|

|

|

|

|

Previous: CONVERGENT GROUP CORP, SC TO-T, EX-99.(F), 2000-10-27 |

Next: CONVERGENT GROUP CORP, SC 14D9, EX-99.(A)(4), 2000-10-27 |

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14D-9

Solicitation/Recommendation Statement

Pursuant to Section 14(d)(4) of the Securities Exchange Act of 1934

CONVERGENT GROUP CORPORATION

(Name of Subject Company)

CONVERGENT GROUP CORPORATION

(Name of Person(s) Filing Statement)

COMMON STOCK, $.001 PAR VALUE

(Title of Class of Securities)

21247V 10

(CUSIP Number of Class of Securities)

GLENN E. MONTGOMERY, JR.

CHAIRMAN AND CHIEF EXECUTIVE OFFICER

CONVERGENT GROUP CORPORATION

6399 SOUTH FIDDLER'S GREEN CIRCLE, SUITE 600

GREENWOOD VILLAGE, COLORADO 80111

(303) 741-8400

(Name, address, and telephone number of person authorized

to receive notices and communications on behalf of the person(s) filing statement)

WITH COPIES TO:

| ILAN S. NISSAN, ESQ. DOMINICK P. DECHIARA, ESQ. O'SULLIVAN GRAEV & KARABELL, LLP 30 ROCKEFELLER PLAZA NEW YORK, NEW YORK 10112 (212) 408-2400 |

RICHARD R. PLUMRIDGE, ESQ. LEXI METHVIN, ESQ. BROBECK, PHLEGER & HARRISON, LLP 370 INTERLOCKEN BOULEVARD, SUITE 500 BROOMFIELD, COLORADO 80021 (303) 410-2000 |

/ / Check

the box if the filing relates solely to preliminary communications

made before the commencement of a tender offer.

Item 1. Subject Company Information.

Name and Address. The name of the subject company is Convergent Group Corporation, a Delaware corporation (the "Company"). The address of the principal executive offices of the Company is 6399 South Fiddler's Green Circle, Suite 600, Greenwood Village, Colorado 80111 and its telephone number is (303) 741-8400.

Securities. The title of the class of equity securities to which this Solicitation/Recommendation Statement on Schedule 14D-9 (the "Statement") relates is the common stock of the Company, par value $.001 per share (the "Shares"). As of October 13, 2000, there were 43,414,402 Shares issued and outstanding.

Item 2. Identity and Background of Filing Person.

Name and Address. The name, business address and business telephone number of the Company, which is the person filing this Statement, are set forth in Item 1 above.

Tender Offer. This Statement relates to the tender offer by Convergent Acquisition Sub, Inc., a Delaware corporation ("Purchaser"), and a wholly owned subsidiary of Convergent Holding Corporation, a Delaware corporation ("Parent"), which is a wholly owned subsidiary of Schlumberger Technology Corporation, a Texas corporation ("STC"), as set forth in the Tender Offer Statement on Schedule TO, dated October 27, 2000 (the "Schedule TO"), to purchase all of the outstanding Shares at a price of $8.00 per Share, net to the seller in cash, without interest thereon, upon the terms and subject to the conditions set forth in the Offer to Purchase, dated October 27, 2000 (the "Offer to Purchase"), and in the related Letter of Transmittal (which, as they may be amended or supplemented from time to time, together constitute the "Offer"), copies of which are filed as Exhibits (a)(1) and (a)(2) hereto, respectively, and are incorporated herein by reference.

The Offer is being made pursuant to an Agreement and Plan of Merger, dated as of October 13, 2000 (the "Merger Agreement"), by and among Parent, Purchaser, STC and the Company. Pursuant to the Merger Agreement, as promptly as practicable following the consummation of the Offer and upon the satisfaction of the other conditions contained in the Merger Agreement, Purchaser will be merged with and into the Company (the "Merger"), with the Company continuing as the surviving corporation. A copy of the Merger Agreement is filed as Exhibit (a)(10) hereto and is incorporated herein by reference.

The Schedule TO states that the principal executive offices of Parent, Purchaser and STC are located at 300 Schlumberger Drive, Sugarland, Texas 77478.

Item 3. Past Contacts, Transactions, Negotiations and Agreements.

The information set forth under "Special Factors — Background of Our Offer; Contacts with Convergent; Negotiations and Agreements" and "The Tender Offer — Merger Agreement; Subscription and Contribution Agreement; Tender and Voting Agreement; Voting Agreement; Exclusivity Agreement; Nondisclosure Agreement; Employment Agreements" in the Offer to Purchase is incorporated herein by reference.

Two of the Company's directors, Glenn E. Montgomery, Jr. and Scott M. Schley, are executive officers of the Company. Mr. Montgomery serves as the Company's President and Chief Executive Officer and Mr. Schley serves as the Company's Executive Vice President of Finance. Because both Messrs. Montgomery and Schley intend to own common stock of Parent and remain employed by the Company after the closing of the Merger, the Board of Directors of the Company (the "Board") unanimously determined that a special committee comprised of the Board's three independent directors (the "Special Committee") be formed to review, evaluate and negotiate the Merger Agreement and the terms of the Offer. As a result, during a special meeting of the Board held on September 18, 2000, the Special Committee was established. The members of the Special Committee are Robert Sharpe, John W. Blend III and Jerry Murdock.

Item 4. The Solicitation or Recommendation.

Recommendation. The Board, by unanimous vote of all of the directors and based on, among other things, the unanimous recommendation of the Special Committee (i) determined that the Merger Agreement, the Offer, the Merger and the consummation of the other transactions contemplated thereby are fair to, advisable and in the best interests of the Company and the stockholders of the Company (the "Stockholders"), (ii) adopted and approved the Merger Agreement, the Offer, the Merger and the other transactions contemplated thereby, (iii) recommended that the Stockholders (A) accept the Offer, (B) tender their Shares to Purchaser pursuant to the Offer and (C) adopt the Merger Agreement, (iv) authorized and directed the Company, if necessary, acting through its Chief Executive Officer, to solicit proxies on behalf of the Board from the Stockholders to vote in favor of the approval and adoption of the Merger Agreement and the transactions contemplated thereby, (v) authorized the Chief Executive Officer of the Company to execute and deliver the Merger Agreement on behalf of the Company and (v) recommended that, if required by applicable law, the Merger Agreement be submitted for adoption at a special meeting of the Stockholders in accordance with the Delaware General Corporation Law.

Accordingly, the Board unanimously recommends that the Stockholders accept the Offer and tender their Shares pursuant to the Offer.

A letter to the Stockholders, a letter to brokers, dealers, commercial banks, trust companies, and other nominees, a letter to clients for use by brokers, dealers, commercial banks, trust companies, and other nominees communicating the Board's recommendation, a joint press release announcing the Offer and the Merger and a separate press release by the Company relating to the Offer and the Merger are filed as Exhibits (a)(4), (a)(5), (a)(6), (a)(8) and (a)(9), respectively, and are incorporated herein by reference.

Reasons for Recommendation. The information set forth in the "Introduction," "Special Factors — Background of Our Offer; Contacts with Convergent; Negotiations and Agreements," "— Purposes, Alternatives, Effects and Plans," "— Reasons and Recommendations of the Special Committee and the Board of Directors of Convergent; Fairness of the Transaction," and "— Reports, Opinions, Appraisals and Negotiations" of the Offer to Purchase is incorporated herein by reference.

Contribution and Tender of Shares. In connection with the Offer and the Merger, (i) entities affiliated with InSight Capital Partners and entities affiliated with Goldman Sachs & Co. have agreed to tender their Shares in the Offer at the price of $8.00 per Share, (ii) Cinergy Ventures, LLC, a Delaware limited liability company ("Cinergy"), has agreed to contribute 50% of its Shares to Parent in exchange for shares of Parent common stock and to tender 50% of its Shares in the Offer at the price of $8.00 per Share and (iii) certain executive officers of the Company (as listed below), have agreed to contribute a portion of their Shares to Parent in exchange for shares of Parent common stock, and to tender their remaining Shares in the Offer, pursuant to the Subscription and Contribution Agreement, dated as of October 13, 2000 (the "Subscription Agreement") by and among Parent, STC, Cinergy and the management investors named therein. The information set forth under "The Tender Offer — Merger Agreement; Subscription and Contribution Agreement; Tender and Voting Agreement; Voting Agreement; Exclusivity Agreement; Nondisclosure Agreement; Employment Agreements" in the Offer to Purchase is incorporated herein by reference.

Pursuant to the Subscription Agreement, Glenn E. Montgomery, Jr., Chairman, President and Chief Executive Officer of the Company, (i) will contribute 2,610,074 Shares to Parent for 2,610,074 shares of Parent common stock and (ii) has agreed to tender 655,019 Shares in the Offer.

Pursuant to the Subscription Agreement, Scott M. Schley, Executive Vice President of Finance of the Company, (i) will contribute 787,427 Shares to Parent for 787,427 shares of Parent common stock and (ii) has agreed to tender 60,000 Shares in the Offer.

2

Pursuant to the Subscription Agreement, Larry J. Engelken, Executive Vice President of Strategic Accounts and Secretary of the Company, will contribute all of his 1,004,915 Shares to Parent for 1,004,915 shares of Parent common stock.

Pursuant to the Subscription Agreement, Andrea S. Maizes, Executive Vice President of Resource Management of the Company, will (i) contribute up to 250,000 Shares to Parent for up to 250,000 shares of Parent common stock and (ii) tender no Shares in the Offer.

Pursuant to the Subscription Agreement, Bryan R. Mileger, Chief Financial Officer, Treasurer and Assistant Secretary of the Company, will (i) contribute up to 250,001 Shares to Parent for up to 250,001 shares of Parent common stock and (ii) tender no Shares in the Offer.

Pursuant to the Subscription Agreement, David Rubinstein, Executive Vice President of Global Delivery of the Company, (i) will contribute up to 204,950 Shares to Parent for up to 204,950 shares of Parent common stock and (ii) has agreed to tender 45,000 Shares in the Offer.

Except as noted above, to the best of the Company's knowledge, each of the Company's executive officers, directors, affiliates and subsidiaries presently intends to tender pursuant to the Offer all Shares held of record or beneficially owned by them (other than Shares which if tendered could cause such persons to incur liability under the provisions of Section 16(b) of the Securities and Exchange Act of 1934, as amended) and to vote their Shares in favor of adoption of the Merger Agreement if, as and when such question is presented to the Stockholders. The Company has no knowledge concerning whether Capital/Convergent LLC, which may be considered an affiliate of the Company, presently intends to tender the Shares owned by it in the Offer or to vote their Shares in favor of adoption of the Merger Agreement if, as and when such question is presented to the Stockholders.

Item 5. Persons/Assets Retained, Employed, Compensated or Used.

Morgan Stanley. Pursuant to a letter agreement with Morgan Stanley & Co. Incorporated ("Morgan Stanley"), dated September 15, 2000, (the "Morgan Stanley Letter Agreement"), the Company retained Morgan Stanley to provide the Company with financial advice and assistance in connection with either a proposed investment in the Company by Purchaser, Parent and STC or a proposed sale of the Company, in whole or in part. Morgan Stanley also agreed, upon request of the Company, to provide a fairness opinion to the Board regarding such transaction.

Pursuant to the Morgan Stanley Letter Agreement, the Company agreed to pay Morgan Stanley: (A) an initial fee of $150,000, which fee is fully creditable to the extent not previously credited against any fees payable by the Company to Morgan Stanley in connection with a transaction pursuant to the Morgan Stanley Letter Agreement and (B) if the transactions contemplated by the Merger Agreement are consummated, $4.0 million. The initial fee paid to Morgan Stanley under clause (A) above will not be creditable in the event a transaction is not completed.

The Company has also agreed to reimburse Morgan Stanley for its reasonable expenses, including the fees of outside legal counsel, provided such counsel is engaged with the Company's consent. The Company has also agreed to indemnify Morgan Stanley, its affiliates and each of Morgan Stanley's and its affiliates' officers, directors, employees and agents and each other person, if any, controlling Morgan Stanley or any of its affiliates, from and against any losses, claims, damages or liabilities related to, arising out of or in connection with the engagement of Morgan Stanley under the Morgan Stanley Letter Agreement.

The Morgan Stanley Letter Agreement may be terminated with or without cause at any time by either party thereto without liability or continuing obligation to either party, except that upon such termination Morgan Stanley shall be entitled to receive from the Company, among other things, (i) any compensation earned to the date of termination and (ii) expenses incurred to the date of termination. Any such termination will not affect the Company's continuing obligation to indemnify Morgan Stanley as provided for in the Morgan Stanley Letter Agreement.

3

A copy of Morgan Stanley's fairness opinion is filed as Exhibit (a)(20) and is incorporated by reference herein.

Item 6. Interest in Securities of the Subject Company.

The Company is not aware of any transactions in securities effected by any executive officer, director or affiliate within the past 60 days.

The information set forth under "The Tender Offer — Merger Agreement; Subscription and Contribution Agreement; Tender and Voting Agreement; Voting Agreement; Exclusivity Agreement; Nondisclosure Agreement; Employment Agreements" in the Offer to Purchase is incorporated herein by reference.

Item 7. Purposes of the Transaction and Plans or Proposals.

Except as set forth in this Statement with respect to the Offer and the Merger, the Company is not undertaking or engaged in any negotiation in response to the Offer that relates to (i) a tender offer or other acquisition of the Shares by the Company, any of its subsidiaries, or any other person, (ii) an extraordinary transaction, such as a merger, reorganization, or liquidation, involving the Company or any of its subsidiaries, (iii) a purchase, sale, or transfer of a material amount of assets by the Company or any of its subsidiaries, or (iv) any material change in the present dividend rate or policy, or indebtedness or capitalization of the Company. The information set forth in "Special Factors — Purposes, Alternatives, Effects and Plans" and "The Tender Offer — Merger Agreement; Subscription and Contribution Agreement; Tender and Voting Agreement; Voting Agreement; Exclusivity Agreement; Nondisclosure Agreement; Employment Agreements" of the Offer to Purchase are incorporated herein by reference.

Except as set forth in this Statement with respect to the Offer and the Merger, there are no transactions, Board resolutions, agreements in principle, or signed contracts in response to the Offer that would relate to one or more of the matters referred to in this Item 7.

Item 8. Additional Information to be Furnished.

Offer to Purchase. The information contained in the Offer to Purchase filed as Exhibit (a)(1) hereto is incorporated herein by reference.

Litigation. The information set forth under "The Tender Offer — Legal Matters and Regulatory Approvals" in the Offer to Purchase is incorporated herein by reference.

Information Statement. The Information Statement attached as Schedule I hereto is being furnished in connection with the possible designation by the Parent, pursuant to the terms of the Merger Agreement, of certain persons to be appointed to the Board other than at a meeting of the Company's Stockholders.

| Exhibit No. |

Description |

|

|---|---|---|

| (a)(1) | Offer to Purchase dated October 27, 2000.*+ | |

| (a)(2) | Form of Letter of Transmittal.*+ | |

| (a)(3) | Form of Notice of Guaranteed Delivery.*+ | |

| (a)(4) | Form of Letter to Company's Stockholders.+ | |

| (a)(5) | Form of Letter to Brokers, Dealers, Commercial Banks, Trust Companies, and Other Nominees.*+ |

4

| (a)(6) | Form of Letter to Clients from Brokers, Dealers, Commercial Banks, Trust Companies, and Other Nominees.*+ | |

| (a)(7) | Form of Summary Advertisement dated October 27, 2000.* | |

| (a)(8) | Press Release, dated October 16, 2000, issued by the Company and Schlumberger Limited.** | |

| (a)(9) | Press Release, dated October 16, 2000, issued by the Company.** | |

| (a)(10) | Agreement and Plan of Merger, dated as of October 13, 2000, among Parent, Purchaser, STC and the Company.* | |

| (a)(11) | Nondisclosure Agreement, dated July 6, 2000, between the Company and Schlumberger Industries, S.A., as amended on August 4, 2000.* | |

| (a)(12) | Exclusivity Agreement, dated September 20, 2000, between the Company and Schlumberger, Ltd.* | |

| (a)(13) | Exclusivity Agreement, dated September 29, 2000, between the Company and Schlumberger Ltd.* | |

| (a)(14) | Tender and Voting Agreement, dated as of October 13, 2000 by and among Purchaser, Parent, STC, the Company and the Stockholders of the Company whose names appear on Schedule I thereto.*** | |

| (a)(15) | Subscription and Contribution Agreement, dated as of October 13, 2000, by and among Parent, STC, Cinergy, Purchaser and the parties listed on the signature pages thereto as Management Investors.*** | |

| (a)(16) | Voting Agreement, dated as of October 13, 2000, by and among Purchaser, Parent, STC and the Stockholders whose names appear on Schedule I thereto.*** | |

| (a)(17) | Waiver Letter provided by the Company to certain Stockholders of the Company regarding the Registration Rights Agreement, dated April 28, 2000, among the Company, the Investors listed on Schedule I thereto, the Continuing Shareholders listed on Schedule II thereto and the Strategic Investor (as defined therein). | |

| (a)(18) | Waiver Letter provided by the Company to holders of options under the Stock Option Plan and to Stockholders of the Company who own Shares issued upon exercise of options granted under the Stock Option Plan. | |

| (a)(19) | Waiver Letter provided by the Company to Cinergy Corp. in connection with the Stock Purchase Agreement, dated April 28, 2000, between the Company and Cinergy Communications, Inc. | |

| (a)(20) | Fairness Opinion of Morgan Stanley & Co. Incorporated.+ | |

| (e)(1) | Employment Agreement, dated as of October 13, 2000, between the Company and Glenn E. Montgomery, Jr.* | |

| (e)(2) | Employment Agreement, dated as of October 13, 2000, between the Company and Larry J. Engelken.* | |

| (e)(3) | Employment Agreement, dated as of October 13, 2000, between the Company and Scott M. Schley.* | |

| (e)(4) | Employment Agreement, dated as of October 13, 2000, between the Company and Bryan R. Mileger.* | |

| (e)(5) | Employment Agreement, dated as of October 13, 2000, between the Company and Andrea S. Maizes.* | |

| (e)(6) | Employment Agreement, dated October 13, 2000, between the Company and David J. Rubinstein.* |

5

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this Statement is true, complete, and correct.

| CONVERGENT GROUP CORPORATION | ||||

| |

|

By: |

|

Glenn E. Montgomery, Jr. Chairman, President and Chief Executive Officer |

| Dated: October 27, 2000 |

|

|

|

|

| |

|

|

|

|

6

SCHEDULE I

CONVERGENT GROUP CORPORATION

6399 SOUTH FIDDLER'S GREEN CIRCLE, SUITE 600

GREENWOOD VILLAGE, COLORADO 80111

INFORMATION STATEMENT

PURSUANT TO SECTION 14(F) OF THE SECURITIES EXCHANGE ACT OF 1934

AND RULE 14F-1 THEREUNDER

General

This Information Statement is being mailed on or about October 27, 2000, by Convergent Group Corporation (the "Company") to the holders of record of shares of common stock of the Company, par value $.001 per share (the "Shares"). You are receiving this Information Statement in connection with the possible appointment or election of persons designated by Convergent Holding Corporation, a Delaware corporation ("Parent"), and a wholly owned subsidiary of Schlumberger Technology Corp., a Texas corporation ("STC"), to a majority of the seats on the Board of Directors of the Company (the "Board"). On October 13, 2000, the Company, Parent, Convergent Acquisition Sub, Inc., a Delaware corporation ("Purchaser"), and a wholly owned subsidiary of Parent, and STC entered into an Agreement and Plan of Merger (the "Merger Agreement"). The Merger Agreement provides for Purchaser to make an all cash tender offer of $8.00 per Share for all of the outstanding Shares (the "Offer") and the subsequent merger of Purchaser with and into the Company (the "Merger"), with the Company being the surviving corporation in the Merger and becoming a wholly owned subsidiary of Parent. Purchaser commenced the Offer on October 27, 2000. The Offer is scheduled to expire at 12:00 midnight, New York City time, on Monday, November 27, 2000, unless the Offer is extended. The Merger Agreement provides that, subject to compliance with applicable laws and promptly following the purchase by Purchaser of the Shares pursuant to the Offer, Parent shall be entitled to designate that number of directors of the Company (the "Parent Designees") equal to the product of (i) the total number of directors on the Board and (ii) that fraction, the numerator of which is equal to the number of Shares which Parent and its subsidiaries beneficially own at the time of such fraction's calculation, and the denominator of which is the total number of Shares then outstanding.

This Information Statement is required by Section 14(f) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and Rule 14f-1 promulgated thereunder. You are urged to read this Information Statement carefully in its entirety. You are not, however, required to take any action at this time.

The information contained in the Information Statement concerning Purchaser, Parent, STC and the Parent Designees has been furnished to the Company by Purchaser, Parent and STC, and the Company assumes no responsibility for the accuracy and completeness of such information.

GENERAL INFORMATION REGARDING THE COMPANY

The Shares are the only class of voting securities of the Company currently outstanding and each Share has one vote. As of October 13, 2000, there were (i) 43,414,402 Shares outstanding, (ii) 5,000 Shares issued and held in the treasury of the Company and (iii) 4,484,786 Shares reserved for issuance upon the exercise of options granted by the Company pursuant to the Company's 1999 Stock Option Plan (the "Stock Option Plan"). The Board currently consists of five directors divided into three classes, one class with one member and two classes with two members each. Each director serves a three year term and until such director's successor has been duly elected and qualified, or until such director's earlier resignation or removal. At each annual meeting of stockholders, directors are elected

I-1

to the class of directors whose terms are due to expire at such meeting. The officers of the Company serve at the discretion of the Board.

INFORMATION WITH RESPECT TO PARENT DESIGNEES

The Merger Agreement provides that Parent shall be entitled to designate that number of directors of the Company, rounded up to the next whole number, as is equal to the product of the total number of directors on the Board (giving effect to the directors designated by Parent pursuant to this sentence) multiplied by the "Board Fraction," the numerator of which shall be the number of Shares which Parent and its subsidiaries beneficially own at the time of the calculation of such fraction, and the denominator of which shall be the total number of Shares then outstanding. The Parent Designees shall take office immediately after (i) the purchase of and payment for any Shares by Parent or any of its subsidiaries as a result of which Parent and its subsidiaries beneficially own at least a majority of then outstanding Shares and (ii) compliance with Section 14(f) of the Exchange Act and Rule 14f-1 thereunder, whichever shall occur later. The Company shall, upon request of Parent, use its best efforts promptly either to increase the size of the Board or to secure the resignations of such number of its incumbent directors, or both as is necessary to enable such Parent Designees to be so elected or appointed to the Board in accordance with the terms of the Merger Agreement and the Company shall take all actions available to the Company to cause such Parent Designees to be so elected or appointed at such time. At such time, the Company shall, if requested by Parent, also take all action necessary to cause Parent Designees to constitute the same Board Fraction of (i) each committee of the Board (other than the special committee of the Board formed for the purpose of reviewing, evaluating and negotiating the terms of the Merger Agreement (the "Special Committee")), (ii) each board of directors (or similar body) of each subsidiary of the Company and (iii) each committee (or similar body) of each such board of directors.

In the event that the Parent Designees are elected or appointed to the Board, until the date and time at which a certificate of merger is filed with the Secretary of State of the State of Delaware or such other date and time as is agreed upon by the parties to the Merger Agreement and specified in the certificate of merger (the "Effective Time"), all members of the Special Committee shall remain on the Board. In the event that the Parent Designees constitute a majority of the directors on the Board, the affirmative vote of a majority of the Special Committee shall be required after the acceptance for payment of Shares pursuant to the Offer and prior to the Effective Time, to (i) amend or terminate the Merger Agreement on behalf of the Company, (ii) exercise or waive any of the Company's rights, benefits or remedies hereunder if such exercise or waiver adversely affects holders of Shares (other than Parent or Purchaser); (iii) take any other action under or in connection with the Merger Agreement if such action adversely affects holders of Shares (other than Parent or Purchaser) or (iv) take any other action by the Company in connection with the Merger Agreement required to be taken by the Board.

I-2

Parent has informed the Company that it will choose the Parent Designees from the persons listed below and that each of the persons listed below has consented to act as a director, if so designated. Biographical information concerning each of the potential Parent Designees is presented below.

| Name |

Age |

Position With Parent; Present Principal Occupation or Employment and Material Positions Held During Past Five Years |

||

|---|---|---|---|---|

| Victor Grijalva | 62 | Vice Chairman of Schlumberger, Ltd. since 1998. Before serving as Vice Chairman, he was the Executive Vice President of Schlumberger, Ltd.'s Oilfield Services division from 1994 to April 1998. Mr. Grijalva is also the Chairman of the Board of Transocean Sedco Forex Inc. He is a citizen of Ecuador. | ||

| Brad Kitterman | 41 | President of North America for Schlumberger, Ltd.'s Resource Measurement Services ("RMS") since 1998. From 1996 to 1998, he was the General Manager in charge of Schlumberger, Ltd.'s Distributed Measurement Services group. Between 1993 and 1996, Mr. Kitterman was the Director of Engineering of the Electricity Management group at RMS. Mr. Kitterman is a US citizen. | ||

| Maarten Scholten | 46 | Director of Legal Services for Schlumberger, Ltd., since 1999. From 1996 to 1999 he served as Deputy General Counsel. Prior to that, from 1993 to 1996, Mr. Scholten held positions within Schlumberger, Ltd. as General Counsel, Schlumberger Wireline and Testing Division worldwide (1993-1996), and General Counsel, Integrated Project Management and Coordinator for Schlumberger Ltd.'s Oilfield Services Shared Resources Legal Department (1995-1996). Mr. Scholten is a citizen of the Netherlands. |

Parent has also advised the Company that, to the best of Parent's knowledge, none of the potential Parent Designees (i) is currently a director of, or holds any position with, the Company, (ii) beneficially owns any securities (or rights to acquire any securities) of the Company or (iii) has been involved in any transaction with the Company or any of its directors, executive officers or affiliates which is required to be disclosed pursuant to the rules and regulations of the Securities and Exchange Commission (the "SEC"), except as may be disclosed herein or in the Company's Solicitation/Recommendation Statement on Schedule 14D-9 or the Offer to Purchase relating to the Offer.

I-3

DIRECTORS AND EXECUTIVE OFFICERS OF THE COMPANY

The executive officers and directors of the Company as of October 13, 2000 are as follows:

| Name |

Age |

Position(s) |

||

|---|---|---|---|---|

| Glenn E. Montgomery, Jr. | 49 | Chairman, Chief Executive Officer and President | ||

| Scott M. Schley | 42 | Executive Vice President, Finance and Director | ||

| John A. Ramseur* | 60 | Executive Vice President | ||

| Larry J. Engelken | 50 | Executive Vice President, Strategic Accounts and Secretary | ||

| Bryan R. Mileger | 40 | Chief Financial Officer, Treasurer and Assistant Secretary | ||

| Andrea S. Maizes | 39 | Executive Vice President, Resource Management | ||

| David J. Rubinstein | 40 | Executive Vice President, Global Delivery | ||

| Robert Sharpe | 56 | Director | ||

| Jerry Murdock | 41 | Director | ||

| John W. Blend III | 54 | Director |

Glenn E. Montgomery, Jr., a founding partner of the Company, has been the Chairman of its Board of Directors and its President and Chief Executive Officer since 1994. He had been President and Chief Executive Officer of the Company's predecessor, UGC Consulting, since 1985. Prior to joining UGC Consulting, he served from 1982 to 1985 as an executive consultant with Kellogg Corporation, an engineering management consulting firm. From 1977 to 1982, Mr. Montgomery served as a projects director with MSE Corporation, a consulting and engineering company, providing consulting, project planning, and management expertise to GIS and land-related information system projects. Mr. Montgomery holds both an M.S.E.S. degree in technology assessment from the School of Environmental Affairs and a B.A. in computer mapping and geography from Indiana University.

Scott M. Schley has been Executive Vice President of Finance of the Company since February 2000 and a director since August 1999. From 1994 until August 2000 Mr. Schley served as the Company's Treasurer, and from 1994 to February 2000 he served as the Company's Chief Financial Officer. Prior to joining the Company, he served as Chief Financial Officer and Executive Vice President of Operations for the John Madden Company, a commercial real estate developer, which he joined after spending five years with a national public accounting firm. He holds a B.S. in business administration and accounting from Colorado State University.

John A. Ramseur has been Executive Vice President of the Company since 1998, and is responsible for the development and implementation of corporate growth, expansion and marketing strategies. Mr. Ramseur joined the Company in 1989 to lead a long-term consulting assignment for IBM. He left in 1993 to become President of Smallworld, North America, a software company, and after their initial public offering in 1997 he returned to the Company. He served as Chief Marketing Officer of Synercom Technology, a software company, from 1983 until their initial public offering in 1986. Prior to joining Synercom, Mr. Ramseur was President of Utility Data Corporation, a data services company.

Larry J. Engelken, a founding partner of the Company, has been Executive Vice President of Strategic Accounts since July 2000, and is responsible for the development and maintenance of certain of the Company's primary accounts. From 1997 to July 2000, Mr. Engelken served as the Executive Vice President of Global Sales, and was responsible for executive leadership of the Company's sales,

I-4

account development and account management activities. Prior to founding the Company in 1985, Mr. Engelken worked at two global engineering design and construction services firms, as well as being a Director and Executive Vice President of EGT, Inc., a data conversion services and GIS application software company. He is past president of the Geospatial Information & Technology Association (GITA). Mr. Engelken holds a B.S. degree in electrical engineering from Kansas State University.

Bryan R. Mileger joined the Company in January 2000 and has been Chief Financial Officer since February 2000. Prior to joining the Company, he served as Director of Corporate Acquisitions and Alliances with Electronic Data Systems Corporation. Mr. Mileger has worked in various capacities with Electronic Data Systems during the past fifteen years, including in its Treasury Department. Mr. Mileger holds an M.B.A. from Baylor University and a B.B.A. in accounting from Abilene Christian University.

Andrea S. Maizes joined the Company in November 1999 as Executive Vice President of Resource Management. Prior to joining the Company, Ms. Maizes held several executive positions at Cambridge Technology Partners, including Director of Human Resources for the Customer Relationship Management and Interactive Solutions practices and National Director of North American Recruitment. Before joining Cambridge Technology Partners in 1995, Ms. Maizes served during 1994 as Director of Human Resources for the northeast management consulting practice of Ernst & Young. Prior to joining Ernst & Young, Ms. Maizes served from 1989 to 1993 as Director of Human Resources for the metropolitan New York tax practice of Arthur Anderson, LLP and from 1985 to 1989 as Director of Human Resources at the financial services center of Deloitte & Touche. Ms. Maizes holds a B.A. in Psychology from Clark University.

David J. Rubinstein joined the Company in December 1999 as Executive Vice President of Global Delivery. Prior to joining the Company, Mr. Rubinstein served as the Vice President of Customer Management Systems at Cambridge Technology Partners. Prior to joining Cambridge Technology Partners in 1997, Mr. Rubinstein was a Managing Director of BSG Alliance/IT, an information technology consulting company. Mr. Rubinstein was also a co-founder of Innovative Systems, Inc., a client/server integration company. Mr. Rubinstein holds a B.S. in Management and Computer Science from Worcester Polytechnic Institute.

Robert Sharpe has been a director of the Company since May 1998. In 1999, he retired from Electronic Data Systems Corporation, where he served in various capacities from 1972 until his retirement, most recently as Corporate Vice President responsible for EDS' corporate global pursuit team. Prior to his position with the global pursuit team, Mr. Sharpe was in charge of North American and international business development for EDS. Mr. Sharpe was named Corporate Vice President in 1982, and during his tenure with EDS he also managed the Industrial Division, Finance and Industrial Group, General Motors Operations Group and Financial and Commercial Group. Mr. Sharpe has a B.S. in marketing and management from the University of Illinois.

Jerry Murdock has been a director of the Company since August, 1999. He co-founded InSight Capital Partners ("InSight") in 1995 and is a general partner of the firm. Mr. Murdock was formerly the managing general partner of the Aspen Technology Group, a consulting firm which he founded in 1987. He was a consultant to E.M. Warburg Pincus from 1989 to 1995. Mr. Murdock is a director of Quest Software, Click Commerce, Software Technology Corporation, WarrantyCheck.com, Ikano, Peace Computers and Planiesia. He graduated from San Diego State University with a B.A. in political science.

John W. Blend III has been a director of the Company since August 1999. He currently consults with InSight and serves on the boards of directors of a number of utility related technology companies. From 1985 to 1997, Mr. Blend served as President of Worldwide Sales and Marketing and Director for Indus International, an enterprise asset management solutions company. Mr. Blend has a B.A. in social sciences from Muhlenberg College.

I-5

During 1999, the Board met three times (including regularly scheduled and special meetings). All of the directors attended at least 75% of all meetings of the Board and the committees on which they served in 1999.

Audit Committee. Prior to the Company's initial public offering on August 1, 2000 (the "IPO"), the Company's Audit Committee consisted of Messrs. Montgomery, Schley and Sharpe. In connection with the IPO, the Board created a new Audit Committee and adopted a written charter for the Audit Committee, which is attached hereto as Exhibit A. The Audit Committee currently consists of Messrs. Blend and Sharpe. Mr. Sharpe qualifies as an independent director for purposes of the amended Nasdaq rules. Mr. Blend, who does not qualify as an independent director due to his relationship with InSight Capital Partners, was appointed to the Audit Committee in accordance with the exception contained in Rule 4460(d)(2)(B) of the amended Nasdaq rules because of his intimate knowledge of the Company's operations, finances, accounting systems and procedures and management. In addition, Mr. Blend has played an integral and active role in defining the Company's strategic and operational direction. Mr. Blend has been actively involved in the utility-related technology industry for over 30 years, both as an investor and in various management capacities, and he currently serves as a director for a number of utility-related technology companies and on the audit committees of some of these companies. The Company believes that Mr. Blend's professional experience provides him with the additional expertise required to serve on the Company's Audit Committee.

With respect to the appointment of a third director to the Audit Committee, in connection with the IPO the Nasdaq National Market System, upon which the Shares are traded, granted the Company a temporary exception to the requirements of Rule 4460(d) for a period of 90 days from August 1, 2000, the first day on which the Company was publicly traded. The Company has requested a second temporary exception to the requirement of Rule 4460(d) until the earlier to occur of either (i) the consummation of the Merger, at which time the Company will no longer be publicly traded and will no longer be required to satisfy the Nasdaq Audit Committee requirement or (ii) 30 days following the termination of the Merger Agreement, at which time the Company will appoint to its Board a new director who will serve on the Audit Committee and who will qualify as an independent director within the meaning of the amended Nasdaq rules.

The Audit Committee's purpose is to provide assistance to the Board in fulfilling its legal and fiduciary obligations with respect to matters involving the accounting, auditing, financial reporting, internal control and legal compliance functions of the Company and its subsidiaries. The Audit Committee oversees the audit efforts of the Company's independent accountants and internal auditors, if any, and, in that regard, takes such actions as it deems necessary to satisfy itself that the Company's auditors are independent of management. It is the objective of the Audit Committee to maintain free and open means of communications among the Board, the independent accountants, the internal auditors, if any, and the financial and senior management of the Company.

The Audit Committee did not issue a report on the Company's audited financial statements for the year ended December 31, 1999.

Compensation Committee. Prior to the Company's recapitalization on August 13, 1999 (the "Recapitalization"), the Company's Compensation Committee consisted of its Chief Executive Officer, Glenn E. Montgomery, Jr., and a former stockholder of the Company, and was responsible for recommending, subject to Board approval, any and all discretionary bonuses and similar compensation arrangements for all officers and employees of the Company who received annual salaried compensation in any one year in excess of $150,000. From the date of the Recapitalization until June 4, 2000, the members of the Board served as the Company's Compensation Committee. In connection with the IPO, the Company changed the rules and procedures governing the activities of its Compensation Committee. The Compensation Committee currently consists of Messrs. Montgomery,

I-6

Sharpe and Murdock, and is responsible for (a) evaluating the Company's compensation policies, determining compensation for the Company's executive officers and administering the Stock Option Plan. During 1999, the Board (post-Recapitalization) held 4 meetings and granted 2,513,001 stock options.

Nomination Procedure for Directors. The Company's amended bylaws set forth an advance notice procedure for its stockholders to make nominations of candidates for election as directors (the "Nomination Procedure"). The Nomination Procedure provides that only persons who are nominated by, or at the direction of, the Board or by a stockholder who has given timely written notice to the Company's Secretary prior to the meeting at which directors are to be elected will be eligible for election as directors. Under the Nomination Procedure, if a stockholder desires to nominate persons for election as directors at an annual meeting, the stockholder must submit written notice not less than 90 days nor more than 120 days prior to the first anniversary of the previous year's annual meeting. In addition, under the Nomination Procedure, a stockholder's notice proposing to nominate a person for election as a director must contain specified information, including (i) all information relating to such nominee as is required to be disclosed in solicitations of proxies for election of directors, or is otherwise required pursuant to Regulation 14A under the Exchange Act, including the written consent of such nominee to be named in the proxy statement and to serve as a director of the Company if so elected; (ii) the name and record address of the stockholder who intends to make the nomination; (iii) the class and number of Shares which are beneficially owned by such stockholder; and (iv) a description of all arrangements and understandings between such stockholder and such proposed nominee and any other person or persons pursuant to which the nominations are to be made by such stockholder. The chairman of the meeting may refuse to acknowledge the nomination of any person not made in compliance with the Nomination Procedure.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

Since the IPO, the Compensation Committee has been comprised of Messrs. Montgomery, Murdock and Sharpe. Mr. Montgomery is the President and Chief Executive Officer of the Company, and Mr. Murdock is a managing member of InSight Venture Associates III, LLC, which is the general partner of InSight Capital Partners III, L.P. which, together with its affiliates InSight Capital Partners III (Cayman), L.P. and InSight Capital Partners III (Co-Investors), L.P., is the Company's largest single stockholder. No executive officer of the Company has served as a director or member of the Compensation Committee of any other entity whose executive officers served as a director or member of the Company's Compensation Committee.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires executive officers and directors of the Company and persons who beneficially own more than ten percent of the Company's common stock to file with the SEC certain reports, and to furnish copies thereof to the Company, with respect to each such person's beneficial ownership of the Company's equity securities. No filings pursuant to Section 16(a) were required to be made by the Company in 1999 because Section 16(a) did not become applicable to the Company until July 31, 2000, in connection with the IPO.

I-7

Summary Compensation Table

The following table sets forth, in accordance with the rules of the SEC, information for the fiscal year ended December 31, 1999 concerning compensation paid to the Company's Chief Executive Officer and each of the four most highly compensated executive officers of the Company (collectively, the "Named Executive Officers") whose salary and bonus compensation for the year ended December 31, 1999 exceeded $100,000.

| |

|

|

|

|

Long Term Compensation |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

Annual Compensation |

|

Securities Underlying Options/SAR's (#) |

|

||||||||||||

| Name and Principal Position |

|

Other Annual Compensation ($)(1) |

All Other Compensation ($) |

||||||||||||||

| Year |

Salary ($) |

Bonus ($) |

|||||||||||||||

| Glenn E. Montgomery, Jr. Chairman of the Board, Chief Executive Officer and President |

1999 | $ | 256,850 | $ | 416,496 | $ | 3,831,391 | (2) | 755,419 | (7) | $ | 1,305,383 | (3)(4) | ||||

| Scott M. Schley(5) Executive Vice President, Finance and Director |

1999 | 154,250 | 62,400 | 1,116,847 | (2) | — | 246,000 | (4) | |||||||||

| Mark L. Epstein Executive Vice President |

1999 | 256,580 | 422,821 | 3,831,391 | (2) | — | 813,383 | (3) | |||||||||

| Larry J. Engelken(6) Executive Vice President, Strategic Accounts |

1999 | 256,580 | 422,821 | 3,831,391 | (2) | — | 813,383 | (3) | |||||||||

| John A. Ramseur Executive Vice President, Corporate Development |

1999 | 126,280 | 50,000 | 76,471 | (7) | 336,142 | (8) | — | |||||||||

I-8

EMPLOYMENT AGREEMENTS, TERMINATION OF EMPLOYMENT AND

CHANGE IN CONTROL ARRANGEMENTS

Employment Agreements

The Company currently has in effect Employment Agreements (the "Employment Agreements") with each of Messrs. Montgomery, Schley, Engelken, Epstein and Mileger. Pursuant to the terms of each Employment Agreement, each of the Company's executive officers receives a base salary and has an opportunity to earn an annual incentive bonus. Incentive bonuses, if any, are paid to executives based upon attainment during the fiscal year of certain financial performance objectives set by the Company. Bonus payments are based upon the extent to which the Company exceeds specific revenue, bookings, EBITDA and/or margin targets established by the Board.

Mr. Montgomery is employed under an Employment Agreement that expires on December 31, 2002, pursuant to which he is entitled to receive a base salary of $225,000 in 2000, with an annual increase of $25,000 each year thereafter. Mr. Montgomery received a performance bonus under his current employment agreement for the period commencing August 15, 1999 through December 31, 1999 equal to $35,375. He is eligible to receive a maximum annual performance bonus of up to $750,000 in 2000, $800,000 in 2001 and $825,000 in 2002, contingent upon the Company's ability to exceed specific revenue, bookings and EBITDA targets established by the Board. The bonus amount is contingent upon the extent to which the Company meets or exceeds the financial targets, and in order for Mr. Montgomery to receive the maximum bonus amounts, the Company must exceed the financial targets by 30%. Up to $333,333 of Mr. Montgomery's annual bonus for these years is payable in the form of immediately exercisable stock options, with an exercise price equal to 25% of the fair market value of the Shares as of December 31 of that year. The remainder of Mr. Montgomery's bonus is payable in cash. If Mr. Montgomery terminates his employment with good reason, or if the Company terminates his employment after a change of control, the Company will be required to purchase all Shares owned by Mr. Montgomery at the time of his termination at their then fair market value.

Mr. Engelken and Mr. Epstein are each employed under an Employment Agreement that expires on December 31, 2002, pursuant to which each was entitled to receive $200,000 in base salary on an annual basis commencing August 15, 1999. Each executive's base salary in 2000 is $210,000, and will increase 5% per year over the previous year's salary each year thereafter. Each executive is also eligible to receive an incentive bonus, the amount of which is targeted at 50% of each executive's base salary. Two-thirds of the incentive bonus is based upon the Company's attainment of targeted revenue goals, and one-third of the incentive bonus is based upon the Company's attainment of targeted margin goals. The Company must achieve more than 90% of the targeted revenues or targeted margins, whichever is being tested during the period in question, for a bonus to be paid with respect to that component. To the extent either bonus amount exceeds 100% of that component's target, one-third of the excess will be payable in cash, and two-thirds will be payable by the issuance of Nonqualified Stock Options at a per share exercise price equal to 25% of the fair market value of the Shares as of December 31 of that year. Messrs. Engelken and Epstein each received a bonus under their current employment agreements for the period commencing August 15, 1999 through December 31, 1999 of $41,700.

Mr. Schley is employed under an Employment Agreement that expires on December 31, 2000, pursuant to which he was entitled to receive $168,000 in base salary on an annual basis commencing August 15, 1999. Mr. Schley received $63,000 in 1999 under this agreement. Mr. Schley's base salary in 2000 is $176,400, and will increase 5% per year over the previous year's salary each year thereafter. Mr. Schley is eligible to receive an incentive bonus targeted at 50% of his base salary. Two-thirds of the incentive bonus is based upon the Company's attainment of targeted EBITDA goals and one-third of the incentive bonus is based upon the Company's attainment of targeted margin goals. The Company must achieve more than 90% of the targeted revenues or targeted margins, whichever is being tested during the period in question, for a bonus to be paid with respect to that component. To the extent

I-9

either bonus amount exceeds 100% of that component's target, one-third of the excess will be payable in cash and two-thirds will be payable by the issuance of Nonqualified Stock Options, at a per Share exercise price equal to 25% of the fair market value of the Shares as of December 31 of that year. Mr. Schley received a bonus for 1999 under his current employment agreement of $62,400.

Mr. Mileger is employed under an Employment Agreement that expires on January 31, 2003, pursuant to which he is entitled to receive $162,500 in base salary in 2000. Mr. Mileger received a $100,000 advance against his incentive bonus earned for 2000. The amount of the advance will be offset against the amount of his incentive bonus, if any, earned in 2000. The advance is payable in eleven monthly installments, provided Mr. Mileger remains employed by the Company during that period. Mr. Mileger is eligible to receive an incentive bonus targeted at 100% of his base salary. Payment of the bonus is dependent upon the attainment of specific performance goals established by Mr. Mileger and the Board. The Company must achieve 90% of these performance goals, and Mr. Mileger must remain employed by the Company as of the last day of the year in order for Mr. Mileger to be eligible to receive the bonus payment.

Termination of Employment

Each of the Employment Agreements between the Company and its executive officers (other than the Employment Agreement between the Company and Mr. Schley) contains change in control severance provisions. The form of severance provision (the "Severance Provision") provides that if the Company terminates the executive's employment without good reason during a specified period following a "Change in Control" of the Company (the "Period"), the executive will be entitled to receive (i) benefits for a period of 6 months, (ii) severance pay for a period of 6 months, (iii) a pro-rated portion of such officer's incentive bonus, and (iv) in the case of Mr. Montgomery, (A) all existing options and restricted stock grants held by Mr. Montgomery immediately vest and (B) Mr. Montgomery has the right to cause the Company to repurchase any Shares owned by him at such Shares' fair market value.

Change in Control Provisions

For purposes of the Severance Provision, a "Change in Control" occurs (A) when individuals who constituted the Board as of the date of the applicable severance agreement (the "Incumbent Board") and individuals whose election or nomination for election by the stockholders of the Company, was approved by a vote of at least two-thirds of the directors then comprising the Incumbent Board (who shall after election be considered members of the Incumbent Board unless such election occurs as a result of an actual or threatened election contest or other actual or threatened solicitation of proxies or consents by or on behalf of a person other than the Board) shall cease to constitute a majority of the Board; (B) when an individual, entity or group acquires beneficial ownership of 30% or more of the combined voting power of the Company's then-outstanding securities eligible to vote for the election of the Board (subject to certain exceptions); (C) upon the consummation of a merger, consolidation or other similar transaction (subject to certain exceptions); or (D) upon approval by the stockholders of the Company of a plan of complete liquidation or dissolution of the Company or the sale of all or substantially all of the assets of the Company.

Pursuant to the terms of the Stock Option Plan, upon the occurrence of a Change in Control, all outstanding options granted prior to October 1, 1999 become immediately exercisable in full. Options granted after October 1, 1999 become immediately exercisable in full if (a) such vesting is specifically provided for in the applicable option agreement, or (b) the Stock Option Plan administrator chooses to accelerate the vesting provisions, either as to all outstanding options or only as to those options designated by the Stock Option Plan administrator. In the event of (i) the dissolution, liquidation or sale of all or substantially all of the Company's assets; or (ii) the merger or consolidation of the Company with another entity; or (iii) any other capital reorganization in which the stockholders of the

I-10

Company immediately prior to such reorganization own less than 2/3 of the outstanding voting securities of the Company following such reorganization (each of (i), (ii) and (iii) above a "Reorganization Event"), then the Stock Option Plan administrator shall either: (A) make appropriate provision for the protection of outstanding options by means of the substitution of the new entity's stock (if applicable) for the stock of the Company; or (B) require that all unexercised options be exercised within a certain time period, or such options shall terminate. The Stock Option Plan administrator may, in its sole discretion, accelerate the exercise dates of outstanding options in connection with any Reorganization Event which does not also result in a Change in Control.

Pursuant to the terms of the Stock Option Plan, a Change in Control was deemed to have occurred upon the execution of the Merger Agreement by the Company. As a result, (i) all outstanding options granted by the Company under the Stock Option Plan prior to October 1, 1999 became immediately exercisable in full, and (ii) all outstanding options granted by the Company under the Stock Option Plan after October 1, 1999 (other than the 251,746 options categorized as "Tranche III Options") became immediately exercisable in full because all of the option agreements applicable to such options contained specific language providing for such accelerated vesting.

The general terms of each of the Company's stock option agreements provide for options granted pursuant to such agreements to expire and terminate as set forth in the applicable stock option Agreement, unless (i) such options are terminated pursuant to a Reorganization Event or (ii) the option holder's employment with the Company is terminated. In addition, the Stock Option Plan administrator may extend the termination date of any option, subject to certain restrictions.

After the consummation of the Merger, new Employment Agreements will be in effect with Messrs. Montgomery, Schley, Engelken and Mileger. The information set forth under "The Tender Offer — Merger Agreement; Subscription and Contribution Agreement; Tender and Voting Agreement; Voting Agreement; Exclusivity Agreement; Confidentiality Agreement; Employment Agreements" in the Offer to Purchase is incorporated herein by reference.

Directors do not receive any cash compensation for serving as directors. The Company pays all reasonable expenses incurred by its directors, including legal and travel expenses, in connection with the performance of their duties as members of the Board, including expenses incurred as a result of attending meetings of the Board and of any committees thereof. However, in its discretion, the Board may determine to pay directors a fixed fee for serving as a director and/or a fixed fee for attendance at each meeting of the Board or a committee thereof. Directors are also eligible to participate in the Stock Option Plan.

On December 29, 1999, the Company entered into a letter agreement with one of its directors, Robert Sharpe, pursuant to which Mr. Sharpe agreed to provide consulting services to the Board regarding operations, tactical strategy and contracts. Under the letter agreement, the Company agreed to reimburse Mr. Sharpe up to $100,000 during 2000 for expenses incurred in connection with the terms of the letter agreement.

I-11

OPTION GRANTS DURING THE YEAR ENDED DECEMBER 31, 1999

The following table sets forth information concerning grants to purchase Shares to each of the officers named in the summary compensation table above during the year ended December 31, 1999.

| Name |

Number of Securities Underlying Options/SARs Granted (#) |

Percent of Total Options/SARs Granted to Employees in Fiscal Year |

Exercise or Base Price ($/sh) |

Expiration Date |

||||

|---|---|---|---|---|---|---|---|---|

| Glenn E. Montgomery, Jr. | 755,419 | (1) | 16.8 | 0.092 | 12/30/09 | |||

| Scott M. Schley | — | — | — | — | ||||

| Mark L. Epstein | — | — | — | — | ||||

| Larry J. Engelken | — | — | — | — | ||||

| John A. Ramseur(2) | 304,403 31,739 |

7.5 | 0.026 | 01/19/09 08/06/09 |

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR AND

FISCAL YEAR-END OPTION VALUE

The following table sets forth information concerning option exercises by each of the officers named in the above summary compensation table.

| |

|

|

Number of Securities Underlying Unexercised Options at Fiscal Year-End |

||||||

|---|---|---|---|---|---|---|---|---|---|

| |

Shares Acquired on Exercise (#) |

|

|||||||

| |

Value Realized($) |

||||||||

| Name |

Exercisable |

Unexercisable |

|||||||

| Glenn E. Montgomery, Jr. | — | — | 755,419 | (1) | — | ||||

| Larry J. Engelken | — | — | — | — | |||||

| Mark L. Epstein | — | — | — | — | |||||

| Scott M. Schley | — | — | — | — | |||||

| John A. Ramseur | 336,142 | (2) | $ | 76,471 | — | — | |||

InSight Capital PartnersTransaction Fee and Management Fee

The Company paid InSight Capital Partners a one-time fee equal to one percent (1%) of the Company's market capitalization in its IPO. The fee was paid in full upon the consummation of the IPO. Based on the number of Shares outstanding upon consummation of the IPO, the fee equaled approximately $3.0 million. In addition, in connection with the Recapitalization the Company agreed to pay InSight a management fee equal to $500,000 per year for management and strategic advice rendered by InSight. During 1999, the Company paid InSight $187,500 for their management and strategic advice. The Company was obligated to pay a pro-rata portion of the fee during 2000 prior to the consummation of the IPO, at which time the Company's obligation to pay the fee terminated. The pro rata portion of the fee paid to InSight during 2000 was $208,334.

I-12

Loan to Glenn E. Montgomery, Jr.

On August 13, 1999, the Company extended a $2,000,000 loan to Glenn E. Montgomery, Jr., evidenced by a promissory note. The current interest rate on the loan is 5.9% per annum, and Mr. Montgomery is required to make payments of principal and interest to the Company in four equal installments of $652,685.27 on or before each of July 1, 2003, January 1, 2004, July 1, 2004 and August 13, 2004. Mr. Montgomery may prepay the outstanding principal and accrued interest on the loan at any time without penalty. Mr. Montgomery will repay this loan pursuant to the terms of his new employment agreement with the Company, Parent and STC, which will become effective upon the consummation of the Merger.

The loan to Mr. Montgomery is non-recourse. To secure the loan, Mr. Montgomery executed a Stock Pledge Agreement whereby he pledged to the Company all Shares then owned by him. In addition, Mr. Montgomery's obligations under the promissory note were initially guaranteed on a non-recourse basis by GMJM Stock Partnership, Ltd. ("GMJM"). GMJM's obligations under the guaranty were secured by a pledge to the Company of all Shares owned by GMJM. The GMJM guaranty and pledge were released in January 2000 in connection with the sale of the Shares owned by GMJM. In connection with the release of the GMJM guaranty and pledge, Mr. Montgomery pledged additional Shares that he acquired subsequent to the date of his original pledge.

Stock Sale by Glenn E. Montgomery, Jr.

Between January 15, 2000 and February 14, 2000, Glenn E. Montgomery, Jr. sold 755,420 shares of preferred and common stock of the Company to three separate investor groups. Total aggregate consideration for the transactions amounted to $6.0 million, or approximately $8.00 per share.

1999/2000 Issuance of Restricted Stock to Certain Directors

On October 29, 1999 the Company issued 377,710 Shares to each of Robert Sharpe and John W. Blend III, members of the Board. Pursuant to the terms of the Restricted Stock Agreements with each of Messrs. Sharpe and Blend, the Shares vested at the rate of 47,213.5 Shares per calendar quarter, effective on the last day of each quarter, commencing September 30, 1999. On October 13, 2000, the Board voted to accelerate the vesting of any remaining unvested Shares issued to Messrs. Sharpe and Blend pursuant to their respective Restricted Stock Agreements, and to waive any restrictions previously imposed upon Messrs. Sharpe and Blend pursuant to the terms of such agreements.

COMMON STOCK OWNERSHIP BY MANAGEMENT AND PRINCIPAL STOCKHOLDERS

The following table provides specific information regarding the beneficial ownership of the Shares as of October 13, 2000 for:

Unless otherwise indicated, the address of each person named in the table below is c/o Convergent Group Corporation, 6399 South Fiddler's Green Circle, Suite 600, Greenwood Village, Colorado 80111. The amounts and percentages of Shares beneficially owned are reported on the basis of regulations of the SEC governing the determination of beneficial ownership of securities. Under the rules of the SEC, a person is deemed to be a "beneficial owner" of a security if that person has or shares "voting power," which includes the power to vote or to direct the voting of the security, or "investment power," which includes the power to dispose of or to direct the disposition of the security. A person is also

I-13

deemed to be a beneficial owner of any securities of which that person has a right to acquire beneficial ownership within 60 days. Under these rules, more than one person may be deemed a beneficial owner of the same securities and a person may be deemed to be a beneficial owner of securities as to which that person has no economic interest. The information set forth in the following table is based on 43,414,402 Shares outstanding as of October 13, 2000.

| |

Beneficial Ownership Before Offering |

||||||||

|---|---|---|---|---|---|---|---|---|---|

| Name of Beneficial Owner |

Shares |

Shares Underlying Options Exercisable Within 60 Days |

Total |

Percent |

|||||

| Entities affiliated with Insight Capital Partners(1) | 17,302,623 | — | 17,302,623 | 39.9 | % | ||||

| Capital/Convergent LLC(2) | 7,960,038 | — | 7,960,038 | 18.3 | % | ||||

| Entities affiliated with GS Private Equity Partners(3) | 2,304,188 | — | 2,304,188 | 5.3 | % | ||||

| Entities associated with Wexford Management LLC(4) | 2,304,220 | — | 2,304,220 | 5.3 | % | ||||

| Glenn E. Montgomery, Jr | 3,275,093 | — | 3,275,093 | 7.5 | % | ||||

| Scott M. Schley | 847,427 | — | 847,427 | 2.0 | % | ||||

| Mark L. Epstein(5) | 3,275,093 | — | 3,275,093 | 7.5 | % | ||||

| Larry J. Engelken(6) | 2,776,081 | — | 2,776,081 | 6.4 | % | ||||

| John A. Ramseur | 388,017 | — | 388,017 | 0.9 | % | ||||

| Robert Sharpe(7) | 784,382 | — | 784,382 | 1.8 | % | ||||

| John W. Blend III(8) | 8,337,763 | — | 8,337,763 | 19.2 | % | ||||

| Jerry Murdock(8) | 17,302,623 | — | 17,302,623 | 39.9 | % | ||||

| All executive officers and directors as a group (10 persons)(9) | 26,085,116 | 416,168 | 26,501,284 | 60.5 | % | ||||

I-14

August 13, 1999 Recapitalization

On August 13, 1999 the Company consummated the Recapitalization pursuant to an agreement among the Company, certain of its then existing stockholders and investors led by InSight Capital Partners III, L.P. and including UBS Capital II LLC and affiliates of Goldman, Sachs & Co. In connection with the Recapitalization, the investors acquired an approximately 63% controlling interest in the Company through the purchase of shares of a new series of voting convertible participating

I-15

preferred stock for a total purchase price of approximately $45.5 million. As part of the Recapitalization:

The following table sets forth the sources and uses of funds for the Recapitalization.

Sources and Uses

(in thousands)

| Sources: | |||||

| Investor proceeds | $ | 45,546 | |||

| Line of credit borrowings | 22,000 | ||||

| Total sources | $ | 67,546 | |||

| Uses: | |||||

| Retirement of preferred stockholder and two largest non-employee common stockholders | $ | 44,265 | |||

| Buyout of employment agreements | 2,440 | ||||

| Legal and other finance fees | 1,356 | ||||

| Fees paid to employees | 738 | ||||

| Payment of previously deferred bonuses | 2,236 | ||||

| Payments to employee stockholders | 11,766 | ||||

| Loan to Chief Executive Officer | 2,000 | ||||

| Total uses | $ | 64,801 | |||

| Net proceeds | $ | 2,745 | |||

Pursuant to the terms of the Recapitalization, the Company agreed to indemnify the investors, in the form of cash, additional shares of stock, or a combination of both, for breaches of representations,

I-16

warranties and covenants made to them by the Company in connection with their purchase of the Company's capital stock, (including representations and warranties regarding the Company's financial condition, its liabilities and its client contracts), up to a maximum of $1.5 million in cash and $3.0 million in Series A Preferred stock, valued at $1.08 per share. Most of the representations and warranties under the recapitalization agreement survived only until the first anniversary of the Recapitalization. The obligation to indemnify the investors against environmental claims remains in effect until the seventh anniversary of the closing of the Recapitalization; the obligations to indemnify the investors against tax-related and ERISA claims remain in effect until the expiration of all applicable statutes of limitation; and the obligation to indemnify the investors against claims made in connection with representations and warranties relating to specific fundamental corporate matters, such as the Company's organization, subsidiaries, outstanding stock and specific corporate approvals, remains in effect indefinitely. Also in connection with the Recapitalization, the Company's continuing stockholders agreed to elect two designees of the investors (Mr. Blend and Mr. Murdock) to serve on the Board. This obligation to elect the designees of the investors terminated upon the closing of the IPO.

REPORT OF COMPENSATION COMMITTEE

As previously noted, prior to the Recapitalization, the Company's Compensation Committee consisted of its Chief Executive Officer, Glenn E. Montgomery, Jr., and a former stockholder of the Company, and was responsible for recommending, subject to Board approval, any and all discretionary bonuses and similar compensation arrangements for all officers and employees of the Company who received annual salaried compensation in any one year in excess of $150,000. Prior to the Recapitalization, the Company's Compensation Committee also determined the nature, time and amounts of option grants under the Stock Option Plan. From the date of the Recapitalization until June 4, 2000, the members of the Board served as the Company's Compensation Committee.

The Compensation Committee administers the Company's executive compensation program, including determination of salary and bonus compensation for the Chief Executive Officer and the other executive officers of the Company and determination of the nature, time and amounts of option grants to the Chief Executive Officer and such executive officers under the Stock Option Plan. Grants of options under the Stock Option Plan to certain executive officers are subject to approval by the Board. The Compensation Committee's report for 1999 is as follows:

Compensation Policy

Generally, the Company's executive compensation is designed to be competitive with compensation offered by other companies against which the Company competes for executive resources. The executive compensation plans are designed to attract and retain individuals of superior ability and managerial talent. In establishing compensation for executive officers, the Compensation Committee seeks to:

To this end, the Company's executive compensation is composed of base salary, bonus awards and long-term incentive compensation.

I-17

Base Salary

Salary levels of executive officers are established after a review of companies deemed comparable to the Company. In general, the Committee attempts to set base salaries at the conservative end of the competitive spectrum with the expectation that as Company performance improves, individual performance will be rewarded with incentives and bonuses. The Committee generally compares the Company's performance with that of other companies engaged in activities similar to those engaged in by the Company.

Bonus Awards

The Committee's practice with regard to awarding bonuses to executive officers is to review the Company's performance after the close of the year, taking into account whatever measures of performance the Committee determines in its sole discretion to be appropriate under the circumstances, and assigning such weight to any such factors as it determines to be appropriate. In addition, the Committee may from time to time pay bonuses to selected individuals in connection with special events or projects as a result of such individuals superior performance in connection with such event or project.

Long-Term Incentive Compensation

The Company's long-term incentive compensation strategy is focused on the grant or award of options to purchase Shares. The Compensation Committee determines who receives grants or awards, the grant or award date, the number of shares subject to the grant or award, the exercise price, the vesting schedule and other matters as specified in the Stock Option Plan. Grants of options under the Stock Option Plan to certain executive officers are subject to approval by the Board. The Compensation Committee believes that these grants or awards reward executive officers for their efforts in improving long-term performance of the Company's common stock and creating value for the Company's stockholders, thereby aligning the financial interests of such executives with those of the Company's stockholders.

Limitation on Deductibility of Executive Compensation

Section 162(m) of the Internal Revenue Code limits the deductibility of compensation paid to certain executive officers of the Company. To qualify for deductibility under Section 162(m), compensation in excess of $1,000,000 per year paid to the Chief Executive Officer and the four other most highly compensated executive officers at the end of such fiscal year generally must be "performance-based" compensation as determined under Section 162(m). The provisions of Section 162(m) were not applicable to the Company in 1999 since it was a private company and will not be applicable to the Company upon consummation of the Merger since it will one again become a private company.

1999 Compensation

Base salaries for the executive officers named in the Summary Compensation Table were paid in accordance with amounts guaranteed to them under their pre and post Recapitalization employment agreements. The amounts shown as 1999 bonus in the Summary Compensation Table were approved and paid in February 2000 and were based on achievement of the Company's business plan targets relating to, among other things, revenues, margins, bookings and EBITDA without assigning relative weight to any such factors, as well as the Committee's subjective assessment of the executives' respective individual performance. These bonus amounts were also determined in accordance with the executive officers pre and post Recapitalization employment agreements. In determining the amount of bonus paid in 1999, the Committee also took into account the amounts of Other Annual Compensation

I-18

and All Other Compensation granted to the executive officers named in the Summary Compensation Table which amounts were determined at the time of the Recapitalization and, in the case of the amounts shown under Other Annual Compensation, were determined in large part through negotiations with Insight Capital Partners. The above-described approach to the compensation of executive officers in 1999 was fully applicable to the compensation of Glenn E. Montgomery, Jr., the Company's Chief Executive Officer and President.

COMPENSATION COMMITTEE

Glenn

E. Montgomery, Jr.

Scott M. Schley

Robert Sharpe

Jerry Murdock

John W. Blend III

THE FOREGOING REPORT SHOULD NOT BE DEEMED INCORPORATED BY REFERENCE BY ANY GENERAL STATEMENT INCORPORATING BY REFERENCE THIS INFORMATION STATEMENT INTO ANY FILING UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR UNDER THE EXCHANGE ACT (TOGETHER, THE "ACTS"), EXCEPT TO THE EXTENT THAT THE COMPANY SPECIFICALLY INCORPORATES THIS INFORMATION BY REFERENCE, AND SHALL NOT OTHERWISE BE DEEMED FILED UNDER SUCH ACTS.

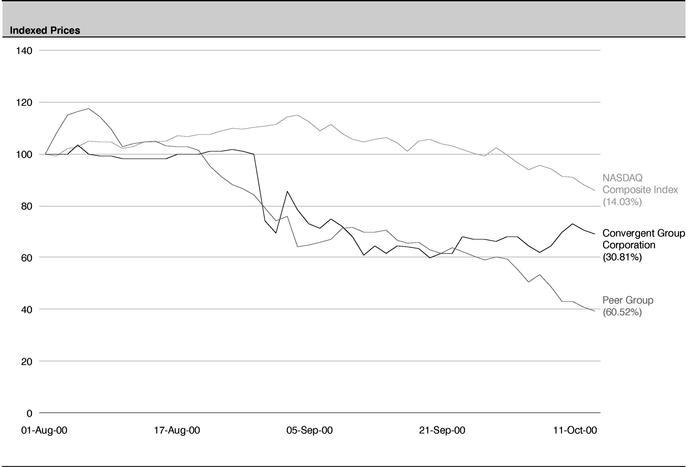

The following line graph compares the percentage change in cumulative stockholder return on the Shares indexed to August 1, 2000, the date of the IPO, with (a) the performance of a broad equity market indicator, and (b) the performance of a peer group index. The graph compares the percentage change in the return on the Shares since August 1, 2000, the date the Shares commenced trading on the Nasdaq National Market System, with the cumulative total return on the NASDAQ Composite Index and the Peer Group identified by the Company's financial advisor (which group includes Cambridge Technology Partners, Inc., Diamond Technology Partners, Inc., iXL Enterprises, Inc., Proxicom, Inc., Razorfish, Inc., Sapient Corporation, Scient Corporation, and Viant Corporation) over such period. The Peer Group companies include the internet consulting and systems integration companies most similar to the Company, and most of the other major publicly traded internet consulting and systems integration companies. The stock price performance graph assumes an investment of $100 in the Company on August 1, 2000 and an investment of $100 in the two indexes on August 1, 2000 and further assumes the reinvestment of all dividends. The stock price performance, presented for the period from August 1, 2000 through October 11, 2000 is not necessarily indicative of future results. Information used in this graph was obtained from FactSet Research Systems, a source believed to be reliable, but the Company is not responsible for errors or omissions in such information.

I-19

Comparison of 10 Week Cumulative Total Return*

Among Convergent Group Corporation,

the NASDAQ Composite Index

and a Peer Group

*$100 invested on 08/01/00 in stock or index, including reinvestment of dividends.

| |

Cumulative Total Return(%) |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

08/11/00 |

08/25/00 |

09/08/00 |

09/22/00 |

10/06/00 |

10/11/00 |

|||||||