|

|

|

|

|

Previous: ENCOUNTER COM INC, SC 13G, 2000-11-03 |

Next: I TRAX COM INC, 8-K, 2000-11-03 |

SCHEDULE 14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant /x/ |

||

| Filed by a Party other than the Registrant / / | ||

| Check the appropriate box: |

||

| / / | Preliminary Proxy Statement | |

| / / | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| /x/ | Definitive Proxy Statement | |

| / / | Definitive Additional Materials | |

| / / | Soliciting Material Pursuant to §240.14a-12 |

|

| Avocent Corporation |

||||

(Name of Registrant as Specified In Its Charter) |

||||

| |

||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| /x/ | No fee required | |||

| / / | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

| / / | Fee paid previously with preliminary materials. | |||

| / / | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

AVOCENT CORPORATION

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON DECEMBER 6, 2000

This Special Meeting of Stockholders of Avocent Corporation, a Delaware corporation (the "Company"), will be held at the Huntsville Marriott located at Five Tranquility Base, Huntsville, Alabama 35805, on Wednesday, December 6, 2000, at 10:00 a.m., local time, for the following purposes:

These items of business are described in the attached proxy statement. We encourage you to read the entire document carefully. Only stockholders of record at the close of business on October 11, 2000, are entitled to notice of, and to vote at, the Special Meeting and any adjournment or postponement thereof. A list of such stockholders is kept at the office of the Company's transfer agent, ChaseMellon Shareholder Services LLC. All stockholders are cordially invited to attend the meeting. However, to assure your representation at the meeting, you are urged to mark, sign and return the enclosed proxy card as promptly as possible in the postage-prepaid envelope enclosed for that purpose.

Any stockholder attending the meeting may vote in person even if he or she has returned a proxy.

By Order of the Board of Directors,

Samuel F. Saracino

Samuel F. Saracino

Secretary

Huntsville,

Alabama

November 6, 2000

YOUR VOTE IS VERY IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE

MEETING, PLEASE SIGN, DATE AND RETURN THE ENCLOSED PROXY AS

PROMPTLY AS POSSIBLE IN THE ENCLOSED ENVELOPE.

AVOCENT CORPORATION

4991 Corporate Drive

Huntsville, Alabama 35805

PROXY STATEMENT

Special Meeting of Stockholders

To be held on December 6, 2000

INFORMATION CONCERNING SOLICITATION AND VOTING

Date, Time and Place

This Proxy Statement is furnished to the stockholders of Avocent Corporation, a Delaware corporation (the "Company"), in connection with the solicitation of proxies by the Board of Directors of the Company (the "Board") for use at the Special Meeting of Stockholders (the "Special Meeting") to be held at the Huntsville Marriott located at Five Tranquility Base, Huntsville, Alabama 35805 on Wednesday, December 6, 2000, at 10:00 a.m., local time, and any and all postponements or adjournments thereof, for the purposes set forth in this proxy statement and the accompanying Notice of Special Meeting of Stockholders. These proxy solicitation materials were first mailed on or about November 6, 2000, to all stockholders entitled to vote at the Special Meeting.

Purposes of the Special Meeting

The purposes of the Special Meeting are to (i) approve the adoption of the Company's 2000 Stock Option Plan (the "2000 Plan") and the reservation of six million (6,000,000) shares of Common Stock for issuance thereunder; (ii) to approve the adoption of the Company's 2000 Employee Stock Purchase Plan (the "2000 ESPP") and the reservation of one million five hundred thousand (1,500,000) shares of Common Stock for issuance thereunder; and (iii) to transact such other business as may properly come before the Special Meeting, or any postponement or adjournment thereof.

Revocability of Proxies

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before its use by delivering to the Company's Corporate Secretary or its transfer agent, ChaseMellon Shareholder Services LLC, a written notice of revocation or a duly executed proxy bearing a later date or by attending the Special Meeting and voting in person.

Record Date and Share Ownership

Stockholders of record at the close of business on October 11, 2000 (the "Record Date"), are entitled to notice of, and to vote at, the Special Meeting. At the Record Date, 43,497,394 shares of the Company's Common Stock, and no shares of the Company's Preferred Stock, were issued and outstanding, held of record by approximately 314 stockholders. For information regarding security ownership by principal stockholders and management, see the Section below entitled "Security Ownership by Principal Stockholders and Management."

Voting and Solicitation; Quorum

Each share held as of the Record Date is entitled to one vote. The transaction of business at the Special Meeting requires the presence, in person or by proxy, of a majority of the holders of the shares of Common Stock issued and outstanding on the Record Date. The affirmative vote of a majority of the shares present, in person or represented by proxy, at the meeting and entitled to vote is required to approve the proposals.

Abstentions and broker non-votes will be counted for the purpose of determining the presence or absence of a quorum for the transaction of business. However, broker non-votes will not be counted for the purpose of determining the number of shares entitled to vote with respect to a proposal on which the broker has expressly not voted. Thus, broker non-votes will not affect the outcome of the voting on a proposal that requires a majority of the shares present and entitled to vote. Abstentions will have the same effect as a vote against the proposals.

The solicitation of proxies will be conducted by mail, and the Company will bear all attendant costs. These costs will include the expense of preparing and mailing proxy solicitation materials for the Special Meeting and reimbursements paid to brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation materials regarding the Special Meeting to such beneficial owners. Proxies may also be solicited by certain of the Company's directors, officers and regular employees, without additional compensation, personally or by telephone, telegram or facsimile. The Company has retained Georgeson Shareholder Communications, Inc. to assist in the solicitation of proxies for a fee of approximately $10,000 plus reasonable out-of-pocket costs and expenses.

Stockholder Proposals for the Next Annual Meeting

Any proposal to be presented at the Company's next Annual Meeting of Stockholders must be received at the Company's offices no later than Friday, January 12, 2001 in order to be considered for inclusion in the Company's proxy materials for such meeting. Any such proposals must be submitted in writing, addressed to the attention of the Company's Corporate Secretary at 9911 Willows Road N.E., Redmond, Washington 98052, and must otherwise comply with the Company's Bylaws and the requirements of Rule 14a-8 of the Securities Exchange Act of 1934, as amended.

PROPOSAL ONE

APPROVAL OF THE 2000 STOCK OPTION PLAN

On September 18, 2000, the Board adopted the 2000 Plan and reserved six million (6,000,000) shares of Common Stock for issuance thereunder. As of October 11, 2000, the Board had approved the grant of 1,780,000 options under the 2000 Plan to the Company's executive officers and directors, subject to stockholder approval of adoption of the 2000 Plan.

At the Special Meeting, the stockholders are being asked to approve the 2000 Plan and the reservation of shares for issuance thereunder.

Summary of the 2000 Plan

General. The purpose of the 2000 Plan is to attract and retain the best available personnel for positions of substantial responsibility with the Company, to provide additional incentive to the employees, directors and consultants of the Company and to promote the success of the Company's business. Options granted under the 2000 Plan may be either incentive stock options, as defined in Section 422 of the Internal Revenue Code of 1986, as amended (the "Code"), or nonstatutory stock options.

Administration. The Plan may generally be administered by the Board or a committee appointed by the Board (as applicable, the "Administrator"). The Board has appointed the Compensation Committee to administer the 2000 Plan.

Eligibility; Limitations. Nonstatutory stock options may be granted under the 2000 Plan to employees, directors and consultants of the Company and any parent or subsidiary of the Company. Incentive stock options may be granted only to employees. The Administrator, in its discretion, selects the employees, directors and consultants to whom options may be granted, the time or times at which such options shall be granted, and the number of shares subject to each such grant.

2

Section 162(m) of the Code places limits on the deductibility for federal income tax purposes of compensation paid to certain executive officers of the Company. In order to preserve the Company's ability to deduct the compensation income associated with options granted to such persons, the Plan provides that no employee, director or consultant may be granted, in any fiscal year of the Company, options to purchase more than five hundred thousand (500,000) shares of Common Stock. Notwithstanding this limit, however, in connection with such individual's initial employment with the Company, he or she may be granted options to purchase up to an additional five hundred thousand (500,000) shares of Common Stock.

Terms and Conditions of Options. Each option is evidenced by a stock option agreement between the Company and the optionee, and is subject to the following additional terms and conditions:

a) Exercise Price. The Administrator determines the exercise price of options at the time the options are granted. The exercise price of an incentive stock option may not be less than 100% of the fair market value of the Common Stock on the date such option is granted; provided, however, the exercise price of an incentive stock option granted to a 10% shareholder may not be less than 110% of the fair market value of the Common Stock on the date such option is granted. The fair market value of the Common Stock is generally determined with reference to the closing sale price for the Common Stock (or the closing bid if no sales were reported) on the date the option is granted.

b) Exercise of Option; Form of Consideration. The Administrator determines when options become exercisable, and may in its discretion, accelerate the vesting of any outstanding option. Stock options granted under the Plan generally vest and become exercisable over four (4) years. The means of payment for shares issued upon exercise of an option is specified in each option agreement. The 2000 Plan permits payment to be made by cash, check, promissory note, other shares of Common Stock of the Company (with some restrictions), cashless exercises, a reduction in the amount of any Company liability to the optionee, any other form of consideration permitted by applicable law, or any combination thereof.

c) Term of Option. The term of an incentive stock option may be no more than ten (10) years from the date of grant; provided that in the case of an incentive stock option granted to a 10% shareholder, the term of the option may be no more than five (5) years from the date of grant. No option may be exercised after the expiration of its term.

d) Termination of Employment. If an optionee's employment or consulting relationship terminates for any reason (other than death or disability), then all options held by the optionee under the 2000 Plan expire on the earlier of (i) the date three (3) months after the optionee's termination or (ii) the expiration date of such option. To the extent the option is exercisable at the time of such termination, the optionee may exercise all or part of his or her option at any time before expiration of the option.

e) Death or Disability. If an optionee's employment or consulting relationship terminates as a result of death or disability, then all options held by such optionee under the 2000 Plan expire on the earlier of (i) twelve (12) months from the date of such termination or (ii) the expiration date of such option. The optionee (or the optionee's estate or the person who acquires the right to exercise the option by bequest or inheritance), may exercise all or part of the option at any time before such expiration to the extent that the option was exercisable at the time of such termination.

f) Limited Transferability of Options. Unless determined otherwise by the Administrator, options granted under the 2000 Plan are not transferable other than by will or the laws of descent and distribution, and may be exercised during the optionee's lifetime only by the optionee.

g) Other Provisions. The stock option agreement may contain other terms, provisions and conditions not inconsistent with the 2000 Plan as may be determined by the Administrator.

3

Adjustments Upon Changes in Capitalization. In the event that the stock of the Company changes by reason of any stock split, reverse stock split, stock dividend, combination, reclassification or other similar change in the capital structure of the Company effected without the receipt of consideration, appropriate adjustments shall be made in the number and class of shares of stock subject to the 2000 Plan, the number and class of shares of stock subject to any option outstanding under the 2000 Plan, and the exercise price of any such outstanding option or stock purchase right.

In the event of a liquidation or dissolution, any unexercised options will terminate. The Administrator may, in its discretion, provide that each optionee shall have the right to exercise all of the optionee's options, including those not otherwise exercisable, until the date ten (10) days prior to the consummation of the liquidation or dissolution.

In connection with any merger, consolidation, acquisition of assets or like occurrence involving the Company, each outstanding option shall be assumed or an equivalent option or right substituted by the successor corporation. If the successor corporation refuses to assume the options or to substitute substantially equivalent options, the optionee shall have the right to exercise the option as to all the optioned stock, including shares not otherwise vested and exercisable. In such event, the Administrator shall notify the optionee that the option is fully exercisable for fifteen (15) days from the date of such notice and that the option terminates upon expiration of such period.

Repricing. Repricing of options granted under the 2000 Plan is prohibited.

Amendment and Termination of the 2000 Plan. The Board may amend, alter, suspend or terminate the 2000 Plan, or any part thereof, at any time and for any reason. However, the Company shall obtain stockholder approval for any amendment to the 2000 Plan to the extent necessary to comply with Section 162(m) and Section 422 of the Code, or any similar rule or statute. No such action by the Board or stockholders may alter or impair any option previously granted under the 2000 Plan without the written consent of the optionee. Unless terminated earlier, the 2000 Plan shall terminate ten (10) years from the date of its approval by the stockholders.

The foregoing is only a summary of the 2000 Plan. It does not purport to be complete. A complete copy of the 2000 Plan is attached as Appendix A. Stockholders are encouraged to review the 2000 Plan in its entirety.

Federal Income Tax Consequences

Options granted under the 2000 Plan may be either incentive stock options or non-statutory stock options.

Incentive Stock Options. An optionee who is granted an incentive stock option does not recognize taxable income at the time the option is granted or upon its exercise, although the exercise may subject the optionee to the alternative minimum tax. Upon a disposition of the shares more than two (2) years after grant of the option and one (1) year after exercise of the option, any gain or loss is treated as long-term capital gain or loss. Net capital gains on shares held between 12 and 18 months are currently taxed at a maximum federal rate of 28%. Net capital gains on shares held for more than 18 months are capped at 20%. Capital losses are allowed in full against capital gains and up to $3,000 against other income. If these holding periods are not satisfied, the optionee recognizes ordinary income at the time of disposition equal to the difference between the exercise price and the lower of (i) the fair market value of the shares at the date of the option exercise or (ii) the sale price of the shares. Any gain or loss recognized on such a premature disposition of the shares in excess of the amount treated as ordinary income is treated as long-term or short-term capital gain or loss, depending on the holding period. A different rule for measuring ordinary income upon such a premature disposition may apply if the optionee is also an officer, director, or 10% shareholder of the Company. The Company is entitled to a deduction in the same amount as the ordinary income recognized by the optionee.

4

Nonstatutory Stock Options. Options that do not qualify as incentive stock options are referred to as non-statutory options. An optionee does not recognize any taxable income at the time he or she is granted a nonstatutory stock option. Upon exercise, the optionee recognizes taxable income generally measured by the excess of the then fair market value of the shares over the exercise price. Any taxable income recognized in connection with an option exercise by an employee of the Company is subject to tax withholding by the Company. The Company is entitled to a deduction in the same amount as the ordinary income recognized by the optionee. Upon a disposition of such shares by the optionee, any difference between the sale price and the optionee's exercise price, to the extent not recognized as taxable income as provided above, is treated as long-term or short-term capital gain or loss, depending on the holding period. Net capital gains on shares held between 12 and 18 months are currently taxed at a maximum federal rate of 28%. Net capital gains on shares held for more than 18 months are capped at 20%. Capital losses are allowed in full against capital gains and up to $3,000 against other income.

The foregoing is only a summary of the effect of federal income taxation on optionees and the Company with respect to the grant and exercise of options under the 2000 Plan. It does not purport to be complete, and does not discuss the tax consequences of the employee's, director's or consultant's death or the provisions of the income tax laws of any municipality, state or foreign country in which the employee, director, or consultant may reside.

Required Vote

At the Special Meeting, the stockholders are being asked to approve the adoption of the 2000 Plan and the reservation of shares for issuance thereunder. The affirmative vote of the holders of a majority of the shares present, in person or represented by proxy, at the Special Meeting and entitled to vote will be required to approve the proposal.

The Board of Directors recommends that stockholders vote "FOR" the adoption of the 2000 Plan and the reservation of six million (6,000,000) shares of Common Stock for issuance thereunder.

PROPOSAL TWO

APPROVAL OF THE 2000 EMPLOYEE STOCK PURCHASE PLAN

On September 18, 2000, the Board adopted the 2000 ESPP. In addition, the Board reserved one million five hundred thousand (1,500,000) shares of Common Stock for issuance thereunder. As of October 11, 2000, no shares had been purchased under the 2000 ESPP.

At the Special Meeting, the stockholders are being asked to approve the 2000 ESPP and the reservation of shares for issuance thereunder.

Summary of the 2000 ESPP

General. The purpose of the 2000 ESPP is to provide employees of the Company and its subsidiaries an opportunity to purchase Common Stock of the Company through payroll deductions. The 2000 ESPP, which is intended to qualify under Section 423 of the Code, contains consecutive, overlapping, twenty-four (24) month offering periods. Each offering period includes four (4) six (6) month purchase periods. The offering periods generally start on the first trading day on or after August 1st and February 1st of each year, except for the first such offering period, which commences on the first trading day on or after December 15, 2000, and ends on the first trading day on or after January 31, 2003.

Administration. The 2000 ESPP may be administered by the Board or a committee appointed by the Board (as applicable, the "Administrator"). The Board has appointed the Compensation Committee to administer the 2000 ESPP. All questions of interpretation or application of the 2000 ESPP are determined by the Board or its appointed committee, and its decisions are final, conclusive and binding on all participants.

5

Eligibility. Employees are eligible to participate if they are customarily employed by the Company, or any participating subsidiary, for at least 20 hours per week and more than five (5) months in any calendar year. However, any employee who (i) immediately after grant owns stock possessing 5% or more of the total combined voting power or value of all classes of capital stock or (ii) whose rights to purchase stock under the Company's employee stock purchase plans accrues at a rate which exceeds $25,000 worth of stock for each calendar year may not be granted an option to purchase stock under the 2000 ESPP. The 2000 ESPP permits participants to purchase Common Stock through payroll deductions of up to 15% of the participant's "compensation." Compensation is defined as the participant's base straight time gross earnings, overtime, shift premiums, commissions, any bonus payments, and any other cash compensation. The maximum number of shares a participant may purchase during a single purchase period is 5,000 shares.

Participation; Purchase Price. Amounts deducted and accumulated by the participant are used to purchase shares of Common Stock at the end of each purchase period. The price of stock purchased under the 2000 ESPP is generally 85% of the lower of the fair market value of the common stock (i) at the beginning of the offering period or (ii) at the end of the purchase period. In the event the fair market value at the end of a purchase period is less than the fair market value at the beginning of the offering period, the participants will be withdrawn from the current offering period following exercise and automatically re-enrolled in a new offering period. The new offering period will use the lower fair market value as of the first date of the new offering period to determine the purchase price for future purchase periods.

Payment of Purchase Price; Payroll Deductions. The purchase price of the shares is accumulated by payroll deductions throughout the offering period. The number of shares of Common Stock a participant may purchase in each offering period is determined by dividing the total amount of payroll deductions withheld from the participant's compensation during that offering period by the purchase price; provided, however, that a participant may not purchase more than 5,000 shares for each offering period. During the offering period, a participant may discontinue his or her participation in the 2000 ESPP, and may decrease or increase the rate of payroll deductions in an offering period within limits set by the Administrator.

All payroll deductions made for a participant are credited to the participant's account under the 2000 ESPP, are withheld in whole percentages only and are included with the general funds of the Company. Funds received by the Company pursuant to exercises under the 2000 ESPP are also used for general corporate purposes. A participant may not make any additional payments into his or her account.

Withdrawal. A participant may terminate his or her participation in the 2000 ESPP at any time by giving the Company a written notice of withdrawal. In such event, the payroll deductions credited to the participant's account will be returned, without interest, to such participant. Payroll deductions will not resume unless a new subscription agreement is delivered in connection with a subsequent offering period.

Termination of Employment. Termination of a participant's employment for any reason, including death, cancels his or her participation in the 2000 ESPP immediately. In such event the payroll deductions credited to the participant's account will be returned without interest to such participant, his or her designated beneficiaries or the executors or administrators of his or her estate.

Adjustments Upon Changes in Capitalization. In the event of any changes in the capitalization of the Company effected without receipt of consideration by the Company, such as a stock split, stock dividend, combination or reclassification of the Common Stock, resulting in an increase or decrease in the number of shares of Common Stock, proportionate adjustments will be made by the Board in the shares subject to purchase and in the price per share under the 2000 ESPP. In the event of liquidation or dissolution of the Company, the offering periods then in progress will terminate immediately prior to the consummation of such event unless otherwise provided by the Board. In the event of a sale of all or substantially all of the assets of the Company, or the merger of the Company with or into another corporation, each option under the 2000 ESPP shall be assumed or an equivalent option shall be substituted by such successor corporation

6

or a parent or subsidiary of such successor corporation. If the successor corporation refuses to assume or substitute for the outstanding options, the offering period then in progress will be shortened and a new exercise date will be set.

Limited Transferability of Rights. Rights granted under the 2000 ESPP are not transferable by a participant other than by will, the laws of descent and distribution, or as otherwise provided under the 2000 ESPP.

Amendment and Termination. The Board may at any time and for any reason amend or terminate the 2000 ESPP, except that no such termination shall affect options previously granted and no amendment shall make any change in an option granted prior thereto which adversely affects the rights of any participant. Stockholder approval for amendments to the 2000 ESPP shall be obtained in such a manner and to such a degree as required to comply with all applicable laws or regulations. The 2000 ESPP will continue in effect for a term of ten (10) years, unless terminated earlier by the Board in accordance with the 2000 ESPP.

The foregoing is only a summary of the 2000 ESPP. It does not purport to be complete. A complete copy of the 2000 ESPP is attached as Appendix B. Stockholders are encouraged to review the 2000 ESPP in its entirety.

Federal Income Tax Consequences

The 2000 ESPP, and the right of participants to make purchases thereunder, is intended to qualify under the provisions of Sections 421 and 423 of the Code. Under these provisions, no income will be taxable to a participant until the shares purchased under the 2000 ESPP are sold or otherwise disposed of. Upon sale or other disposition of the shares, the participant will generally be subject to tax in an amount that depends upon the holding period. If the shares are sold or otherwise disposed of more than two years from the first day of the applicable offering period and one year from the applicable date of purchase, the participant will recognize ordinary income measured as the lesser of (i) the excess of the fair market value of the shares at the time of such sale or disposition over the purchase price, or (ii) an amount equal to 15% of the fair market value of the shares as of the first day of the applicable offering period. Any additional gain will be treated as long-term capital gain. If the shares are sold or otherwise disposed of before the expiration of these holding periods, the participant will recognize ordinary income generally measured as the excess of the fair market value of the shares on the date the shares are purchased over the purchase price. Any additional gain or loss on such sale or disposition will be long-term or short-term capital gain or loss, depending on the holding period. The Company generally is not entitled to a deduction for amounts taxed as ordinary income or capital gain to a participant except to the extent of ordinary income recognized by participants upon a sale or disposition of shares prior to the expiration of the holding periods described above.

The foregoing is only a summary of the effect of federal income taxation on participants in the 2000 ESPP and the Company with respect to the shares purchased under the 2000 ESPP. It does not purport to be complete and does not discuss the tax consequences of the participant's death or the provisions of the income tax laws of any municipality, state or foreign country in which the participant resides.

Required Vote

At the Special Meeting, the stockholders are being asked to approve the adoption of the 2000 ESPP. The affirmative vote of the holders of a majority of the shares present, in person or represented by proxy, at the Special Meeting and entitled to vote will be required to approve the proposal.

The Board recommends that stockholders vote "FOR" the adoption of the 2000 ESPP and the reservation of one million five hundred thousand (1,500,000) shares of Common Stock for issuance thereunder.

7

COMPENSATION OF EXECUTIVE OFFICERS

The following table shows (i) the compensation earned by the Company's Chief Executive Officer during the last completed fiscal year; (ii) the compensation earned by the four other most highly compensated individuals who served as executive officers of the Company during the last completed fiscal year; and (iii) the compensation received by each such individual for the Company's two preceding fiscal years.

On July 1, 2000, the stockholders of Cybex Computer Products Corporation ("Cybex") and Apex Inc. ("Apex") approved a merger, resulting in the Company's formation (the "Merger"). In the Merger, holders of Apex's common stock received 1.0905 shares of the Company's Common Stock for each share they owned, and holders of Cybex's Common Stock received one share of the Company's Common Stock for each share they owned. For ease of comparison, in the following table, and wherever applicable throughout this proxy statement, the number and price of shares have been converted to reflect the exchange ratio resulting from the Merger.

| |

|

Annual Compensation |

Long-Term Compensation |

|

||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name & Principal Position |

Year(1) |

Salary |

Bonus(2) |

Number of Securities Underlying Options(3) |

Other Compensation(4) |

|||||||

| Stephen F. Thornton Chief Executive Officer |

1999 1998 1997 |

$ |

250,000 185,015 165,150 |

$ |

317,650 51,953 89,800 |

45,000 67,500 50,625 |

6,773 6,303 5,055 |

|||||

| Doyle C. Weeks Executive Vice President, Group Operations and Business Development |

1999 1998 1997 |

175,000 135,857 115,150 |

222,400 38,521 97,588 |

37,500 68,593 33,750 |

6,470 3,604 3,826 |

|||||||

| Gary R. Johnson Senior Vice President, Sales and Marketing |

1999 1998 1997 |

136,000 112,008 100,150 |

159,270 52,097 75,890 |

15,000 84,375 — |

3,922 3,640 2,214 |

|||||||

| C. David Perry Vice President, OEM Sales |

1999 1998 |

180,000 20,769 |

222,304 — |

81,787 327,150 |

73,146 — |

|||||||

| Douglas E. Pritchett Senior Vice President, Finance |

1999 1998 |

150,000 69,058 |

190,650 24,712 |

22,500 56,250 |

4,947 1,225 |

|||||||

8

Cybex's fiscal years ended March 31, 1998, 1999 and 2000. For Mr. Perry, the compensation is based on Apex's fiscal years ended December 31, 1997, 1998 and 1999. Mr. Perry joined Apex in November 1998, so he did not receive any compensation from Apex in 1997. Similarly, Mr. Pritchett joined Cybex in September 1998, so he did not receive any compensation from Cybex in 1997.

In Cybex's fiscal year ended March 31, 2000, Mr. Thornton received $2,889 in employer contributions to Cybex's 401(k) Retirement Plan, $3,340 in payment of life insurance premiums, and $544 in payment of disability insurance premiums. In Cybex's fiscal year ended March 31, 1999, he received $2,723 in contributions to the 401(k) plan, $3,036 in payment of life insurance premiums, and $544 in payment of disability insurance premiums. In Cybex's fiscal year ended March 31, 1998, he received $1,843 in contributions to the 401(k) plan, $2,638 in payment of life insurance premiums, and $574 in payment of disability insurance premiums.

In Cybex's fiscal year ended March 31, 2000, Mr. Weeks received $5,242 in employer contributions to Cybex's 401(k) Retirement Plan, $684 in payment of life insurance premiums, and $544 in payment of disability insurance premiums. In Cybex's fiscal year ended March 31, 1999, he received $2,422 in contributions to the 401(k) plan, $638 in payment of life insurance premiums, and $544 in payment of disability insurance premiums. In Cybex's fiscal year ended March 31, 1998, he received $2,728 in contributions to the 401(k) plan, $524 in payment of life insurance premiums, and $574 in payment of disability insurance premiums.

In Cybex's fiscal year ended March 31, 2000, Mr. Johnson received $2,758 in employer contributions to Cybex's 401(k) Retirement Plan, $620 in payment of life insurance premiums, and $544 in payment of disability insurance premiums. In Cybex's fiscal year ended March 31, 1999, he received $2,585 in contributions to the 401(k) plan, $511 in payment of life insurance premiums, and $544 in payment of disability insurance premiums. In Cybex's fiscal year ended March 31, 1998, he received $1,184 in contributions to the 401(k) plan, $456 in payment of life insurance premiums, and $574 in payment of disability insurance premiums.

In Apex's fiscal year ended December 31, 1999, Mr. Perry received $4,500 in employer contributions to Apex's 401(k) Retirement Plan and $68,646 in reimbursement for moving expenses. Mr. Perry joined Apex in November 1998. Consequently, he did not receive any compensation other than salary and options in Apex's fiscal year ended December 31, 1998.

In Cybex's fiscal year ended March 31, 2000, Mr. Pritchett received $3,719 in employer contributions to Cybex's 401(k) Retirement Plan, $684 in payment of life insurance premiums, and $544 in payment of disability insurance premiums. In Cybex's fiscal year ended March 31, 1999, he received $935 in contributions to the 401(k) plan, $154 in payment of life insurance premiums, and $136 in payment of disability insurance premiums. Mr. Pritchett joined Cybex in September 1998. Consequently, in Cybex's fiscal year ended March 31, 1998, he did not receive contributions to the 401(k) plan, payments of life insurance premiums, or payments of disability insurance premiums.

9

OPTION GRANTS IN LAST FISCAL YEAR

The following table provides information with respect to stock options granted to the executive officers named in the Summary Compensation Table in the last completed fiscal year. In addition, as required by Securities and Exchange Commission rules, the table sets forth the hypothetical gains that would exist for the options based on assumed rates of annual compound stock price appreciation during the option term.

| |

Individual Grants(2) |

Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation For Option Term(3) |

|||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name(1) |

Number of Securities Underlying Options Granted(4) |

Percent of Total Options Granted To Employees in Fiscal Year (%)(5) |

Exercise Price ($/sh)(6) |

Expiration Date |

5% |

10% |

|||||||||

| Stephen F. Thornton | 45,000 | 6.58 | $ | 12.00 | 4/23/09 | $ | 339,603 | $ | 860,621 | ||||||

| Doyle C. Weeks | 37,500 | 5.48 | 12.00 | 4/23/09 | 283,003 | 717,184 | |||||||||

| Gary R. Johnson | 15,000 | 2.19 | 12.00 | 4/23/09 | 113,201 | 286,874 | |||||||||

| C. David Perry | 81,787 | 10.6 | 10.60 | 3/12/09 | 545,370 | 1,382,074 | |||||||||

| Douglas E. Pritchett | 22,500 | 3.29 | 12.00 | 4/23/09 | 169,802 | 430,310 | |||||||||

10

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR-END OPTION VALUES

The following table sets forth information with respect to stock options exercised by the executive officers named in the Summary Compensation Table during the last completed fiscal year. In addition, the table sets forth the number of shares covered by stock options as of the last completed fiscal year, and the value of "in-the-money" stock options, which represents the positive spread between the exercise price of a stock option and the market price of the shares subject to such option at the end of the last completed fiscal year.

| Name(1) |

Number of Shares Acquired on Exercise |

Value Realized(2) |

Number of Securities Underlying Unexercised Options at Fiscal Year End Exercisable/Unexercisable(3) |

Value of Unexercised In-The-Money Options at Fiscal Year End Exercisable/Unexercisable(4) |

|||||

|---|---|---|---|---|---|---|---|---|---|

| Stephen F. Thornton | — | $ | — | 80,277 / 104,625 | $2,236,259 / 3,154,739 | ||||

| Doyle C. Weeks | 36,562 | 975,076 | 34,725 / 123,499 | 1,007,950 / 3,591,362 | |||||

| Gary R. Johnson | 50,625 | 1,194,845 | 20,625 / 129,375 | 646,015 / 3,852,732 | |||||

| C. David Perry | — | — | 81,787 / 327,150 | 1,162,500 / 5,039,063 | |||||

| Douglas E. Pritchett | — | — | 16,875 / 61,875 | 466,172 / 1,720,547 | |||||

11

During Apex's fiscal year ended December 31, 1999, Directors Edwin L. Harper and William McAleer, who were then directors of Apex, each received $12,750 for service as a director. Each individual who was a director of Apex in October 1999 was also granted options at that time to purchase 13,086 shares of Apex's Common Stock at $13.70 per share. These options were to vest monthly over a one-year period after the expiration of the vesting period for currently outstanding options.

During Cybex's fiscal year ended March 31, 2000, Director John R. Cooper, who was then a director of Cybex, received $10,000 for his service as a director. In April 1999, Mr. Cooper was also granted options to purchase 3,750 shares of Cybex's Common Stock at $12.00 per share and in January 2000 was granted options to purchase another 3,750 shares at $30.38 per share, taking into account a 3-for-2 stock split effected by Cybex on February 18, 2000. Mr. Cooper's options vested immediately on the date of grant.

The Company reimburses each member of the Board for out-of-pocket expenses incurred in connection with attending board meetings. No member of the Board currently receives any additional cash compensation for serving as a member of the Board, although the Company anticipates paying outside, non-executive directors an annual cash fee of $19,000 for their service on the Board. The Board has discretion to grant options to directors under the Company's option plans.

EMPLOYMENT CONTRACTS AND SEVERANCE AGREEMENTS

The Company has entered into amended and restated employment agreements with certain of its executive officers, including those executive officers of the Company named in the Summary Compensation Table. Under each agreement, the employee receives an annual base salary, subject to annual increases at the discretion of the Compensation Committee of the Company's Board of Directors (the "Compensation Committee") not less than the annual cost of living increase percentage, and is entitled to receive an annual bonus at the discretion of the Compensation Committee based on the executive officer's and the Company's performance and to participate in stock option plans and all other benefit programs generally available to executive officers of the Company.

Under the terms of the employment agreements, the Company's executive officers have also agreed that during the term of their employment and for a term of twelve (12) months thereafter, they will not compete against the Company, without the prior written consent of the Company, by engaging in any capacity in any business activity in the United States, Canada or Europe that is substantially similar to or in direct competition with the business of the Company, except that Stephen F. Thornton, the Company's Chief Executive Officer, has agreed not to compete against the Company during the term of his employment and for a term of thirty-six (36) months thereafter in exchange for a $400,000 cash payment.

Under the terms of the employment agreements, the Company may terminate an executive officer's employment for "cause," which includes termination by reason of acts of (i) willful dishonesty, fraud, or deliberate injury or attempted injury to the Company or (ii) the executive officer's willful material breach of the employment agreement that has resulted in material injury to the Company, in which event, the executive shall receive accrued salary, earned bonus and other benefits through the date of termination but not including severance compensation. If a participating executive officer is terminated by the Company without cause, he is entitled to receive his accrued salary, earned bonus and other benefits through the date of termination, including severance compensation.

Severance compensation is generally equal to the executive officer's base salary at the rate payable at the time of termination for a period of twelve (12) months following the date of termination and an amount equal to the executive officer's average annual bonus during the two years immediately preceding his termination. However, Mr. Thornton is entitled to his base salary for a period of twenty-four (24) months after the date of termination, and Doyle C. Weeks is entitled to his base salary for a period of eighteen (18) months after the date of termination. At the executive officer's election, he or she may

12

receive a lump sum severance amount equal to the present value of such severance payments (using a discount rate equal to the 90-day Treasury bill interest rate in effect on the date of delivery of such election notice). Severance compensation also entitles executive officers, upon termination without cause, to accelerate vesting of any award granted under the Company's, Apex's or Cybex's stock option plans and continuation of medical plan benefits for a period of twelve (12) months after the date of termination.

If a "change-in-control" occurs and the executive officer terminates his or her employment within six (6) months or the Company terminates his or her employment within eighteen (18) months, the executive officer is immediately entitled to receive accrued salary, earned bonus and other benefits through the date of termination, including the severance compensation described above. Executive officers of the company are not entitled to severance compensation for voluntary termination or termination by reason of the executive officer's death or disability.

Under the terms of the employment agreements, the Company agrees to indemnify each executive officer for certain liabilities arising from actions taken by the executive officer within the scope of his employment.

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The Company was formed July 1, 2000, from the merger of Cybex and Apex. The following is a report of the Company's Compensation Committee. The first two sections below disclose the compensation policies applicable to Cybex's and Apex's executive officers during each company's last completed fiscal year, which for Cybex ended March 31, 2000, and for Apex ended December 31, 1999. The third section below discusses the compensation policies that will apply prospectively to the Company's executive officers. The Company's Compensation Committee is composed of Directors Edwin L. Harper, Chairman, John R. Cooper, and William McAleer. Cybex's compensation committee during its last completed fiscal year was composed of Mr. Cooper, who is a former director of Cybex, and another former Cybex director, David S. Butler. Apex's compensation committee during its last completed fiscal year was composed of Mr. Harper and Mr. McAleer, who are both former directors of Apex.

Report on Executive Compensation for Cybex

Introduction. This report discloses the compensation policies and the basis for the compensation paid to Cybex's executive officers and to Stephen F. Thornton, the former President, Chief Executive Officer and Chairman of the Board of Cybex, during Cybex's fiscal year ended March 31, 2000.

Cybex's policy with respect to executive compensation was designed to (i) adequately and fairly compensate executive officers in relation to their responsibilities, capabilities and contributions to the company, (ii) reward executive officers for the achievement of short-term operating goals and for the enhancement of the long-term shareholder value of the company; and (iii) align the interest of executive officers with those of the company's stockholders with respect to short-term operating results and long-term increases in the price of Cybex's Common Stock.

The components of compensation paid to executive officers consisted of (i) base salary, (ii) incentive compensation in the form of an annual bonus, (iii) long-term incentive compensation in the form of options awarded by Cybex under its 1995 Employee Stock Option Plan, (iv) long-term incentive compensation in the form of options or shares of restricted stock awarded by Cybex under its 1998 Employee Stock Incentive Plan, (v) amounts paid on behalf of executives under Cybex's 401(k) Plan and (vi) certain other benefits provided to executive officers.

Cybex's compensation committee established the general compensation policy for the company and had the responsibility for approving cash compensation and increases in compensation paid to executive officers of the company. Cybex's compensation committee also administered the company's 1995 Employee Stock Option Plan and its 1998 Employee Stock Incentive Plan (collectively, the "Incentive

13

Plans"). Cybex's compensation committee selected the individuals who would receive awards under the Incentive Plans and determined the timing, pricing and amounts of options or shares of restricted stock granted under the Incentive Plans, each in accordance with the terms of the respective plan. Cybex's compensation committee consisted of three non-employee directors of the company. Cybex's Board of Directors was responsible for determining annual contributions by Cybex under the company's 401(k) Plan.

Cybex's executive compensation program historically emphasized the use of incentive based compensation to reward members of senior management for the achievement of short-term operating goals and for increasing the long-term stockholder value of Cybex. Annual bonus payments were discretionary and were related primarily to the operating performance of Cybex, in general, and the executive, in particular. Cybex believed that its compensation policies rewarded management when the company and its stockholders had benefited from short-term operating results and long-term increases in the price of Cybex's Common Stock.

Executive officers of Cybex were rewarded based upon corporate performance, business unit performance and individual performance. Corporate performance and business unit performance were evaluated by reviewing the extent to which strategic and business plan goals were met, including such factors as profitability, performance relative to competitors, timely product enhancements, new product introductions and new product acquisitions. Individual performance is evaluated by reviewing organizational and management development progress against set objectives and the degree to which teamwork and Company values are fostered.

Compensation Vehicles. Cybex had a long and successful history of using a simple total compensation program that consisted of cash-based and equity-based compensation. Having a compensation program that allowed Cybex to successfully attract and retain key employees permitted it to provide useful products and services to customers, enhance stockholder value, motivate technological innovation, foster teamwork, and adequately reward employees.

Base Salary. Each year, Cybex's compensation committee reviewed and approved the base salaries paid by Cybex to its executive officers. Cybex's Chief Executive Officer and its four other most highly compensated executive officers each executed employment agreements with the company. These employment agreements provided for a base salary for each executive officer. At the meeting of Cybex's compensation committee on May 2, 2000, it reviewed base salaries of executive officers and the performance of the executive officers and Cybex against the targets and expectations set for the year. The committee approved increases in the base salaries of all executive officers of the company for Cybex's fiscal year that would have ended March 31, 2001, in amounts that the committee believed would provide base salaries commensurate with executive officers performing comparable services for comparable companies based on the results achieved in Cybex's fiscal year ended March 31, 2000. Cybex's compensation committee believed that base salaries earned by its executive officers had historically been reasonable in relation to Cybex's performance.

Annual Bonus. The compensation plan for Cybex's executive officers contemplated consideration of discretionary annual bonuses. The annual bonus was designed to reward the achievement of short-term operating goals and long-term increases in stockholder value. Cybex's compensation committee adopted a bonus program for senior executive officers of the company designed to award bonuses to the senior executives based upon the achievement of certain financial goals. The bonus program was divided into two elements. The first element was based on the achievement of certain sales and net income goals. In particular, the bonus program awarded a 10% bonus if a specific revenue target was achieved and an additional 10% bonus if a specific earnings per share target was achieved, excluding mergers, acquisitions and reorganizations during the fiscal year. Both of these targets were achieved in Cybex's fiscal year ended March 31, 2000.

14

The second element was determined by comparing the closing stock price of Cybex on the last day of the prior year to the highest sustained closing price during the year (determined by selecting the highest closing price which was equaled or exceeded for twenty consecutive trading days during the fiscal year). The change in stock price was measured by selecting the highest of the lowest reported closing prices for Cybex's Common Stock for each twenty day trading period during the fiscal year. A cash bonus equal to two percent (2%) of base salary was paid to each executive officer of the Company for each five percent (5%) increase in the market price of Cybex's Common Stock at March 31 of the current fiscal year, as compared to the market price of the Common Stock at March 31 of the prior fiscal year. Similarly, a reduction in the market price of the Common Stock reduced the bonus under the first element by an amount equal to two percent (2%) of base salary for each five percent (5%) decrease in the market price of Cybex's Common Stock. Under this formula, the price of Cybex's Common Stock appreciated 230.31% from March 31, 1999 to March 31, 2000. Cybex's compensation committee contemplated that this portion of the bonus for its fiscal year that would have ended March 31, 2001 would be calculated by comparing the highest sustained closing price during its fiscal year ended March 31, 2000 to the highest sustained closing price during its fiscal year that would have ended March 31, 2001.

If the total bonus earned in the fiscal year via the two elements described was less than 30%, the executive officers would earn additional bonuses up to a maximum total bonus of 30% if Cybex's earnings per share ("EPS") exceeded the specific earnings per share target. For each 1% that actual EPS exceeded targeted EPS, an additional 2% bonus was earned.

On May 2, 2000, Cybex's compensation committee authorized the payment of bonuses to its executive officers and staff employees based upon their respective performance and contribution toward the attainment of the goals of its fiscal year ended March 31, 2000. During Cybex's last completed fiscal year, its goals were to increase net sales and net income, introduce new products, introduce enhancements to existing products, expand the company's customer base, expand its manufacturing, marketing and distribution facilities in Europe, increase international sales, and increase the coverage of the company by analysts. Substantially all of its goals for its last completed fiscal year were achieved, including the specific revenue and earnings per share targets. Cybex's compensation committee evaluated the performance of each executive officer and concluded that the successful performance of the company during its last completed fiscal year was due largely to the efforts of all of the executive officers. The amount of the bonuses for the executive officers was based on the achievement of the financial goals by Cybex in its last completed fiscal year as set out in the bonus program, and bonuses for other employees were based on a subjective assessment of the performance of Cybex during its last completed fiscal year and the individual performance of such employees as compared with Cybex's and the employee's goals for the year.

Because both targets set under the first element of the executive bonus plan were achieved, Cybex's compensation committee approved a 20% bonus to its Chief Executive Officer and the other four most highly compensated executive officers under the first element of the plan. The increase in the price of Cybex's Common Stock during its fiscal year ended March 31, 2000 resulted in a bonus for these executive officers under the second element of the plan of 92%. Therefore, the total bonus percentage for all elements under the plan was 112% for Cybex's last completed fiscal year. Cybex's compensation committee approved the payment of bonuses to all of these executive officers.

In addition, Cybex's compensation committee established a bonus goal for certain executive officers of 5% for each qualified analyst that began to follow the company. The definition of who constituted a qualified analyst was made by the committee. Based on the results achieved during Cybex's fiscal year ended March 31, 2000, its compensation committee awarded additional bonuses of 15% of base salary to each of Stephen F. Thornton, Doyle C. Weeks and Douglas E. Pritchett and 5% of base salary to Gary R. Johnson.

Incentive Compensation. The purpose of Cybex's Incentive Plans was to provide additional incentives to employees to work to maximize shareholder value. Cybex also recognized that a stock incentive program

15

was a necessary element of a competitive compensation package for its employees. The plan utilized vesting periods to encourage key employees to continue in the employ of Cybex and thereby acted as a retention device for key employees. Cybex believed that the program encouraged employees to maintain a long-term perspective. Cybex granted stock options annually to a broad-based group of the total employee population. For Cybex's fiscal year ended March 31, 2000, it granted options to purchase 240,000 shares of its Common Stock to certain key employees, of which options to purchase shares were granted to its then Chief Executive Officer and other four most highly compensated executive officers during its last completed fiscal year as follows: (i) 45,000 to Stephen F. Thornton; (ii) 37,500 to Doyle C. Weeks; (iii) 22,500 to Douglas C. Pritchett; (iv) 15,000 to Remigius Shatas; and (v) 15,000 to Gary R. Johnson.

In determining the size of an option award for an executive officer, Cybex's compensation committee's primary considerations were the "grant value" of the award and the performance of the officer measured against the same performance criteria described above under "Introduction" which is used to determine salary. In addition to considering the grant value and the officer's performance, Cybex's compensation committee also considered the number of outstanding unvested options which the officer held and the size of previous option awards to that officer. Cybex did not assign specific weights to these items. Options to purchase shares of Cybex's Common Stock were generally at the fair market value of such shares as reported by the NASDAQ Stock Market on the date of grant. Under the terms of the Incentive Plans, Cybex's compensation committee had sole authority, within the terms of the Incentive Plans, to select the employees who would be granted options under the Incentive Plans and to determine the timing, pricing and amount of options awarded. Cybex's compensation committee had adopted guidelines with respect to the granting of options under the plan to employees upon their promotion to important managerial or supervisory classifications. These guidelines, which were developed over a number of years, were designed to reward employees upon promotion to important positions and to provide such employees with the opportunity to share in increases in the long-term shareholder value of Cybex in amounts that were consistent with their managerial responsibilities. Cybex's compensation committee believed that stock options granted under the Incentive Plans rewarded executive officers only to the extent that stockholders had benefited from increases in the value of the Cybex's Common Stock.

Compensation of the Chief Executive Officer. Mr. Thornton was President and Chief Executive Officer of Cybex from 1984 to the date of the Merger and Chairman of Cybex's Board of Directors from 1987 to the date of the Merger. Cybex's compensation committee used the same compensation policy described above for all employees to determine Mr. Thornton's compensation during Cybex's last completed fiscal year. In setting Mr. Thornton's compensation, the committee made an overall assessment of Mr. Thornton's leadership in achieving Cybex's long-term strategic and business goals. Mr. Thornton's base salary reflects a consideration of both the Cybex's performance and Mr. Thornton's individual performance. Cybex does not assign specific weights to these categories.

In May 2000, Cybex's compensation committee increased Mr. Thornton's base salary from $250,000 to $275,000 and approved a bonus to Mr. Thornton of $317,650 for Cybex's fiscal year ended March 31, 2000, which was approximately 127% of base salary and in accordance with Cybex's bonus program for senior executive officers adopted by Cybex's compensation committee.

Report on Executive Compensation for Apex

Introduction. This report discloses the compensation policies and the basis for the compensation paid to Apex's executive officers and to Kevin J. Hafer, the former President, Chief Executive Officer and Chairman of the Board of Apex, during Apex's last completed fiscal year ended December 31, 1999. The compensation committee of Apex's Board of Directors, which was composed of two non-employee directors, reviewed and approved individual executive officer salaries, incentive performance goals, and stock option grants. It also reviewed guidelines for compensation, bonus, and stock option grants for non-officer employees.

16

Apex's compensation committee's overall compensation philosophy was to provide competitive levels of total compensation that would enable Apex to attract, motivate, reward, and retain qualified employees. The committee believed that compensation should promote continued performance of corporate and personal goals and that any long-term incentive should be aligned with the interest of Apex's stockholders. Apex's executive compensation policies were designed to provide competitive levels of compensation to motivate officers to achieve Apex's business objectives and to reward these officers based on their achievements. The executive compensation program primarily consisted of the following: (i) base salary; (ii) incentive compensation in the form of an annual bonus; and (iii) stock options awarded under Apex's Employee Stock Plan.

Compensation for Apex's executive officers (including its Chief Executive Officer and its four other most highly compensated executive officers) consisted of the following components:

Base Salary. In setting compensation levels for executive officers, Apex's compensation committee reviewed several salary surveys detailing information relating to competitive compensation levels at other technology companies in the Pacific Northwest and, to a lesser extent, in California. The committee examined recommendations by management in the light of this reported information. Officer base compensation may have varied based on tenure with Apex, experience, assessment of individual performance, duties and responsibilities, and other factors of importance to Apex's success.

Incentive Bonuses. Apex's incentive bonus program provided a variable compensation opportunity for Apex's executive officers. Bonus payments were discretionary and based on a combination of Apex's financial performance and individual officer performance relative to achievement of Apex's pre-established specified management and strategic objectives. Target bonuses for executive officers ranged up to seventy-five percent of the base salary of the individual executive officer.

Stock Options. Apex's compensation committee believed that stock ownership provided significant incentive to employees by providing an opportunity to receive additional compensation by increasing stockholder value. This compensation element aligned the interests of employees with those of the stockholders. The long-term incentive was realized through the granting of stock options to employees and eligible executive officers. Stock options had value for the employee only if the price of Apex's stock increased above the exercise price, which was typically set at the fair market value of Apex's Common Stock on the date the stock option was granted. The number of shares awarded with each stock option grant was based on the employee's current and anticipated future performance and ability to promote achievement of strategic corporate goals and anticipated future performance. Apex's compensation committee reviewed the stock option holdings of its Chief Executive Officer and its four other most highly compensated executive officers annually to determine whether additional grants were appropriate. Initial stock options granted generally vested over a four-year period commencing one year after the option grant, and subsequent grants were generally exercisable at the end of the initial vesting period, thus providing an incentive to remain employed with Apex.

Other. In addition to the compensation paid to Apex's Chief Executive Officer and its four other most highly compensated executive directors, Apex's other executive officers and all other participating regular employees were eligible to receive an annual matching contribution up to a specified percentage (which was determined annually by Apex's Board of Directors) of their eligible compensation under Apex's 401(k) Plan. For Apex's fiscal year ended December 31, 1999, it matched 100% of an employee's or officer's elective contribution up to 5% of eligible compensation. Executive officers, subject to plan provisions, and all other regular employees were also eligible to participate in Apex's Employee Stock Purchase Plan (which qualified as a non-compensatory plan under Section 423 of the Internal Revenue Code).

Compensation of the Chief Executive Officer. Apex's compensation committee annually reviewed and approved the compensation of Mr. Hafer. In setting the compensation level for Mr. Hafer, the committee

17

reviewed competitive information reflecting compensation practices for technology companies and examined Mr. Hafer's performance relative to Apex's financial performance and his specific strategic objectives and goals. We also considered Mr. Hafer's achievements against the same pre-established objectives and determined whether his base salary, bonus and total compensation approximated the competitive range of compensation for chief executive officer positions in the technology industry. In establishing Mr. Hafer's compensation in Apex's fiscal year ended December 31, 1999, its compensation committee reviewed Mr. Hafer's experience and past performance and compared them with chief executive officers of other companies.

Report on Executive Compensation for the Company

Introduction. The Company's Compensation Committee is responsible for establishing and monitoring the general compensation policies and compensation plans of the Company, as well as the specific compensation levels for executive officers. It also makes recommendations to the Board concerning the granting of options under the 2000 Plan. Stephen F. Thornton, the Company's President, Chief Executive Officer and Chairman of the Board, will participate in all discussions and decisions regarding salaries and incentive compensation for all employees and consultants, except that he will be excluded from discussions regarding his own salary and incentive compensation.

General Compensation Policy. Under the supervision of the Board, the Company's compensation policy is designed to attract and retain qualified key executives critical to the Company's growth and long-term success. It is the objective of the Board to have a portion of each executive's compensation contingent upon the Company's performance as well as upon the individual's personal performance. Accordingly, each executive officer's compensation package is comprised of three elements: (i) annual base salary; (ii) annual bonus based on the achievement of certain performance goals established for the executive officer and the Company; and (iii) stock-based benefit plans that are designed to strengthen the mutuality of interests between the executive officers and the Company's stockholders.

The summary below describes in more detail the factors that the Board considers in establishing each of the three primary components of the compensation package provided to the executive officers.

Base Salary. The level of base salary is established primarily on the basis of the individual's qualifications and relevant experience, the strategic goals for which he or she has responsibility, the compensation levels at companies which compete with the Company for business and executive talent, and the incentives necessary to attract and retain qualified management. Base salary is adjusted each year to take into account the individual's performance and to maintain a competitive salary structure. Company performance does not play a significant role in the determination of base salary.

Bonuses. Bonuses are awarded on a discretionary basis to executive officers based on their success in achieving certain individual goals and the Company's success in achieving specific financial goals, including revenue growth and earnings growth.

Stock-Based Benefit Plans. The Company utilizes its stock option plans to provide executives and other key employees with incentives to maximize long-term stockholder values. Awards by the Board take the form of stock options designed to give the recipient a significant equity stake in the Company and thereby closely align his or her interests with those of the Company's stockholders. Factors considered in making such awards include the individual's position in the Company, his or her performance and responsibilities, and internal comparability considerations. In addition, the Board has established certain general guidelines in making option grants to the executive officers in an attempt to target a fixed number of unvested option shares based upon each individual's position with the Company and his or her existing holdings of unvested options. However, the Board is not required to adhere strictly to these guidelines and may vary the size of the option grant made to each executive officer as it determines the circumstances warrant.

18

Each option grant allows the executive officer to acquire shares of Common Stock at a fixed price per share (the fair market value on the date of grant) over a specified period of time (up to 10 years). The options typically vest in periodic installments over a four-year period, contingent upon the executive officer's continued employment with the Company. Accordingly, the option will provide a return to the executive officer only if he or she remains in the Company's service, and then only if the market price of the Common Stock appreciates over the option term.

Compensation of the Chief Executive Officer. Mr. Thornton has served as the Company's Chief Executive Officer since July 1, 2000, when the Company was formed by the Merger. Before the Merger, Mr. Thornton was the Chief Executive Officer of Cybex. For disclosure of Mr. Thornton's compensation during Cybex's last completed fiscal year, see the section above entitled "Report on Executive Compensation for Cybex."

Deductibility of Executive Compensation. The Compensation Committee has considered the impact of Section 162(m) of the Code, which section disallows a deduction for any publicly held corporation for individual compensation exceeding $1 million in any taxable year for the Chief Executive Officer and the four other most highly compensated executive officers, respectively, unless such compensation meets the requirements for the "performance-based" exception to Section 162(m). As the cash compensation paid by the Company to each of its executive officers is expected to be below $1 million and the Compensation Committee believes that options granted under the 2000 Plan to such officers and shares purchased under the 2000 ESPP by such officers will meet the requirements for qualifying as performance-based, the Compensation Committee believes that Section 162(m) will not affect the tax deductions available to the Company with respect to the compensation of its executive officers. It is the Compensation Committee's policy to qualify, to the extent reasonable, its executive officers' compensation for deductibility under applicable tax law. However, the Company may from time to time pay compensation to its executive officers that may not be deductible.

COMPENSATION

COMMITTEE

Edwin L. Harper, Chairman

John R. Cooper

William McAleer

19

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

No member of the Compensation Committee or executive officer of the Company has a relationship that would constitute an interlocking relationship with executive officers or directors of another entity.

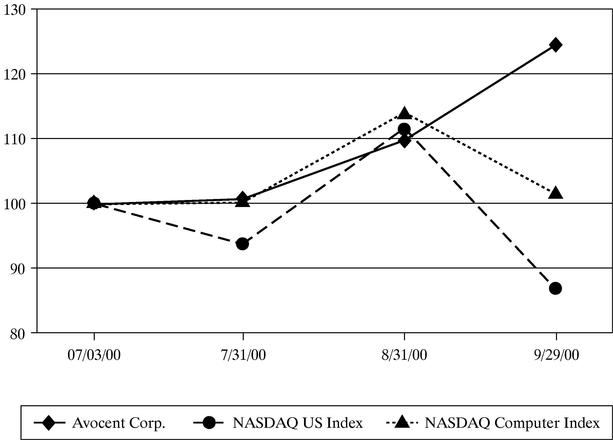

The following graph compares the cumulative total stockholder return data for the Company's stock to the cumulative return of (i) the NASDAQ US Index and (ii) the NASDAQ Computer Index for the period beginning July 3, 2000, the date the Company's stock was first traded, and ending on September 29, 2000, the most recent date for which data is available. The graph assumes that $100 was invested on July 3, 2000. The graph further assumes that such amount was initially invested in the Common Stock of the Company at a per share price of $44.25, the price to which such stock was first offered to the public by the Company, and reinvestment of any dividends. The stock price performance on the following graph is not necessarily indicative of future stock price performance.

| Date |

Avocent Corp. |

NASDAQ US Index |

NASDAQ Computer Index |

|||

|---|---|---|---|---|---|---|

| 07/03/00 | 100 | 100 | 100 | |||

| 07/31/00 | 100.88 | 94.02 | 100.30 | |||

| 08/31/00 | 109.89 | 111.82 | 114.30 | |||

| 09/29/00 | 124.58 | 87.04 | 101.64 |

20

SECURITY OWNERSHIP BY PRINCIPAL STOCKHOLDERS AND MANAGEMENT

The table below indicates the number of shares of the Company's Common Stock beneficially owned as of October 11, 2000 by: (i) each person or entity known by the Company to be the beneficial owner of more than 5% of the Company's outstanding stock; (ii) each of the executive officers listed in the Summary Compensation Table; (iii) each of the Company's directors; and (iv) all directors and executive officers as a group. Except as otherwise indicated, each person has sole investment and voting powers with respect to the shares shown as beneficially owned, subject to community property laws where applicable. Ownership information is based upon information furnished by the respective individuals.

| Name and Address of Beneficial Owner(1) |

Number of Shares Beneficially Owned |

Percentage of Shares Beneficially Owned |

||

|---|---|---|---|---|

| Alliance Capital Management L.P.(2) 1290 Avenue of the Americas New York, NY 10104 |

2,670,816 | 6.1% | ||

| J. & W. Seligman & Co., Inc.(3) 100 Park Avenue, Eighth Floor New York, NY 10006 |

2,625,091 | 6.0% | ||

| Stephen F. Thornton(4) | 1,109,360 | 2.5% | ||

| Doyle C. Weeks(5) | 58,069 | * | ||

| Barry L. Harmon(6) | 204,467 | * | ||

| Gary R. Johnson(7) | 94,375 | * | ||

| C. David Perry(8) | 120,771 | * | ||

| Douglas E. Pritchett(9) | 43,575 | * | ||

| John R. Cooper(10) | 14,625 | * | ||

| Edwin L. Harper(11) | 43,980 | * | ||

| William McAleer(12) | 32,714 | * | ||

| All executive officers and directors as a group (14 persons)(13) | 2,083,980 | 4.7% |

21

(iv) 114,027 shares issuable upon exercise of stock options currently exercisable or exercisable within 60 days of October 11, 2000.

22

The following table sets forth the number of shares underlying options that will be granted under the 2000 Plan to (i) each of the executive officers named in the Summary Compensation Table; (ii) all executive officers as a group; (iii) all non-executive directors as a group; (iv) all employees other than executive officers as a group; and (v) any person or entity that will receive 5% or more of the shares reserved for issuance under the 2000 Plan. However, the Company cannot determine the number of shares underlying options that will be granted in the future. The table below sets forth the number of shares underlying options granted under the 2000 Plan by the Company's Board on September 18, 2000, subject to stockholder approval of the adoption of the 2000 Plan. The Board does not anticipate that any one person or entity will receive 5% or more of the shares reserved for issuance under the 2000 Plan, nor did the Board approve the grant of options representing 5% or more of the shares reserved for issuance under the 2000 Plan on September 18, 2000.

| Name and Principal Position |

2000 Stock Option Plan Number of Shares(1) |

|

|---|---|---|

| Stephen F. Thornton Chief Executive Officer |

225,000 | |

| Doyle C. Weeks Executive Vice President of Group Operations & Business Development |

200,000 | |

| C. David Perry Vice President of OEM Sales |

0 | |

| Douglas E. Pritchett Senior Vice President of Finance |

200,000 | |

| Gary R. Johnson Senior Vice President of Sales & Marketing |

175,000 | |

| Executive Officers as a Group (11 persons) | 1,700,000 | |

| Non-Executive Directors as a Group (3 persons) | 80,000 | |

| Employees other than Executive Officers as a group | 0 |

The Company cannot determine the number or dollar value of shares to be awarded employees under the 2000 ESPP. The 2000 ESPP permits certain employees employed by the Company on a given Enrollment Date, as defined in the 2000 ESPP, to subscribe to purchase shares of the Company's Common Stock. Under the 2000 ESPP, shares are not allocated to particular employees. Rather, a pool of shares is reserved under the 2000 ESPP for purchase by plan participants. The maximum number of shares a participant may purchase during a single Purchase Period, as defined in the 2000 ESPP, is 5,000 shares.

23