|

|

|

|

|

Previous: CNH CAPITAL RECEIVABLES INC, S-3/A, EX-99.(C), 2000-08-09 |

Next: ORIENT EXPRESS HOTELS LTD, S-1/A, EX-23.1, 2000-08-09 |

As filed with the Securities and Exchange Commission on August 9, 2000

Registration No. 333-12030

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 6

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ORIENT-EXPRESS HOTELS LTD.

(Exact name of registrant as specified in its charter)

| Bermuda | 7011 | 98-0223493 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

| 41 Cedar Avenue P.O. Box HM 1179 Hamilton HM EX, Bermuda (441) 295-2244 (Address, including zip code, and telephone number, including area code, of registrant's principal executive offices) |

JOHN T. LANDRY, JR. Orient-Express Hotels Inc. 1155 Avenue of the Americas New York, New York 10036 (212) 302-5066 (Name, address, including zip code, and telephone number, including area code, of agent for service) |

Copies to:

| STEPHEN V. BURGER Carter, Ledyard & Milburn 2 Wall Street New York, New York 10005 (212) 732-3200 |

ROHAN S. WEERASINGHE Shearman & Sterling 599 Lexington Avenue New York, New York 10022 (212) 848-4000 |

Approximate date of commencement of proposed sale to the public:

As soon as possible after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. / /

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. / /

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. / /

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. / /

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. / /

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

This registration statement contains two forms of prospectus: one to be used in connection with a United States and Canadian offering of the registrant's class A common shares and one to be used in connection with a concurrent international offering of class A common shares. The U.S. prospectus and the international prospectus will be identical in all respects except that they will have different front and back cover pages and a different "Underwriting" section. The form of the U.S. prospectus is included herein and is followed by the alternate front cover page to be used in the international prospectus. The form of the front cover page of the international prospectus is labeled "Alternate Front Cover Page for International Prospectus", and the form of the back cover page for the international prospectus is labelled "Alternate Back Cover Page for International Prospectus." The form of the "Underwriting" section for the international prospectus is labelled "Alternate `Underwriting' section for International Prospectus." Final forms of each prospectus will be filed with the Securities and Exchange Commission under Rule 424(b) of the General Rules and Regulations under the Securities Act of 1933.

ii

Subject to Completion

Preliminary Prospectus dated August 9, 2000

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

P R O S P E C T U S

|

10,000,000 Shares Orient-Express Hotels Ltd. Class A Common Shares |

This is Orient-Express Hotels Ltd.'s initial public offering. Orient-Express Hotels is selling 5,000,000 of the shares and Sea Containers Ltd. is selling 5,000,000 of the shares. The U.S. underwriters are offering 8,000,000 shares in the U.S. and Canada, and the international managers are offering 2,000,000 shares outside the U.S. and Canada.

We expect the public offering price to be between $20.00 and $23.00 per share. Currently, no public market exists for the shares. After pricing of this offering, we expect that the class A common shares will be listed on the New York Stock Exchange under the symbol "OEH."

After completion of this offering, the outstanding common shares of Orient-Express Hotels will consist of 28,440,601 class A common shares, of which Sea Containers will own about 65%, or 60% if the underwriters fully exercise their over-allotment option, and 2,459,399 class B common shares, all of which Sea Containers will own. In general, holders of class A common shares and class B common shares vote together as a single class on all matters submitted to a vote of Orient-Express Hotels' shareholders, with holders of class B common shares having one vote per share and holders of class A common shares having one-tenth of one vote per share. Each class B common share is convertible at any time into one class A common share. In all other material respects, the class A common shares and class B common shares are identical and are treated as a single class of common shares. See "Description of Common Shares."

Investing in the class A common shares involves risks that are described in the "Risk Factors" section beginning on page 8 of this prospectus.

| |

Per Share |

Total |

||

|---|---|---|---|---|

| Public offering price | $ | $ | ||

| Underwriting discount | $ | $ | ||

| Proceeds, before expenses, to Orient-Express Hotels | $ | $ | ||

| Proceeds, before expenses, to Sea Containers | $ | $ |

The U.S. underwriters may also purchase up to an additional 1,200,000 shares from Sea Containers at the public offering price, less the underwriting discount, within 30 days from the date of this prospectus to cover over-allotments. The international managers may similarly purchase up to an additional 300,000 shares from Sea Containers.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the class A common shares being offered by this prospectus, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The shares will be ready for delivery on or about , 2000.

| Merrill Lynch & Co. | Lazard |

Salomon Smith Barney

Banc of America Securities LLC

The date of this prospectus is , 2000.

| |

Page |

|

|---|---|---|

| Prospectus Summary | 2 | |

| Risk Factors | 8 | |

| Forward-Looking Statements | 18 | |

| Use of Proceeds | 18 | |

| Dividend Policy | 18 | |

| Capitalization | 19 | |

| Dilution | 20 | |

| Selected Consolidated Financial Data | 21 | |

| Management's Discussion and Analysis of Financial Condition and Results of Operations | 23 | |

| Our Business | 36 | |

| Management | 59 | |

| Our Separation from Sea Containers | 64 | |

| Security Ownership of Sea Containers' Principal Shareholders and Management | 69 | |

| Description of Common Shares | 72 | |

| Shares Eligible for Future Sale | 75 | |

| Material Tax Considerations | 76 | |

| Underwriting | 77 | |

| Legal Matters | 81 | |

| Experts | 81 | |

| Where You Can Find More Information | 81 | |

| Index to Consolidated Financial Statements | F-1 |

You should rely only on the information contained in this prospectus. We have not, and the underwriters have not, authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

In this prospectus, "Orient-Express Hotels," "we," "us" and "our" each refers to Orient-Express Hotels Ltd., a Bermuda company, and, unless otherwise required by the context, its subsidiaries, and not to the underwriters or Sea Containers. "Sea Containers" refers to Sea Containers Ltd., a Bermuda company, and, unless otherwise required by the context, its subsidiaries.

Orient-Express Hotels, our logo and other brand names of Orient-Express Hotels mentioned in this prospectus are the property of Orient-Express Hotels. All other brand and trade names referred to in this prospectus are the property of their respective owners.

This summary highlights information contained elsewhere in this prospectus. It does not contain all the information that may be important to you. You should read carefully this entire prospectus, especially the Risk Factors section and the consolidated financial statements and accompanying notes to those statements, before you decide whether to invest in the class A common shares.

When we look at results for a period on a comparable basis, we look only at the results for those hotels we owned throughout the period.

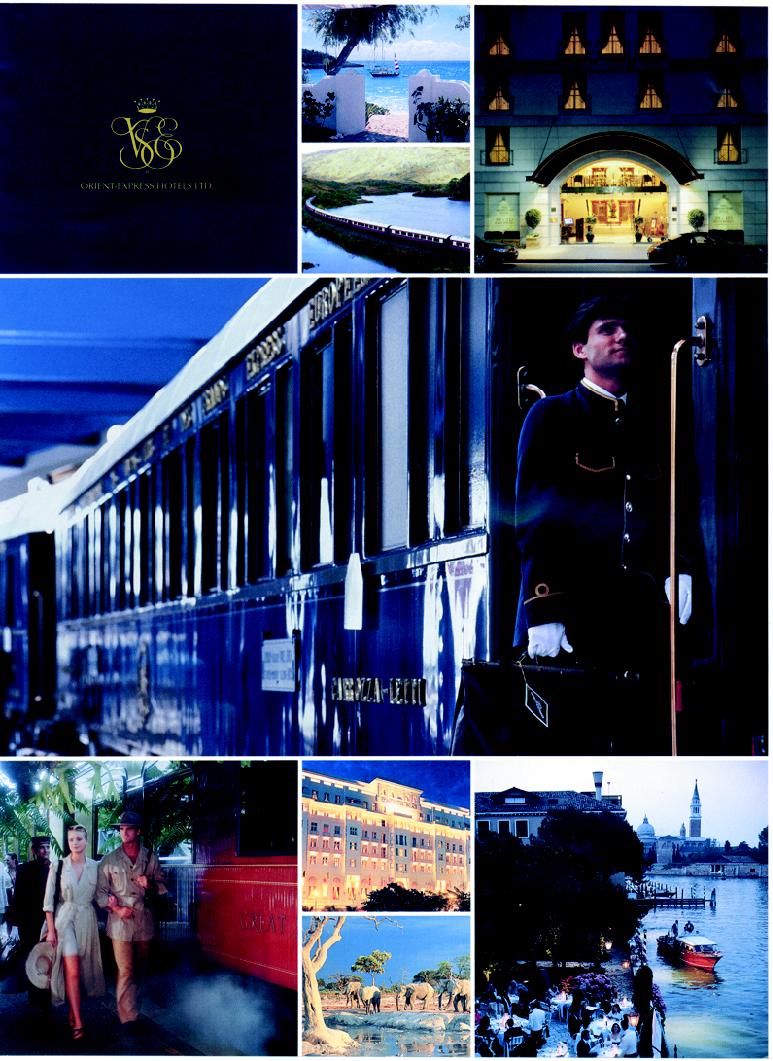

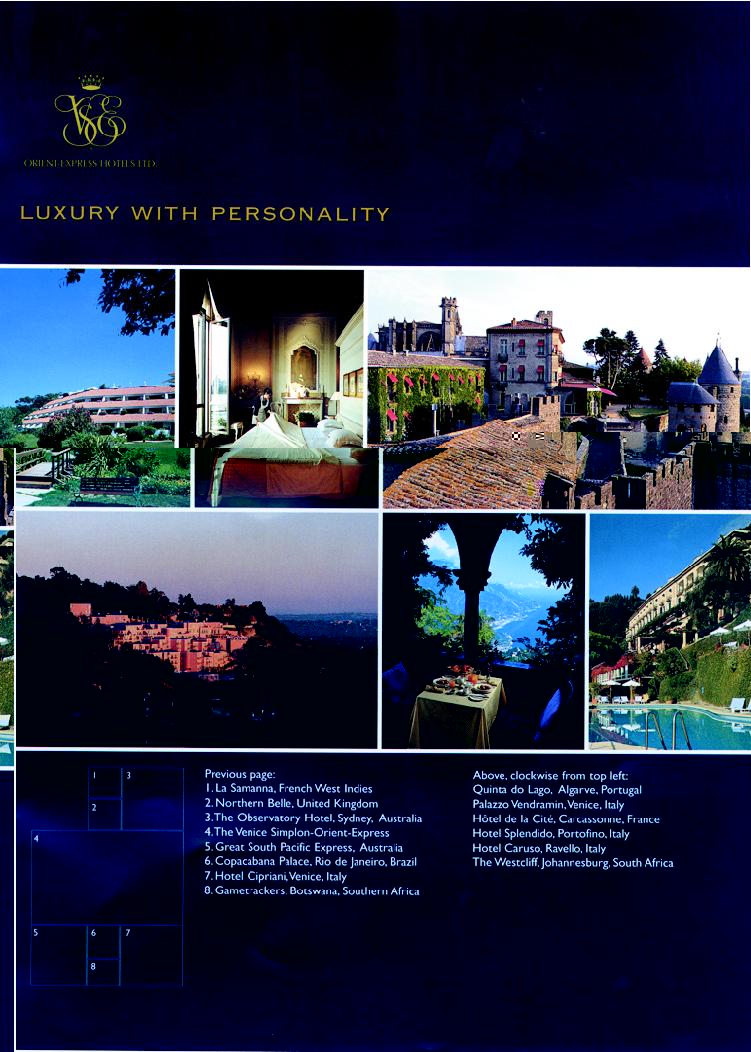

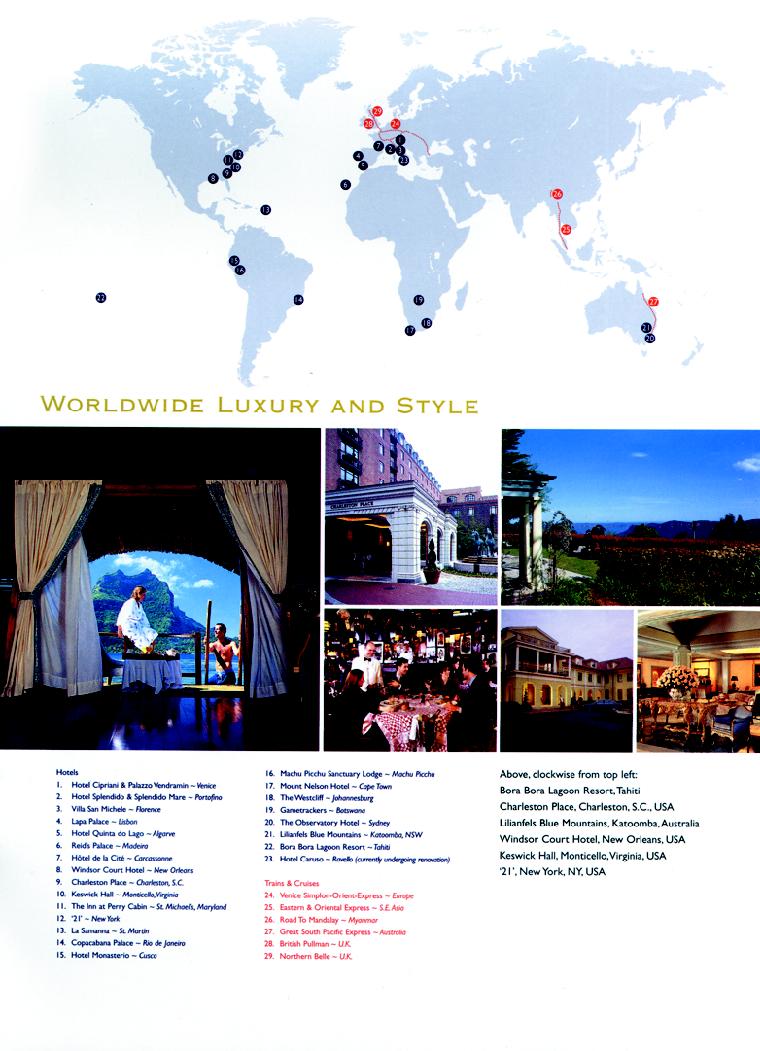

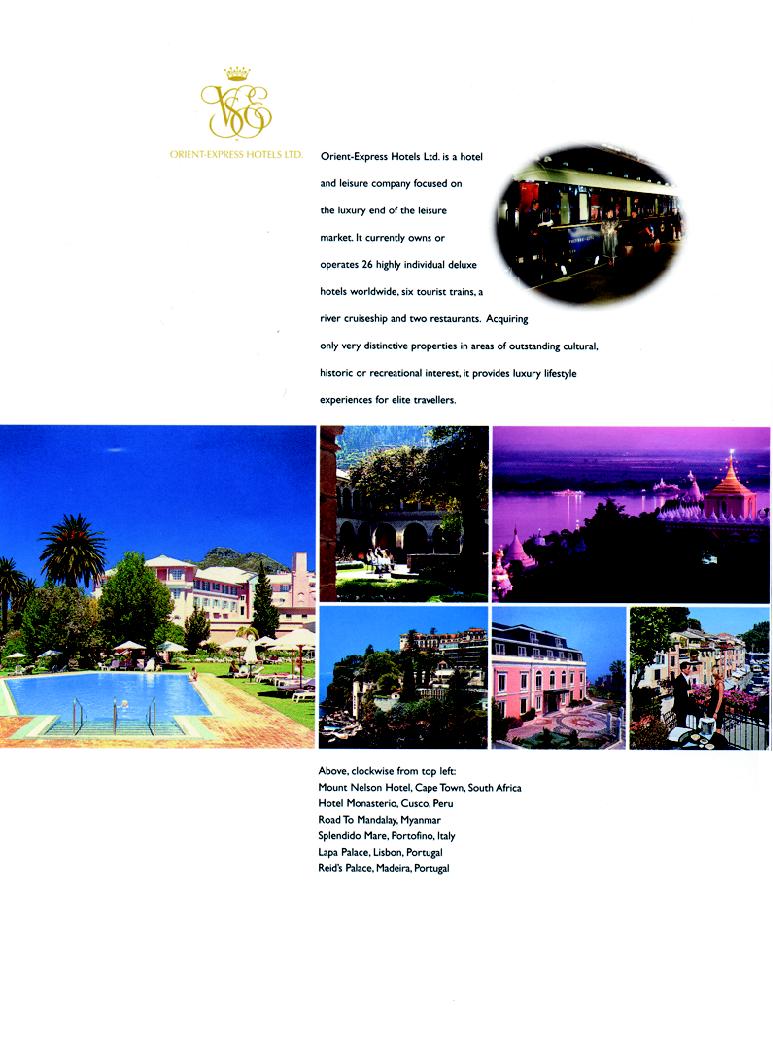

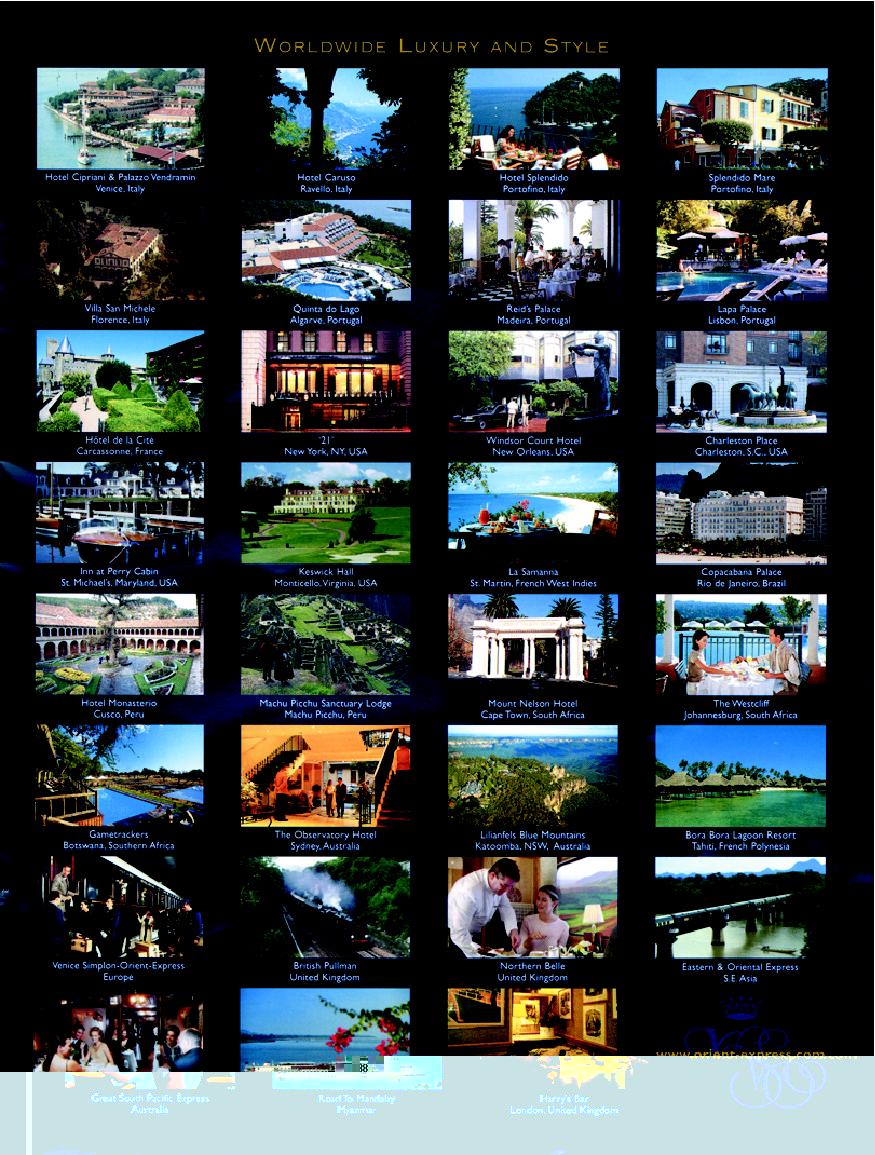

Orient-Express Hotels Ltd. is a hotel and leisure company focused on the luxury end of the leisure market. We currently own and/or operate 26 highly individual deluxe hotels worldwide reported as 22 business units, six tourist trains, a river cruiseship and two restaurants. We acquire only very distinctive properties in areas of outstanding cultural, historic or recreational interest in order to provide luxury lifestyle experiences for the elite traveler.

Orient-Express Hotels has been since its incorporation in 1987 a wholly-owned subsidiary of Sea Containers Ltd. Sea Containers' hotel and leisure operations began in the late 1970s when Orient-Express Hotels' corporate predecessor acquired the Hotel Cipriani in Venice and the legendary Venice Simplon-Orient-Express tourist trains. Since then, we have grown into an international leisure company. We were recently voted one of the top two hotel groups in Europe by Conde Nast Traveler magazine, and over the last 18 months, our 31 properties have won 67 national and international awards, 13 of which were "Number One" or "Best" in the category. Some of our most prominent properties are the Windsor Court in New Orleans, the Copacabana Palace Hotel in Rio de Janeiro, the Mount Nelson Hotel in Cape Town, South Africa, Reid's Palace Hotel in Madeira, Portugal, and the '21' Club in New York City.

Hotels and restaurants represent the largest segment of our business, contributing 84% of revenue in 1999. Tourist trains and cruises accounted for the remaining 16%. Our worldwide portfolio of hotels consists of 2,563 individual guest rooms and multiple-room suites, each known as a key, which achieved an average daily room rate, or ADR, of $289 in 1999. A majority of our customers are leisure travelers, with approximately 54% of our guests in 1999 originating from the United States, 20% from Europe and the remaining 26% from elsewhere in the world.

Unique Portfolio of Properties in Areas Where There Are High Barriers to Entry. Our properties are all in distinctive locations throughout the world. Many of our properties are an essential part of the local history and could not be replaced or would be prohibitively expensive to replicate. Also, strict zoning regulations in a number of countries where we operate, particularly Italy, prohibit or significantly restrict new hotel development in our areas.

Distinguished Brand Names. Our brand name "Orient-Express Hotels" originated with the legendary luxury train traveling between Paris and Istanbul in the late 19th and early 20th centuries. This brand name is recognized worldwide and is synonymous with sophisticated travel and refined elegance. Also, many of our individual properties, such as the Hotel Cipriani or the '21' Club, have distinctive, local brand identities.

Luxury Market Focus. We focus exclusively on the luxury end of the leisure market. We serve those guests who are less price sensitive and are willing to pay a premium for services and accommodations which have a special image, style and character. Our philosophy is that "quality is luxury with personality."

2

Pricing Power. Given their strong reputation and distinctive character, our properties tend to command a considerable rate premium over those of our competitors. Since a large proportion of hotel operating costs is fixed, we thereby can achieve an enhanced return on our investment.

Successful Acquisition Strategy. In 1999 and the first quarter of 2000, we spent $85 million on acquisitions which will positively impact profits in 2000 and beyond. Acquisitions in 1999 consisted of Keswick Hall near Monticello in Charlottesville, Virginia, the Inn at Perry Cabin at St. Michael's on the eastern shore of Chesapeake Bay in Maryland, and our 50% interests in a joint venture which operates two hotels in Peru and a joint venture which operates the tourist railway up to the famous Machu Picchu ruins. In the first quarter of 2000, we acquired two Australian hotels—the Observatory in Sydney, which we had previously managed for over seven years, and Lilianfels in the Blue Mountains.

Sales, Marketing and Distribution Advantages. We attract guests who we believe have often made a specific decision to stay at one or more of our properties and therefore are more likely to book directly with our hotels and tours. This reduces our marketing costs and third-party sales commissions. We extensively utilize public relations as a communications tool by working with journalists and travel writers, and we enjoy exceptional media exposure because of the distinctive nature of our properties. During 1999, we hosted over 1,000 journalists at our properties, who generated over 3,000 articles in newspapers and magazines around the world.

Global Presence. We operate hotels and restaurants in eleven countries across six continents. Also, our trains and cruiseship operate in the U.K., continental Europe, Southeast Asia, South America and Australia. Our geographic diversification makes our results of operations less susceptible to an economic downturn in a particular region.

Positive Leisure Spending and Demographic Trends. We believe that positive travel and tourism spending trends as well as demographic shifts in both the U.S. and European populations will increase the long-term demand for our hotels and trains.

Strong Management Team. Our executive management team includes nine individuals who are responsible for our global strategic direction and have an average of ten years of experience with Orient-Express Hotels and 18 years of experience in the hotel and leisure industry.

Strong Internal Growth. We intend to pursue increases in pricing and earnings both at our established properties and at our newer acquisitions. We believe that Orient-Express Hotels will be able to increase average daily rates, or ADRs, further, and consequently rooms revenue, at our established properties, given the prestige of our brand names and significant barriers to entry. In addition, since a number of our newer acquisitions have been from individuals and small companies with limited hotel experience, we have been able to increase revenue per available room, or REVPAR, and operating margins at these newer properties by applying our managerial experience, marketing skills, strong brand name and cost controls.

Growth from Expansions. We have significant expansion opportunities at our existing properties. In our hotels and restaurants segment, we have plans over the next few years to add between 300 and 600 keys, expand existing banquet and dining facilities and develop new amenities at various properties, including spas and conference facilities.

Growth from Acquisitions. We intend to continue to acquire additional distinctive, luxury properties throughout the world. We target unique properties in markets with high barriers to entry and opportunities to increase cash flow through either expansions or REVPAR increases.

Internet Initiatives. We believe that there is significant potential for the internet to enhance our distribution and reduce our sales and marketing expenses. The combination of our strong local brand identities and our strong umbrella brand name is an effective way to attract those internet users who

3

are looking for a travel experience with distinctive character but who still need the assurance of quality. Internet technology also permits lower transaction costs.

Our Relationship with Sea Containers

Sea Containers, which is a public company whose common shares are listed on the New York Stock Exchange, currently engages in three main businesses:

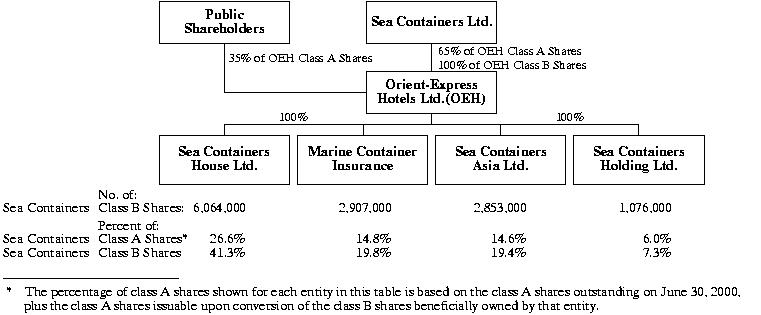

After the completion of this offering, Sea Containers will own approximately 65% of the outstanding class A common shares of Orient-Express Hotels, or approximately 60% if the underwriters fully exercise their over-allotment option. Sea Containers will also own all of the outstanding 20,503,877 class B common shares of Orient-Express Hotels, of which 18,044,478 shares will be subject to an agreement for their purchase by subsidiaries of Orient-Express Hotels. See "Our Separation from Sea Containers—Separation Agreements—Share Owning Subsidiaries Restructuring Agreement" and note 9(e) to the consolidated financial statements in this prospectus. Under applicable Bermuda corporate law, these 18,044,478 shares are outstanding and may be voted by Sea Containers although for purposes of computing earnings per share, these shares are deemed to be owned by subsidiaries of Orient-Express Hotels and will be accounted for as a reduction to outstanding shares.

The shares to be owned by Sea Containers after this offering will represent about 96% of the combined voting power for most matters submitted to a vote of our shareholders, or 95% if the underwriters fully exercise their over-allotment option.

Sea Containers currently intends to distribute to its shareholders all of our class A and class B common shares that it owns approximately six months after this offering, if Sea Containers receives all necessary consents and approvals from its board of directors, shareholders, lenders and others, and a favorable tax opinion. Sea Containers is not obligated to make this spinoff distribution, and the distribution may not occur in six months or at all. If the distribution is delayed or is not completed at all, Sea Containers may elect to sell additional shares of Orient-Express Hotels.

We believe that we will realize benefits from our separation from Sea Containers, including greater strategic focus, better incentives for employees and greater accountability, and more direct access to capital markets.

Orient-Express Hotels has entered into agreements with Sea Containers providing for the separation of its business operations from those of Sea Containers, for the transfer to Orient-Express Hotels of all Sea Containers' subsidiaries that relate to Sea Containers' hotel and leisure business and that are not already owned by Orient-Express Hotels, and for various ongoing relationships between Sea Containers and Orient-Express Hotels. For more information on the proposed distribution, the benefits of our separation from Sea Containers, and these agreements, see the section entitled "Our Separation from Sea Containers" in this prospectus.

* * *

Orient-Express Hotels maintains its registered office at 41 Cedar Avenue, P.O. Box HM 1179, Hamilton HM EX, Bermuda, telephone 441-295-2244. Its main service subsidiary in the United Kingdom is located at Sea Containers House, 20 Upper Ground, London SE1 9PF, England, telephone 011-44-20-7805-5060, and its main United States service subsidiary—Orient-Express Hotels Inc.—has offices at 1155 Avenue of the Americas, New York, New York 10036, telephone 212-302-5055.

Our website is www.orient-expresshotels.com. The information on this website is not a part of this prospectus.

4

| |

|

|||

|---|---|---|---|---|

| Class A common shares offered by Orient-Express Hotels: |

||||

| U.S. offering | 4,000,000 shares | |||

| International offering |

|

1,000,000 shares |

||

| Class A common shares offered by Sea Containers: |

|

|

||

| U.S. offering |

|

4,000,000 shares |

||

| International offering |

|

1,000,000 shares |

||

| Total |

|

10,000,000 shares |

||

| Class A common shares to be held by Sea Containers immediately after this offering |

|

18,440,601 shares |

||

| Class A common shares to be outstanding immediately after this offering |

|

28,440,601 shares |

||

| Class B common shares to be outstanding immediately after this offering |

|

2,459,399 shares |

||

| Class A and class B common shares to be outstanding immediately after this offering |

|

30,900,000 shares |

||

| Use of proceeds |

|

We estimate that the net proceeds to Orient-Express Hotels from this offering will be approximately $100 million, assuming a public offering price of $21.50 per share. We intend to use these net proceeds to repay approximately $95 million of our existing indebtedness secured by five of our properties and guaranteed by Sea Containers. These properties will then be available to secure future borrowings. The balance of the proceeds to us will be used for working capital and general corporate purposes, which may include repayment of other debt. Our use of proceeds is more fully described under "Use of Proceeds." |

||

| |

|

Orient-Express Hotels will not receive any of the proceeds from the sale of shares in this offering by Sea Containers. |

||

| |

|

|

||

| Proposed New York Stock Exchange symbol |

|

OEH |

||

| Risk factors |

|

See "Risk Factors" and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in the class A common shares. |

||

| |

|

|

||

5

| Preferred share purchase rights |

|

This prospectus also relates to rights to purchase Orient-Express Hotels' series A junior participating preferred shares. These rights will be attached to and transferable only with the class A common shares, including those sold in this offering. See "Description of Common Shares—Shareholder Rights Agreement." |

||

| |

|

|

||

The 28,440,601 class A common shares shown above as outstanding after the offering exclude 750,000 class A common shares which will be reserved for issuance under a stock option plan we have adopted in connection with the offering, as described under "Management."

The 5,000,000 class A common shares shown above as offered by Sea Containers in this offering, and the 18,440,601 class A common shares shown above as held by Sea Containers immediately after this offering, assume that the U.S. underwriters and international managers do not exercise their over-allotment options. Sea Containers has granted options to the U.S. underwriters and the international managers to purchase up to 1,500,000 additional class A common shares at the public offering price less the underwriting discount, solely to cover over-allotments. Orient-Express Hotels will not receive any of the proceeds from the sale of these shares by Sea Containers.

The 2,459,399 class B common shares shown above do not include 18,044,478 shares owned by Sea Containers but accounted for as a reduction to outstanding shares including for purposes of computing earnings per share because they are deemed to be owned by subsidiaries of Orient-Express Hotels. See note 9(e) to the consolidated financial statements in this prospectus.

Summary Consolidated Financial Data

The data presented in the following table as of December 31, 1999, 1998, 1997, 1996 and 1995 and for the years then ended are derived from our audited financial statements. The data for the years ended December 31, 1999, 1998 and 1997 and as of December 31, 1999 and 1998 are derived from our audited consolidated financial statements included in this prospectus which have been audited by Deloitte & Touche LLP, independent auditors, whose report is included elsewhere in this prospectus. The data for the six months ended June 30, 2000 and 1999, and as of June 30, 2000 and 1999, have been derived from the unaudited consolidated financial statements of Orient-Express Hotels which, in the opinion of management, have been prepared on the same basis as the audited financial statements and reflect all adjustments, consisting only of normal recurring adjustments, necessary for a fair presentation of our financial position and results of operations for these periods. These unaudited consolidated financial statements are also included in this prospectus. Results for the six-month period ended June 30, 2000 are not necessarily indicative of results that may be expected for the entire year. You should read our selected consolidated financial data set forth below together with "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our historical consolidated financial statements and notes to those statements appearing elsewhere in this prospectus.

Orient-Express Hotels has been accounted for as a separate division of Sea Containers, with each hotel and leisure business subsidiary being consolidated to provide the divisional accounts, to which we add our directly incurred central overheads and costs paid for under the services agreement with Sea Containers. No material assumptions or allocations have been made to present our consolidated financial position, results of operations or cash flows as each of our subsidiaries produces separate stand-alone accounts.

The historical financial information below may not give an accurate indication of our future performance and does not reflect what our financial position and results of operations would have been had we operated as a separate, stand-alone entity during the periods presented.

6

Orient-Express Hotels Ltd. and Subsidiaries

| |

Six months ended June 30, |

Year ended December 31, |

||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2000 |

1999 |

1999 |

1998 |

1997 |

1996 |

1995 |

|||||||||||||||||

| |

(In millions except ratios and per share amounts) |

|||||||||||||||||||||||

| Income statement data: | ||||||||||||||||||||||||

| Revenues: | ||||||||||||||||||||||||

| Revenue | $ | 126.3 | $ | 114.1 | $ | 242.1 | $ | 225.8 | $ | 194.7 | $ | 166.3 | $ | 121.4 | ||||||||||

| Earnings from unconsolidated companies | 6.5 | 5.2 | 7.0 | 5.1 | 4.0 | 3.2 | 0.8 | |||||||||||||||||

| Gains on sale of assets and other | — | 1.3 | 3.8 | — | 5.0 | — | — | |||||||||||||||||

| Expenses: | ||||||||||||||||||||||||

| Depreciation and amortization | 7.4 | 6.5 | 13.2 | 14.2 | 13.1 | 10.8 | 8.2 | |||||||||||||||||

| Operating | 59.2 | 55.8 | 111.4 | 105.3 | 92.2 | 81.9 | 59.6 | |||||||||||||||||

| Selling, general and administrative | 34.7 | 30.8 | 66.1 | 64.5 | 54.8 | 49.4 | 39.2 | |||||||||||||||||

| Earnings from operations before net finance costs | 31.5 | 27.5 | 62.2 | 46.9 | 43.6 | 27.4 | 15.2 | |||||||||||||||||

| Net finance costs | 11.6 | 9.6 | 19.0 | 16.5 | 12.4 | 9.2 | 8.0 | |||||||||||||||||

| Earnings before income taxes and cumulative effect of change in accounting principle | 19.9 | 17.9 | 43.2 | 30.4 | 31.2 | 18.2 | 7.2 | |||||||||||||||||

| Provision for income taxes | 2.4 | 2.1 | 5.2 | 3.7 | 3.2 | 1.7 | 0.3 | |||||||||||||||||

| Earnings before cumulative effect of change in accounting principle |

17.5 | 15.8 | 38.0 | 26.7 | 28.0 | 16.5 | 6.9 | |||||||||||||||||

| Cumulative effect of change in accounting principle(1) | — | (3.0 | ) | (3.0 | ) | — | — | — | — | |||||||||||||||

| Net earnings | $ | 17.5 | $ | 12.8 | $ | 35.0 | $ | 26.7 | $ | 28.0 | $ | 16.5 | $ | 6.9 | ||||||||||

| Net earnings per share: | ||||||||||||||||||||||||

| Basic: | ||||||||||||||||||||||||

| Earnings before cumulative effect of change in accounting principle |

$ | 0.67 | $ | 0.61 | $ | 1.47 | $ | 1.03 | $ | 1.08 | $ | 0.64 | $ | 0.27 | ||||||||||

| Cumulative effect of change in accounting principle | — | (0.12 | ) | (0.12 | ) | — | — | — | — | |||||||||||||||

| Net earnings per share | $ | 0.67 | $ | 0.49 | $ | 1.35 | $ | 1.03 | $ | 1.08 | $ | 0.64 | $ | 0.27 | ||||||||||

| Weighted average number of shares | 25.9 | 25.9 | 25.9 | 25.9 | 25.9 | 25.9 | 25.9 | |||||||||||||||||

| Balance sheet data (at end of period): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

| Cash | $ | 11.0 | 12.0 | $ | 11.1 | $ | 12.4 | $ | 11.3 | $ | 9.6 | $ | 12.1 | |||||||||||

| Total assets | 712.9 | 644.1 | 661.9 | 602.5 | 496.0 | 472.2 | 369.2 | |||||||||||||||||

| Long-term debt (including current portion) | 377.3 | 288.6 | 310.0 | 279.1 | 206.1 | 187.4 | 132.9 | |||||||||||||||||

| Total shareholders' equity | 268.5 | 290.9 | 292.3 | 266.0 | 250.4 | 243.4 | 188.9 | |||||||||||||||||

| Other financial data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

| Cash flows provided by (used in): | ||||||||||||||||||||||||

| Operating activities | 22.3 | 27.7 | 42.3 | 39.4 | 40.8 | 16.2 | 27.6 | |||||||||||||||||

| Investing activities | (64.3 | ) | (69.4 | ) | (89.9 | ) | (94.4 | ) | (41.8 | ) | (84.8 | ) | (74.0 | ) | ||||||||||

| Financing activities | 42.1 | 43.3 | 48.5 | 56.5 | 3.1 | 66.2 | 52.2 | |||||||||||||||||

| Capital expenditures (excluding acquisitions) | (22.3 | ) | (37.7 | ) | (44.3 | ) | (43.5 | ) | (49.7 | ) | (47.4 | ) | (35.9 | ) | ||||||||||

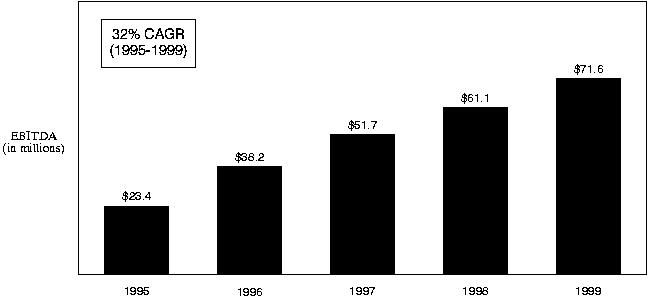

| EBITDA(2) | 38.9 | 34.0 | 75.4 | 61.1 | 56.7 | 38.2 | 23.4 | |||||||||||||||||

| EBITDA margin (% of total revenues) | 29% | 28% | 30% | 26% | 28% | 23% | 19% | |||||||||||||||||

| Ratio of earnings to fixed charges(3) | 2.5x | 2.6x | 2.9x | 2.6x | 2.9x | 2.1x | 1.4x | |||||||||||||||||

7

You should carefully consider the risks described below and the other information contained in this prospectus before making a decision to purchase our class A common shares.

If any event arising from these risks occurs, our business, prospects, financial condition, results of operations or cash flows could be materially adversely affected. In such case, the market price of our class A common shares could decline.

Risks Relating to Our Business

Our operations are subject to adverse factors generally encountered in the hospitality industry.

Besides the specific conditions discussed in the risk factors below, these factors include

The effect of these factors varies among our hotels and other properties because of their geographic diversity.

The hospitality industry is highly competitive, both for acquisitions of new hotels and restaurants and for customers for our properties.

We compete for hotel and restaurant acquisition opportunities with others who have substantially greater financial resources than we do. This competition may have the effect of reducing the number of suitable investment opportunities offered to us and increasing our acquisition costs by enhancing the bargaining power of property owners seeking to sell or to enter into management agreements.

Some of our properties—for example, the Windsor Court Hotel—are located in areas where there are numerous competitors, many of which have substantially greater resources than Orient-Express Hotels. Competitive factors in the hospitality industry include convenience of location, the quality of the property, pricing, range and quality of food services and amenities offered, and name recognition. Demographic, geographic or other changes in one or more of our markets could impact the convenience or desirability of our hotels and restaurants, and so could adversely affect their operations. Also, new or existing competitors could significantly lower rates or offer greater conveniences, services or amenities or significantly expand, improve or introduce new facilities in markets in which our hotels and restaurants compete. See "Our Business—Competition."

The hospitality industry is heavily regulated, including with respect to food and beverage sales, employee relations, construction and environmental concerns, and compliance with these laws could reduce revenues and profits of properties owned or managed by Orient-Express Hotels.

Orient-Express Hotels and its various properties are subject worldwide to numerous laws, including those relating to the preparation and sale of food and beverages, such as health and liquor license laws. Our properties are also subject to laws governing our relationship with our employees in such areas as minimum wage and maximum working hours, overtime, working conditions, hiring and firing employees and work permits. Also, the success of our strategy to expand our existing properties may be dependent

8

upon our obtaining necessary building permits or zoning variances from local authorities. We have applications pending for various types of governmental permits to expand many of our properties, such as the Villa San Michele, Hotel Quinta do Lago and Keswick Hall. The failure to obtain any of these permits could adversely affect our strategy of increasing revenues and net income through expansion of our existing properties. For example, 14 new rooms currently under construction at the Lapa Palace Hotel are now expected to open about three months later than originally scheduled due to a delay in receiving the required permits. This delay in itself did not have a material adverse effect on Orient-Express Hotels; however, given the increase in expansion construction spending that we anticipate, similar delays at a number of our properties could have a material adverse impact in the aggregate.

Orient-Express Hotels also is subject to foreign and U.S. federal, state and local laws and regulations relating to the environment and the handling of hazardous substances which may impose or create significant potential environmental liabilities, even in situations where the environmental problem or violation occurred on a property before we acquired it.

Our acquisition, expansion and development strategy may be less successful than we expect, and therefore, our growth may be limited.

We intend to increase our revenues and net income through acquisitions of new properties and expansion of our existing properties. Our ability to pursue new growth opportunities successfully will depend on our ability to identify properties suitable for acquisition and expansion, to negotiate purchases or construction on satisfactory terms, to obtain the necessary financing and permits and to integrate new properties into our operations. Also, our acquisition of properties in new locations may present operating and marketing challenges that are different from those we currently encounter in our existing locations. We cannot assure you that we will succeed in our growth strategy.

We may develop new properties in the future. New project development is subject to such adverse factors as market or site deterioration after acquisition, inclement weather, labor or material shortages, work stoppages and the continued availability of construction and permanent financing. For example, the opening of the Westcliff Hotel occurred about six months later than originally planned as construction took longer than expected. This delay had a significant adverse impact on the revenues and profitability of our African operations.

We cannot be sure that we will obtain the necessary additional capital to finance the growth of our business.

The acquisition and expansion of leisure properties, as well as the ongoing renovations, refurbishments and improvements required to maintain or upgrade our existing properties, are capital intensive. Our current expansion plans call for the expenditure of up to an aggregate of $150 million over the next three years to add new rooms and/or facilities to our existing properties, and our current acquisition plans call for the expenditure of about $80 million per year for new properties, which would be financed by a suitable level of mortgage debt. The availability of future borrowings and access to the capital markets for equity financing to fund these acquisitions and expansions depends on prevailing market conditions and the acceptability of financing terms offered to us. We cannot assure you that future borrowings or equity financing will be available to us, or available on acceptable terms, in an amount sufficient to fund our needs. Future equity financings would be dilutive to the existing holders of our common shares. Future debt financings could involve restrictive covenants which would limit our flexibility in operating our business.

Currency fluctuations may have a material adverse effect on our financial statements and/or our operating margins.

Seven of our owned hotels operate in currencies linked to the European euro, two operate in South African rand, two operate in Australian dollars, one operates in Botswanan pula, and one operates in Brazilian reais. The remaining owned hotels operate in U.S. dollars. The operating results

9

of all these hotels are set out in the tables on pages 52 through 54, including the average daily rate in the relevant operating currency. The Venice Simplon-Orient-Express and British Pullman tourist trains operate primarily in British pounds sterling and currencies linked to the European euro.

Our financial statements, which are presented in U.S. dollars, can be impacted by foreign exchange fluctuations through both

With respect to translation risk, even though the fluctuations of currencies against the U.S. dollar can be substantial and therefore significantly impact comparisons with prior periods, the translation impact is a reporting consideration and does not affect the underlying results of operations, as transaction risk does. As far as we can, we match foreign currency revenues and costs and assets and liabilities to provide a natural hedge against translation risks although this is not a perfect hedge.

Our substantial indebtedness could adversely affect our financial health.

Orient-Express Hotels and its subsidiaries have a significant amount of debt and may incur additional debt from time to time. As of June 30, 2000, our consolidated long-term indebtedness was $377.3 million. Approximately $95 million of the net proceeds to Orient-Express Hotels in this offering will go to the repayment of debt. Our substantial indebtedness could

Also, since about 99% of our consolidated long-term debt at June 30, 2000 accrued interest at rates that fluctuate with prevailing interest rates, any increases in prevailing interest rates may increase our interest payment obligations. From time to time we enter into hedging transactions in order to manage our floating interest-rate exposure although no hedging contract is currently outstanding.

Covenants in our financing agreements could limit our discretion in operating our businesses, causing us to make less advantageous business decisions; our indebtedness is secured by substantially all of our properties.

Our financing agreements with about 20 commercial bank lenders contain covenants which include limits on additional debt secured by mortgaged properties, limits on liens on property, and limits on mergers and asset sales. Our indebtedness is also secured by substantially all of our properties. Future financing agreements may contain similar, or even more restrictive, provisions and covenants. If Orient-Express Hotels fails to comply with the restrictions in its present or future financing agreements, a default may occur. A default could allow the creditors to accelerate the related debt as well as any

10

other debt to which a cross-acceleration or cross-default provision applies. A default could also allow the creditors to foreclose on the properties securing such debt.

Our operations may be adversely affected by extreme weather conditions and the impact of natural disasters.

We operate properties in a variety of locales, each of which is subject to local weather patterns and their effects on our properties as well as on customer travel. Since our revenues are dependent on the revenues of individual properties, extreme weather conditions can from time to time have a major adverse impact upon individual properties or particular regions. For example, in November 1999 a major hurricane passed over St. Martin where our La Samanna hotel is located, resulting in the closing of the hotel until February 2000 so that we missed much of the high season.

Our properties are also vulnerable to the effects of destructive forces, such as fire, storms and flooding. Although our properties are insured against property damage, damages resulting from acts of God or otherwise may exceed the limits of our insurance coverage or be outside the scope of that coverage. Our La Samanna hotel, for example, suffered substantial wind and flooding damage during the 1999 hurricane. Although we were fully insured for such damage, we may face losses with other natural disasters affecting our properties in the future.

If our relationships with our employees were to deteriorate, we may be faced with labor shortages or stoppages, which would adversely affect our ability to operate our facilities.

Our relations with our employees in various countries, including the approximately 2,000 employees represented by labor unions, could deteriorate due to disputes related to, among other things, wage or benefit levels or our response to changes in government regulation of workers and the workplace. Our operations rely heavily on our employees' providing high-quality personal service, and any labor shortage or stoppage caused by poor relations with employees, including labor unions, could adversely affect our ability to provide those services, which could reduce occupancy and room revenue and even tarnish our reputation.

Risks Relating to Our Relationship with and Separation from Sea Containers

A default under Sea Containers' debt instruments could trigger a default under some of Orient-Express Hotels' loan agreements.

A default under Sea Containers' public debt indentures or loan agreements could result in a default under some Orient-Express Hotels' loan agreements which contain cross-default provisions to debt of Sea Containers. Also, a default under the financial covenants contained in Sea Containers' credit facilities could result in a default under some Orient-Express Hotels loan agreements guaranteed by Sea Containers. Any default under loan agreements of Orient-Express Hotels triggered by a default under Sea Containers' debt instruments could also result in cross defaults to other loan agreements which Orient-Express Hotels may enter into in the future. In addition, a default under Orient-Express Hotels' loan agreements could lead to foreclosure and loss of control of the properties securing these loan agreements.

Orient-Express Hotels' loan agreements that finance the Hotel Cipriani, Villa San Michele, Hotel Splendido, Observatory Hotel, Lilianfels Hotel, Charleston Place, Venice Simplon-Orient-Express, Eastern & Oriental Express and our 50% interest in the joint venture for the two hotels in Peru contain cross-default provisions to debt of Sea Containers. As a consequence, a default under Sea Containers' public debt indentures or loan agreements could result in a default under these Orient-Express Hotels loan agreements. As of June 30, 2000, about $182 million was outstanding under these facilities, of which approximately $128 million was included in the consolidated long-term debt of Orient-Express Hotels since it was debt of consolidated subsidiaries, and approximately $54 million was not included in consolidated debt since it was debt of companies which are not consolidated. Orient-

11

Express Hotels will seek to amend these loan agreements in connection with the spinoff distribution to remove these cross-default provisions but cannot assure you that we will be able to do so. We do not intend to enter into loan agreements in the future with provisions containing cross-defaults to Sea Containers' debt.

Sea Containers has guaranteed a number of loans made by various commercial banks to Orient-Express Hotels. As of June 30, 2000, approximately $330 million was outstanding under Orient-Express Hotels loans guaranteed by Sea Containers, including about $9 million of loans to unconsolidated companies. Approximately $35 million of these guaranteed loans represented loans that finance the '21' Club, Keswick Hall, the Inn at Perry Cabin and our 50% interest in the Peruvian hotels joint venture. The guarantees of the $35 million of loans contain some of the financial covenants found in Sea Containers' credit facilities. As a consequence, a default under the financial covenants in Sea Containers' credit facilities could result in a default under these Orient-Express Hotels loan agreements. The loans for the '21' Club, Keswick Hall and the Inn at Perry Cabin will be repaid out of the net proceeds of this offering, leaving the $5 million loan outstanding on June 30, 2000 for our Peruvian hotels joint venture as the only loan with a guarantee containing Sea Containers financial covenants. Orient-Express Hotels will seek to amend this loan, as well as other loans guaranteed by Sea Containers, to remove the Sea Containers guarantee but we cannot assure you that we will be able to do so. We do not intend to enter into loan agreements guaranteed by Sea Containers in the future.

Some holders of Sea Containers' publicly held notes have begun a lawsuit in which they allege that this offering and the spinoff distribution will cause defaults under those notes and they seek damages and injunctive relief; a court injunction could delay or prevent the spinoff, and a determination of default could trigger defaults under Orient-Express Hotels' loan agreements.

On August 4, 2000, a group of institutional investors which in the aggregate claim to own, and/or to be investment advisors to accounts that own, approximately $158 million of the $430 million aggregate outstanding principal amount of Sea Containers' four series of publicly held senior notes commenced a lawsuit in the Supreme Court of New York, County of New York. The defendants named in this action are Sea Containers, Orient-Express Hotels, James B. Sherwood, who is the President of Sea Containers and the Chairman of Orient-Express Hotels, and United States Trust Company of New York, as trustee of the four series of senior notes. The plaintiffs allege that this offering and the proposed spinoff distribution will violate covenants in the senior note indentures, including covenants which restrict the ability of Sea Containers and its subsidiaries to pay dividends and make other distribution to shareholders, to dispose of their assets, and to enter into transactions with affiliates of Sea Containers, and will also constitute a fraudulent conveyance.

The plaintiffs are seeking, among other things,

12

Sea Containers has been advised by its counsel, Carter, Ledyard & Milburn, that this offering will not violate the indentures. Also, management of Sea Containers intends to effect the spinoff distribution in a manner which will not result in any violation of the indenture covenants or in a fraudulent conveyance. Accordingly, management of Sea Containers has concluded that the allegations of the senior noteholders are without merit, and that Sea Containers will oppose this lawsuit vigorously. However, a court injunction could delay or prevent the spinoff distribution. Also, a declaratory judgment by a court of a default under these Sea Containers indentures would require that Sea Containers repay the $430 million principal amount of the senior notes and any accrued and unpaid interest on the notes, and could cause a default under Orient-Express Hotels' financings which contain cross-default provisions or have guarantees by Sea Containers which contain Sea Containers' financial covenants. At June 30, 2000, about $182 million was outstanding under Orient-Express Hotels' loan agreements which contain cross-default provisions to debt of Sea Containers, and $35 million was outstanding under Orient-Express Hotels' loan agreements guaranteed by Sea Containers where the guarantees contain Sea Containers' financial covenants. Of such $35 million of guaranteed debt, $30 million will be repaid out of the net proceeds of this offering. In the event debt of Orient-Express Hotels defaults as a result of a default on Sea Containers' debt, Orient-Express Hotels will have to seek waivers from its lenders or refinance the defaulted debt. Orient-Express Hotels may be unable to do so or may only be able to do so on terms less favorable to it than currently are contained in its loan agreements.

In order to protect Orient-Express Hotels, Sea Containers has agreed to indemnify Orient-Express Hotels with respect to losses arising from this offering or the spinoff distribution as a result of any declaration of default or proceeding brought by holders of Sea Containers' public debt within one year after August 1, 2000, including the above-mentioned lawsuit. There is no assurance though that this indemnity will be available when needed or that it will fully compensate for losses incurred by Orient-Express Hotels.

Our share price may be adversely affected due to the limited liquidity of our shares in the market if Sea Containers does not complete its separation from us.

Sea Containers currently intends to distribute to its shareholders, approximately six months after this offering, all of our class A common shares that it owns after this offering and the class B common shares that are not distributed to Orient-Express Hotels' subsidiaries, subject to the receipt by Sea Containers of all necessary consents and approvals from its board of directors, shareholders, lenders and others, and the delivery to Sea Containers of a favorable tax opinion. Sea Containers is not obligated to make this distribution, and the distribution may not occur in six months or at all. A claim by bondholders under the public debt indentures of Sea Containers, as noted above, that the distribution is a default under those public debt indentures could delay or even prevent the distribution from occurring. If the distribution is delayed or not completed at all, the liquidity of our shares in the market will continue to be limited unless and until Sea Containers elects to sell some or all of its significant ownership.

Substantial sales of class A common shares may occur whether or not the distribution occurs, which sales could cause our stock price to decline.

If Sea Containers does distribute all of our class A common shares that it owns after this offering to its shareholders as described in the preceding paragraph, those shareholders who are not affiliates of Orient-Express Hotels will be able to sell those class A common shares without restriction. We are unable to predict whether significant amounts of our class A common shares will be sold in the open market following this distribution. Also, if the distribution is delayed or does not occur, Sea Containers may determine to sell our class A or class B common shares, other than the shares deemed owned by our subsidiaries. Any sales of substantial amounts of our common shares in the public market, or the

13

perception that such sales might occur, could adversely affect the market price of our class A common shares.

Before our separation from Sea Containers, we will be controlled by Sea Containers as long as it continues to own a substantial number of our class B common shares.

After the completion of this offering and prior to our separation from Sea Containers in the proposed distribution or otherwise, Sea Containers will own directly, or indirectly through subsidiaries, approximately 65% of our class A common shares and all of our class B common shares, together representing about 96% of the combined voting power for most matters that may be submitted to a vote of our shareholders, or 95% if the underwriters exercise their over-allotment options in full. As a result, until Sea Containers distributes these shares to its shareholders, or otherwise disposes of them, it will continue to be able to elect our entire board of directors and to remove any director, with or without cause, without calling a special meeting, and Sea Containers will control all matters affecting Orient-Express Hotels, including

After our separation from Sea Containers, our directors and officers may control the outcome of most matters submitted to a vote of our shareholders.

If Sea Containers distributes to its shareholders our class A and class B common shares which it owns, or otherwise disposes of them, subsidiaries of Orient-Express Hotels, together with the directors and executive officers of Orient-Express Hotels, will hold 19,407,882 class B common shares, representing about 83% of the combined voting power for most matters submitted to a vote of our shareholders. In general, holders of our class A common shares and holders of our class B common shares vote together as a single class, with holders of class A common shares having one-tenth of one vote per share and holders of class B common shares having one vote per share. Therefore, so long as the number of outstanding class B shares exceeds one-tenth the number of outstanding class A common shares, the holders of class B common shares could control the outcome of most matters submitted to a vote of the shareholders. Under Bermuda law, common shares of Orient-Express Hotels owned by its subsidiaries, representing approximately 77% of such combined voting power, will be deemed to be outstanding and may be voted by those subsidiaries. The manner in which the subsidiaries vote their common shares will be determined by the respective directors of those subsidiaries, many of whom are also directors or officers of Orient-Express Hotels, consistently with the exercise by those directors of their fiduciary duties to the subsidiaries. Those directors, should they choose to act together, will be able to control substantially all matters affecting Orient-Express Hotels, including those listed in the preceding paragraph, and to block a number of matters relating to any potential change of control of Orient-Express Hotels. See "Description of Common Shares—Voting Rights."

14

Sea Containers will be transferring its leisure assets to us without any representations, warranties or indemnity, and so we will not have any recourse to Sea Containers if there is any deficiency or other liability.

Under the terms of a restructuring agreement among Sea Containers, Orient-Express Hotels and various subsidiaries of each, Sea Containers will be transferring to us all of the assets and liabilities relating to its hotel and leisure business segment which Orient-Express Hotels does not currently own. Such assets and liabilities are being transferred without any representations or warranties being made by Sea Containers, including as to value, the existence of any liens or encumbrances or the legal sufficiency of any conveyance of title. Sea Containers will also not be providing any indemnity relating to the assets transferred or any related liability. A transferor in an arm's-length transaction would customarily make these representations and warranties and provide some form of indemnity. In the absence of these, we will not have any recourse to Sea Containers in the event of any deficiency or other liability.

Covenants in Sea Containers' financing agreements could prevent Sea Containers from making business decisions which may otherwise be advantageous to Orient-Express Hotels.

Sea Containers is the borrower under financing agreements which contain covenants limiting the actions which Sea Containers may take, or permit a material subsidiary such as Orient-Express Hotels to take. Orient-Express Hotels will continue to be a material subsidiary for purposes of these covenants after this offering so long as it remains majority-owned by Sea Containers. These covenants include limitations on dividends, limitations on incurring indebtedness, limitations on transactions with affiliates, limitations on the ability of subsidiaries, such as Orient-Express Hotels, to impose restrictions on their payment of dividends or distributions or loans to Sea Containers, limitations on merger and asset sales and limitations on liens. Sea Containers' financing agreements also impose financial covenants on Sea Containers measured on a consolidated basis with its subsidiaries, including Orient-Express Hotels.

Sea Containers' decisions with respect to Orient-Express Hotels may be affected by its having to remain in compliance with these covenants and other requirements. This may adversely affect Orient-Express Hotels' financial and operational flexibility.

Shares of Companhia Hoteis Palace, which owns the Copacabana Palace Hotel, are pledged as collateral for a loan to Orient-Express Hotels but continue to be owned by Sea Containers; should Sea Containers fail to transfer these shares to Orient-Express Hotels, this would result in a default under the loan which could lead to foreclosure and loss of control of the hotel.

To finance capital expenditures at the Copacabana Palace Hotel, Sea Containers borrowed $35 million which was secured by Sea Containers' shares of Companhia Hoteis Palace, the subsidiary which owns the hotel. This loan is included in Orient-Express Hotels' $377.3 million consolidated long-term debt at June 30, 2000, as Orient-Express Hotels used all proceeds of the loan. The lender under such loan has entered into an agreement with Sea Containers and Orient-Express Hotels under which Sea Containers will transfer its shares in Companhia Hoteis Palace to Orient-Express Hotels, and Orient-Express Hotels has entered into a new $35 million loan to substitute for the loan to Sea Containers. However, until such shares are actually transferred, the Copacabana Palace Hotel will continue to be owned by Sea Containers. If the shares are not transferred to Orient-Express Hotels on or before September 15, 2000 the loan would be in default which could lead to foreclosure and loss of control of the hotel.

We will not be able to rely on Sea Containers to fund our future capital requirements, and financing from other sources may not be available on as favorable terms or at all.

In the past, a significant portion of our capital needs have been satisfied by Sea Containers. However, following our separation, Sea Containers will no longer provide funds to finance our working

15

capital or other cash requirements although it will continue to guarantee some of our existing bank debt. We cannot assure you that financing from other sources, if needed, will be available at all or on terms as favorable as those we obtained as part of Sea Containers.

Some of our directors and executive officers may have conflicts of interest because of their ownership of Sea Containers class A and class B common shares or their positions at Sea Containers.

Some of our directors and executive officers—James B. Sherwood, Simon M.C. Sherwood, John D. Campbell, Daniel J. O'Sullivan and Edwin S. Hetherington—hold Sea Containers class A and class B common shares and options to purchase Sea Containers class A and class B common shares. See "Security Ownership of Sea Containers' Principal Shareholders and Management" elsewhere in this prospectus. Also, after the completion of this offering, these persons other than Simon M.C. Sherwood will continue to be executive officers or directors of Sea Containers. Ownership of Sea Containers class A and class B common shares by our directors and officers, or their positions as executive officers or directors of Sea Containers, could create, or appear to create, potential conflicts of interest when directors and officers are faced with decisions that could have different implications for Sea Containers and us. We currently do not have any internal controls or procedures in place for resolving these conflicts.

James B. Sherwood, our Chairman of the board of directors and the President of Sea Containers, has an option to purchase the Hotel Cipriani in Venice from us at its fair market value if a change of control of Sea Containers occurs prior to the distribution, or a change in control of Orient-Express Hotels occurs after the distribution. See "Management—Interests of Management in Certain Transactions."

The agreements between Orient-Express Hotels and Sea Containers that detail their separation and their interim and ongoing relationships were not the result of arm's length negotiations.

Sea Containers has agreed to provide services to Orient-Express Hotels such as financial, legal, accounting, corporate executive, public company, human resources administration, insurance, pension benefits, office facilities and information technology. Also, Sea Containers has agreed to provide Orient-Express Hotels with office space in New York, London and elsewhere. These agreements were made in the context of the parent-subsidiary relationship, were negotiated in the overall context of our separation from Sea Containers and were not the result of arm's length negotiations, and we cannot assure you that they are on terms comparable to those we could have obtained from unaffiliated third parties. These agreements are for a one-year period renewable annually thereafter.

Other Risks Relating to Ownership of Our Class A Common Shares

Our shares have no market, and we cannot assure you that our share price will not decline after this offering.

Before this offering, there has been no public market for our class A common shares. An active public market for our class A common shares may not develop or be sustained after this offering. The market price of our class A common shares could be subject to significant fluctuations after this offering.

The stock markets in general have experienced extreme volatility that has often been unrelated to the operating performance of particular companies. These broad market fluctuations may adversely affect the trading price of our class A common shares. In particular, we cannot assure you that you will be able to resell your shares at or above the initial public offering price, which will be determined by negotiations between the representatives of the underwriters and us.

16

Provisions in our charter documents may discourage potential acquisitions of Orient-Express Hotels, even those which the holders of a majority of our class A common shares might favor.

Our memorandum of association and bye-laws contain provisions that could make it harder for a third party to acquire us without the consent of our board of directors. These provisions include

Also, our board of directors has the right under Bermuda law to issue preferred shares without shareholder approval, which could be done to dilute the stock ownership of a potential hostile acquirer. Although we believe these provisions provide for an opportunity to receive a higher bid by requiring potential acquirers to negotiate with our board of directors, these provisions apply even if the offer may be considered beneficial by many shareholders.

These provisions are in addition to the ability of our subsidiaries and directors and officers to vote shares representing a significant majority of the total voting power of our common shares following the proposed distribution by Sea Containers of our shares which it currently holds. See "Description of Common Shares—Voting Rights." Also, the rights to purchase series A junior preferred shares, one of which is attached to each class A and class B common share, may have antitakeover effects. See "Description of Common Shares—Shareholder Rights Agreement."

You may not receive cash dividends on our shares.

We intend to retain our earnings to finance the development and expansion of our business and have not yet decided on a dividend policy. Also, our ability to declare and pay cash dividends on our shares is restricted by covenants in our credit facilities. As a result, capital appreciation, if any, of our shares may be your sole source of gain for the foreseeable future.

Purchasers in this offering will experience immediate dilution in net tangible book value per share.

Purchasers of our class A common shares in this offering will experience immediate dilution of $10.57 in net tangible book value per share. See "Dilution."

We cannot assure you that a judgment of a United States court for liabilities under U.S. securities laws would be enforceable in Bermuda, or that an original action can be brought in Bermuda against Orient-Express Hotels for liabilities under U.S. securities laws.

Orient-Express Hotels is a Bermuda company, a majority of its directors and officers are residents of Bermuda, the United Kingdom and elsewhere outside the United States, and most of its assets and the assets of its directors and officers are located outside the United States. As a result, it may be difficult for you to

Orient-Express Hotels has been advised by its Bermuda counsel, Appleby Spurling & Kempe, that there is doubt as to

17

This prospectus contains forward-looking statements, including statements regarding matters such as

We have based these forward-looking statements largely on our expectations as well as assumptions we have made and information currently available to our management. When used in this prospectus, the words "anticipate," "believe," "estimate," "expect" and similar expressions, as they relate to Orient-Express Hotels or its management, are intended to identify forward-looking statements. Forward-looking statements are subject to a number of risks and uncertainties, some of which are beyond our control. Our actual results could differ materially from those anticipated, because of the factors described in the "Risk Factors" section and elsewhere in this prospectus, and other factors. Furthermore, in light of these risks and uncertainties, the forward-looking events and circumstances discussed in this prospectus might not transpire.

We undertake no obligation to update publicly or revise any forward-looking statements after the completion of this offering, whether as a result of new information, future events or otherwise, unless a statement is revealed by subsequently discovered information to have been unreasonable or inaccurate at the time made.

We estimate that Orient-Express Hotels and Sea Containers will each receive net proceeds from this offering of approximately $100 million, based on an estimated initial public offering price of $21.50 per share and after deducting the underwriting discount and estimated offering expenses.

We intend to use approximately $95 million of the proceeds of this offering to repay existing indebtedness of Orient-Express Hotels bearing interest at a weighted average rate of approximately 8.8% per year and repayable on dates from 2002 to 2004. The lenders being repaid are Bank of Nova Scotia, as agent for a group of commercial banks, First Union National Bank and Bank of America N.A. This indebtedness is guaranteed by Sea Containers and secured by the Windsor Court Hotel, La Samanna, Keswick Hall, the Inn at Perry Cabin and the '21' Club. These properties will then be available to secure future borrowings. See "Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Liquidity."

The balance of the proceeds to Orient-Express Hotels will be used for working capital and general corporate purposes, which may include repayment of other debt.

Orient-Express Hotels will not receive any of the proceeds from the sale of shares in this offering by Sea Containers, which Sea Containers will use initially to repay its existing indebtedness.

We currently intend to retain any future earnings to fund the development and growth of our business. We have not yet established a dividend policy. Our future dividend policy will depend on our earnings, capital requirements and financial condition, the requirements of the financing agreements to which Orient-Express Hotels is a party, and other factors which our board of directors considers relevant. Also, covenants in our bank loan agreements limit our ability to declare and pay cash dividends on our class A common shares.

18

The following table sets forth our capitalization as of June 30, 2000,

You should read this table together with "Selected Consolidated Financial Data," our historical consolidated financial statements and the notes to those statements and "Management's Discussion and Analysis of Financial Condition and Results of Operations" included elsewhere in this prospectus.

| |

June 30, 2000 |

||||||||

|---|---|---|---|---|---|---|---|---|---|

| |

Actual |

As adjusted |

|||||||

| |

(in thousands) |

||||||||

| Cash | $ | 10,978 | $ | 15,978 | |||||

| Working capital facilities | $ | 7,601 | $ | 7,601 | |||||

| Long term debt (including current portion) | 377,315 | 282,315 | |||||||

| 384,916 | 289,916 | ||||||||

| Shareholders' equity: |

|

|

|

|

|

|

|

||

| Class A common shares | 234 | 284 | |||||||

| Class B common shares | 205 | 205 | |||||||

| Additional paid-in capital | 135,940 | 235,890 | |||||||

| Retained earnings | 150,910 | 150,910 | |||||||

| Accumulated other comprehensive loss | (18,656 | ) | (18,656 | ) | |||||

| Acquired shares | (181 | ) | (181 | ) | |||||

| Total shareholders' equity | 268,452 | 368,452 | |||||||

| Total capitalization | $ | 653,368 | $ | 658,368 | |||||

19

Our net tangible book value at June 30, 2000, was approximately $237.8 million, or $9.18 per class A and class B common share. Net tangible book value per share is determined by dividing our tangible net worth, which is total tangible assets less total liabilities, by the number of class A and class B common shares outstanding immediately before this offering. Dilution in our net tangible book value per share represents the difference between the amount per share paid by purchasers of our class A common shares in this offering and our net tangible book value per share of our common shares on a pro forma basis immediately afterwards. After giving effect to the sale of 10,000,000 class A common shares in this offering at an assumed initial public offering price of $21.50 per share, the midpoint of the initial public offering price range set forth on the front cover of this prospectus, and after deducting estimated underwriting discounts and offering expenses payable by Orient-Express Hotels of $7.5 million and applying the net proceeds from this offering as described under "Use of Proceeds," our pro forma as adjusted net tangible book value at June 30, 2000, would have been approximately $337.8 million, or $10.93 per share. This represents an immediate increase in pro forma net tangible book value of $1.75 per share to Sea Containers as our existing shareholder and an immediate dilution in pro forma net tangible book value of $10.57 per share to new investors purchasing class A common shares in this offering. The following table illustrates this dilution per share, without giving effect to the exercise of the underwriters' over-allotment options:

| Assumed initial public offering price per share | $ | 21.50 | ||||

| Net tangible book value per share as of June 30, 2000 |

$ | 9.18 | ||||

| Pro forma increase in book value per share attributable to new investors in this offering |

1.75 | |||||

| Pro forma as adjusted net tangible book value per share after this offering |

10.93 | |||||

| Dilution per share to new investors | $ | 10.57 | ||||

To the extent that any shares are issued in connection with the underwriters' over-allotment options, there will be further dilution to new investors.

The following table sets forth, as of June 30, 2000, on the pro forma as adjusted basis described above, the differences between the number of class A common shares purchased from Orient-Express Hotels, the total price paid and average price per class A common share paid by Sea Containers, our sole existing shareholder, and by the new investors in this offering at the initial public offering price of $21.50 per share, before deducting the estimated underwriting discounts and commissions and offering expenses payable by us:

| |

Shares purchased |

Total consideration |

|

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Average price per share |

||||||||||||

| |

Number |

Percentage |

Amount |

Percentage |

|||||||||

| Sea Containers | 18,440,601 | 65 | % | -0- | — | — | |||||||

| New investors | 10,000,000 | 35 | % | $ | 215,000,000 | 100 | % | $ | 21.50 | ||||

| Total | 28,440,601 | 100 | % | $ | 215,000,000 | 100 | % | ||||||

No cash was paid by Sea Containers in consideration for our class A common shares. Accordingly, the cash consideration related to Sea Containers is reported as zero in the above table.

If the underwriters' option to purchase additional shares is exercised in full,

20

SELECTED CONSOLIDATED FINANCIAL DATA

The data presented in the following table as of December 31, 1999, 1998, 1997, 1996 and 1995 and for the years then ended are derived from our audited financial statements. The data for the years ended December 31, 1999, 1998 and 1997 and as of December 31, 1999 and 1998 are derived from our audited consolidated financial statements included in this prospectus which have been audited by Deloitte & Touche LLP, independent auditors, whose report is included elsewhere in this prospectus. The data for the six months ended June 30, 2000 and 1999, and as of June 30, 2000 and 1999, have been derived from the unaudited consolidated financial statements of Orient-Express Hotels which, in the opinion of management, have been prepared on the same basis as the audited financial statements and reflect all adjustments, consisting only of normal recurring adjustments necessary for a fair presentation of our financial position and results of operations for these periods. These unaudited consolidated financial statements are also included in this prospectus. Results for the six-month period ended June 30, 2000 are not necessarily indicative of results that may be expected for the entire year. You should read our selected consolidated financial data set forth below together with "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our historical consolidated financial statements and notes to those statements appearing elsewhere in this prospectus.

The historical financial information below may not give an accurate indication of our future performance and does not reflect what our financial position and results of operations would have been had we operated as a separate, stand-alone entity during the periods presented.

21

Orient-Express Hotels Ltd. and Subsidiaries

| |

Six months ended June 30, |

Year ended December 31, |

||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2000 |

1999 |

1999 |

1998 |

1997 |

1996 |

1995 |

|||||||||||||||||

| |

(In millions except ratios and per share amounts) |

|||||||||||||||||||||||

| Income statement data: | ||||||||||||||||||||||||

| Revenues: | ||||||||||||||||||||||||

| Revenue | $ | 126.3 | $ | 114.1 | $ | 242.1 | $ | 225.8 | $ | 194.7 | $ | 166.3 | $ | 121.4 | ||||||||||

| Earnings from unconsolidated companies | 6.5 | 5.2 | 7.0 | 5.1 | 4.0 | 3.2 | 0.8 | |||||||||||||||||

| Gains on sale of assets and other | — | 1.3 | 3.8 | — | 5.0 | — | — | |||||||||||||||||

| Expenses: | ||||||||||||||||||||||||

| Depreciation and amortization | 7.4 | 6.5 | 13.2 | 14.2 | 13.1 | 10.8 | 8.2 | |||||||||||||||||

| Operating | 59.2 | 55.8 | 111.4 | 105.3 | 92.2 | 81.9 | 59.6 | |||||||||||||||||

| Selling, general and administrative | 34.7 | 30.8 | 66.1 | 64.5 | 54.8 | 49.4 | 39.2 | |||||||||||||||||

| Earnings from operations before net finance costs | 31.5 | 27.5 | 62.2 | 46.9 | 43.6 | 27.4 | 15.2 | |||||||||||||||||