|

|

|

|

|

Previous: YELLOWBUBBLE COM INC, NT 10-Q, 2000-11-15 |

Next: ING VARIABLE INSURANCE TRUST, 497, 2000-11-15 |

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F/A

o REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR

12(g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

ý ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended March 31, 2000

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF

For the transition period from ________________________ to ____________________________

Commission file number: 0-30204

| Kabushiki Kaisha Internet Initiative

|

|

| (Exact name of Registrant as specified in its charter)

|

|

| Internet Initiative Japan Inc.

|

|

| (Translation of Registrant’s name into English)

|

|

| Takebashi Yasuda Bldg.

|

|

| 3-13, Kanda Nishiki-cho

|

|

| Japan

|

Chiyoda-ku, Tokyo 101-0054 Japan

|

| (Jurisdiction of incorporation or organization)

|

(Address of principal executive offices)

|

| Securities registered or to be registered pursuant to Section 12(b) of the Act.

|

|

| Title of Each Class

|

Name of Each Exchange On Which Registered

|

| None

|

None

|

| Securities registered or to be registered pursuant to Section 12(g) of the Act.

|

|

(1) Common Stock, par value ¥50,000 per share (“Shares”)*

(2) American Depositary Shares (“ADSs”), each of which represents 1/2000th of a Share

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

As of March 31, 2000, 22,480 shares of common stock were outstanding, comprised of 16,628 Shares and 11,704,000 ADSs (equivalent to 5,852 shares).

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes X No __

Indicate by check mark which financial statement item the registrant has elected to follow.

Item 17___ Item 18 X

TABLE OF CONTENTS

| Page

|

|||||

| Forward-looking Statement | 3 | ||||

| PART I

|

|||||

| Item 1. | Identity of Directors, Senior Management and Advisors | 4 | |||

| Item 2. | Offer Statistics and Expected Timetable | 4 | |||

| Item 3. | Key Information | 4 | |||

| Item 4. | Information on the Company | 13 | |||

| Item 5. | Operating and Financial Review and Prospects | 37 | |||

| Item 6. | Directors, Senior Management and Employees | 55 | |||

| Item 7. | Major Shareholders and Related Party Transactions | 57 | |||

| Item 8. | Financial Information | 59 | |||

| Item 9. | The Offer and Listing | 59 | |||

| Item 10. | Additional Information | 60 | |||

| Item 11. | Quantitative and Qualitative Disclosures About Market Risk | 72 | |||

| Item 12. | Description of Securities Other than Equity Securities | 73 | |||

| PART II

|

|||||

| Item 13. | Defaults, Dividend Arrearages and Delinquencies | 74 | |||

| Item 14. | Material Modifications to the Rights of Security Holders and Use of Proceeds | 74 | |||

| Item 15. | [Reserved] | 74 | |||

| Item 16. | [Reserved] | 74 | |||

| PART III

|

|||||

| Item 17. | Financial Statements | 75 | |||

| Item 18. | Financial Statements | 75 | |||

| Item 19. | Exhibits | 75 | |||

-2-

This annual report contains forward-looking statements that are based on our current expectations, assumptions, estimates and projections about us and our industry and that are subject to various risks and uncertainties. These statements discuss future expectations, identify strategies, contain projections of results of operations or of financial condition of ours or our group companies or state other “ forward-looking” information. Known and unknown risks, uncertainties and other factors could cause the actual results to differ materially from those contained in any forward-looking statement.

Although we believe that our expectations that are expressed in these forward-looking statements are reasonable, we cannot promise that our expectations will turn out to be correct. Our actual results could be materially different from and worse than our expectations. Important risks and factors that could cause our actual results to be materially different from our expectations are generally set forth in Item 3.D. and include, without limitation:

-3-

PART I

Item 1. Identity of Directors, Senior Management and Advisors

Not Applicable

Item 2. Offer Statistics and Expected Timetable

Not Applicable

A. Selected financial data

The selected consolidated financial data set forth below should be read in conjunction with the consolidated financial statements of Internet Initiative Japan Inc., or IIJ, and the notes thereto beginning on page F-1 in response to Item 8. and Item 18. and Operating and Financial Review and Prospects included as Item 5. The statement of operations data below for the fiscal years ended March 31, 1997, 1998, 1999, and 2000 and the balance sheet data as of March 31, 1998, 1999, and 2000 are derived from the audited financial statements of IIJ, which have been prepared in accordance with U.S. GAAP and audited by Deloitte Touche Tohmatsu, independent auditors. The statement of operations data set forth below for the fiscal year ended March 31, 1996 and the balance sheet data as of March 31, 1996 and 1997 are derived from the unaudited financial statements. The unaudited data reflect all adjustments, consisting of normal recurring adjustments, that, in the opinion of management, are necessary for a fair presentation of the amounts involved, on a basis consistent with selected consolidated financial data derived from the audited financial statements. The historical results are not necessarily indicative of results to be expected for any future period. See Item 5. Operating and Financial Review and Prospects.

-4-

| As of and for the year ended March 31, | ||||||||||||||||||||

| |

||||||||||||||||||||

| 1996

|

1997

|

1998

|

1999

|

2000

|

2000

|

|||||||||||||||

| |

|

|

|

|

|

|||||||||||||||

| (millions of yen, except per share and ADS data)

|

(thousands

of dollars) |

|||||||||||||||||||

| Statement of Operations Data: | ||||||||||||||||||||

| Connectivity services and value-added services | ||||||||||||||||||||

| revenues: | ||||||||||||||||||||

| Dedicated access service revenues | ¥ 1,881

|

¥ 4,291

|

¥ 6,756

|

¥ 7,798

|

¥ 9,999

|

$97,328

|

||||||||||||||

| Dial-up access service revenues | 1,632

|

3,478

|

4,474

|

4,101

|

4,496

|

43,767

|

||||||||||||||

| Value-added service revenues | 79

|

202

|

368

|

496

|

884

|

8,610

|

||||||||||||||

| Other(1) | -

|

44

|

132

|

110

|

408

|

3,970

|

||||||||||||||

| |

|

|

|

|

|

|||||||||||||||

| Total connectivity and value-added services | 3,592

|

8,015

|

11,730

|

12,505

|

15,787

|

153,675

|

||||||||||||||

| Systems integration revenues, including related | ||||||||||||||||||||

|

equipment sales(1) |

-

|

455

|

527

|

1,179

|

7,640

|

74,373

|

||||||||||||||

| Other equipment sales revenues(1) | 466

|

63

|

66

|

1,085

|

1,875

|

18,247

|

||||||||||||||

| |

|

|

|

|

|

|||||||||||||||

| Total revenues | 4,058

|

8,533

|

12,323

|

14,769

|

25,302

|

246,295

|

||||||||||||||

| |

|

|

|

|

|

|||||||||||||||

| Cost of connectivity services and value-added services | ||||||||||||||||||||

|

revenues(1) |

2,368

|

5,159

|

9,015

|

11,178

|

15,091

|

146,900

|

||||||||||||||

| Cost of systems integration revenues, including | ||||||||||||||||||||

| related equipment sales(1)

|

-

|

306

|

329

|

950

|

6,272

|

61,056

|

||||||||||||||

| Cost of other equipment sales revenues(1) | -

|

62

|

60

|

1,074

|

1,807

|

17,589

|

||||||||||||||

| |

|

|

|

|

|

|||||||||||||||

| Total cost of revenues | 2,368

|

5,527

|

9,404

|

13,202

|

23,170

|

225,545

|

||||||||||||||

| Sales and marketing | 511

|

1,211

|

1,508

|

1,570

|

2,604

|

25,343

|

||||||||||||||

| General and administrative | 400

|

892

|

939

|

1,065

|

1,234

|

12,014

|

||||||||||||||

| Research and development | 97

|

103

|

152

|

243

|

364

|

3,539

|

||||||||||||||

| |

|

|

|

|

|

|||||||||||||||

| Total cost and expenses | 3,376

|

7,733

|

12,003

|

16,080

|

27,372

|

266,441

|

||||||||||||||

| |

|

|

|

|

|

|||||||||||||||

| Operating income (loss): | 682

|

800

|

320

|

(1,311

|

)

|

(2,070

|

)

|

(20,146

|

)

|

|||||||||||

| |

|

|

|

|

|

|||||||||||||||

| Other income (expenses): | ||||||||||||||||||||

| Interest income | 5

|

5

|

7

|

4

|

362

|

3,529

|

||||||||||||||

| Interest expense | (48

|

)

|

(120

|

)

|

(216

|

)

|

(219

|

)

|

(277

|

)

|

(2,699

|

)

|

||||||||

| Other – net | 11

|

(30

|

)

|

(35

|

)

|

(15

|

)

|

(830

|

)

|

(8,083

|

)

|

|||||||||

| |

|

|

|

|

|

|||||||||||||||

| Other expenses – net | (32

|

)

|

(145

|

)

|

(244

|

)

|

(199

|

)

|

(745

|

)

|

(7,253

|

)

|

||||||||

| |

|

|

|

|

|

|||||||||||||||

| Income (loss) before income taxes | 650

|

655

|

(76

|

)

|

(1,510

|

)

|

(2,815

|

)

|

(27,399

|

)

|

||||||||||

| Income taxes | 365

|

377

|

289

|

16

|

(1,280

|

)

|

(12,461

|

)

|

||||||||||||

| Minority interest in consolidated subsidiaries | 24

|

(31

|

)

|

(42

|

)

|

123

|

(70

|

)

|

(686

|

)

|

||||||||||

| Equity in net income (loss) of affiliated | ||||||||||||||||||||

| companies | 10

|

(44

|

)

|

(105

|

)

|

(26

|

)

|

(3,180

|

)

|

(30,950

|

)

|

|||||||||

| |

|

|

|

|

|

|||||||||||||||

| Net income (loss) | ¥ 319

|

¥ 203

|

¥ (360

|

)

|

¥ (1,429

|

)

|

¥ (4,785

|

)

|

$(46,574

|

)

|

||||||||||

| |

|

|

|

|

|

|||||||||||||||

| Basic and diluted net income (loss) | ||||||||||||||||||||

| per share | ¥24,251

|

¥13,552

|

¥(23,565

|

)

|

¥(75,720

|

)

|

¥(225,791

|

)

|

$(2,198

|

)

|

||||||||||

| Basis and diluted net income (loss) per ADS | ||||||||||||||||||||

| equivalent | 12.13

|

6.78

|

(11.78

|

)

|

(37.86

|

)

|

(112.90

|

)

|

(1.10

|

)

|

||||||||||

| Weighted average number of shares | 13,142

|

15,000

|

15,286

|

18,868

|

21,190

|

21,190

|

||||||||||||||

| Weighted average number of ADS equivalents | ||||||||||||||||||||

| (thousands) | 26,284

|

30,000

|

30,572

|

37,736

|

42,380

|

42,380

|

||||||||||||||

| Balance Sheet Data: | ||||||||||||||||||||

| Cash | ¥577

|

¥376

|

¥1,158

|

¥ 1,061

|

¥16,158

|

$157,290

|

||||||||||||||

| Total assets | 3,638

|

7,615

|

9,340

|

13,359

|

39,001

|

379,643

|

||||||||||||||

| Short-term borrowings | 700

|

1,880

|

2,440

|

6,679

|

13,690

|

133,266

|

||||||||||||||

| Current portion of long-term debt, including | ||||||||||||||||||||

| capital lease obligations | 224

|

812

|

1,142

|

1,855

|

2,255

|

21,950

|

||||||||||||||

| Long-term debt, including capital lease obligations | 635

|

2,394

|

2,929

|

2,151

|

2,300

|

22,385

|

||||||||||||||

| Shareholder’s equity | 1,164

|

1,361

|

1,868

|

485

|

15,001

|

146,025

|

||||||||||||||

| Operating Data: | ||||||||||||||||||||

| Capital expenditures, including capitalized leases | ¥884

|

¥ 2,501

|

¥ 1,696

|

¥ 1,929

|

¥ 3,465

|

$33,728

|

||||||||||||||

| EBITDA(2) | 901

|

1,356

|

1,448

|

111

|

(37

|

)

|

(361

|

)

|

||||||||||||

| Operating margin(3) | 16.8

|

%

|

9.4

|

%

|

2.6

|

%

|

(8.9

|

)%

|

(8.2

|

)%

|

||||||||||

| EBITDA(2)(4) | 22.2

|

%

|

15.9

|

%

|

11.7

|

%

|

0.7

|

%

|

(0.1

|

)%

|

||||||||||

| Net cash provided by (used in): | ||||||||||||||||||||

| Operating activities | ¥502

|

¥219

|

¥ 292

|

¥400

|

¥ 1,199

|

$11,667

|

||||||||||||||

| Investing activities | (717

|

)

|

(1,695

|

)

|

(300

|

)

|

(3,695

|

)

|

(7,135

|

)

|

(69,456

|

)

|

||||||||

| Financing activities | 281

|

1,274

|

785

|

3,186

|

22,192

|

216,021

|

||||||||||||||

| ______________________ | ||||||||||||||||||||

| (1)

|

We have reclassified the amounts of certain revenues and cost of revenues for fiscal 1997, 1998 and 1999 to conform with the presentation of fiscal 2000. Because the

corresponding amount of certain revenues and cost of sales component for the year ended March 31, 1996 is not accurately obtainable and is considered immaterial as a whole, they are included in other equipment sales revenues and cost of connectivity

services and value-added services revenues.

|

|

| (2)

|

EBITDA represents operating income (loss) plus depreciation and amortization. EBITDA is provided because it is a measure commonly used by investors to analyze and compare

companies on the basis of operating performance. EBITDA is not a measurement of financial performance under generally accepted accounting principles and should not be construed as a substitute for operating income, net income or

|

cash flows from operating activities for purposes of analyzing IIJ’s operating performance, financial position and cash flows. EBITDA is not necessarily comparable with

similarly titled measures for other companies.

|

| (3)

|

Operating income (loss) as a percentage of total revenues.

|

|

| (4)

|

EBITDA as a percentage of total revenues.

|

Exchange rates

In parts of this annual report, we have translated Japanese yen amounts into U.S. dollars for the convenience of investors. The rate we used for the translations was ¥102.73 equal to $1.00, which was the noon buying rate announced by the Federal Reserve Bank of New York on March 31, 2000. The following table shows the noon buying rates for Japanese yen expressed in Japanese yen per $1.00. The noon buying rate on June 30, 2000 was $1= ¥106.14. No representation is made that the Japanese yen or U.S. dollar amounts referred to herein could have been or could be converted into U.S. dollars or Japanese yen, as the case may be, at any particular rate or at all.

| Year 2000

|

||||||||||||

| |

||||||||||||

| January

|

February

|

March

|

April

|

May

|

June

|

|||||||

| |

|

|

|

|

|

|||||||

| Yen exchange rates per U.S. dollar: | ||||||||||||

| High | ¥ 107.33

|

¥ 111.11 | ¥107.80 | ¥107.98 | ¥109.75

|

¥108.74

|

||||||

| Low | 101.70

|

107.54 | 102.73 | 104.19 | 106.44

|

104.40

|

||||||

| Year Ended March 31 | |||||

|---|---|---|---|---|---|

| |

|||||

| 1996 | 1997 | 1998 | 1999 | 2000 | |

| |

|

|

|

|

|

| Yen exchange rates per U.S. dollar: | |||||

| Average (of month-end rates) | 96.95 | 113.20 | 123.57 | 128.10 | 102.73 |

| B.

|

Capitalization and indebtedness

Not applicable. |

| C.

|

Reasons for the offer and use of proceeds

|

| D.

|

Risk factors

You should carefully consider the risks described below before making an investment decision. If any of the risks described below actually occurs, our business,

financial condition or results of operations could be adversely affected. The trading price of our securities could decline, and you may lose all or part of your investment.

We had operating and net losses last year which will continue for an uncertain period

We incurred an operating loss of ¥2,070 million and a net loss of ¥4,785 million for the year ended March 31, 2000. We expect to continue to incur net losses for at least the next several quarters. The losses in the current fiscal year will also be substantial and may increase beyond those for the year ended March 31, 2000. Our results of operations and, therefore, the magnitude of our losses and the extent to which they continue, will be affected by a number of factors. For example: |

Please see Item 5. Operating and Financial Review and Prospects for more detailed information concerning our losses and other operating results.

Our large capital investment in Crosswave may not produce profits

In February 2000, we invested an additional ¥4.8 billion in Crosswave bringing our total investment to date to ¥8 billion. As of March 31, 2000, we were a 40.0% owner of Crosswave and Sony and Toyota Motor each owned 30.0%. In August 2000, Crosswave completed an initial public offering and was approved for quotation on the Nasdaq National Market. We purchased an additional 15,000 shares of Crosswave for ¥4.6 billion in a private placement concurrently with its initial public offering.

Our investment in Crosswave is substantial and we are not certain that this investment will produce profits. We expect that Crosswave will lose money for at least the next several fiscal years. These losses will have a direct impact on our financial performance as a portion of these losses will be included in our financial results under the equity method of accounting that we have used to account for our investment in Crosswave; however, we are not directly responsible for any of the expenses of Crosswave beyond our equity investment.

We expect that Crosswave will require additional funds beyond those currently contemplated in its business plan which it may obtain by securing loans from third party financial institutions or pursuant to capital raising transactions in the financial markets. However, there can be no assurance that adequate funding will be available or available on terms acceptable to Crosswave. Our investment in Crosswave may be adversely affected if Crosswave is unable to secure adequate financing to implement its business plan.

Since Crosswave started operating only in April 1999, it has a limited operating history. Crosswave could have problems in operating and managing its nationwide optical fiber network. Currently, Crosswave’s main customer is IIJ. Crosswave may have difficulty attracting additional customers to its services. The data communications market is a new market in Japan, and Japan’s

-7-

recession has led companies to limit spending on information technology. Although Crosswave operates the first nationwide optical fiber network dedicated to high-speed data communications in Japan, competitors of Crosswave including NTT Communications, Japan Telecom and KDD are introducing data communications services that may compete with Crosswave’s service. Additionally, this competition may lead to downward pricing pressure which may result in Crosswave generating less revenue than anticipated and potentially increasing Crosswave’s losses.

Crosswave is discussed in more detail under “Business—Crosswave Communications Inc.” below.

Our competitors’ decisions can strongly influence our markets and we may be vulnerable to decisions resulting in downward pricing pressure

The marketing and pricing decisions of our competitors can strongly influence our markets. Increased competition in the industry has caused significant downward pricing pressure including lower-priced Internet access services offered to small- and medium-sized companies and to larger corporations which are our primary target markets. To the extent that potential and existing customers make decisions based solely or primarily on price, we may be unable to retain existing or attract new customers or we may be forced to reduce our prices to keep existing customers.

We may not be able to compete effectively, especially against established competitors which have greater financial, marketing and other resources

Some of our major competitors in Japan are major telecommunications carriers like NTT, KDD and Japan Telecom and their affiliates, and ISPs who are affiliated with large corporations like NEC, Fujitsu, Sony and Matsushita Electric. These competitors have certain advantages over us including:

With these advantages, our competitors may be better able to:

In addition, if telecommunications carriers replace their existing switches and equipment with more advanced switches and equipment, this may increase their ability to use their existing extensive networks for Internet and data transmission.

-8-

New competitors may attract customers away from us

New competitors, both foreign and domestic, may attract customers away from us. A number of major foreign ISPs are operating and have increased their presence in the Japanese market, including PSINet and UUNET, an affiliate of WorldCom, and, AT&T and BT through their significant minority investment in equity of Japan Telecom. PSINet and UUNET have extensive financial resources and already have extensive global networks and they have substantial resources, including the capability to develop and operate high-quality backbones in Japan. These new foreign entrants may be strong competitors of ours and if they are successful in the market we could lose subscribers or grow less rapidly.

We may also compete with new ISPs that emerge as the Internet market continues to grow. For example, many of the major cable television companies and mobile communications companies are increasing the number of subscribers to their Internet access services. New ISPs, including DSL providers and other broadband service providers, may also affect our growth.

Additionally, a number of companies have begun operations of new data centers in Japan, including, among others, Exodus and Digital Island. These new data centers, when operational, will compete with our Internet connectivity services and data center services.

Our customers that are also our competitors may terminate our services if they are able to do so without sacrificing quality

Currently, because of the high quality of our services and the large capacity of our network, many of the major telecommunications carriers and their affiliated ISPs are our customers. They may also terminate or reduce our services when lower cost services of reasonably good quality are available from other providers or to the extent they are able to increase their ability to use their own networks.

If we fail to keep up with the rapid technological changes in our industry, our services may become obsolete and we may lose customers

Our markets are characterized by:

The introduction of services using new technologies and the emergence of new industry standards could render our existing services obsolete.

If we fail to obtain access to new or important technologies or to develop and introduce new services and enhancements that are compatible with changing industry technologies and standards and customer requirements, we may lose customers.

Our pursuit of necessary technological advances may require substantial time and expense. Many of our competitors have greater financial and other resources than we do and, therefore, may be better able to meet the time and expense demands. Additionally, this may allow our competitors to respond more quickly to new and emerging technologies and standards or invest more heavily in upgrading or replacing equipment to take advantage of new technologies and standards.

Foreign exchange fluctuations could negatively affect our results of operations because of our committed U.S. dollar obligations and may negatively affect the value of our U.S. dollar assets

Our reporting currency and most of our revenues are in yen. However, a substantial amount of our lease payments for international lines are payable in U.S. dollars. As we expand our international network, we expect the total amount of these payments to increase. In connection with our initial public offering in August 1999, we obtained U.S. dollar proceeds, and as of March 31, 2000 we held approximately $112 million in dollar-denominated demand and short-term time deposits. We recorded a ¥1.1 billion foreign exchange loss for the year ended March 31, 2000. Although we are going to use these proceeds mainly for the U.S. dollar lease payments for international lines, future fluctuations in currency exchange rates may adversely affect our financial results.

Our operating results are likely to fluctuate significantly and may differ from market expectations

Our annual and quarterly operating results have varied significantly and are likely to vary significantly in the future due to a number of factors, many of which are beyond our control. As a result, we believe that quarter-to-quarter comparisons of our operating results are not a good indication of our future performance. It is likely that in some future quarters, our operating results may be below the expectations of public market analysts and investors. In this event, the trading price of our ADSs may fall.

Examples of factors which may cause fluctuation include:

We depend on the continued use of TCP/IP which could be replaced by new transmission technologies

The core of IIJ’s business relies on the continued widespread commercial use of Transmission Control Protocol/Internet Protocol, commonly known as TCP/IP, which is an industry standard to facilitate the transfer of data. Alternative open protocol and proprietary protocol

-10-

standards could emerge and become widely adopted. The resulting reduction in the use of TCP/IP could render our services obsolete and unmarketable.

We depend on key personnel and our business may suffer if we cannot attract or retain qualified personnel or if we lose the services of our executive officers

If we fail to attract or retain the qualified personnel we need, our business may be adversely affected. Because our network, services, products and technologies are complex, we depend on the continued service of our existing engineering and other personnel and we will need to hire additional engineers and research and development personnel. Competition for qualified engineers, research and development personnel and employees in the Internet services industry in Japan is intense and there are a limited number of persons with the necessary knowledge and experience.

Our future success also depends on the continued service of our executive officers, particularly Mr. Koichi Suzuki, who is the President of IIJ and also serves as the President ofCrosswave and most of the other IIJ group companies. We rely on his expertise in the operations of our businesses and on his personal relationships with our shareholders and the shareholders of the IIJ group companies and with our business partners. None of our officers or key employees, including Mr. Suzuki, is bound by an employment or noncompetition agreement.

Rapid growth and a rapidly changing operating environment may strain our limited resources

We have limited operational, administrative and financial resources, which could be inadequate to sustain the growth we want to achieve. As our customers and their Internet use increase, as traffic patterns change and as the volume of information transferred increases, we will need to increase our investment in our network and other facilities in order to adapt our services and to maintain and improve the quality of our services. If we are unable to manage our growth and expansion, the quality of our services could deteriorate and our business may suffer.

Our business may be adversely affected if we fail to maintain the reliability and security of our network

The reliability of our network could be affected by damage from fire, earthquakes and other natural disasters, power loss, telecommunications failures and similar events. Much of our computer and networking equipment and the lines that make up our network backbones are concentrated in a few locations that are in earthquake-prone areas. Computer viruses and interruptions in service as a result of the accidental or intentional actions of Internet users and others may also prevent us from providing service to our customers. Any problems that cause interruptions in the services we provide could have a material adverse effect on our business, financial condition and results of operations.

Part of our business is supported by several minority-owned affiliates which limits their contribution to our results of operations and limits our ability to control these companies

We conduct our business directly and by working together with a number of subsidiaries and affiliates. While we have invested heavily in and exercise significant influence over these companies, we do not own a majority interest in our affiliates. There are risks associated with this group structure:

-11-

There are risks associated with our continued international expansion

By operating and rapidly expanding our network internationally, we expose ourselves to the risks of those markets and other risks that do not exist or are less significant in Japan. A key component of our strategy is to continue to expand our international networks and capacity, particularly between the United States and Japan. This will require significant management attention and financial resources. We may have significant exposure to risks in connection with our international operations. Among these risks are the following:

These factors could adversely affect our future international operations and, consequently, our business, financial condition and results of operations.

We depend on telecommunications carriers and other suppliers and we could be affected by disruptions in service or delays in the delivery of their products and services

We rely on telecommunications carriers like KDD, Japan Telecom and AT&T for significant portions of our network backbone and NTT for our customers’ local access lines and in the future we will also rely on Crosswave to provide telecommunications services that we need. We are subject to potential disruptions in these telecommunications services and we may have no means of replacing these services, on a timely basis or at all, in the event of any such disruption.

In the Asia-Pacific region and for the operation of the A-Bone by Asia Internet Holding, we depend on telecommunications carriers in various countries including lesser

developed countries in regions whose quality of service may not be stable or who are more susceptible to economic or political instability in regions where they conduct business.

We also depend on third-party suppliers of hardware components like routers that are used in our network. We acquire some components from only one or two sources, including Cisco Systems and Lucent Technologies. A

failure by one of our suppliers to deliver quality products on a timely basis, or the inability to develop alternative sources if and as required, could delay our ability to increase the number of our POPs or to expand the capacity of our network.

-12-

Item 4. Information on the Company

A. History and development of the company

We are incorporated in Japan as a joint stock corporation under the name Internet Initiative Japan Inc. We were founded in December 1992 and operate under the laws of Japan. We began operations in July 1993, making us one of the first commercial Internet service providers in Japan offering Internet access. We became a public company in August 1999 with our initial public offering on the Nasdaq National Market.

Our head office is located at Takebashi Yasuda Bldg., 3-13, Kanda Nishiki-cho, Chiyoda-ku, Tokyo 101-0054, Japan, and our telephone number at that location is 81-3-5259-6500. Our agent in the United States is IIJ America, Inc., 399 Park Avenue, 23rd Floor, New York, New York 10022 and our telephone number at that location is 212-350-1300. We have a Web site that you may access at http://www.iij.ad.jp/. Information contained on our Web site does not constitute part of this annual report filed on Form 20-F.

B. Business overview

We offer a comprehensive range of Internet access services and Internet-related services to our customers in Japan. We offer our services on one of the most advanced and reliable Internet networks available in Japan and between Japan and the United States. Our services are based upon high-quality networking technology tailored to meet the specific needs and demands of our customers.

We offer a variety of services to our customers as part of our total Internet solutions. Our primary services are our Internet access services, which range from low-cost dial-up access to high-speed continuous access through dedicated lines, and our systems integration services.

We also offer independently, or together with our IIJ group companies, a variety of other value-added Internet services and products, including:

This extensive variety of Internet access services, systems integration services, value-added services and products enables our customers to purchase all their Internet-related services and

-13-

products through a single source. We aim to be the leading supplier of total Internet solutions in Japan.

We have created a high-quality network that extends throughout Japan. Our backbone is one of the highest capacity Internet backbones in Japan and to the United States by leasing lines from telecommunications carriers. Our domestic backbone is anchored by two 155 Mbps lines between Tokyo (Otemachi) and Tokyo (Ariake) and between Tokyo and Osaka and has large connections to the other major business regions in Japan. Our backbone is also one of the largest between Japan and the United States, with a total capacity of 775 Mbps as of March 31, 2000. In addition, we have recently increased our capacity by adding two additional 155 Mbps lines, and as a result, as of July, 2000 had total capacity of 1,085 Mbps between Japan and the United States. This allows us to better serve users that require high-speed, high-capacity and reliable services and provides us with the ability to gather and transmit large amounts of data traffic.

In addition to our network, we have significant interests in two other networks: the A-Bone and the Crosswave network. We currently own 20.6% of Asia Internet Holding, the company that owns the A-Bone. The A-Bone is an Internet network using leased lines that connects eight countries in the Asia-Pacific region, including Japan, China, Singapore, Hong Kong, Malaysia, Philippines, Indonesia and Thailand. We believe, based on publicly available information, our network backbone and the A-Bone together form the most extensive Internet backbone connecting the countries in the Asia-Pacific region to each other and to the United States. Using our network and engineering expertise and pursuant to an agreement with Asia Internet Holding, we operate and manage the A-Bone.

We also owned 40% of Crosswave at March 31, 2000, which operates one of the first high-speed telecommunications facilities and networks in Japan designed specifically for data communications. Through DWDM and SONET, advanced multiplexing and transmission technologies, we believe that Crosswave’s network will have the capacity to provide over 100 Gbps of bandwidth with multiplexing and transmission equipment upgrades .

Crosswave’s network began operating in April 1999 with 20 access points in the Tokyo-Nagoya-Osaka-Hokuriku ring. In October 1999, the network expanded to 53 access points and extended to most major cities in Japan and to Hokkaido and Kyushu. At the end of March 2000, we were operating over 70 access points throughout Japan and, as of May 2000, the network was operating nationwide, except Okinawa and Shimane, with over 80 access points.

Crosswave provides its customers with access to dedicated lines at prices that are significantly lower than currently available. We are Crosswave’s largest customer and use Crosswave’s lines for significant portions of our domestic backbone. We will continue to use Crosswave’s lines as we add new lines and replace or upgrade existing lines. Crosswave’ s lines allow us to significantly expand our network by adding additional capacity to handle increasing traffic volume and by increasing the number of our Pops It will also allow us to reduce our cost structure. We also expect that we will lease significant amounts of our international capacity from Crosswave in the near future.

-14-

Services

Our total Internet solutions

We are a provider of total Internet solutions. We provide our customers with tailored, end-to-end Internet and private network solutions. The diversity of services we offer permits each customer to purchase individual services or a bundle of services that provide the most efficient, reliable and cost-effective solution for that customer’s particular needs.

The primary resources that we use to provide total Internet solutions to our customers and the primary reasons that our customers choose us to provide them total Internet solutions include:

Our total Internet solutions for business users is one of the main focuses of our business. We consult with businesses and other customers to identify their particular situations and needs. We draw upon our extensive resources to address those needs.

Our Internet access services

We offer two categories of Internet access services: dedicated access services and dial-up access services. Dedicated access services are based on dedicated local-line connections provided by carriers between our backbone and customers. Dial-up access services require customers to connect to our Pops through public-switched telephone network or ISDN. The Internet access part of our total Internet solutions ranges from cost-effective, entry-level dial-up connections from home personal computers to customized wide-area network solutions deploying a range of the dedicated and dial-up services listed below to connect the headquarters, data centers, branch offices and mobile personnel.

-15-

The following table shows the numbers of our Internet access service subscribers as of the dates indicated.

| As of March 31, |

||||||||||||

| 1996 |

1997 |

1998 |

1999 |

2000 |

||||||||

| Dedicated access service contracts: | ||||||||||||

| IP Service | ||||||||||||

| 64kbps - 128kbps | 320 | 711 | 794 | 654 | 484 | |||||||

| 192kbps - 768kbps | 57 | 122 | 169 | 171 | 155 | |||||||

| 1Mbps - 1.5Mbps | 12 | 52 | 51 | 66 | 140 | |||||||

| 3Mbps - 150Mbps | 2 |

12 |

34 |

57 |

71 |

|||||||

| Total IP Service | 391 | 897 | 1,048 | 948 | 850 | |||||||

| IIJ T1 Standard (1.5 Mbps) | — | — | — | — | 146 | |||||||

| IIJ Economy | ||||||||||||

| 64kbps - 128kbps | — |

— |

156 |

708 |

1,008 |

|||||||

| Total dedicated access service contracts | 391 | 897 | 1,204 | 1,656 | 2,004 | |||||||

| Dial-up access service contracts: | ||||||||||||

| IIJ4U | — | 10,766 | 21,422 | 48,195 | 75,170 | |||||||

| Others | 17,706 |

17,929 |

14,534 |

10,508 |

54,970 |

|||||||

| Total dial-up access service contracts | 17,706 | 28,695 | 35,956 | 58,703 | 130,140 | |||||||

As of March 31, 2000, we offered the following Internet access services:

| Service Type |

Summary Description |

Pricing |

||

| Dedicated access services | ||||

| IP Service | Full-scale dedicated line service with high-speed access for businesses and other ISP’s with demanding throughput requirements. | The fees include various setup fees and monthly fees that vary according to carrier, line speed, line type and distance involved. | ||

| IIJ T1 Standard | Packaged dedicated line service offering 1.5 Mbps connection but not including certain features of full-scale IP Service such as dynamic routing and unlimited IP addresses. | Initial setup fee of ¥50,000 and monthly access fee of ¥167,000.* | ||

-16-

| Service Type |

Summary Description |

Pricing |

||

| IIJ Economy | Service for dedicated-line access to the Internet with inexpensive monthly fees primarily for medium and small businesses and local and regional offices of corporate groups. | Initial setup fee of ¥40,000 and ¥15,000 for an IP address application. Monthly access fees of ¥38,000 for 64 kbps service and ¥45,000 for 128 kbps service. | ||

| Dial-up access services | ||||

| IIJ Dial-up Standard | Service for corporate users permitting simultaneous Internet access from several dial-up lines under a single contract. | Initial setup fee of ¥20,000, Monthly basic fee of ¥2,000 plus access charges of ¥10 per minute. | ||

| Enterprise Dial-up IP Service | Service for businesses offering multiple dial-up accounts at a fixed monthly fee. | Initial setup fee of ¥50,000. Monthly basic fees from ¥3,000 to ¥4,900 per account depending on the number of accounts. | ||

| IIJ4U | Service for individual users which includes Internet access and 5 megabytes of disk space for personal Web pages and e-mail account options for multiple users. | Initial setup fee of ¥1,900. Monthly service fee of ¥800 for the first 8 hours and charge of ¥5 per minute, with a ceiling of ¥4,900, for the next 13 hours and 40 minutes. | ||

| Dial-up E-rate Service | Service for educational institutions. Services include Internet access, e-mail and disk space for home pages. | Initial setup fee of ¥5,000. ¥30,000 per year. | ||

* As of June 1, 2000, the monthly access fee was changed to ¥117,000 for up to 6 IP addresses and ¥167,000 for up to 14 IP addresses.

Dedicated access services

Our dedicated line access services, IP Service, IIJ T1 Standard and IIJ Economy, are our most important Internet access options. Total bandwidth allocated to our dedicated access services has increased to approximately 1,540 Mbps as of March 31, 2000, an approximately 148% increase from approximately 620 Mbps at March 31, 1999. In addition, the number of customers who had subscribed for service at 1 Mbps or higher increased to 357 as of March 31, 2000 from 123 as of

-17-

March 31, 1999.

IP Service. Our IP Service is a full-scale, high-speed access service that connects the customer’s network to our network and the Internet and is the most important service we offer. As of March 31, 2000, we had 850 customers for our IP Service, which has declined from 948 in March 31, 1999. Our IP Service allows unlimited, two-way communications not only with sites in Japan, but also with any organization connected to the Internet worldwide. The customer chooses the level of service it needs based upon its throughput requirements. As of March 31, 2000, we offered service from 64 kbps to 150 Mbps.

Our IP Service revenues including IIJ T1 Standard revenues, represented 36.0% of our total revenues for the year ended March 31, 2000 and 49.2% for the year ended March 31, 1999. We believe that, as businesses continue to develop Internet capabilities, this service will continue to be the central focus of our business.

The subscriber must pay a monthly fee for the leased local access line from the customer’s location to one of our POPs. The amount of this fee varies depending on the carrier used and the distance between the customer’s site and our POPs. We collect this fee from the customer and pay this fee amount over to the carrier.

Although fees are charged on a monthly basis, the minimum contract length is one year. For contracts of three years, a 10% per month discount is given. Approximately 28% of our IP Service contracts as of the end of March 2000 are for at least three years.

We have also introduced ATM access to our IP Service in several larger metropolitan areas including Tokyo and Osaka. A subscriber may now connect to our network using NTT’s ATM MegaLink service or the equivalent service from other carriers. ATM service was available at speeds from 3 Mbps to 135 Mbps as of March 31, 2000 at rates comparable to our IP Service rates.

For our IP Service, we offer service level agreements to our customers to better define the high quality of services our customers receive. We were the first ISP in Japan to introduce this agreement. This also differentiates our services from those of other ISPs who are unable to match our service quality.

We guarantee the performance of the following elements under our service level agreements:

We are able to offer these service level agreements because of the high quality and reliability of our network. Our service level agreements provide customers credit against the amount invoiced for the services if our service quality fails to meet the prescribed standards.

Subscribers to our IP Service receive 24-hour-a-day, seven-day-a-week technical support.

-18-

IIJ T1 Standard. Our IIJ T1 Standard is a connectivity service at 1.5 Mbps that we introduced in October 1999. It is similar to our IP Service but offers a more limited range of services in a package. For example, with IIJ T1 Standard customers are limited to static routing only and as of June 1, 2000, can have only up to 14 IP addresses depending on the level of service and service level guarantees only extend to latency rates. Otherwise, a customer of IIJ T1 Standard enjoys essentially the same benefits and high quality of service available under our IP Service. Local access must be through NTT’s Digital Access 1500 or Digital Reach 1500 or similar services from other carriers.

IIJ T1 Standard is specifically designed for medium and small businesses who may not need the full services available from IP Service but who do need high-speed reliable Internet connectivity service.

Although just introduced in October 1999, as of March 31, 2000, we had 146 subscribers to IIJ T1 Standard.

IIJ Economy. Our IIJ Economy is Internet access via a dedicated line at 64 kbps or 128 kbps. IIJ Economy represented approximately 3.5% of our total revenue for the year ended March 31, 2000 and 3.6% in the year ended March 31, 1999. We had 1,008 customers for IIJ Economy as of March 31, 2000 compared to 708 customers as of March 31, 1999 and only 156 in March 31, 1998. We introduced IIJ Economy in November, 1997.

IIJ Economy is specifically designed for users such as medium and small businesses who do not have large throughput requirements and do not require the higher levels of support available to IP Service subscribers. IIJ Economy allows them to access the IIJ network at either 64 kbps or 128 kbps at affordable rates but limits the amount of IP addresses a customer may have. In addition to medium and small businesses, another important group of subscribers to this service is regional and local offices of large corporations. The head office and other larger offices would use our IP Service to handle the larger numbers of employees and higher throughput requirements while the local and regional offices would use our IIJ Economy. We currently guarantee latency rates under service level agreements for IIJ Economy.

Dial-up access services

We offer a variety of dial-up access services. Our dial-up access services provide essentially the same high-quality services on the same high-quality network as our dedicated access services but do not have the same variety of options for bandwidth and levels of customer service and support. We consider our dial-up services to be primarily cost-effective, entry-level Internet access services for businesses and individuals.

Our dial-up access services are also, however, an important resource in offering total Internet solutions to corporate customers. It is our dial-up services for example that allow frequent travelers to access our network or their own corporate networks through one of our POPs or through our roaming access points. Our dial-up access services are also an important option for our large corporate groups that will be linking many offices through our network. Although these corporate groups would use dedicated lines for the main offices and their larger regional and local offices, they would also likely use our dial-up access services for their smaller branch offices.

-19-

Our main dial-up access services are our IIJ Dial-up Standard, Enterprise Dial-up IP Service, IIJ4U, and Dial-up E-rate Service all as described in the table above. We also provide Network-type Dial-up IP Service, Terminal-type Dial-up IP Service and UUCP Service to customers but we are no longer promoting these services. Our new IIJ Dial-up Standard has essentially the same features and options as the Network-type Dial-up IP Service and the Terminal-type Dial-up IP Service and costs less per month to use.

We will be expanding dial-up access to our network by increasing the number of our POPs. We will do this primarily by leveraging off of Crosswave and its nationwide network of POPs. We believe that increasing our POPs will be the key to increasing our revenues from individuals and other dial-up customers, it will also be one of the key elements in successfully introducing and implementing our OEM services.

We have also expanded access to our network through roaming agreements that are an important part of our dial-up access services. We offer global Internet roaming areas in 30 countries with over 473 POPs. Additionally, in the United States and Canada through IIJ America, we have roaming access through a toll-free number for areas where we don’t already have local POPs through roaming agreements or otherwise. We will continue to expand our roaming areas through these arrangements.

Our systems integration services

We offer network consulting and systems integration services. We plan and design server and network configurations, design and implement intranets or virtual private networks and maintain and operate network systems using our advanced network and provide other advice with a particular focus on helping customers make effective use of the Internet. For our more sophisticated client projects, network consulting and systems integration is the design platform on which we provide total Internet solutions that incorporate many of our other access and value-added services.

We also provide our customers with basic, easy-order systems integration services, which we refer to as iBPS e-business solutions, consisting of consulting and the supply of various components such as server equipment, settlement distribution systems, network monitoring and systems operation management that allow our customers to launch their own e-commerce businesses quickly and cost-effectively.

Our value-added services

Although our primary service to our customers has been Internet access, our customers are increasingly seeking additional services. We provide our customers with a broad range of Internet related, high-quality services and products which allows customers to purchase access, applications and services, in other words total Internet solutions, directly from us.

We believe that business customers will continue to increase their use of the Internet as a business tool and will increasingly rely on an expanding range of value-added services to enhance productivity, reduce costs and improve service reliability.

We offer a variety of value-added services that complement and enhance our Internet access services and systems integration services. These services include:

-20-

| |

Security solutions. As of March 31, 2000, we offered three main security services that protect customers’ internal networks from unauthorized access: firewalls, comprehensive network security services and security standard services. In July 2000, we also began offering “IIJ Security Premium”, a high value-added firewall operation and management service based on Firewall-1, a product which has the biggest market share, we license from Check Point Software Technologies. |

IIJ Firewall Service. We sell and install firewall hardware and software. A firewall is a system placed between the customers’ internal network and external networks. A firewall stands as a barrier between the areas of a customer’s network that are open to the public, such as a Web site, and those that a customer wants to protect from public access, such as databases. Firewalls also filter data passing through the firewall removing unauthorized traffic. We were the first ISP in Japan to provide firewalls, which we first offered in 1994. We no longer actively market IIJ Firewall Service, an integrated hardware and software product we developed based on the Gauntlet system developed in the United States.

Network security services. We offer or will offer a series of services which collectively add up to total security solutions for a customer’s corporate network. Our network security services will include:

Consultation. We analyze the security level of a customer’s network and suggest measures for security enhancement.

Integration. We develop and implement security measures based upon the results of our consultation review.

Monitoring. We will monitor traffic over the customers network and report statistics and security events.

Operation. We will operate a customer’s network firewall system, including configuration, installation of software upgrades, the handling of alerts, the detection and deflection of attacks on a system’s security and the modification of network settings.

IJ Security Standard Service. We began offering in October 1999 security standard services pursuant to which we install and manage (24 x 7) the operation of firewall systems. The initial setup fee is ¥120,000 and the monthly fee is ¥60,000 or ¥90,000 depending on the customer’s hardware.

| |

Co-location. Our co-location services allow companies to house their servers and routers off-site in our facilities at our data centers. We monitor and maintain the equipment as necessary for our customers. This service enhances reliability, since we provide 24-hour monitoring and have specialized maintenance personnel and facilities. This service also increases the efficiency of many networks, particularly where the customer’s routers and servers are servicing multiple locations. Our co-location services will be enhanced by the completion of our new data center. |

-21-

IIJ Post Office Service. IIJ Post Office Service essentially outsources to us the job performed by an e-mail server — an easy, inexpensive way for a customer to allocate and maintain a number of e-mail accounts under its own domain name for its employees, members or other relevant users. We do all the necessary work to set up a mail server so the customer does not have to incur trouble and expense of setting up its own mail server. The customer can administer e-mail accounts on-line through our customer support Web interface. IIJ Post Office Service is available to customers subscribing to our IP Service, IIJ Economy, Enterprise Dial-Up IP service, IIJ Dial-up Standard and to Internet connection services of other ISPs.

IIJ Mail Box Service. IIJ Mail Box Service is essentially the same as IIJ Post Office Service. However, customers do not have to obtain their own domain names. IIJ serves as the mail box for the customers. As with IIJ Post Office Service, the customer can administer the e-mail accounts on-line through IIJ’s Customer Support Website.

ID Gateway Service. ID Gateway Service is an access control service available to complement our Enterprise Dial-up IP Service. When used in combination with our Enterprise Dial-up IP Service, ID Gateway Service provides customers’ employees and associates the ability to access the customers’ networks through any of our POPs. A customer that buys our ID Gateway Service is spared the trouble of authenticating users. ID Gateway systems placed at the entry to the customer’s network identify the accessing user by interacting with the ID servers at our sites which keep the information relating to user accounts and IP addresses. ID Gateway provides access control functions based on this user account information.

Customer support. We provide our customers with comprehensive service and support that includes network service and support as well as training seminars to educate new and existing customers about various Internet uses and applications. Most of our customer support services are provided as an integral part of other services we sell, such as Internet access. A portion of our customer support services are provided for a fee, or without compensation as part of our marketing efforts.

Web hosting and content development and distribution. We provide Web hosting and content development and distribution services. These services help our customers to market their own products and services on the Internet without having to invest in technology infrastructure and operations staff. We help customers design their Web pages which they place on our WWW servers that are linked directly to our network. We will also manage the posting of content on the Web page and the distribution of content to mailing lists, to news groups or to other simultaneous distribution services.

Web access management service. We provide a full-scale web access control service which controls inappropriate access to Web sites for businesses and other organizations. This service allows customers to clearly control Web site access by changing firewall and proxy server settings through application software over the Internet.

-22-

Network

Our network is one of our most important assets. We have developed and operate a high-capacity network that has been designed to provide reliable, high-speed, high-quality Internet access services.

We are able to achieve and maintain high speeds through our advanced network architecture, routing technology and aggressive load balancing that optimize traffic through our multiple Internet connections.

The primary components of our network consist of:

Backbone

Leased lines. Our network is anchored by our extensive Internet backbone in Japan and between Japan and the United States. As of March 31, 2000, we had a total capacity of 775 Mbps between Japan and the United States. As a result of recent additions of capacity, this capacity has increased to 1,085 Mbps as of July 2000. We use our expertise in developing and operating our network to organize and connect these leased lines to form a backbone that has substantial transmission capacity.

We lease high-capacity, high-speed digital transmission lines in Japan from various carriers, including Crosswave. However, because Crosswave's standard leased line rates are generally significantly lower than other carriers, recently we have been converting our existing leases to leases from Crosswave. As of March 31, 2000, we had shifted over 80% of our domestic backbone capacity to Crosswave. We also plan to use Crosswave’s SONET technology to further improve the efficiency of our network.

Because of the scalable nature of our network, we have had no problems and anticipate having few, if any, problems integrating Crosswave’s networks with ours. One of the primary means to grow our network in terms of capacity and geographic coverage in the coming years will be through our use of Crosswave’s network.

With respect to our leased lines to the United States, IIJ has long-term contracts with KDD, C&W IDC, WorldCom and AT&T. The table below sets out our international backbone capacity and cost. Average total capacity is calculated by averaging the international capacity at the end of each month.

-23-

International Backbone Capacity and Cost

| For the year ended March 31, |

|||||||||

| 1996 |

1997 |

1998 |

1999 |

2000 |

|||||

| Backbone cost (thousand yen) | 233,174 | 1,372,452 | 3,095,149 | 3,722,676 | 5,660,277 | ||||

| Average total capacity (Mbps) | 12.17 | 78.75 | 204.58 | 282.08 | 620.00 | ||||

| Average cost per 1 Mbps (thousand yen) | 19,165 | 17,428 | 15,129 | 13,197 | 9,129 | ||||

In the United States, our network backbone connects to the following major interexchange points (IX):

Through these IX points we connect to many other ISPs in the United States, including Sprint, C&W (Internet MCI) and MCI WorldCom (UUNET).

In Asia, we have established a backbone connection through A-Bone, the Internet backbone network covering the Asia-Pacific region. The A-Bone is operated by Asia Internet Holding, of which we own 20.6%. Asia Internet Holding commissioned IIJ to design and build the A-Bone and IIJ currently manages the A-Bone.

In Europe, Asia Internet Holding has established a roaming alliance with KPN Qwest through the A-Bone that allows us to offer roaming to our customers.

Expansion plans. We have placed a high priority on the continued expansion of the capacity and geographic reach of our networks. We will look first at increasing our domestic network and our network between Japan and the United States. We will also look at expanding our network in the Asia-Pacific region, into Europe and in the United States as opportunities arise.

With respect to our domestic expansion, we are extending our geographic coverage and our capacity by leasing lines from Crosswave, particularly in areas where we do not currently have POPs. We are also replacing our existing lines with new lines of the same or higher capacity from Crosswave.

Between Japan and the United States, we will look primarily to increase our capacity by securing long-term committed capacity either directly or through Crosswave, who would then lease all or a substantial portion of the international capacity to us on a long-term basis. To this end, Crosswave entered into a long-term IRU contract (23 years) with Global Crossing in March 2000 for significant amounts of dedicated capacity between Japan and the United States.

Although we believe that our total expenditures for additional capacity in the near term will increase in absolute terms, we believe that the per unit costs will be significantly reduced because of

-24-

the availability of lower-cost lines from Crosswave and because of the anticipated increase of available capacity between Japan and the United States from the expected completion later this year of a number of undersea cables. To the extent that domestic and trans-Pacific leased line costs do not decline as anticipated, we may not realize the cost savings we anticipate and/or we may choose not to add as much capacity as we currently plan to.

Network equipment. We use advanced equipment in our network. Our primary routers for our dedicated lines are Cisco routers. Our primary dial-up routers are Lucent Technologies MAX routers. The size of our routers varies depending on the number of customers and volume of traffic served by our POPs. At each POP we connect our dedicated line and dial-up access routers to Cisco backbone routers which then transmit and receive information throughout our network. We primarily lease our network equipment.

POPs

POPs are the main points at which our customers connect to the IIJ backbone. We provide Internet access from our POPs to commercial and residential customers through leased lines and dial-up connections over local exchange facilities. As of March 31, 2000, we had 23 primary POPs which allow for dedicated and dial-up access and include the main Internet backbone routers that form our network. As of the same date, we also had 11 additional POPs for dial-up access. We are also in a position to leverage off a Crosswave’s nationwide network and access points and can easily add additional POPs for either dedicated or dial-up access as demand merits.

Many of our POPs are located in, or in close physical proximity to, “carrier hotels.” Carrier hotels are facilities where we and other major carriers and ISPs have POPs. These are mainly located at facilities of various carriers in Japan like NTT, KDD, Japan Telecom and C&W IDC. We lease the physical space from these carriers or use such space under other arrangements with terms ranging from one to two years most of which can be terminated by either party on three to six months’ notice. We maintain our routers and other networking equipment at these POPs. Our actual location in, or in close proximity to, the same building in which the switches and routers of these carriers and ISPs are located offers us the ability to quickly and easily interconnect our equipment to theirs.

Data centers

We currently have data centers in Tokyo and Yokohama, Japan. Our current data centers are in space that we lease. Crosswave is building and operating data centers in major metropolitan areas in Japan (Tokyo, Osaka, Sapporo, Sendai, Nagoya and Fukuoka). These data centers will be specifically designed for application hosting, co-location services and high capacity access to both IIJ’s and Crosswave’s networks. At these data centers, we plan to offer co-location services, application hosting services, asymmetric connectivity services, quality assurance programs and a variety of other services that will allow us to continue to provide total Internet solutions to our customers. Our data centers will also support the growing e-commerce and content businesses. We will also connect directly to Crosswave’s network at these data centers.

These data centers will have 24-hour-a-day, seven-day-a-week operations and security and will be equipped with uninterruptible power supply and backup generators, anti-seismic damage precautions, fire suppression equipment and other features to optimize our ability to offer high-quality services through these data centers.

-25-

Network operations center and technical and customer support

Our network operations center or NOC in Tokyo operates 24 hours a day, seven days a week. From our NOC we monitor the status of our network, the traffic on the network, the network equipment and components and many other aspects of our network including our customers’ dedicated access lines leased from carriers. From our NOC, we will monitor our networks to ensure that we meet our commitments under our service level agreements.

Our group companies

We offer our services directly and together with our group companies. Our group companies work closely together in providing total Internet solutions to our customers. We collaborate on the development of various services and products and we market our services and products together as a group. However, our group companies specialize in different aspects of the Internet. Our customers’ main point of contact is IIJ itself. We then draw upon the resources and specialization of the group companies to offer total Internet solutions.

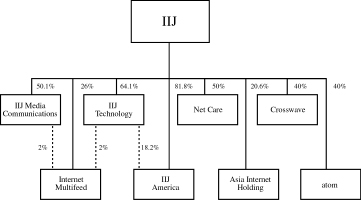

The chart below sets out our group companies and our ownership of each of them as of March 31, 2000*:

*As of August 9, 2000, as a result of the initial public offering of Crosswave, our ownership of Crosswave was 34.9%. Additionally, in April 2000, we increased our stake in IIJ America to 84.6% while IIJ Technology's stake decreased to 15.4%.

Our group companies are not all majority-owned subsidiaries. Therefore, although we don’t consolidate all of the group companies, we do exercise significant influence over several of them. IIJ Technology, IIJ Media Communications, IIJ America and Net Care are subsidiaries that we account for on a consolidated basis. Among the other shareholders of the group companies are shareholders who are also shareholders of ours. Mr. Suzuki, our President, is also the sole Representative Director of each of the group companies except atom where he serves as a director. All of our group companies are incorporated in Japan except for IIJ America, which is incorporated in New York.

-26-

Crosswave Communications Inc.

Crosswave is a pioneer in the introduction of broadband data communications infrastructure and services to businesses and telecommunications carriers in Japan, including the high-speed backbone, wide area Ethernet platform, data center and other value-added services. Crosswave operates the first nationwide fiber optic network in Japan specifically designed for the high-speed transmission of data. Its network uses advanced optical technologies that allow it to deliver high-capacity, cost-effective and highly reliable data communication services, eliminating the burden of multiple layers of equipment employed in traditional telephony systems. Its extensive, flexible, and scalable network can be easily upgraded to increase capacity, support new services and incorporate new transmission technologies, as the market demands.

Crosswave was formed in October 1998 by IIJ, Sony and Toyota Motor and began offering services in May 1999. As of March 31, 2000, IIJ, Sony and Toyota Motor owned 40%, 30% and 30%, respectively, of Crosswave. As a result of the August 2000 initial public offering and listing of ADRs representing Crosswave’s common stock on the Nasdaq National Market and a concurrent private placement to IIJ, however, these percentages have been reduced to 34.9%, 23.9% and 23.9%, respectively.

As of March 31, 2000, Crosswave had 44 full-time employees, 15 of whom were seconded to Crosswave.

Crosswave is a Type I carrier, which allows it to provide telecommunications services through its own telecommunications circuit facilities.

For the year ended March 31, 2000, it had revenues of ¥232 million and a net loss of ¥7,849 million.

Crosswave’s network. Crosswave’s primary asset is its network. As of March 31, 2000, it had made operational the 3,409 route miles of backbone fiber in its network that are leased from KDD providing a nationwide backbone reaching into every prefecture in Japan except Okinawa and Shimane. Crosswave’s primary expenses are related to the development of its domestic network. Crosswave has also contracted with KDD to receive from KDD maintenance services covering the leased dark fiber. For a discussion of Crosswave’s expenses and the contract with KDD, please see Item 5. Operating and Financial Review and Prospects.

Through this optical fiber network, Crosswave is able to offer data transmission rates at speeds faster than currently available in Japan and at significantly lower prices than currently available. Crosswave currently offers transmission at speeds of up to 600 Mbps but this can be increased as necessary to meet increasing traffic requirements.

We have been primarily responsible for and have actively participated, as a third party contractor or through our seconded employees, in the planning and design of the Crosswave network and services. We worked closely with Crosswave to ensure that its network is well suited, in terms of quality of technology and otherwise, to integrate with our network and the services we currently offer and will offer in the future. In addition, we assist Crosswave in the operation and maintenance of its optical fiber network as a third-party contractor.

-27-

In addition to its optical fiber network in Japan, Crosswave is expanding its network internationally by securing contractual rights from third parties to dedicated capacity between Japan and the United States. Depending upon the rate of expansion, we would anticipate securing leases for a large amount of our international capacity from Crosswave. As with domestic leased lines that Crosswave offers, we expect that this international capacity would be available at significantly lower per unit costs than we are currently paying.

Crosswave's primary services. Crosswave offers four main types of services: high speed backbone service, wide area Ethernet platform service, dial-up port service and data center services.

Crosswave's customers. Crosswave's sales and marketing is primarily done by Crosswave and IIJ although Crosswave also uses third-party agents throughout Japan. In addition, IIJ markets Crosswave's services as an agent and as part of the services offered by the IIJ group. As a Type I carrier, Crosswave is required to make its tariff-based services available on the same terms and conditions to all customers, without special treatment to its shareholders, including IIJ.

Our plan to increase our use of Crosswave's services. We will benefit from Crosswave's network in four primary ways. First, we will be able over time to replace existing leased lines with Crosswave's leased lines. As the lease periods of our current leased lines expire, we will switch to a Crosswave line if one is available. This will reduce our domestic backbone cost (which was ¥1.5 billion in the year ended March 31, 2000) as Crosswave's leased line rates are significantly lower than rates we currently pay to others.

Second, we will be able to add additional capacity to our current network in a more cost effective manner. As the volume of traffic across our network continues to increase, we need to add additional capacity. Crosswave allows us to add significant capacity to our existing networks at lower rates than we are currently paying to others.

Third, we will be able to leverage Crosswave's network infrastructure to expand the geographic coverage of our network. Crosswave had over 70 POPs as of March 31, 2000. We will be able to use those POPs if we purchase Crosswave's leased line service or network platform service. We can also use Crosswave's dial-up ports as dial-up access points for our own dial-up access services, including IIJ4U and OEM services.