As filed with the

Securities and Exchange Commission on June 2, 2000

Registration No.

333-

SECURITIES AND

EXCHANGE COMMISSION

WASHINGTON, D. C.

20549

FORM

S-1

REGISTRATION

STATEMENT

UNDER

THE SECURITIES

ACT OF 1933

Insession

Technologies, Inc.

(Exact name of

registrant as specified in its charter)

| Delaware

(State or other

jurisdiction of

incorporation or organization)

|

|

7372

(Primary

Standard Industrial

Classification Code Number)

|

|

47-0830767

(I.R.S. Employer

Identification Number)

|

|

Insession

Technologies, Inc.

907 North Elm

Street

Hinsdale, Illinois

60521

(630)

789-2881

(Address,

including zip code, and telephone number, including area code, of

registrant’s principal executive offices)

Anthony J.

Parkinson,

President and

Chief Executive Officer

Insession

Technologies, Inc.

907 North Elm

Street

Hinsdale, Illinois

60521

(630)

789-2881

(Name, address,

including zip code, and telephone number, including area code, of agent for

service)

Copy

to:

| Daniel W.

Rabun

Baker &

McKenzie

2300 Trammel

Crow Center

2001 Ross

Avenue

Dallas, Texas

75201

(214)

978-3000

|

|

Raymond B.

Check

Cleary,

Gottlieb, Steen & Hamilton

One Liberty

Plaza

New York, New

York 10006-1470

(212)

225-2000

|

|

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement becomes

effective.

If any of

the securities being registered on this form are to be offered on a delayed

or continuous basis pursuant to Rule 415 under the Securities Act of 1933,

check the following box. ¨

If this

form is filed to register additional securities for an offering pursuant to

Rule 462(b) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective

registration statement for the same offering. ¨

If this

form is a post-effective amendment filed pursuant to Rule 462(c) under the

Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration

statement for the same offering. ¨

If this

form is a post-effective amendment filed pursuant to Rule 462(d) under the

Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration

statement for the same offering. ¨

If

delivery of the prospectus is expected to be made pursuant to Rule 434,

please check the following box. ¨

CALCULATION OF

REGISTRATION FEE

Title of each

class of securities

to be registered |

|

Proposed Maximum

Aggregate Offering

Price (1)(2) |

|

Amount of

Registration Fee |

|

| Common Stock, $.01 par value |

|

$70,000,000 |

|

$18,480 |

|

| Options to acquire

Common Stock(3) |

|

— |

|

— |

|

(1)

|

Estimated solely

for the purpose of computing the amount of the registration fee pursuant

to Rule 457(o) promulgated under the Securities Act of 1933, as

amended.

|

(2)

|

Includes shares of

common stock that the underwriters have the option to purchase from

Insession Technologies, Inc. to cover over-allotments, if any.

|

(3)

|

Insession

Technologies, Inc. is offering to its employees the right to acquire

shares of common stock. Under certain circumstances, employees purchasing

shares of common stock will also receive options to acquire common stock

under the Insession Technologies, Inc. Concurrent Offering Stock Plan. No

separate filing fee is being made with respect to these options since no

additional consideration is being paid for the options.

|

The

registrant hereby amends this registration statement on such date or dates

as may be necessary to delay its effective date until the registrant shall

file a further amendment which specifically states that this registration

statement shall thereafter become effective in accordance with Section 8(a)

of the Securities Act of 1933 or until the registration statement shall

become effective on such date as the Commission, acting pursuant to said

Section 8(a).

EXPLANATORY

NOTE

This

registration statement contains two forms of prospectus: (1) a prospectus to

be used in connection with an underwritten offering of common stock to the

public and (2) a prospectus to be used in connection with a concurrent

offering of common stock and options to purchase common stock to employees

of Insession Technologies, Inc. The prospectus for the underwritten offering

and the concurrent offering will be identical in all respects except for the

front cover page, the section entitled “Legal Matters,” the

section entitled “Underwriting” which in the prospectus for the

concurrent offering will be replaced with a section entitled “Plan of

Distribution” and the back cover page. In addition, a description of

the concurrent offering and our Concurrent Offering Stock Plan will be added

to the prospectus for the concurrent offering as an appendix. The front

cover page, the sections entitled “Legal Matters” and “Plan

of Distribution,” and the back cover page for the concurrent offering

prospectus and the appendix to the concurrent offering prospectus included

in this registration statement are labeled “Alternate Concurrent

Offering Page.” The form of prospectus for the underwritten offering is

included in this registration statement and the alternate pages for the

concurrent offering prospectus follow the underwritten

prospectus.

SUBJECT TO

COMPLETION, DATED JUNE 2, 2000

PROSPECTUS

Shares

Insession

Technologies, Inc.

Common

Stock

Insession

Technologies, Inc. is selling shares of

its common stock. The underwriters named in this prospectus may purchase up

to additional shares of common

stock from Insession to cover over-allotments.

This is

the initial public offering of our common stock. Insession currently expects

the initial public offering price to be between

$ and

$ per share and will apply to have

the common stock included for quotation on the Nasdaq National Market under

the symbol “INSX.”

Investing in our common stock involves risks. See “Risk

Factors” beginning on page 7.

Neither

the Securities and Exchange Commission nor any state securities commission

has approved or disapproved these securities or determined if this

prospectus is truthful or complete. Any representation to the contrary is a

criminal offense.

| |

|

Per

Share

|

|

Total

|

| Initial Public

Offering Price |

|

$ |

|

$ |

| Underwriting

Discount |

|

$ |

|

$ |

| Proceeds to

Insession (before expenses) |

|

$ |

|

$ |

The

underwriters are offering the shares subject to various conditions. The

underwriters expect to deliver the shares to purchasers on or about

, 2000.

Salomon Smith

Barney

The

Robinson-Humphrey Company

,

2000

The information in this

prospectus is not complete and may be changed. We may not sell these

securities until the registration statement filed with the Securities and

Exchange Commission is effective. This prospectus is not an offer to sell

these securities and it is not soliciting an offer to buy these securities

in any state where the offer or sale is not permitted.

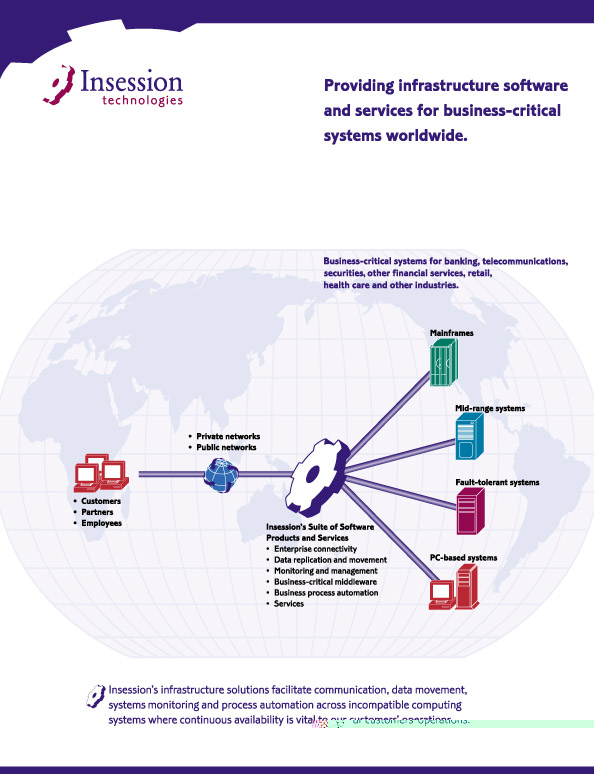

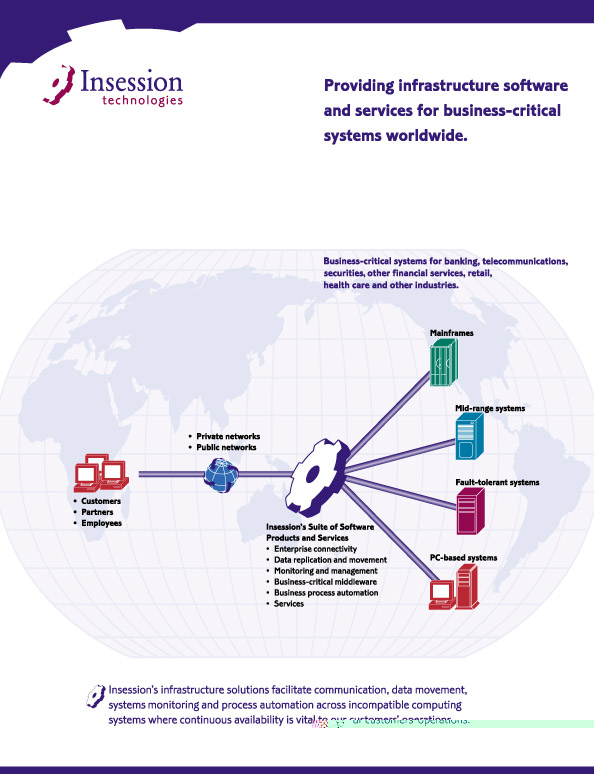

[Description of

Inside Cover Graphics:]

The

Insession logo appears in the upper left hand corner. The Insession logo is

represented by a 3-dimensional gear tilted to the right. The gear is to the

left of the words “Insession Technologies.”

The

following text appears in the upper right hand corner:

Providing

electronic infrastructure software and services for business-critical

systems worldwide.

A large

image of a globe is in the center of the page. On top of the global image is

the following diagram:

The

Insession logo gear is slightly off center to the right. The following text

appears under the logo:

Insession’s Suite of Software Products and Services.

|

Ÿ

|

Enterprise

connectivity

|

|

Ÿ

|

Data replication

and movement

|

|

Ÿ

|

Monitoring and

management

|

|

Ÿ

|

Business-critical

middleware

|

|

Ÿ

|

Business process

automation

|

Extending

to the right of the Insession gear are 4 lines that connect to individual

3-dimensional computer icons. The heading above the icons reads:

Business-Critical Systems for Banking, Telecommunications, Securities,

Other Financial Services, Retail,

Health

Care and other industries.

Above

each of the icons is a caption identifying the hardware platform

represented. The captions, in clockwise order, read: Mainframes, Mid-range

systems, Fault-tolerant systems and PC-based systems.

Extending

to the left of the Insession gear is a single line. Along that line is a

3-dimensional globe with 4 arrows circling it. Above the globe the text

reads:

At the

end of the line to the left of the 3-dimensional globe is a cluster of three

3-dimensional computer monitors. Under the monitors is the following

text:

At the

bottom of the page is the following text:

Insession’s infrastructure solutions facilitate communication,

data movement, systems monitoring and process automation across incompatible

computing systems where continuous availability is vital to our

customers’ operations.

To the

left of the text is the Insession gear logo.

You

should rely only on the information contained in this prospectus. We have

not authorized anyone to provide you with information different from that

contained in this prospectus. We are offering to sell, and seeking offers to

buy, shares of our common stock only in jurisdictions where offers and sales

are permitted. The information contained in this prospectus is accurate only

as of the date of this prospectus, regardless of the time of delivery of

this prospectus or of any sale of our common stock.

TABLE OF

CONTENTS

| |

|

Page

|

| Prospectus

Summary |

|

1 |

| Risk

Factors |

|

7 |

| Forward-Looking

Statements |

|

18 |

| Use of

Proceeds |

|

18 |

| Dividend

Policy |

|

19 |

| Capitalization |

|

20 |

| Dilution |

|

21 |

| Selected

Consolidated Financial Data |

|

22 |

| Management’s

Discussion and Analysis of Financial Condition and Results of

Operations |

|

24 |

| Business |

|

34 |

| Management |

|

42 |

| Our Relationship

with TSA |

|

51 |

| Principal

Stockholder |

|

58 |

| Description of

Capital Stock |

|

59 |

| Shares Eligible for

Future Sale |

|

62 |

| Material United

States Federal Tax Consequences to Non-United States Holders |

|

63 |

| Underwriting |

|

66 |

| Legal

Matters |

|

68 |

| Experts |

|

68 |

| Where You Can Find

More Information |

|

68 |

| Index to Financial

Statements |

|

F-1 |

In this

prospectus, “Insession,” the “company,” “we,”

“us” and “our” each refers to Insession Technologies,

Inc. and its subsidiaries. “TSA” refers to Transaction Systems

Architects, Inc. and its subsidiaries. “ACI Worldwide” refers to

ACI Worldwide, Inc., which is a subsidiary of TSA. Most of TSA’s

business operations are conducted through ACI Worldwide.

Until

, 2000, all dealers

that buy, sell or trade our common stock, whether or not participating in

this offering, may be required to deliver a prospectus. This is in addition

to the dealers’ obligation to deliver a prospectus when acting as

underwriters and with respect to their unsold allotments or

subscriptions.

“Insession,” “ENGUARD,” “TransFuse” and

“WorkPoint” are registered trademarks and the Insession logo is a

trademark of Insession. This prospectus also includes trademarks owned by

other parties.

PROSPECTUS

SUMMARY

This

summary highlights information contained elsewhere in this prospectus. This

summary is not complete and does not contain all of the information that you

should consider before deciding to invest in our common stock. We urge you

to read this entire prospectus carefully, including the “Risk

Factors” section and the consolidated financial statements and related

notes included elsewhere in this prospectus.

Insession

Technologies, Inc.

Our

Business

We

provide electronic business infrastructure software and services for

critical business applications. Electronic business, or eBusiness, refers to

the movement of business data or financial information and the processing of

transactions electronically over public and private networks. Our

infrastructure software facilitates communication, data movement, systems

monitoring and process automation across incompatible computing systems

involving mainframes, distributed computing networks and, more recently, the

Internet. We enable our customers to deploy new eBusiness services while

preserving their investments in their legacy mainframe systems. Our focus is

on business-critical systems, which are those systems required to conduct

the fundamental business operations of an enterprise reliably and

continuously.

We began

licensing our software in 1991 and currently have over 340 customers

worldwide for our software products and services. Our target customers

include large and medium-sized banking, telecommunications, securities,

other financial services, retail and health care companies for whom the

ability to process high volumes of online transactions reliably and

continuously is critical. Our customers include Bank of America Corp., The

Pacific Stock Exchange, SBC Communications Inc., MBNA Corp., Dayton Hudson

Corporation and Kaiser Permanente.

Market

Opportunity

The

Internet and other new technologies are dramatically increasing the

complexity of computing environments. These environments typically are

comprised of a variety of incompatible computer systems and software

applications. Many of these systems and applications cannot communicate

directly with each other because they use different sets of rules for

communication, operate on different computing platforms and may use

different data storage formats. As companies increasingly adopt eBusiness

models, they must link legacy hardware, applications and data with new

technologies.

In

response to these challenges, the market for software that integrates new

technologies with legacy systems and provides tools to manage business

processes has emerged. International Data Corporation, an information

technology research firm, has defined middleware and businessware software

as system software that is used to share computing resources across

heterogeneous technologies. International Data Corporation estimated the

worldwide market for middleware and businessware software at $2.2 billion in

1998 and projects that it will grow to $11.6 billion in 2003. This

represents a compound annual growth rate of 40%.

Our

Solution

Our

solution is comprised of a suite of software products and services that

address the following areas:

|

Ÿ

|

Enterprise

connectivity. Our connectivity software products link incompatible

computing systems involving mainframes, distributed computing networks and

the Internet for business-critical applications.

|

|

Ÿ

|

Data replication

and movement. Our data replication software product duplicates and moves

data between systems efficiently and reliably.

|

|

Ÿ

|

Monitoring and

management. Our monitoring and management software continuously monitors

business-critical systems and applications for problems or other

user-designated events, and provides utilities that assist with

development, testing and database administration.

|

|

Ÿ

|

Business-critical middleware. Our middleware product provides a

framework for developing online business applications.

|

|

Ÿ

|

Business process

automation. Our business process automation software enables our customers

to model, automate and manage business processes within their enterprises

and with their suppliers, customers and other business

partners.

|

|

Ÿ

|

Services. We

offer our customers an established service organization to install our

software products and integrate them with existing hardware and

applications. In addition, we offer a range of analysis, design,

development, implementation, integration and training services focused on

business-critical systems.

|

We

believe that our solutions improve the service levels of our customers and

reduce the overall cost of deploying and operating business-critical

applications by providing the following benefits:

|

Ÿ

|

Preservation of

legacy systems investment. Our solutions allow our customers to connect

their legacy systems to new eBusiness applications without the need to

replace or re-engineer their existing systems.

|

|

Ÿ

|

Continuous

availability. We believe our customers benefit from our extensive

experience in transaction processing environments where reliability and

continuous availability are vital.

|

|

Ÿ

|

Scalability. Our

software products are designed to support rapid growth in transaction

volumes without requiring substantial modification of systems

connections.

|

|

Ÿ

|

High-volume

operation. Our software products are designed for high-volume transaction

processing environments and have been operating for many years in banks

and other financial institutions where daily transaction volumes are in

the millions.

|

Our Business

Strategy

Our

objective is to be a global leader in providing eBusiness infrastructure

software and services. Key elements of our strategy to achieve this

objective are to:

|

Focus on the business-critical segment of the eBusiness

infrastructure software market. We believe that the market for

software and services that enable companies to integrate their systems,

applications and processes electronically will grow. We will continue to

focus on the business-critical segment of this market where continuous

availability at high transaction volumes is vital to our customers’

operations.

|

|

Maintain our technology leadership. We intend to use our

technical expertise to develop new infrastructure software solutions and

continually upgrade our existing products to maintain and enhance our

competitive position.

|

|

Expand our worldwide direct sales organization. We will

continue to hire new personnel to increase our penetration of a variety of

industry markets, and to increase sales of our products and services in

markets outside the United States.

|

|

Offer additional products and services to our existing customer

base. Over 340 customers around the world currently use our software

products and services. As we add new products and services, we intend to

aggressively market these new offerings to our existing

customers.

|

|

Pursue strategic alliances. To broaden the market for our

products, we intend to enter into strategic relationships with leading

third-party systems integrators and technology providers. In addition, we

intend to enter into relationships with providers whose technologies and

application-specific expertise complement our products.

|

|

Acquire new product technologies. In order to supplement our

internal research and development efforts, we intend to obtain

technologies and products through acquisitions. We will also identify

technologies and products that we can license from third parties and

distribute through our direct sales organization. For the six months ended

March 31, 2000, revenues from products sold for third parties accounted

for 11.9% of our total revenues.

|

Other

Information

We are

currently a wholly-owned subsidiary of TSA. Our business began in 1986 with

the formation of Grapevine Systems, Inc. TSA acquired Grapevine Systems,

Inc. in 1996. In 1999, TSA acquired Insession Inc., which was formed in

1991. Prior to the acquisition of Insession Inc., TSA had distributed

Insession Inc.’s primary product. TSA acquired WorkPoint Systems, Inc.

in April 2000. We were incorporated in Delaware in March 2000. TSA will

contribute the Grapevine, Insession and WorkPoint businesses and other

assets to us prior to the consummation of offering.

Concurrent

Offering

Concurrently with our underwritten public offering, we are offering

directly to our employees

shares of our common stock and options to purchase an

additional

shares of our common stock. The sales of common stock and

options directly to our employees are subject to the terms and conditions of

the Insession Technologies, Inc. Concurrent Offering Stock Plan and related

purchase and stock option agreements. See “Management—Concurrent

Offering of Restricted Stock.”

The

Offerings

Common stock

offered by Insession in the

underwritten offering to the public |

|

shares |

| |

|

Common stock

offered by Insession in the

concurrent offering to our

employees |

|

shares |

| |

|

Common stock of

Insession to be outstanding

immediately after the offerings, assuming the

concurrent offering to employees is fully

subscribed |

|

shares |

| |

|

Common stock of

Insession to be held by TSA

immediately after the offering |

|

shares |

| |

|

| Use of

proceeds |

|

We estimate that we

will receive net proceeds from the

offering and the concurrent offering of approximately

$

million based on an assumed initial public

offering price of

$

per share, the midpoint of the

range described on the cover of this prospectus. We intend

to use a portion of the net proceeds to repay approximately

$7.2 million of indebtedness under promissory notes due to

TSA and approximately $9.0 million of TSA’s bank

indebtedness assumed by us. We intend to use some of the

net proceeds for general working capital purposes. In

addition, we may use a portion of the net proceeds for

acquisitions of businesses, products and technologies that

are complementary to ours. See “Use of Proceeds.” |

| |

|

| Proposed Nasdaq

National Market symbol |

|

INSX |

Unless we

specifically state otherwise, the information in this prospectus does not

take into account the issuance of up to

shares of common stock which the underwriters have the option

to purchase solely to cover over-allotments. If the underwriters exercise

their over-allotment option in full,

shares of common stock will be outstanding after the

offerings.

The

number of shares of our common stock to be outstanding immediately after the

offerings does not take into account an estimated

shares of our common stock that will be issuable upon exercise by our

employees and directors, and by employees of TSA, of stock options that we

expect to grant concurrently with the offerings and

additional shares of our common stock that

will be reserved for issuance under our stock incentive plans. The actual

number of options will be determined at the time of the offerings. For a

discussion of these stock options, see “Management.”

Our Relationship

with TSA

We are

currently a wholly-owned subsidiary of TSA. After the completion of this

offering and the concurrent offering, TSA will own approximately 81.9% of

the outstanding shares of our common stock, or approximately 80.1% if the

underwriters fully exercise their over-allotment option. Until TSA holds

less than 50% of the voting power of our common stock, TSA will be able to

control the vote on all matters submitted to stockholders, including the

election of directors and the approval of extraordinary corporate

transactions, such as mergers.

TSA

currently plans to complete its divestiture of Insession within 12 months

following this offering by distributing all of TSA’s shares of

Insession to its stockholders. However, TSA is not obligated to complete the

distribution or otherwise divest its shares of Insession common stock, and

the distribution or other divestiture may not occur by the anticipated time

or at all.

TSA will,

in its sole discretion, determine the timing, structure and all terms of its

distribution to TSA’s stockholders or any other divestiture of our

common stock that it owns. TSA’s distribution is subject to receiving a

private letter ruling from the Internal Revenue Service that the

distribution of its shares of Insession common stock to TSA stockholders

will be tax-free to TSA and its stockholders for United States federal

income tax purposes. TSA may elect to divest its shares of Insession common

stock through means other than a distribution, whether through public or

private sales, or otherwise.

Prior to

the completion of this offering, we will enter into agreements with TSA that

provide for our separation from TSA and other provisions applicable to the

distribution, if any, of TSA’s shares of Insession common stock to

TSA’s stockholders. These agreements provide for, among other

things:

|

Ÿ

|

the transfer from

TSA to us of assets and the assumption by us of liabilities relating to

our business; and

|

|

Ÿ

|

various interim and

ongoing relationships between us and TSA.

|

All of

the agreements providing for our separation from TSA were prepared in the

context of a parent-subsidiary relationship and the terms were determined in

the overall context of our separation from TSA. The terms of these

agreements may be more or less favorable to us than if they had been

negotiated with unaffiliated third parties. See “Our Relationship with

TSA—Arrangements with TSA” and “Risk Factors—Risks

Related to Our Separation from TSA.”

Our

principal executive offices are located at 907 North Elm Street, Hinsdale,

Illinois 60521, and our telephone number is (630) 789-2881.

Summary

Historical and Pro Forma Consolidated Financial Data

The

following summary historical and pro forma consolidated financial and

operating data should be read together with “Management’s

Discussion and Analysis of Financial Condition and Results of

Operations” and the consolidated financial statements and related notes

included elsewhere in this prospectus. You should also read “Risk

Factors — Our historical financial information may not be

representative of our results as a separate company.”

The

consolidated statements of income data for each of the three years in the

period ended September 30, 1999 and for the six months ended March 31, 2000,

and the consolidated balance sheet data at March 31, 2000, have been derived

from the consolidated financial statements and related notes audited by

Arthur Andersen LLP, independent public accountants. The consolidated

statements of income data for the six months ended March 31, 1999, and the

consolidated other data are unaudited and are based on our and TSA’s

accounting records which, in management’s opinion, include all

adjustments, consisting only of normal recurring adjustments, necessary for

the fair presentation of our financial data for the periods. The pro forma

1999 financial data presented represents the unaudited pro forma results of

operations for fiscal 1999 and for the six months ended March 31, 1999 as if

the Insession Inc. acquisition had occurred as of October 1, 1998. See note

3 to the consolidated financial statements of Insession Technologies, Inc.

included elsewhere in the prospectus. The financial information presented

below may not be indicative of our future performance and does not

necessarily reflect what our results of operations or financial position

would have been had we operated as a separate, stand-alone entity during the

periods presented.

| |

|

Year Ended

September 30,

|

|

Six Months Ended

March 31,

|

| |

|

1997

|

|

1998

|

|

1999

|

|

Pro Forma

1999

|

|

1999

|

|

Pro Forma

1999

|

|

2000

|

| |

|

|

|

|

|

|

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

|

| |

|

(in

thousands) |

| Consolidated

Statements of Income Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Software license and maintenance

fees (1) |

|

$13,413 |

|

|

$24,973 |

|

|

$31,418 |

|

|

$32,012 |

|

|

$16,591 |

|

|

$17,261 |

|

|

$19,142 |

|

| Services |

|

6,521 |

|

|

8,027 |

|

|

8,166 |

|

|

8,182 |

|

|

4,321 |

|

|

4,337 |

|

|

2,705 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total

revenues |

|

19,934 |

|

|

33,000 |

|

|

39,584 |

|

|

40,194 |

|

|

20,912 |

|

|

21,598 |

|

|

21,847 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of software license and maintenance

fees: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of

software |

|

6,371 |

|

|

12,419 |

|

|

7,711 |

|

|

337 |

|

|

7,374 |

|

|

— |

|

|

366 |

|

| Amortization of

software |

|

413 |

|

|

393 |

|

|

3,294 |

|

|

5,449 |

|

|

495 |

|

|

2,650 |

|

|

2,716 |

|

| Cost of support and

maintenance |

|

158 |

|

|

122 |

|

|

1,829 |

|

|

2,540 |

|

|

569 |

|

|

1,280 |

|

|

1,174 |

|

| Cost of services |

|

4,433 |

|

|

5,109 |

|

|

4,183 |

|

|

4,183 |

|

|

2,107 |

|

|

2,107 |

|

|

1,823 |

|

| Research and development |

|

— |

|

|

— |

|

|

2,080 |

|

|

3,764 |

|

|

792 |

|

|

2,476 |

|

|

1,355 |

|

| Sales and marketing |

|

4,685 |

|

|

6,181 |

|

|

8,325 |

|

|

8,743 |

|

|

4,264 |

|

|

4,682 |

|

|

4,690 |

|

| General and administrative |

|

1,970 |

|

|

2,798 |

|

|

5,424 |

|

|

8,019 |

|

|

2,624 |

|

|

5,219 |

|

|

3,647 |

|

| Amortization of goodwill |

|

— |

|

|

— |

|

|

2,047 |

|

|

4,172 |

|

|

373 |

|

|

2,498 |

|

|

2,399 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total

expenses |

|

18,030 |

|

|

27,022 |

|

|

34,893 |

|

|

37,207 |

|

|

18,598 |

|

|

20,912 |

|

|

18,170 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

income |

|

1,904 |

|

|

5,978 |

|

|

4,691 |

|

|

2,987 |

|

|

2,314 |

|

|

686 |

|

|

3,677 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income

(expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income |

|

— |

|

|

— |

|

|

54 |

|

|

54 |

|

|

— |

|

|

— |

|

|

86 |

|

| Interest expense to related

party |

|

— |

|

|

— |

|

|

(308 |

) |

|

(497 |

) |

|

(45 |

) |

|

(234 |

) |

|

(260 |

) |

| Minority interest in net income |

|

— |

|

|

— |

|

|

(526 |

) |

|

— |

|

|

(175 |

) |

|

— |

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total

other |

|

— |

|

|

— |

|

|

(780 |

) |

|

(443 |

) |

|

(220 |

) |

|

(234 |

) |

|

(174 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before

income taxes |

|

1,904 |

|

|

5,978 |

|

|

3,911 |

|

|

2,544 |

|

|

2,094 |

|

|

452 |

|

|

3,503 |

|

| Provision for

income taxes |

|

(732 |

) |

|

(2,293 |

) |

|

(2,283 |

) |

|

(2,552 |

) |

|

(1,222 |

) |

|

(1,121 |

) |

|

(2,258 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income

(loss) |

|

$ 1,172 |

|

|

$ 3,685 |

|

|

$ 1,628 |

|

|

$ (8 |

) |

|

$ 872 |

|

|

$ (669 |

) |

|

$ 1,245 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Year Ended

September 30,

|

|

Six Months Ended

March 31,

|

| |

|

1997

|

|

1998

|

|

1999

|

|

Pro Forma

1999

|

|

1999

|

|

Pro Forma

1999

|

|

2000

|

| |

|

|

|

|

|

|

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

|

| Basic and diluted

net income (loss) per common share (2) |

|

$ |

|

$ |

|

$

|

|

$

|

|

$ |

|

$ |

|

$ |

|

|

Shares used in

computing basic and diluted net

income (loss) per common share (2) (in

thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

| Consolidated

Other Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBITDA (3) (unaudited) (in

thousands) |

|

$2,449 |

|

$6,535 |

|

$10,351 |

|

$12,927 |

|

$3,297 |

|

$5,949 |

|

$8,968 |

The

following table sets forth a summary of our consolidated balance sheet at

March 31, 2000:

|

Ÿ

|

on a pro forma

basis to reflect our assumption of approximately $9.0 million of

TSA’s bank indebtedness; and

|

|

Ÿ

|

on a pro forma as

adjusted basis to reflect our receipt of the estimated net proceeds from

the sale of shares

of common stock in this offering and the concurrent offering, the

repayment of approximately $7.2 million of indebtedness due to TSA and the

repayment of approximately $9.0 million of TSA’s bank

indebtedness.

|

| |

|

As of March 31,

2000

|

| Consolidated

Balance Sheet Data: |

|

Actual

|

|

Pro Forma

|

|

Pro Forma

As Adjusted

|

| |

|

|

(in

thousands) |

| Working capital

(deficit) |

|

$ (7,215 |

) |

|

$(16,215 |

) |

|

$ |

| Total

assets |

|

59,921 |

|

|

59,921 |

|

|

|

| Total

debt |

|

7,168 |

|

|

16,168 |

|

|

— |

| Total

stockholders’ equity |

|

35,952 |

|

|

26,952 |

|

|

|

(1)

|

Effective October

1, 1998, we changed our method of accounting for software license fees

revenue. See note 2 to the consolidated financial statements of Insession

Technologies, Inc. included elsewhere in the prospectus.

|

(2)

|

Prior to the

consummation of the offering, we intend to issue

shares of our

common stock to TSA in consideration for TSA’s contribution to us of

the businesses of Grapevine Systems, Inc., Insession Inc. and WorkPoint

Systems, Inc. and other assets and liabilities. For more information, see

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations—Overview.”

|

(3)

|

EBITDA represents

income before income taxes, plus depreciation and amortization expense,

minority interest in net income and net interest expense. EBITDA is not a

measure of performance under generally accepted accounting principles and

should not be considered as an alternative to net income as a measure of

operating results or to cash flows as a measure of liquidity. We have

included information concerning EBITDA as one measure of our cash flow and

our ability to incur and service indebtedness and because we believe

investors find this information useful. EBITDA as defined may not be

comparable to similarly titled measures reported by other

companies.

|

RISK

FACTORS

An

investment in our common stock involves a high degree of risk. You should

carefully consider the risks described below and all other information

contained in this prospectus before purchasing our common stock. Any of the

following risks could materially harm our business, operating results and

financial condition. Additional risks and uncertainties not currently known

to us or that we currently consider immaterial could also harm our business,

operating results and financial condition. You could lose all or part of

your investment as a result of these risks.

RISKS RELATED TO

OUR BUSINESS AND INDUSTRY

Our operating

results have historically been dependent on license revenues from our ICE

product and factors that adversely affect the pricing and demand for this

product could materially harm our business.

Revenues

from our connectivity software product, ICE, accounted for approximately 72%

of our total revenues in fiscal 1999 and approximately 73% of our total

revenues in the six months ended March 31, 2000. We believe that a material

portion of our total revenues for the foreseeable future will continue to be

derived from the license of ICE. Accordingly, our future operating results

will depend on the demand for the ICE product, including new and enhanced

releases that we introduce. If our competitors release new products that are

superior to ICE in performance or price, or we fail to enhance ICE in a

timely manner, demand for ICE may decline. A decline in demand for ICE as a

result of competition, technological change or other factors would

significantly reduce our revenues.

Our future growth

will be harmed if we are unsuccessful in developing and licensing our new

products that we plan to market for use in conducting business over the

Internet.

An

important part of our business strategy is to adapt our existing products,

and to offer new software products and services, for conducting business

over the Internet. Our revenues to date have been derived primarily from our

customers licensing our products for use within their private networks.

Accordingly, our strategy of offering software products and services that

directly facilitate the conduct of business over the Internet is a new

business for us and our customers may not accept these offerings. Our

WorkPoint business process automation and TransFuse connectivity products

are new products that are important to this strategy. Only a few customers

have licensed these products to date and we will need to devote significant

resources to develop these products further. If we are not successful in

further developing WorkPoint and TransFuse, continuing to adapt our existing

solutions, and acquiring or developing new solutions to address the rapidly

evolving standards and technologies involved in business over the Internet,

our revenues, operating results and opportunities for growth will

suffer.

Our principal

products operate on the Compaq NonStop Himalya computer and we therefore

rely on the continued success of this computer and Compaq.

ICE and

certain of our other principal products currently operate solely on the

Compaq NonStop Himalaya computer. One of our other principal products,

Extractor/Replicator, has only recently been adapted for use on other

computers. We therefore rely on the continued utilization of the Compaq

NonStop Himalaya computer by both our current and potential customers. If

our customers decrease their reliance on the Compaq NonStop Himalaya

computer, or if Compaq stops producing or enhancing the Compaq NonStop

Himalaya computer, demand for ICE and certain of our other principal

products could decline.

Our business

strategy depends in part on the increasing use of the Internet for

business-critical applications. If this trend does not continue, our

revenues will suffer and operating results will be harmed.

Our

business strategy depends in part on the increased acceptance and use of the

Internet for business-critical applications. However, this acceptance and

use is a recent phenomenon and its future is difficult to

predict. The Internet may not be accepted as a viable long-term communications

tool for business-critical applications for a number of reasons, which may

include:

|

Ÿ

|

inadequate

development of the necessary communications and computer network

technology, particularly if rapid growth of the Internet

continues;

|

|

Ÿ

|

delayed development

of enabling technologies and performance improvements;

|

|

Ÿ

|

increased security

risks in transmitting and storing confidential information over public

networks; and

|

|

Ÿ

|

increased

governmental regulation or taxation.

|

Our revenues are

concentrated in the banking industry. If our customers in this industry

decrease their spending on software and related services or if we fail to

penetrate other industries, our revenues may decline.

Customers

in the banking industry accounted for 42% of our total revenues in fiscal

1999 and 49% of our total revenues in the six months ended March 31, 2000.

Since our revenues are currently concentrated in the banking industry, we

are susceptible to a downturn in that industry. Part of our business

strategy is to expand our sales and marketing efforts directed at companies

outside the banking industry. There can be no assurance that these efforts

will be successful. If we fail to penetrate new markets, our revenues may be

adversely affected. Customers in these new markets are likely to have

different requirements and we may need to change our product design or

features, sales methods, support capabilities or pricing policies to compete

effectively. These changes could be costly and require the diversion of

technical and research and development resources.

If we are unable

to obtain new product technologies, our growth could be

limited.

Part of

our business strategy is to obtain technologies and products through

acquisitions and to license technologies and products from third parties and

distribute them through our sales organization. Our future growth depends in

part upon the success of this strategy. We may not be able to identify

suitable candidates to enter into licensing and distribution or other

arrangements with or to acquire. We also may not be able to complete

acquisitions or enter into licensing and distribution agreements on

acceptable terms. Acquisitions of businesses, products and technologies

involve many risks, including:

|

Ÿ

|

acquired

businesses, technologies and products may not achieve anticipated

revenues, earnings or cash flow;

|

|

Ÿ

|

technologies,

products, personnel or operations may be difficult to combine;

|

|

Ÿ

|

issuances of stock

as consideration for acquisitions may have a dilutive effect on current

stockholders’ ownership;

|

|

Ÿ

|

amortization

expense relating to goodwill and other intangible assets and other

acquisition-related charges, costs and expenses may have an adverse effect

on net income; and

|

|

Ÿ

|

conducting and

integrating acquisitions may disrupt our existing business and divert

management’s attention and other resources.

|

For a

period ending two years after the time TSA completes a distribution of our

common stock to its stockholders, if any, we will be subject to contractual

restrictions that may limit our ability to make acquisitions. For a

discussion of the principal contractual restrictions to which we are

subject, see “Our Relationship with TSA—Arrangements with

TSA.”

If we do not

respond adequately to our industry’s rapid pace of change, revenues

from our products may decline.

If we are

unable to develop, introduce and market new software solutions or

enhancements to our existing products on a timely and cost-effective basis,

or if our new products or enhancements do not achieve market

acceptance, our revenues may decline. The life cycle for some of our products

is difficult to predict and is effected by rapid technological change,

frequent new product introductions and enhancements, and changing customer

needs and industry standards. The introduction of products employing new

technologies could render our existing products or services obsolete. We

expect that this rapid technological change and evolution of standards will

require us to adapt our products in order to remain competitive. As a

result, we will need to continue to make substantial investments in product

development. We cannot assure you that we will successfully develop new

products or product enhancements, or that our products will achieve broad

market acceptance.

If we fail to

expand our sales and distribution channels, our growth could be

limited.

We need

to significantly expand our direct and indirect sales operations in order to

increase market awareness of our software products. New sales personnel will

require training and take time to achieve full productivity. There is strong

competition for qualified sales personnel in our business, and we may not be

able to attract and retain sufficient new sales personnel to expand our

operations. In addition, we believe that our future success is dependent

upon expansion of our indirect distribution channel, which consists of our

relationships with a variety of distribution partners, including systems

integrators. We currently have relationships with only a limited number of

these partners. We cannot be certain that we will be able to establish

relationships with additional distribution partners on a timely basis, or at

all, or that these distribution partners will devote adequate resources to

promoting or selling our products. In addition, we may also face potential

conflicts between our direct sales force and third-party reselling

efforts.

If we lose key

personnel, or are unable to attract and retain additional personnel, our

growth could be limited.

Our

future success depends to a significant degree on the continued service of

our executive officers, as well as other key management, sales and technical

personnel. Our officers and key employees are not bound by employment

agreements, and we do not maintain life insurance policies on any of our

employees. The loss of services of any of these employees for any reason

could harm our business.

We also

must attract, integrate and retain additional skilled sales, technical,

research and development, marketing and management personnel. Competition

for these types of employees is intense. Competition for technical personnel

is characterized by rapidly increasing salaries, which may increase our

operating expenses or hinder our ability to recruit qualified candidates.

Failure to hire and retain qualified personnel would hinder our ability to

grow our business.

The lengthy and

unpredictable sales cycle for some of our products may make our revenues

susceptible to fluctuations, which could cause volatility in our stock

price.

Delay or

failure to complete sales in a particular quarter or year would reduce our

quarterly and annual revenue. We believe that the purchase of our products

is often discretionary and generally involves a significant commitment of

capital and other resources by a customer. Before purchasing our products,

our customers spend a substantial amount of time performing internal reviews

and obtaining capital expenditure approvals. The evolving nature of the

eBusiness infrastructure software market may also cause prospective

customers to postpone their purchase decisions. As a result, our sales cycle

can be lengthy, typically ranging from four to 18 months, and is difficult

to predict. Consequently, sales of our software solutions that are

anticipated to occur in a given quarter or year may be delayed, potentially

resulting in significant variations in expected quarterly or annual revenue.

These variations could result in volatility in our stock price.

Fluctuations in

our quarterly operating results could cause our stock price to

decline.

Our

quarterly operating results have fluctuated in the past and are expected to

continue to fluctuate in the future. If our quarterly operating results fail

to meet expectations, the trading price of our common stock could

decline. In addition, significant fluctuations in our quarterly operating

results may make it difficult to forecast accurately our revenue for any

given period and implement our budget and business plan.

Historically, a substantial portion of our revenues in a given quarter

has been recorded in the third month of that quarter, with a concentration

of these revenues in the last two weeks of the third month. We expect this

trend to continue. Therefore, any failure or delay in the closing of orders

would have a material adverse effect on our quarterly operating

results.

In

various quarters in the past, we have derived a significant portion of our

revenues from a small number of large sales. We expect this trend to

continue and, therefore, any failure or delay in the closing of orders could

have a material adverse effect on our quarterly operating

results.

Factors,

some of which are outside our control, which could cause our operating

results to fluctuate, include:

|

Ÿ

|

the size and timing

of customer orders and the payment plans selected by our customers, which

can be affected by customer budgeting and purchasing cycles;

|

|

Ÿ

|

the date of product

delivery;

|

|

Ÿ

|

employee

compensation policies, which tend to reward our sales personnel for

achieving fiscal year-end, rather than quarterly, revenue

quotas;

|

|

Ÿ

|

our ability to

develop, introduce and market new products on a timely basis;

|

|

Ÿ

|

the demand for, and

market acceptance of, our software solutions;

|

|

Ÿ

|

our

competitors’ announcements or introductions of new software

solutions, services or technological innovations;

|

|

Ÿ

|

the amount and

timing of operating costs and capital expenditures related to the

expansion of our operations; and

|

|

Ÿ

|

general economic

conditions that may affect our customers’ capital investment

levels.

|

Our

quarterly expense levels are relatively fixed and are based in part on

expectations as to future revenue. As a result, if revenue levels fall below

our expectations, our net income will decrease because only a small portion

of our expenses varies directly with our revenue.

We intend to

significantly increase our spending, which will make it more difficult to

remain profitable.

We intend

to significantly increase our spending in the future as we:

|

Ÿ

|

increase our

research and development activities;

|

|

Ÿ

|

increase our

services activities;

|

|

Ÿ

|

expand our

distribution channels;

|

|

Ÿ

|

increase our sales

and marketing activities, including expanding our direct sales

force;

|

|

Ÿ

|

build our internal

information technology system; and

|

|

Ÿ

|

operate as an

independent public company.

|

We will incur these

additional expenses before we generate any revenue from this increased

spending. If this spending does not result in significantly increased

revenue, it may be difficult to remain profitable.

Competitive

pressures could reduce our market share or require us to reduce our prices,

which would reduce our revenue and/or operating margins.

The

market for our software solutions and services is highly competitive and

subject to rapidly changing technology. In different product areas, we have

different competitors. For a more detailed discussion of our

competitive position, see “Business—Competition.” We also

expect our field of competitors to continue to expand. Competition could

seriously impede our ability to sell additional products and services on

terms favorable to us. Many of our competitors have substantially greater

financial, technical, marketing or other resources, greater name

recognition, and larger customer bases than we do. In addition, these

companies may adopt aggressive pricing policies that could compel us to

reduce the prices of our products and services in response. Our competitors

may also be able to respond more rapidly than we can to new or emerging

technologies and changes in customer requirements and devote greater

resources to the promotion and sale of their products. Our current and

potential competitors may also:

|

Ÿ

|

develop and market

new technologies that render our existing or future products obsolete,

unmarketable or less competitive;

|

|

Ÿ

|

make strategic

acquisitions or establish cooperative relationships among themselves or

with other systems solution providers, which would increase the ability of

their products to address the needs of our customers; and

|

|

Ÿ

|

establish or

strengthen cooperative relationships with our current or future strategic

partners, which would limit our ability to sell products through these

channels.

|

In

addition, in-house information technology departments of potential customers

have developed or may develop software that provides for some or all of the

functions of some of our products. We expect that internally developed

software will continue to be a significant source of competition for the

foreseeable future. In particular, it can be difficult to sell our products

to a potential customer whose internal development group has already made

large investments in software that our products are intended to

replace.

If the products

that we resell for third-party technology providers are not supported or

become unavailable, our revenues may decline and we may not achieve growth

in our business.

An

important part of our business strategy is to market the products of

third-party product developers to our customers. We rely on these third

parties to enhance and update their products. If our third-party product

providers fail to adequately support these products, we may lose revenues

and our reputation may be harmed. Our agreements with third-party providers

are generally short-term in nature and dependent on our generating minimum

sales of their products. There is no assurance that we will be able to renew

these agreements on acceptable terms or that we will achieve the minimum

sales.

If we lose access

to third-party technology that we incorporate in our products, or if that

technology is not supported, our reputation and revenues may

suffer.

We

license technology that is incorporated into some of our products from third

parties. Any significant interruption in the supply of any licensed

software, or any failure by these third parties to deliver and support

reliable products, enhance their current products, or develop new products

on a timely and cost-effective basis, could adversely affect our revenues or

harm our reputation with existing customers, unless and until we can replace

the functions provided by the licensed software and perform any necessary

modifications to our products.

If our

intellectual property is not adequately protected, our competitors may gain

access to our technology and we may lose customers, market share and

revenues.

We depend

on our ability to develop and maintain the proprietary aspects of our

technology to distinguish our products from our competitors’ products.

To protect our proprietary technology, we rely primarily on a combination of

contractual provisions, confidentiality procedures, trade secrets, and

copyright, trademark, and patent laws.

Despite

our efforts to protect our proprietary rights, unauthorized parties may

attempt to copy aspects of our products or to obtain and use information

that we regard as proprietary. The use by others of our

proprietary technology could harm our business. Policing unauthorized use of

our products is difficult and expensive, and while we are unable to

determine the extent to which piracy of our software products exists,

software piracy may be a problem. In addition, the laws of some foreign

countries do not protect our proprietary rights to the same extent as do the

laws of the United States. Litigation to protect our intellectual property

rights can be costly and time-consuming to prosecute and we cannot be

certain that we will be able to enforce our rights or prevent other parties

from developing similar technology, duplicating our products or designing

around our intellectual property.

Our products may

infringe the intellectual property rights of others, and resulting claims

against us could be costly and require us to enter into disadvantageous

license or royalty arrangements or prevent us from selling our

products.

The

software industry is characterized by the existence of a large number of

patents and frequent litigation based on allegations of patent infringement

and the violation of other intellectual property rights. We may increasingly

be subject to these claims as the number of products and competitors in our

industry grows and the functions of products overlap. Furthermore, former

employers of our current and future employees may assert that our employees

have improperly disclosed confidential or proprietary information to

us.

We cannot

be certain that our products do not infringe issued patents or other

intellectual property rights of others. Because patent applications in the

United States are not publicly disclosed until a patent is issued,

applications of which we are not aware may have been filed which relate to

our software products. We may be subject to legal proceedings and claims for

alleged infringement by us or our licensees of third-party proprietary

rights, such as patents, trademarks or copyrights, from time to time in the

ordinary course of business. In addition, we may be required to indemnify

our distribution partners and customers for any similar claims made against

them. Any claims relating to the infringement of third-party proprietary

rights, even if not meritorious, could result in costly litigation and

divert management’s attention and resources. In addition, parties

making these claims may be able to obtain an injunction, which could delay

or prevent us from selling or installing our products in the United States

or abroad. If we were to discover that our products violated the

intellectual property rights of others, we would have to obtain licenses

from these parties in order to continue marketing our products without

substantial modifications. We might not be able to obtain license or royalty

agreements on acceptable terms, or at all. If we could not obtain these

agreements, we might not be able to modify our products successfully or in a

timely fashion. Any of these results could harm our business.

Our software

products are complex and may contain unknown defects that could harm our

reputation, result in product liability or decrease market acceptance of our

products.

Our

software products are complex and include software that is internally

developed and licensed from third parties. Our software products may contain

defects, particularly when first introduced, when new versions or

enhancements are released or when we develop custom applications. These

defects could:

|

Ÿ

|

damage or interrupt

our customers’ critical systems or business functions;

|

|

Ÿ

|

cause our customers

to experience severe system failures;

|

|

Ÿ

|

increase our

product development costs;

|

|

Ÿ

|

divert our product

development resources;

|

|

Ÿ

|

cause us to lose

sales; or

|

|

Ÿ

|

delay market

acceptance of our products.

|

We may

not discover software defects that affect our current or new products or

enhancements until after they are sold and integrated into our

customers’ systems. Our software products are designed to work in

conjunction with a wide variety of applications; however, we do not test our

products with each of them.

The

sale of products containing defects entails the risk of product liability or

warranty claims. These claims could require us to pay significant damages.

Any of these claims, even if not meritorious, could result in costly

litigation, damage our reputation or divert management’s attention and

resources. Our current insurance coverage and our contractual protections

would likely be insufficient to protect us from all liability that might

result from these types of claims.

Our business is

subject to foreign currency, economic, political and other risks associated

with international markets which may impair our ability to generate revenue

in international markets or expand our international

operations.

Since we

sell our products worldwide, our business is subject to risks associated

with doing business internationally. A portion of our international sales is

denominated in local currencies. To the extent that our sales are

denominated in local currencies, the revenue we receive could be subject to

fluctuations in currency exchange rates. If the effective price to our

international customers of the products we sell to them in U.S. dollars were

to increase due to fluctuations in local currency exchange rates, demand for

our technology could fall or we may be required to reduce our prices, either

of which would, in turn, reduce our revenue. We have not historically

attempted to mitigate the effect that currency fluctuations may have on our

revenue through the use of hedging instruments, and we do not currently

intend to do so in the future.

Part of

our business strategy is to add sales personnel to increase sales of our

products and services in markets outside the United States. This strategy

will require significant management attention and financial resources. Our

future revenues from international markets could be harmed by a variety of

factors, including:

|

Ÿ

|

changes in a

specific country’s or region’s political or economic conditions

and stability, particularly in emerging markets;

|

|

Ÿ

|

trade protection

measures and import or export licensing requirements;

|

|

Ÿ

|

potentially

negative consequences from changes in tax laws;

|

|

Ÿ

|

difficulty in

staffing and managing widespread operations;

|

|

Ÿ

|

international

variations in technology standards;

|

|

Ÿ

|

differing levels of

protection of intellectual property;

|

|

Ÿ

|

unexpected changes

in regulatory requirements, including imposition of currency exchange

controls, applicable to our business or to the Internet;

|

|

Ÿ

|

difficulty in

establishing or maintaining relationships with systems integrators and

service, distribution and marketing partners and the performance of these

partners in selling our products;

|

|

Ÿ

|

difficulties and

costs of adapting products for foreign markets, including the development

of multilingual capabilities in our products;

|

|

Ÿ

|

costs of enforcing

contractual obligations; and

|

|

Ÿ

|

greater risk of

uncollectable accounts and longer collection periods.

|

Changes in

accounting standards could affect the calculation of our operating

results.

Statement

of Position 97-2, “Software Revenue Recognition,” was issued in

October 1997 by the American Institute of Certified Public Accountants. We

were required to adopt Statement of Position 97-2 beginning in fiscal 1999.

Additional interpretations and additional revenue recognition standards or

guidance could be issued in the future. These interpretations and additional

standards and guidance could lead to unanticipated changes in our current

revenue recognition policies, which could affect the timing of the

recognition of revenue and cause fluctuations in our operating results. Our

revenue recognition policies are further discussed in

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations —Overview.”

RISKS RELATED TO

OUR SEPARATION FROM TSA

We

have no experience as a stand-alone company and the transitional services

provided by TSA may not be sufficient to meet our needs.

We may

encounter risks, expenses and difficulties as a newly formed company with a

new management team implementing a new business strategy in a rapidly

evolving market. Following this offering, TSA has agreed to provide certain

transitional services. Although TSA will be contractually obligated to

provide us with these services, these services may not be provided at the

same level as when we were part of TSA, and we may not be able to obtain the

same benefits. These arrangements were prepared in the context of a

parent-subsidiary relationship and in connection with this offering. The

prices charged to us under these agreements may be higher or lower than the

prices that we may be required to pay third parties for similar services or

the costs of similar services if we undertake them ourselves. After the

expiration of these various arrangements, we may not be able to replace

these transitional services in a timely manner or on terms and conditions,

including cost, as favorable as those we will receive from TSA.

Additionally, we will be required to supplement our financial,

administrative and other resources to provide services necessary to operate

successfully as a fully independent company. There can be no assurance that

we can successfully operate as a stand-alone company. For more information

about these arrangements, see “Our Relationship with

TSA—Arrangements with TSA.”

Our historical

financial information may not be representative of our results as a separate

company.

Our

consolidated financial statements have been carved out from the consolidated

financial statements of TSA using the historical results of operations and

historical bases of the assets and liabilities of the TSA business that we

comprise. Accordingly, the historical financial information we have included

in this prospectus does not necessarily reflect what our financial position,

results of operations and cash flows would have been had we been a single,

separate, stand-alone entity during the periods presented. TSA did not

account for us, and we were not operated, as a separate entity for the

periods presented. Our historical reported costs and expenses include

allocations from TSA for centralized corporate services and infrastructure

costs, including:

|

Ÿ

|

accounting/financial planning;

|

|

Ÿ

|

information

technology;

|

We have

not made adjustments to our historical financial information to reflect any

significant changes that will occur in our cost structure, funding and

operations as a result of our separation from TSA, including increased costs

associated with reduced economies of scale, increased marketing expenses

related to building a company brand identity separate from TSA and increased