|

|

|

|

|

Previous: PLANET RESOURCES INC /DE/, SB-2/A, EX-27, 2000-12-21 |

Next: IJC VENTURES CORP, 8-K, 2000-12-21 |

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrant /x/ |

|||

| Filed by a Party other than the Registrant / / | |||

Check the appropriate box: |

|||

| /x/ | Preliminary Proxy Statement | ||

| / / | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

| / / | Definitive Proxy Statement | ||

| / / | Definitive Additional Materials | ||

| / / | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12 |

||

ARIBA, INC. |

||||

(Name of Registrant as Specified In Its Charter) |

||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| /x/ | No fee required. | |||

| / / | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

| / / | Fee paid previously with preliminary materials. | |||

| / / | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

|

||||

ARIBA, INC.

1565 Charleston Road

Mountain View, California 94043

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of Ariba, Inc., which will be held in the Crystal Springs Ballroom of the San Mateo Marriott located at 1770 S. Amphlett Boulevard, San Mateo, California, on Monday, February 26, 2001, at 8:00 a.m.

Details of the business to be conducted at the Annual Meeting are given in the attached Proxy Statement and Notice of Annual Meeting of Stockholders.

It is important that your shares be represented and voted at the meeting. WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE COMPLETE, SIGN, DATE AND PROMPTLY RETURN THE ACCOMPANYING PROXY IN THE ENCLOSED POSTAGE-PAID ENVELOPE. Returning the proxy does NOT deprive you of your right to attend the Annual Meeting. If you decide to attend the Annual Meeting and wish to change your proxy vote, you may do so automatically by voting in person at the meeting.

On behalf of the Board of Directors, I would like to express our appreciation for your continued interest in the affairs of Ariba. We look forward to seeing you at the Annual Meeting.

Sincerely, |

||

|

||

KEITH J. KRACH Chairman of the Board and Chief Executive Officer |

Mountain View, California

January 22, 2001

ARIBA, INC.

1565 Charleston Road

Mountain View, California 94043

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held February 26, 2001

To the Stockholders:

The annual meeting of stockholders (the "Annual Meeting") of Ariba, Inc. (the "Company") will be held in the Crystal Springs Ballroom of the San Mateo Marriott located at 1770 S. Amphlett Boulevard, San Mateo, California, on Monday, February 26, 2001, at 8:00 a.m. for the following purposes:

The foregoing items of business are more fully described in the attached Proxy Statement. Only stockholders of record at the close of business on January 16, 2001, the record date, are entitled to notice of, and to vote at, the Annual Meeting and at any adjournments or postponements thereof. A list of such stockholders will be available for inspection at the Company's headquarters located at 1565 Charleston Road, Mountain View, California, during ordinary business hours for the ten day period prior to the Annual Meeting.

By Order Of The Board Of Directors |

||

Craig M. Schmitz Secretary |

Mountain View, California

January 22, 2001

IMPORTANT

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE COMPLETE, SIGN, DATE AND PROMPTLY RETURN THE ACCOMPANYING PROXY IN THE ENCLOSED POSTAGE-PAID ENVELOPE. YOU MAY REVOKE YOUR

PROXY AT ANY TIME PRIOR TO THE ANNUAL MEETING. IF YOU DECIDE TO ATTEND THE ANNUAL MEETING AND WISH TO CHANGE YOUR PROXY VOTE, YOU MAY DO SO AUTOMATICALLY BY VOTING IN PERSON AT THE

MEETING.

ARIBA, INC.

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

To be held February 26, 2001

These proxy materials are furnished in connection with the solicitation of proxies by the Board of Directors of Ariba, Inc., a Delaware corporation (the "Company"), for the Annual Meeting of Stockholders (the "Annual Meeting") to be held in the Crystal Springs Ballroom of the San Mateo Marriott located at 1770 S. Amphlett Boulevard, San Mateo, California, on Monday, February 26, 2001, at 8:00 a.m., and at any adjournment or postponement of the Annual Meeting. These proxy materials were first mailed to stockholders on or about January 22, 2001.

The specific proposals to be considered and acted upon at the Annual Meeting are summarized in the accompanying Notice of Annual Meeting of Stockholders. Each proposal is described in more detail in this Proxy Statement.

VOTING RIGHTS AND SOLICITATION OF PROXIES

The Company's Common Stock (the "Common Stock") is the only type of security entitled to vote at the Annual Meeting. On January 16, 2001, the record date for determination of stockholders entitled to vote at the Annual Meeting, there were shares of Common Stock outstanding. Each stockholder of record on January 16, 2001 is entitled to one vote for each share of Common Stock held by such stockholder on January 16, 2001. Shares of Common Stock may not be voted cumulatively. All votes will be tabulated by the inspector of election appointed for the meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes.

Quorum Required

The Company's bylaws provide that the holders of a majority of the Common Stock issued and outstanding and entitled to vote generally in the election of directors, present in person or represented by proxy, shall constitute a quorum for the transaction of business at the Annual Meeting. Abstentions and broker non-votes will be counted as present for the purpose of determining the presence of a quorum.

Votes Required

Proposal 1. Directors are elected by a plurality of the affirmative votes cast by those shares present in person, or represented by proxy, and entitled to vote at the Annual Meeting. The two (2) nominees for director receiving the highest number of affirmative votes will be elected. Abstentions and broker non-votes will not be counted toward a nominee's total. Stockholders may not cumulate votes in the election of directors.

Proposal 2. Approval of the amendment to the Company's Amended and Restated Certificate of Incorporation (the "Certificate of Incorporation") requires the affirmative vote of holders of at least sixty-six and two-thirds percent (662/3%) of the shares of the Common Stock issued and outstanding and entitled to vote at the Annual Meeting. Abstentions and broker non-votes are not affirmative votes and, therefore, will have the same effect as votes against the proposal.

Proposal 3. Ratification of the appointment of KPMG LLP as the Company's independent public accountants for the fiscal year ending September 30, 2001 requires the affirmative vote of a majority of

those shares present in person, or represented by proxy, and cast either affirmatively or negatively at the Annual Meeting. Abstentions and broker non-votes will not be counted as having been voted on the proposal.

Proposal 4. Approval of the amendment to the Company's 1999 Equity Incentive Plan requires the affirmative vote of a majority of those shares present in person, or represented by proxy, and cast either affirmatively or negatively at the Annual Meeting. Abstentions are not affirmative votes and, therefore, will have the same effect as votes against the proposal. Broker non-votes will not be treated as entitled to vote on the matter and thus will not affect the outcome of voting on the proposal.

Proxies

Whether or not you are able to attend the Annual Meeting, you are urged to complete and return the enclosed proxy, which is solicited by the Company's Board of Directors (the "Board of Directors") and which will be voted as you direct on your proxy when properly completed. In the event no directions are specified, such proxies will be voted FOR the nominees for election to the Board of Directors (as set forth in Proposal No. 1), FOR Proposal Nos. 2, 3 and 4 and in the discretion of the proxy holders as to other matters that may properly come before the Annual Meeting. You may also revoke or change your proxy at any time before the Annual Meeting. To do this, send a written notice of revocation or another signed proxy with a later date to the Secretary of the Company at the Company's principal executive offices before the beginning of the Annual Meeting. You may also automatically revoke your proxy by attending the Annual Meeting and voting in person. All shares represented by a valid proxy received prior to the Annual Meeting will be voted.

Solicitation of Proxies

The Company will bear the entire cost of solicitation, including the preparation, assembly, printing, and mailing of this Proxy Statement, the proxy, and any additional soliciting material furnished to stockholders. Copies of solicitation material will be furnished to brokerage houses, fiduciaries, and custodians holding shares in their names that are beneficially owned by others so that they may forward this solicitation material to such beneficial owners. In addition, the Company may reimburse such persons for their costs of forwarding the solicitation material to such beneficial owners. The original solicitation of proxies by mail may be supplemented by solicitation by telephone, telegram, or other means by directors, officers, employees or agents of the Company. No additional compensation will be paid to these individuals for any such services. The Company has also retained Corporate Investor Communications to assist in the solicitation of proxies. Corporate Investor Communications will receive a fee for such services of approximately $6,000 including out-of-pocket expenses, which will be paid by the Company. Except as described above, the Company does not presently intend to solicit proxies other than by mail.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The Certificate of Incorporation provides for a classified Board of Directors, with the terms of office of each class of directors ending in successive years. The Company currently has authorized six directors with each class of directors consisting of two directors. At the Annual Meeting, two directors are to be elected to serve until the Company's 2004 annual meeting of stockholders of the Company or until their successors are elected and qualified. The directors who are being nominated for election to the Board of Directors (the "Nominees"), their ages as of December 31, 2000, their positions and offices held with the Company and certain biographical information are set forth below. The proxy holders intend to vote all proxies received by them in the accompanying form FOR the Nominees listed below unless otherwise instructed. In the event any Nominee is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee who may be designated by the present Board of Directors to fill the vacancy. As of the date of this Proxy Statement, the Board of Directors is not aware of

2

any Nominee who is unable or will decline to serve as a director. The two (2) Nominees receiving the highest number of affirmative votes of the shares entitled to vote at the Annual Meeting will be elected directors of the Company. Proxies cannot be voted for more than two (2) people.

| Nominees |

Age |

Year Term Expires |

Positions and Offices Held with the Company |

|||

|---|---|---|---|---|---|---|

| Paul Hegarty | 36 | 2001 | Director | |||

| John B. Mumford(1) | 57 | 2001 | Director |

Paul Hegarty, a co-founder of the Company, served as Vice President of Engineering from our inception in September 1996 to August 1997, and as Chief Technical Officer from our inception to October 1998 and has served as a director since October 1998. From June 1996 to September 1996, Mr. Hegarty served as an Entrepreneur in Residence at Benchmark Capital. From February 1988 to May 1996, Mr. Hegarty served in various engineering capacities at NeXT Software, Inc., including Vice President of Engineering. Mr. Hegarty holds Bachelor of Science and Master of Science degrees in Electrical Engineering from Stanford University.

John B. Mumford, has served as a director of the Company since our inception in September 1996. Mr. Mumford has served as Managing Partner of Crosspoint Venture Partners since 1970. Mr. Mumford currently serves as a director of a number of private companies, primarily in the information technology area. Mr. Mumford is a co-founder and director of Hello Direct, Inc., a public company, and served as a director of Office Depot, a public company, from its formation in 1986 to April 1997. Mr. Mumford was also a founding director of Inmac Corp., a public company, and served in this capacity until its merger with Micro Warehouse in 1996. Mr. Mumford holds a Bachelor of Science degree in Accounting from Arizona State University and a Master of Business Administration degree in Operations Research from the Stanford Graduate School of Business.

Set forth below is information regarding each of the continuing directors of the Company, including his age as of December 31, 2000, the period during which he has served as a director, and information furnished by him as to principal occupations and directorships held by him in corporations whose shares are publicly registered.

Continuing Director—Term Ending in 2002

Hatim A. Tyabji, age 55, has served as a director of the Company since January 1998. Mr. Tyabji has served as Chairman and Chief Executive Officer of Saraide.com, a privately held company, since September 1998. Prior to joining Saraide, he served as President and Chief Executive Officer from 1986 to 1998 and as Chairman of the Board from 1992 to 1998 of VeriFone, Inc., a wholly-owned subsidiary of Hewlett-Packard. Prior to joining VeriFone, Mr. Tyabji served as President of the Information Systems Products and Technologies Group of Unisys Corporation, formerly known as Sperry Corporation. Mr. Tyabji holds a Bachelor of Science degree in Electrical Engineering from the College of Engineering in Poona, India and a Master of Science degree in Electrical Engineering from the State University of New York, Buffalo. He also has a Master of Business Administration in International Business from Syracuse University and is a graduate of the Stanford University Executive Program.

Robert E. Knowling, age 44, has served as a director of the Company since July 2000. Mr. Knowling served as Chairman of the Board of Directors, President and Chief Executive Officer of Covad Communications Group, Inc. from 1998 until October 2000. Prior to joining Covad, he served as Executive Vice President of Operations and Technologies from October 1997 to July 1998 and as Vice President of Network Operations from March 1996 to September 1997 at US West Communications, Inc. Prior to joining US West, Mr. Knowling served as Vice President of Network Operations for Ameritech Corporation from November 1994 to March 1996. In addition to serving as a director of the Company, he is also a member of the board of directors of Hewlett-Packard Company, Broadmedia, Inc. and the Juvenile

3

Diabetes Foundation International. Mr. Knowling holds a Bachelor of Arts degree in Theology from Wabash College, and a Master of Business Administration from Northwestern University's Kellogg Graduate School of Business.

Continuing Directors—Term Ending in 2003

Keith J. Krach, age 43, a co-founder of the Company, has served as Chairman of the Board of Directors and Chief Executive Officer since our inception in September 1996. From March 1996 to September 1996, Mr. Krach served as an Entrepreneur in Residence at Benchmark Capital. From October 1988 to August 1995, Mr. Krach served as Chief Operating Officer of Rasna Corporation, a mechanical computer-aided design automation software company. Prior to joining Rasna, Mr. Krach held various positions with General Motors, including General Manager and Vice President of GMF Robotics. Mr. Krach holds a Bachelor of Science degree in Industrial Engineering from Purdue University and a Master of Business Administration from Harvard Business School.

Robert C. Kagle, age 45, has served as a director of the Company since our inception in September 1996. Mr. Kagle has been a Managing Member of the general partner of Benchmark Capital Partners, L.P since May 1995. Mr. Kagle also has been a General Partner of Technology Venture Investors since January 1984. Mr. Kagle currently serves as a director of eBay Inc. and E-Loan, publicly held companies, and is currently a director of the National Association of Venture Capitalists and a Trustee of Kettering University, formerly known as the General Motors Institute. Mr. Kagle holds a Bachelor of Science degree in Electrical and Mechanical Engineering from the General Motors Institute and a Master of Business Administration from the Stanford Graduate School of Business.

Board of Directors Meetings and Committees

During the fiscal year ended September 30, 2000, the Board of Directors held ten (10) meetings and acted by written consent in lieu of a meeting on four (4) occasions. For the fiscal year, each of the directors during the term of their tenure attended or participated in at least 75% of the aggregate of (i) the total number of meetings or actions by written consent of the Board of Directors and (ii) the total number of meetings held by all committees of the Board of Directors on which each such director served. The Board of Directors has three (3) standing committees: the Audit Committee; the Compensation Committee; and the Stock Option Committee.

Audit Committee. During the fiscal year ended September 30, 2000, the Audit Committee of the Board of Directors (the "Audit Committee") held two (2) meetings and did not act by written consent in lieu of a meeting. The Audit Committee reviews, acts on and reports to the Board of Directors with respect to various auditing and accounting matters, including the selection of the Company's accountants, the scope of the annual audits, fees to be paid to the Company's accountants, the performance of the Company's accountants and the accounting practices of the Company. The members of the Audit Committee are Messrs. Kagle and Mumford.

Compensation Committee. During the fiscal year ended September 30, 2000, the Compensation Committee of the Board of Directors (the "Compensation Committee") held one (1) meeting and acted by written consent in lieu of a meeting on six (6) occasions. The Compensation Committee reviews the performance of the executive officers of the Company, establishes compensation programs for the officers, and reviews the compensation programs for other key employees, including salary and cash bonus levels and option grants under the 1999 Equity Incentive Plan. The members of the Compensation Committee are Messrs. Kagle and Tyabji.

Stock Option Committee. The Stock Option Committee of the Board of Directors (the "Stock Option Committee"), which was established in June 1999, has the right to administer the Company's 1999 Equity Incentive Plan with respect to persons other than directors and officers of the Company, and with

4

respect to options to purchase no more than 60,000 shares. Options to purchase more than 60,000 shares must be approved by the Compensation Committee or the full Board of Directors. The Stock Option Committee acted by written consent in lieu of a meeting on fifty-two (52) occasions to authorize grants of stock options in the fiscal year ended September 30, 2000. The sole member of the Stock Option Committee is Mr. Krach.

Director Compensation

Except for grants of stock options, directors of the Company generally do not receive compensation for services provided as a director. The Company also does not pay compensation for committee participation or special assignments of the Board of Directors.

Non-employee directors are eligible for option grants pursuant to the provisions of the 1999 Directors' Stock Option Plan. Under the 1999 Directors' Stock Option Plan, as amended, each individual who first becomes a non-employee director after the date of the Company's initial public offering will be granted an option to purchase 25,000 shares on the date such individual joins the Board, provided such individual has not been in the prior employ of the Company. In addition, at each Annual Meeting, each individual who will continue serving as a director thereafter will receive an additional option grant to purchase 10,000 shares of Common Stock, whether or not such individual has been in the prior employ of the Company. The option price for each option grant under the 1999 Directors' Stock Option Plan will be equal to the fair market value per share of Common Stock on the automatic grant date. Each initial grant will become exercisable for fifty percent (50%) of the shares at the automatic grant date and the remaining fifty percent (50%) of the shares after twelve (12) months of Board service. Each annual option grant is fully exercisable at grant. On January 21, 1998, in connection with his election to the board of directors, Mr. Tyabji was granted from the 1996 Stock Plan an option to purchase 800,000 shares of Common Stock at an exercise price of $0.0938 per share, subject to a four-year vesting schedule. On January 27, 1999, Mr. Hegarty was granted from the 1996 Stock Plan an option to purchase 80,000 shares of Common Stock at an exercise price of $0.5938 per share, subject to a four-year vesting schedule. On July 26, 2000, in connection with his election to the board of directors, Mr. Knowling was granted an option to purchase 25,000 shares of Common Stock at an exercise price of $122.25 per share, subject to a two-year vesting schedule. Pursuant to the 1999 Directors' Stock Option Plan, each of Messrs. Hegarty, Kagle, Mumford and Tyabji were also granted options to purchase 10,000 shares of Common Stock on February 29, 2000. Pursuant to the 1999 Directors' Stock Option Plan, each of Messrs. Hegarty, Kagle, Mumford, Knowling and Tyabji will be granted options to purchase 10,000 shares of Common Stock on the date of the Annual Meeting. The preceeding option grant information has been adjusted for stock splits where applicable.

Directors are eligible to receive options and be issued shares of Common Stock directly under the 1999 Equity Incentive Plan and directors who are also employees of the Company are also eligible to participate in the Company's Employee Stock Purchase Plan (unless such employee owns 5% or more of the Company's outstanding shares) and, if an executive officer of the Company, the 1999 Executive Bonus Program.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" THE NOMINEES LISTED HEREIN.

PROPOSAL NO. 2

AMENDMENT TO THE COMPANY'S CERTIFICATE

OF INCORPORATION

The Board of Directors has determined that it is in the best interests of the Company and its stockholders to amend the Certificate of Incorporation to provide that the affirmative vote of a majority

5

rather than at least sixty-six and two-thirds percent (662/3%) of the voting power of all of the then outstanding shares of capital stock of the Company entitled to vote generally in the election of directors is required to amend or repeal Article IV of the Certificate of Incorporation. Accordingly, the Board of Directors has unanimously approved the proposed Certificate of Amendment to the Amended and Restated Certificate of Incorporation of the Company, in the form attached hereto as Exhibit A (the "Certificate of Amendment"), and hereby solicits the approval of the Company's stockholders of the Certificate of Amendment. If the stockholders approve the Certificate of Amendment, the Board of Directors currently intends to file the Certificate of Amendment with the Secretary of State of the State of Delaware as soon as practicable following such stockholder approval. If the Certificate of Amendment is not approved by the stockholders, the existing Certificate of Incorporation will continue in effect unless otherwise amended and approved by the stockholders.

As currently in effect, Article IX of the Certificate of Incorporation requires the affirmative vote of at least sixty-six and two-thirds percent (662/3%) of the voting power of all of the then outstanding shares of the capital stock of the Company entitled to vote generally for the election of directors to amend or repeal Article IV of the Certificate of Incorporation. Article IV (i) authorizes the capital stock of the Company and (ii) authorizes the Board of Directors, subject to certain limitations, to provide for the issuance of shares of the Company's Preferred Stock in series, to establish the number of shares of such series and to fix designations, powers, preferences and rights of such series and any qualifications, limitations or restrictions thereof. The Board of Directors proposes that Article IX of the Certificate of Incorporation be amended to reduce the vote required to amend or repeal provisions regarding Article IV of the Certificate of Incorporation from at least sixty-six and two-thirds percent (662/3%) to a majority of the voting power of all of the then outstanding shares of capital stock of the Company entitled to vote generally in the election of directors of the Company. The full text of the amendment to Article IX is set forth in the Certificate of Amendment attached as Exhibit A to this Proxy Statement.

The Board of Directors supports the proposal to amend Article IX to permit the amendment of Article IV upon the approval of the holders of a majority of the voting power of all of the then outstanding shares of capital stock of the Company entitled to vote generally in the election of directors. If Article IX of the Certificate of Incorporation is amended as proposed, a majority of all of the then outstanding shares of the capital stock of the Company will be sufficient to amend or repeal Article IX. The Board of Directors believes that if stockholders who own, in the aggregate, a majority of the voting power of the outstanding shares of the capital stock of the Company entitled to vote generally for the election of directors want to change the Company's authorized capital stock, they should be able to do so.

Possible Effects of the Proposed Amendment to the Certificate of Incorporation

This proposed amendment to Article IX would make it easier for the Company's stockholders to increase or decrease the Company's authorized capital stock. Currently, the holders of a minority of the total shares of the Company's capital stock outstanding and entitled to vote have a veto power over the increase or decrease of the Company's authorized capital stock.

In considering this proposal, stockholders should be aware that the provision in the current Article IX that requires a sixty-six and two-thirds percent (662/3%) stockholder vote to amend or repeal Article IV was initially implemented, along with other approval and amendment requirements in the Certificate of Incorporation, to protect against abusive or unfair tactics in unsolicited attempts to buy the Company. These provisions are intended to enhance the likelihood of continuity and stability in the composition of the Board of Directors and in the policies formulated by the Board of Directors and to discourage certain types of transactions that may involve an actual or threatened change of control of the Company. These provisions are designed to reduce the Company's vulnerability to an unsolicited acquisition proposal and to discourage certain tactics that may be used in proxy fights. If the amendment to Article IX is approved, the anti-takeover protections provided by a sixty-six and two-thirds percent (662/3%) stockholder vote to amend or repeal Article IV will be eliminated.

6

The current Board of Directors of the Company has unanimously determined after due consideration that requiring a supermajority to amend or repeal Article IV is no longer in the best interests of the Company or its stockholders. For example, this requirement may potentially impede the Company's growth and development by not allowing the Company to increase its authorized capital stock in order to pursue financing programs, acquisitions and other transactions necessary for the continued success of the Company. Further, the Delaware General Corporation Law requires only a simple majority vote of the outstanding stock entitled to vote and a simple majority vote of the outstanding stock of each class of stock entitled to vote as a class in order to amend a Certificate of Incorporation.

In the view of the current Board of Directors, the elimination of the supermajority requirement will not have a negative material effect on the anti-takeover protection afforded to the Company and its stockholders. The Company has in place other anti-takeover measures which the Board of Directors believes are sufficient to provide reasonable protection against unsolicited takeover attempts. For example, the Certificate of Incorporation provides that the Board of Directors is divided into three classes of directors, with each class serving a staggered three-year term. This classification system of electing directors may tend to discourage a third party from making a tender offer or otherwise attempting to obtain control of the Company and may maintain the incumbency of the Board of Directors, as the classification of the Board of Directors generally increases the difficulty of replacing a majority of the directors. The Certificate of Incorporation also provides that all stockholder actions must be effected at a duly called meeting and not by a consent in writing.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" THE APPROVAL OF THE AMENDMENT TO THE COMPANY'S CERTIFICATE OF INCORPORATION.

PROPOSAL NO. 3

RATIFICATION OF INDEPENDENT ACCOUNTANTS

The Company is asking the stockholders to ratify the appointment of KPMG LLP as the Company's independent public accountants for the fiscal year ending September 30, 2001. The affirmative vote of the holders of a majority of shares present or represented by proxy and voting at the Annual Meeting will be required to ratify the appointment of KPMG LLP.

In the event the stockholders fail to ratify the appointment, the Board of Directors will reconsider its selection. Even if the appointment is ratified, the Board of Directors, in its discretion, may direct the appointment of a different independent accounting firm at any time during the year if the Board of Directors feels that such a change would be in the best interest of the Company and its stockholders.

KPMG LLP has audited the Company's financial statements since 1997. Its representatives are expected to be present at the Annual Meeting, will have the opportunity to make a statement if they desire to do so, and will be available to respond to appropriate questions.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" THE RATIFICATION OF THE SELECTION OF KPMG LLP TO SERVE AS THE COMPANY'S INDEPENDENT PUBLIC ACCOUNTANTS FOR THE FISCAL YEAR ENDING SEPTEMBER 30, 2001.

PROPOSAL NO. 4

AMENDMENT OF THE 1999 EQUITY INCENTIVE PLAN

The stockholders are being asked to approve an amendment to the Ariba, Inc. 1999 Equity Incentive Plan (the "Incentive Plan"). The Board of Directors amended the Incentive Plan on December 19, 2000 to amend the existing provision automatically increasing the number of shares available for issuance under

7

the Incentive Plan. Prior to the amendment, the number of available shares automatically increases on the first day of each calendar year beginning in the year 2000 and ending in the year 2005 by a number of shares equal to the lesser of (i) five percent (5%) of the number of shares of Common Stock then outstanding or (ii) 8,000,000 shares of Common Stock. Under the amendment which is the subject matter of this Proposal No. 4, the automatic annual increase for the years 2001 through 2005 will be a number of shares equal to the lesser of (i) five percent (5%) of the number of shares of Common Stock then outstanding or (ii) 20,000,000 shares of Common Stock. The Board of Directors believes that equity awards under the Incentive Plan play an important role in the Company's efforts to attract, employ and retain employees, directors and consultants of outstanding ability.

The Company established the Incentive Plan on April 20, 1999 as a successor to its 1996 Stock Plan ("1996 Plan") to provide a means whereby eligible individuals may be given an opportunity to acquire shares of Common Stock and to benefit from increases in value of the Common Stock. The Incentive Plan was approved by the stockholders of the Company on June 11, 1999.

The principal terms and provisions of the Incentive Plan are summarized below. The summary, however, is not intended to be a complete description of all the terms of the Incentive Plan. A copy of the Incentive Plan will be furnished by the Company to any stockholder upon written request to the Corporate Secretary at the executive offices in Mountain View, California.

Structure. Four separate types of equity compensation may be issued under the Incentive Plan. First, stock options may be granted to eligible individuals under the Incentive Plan. Stock options give optionees the right to purchase shares of Common Stock at an exercise price determined at the time the option is granted. Second, direct issuances of restricted stock may be made to eligible persons under the Incentive Plan. Persons receiving direct issuances of restricted stock may purchase shares of Common Stock at a price not less than eighty-five percent (85%) of their fair market value at the time of their issuance or as a bonus for the performance of services. Third, stock appreciation rights ("SAR") may be granted to eligible persons under the Incentive Plan. A SAR allows eligible persons to benefit from increases in the value of the Common Stock, but does not provide any ownership interest in the Common Stock. Fourth, stock units may be issued to eligible persons under the Incentive Plan. Stock units allow persons to obtain shares of Common Stock without any cash consideration. In addition, the Incentive Plan permits the Board of Directors to implement a fee deferral program for the outside directors.

Administration. The Compensation Committee, which is comprised of two (2) or more outside members of the Board of Directors, administers the Incentive Plan. Committee members serve for such period of time as the Board of Directors may determine. The Incentive Plan may also be administered with respect to optionees who are not executive officers subject to the short-swing profit rules of the federal securities laws by the Board of Directors or a secondary committee comprised of one or more members of the Board of Directors.

The Compensation Committee (or Board of Directors or secondary committee to the extent acting as plan administrator) has full authority (subject to the express provisions of the Incentive Plan) to determine the eligible individuals who are to receive awards under the Incentive Plan, the number of shares to be covered by each granted option or other award, the date or dates on which the option is to become exercisable or the award is to vest, the maximum term for which the option or award is to remain outstanding, whether the granted option will be an incentive stock option that satisfies the requirements of Section 422 of the Internal Revenue Code (the "Code") or a non-statutory option not intended to meet such requirements and the remaining provisions of the option grant or award.

Eligibility. Employees (including officers), outside directors and consultants who render services to the Company or its subsidiary corporations (whether now existing or subsequently established) are eligible to receive awards under the Incentive Plan. However, only employees are eligible to receive incentive stock options.

8

As of December 19, 2000, approximately 1,970 persons (including five executive officers) were eligible to participate in the Incentive Plan.

Securities Subject to Incentive Plan. The number of shares of Common Stock that may be currently issued under the Incentive Plan shall not exceed 21,929,403 shares, which includes 8,000,000 shares added to the reserve on January 1, 2000 pursuant to the existing annual increase provision of the Incentive Plan. Assuming the approval of this Proposal No. 4, the number of available shares subject to the Incentive Plan shall automatically increase on the first day of each calendar year beginning with the year 2001 and ending in the year 2005 by an amount equal to the lesser of (i) five percent (5%) of the shares of Common Stock then outstanding or (ii) 20,000,000 shares.

No one person participating in the Incentive Plan may receive options for more than 8,000,000 shares of Common Stock per calendar year. However, for the calendar year in which a person first commences services, the limit shall be 10,000,000 shares.

Should an option or award under the Incentive Plan (including any options or shares incorporated from the 1996 Plan) expire or terminate for any reason prior to exercise in full or should restricted shares acquired upon exercise of an option or award be repurchased by the Company for any reason, the shares subject to the termination or repurchase will be available for subsequent options or awards under the Incentive Plan.

Option Grants

Price and Exercisability. The option exercise price per share in the case of an incentive stock option may not be less than one hundred percent (100%) of the fair market value of the Common Stock on the grant date and, in the case of a non-statutory option, eighty-five percent (85%) of the fair market value of the Common Stock on the grant date. Options become exercisable at such time or times and during such period as the Committee may determine and set forth in the instrument evidencing the option grant.

The exercise price may be paid in cash or in shares of Common Stock. Options may also be exercised through a same-day sale program, pursuant to which a designated brokerage firm is to effect the immediate sale of the shares purchased under the option and pay over to the Company, out of the sale proceeds on the settlement date, sufficient funds to cover the exercise price for the purchased shares plus all applicable withholding taxes. The Compensation Committee may also assist any optionee (including an officer or director) in the exercise of his or her outstanding options by (a) authorizing a Company loan to the optionee or (b) permitting the optionee to pay the exercise price in installments over a period of years. The terms and conditions of any such loan or installment payment will be established by the Compensation Committee in its sole discretion. The Compensation Committee has the discretionary authority to reprice options through the cancellation of those options and the grant of replacement options with an exercise price based on the fair market value of the option shares on the regrant date.

No optionee is to have any stockholder rights with respect to the option shares until the optionee has exercised the option, paid the exercise price and become a holder of record of the shares. Options are not assignable or transferable other than by will or the laws of descent and distribution, and during the optionee's lifetime, the option may be exercised only by the optionee.

Termination of Service. Any option held by the optionee at the time of cessation of service will not remain exercisable beyond the designated post-service exercise period, which generally is three months from termination date. Under no circumstances, however, may any option be exercised after the specified expiration date of the option term. Each such option will normally, during such limited period, be exercisable only to the extent of the number of shares of Common Stock in which the optionee is vested at the time of cessation of service. The Compensation Committee has complete discretion to extend the period following the optionee's cessation of service during which his or her outstanding options may be exercised and/or to accelerate the exercisability of such options in whole or in part. Such discretion may be

9

exercised at any time while the options remain outstanding, whether before or after the optionee's actual cessation of service.

The shares of Common Stock acquired upon the exercise of one or more options may be subject to repurchase by the Company at the original exercise price paid per share upon the optionee's cessation of service prior to vesting in such shares. The Committee has complete discretion in establishing the vesting schedule to be in effect for any unvested shares and may cancel the Company's outstanding repurchase rights with respect to those shares at any time, thereby accelerating the vesting of the shares subject to the canceled rights.

Incentive Stock Options. Incentive stock options may only be granted to individuals who are employees of the Company or its parent or subsidiary corporation. During any calendar year, the aggregate fair market value (determined as of the grant date(s)) of the Common Stock for which one or more options granted to any employee under the Incentive Plan (or any other equity plan of the Company or its parent or subsidiary corporations) may for the first time become exercisable as incentive stock options under Section 422 of the Code shall not exceed $100,000.

Awards of Restricted Stock

Restricted stock may be sold at a price per share not less than eighty-five percent (85%) of the fair market value of the Common Stock on the date of issuance, payable in cash or through a promissory note payable to the Company. Shares may also be issued solely as a bonus for past services.

The issued shares may either be immediately vested upon issuance or subject to a vesting schedule tied to the performance of service or the attainment of performance goals. The Compensation Committee will, however, have the discretionary authority at any time to accelerate the vesting of any and all unvested shares outstanding under the Incentive Plan.

Stock Appreciation Rights

One or more eligible individuals may, at the discretion of the Compensation Committee, be granted stock appreciation rights either in tandem with or independent of their option grants under the Incentive Plan. Upon exercise of an independent stock appreciation right, the individual will be entitled to a cash distribution from the Company in an amount per share equal to the excess of (i) the fair market value per share of Common Stock on the date of exercise over (ii) the exercise or base price. Tandem stock appreciation rights provide the holders with the right to surrender their options for an appreciation distribution from the Company equal in amount to the excess of (i) the fair market value of the vested shares of Common Stock subject to the surrendered option on the date of exercise over (ii) the aggregate exercise price payable for such shares. An appreciation distribution may, at the discretion of the Compensation Committee, be made in cash or in shares of Common Stock.

Awards of Stock Units

Stock units may be awarded for no cash consideration. Stock units may also be granted in consideration of a reduction in the recipient's other compensation or in consideration of services rendered. Each award of stock units may or may not be subject to vesting, and vesting, if any, shall occur upon satisfaction of the conditions specified by the Compensation Committee. Settlement of vested stock units may be made in the form of cash, shares of Common Stock or a combination of both.

General Provisions

Acceleration of Options/Termination of Repurchase Rights. Upon the occurrence of a "Change in Control" (as defined below) each outstanding option or award under the Incentive Plan will, immediately prior to the effective date of the Change in Control, become fully exercisable for all of the shares at the time subject to such option. However, an outstanding option or award shall not accelerate if, and to the

10

extent such option or award is, in connection with the Change in Control, either to be assumed by the successor corporation (or parent) or to be replaced with a comparable option or award to purchase shares of the capital stock of the successor corporation (or parent). Immediately following the consummation of the Change in Control, all outstanding options will terminate and cease to be exercisable, except to the extent assumed by the successor corporation.

Any options or awards that are assumed or replaced in the Change in Control by the surviving corporation will accelerate (and any of the Company's outstanding repurchase rights that do not otherwise terminate at the time of the Change in Control shall automatically terminate and the shares of Common Stock subject to those terminated rights shall immediately vest) as follows: (i) if the Change in Control occurs within twelve (12) months of the date the optionee or participant commenced service with the Company, the optionee or participant will vest in a number of shares as if he or she provided an additional twelve (12) months of service or (ii) if the Change in Control occurs more than twelve (12) months after the date the optionee or participant commenced service with the Company, the optionee or participant will vest in a number of shares equal to the lesser of fifty percent (50%) of the remaining unvested shares or the excess of seventy-five percent (75%) of the total number of original shares over the number of shares to which the option or award has already become vested.

In addition, if the options or awards are assumed or replaced in the Change in Control and the optionee or participant is involuntarily terminated by the surviving company following the effective date of such Change in Control, all remaining unvested options or awards shall become fully vested (and any of the Company's outstanding repurchase rights shall automatically terminate and the shares of Common Stock subject to those terminated rights shall immediately vest). Involuntary termination includes discharge without misconduct and certain voluntary resignations following a reduction in compensation or responsibility or a relocation.

A Change in Control includes:

11

A transaction shall not constitute a Change in Control if its sole purpose is to change the state of the Company's incorporation or to create a holding company that will be owned in substantially the same proportions by the persons who held the Company's securities immediately before such transaction.

The Compensation Committee also has the discretion to accelerate outstanding options and awards and/or terminate the Company's outstanding repurchase rights upon a Change in Control, which acceleration or termination may or may not be conditioned upon the subsequent termination of the optionee's service within a specified period following the transaction. The acceleration of options or awards in the event of a Change in Control may be seen as an anti-takeover provision and may have the effect of discouraging a merger proposal, a takeover attempt, or other efforts to gain control of the Company.

Valuation. For purposes of establishing the option price and for all other valuation purposes under the Incentive Plan, the fair market value of a share of Common Stock on any relevant date will be the closing price per share of Common Stock on that date, as such price is reported on the Nasdaq National Market. The market value of the Common Stock as reported on the Nasdaq Stock Market as of December 19, 2000 was $59.25 per share.

Changes in Capitalization. In the event any change is made to the Common Stock issuable under the Incentive Plan by reason of any stock split, stock dividend, combination of shares, exchange of shares, or other change affecting the outstanding Common Stock as a class without the Company's receipt of consideration, appropriate adjustments will be made to (i) the maximum number and/or class of securities issuable under the Incentive Plan, (ii) the maximum number and/or class of securities for which any one person may be granted options and direct stock issuances per calendar year, (iii) the maximum number and/or class of securities for which the share reserve is to increase automatically each year, and (iv) the number and/or class of securities and the exercise price per share in effect under each outstanding option (including any option incorporated from the 1996 Plan) in order to prevent the dilution or enlargement of benefits thereunder.

Each outstanding option or award that is assumed in connection with a Change in Control will be appropriately adjusted to apply and pertain to the number and class of securities that would otherwise have been issued, in consummation of such Change in Control, to the optionee or participant had the option or award been exercised immediately prior to the Change in Control. Appropriate adjustments will also be made to the exercise price payable per share and to the class and number of securities available for future issuance under the Incentive Plan on both an aggregate and a per-participant basis.

Incentive Plan Amendments and Termination. The Board of Directors may amend or modify the Incentive Plan in any and all respects whatsoever. The approval of the Company's stockholders will be obtained to the extent required by applicable law. The Board may, at any time and for any reason, terminate the Incentive Plan. Any options or awards outstanding at the time of such termination will remain in force in accordance with the provisions of the instruments evidencing such grants.

As of December 19, 2000, options covering 17,257,454 shares were outstanding under the Incentive Plan, 4,344,359 shares remained available for future option grant, without giving effect to the annual increase which is the subject of this Proposal No. 4. The expiration dates for all such options range from August 1, 2004 to December 3, 2010.

New Plan Benefits and Option Grant Table

Because the Incentive Plan is discretionary, benefits to be received by individual optionees are not determinable. The table below shows, as to each of the executive officers named in the Summary Compensation Table below and the various indicated groups, (i) the number of shares of Common Stock for which options have been granted under the Incentive Plan, for the one (1)-year period ended

12

September 30, 2000 plus the period through December 31, 2000 and (ii) the weighted-average exercise price per share.

| Name and Position |

Number of Option Shares |

Weighted-Average Exercise Price of Granted Options |

|||

|---|---|---|---|---|---|

| Keith J. Krach, Chairman of the Board and Chief Executive Officer | 0 | n/a | |||

| Larry A. Mueller, President and Chief Operating Officer | 1,400,000 | $ | 91.13 | ||

| Robert J. DeSantis, Executive Vice President and Chief Marketing Officer | 0 | n/a | |||

| Edward P. Kinsey, Former Executive Vice President and Chief Financial Officer | 50,000 | $ | 54.44 | ||

| K. Charly Kleissner, Senior Vice President | 50,000 | $ | 54.44 | ||

| Paul L. Melchiorre, Vice President | 0 | n/a | |||

| All current executive officers as a group | 1,586,000 | $ | 77.57 | ||

| All current directors who are not executive officers as a group | 65,000 | $ | 130.79 | ||

| All employees, including current officers who are not executive officers, as a group | 14,697,600 | $ | 90.32 | ||

Federal Income Tax Consequences of Options Granted under the Incentive Plan

Options granted under the Incentive Plan may be either incentive stock options that satisfy the requirements of Section 422 of the Code or non-statutory options that are not intended to meet such requirements. The federal income tax treatment for the two types of options differs, as follows:

Incentive Stock Options. No taxable income is recognized by the optionee at the time of the option grant, and no taxable income is generally recognized at the time the option is exercised. However, the excess of the fair market value of the purchased shares on the exercise date over the exercise price paid for the shares generally is includable in alternative minimum taxable income. The optionee will recognize taxable income in the year in which the purchased shares are sold or otherwise made the subject of disposition.

For federal tax purposes, dispositions are divided into two categories: (i) qualifying and (ii) disqualifying. The optionee will make a qualifying disposition of the purchased shares if the sale or other disposition of such shares is made after the optionee has held the shares for more than two (2) years after the grant date of the option and more than one (1) year after the exercise date. If the optionee fails to satisfy either of these two holding periods prior to the sale or other disposition of the purchased shares, then a disqualifying disposition will result.

Upon a qualifying disposition of the shares, the optionee will recognize long-term capital gain in an amount equal to the excess of (i) the amount realized upon the sale or other disposition of the purchased shares over (ii) the exercise price paid for such shares. If there is a disqualifying disposition of the shares, then the excess of (i) the fair market value of those shares on the date the option was exercised over (ii) the exercise price paid for the shares will be taxable as ordinary income. Any additional gain recognized upon the disposition will be a capital gain.

If the optionee makes a disqualifying disposition of the purchased shares, then the Company will be entitled to an income tax deduction for the taxable year in which such disposition occurs equal to the excess of (i) the fair market value of such shares on the date the option was exercised over (ii) the exercise price paid for the shares. In no other instance will the Company be allowed a deduction with respect to the optionee's disposition of the purchased shares. The Company anticipates that any compensation deemed paid by the Company upon one or more disqualifying dispositions of incentive stock option shares by the Company's executive officers will remain deductible by the Company and will not have to be taken into

13

account for purposes of the $1 million limitation per covered individual on the deductibility of the compensation paid to certain executive officers of the Company.

Non-Statutory Options. No taxable income is recognized by an optionee upon the grant of a non-statutory option. The optionee will in general recognize ordinary income in the year in which the option is exercised equal to the excess of the fair market value of the purchased shares on the exercise date over the exercise price paid for the shares, and the optionee will be required to satisfy the tax withholding requirements applicable to such income.

Special provisions of the Code apply to the acquisition of Common Stock under a non-statutory option if the purchased shares are subject to repurchase by the Company. These special provisions may be summarized as follows:

The Company will be entitled to a business expense deduction equal to the amount of ordinary income recognized by the optionee with respect to the exercised non-statutory option. The deduction will in general be allowed for the taxable year of the Company in which such ordinary income is recognized by the optionee. The Company anticipates that the compensation deemed paid by the Company upon the exercise of non-statutory options with exercise prices equal to the fair market value of the option shares on the grant date will remain deductible by the Company and will not have to be taken into account for purposes of the $1 million limitation per covered individual on the deductibility of the compensation paid to certain executive officers of the Company.

Stock Appreciation Rights. A participant who is granted a stock appreciation right will recognize ordinary income in the year of exercise equal to the amount of the appreciation distribution. The Company will be entitled to a business expense deduction equal to the appreciation distribution for the taxable year of the Company in which the ordinary income is recognized by the participant.

If Proposal No. 4 is not approved by the stockholders, the Company intends to continue the Incentive Plan based on the existing provisions.

Stock Issuances. The tax principles applicable to direct stock issuances under the Incentive Plan will be substantially the same as those summarized above for the exercise of non-statutory option grants.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" THE APPROVAL OF THE AMENDMENT TO THE 1999 EQUITY INCENTIVE PLAN

14

STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of December 31, 2000, certain information with respect to shares beneficially owned by (i) each person who is known by the Company to be the beneficial owner of more than five percent (5%) of the Company's outstanding shares of Common Stock, (ii) each of the Company's directors and the executive officers named in the Summary Compensation Table below and (iii) all current directors and executive officers as a group.

Beneficial ownership has been determined in accordance with Rule 13d-3 under the Exchange Act. Under this rule, certain shares may be deemed to be beneficially owned by more than one person (if, for example, persons share the power to vote or the power to dispose of the shares). In addition, shares are deemed to be beneficially owned by a person if the person has the right to acquire shares (for example, upon exercise of an option or warrant) within sixty (60) days of the date as of which the information is provided. In computing the percentage ownership of any person, the amount of shares is deemed to include the amount of shares beneficially owned by such person (and only such person) by reason of such acquisition rights. As a result, the percentage of outstanding shares of any person as shown in the following table does not necessarily reflect the person's actual voting power at any particular date.

To our knowledge, except as indicated in the footnotes to this table and pursuant to applicable community property laws, the persons named in the table have sole voting and investment power with respect to all shares of Common Stock shown as beneficially owned by them.

| |

Shares Beneficially Owned as of December 31, 2000 (1) |

||||

|---|---|---|---|---|---|

| Beneficial Owner** |

Number of Shares |

Percentage of Class |

|||

| Keith J. Krach | 18,631,164 | 7.5 | % | ||

| John B. Mumford | 484,078 | * | |||

| Hatim A. Tyabji | 977,364 | * | |||

| Paul Hegarty(2) | 2,746,593 | 1.1 | % | ||

| Robert C. Kagle(3) | 1,081,540 | * | |||

| Robert E. Knowling(4) | 12,500 | * | |||

| Larry A. Mueller(5) | 798,407 | * | |||

| Robert J. DeSantis(6) | 5,578,165 | 2.2 | % | ||

| Edward P. Kinsey(7) | 3,838,144 | 1.5 | % | ||

| K. Charly Kleissner(8) | 1,710,668 | * | |||

| Paul L. Melchiorre(9) | 620,000 | * | |||

| All current directors and executive officers as a group (12 persons)(10) | 37,073,196 | 14.7 | % | ||

15

COMPLIANCE WITH SECTION 16(a) OF THE EXCHANGE ACT

The members of the Board of Directors, the executive officers of the Company and persons who hold more than 10% of the Company's outstanding Common Stock are subject to the reporting requirements of Section 16(a) of the Exchange Act, as amended, which require them to file reports with respect to their ownership of Common Stock and their transactions in Common Stock. Based upon (i) the copies of Section 16(a) reports that the Company received from such persons for their 2000 fiscal year transactions in the Common Stock and their Common Stock holdings and (ii) the written representations received from one or more of such persons that no annual Form 5 reports were required to be filed by them for the 2000 fiscal year, the Company believes that all reporting requirements under Section 16(a) for such fiscal year were met in a timely manner by its executive officers, Board members and greater than ten-percent stockholders, except that David Rome filed a delinquent Form 4.

EXECUTIVE COMPENSATION AND RELATED INFORMATION

The following Summary Compensation Table sets forth the compensation earned by the Company's Chief Executive Officer and the four other most highly compensated executive officers who were serving as such as of September 30, 2000 and one individual who ceased to be an executive officer (collectively, the "Named Officers"), each of whose aggregate compensation for fiscal year 2000 exceeded $100,000 for services rendered in all capacities to the Company and its subsidiaries for that fiscal year.

16

Summary Compensation Table

| |

|

|

|

Long-Term Compensation Awards/ Securities Underlying Options |

|

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

Annual Compensation |

|

||||||||||||

| |

Fiscal Year |

All Other Compensation |

|||||||||||||

| Name and Principal Position |

Salary(1) |

Bonus |

|||||||||||||

| Keith J. Krach | 2000 | $ | 200,000 | $ | 84,458 | 0 | $ | 0 | |||||||

| Chairman of the Board and | 1999 | 119,583 | 47,400 | 1,600,000 | 0 | ||||||||||

| Chief Executive Officer | 1998 | 106,667 | 33,000 | 0 | 0 | ||||||||||

| Larry A. Mueller | 2000 | 229,167 | 155,971 | 1,400,000 | 0 | ||||||||||

| President and | 1999 | 0 | 0 | 2,000,000 | 0 | ||||||||||

| Chief Operating Officer | 1998 | 0 | 0 | 0 | 0 | ||||||||||

| Robert J. DeSantis | 2000 | 150,000 | 51,700 | (2) | 0 | 5,898 | (3) | ||||||||

| Executive Vice President and | 1999 | 129,167 | 488,427 | (2) | 320,000 | 9,975 | (3) | ||||||||

| Chief Marketing Officer | 1998 | 106,667 | 76,605 | (2) | 800,000 | 0 | |||||||||

| Edward P. Kinsey | 2000 | 209,583 | 74,083 | 50,000 | 0 | ||||||||||

| Former Executive Vice President and | 1999 | 119,583 | 50,000 | 640,000 | 0 | ||||||||||

| Chief Financial Officer | 1998 | 106,667 | 36,333 | 0 | 0 | ||||||||||

| K. Charly Kleissner | 2000 | 175,000 | 73,250 | 50,000 | 0 | ||||||||||

| Senior Vice President | 1999 | 119,583 | 47,400 | 640,000 | 0 | ||||||||||

| 1998 | 106,667 | 33,000 | 320,000 | 0 | |||||||||||

| Paul L. Melchiorre | 2000 | 127,292 | 198,210 | (4) | 0 | 5,898 | (5) | ||||||||

| Vice President | 1999 | 140,417 | 212,500 | (4) | 640,000 | 0 | |||||||||

| 1998 | 32,083 | 21,773 | (4) | 2,560,000 | 50,000 | (5) | |||||||||

The following table contains information concerning the stock option grants made to each of the Named Officers for the fiscal year ended September 30, 2000. No stock appreciation rights were granted during such year.

17

Option Grants in Last Fiscal Year

| |

Individual Grants(1) |

|

|

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

% of Total Options Granted to Employees in 2000(2) |

|

|

|

|

|||||||||

| |

|

|

|

Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(3) |

|||||||||||

| |

Number of Securities Underlying Options Granted |

|

|

||||||||||||

| |

Exercise Price Per Share |

Expiration Date |

|||||||||||||

| Name |

5% |

10% |

|||||||||||||

| Keith J. Krach | 0 | n/a | n/a | n/a | n/a | n/a | |||||||||

| Larry A. Mueller | 400,000 | 2.80 | 54.4375 | 4/16/10 | 13,689,439 | 34,688,996 | |||||||||

| 1,000,000 | 7.10 | 91.1250 | 7/10/10 | 57,288,183 | 145,168,072 | ||||||||||

| Robert J. DeSantis | 0 | n/a | n/a | n/a | n/a | n/a | |||||||||

| Edward P. Kinsey | 50,000 | 0.35 | $ | 54.4375 | 4/16/10 | $ | 1,711,180 | $ | 4,336,125 | ||||||

| K. Charly Kleissner | 50,000 | 0.35 | 54.4375 | 4/16/10 | 1,711,180 | 4,336,125 | |||||||||

| Paul L. Melchiorre | 0 | n/a | n/a | n/a | n/a | n/a | |||||||||

18

The following table sets forth information concerning option exercises in fiscal year 2000 and option holdings as of September 30, 2000 with respect to each of the Named Officers. No stock appreciation rights were outstanding at the end of that year.

Aggregate Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

| |

|

|

Number of Securities Underlying Unexercised Optionsat September 30, 2000 |

|

|

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

Value Realized (Market Price at Exercise Less Exercise Price) |

|

|

|||||||||||

| |

|

Value of Unexercised in-the-Money Options At September 30, 2000 (1) |

|||||||||||||

| |

Shares Acquired on Exercise |

||||||||||||||

| Name |

Exercisable |

Unexercisable |

Exercisable |

Unexercisable |

|||||||||||

| Keith J. Krach | 0 | n/a | n/a | n/a | n/a | n/a | |||||||||

| Larry A. Mueller | 0 | n/a | 500,000 | 2,900,000 | $ | 54,820,300 | $ | 252,132,740 | |||||||

| Robert J. DeSantis | 198,667 | $ | 18,042,862 | 469,749 | 151,584 | 67,134,535 | 21,626,762 | ||||||||

| Edward P. Kinsey | 64,000 | 4,377,997 | 278,041 | 347,949 | 39,388,139 | 47,232,223 | |||||||||

| K. Charly Kleissner | 380,416 | 38,673,203 | 281,625 | 347,959 | 39,936,605 | 47,232,223 | |||||||||

| Paul L. Melchiorre | 0 | n/a | n/a | n/a | n/a | n/a | |||||||||

Bonus Plan. In 1999, the Company instituted an executive bonus program pursuant to which bonuses will be paid to executive officers based on Company performance targets. In addition, certain non-executive employees receive quarterly and annual bonuses if the Company meets its performance targets. The Company's performance targets are based on meeting revenue and income levels on a quarterly and annual basis.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

The Certificate of Incorporation limits the liability of the Company's directors for monetary damages arising from a breach of their fiduciary duty as directors, except to the extent otherwise required by the Delaware General Corporation Law. Such limitation of liability does not affect the availability of equitable remedies such as injunctive relief or rescission.

The Company's bylaws provide that the Company shall indemnify its directors and officers to the fullest extent permitted by Delaware law, including in circumstances in which indemnification is otherwise discretionary under Delaware law. The Company expects to enter with its officers and directors into indemnification agreements containing provisions that may require the Company, among other things, to indemnify such officers and directors against certain liabilities that may arise by reason of their status or service as directors or officers and to advance their expenses incurred as a result of any proceeding against them as to which they could be indemnified.

EMPLOYMENT CONTRACTS AND CHANGE IN CONTROL ARRANGEMENTS

The Compensation Committee, as administrator of the Incentive Plan, can provide for accelerated vesting of the shares of Common Stock subject to outstanding options held by any executive officer or director of the Company in connection with certain changes in control of the Company. The accelerated vesting may be conditioned on the termination of the individual's employment following the change in control event. None of the Company's executive officers have employment agreements with the Company, and they may resign and their employment may be terminated at any time.

The Compensation Committee (or the "Committee") has the exclusive authority to establish the level of base salary payable to the Chief Executive Officer ("CEO") and certain other executive officers of the

19

Company and to administer the Incentive Plan and the Company's Employee Stock Purchase Plan. In addition, the Committee has the responsibility for approving the individual bonus programs to be in effect for the CEO and certain other executive officers. The Committee is comprised of non-employee directors and acts on a scheduled basis to evaluate the effectiveness of the compensation program in linking Company performance and executive pay. Additionally, the Committee is routinely consulted to approve the compensation package of a newly hired executive or of an executive whose scope of responsibility has changed significantly.

For the fiscal year ended September 30, 2000, the process utilized by the Committee in determining executive officer compensation levels was based on the subjective judgment of the Committee. Among the factors considered by the Committee were the recommendations of the CEO with respect to the compensation of the Company's key executive officers. However, the Committee made the final compensation decisions concerning such officers.

General Compensation Policy. The objective of the Company's executive compensation program is to align executive compensation with the Company's long and short-term business objectives and performance. Additionally, it is imperative that executive compensation enables the Company to attract, retain, and motivate qualified executives who are able to contribute to the long-term success of the Company. The following specific strategies are utilized to guide the Company's executive compensation decisions:

During 2000, the Company's executive compensation program included these key elements:

20

number of stock option shares that are granted to individual executives is based on demonstrated performance and independent survey data reflecting competitive market practice.

CEO Compensation. The annual base salary for Mr. Krach, the Company's CEO, was increased from $120,000 in 1999 to $200,000 in 2000.

The remaining components of the CEO's 2000 fiscal year incentive compensation were entirely dependent upon the Company's performance and provided no dollar guarantees. The bonus paid to the CEO for the fiscal year was based on the same incentive plan as the other executives.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The Compensation Committee was formed in April 1999, and the members of the Compensation Committee are Messrs. Kagle and Tyabji. Neither of these individuals was at any time during fiscal 2000, or at any other time, an officer or employee of the Company. No executive officer of the Company serves as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of the Company's Board of Directors or Compensation Committee.

In accordance with its written charter, a copy of which is attached as Exhibit B, adopted by the Board of Directors (the "Board"), the Audit Committee assists the Board in fulfilling its responsibility for oversight of the quality and integrity of the accounting, auditing and financial reporting practices of the Company. The Audit Committee recommends to the Board of Directors, subject to stockholder approval, the selection of the Company's independent accountants.

Management is responsible for the Company's internal controls. The Company's independent auditors are responsible for performing an independent audit of the Company's consolidated financial statements in accordance with generally accepted auditing standards and to issue a report thereon. The Audit Committee has general oversight responsibility with respect to the Company's financial reporting, and reviews the results and scope of the audit and other services provided by the Company's independent auditors.

In this context, the Audit Committee has met and held discussions with management and the Company's independent auditors. Management represented to the Audit Committee that the Company's consolidated financial statements were prepared in accordance with U.S. generally accepted accounting principles, and the Audit Committee has reviewed and discussed the consolidated financial statements with management and the Company's independent auditors. The Audit Committee discussed with the independent accountants matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees).

The Company's independent auditors also provided to the Audit Committee the written disclosures required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and the Audit Committee discussed with the independent auditors' their independence.

Based upon the Audit Committee's discussion with management and the independent auditors and the Audit Committee's review of the representation of management and the report of the independent accountants to the Audit Committee, the Audit Committee recommended that the Board of Directors include the Company's audited consolidated financial statements in the Company's Annual Report on Form 10-K for the year ended September 30, 2000 filed with the Securities and Exchange Commission.

Submitted by the Audit Committee of the Company's Board of Directors:

Robert C. Kagle John B. Mumford |

21

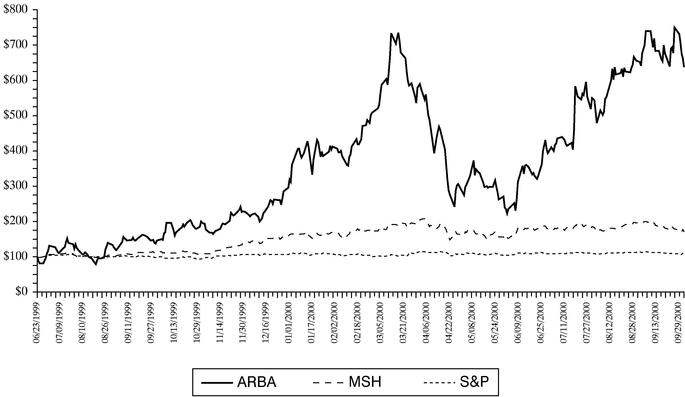

The graph set forth below compares the cumulative total stockholder return on the Company's Common Stock between June 23, 1999 (the date the Common Stock commenced public trading) and September 30, 2000 with the cumulative total return of (i) the Morgan Stanley High Tech Index (the "MSH Index") and (ii) the Standard and Poor's 500 Index (the "S&P Index"), over the same period. This graph assumes the investment of $100.00 on June 23, 1999 in the Common Stock, the MSH Index and the S&P Index, and assumes the reinvestment of dividends, if any.

The comparisons shown in the graph below are based upon historical data. The Company cautions that the stock price performance shown in the graph below is not indicative of, nor intended to forecast, the potential future performance of the Common Stock. Information used in the graph was obtained from Bloomberg, a source believed to be reliable, but the Company is not responsible for any errors or omissions in such information.

Note: S&P performance does not include reinvested dividends.

The Company effected its initial public offering of Common Stock on June 23, 1999 at a price of $5.75 per share (as adjusted to reflect the 1999 and 2000 Stock Splits). The graph above, however, commences with the closing price of $22.50 per share (as adjusted to reflect the 1999 and 2000 Stock Splits) on June 23, 1999—the date the Company's Common Stock commenced public trading.

Notwithstanding anything to the contrary set forth in any of the Company's previous or future filings under the Securities Act of 1933, as amended, or the Exchange Act, that might incorporate this Proxy Statement or future filings made by the Company under those statutes, the Compensation Committee Report and Stock Performance Graph shall not be deemed filed with the Securities and Exchange Commission and shall not be deemed incorporated by reference into any of those prior filings or into any future filings made by the Company under those statutes.

22

THE COMPANY WILL MAIL WITHOUT CHARGE, UPON WRITTEN REQUEST, A COPY OF THE COMPANY'S FORM 10-K REPORT FOR FISCAL YEAR ENDED SEPTEMBER 30, 2000, INCLUDING THE FINANCIAL STATEMENTS. REQUESTS SHOULD BE SENT TO ARIBA, INC., 1565 CHARLESTON ROAD, MOUNTAIN VIEW, CALIFORNIA 94043, ATTN: INVESTOR RELATIONS.

STOCKHOLDER PROPOSALS FOR 2002 ANNUAL MEETING

Stockholders who intend to have a proposal considered for inclusion in the Company's proxy materials for presentation at the 2002 Annual Meeting pursuant to Rule 14a-8 under the Exchange Act must submit the proposal to the Company at its offices at 1565 Charleston Road, Mountain View, California 94043, Attn: Craig M. Schmitz, not later than September 30, 2001. Stockholders who intend to present a proposal at the Company's 2002 annual meeting of stockholders without inclusion of such proposal in the Company's proxy materials pursuant to Rule 14a-8 under the Exchange Act are required to provide advance notice of such proposal to the Company at the aforementioned address not earlier than November 8, 2001 and not later than December 8, 2001. The Company reserves the right to reject, rule out of order, or take other appropriate action with respect to any proposal that does not comply with these and other applicable requirements, including conditions established by the Securities and Exchange Commission.