|

|

|

|

|

Previous: C ME RUN CORP, 8-K, 2000-12-22 |

Next: INFOBOOTH INC, 10-Q, 2000-12-22 |

| Check the appropriate box: | |||

| [ ] | Preliminary Proxy Statement | [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [X] | Definitive Proxy Statement | ||

| [ ] | Definitive Additional Materials | ||

| [ ] | Soliciting Material Pursuant to §240.14a-12 | ||

| VARIAN, INC. |

|

|

| (Name of Registrant as Specified In Its Charter) |

|

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): |

| [X] | No fee required. | |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |

|

|

||

| (1) | Title of each class of securities to which transaction applies: | |

|

|

||

| (2) | Aggregate number of securities to which transaction applies: | |

|

|

||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

|

|

||

| (4) | Proposed maximum aggregate value of transaction: | |

|

|

||

| (5) | Total fee paid: | |

|

|

||

| [ ] | Fee paid previously with preliminary materials. | |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |

|

|

||

| (2) | Form, Schedule or Registration Statement No.: | |

|

|

||

| (3) | Filing Party: | |

|

|

||

| (4) | Date Filed: | |

|

|

Notes:

December 22, 2000

Dear Stockholder:

It is my pleasure to invite you to Varian, Inc.’s annual meeting of stockholders. The meeting will be held on Thursday, February 8, 2001, at 2:00 p.m., at the Sheraton Palo Alto Hotel, 625 El Camino Real, Palo Alto, California. The formal notice of the meeting and the proxy statement appear on the following pages and describe the matter to be acted upon at the meeting.

I hope that you will be able to attend the meeting in person. If you cannot attend, or if you plan to be present but want the proxy holders to vote your shares, please complete, sign and return the enclosed proxy card at your earliest convenience. Your vote is important.

| Sincerely, | |||

| |||

| Allen J. Lauer | |||

| President and Chief Executive Officer |

VARIAN, INC.

3120 Hansen Way

Palo Alto, California 94304-1030

NOTICE OF THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON FEBRUARY 8, 2001

Date, Time and Location

The Annual Meeting of Stockholders of Varian, Inc. will be held on Thursday, February 8, 2001, at 2:00 p.m., local time, at the Sheraton Palo Alto Hotel, 625 El Camino Real, Palo Alto, California.

Agenda

The agenda for the Annual Meeting is as follows:

Record Date

The record date for the Annual Meeting was December 11, 2000. Only stockholders of record at the close of business on that date are entitled to notice of and to vote at the Annual Meeting. A list of these stockholders will be available at our principal executive offices, 3120 Hansen Way, Palo Alto, California 94304-1030, for a period of ten days before the Annual Meeting.

Voting

It is important that you vote or grant a proxy to vote at the Annual Meeting. Therefore, whether or not you expect to attend the Annual Meeting, please complete, sign and date the enclosed proxy and mail it promptly in the accompanying return envelope. You may revoke your proxy at any time before it is voted, and you may vote in person at the Annual Meeting even if you have returned a proxy. These and other voting procedures are explained in the Proxy Statement following this notice.

| By Order of the Board of Directors | |||

| |||

| A. W. Homan | |||

| Secretary |

December 22, 2000

Palo Alto, California

VARIAN, INC.

3120 Hansen Way

Palo Alto, California 94304-1030

(650) 213-8000

PROXY STATEMENT

INFORMATION REGARDING VOTING AND SOLICITATION OF PROXIES

General

This Proxy Statement is being furnished to you as a stockholder of Varian, Inc., a Delaware corporation (the “Company”), in connection the Company’s Annual Meeting of Stockholders to be held on February 8, 2001, at 2:00 p.m., local time, at the Sheraton Palo Alto Hotel, 625 El Camino Real, Palo Alto, California, and any adjournment or postponement of that meeting (the “Annual Meeting”). The Board of Directors is soliciting your proxy to vote your shares at the Annual Meeting. You may grant your proxy by signing, dating and returning the enclosed proxy form in the pre-addressed, postage-paid return envelope.

The agenda for the Annual Meeting is to elect two Class II directors to the Board of Directors, as is described in more detail below. The Board of Directors does not know of any matter to be brought before the Annual Meeting other than that described in this Proxy Statement. If any other matter does properly come before the Annual Meeting, the Board intends that the persons named in the enclosed proxy will vote on such matter in accordance with their judgment.

This Proxy Statement and the accompanying form of proxy were first sent or given to stockholders on or about December 22, 2000.

Voting

The Company’s common stock is the only type of security issued and entitled to vote at the Annual Meeting. Each share of common stock is entitled to one vote. Only stockholders of record at the close of business on December 11, 2000 are entitled to notice of and to vote at the Annual Meeting. As of that record date, there were 32,869,933 shares of the Company’s common stock outstanding.

The presence, either in person or by proxy, of the holders of a majority of the outstanding shares of the Company’s common stock is necessary to constitute a quorum permitting action to be taken at the Annual Meeting. Abstentions and broker non-votes are counted as present at the Annual Meeting for the purpose of determining the presence of a quorum.

The affirmative vote of a plurality of the shares of the Company’s common stock present or represented by proxy at the Annual Meeting is required to elect the Class II directors. This means that John G. McDonald and Wayne R. Moon, the Board of Directors’ nominees for Class II directors, must receive the highest numbers of votes cast in order to be elected as the Class II directors. Therefore, any shares not voted (whether by abstention, broker non-vote or otherwise) will have no legal effect on the election of the Class II directors.

Your shares will be voted in accordance with your instructions set forth on the proxy that you sign and return. If you provide no instructions, your proxy will be voted for the election of John G. McDonald and Wayne R. Moon as the Class II directors.

Even if you sign and return your proxy, you may revoke or change your proxy at any time prior to the Annual Meeting. You may do this by sending to A. W. Homan, the Company’s Secretary (at the Company’s address set forth above), prior to the Annual Meeting, a written notice of revocation or a new proxy bearing a later date. You may also revoke your proxy by attending the Annual Meeting and voting in person.

Solicitation of Proxies

The cost of soliciting proxies will be borne by the Company. Copies of solicitation material will be furnished to brokerage houses, fiduciaries and custodians to forward to beneficial owners of the Company’s common stock held in their names. The Company will reimburse such persons for their reasonable out-of-pocket expenses in forwarding solicitation materials. In addition to solicitations by mail, some of the Company’s directors, officers and other employees, without extra remuneration, might supplement this solicitation by letter, telephone or personal interview. The Company might also retain Corporate Investor Communications, Inc., 111 Commerce Road, Carlstadt, New Jersey 07072-2586, to assist with the solicitation of proxies from brokers, bank nominees and other holders, for a fixed retainer fee of no more than $2,500 plus reasonable out-of-pocket expenses, which fees and expenses would be borne by the Company.

ELECTION OF DIRECTORS

Board Structure and Nominees

The Board of Directors consists of five members. Pursuant to the Company’s Restated Certificate of Incorporation, the Board is divided into three classes. The sole Class I director is Allen J. Lauer. The Class II directors are John G. McDonald and Wayne R. Moon. The Class III directors are D. E. Mundell and Elizabeth E. Tallett.

Members of each class are elected for three-year terms. However, because all directors were initially elected in 1999 as part of the formation of the Company, the Company’s Restated Certificate of Incorporation provides that the terms of office of the initial Class II directors will expire at the annual meeting of stockholders in 2001, and the terms of office of the initial Class III directors will expire at the annual meeting of stockholders in 2002, or in each case until his or her successor is duly elected and qualified, unless such director dies, resigns, retires or is disqualified or removed. The initial term of the Class I director expired in 2000, when that director was elected to a three-year term expiring at the annual meeting of stockholders in 2003.

Messrs. McDonald’s and Moon’s initial terms expire at the Annual Meeting. The Board of Directors has nominated each of them for re-election at the Annual Meeting for terms expiring at the annual meeting of stockholders in 2004 and when their respective successors are elected and qualified. Messrs. McDonald and Moon have stated their willingness to serve if elected, and the Company does not contemplate that either will be unable to serve. However, in the event that either nominee subsequently declines or becomes unable to serve, proxies will be voted for such substitute nominee as shall be designated by the proxy holders in their discretion.

The Board of Directors recommends that stockholders vote FOR the election of Messrs. McDonald and Moon as Class II directors.

Business Experience of Directors

D. E. Mundell is Chairman of the Company’s Board of Directors, a position he has held since 1999. From 1991 to 1999, he was Chairman of the Board of ORIX USA Corporation (a financial services company), where he still serves as a director. He is a director of Beazer Homes USA, Inc. and Stockton Holdings, Ltd. Mr. Mundell has been a director of the Company since 1999. Age: 69

Allen J. Lauer is the Company’s President and Chief Executive Officer, a position he has held since 1999. From 1990 to 1999, he was Executive Vice President of Varian Associates, Inc. and responsible for its Instruments business. Mr. Lauer has been a director of the Company since 1999. Age: 63

John G. McDonald is The IBJ Professor of Finance at Stanford University’s Graduate School of Business, where he has served on the faculty since 1968. He is a director of Scholastic Corp., Plum Creek Timber Company, Inc. and iStar Financial, Inc., and is an independent director of eight mutual funds managed by Capital Research & Management Co. He has been a director of the Company since 1999. Age: 63

Wayne R. Moon is the former Chairman of the Board and Chief Executive Officer of Blue Shield of California (a health care company), a position he held from 1993 to 1999. He has been a director of the Company since 1999. Age: 60

Elizabeth E. Tallett is President and Chief Executive Officer of Galenor Inc. (a biopharmaceutical company), a position she has held since 1999. She is also President and Chief Executive Officer of Dioscor, Inc. and President and

Chief Executive Officer of Ellard Pharmaceuticals, Inc. (both biopharmaceutical companies), positions she has held since 1996 and 1997, respectively. From 1992 to 1996, Ms. Tallett was President and Chief Executive Officer of Transcell Technologies, Inc. (a biotechnology company). She is a director of Coventry Health Care, Inc., IntegraMed America, Inc. and The Principal Mutual Life Insurance Company. Ms. Tallett has been a director of the Company since 1999. Age: 51

Committees and Meetings

The Board of Directors has three standing committees: The Audit Committee; the Compensation Committee; and the Stock Committee. The Board of Directors does not have a nominating committee or a committee serving a similar function.

The Audit Committee is comprised of directors McDonald (Chairman), Moon, Mundell and Tallett, all of whom are non-employee, outside directors. This Committee is responsible for monitoring and overseeing the independence and performance of the Company’s internal auditors and independent accountants, the integrity of the Company’s financial statements, and the Company’s compliance with legal and regulatory requirements. The Audit Committee held four meetings during fiscal year 2000.

The Compensation Committee is comprised of directors Mundell (Chairman), McDonald, Moon and Tallett, all of whom are non-employee, outside directors. This Committee approves all officer compensation, and is responsible for administration of the Company’s Omnibus Stock Plan, Management Incentive Plan and Supplemental Retirement Plan. The Compensation Committee held three meetings during fiscal year 2000.

The Stock Committee is comprised of director Lauer. This Committee approves grants of nonqualified stock options under the Company’s Omnibus Stock Plan, pursuant to delegations permitting the Committee to make such grants within certain guidelines, to eligible participants who are not Company officers. The Committee also administers the Company’s Employee Stock Purchase Plan. The Stock Committee held no meetings during fiscal year 2000, but took various actions by written consent.

The Board of Directors held four meetings during fiscal year 2000.

During fiscal year 2000, each director attended all meetings of the Board and committees of the Board of which the director was a member.

Director Compensation

Each director who is not a Company employee receives an annual retainer fee of $20,000, and $1,000 for each Board and committee meeting attended. The Chairman of the Board receives an annual retainer fee of $90,000 (in lieu of any other annual retainer, committee chair or attendance fees), and directors chairing standing committees of the Board each receive an additional annual retainer fee of $5,000. Directors may elect to receive, in lieu of all or a portion of the foregoing fees, shares of the Company’s common stock based on the fair market value of the stock on the date the fees would have been paid.

Under the Company’s Omnibus Stock Plan, each director who is not a Company employee also receives (a) upon initial appointment or election to the Board, a nonqualified stock option to acquire 10,000 shares of the Company’s common stock, and (b) annually thereafter a nonqualified stock option to acquire 5,000 shares of the Company’s common stock. In lieu of these grants, the non-employee Chairman of the Board receives upon initial appointment a nonqualified stock option to acquire 50,000 shares of the Company’s common stock. All such stock options are granted with an exercise price equal to the fair market value of the Company’s common stock on the grant date, are exercisable on the grant date and have a ten-year term.

Each director is also reimbursed for all reasonable out-of-pocket expenses that such director and his or her spouse incurs attending Board meetings and functions.

Director Lauer, because he is a Company employee, receives no compensation for his services as a director.

STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

The following table sets forth certain information as of December 1, 2000 regarding beneficial ownership of the Company’s common stock by (a) each person who, to the Company’s knowledge, beneficially owned more than five percent of the outstanding shares of the Company’s common stock as of that date, (b) each of the executive officers named in the Summary Compensation Table on page 6, (c) each of the Company’s directors and nominees for director, and (d) all executive officers and directors as a group.

| Name and Address (if applicable) of Beneficial Owner | Amount and Nature of Beneficial Ownership(1) |

Percent of Outstanding Shares(2) |

|||||

| FMR Corp. 82 Devonshire Street, Boston, MA 02109 |

2,582,960 | (3) | 7.86 | % | |||

| Franklin Resources, Inc. 777 Mariners Island Boulevard, San Mateo, CA 94404 |

2,059,442 | (4) | 6.27 | ||||

| I.G. Investment Management Ltd. 447 Portage Avenue, Winnipeg, Manitoba R3C 3B6, Canada |

1,929,600 | (5) | 5.87 | ||||

| Allen J. Lauer, President and Chief Executive Officer, Director | 736,059 | (6) | 2.20 | ||||

| G. Edward McClammy, Vice President and Chief Financial Officer | 33,334 | (7) | — | ||||

| A. W. Homan, Vice President, General Counsel and Secretary | 64,282 | (8) | — | ||||

| Garry W. Rogerson, Vice President, Analytical Instruments | 49,045 | (9) | — | ||||

| Sergio Piras, Vice President, Vacuum Technologies | 80,533 | (10) | — | ||||

| D. E. Mundell, Chairman of the Board | 39,400 | (11) | — | ||||

| John G. McDonald, Director | 35,228 | (12) | — | ||||

| Wayne R. Moon, Director | 26,452 | (13) | — | ||||

| Elizabeth E. Tallett, Director | 24,314 | (14) | — | ||||

| All Executive Officers and Directors as a Group (12 persons) | 1,350,825 | (15) | 4.06 | ||||

______________

| (1) | For purposes of this table, a person or group of persons is deemed to have beneficial ownership of shares of the Company’s common stock which such person or group has the right to acquire on or within 60 days after December 1, 2000. Unless otherwise indicated, to the Company’s knowledge the person named has sole voting and investment power, or shares voting and/or investment power with such person’s spouse, with respect to all shares beneficially owned by that person. | |

| (2) | The percentage of outstanding shares is based on the 32,869,426 shares outstanding on December 1, 2000. However, for purposes of computing the percentage of outstanding shares of common stock beneficially owned by each person or group of persons, any stock which such person or group of persons has a right to acquire on or within 60 days of December 1, 2000 is deemed to be outstanding, but is not deemed to be outstanding for the purpose of computing the percentage of beneficial ownership of any other person. The percentage of outstanding shares of the Company’s common stock is only reported to the extent it exceeds one percent of the shares of the Company’s common stock outstanding on December 1, 2000. | |

| (3) | As of September 30, 2000, based on a Schedule 13F Holdings Report filed with the Securities and Exchange Commission on November 14, 2000, which Schedule 13F states that FMR Corp. shares investment discretion as to all shares reported, has sole voting authority as to 495,910 of those shares and has no voting authority as to 2,087,050 of those shares. | |

| (4) | As of September 30, 2000, based on a Schedule 13F Holdings Report filed with the Securities and Exchange Commission on November 13, 2000, which Schedule 13F states that Franklin Resources, Inc. shares investment discretion as to all shares reported, has sole voting authority as to 1,883,500 of those shares and has no voting authority as to 175,942 of those shares. | |

| (5) | As of September 30, 2000, based on a Schedule 13F Holdings Report filed with the Securities and Exchange Commission on November 13, 2000, which Schedule 13F states that I.G. Investment Management Ltd. shares investment discretion as to all shares reported, has sole voting authority as to 1,883,500 of those shares and has no voting authority as to 175,942 of those shares. | |

| (6) | Includes 736,059 shares which may be acquired on or within 60 days of December 1, 2000 by exercise of nonqualified stock options granted pursuant to the Omnibus Stock Plan, and 98,610 shares held in a trust of which Mr. Lauer is co-trustee with his wife. | |

| (7) | Shares which may be acquired on or within 60 days of December 1, 2000 by exercise of nonqualified stock options granted pursuant to the Omnibus Stock Plan. | |

| (8) | Includes 60,950 shares which may be acquired on or within 60 days of December 1, 2000 by exercise of nonqualified stock options granted pursuant to the Omnibus Stock Plan, and 3,332 shares held in a trust of which Mr. Homan is co-trustee with his wife. | |

| (9) | Includes 46,734 shares which may be acquired on or within 60 days of December 1, 2000 by exercise of nonqualified stock options granted pursuant to the Omnibus Stock Plan. | |

| (10) | Shares which may be acquired on or within 60 days of December 1, 2000 by exercise of nonqualified stock options granted pursuant to the Omnibus Stock Plan. | |

| (11) | Includes 30,000 shares which may be acquired on or within 60 days of December 1, 2000 by exercise of nonqualified stock options granted pursuant to the Omnibus Stock Plan, and 8,400 shares held in a trust of which Mr. Mundell is co-trustee with his wife. | |

| (12) | Includes 31,428 shares which may be acquired on or within 60 days of December 1, 2000 by exercise of nonqualified stock options granted pursuant to the Omnibus Stock Plan. | |

| (13) | Includes 25,952 shares which may be acquired on or within 60 days of December 1, 2000 by exercise of nonqualified stock options granted pursuant to the Omnibus Stock Plan. | |

| (14) | Includes 23,214 shares which may be acquired on or within 60 days of December 1, 2000 by exercise of nonqualified stock options granted pursuant to the Omnibus Stock Plan. | |

| (15) | Includes 1,215,240 shares which may be acquired on or within 60 days of December 1, 2000 by exercise of nonqualified stock options granted pursuant to the Omnibus Stock Plan, and 110,342 shares as to which voting and/or investment power is shared (see certain of the foregoing footnotes). | |

EXECUTIVE COMPENSATION INFORMATION

The following tables set forth certain information with respect to compensation paid by the Company to its chief executive officer and four other most highly compensated executive officers for services rendered to the Company in fiscal years 2000 and 1999. The Company first became a separate, public company effective as of April 2, 1999, the date of its “spin-off” from Varian Associates, Inc. (“VAI”). Accordingly, the fiscal year 1999 compensation reported below covers only the six month period of fiscal year 1999 following the spin-off, from April 3, 1999 to October 1, 1999. The named executive officers did not earn any compensation from the Company or for services to the Company prior to April 2, 1999, and the table does not include compensation paid by VAI.

Summary Compensation Table

| Long Term Compensation |

|||||||||||||||||||

| Annual Compensation | Awards | ||||||||||||||||||

| Name and Principal Position |

Year | Salary ($) |

Bonus ($)(1) |

Other Annual Compensation ($)(2) | Securities Underlying Options/SARs (#)(3) |

All Other Compensation ($)(4) |

|||||||||||||

| Allen J. Lauer | 2000 | $ | 550,004 | $ | 1,091,978 | $ | 18,830 | 182,000 | $ | 67,129 | |||||||||

| President and Chief Executive Officer |

1999 | 275,002 | 400,125 | 0 | 1,089,808 | 5,006 | |||||||||||||

| G. Edward McClammy | 2000 | 250,000 | 372,263 | 9,713 | 40,000 | 11,710 | |||||||||||||

| Vice President and Chief Financial Officer |

1999 | 116,347 | 236,406 | 0 | 150,000 | 844 | |||||||||||||

| A. W. Homan | 2000 | 193,846 | 297,810 | 20,548 | 30,000 | 13,952 | |||||||||||||

| Vice President, General Counsel and Secretary |

1999 | 100,000 | 109,125 | 0 | 198,014 | 2,653 | |||||||||||||

| Garry W. Rogerson | 2000 | 200,000 | 234,435 | 17,157 | 30,000 | 16,840 | |||||||||||||

| Vice President, Analytical Instrument |

1999 | 100,000 | 118,500 | 0 | 207,945 | 4,491 | |||||||||||||

| Sergio Piras(5) | 2000 | 172,916 | 200,828 | 0 | 17,000 | 29,912 | |||||||||||||

| Vice President, Vacuum Technologies |

1999 | 85,723 | 73,610 | 0 | 139,101 | 18,660 | |||||||||||||

______________

| (1) | Consists of annual cash bonuses paid under the Management Incentive Plan. The amount reported for Mr. McClammy for fiscal year 1999 also includes a $100,000 hiring bonus paid when he commenced employment on April 16, 1999. | |

| (2) | Consists of amounts reimbursed for the payment of taxes on income imputed for the personal use of a Company-leased automobile. | |

| (3) | Consists of shares of the Company’s common stock that may be acquired by exercise of nonqualified stock options granted pursuant to the Omnibus Stock Plan. | |

| (4) | Consists of (a) Company matching contributions or credits in fiscal years 2000 and 1999, respectively, to retirement plan and/or supplemental retirement plan accounts (Mr. Lauer, $62,968 and $2,500; Mr. McClammy, $10,307 and $0; Mr. Homan, $13,612 and $2,308; Mr. Rogerson, $15,160 and $3,480; and Mr. Piras, $3,900 and $2,141); (b) Company paid premiums in fiscal years 2000 and 1999, respectively, for group term life insurance (Mr. Lauer, $4,161 and $2,506; Mr. McClammy, $1,403 and $844; Mr. Homan, $340 and $345; Mr. Rogerson, $1,680 and $1,011; and Mr. Piras, $1,052 and $503); and (c) in the case of Mr. Piras, Company paid premiums in fiscal years 2000 and 1999, respectively for group medical and disability insurance ($5,876 and $4,214), and amounts accrued by the Company in fiscal years 2000 and 1999, respectively, for a severance payment that Italian law will require be paid to Mr. Piras upon termination of his employment ($19,084 and $11,802). | |

| (5) | Mr. Piras is employed by Varian S.p.A., a wholly-owned subsidiary, at its facility in Torino, Italy. All cash amounts reported for Mr. Piras are converted to U.S. dollars from Italian lira. | |

Option/SAR Grants in Last Fiscal Year

| Individual Grants | |||||||||||||||||||

| Number of Securities Underlying Options/ SARs Granted |

% of Total Options/SARs Granted to Employees |

Exercise or Base Price |

Expiration | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(2) |

|||||||||||||||

| Name | (#)(1) | in Fiscal Year | ($/Sh) | Date | 5% ($) | 10% ($) | |||||||||||||

| Allen J. Lauer | 182,000 | 19.76% | $ | 22.0625 | 11/11/09 | $ | 2,525,269 | $ | 6,399,303 | ||||||||||

| G. Edward McClammy | 40,000 | 4.34 | 22.0625 | 11/11/09 | 555,004 | 1,406,440 | |||||||||||||

| A. W. Homan | 30,000 | 3.26 | 22.0625 | 11/11/09 | 416,253 | 1,054,830 | |||||||||||||

| Garry W. Rogerson | 30,000 | 3.26 | 22.0625 | 11/11/09 | 416,253 | 1,054,830 | |||||||||||||

| Sergio Piras | 17,000 | 1.85 | 22.0625 | 11/11/09 | 235,877 | 597,737 | |||||||||||||

______________

| (1) | Consists of nonqualified stock options to acquire the Company’s common stock, which stock options were granted pursuant to the Omnibus Stock Plan at an exercise price equal to the closing market price of the Company’s stock on the grant date, become exercisable over three years at the rate of approximately one-third each year and expire ten years from the grant date. Payment of the exercise price may be made by delivery of already-owned shares. | |

| (2) | The 5% and 10% assumed annual rates of stock price appreciation would result from per share prices of $35.94 and $57.22, respectively. These assumed rates are not intended to represent a forecast of possible future appreciation of the Company’s stock. | |

Aggregated Option/SAR Exercises in Last Fiscal Year

and Fiscal Year-End Option/SAR Values

| Number of Securities Underlying Unexercised Options/SARs at Fiscal Year-End (#) |

Value of Unexercised In-the-Money Options/SARs at Fiscal Year-End ($)(1) |

||||||||||||||||||

| Name | Shares Acquired on Exercise (#) |

Value Realized ($) |

Exercisable | Unexercisable | Exercisable | Unexercisable | |||||||||||||

| Allen J. Lauer | 246,360 | $ | 8,632,525 | 527,510 | 497,938 | $ | 16,563,735 | $ | 14,195,879 | ||||||||||

| G. Edward McClammy | 30,000 | 1,252,543 | 20,000 | 140,000 | 671,250 | 4,196,250 | |||||||||||||

| A. W. Homan | 67,064 | 1,812,834 | 40,000 | 120,950 | 1,342,500 | 3,631,442 | |||||||||||||

| Garry W. Rogerson | 91,211 | 2,642,861 | 25,100 | 121,634 | 842,419 | 3,651,209 | |||||||||||||

| Sergio Piras | 30,901 | 502,576 | 65,832 | 59,368 | 2,023,524 | 1,678,508 | |||||||||||||

______________

| (1) | Based on the closing market price of the underlying shares of the Company’s common stock on September 29, 2000 ($43.0625 per share). | |

Severance Arrangements

On December 1, 2000, Mr. Lauer was granted a nonqualified stock option to acquire 145,000 shares of the Company’s common stock. Under the terms of that stock option, one-third of the option shares will vest on December 1, 2001 and one-third will vest on December 1, 2002 if on each of such dates he is still actively employed by the Company. The final one-third will vest on the earlier of December 1, 2003 or the date of Mr. Lauer’s retirement from the Company, as long as his retirement is not earlier than December 1, 2002.

Under Italian law, Mr. Piras is entitled to a severance payment at the time his employment terminates for any reason, including retirement or voluntary separation. The Company is required to regularly accrue for this severance payment an amount equal to Mr. Piras’ annual base salary and annual cash bonus divided by 13.5. At the end of fiscal year 2000, approximately $222,893 was accrued for purposes of this severance benefit for Mr. Piras.

Change in Control Agreements

The Board of Directors has approved Change in Control Agreements (“Agreements”) between the Company and the five executive officers named in the Summary Compensation Table on page 6 which provide for the payment of specified compensation and benefits upon certain terminations of their employment following a change in control of the Company. A change in control of the Company is defined in each Agreement to occur if (a) any individual or group becomes the beneficial owner of 30% or more of the combined voting power of the Company’s outstanding securities, (b) ”continuing directors” (defined as the directors of the Company as of the date of the Agreement and any successor to any such directors who was nominated by a majority of the directors in office at the time of his nomination or selection and who is not associated in any way with an individual or group who is a beneficial owner of more than 10% of the combined voting power of the Company’s outstanding securities) cease to constitute at least a majority of the Board of Directors, (c) there occurs a reorganization, merger, consolidation or other corporate transaction involving the Company in which the Company’s stockholders do not own more than 50% of the combined voting power of the Company or other corporation resulting from such transaction, or (d) all or substantially all of the Company’s assets are sold, liquidated or distributed. In their respective Agreements, the named executive officers agreed to not voluntarily leave the Company’s employ during a tender or exchange offer, proxy solicitation in opposition to the Board of Directors or other effort by any party to effect a change in control of the Company. This is intended to assure that management will continue to act in the interest of the stockholders rather than be affected by personal uncertainties during any attempt to effect a change in control of the Company, and to enhance the Company’s ability to attract and retain executives.

Each Agreement provides that if within 18 months after a change in control the Company terminates the executive’s employment other than by reason of his death, disability, retirement or for cause, or the executive officer terminates his employment for any “good reason,” the executive will receive a lump sum severance payment equal to 2.99 (in the case of Mr. Lauer) or 2.5 (in the case of Messrs. McClammy, Homan, Rogerson and Piras) times the executive’s annual base salary and highest annual and multi-year bonuses paid to him in any of the three years ending prior to the date of termination. “Good reason” is defined in each Agreement as any of the following that occurs after a change in control of the Company: certain reductions in compensation; certain material changes in employee benefits and perquisites; a change in the site of employment; the Company’s failure to obtain the written assumption by its successor of the obligations set forth in the Agreement; attempted termination of employment on grounds insufficient to constitute a basis of termination for cause under the terms of the Agreement; or the Company’s failure to promptly make any payment required under the terms of the Agreement in the event of a dispute relating to employment termination. In the case of Mr. Lauer, “good reason” as defined also to exist if he is not appointed as Chief Executive Officer of the combined or acquiring entity. In the case of Messrs. McClammy and Homan, “good reason” is defined also to exist if they are not given an “equivalent position” as defined in their Agreements. In the case of Messrs. Rogerson and Piras, “good reason” is defined also to exist if there is a material change in duties and a material reduction in authority and responsibility.

Each Agreement provides that upon termination or resignation occurring under the circumstances described above, the executive officer will receive a continuation of all insurance and other benefits on the same terms as if he remained an employee (or equivalent benefits will be provided) until the earlier to occur of commencement of substantially equivalent full-time employment with a new employer or 24 months after the date of termination of employment with the Company. Each Agreement also provides that all stock options granted by the Company become exercisable in full according to their terms, and that restricted stock (if any) be released from all restrictions. Each Agreement further provides that in the event that any payments and benefits received by the executive officer from the Company subject that person to an excise tax pursuant to Section 4999 of the Internal Revenue Code of 1986, as amended, the executive officer will be entitled to receive an additional payment so as to place the executive officer in the same after-tax economic position as if such excise tax had not been imposed.

REPORT OF THE COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORS

ON EXECUTIVE COMPENSATION

The Compensation Committee of the Board of Directors is responsible for determining compensation of the Company’s executive officers. The Compensation Committee is comprised of directors D. E. Mundell (Chairman), John G. McDonald, Wayne R. Moon and Elizabeth E. Tallett. Each of these non-employee directors qualifies as an outside director under Section 162(m) of the Internal Revenue Code .

Philosophy and Overview. The Compensation Committee’s general philosophy is that executive officer compensation should promote stockholder returns by linking compensation with an appropriate balance of near- and long-term objectives and strategies; be competitive within the Company’s industry and community; and attract, retain, motivate and reward individuals with the experience and skills necessary to promote the Company’s success.

Consistent with these objectives, the Compensation Committee developed its current executive compensation programs in the context of the Company becoming a separate, publicly-traded company in April 1999. The Compensation Committee retained an executive compensation consultant which prepared a comprehensive analysis of total direct compensation and its individual components relative to competitive market data for each of the Company’s new executive officer positions. Market data was derived from published surveys of electronics, technology and/or general industrial companies, as well as a more focused survey of eleven companies in related industries, of similar size or in the same geographic area. The report included competitive market data on incentive compensation practices, such as plan types, plan features and performance measures.

After considering all of the foregoing, the Compensation Committee developed an executive compensation program in fiscal year 1999 that consisted of three basic elements: base salary; near-term incentives in the form of annual cash bonuses; and long-term incentives in the form of nonqualified stock options. This program was maintained in fiscal year 2000.

Base Salaries. Annual base salaries are designed primarily to attract and retain executives, and are intended to contribute less to total compensation than incentive-based compensation. After consideration of competitive market data provided by the Compensation Committee’s compensation consultant, the Compensation Committee determined for fiscal year 2000 to not increase the salary of any of the Company’s executive officers from the starting salary set by the Compensation Committee in fiscal year 1999. The Committee did, however, increase the salaries of one individual who was promoted to an executive officer position during the fiscal year, which increase was based on competitive market data and reflected his increased responsibilities.

Cash Bonuses. Cash bonuses are intended to motivate executive officers to achieve pre-determined near-term financial objectives consistent with the Company’s overall business strategies. For fiscal year 2000, the Compensation Committee determined that cash bonuses under the Company’s Management Incentive Plan (the “MIP”) should be based on Company or business unit performance during the fiscal year against pre-determined objectives for earnings before interest and taxes (“EBIT”), return on sales (“ROS”) and operating cash flow (“Cash Flow”), the targets for which were determined by the Compensation Committee after consideration of historical and budgeted EBIT, ROS and Cash Flow.

Under the MIP payout formula for fiscal year 2000, the bonus to the CEO could have ranged from zero to 200% of his annual base salary, depending on the EBIT, ROS and Cash Flow achieved. In the case of other executive officers, bonuses could have ranged from zero to 150% of annual base salary, depending on the EBIT, ROS and Cash Flow achieved and the pre-determined participation level for that executive officer. Each executive officer’s participation level was determined by the Compensation Committee after consideration of the executive officer’s relative position and responsibilities, base salary and potential award, as well as the competitive market data included in the 1999 report prepared by the Compensation Committee’s compensation consultant (although the Compensation Committee did not place any particular weight on any particular factor or data).

Stock Options. Stock options are intended to provide longer-term incentives for executive officers to promote stockholder value. Nonqualified stock options granted under the Company’s Omnibus Stock Plan have an exercise price equal to the market price of the Company’s stock on the grant date, vest in equal installments over three years assuming continued employment and expire at the end of ten years. Stock options therefore compensate executive officers only if the Company’s stock price increases after the date of grant and the executive officer remains employed for the periods required for the stock option to become exercisable. Accordingly, the Compensation Committee believes that stock options are the best method of linking executive compensation to stockholder returns.

Executive officer grants in fiscal year 2000 were determined by the Compensation Committee after consideration of each executive officer’s relative position and responsibilities and total cash compensation, as well as the competitive market data included in the 1999 report prepared by the Compensation Committee’s compensation consultant (although the Compensation Committee did not place any particular weight on any particular factor or data). The Compensation Committee then determined an appropriate long-term incentive multiple of base salary for each executive officer, and using an option pricing value for the Company’s stock determined how many option shares would deliver that targeted long-term incentive amount.

Other Compensation. In order to attract and retain talented executive officers, the Compensation Committee has also approved arrangements providing executive officers with certain perquisites, such as use of a Company-leased automobile, reimbursement for taxes on income imputed for their personal use of that automobile, reimbursement for tax planning and tax return preparation and financial counseling services, and reimbursement for an annual medical examination. In addition, in order to compensate for retirement contributions that could not be made to executive officers’ qualified retirement plan accounts due to Internal Revenue Code limitations, the Compensation Committee approved the Supplemental Retirement Plan under which the Company makes unfunded supplemental retirement contributions.

Tax Deductibility of Executive Compensation. Section 162(m) of the Internal Revenue Code generally provides that publicly-held corporations may not deduct in any taxable year certain compensation in excess of $1,000,000 paid to the chief executive officer and the next four most highly compensated executive officers. In February 1999, the Company’s Omnibus Stock Plan and Management Incentive Plan were approved by the stockholders of Varian Associates, Inc. in order for awards under those Plans to be eligible for continued tax deductibility. However, the Compensation Committee considers one of its primary responsibilities to be structuring a compensation program that will attract, retain and reward executives with the experience, skills and proven ability to maximize stockholder returns. Accordingly, the Compensation Committee believes that the Company’s interests are best served in some circumstances by providing compensation (such as salary and perquisites), or adjusting participation in or payouts under the Management Incentive Plan, which might result in such compensation being subject to the tax deductibility limitation of Section 162(m). The Company did not pay any compensation in fiscal year 2000 that was not deductible under Section 162(m).

CEO Compensation. The Compensation Committee followed the same philosophy and programs described above in determining fiscal year 2000 compensation for Mr. Lauer, the Company’s President and Chief Executive Officer. The Compensation Committee determined not to change Mr. Lauer’s annual base salary in fiscal year 2000 from his starting salary in fiscal year 1999, based on competitive market data provided by the Compensation Committee’s compensation consultant, which data showed that Mr. Lauer’s salary fell between the 50th and 75th percentiles of the market data.

Mr. Lauer participated in the MIP as described above for fiscal year 2000. Mr. Lauer’s targeted cash bonus for that period was determined by the Compensation Committee after consideration of the consultant’s report and other factors described above. Fiscal year 2000 EBIT, ROS and Cash Flow relative to the pre-determined targets and payout formula resulted in Mr. Lauer earning a cash bonus of $1,091,978.

The Compensation Committee also approved granting to Mr. Lauer a 182,000-share nonqualified stock option in fiscal year 2000. That option was granted with an exercise price equal to the closing market price of the Company’s stock on the grant date, will vest in equal installments over three years and has a term of ten years. The number of option shares granted was determined in accordance with the considerations, consultant’s report and methodology described above.

| D. E. Mundell (Chairman) | Wayne R. Moon | ||

| John G. McDonald | Elizabeth E. Tallett |

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The Board of Directors adopted a formal written Charter for its Audit Committee upon formation of that Committee in February 1999, just prior to the “spin-off” of the Company from Varian Associates, Inc. Following issuance of the new Nasdaq Stock Market rules and Securities and Exchange Commission regulations regarding audit committees, the Board reviewed and revised the Audit Committee’ s Charter, more to add specificity than to change the Audit Committee’s already established responsibilities and practices. The Audit Committee’s current Charter is attached as Exhibit A to this Proxy Statement.

In fulfilling its responsibilities as set forth in its Charter, the Audit Committee reviewed and discussed with management the Company’s audited financial statements for fiscal year 2000.

The Audit Committee discussed with the Company’s independent accountant, PricewaterhouseCoopers LLC (“PwC”), the matters required to be discussed by the Codification of Statements on Auditing Standards 61, Communication with Audit Committees.

The Audit Committee received the written disclosures and the letter from the Company’s independent accountant, PwC, required by Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees, and discussed with PwC its independence from the Company.

Based on these reviews and discussions and in reliance thereon, the Audit Committee recommended to the Board of Directors that the audited financial statements for the Company be included in the Company’s Annual Report on Form 10-K for the fiscal year ended September 29, 2000.

| John G. McDonald (Chairman) | D. E. Mundell | ||

| Wayne R. Moon | Elizabeth E. Tallett |

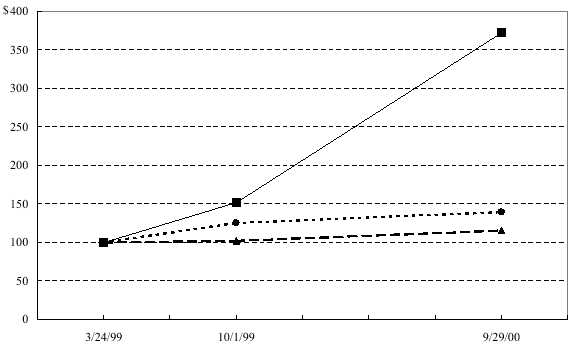

COMPARISON OF CUMULATIVE TOTAL RETURN AMONG THE COMPANY,

THE DOW JONES TECHNOLOGY SECTOR INDEX AND

THE STANDARD & POOR’S 500 COMPOSITE INDEX

The following graph compares the cumulative total return of the Company’s common stock with the Dow Jones Technology Sector Index and the Standard & Poor’s 500 Composite Index. The comparison covers the period from the commencement of trading in the Company’s stock on March 24, 1999 through the end of the Company’s fiscal year 2000 on September 29, 2000. The graph assumes that the value of the investment in the Company’s common stock and in each index on March 24, 1999 was $100, and assumes reinvestment of dividends (although the Company has paid no dividends). Research Data Group, Inc. is the source of the following data. The comparisons in this graph are not intended to represent a forecast of possible future performance of the Company’s common stock or stockholder returns.

| March 24, 1999 |

October 1, 1999 |

September 29, 2000 |

||||||||

| Varian, Inc. | $ | 100 | $ | 152 | $ | 372 | ||||

| Dow Jones Technology Sector Index | 100 | 125 | 139 | |||||||

| Standard & Poor’s 500 Composite Index | 100 | 102 | 115 | |||||||

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires that the Company’s directors and executive officers, and persons who own more than ten percent of the Company’s securities, file reports of ownership and changes in ownership of Company securities with the Securities and Exchange Commission. Based solely on the Company’s review of the reporting forms and written representations received by it from such directors and executive officers, the Company believes that through September 29, 2000, all reporting requirements applicable to directors, executive officers and ten percent stockholders were timely satisfied.

AUDIT COMMITTEE CHARTER AND INDEPENDENCE

Attached as Exhibit A to this Proxy Statement is the current Charter of the Audit Committee of the Board of Directors as adopted by the Board of Directors. Each member of the Audit Committee qualifies as independent under the rules of The Nasdaq Stock Market, Inc.

INDEPENDENT PUBLIC ACCOUNTANTS

PricewaterhouseCoopers LLP served as the Company’s independent public accountants for fiscal year 2000, and upon recommendation of the Audit Committee of the Board of Directors is currently serving as the Company’s independent public accountants. A representative of PricewaterhouseCoopers LLP is expected to attend the Annual Meeting, and will have an opportunity to make a statement if he or she so desires and to respond to appropriate questions.

STOCKHOLDER PROPOSALS

Any stockholder who wishes to present a proposal for action at the Company’s Annual Meeting of Stockholders in 2002, and who wishes to have it set forth in the Proxy Statement and identified in the form of proxy prepared by the Company for that meeting, must notify the Company’s Secretary not later than August 24, 2001 at the Company’s address set forth on the first page of this Proxy Statement. Such a proposal must be in the form required under the rules and regulations of the Securities and Exchange Commission.

The Company’s Bylaws contain specific procedural requirements regarding a stockholder’s ability to nominate a director or submit a proposal to be considered at a meeting of stockholders. If you would like a copy of the procedures contained in the Bylaws, contact the Company’s Secretary, A. W. Homan, at Varian, Inc., 3120 Hansen Way, Palo Alto, California 94304-1030.

| By Order of the Board of Directors | |||

| |||

| A. W. Homan | |||

| Secretary |

December 22, 2000

Palo Alto, California

Exhibit A

CHARTER OF THE AUDIT COMMITTEE

OF THE BOARD OF DIRECTORS

OF VARIAN, INC.

(as amended and restated on April 28, 2000)

I. Purpose

The Audit Committee (the “Committee”) of the Board of Directors of Varian, Inc. (the “Company”) shall assist the Board of Directors in monitoring and overseeing (1) the independence and performance of the Company’s internal auditors and independent accountants, (2) the integrity of the Company’s financial statements, and (3) the Company’s compliance with legal and regulatory requirements.

II. Composition and Meetings

The Committee shall have a minimum of three members who shall be appointed by the Board of Directors, which shall also appoint the Committee’s Chairman. Committee members shall meet the independence and experience requirements of The Nasdaq Stock Market, Inc.

The Committee shall meet at least once each fiscal quarter, or more frequently if necessary to fulfill its responsibilities. Special meetings may be called by the Chairman of the Committee or the Chairman of the Board as necessary or appropriate to address unusual issues which cannot be deferred to the next regularly scheduled meeting.

Except as the Committee may otherwise decide in its discretion, Committee meetings shall be attended by the Company’s Chief Financial Officer, Controller, Treasurer and General Counsel and a representative of the Company’s independent accountants. The Committee may request that any other officer or employee of the Company or the Company’s outside legal counsel or independent accountants attend a Committee meeting or meet with any member of the Committee or its consultants. The Committee may meet with any person in executive session.

The Committees shall have the authority to retain, at the Company’s expense, special legal, accounting or other consultants to advise the Committee.

III. Responsibilities

A. Independent Accountants. The Committee shall:

B. Internal Audit. The Committee shall:

C. Financial Reporting. The Committee shall:

D. Compliance with Laws and Ethical Conduct. The Committee shall:

E. Other Responsibilities. The Committee shall:

|

P

R

O

X

Y |

VARIAN, INC.

PROXY FOR ANNUAL MEETING OF STOCKHOLDERS-FEBRUARY 8,

2001 THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned stockholder of Varian, Inc. hereby constitutes and appoints Allen J. Lauer and Arthur W. Homan, and each of them, proxies and attorneys-in-fact of the undersigned, with full power of substitution, to vote all of the shares of Common Stock of Varian, Inc. standing in the name of the undersigned, at the Annual Meeting of Stockholders of Varian, Inc. to be held at the Sheraton Palo Alto Hotel, 625 El Camino Real, Palo Alto, California, on February 8, 2001, at 2:00 p.m., local time, and at any adjournment or postponement thereof. Unless a contrary instruction is provided, this Proxy will be voted FOR the nominees for Class II directors listed in Proposal 1 and in accordance with the judgment of the proxies as to the best interests of the Company on such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. If specific instructions are provided below, this Proxy will be voted in accordance therewith. |

|

|

|

||

|

|

||

|

(If you have written in the above space, please mark the corresponding box on the reverse side of this card) |

||

|

PLEASE COMPLETE, DATE, SIGN AND MAIL THIS PROXY IN THE

ENCLOSED |

||

|

(Continued and to be Signed on Reverse Side) |

||

|

SEE REVERSE SIDE |

FOLD AND DETACH HERE

|

[LOCATER MAP OMITTED] |

[SHERATON LOGO] Locater Map The Sheraton Palo Alto Hotel is easily accessible from Highway 101 and from Interstate 280.

|

|

625 EL CAMINO REAL

• PALO ALTO, CA 94301 |

|

[X] |

Please mark your |

3855 |

The Board of Directors Recommends a Vote "FOR" Proposal 1.

|

FOR |

WITHHELD |

||||

|

1. Election of Directors |

[ ] |

[ ] |

|||

| Nominees: | John G. McDonald |

| Wayne R. Moon |

Instructions/Change of Address [ ]

| Please sign exactly as name appears on your stock certificate. If the stock is registered in the names of two or more persons, each should sign. Executors, administrators, trustees, guardians, attorneys and corporate officers should so indicate and insert their titles. | ||

|

|

||

|

|

||

| SIGNATURE(S) | DATE | |

DETACH AND RETURN PROXY CARD

VARIAN, INC.

Annual Meeting of Stockholders

February 8, 2001

2:00 p.m.

Sheraton Palo Alto Hotel

625 El Camino Real

Palo Alto, California

(Map on Reverse Side)

|

|