As filed with the Securities and Exchange Commission on January 18, 2001

Registration No. 333-52724

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM F-4

REGISTRATION STATEMENT

Under

The Securities Act of 1933

Silverline Technologies Limited

(Exact name of registrant as specified in its charter)

| Republic of India

(State or other jurisdiction of

incorporation or organization)

|

|

7371

(Primary Standard Industrial Classification Code Number)

|

|

Not applicable

(I.R.S. Employer

Identification No.)

|

|

Silverline Technologies Limited

Unit 121, SDF IV,

SEEPZ, Andheri (East)

Mumbai (Bombay) 400096

India

011-91-22-829-1950

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Shankar Iyer

Silverline Technologies, Inc.

Silverline Corporate Plaza

53 Knightsbridge Road, Piscataway, NJ 08854

(732) 457-0200

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| RAJIV KHANNA

Greenberg Traurig, LLP

200 Park Avenue

New York, New York 10166

(212) 801-9268

|

|

JAMES E. ABBOTT

Carter, Ledyard & Milburn

2 Wall Street

New York, New York 10005

(212) 732-3200

|

|

Approximate date of commencement of proposed sale of the securities to the public:

Upon consummation of the merger referred to herein.

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the

Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

CALCULATION OF REGISTRATION FEE

| Title of each class of securities to be registered |

|

Amount

to be

registered |

|

Proposed maximum

offering price

per unit |

|

Proposed maximum

aggregate

offering price |

|

Amount of

registration fee |

|

Equity Shares, par value Rs. 10 each, represented by one-half of

an American Depositary Share(1) |

|

12,473,618 shs.(2

|

) |

|

$4.0401429 |

|

$50,395,199

|

|

|

$12,598.80 |

|

Equity Shares, par value Rs. 10 each, represented by one-half of

an American Depositary Share(1) |

|

2,800,000 shs.(3

|

) |

|

$4.0401429 |

|

11,312,400

|

(5)

|

|

2,828.10 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Totals |

|

15,273,618 shs.

|

|

|

|

|

$61,707,599

|

|

|

$15,426.90 |

(6) |

|

(1)

|

American Depositary Shares (“ADSs”), each representing two Equity Shares, have been registered on a separate

Registration Statement on Form F-6 (Registration No. 333-12000).

|

(2)

|

Represents the estimated maximum number of Equity Shares of the registrant which may be issued to the holders of the common stock

of SeraNova, Inc. (“SeraNova”) in connection with the merger and related transactions described herein, based on the exchange ratio in the merger of 0.35 of an ADS for each of 17,820,883 shares of SeraNova common stock. Includes 216,000 Equity

Shares which may be issued in connection with or after the merger upon the exercise of currently outstanding warrants and employee stock options to purchase the common stock of SeraNova.

|

(3)

|

Represents the estimated maximum number of Equity Shares of the registrant which may be issued to the holders of the 6% Series A

convertible preferred stock of SeraNova in connection with the merger described herein, assuming that all shares of the preferred stock are converted into SeraNova common stock immediately before the merger at a conversion rate of one share of common

stock for each $2.00 of stated value of the preferred stock.

|

(4)

|

Pursuant to Rules 457(f)(1) and 457(c) under the Securities Act of 1933, the proposed maximum aggregate offering price for the

SeraNova common stock is equal to 17,820,883 (the maximum number of shares of SeraNova common stock to be converted in the merger and to be issued upon exercise of the warrants and options referred to in footnote (2), multiplied by the average ($2.8281)

of the high and low prices of a share of SeraNova common stock as quoted on the Nasdaq National Stock Market on January 12, 2001.

|

(5)

|

Pursuant to Rules 457(f)(1) and 457(c) under the Securities Act of 1933, the proposed maximum aggregate offering price for the

SeraNova 6% Series A convertible preferred stock is equal to 4,000,000 (the estimated maximum number of shares of SeraNova common stock issuable upon conversion of the preferred stock immediately prior to the merger) multiplied by the average ($2.8281) of

the high and the low sales prices of a share of SeraNova common stock as quoted on the Nasdaq National Stock Market on January 12, 2001.

|

(6)

|

$13,214 of this fee was paid by the Registrant with the initial filing of this Registration Statement on December 26, 2000. The

balance of this fee is being paid with this Amendment No. 1.

|

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay

its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration

statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

PROXY STATEMENT/PROSPECTUS

MERGER PROPOSED—YOUR VOTE IS VERY IMPORTANT.

SeraNova, Inc.

499 Thornall Street

Edison, NJ 08837

January 18, 2001

Dear SeraNova Shareholder:

We are pleased to present a proposal for the acquisition of your company by Silverline Technologies Limited.

Silverline is an international software solutions provider with more than 12 years of industry experience, over

1,650 software professionals globally and a strong offshore delivery model with ISO 9001 and SEI CMM Level 4 certified facilities in the United States, India, Canada, the U.K., Germany, Hong Kong, Japan and Egypt and revenues of over $129 million for the

trailing twelve months ended September 30, 2000. Silverline provides solutions to Fortune 500 companies as well as major corporations throughout the world.

The proposed acquisition will create one of the largest global services companies, operating with an offshore

delivery model, to provide software information technology services and e-business solutions. The combined entity will offer a wide range of value-added services such as strategic consulting, e-business services and high-end application development. The

board of directors of SeraNova views the acquisition as a natural evolution of our stated strategy of migrating our business towards an offshore execution model. By combining forces with Silverline, we will be able to offer expanded services to existing

clients and broad-based information technology services to new clients, both onshore and offshore.

You are cordially invited to attend a special meeting of our common shareholders on Monday, February 12, 2001, at

10:00 a.m., local time, at the Woodbridge Sheraton, 515 Route 1 South, Iselin, New Jersey 08830. At the special meeting, we will ask you to vote on the merger of SeraNova with a wholly-owned subsidiary of Silverline. In the merger, you will receive 0.35

of an American depositary share (or an “ADS”) of Silverline for each share of SeraNova common stock that you own. One ADS of Silverline represents two of its equity shares. You will receive cash for any fraction of an ADS which you would

otherwise receive in the merger. Silverline ADSs are listed on the New York Stock Exchange under the trading symbol “SLT”. On January 16, 2001, the closing price for a Silverline ADS was $ 9.375. Until March 31, 2001, the ADSs issuable in the

merger will trade under the separate trading symbol “SLT.pr”.

Only holders of SeraNova common stock of record at the close of business on January 18, 2001 will be entitled to

vote at the special meeting.

The merger has been structured with the intent that you will not recognize any gain or loss for U.S. Federal

income tax purposes on your receipt of Silverline ADSs in exchange for your SeraNova common stock. You will find a detailed analysis of the material Federal income tax consequences of the merger in this proxy statement/prospectus.

We cannot complete the merger unless the amended and restated agreement and plan of merger—Annex A to this

proxy statement/prospectus—is approved by holders of a majority of the votes cast by the holders of SeraNova common stock entitled to vote.

Four executive officers and directors of SeraNova, including myself, have entered into an agreement with

Silverline in which we have granted to Silverline representatives an irrevocable proxy to vote our shares of SeraNova stock for approval of the amended and restated agreement and plan of merger and against any other proposal for any recapitalization,

merger, sale of assets or other business combination between SeraNova and any other person or entity. On the record date for the special meeting, we in the aggregate owned and were entitled to vote about 21.75% of the outstanding shares of SeraNova common

stock.

Please review carefully this entire proxy statement/prospectus. You should especially consider the “

Risk Factors” beginning on page 15 of this proxy statement/prospectus before voting.

Punk, Ziegel & Company, L.P., SeraNova’s financial advisor, delivered to the board of directors its

opinion dated October 27, 2000, to the effect that, based upon and subject to certain assumptions made, matters considered and limitations on the review undertaken, as of the date of such opinion, the consideration to be received by the holders of

SeraNova common stock pursuant to the agreement and plan of merger was fair, from a financial point of view, to such holders. The opinion of Punk, Ziegel & Company, L.P. is included in this proxy statement/prospectus as Annex B and should be carefully

read in its entirety by all shareholders.

After careful consideration, SeraNova’s board of directors has unanimously approved the agreement and

plan of merger, has unanimously determined that the merger is fair to you and in your best interests and unanimously recommends that you vote for the approval of the agreement and plan of merger.

Please complete, sign and return your proxy card. Do not send to us any SeraNova stock certificates at this time.

Thank you for your cooperation.

|

Chairman, Chief Executive Officer and President

|

Neither the Securities and Exchange Commission nor any state securities regulator has approved or disapproved

the Silverline ADSs or equity shares to be issued in connection with the merger, or determined if this proxy statement/prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This proxy statement/prospectus is dated January 18, 2001, and is first being mailed to shareholders of SeraNova

on or about January 19, 2001.

SeraNova, Inc.

499 Thornall Street

Edison, NJ 08837

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON FEBRUARY 12, 2001

To the Shareholders of SeraNova, Inc.:

We will hold a special meeting of the shareholders of SeraNova, Inc., a New Jersey corporation (or “

SeraNova”), on Monday, February 12, 2001, at 10:00 a.m., local time, at the Woodbridge Sheraton, 515 Route 1 South, Iselin, New Jersey 08830, to consider and vote upon a proposal to approve an amended and restated agreement and plan of merger dated

as of October 27, 2000, among Silverline Technologies Limited, an Indian corporation (or “Silverline”), Silverline Acquisition Corp., Silverline Technologies, Inc. and SeraNova.

Under the agreement and plan of merger, we anticipate that SeraNova will become a wholly-owned subsidiary of

Silverline, and each outstanding share of SeraNova common stock will be converted into the right to receive 0.35 of an American depositary share of Silverline. Each whole American depositary share represents two equity shares of Silverline.

We will transact no other business at the special meeting.

Only holders of record of shares of SeraNova common stock at the close of business on January 18, 2001, the

record date for the special meeting, are entitled to notice of, and to vote at, the special meeting and any adjournments or postponements of it.

We cannot complete the merger unless the agreement and plan of merger is approved by receiving the affirmative

vote of a majority of the votes cast by the holders of the SeraNova common stock outstanding on the record date.

For more information about the merger, please review the attached proxy statement/prospectus and the agreement

and plan of merger attached as Annex A to the proxy statement/prospectus.

Whether or not you plan to attend the special meeting, please complete, sign and date the enclosed proxy card

and return it promptly in the enclosed postage-paid envelope. You may vote in person at the special meeting, even if you previously returned a proxy card.

Please do not send us any stock certificates at this time.

|

BY

ORDER OF THE

BOARD OF

DIRECTORS

|

Edison, New Jersey

January 18, 2001

You should rely only on the information contained in this proxy statement/prospectus when considering whether

to approve the agreement and plan of merger. We have not authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not offering ADSs in any

jurisdiction where offers and sales are not permitted. You should not assume that the information provided by this proxy statement/prospectus is accurate as of any date other than the date on the front cover of this proxy statement/prospectus.

TABLE OF CONTENTS

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

There are forward-looking statements in this proxy statement/prospectus that relate to future results of

operations, plans, objectives, expectations and intentions of Silverline and SeraNova. These statements are based on a number of assumptions and estimates which are subject to significant uncertainties, many of which are beyond our control. In some cases,

you can identify forward-looking statements by terminology such as “believe”, “may”, “would”, “could”, “will”, “expect”, “intend”, “continue”, “anticipate”, “

predict”, “estimate” or similar expressions. Actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including the risks described in “Risk Factors” and

elsewhere in this proxy statement/prospectus.

Readers are cautioned not to place undue reliance on these forward-looking statements which reflect our views

only as of the date of this proxy statement/prospectus. Silverline and SeraNova undertake no obligation to update such statements or publicly release the result of any revisions to these forward-looking statements which we may make to reflect events or

circumstances after the date of this proxy statement/prospectus or to reflect the occurrence of unanticipated events.

The presentation of Silverline’s net income in Indian rupees or U.S. dollars can be significantly affected

by movements in currency exchange rates, in particular the movement of the Indian rupee against the U.S. dollar. See “Risk Factors—Silverline’s results of operations may be materially adversely affected if the Indian rupee appreciates

against the U.S. dollar”, “—The trading price of the ADSs may be materially adversely affected by exchange rate fluctuations between the U.S. dollar and the Indian rupee”, and “Silverline’s Management’s Discussion and

Analysis of Financial Condition and Results of Operations”.

The table below provides the following information for the years indicated concerning the number of Indian rupees

for which one U.S. dollar could be exchanged:

|

Ÿ

|

the noon buying rate at each year end;

|

|

Ÿ

|

the average of the noon buying rates on the last day of each month during each year;

|

|

Ÿ

|

the high noon buying rate during the year; and

|

|

Ÿ

|

the low noon buying rate during the year.

|

Year

|

|

Year end

|

|

Average

|

|

High

|

|

Low

|

| 1996 |

|

Rs. 35.95 |

|

Rs. 35.53 |

|

Rs. 36.46 |

|

Rs. 34.35 |

| 1997 |

|

39.30 |

|

36.53 |

|

39.30 |

|

35.72 |

| 1998 |

|

42.52 |

|

41.43 |

|

42.65 |

|

38.80 |

| 1999 |

|

43.51 |

|

43.20 |

|

43.59 |

|

42.50 |

| 2000 |

|

46.75 |

|

45.00 |

|

46.82 |

|

43.59 |

These rates are provided solely for your convenience and are not necessarily the exchange rates used by

Silverline in the preparation of the financial statements or other information included elsewhere in this proxy statement/prospectus. The noon buying rate is the U.S. dollar buying rate in the City of New York for cable transfers in Indian rupees at noon

as certified for customs purposes by the Federal Reserve Bank of New York.

QUESTIONS AND ANSWERS ABOUT THE MERGER AND THE SPECIAL MEETING

Q: Why is SeraNova being acquired by Silverline?

A: This is an excellent opportunity for SeraNova to join and become part of what will be one of the largest global services companies that operates

with an offshore execution model, which is ISO 9001 and SEI CMM Level 4 certified. This will enable SeraNova to offer expanded broad based information technology services to clients, both onshore and offshore. The combined entity will offer a wide range

of value-added services such as strategic consulting, e-business services and high-end application development.

Q: What will I receive in the merger?

A: If the merger is completed, you will receive 0.35 of an American depositary share (or “ADS”) of Silverline for each share of SeraNova

common stock that you own, and cash for any fractional ADS you would otherwise receive in the merger. Each whole ADS represents two equity shares of Silverline.

Q: Why is the SeraNova board of directors recommending that I vote for approval of the amended and restated agreement and plan of merger?

A: After considering the support for the merger from its two non-employee directors and the other reasons set forth on pages 48 and 49 of this proxy

statement/prospectus, your board of directors unanimously believes that the terms of the amended and restated agreement and plan of merger are fair to, and in the best interests of, SeraNova and its shareholders.

Q: What if the merger is not completed?

A: It is possible the merger will not be completed. That might happen if, for example, SeraNova’s shareholders or Silverline shareholders do not

approve the agreement and plan of merger. Should the merger not be completed, none of Silverline, SeraNova or any other person is under any obligation to make or consider any alternative proposal regarding the acquisition of SeraNova. It is therefore

possible that SeraNova could continue indefinitely as an independent company.

Q: What else will happen at the special meeting?

A: No other matters can come before the special meeting. SeraNova’s by-laws provide that business transacted at a special meeting shall be

confined to the purpose or purposes stated in the notice calling such meeting.

Q: What do I need to do now?

A: After carefully reading and considering the information contained in this proxy statement/prospectus, please complete, sign and date your proxy

card and return it in the enclosed return envelope as soon as possible so that your shares may be represented and voted at the special meeting. If you sign, date and send in your proxy and do not mark on it how you want to vote, we will count your proxy

as a vote for approval of the agreement and plan of merger. You may attend the special meeting and vote your shares in person, rather than signing and mailing your proxy card.

Q: Who may vote at the special meeting?

A: All holders of record of SeraNova common stock as of the close of business on January 18, 2001 may vote. You are entitled to one vote for each

share of SeraNova common stock that you own on the record date.

Q: May I change my vote after I have mailed my signed proxy card?

A: Yes. You may change your vote in one of three ways before your proxy is voted at the special meeting. First, you may send a written notice stating

that you revoke your proxy. Second, you may complete and submit a new proxy card bearing a later date. If you choose either of these two methods, you must submit your notice of revocation or your new proxy card to the Secretary of SeraNova at the address

set forth in the answer to the last question below. Third, you may attend the special meeting and vote in person.

Q: If my SeraNova shares are held in “street name” by my broker, will my broker vote my shares for me?

A: Your broker will not be able to vote your shares without instructions from you. You should instruct your broker how to vote your shares following

the directions provided by your broker. Failure to instruct your broker to vote your shares will not affect the outcome of the vote on the agreement and plan of merger so long as a quorum is present in person or by proxy at the special meeting.

Q: Will the Silverline American depositary shares issued in the merger be listed on the New York Stock Exchange?

A: Yes. Silverline American depositary shares are currently listed on the New York Stock Exchange under the symbol “SLT”. The Silverline

American depositary shares issued in the merger will be listed on the exchange and initially will trade under the symbol “SLT.pr” until April 1, 2001, or as soon thereafter as practicable.

Q: What are the tax consequences of the merger to SeraNova shareholders?

A: The exchange of SeraNova common stock for Silverline American depositary shares in the merger is intended to be a tax-free transaction for federal

income tax purposes for SeraNova shareholders, except to the extent that they receive any cash instead of fractional Silverline American depositary shares.

Q: Should I send in my stock certificates now?

A: No. After the merger has been completed, you will receive written instructions for exchanging your SeraNova stock certificates for Silverline

American depositary shares. PLEASE DO NOT SEND IN YOUR SERANOVA STOCK CERTIFICATES WITH YOUR PROXY CARD.

Q: When do you expect the merger to be completed?

A: We are working to complete the merger as quickly as possible after the special meeting. We expect to complete the merger shortly after the special

meeting.

Q: What rights do I have if I oppose the merger?

A: If the shareholders of SeraNova approve the merger and it becomes effective, you will not have any rights except to receive Silverline American

depositary shares in exchange for your SeraNova shares. Shareholders of SeraNova will have no rights under New Jersey law to dissent from the agreement and plan of merger and to obtain a court-determined cash payment of their shares’ “fair

value.”

Q: Who can answer my questions?

A: If you have any questions about the merger or if you need additional copies of this proxy statement/prospectus or the enclosed proxy card, you

should contact Ravi Singh, the Chief Financial Officer of SeraNova, at 499 Thornall Street, Edison, New Jersey 08837, telephone (732) 362-1601.

This summary, together with the preceding Questions and Answers section, highlights selected information from

this proxy statement/prospectus but may not contain all the information that may be important to you. For a more complete understanding of the merger, you should carefully read this entire proxy statement/prospectus and the other documents to which we

refer you. In particular, you should read the documents annexed to this proxy statement/prospectus, including the agreement and plan of merger which is attached as Annex A. The agreement and the plan of merger is incorporated by reference into this proxy

statement/prospectus. Also, see “Where You Can Find More Information” on page 182. We have included page references parenthetically to direct you to a more complete description of the topics presented in this summary.

General

The Merger (Page 65)

We are proposing a merger in which Silverline Acquisition Corp., a wholly-owned subsidiary of Silverline, will

merge into SeraNova and will cease to exist, and SeraNova will remain as the surviving corporation. After the merger, SeraNova will be a wholly-owned subsidiary of Silverline. The merger may be structured differently if Silverline and SeraNova deem it

necessary to do so to assure that the merger will be a tax-free transaction.

What You Will Receive in the Merger (Page 65)

In the merger, you will receive 0.35 of an American depositary share (or an ADS) of Silverline for each share of

SeraNova common stock that you own. Each whole ADS of Silverline represents two equity shares of Silverline. You will receive cash for any fractional ADS that you would otherwise receive in the merger.

Ownership of Silverline Following the Merger

Based on the number of currently outstanding shares of SeraNova common and preferred stock, we anticipate that

SeraNova shareholders will receive approximately 7,580,000 ADSs of Silverline in the merger. Based on that number and on the number of currently outstanding equity shares of Silverline, following the merger, former SeraNova shareholders will own (through

their holding the ADSs) approximately 17% of the outstanding equity shares of Silverline.

Material United States Federal Income Tax Consequences of the Merger (Page 57)

The merger is intended to qualify as a reorganization within the meaning of the Internal Revenue Code of 1986. It

is a condition to the completion of the merger that SeraNova receive an opinion from its counsel, Carter, Ledyard & Milburn, and that Silverline receive an opinion from Deloitte & Touche LLP, stating that the merger will qualify as a

reorganization within the meaning of Section 368(a) the Internal Revenue Code. In addition, the opinion of Carter, Ledyard & Milburn must state that you will not recognize gain for United States federal income tax purposes solely as a result of your

receipt of Silverline ADSs for your SeraNova stock in the merger, except for any cash received in lieu of a fractional ADS of Silverline.

It is a condition to the merger that the exchange of SeraNova common stock for Silverline ADSs in the merger will

be a tax-free transaction for U.S. federal income tax purposes for SeraNova shareholders, except to the extent that they receive any cash instead of fractional Silverline ADSs.

Tax matters are very complicated, and the tax consequences of the merger to you will depend on the facts of

your own situation. We urge you to consult your own tax advisers for a full understanding of the specific tax consequences of the merger to you.

Interests of SeraNova Directors and Management in the Merger (Page 52)

SeraNova shareholders should note that the directors and officers of SeraNova have interests in the merger that

are different from, or in addition to, those of a shareholder generally.

At the effective time of the merger, each outstanding SeraNova employee stock option will become an option to

purchase Silverline ADSs in a number and at an exercise price adjusted to reflect the exchange ratio of SeraNova common stock into Silverline ADSs in the merger. As a result of the change in control arising from the merger, unvested options for an

aggregate of 1,252,093 shares of SeraNova common stock held by officers of SeraNova will vest immediately, subject to the approval of the Indian Ministry of Finance as described below in this summary under “Indian Regulatory Approvals.” Such

options would have otherwise vested over a period of three years from the dates of grant.

Currently, SeraNova’s two non-employee directors—James E. Abbott and Nagarjun Valluripalli—hold

options from SeraNova to purchase respectively 50,000 shares of SeraNova common stock for $3.25 per share and 300,000 shares for $6.51 per share. Mr. Abbott’s option is currently unvested and Mr. Valluripalli’s option is currently vested for

75,000 shares. Silverline is prohibited under Indian law from issuing replacement options to non-employee directors. Therefore, SeraNova has agreed that if either of these director options is in-the-money immediately before the effective time of the

merger, SeraNova will accelerate such option so that it is 100% vested and the option holder will be able to effect a cashless exercise of the entire option before the merger. If either of the director options is out-of-the-money immediately before the

effective time of the merger, SeraNova will cancel the option and pay the holder a cash amount equal to his option’s fair value, based on the Black-Scholes model or another generally accepted valuation method.

Further, if we complete the merger, indemnification arrangements for SeraNova’s current directors and

officers will be continued, and it is anticipated that certain executive officers of SeraNova will continue as employees of SeraNova under their existing employment contracts with SeraNova.

No Appraisal Rights (Page 56)

If the merger becomes effective, those shareholders of SeraNova who vote against the merger will not have any

right of dissent under New Jersey law to have their SeraNova shares appraised by a court and to be paid such appraised “fair value” in cash.

Recommendation of the SeraNova Board of Directors (Page 48)

The SeraNova board of directors believes that the terms of the merger and the agreement and plan of merger are

fair to, and in the best interests of, SeraNova and its shareholders and unanimously recommends that the shareholders vote “for” approval of the agreement and plan of merger.

The Companies (Page 38)

To review the background and reasons for the merger in greater detail, as well as certain risks related to the

merger, see pages 15 to 18 and 47 to 48.

SERANOVA, INC.

499 Thornall Street

Edison, New Jersey 08837

Telephone: (732) 362-1601

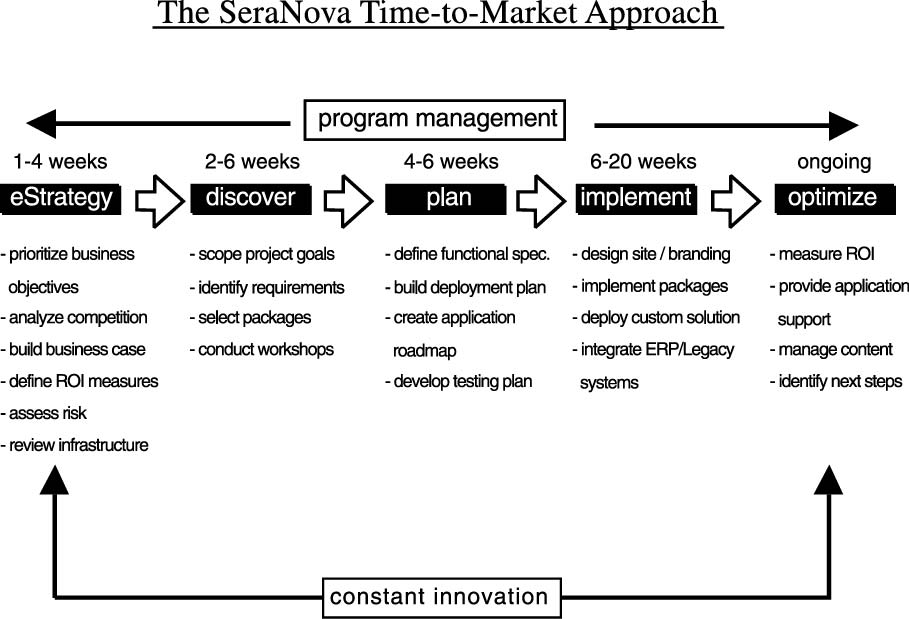

SeraNova provides Internet professional services to businesses. SeraNova’s services enable its clients to

combine the scope and efficiencies of the Internet with their existing business processes. SeraNova designs and

implements Internet-based software applications that help companies manage procurement, sell products and services, provide customer service, conduct supplier transactions and communicate with their employees over the Internet. SeraNova’s services

include strategy consulting, creative design, technology implementation and maintenance of Internet-based software applications. In all of SeraNova’s client engagements, SeraNova applies its Time-to-Market Approach and its proprietary methodology, to

deliver these services. SeraNova focuses on five industry markets—financial services, telecommunications, automotive technology and healthcare.

SeraNova was incorporated in New Jersey under the name Infinient, Inc. on September 9, 1999 as a wholly-owned

subsidiary of Intelligroup, Inc. Effective January 1, 2000, Intelligroup contributed the assets and liabilities of its Internet solutions group—including SeraNova India which commenced operations in October 1999, the capital stock of Network

Publishing, Inc. and the capital stock of the Azimuth Companies—to SeraNova. Intelligroup had acquired the Azimuth Companies in a transaction accounted for as a pooling of interests and had acquired Network Publishing, Inc. through a purchase

acquisition. The financial statements of Network Publishing, Inc. on December 31, 1998 and 1997, and for the years ended December 31, 1998, 1997 and 1996, appear in this proxy statement/prospectus beginning on page F-46. SeraNova began operations in India

in October 1999 and the United Kingdom in November 1999.

On July 5, 2000, Intelligroup distributed to its shareholders all the shares of SeraNova common stock then

outstanding. For each share of Intelligroup common stock held by an Intelligroup shareholder, one share of SeraNova common stock was issued.

SILVERLINE TECHNOLOGIES LIMITED

Unit 121, SDF IV,

SEEPZ, Andheri (East)

Mumbai (Bombay) 400096

India

Telephone: 011-91-22-829-1950

Silverline is an India-based provider of information technology services. Silverline provides consulting services

for customized projects, architects and implements open client server systems, performs offshore development, maintenance and support, and re-engineers and maintains legacy systems. Silverline specializes in providing e-business solutions, customer

relationship management, legacy transformation, and application development, maintenance and outsourcing. Silverline’s clientele consists of companies worldwide in the fields of telecommunications, financial services, healthcare, education and other

fields.

Recent Developments—Silverline

|

Ÿ

|

In April 2000, Silverline’s wholly-owned subsidiary Silverline Technologies, Inc. acquired CIT Canada, a software development

firm in Toronto, Canada, for approximately $4.2 million in cash. CIT Canada had approximately $3.1 million in annual revenues and 70 employees as of December 31, 1999.

|

|

Ÿ

|

As of September 2000, Silverline had invested $30.2 million in Silverline Technologies, Inc. for expansion of its sales and

marketing operations and to meet the working capital requirements for the expanded scope of the business. On September 30, 2000, Silverline Technologies, Inc. issued 32,681 shares of its common stock to Silverline Technologies Limited.

|

|

Ÿ

|

In September 2000, Silverline Technologies, Inc. acquired Megasys Software Services Inc., an information technology services

provider based in Columbus, Ohio for $6.22 million. Megasys had approximately $10 million in annual revenues as of December 1999 and 149 employees.

|

|

Ÿ

|

Silverline Technologies, Inc. invested $6.5 million for a 36% interest in Expo 24-7.com, a U.K.-based company, and $5 million for

a 15% interest in Unified Herbal, a U.K.-based company.

|

|

Ÿ

|

In October 2000, Silverline acquired its second largest customer, Sky Capital International Ltd., a Hong Kong based information

technology consulting company, for $22 million in cash. Sky Capital had $24.3 million in revenues for the year ended June 30, 2000 and 100 professionals as of June 30, 2000.

|

|

Ÿ

|

Silverline has finalized an investment and a strategic alliance agreement with TIS Worldwide, Inc. (or “TIS”), an

e-business solutions integrator that specializes in delivery of Internet-based applications to help corporations increase and improve customer services. Silverline has agreed to invest $12.5 million for a 6% interest in TIS. Silverline will be TIS’s

exclusive Indian supplier for all software development services for a period of three years. This investment is subject to Indian regulatory approvals. TIS has operations in 10 offices with over 600 professionals.

|

Market Price and Dividend Information (Pages 72-74 and 127)

Silverline ADSs are listed on the New York Stock Exchange under the symbol “SLT”. On October 26, 2000,

the last full trading day prior to the public announcement of the proposed merger, the last reported sale price of one Silverline ADS, as reported for New York Stock Exchange composite transactions, was $15.875. On January 16, 2000, the last day for which

information was available prior to the printing of this proxy statement/prospectus, the last reported sale price of one Silverline ADS, as reported for New York Stock Exchange composite transactions, was $9.375.

SeraNova common stock is listed on the Nasdaq National Stock Market under the symbol “SERA.” On October

26, 2000, the last full trading day prior to the public announcement of the proposed merger, the last reported sale price of one share of SeraNova common stock as quoted on the Nasdaq Stock Market was $4.4375. On January 16, 2000, the last day for which

information was available prior to the printing of this proxy statement/prospectus, the last reported sale price of one share of SeraNova common stock, as quoted on the Nasdaq Stock Market, was $2.8125.

Public companies in India typically pay cash dividends annually. For the financial year ended March 31, 2000,

Silverline declared and paid a cash dividend of 1.75 Indian rupees per equity share, or approximately US$0.04. SeraNova has never paid dividends to its shareholders. Dividends for the financial year ending March 31, 2001, payable on the ADSs received in

the merger will be prorated for the number of days on which they will be outstanding during that financial year. As a consequence, the ADSs issued in the merger will trade under the symbol “SLT.pr” on the New York Stock Exchange as a class

separate from the other Silverline ADSs until April 1, 2001, or as soon thereafter as practicable. Silverline has agreed that the annual dividend which it declares and pays on its equity shares for the financial year ending March 31, 2001, will not exceed

2 Indian rupees per share.

The Special Meeting (Page 41)

The special meeting of SeraNova shareholders will be held at the Woodbridge Sheraton, 515 Route 1 South, Iselin,

New Jersey 08830, at 10:00 a.m., local time, on February 12, 2001. At the special meeting, the shareholders will be asked to approve the amended and restated agreement and plan of merger among Silverline Technologies Limited, Silverline Acquisition Corp.,

Silverline Technologies, Inc. and SeraNova.

Record Date; Voting Power (Page 41)

SeraNova shareholders are entitled to notice of, and to vote at, the special meeting if they held shares of

SeraNova common stock of record as of the close of business on January 18, 2001, the record date.

On the record date, there were 17,510,883 shares of SeraNova common stock outstanding. Shareholders will have one

vote at the special meeting for each share of SeraNova common stock that they owned of record on the record date.

Vote Required (Page 41)

The affirmative vote of a majority of the votes cast by the holders of the shares of the SeraNova common stock

outstanding on the record date is required to approve the agreement and plan of merger.

On the record date, 3,808,941 shares of SeraNova common stock, or about 21.75% of those outstanding, were held by

four directors and executive officers of SeraNova—Rajkumar Koneru, Nagarjun Valluripalli, Ravi Singh and Rajan Nair—who have advised SeraNova that they intend to vote all their shares in favor of approval of the agreement and plan of merger. In

addition, these four directors and executive officers have entered into an agreement with Silverline in which they have granted an irrevocable proxy to Silverline representatives to vote their shares of SeraNova stock for approval of the agreement and

plan of merger and against any other proposal for any recapitalization, merger, sale of assets or other business combination between SeraNova and any other person or entity. This agreement also provides that these shareholders may not sell on the New York

Stock Exchange the Silverline ADSs they receive in the merger for a period of one year from the effective date of the merger without Silverline’s written consent.

The Agreement and Plan of Merger (Page 65)

The amended and restated agreement and plan of merger is attached as Annex A to this proxy statement/prospectus.

We encourage you to read the entire agreement and plan of merger. It is the principal document governing the merger.

Conditions to the Merger (Page 66)

Silverline and SeraNova will complete the merger only if several conditions are satisfied or are waived by them,

including the following:

|

Ÿ

|

SeraNova must obtain the necessary shareholder approval for the agreement and plan of merger.

|

|

Ÿ

|

Silverline must obtain the approval of the agreement and plan of merger by the holders of 75% of its equity shares at an

extraordinary general meeting of Silverline shareholders which is being scheduled. Three shareholders of Silverline holding in the aggregate about 31.5% of the outstanding Silverline equity shares have granted to SeraNova an irrevocable proxy to vote

their equity shares in favor of the agreement and plan of merger.

|

|

Ÿ

|

No laws shall have been adopted or promulgated, and no temporary restraining order, injunction or other order issued by a court or

other governmental entity is in effect, that would make the merger illegal or otherwise prohibit consummation of the merger.

|

|

Ÿ

|

No stop order shall have been issued by the Securities and Exchange Commission suspending the effectiveness of Silverline’s

Form F-4 registration statement of which this proxy statement/prospectus is a part, and no proceedings for that suspension shall have been initiated or threatened by the SEC.

|

|

Ÿ

|

Each of Silverline and SeraNova must obtain all required approvals from the Reserve Bank of India and other regulatory authorities

in India in order to consummate the merger and other transactions set forth in the agreement and plan of merger.

|

|

Ÿ

|

Each of the representations and warranties of SeraNova and Silverline in the agreement and plan of merger must be true and correct

as of the closing date of the merger except to the extent a representation or warranty is expressly made as of an earlier date.

|

|

Ÿ

|

Each of Silverline and SeraNova must have performed or complied in all material respects with all its material agreements and

covenants in the agreement and plan of merger at or prior to the closing date of the merger.

|

|

Ÿ

|

Silverline must receive from Deloitte & Touche LLP on the closing date of the merger a written opinion in form reasonably

acceptable to Silverline stating that: (1) the merger will qualify as a tax-free

“reorganization” within the meaning of Section 368(a) of the Internal Revenue Code of 1986, or the “Code”, (2) Silverline and SeraNova will each be a “party” to that reorganization within the meaning of Section 368(b) of the

Code, and (3) the issuance of the Silverline ADSs to the holders of the SeraNova common stock in the merger will not result in Silverline’s recognizing an amount of income or gain and/or being subject to an amount of tax that is reasonably likely to

have a material adverse effect on Silverline.

|

|

Ÿ

|

SeraNova must receive from Carter, Ledyard & Milburn, counsel to SeraNova, on the closing date of the merger, a written

opinion in form reasonably acceptable to Silverline stating that: (1) the merger will qualify as a tax-free “reorganization” within the meaning of Section 368(a) of the Code, (2) SeraNova and Silverline will each be a “party” to that

reorganization within the meaning of Section 368(b) of the Code, and (3) the Silverline ADSs received in the merger by holders of SeraNova common stock is properly permitted to be received under Section 354 of the Code without the recognition of gain.

|

|

Ÿ

|

Since the date of the agreement and plan of merger, there shall not have been any material adverse change in SeraNova or Silverline.

|

|

Ÿ

|

Each of Rajan Nair, the chief operating officer of Sera Nova, and Ragu Rajagopal, the chief executive officer of SeraNova India,

shall have entered into an employment retention agreement in form and substance reasonably satisfactory to Silverline.

|

|

Ÿ

|

The representations and warranties of certain directors and officers of SeraNova in support of the tax-free treatment of

SeraNova’s spin-off from Intelligroup will be true and correct as of the closing date of the merger.

|

|

Ÿ

|

SeraNova has reached an agreement with its preferred shareholders, or such shareholders have otherwise exercised their rights

under SeraNova’s certificate of incorporation dated September 26, 2000, so that one, and only one, of the alternatives set forth in Section 1.5(c)(A), (B) or (C) of the agreement and plan of merger can and will take place, and the merger qualifies as

a tax-free reorganization under §368(a) of the Internal Revenue Code, See Annex A.

|

Termination of the Agreement and Plan of Merger (Page 68)

The agreement and plan of merger may be terminated and the merger abandoned at any time before the merger,

whether before or after approval of the agreement and plan of merger by the shareholders of SeraNova:

|

Ÿ

|

by mutual consent of Silverline and SeraNova;

|

|

Ÿ

|

by Silverline or SeraNova if the merger has not been completed by July 31, 2001;

|

|

Ÿ

|

by SeraNova or Silverline if any governmental entity shall have issued an order, decree or taken any other action permanently

restraining, enjoining or otherwise prohibiting the transactions contemplated by the agreement and plan of merger, and such order, decree, ruling or to take any other action shall have become final and nonappealable;

|

|

Ÿ

|

by SeraNova or Silverline if the approval by the shareholders of SeraNova or Silverline required for the consummation of the

merger shall not have been obtained;

|

|

Ÿ

|

by SeraNova in certain circumstances where it receives an acquisition proposal superior to the merger with Silverline; or

|

|

Ÿ

|

by Silverline or SeraNova if the other has materially breached any of its representations or obligations under the agreement and

plan of merger, unless the breach is cured within 45 days after Silverline or SeraNova receive a notice of breach from the other.

|

The agreement and plan of merger provides that SeraNova will pay Silverline a termination fee of $4 million in

certain circumstances if:

|

Ÿ

|

the agreement and plan of merger is terminated after a competing proposal or offer is made to acquire at least 20% of the assets

of SeraNova and its subsidiaries or at least 20% of the combined voting power of the shares of SeraNova common stock, or after a competing proposal is made to involve SeraNova or any of its subsidiaries in a merger, consolidation, business combination,

recapitalization, dissolution, liquidation or similar transaction in which the other party to the transaction or its stockholders would own at least 20% of the combined voting power of the parent entity resulting from any such transaction, and

|

|

Ÿ

|

within twelve months of such termination, SeraNova or any of its subsidiaries enters into an agreement with respect to, or

approves or consummates, a proposal to acquire at least 50% of the assets of SeraNova and its subsidiaries or at least 50% of the combined voting power of the shares of SeraNova common stock, or a proposal involving SeraNova or any of its subsidiaries in

a merger, consolidation, business combination, recapitalization, dissolution, liquidation or similar transaction in which the other party to the transaction or its stockholders will own at least 40% of the combined voting power of the parent entity

resulting from any such transaction.

|

Regulatory and Corporate Approvals

U.S. Regulatory and Corporate Approvals (page 56)

Silverline and SeraNova furnished information and materials concerning themselves and the proposed merger to the

Antitrust Division of the United States Department of Justice and to the Federal Trade Commission under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, and the required waiting period was terminated on December 29, 2000. However, the Antitrust

Division and the Federal Trade Commission still have the power to challenge the merger on antitrust grounds before or after the merger is completed.

No other material U.S. regulatory approval is required in connection with the merger.

Indian Regulatory and Corporate Approvals (page 55)

Silverline has applied to the Reserve Bank of India:

|

Ÿ

|

for approval, under the Indian Foreign Exchange Management (Transfer or Issue of a Foreign Security) Regulations, 2000 of the

exchange of SeraNova common stock for Silverline ADSs in the merger;

|

|

Ÿ

|

for certain clarifications, under the Indian Foreign Exchange Management (Transfer or Issue of Security By a Person Resident

Outside India) Regulations, 2000 with respect to the proposed conversion of SeraNova stock options held by non-Indian resident employees of SeraNova into options to purchase Silverline ADSs; and

|

|

Ÿ

|

for permission, under the Indian Foreign Exchange Management (Transfer or Issue of a Foreign Security) Regulations, 2000, for the

proposed conversion of SeraNova stock options held by Indian resident employees of SeraNova into options to purchase Silverline ADSs.

|

Silverline has also applied to the Securities and Exchange Board of India for:

|

Ÿ

|

exemption from certain provisions of the Securities and Exchange Board of India (Employee Stock Option Scheme and Employee Stock

Purchase Scheme) Guidelines, 1999 relating to the conversion in the merger of SeraNova employee stock options into Silverline ADS options, particularly the exemption from the requirement that the converted options have a minimum vesting period of one year

from the date of the conversion. The Securities and Exchange Board of India has refused to grant the requested exemption, and Silverline is applying to the Ministry of Finance of India to review this refusal. Silverline cannot predict the outcome of this

review by the Ministry of Finance. If the requested exemptions are not granted, Silverline will be required to comply with the provisions of the Securities and Exchange Board of India (Employee Stock Option Scheme and Employee Stock Purchase Scheme)

Guidelines, 1999; and

|

|

Ÿ

|

clarifications with regard to the non-applicability of certain provisions of the Securities and Exchange Board of India

(Disclosure and Investor Protection) Guidelines, 2000 to the proposed issue of ADSs to the shareholders of SeraNova and the issuance of the equity shares underlying the ADSs to the depositary.

|

Silverline will be applying to the Indian Department of Company Affairs requesting it to confirm that the

provisions of the Indian Companies Act, 1956 which require an Indian company making a public offering of securities to distribute a prospectus within India do not apply to Silverline in connection with the proposed merger.

In addition, pursuant to the relevant provisions of the Indian Companies Act, 1956, Silverline will require the

prior approvals of its shareholders for the issuance in the merger of the equity shares underlying the ADSs, for the issuance of the ADSs to the shareholders of SeraNova, and for the conversion of SeraNova stock options held by the employees of Seranova

and its Indian subsidiary into options to purchase Silverline ADSs. An extraordinary general meeting of Silverline’s shareholders is being called to obtain these approvals.

Except as stated above, no other material Indian regulatory approval is required in connection with the merger.

No Solicitation of Alternative Transactions (Page 68)

The agreement and plan of merger provides in general that SeraNova will not, and will not authorize or permit any

officer, director, employee or other adviser or representative of SeraNova, to solicit, initiate or knowingly encourage, or participate in any discussion or negotiation regarding, any acquisition proposal other than the proposal contemplated by the

agreement and plan of merger.

Accounting Treatment (Page 54)

The merger will be accounted for under the “purchase” method of accounting in accordance with

accounting principles generally accepted in the United States of America. Silverline expects the purchase price to exceed the fair value of the identifiable tangible and intangible assets of SeraNova. Such excess will be allocated to goodwill.

Expenses (Page 71)

Silverline and SeraNova will each pay its own expenses incurred in connection with the agreement and plan of

merger and the transactions therein contemplated, whether or not the merger is consummated, except that all printing and mailing expenses of this proxy statement/prospectus, estimated at $220,000, Securities and Exchange Commission filing fees ($15,428)

relating to this proxy statement/prospectus and the Form F-4 Registration Statement of which it is a part, and filing fees ($45,000) for the pre-merger notification and report forms filed pursuant to the Hart-Scott-Rodino Act, will be divided equally

between Silverline and SeraNova.

SUMMARY OF SERANOVA’S UNAUDITED PRO FORMA COMBINED FINANCIAL DATA

SeraNova has entered into agreements with Intelligroup that became effective January 1, 2000. Under these

agreements, Intelligroup is continuing to provide SeraNova with certain general and administrative functions on a fee basis. SeraNova believes that, temporarily, these agreements are the most cost efficient and least disruptive way to maintain the

administrative support services which SeraNova requires.

The pro forma statement of operations for the year ended December 31, 1999 below adjusts the results of

operations as if the agreements with Intelligroup had been effective during 1999. The pro forma amounts are presented for informational purposes only. The pro forma financial data are not necessarily indicative of SeraNova’s results of operations.

SeraNova, Inc. and Affiliates

Unaudited Pro Forma Combined Statement of Operations

for the Year Ended December 31, 1999

(in thousands, except per share data)

| |

|

Historical

SeraNova,

Inc.

|

|

Pro forma

adjustments

|

|

Pro

forma

|

| Revenues |

|

$39,795 |

|

|

|

|

|

|

|

|

$39,795 |

|

| Cost of sales |

|

22,475 |

|

|

|

|

|

|

|

|

22,475 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

17,320 |

|

|

|

|

|

|

|

|

17,320 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Selling, general and administrative expenses |

|

17,605 |

|

|

$(803 |

)(1) |

|

$ 1,162 |

(2) |

|

17,964 |

(3) |

| Depreciation and amortization |

|

1,131 |

|

|

|

|

|

|

|

|

1,131 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

18,736 |

|

|

(803 |

) |

|

1,162 |

|

|

19,095 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating loss |

|

(1,416 |

) |

|

803 |

|

|

(1,162 |

) |

|

(1,775 |

) |

| Other income (expense), net |

|

(80 |

) |

|

|

|

|

(288 |

)(4) |

|

(368 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Loss before income taxes |

|

(1,496 |

) |

|

803 |

|

|

(1,450 |

) |

|

(2,143 |

) |

| Benefit for income taxes |

|

(235 |

) |

|

|

|

|

|

|

|

(235 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$(1,261 |

) |

|

$803 |

|

|

$(1,450 |

) |

|

$(1,908 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Unaudited pro forma net loss per common share—basic and

diluted |

|

$ (0.08 |

) |

|

|

|

|

|

|

|

$ (0.11 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Shares used in per share calculation of unaudited pro forma net

loss—basic and diluted |

|

16,629 |

|

|

|

|

|

|

|

|

16,629 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

Represents the elimination of historical costs covered by the services and space sharing agreements.

|

(2)

|

Represents the estimated annual costs that would have been incurred under the services and space sharing agreements (See Note 4 to

SeraNova’s Combined Financial Statements).

|

(3)

|

The difference between the historical costs covered by the services and space sharing arrangements and the costs to be incurred

under the services and space sharing agreements is due to SeraNova’s growth throughout 1999 which resulted in it utilizing an increasing volume of office space and incurring higher costs as the year progressed.

|

(4)

|

Represents the estimated annual interest expense that would have been incurred if the bank credit facility had been in place for

the year 1999.

|

SUMMARY HISTORICAL AND PRO FORMA DATA

The following table presents selected data for Silverline and SeraNova on an historical basis, for Silverline and

SeraNova on a pro forma basis assuming the merger had been effective during the periods presented, and for SeraNova on a pro forma equivalent share basis. The pro forma equivalent share data for SeraNova common stock are based on the exchange ratio of

0.35 of a Silverline ADS for each outstanding share of SeraNova common stock in the merger. Management of Silverline and SeraNova are currently assessing non-recurring merger charges which could be material to the combined companies’ results of

operations and financial condition for the period in which the charges occur. No estimate of these charges is reflected in the historical and pro forma per ADS and per share data below.

The merger will be accounted for under the purchase accounting method and the pro forma data are derived in

accordance with that method. The following information is based upon the historical financial statements of Silverline and SeraNova and the related notes appearing in this proxy statement/prospectus, and should be read together with such historical

financial statements and the notes thereto. This information is not necessarily a reliable indication of the results of the future operations of Silverline after the merger or the actual results had the merger been consummated prior to the periods indicated

.

| |

|

Nine months

ended

September 30,

2000

|

|

Year ended

December 31,

1999

|

| Silverline Technologies Limited |

|

|

|

|

|

|

| Pro forma results of operations (in thousands): |

|

|

|

|

|

|

| Revenues |

|

$164,538 |

|

|

$133,602 |

|

| Income before extraordinary item |

|

12,198 |

|

|

5,561 |

|

| Pro forma financial position at end of period (in thousands): |

|

|

|

|

|

|

| Total assets |

|

364,585 |

|

|

110,751 |

|

| Total debt |

|

87,308 |

|

|

35,678 |

|

| Book value per ADS (at end of period): |

|

|

|

|

|

|

| Historical |

|

$5.51 |

|

|

$2.40 |

|

| Pro forma combined |

|

6.49 |

|

|

2.08 |

|

| Pro forma per equivalent share of SeraNova common stock |

|

18.67 |

|

|

5.97 |

|

| Cash dividends declared per ADS (1) |

|

|

|

|

|

|

| Historical |

|

0 |

|

|

0 |

|

| Pro forma combined |

|

0 |

|

|

0 |

|

| Pro forma per equivalent share of SeraNova common stock |

|

0 |

|

|

0 |

|

| Income before extraordinary item per ADS (diluted): |

|

|

|

|

|

|

| Historical |

|

0.70 |

|

|

0.49 |

|

| Pro forma combined |

|

0.29 |

|

|

0.14 |

|

| Pro forma per equivalent share of SeraNova common stock |

|

0.84 |

|

|

0.40 |

|

| |

| SeraNova, Inc. |

|

|

|

|

|

|

| Book value per share (at end of period) |

|

0.60 |

|

|

0.30 |

|

| Diluted earnings per share from continuing operations |

|

(0.30 |

) |

|

(0.08 |

) |

|

|

(footnotes on next page)

| |

|

October 26,

2000(2)

|

|

January 8,

2001(2)

|

| Closing price: |

|

|

|

|

| Silverline ADS |

|

$15.875 |

|

$10.00 |

| SeraNova common stock: |

|

|

|

|

| Per share |

|

4.4375 |

|

2.375 |

| Per equivalent Silverline ADS |

|

5.55625 |

|

3.50 |

(1)

|

During 1999 and 2000, Silverline declared dividends to its equity shareholders of record as of March 31 in each year of 1.75

Indian rupees per equity share in 1999 and 1.75 Indian rupees per equity share in 2000 (approximately $0.04 per share and $0.04 per share, respectively). On June 20, 2000, Silverline completed its U.S. initial public offering of its ADSs. No dividends

have been declared to holders of Silverline’s ADSs since its initial public offering; therefore, dividends per ADS are computed at 0.

|

(2)

|

October 26, 2000, was the last trading day preceding the date on which the proposed general terms of the merger were publicly

announced. The closing prices of SeraNova common stock per equivalent Silverline ADS were calculated by multiplying the respective closing prices of Silverline ADS by 0.35, the exchange ratio in the merger. The Silverline ADSs are listed on the New York

Stock Exchange, and the SeraNova common stock is quoted on the Nasdaq National Stock Market. See “Price Range of SeraNova Common Stock” on page 127.

|

You should carefully consider the risks described below and the other information included in this proxy

statement/prospectus. If any of these risks actually occur, Silverline’s business, results of operations and financial condition could be materially adversely affected, the trading prices of Silverline’s equity shares and ADSs could decline, and

you could lose all or part of your investment. See also “Special Note Regarding Forward-Looking Statements.”

Risk Factors Relating to the Merger

The exchange ratio for the ADSs to be received in the merger is fixed.

Under the agreement and plan of merger, each share of SeraNova common stock will be converted into a right to

receive 0.35 of a Silverline ADS. This exchange ratio is fixed and will not be adjusted in the event of any change in the relative market values of the SeraNova common stock and the Silverline ADSs before the effective time of the merger.

The market prices of Silverline ADSs and SeraNova common stock, and the value of Silverline ADSs relative to

SeraNova common stock, may be substantially different on the date the agreement and plan of merger was signed, the date of this proxy statement/prospectus, the date of the meetings of the SeraNova and Silverline shareholders to approve the merger, and the

effective date of the merger. These market prices may vary depending upon changes in the business, operations or prospects of SeraNova and Silverline, market assessments of the likelihood that the merger will be consummated and the timing thereof, general

market and economic conditions, and other factors both within and beyond the control of SeraNova and Silverline. For example, since June 20, 2000, when the Silverline ADSs commenced trading on the New York Stock Exchange, the price of a Silverline ADS

ranged from a low of $9.375 to a high of $30.75, and since July 6, 2000, when the SeraNova common stock commenced trading on the Nasdaq Stock Market, the closing price of a share of SeraNova common stock ranged from a low of $1.7812 to a high of $12.25.

Further, because the effective date of the merger will be later than the date of the special meeting, the price of Silverline ADSs on the date of the special meeting may not be indicative of its price on the date the merger is completed. For example, on

October 26, 2000, the day before the agreement and plan of merger was signed, the closing price of a Silverline ADS for New York Stock Exchange composite transactions was $15.875, so that the consideration offered in the agreement and plan of merger per

share of SeraNova common stock had a value on that date of $15.875 x 0.35, or $5.5563. However, if the market value of Silverline ADSs on the effective date of the merger is less than $15.875, holders of SeraNova common stock will receive Silverline ADSs

in the merger with an initial value less than $5.5563 per share of SeraNova common stock. In addition, because the Silverline ADSs received in the merger are subject to dividend proration for the financial year ended March 31, 2001, they initially will

trade separately from Silverline’s other ADSs, under the symbol “SLT.pr” until April 1, 2001, or as soon thereafter as practicable. See “Silverline’s Dividend Policy.” This may result in their trading temporarily at a lower

price than the existing Silverline ADSs.

We urge SeraNova shareholders to obtain current market quotations for Silverline ADSs and SeraNova common stock.

Silverline may not realize fully the cost savings and other benefits it expects to realize from the merger. This may adversely affect its earnings and financial condition.

To achieve the benefits which Silverline and SeraNova expect from the merger, Silverline will need to integrate

the operations of SeraNova into its operations quickly and efficiently. The integration of SeraNova into Silverline will be complex and time consuming, and will require substantial attention from Silverline’s management. The resulting diversion of

management attention from other matters, and any difficulties encountered in the integration process, could have a material adverse effect upon Silverline’s sales, level of expenses, operating results and financial condition.

Further, SeraNova engages in some aspects of the internet strategy and technology implementation services

business in which Silverline has only limited experience. Silverline views this as an opportunity and a benefit of the merger, because the companies’ differing strengths and areas of expertise complement one another. However, if Silverline is unable

to integrate SeraNova’s activities with its own, some of the anticipated benefit of the merger could be lost.

After the merger, Silverline’s and SeraNova’s customers may seek alternative information technology services.

After the merger, some customers of either Silverline or SeraNova could transfer their business. Silverline and

SeraNova cannot predict whether this will occur or to what extent.

As a result of the merger, SeraNova may become liable to Intelligroup for taxes connected with the spin-off.

Intelligroup and SeraNova have treated Intelligroup’s spin-off of SeraNova as tax-free under the Internal

Revenue Code. However, Section 355(e) of the Code provides that if one of the companies involved in the spin-off is acquired or sold within a two-year period after the spin-off, the spin-off may become taxable to Intelligroup. SeraNova has agreed to

indemnify Intelligroup for any tax liabilities which Intelligroup may incur if the completion of the merger were to result in the spin-off being deemed a taxable transaction. If Section 355(e) were to apply, it is possible that Intelligroup would be

liable for tax in an amount as high as $60-65 million, to which would be added interest and, possibly, penalties. For a further discussion of this issue, see “Material U.S. Federal Income Tax Consequences—The Merger may cause SeraNova to become

liable for taxes payable by Intelligroup in connection with its spin-off of SeraNova” below.

Factors affecting Silverline’s ADSs may be different from those affecting SeraNova stock.

The price of Silverline ADSs may be affected by factors different from those affecting the value of SeraNova

common stock. Silverline’s business differs from that of SeraNova, and Silverline’s results of operations, as well as the price of its ADSs, may be affected by factors different from those affecting SeraNova’s results of operations and the

value of SeraNova stock. For example, if e-business consulting declines more rapidly than the mainframe consulting business, the value of SeraNova’s common shares will decline more rapidly than the value of Silverline ADSs and vice versa.

SeraNova’s Indian subsidiary may lose its tax benefits.

SeraNova’s Indian subsidiary (or “SeraNova India”) benefits from significant tax incentives under

the Indian tax laws for income from its software development centers which are “Export Oriented Undertakings,” or located in “Software Technology Parks” or in “Export Processing Zones.” SeraNova has three centers located in

Bangalore, Chennai and Hyderabad. An Indian software company loses this tax benefit with respect to a particular software development center if there is a change of more than 49% in its ownership between the last date of the financial year in which the

software development center was set up and the last date of any subsequent financial year. In the case of SeraNova India, pursuant to the spin-off of the SeraNova by Intelligroup in July 2000 and related Indian subsidiary spin-offs in 2000, the Indian tax

authorities could take the position that there was a change of more than 49% in its beneficial ownership compared to the last day of the year in which the centers were set up. As a result, Silverline’s Indian counsels are of the view that due to the

spin-offs previously mentioned, SeraNova India may not be eligible for tax benefit even though no deferred tax has been recognized for SeraNova India’s income in SeraNova’s financials. Also, if, in order to qualify the merger as a tax-free

reorganization, it becomes necessary to restructure the merger as a forward triangular merger in which SeraNova merges into a wholly-owned subsidiary of Silverline, the Indian tax authorities could contend that there has been a change of more than 49% in

the ownership of SeraNova India and therefore the proposed merger could result in loss of the Indian tax exemption to SeraNova India. Even if the merger

continues to be structured as a reverse triangular merger in which a wholly-owned subsidiary of Silverline merges into SeraNova India, Silverline cannot assure you that the Indian tax authorities will not construe the merger as a change of more than 49%

in the beneficial ownership of SeraNova India and that the merger will not result in a loss of the Indian tax exemption by SeraNova India.

THE INDIAN TAX PROVISIONS IN RESPECT OF A SPIN-OFF ARE NEW AND THE INDIAN TAX AUTHORITIES ARE UNFAMILIAR IN

DEALING WITH THESE TRANSACTIONS. NO ASSURANCE CAN BE GIVEN AS TO HOW THE INDIAN TAX AUTHORITIES MAY INTERPRET THE TAX IMPLICATIONS OF A SPIN-OFF.

Even if SeraNova India is not entitled to the Indian tax exemption for the reasons mentioned above, it will be

entitled to a tax deduction for income from export of software development services. This deduction decreases by 20% each year with effect from the financial year 2000–2001 and will cease to be available after the financial year 2004–2005. This

is an alternative tax benefit which SeraNova India can claim if the tax exemption is not available to it for the reasons previously mentioned.

Upon loss of the tax benefits with respect to SeraNova’s software development centers, SeraNova India’s

provision for income taxes would increase by substantially more and would have a material adverse effect on our net income and the trading prices of Silverline’s equity shares.

If the merger fails to qualify as a reorganization, SeraNova shareholders will recognize additional gains or losses on their SeraNova common shares, and SeraNova might

recognize taxable gain.

Silverline and SeraNova have structured the merger to qualify as a reorganization within the meaning of Section

368(a) of the United States Internal Revenue Code of 1986, as amended. If the merger takes place but fails to qualify as a reorganization, a shareholder of SeraNova generally will recognize gain or loss on each share of SeraNova common stock he or she

surrendered. The amount of the gain or loss will be the difference between the shareholder’s tax basis in that share and the fair market value, at the effective time of the merger, of the ADSs received in exchange therefor. In addition, if the merger

fails to qualify as a reorganization and if the merger is structured as a forward triangular merger in which SeraNova merges into a wholly-owned subsidiary of Silverline, SeraNova would be subject to U.S. federal income tax as if it had sold all of its

assets in a taxable transaction for a price reflecting the sum of the fair market value of the ADSs issued in the merger plus the amount of its liabilities.

Risk related to uncertainty of tax implications in India of the merger.

Cross border mergers and acquisitions by Indian companies are new phenomena. There is no direct precedent in

respect of the tax implications of such transactions. Therefore, there is considerable uncertainty regarding the issues that may be raised by the Indian tax authorities for such transactions. No assurance can be given as to their interpretation of these

transactions by the Indian tax authorities.

You are urged to consult your individual tax advisers to ascertain the Indian tax effects of the proposed merger.

Double taxation of gains recognized on sales of equity shares.

Any gain that a United States person recognizes on a sale of equity shares of Silverline received upon converting

the ADSs into equity shares would be subject to capital gains tax in India and would also be subject to U.S. federal income tax. Because such a gain is likely to be characterized, for U.S. foreign tax credit limitation purposes, as U.S. source passive

income, unless the United States person has sufficient foreign source passive income from other transactions taxable at a rate sufficiently below the U.S. federal income tax rate applicable to that income, the U.S. foreign tax credit limitation rules