|

|

|

|

|

Previous: PNC MORTGAGE SECURITIES CORP MORT PASS THROU CERT SER 2000 6, 8-K, 2000-12-06 |

Next: NEW CERIDIAN CORP, 10-12B, EX-3.1, 2000-12-06 |

As filed with the Securities and Exchange Commission on December 6, 2000

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

PURSUANT TO SECTION 12(b) OR 12(g) OF THE

SECURITIES EXCHANGE ACT OF 1934

NEW CERIDIAN CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

41-1981625 (I.R.S. Employer Identification No.) |

3311 East Old Shakopee Road

Minneapolis, Minnesota 55425

(Address of principal executive offices) (Zip Code)

(952) 853-8100

(Issuer's telephone number, including area code)

Securities to be registered under Section 12(b) of the Act:

| Title of Each Class To Be So Registered |

Name of Each Exchange on Which Each Class is to be Registered |

|

|---|---|---|

| Common Stock, par value $.01 per share | The New York Stock Exchange |

Securities to be registered under Section 12(g) of the act:

None

INFORMATION REQUIRED IN REGISTRATION STATEMENT

ITEM 1. BUSINESS.

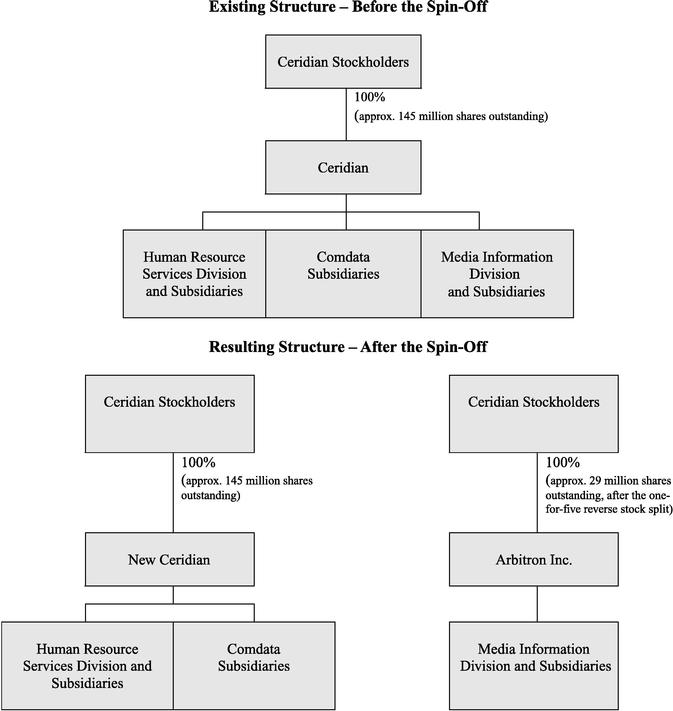

The registrant, New Ceridian Corporation, a Delaware corporation ("New Ceridian"), is a wholly owned subsidiary of Ceridian Corporation, a Delaware corporation ("Ceridian"). Ceridian will be renamed "Arbitron Inc." ("Arbitron") in connection with the spin-off of New Ceridian. Upon completion of the spin-off, New Ceridian will be renamed "Ceridian Corporation."

The information required by this item is contained in the sections entitled "Summary," "Risk Factors," "Business of New Ceridian" and "Where You Can Find More Information About New Ceridian" of the attached information statement.

ITEM 2. FINANCIAL INFORMATION.

The information required by this item is contained in the sections entitled "Summary," "Capitalization of New Ceridian (Accounting Successor to Ceridian)," "Selected Historical Consolidated Financial Data of Ceridian," "Unaudited Pro Forma Consolidated Financial Information of New Ceridian (Accounting Successor to Ceridian)" and "Management's Discussion and Analysis of Financial Condition and Results of Operations of Ceridian" of the attached information statement.

ITEM 3. PROPERTIES.

The information required by this item is contained in the section entitled "Business of New Ceridian—Facilities" of the attached information statement.

ITEM 4. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT.

The information required by this item is contained in the section entitled "New Ceridian Stock Ownership Information" of the attached information statement.

ITEM 5. DIRECTORS AND EXECUTIVE OFFICERS.

The information required by this item is contained in the sections entitled "Management of New Ceridian—Board of Directors" and "Management of New Ceridian—Executive Officers" of the attached information statement.

ITEM 6. EXECUTIVE COMPENSATION.

The information required by this item is contained in the sections entitled "Management of New Ceridian—Executive Compensation" and "Management of New Ceridian—Director Compensation" of the attached information statement.

ITEM 7. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS.

The information required by this item is contained in the sections entitled "Relationship Between New Ceridian and Arbitron After the Spin-Off" and "New Ceridian Related Party Relationships and Transactions" of the attached information statement.

ITEM 8. LEGAL PROCEEDINGS.

The information required by this item is contained in the section entitled "Business of New Ceridian—Legal Proceedings" of the attached information statement.

II-1

ITEM 9. MARKET PRICE OF AND DIVIDENDS ON THE REGISTRANT'S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS.

The information required by this item is contained in the sections entitled "The Spin-Off—Manner of Effecting the Spin-Off," "New Ceridian Stock Ownership Information" and "Description of New Ceridian Capital Stock" of the attached information statement.

ITEM 10. RECENT SALES OF UNREGISTERED SECURITIES TO BE REGISTERED.

On August 8, 2000, as part of its original incorporation, New Ceridian issued 1,000 shares of its common stock, for a total consideration of $10.00, to Ceridian, which is and will be the registrant's sole stockholder until the date of the distribution of New Ceridian common stock. Subsequent to the spin-off, Arbitron will hold no capital stock of the New Ceridian.

ITEM 11. DESCRIPTION OF REGISTRANT'S SECURITIES TO BE REGISTERED.

The information required by this item is contained in the section entitled "Description of New Ceridian Capital Stock" of the attached information statement.

ITEM 12. INDEMNIFICATION OF DIRECTORS AND OFFICERS.

The information required by this item is contained in the section entitled "Management of New Ceridian—Liability and Indemnification of Directors and Officers" of the attached information statement.

ITEM 13. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

The information required by this item is identified in the Index to New Ceridian Corporation Financial Statement and Index to Ceridian Corporation Consolidated Financial Statements of the attached information statement.

ITEM 14. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE.

None.

ITEM 15. FINANCIAL STATEMENTS AND EXHIBITS.

(a) Financial Statements

The following is a list of financial information included in the attached information statement and filed as a part of this registration statement on Form 10:

(1) Unaudited Pro Forma Consolidated Financial Information of New Ceridian (Accounting Successor to Ceridian) as of September 30, 2000, and for the nine months ended September 30, 2000 and for the year ended December 31, 1999;

(2) Unaudited Pro Forma Combined Financial Information of Arbitron as of September 30, 2000, and for the nine months ended September 30, 2000 and for the year ended December 31, 1999;

(3) Consolidated Financial Statements of Ceridian as of September 30, 2000 (unaudited), December 31, 1999 and 1998, and for the nine months ended September 30, 2000 and 1999 (unaudited) and the years ended December 31, 1999, 1998 and 1997;

(4) Balance Sheet of New Ceridian as of August 8, 2000;

(5) Combined Financial Statements of Arbitron as of September 30, 2000 (unaudited), December 31, 1999 and 1998, and for the nine months ended September 30, 2000 and 1999 (unaudited) and the years ended December 31, 1999, 1998 and 1997;

II-2

(6) Ceridian Corporation and Subsidiaries Schedule of Valuation and Qualifying Accounts with Independent Auditors' Report thereon for the years ended December 31, 1999, 1998 and 1997; and

(7) Arbitron Schedule of Valuation and Qualifying Accounts with Independent Auditors' Report thereon for the years ended December 31, 1999, 1998 and 1997.

(b) Exhibits

| Exhibit No. |

Description |

|

|---|---|---|

| 3.1 | Amended and Restated Certificate of Incorporation of New Ceridian (to be effective upon completion of the spin-off) | |

| 3.2 | Amended and Restated Bylaws of New Ceridian (to be effective upon completion of the spin-off) | |

| 10.1 | Form of Distribution Agreement between Ceridian and New Ceridian, to be adopted in connection with the spin-off | |

| 10.2 | Form of Personnel Agreement between Ceridian and New Ceridian, to be adopted in connection with the spin-off | |

| 10.3 | Form of Tax Matters Agreement between Ceridian and New Ceridian, to be adopted in connection with the spin-off | |

| 10.4 | Form of Transition Services Agreement between Ceridian and New Ceridian, to be adopted in connection with the spin-off | |

| 10.5 | Form of Sublease Agreement between Ceridian and New Ceridian, to be adopted in connection with the spin-off | |

| 10.6 | Form of 2001 Long-Term Stock Incentive Plan, to be adopted in connection with the spin-off | |

| 10.7 | Form of Employee Stock Purchase Plan, to be adopted in connection with the spin-off | |

| 10.8 | Form of 2001 Director Performance Incentive Plan, to be adopted in connection with the spin-off | |

| 10.9 | Form of Employment Agreement between New Ceridian and Ronald L. Turner | |

| 10.10 | Form of Employment Agreement between New Ceridian and John R. Eickhoff | |

| 10.11 | Form of Employment Agreement between New Ceridian and Tony G. Holcombe, Gary M. Nelson and Gary A. Krow | |

| 21.1 | Subsidiaries of New Ceridian | |

| 99.1 | Information Statement dated December 6, 2000 attached as Annex A to this registration statement | |

| 99.2 | Consent to be named as directors of New Ceridian for: Bruce R. Bond, William J. Cadogan, Nicholas D. Chabraja, Robert H. Ewald, Ronald T. LeMay, George R. Lewis, Ronald L. Turner, Carole J. Uhrich and Paul S. Walsh | |

| 99.3 | Consent to be named as directors of Arbitron for: Erica Farber, Kenneth F. Gorman, Philip Guarascio, Larry E. Kittelberger, Stephen B. Morris, Luis G. Nogales, Richard A. Post and Lawrence Perlman | |

| 99.4* | Opinion and Consent of Houlihan, Lokey, Howard & Zukin Financial Advisors, Inc. | |

| 99.5* | Opinion and Consent of Bear, Stearns & Co. Inc. | |

| 99.6 | Letter Ruling from the Internal Revenue Service dated November 7, 2000 |

II-3

In accordance with Section 12 of the Securities Exchange Act of 1934, the registrant caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized.

| Dated: December 5, 2000 | NEW CERIDIAN CORPORATION | |||

| |

|

By |

|

/s/ RONALD L. TURNER Ronald L. Turner Chairman of the Board, President and Chief Executive Officer |

II-4

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

EXHIBIT INDEX

to

FORM 10

NEW CERIDIAN CORPORATION

| Exhibit No. |

Description |

|

|---|---|---|

| 3.1 | Amended and Restated Certificate of Incorporation of New Ceridian (to be effective upon completion of the spin-off) | |

| 3.2 |

|

Amended and Restated Bylaws of New Ceridian (to be effective upon completion of the spin-off) |

| 10.1 |

|

Form of Distribution Agreement between Ceridian and New Ceridian, to be adopted in connection with the spin-off |

| 10.2 |

|

Form of Personnel Agreement between Ceridian and New Ceridian, to be adopted in connection with the spin-off |

| 10.3 |

|

Form of Tax Matters Agreement between Ceridian and New Ceridian, to be adopted in connection with the spin-off |

| 10.4 |

|

Form of Transition Services Agreement between Ceridian and New Ceridian, to be adopted in connection with the spin-off |

| 10.5 |

|

Form of Sublease Agreement between Ceridian and New Ceridian, to be adopted in connection with the spin-off |

| 10.6 |

|

Form of 2001 Long-Term Stock Incentive Plan, to be adopted in connection with the spin-off |

| 10.7 |

|

Form of Employee Stock Purchase Plan, to be adopted in connection with the spin-off |

| 10.8 |

|

Form of 2001 Director Performance Incentive Plan, to be adopted in connection with the spin-off |

| 10.9 |

|

Form of Employment Agreement between New Ceridian and Ronald L. Turner |

| 10.10 |

|

Form of Employment Agreement between New Ceridian and John R. Eickhoff |

| 10.11 |

|

Form of Employment Agreement between New Ceridian and Tony G. Holcombe, Gary M. Nelson and Gary A. Krow |

| 21.1 |

|

Subsidiaries of New Ceridian |

| 99.1 |

|

Information Statement dated December 6, 2000 attached as Annex A to this registration statement |

| 99.2 |

|

Consent to be named as directors of New Ceridian for: Bruce R. Bond, William J. Cadogan, Nicholas D. Chabraja, Robert H. Ewald, Ronald T. LeMay, George R. Lewis, Ronald L. Turner, Carole J. Uhrich and Paul S. Walsh |

| 99.3 |

|

Consent to be named as directors of Arbitron for: Erica Farber, Kenneth F. Gorman, Philip Guarascio, Larry E. Kittelberger, Stephen B. Morris, Luis G. Nogales, Richard A. Post and Lawrence Perlman |

| 99.4 |

* |

Opinion and Consent of Houlihan, Lokey, Howard & Zukin Financial Advisors, Inc. |

| 99.5 |

* |

Opinion and Consent of Bear, Stearns & Co. Inc. |

| 99.6 |

|

Letter Ruling from the Internal Revenue Service dated November 7, 2000 |

Annex A

![]()

, 2001

Dear Stockholder:

As we first announced in July 2000, Ceridian will split into two independent, publicly-traded companies, Ceridian and Arbitron, through a tax-free spin transaction. We believe the separation of Arbitron and Ceridian will create two sharply focused companies well-positioned to pursue and realize their potential as independent companies in the distinctly different markets they serve. Both businesses have strong competitive positions within their respective markets, solid existing businesses and attractive future prospects. As separate companies, we believe they will be in a better position to pursue attractive growth opportunities for the benefit of the employees and customers of their businesses while optimizing the value of each individual company.

After the transaction, Ceridian will be comprised of its human resource services division and subsidiaries and Comdata subsidiaries. These businesses have similar operational profiles in that both provide outsourcing services to customers of all sizes and both have large-scale transaction processing, money movement and regulatory compliance services as their core businesses. Both businesses have significant growth opportunities in their respective markets. We plan to maximize the synergies and the opportunities for cross-selling that exist among and between Comdata and our human resource services business to take better advantage of the potential in these markets.

As an independent company, Arbitron will be in a better position to take advantage of the opportunities presented by its two promising new technologies, the Portable People Meter and Arbitron Webcast Ratings. Arbitron plans to pursue co-product development, co-marketing and other relationships with third parties to help accelerate the full commercialization of these two new services which Arbitron believes will significantly improve the way radio, television, cable and Internet streaming media audiences are measured.

The spin-off, which generally will be tax-free to Ceridian's stockholders, does not require any action on your part, and will be completed on , 2001. For each share of Ceridian common stock that you own as of the close of business on , 2001, you will receive one share of "New Ceridian" common stock. Shares of New Ceridian common stock will trade on The New York Stock Exchange under the ticker symbol "CEN." Your current "Old Ceridian" common stock will become known as "Arbitron" common stock and will continue to trade on The New York Stock Exchange, but under the symbol "ARB." We also intend to effect a one-for-five reverse stock split of Arbitron common stock immediately after the spin-off.

The enclosed Information Statement provides important information about the spin-off and the business, management and financial performance of the two separate companies that will result—Ceridian and Arbitron. We encourage you to read the Information Statement carefully. Please note that a stockholder vote is not required for the spin-off, and holders of Ceridian's common stock are not required to take any action to participate in the spin-off. Therefore, we are not asking you for a proxy.

Very

truly yours,

Ronald L. Turner

Chairman, President and Chief Executive Officer

Subject to Completion, Dated December 6, 2000

INFORMATION STATEMENT

NEW CERIDIAN CORPORATION

Common Stock

ARBITRON INC.

Common Stock

We are furnishing you with this information statement in connection with the spin-off by Ceridian Corporation (which entity this document refers to as "Ceridian") of all of the outstanding common stock of a wholly owned subsidiary of Ceridian (which subsidiary is currently named "New Ceridian Corporation," will be renamed "Ceridian Corporation" after the spin-off and this document refers to as "New Ceridian") that will own and operate Ceridian's human resource services division and human resource services and Comdata subsidiaries. Prior to the spin-off, Ceridian will contribute to New Ceridian substantially all of the assets, liabilities and operations of its human resource services division and the capital stock of its human resource services subsidiaries and Comdata subsidiaries, which together accounted for 85.6 percent of Ceridian's revenues and 70.1 percent of its former income from continuing operations in 1999. After the spin-off, Ceridian's only remaining business will be its media information business known as "Arbitron." Therefore, in connection with the spin-off, Ceridian will change its name to "Arbitron Inc." (which entity this document refers to as "Arbitron").

If you are a Ceridian stockholder at the close of business on , 2001, you will receive one share of New Ceridian common stock for every one share of Ceridian common stock you hold at that time. You will receive your shares of New Ceridian automatically. You do not need to take any action. Currently, New Ceridian expects the spin-off to occur on or about , 2001.

The spin-off does not require approval by stockholders of Ceridian. Therefore, we are not asking you for a proxy and request that you do not send us a proxy.

Currently, there is no trading market for New Ceridian's common stock. However, New Ceridian expects that a limited market, commonly known as a "when-issued" trading market, for its common stock will develop on or shortly before the record date for the spin-off, and expects "regular way" trading of its common stock to begin on the first trading day after the spin-off. New Ceridian expects to apply to list its common stock on The New York Stock Exchange under the trading symbol "CEN."

Consistent with the name change of Ceridian to Arbitron, the trading symbol under which the common stock of Arbitron will trade will be changed to "ARB" in connection with the spin-off. Additionally, it is expected that a one-for-five reverse stock split of Arbitron common stock will take place effective immediately after the spin-off.

Owning shares of New Ceridian and Arbitron will involve risks. You should consider carefully the risk factors beginning on page 21 of this information statement.

This information statement does not constitute an offer to sell or the solicitation of an offer to buy any securities of New Ceridian or Arbitron.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities, or determined if this information statement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this information statement is , 2001.

| |

Page |

|

|---|---|---|

| Summary | 1 | |

| Risk Factors | 21 | |

| Cautionary Statement as to Forward-Looking Statements | 41 | |

| The Spin-Off | 42 | |

| Relationship Between New Ceridian and Arbitron After the Spin-Off | 56 | |

| Financing Arrangements for New Ceridian | 64 | |

| Capitalization of New Ceridian (Accounting Successor to Ceridian) | 66 | |

| Dividend Policy of New Ceridian | 67 | |

| Selected Historical Consolidated Financial Data of Ceridian | 68 | |

| Unaudited Pro Forma Consolidated Financial Information of New Ceridian (Accounting Successor to Ceridian) | 70 | |

| Management's Discussion and Analysis of Financial Condition and Results of Operations of Ceridian | 75 | |

| Business of New Ceridian | 89 | |

| Management of New Ceridian | 105 | |

| New Ceridian Related Party Relationships and Transactions | 127 | |

| New Ceridian Stock Ownership Information | 128 | |

| Description of New Ceridian Capital Stock | 131 | |

| Financing Arrangements for Arbitron | 134 | |

| Capitalization of Arbitron | 136 | |

| Dividend Policy of Arbitron | 136 | |

| Selected Historical Combined Financial Data of Arbitron | 137 | |

| Unaudited Pro Forma Combined Financial Information of Arbitron | 138 | |

| Management's Discussion and Analysis of Financial Condition and Results of Operations of Arbitron | 143 | |

| Business of Arbitron | 150 | |

| Management of Arbitron | 165 | |

| Arbitron Related Party Relationships and Transactions | 178 | |

| Arbitron Stock Ownership Information | 179 | |

| Description of Arbitron Capital Stock | 182 | |

| Where You Can Find More Information About New Ceridian | 185 | |

| Where You Can Find More Information About Arbitron | 186 | |

| Index to Ceridian Corporation Consolidated Financial Statements | F-1 | |

| Index to New Ceridian Corporation Financial Statement | F-46 | |

| Index to Arbitron Inc. Combined Financial Statements | F-50 |

All references to "Ceridian," "we" or "our" in this information statement mean Ceridian Corporation and its subsidiaries, as they exist before the spin-off, and therefore, including the human resource services division and subsidiaries and Comdata subsidiaries and media information division and subsidiaries.

All references to "New Ceridian" in this information statement mean New Ceridian Corporation, the corporation that will own substantially all of the assets, liabilities and operations of Ceridian's human resource services division and the capital stock of its human resource services subsidiaries and Comdata subsidiaries and whose common stock will be distributed to Ceridian's stockholders in the spin-off. New Ceridian will be renamed "Ceridian Corporation" after the spin-off.

i

All references to "Arbitron" in this information statement mean the media information division of Ceridian with that name before the spin-off and the corporation currently known as Ceridian after the spin-off, which corporation will continue to own substantially all of the assets, liabilities and operations of Ceridian's media information division and the capital stock of its media information subsidiaries. Arbitron will be renamed "Arbitron Inc." after the spin-off.

Unless otherwise indicated, all references to Arbitron common stock share and per share numbers in this information statement do not reflect the reverse stock split of Arbitron common stock that will likely take place immediately after the spin-off.

Before the spin-off, Ceridian owns or has the rights to various trademarks, trade names or service marks used in its human resource services division and subsidiaries and Comdata subsidiaries, including the following: the Ceridian name and logo, Powerpay,™ Signature,® Comchek,® Comdata Corporation,® Comchek eCash,™ MOTRS,™ LoadMatcher,™ CobraServ,® and LifeWorks®. After the spin-off, New Ceridian and its subsidiaries will own or have the rights to these trademarks, trade names or service marks.

Before the spin-off, Ceridian owns or has the rights to various trademarks, trade names or service marks used in its media information division and subsidiaries, including the following: the Arbitron name and logo, RetailDirect,® Arbitron Webcast Ratings,SM Arbitron Portable People Meter,SM Maximi$er 99,SM Media Professional,SM Tapscan,® and Tapscan WorldWide®. After the spin-off, Arbitron and its subsidiaries will own or have the rights to these trademarks, trade names or service marks.

The trademarks MasterCard,® Maestro,® Cirrus,® Visa,® Windows,® and Microsoft® referred to in this information statement are the registered trademarks of others.

ii

This summary highlights selected information from this information statement relating to the spin-off and the two public companies that will result from the spin-off, New Ceridian and Arbitron. This summary does not, however, contain all the details concerning the spin-off and these two companies, including information that may be important to you.

In some places in this information statement, New Ceridian and Arbitron have presented pro forma consolidated or combined financial information, adjusted to reflect the spin-off, the refinancing of Ceridian's debt and changes in the two companies' operations as a result of the spin-off. To better understand the spin-off and the businesses and financial positions of New Ceridian and Arbitron after the spin-off, you should carefully review this entire information statement, including the risk factors and the consolidated or combined historical and pro forma financial statements and notes to those statements appearing elsewhere in this information statement.

Questions and Answers About the Spin-Off

The following answers some of the questions you may have regarding the spin-off.

| What is the spin-off? | The spin-off is the method by which Ceridian will be separated into two publicly traded companies: (1) New Ceridian, which will consist of Ceridian's human resource services division and subsidiaries and Comdata subsidiaries; and (2) Arbitron, which will consist of Ceridian's media information division and subsidiaries. | |

| |

|

To effect the spin-off, Ceridian will distribute to each of its stockholders one share of New Ceridian common stock for each share of Ceridian common stock held as of the close of business on , 2001. Immediately after the spin-off, Ceridian's stockholders will continue to own all of Ceridian's current businesses, but they will own them through their ownership in New Ceridian and Arbitron. |

| Why is Ceridian separating its businesses? |

|

Ceridian believes that the separation of its human resource services division and subsidiaries and Comdata subsidiaries from its media information division and subsidiaries would permit management of New Ceridian and Arbitron to focus on the challenges and opportunities of their respective businesses, allowing each company to adopt strategies and pursue objectives appropriate for their specific needs. |

| |

|

Specifically, it would enable New Ceridian's management to focus on: |

| |

|

• taking advantage of the trend among larger employers to outsource their human resources work; |

| |

|

|

1

| |

|

• developing the systems necessary to integrate New Ceridian's payroll processing business with its other human resource services, such as employee assistance programs and COBRA, HIPAA and flexible spending account, and 401(k) administration, so as to provide the customer with a complete, easy to use and customer friendly package of services; |

| |

|

• leveraging the synergies between its human resource services division and subsidiaries and its Comdata subsidiaries which New Ceridian believes may result from the two businesses cross-marketing their services to each other's customers; and |

| |

|

• developing and fully implementing an integrated strategy for its human resource services division and subsidiaries to provide services to its customers over the Internet. |

| |

|

The spin-off would enable Arbitron's management to focus on: |

| |

|

• developing products and services that Arbitron believes it needs to continue to compete in the radio audience measurement business, including its proposed Portable People Meter, which is a portable device designed to measure radio, television, cable, Internet streaming and satellite audiences more efficiently and accurately than diaries or television audience meters currently used, and its proposed Arbitron Webcast Ratings service, which is a service designed to measure the audiences of audio and video content on the Internet, commonly known as "Webcasts" or "streaming media"; |

| |

|

• pursuing acquisitions of complementary technology and co-product development, co-marketing and other relationships with third parties that will provide it access to required technology and expertise in product development, sales and marketing to help it accelerate the commercialization of its proposed Portable People Meter and Arbitron Webcast Ratings services; and |

| |

|

• growing the media measurement business by selling existing services to new customers, selling additional services to existing customers, expanding current services into new geographic markets in the U.S. and selected international markets, such as Western Europe, Singapore, Mexico and Japan, and introducing new services into current markets. |

| |

|

|

2

| Why is this transaction structured as a spin-off of New Ceridian as opposed to a spin-off of Arbitron? |

|

The spin-off of New Ceridian is the most tax efficient means of separating Ceridian's human resource services division and subsidiaries and Comdata subsidiaries from its media information division and subsidiaries. Ceridian has received a letter ruling from the Internal Revenue Service that the spin-off will be tax-free to Ceridian and its stockholders for United States federal income tax purposes. |

| What steps must Ceridian take before completing the spin-off? |

|

Ceridian will not complete the spin-off unless, among other things: (1) it has received a letter ruling from the Internal Revenue Service that the spin-off will be tax-free to Ceridian and its stockholders for United States federal income tax purposes, which letter ruling was received by Ceridian in November 2000; and (2) it has completed its corporate restructuring transactions and refinanced substantially all of its outstanding domestic indebtedness. |

| What are the corporate restructuring transactions? |

|

Prior to the spin-off, Ceridian will need to transfer some of the assets, liabilities and operations of Ceridian's existing businesses so that in general after the spin-off: |

| |

|

• the assets, liabilities and operations associated with its human resource services division and the capital stock of its human resource services subsidiaries and Comdata subsidiaries and other liabilities expressly allocated to New Ceridian will be owned by New Ceridian and its subsidiaries; and |

| |

|

• the assets, liabilities and operations associated with its media information division and the capital stock of its media information subsidiaries will be owned by Arbitron and its subsidiaries. |

| |

|

The operations conducted by Ceridian's human resource services division and subsidiaries and Comdata subsidiaries on the one hand and its media information division and subsidiaries on the other hand are conducted in separate facilities, with the exception that both businesses share leased office space in New York. The distinct operations of these businesses makes it relatively easy to determine those assets and liabilities that are associated with Ceridian's human resource services division and subsidiaries and Comdata subsidiaries (which will be transferred to New Ceridian) and those that are associated with Ceridian's media information division and subsidiaries (which will be retained by Arbitron). |

| |

|

|

3

| |

|

In order to accomplish this transfer, Ceridian has created a wholly owned subsidiary (New Ceridian Corporation) and will contribute to New Ceridian all of the assets, liabilities and operations of its human resource services division and the capital stock of its human resource services subsidiaries and Comdata subsidiaries, which together accounted for 85.6 percent of Ceridian's revenues and 70.1 percent of its former income from continuing operations in 1999, and other liabilities expressly allocated to New Ceridian. The name of this new subsidiary will be changed from "New Ceridian Corporation" to "Ceridian Corporation" in connection with the spin-off. |

| |

|

The assets, liabilities and operations of Ceridian's media information division and the capital stock of its media information subsidiaries, which accounted for 14.4 percent of Ceridian's revenues and 29.9 percent of its former income from continuing operations in 1999, will remain with Ceridian, which will be renamed "Arbitron Inc." in connection with the spin-off. |

| What is the debt refinancing? |

|

To reflect the independent status of New Ceridian and Arbitron after the spin-off, each company will enter into its own credit facilities. In addition, Arbitron will issue seven-year secured notes with an aggregate principal amount of $50 million. The proceeds of the initial borrowings under these credit facilities and from the notes will be used in part to repay Ceridian's existing borrowings from third parties, including, as of the date of this information statement, approximately $430 million of principal (plus accrued interest) plus approximately $18 million of a prepayment premium (such premium amount varying with changes in the yield of the specified comparable treasury issue) under its outstanding 7.25% senior notes, and approximately $50 million under its revolving credit facility. |

| |

|

The credit facilities of New Ceridian's Canadian and United Kingdom subsidiaries, which are guaranteed by Ceridian, will either be replaced by new facilities guaranteed by New Ceridian or the guarantee by Ceridian of the existing facilities will be replaced by a guarantee by New Ceridian. |

| |

|

If the debt refinancing and spin-off had occurred on September 30, 2000, New Ceridian would have had total indebtedness of about $300 million of unsecured debt on a pro forma basis, and Arbitron would have had total indebtedness of about $250 million of secured debt on a pro forma basis. The allocation of debt between New Ceridian and Arbitron was primarily based on a determination by Ceridian's management of the estimated cash needs and cash flows of the two companies after the spin-off. In making this determination, Ceridian's management considered the historical cash needs and estimated future cash needs of the two companies, the impact that the amount of debt would have on the credit ratings of the two companies, the ability of Ceridian to obtain credit arrangements for the two companies, and the ability of each company to service its debt after the spin-off. |

| |

|

|

4

| What will I receive in the spin-off? |

|

For every one share of Ceridian common stock that you hold at the close of business on , 2001, you will receive one share of New Ceridian common stock. For example, if you own 100 shares of Ceridian common stock, you will receive 100 shares of New Ceridian common stock. After the spin-off, you will own New Ceridian common stock as well as continue to own Ceridian common stock. Your New Ceridian common stock, however, will be common stock of "Ceridian Corporation," and your Ceridian common stock will be common stock of "Arbitron Inc." |

| |

|

In addition, as discussed in the next question, a one-for-five reverse stock split of Arbitron common stock will take place effective immediately after the spin-off. This reverse stock split will decrease the number of shares of Arbitron common stock that you will own after the spin-off by a factor of five. In the absence of a reverse stock split, it is expected that the market price per share of Arbitron common stock after the spin-off will be significantly less than the market price per share of Ceridian common stock prior to the spin-off. The purpose of the reverse stock split is to try to increase the expected trading price of Arbitron common stock after the spin-off so as to increase the likelihood that institutional investors, who generally view stocks that trade at low prices as unduly speculative in nature, will be less likely to sell their shares of Arbitron's common stock solely because of a low stock price. |

| What will happen to Ceridian and my existing Ceridian common stock as a result of the spin-off? |

|

After the spin-off, Ceridian will continue to own and operate its media information business, but it will change its name to "Arbitron Inc." Arbitron's common stock will continue to trade on The New York Stock Exchange, but consistent with its name change, its trading symbol will be changed to "ARB." Arbitron's common stock will not continue to trade on The Chicago Stock Exchange or the Pacific Exchange after the spin-off. |

| |

|

A one-for-five reverse stock split of Arbitron common stock will take place effective immediately after the spin-off. The reverse stock split will decrease the number of shares of Arbitron common stock that you would own immediately after the spin-off by a factor of five. |

| |

|

For example, if you owned 100 shares of Ceridian common stock as of the record date for the spin-off, immediately after the spin-off and the reverse stock split, each of which would occur on the distribution date, the stock certificates representing your 100 shares of Ceridian common stock would represent 20 shares of Arbitron common stock, and 100 shares of New Ceridian common stock. Arbitron will not issue fractional shares in connection with the reverse stock split. Stockholders who would otherwise be entitled to receive fractional shares as a result of the reverse stock split will receive a cash distribution in lieu of any fractional shares. A stockholder who receives cash for a fractional share of Arbitron common stock will recognize a tax gain or loss in the amount equal to the difference between the amount of cash received and the holder's basis in the fractional share. We estimate that Arbitron will make cash distributions for approximately .01% of the shares of Arbitron common stock which were outstanding before the reverse stock split. As soon as practicable after the reverse stock split, Arbitron will notify you as to the effectiveness of the reverse stock split and instruct you as to how and when to surrender your certificates representing shares of Arbitron common stock. The Arbitron reverse stock split will have no effect on your shares of New Ceridian common stock or the one-for-one distribution ratio for the spin-off. |

| |

|

|

5

| |

|

Please do not send Ceridian or its transfer agent your Ceridian stock certificates now. A letter of transmittal will be mailed to you soon after the reverse stock split is effective. You should send your stock certificates to Arbitron's transfer agent only after you receive that letter of transmittal. |

| Will I be taxed on the shares of New Ceridian that I receive in the spin-off? |

|

No. Ceridian has received a favorable letter ruling from the Internal Revenue Service to the effect that, for United States federal income tax purposes, the spin-off generally will be tax-free to Ceridian stockholders. The tax ruling, however, does not address state, local or foreign tax consequences that may apply to Ceridian stockholders. However, a stockholder who receives cash for a fractional share of Arbitron Common Stock in the reverse stock split of Arbitron Common Stock will recognize a tax gain or loss in the amount equal to the difference between the amount of cash received and the holder's basis in the fractional share. You should consult your tax advisor as to the particular tax consequences to you of the spin-off. |

| What do I have to do to participate in the spin-off? |

|

Nothing, except continue to own shares of Ceridian common stock on the record date. Because the spin-off of New Ceridian shares is a dividend, no stockholder vote is required. New Ceridian intends to use a book-entry system to distribute shares of its common stock, which means that ownership of the stock will be recorded in the records maintained by New Ceridian's transfer agent. Physical stock certificates will not be issued unless a stockholder requests a physical certificate. Following the spin-off, each stockholder of record on the record date will receive a statement showing the number of shares of New Ceridian common stock credited to the stockholder's account. This statement will also include instructions for requesting a physical stock certificate, if desired. |

| |

|

|

6

| |

|

You do not need to, and should not, mail in your certificates of Ceridian common stock to receive your New Ceridian common stock in the spin-off. As discussed above, however, after the reverse stock split is effective, a letter of transmittal will be mailed to you instructing you to mail your certificates representing Arbitron common stock to Arbitron's transfer agent. |

| When will the spin-off occur? |

|

The spin-off will be completed on or around , 2001 so long as the conditions to the spin-off are met. These conditions include, among others, the: |

| |

|

• receipt of a favorable letter ruling from the Internal Revenue Service on the tax-free nature of the transaction, which letter ruling was received by Ceridian in November 2000; |

| |

|

• refinancing of substantially all of Ceridian's existing domestic debt; |

| |

|

• approval for listing of Arbitron common stock and New Ceridian common stock on The New York Stock Exchange; |

| |

|

• registration of New Ceridian's common stock under the Securities Exchange Act of 1934; |

| |

|

• receipt by Ceridian's board of directors of fairness, financing ability, solvency and Delaware law opinions; and |

| |

|

• approval by Ceridian's board of directors of the final terms of the spin-off, including the formal declaration of a dividend to Ceridian's stockholders and other specific actions necessary for the spin-off. |

| On which exchange will New Ceridian common stock trade? |

|

New Ceridian common stock will trade on The New York Stock Exchange under the trading symbol "CEN." |

| When will I be able to buy and sell New Ceridian common stock? |

|

Regular trading of New Ceridian common stock will begin on , 2001. A temporary form of interim trading, called "when-issued" trading, may occur for New Ceridian common stock on or before , 2001. "When-issued" trading reflects the value at which the market expects the New Ceridian common stock to trade after the spin-off. |

| |

|

|

7

| |

|

If when-issued trading develops, you will be able to buy and sell New Ceridian common stock before the spin-off. None of these trades, however, will settle until after the spin-off, when regular trading in New Ceridian common stock has begun. If the spin-off does not occur, all when-issued trading will be null and void. If when-issued trading occurs, the listing for New Ceridian common stock will be under the trading symbol "CEN" and accompanied by the letters "wi" on The New York Stock Exchange. |

| How will Ceridian and Arbitron common stock trade? |

|

Ceridian common stock will continue to trade on a regular basis through the date of the spin-off under the current symbol "CEN." Any shares of Ceridian common stock sold on a regular basis in the period between the date that is two days before the record date and the spin-off date (i.e., between and , 2001) will be accompanied by an attached "due bill" representing New Ceridian common stock to be distributed in the spin-off. |

| |

|

Additionally, it is expected that "ex-distribution" trading for Ceridian common stock will develop before the spin-off date. "Ex-distribution" trading means that you may trade Ceridian common stock before the completion of the spin-off, but on a basis that reflects the value at which the market expects the Arbitron common stock to trade after the spin-off taking into consideration the reverse stock split. |

| |

|

If ex-distribution trading develops, you may buy and sell those shares before the spin-off. None of these trades, however, will settle until after the spin-off, when regular trading in Arbitron common stock has begun. If the spin-off does not occur, all ex-distribution trading will be null and void. If ex-distribution trading occurs, the listing for Ceridian common stock will be represented by the trading symbol "ARB" and accompanied by the letters "wi" on The New York Stock Exchange. |

| What will be the relationship between New Ceridian and Arbitron after the spin-off? |

|

After the spin-off, Arbitron will not own any New Ceridian common stock, New Ceridian will not own any Arbitron common stock, and New Ceridian and Arbitron will operate independently of each other as separate public companies. Prior to the spin-off, New Ceridian will enter into the following agreements with Ceridian (which agreements will be with Arbitron after the spin-off): |

| |

|

• distribution agreement, which sets forth the manner in which assets and liabilities of Ceridian will be divided between New Ceridian and Arbitron; |

| |

|

• personnel agreement, which sets forth the manner in which assets and liabilities under Ceridian's benefit plans and other employment-related liabilities will be divided between New Ceridian and Arbitron; |

| |

|

|

8

| |

|

• transition services agreement, which describes the services that New Ceridian will provide to Arbitron after the spin-off and the fees that will be charged for those services; |

| |

|

• sublease agreement, which sets forth the arrangement under which Arbitron will lease office space to New Ceridian; and |

| |

|

• tax matters agreement, which specifies how income and sales tax refunds and income and sales tax obligations associated with time periods before the spin-off will be divided between New Ceridian and Arbitron. |

| |

|

These agreements will outline the mechanics of the spin-off itself and govern the on-going relationship between New Ceridian and Arbitron after the spin-off. |

| What else should I be concerned about with respect to the spin-off and are there any risks I should know about in owning Arbitron and New Ceridian common stock? |

|

You should read this entire information statement carefully. New Ceridian's human resource services division and subsidiaries and Comdata subsidiaries and Arbitron's media information division and subsidiaries are subject to general and specific business risks relating to each company's operation of those businesses. In addition, the spin-off presents other risks relating to the nature of the spin-off transaction itself as well as risks relating to New Ceridian being an independent public company for the first time and Arbitron being a very different public company than Ceridian. These risks include the possibility that: |

| |

|

• The Internal Revenue Service may determine that representations and undertakings of Ceridian and New Ceridian made to the IRS in obtaining the letter ruling that the spin-off will qualify as a tax-free distribution are inaccurate and as a result, the spin-off will not qualify as a tax-free distribution and thus treat the spin-off as taxable to Ceridian and its stockholders, which could subject Ceridian and its stockholders to a material amount of taxes; |

| |

|

• The combined post-spin-off value of Arbitron and New Ceridian shares may not equal or exceed the pre-spin-off value of Ceridian shares; |

| |

|

• Substantial sales of Arbitron's and New Ceridian's common stock following the spin-off could cause a significant decrease in the market price of Arbitron's and New Ceridian's common stock; |

| |

|

• An active trading market may not develop for New Ceridian's common stock, thereby making it difficult for you to sell your shares of New Ceridian common stock, and an active trading market may not be maintained for Arbitron's Common Stock, thereby making it difficult for you to sell your shares of Arbitron Common Stock; and |

| |

|

|

9

| |

|

• While both New Ceridian and Arbitron have been profitable as part of Ceridian, there can be no assurance that the future profitability of New Ceridian and Arbitron, as stand-alone companies, will be comparable to their respective historical operating results as part of Ceridian before the spin-off. |

| |

|

These risks are more fully described in the "Risk Factors" section of this information statement, beginning on page 21. We encourage you to read this section in evaluating whether and for how long you should retain your Arbitron common stock and the New Ceridian common stock you will receive in the spin-off. |

| |

|

|

10

Overview of Spin-Off Transaction

11

Who Can Help Answer Your Questions

If you have additional questions about the spin-off, you should contact:

Stockholder

Services Department

Ceridian Corporation

3311 East Old Shakopee Road

Minneapolis, Minnesota 55425-1640

(952) 853-8100

http://[email protected]

If you would like additional copies of this information statement or if you have additional questions about the spin-off, you should contact:

The

Bank of New York

P.O. Box 11258

Church Street Station

New York, New York 10286

(800) 524-4458

http://[email protected]

The Bank of New York will be the distribution agent for the spin-off and the transfer agent and registrar for both Arbitron's and New Ceridian's common stock after the spin-off.

After the corporate restructuring transactions in connection with the spin-off, New Ceridian will serve primarily the human resources and transportation markets through its human resource services division and subsidiaries and Comdata subsidiaries. Its human resource services division and subsidiaries will offer outsourced human resources and benefits administration solutions that support an organization's complete employment life cycle, which means that it will provide its customers with services that cover all phases of employment, from pre-hire recruitment and application verification, to payroll processing, training, employee assistance programs and other services associated with active employment to post- employment COBRA, HIPAA and retirement plan administration. Throughout this information statement, we generally refer to these types of services as "information services." New Ceridian's Comdata subsidiary will provide payment processing services associated with debit cards, cash advances, expense reimbursement and other similar types of funds transfer (which we generally refer to as "transaction processing") as well as regulatory compliance services to the transportation industry. It will also provide transaction processing services to other industries. New Ceridian was incorporated as a Delaware corporation on August 8, 2000. New Ceridian is currently a wholly owned subsidiary of Ceridian. New Ceridian will be an independent, publicly traded company after the spin-off. New Ceridian's name will be changed to "Ceridian Corporation" in connection with the spin-off. New Ceridian expects to apply to list its common stock on The New York Stock Exchange under the trading symbol "CEN."

New Ceridian's Businesses

Human Resource Services

The divisions and subsidiaries that will comprise New Ceridian's human resource services business after the spin-off (which this document refers to as "HRS") offer a broad range of services and software designed to help employers more effectively manage their work forces and information that is integral to human resource processes. HRS serves more than 150,000 employers with broad, integrated

12

solutions. HRS' products include payroll processing and tax filing services, human resources information systems, comprehensive benefits administration, employee assistance and work-life programs, training and other services. HRS provides these products and services in the United States, Canada and the United Kingdom. HRS' revenue for the years 1999, 1998 and 1997 was as follows:

| |

1999 |

1998 |

1997 |

|||

|---|---|---|---|---|---|---|

| Revenue | $828.1 million | $700.3 million | $578.7 million | |||

| Percent of revenue attributable to payroll processing and tax filing services | 77% | 86% | 84% | |||

| Percent of payroll processing and tax filing services revenue attributable to the U.S. |

|

77% |

|

80% |

|

91% |

Payroll processing and tax filing services generally accounts for a substantial portion of HRS' revenue, with most of the payroll processing and tax filing revenue derived from the United States.

Comdata

Ceridian's Comdata subsidiary will become a subsidiary of New Ceridian in connection with the spin-off. While HRS focuses on providing administrative services, such as payroll processing and tax filing, human resource information systems, benefit administration and employee training, Comdata focuses on providing transaction processing and regulatory compliance services primarily to the transportation industry. Comdata provides services to approximately 21,000 long-haul trucking companies covering over 400,000 drivers, 7,000 truck stop service centers and 400 terminal fueling locations, and is expanding its service offerings to the local fleet segment. Comdata provides trucking companies with Comchek fuel cards, driver payroll and financial settlement services, as well as fuel management, electronic cash access, permitting, licensing, fuel tax reporting, vehicle escort and other services. In the truck stop market, Comdata helps operators improve productivity through automation, providing equipment that enables the service centers to process fuel purchases and cash advances. Comdata also provides transaction processing services by the use of cash cards to other industries including the retail, temporary staffing and university sectors, through its payment services division and its subsidiary, Stored Value Systems, Inc. Comdata's subsidiary, Stored Value Systems, Inc., provides electronic cash cards to retailers for use as promotional tools, merchandise returns or credit processing and replacements for paper gift certificates. Comdata's payment services division provides electronic cash cards to the temporary staffing and university sectors for employee payroll and expense disbursements. New Ceridian does not intend to have Comdata or HRS offer services that are currently offered by the other. However, both Comdata and HRS will market its services to customers of the other.

Comdata's revenue from products and services for the years 1999, 1998 and 1997 was as follows, excluding revenue of $5.8 million in 1998 and $133.2 million in 1997 from Comdata's gaming services business which was sold to First Data Corporation in exchange for its NTS transportation services business in the first quarter of 1998:

| 1999 |

1998 |

1997 |

||

|---|---|---|---|---|

| $298.9 million | $261.5 million | $197.8 million |

Approximately 91 percent of Comdata's revenue for 1999 was attributable to its transportation business.

13

New Ceridian's Strategy

New Ceridian intends to pursue the following strategies:

New Ceridian's Management

Board of Directors

New Ceridian's directors after the spin-off will be:

| Bruce R. Bond Robert H. Ewald Ronald L. Turner |

William J. Cadogan Ronald T. LeMay Carole J. Uhrich |

Nicholas D. Chabraja George R. Lewis Paul S. Walsh |

Executive Officers

New Ceridian's executive officers after the spin-off will be:

| Ronald L. Turner | Chairman of the Board, President and Chief Executive Officer | |

| John R. Eickhoff |

|

Executive Vice President and Chief Financial Officer |

| Loren D. Gross |

|

Vice President and Corporate Controller |

| Tony G. Holcombe |

|

Executive Vice President of New Ceridian and President of Ceridian Employer/Employee Services |

| Shirley J. Hughes |

|

Senior Vice President of Human Resources |

| Gary A. Krow |

|

Executive Vice President of New Ceridian and President of Comdata |

| Gary M. Nelson |

|

Vice President, General Counsel and Secretary |

| |

|

|

Other Information About New Ceridian

New Ceridian was organized as a corporation under the laws of Delaware on August 8, 2000. New Ceridian's principal executive offices are located at 3311 East Old Shakopee Road, Minneapolis, Minnesota 55425. Its telephone number at that address is (952) 853-8100. After the spin-off, New Ceridian's web site will be located at http://www.ceridian.com. New Ceridian's web site and the information contained on that site, or connected to that site, are not incorporated into and do not constitute part of this information statement.

14

Summary Historical Consolidated Financial Data of Ceridian

The summary historical financial data of New Ceridian (Accounting Successor to Ceridian) is derived from audited annual and unaudited interim condensed consolidated financial statements of Ceridian. The statements of operations data for each of the three years ended December 31, 1999, 1998 and 1997 and the balance sheet data at December 31, 1999 and 1998 set forth below are derived from audited consolidated financial statements of Ceridian included elsewhere in this information statement. The statement of operations data for the years ended December 31, 1996 and 1995 and the balance sheet data at December 31, 1997, 1996 and 1995 set forth below are derived from audited consolidated financial statements of Ceridian not included in this information statement. The statement of operations data for the nine months ended September 30, 2000 and 1999 and the balance sheet data as of September 30, 2000 are derived from unaudited condensed consolidated financial statements of Ceridian included elsewhere in this information statement.

This historical data should be read together with the information under the heading "Management's Discussion and Analysis of Financial Condition and Results of Operations of New Ceridian (Accounting Successor to Ceridian)" and Ceridian's consolidated financial statements and related notes included elsewhere in this information statement.

| |

Nine Months Ended September 30, |

Years Ended December 31, |

|||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2000 |

1999 |

1999 |

1998 |

1997 |

1996 |

1995 |

||||||||||||||||

| |

(dollars in millions, except per share data) |

||||||||||||||||||||||

| Statement of Operations Data: | |||||||||||||||||||||||

| Revenue | $ | 872.0 | $ | 822.5 | $ | 1,127.0 | $ | 967.6 | $ | 909.7 | $ | 789.6 | $ | 686.3 | |||||||||

| Earnings from continuing operations | 45.2 | 79.0 | 104.4 | 125.3 | 0.6 | 91.5 | 22.2 | ||||||||||||||||

| Gains and earnings from discontinued operations(1) | 37.7 | 33.4 | 44.5 | 64.5 | 471.8 | 90.4 | 75.3 | ||||||||||||||||

| Extraordinary loss | — | — | — | — | — | — | (38.9 | ) | |||||||||||||||

| Net earnings | 82.9 | 112.4 | 148.9 | 189.8 | 472.4 | 181.9 | 58.6 | ||||||||||||||||

| Earnings per common share | |||||||||||||||||||||||

| Basic | |||||||||||||||||||||||

| Continuing operations | 0.31 | 0.55 | 0.72 | 0.87 | — | 0.58 | 0.07 | ||||||||||||||||

| Net earnings | 0.57 | 0.78 | 1.03 | 1.32 | 3.01 | 1.24 | 0.34 | ||||||||||||||||

| Diluted | |||||||||||||||||||||||

| Continuing operations | 0.31 | 0.53 | 0.71 | 0.85 | — | 0.56 | 0.14 | ||||||||||||||||

| Net earnings | 0.57 | 0.76 | 1.01 | 1.29 | 2.96 | 1.12 | 0.37 | ||||||||||||||||

| Shares used in calculations (in thousands) | |||||||||||||||||||||||

| Basic | 145,073 | 144,472 | 144,524 | 144,070 | 156,835 | 135,841 | 132,269 | ||||||||||||||||

| Diluted | 146,472 | 148,529 | 147,964 | 147,597 | 159,481 | 161,938 | 159,473 | ||||||||||||||||

15

| |

September 30, |

December 31, |

||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2000 |

1999 |

1998 |

1997 |

1996 |

1995 |

||||||||||||

| |

(dollars in millions) |

|||||||||||||||||

| Balance Sheet Data: | ||||||||||||||||||

| Working capital | $ | 250.0 | $ | 205.2 | $ | 213.7 | $ | 242.6 | $ | 59.0 | $ | 24.6 | ||||||

| Total assets | 2,164.6 | 1,995.2 | 1,227.7 | 1,190.9 | 967.8 | 855.3 | ||||||||||||

| Debt obligations | 555.8 | 611.3 | 54.5 | 3.0 | 136.8 | 199.5 | ||||||||||||

| Stockholders' equity | 956.3 | 842.7 | 650.6 | 588.3 | 346.3 | 150.0 | ||||||||||||

Summary Unaudited Pro Forma Condensed Consolidated Financial Data of

New Ceridian (Accounting Successor to Ceridian)

The summary unaudited pro forma condensed consolidated financial data for New Ceridian set forth below is derived from the unaudited pro forma consolidated financial information for New Ceridian included in this information statement. The pro forma data does not represent what New Ceridian's financial position or results of operations would have been had New Ceridian operated as a separate, independent public company, nor does the pro forma data give effect to any events other than those discussed in the related notes. The pro forma data also does not project New Ceridian's financial position or results of operations as of any future date or for any future period.

Notwithstanding the legal form of the spin-off, because of the relative significance of the human resource services division and subsidiaries and Comdata subsidiaries to Ceridian, New Ceridian will be considered the divesting entity and treated as the "accounting successor" to Ceridian for financial reporting purposes. The relative significance of New Ceridian to Ceridian is substantiated based upon New Ceridian net assets and revenues representing 99% and 85% of Ceridian net assets and revenues as of and for the nine month period ended September 30, 2000.

The following summary unaudited pro forma condensed consolidated financial data as of and for the nine months ended September 30, 2000, and for the year ended December 31, 1999, reflects the effects of the anticipated debt refinancing and the spin-off and related transactions. The capital structure that existed when New Ceridian's businesses operated as a part of Ceridian is not relevant because it does not reflect New Ceridian's expected future capital structure as a separate, independent public company. The basic weighted average shares outstanding were calculated by applying the distribution ratio (one share of New Ceridian common stock for every one share of Ceridian common stock) to Ceridian's basic weighted average shares outstanding during each period.

| |

Nine Months Ended September 30, 2000 |

Year Ended December 31, 1999 |

|||||

|---|---|---|---|---|---|---|---|

| |

(dollars in millions, except per share data) |

||||||

| Pro Forma Statement of Operations Data: | |||||||

| Revenue | $ | 872.0 | $ | 1,127.0 | |||

| Earnings from continuing operations | $ | 42.5 | $ | 100.7 | |||

| Earnings from continuing operations per common share | |||||||

| Basic | $ | 0.29 | $ | 0.70 | |||

| Diluted | $ | 0.29 | $ | 0.68 | |||

| Shares used in calculations (in thousands) | |||||||

| Basic | 145,073 | 144,524 | |||||

| Diluted | 146,472 | 147,964 | |||||

| Pro Forma Balance Sheet Data (at end of period): | |||||||

| Working capital | $ | 160.2 | |||||

| Total assets | $ | 2,104.8 | |||||

| Debt obligations | $ | 325.7 | |||||

| Stockholders' equity | $ | 1,096.6 | |||||

16

After the corporate restructuring transactions in connection with the spin-off, Ceridian's only remaining business will be its media information business known as "Arbitron"; and therefore, in connection with the spin-off, Ceridian will change its name to "Arbitron Inc." After the spin-off, Ceridian's common stock will continue to trade on The New York Stock Exchange, but its trading symbol will be changed to "ARB."

Arbitron's Business

Arbitron, which before the corporate restructuring transactions is a division of Ceridian, is an international media and marketing research firm serving radio and other broadcasters, cable companies, advertisers and advertising agencies in the United States and Europe. Arbitron currently has four core businesses:

Arbitron provides radio audience measurement information in the United States to over 3,690 radio stations. Arbitron estimates audience size and demographics in the United States for local radio stations, and reports these estimates and related data to its customers. This information is used as a form of "currency" for media transactions in the radio industry. Radio stations use Arbitron's data to price and sell advertising time, and advertising agencies and large corporate advertisers use Arbitron's data in purchasing advertising time. Arbitron also provides software applications that give its customers access to Arbitron's estimates via Arbitron's proprietary database of estimates, and enable them to more effectively analyze and understand that information for sales, management and programming purposes. In addition to its core radio ratings service, which provides primarily quantitative data, such as how many people are listening, Arbitron also provides qualitative data on listeners, viewers and readers that contains detailed socioeconomic information and information on what the respondents buy, where they shop and what forms of media they use. Arbitron provides these measurements of consumer demographics, retail behavior and media usage in approximately 278 local markets throughout the United States. Arbitron Cable provides qualitative audience descriptors to the local cable advertising sales organizations of cable companies. Arbitron plans to offer to customers its Arbitron Webcast Ratings service beginning in the second quarter of 2001. This service measures the audiences of audio and video content on the Internet, commonly known as "Webcasts" or "streaming media."

Arbitron's revenue for the years ended December 31, 1999, 1998 and 1997 was as follows:

| 1999 |

1998 |

1997 |

||

|---|---|---|---|---|

| $190.1 million | $173.8 million | $143.9 million |

The revenue reported for Arbitron does not include the revenue of the Scarborough Research Group Partnership, which has been treated as an equity method investment.

Arbitron's radio audience measurement business has generally accounted for a substantial portion of its revenue. The radio audience measurement service and related software sales represented 89 percent of Arbitron's total 1999 revenue.

17

Arbitron's Strategy

Arbitron intends to pursue the following strategies:

Arbitron's Management

Board of Directors

Arbitron's directors after the spin-off will be:

| Erica Farber Larry E. Kittelberger Richard A. Post |

Kenneth F. Gorman Stephen B. Morris Lawrence Perlman |

Philip Guarascio Luis Nogales |

Executive Officers

Arbitron's executive officers after the spin-off will be:

| Stephen B. Morris | Chief Executive Officer and President | |

| Pierre C. Bouvard | President of Internet Information Services | |

| Marshall L. Snyder | President of Cable and Worldwide PPM | |

| Owen Charlebois | President of U.S. Media Services | |

| William J. Walsh | Executive Vice President of Finance and Planning and Chief Financial Officer | |

| David A. Lapovsky | Executive Vice President of Worldwide Research | |

| Janice M. Giannini | Executive Vice President and Chief Information Officer | |

| Dolores L. Cody | Vice President, Chief Legal Officer and Secretary | |

| Kathleen T. Ross | Vice President of Organization Effectiveness and Public Relations | |

| Claire L. Kummer | Vice President of Operations |

Other Information About Arbitron

Founded in 1949, Arbitron has been a part of Ceridian since 1967. In connection with the spin-off, Arbitron will be the successor to the corporate entity of Ceridian, which is a Delaware corporation that was formed in 1912. Arbitron's principal executive offices will be located at 142 West 57th Street, New York, New York 10019-3300. Its telephone number at that address will be (212) 887-1300. Its web site will be located at http://www.arbitron.com. Arbitron's web site and the information contained on that site, or connected to that site, are not incorporated into and do not constitute a part of this information statement.

18

Arbitron Summary Historical Combined Financial Data

The following table summarizes historical combined financial data for Arbitron. The statement of income data for the years ended December 31, 1999, 1998 and 1997 and the balance sheet data at December 31, 1999 and 1998 set forth below are derived from audited combined financial statements of Arbitron included elsewhere in this information statement. The statements of income data for the years ended December 31, 1996 and 1995 and the balance sheet data at December 31, 1997, 1996 and 1995 set forth below are derived from unaudited combined financial statements of Arbitron not included in this information statement. The statement of income data for the nine months ended September 30, 2000 and 1999 and the balance sheet data as of September 30, 2000 are derived from unaudited condensed combined financial statements of Arbitron included elsewhere in this information statement.

The summary historical combined financial data is not necessarily indicative of the results of operations or financial position that would have occurred if Arbitron had been a separate, independent company during the periods presented, nor is it indicative of Arbitron's future performance. This historical data should be read together with the information under the heading "Management's Discussion and Analysis of Financial Condition and Results of Operations of Arbitron" and Arbitron's combined financial statements and related notes included elsewhere in this information statement.

| |

Nine Months Ended September 30, |

Years Ended December 31, |

|||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2000 |

1999 |

1999 |

1998 |

1997 |

1996 |

1995 |

||||||||||||||||

| |

(dollars in millions, except per share data) |

||||||||||||||||||||||

| Statement of Income Data: | |||||||||||||||||||||||

| Revenue | $ | 159.6 | $ | 146.1 | $ | 190.1 | $ | 173.8 | $ | 143.9 | $ | 133.7 | $ | 125.4 | |||||||||

| Costs and expenses | 96.9 | 90.7 | 127.0 | 119.8 | 104.8 | 90.6 | 85.6 | ||||||||||||||||

| Operating income | 62.7 | 55.4 | 63.1 | 54.0 | 39.1 | 43.1 | 39.8 | ||||||||||||||||

| Equity in net income (loss) of affiliate | 0.3 | (0.2 | ) | 2.6 | 2.5 | 1.7 | 0.9 | 1.2 | |||||||||||||||

| Income before income tax expense | 63.0 | 55.2 | 65.7 | 56.5 | 40.8 | 44.0 | 41.0 | ||||||||||||||||

| Income tax expense | 24.9 | 21.8 | 26.0 | 22.3 | 16.1 | 17.3 | 16.2 | ||||||||||||||||

| Net income | $ | 38.1 | $ | 33.4 | $ | 39.7 | $ | 34.2 | $ | 24.7 | $ | 26.7 | $ | 24.8 | |||||||||

| Unaudited Pro Forma Net Income Per Common Share Data(1) | |||||||||||||||||||||||

| Basic | $ | 1.31 | $ | 1.16 | $ | 1.37 | $ | 1.19 | $ | 0.79 | $ | 0.98 | $ | 0.94 | |||||||||

| Diluted | $ | 1.30 | $ | 1.12 | $ | 1.34 | $ | 1.16 | $ | 0.77 | $ | 0.82 | $ | 0.78 | |||||||||

| Weighted average common shares used in the calculation (in thousands) | |||||||||||||||||||||||

| Basic | 29,015 | 28,894 | 28,905 | 28,814 | 31,367 | 27,168 | 26,454 | ||||||||||||||||

| Diluted(2) | 29,294 | 29,706 | 29,593 | 29,519 | 31,896 | 32,388 | 31,895 | ||||||||||||||||

| |

|

|

|

December 31, |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

September 30, 2000 |

|||||||||||||||||

| |

1999 |

1998 |

1997 |

1996 |

1995 |

|||||||||||||

| |

(dollars in millions) |

|||||||||||||||||

| Balance Sheet Data: | ||||||||||||||||||

| Current assets | $ | 40.7 | $ | 43.6 | $ | 42.2 | $ | 41.4 | $ | 35.4 | $ | 35.7 | ||||||

| Total assets | $ | 71.6 | $ | 79.3 | $ | 82.3 | $ | 65.0 | $ | 60.4 | $ | 65.1 | ||||||

| Divisional equity (deficit) | $ | 8.8 | $ | 6.6 | $ | 9.1 | $ | (0.8 | ) | $ | 0.7 | $ | 1.6 | |||||

19

Summary Unaudited Pro Forma Condensed Combined Financial Data of Arbitron

The summary unaudited pro forma condensed combined financial data for Arbitron set forth below is derived from the unaudited pro forma combined financial information for Arbitron included elsewhere in this information statement. The pro forma data does not represent what Arbitron's financial position or results of operations would have been had Arbitron operated as a separate, independent public company, nor does the pro forma data give effect to any events other than those discussed in the related notes. The pro forma data also does not project Arbitron's financial position or results of operations as of any future date or for any future period.

The following summary unaudited pro forma condensed combined financial data as of and for the nine months ended September 30, 2000, and for the year ended December 31, 1999, reflects the effects of the anticipated debt refinancing and the spin-off.

| |

Nine Months Ended September 30, 2000 |

Year Ended December 31, 1999 |

|||||

|---|---|---|---|---|---|---|---|

| |

(dollars in millions, except per share data) |

||||||

| Statement of Income Data: | |||||||

| Revenue | $ | 159.6 | $ | 190.1 | |||

| Net income | $ | 26.7 | $ | 24.5 | |||

| Net income per common share | |||||||

| Basic | $ | 0.92 | $ | 0.85 | |||

| Diluted | $ | 0.91 | $ | 0.83 | |||

| Shares used in calculations (in thousands) | |||||||

| Basic | 29,015 | 28,905 | |||||

| Diluted | 29,294 | 29,593 | |||||

| Pro forma ratio of earnings to fixed charges | 3.3 to 1 | 2.5 to 1 | |||||

| Balance Sheet Data (at end of period): |

|

|

|

|

|

|

|

| Total assets | $ | 126.1 | |||||

| Debt obligations | $ | 250.0 | |||||

| Stockholders' deficit | $ | 186.7 | |||||

20

You should carefully consider each of the following risks and all of the other information in this information statement. Some of the following risks relate principally to the spin-off while other risks relate principally to the indebtedness of New Ceridian and Arbitron after the spin-off, their businesses in general and the industries in which the companies will operate. Finally, other risks relate principally to the securities markets and ownership of New Ceridian and Arbitron common stock. The risks and uncertainties described below are not the only ones New Ceridian and Arbitron will face. Additional risks and uncertainties not presently known to New Ceridian or Arbitron or that they currently believe to be immaterial may also adversely affect New Ceridian's and Arbitron's businesses.

If any of the following risks and uncertainties develops into actual events, the business, financial condition or results of operations of New Ceridian or Arbitron could be materially adversely affected. If that happens, the trading prices of the common stock of New Ceridian and Arbitron could decline significantly.

Risks Relating to the Spin-Off

The Internal Revenue Service may determine that the spin-off does not qualify as a tax-free distribution and thus treat the spin-off as taxable to Ceridian and its stockholders, which could subject Ceridian and its stockholders to a material amount of taxes.

Ceridian has received a favorable letter ruling from the Internal Revenue Service to the effect that, for United States federal income tax purposes, the spin-off generally will be tax-free to Ceridian and its stockholders. Even though Ceridian has received a favorable letter ruling from the IRS, it is possible that Ceridian and its stockholders could be subject to a material amount of taxes as a result of the spin-off if the representations and undertakings of Ceridian and New Ceridian made to the IRS in connection with obtaining the letter ruling are determined to be inaccurate. For a description of material United States federal income tax consequences to Ceridian's stockholders of the spin-off, we refer you to "The Spin-Off—Material U.S. Federal Income Tax Consequences of the Spin-Off."

The Internal Revenue Service may determine that the spin-off is part of a plan in which a 50 percent or greater interest is acquired in either New Ceridian or Arbitron and thus treat the spin-off as taxable to Ceridian, which could affect the value of your shares of New Ceridian and Arbitron common stock.