|

|

|

|

|

Previous: UNITED NETWORK MARKETING SERVICES INC, 10SB12G/A, 2000-12-13 |

Next: AQUILA CORP, S-1, EX-21.1, 2000-12-13 |

As filed with the Securities and Exchange Commission on December 13, 2000

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

Under the Securities Act of 1933

AQUILA ENERGY CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 4939 | 47-0683480 |

| (State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer |

| incorporation or organization) | Classification Code Number) | Identification No.) |

1100 Walnut, Suite 3300

Kansas City, Missouri 64106

(816) 527-1000

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Jeffrey D. Ayers

General Counsel and Corporate Secretary

Aquila Energy Corporation

1100 Walnut, Suite 3300

Kansas City, Missouri 64106

(816) 527-1000

(Name, address, including zip code, and telephone number, including area code of agent for service)

Copies to:

| Jeffrey T. Haughey | Robert W. Mullen, Jr. | |

| Blackwell Sanders Peper Martin LLP | Milbank, Tweed, Hadley & McCloy LLP | |

| Two Pershing Square | 1 Chase Manhattan Plaza | |

| 2300 Main Street, Suite 1000 | New York, New York 10005 | |

| Kansas City, Missouri 64108 | (212) 530-5000 | |

| (816) 983-8000 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. / /

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. / /

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. / /

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. / /

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. / /

CALCULATION OF REGISTRATION FEE

| |

||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price (1)(2) |

Amounts of Registration Fee |

||

| Class A Common Stock, par value $0.01 per share | $425,000,000 | $112,200 | ||

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

The information in this Prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated December 13, 2000

PROSPECTUS

Shares

[LOGO]

AQUILA ENERGY CORPORATION

Common Stock

This is our initial public offering of shares of common stock. We are offering shares. No public market currently exists for our shares.

We currently estimate that the initial public offering price per share will be between $ and $ . We have applied to list our common stock on the New York Stock Exchange under the symbol " ."

Investing in the shares involves risks. "Risk Factors" begin on page 10.

| |

Per Share |

Total |

||||

|---|---|---|---|---|---|---|

| Initial Public Offering Price | $ | $ | ||||

| Underwriting Discount | $ | $ | ||||

| Proceeds to Aquila Before Expenses | $ | $ | ||||

Aquila has granted the underwriters a 30-day option to purchase up to additional shares of common stock on the same terms and conditions as set forth above solely to cover over-allotments, if any.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Lehman Brothers, on behalf of the underwriters, expects to deliver the shares on or about , 2001.

| LEHMAN BROTHERS | MERRILL LYNCH & CO. |

SALOMON SMITH BARNEY

CHASE H&Q

CREDIT LYONNAIS SECURITIES (USA) INC.

, 2001

| |

Page |

||

|---|---|---|---|

| Prospectus Summary | 2 | ||

| Risk Factors | 10 | ||

| Forward-Looking Statements | 25 | ||

| Use of Proceeds | 26 | ||

| Dividend Policy | 26 | ||

| Capitalization | 27 | ||

| Dilution | 28 | ||

| Selected Financial Information | 29 | ||

| Management's Discussion and Analysis | |||

| Of Financial Condition and Results of | |||

| Operations | 31 | ||

| Business | 46 | ||

| Management | 72 | ||

| Our Separation from UtiliCorp | 83 | ||

| Relationship with UtiliCorp and Related Party Transactions | 85 | ||

| Agreements Between Us and UtiliCorp | 86 | ||

| Federal Tax Matters Related to Our | |||

| Separation from UtiliCorp | 93 | ||

| Principal Stockholder | 94 | ||

| Description of Our Capital Stock | 95 | ||

| U.S. Federal Tax Considerations for Non-U.S. Holders | 102 | ||

| Shares Available for Future Sale | 104 | ||

| Underwriting | 105 | ||

| Legal Matters | 108 | ||

| Experts | 108 | ||

| Where You Can Find More | |||

| Information | 108 | ||

| Glossary | 109 | ||

| Index to Financial Statements | F-1 | ||

Our operations are conducted through a number of subsidiaries. As used in this prospectus, the terms "Aquila," "we," "us," or "our" means Aquila Energy Corporation and all of our subsidiaries.

We refer to our Class A common stock as common stock in this prospectus.

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with different information. We are offering to sell shares of common stock and seeking offers to buy shares of common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of common stock.

Until , 2001, all dealers that effect transactions in the securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers' obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

Aquila and the Aquila logo as displayed on the cover of this prospectus are our service marks. Service mark registration applications are pending for AquilaInsiderSM, Fixed BillSM, GuaranteedBillSM, GuaranteedCapacitySM, GuaranteedGenerationSM, GuaranteedPeakingSM, GuaranteedPowerSM and GuaranteedTransmissionSM. GuaranteedWeather® is our registered service mark. All other trade names, trademarks and service marks used in this prospectus are the property of their respective owners.

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all the information you should consider before investing in our common stock. You should read the entire prospectus carefully, especially the risks of investing in our common stock discussed under "Risk Factors."

We are a leading wholesale energy merchant that is experiencing rapid growth by utilizing our strong commercial capabilities to maximize returns from our expanding base of wholesale energy assets and by providing comprehensive energy solutions to our clients in North America, the United Kingdom and continental Europe. We market and trade a diverse portfolio of commodities including natural gas, electricity, weather, coal, bandwidth capacity, emission allowances and other commodities. We offer a number of risk management products and services to our clients. We believe our ownership or control of a geographically diverse asset base and transportation network that includes electric power generation plants; natural gas gathering, transportation, processing and storage assets; and a coal blending, storage and loading facility enhances our ability to profit from our energy merchant activities.

We have experienced substantial growth by aggressively pursuing a strategy that exploits the marketing, trading and arbitrage opportunities resulting from the trend towards deregulation of the global energy markets and the convergence of the natural gas, power and other related markets. These opportunities are enhanced by our control of related physical assets that we optimize using information sourced by our marketing and trading efforts. We also believe we can apply our skills developed in our merchant energy businesses to other commodities and developing marketplaces such as bandwidth. We have already begun such initiatives and believe they will be important drivers of our future growth.

We expect additional growth from our continuing development of new products to meet our customers' needs. Recent examples of our product innovations include our GuaranteedWeather® and GuaranteedGenerationSM products, both of which enable clients to manage risks associated with their businesses (e.g., weather and power supplies) that are generally beyond their control. Like GuaranteedWeather®, many of our products and services are value-added to clients outside of the energy sector. We believe our ability to develop new products and to be among the first to enter into new markets provides us with an advantage over many of our competitors.

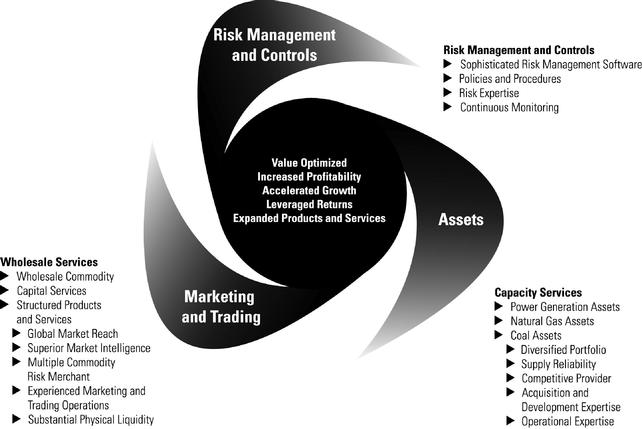

We view our control of energy assets, our marketing and trading activities and our risk management expertise as an integrated business and, as an integrated company, we believe that we are well positioned to capitalize on new growth opportunities. Our wholesale commodity marketing and trading skills add value to our energy assets by providing national market access, market intelligence, risk management and arbitrage opportunities, fuel management, procurement and transmission expertise for inputs (natural gas and coal) and outputs (power). Our asset base adds value to our wholesale marketing and trading franchise by providing a source of reliable power and natural gas supplies and an enhanced ability to structure innovative products and services for our clients. We believe that we are an industry leader in incorporating sophisticated risk management tools into the products and services we offer.

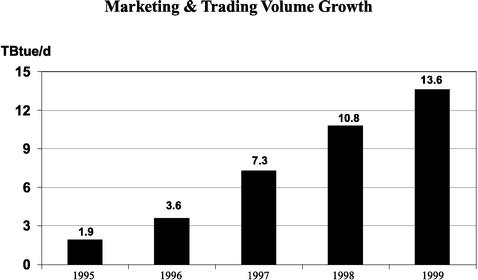

Our sales increased from $1.4 billion for the twelve months ended December 31, 1995 to $21.4 billion during the twelve months ended September 30, 2000, representing a compound annual growth rate of 77%. Our net income grew from $26 million to $67 million during the same period, representing a compound annual growth rate of 22%.

2

We conduct our business through two interconnected and complementary business groups: Wholesale Services and Capacity Services.

Wholesale Services: We provide commodity risk management services focusing on the energy industry. The recent volatility in the natural gas and power markets has increased the demand for our risk management products and services and has enhanced our ability to capture arbitrage opportunities. For the twelve months ended September 30, 2000, Natural Gas Week ranked us as the third largest wholesale marketer of power and gas on a combined basis in North America, and we have a growing presence in the United Kingdom and continental Europe. During 1999, we marketed approximately 10.4 Bcf/d of natural gas, 236.5 MMWhs of power and 16.9 million tons of coal and related products worldwide. In addition, we buy and sell NGLs, crude oil, refined products and emissions allowances. We also offer structured capital products to our clients by bundling financing with innovative energy products and services and engage in e-commerce marketing and trading efforts.

Capacity Services: We own, operate and contractually control significant electric power generation assets; natural gas gathering, transportation, processing and storage assets; and a coal blending, storage and loading facility. We have approximately 4,500 MW of electric power generation capacity owned, controlled or under development. In addition, we control 11 natural gas gathering systems, 1.8 Bcf/d of natural gas transportation capacity, 30,000 Bbls/d of natural gas processing capacity, 37 Bcf of net working natural gas storage capacity and a coal terminal facility with 22 million tons of annual throughput capacity. Our energy assets complement our wholesale marketing and trading businesses by providing natural gas and coal supplies, a source of reliable power supply and an enhanced ability to structure innovative products and services. Our strategy includes diversifying our capacity assets into various regions to balance our portfolio geographically and to reduce our concentration risk. In part due to our ability to generate enhanced returns with our commercial capability, in the future we expect to significantly grow our asset base via both acquisitions and development.

The ongoing restructuring and deregulation of the United States, the United Kingdom and continental European gas, electricity and telecommunications industries continue to create significant growth opportunities for companies like us. As regulated utilities continue to unbundle their generation, transmission and distribution services, we expect to continue capitalizing on opportunities to create value for both our customers and our stockholders as a wholesale energy merchant that supplies comprehensive energy solutions to the market.

During the late 1980s and early 1990s, we took advantage of changes caused by deregulation of natural gas markets, creating one of the largest and most profitable wholesale gas marketing franchises in the U.S. natural gas industry. Over the last three years, we have been focused on capturing similar opportunities afforded by the deregulation and restructuring of the U.S. power industry. As the natural gas and power markets continue to deregulate, unbundle and converge, we believe that our commercial expertise, risk management capabilities and products and control of selected assets in both commodities position us to capture value along the entire energy convergence chain.

The competitive electric generation market greatly favors low cost generation technologies such as natural gas-fired combustion turbines or combined-cycle plants. In addition, natural gas continues to be the most cost-effective fuel source that meets increasingly stringent clean-air requirements. In most regions of the U.S., the incremental or peaking sources of electricity are almost all gas-fired. Consequently, there has been increased demand for natural gas used in power generation and the natural gas and power commodity markets are converging rapidly. This convergence creates significant arbitrage opportunities for us in that we are a top marketer and trader of both natural gas and power, and we own and control strategic gas and power assets.

3

The ongoing power industry restructuring caused by industry trends and regulatory initiatives is transforming traditional vertically integrated, price-regulated markets into highly competitive, highly volatile markets. This transformation provides opportunities for us to manage risks related to producing and delivering energy commodities for our clients. We believe the move towards competitive marketplaces will increase in the U.S. and abroad, providing substantial opportunities for us to grow our risk management business.

We believe that many of the trends currently impacting the U.S. energy market will spread to continental Europe. Over the next three years, we expect that the energy markets in Europe will become increasingly competitive as they transition from being dominated by regulated, often state-owned, monopolies to open markets. Based on our strong position in gas and power in the U.S. and our existing operations in Europe, we believe we are well-positioned to take advantage of these trends in Europe.

Deregulation created by the Telecommunications Act of 1996, technological innovation and the impact of the Internet are creating substantial market opportunities in the communications industry. We believe that the emerging standardization of bandwidth capacity and the development of active neutral pooling points will facilitate a robust liquid commodity market for bandwidth capacity. Further, we believe bandwidth has very similar characteristics to energy commodities in that it is transmitted over sophisticated networks, has limited storage capabilities, has no effective substitute and has a high value in daily life. Because of these similarities, we expect to have opportunities to participate in this emerging market by applying our skills developed in the merchant energy business. We believe the potential for this business is very large, possibly exceeding the size of our current combined energy merchant activity.

We fully intend to aggressively pursue profitable opportunities created by the unbundling and restructuring initiatives in the wholesale commodity markets, including the natural gas, power and bandwidth markets, by maximizing our current asset base and by leveraging our commodity merchant skills in these emerging markets.

We plan to implement this strategy by:

We will continue to seek opportunities to grow our asset base by acquiring existing energy assets (e.g., our pending acquisition of GPU International), developing energy assets and entering into tolling and other contractual arrangements with third parties. Expanding our asset base will allow us to increase the depth of liquidity of our marketing and trading operations and will enhance our ability to structure innovative products and services for our clients. We believe our ability to grow our wholesale asset base will be enhanced as a public company as we will have significantly expanded financing alternatives.

Creating and packaging together sophisticated risk management products affords us the opportunity to sell innovative risk management tools that our clients can use to hedge their energy costs and effectively deal with other risks created by the increasingly volatile energy markets. Recent examples of our risk management products include GuaranteedPeakingSM, GuaranteedWeather®, Fixed BillSM and other weather-to-commodity related products.

4

We have a proven track record in the United States for being an early entrant into deregulating markets by utilizing proven business models and practices. We intend to capitalize on the current deregulation and restructuring of the European energy market by exporting our proven business practices. We believe our existing European operations are well positioned to grow as deregulation accelerates in Europe.

In 1995, we successfully leveraged our skills in natural gas marketing and trading to build a highly successful power marketing and trading business. Similarly, we have recently created our bandwidth capacity trading initiative. We are working with industry participants in developing standardized terms and conditions to allow for efficient commodity trading of bandwidth capacity. We expect our initial bandwidth capacity products and services will be similar to our current merchant energy offerings. Our longer term plan includes owning and controlling regional communication assets that would complement our bandwidth capacity trading initiative. We also intend to continue to leverage our existing infrastructure into other commodities to enhance our growth.

We commit funds via structured capital market products to clients throughout the energy convergence chain, including independent oil and gas producers, independent power generators, energy asset owners, municipalities and developers. We target clients who are looking for innovative ways to obtain financing through commodity transaction bundling. We have committed approximately $500 million to clients in the upstream and midstream oil and gas sector in the form of asset-based loans. We also fund gas production by pre-paying for deliveries at a discounted rate. On the opposite side of this activity, clients pre-pay for long-term gas delivery. To date, we have received approximately $1 billion of capital from these transactions. The ability to provide capital to customers generates increased trading and risk management origination opportunities.

We believe that the Internet will increasingly become an important part of the energy sector as it reduces costs and becomes an efficient alternative to traditional methods of transacting business. To capitalize on this opportunity, we are an equity participant in the IntercontinentalExchange, an Internet trading platform for over-the-counter trading of energy products and precious metals. We have also established a web-based auction platform in which multiple energy suppliers can compete for energy contracts. We intend to pursue other similar endeavors to take advantage of business opportunities provided by the Internet.

On October 25, 2000, we announced a 15-year agreement with Elwood Energy, LLC, a joint venture between subsidiaries of Peoples Energy Corporation and Dominion Resources Inc., for the output of Elwood's Phase II expansion of its natural gas-fired peaking facility. The agreement provides us with approximately 600 MW of the total 750 MW of additional output from the expansion, which we expect to become operational in the summer of 2001.

On October 20, 2000, we announced a 20-year contract with Cleco Corporation and Calpine Corporation for 580 MW of output from the Acadia Power Plant currently under construction in

5

Acadia Parish, Louisiana. The combined-cycle plant, which we expect to be operational in July 2002, is jointly owned by Cleco and Calpine. Under the new tolling agreement, we will supply the natural gas necessary to generate the 580 MW of electricity and will own and market the power produced.

On

October 5, 2000, we announced the acquisition of GPU International Inc., a wholly owned subsidiary of GPU, Inc., for $225 million. GPU International has

interests in six independent

U.S.-based generating plants with approximately 500 MW of capacity and a one-half interest in a 715 MW development project. We expect this transaction to close in

December 2000.

Our Relationship with UtiliCorp

We are currently a wholly owned subsidiary of UtiliCorp United Inc. Upon the completion of this offering, UtiliCorp will own 100% of our outstanding Class B common stock, which entitles the holder to five votes per share. As a result, UtiliCorp will hold approximately % of the combined voting power of our outstanding capital stock. UtiliCorp has announced that, within 12 months after the completion of this offering, it currently plans to distribute all of its shares of our capital stock to the holders of UtiliCorp common stock in a tax-free transaction.

Prior to the completion of this offering, we will enter into agreements with UtiliCorp related to the separation of our businesses from UtiliCorp. These separation agreements will provide for the transfer of assets and liabilities relating to our businesses. These agreements will also govern interim relationships with UtiliCorp, including various interim services UtiliCorp will provide to us.

We believe that we will realize certain benefits from our complete separation from UtiliCorp, including the following: increased capital financing flexibility, enhanced strategic focus, increased speed and responsiveness, a more targeted investment for stockholders and more targeted incentives for management and employees.

Aquila Energy Corporation was incorporated in Delaware in 1986 as a wholly owned subsidiary of UtiliCorp. Our executive offices are located at 1100 Walnut Street, Suite 3300, Kansas City, Missouri 64106, and our telephone number is (816) 527-1000. Our website is www.aquila.com. We do not intend for the information found on our website to be a part of this prospectus.

6

| Common stock offered by Aquila | shares | ||

| Common stock outstanding after this offering | shares | ||

| Class B common stock owned by UtiliCorp | shares | ||

| Total capital stock outstanding after this offering | shares | ||

| Use of proceeds | To repay intercompany indebtedness owed by us to UtiliCorp, and for general corporate purposes. | ||

| Voting rights: | |||

| Common stock | One vote per share | ||

| Class B common stock | Five votes per share | ||

| Other common stock provisions | Apart from the different voting rights, shares of common stock and shares of Class B common stock generally have identical rights and privileges. | ||

| Proposed NYSE symbol | " " | ||

| Dividend policy | We do not intend to declare any cash dividends on our capital stock in the foreseeable future. | ||

The calculation of the number of shares outstanding after this offering is based on the number of shares outstanding on , 2001.

In addition to the shares of capital stock to be outstanding after this offering, we may issue shares of common stock under our incentive plans.

Unless otherwise indicated, all information in this prospectus assumes that:

7

Summary Consolidated Financial Data

(Dollars in millions, except per share data and other operating data)

The following table summarizes the financial data of our business. You should also read "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and related notes included elsewhere in this prospectus.

Pro forma balance sheet amounts as of September 30, 2000 and pro forma income statement amounts for 1999 and the nine months ended September 30, 2000, give effect to our planned acquisition of GPU International, a wholly owned subsidiary of GPU. We expect that this transaction will close in December 2000. This acquisition will be accounted for using the purchase method of accounting and will be funded with an increase in our notes payable to UtiliCorp. Pro forma balance sheet amounts, as adjusted, give effect to our sale of shares of common stock in this offering at an assumed initial public offering price of $ and the application of the proceeds from this offering.

| |

Years Ended December 31, |

Nine Months Ended September 30, |

|||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

1995(1) |

1996(2) |

1997(3) |

1998(4) |

1999(5) |

Pro Forma 1999(6) |

1999(5) |

2000 |

Pro Forma 2000 |

||||||||||||||||||||

| |

|

|

|

|

|

(unaudited) |

|

(unaudited) |

|

||||||||||||||||||||

| Income Statement Data: | |||||||||||||||||||||||||||||

| Sales | $ | 1,367 | $ | 2,636 | $ | 6,972 | $ | 10,703 | $ | 16,685 | $ | 16,769 | $ | 12,672 | $ | 17,381 | $ | 17,434 | |||||||||||

| Cost of sales | 1,146 | 2,441 | 6,763 | 10,497 | 16,405 | 16,466 | 12,492 | 17,039 | 17,082 | ||||||||||||||||||||

| Equity in earnings of investments | 16 | 45 | 21 | 22 | 19 | 22 | 13 | 13 | 23 | ||||||||||||||||||||

| Gross profit | 237 | 240 | 230 | 228 | 299 | 325 | 193 | 355 | 375 | ||||||||||||||||||||

| Operating expenses | 134 | 98 | 110 | 128 | 170 | 182 | 107 | 204 | 214 | ||||||||||||||||||||

| Depreciation expense | 31 | 29 | 32 | 34 | 38 | 49 | 25 | 36 | 45 | ||||||||||||||||||||

| Other (income) expense | (1 | ) | 8 | 24 | 15 | 3 | (20 | ) | 1 | 7 | — | ||||||||||||||||||

| Earnings before interest and taxes | 73 | 105 | 64 | 51 | 88 | 114 | 60 | 108 | 116 | ||||||||||||||||||||

| Interest expense | 33 | 24 | 18 | 24 | 24 | 37 | 16 | 19 | 29 | ||||||||||||||||||||

| Provision in lieu of income taxes | 13 | 34 | 20 | 11 | 26 | 29 | 17 | 33 | 32 | ||||||||||||||||||||

| Net income | $ | 27 | $ | 47 | $ | 26 | $ | 16 | $ | 38 | $ | 48 | $ | 27 | $ | 56 | $ | 55 | |||||||||||

| Earnings Per Share Information: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings per share | $ | 27 | $ | 47 | $ | 26 | $ | 16 | $ | 38 | $ | 48 | $ | 27 | $ | 56 | $ | 55 | |||||||||||

| Diluted earnings per share | $ | 27 | $ | 47 | $ | 26 | $ | 16 | $ | 38 | $ | 48 | $ | 27 | $ | 56 | $ | 55 | |||||||||||

| Statement of Cash Flows Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash flows from operating activities | $ | 59 | $ | 60 | $ | 200 | $ | 73 | $ | 328 | $ | 346 | $ | 89 | $ | 359 | $ | 357 | |||||||||||

| Cash flows (used in) from investing activities | 72 | (182 | ) | (21 | ) | (50 | ) | (416 | ) | (416 | ) | (371 | ) | (173 | ) | (173 | ) | ||||||||||||

| Cash flows (used in) from financing activities | (135 | ) | 154 | (223 | ) | (20 | ) | 59 | 59 | 240 | (192 | ) | (192 | ) | |||||||||||||||

| Other Operating Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBITDA(7) | $ | 104 | $ | 134 | $ | 96 | $ | 85 | $ | 126 | $ | 163 | $ | 85 | $ | 144 | $ | 161 | |||||||||||

| Wholesale power sales (MMWhs) | 0.1 | 6.5 | 65.3 | 121.2 | 236.5 | 236.5 | 178.7 | 131.9 | 131.9 | ||||||||||||||||||||

| Natural gas sales (Bcf/d) | 1.9 | 3.5 | 6.7 | 9.6 | 10.4 | 10.4 | 10.4 | 10.4 | 10.4 | ||||||||||||||||||||

| |

As of September 30, 2000 |

||||||||

|---|---|---|---|---|---|---|---|---|---|

| |

Actual |

Pro Forma |

Pro Forma, As Adjusted |

||||||

| |

|

(unaudited) |

|

||||||

| Balance Sheet Data: | |||||||||

| Current assets | $ | 3,432 | $ | 3,432 | |||||

| Property, plant and equipment, net | 638 | 638 | |||||||

| Investments in subsidiaries and partnerships | 256 | 376 | |||||||

| Total assets | 5,232 | 5,457 | |||||||

| Current liabilities | 3,513 | 3,513 | |||||||

| Long-term debt, net | 98 | 323 | |||||||

| Stockholders' equity | 337 | 337 | |||||||

8

Also in 1995, we sold substantially all of our oil and gas production assets at book value. This business contributed approximately $5.0 million to EBIT in 1995.

9

You should carefully consider the risks described below before buying shares in this offering. You should also refer to other information contained in this prospectus, including our financial statements and related notes.

Risks Related To Our Wholesale Services Business Segment

We are exposed to market risk and may incur losses from our marketing and trading operations.

Our trading portfolios consist of physical and financial commodity contracts including contracts for natural gas, electricity, weather, coal, emissions allowances and other commodities. If the values of these contracts change in a direction or manner that we do not anticipate, we could realize material losses from our trading activities.

In the past, certain marketing and trading companies have experienced severe financial problems due to price volatility in the energy commodity markets. In certain instances this volatility has caused companies to be unable to deliver power that they had guaranteed under contract. These defaults severely and adversely impacted the financial condition of these companies and, in some cases, have resulted in losses to their trading partners.

We have marketing and trading operations in the United Kingdom and Canada and have commenced marketing and trading operations in continental Europe by opening offices in Germany, Spain and Norway. We incur similar trading risks and market exposures in these foreign markets. As we open additional foreign offices and our trading volumes in these offices increase, we will be exposed to increased trading risks.

We do not attempt to fully hedge our assets or positions against changes in commodity prices and our hedging procedures may not work as planned.

To lower our financial exposure related to commodity price fluctuations, our marketing, trading and risk management operations routinely enter into contracts to hedge a portion of our purchase and sale commitments, weather and emissions positions, and inventories of electricity, natural gas, coal and other commodities. As part of this strategy, we routinely utilize fixed-price, forward, physical purchase and sales contracts, futures, financial swaps and option contracts traded in the over-the-counter markets or on exchanges. However, we do not always cover the entire exposure of our assets or our positions to market price volatility and the coverage will vary over time. To the extent we have unhedged positions, fluctuating commodity prices can unfavorably impact our financial results and financial position.

Our risk management procedures may not prevent losses.

Although we have sophisticated risk management systems in place that use advanced methodologies to quantify risk, these systems may not prevent material trading losses. The risk management procedures we have in place may not always be followed or may not always work as planned. Our daily value-at-risk and loss limits are derived from historic price movements. If prices significantly deviate from historic prices, the limits may not protect us from significant losses. As a result of these and other factors, we cannot assure you that our risk management procedures will prevent losses that would negatively affect our business, operating results and financial position.

If we and UtiliCorp do not maintain an investment grade credit rating and a favorable credit profile, our operations and financial condition will be negatively impacted.

Currently, we do not have a credit rating separate from UtiliCorp's credit rating, but we will seek to obtain one prior to this offering. We have certain contracts that require UtiliCorp or us to maintain an investment grade credit rating. Further, our ability to enter into contracts with counterparties on favorable terms depends on such counterparties viewing us as a favorable credit risk. If UtiliCorp's or

10

our credit rating declines below investment grade or if UtiliCorp or we are viewed as a credit risk by counterparties, we will likely be obligated to provide credit enhancement to the counterparty in the form of a pledge of cash collateral, a letter of credit or other similar credit enhancement. Furthermore, our trading partners may refuse to trade with us or trade only on terms less favorable to us.

Any of these events would likely result in increased borrowing costs, more restrictive covenants and reduced lines of credit from lenders, suppliers and counterparties, all of which would adversely affect our business and results of operations and our ability to raise capital to pursue our growth strategy. We cannot assure you that we will be able to obtain an investment grade rating or maintain a favorable credit profile.

We rely on transmission and distribution assets that we do not own or control to deliver our wholesale electricity and natural gas.

We depend on transmission and distribution facilities owned and operated by utilities and other energy companies to deliver the electricity and natural gas we sell to the wholesale market, as well as the natural gas we purchase to supply some of our electric generation facilities. If transmission is disrupted, or if capacity is inadequate, our ability to sell and deliver products may be hindered.

The Federal Energy Regulatory Commission, or the "FERC," has issued power transmission regulations that require wholesale electric transmission services to be offered on an open-access, non-discriminatory basis. Although these regulations are designed to encourage competition in wholesale market transactions for electricity, there is the potential that fair and equal access to transmission systems will not be available or that insufficient transmission capacity will be available to transmit electric power as we desire. We cannot predict the timing of industry changes as a result of these initiatives or the adequacy of transmission facilities in specific markets.

In addition, the independent system operators who oversee the transmission systems in certain wholesale power markets have in the past been authorized to impose, and may continue to impose, price limitations and other mechanisms to address volatility in the power markets. These types of price limitations and other mechanisms may adversely impact the profitability of our wholesale power marketing and trading. Given the extreme volatility and lack of meaningful long-term price history in many of these markets and the imposition of price limitations by regulators, independent system operators or other market operators, we can offer no assurance that we will be able to operate profitably in all wholesale power markets.

Risks Related to Our Capacity Services Business Segment

Our sales and results of operations are subject to fluctuations in the market prices of commodities that are beyond our control.

We sell electricity, natural gas and NGLs from our power generation facilities and our pipeline gathering and processing systems into the spot market or other competitive markets or on a contractual basis. The market prices for these commodities may fluctuate substantially over relatively short periods of time. Our sales and results of operations depend, in large part, upon prevailing market prices for electricity, natural gas and NGLs in our regional markets and other competitive markets. For example, we estimate that if our positions were completely unhedged as of September 30, 2000, every $1.00 change (annualized) in the price for a Mcf of natural gas would impact our EBIT by approximately $1 million, and every $0.01 change (annualized) in the price for a gallon of NGLs would impact our EBIT by approximately $2 million.

11

Volatility in market prices for electricity, natural gas and NGLs results from multiple factors, including:

In addition, the FERC, which has jurisdiction over wholesale power rates, as well as independent system operators and other market operators that control transmission in some of the markets in which we operate, may seek to impose or authorize other entities to impose price limitations, bidding rules and other mechanisms to address volatility in the power generation markets. Fuel prices may also be volatile, and the price we can obtain for power sales may not change at the same rate as changes in fuel costs.

In the future, we may not be able to secure long-term purchase agreements for our power generation facilities, and our existing power purchase agreements may not be enforceable, either of which would subject our sales to increased volatility.

Historically, power from our generation facilities has been sold under long-term power purchase agreements pursuant to which all energy and capacity was generally sold to a single party at fixed prices. Because of changes in the industry, the percentage of facilities, including ours, with these types of long-term power purchase agreements has decreased, and it is likely that over time, most of our facilities will operate without these agreements. Without the benefit of long-term power purchase agreements, we cannot assure you that we will be able to sell the power generated by our facilities or that our facilities will be able to operate profitably.

Recently, some utilities have brought litigation or regulatory proceedings aimed at forcing the renegotiation or termination of power purchase agreements requiring payments to owners of generating facilities that are classified as "qualifying facilities," under the Public Utility Regulatory Policies Act of 1978, or "PURPA." Many qualifying facilities sell their electric output to utilities at prices that are based upon past estimates of the purchasing utility's "avoided cost" and that are now substantially in excess of market prices. In addition, in the future, utilities, with the approval of federal or state regulatory authorities, could seek to abrogate their existing power purchase agreements with qualifying facilities or with other power generators. Some of our power purchase agreements for power generated from our independent power projects and the generation assets purchased from GPU International could be subject to similar efforts by the entities who contract to purchase power from our facilities. If those efforts were to be successful, our sales could decrease and could be subject to increased volatility.

Our efforts to gain control over additional energy assets may not be successful, which would impair our ability to execute our growth strategy.

Our growth strategy depends, in part, on our ability to gain control over additional energy assets. We gain control over energy assets by purchasing them, developing them or entering into contracts

12

under which we obtain the right to control the asset. We may not be able to identify attractive acquisition or development opportunities or to complete acquisitions or development projects that we undertake. In addition, we may not be able to enter into favorable contracts to control energy assets. If we are not able to gain control over additional energy assets, we will not be able to successfully execute our growth strategy. Factors that could cause our efforts to gain control over energy assets to be unsuccessful include:

We are involved in the construction or development of generation facilities which exposes us to many risks and could adversely affect our results of operations.

We are currently constructing or developing power plants, and we intend to pursue additional development projects, including the expansion of some of our existing facilities, in the future. Our completion of these facilities is subject to substantial risks, including:

Any of these factors could give rise to delays, cost overruns or the termination of the plant construction, development or expansion. Any delays could result in the loss of sales and may, in turn, adversely affect our results of operations. In addition, the failure to complete construction according to specifications and cost overruns can result in liabilities, reduced plant efficiency, higher operating costs and reduced earnings. If we were unable to complete the development of a facility, we would generally not be able to recover our investment in the project. The process for obtaining initial environmental, siting and other governmental permits and approvals is complicated, expensive, lengthy and subject to significant uncertainties. We may not be successful in the development or construction of power generation facilities.

Recently, we have made substantial investments in generation assets, and we intend to acquire control of additional energy assets in the future, and our success depends on our ability to successfully operate, manage and leverage these assets.

Recently, we have acquired control over 1,700 MW of electric generation capacity, and we intend to acquire control over additional power and natural gas assets in the future. The prices we paid, and will pay, for these assets are based on our assumptions as to the economics of operating the acquired assets and the prices at which we would be able to sell energy, capacity and other products from them. If any of the assumptions as to a given asset prove to be materially inaccurate, it could have a

13

significant impact on the financial performance of that asset and possibly on our entire company. In addition, we may sell certain assets depending on future market conditions. If we are unable to sell those assets on favorable terms, it could have a negative effect on our financial condition.

We may not be able to successfully or profitably integrate, operate, maintain and manage our newly acquired or developed assets in a competitive environment. Our ability to successfully integrate acquired assets into our operations will depend on, among other things, the adequacy of our implementation plans and the ability to achieve desired operating efficiencies. If we are unable to successfully integrate new assets into our operations, our future earnings could be adversely affected, which would in turn adversely affect the value of our common stock.

Changes in technology may impair the value of our power plants and natural gas assets and may significantly impact our business in other ways as well.

Research and development activities are ongoing to improve the efficiency of power generation facilities, including the development of more efficient turbines and single-cycle and combined-cycle facilities. It is possible that advances in power generation technologies will reduce the cost of electricity produced from these more efficient technologies to a level that renders our current assets unprofitable. In addition, electricity and natural gas demand could be reduced by increased conservation efforts and advances in technology, which could likewise significantly reduce the value of our power generation and natural gas assets.

Our operations require numerous permits and other governmental approvals from various federal, state and local governmental agencies.

The acquisition, ownership and operation of power generation facilities and natural gas assets require numerous permits, approvals and certificates from federal, state and local governmental agencies. We may not be able to obtain or maintain all required regulatory approvals. If there is a delay in obtaining any required regulatory approvals or if we fail to obtain any required approval or comply with any applicable law or regulation, the operation of our assets and our sales of natural gas and electricity could be prevented or become subject to additional costs.

The FERC has authorized us to sell generation from our facilities at market prices. The FERC retains the authority to modify or withdraw our market-based rate authority and to impose "cost of service" rates if it determines that the market is not workably competitive, that we possess market power or that we are not charging just and reasonable rates. Any reduction by the FERC of the rates we may receive or any unfavorable regulation of our business by state regulators could materially adversely affect our results of operations.

Our costs of compliance with environmental laws are significant, and the cost of compliance with new environmental laws could adversely affect our profitability.

Our businesses are subject to extensive federal, state and local statutes, rules and regulations relating to environmental protection. We are required to comply with numerous environmental laws and regulations and to obtain numerous governmental permits, licenses and other approvals in operating our energy assets. With the trend toward stricter standards, greater regulation, more extensive permitting requirements and an increase in the number and types of assets operated by us subject to environmental regulation, we expect our environmental expenditures to be substantial in the future. Our contracts with clients may not allow us to recover capital costs we incur to comply with new environmental regulations.

Should we fail to comply with all applicable environmental laws, we may be subject to penalties and fines imposed against us by regulatory authorities. Further, steps to bring our facilities into compliance could be prohibitively expensive and may adversely affect our financial condition.

14

The federal government and several states recently have proposed increased environmental regulation of many industrial activities, including increased regulation of air quality, water quality and solid waste management. For example, the U.S. Environmental Protection Agency has recently promulgated more stringent air quality standards for particulate matter emitted from power plants. The scope and extent of new environmental regulations, including their effect on our operations, is unclear. In addition, existing environmental regulations could be revised or reinterpreted, new laws and regulations could be adopted or become applicable to us or our facilities and future changes in environmental laws and regulations could occur. If any of these events occur, our business, operations and financial condition could be adversely affected.

We are generally responsible for all on-site liabilities associated with the environmental condition of our power generation facilities and natural gas assets which we have acquired or developed, regardless of when the liabilities arose and whether they are known or unknown. In addition, in connection with certain acquisitions and sales of assets, we may obtain, or be required to provide, indemnification against certain environmental liabilities. The incurrence of a material liability, or the failure of the other party to meet its indemnification obligations to us, could have a material adverse effect on our operations and financial condition.

Risks Related To Our Businesses Generally

The growth of our business is dependent upon us capitalizing on market opportunities.

We have been able to consistently grow our company by capitalizing on market opportunities. For example, we leveraged our experience in the deregulated natural gas industry to take advantage of market opportunities created by the deregulation of the electricity industry. We also intend to leverage our experience in the energy industry to begin trading bandwidth capacity. If any of our efforts to capitalize on market opportunities fails, if we fail to pursue any market opportunities or if any of our targeted markets fails to develop, the future success of our company, as well as the price of our common stock, may be adversely affected.

Our business is dependent upon the retention of our skilled employees.

We depend to a significant degree on the skills, experience and efforts of our employees. Their knowledge of the energy markets and their skills and experience are a crucial element to the success of our marketing and trading and risk management activities. Qualified personnel are in great demand throughout the energy industry, and our future success depends in large part on our ability to attract, train, motivate and retain skilled employees. If we fail to attract and retain qualified personnel, our business and financial condition will be adversely affected.

The profitability of our business is dependent on the counterparties performing in accordance with our agreements with them.

Our marketing, trading and risk management operations are exposed to the risk that counterparties which owe us money or energy as a result of market transactions will not perform their obligations. Should the counterparties to these arrangements fail to perform, we might be forced to acquire alternative hedging arrangements or to honor the underlying commitment at then-current market prices. In such event, we might incur additional losses to the extent of amounts, if any, already paid to counterparties. In addition, we often provide financing to oil and natural gas development projects. We attempt to ensure that we have adequate collateral to secure these transactions. If the counterparty to such a financing transaction fails to perform and the collateral we have secured is inadequate, we will lose money.

In addition, we often rely on a single client or a few clients to purchase all or a significant portion of a generating facility's output, in some cases under long-term agreements that provide the support for any project debt used to finance the facility. As a result, if a major client fails to meet its contractual

15

obligations, it could have a negative impact on the financial condition of that project and possibly the entire company.

Our competition in the wholesale power market is increasing.

The wholesale power industry has numerous competitors, some of which may have more operating experience, more acquisition and development experience, larger staffs and greater financial resources than we do. In addition, many of our competitors control more energy assets than we do, which may give them a competitive advantage over us in wholesale commodity markets. Like us, many of our competitors are seeking attractive opportunities to acquire or develop energy assets both in the United States and abroad. This competition may adversely affect our ability to make investments or acquisitions.

We may not be able to respond in a timely or effective manner to the many changes intended to increase competition in the electricity industry. To the extent competitive pressures increase and the pricing and sale of electricity assumes more characteristics of a commodity business, the economics of our business may come under increasing pressure.

In addition, regulatory changes have also been proposed to increase access to electricity transmission grids by utility and non-utility purchasers and sellers of electricity. We believe that these changes will continue the disaggregation of many vertically-integrated utilities into separate generation, transmission, distribution and retail businesses. As a result, a significant number of additional competitors could become active in the wholesale power generation segment of our industry.

While demand for electricity is generally increasing throughout the United States, the rate of construction and development of new electric assets may exceed the increase in demand in some regional markets. The commencement of commercial operation of new facilities in the regional markets where we own or control generating capacity will likely increase the competitiveness of the wholesale power market in those regions, which could have a material negative effect on our business, results of operations and financial condition.

We will likely need significant additional financing to pursue our business strategy, which may include additional equity issuances or borrowings.

Our business strategy anticipates significant future acquisition and development of additional generating facilities and natural gas assets. We are continually reviewing potential acquisitions and development projects and may enter into significant acquisitions or development projects in the near future. Any acquisition or development project will likely require access to substantial capital from outside sources on acceptable terms. We may also need external financing to fund capital expenditures, including capital expenditures necessary to comply with environmental regulations or other regulatory requirements.

To finance these future activities, we may wish to issue additional equity. In order for the distribution of the remaining shares of our common stock to be tax-free to UtiliCorp and its stockholders, UtiliCorp must own at least 80% of the combined voting power of our outstanding voting stock and 80% of each class of our outstanding non-voting stock, if any, at the time of the distribution. Therefore, prior to our separation from UtiliCorp, we will not be able to issue equity or voting debt that dilutes UtiliCorp's voting power to less than 80% without UtiliCorp's prior consent, and UtiliCorp will not give that consent so long as it still intends to distribute the remaining shares. If we issue additional equity, it may result in dilution to our stockholders.

We may also seek debt financing to fund our future operations. Our ability to arrange debt financing and the costs of debt capital are dependent on numerous factors, including:

16

In the past, a significant amount of our capital needs has been satisfied by UtiliCorp. UtiliCorp has also periodically provided credit support to us. In addition, we believe that we have obtained third-party financing on relatively favorable terms based in part on UtiliCorp's ownership interest in us. Following this offering, UtiliCorp may no longer provide financing or credit support except for specified transactions or for a limited period of time. Future indebtedness may include terms that are more restrictive or burdensome than those of our current indebtedness. As a result, we may not be able to obtain third-party financing on terms that are as favorable as we have experienced in the past.

If we are unable to obtain financing on terms that are acceptable to us, we will not be able to pursue desirable acquisition and development opportunities or to fund capital expenditures. This would have a material adverse effect on our growth prospects and the market price of our common stock.

Our businesses in North America are subject to complex government regulations and may be adversely affected by changes in these regulations or in their interpretation or implementation.

The regulatory environment applicable to the electric power industry has recently undergone substantial changes, both on a federal and state level, which have had a significant impact on the nature of the industry and the manner in which its participants conduct their business. These changes are ongoing and we cannot predict the future course of changes in this regulatory environment or the ultimate effect that this changing regulatory environment will have on our business.

The Public Utility Holding Company Act, or "PUHCA," and the Federal Power Act, or "FPA," regulate public utility holding companies and their subsidiaries and place certain constraints on the conduct of their business. PURPA provides qualifying facilities with exemptions from certain federal and state laws and regulations, including PUHCA and most provisions of the FPA. The Energy Policy Act of 1992, or "Energy Act," also provides relief from regulation under PUHCA to exempt wholesale generators, or "EWGs." Maintaining the status of our facilities as qualifying facilities or EWGs is conditioned on the facilities continuing to meet statutory criteria. Under current law, we are not and will not be subject to regulation as a registered holding company under PUHCA as long as the domestic power plants we own are qualifying facilities under PURPA or are EWGs. If we were subject to these regulations, it would negatively affect our results of operations and financial condition.

Proposals have been introduced in Congress to repeal PURPA and PUHCA in whole or in part. If the repeal of PURPA or PUHCA occurs, either separately or as part of comprehensive legislation designed to encourage the broader introduction of wholesale and retail competition, the significant competitive advantages that independent power producers currently enjoy over certain regulated utility companies would be eliminated or sharply curtailed, and the ability of regulated utility companies to compete more directly with independent power companies would be increased. In addition, such repeal might adversely impact our existing power sales agreements under which we sell power from qualifying facilities.

Moreover, existing regulations may be revised or reinterpreted, new laws and regulations may be adopted or become applicable to us or our facilities, and future changes in laws and regulations may have a detrimental effect on our business. In some markets which have been restructured, governmental agencies and other interested parties may attempt to re-regulate areas of our business which have previously been deregulated.

17

In Canada, national and provincial governments have instituted natural gas regulations also designed to encourage the development of competitive markets. However, we cannot predict the timing and scope of the development of a competitive market in Canada or the effect of these or future regulations on these markets.

Our operations located outside of North America expose us to risks related to laws of other countries, taxes, economic conditions, fluctuations in currency rates, labor supply and labor relations. These risks may delay or reduce our realization of value from our international operations.

We currently have trading, marketing and risk management operations in the United Kingdom and continental Europe and a natural gas storage facility in the United Kingdom. Our strategy includes the expansion of our trading, marketing and risk management operations throughout Europe and the acquisition of additional energy assets in these locations. Having trading, marketing and risk management operations and owning energy assets in foreign jurisdictions subjects us to significant political and financial risks which vary by country, including:

The occurrence of any of these events could substantially reduce the value of the impacted businesses or assets.

We are also subject to foreign currency risks, which can arise when the revenues received by our foreign subsidiaries are not in U.S. dollars. In such cases, a strengthening of the U.S. dollar could reduce the amount of cash and income we receive from these foreign subsidiaries. While we believe we have hedges and contracts in place to mitigate our most significant foreign currency exchange risks, we have some exposure that is not hedged.

Risks Related To Our Separation From UtiliCorp

While UtiliCorp currently intends to distribute our capital stock to its stockholders, it is not required to do so. Our business and your investment in our stock may be adversely affected if UtiliCorp does not complete the distribution of our capital stock to its stockholders.

Although UtiliCorp has advised us that it currently plans to complete the distribution of our capital stock to its stockholders within 12 months of this offering, we cannot assure you whether or when the distribution will occur. UtiliCorp is not obligated to complete the distribution, and it may decide not to do so.

The distribution of our capital stock by UtiliCorp, if it occurs, will violate certain provisions of UtiliCorp's and our credit agreements and other agreements. While we each intend to seek waivers of these violations, we may not be able to do so on favorable terms or at all. If UtiliCorp is unable to obtain the necessary waivers, it may elect not to distribute our capital stock to its stockholders, which may materially affect our stock price.

UtiliCorp intends to seek a ruling from the IRS that the distribution will be tax-free to UtiliCorp and its stockholders. At the time of this offering, UtiliCorp does not have a ruling from the IRS regarding the tax treatment of the distribution. The IRS is not required to issue a ruling within a

18

particular time-frame and delay in issuing a ruling may delay the distribution. If UtiliCorp does not obtain a favorable tax ruling, it is not likely to make the distribution in the expected time frame or, perhaps, at all. In order for the distribution to be tax-free, UtiliCorp must satisfy various complex requirements, including owning at least 80% of the combined voting power of all classes of our outstanding voting stock and 80% of each class of our outstanding non-voting stock, if any, at the time of the distribution. While UtiliCorp believes it should be able to satisfy these requirements, its factual situation may change, the law governing the requirements for a tax-free distribution may change or the IRS could adopt legal interpretations adverse to UtiliCorp's position, any of which could prevent it from meeting these requirements.

UtiliCorp and we will file a request with the SEC and other regulatory authorities to allow the distribution to proceed as contemplated by the separation agreements. These regulatory authorities may impose conditions on or disapprove of the distribution or the proposed separation and any of the separation agreements.

In addition, until the distribution occurs, the risks discussed below relating to UtiliCorp's control of our company and the potential business conflicts of interest between UtiliCorp and us will continue to be relevant to you.

We will be controlled by UtiliCorp as long as it owns a majority of the combined voting power of our outstanding capital stock.

After the completion of this offering, UtiliCorp will own 100% of our Class B common stock and will therefore hold approximately % of the combined voting power of our outstanding capital stock. As long as UtiliCorp holds a majority of the combined voting power of our outstanding capital stock, investors in this offering, by themselves, will not be able to affect the outcome of any stockholder vote. As a result, UtiliCorp will be able to control all matters affecting our company, including:

Following this offering, the agreements we will enter into with UtiliCorp may be amended upon agreement of the parties. While we are controlled by UtiliCorp, UtiliCorp may be able to require us to agree to amendments to these agreements. We may not be able to resolve any potential conflicts with UtiliCorp, and even if we do, the resolution may be less favorable than if we were dealing with an unaffiliated party.

In circumstances involving a conflict of interest between UtiliCorp as the controlling stockholder, on one hand, and our other stockholders on the other, we can offer no assurance that UtiliCorp would not exercise its power to control us in a manner that would benefit UtiliCorp to the detriment of our other stockholders. In addition, UtiliCorp may enter into credit agreements, indentures or other contracts that limit the activities of its subsidiaries. While we would not likely be contractually bound by

19

these limitations, UtiliCorp would likely cause its representatives on our board to direct our business so as not to breach any of these agreements.

Our historical financial results as a subsidiary of UtiliCorp may not be representative of our results as a separate company.

The historical financial information we have included in this prospectus does not necessarily reflect what our financial position, results of operations and cash flows would have been had we been a separate, stand-alone entity during the periods presented. Our costs and expenses reflect charges from UtiliCorp for centralized corporate services and infrastructure costs including:

These allocations have been determined based on what we and UtiliCorp considered to be reasonable reflections of the utilization of services provided to us or for the benefits received by us. This historical financial information is not necessarily indicative of what our results of operations, financial position and cash flows will be in the future. We may experience significant changes in our cost structure, funding and operations as a result of our separation from UtiliCorp, including increased costs associated with reduced economies of scale and with being a publicly traded, stand-alone company.

Our executive officers and some of our directors may have potential conflicts of interest because of their ownership of UtiliCorp common stock. In addition, some of our directors and officers will also be directors and officers of UtiliCorp.

Our executive officers and some of our directors own a substantial amount of UtiliCorp common stock and options to purchase UtiliCorp common stock. Ownership of UtiliCorp common stock by our directors and officers after our separation from UtiliCorp could create, or appear to create, potential conflicts of interest when directors and officers are faced with decisions that could have different implications for UtiliCorp than they do for us.

As long as UtiliCorp holds a majority of the combined voting power of our outstanding capital stock, it will be able to elect all of our directors. Further, under the separation agreements, as long as UtiliCorp owns between 20% and 50% of the combined voting power of our outstanding capital stock, it may appoint a number of our directors proportionate to its percentage ownership of the combined voting power of our capital stock. Accordingly, until UtiliCorp owns less than 20% of the combined voting power of our outstanding capital stock, it is likely that some of our directors will also be directors of UtiliCorp. These directors will owe fiduciary duties to the stockholders of each company. As a result, these directors may need to recuse themselves and to not participate in any board action relating to any transaction or other relationship involving both companies.

Our ability to operate our businesses may suffer if we do not develop our own infrastructure quickly and cost-effectively, and we cannot assure you that the transitional services that UtiliCorp has agreed to provide us will be sufficient for our needs.

We currently use UtiliCorp systems to support many of our operations. We are in the process of creating our own systems to replace UtiliCorp's. These systems are very complex and we may not be successful in implementing these systems or transitioning data from UtiliCorp's systems to our own.

20

Following this offering, UtiliCorp has agreed to provide some transition services to us, including, but not limited to, services related to:

After the expiration of our separation agreements with UtiliCorp, we may not be able to replace the transitional services with a comparable quality of service or on terms and conditions as favorable as those we will receive from UtiliCorp. Under the separation agreements, UtiliCorp is only obligated to provide services to us at the levels provided to us before the separation and for the purpose of supporting our businesses as they were conducted prior to the separation. Accordingly, the services provided by UtiliCorp may not be sufficient for our needs. In addition, UtiliCorp has wide discretion over which employees it will utilize to provide services to us. Consequently, the quality of the services we receive from UtiliCorp may not be as good as the quality of services we received prior to the effectiveness of the separation agreements.

If we do not obtain the consent or waiver of certain provisions of our credit and other agreements to the distribution of our capital stock by UtiliCorp, our operations will be adversely affected.

The distribution of our capital stock by UtiliCorp, if it occurs, will violate certain provisions of our credit agreements and other agreements. Without the consent of, or a waiver from, the lenders and other parties to these agreements, the distribution will result in an event of default which may trigger an event of default under our credit agreements and these other agreements. Upon an event of default under these credit agreements, the lenders may terminate any obligation to make further advances and declare all outstanding indebtedness immediately due and payable. We will seek consents or waivers of these provisions prior to the distribution of our capital stock by UtiliCorp. We may incur additional costs to obtain these consents and waivers. In addition, we may be required to renegotiate the terms of these agreements or replace them on terms less favorable than we currently enjoy. We cannot assure you that we will be successful in obtaining consents or waivers on favorable terms or at all. If we cannot obtain consents or waivers, we may incur material costs to replace these agreements. We cannot assure you that we will be able to replace these agreements. Any of these events could have an adverse effect on our business and our results of operations.

If we take actions which cause the distribution of our stock by UtiliCorp to its stockholders to fail to qualify as a tax-free transaction, we will be required to indemnify UtiliCorp for any resulting taxes. This potential obligation to indemnify UtiliCorp may prevent or delay a change of control of our company after UtiliCorp distributes our capital stock to its stockholders.

UtiliCorp intends to distribute its shares of our capital stock to its stockholders within 12 months of the completion of this offering. Prior to the distribution, UtiliCorp intends to obtain a ruling from the IRS that the distribution will be tax-free to UtiliCorp and its stockholders. Under a tax matters agreement to be entered into between us and UtiliCorp in connection with this offering, we will make various representations to UtiliCorp relating to the ruling. If we breach any of these representations, take any action that causes those representations to be untrue or engage in a transaction after the distribution that causes the distribution to be taxable to UtiliCorp or its stockholders, we will be required to indemnify UtiliCorp for any resulting taxes, including taxes payable by UtiliCorp on indemnification amounts paid by us. The amount of any indemnification payments would be substantial, and we likely would not have sufficient financial resources to achieve our growth strategy after making such payments.

21

Current tax law provides for a presumption that the distribution of our stock by UtiliCorp, if it occurs, may be taxable to UtiliCorp if our company undergoes a 50% or greater change in stock ownership within two years after the distribution. Under the tax matters agreement, UtiliCorp will be entitled to require us to reimburse any tax costs incurred by UtiliCorp as a result of such a transaction. These costs may be so great that they delay or prevent a strategic acquisition or change in control of our company.

Many of our income tax reporting positions have not been audited and could be disallowed.

In connection with the preparation of UtiliCorp's consolidated income tax returns, we have taken tax positions on various issues. Although we believe that our reporting positions are correct, many of these returns have not been audited, and we cannot assure you that our reporting positions will not be disallowed. The disallowance of one or more of these reporting positions could have a material adverse effect on our cash flows and net income, which could impair, at least temporarily, our ability to execute our growth strategy.

Our deconsolidation from the UtiliCorp consolidated tax group will change our overall future income tax position.

We will cease to be a member of the UtiliCorp consolidated tax group once UtiliCorp ceases to own at least 80% of the combined voting power of our outstanding capital stock or 80% of the value of our outstanding capital stock. This deconsolidation will have both current and future income tax implications to us. The event of deconsolidation itself will result in the triggering of deferred intercompany gains. We will recognize taxable income related to these gains, which we do not expect will have a material impact on our net income and cash flow.

We could be limited in our future ability to effectively use certain tax attributes, including foreign tax credits. Also, under the tax matters agreement that we will enter into with UtiliCorp, we will agree at UtiliCorp's request to make a tax election to forego the carry back of net operating losses, if any, we generate in our tax years after deconsolidation to tax years when we were part of the UtiliCorp consolidated group. We will be able to utilize those net operating losses in our tax years after deconsolidation (subject to the applicable carryforward limitation periods), but only to the extent of our income in such tax years. We could be liable in the event that any federal tax liability is incurred, but not discharged, by other members of UtiliCorp's consolidated group.

We intend to undertake appropriate measures after deconsolidation in order to mitigate any adverse tax effect of no longer being a part of the UtiliCorp consolidated tax group. We cannot assure you that these efforts will be successful. Should these efforts be unsuccessful, our deconsolidation from the UtiliCorp tax group may have a material impact on our tax liabilities and financial position. Currently, we cannot quantify these potential impacts.

Risks Related To The Securities Markets and Ownership

Of Our Common Stock

Substantial sales of our common stock may occur in connection with the distribution of our capital stock to UtiliCorp's stockholders. These sales could cause our stock price to decline.

UtiliCorp currently intends to distribute all of the shares of our capital stock it owns to its stockholders within 12 months of this offering. Substantially all of these shares will be eligible for immediate resale in the public market. Our Class B common stock held by UtiliCorp is convertible into common stock on a share-for-share basis at the option of UtiliCorp at any time, and automatically converts if it is transferred by UtiliCorp to an unaffiliated third party other than in a distribution to UtiliCorp's stockholders. Following the distribution of Class B common stock, if any, to stockholders of UtiliCorp, shares of Class B common stock will no longer be convertible into shares of common stock. We cannot predict whether significant amounts of our common stock will be sold in the open market in

22