|

|

|

|

|

Previous: CONVERGENT GROUP CORP, SC TO-T, EX-99.(A)(9), 2000-10-27 |

Next: CONVERGENT GROUP CORP, SC TO-T, EX-99.(D)(1), 2000-10-27 |

Project Greece

Presentation to the Special Committee of the Board of Directors

October 13, 2000

MORGAN STANLEY DEAN WITTER

Project Greece |

Description of Key Transaction Terms |

|||||||

| |

|

|

||||||

| |

|

|

||||||

| Overview of Terms | ||||||||

| Price | • | $8.00 cash tender offer by Schlumberger for all of Convergent's issued and outstanding shares | ||||||

| |

|

|

|

|

|

— |

|

Management/Employees have agreed to exchange existing stake in Convergent for approximately 26% stake in new company |

| |

|

|

|

|

|

— |

|

Cinergy to own approximately 2.3% |

| Accounting Treatment | • | Purchase Accounting | ||||||

| Tax Treatment | • | Taxable | ||||||

| Tender Agreement | • | Major stockholders have agreed to tender shares, subject to being able to accept a superior acquisition proposal | ||||||

| Definitive Agreement | • | Customary reps, warranties and covenants | ||||||

| |

|

|

|

• |

|

Closing conditions including |

||

| |

|

|

|

|

|

— |

|

Accuracy of reps and warranties |

| |

|

|

|

|

|

— |

|

If required, a stockholder vote |

| |

|

|

|

|

|

— |

|

Customary regulatory approvals |

| |

|

|

|

• |

|

Indemnification |

||

| |

|

|

|

|

|

— |

|

None |

| |

|

|

|

|

|

— |

|

Reps and warranties do not survive closing |

| |

|

|

|

• |

|

Employment agreements with certain Corinth employees |

||

| Deal Protection | • | Fiduciary out | ||||||

| |

|

|

|

• |

|

Termination fee |

||

| |

|

|

|

|

|

— |

|

Approximately 3% |

| |

|

|

|

|

|

— |

|

Termination must be related to a superior acquisition proposal |

| |

|

|

|

|

|

— |

|

Expires after March 31, 2001 |

MORGAN STANLEY DEAN WITTER

1

Project Greece |

Shareholder Composition |

||||||||

| |

|

|

|||||||

| |

|

|

|

|

|||||

| Shareholders | |||||||||

| |

|

Shareholder |

|

Shares |

|

Total % |

|

|

|

| Strategic Investors | |||||||||

| InSight Capital Partners | 7,960 | 17.1 | |||||||

| UBS Capital Americas | 7,960 | 17.1 | |||||||

| Goldman Sachs | 2,304 | 5.0 | |||||||

| Cinergy Corporation | 2,166 | 4.7 | |||||||

| Other | 5,263 | 11.3 | |||||||

| Total | 25,653 | 55.2 | |||||||

| Founders | |||||||||

| Glenn E. Montgomery | 3,275 | 7.0 | |||||||

| Larry Engleken | 2,766 | 5.9 | |||||||

| Mark Epstein | 3,275 | 7.0 | |||||||

| Total | 9,316 | 20.0 | |||||||

| Executive VP's & VP's | 2,763 | 5.9 | |||||||

| Other Employees | 680 | 1.5 | |||||||

| Public Float | 5,000 | 10.8% | |||||||

| Issued/Unvested Options | 3,089 | 6.6 | |||||||

| Fully Diluted Shares o/s | 46,501 | 100.0 | |||||||

MORGAN STANLEY DEAN WITTER

2

Project Greece |

Corinth — Financial Overview |

||||||||

| |

|

|

|

||||||

| |

|

|

|

||||||

| Trading Statistics(1) | |||||||||

| Market Capitalization ($MM) | 225.1 | ||||||||

| 2000E P/E (x)(2) | 121.0 | ||||||||

| 2001E P/E (x)(2) | 30.3 | ||||||||

| LT Growth (%)(3) | 35.0 | ||||||||

| Dividend Yield (%) | NM | ||||||||

| |

|

|

|

|

|

|

|

|

|

| Income Statement $MM, except per share amounts |

|||||||||

| |

|

2000E(3) Estimated |

1999 Actual |

1998 Actual |

|||||

|---|---|---|---|---|---|---|---|---|---|

| Revenues | 83.01 | 66.61 | 47.42 | ||||||

| EBITDA | 3.09 | 8.66 | 4.99 | ||||||

| EBIT(4) | 1.35 | 7.26 | 3.66 | ||||||

| Net Income(4) | (2.17 | ) | (1.30 | ) | 5.62 | ||||

| EPS (diluted)(4) | (0.01 | ) | (0.09 | ) | 0.23 | ||||

| |

|

|

|

|

|

|

|

|

|

| Balance Sheet $MM |

|||||||||

| |

|

6/30/00 |

12/31/99 |

12/31/98 |

|||||

| Cash and cash equivalents | 8.87 | 1.60 | 4.96 | ||||||

| Net Fixed Assets | 4.85 | 3.10 | 2.73 | ||||||

| Total Assets | 43.23 | 26.71 | 17.98 | ||||||

| Stockholder's Equity | (1.49 | ) | (11.04 | ) | (28.82 | ) | |||

| Long Term Debt | 22.93 | 21.75 | 0.00 | ||||||

| |

|

|

|

|

|

|

|

|

|

| Statement of Cash Flows $MM |

|||||||||

| |

|

|

1999 Actual |

1998 Actual |

|||||

| Net Income for Common(4) | (1.30 | ) | 5.62 | ||||||

| Operating Cash Flow | 2.53 | (1.80 | ) | ||||||

| Investing Cash Flow | (1.76 | ) | (1.03 | ) | |||||

| Financing Cash Flow | 11.12 | (0.01 | ) | ||||||

| Net Cash Flow | 10.59 | 2.78 | |||||||

| |

|

|

|

|

|

|

|

|

|

| Notes | |||||||||

| 1. Reflects share price as of 10/11/00 | |||||||||

| 2. Based on cash EPS projections in Robertson Stephens Equity Research Report (08/29/00) | |||||||||

| 3. Based on Robertson Stephens Equity Research Report (08/29/00) | |||||||||

| 4. Excludes employee stock compensation expense and recapitalization costs | |||||||||

MORGAN STANLEY DEAN WITTER

3

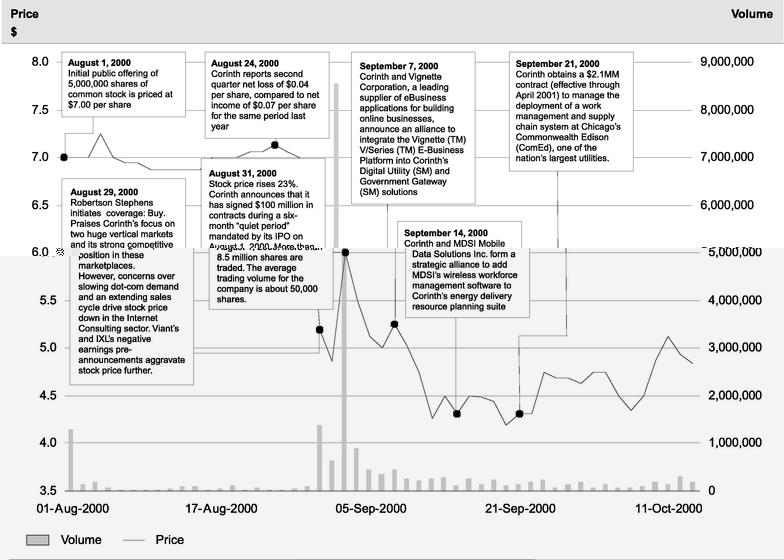

| Project Greece |

|

Annotated Price and Volume Analysis Since IPO on August 1, 2000 |

| |

|

|

| |

|

|

|

MORGAN STANLEY DEAN WITTER

4

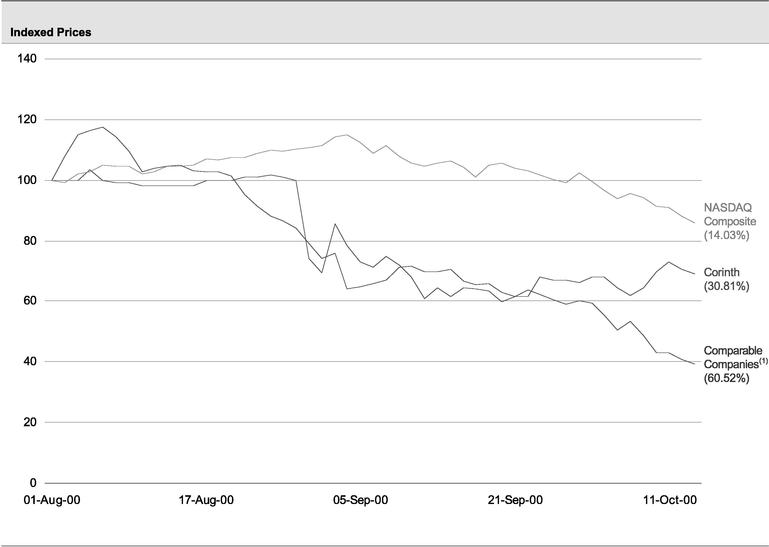

| Project Greece |

|

Corinth Indexed Price Analysis Since August 1, 2000 |

| |

|

|

| |

|

|

|

||

| |

|

|

| Note 1. Comparable Companies include Scient, Viant, Sapient, Razorfish, iXL Enterprise, Proxicom, Diamond Technology Partners and Cambridge Technology Partners |

MORGAN STANLEY DEAN WITTER

5

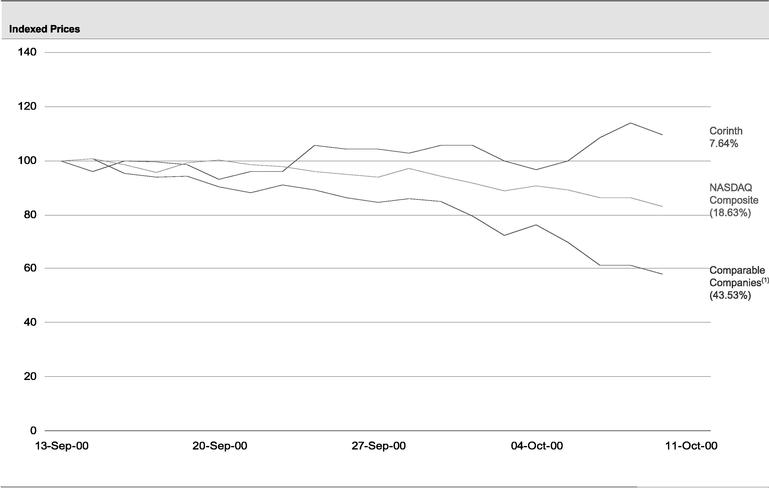

| Project Greece |

|

Corinth Indexed Price Analysis Since September 13, 2000 |

| |

|

|

| |

|

|

|

||

| |

|

|

| Note 1. Comparable Companies include Scient, Viant, Sapient, Razorfish, iXL Enterprise, Proxicom, Diamond Technology Partners and Cambridge Technology Partners |

MORGAN STANLEY DEAN WITTER

6

Project Greece |

Summary of Equity Research Commentary |

|||||||||||||||

| |

|

|

||||||||||||||

| |

|

|

||||||||||||||

| Estimates | ||||||||||||||||

| |

|

Date |

|

Firm |

|

Recommendation |

|

Price at Report $ |

|

Target Price $ |

|

2000E $ |

|

2001E $ |

|

5 Year Growth Rate % |

| 08/29/00 | Robertson Stephens | Buy | 7.00 | N/A | 0.04 | 0.16 | 35 | |||||||||

| 08/30/00 | Wit Soundview | Buy | 7.00 | 11.00 | 0.05 | 0.17 | N/A | |||||||||

| |

|

|

||||||||||||||

| Selected Analyst Commentary | ||||||||||||||||

| |

|

|

||||||||||||||

| • "The market for Internet professional services within the U.S. utilities industry was $345MM in 1999 and is expected to grow to approximately $2Bn in 2003, with 30% of all utility business expected to be conducted on the Internet within the same time frame. Additionally, the market for Internet professional services within the U.S. local government market was approximately $500MM in 1999 and is estimated to reach approximately $2.8Bn in 2003. They provide Corinth with highly predictable and stable revenue streams" | ||||||||||||||||

| |

|

• "As a pure play in consulting to utilities and local governments, Corinth enjoys strong brand recognition in the marketplace" |

||||||||||||||

| |

|

• "At 43.8x our 2001 cash EPS estimate, Corinth is trading at a significant discount to other iBuilders including Sapient, Proxicom and Predictive Systems" |

||||||||||||||

| |

|

• "Given the highly specialized verticals for which Corinth does work, it can be difficult for the firm to find consultants with the necessary skill sets" |

||||||||||||||

| Robertson Stephens (8/29/00) | ||||||||||||||||

| |

|

• "While the company does not grow as fast as the rest of Web Integration group, we believe the company should trade up to the average multiple for the group, 4.2X (2001E Revenues), or $11 over the next 12 months" |

||||||||||||||

| Wit Soundview (8/30/00) | ||||||||||||||||

| |

|

|

||||||||||||||

MORGAN STANLEY DEAN WITTER

7

| Project Greece |

|

Corinth Versus Comparable Companies Sorted by Projected Five Year Growth Rate |

||||||||||||||||||||||||||||

| • Corinth is currently projected to have a lower five year growth rate than all but one of its comparable

companies — Corinth's depressed trading multiples reflect this below average projected growth rate |

||||||||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

Agg. Value/Sales (4)(5)(6)(7) |

|

|||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

|

|

|

|

|

|

LTM Net Inc. $MM (3)(4) |

P/E Ratio (1)(3)(4)(5)(8) |

CY2001E P/E / 5 Yr Growth x |

||||||||||||||||||||

| |

|

Est. 5 Yr Growth Rate % (1) |

Current Price 10/11/00 $ |

Discount to LTM High % |

Premium to LTM Low % |

Market Value $MM (2) |

LTM Revenue $MM (4) |

|||||||||||||||||||||||

| |

Company (fiscal year end) |

LTM x |

CY2000E x |

CY2001E x |

LTM x |

CY2000E x |

CY2001E x |

|||||||||||||||||||||||

| Internet Consulting Companies | ||||||||||||||||||||||||||||||

| Scient (03/00) | 52.5% | 11.63 | (91.3%) | 2.2% | 904 | 231 | 12 | 73.1 | 48.8 | 19.7 | 3.1 | 1.9 | 1.1 | 0.4 | ||||||||||||||||

| Viant (12/99) | 50.0% | 5.19 | (91.8%) | 9.2% | 275 | 112 | 17 | 16.1 | 51.9 | 22.6 | 0.9 | 0.6 | 0.4 | 0.5 | ||||||||||||||||

| Razorfish (12/99) | 50.0% | 4.56 | (92.0%) | 2.1% | 449 | 238 | 3 | 155.4 | 14.7 | 9.7 | 1.5 | 1.2 | 0.8 | 0.2 | ||||||||||||||||

| iXL Enterprises (12/99) | 50.0% | 3.00 | (94.9%) | 2.1% | 227 | 361 | (65) | N.M. | N.M. | N.M. | 0.3 | 0.3 | 0.3 | N.M. | ||||||||||||||||

| Proxicom (12/99) | 50.0% | 12.44 | (81.6%) | 2.6% | 714 | 142 | 5 | 131.2 | 59.2 | 40.1 | 4.3 | 2.9 | 1.9 | 0.8 | ||||||||||||||||

| Sapient (12/99) | 45.0% | 29.94 | (60.4%) | 41.3% | 3,724 | 381 | 45 | 81.9 | 65.1 | 49.1 | 9.1 | 6.9 | 4.9 | 1.1 | ||||||||||||||||

| Diamond Technology Partners (03/00) | 40.0% | 46.38 | (56.8%) | 55.9% | 1,161 | 163 | 17 | 68.2 | 47.3 | 33.7 | 6.0 | 3.9 | 2.7 | 0.8 | ||||||||||||||||

| Cambridge Technology Partners (12/99) | 25.0% | 3.81 | (85.9%) | 29.8% | 240 | 621 | (46) | N.M. | N.M. | 10.9 | 0.2 | 0.2 | 0.2 | 0.4 | ||||||||||||||||

| Mean | 45.3% | (81.8%) | 18.1% | 87.6 | 47.8 | 26.5 | 3.2 | 2.2 | 1.5 | 0.6 | ||||||||||||||||||||

| Median | 50.0% | (88.6%) | 5.9% | 77.5 | 50.3 | 22.6 | 2.3 | 1.5 | 0.9 | 0.5 | ||||||||||||||||||||

| Corinth (12/99) | 35.0% | 4.84 | (37.5%) | 21.1% | 225 | 76 | (6) | N.M. | N.M. | 36.6 | 3.1 | 2.9 | 2.1 | 1.0 | ||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Notes |

||||||||||||||||||||||||||||

| 1. Estimates from I/B/E/S | ||||||||||||||||||||||||||||||

| 2. Market Value includes exercisable options outstanding using treasury method | ||||||||||||||||||||||||||||||

| 3. Earnings exclude amortization of deferred stock compensation and other extraordinary and one-time charges | ||||||||||||||||||||||||||||||

| 4. Financial data based on latest available public information | ||||||||||||||||||||||||||||||

| 5. Estimates calendarized to December year end | ||||||||||||||||||||||||||||||

| 6. Aggregate Market Value defined as Market Value plus Total Debt plus Preferred Stock plus Minority Interest less Cash | ||||||||||||||||||||||||||||||

| 7. Revenue estimates from publicly available MSDW research, or most recent comparable research. Corinth revenue estimates from Robertson Stephens equity research | ||||||||||||||||||||||||||||||

| 8. Corinth EPS estimates from Robertson Stephens equity research | ||||||||||||||||||||||||||||||

MORGAN STANLEY DEAN WITTER

8

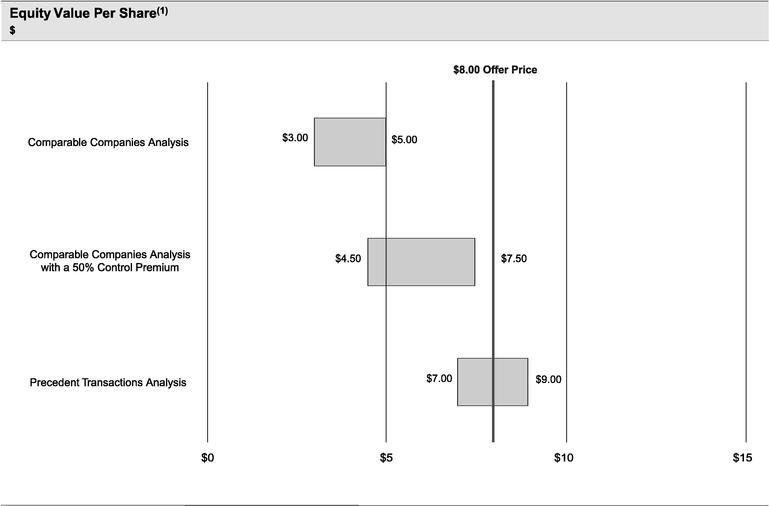

| Project Greece |

|

Corinth Valuation Summary Transaction Valuation |

| |

|

|

|

||

| |

|

Note |

| 1. Based upon 46.5 million fully-diluted shares outstanding |

MORGAN STANLEY DEAN WITTER

9

Project Greece |

Implied Historical Transaction Premium Analysis |

||||||

| |

|

|

|||||

| • The consideration reflects a 14% - 69% premium to Corinth's stock price over pre-announcement trading periods | Period Ending 10/11/00 |

Price |

Implied Premium to Offer | ||||

| $ | |||||||

| 10/11/00 | 4.84 | 65.16% | |||||

| 5-Day Average | 4.86 | 64.74% | |||||

| 10-Day Average | 4.73 | 69.31% | |||||

| 30-Day Average | 4.74 | 68.77% | |||||

| Average since IPO (8/1/00) | 5.63 | 42.06% | |||||

| IPO Price | 7.00 | 14.29% | |||||

MORGAN STANLEY DEAN WITTER

10

| Project Greece |

|

Corinth Valuation Matrix Valuation Based on Comparable Company Trading Multiples |

||||||||||||||||||

| |

|

|

||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($MM, except share price data) | ||||||||||||||||||||

| |

|

|

|

Agg. Value/ |

Equity Value/ |

|

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Price Per Share |

Implied Equity Value(1) |

Implied Agg. Value(2) |

2001E P/E / 5 Yr Growth |

||||||||||||||||

| |

|

LTM Revenue |

|

2000E Revenue(3) |

|

2001E Revenue(3) |

|

2001E Net Income(4) |

||||||||||||

| $ | 76.1 | $ | 83.0 | $ | 113.0 | $ | 6.2 | 35% | ||||||||||||

| 2.50 | 116.3 | 106.3 | 1.4x | 1.3x | 0.9x | 18.8x | 0.5x | |||||||||||||

| 3.00 | 139.5 | 129.5 | 1.7x | 1.6x | 1.1x | 22.5x | 0.6x | |||||||||||||

| 3.50 | 162.8 | 152.8 | 2.0x | 1.8x | 1.4x | 26.3x | 0.8x | |||||||||||||

| 4.00 | 186.0 | 176.0 | 2.3x | 2.1x | 1.6x | 30.0x | 0.9x | |||||||||||||

| 4.50 | 209.3 | 199.3 | 2.6x | 2.4x | 1.8x | 33.8x | 1.0x | |||||||||||||

| 5.00 | 232.5 | 222.5 | 2.9x | 2.7x | 2.0x | 37.5x | 1.1x | |||||||||||||

| 5.50 | 255.8 | 245.8 | 3.2x | 3.0x | 2.2x | 41.3x | 1.2x | |||||||||||||

| 6.00 | 279.0 | 269.0 | 3.5x | 3.2x | 2.4x | 45.0x | 1.3x | |||||||||||||

| 6.50 | 302.3 | 292.3 | 3.8x | 3.5x | 2.6x | 48.8x | 1.4x | |||||||||||||

| 7.00 | 325.5 | 315.5 | 4.1x | 3.8x | 2.8x | 52.5x | 1.5x | |||||||||||||

| 7.50 | 348.8 | 338.8 | 4.5x | 4.1x | 3.0x | 56.3x | 1.6x | |||||||||||||

| 8.00 | 372.0 | 362.0 | 4.8x | 4.4x | 3.2x | 60.0x | 1.7x | |||||||||||||

| 8.50 | 395.3 | 385.3 | 5.1x | 4.6x | 3.4x | 63.8x | 1.8x | |||||||||||||

| 9.00 | 418.5 | 408.5 | 5.4x | 4.9x | 3.6x | 67.6x | 1.9x | |||||||||||||

| 9.50 | 441.8 | 431.8 | 5.7x | 5.2x | 3.8x | 71.3x | 2.0x | |||||||||||||

| 10.00 | 465.0 | 455.0 | 6.0x | 5.5x | 4.0x | 75.1x | 2.1x | |||||||||||||

| 10.50 | 488.3 | 478.3 | 6.3x | 5.8x | 4.2x | 78.8x | 2.3x | |||||||||||||

| 11.00 | 511.5 | 501.5 | 6.6x | 6.0x | 4.4x | 82.6x | 2.4x | |||||||||||||

| 11.50 | 534.8 | 524.8 | 6.9x | 6.3x | 4.6x | 86.3x | 2.5x | |||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Notes | ||||||||||||||||||||

| 1. Based on 46.5 million fully-diluted shares outstanding | ||||||||||||||||||||

| 2. Aggregate value based on 6/30/2000 balance sheet, adjusted for Corinth's initial public offering | ||||||||||||||||||||

| 3. Based on Robertson Stephens Equity Research Report (08/29/00) | ||||||||||||||||||||

| 4. Based on Robertson Stephens Equity Research Report (08/29/00). Net income excludes employee stock compensation expense and recapitalization |

||||||||||||||||||||

MORGAN STANLEY DEAN WITTER

11

| Project Greece |

|

Corinth Valuation Matrix Valuation Based on Values Paid in Selected Transactions |

|||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($MM, except share price data) | |||||||||||||||||

| |

|

|

|

|

% Premium to Average Unaffected Market Price(3) |

Agg. Value/ |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Price Per Share |

Implied Equity Value(1) |

Implied Agg. Value(2) |

|

|||||||||||||

| |

|

% Premium to IPO Price |

|

LTM Revenue |

|

LTM Operating Income |

|||||||||||

| $ | 7.00 | $ | 5.63 | $ | 76.1 | $5.3 | |||||||||||

| 2.50 | 116.3 | 106.3 | -64% | -56% | 1.4x | 20.0x | |||||||||||

| 3.00 | 139.5 | 129.5 | -57% | -47% | 1.7x | 24.4x | |||||||||||

| 3.50 | 162.8 | 152.8 | -50% | -38% | 2.0x | 28.8x | |||||||||||

| 4.00 | 186.0 | 176.0 | -43% | -29% | 2.3x | 33.1x | |||||||||||

| 4.50 | 209.3 | 199.3 | -36% | -20% | 2.6x | 37.5x | |||||||||||

| 5.00 | 232.5 | 222.5 | -29% | -11% | 2.9x | 41.9x | |||||||||||

| 5.50 | 255.8 | 245.8 | -21% | -2% | 3.2x | 46.3x | |||||||||||

| 6.00 | 279.0 | 269.0 | -14% | 7% | 3.5x | 50.7x | |||||||||||

| 6.50 | 302.3 | 292.3 | -7% | 15% | 3.8x | 55.0x | |||||||||||

| 7.00 | 325.5 | 315.5 | 0% | 24% | 4.1x | 59.4x | |||||||||||

| 7.50 | 348.8 | 338.8 | 7% | 33% | 4.5x | 63.8x | |||||||||||

| 8.00 | 372.0 | 362.0 | 14% | 42% | 4.8x | 68.2x | |||||||||||

| 8.50 | 395.3 | 385.3 | 21% | 51% | 5.1x | 72.5x | |||||||||||

| 9.00 | 418.5 | 408.5 | 29% | 60% | 5.4x | 76.9x | |||||||||||

| 9.50 | 441.8 | 431.8 | 36% | 69% | 5.7x | 81.3x | |||||||||||

| 10.00 | 465.0 | 455.0 | 43% | 78% | 6.0x | 85.7x | |||||||||||

| 10.50 | 488.3 | 478.3 | 50% | 86% | 6.3x | 90.1x | |||||||||||

| 11.00 | 511.5 | 501.5 | 57% | 95% | 6.6x | 94.4x | |||||||||||

| 11.50 | 534.8 | 524.8 | 64% | 104% | 6.9x | 98.8x | |||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Note | |||||||||||||||||

| 1. Based on 46.5 million fully-diluted shares outstanding | |||||||||||||||||

| 2. Aggregate value based on 6/30/2000 balance sheet, adjusted for Corinth's initial public offering | |||||||||||||||||

| 3. Average price from IPO date, 8/1/00, through 10/11/00 |

|||||||||||||||||

MORGAN STANLEY DEAN WITTER

12

| Project Greece |

|

Precedent Transactions Analysis Premiums Paid in Selected Technology Services Transactions |

|

|||||||||||||||||||||

| ($MM) | ||||||||||||||||||||||||

| |

|

|

|

|

|

|

Aggregate Value / |

Premium Paid |

||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Date Announced |

Acquiree / Acquiror Business Description |

Transaction Summary |

Equity Value |

Aggregate Value |

LTM P/E |

LTM Rev. |

LTM Oper. Inc. |

Number of Employees |

Price 1 Month Prior |

||||||||||||||

| |

|

9/11/00 |

|

Cluster Consulting/Diamond Technology Partners Spain based wireless digital technology company |

|

$44MM cash and 13.9MM DTPI stock |

|

$ |

930.0 |

|

$ |

930.0 |

|

57.3 |

x(1) |

6.8 |

x(2) |

NA |

|

$ |

1.86 |

(3) |

NA |

|

| |

|

8/17/00 |

|

Smallworldwide/GE UK based supplier of spatial technology and network solutions for the global marketplace with focus in the utilities, communications, and public systems industries. |

|

Cash tender offer for all Smallworldwide common stock at $20 per share. |

|

|

210.0 |

|

|

199.2 |

|

179.5 |

|

6.5 |

|

116.5 |

x |

|

0.40 |

|

73.9 |

% |

| |

|

6/20/00 |

|

AppNet / Commerce One Provider of end-to-end e-business solutions, from interactive marketing to back-office integration. |

|

Fixed exchange ratio of 0.8 |

|

|

1,505.0 |

|

|

1,454.2 |

|

NM |

|

10.8 |

|

NM |

|

|

1.39 |

|

109.0 |

|

| |

|

6/13/00 |

|

Cereus Technology Partners / Eltrax Systems Provider of Solutions involving technology, outsourcing, focusing on integrated business solutions for middle-market companies. The Company offers Web-centric solutions that bridge the gap between core financial and specialized horizontal applications. Provides enterprise resource planning, connectivity and custom application development. |

|

Eltrax will issue 1.67 shares for each share of Cereus. Cereus will invest $5MM in Eltrax in the form of convertible subordinate notes prior to closing. Closing conditioned on Cereus having $12 - 13MM at closing. |

|

|

122.3 |

|

|

106.6 |

|

NM |

|

32.4 |

|

NM |

|

|

1.67 |

|

-5.1 |

|

| |

|

6/20/00 |

|

Policy Management Systems / Computer Sciences Corporation Provider of enterprise and electronic commerce application software, professional services, and outsourcing designed to meet the needs of the global insurance and related financial services industries. |

|

100% cash offer for 100% of the outstanding shares. |

|

|

569.4 |

|

|

704.8 |

|

NM |

|

1.1 |

|

NM |

|

|

0.12 |

|

80.3 |

(4) |

| |

|

3/22/00 |

|

Metamor Worldwide / PSINet A leading provider of information technology services with a broad and diverse service offering. Delivers value-added services through a combination of geographic presence, industry focus and specialized technology practices with major delivery capabilities in e-commerce. |

|

PSINet will pay 0.9 shares of stock for each Metamor share held. |

|

|

1,592.0 |

|

|

1,850.3 |

|

38.9 |

|

1.8 |

|

19.1 |

|

|

0.40 |

|

121.4 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Notes | ||||||||||||||||||||||||

| 1. Press release (09/12/00) announced that Cluster Consulting generated $16.23MM in earnings in the fiscal year 1999. | ||||||||||||||||||||||||

| 2. Press release (09/12/00) announced that Cluster Consulting generated $136 MM in revenues in the fiscal year 1999. | ||||||||||||||||||||||||

| 3. Press release (09/12/00) announced that Cluster Consulting employed approximately 500 people in the fiscal year 1999. | ||||||||||||||||||||||||

| 4. February 24, 2000 stock price of PMS used to calculate Premium paid to one month prior, since, the first bid, from Welsh, Carson, Anderson & Stowe, was announced on March 30, 2000. | ||||||||||||||||||||||||

MORGAN STANLEY DEAN WITTER

13

| Project Greece |

|

Precedent Transactions Analysis (Cont'd) Premiums Paid in Selected Technology Services Transactions |

|

|||||||||||||||||||||

| ($MM) | ||||||||||||||||||||||||

| |

|

|

|

|

|

|

Aggregate Value / |

Premium Paid |

||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Date Announced |

Acquiree / Acquiror Business Description |

Transaction Summary |

Equity Value |

Aggregate Value |

LTM P/E |

LTM Rev. |

LTM Oper. Inc. |

Number of Employees |

Price 1 Month Prior |

||||||||||||||

| |

|

12/13/99 |

|

USWeb/CKS / Whittman-Hart Professional services firm with expertise in business strategy, marketing, communications, and Internet technology solutions. USWeb provides intranet, extranet, and web site solutions, as well as marketing communications programs. |

|

Stock for stock merger of equals with fixed exchange ratio of 0.8650 Whittman-Hart common shares per common share of USWeb. |

|

$ |

8,426.2 |

|

$ |

8,290.8 |

|

284.0 |

x |

14.3 |

x |

246.5 |

x |

$ |

4.23 |

|

76.1 |

% |

| |

|

10/5/99 |

|

Tessera Enterprise Systems, Inc. / iXL Enterprises Boston-based consulting and software company specializing in building marketing-focused databases and providing enterprise relationship management solutions. |

|

Consideration of 3.4 million iXL shares, 200,000 iXL options plus $2MM in cash. |

|

|

117.7 |

|

|

125.7 |

|

227.2 |

|

5.5 |

|

270.4 |

|

|

0.97 |

|

NA |

|

| |

|

8/10/99 |

|

International Network Services / Lucent Provider of network consulting and software solutions. |

|

Fixed exchange ratio of 0.8473 Lucent common shares per common share of INS. |

|

|

3,284.3 |

|

|

3,228.6 |

|

149.0 |

|

11.9 |

|

71.1 |

|

|

2.04 |

|

25.4 |

|

| |

|

8/10/99 |

|

I-Cube / Razorfish Provides technology solutions, specializing in consulting, electronic business and transformation services. Utilizes a set of tools and methodologies, known as "I-structure," to provide solutions. |

|

Fixed exchange ratio of 0.875 Razorfish shares for each share of I-Cube. |

|

|

626.5 |

|

|

589.2 |

|

62.6 |

|

11.8 |

|

44.9 |

|

|

NA |

|

15.3 |

|

| |

|

7/30/99 |

|

Mitchell Madison Group / USWeb/CKS Leading strategic management consulting firm formed in 1994 as a result of buyout by partners at A.T. Kearney. The Company's functional practices include sourcing, marketing, technology, and risk management. |

|

Consideration of 14.4MM USWeb/CKS common shares (valued at $308MM), released as follows: 50% at closing and up to 25% on each of the first and second anniversaries, based on certain MMG partner retention targets. |

|

|

308.3 |

|

|

312.5 |

|

20.6 |

|

1.6 |

|

12.6 |

|

|

NA |

|

NM |

|

| |

|

6/21/99 |

|

Conduit / I-Cube Provides information-technology consulting, such as teaching companies like American Express Co. how to market and sell over the Internet. |

|

I-Cube will issue 3.26MM shares (including the assumption of 0.86MM in stock options/convertible notes). |

|

|

58.7 |

|

|

58.7 |

|

NA |

|

4.3 |

|

NA |

|

|

NA |

|

NM |

|

| |

|

6/25/99 |

|

Think New Ideas / AnswerThink Consulting Group Provides marketing, technology, and interactive solutions to Fortune 500 and other clients. The company's integrated solutions include the development of several proprietary Internet and Intranet tools and applications. |

|

0.700 shares of AnswerThink common stock for each share of Think New Ideas common stock outstanding. |

|

|

216.5 |

|

|

209.1 |

|

NM |

|

4.1 |

|

NM |

|

|

0.59 |

|

40.0 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MORGAN STANLEY DEAN WITTER

14

| Project Greece |

|

Precedent Transactions Analysis (Cont'd) Premiums Paid in Selected Technology Services Transactions |

|

|||||||||||||||||||||

| ($MM) | ||||||||||||||||||||||||

| |

|

|

|

|

|

|

Aggregate Value / |

Premium Paid |

||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Date Announced |

Acquiree / Acquiror Business Description |

Transaction Summary |

Equity Value |

Aggregate Value |

LTM P/E |

LTM Rev. |

LTM Oper. Inc. |

Number of Employees |

Price 1 Month Prior |

||||||||||||||

| |

|

4/5/99 |

|

Banctec / Welsh Carson Anderson & Stowe Worldwide systems integration and services company specializing in transaction management solutions for banking, financial services, insurance, healthcare, government, utility, telecom and retail industries. |

|

97% interest for $18.50 per Banctec share in cash. |

|

$ |

364.21 |

|

$ |

497.21 |

|

NM |

|

0.8 |

x |

76.5 |

x |

$ |

0.12 |

|

23.8 |

% |

| |

|

3/9/99 |

|

Data Base, Inc. / Iron Mountain Inc. Privately held service provider in the data security services industry. Services comprised primarily of off-site data security services and data recovery support services. |

|

Total consideration of $116MM comprised of cash, assumed debt, and IMTN common stock. |

|

|

116.0 |

|

|

116.0 |

|

16.8 |

|

4.4 |

|

13.3 |

|

|

NA |

|

NM |

|

| |

|

2/8/99 |

|

Computer Mgmt. Sys., Inc. / Computer Associates Int'l., Inc. Custom develops cutting-edge IT solutions specializing in Internet development and business process re-engineering. |

|

CA will purchase in a tender offer all outstanding CMSI shares for a cash price of $28 per share of common stock. |

|

|

435.6 |

|

|

425.4 |

|

35.0 |

|

4.7 |

|

23.0 |

|

|

0.47 |

|

73.6 |

|

| |

|

10/19/98 |

|

BRC Holdings Inc. / Affiliated Computer Services Provides specialized information technology services primarily to local governments and health-care institutions. The Company's products and services include informaion systems and services, government records management and consulting services. |

|

Cash tender offer for all outstanding BRC Holdings' stock at a price of $19.00 per share. |

|

|

284.0 |

|

|

165.7 |

|

38.7 |

|

1.5 |

|

21.3 |

|

|

0.17 |

|

15.2 |

|

| |

|

8/10/98 |

|

ATEC Group / IAT Multimedia, Inc. System integrator and provider of a full spectrum of value added support and services to corporate, government and educational markets. ATEC also offers computer hardware, software, connectivity devices, multimedia products, data communications and Internet and Intranet solutions. |

|

Exchange ratio of 1.000 based on an assumed $10/share market price of IAT common stock. |

|

|

62.8 |

|

|

69.6 |

|

26.7 |

|

0.5 |

|

17.9 |

|

|

0.58 |

|

49.8 |

|

| |

|

|

|

|

|

|

|

|

|

|||||||||||||||

| |

|

|

|

|

|

|

|

|

Mean: |

|

94.7 |

x |

6.9 |

x |

77.8 |

x |

|

1.07 |

|

53.7 |

% |

|||

| |

|

|

|

|

|

|

|

|

Median: |

|

48.1 |

|

4.5 |

|

34.0 |

|

|

0.58 |

|

49.8 |

% |

|||

| |

|

|

|

|

|

|

|

|

|

|||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MORGAN STANLEY DEAN WITTER

15

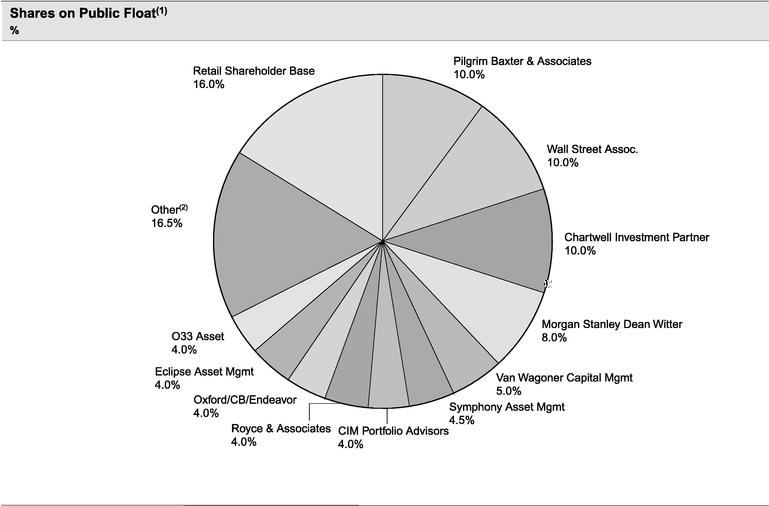

Project Greece |

Corinth Shareholder Composition |

|

| |

|

|

| |

|

|

|

||

| |

|

Note |

| 1. Total of 5,000,000 shares, comprising 10.8% of total shares outstanding as of 08/01/00 |

16

| 2. Other includes State Street Research & Mgmt., Olympic Holdings LLC, Unterberg Harris Capital, Furman Selz Capital Management, California Public Empl. Ret.Sys.,Integral Capital Partners, Constitution Research & Mgmt., Viewpoint Investment Partner,and KB. |

MORGAN STANLEY DEAN WITTER

17

|

|