|

|

|

|

|

Previous: TRITON PCS HOLDINGS INC, 8-K, EX-99.1, 2001-01-12 |

Next: SIERRA GIGANTE RESOURCES INC, NT 10-Q, 2001-01-12 |

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrant /x/ | ||

| Filed by a Party other than the Registrant / / | ||

Check the appropriate box: |

||

| / / | Preliminary Proxy Statement | |

| /x/ | Definitive Proxy Statement | |

| / / | Definitive Additional Materials | |

| / / | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12 | |

| / / | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

Charlotte Russe Holding, Inc. |

||||

(Name of Registrant as Specified In Its Charter) |

||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| /x/ | No fee required | |||

| / / | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

| / / | Fee paid previously with preliminary materials. | |||

| / / | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

CHARLOTTE RUSSE HOLDING, INC.

4645 Morena Boulevard

San Diego, CA 92117

January 12, 2001

Dear Stockholder:

It is my pleasure to invite you to the Annual Meeting of Stockholders of Charlotte Russe Holding, Inc. to be held Tuesday, February 13, 2001, at 9:00 a.m. at the Hyatt Islandia on Mission Bay, 1441 Quivera Road, San Diego, California 92109.

Whether or not you plan to attend, and regardless of the number of shares you own, please sign and date your proxy and return it promptly in the enclosed envelope, which requires no postage if mailed in the United States. If you attend the meeting, you may vote in person even if you return your enclosed proxy card.

I hope that you will be able to attend the meeting. The officers and directors of the Company look forward to seeing you at that time.

Very truly yours,

BERNARD ZEICHNER

President, Chairman and Chief Executive Officer

CHARLOTTE RUSSE HOLDING, INC.

4645 Morena Boulevard

San Diego, California 92117

NOTICE OF 2001 ANNUAL MEETING OF STOCKHOLDERS

Tuesday, February 13, 2001

9:00AM

The 2001 Annual Meeting of Stockholders of Charlotte Russe Holding, Inc. (the "Company") will be held at the Hyatt Islandia on Mission Bay, 1441 Quivera Road, San Diego, California, 92109 on Tuesday, February 13, 2001, at 9:00 a.m., for the following purposes:

The Board of Directors has fixed Tuesday, January 2, 2001 as the record date for the annual meeting. Only holders of record at the close of business on that day will be entitled to vote at the annual meeting or any adjournment of the annual meeting.

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE DATE, SIGN AND COMPLETE THE ENCLOSED PROXY AND RETURN IT PROMPTLY IN THE ENVELOPE PROVIDED. It is important that your shares be represented at the annual meeting, and your promptness will assist us to prepare for the annual meeting and to avoid the cost of a follow-up mailing. If you receive more than one proxy card because you own shares registered in different names or at different addresses, each proxy card should be completed and returned.

BY

ORDER OF THE BOARD

OF DIRECTORS,

JENNIFER L. BOLINGER

Secretary

January 12, 2001

CHARLOTTE RUSSE HOLDING, INC.

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

The board of directors of Charlotte Russe Holding, Inc., a Delaware Corporation (the "Company"), is soliciting the enclosed proxy form from our stockholders. The proxy will be used at our 2001 Annual Meeting of Stockholders to be held at 9:00 a.m. on Tuesday, February 13, 2001 at the Hyatt Islandia on Mission Bay, 1441 Quivera Road, San Diego, California 92109.

This proxy statement contains important information regarding our annual meeting. Specifically, it identifies the proposals on which you are being asked to vote, provides information that you may find useful in determining how to vote, and describes voting procedures.

We use several abbreviations in this proxy statement. We refer to our company as "Charlotte Russe" or the "Company." We call our board of directors the "Board." References to "fiscal 2000" mean our 2000 fiscal year, which began on September 26, 1999 and ended on September 30, 2000.

Who May Attend and Vote?

Our board of directors is sending this proxy statement on or about January 12, 2001 to all of our stockholders as of the record date, January 2, 2001. Stockholders who owned Charlotte Russe common stock at the close of business on January 2, 2001 are entitled to attend and vote at the annual meeting. On the record date, we had approximately 20,384,412 shares of our common stock issued and outstanding. We had 10 record stockholders as of the record date and believe that our common stock is held by more than 600 beneficial owners.

How Do I Vote?

As a stockholder, you have the right to vote on certain business matters affecting our company. The two proposals that will be presented at the annual meeting, and upon which you are being asked to vote, are discussed in the sections entitled "Proposal One" and "Proposal Two". Each share of Charlotte Russe common stock you own entitles you to one vote. The enclosed proxy card indicates the number of shares you own.

By signing and returning the proxy card according to the enclosed instructions, you are enabling the individuals named on the proxy card (known as "proxies") to vote your shares at the meeting in the manner you indicate. We encourage you to sign and return the proxy card even if you plan to attend the meeting. In this way, your shares will be voted even if you are unable to attend the meeting. Your shares will be voted as you direct on the proxy card. If you attend the meeting, you may deliver your completed proxy card in person or fill out and return a ballot that will be supplied to you.

What Does the Board of Directors Recommend?

If you submit the proxy card but do not indicate your voting instructions, the persons named as proxies on your proxy card will vote in accordance with the recommendations of the Board of Directors. The Board recommends that you vote:

1

What Vote Is Required for Each Proposal?

Consistent with Delaware law and the Company's by-laws, the holders of a majority of the shares entitled to be cast on a particular matter, present in person or represented by proxy, constitutes a quorum as to such matter. The affirmative vote of the majority of votes cast is required for the election of the directors. The affirmative vote of the majority of outstanding shares of common stock is necessary to approve the increase in the number of shares available for issuance under the Company's 1999 Equity Incentive Plan. The SK Equity Fund, L.P. and the SK Investment Fund, L.P. (the "SKM Funds") together hold a majority of the outstanding shares of our common stock and have informed us that they intend to vote in favor of each of the proposals outlined above.

Shares represented by proxies that indicate an abstention or a "broker non-vote" (that is, shares represented at the Annual Meeting held by brokers or nominees as to which (i) instructions have not been received from the beneficial owners or persons entitled to vote and (ii) the broker or nominee does not have discretionary voting power on a particular matter) will be counted as shares that are present and entitled to vote on the matter for purposes of determining the presence of a quorum. Shares indicating an abstention and shares indicating a broker non-vote, however, will not constitute votes cast at the meeting and thus will have no effect on the outcome.

May I Change My Vote After I Return My Proxy Card?

Yes. Any stockholder has the right to revote his or her proxy at any time before it is voted by: (1) attending the meeting and voting in person; (2) by filing with our Secretary a written instrument revoking the proxy; or (3) delivering to our Secretary another newly executed proxy bearing a later date.

PROPOSAL ONE: ELECTION OF DIRECTORS

The Board of Directors

Under our current certificate of incorporation and by-laws, our Board of Directors determines the number of our directors. We currently have five directors.

The Election

The five directors whose regular terms of office expire at the 2000 annual meeting have been nominated for reelection to our Board of Directors. Information about these directors is given below. If elected, each director would serve until the next annual meeting and until his successor is elected and qualified, or until his earlier death, removal, or resignation.

The Board of Directors has no reason to believe that any of the listed nominees will not serve if elected. If, however, any nominee cannot or will not serve as a director, the persons named on your proxy card may vote for a substitute nominee designated by the Board.

2

Set forth below is information as of December 15, 2000 concerning each of the nominees for director.

| Name |

Age |

Experience; Principal Occupation; Directorships of Other Public Companies |

||

|---|---|---|---|---|

| Bernard Zeichner | 56 | Mr. Zeichner has been our President since May 1996. Mr. Zeichner also serves as Chief Executive Officer and Chairman of the Board of Directors. Prior to joining the Company, he was President of the retail division of Guess? from 1993 to 1995. Prior to that, Mr. Zeichner was employed by Contempo Casuals, serving as President from 1982 to 1993 and as Chief Executive Officer from 1989 to 1993. From 1977 to 1982, Mr. Zeichner was Executive Vice President of Joske's of Texas, a department store chain. | ||

| Allan W. Karp | 45 | Mr. Karp has been a Director since September 1996. Since 1990, Mr. Karp has been a Partner of Saunders Karp & Megrue Partners, L.L.C., or its predecessor, which serves as the general partner of three private investment funds. Before founding Saunders Karp & Megrue Partners, L.L.C., Mr. Karp was a Principal in the Merchant Banking Department at Morgan Stanley & Co., Inc. Mr. Karp also serves on boards of directors of Mimi's Cafe, Souper Salad, Inc., Constellation Concepts, Inc., Accessory Network Group, Inc., Party Concepts, Inc., World Bazaars, Inc., S.B. Restaurant Co. and UpToDate, Inc. | ||

| David J. Oddi | 30 | Mr. Oddi has been a Director since September 1996. Mr. Oddi joined Saunders Karp & Megrue, L.P. as an Associate in 1994 and is currently a Partner of Saunders Karp & Megrue Partners, L.L.C., which serves as the general partner of three private investment funds. Prior to joining Saunders Karp & Megrue, Mr. Oddi was a financial analyst in the Leveraged Finance Group at Salomon Brothers, Inc. Mr. Oddi also serves on the boards of directors of The Children's Place Retail Stores, Inc., Pennsylvania Fashions, Inc., S.B. Restaurant Co., Inc., SWH Corporation, Inc., Giftware Holdings, Inc., and Souper Salad, Inc. | ||

| Paul R. Del Rossi | 58 | Mr. Del Rossi has been a Director since January 2000. He served as President and CEO of General Cinema Theatres from 1983 through 1997, and currently serves as Chairman of General Cinema Theatres and General Cinema International. Prior to joining General Cinema, Mr. Del Rossi was Senior Vice President of the Venture Capital Group at The Boston Company and was a management consultant with Arthur D. Little. Mr. Del Rossi is also a director of the Massachusetts Chapter of the Cystic Fibrosis Foundation and the DeWolfe Companies, and serves as a trustee of Babson College. | ||

| W. Thomas Gould | 54 | Mr. Gould became a Director in January 2000. Mr. Gould began his career with Maas Brothers, a division of Allied Stores Corporation, in 1969 and in 1985 joined Younkers as President. During his time at Younkers, Mr. Gould also served as both the CEO and Chairman until it merged with Proffitt's (now owned by Saks Incorporated) in 1996. He then served as Vice Chairman of Proffitt's until his retirement in April 1997. Mr. Gould also serves on the Board of Directors of Sentry Insurance Company. |

3

| Recommendation: | Our Board of Directors recommends that you vote "FOR" the election of each nominee named above. |

Information Concerning the Board of Directors and Its Committees

During fiscal 2000, our Board of Directors held four meetings, including one meeting by telephone, and acted by unanimous written consent on four occasions. The Board of Directors has two standing committees: the Audit Committee and the Compensation Committee. Each of our directors attended at least 75% of the meetings of the Board of Directors and of each committee of which he is a member.

The Audit Committee, which consists of Paul R. Del Rossi and W. Thomas Gould, was established in January 2000 and held three meetings during fiscal 2000. The Audit Committee serves as the representative of the Board for the general oversight of Company affairs in the area of financial reporting and internal operating controls. In meeting its responsibilities, the Audit Committee is expected to (i) to review with management and the independent auditors the scope and results of the annual audit, the nature of any other services provided by the independent auditors, changes in the accounting principles applied to the presentation of the Company's financial statements, and any comments by the independent auditors on the Company's policies and procedures with respect to internal accounting, auditing and financial controls, (ii) to review the consistency and reasonableness of the financial statements contained in the Company's quarterly and annual reports prior to filing them with the Securities and Exchange Commission and discuss the results of these quarterly reviews, annual audits and any other matters required to be communicated by the independent auditors under generally accepted auditing standards, and (iii) to make recommendations to the Board of Directors on the engagement of independent auditors.

The Compensation Committee, which consists of Allan W. Karp and David J. Oddi, was established in October 1996 and held one meeting during fiscal 2000. The duties of the Compensation Committee are (i) to exercise the power of the Board of Directors with respect to the administration of, and grant of awards under, the Company's 1999 Equity Incentive Plan and (ii) to review and establish compensation practices and policies for the officers of the Company.

Our non-employee directors currently receive an annual fee of $10,000 plus $500 for each meeting attended. Any director may waive these fees, and in fiscal 2000, Allan W. Karp and David J. Oddi waived them. Directors who are employees of the Company are not entitled to any fees or additional compensation for service as members of the Board of Directors or any of its committees. All directors are reimbursed for reasonable travel and other expenses of attending meetings of the Board of Directors and committees of the Board of Directors. In addition, each non-employee director is eligible to participate in the 1999 Equity Incentive Plan. In fiscal 2000, Paul R. Del Rossi and W. Thomas Gould each received an option to purchase 10,000 shares of common stock in connection with their appointment to the Board of Directors. These options are exercisable in four equal annual installments commencing on the first anniversary of the date of grant.

Information about ownership of the Company's securities by the nominees for director is included under the heading "Security Ownership of Certain Beneficial Owners and Management."

4

The names and business experience of the executive officers of the Company who are not also directors are set forth below.

| Name |

Age |

Position |

||

|---|---|---|---|---|

| Harriet A Bailiss-Sustarsic | 43 | Executive Vice President, General Merchandise Manager | ||

| Daniel T. Carter | 44 | Executive Vice President, Chief Financial Officer | ||

| R. Tina Kernohan | 47 | Executive Vice President, Store Operations |

Ms. Sustarsic has been our Executive Vice President and General Merchandise Manager since October 1996. From 1993 to 1996, Ms. Sustarsic was Director of Merchandising for the knits division of Rampage Clothing Company, a junior apparel manufacturer. Previously, Ms. Sustarsic worked for Contempo Casuals from 1987 to 1993, starting as a buyer and rising to a Divisional Merchandise Manager. Ms. Sustarsic began her retail career in 1980 at The Broadway department store chain and served in various merchandising positions.

Mr. Carter joined us in June 1998 as Executive Vice President and Chief Financial Officer. From September 1997 through May 1998, Mr. Carter was Chief Financial Officer for Advanced Marketing Services, a public company that wholesales books to Costco and Sam's Club. From 1986 to September 1997, Mr. Carter was employed by The Price Company, the operator of Price Clubs, and follow-up entities, ultimately serving as Senior Vice President for PriceCostco and Chief Financial Officer for Price Enterprises. Mr. Carter is a Certified Public Accountant.

Ms. Kernohan joined us in June 1996 as a Regional Manager and was promoted to Executive Vice President, Store Operations in October 1997. From 1991 to 1996, Ms. Kernohan was a District Manager at Miller's Outpost, where she supervised the operation of 20 stores. Ms. Kernohan was employed by Contempo Casuals from 1974 to 1990, where she advanced from sales to regional management, supervising 40 stores across five states.

5

The following table sets forth all compensation for the last three completed fiscal years awarded to, earned by, or paid to the persons who served as our executive officers during the fiscal 2000 for all services rendered in all capacities to the Company and its subsidiaries.

| |

|

|

|

Long Term Compensation Awards |

|

||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Name and Principal Position at Fiscal Year End |

Year |

Salary ($) |

Bonus ($) |

Securities Underlying Options (#) |

All Other Compensation($) |

||||||

| Bernard Zeichner President, Chief Executive Officer |

2000 1999 1998 |

362,788 280,288 275,001 |

300,124 275,000 -0- |

— — — |

30,067 — 8,148 |

(1) (2) |

|||||

| Harriet A. Bailiss-Sustarsic Executive Vice President, General Merchandise Manager |

2000 1999 1998 |

231,590 200,346 161,231 |

94,000 111,000 -0- |

35,000 — — |

— — — |

||||||

| Daniel T. Carter Executive Vice President, Chief Financial Officer |

2000 1999 1998 |

236,731 206,834 56,154 |

88,000 120,000 -0- |

35,000 100,000 — |

— — — |

||||||

| R. Tina Kernohan Executive Vice President, Store Operations |

2000 1999 1998 |

118,125 102,558 93,942 |

26,250 48,780 13,247 |

10,000 — — |

— — — |

Option Grants in Last Fiscal Year

The following table sets forth the individual grants of stock options made by the Company during the fiscal year ended September 30, 2000 to our executive officers.

| |

|

|

|

|

Potential Realizable Value At Assumed Annual Rates of Stock Price Appreciation for Option Term |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

Percent of Total Options Granted to Employees in Fiscal 2000 |

|

|

|||||||||||

| |

Number of Securities Underlying Options Granted |

|

|

||||||||||||

| |

Exercise Price |

Expiration Date |

|||||||||||||

| Name |

5% |

10% |

|||||||||||||

| Bernard Zeichner | — | — | — | — | — | — | |||||||||

| Harriet A. Bailiss-Sustarsic | 35,000 | 14.00 | % | $ | 11.00 | 10/19/09 | $ | 627,124 | $ | 998,591 | |||||

| Daniel T. Carter | 35,000 | 14.00 | % | $ | 11.00 | 10/19/09 | $ | 627,124 | $ | 998,591 | |||||

| R. Tina Kernohan | 10,000 | 4.00 | % | $ | 11.00 | 10/19/09 | $ | 179,178 | $ | 285,312 | |||||

6

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

The following table summarizes for each of our executive officers (i) the total number of shares received upon exercise of stock options during the fiscal year ended September 30, 2000, (ii) the aggregate dollar value realized upon such exercise, (iii) the total number of unexercised options, if any, held at September 30, 2000 and (iv) the value of unexercised in-the-money options, if any, held at September 30, 2000. In-the-money options are options where the fair market value of the underlying securities exceeds the exercise or base price of the option. The aggregate value realized upon exercise of a stock option is the difference between the aggregate exercise price of the option and the fair market value of the underlying stock on the date of exercise. The value of unexercised, in-the-money options at fiscal year-end is the difference between the exercise price of the option and the closing sale price of a share of common stock on September 30, 2000, which was $13.25. With respect to unexercised, in-the-money options, actual gains, if any, realized on exercise will depend on the value of the common stock on the date of exercise.

| |

|

|

Number of Securities Underlying Unexercised Options at September 30, 2000 |

|

|

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

|

Value of Unexercised In-the-Money Options at September 30, 2000 |

||||||||||||

| |

Shares Acquired on Exercise |

|

|||||||||||||

| |

Value Realized |

||||||||||||||

| Name |

Exercisable |

Unexercisable |

Exercisable |

Unexercisable |

|||||||||||

| Bernard Zeichner | — | — | 823,500 | 91,500 | $ | 9,840,825 | $ | 1,093,425 | |||||||

| Harriet A. Bailiss-Sustarsic | 50,600 | $ | 536,950 | 14,200 | 78,200 | $ | 173,950 | $ | 607,950 | ||||||

| Daniel T. Carter | — | — | 40,000 | 95,000 | $ | 390,000 | $ | 663,750 | |||||||

| R. Tina Kerrnohan | 5,000 | $ | 56,250 | 27,400 | 31,600 | $ | 335,650 | $ | 287,100 | ||||||

Employment Arrangements with Executive Officers

We entered into an employment agreement with Bernard Zeichner that remains effective through September 30, 2001. Under the terms of the employment agreement, Mr. Zeichner has agreed to serve as President and Chief Executive Officer of our operating subsidiary and as a member of the Board of Directors of the Company and each subsidiary. Mr. Zeichner will receive an annual base salary of $350,000, an annual incentive bonus, lump sum cash payment of $25,000, and certain medical and other benefits for fiscal 2001. The incentive bonus will be based on a percentage, up to .75%, of the Company's earnings before interest, taxes, depreciation and amortization, depending on the growth in such earnings. If Mr. Zeichner's employment is terminated without cause or Mr. Zeichner resigns his position as a consequence of material breach of the employment agreement or the Stockholders Agreement, he will be entitled to one year of his base salary at the time of termination, payable in 12 equal monthly installments.

Compensation Committee Interlocks and Insider Participation

None of our executive officers has served as a director or member of the compensation committee of any other entity whose executive officers served as a director or member of our compensation committee.

Compensation Committee Report

The Compensation Committee of the Board of Directors is currently composed of two outside directors, Allan W. Karp and David J. Oddi. The Compensation Committee is responsible for setting and administering the policies governing executive officer compensation, including cash compensation and stock ownership programs. The goals of the Company's compensation policy are to attract and retain executive officers who contribute to the Company's overall success, by offering compensation that is competitive in the retail apparel industry for similarly sized companies, to motivate executives to achieve business objectives and to reward them for their achievements. The Company generally uses salary, incentive compensation and stock options to meet these goals.

Salary. The Compensation Committee sets the salary for the Company's Chief Executive Officer within the range of salary that is competitive for similar positions in comparable companies in the retail apparel industry, based in part on a review of industry salary surveys and other publicly available

7

information. The Committee uses the median of the range of base salaries for comparable companies as a target for the Chief Executive Officer's base salary level, and adjusts this number based on the Chief Executive Officer's experience, tenure, performance and level of equity ownership in the Company. The Company's Chief Executive Officer currently determines the salaries of the other executive officers.

Incentive Compensation. The Company has developed an incentive bonus program under which the Company's employees are eligible to receive incentive cash bonuses equal to a percentage of their base salary based on annual performance goals set by the Compensation Committee. The Company's Chief Executive Officer approves which employees will be eligible to participate in the incentive bonus program. Generally, bonuses are intended to reward the employees when the Company achieves its business objectives.

Equity Compensation. The Compensation Committee believes that employee equity ownership provides additional motivation to maximize value for the Company's stockholders. Since stock options are granted at market price, the value of the stock options is wholly dependent on an increase in the price of the Company's Common stock. The Compensation Committee believes, therefore, that the stock options align the interests of the employees with those of the stockholders. In general, awards to employees are made taking into account the anticipated contributions by such employees in helping the Company achieve its strategic goals and objectives.

Compensation

Committee Of

The Board Of Directors

Allan

W. Karp

David J. Oddi

Audit Committee Report

The Audit Committee of the Board of Directors currently consists of two directors, Paul R. Del Rossi and W. Thomas Gould, both of whom are independent directors (as defined in the National Association of Securities Dealers' listing standards). The primary function of the audit committee is to assist the Board of Directors in fulfilling its oversight responsibilities by reviewing financial reports and other financial information provided by the Company to any governmental body or the public, the Company's systems of internal controls regarding finance, accounting, legal compliance and ethics that management and the Board have established, and the Company's auditing, accounting and financial processes generally. The Board of Directors has adopted a written charter of the Audit Committee, a copy of which is included as an Appendix to this Proxy Statement.

The Audit Committee has reviewed and discussed with the Company's management the audited financial statements for fiscal 2000. The Audit Committee has also discussed with Ernst & Young LLP various matters related to the financial statements, including those matters required to be discussed pursuant to SAS 61 (Codification of Statements on Auditing Standards, AU 380). The Audit Committee has also received the written disclosures and the letter from Ernst & Young LLP required by the Independence Standards Board Standard No. 1 (Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees), and has discussed with Ernst & Young LLP its independence.

Based on the review and discussion described in the immediately preceding paragraph, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company's Annual Report on Form 10-K for the fiscal year ending September 30, 2000 for filing with the Securities and Exchange Commission.

Audit

Committee Of

The Board Of Directors

Paul

R. Del Rossi

W. Thomas Gould

8

PROPOSAL TWO: INCREASE SHARES AVAILABLE UNDER 1999 EQUITY INCENTIVE PLAN

Our Board of Directors and stockholders approved the 1999 Equity Incentive Plan in July 1999. A total of 750,000 shares were initially reserved for issuance under the plan. By the terms of the plan, the Compensation Committee may amend the 1999 Equity Incentive Plan, provided that any amendment approved by the Compensation Committee which is of a scope that requires stockholder approval in order to ensure favorable federal income tax treatment for any incentive stock options under Internal Revenue Code Section 422 is subject to obtaining the approval of our stockholders. The Compensation Committee voted to approve amendments to the Plan to increase by 500,000 shares the aggregate number of shares of Common stock for which stock options may be granted under the Plan. The Compensation Committee believes that the increase is advisable to give us the flexibility needed to attract, retain and motivate our employees.

Summary of 1999 Equity Incentive Plan

Our Board of Directors and stockholders adopted the 1999 Equity Incentive Plan, effective upon the completion of our initial public offering. The 1999 Equity Incentive Plan, which is administered by the Compensation Committee, provides for the grant of a variety of stock and stock-based awards and related benefits, including stock options, restricted and unrestricted shares, deferred stock performance awards and rights to receive cash or shares with respect to an increase in value of our common stock. The 1999 Equity Incentive Plan's eligibility criteria are intended to encompass those employees, officers, directors and consultants who are in a position to make a significant contribution to the success of Charlotte Russe.

The 1999 Equity Incentive Plan permits the grant of options that qualify as incentive stock options and nonqualified options. The Compensation Committee of the Board of Directors determines the option exercise price of each incentive stock option. In the case of incentive stock options, however, the exercise price may not be less than 100% of the fair market value of the shares on the date of grant. Options granted below the fair market value of the common stock on the date of grant could result in a charge against our reported earnings.

In general, and except as otherwise determined by the Compensation Committee, all rights under awards granted pursuant to the 1999 Equity Incentive Plan to which the participant has not become irrevocably entitled will terminate upon termination of the participant's employment, consulting or service relationship with us. No award granted under the 1999 Equity Incentive Plan, other than an award in the form of an outright transfer of cash or unrestricted stock, may be transferred other than by will or by the laws of descent and distribution. During a person's lifetime an award requiring exercise may be exercised only by the participant, or in the event of the participant's incapacity, the person legally appointed to act on the participant's behalf.

Subject to adjustment for stock splits and similar events, the total number of shares of common stock that can be issued under the 1999 Equity Incentive Plan is 750,000 shares. If this Proposal Two is adopted, the total number of shares of common stock that can be issued under the plan will be 1,250,000 shares. The maximum number of shares of common stock as to which options or stock appreciation rights may be granted to any participant in any one calendar year is 200,000. There are currently options to acquire 506,000 shares of our common stock outstanding under the 1999 Equity Incentive Plan.

| Recommendation: | The Board of Directors recommends that you vote "FOR" approval of Proposal Two. |

9

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding the beneficial ownership of the Company's common stock owned as of the close of business on January 2, 2001, by the following persons: (i) each person who is known by the Company to own more than 5% of the outstanding shares of common stock; (ii) each director and executive officer; and (iii) all directors and executive officers as a group. Unless otherwise indicated below, to the Company's knowledge, all persons listed below have sole voting and investment power with respect to their shares of common stock, except to the extent that authority is shared by spouses. Unless otherwise indicated, each person listed below maintains a mailing address of c/o Charlotte Russe Holding, Inc., 4645 Morena Boulevard, San Diego, CA 92117. The information on beneficial ownership in the table and footnotes thereto is based upon data furnished to the Company by, or on behalf of, the persons listed in the table.

| |

Shares Beneficially Owned |

||||

|---|---|---|---|---|---|

| Name Of Beneficial Owner |

Number |

Percent |

|||

| Directors and Executive Officers | |||||

| Bernard Zeichner(1) | 1,418,522 | 6.67 | % | ||

| Harriet A. Bailiss-Sustarsic(2) | 42,800 | * | |||

| Daniel T. Carter(3) | 54,666 | * | |||

| R. Tina Kernohan(4) | 40,894 | * | |||

| Allan W. Karp 262 Harbor Drive Stamford, CT 06902 |

25,800 | * | |||

| David J. Oddi 262 Harbor Drive Stamford, CT 06902 |

2,000 | * | |||

| Paul R. Del Rossi 1280 Boylston Street Chestnut Hill, MA 02167 |

500 | * | |||

| W. Thomas Gould 701 Walnut Street Des Moines, IA 50309 |

33,000 | * | |||

| All officers and directors as a group, including those named above (8 persons) | 1,618,182 | 7.56 | % | ||

| Five Percent (5%) Stockholders | |||||

| SKM Funds(5) 262 Harbor Drive Stamford, CT 06902 |

18,207,348 | 81.41 | % | ||

10

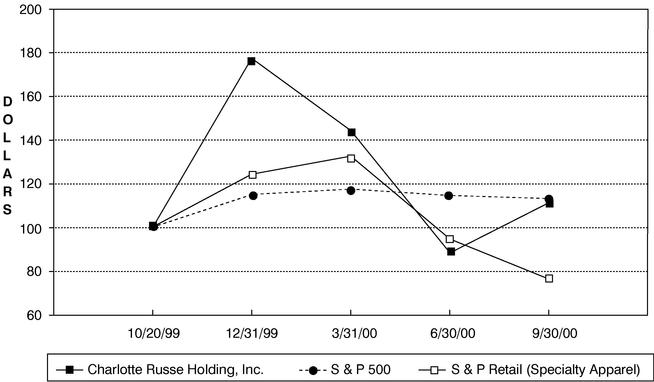

Stockholder Return Presentation

Set forth below is a line graph comparing the cumulative total return on the Company's common stock against the cumulative total return of the Standard & Poor's 500 Index and the Standard & Poor's Specialty Retailers Index for the period commencing on October 20, 1999 (the date of pricing of the Company's common stock in its initial public offering) and ending on September 30, 2000, assuming in each case that $100 was invested on October 20, 1999 and that all dividends were reinvested. The Company's stock price on the Nasdaq National Market was $13.25 on September 30, 2000.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Related Party Transactions

During fiscal 2000, we purchased approximately $275,000 of merchandise from Slant, Inc., a manufacturer of women's apparel. Mr. Zeichner's daughter is the President and Chief Executive Officer of Slant and his wife is also a principal officer. Mr. Zeichner's wife and daughter also own a majority of the outstanding equity interests in Slant, Inc. We believe these purchases were on terms no less favorable to us than could have been obtained from a disinterested third party.

11

Stockholders Agreement

The Company, the SKM Funds and Mr. Bernard Zeichner have entered into a Stockholders Agreement. This agreement provides that (1) so long as the SKM Funds own at least 25% of the total outstanding shares of common stock, they will have the right to nominate three directors and designate the Chairman of the Board of Directors and (2) so long as the SKM Funds own at least 10% of the shares of common stock held by them immediately after the completion of our initial public offering, including shares of stock issuable upon the exercise of outstanding warrants at such date, they will have the right to nominate two directors and include one director elected by the SKM Funds on each committee of the Board of Directors. The Stockholders Agreement grants Mr. Zeichner tag along rights in the event of a private sale by the SKM Funds of their shares of common stock. The Stockholders Agreement also grants, subject to limitations and exceptions, demand and piggyback registration rights to the SKM Funds and piggyback registration rights to Mr. Zeichner.

The stockholders agreement provides for Saunders Karp & Megrue, L.P., an affiliate of the SKM Funds, to render financial advisory services, including review and analysis of operational results and budgets, to us in exchange for an annual fee of $250,000, payable in advance, plus reimbursement for out-of-pocket expenses. This fee terminates when the SKM Funds own less than 10% of the shares of common stock held by them immediately after the completion of the initial public offering, including shares of common stock issuable upon exercise of outstanding warrants at such date.

COMPLIANCE WITH SECTION 16(A) OF THE EXCHANGE ACT

Section 16(a) of the Exchange Act requires the Company's officers and directors, and persons who own more than ten percent of the Company's common stock to file reports of ownership and changes in ownership on Forms 3, 4 and 5 with the SEC. Officers, directors and greater than ten-percent beneficial stockholders are required by SEC regulation to furnish to the Company copies of all Forms 3, 4 and 5 they file. Based solely on the Company's review of copies of such forms it has received, the Company believes that all of its officers, directors and greater than ten-percent beneficial owners complied on a timely basis with all filing requirements applicable to them with respect to transactions during fiscal 2000, except that each of the SKM Funds and Messrs. Zeichner, Carter, Karp and Oddi and Mss. Sustarsic and Kernohan failed to file their initial Form 3 on a timely basis in connection with the registration of the common stock under the Exchange Act and Mr. Zeichner failed to file one Form 4 in a timely manner in connection with the transfer of his shares into the Living Trust.

The Company will bear all the costs of the solicitation of proxies. Our Board of Directors may arrange with brokerage houses and other custodians, nominees and fiduciaries to forward solicitation materials to the beneficial owners of the stock held of record by such persons, and the Company may reimburse them for the reasonable out-of-pocket expenses incurred in so doing. In addition to the solicitation of proxies by mail, the Company may use the services of its directors, officers and regular employees (who will receive no compensation therefor in addition to their regular salaries) to solicit proxies personally or by mail or telephone.

Stockholders may present proposals for inclusion in the 2002 Proxy Statement and form of proxy relating to that meeting provided they are received by our Secretary no later than September 14, 2001 and are otherwise in compliance with applicable Securities and Exchange Commission regulations.

12

The Board of Directors has appointed Ernst & Young LLP to examine our financial statements for fiscal year 2001. The Company expects that a representative of Ernst & Young LLP will be present at the annual meeting and available to respond to appropriate questions and will have the opportunity to make a statement if he or she desires to do so.

The Board of Directors has no knowledge of any other matter that may come before the annual meeting and does not, itself, currently intend to present any other such matter. However, if any such other matters properly come before the meeting or any adjournment of the meeting, the persons named as proxies will have discretionary authority to vote the shares represented by the accompanying proxy in accordance with their own judgment.

13

A-1

CHARLOTTE RUSSE HOLDING, INC.

AUDIT COMMITTEE CHARTER

MISSION/ROLE

The Audit Committee will assist the Board of Directors to fulfill its responsibility for oversight of the quality and integrity of the financial reports of the Company, its financial policies, procedures and reporting process, the audit process, and the Company's system of financial and operating controls.

MEMBERSHIP/COMPOSITION

The Audit Committee shall consist of a minimum of two outside Directors, one of whom shall be the Chairperson of the Committee. All members shall be independent Directors. Charlotte Russe management shall be a participant in scheduled meetings of the Committee unless otherwise instructed. Members shall have a working understanding of finance and accounting practices and the duties and responsibilities of the Committee. Normally, members should serve on the Committee for at least three consecutive years before being reassigned. Committee appointments will be submitted to the Board of Directors for approval.

The Committee shall meet at least three times per year on dates generally coinciding with Board of Directors meetings.

CORPORATE POLICY AND AUTHORITY

The Audit Committee is an integral part of the corporate structure. As a standing committee of the Board, it shall provide assistance to the Board in fulfilling their oversight responsibilities to the stockholders, potential stockholders, investment community and others relating to the Company's financial statements, financial reporting process, systems of internal controls and independent audits of the annual financial statements. In discharging its oversight role, the Committee is empowered to investigate any matter brought to its attention with full access to all books, records, facilities and personnel of the Company, in addition to open and direct access to the directors, independent auditors and financial management of the Company.

RESPONSIBILITIES AND PROCESSES

The primary responsibility for the Company's financial reporting and internal operating controls is vested in senior operating management, as overseen by the Board. The Audit Committee serves as the representative of the Board for the general oversight of Company affairs in the area of financial reporting and internal operating controls. In carrying out its responsibilities, the Committee believes that its policies and procedures should remain flexible, in order to react to changing conditions and circumstances. The Committee shall take the appropriate actions to set the overall corporate "tone" for quality financial reporting, sound business risk practices and ethical behavior.

The Committee is to provide reasonable assurance that financial reporting and disclosures made by management present fairly the Company's financial condition and results of operations. The Committee's responsibility in the area of internal controls is to ensure that they are designed to provide reasonable assurance that assets are safeguarded and transactions are authorized and properly recorded. Such controls should permit for the preparation of fairly presented financial reports and help fulfill the responsibility for stewardship of corporate assets.

In meeting its responsibilities, the Audit Committee is expected to:

A-2

RELATIONSHIP WITH INDEPENDENT AUDITORS

The Audit Committee shall have a clear understanding with management and the independent auditors that the independent auditors are ultimately accountable to the Board and the Audit Committee, as representatives of the stockholders. The Audit Committee shall review the performance of the independent auditors and shall make recommendations to the Board regarding the appointment or termination of the independent auditors. Such review shall include assessing the independence of the independent auditors and discussing the matters included in the written disclosures required by the Independence Standards Board. Accordingly, the independent auditors and the Committee shall establish a direct and open working relationship with each other so as to allow the Audit Committee to discharge its responsibilities as specified in this Charter.

A-3

PROXY

CHARLOTTE RUSSE HOLDING, INC.

4645 Morena Boulevard

San Diego, California 92117

The undersigned stockholder of Charlotte Russe Holding, Inc., a Delaware corporation (the "Company"), hereby appoints Bernard Zeichner and Allan W. Karp, and each of them, as proxies for the undersigned with full power of substitution in each of them, to attend the Annual Meeting of the Stockholders of the Company to be held on Tuesday, February 13, 2001 at 9:00 a.m. Pacific Standard Time, and any adjournment or postponement thereof, to cast on behalf of the undersigned all votes that the undersigned is entitled to cast at such meeting and otherwise to represent the undersigned at the meeting with all powers possessed by the undersigned if personally present at the meeting. The undersigned hereby acknowledges receipt of the Notice of Annual Meeting of Stockholders and revokes any proxy heretofore given with respect to such meeting.

This proxy is being solicited by the Board of Directors of the Company. The votes entitled to be cast by the undersigned will be cast as instructed below. If this proxy is executed but no instruction is given, the votes entitled to be cast by the undersigned will be cast "FOR" the following proposal:

(Continued and to Be Signed on the Reverse Side)

/*\ FOLD AND DETACH HERE /*\

| Please mark your votes as indicated in this example |

/x/ |

| FOR ALL NOMINEES LISTED BELOW (except as marked to the contrary below) |

WITHHOLD AUTHORITY to vote for all nominees listed below |

|||||||||||

1. ELECTION OF DIRECTORS. |

/ / |

/ / |

WITHHELD FOR: (To withhold authority to vote for any individual nominee, write that nominee's name in the space provided below.) |

|||||||||

Bernard Zeichner David J. Oddi W. Thomas Gould |

Allan W. Karp Paul R. Del Rossi |

|||||||||||

2. PROPOSAL: |

||||||||||||

To increase by 500,000 shares the aggregate number of shares available for issuance under the company's 1999 Equity Incentive Plan. |

FOR / / |

AGAINST / / |

ABSTAIN / / |

NOTE: The proxies of the undersigned may vote according to their discretion on any other matter that may properly come before the meeting. |

||||||||

I plan to attend the meeting |

/ / |

|||||||||||

Please mark, sign, date and return the proxy card promptly using the enclosed envelope. |

||||||||||||

| Signature(s) | Dated | |||

NOTE: Please sign as name appears hereon. Joint owners should each sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such.

/*\ FOLD AND DETACH HERE /*\

|

|