EXHIBIT 99.1

Willamette Industries

The Premier Franchise in Paper and Forest Products

November 27, 2000

Forward-looking statements in this presentation are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995.

Such forward-looking statements are subject to risks and uncertainties and actual results could differ materially from those projected. Such risks and uncertainties include, but are not limited to, the effect of general economic conditions; the level of

new housing starts and remodeling activity; the availability and terms of financing for construction; competitive factors, including price pressures; the cost and availability of wood fiber; the effect of natural disasters on the Company’s

timberlands; construction delays; risk of nonperformance by third parties; and the impact of environmental regulations and other costs associated with complying with such regulations. Please refer to Willamette Industries’ Securities and Exchange

Commission filings for further information.

Proposal Dramatically Undervalues

Premier Willamette Franchise

- Proposal dramatically undervalues Willamette’s unique franchise, its businesses and prospects.

- The proposal is not in the best interests of Willamette, its shareholders and other constituencies.

- It is an opportunistic attempt to acquire one of the industry’s leading franchises when stock prices are depressed and does not reflect the near-term payoff from recent strategic investments.

- Willamette has consistently led the industry by most key financial metrics and is well positioned to continue to deliver top tier performance which will ultimately be reflected in its share price.

- This presentation highlights Willamette’s ongoing program of enhancing and profitably growing its business. It also shows how this program has given the Company a solid base from which to derive

increasing value for its shareholders in the near and long term.

Unique Franchise Value

- Proven Track Record of Delivering Shareholder Value

- Strong, Entrepreneurial, Results-Oriented Culture

- Vertically Integrated Low Cost Producer; Market-Driven Production

- Effective Deployment of Capital and Assets

- Well Positioned to Continue to Produce EPS Growth in Excess of Peer Group Over Cycle

- Over the past ten years, the Company has consistently delivered excellent value for shareholders far in excess of its peer group. $1000 invested in Willamette in October of 1990 would be worth

$5,976 today versus $2,670 if it were invested in the S&P Paper and Forest index.

- The Company has a strong, entrepreneurial, results-oriented culture.

- Willamette is a highly efficient, low cost manufacturer that benefits from a unique, market-driven strategy centered on product being sold before volume is added.

- Willamette is the most vertically integrated company in the industry, lowering its exposure to cyclicality.

- Willamette is the only integrated company with all of its timberlands certified for sustainable forest management.

- The Company has effectively deployed capital and assets to position itself for future growth and financial performance.

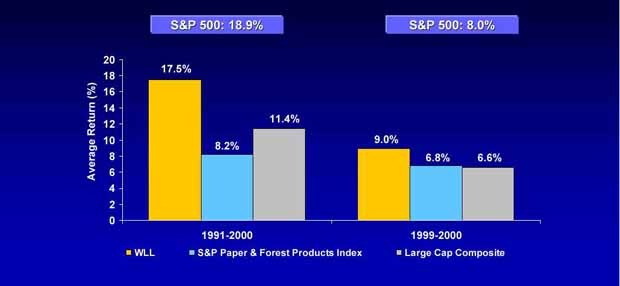

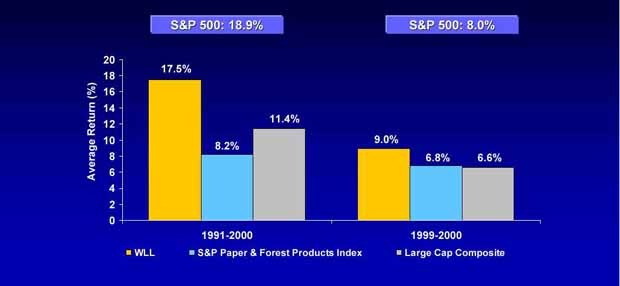

Superior Price Performance

Note: Reflects the average total return, including reinvested dividends, for the annual periods indicated through November 10, 2000.

Large Cap Composite includes International Paper, Georgia-Pacific and Weyerhaeuser.

- Over the past ten years, Willamette has consistently outperformed its peers in delivering value to shareholders.

- Willamette’s stock performance has been double that of the S&P Paper and Forest Products Index over the period 1991 to 2000, and has almost matched the S&P 500 performance over that

period (despite a very difficult decade for the industry and an extraordinarily good performance for the S&P 500).

- Over the last two years, Willamette has beaten both the S&P Paper and Forest Products Index and the S&P 500.

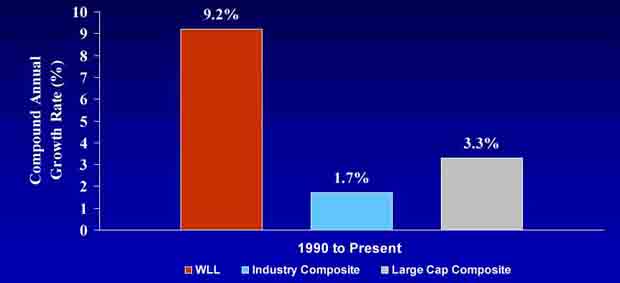

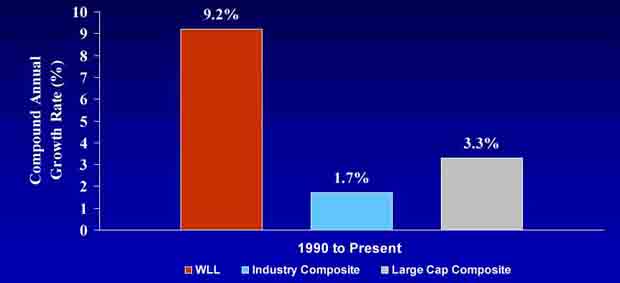

Stronger EPS Growth

Industry composite includes Boise Cascade, Bowater, Chesapeake, Georgia-Pacific, International Paper, Longview Fibre, Louisiana-Pacific, Mead, Temple-Inland, Westvaco and Weyerhaeuser.

Large cap composite includes International Paper, Georgia-Pacific and Weyerhaeuser.

Source: Company reports/Factset

- For the last 10 years Willamette’s earnings have far outstripped both the total industry and the industry large cap composite.

- Willamette’s earnings growth has been more than 5x the industry composite and nearly 3x the large cap composite.

Low Cost Producer…

- Campti, Louisiana brown paper mill believed to be lowest cost integrated mill in North America and Albany, Oregon brown paper mill

lowest cost integrated mill in Western U.S.

- Willamette is profitable in its corrugated business while the industry on average is unprofitable; Willamette exceeds industry average by over $3 per MSF sold in terms of operating income

- Average white paper production per machine believed to be highest in the industry

- Willamette has a disciplined approach to market and ranks among the lowest in the industry in terms of SG&A

- Willamette is a highly efficient, low cost manufacturer that has outperformed its peers in terms of return on sales, assets, equity and capital employed.

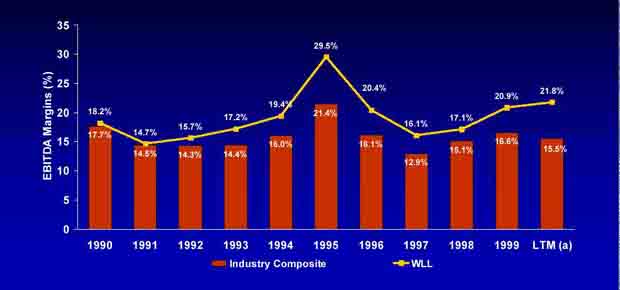

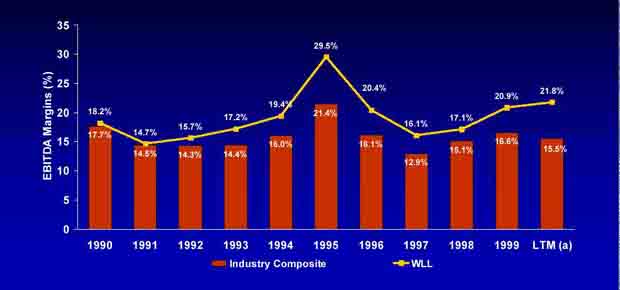

…Translates into Higher Margins

Industry composite includes Boise Cascade, Bowater, Chesapeake, Georgia-Pacific, International Paper, Longview Fibre, Louisiana-Pacific, Mead, Potlatch, Smurfit-Stone, Temple-Inland, Westvaco and

Weyerhaeuser.

Source: Company reports/Factset

(a) Last twelve months ended Q3 2000

- EBITDA margins have been consistently and substantially higher than the industry average over the last ten years and that trend has been widening in the last two years.

Capital Allocation

- 15%+ internal rate of return target on capital projects, except environmental and maintenance

- Invested $1 billion in capital projects since 1997, excluding acquisitions

- Debt Paydown -- $370 million since 1997

- Repurchased 2.5 million shares in 1H 2000

- Dividend increased 31% since 1997, more than 100% in last decade

- Willamette has a target criteria of at least 15% internal rate of return on capital projects greater than $1 million, except environmental and maintenance.

- The Company has invested about $1 billion in new projects since 1997, and expects significant returns from these initiatives in the near and long term. These investments are expected to add

substantially to EPS growth in the next few years.

- The Company has paid down $370 million of debt since 1997.

- New capacity is not built unless output is already sold.

- Willamette ranks shareholder value as the top priority, and has repurchased 2.5 million shares in 1H 2000, and has never reduced its dividend.

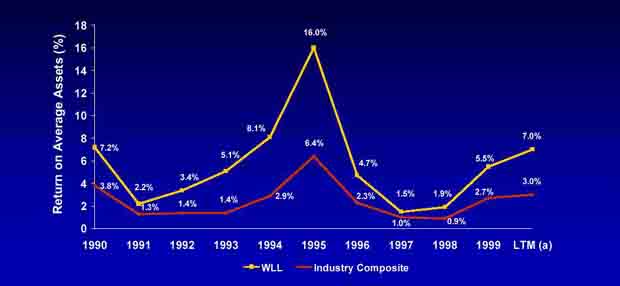

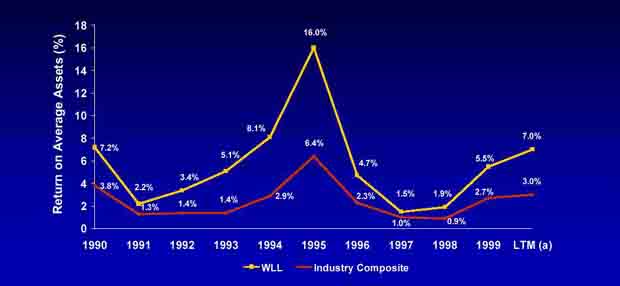

Higher Returns

Return on Average Assets = Net Income/Average Assets

Composite includes Boise Cascade, Bowater, Chesapeake, Georgia-Pacific, International Paper, Longview Fibre, Louisiana-Pacific, Mead, Potlatch, Smurfit-Stone, Temple- Inland, Westvaco and Weyerhaeuser.

Source: Company reports/Factset

(a) Last twelve months ended Q3 2000

- For the past ten years, Willamette has demonstrated its ability to generate higher returns on assets than its peers.

- The disparity between Willamette and its peers narrowed during the 1997-98 period, primarily as a result of the Cavenham timberlands acquisition, which significantly increased average assets and

interest costs. The above chart shows how the spread relative to the industry is widening again.

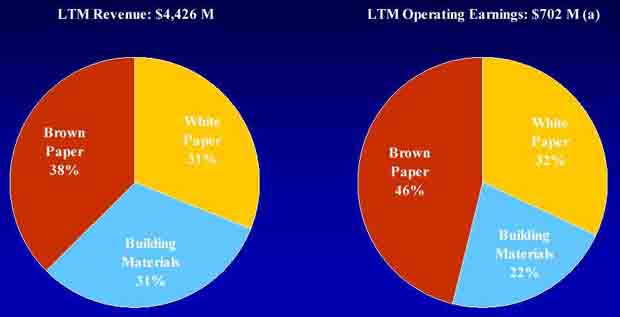

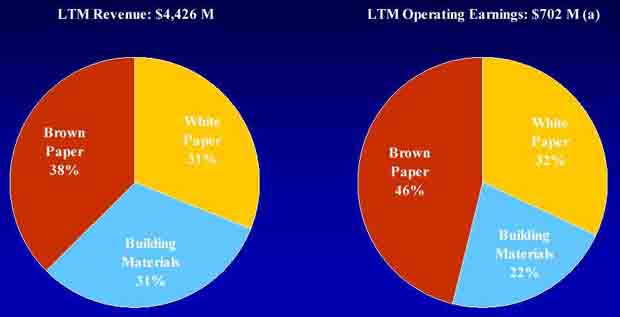

Balanced Business Portfolio Reduces Volatility

LTM: Last twelve months ended Q3 2000.

Source: Company reports

(a) Excludes corporate items.

- As a result of the implementation of a carefully planned and consistently executed business plan, Willamette has achieved a well balanced portfolio of low cost, vertically integrated businesses.

- This has enabled the Company to manage, better than most, the vagaries of the industry's business cycles.

- We believe our 1.7 million acres of timberland are among the highest quality in the industry, and that our 58% sawlog self-sufficiency is also among the highest.

Outlook for Business

Brown Paper

- Industry wide volume growth is flat to down, however, Willamette volume up 1.6% in first nine months and October volume up 8.7% over prior year

- Pricing appears stable at current profitable level

White Paper

- Price increases implemented in October at approximately $40 per ton and holding

- Willamette inventory levels near historic lows

- IP’s announced closure of 820,000 tons of uncoated free sheet capacity should strengthen market

- Pulp markets softening on a worldwide basis

Building Materials

- At or near low point in cycle; Willamette’s strength in particleboard, medium density fiberboard and log exports help mitigate the impact

Brown Paper

- Willamette inventories have declined approximately 20,000 tons (10%) in last three months.

- Willamette volume is up 1.6% in the first nine months and October volume is up 8.7% over the prior year.

- Pricing appears stable at current profitable level.

White Paper

- Demand for uncoated free sheet remains solid; recent price increases implemented

- Pulp markets softening on worldwide basis.

Building Materials

- The sector is at or near the low point in the cycle but the Company’s strength in composite panels and other areas have helped to mitigate the impact on earnings. Recent investments will

benefit Willamette as the Company moves through the cycle. Willamette is optimistic that there will be improvement in late 2001.

Permanent Capacity Reductions

| Plywood

|

|

|

|

|

| |

|

|

|

|

| Date

|

|

Facility

|

|

Capacity

|

| |

|

|

|

|

| 1997

|

|

Taylor

|

|

210 MM Sq. Ft.

|

| |

|

|

|

|

| 2000

|

|

Dallas

|

|

154 MM Sq. Ft.

|

| |

|

|

|

|

| 2000E

|

|

Ruston

|

|

226 MM Sq. Ft.

|

|

| |

|

|

|

590 MM Sq. Ft.

|

| |

|

|

|

|

| White Paper

|

|

|

|

|

| |

|

|

|

|

| Date

|

|

Facility

|

|

Capacity

|

| |

|

|

|

|

| 1995

|

|

Johnsonburg #4 PM

|

|

22,000 tons

|

| |

|

|

|

|

| 1999

|

|

Kingsport #3 PM

|

|

56,000 tons

|

| |

|

|

|

|

| 2000E

|

|

Johnsonburg #2 PM

|

|

40,000 tons

|

| |

|

|

|

|

| 2001E

|

|

Johnsonburg #3 PM

|

|

45,000 tons

|

| |

|

|

|

|

| 2002E

|

|

Kingsport #4 & 5 PM

|

|

170,000 tons

|

|

| |

|

|

|

333,000 tons

|

- Willamette has consistently eliminated and will continue to eliminate inefficient or unprofitable capacity.

Value Enhancing Initiatives

| Investments |

| |

|

|

|

|

- Mexican Corrugated Acquisition

- French Particleboard Expansion

- Particleboard Start-ups

- Kingsport Modernization

- Port Wentworth Pulp Mill Start-up

- Corrugated Start-ups

- Integration of Cavenham Timberland Acquisition

- Cogeneration Facility Installations

|

|

}

|

|

Fully implemented*,

adds in excess of

$ 340 million

to EBITDA

based on today’s

pricing |

| * All projects expected to be complete by Q4 2003. |

|

|

|

|

| |

- Over the last three years, the Company has made a number of strategic investments aimed at seizing market opportunity and increasing EPS growth.

- Based on today’s pricing environment, if all of the value enhancing initiatives were complete, they would add in excess of $340 million to EBITDA (the equivalent of approximately 35% of LTM

EBITDA).

- Total investments, excluding Cavenham, approximate $950 million, of which about 1/3 has already been spent.

Kingsport

- In 2001, Willamette’s white paper system will need to purchase approximately 250,000 tons of uncoated free sheet to meet demand, already

matching the additional net output of the new paper machine in late 2003

- Manufacturing costs per ton are forecasted to decline almost $250 per ton when modernization is completed

- Pricing assumptions used are $50 per ton less than the current market environment

- Projected internal rate of return in excess of 15%

- Cost competitive with imports from Brazil and Indonesia

- The investment in Kingsport is entirely consistent with the Company’s marketing oriented capital spending strategy and commitment to being the lowest cost producer.

- Net increase in capacity of 200,000 tons, taking into account shutdowns of the other 3 paper machines.

- When finished, this project, which will modernize the Company’s oldest uncoated free sheet mill, is expected to pull the Company far away from competitors as the lowest cost U.S. producer.

- In 2001, Willamette will not be able to produce enough free sheet to meet its demand and will have to purchase from other sources.

- While there has been some criticism of this initiative, it exceeds our internal rate of return threshold and helps drive our future earnings.

Proposal Dramatically Undervalues Willamette

| |

|

|

|

Stora-Enso/

|

|

Selected Transaction

|

| Benchmark (a) |

|

Proposal

|

|

Consolidated Papers

|

|

Average (b)

|

|

| |

|

|

|

|

|

|

| Premiums to: |

|

|

|

|

|

|

| |

|

|

|

|

|

|

Market

|

|

36%

|

|

69%

|

|

53%

|

52-week High

|

|

(1)

|

|

34

|

|

20

|

All-Time High

|

|

(6)

|

|

28

|

|

17

|

| |

|

|

|

|

|

|

| Enterprise Value/EBITDA |

|

|

|

|

|

|

| |

|

|

|

|

|

|

Latest Twelve Months

|

|

7.3 x

|

|

14.0 x

|

|

11.5x

|

Peak

|

|

6.1

|

|

10.3

|

|

7.1

|

5-year Average

|

|

9.0

|

|

12.4

|

|

10.5

|

| |

|

|

|

|

|

|

|

(a) Represents one of many approaches which can be used to assess value

(b) Average includes Stora-Enso/Consolidated Papers, International Paper/Champion, and International Paper/Union Camp transactions.

- Willamette is not for sale and we are committed to our long-term strategy.

- Even if we were for sale, now is not the right time, and $48 is certainly not the right price.

- Premiums paid in comparable industry deals exceed the proposal:

- Stora Enso paid a 69% premium (relative to the day prior to the

announcement) for Consolidated and a 28% premium to Consolidated’s all-time high.

- Proposal values Willamette at a discount (1%) to its 52-week high and a 6% discount to its all time high.

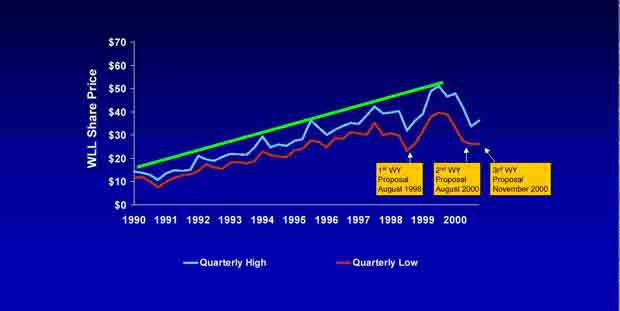

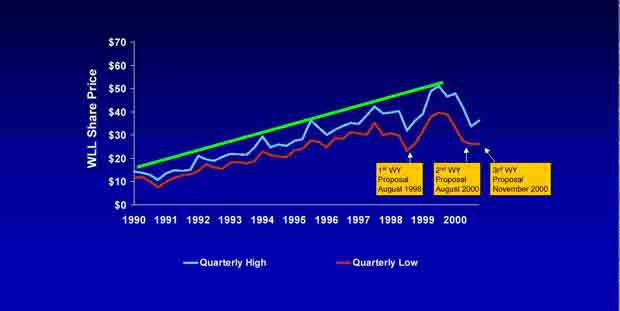

Delivering Increasing Value to Shareholders

- The net result of Willamette’s market–driven focus, intelligent acquisition strategy and commitment to low cost, efficient production, is a consistent increase in share price.

- Willamette should continue to increase value based on initiatives underway.

- The chart also demonstrates the cyclical nature of the business and clearly shows, as most industry analysts suggest, that the valuation cycle looks set to trend upwards.

- We are not for sale. This is not the right time, and $48 is certainly not the right price.

Our Future is Bright

- Proven Track Record of Delivering Shareholder Value

- Significant Benefits Yet to be Realized

- Well Positioned to Continue Outperforming the Industry

- Confident in Our Ability to Deliver Future Value to Shareholders