Executive Officers in effect during the 2000 fiscal year.

T.J.T. entered into a separate employment, nondisclosure and noncompetition agreement with Ulysses B. Mori. The term of his employment agreement is through June 24, 2001. Mr. Mori currently serves as a Senior Vice President and Corporate Sales Manager for T.J.T., and as a Director of T.J.T. The contract provides for a minimum annual base salary of $150,000 which was reduced to $104,355 in 1999 pursuant to the terms of the contract.

14

T.J.T. has entered into a separate employment, nondisclosure and noncompetition agreement with Rickie Treadwell. The term of his employment agreement is through May 31, 2002. Mr. Treadwell currently serves as a Senior Vice President and General Manager of T.J.T.'s Phoenix Arizona facility. Mr. Treadwell receives a minimum annual base salary of $150,000.

Under their employment agreements, Messrs. Mori and Treadwell are eligible for other benefits. Under his employment agreement, Mr. Treadwell was not eligible for a bonus in 2000. Messrs. Mori and Treadwell received other benefits comparable to the benefits received by other T.J.T. employees.

CEO's Compensation

Mr. Sheldon currently has no employment contract or compensation agreement with T.J.T. On February 10, 2000, Mr. Sheldon voluntarily reduced his annual base compensation to $120,000. Any bonus amounts and stock option awards to Mr. Sheldon will be based on T.J.T.'s performance and Mr. Sheldon's level of responsibility and experience.

COMPENSATION

COMMITTEE

Terrence J. Sheldon (Chairman)

Scott M. Hayes

Joe Light

Arthur J. Berry

15

Discussion with Management

T.J.T.'s Audit Committee is comprised of Messrs. Berry, Light and Hayes as voting members. The Audit Committee has reviewed and discussed the audited financial statements for T.J.T. with the management of T.J.T.

S.A.S. 61

T.J.T.'s Audit Committee has discussed with Balukoff Lindstrom & Co., P.A., T.J.T.'s auditors the matters required to be discussed by S.A.S. 61 (Codification of Statements on Auditing Standards).

T.J.T.'s Audit Committee has received the written disclosures and the letter from Balukoff Lindstrom & Co., P.A. (T.J.T.'s "Independent Accountants") required by Independence Standards Board Standards No. 1 and has discussed with the Independent Accountants their independence.

Audited Financial Statements for T.J.T.'s Annual Report

Based on review of the Independence Standards Board Standard No. 1 and S.A.S. 61, T.J.T.'s Audit Committee recommended to the Board of Directors that the audited financial statements be included in T.J.T.'s Annual Report on Form 10-K for the last fiscal year for filing with the Securities and Exchange Commission.

AUDIT

COMMITTEE

Arthur J. Berry (Chairman)

Joe Light

Scott M. Hayes

16

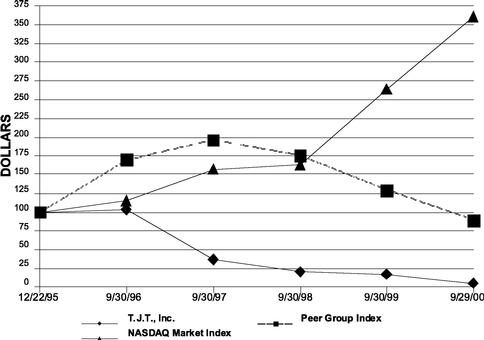

PERFORMANCE GRAPH

COMPARE CUMULATIVE TOTAL RETURN AMONG T.J.T., INC.,

NASDAQ MARKET INDEX AND PEER GROUP INDEX

The graph presented above compares the cumulative total return of the Company, the Nasdaq Market Index and a Peer Group Index from December 22, 1995, when the Company's common stock became publicly traded, through September 30, 2000. Total return is based on an investment of $100 on December 22, 1995, and reinvestment of dividends through September 30, 2000. The Customer Selected Stock List(1) is based upon a publicly held distributor of manufactured housing accessories and refurbisher of tires and axles for manufactured homes.

ASSUMES $100 INVESTED ON DEC. 22, 1995

ASSUMES DIVIDEND REINVESTED

FISCAL YEAR ENDING SEPT. 30, 2000

17

CERTAIN RELATIONSHIPS AND OTHER TRANSACTIONS

T.J.T. leases three pieces of property from T.J.T. Enterprises to form a portion of its property in Emmett, Idaho. T.J.T. Enterprises is composed of two general partners each of which has a one-half partnership interest: Mr. Sheldon, T.J.T.'s President and Chief Executive Officer, and Jerry Radandt.

T.J.T. leases its corporate office located in Emmett, Idaho, from Sheldon Homedale Family Limited Partnership. Sheldon Homedale Family Limited Partnership is a partnership owned by the Terrence Sheldon family. Terrence Sheldon, President and Chief Executive Officer of the Company is a five percent owner and general partner of the partnership.

T.J.T. leases one property in Centralia, Washington from MBFI, Inc., a corporation owned by the Patricia Bradley family. Patricia Bradley, former Executive Vice President and former member of the Board of Directors of the Company, owns approximately 95 percent of MBFI, Inc.

T.J.T. leases its Woodland, California facility from Ulysses B. Mori, Senior Vice President and Corporate Sales Manager of the Company. T.J.T. believes that these lease agreements contain commercially reasonable terms and conditions no less favorable to T.J.T. than could have been obtained from an unaffiliated party.

In addition, T.J.T. purchases piers and other materials used to set up manufactured homes from SAC Industries, Inc. ("SAC"), of which the controlling interest is owned by Ms. Bradley, past employee and a former member of the Board of Directors. During 2000, T.J.T. purchased materials in the amount of $915,640 from SAC and $781,305 in 1999. T.J.T. purchases the materials from SAC at market rates.

Scott M. Hayes, a member of the Board of Directors, Audit and Compensation Committees, and Chairman of the Executive Committee, was paid $5,316.49 for consulting services provided to T.J.T. Mr. Hayes has an oral agreement with T.J.T. to provide consulting services for financial and managerial questions. T.J.T. expects to utilize Mr. Hayes' services to approximately the same extent in the next fiscal year.

Joe Light, a member of the Board of Directors, Audit, Compensation and Executive Committees has a consulting agreement with T.J.T. to provide consulting services in the area of sales to T.J.T. This agreement is a result of Mr. Light's relationships in the manufactured housing industry. T.J.T. has agreed to pay Mr. Light $65.00 per hour for his consulting services. Mr. Light has not received payment for services as of the date of this proxy statement.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The Directors Compensation Committee consists of Mr. Sheldon and three non-employee Directors: Messrs. Hayes, Light and Berry. None of T.J.T.'s executive officers serve as a director of another corporation in a case where an executive officer of the other corporation serves as a director of T.J.T.

Compliance With Section 16(a) of the Exchange Act

Section 16(a) of the Exchange Act, as amended, requires T.J.T.'s Executive Officers and Directors and persons who own more than 10% of T.J.T.'s common stock to file reports of ownership and changes in ownership with the Securities and Exchange Commission and NASDAQ SmallCap Market System and furnish T.J.T. with copies.

18

The Board of Directors does not know of any other matters that will be presented at the Annual Meeting besides the two proposals discussed in this proxy statement. However, if any other matters are properly presented, the people named as proxies will vote in accordance with their judgment on such matters.

By

Order of the Board of Directors

Julie Vick

Secretary

Emmett,

Idaho

January 16, 2001

The Company's 2000 Annual Report is being mailed to shareholders with this Proxy Statement.

19

CHARTER OF THE AUDIT COMMITTEE(1)

Role

The Audit Committee of the Board of Directors shall be responsible to the Board of Directors for oversight of the quality and integrity of the accounting, auditing, and reporting practices of the Company and shall perform such other duties as may be directed by the Board. The Committee shall maintain free and open communication with the Company's outside auditors and management of the Company and shall meet in executive session at least annually. In discharging this oversight role, the Committee is empowered to investigate any matter brought to its attention, with full power to retain outside counsel or other experts for this purpose. The Board and the Audit Committee have the ultimate authority and responsibility to select, oversee, evaluate, and, where appropriate, to replace the outside auditor (or to nominate the outside auditor to be proposed for shareholder approval in any proxy statement). The outside auditor is ultimately accountable to the Board of Directors and the Audit Committee as the representatives of the shareholders.

Membership and Independence

The Audit Committee shall include at least three members of the Board of Directors, who are independent directors, each of whom is able to read and understand fundamental financial statements, including the Company's balance sheet, income statement, and cash flow statement or will become able to do so within a reasonable period of time after his or her appointment to the Audit Committee. At least one member of the Audit Committee shall have past employment experience in finance or accounting, requisite professional certification in accounting, or any other comparable experience or background which results in the individual's financial sophistication, including being or having been a chief executive officer, chief financial officer or other senior officer with financial oversight responsibilities. Notwithstanding the above, one director who is not independent as defined in Rule 4200 of the SEC, and is not a current employee or an immediate family member of such employee, may be appointed to the Audit Committee, if the Board, under the circumstances, determines that membership on the committee by such individual is required by the best interests of the corporation and its shareholders, and the Board discloses, in its next annual proxy statement subsequent to such determination, the nature of the relationship and the reasons for that determination.

Responsibilities

Internal Control

20

Financial Reporting

External Audit

Reporting to Board of Directors

21

T.J.T., INC.

PROXY FOR THE ANNUAL MEETING OF SHAREHOLDERS ON FEBRUARY 20, 2001

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned hereby appoints Terrence J. Sheldon and Julie Vick attorneys and proxies, with full power of substitution in each of them, in the name, place, and stead of the undersigned to vote as proxy all the stock of the undersigned in T.J.T., Inc.

Please sign and date on the reverse side and mail promptly. You are encouraged to specify your choices by marking the appropriate boxes on the reverse side, but you need not mark any boxes if you wish to vote in accordance with the Board of Director's recommendations. If you do not sign and return a proxy or attend the meeting and vote by ballot, your shares cannot be voted.

(Continued, and to be marked, dated and signed, on the other side)

FOLD AND DETACH HERE

Annual Meeting of Shareholders of

T.J.T., INC.

February 20, 2001, 10:00 a.m.

Statehouse Inn

Boise, Idaho

THIS PROXY WHEN PROPERLY EXECUTED WILL BE VOTED ACCORDING TO YOUR INSTRUCTIONS. IF YOU SIGN AND RETURN THE CARD BUT DO NOT VOTE ON ALL MATTERS, THEN PROPOSALS 1 AND 2, IF UNMARKED WILL RECEIVE YOUR VOTES.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR PROPOSALS 1 AND 2.

| |

|

|

|

|

|

|

||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. | ELECTION OF DIRECTORS | 2. | The appointment of Balukoff Lindstrom & Co., P.A. | |||||||||

| NOMINEES: | Arthur J. Berry Scott M. Hayes Ulysses B. Mori |

as T.J.T.'s independent auditors for the fiscal year ending September 30, 2001. | ||||||||||

FOR [ ] |

WITHHELD [ ] |

FOR [ ] |

AGAINST [ ] |

ABSTAIN [ ] |

||||||||

INSTRUCTION: To withhold authority to vote for any individual nominee, write that nominee's name in the space provided below. |

||||||||||||

3. |

In their discretion, the proxies are authorized to vote upon such other business as may properly come before the meeting. |

|||||||||||

Please sign exactly as name appears below. When shares are held by joint tenants, both should sign. When signing as attorney, executor, administrator, trustee, or guardian, please give full title as such. If a corporation, please sign in full corporate name by president or other authorized officer. If a partnership, please sign in partnership name by authorized person.

Dated: , 2001

(Signature)

(Signature if held jointly)

PLEASE SIGN, DATE, AND RETURN THE PROXY CARD PROMPTLY USING THE ENCLOSED ENVELOPE.

FOLD AND DETACH HERE

Admission Ticket

Annual Meeting of

Shareholders

T.J.T., Inc.

February 20, 2001 10:00 a.m.

Statehouse Inn

Boise, Idaho

Agenda

|

|