|

|

|

|

|

|

|

Previous: UACSC 2000-D OWNER TRUST AUTO REC BACKED NOTES, 8-K, EX-24, 2000-11-22 |

Next: BADGER STATE ETHANOL LLC, SB-2, EX-3.1, 2000-11-22 |

As filed with the Securities and Exchange Commission on November 22, 2000

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SB-2

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

BADGER STATE ETHANOL, LLC

(Name of Small Business issuer in its charter)

| Wisconsin | 2040 | 39-1996522 |

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

27402 Malchine Road

Waterford, Wisconsin 53185

(262) 895-2206

(Address and telephone number of principal executive offices)

27402 Malchine Road

Waterford, Wisconsin 53185

(262) 895-2206

(Address and telephone number of principal place of business or intended place of business)

John Malchine, Interim Vice President and Chief Financial Officer

27402 Malchine Road

Waterford, Wisconsin 53185

(262) 895-2206

(Name, address and telephone number of agent for service)

Copies to:

Jonathan B. Levy, Esq.

Cheng S. Lor, Esq.

Lindquist & Vennum, P.L.L.P.

4200 IDS Center

Minneapolis, MN 55402

(612) 371-3211

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement becomes effective.

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: / /

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: / /

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: / /

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box: / /

CALCULATION OF REGISTRATION FEE

| |

||||||||

| Title of Each Class of Securities to be Registered | Dollar Amount to be Registered | Proposed Maximum Offering Price Per Unit | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee | ||||

| Class A Limited Liability Company Unit no par value | $12,000,000 | $1,000 | $12,000,000 | $3,168 | ||||

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Preliminary Prospectus

Subject to Completion Dated November 22, 2000

The information in this prospectus is not complete and may be changed. The securities offered by this prospectus may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and it is not a solicitation of an offer to buy these securities in any state where the offer or sale is not permitted.

10,000 Class A Units $10 Million Minimum Offering

12,000 Class A Units $12 Million Maximum Offering

BADGER STATE ETHANOL, LLC

$1,000 per Unit

Investing in the units of Badger State Ethanol involves risks. Please see "Risk Factors" beginning on page 4.

| |

Minimum |

Maximum |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Per Unit |

Total |

Per Unit |

Total |

||||||||

| Public Offering Price | $ | 1,000 | $ | 1,000 | $ | 1,000 | $ | 1,000 | ||||

| Proceeds to Badger State Ethanol | $ | 1,000 | $ | 10,000,000 | $ | 1,000 | $ | 12,000,000 | ||||

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

, 2000

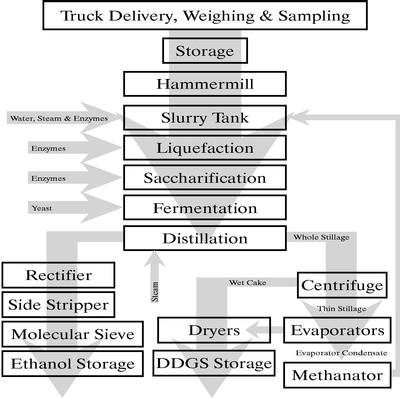

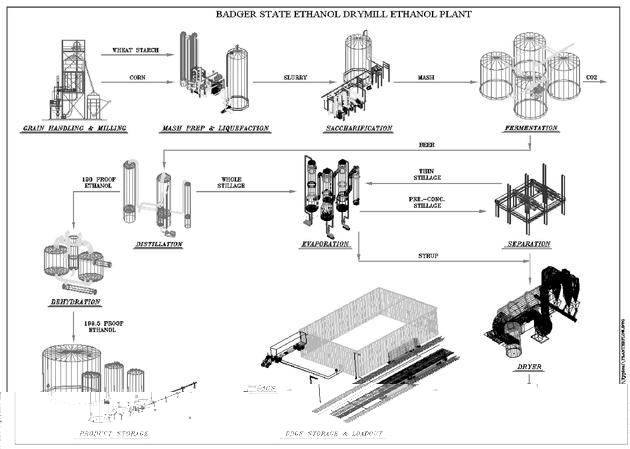

[On this inside cover page would appear a diagram depicting the proposed plant.]

| |

Page |

|

|---|---|---|

| Prospectus Summary | 1 | |

| Risk Factors | 4 | |

| Warning Regarding Forward-Looking Statements | 20 | |

| Use of Proceeds | 20 | |

| Capitalization | 21 | |

| Dilution | 22 | |

| Distribution Policy | 23 | |

| Selected Financial Data | 23 | |

| Management's Plan of Operation | 24 | |

| Business | 27 | |

| Management | 47 | |

| Executive Compensation | 48 | |

| Certain Relationships and Related Party Transactions | 50 | |

| Security Ownership of Certain Beneficial Owners and Management | 51 | |

| Plan of Distribution | 52 | |

| Description of Offering Price Determination | 53 | |

| Description of Units | 53 | |

| Description of Operating Agreement | 56 | |

| Units Eligible for Future Sale | 58 | |

| Federal Income Tax Consequences of Owning Our Units | 58 | |

| Legal Matters | 65 | |

| Experts | 65 | |

| Transfer Agent | 66 | |

| Where You Can Get More Information | 66 | |

| Financial Statements | F-1 |

Our executive offices are located at Badger State Ethanol, LLC, 27402 Malchine Road, Waterford, Wisconsin 53185

Our telephone number is 262-895-2206.

Notes to Readers of this Prospectus

You should rely only on the information contained in this document or information to which we have referred you. We have not authorized anyone to provide you with information that is different. This document may only be used where it is legal to sell these securities. The information in this document may only be accurate on the date of this document.

1

Because this is a summary, it does not contain all the information that may be important to you. You should read the entire prospectus carefully, including the risk factors and financial statements, before you decide whether to invest.

Badger State Ethanol, LLC

We are a recently formed Wisconsin limited liability company. We are seeking to raise capital in order to develop, build and operate a 40 million-gallon per year ethanol plant in Monroe, Wisconsin. We have entered into letters of intent with leading ethanol construction and engineering firms, Fagen, Inc. and ICM, Inc. which have agreed to provide engineering and construction services to us to build the proposed ethanol plant if the offering is successful, and we are able to secure debt financing.

The Opportunity

Ethanol is a fuel component utilized to enhance gasoline performance properties and abate gasoline exhaust emissions. It is derived primarily from processing corn into alcohol. Because it is derived from corn, a readily available agricultural commodity, ethanol is a renewable source of energy. Its creation and use as a gasoline additive generally involves less toxic emissions than the other principal gasoline additive, methyl tertiary butyl ether ("MTBE"). MTBE is a petroleum-based additive that has begun to fall out of favor in many areas because of environmental risks. California recently began to phase-in a ban on MTBE after detecting unacceptable levels of MTBE in groundwater. To assist in the development of ethanol production and stimulate demand for domestically produced corn, the federal government and certain state governments, including Wisconsin, have created incentive programs to encourage ethanol production. These incentive programs involve tax credits at the federal level and payments to ethanol producers at the state level. The Clean Air Act Amendments of 1990 also require that gasoline used in nine metropolitan areas suffering air quality problems use reformulated gasoline. Reformulated gasoline is gasoline that contains additives such as MTBE or ethanol to reduce environmentally harmful emissions.

We believe that perceived increased risks associated with MTBE, the growth in the number of larger gasoline consuming vehicles in many metropolitan areas, federal and Wisconsin subsidies for ethanol producers, and an abundant supply of corn, create an exciting opportunity for a large-scale ethanol plant in southern Wisconsin. The Monroe, Wisconsin area, where the plant is proposed to be located, is served generally by good rail and highway transportation networks. This network provides access to Milwaukee, Wisconsin, Chicago, Illinois and other midwest locations. We believe that these industrial centers will be attractive markets for ethanol.

Processing corn into ethanol produces natural by-products known as distiller gains, which may be sold as Distillers Dried Grains with Solubles ("DDGS"), Distillers Wet Grains with Solubles ("DWS") and Distillers Modified Wet Grains ("DMWS"). These are animal feed products. The area in the immediate vicinity of the proposed plant is generally an agricultural area that we believe will generate strong demand for these feed products.

The Project

If we are successful in this offering, and are able to obtain the debt financing that we are seeking, we plan to build a 40 million-gallon per year dry mill ethanol plant. The proposed plant is expected to convert, on an annual basis, 14.8 million bushels of corn into approximately 40 million gallons of ethanol, 128 thousand tons of distiller grains and 126 thousand tons of raw carbon dioxide gas. The City of Monroe, Wisconsin has agreed to provide us with at least 25 acres of land for the project if we satisfy certain conditions, including securing debt financing and completing this offering. We expect to commence construction, depending upon the season and weather, approximately 60 days after we close

1

on this offering, which is contingent upon our receipt of written agreements from lenders to provide debt financing. We call this the financial closing. We expect that the construction will take approximately 14 months, with an additional two months of post-construction testing and engineering. We plan to begin accepting shipments of corn and producing ethanol, distiller grains and raw carbon dioxide gas, approximately 16-18 months after the close of this offering.

Under the terms of our letter of intent with Fagen and ICM, Fagen will serve as the general contractor and ICM will be the primary subcontractor on the project. Fagen has been the principal contractor on thirteen ethanol projects and has performed significant work on a total of 29 projects. These two firms have developed, designed and built numerous ethanol plants throughout the country. Both Fagen and ICM also have representatives serving on our board of directors.

Our Financing Plan

Our letter of intent with Fagen provides that the proposed ethanol plant will cost no more than $45 million. We intend to raise between $10 and $12 million in this offering, seek approximately $33 million in senior debt from one or more banks and approximately $12 million in subordinated debt from third party credit providers to pay for the construction and initial operating and maintenance costs. We have no contracts or commitments with any bank, lender or financial institution for this debt financing, but we will not close on this offering until we execute binding financing agreements. We are also seeking a loan of approximately $2.3 million from our electrical utility provider to fund electrical infrastructure, approximately $1.6 million in tax increment financing from the City of Monroe to fund improvements to the proposed site and a $300,000 grant from the Wisconsin Department of Commerce. We intend to raise approximately $59 million.

Summary of Operating Agreement

Because we are a limited liability company we are governed by an operating agreement. Under our operating agreement we are managed by at least five, but no more than seven directors who must also be unit holders. Unit holders may vote on a limited number of items, such as dissolving us, amending our operating agreement and electing future directors.

As a unit holder, you will have a capital account to which we will credit your contributions to us. Your account will also be increased by your allocated share of our profits and other applicable items of income or gain. We will decrease your account for your share of our losses and other applicable items of expenses or losses and any distributions that we make to you. Generally, we will allocate our profits and losses to you based upon the number of units you own.

We expect to be treated as a partnership for federal income tax purposes. We will not pay any federal income taxes and will instead allocate our net income to our unit holders who must include that income as part of his or her taxable income. This means that you will have to pay taxes on your allocated share of our income whether or not we make a distribution to you in that year. Please see "Federal Income Tax Consequences of Owning Our Units" for a discussion of important federal income tax consequences.

Transfer of your units is restricted by our operating agreement. Generally, unless a transfer is by operation of law, such as due to death or divorce, you cannot transfer your units without the prior written approval of a majority of our directors. Directors will not approve any transfer until the proposed ethanol plant is operating. This means that your units will not be transferable for approximately 18 months after we close on the offering. We will not be generating any revenue during that time. Please see the section entitled "Description of Units" for a discussion of transfer restrictions.

2

The Offering

| |

Minimum |

Maximum |

|||

|---|---|---|---|---|---|

| Class A Units offered |

|

10,000 |

Units |

12,000 |

Units |

| Class A Units outstanding after completion of the offering |

|

11,720( |

1) |

13,720( |

1) |

| Use of proceeds |

|

|

|

|

|

| |

|

|

|

|

|

3

Investing in our units is highly speculative and very risky. You should be able to bear a complete loss of your investment. In addition to the other information in this prospectus, you should consider the following risks carefully in deciding whether to invest in our units.

RISKS RELATED TO OUR FORMATION AND FINANCING PLAN

We are recently formed and we expect losses.

We are start-up business venture, with virtually no history of operations. We have limited financial and human resources. For the period from inception May 11, 2000 through September 30, 2000, we have an accumulated net loss of $44,485. We will continue to incur significant losses until we are able to secure financing and successfully complete construction and commence operations of our proposed ethanol plant. There can be no assurance that we will be successful in completing the offering, securing additional financing and building and operating an ethanol plant. Even if we are successful in completing the proposed ethanol plant, there can be no assurance that we will be able to operate profitably.

We may not raise sufficient capital to proceed with our business plan; we have no commitments for our debt financing requirements.

We believe that we must raise at least $10 million in the offering in order to proceed with our business plan. We have begun discussions with potential lenders regarding debt financing. Based on current construction cost estimates, we believe we will need approximately fifty-nine million dollars ($59,000,000) in total funds to construct the proposed ethanol plant and finance start-up operations. We are seeking to secure approximately $33 million in senior debt and approximately $12 million in subordinated debt from one or more commercial banks or other lenders. We are seeking to raise $10 to $12 million in this offering. We are seeking approximately $2.3 million in a loan from our electrical utility service provider, approximately $1.6 million of tax increment financing from the City of Monroe, Wisconsin and a $300,000 grant from the Wisconsin Department of Commerce. While we have a proposal from our electrical utility provider and a commitment from Monroe, subject to various conditions, we have received no proposals from any banks or financial institutions for the significant debt financing needed to construct the ethanol plant. There can be no assurance that we will be able to obtain debt financing or, if available, that it will be on terms acceptable to us. If the financing is unavailable for any reason, we will be forced to abandon our business. If we are unable to receive binding written commitment letters on the senior and subordinated debt financing on or before September 30, 2001, we will return your investment in escrow, without interest or deduction.

In addition to funding the project, we will also need permanent working capital and seasonal funding to finance operations. We anticipate borrowing these funds from commercial banks, but we have commitments from any bank to provide these funds.

We anticipate having substantial debt and debt service requirements.

We anticipate incurring substantial debt to build the ethanol plant and implement our business plan. Therefore, we anticipate substantial debt and debt service requirements. Upon completion of the ethanol plant, we anticipate that our total debt obligation will be approximately $49 million and our capital structure will be highly leveraged.

The amount of debt we plan to assume will have important consequences including:

4

To service our debt, we will require a significant amount of cash and our ability to generate cash depends on many factors.

Our ability to repay our debt will depend on our financial and operating performance and on our ability to successfully implement our business strategy. We cannot assure you that we will be successful in implementing our strategy or in realizing our anticipated financial results. Our financial and operational performance depends on numerous factors including prevailing economic conditions and on certain financial, business and other factors beyond our control. We cannot assure you that our cash flows and capital resources will be sufficient to repay our anticipated debt obligations. In the event that we are unable to pay our debt service obligations, we may be forced to reduce or eliminate distributions or capital expenditures. We could be forced to sell assets, obtain additional equity capital or refinance or restructure all or a portion of our debt. In the event that we are unable to refinance our indebtedness or raise funds through asset sales, sales of equity or otherwise, our business would be adversely affected.

Our debt financing may contain numerous covenants, in which a breach may result in default.

Our debt obligations will likely contain a number of significant covenants. These covenants may limit our ability to, among other things:

A breach of any of these covenants could result in default under our debt agreements. If we default on any of these covenants, and if not waived, a lender could rightfully accelerate our indebtedness, in which case the debt would become immediately due and payable. If this occurs, we may not be able to repay our debt or borrow sufficient funds to refinance it. Even if new financing is available, it may not be on terms that are acceptable to us. This could cause us to cease building our proposed ethanol plant, or if the plant is constructed, this could cause us to cease operations.

5

If we are able to close on the offering, we will be required to spend funds raised in the offering before any of our lenders disburse loan proceeds for construction.

Assuming we are successful in the offering, and are able to obtain the necessary commitments for senior and subordinated debt, we expect that our lenders will require that we first spend the capital that we raise in this offering before using any loan proceeds. While we will not close on this offering until we have binding written credit agreements from these lenders, there can be no assurance that these lenders will disburse the loan proceeds at the appropriate time. If we must initiate litigation to compel the disbursement of loan proceeds, it would materially harm our business.

RISKS RELATED TO CONSTRUCTION AND DEVELOPMENT

We are dependent upon Fagen and ICM to design and build the ethanol plant, but we have no executed definitive agreement with either of them.

We have a letter of intent with Fagen and ICM for various design and construction services. Fagen has delivered to us a proposed Design-Build Contract that is substantially final, in which Fagen will serve as our general contractor and will engage ICM to provide design and engineering services to us. Fagen's obligation to build the proposed ethanol plant is not reflected in a binding definitive agreement. While we expect that in order to secure our debt financing and consequently close on this offering, we will execute the contract with Fagen, there can be no assurance that the contract will be executed. If Fagen were to terminate its relationship with us, we might not be able to secure a replacement general contractor and our business would be materially harmed.

We are also dependent upon Fagen and ICM's experience and ability to build and train us in operating the proposed ethanol plant. If the plant is built and does not operate as we expect, we will rely on Fagen and ICM to remedy any deficiencies or defects.

Our agreements or understandings with Fagen and ICM were not negotiated at arm's length, we may not have obtained terms as favorable to us as those we could have obtained from third parties, and any claims that we may have against Fagen or ICM may be difficult for us to enforce.

We are heavily dependent upon the services that Fagen and ICM are providing. Without these services, we will not be able to build our proposed ethanol plant. Representatives of Fagen and ICM also serve on our board, and have been involved in nearly all aspects of our formation, capital raising and operation to date. Consequently, the terms of our agreements and understandings with them have not been negotiated at arm's length, and therefore, there is no assurance that our arrangements with them are as favorable to us as those we could have obtained from unaffiliated third parties. Because of Fagen and ICM's role in this project, and their representation on our board of directors, it could be difficult or impossible to enforce claims that we may have against these parties if, for example, one or both of them breaches agreements or understandings with us. If, for example, the proposed plant is not built on time or suffers from a defect of one kind or another due to alleged errors in design or construction, we would look to Fagen or ICM to remedy any problem with the plant. Because of Fagen and ICM's affiliation with us, it may be difficult to enforce any claims we may have arising from construction or operation of the plant.

We may encounter defective material and workmanship from Fagen.

Under the terms of the proposed Design-Build Contract, Fagen warrants that the material and equipment furnished to build the ethanol plant will be new, of good quality, and free from defects in material or workmanship. Although Fagen will, for a period of one year after substantial completion of the ethanol plant, correct all defects in material or workmanship, any defects in material or workmanship may cause substantial delay in the commencement of operation of the ethanol plant. If defects are discovered after commencement of operation, it could cause us to halt or discontinue our

6

operation, which may have a material adverse impact on our financial performance. If we encounter defects in material or workmanship prior to or after we commence operation it could harm our business.

We may encounter hazardous conditions at the construction site that may delay the construction of the ethanol plant.

Fagen is not responsible for any hazardous conditions encountered at the construction site, such as environmental or other types of contamination. Upon encountering a hazardous condition, Fagen may immediately stop work in the affected area. Once we receive notice of a hazardous condition, we must correct the condition. The presence of a hazardous condition will likely delay construction of the project and may require significant expenditure of our resources to correct the condition. In addition, Fagen will be entitled to an adjustment in price and time of performance if its price and performance time has been adversely affected by the hazardous condition. If we encounter any hazardous conditions, it will likely have a material adverse impact on our financial condition. Although the site will be tested prior to commencing construction and we are aware of no hazardous conditions, there can be no assurance that we will not encounter hazardous conditions.

The condition of our construction site may differ from what we or Fagen expects.

If Fagen encounters "differing site conditions," then it will be entitled to an adjustment in the contract price and time of performance if the differing conditions adversely affect its costs and performance time. By "differing site conditions," we mean any concealed physical conditions at the site that:

We must obtain liability insurance prior to the commencement of construction of the ethanol plant and we currently have no insurance.

Prior to the commencement of construction of the ethanol plant, we must obtain and maintain liability and property insurance covering claims, injuries, losses and damages that arise as a result constructing the ethanol plant. We currently do not have any liability insurance and there can be no assurance that we will be able to obtain liability insurance on terms acceptable to us, or if at all.

Fagen is not required to maintain any bond or performance security in connection with the construction of the ethanol plant.

Under the proposed Design-Build Contract, Fagen is not required to obtain any performance and labor and material payment bonds, or any other form of performance security. In the event of Fagen's failure to perform or pay for labor or material it has procured, our only means of recourse will be from Fagen only. Although we believe that Fagen will perform pursuant to the proposed Design-Build Contract, there can be no assurance that such performance will occur or if Fagen does not perform, that we will be able to recover damages from Fagen.

7

Acts, omissions, conditions or events beyond Fagen's control may occur and could delay the completion of the proposed ethanol plant.

If Fagen's completion of the ethanol plant is delayed due to any acts, omissions, condition, events or circumstances beyond its control, then the time for completion of the proposed ethanol plant will be reasonably extended if the delay was not caused by Fagen. To the extent a delay is caused by us, then Fagen will also be entitled to an appropriate adjustment of the contract price. Although we will work diligently to prevent any delays, there can be no assurance that delays will not occur as a result of acts or circumstances that are within or beyond our control.

All disputes arising from the proposed Design-Build contract must be resolved by the parties or through arbitration.

If a dispute arises with Fagen concerning construction of the proposed ethanol plant, we may not bring action in court, but must instead first attempt to resolve the dispute with Fagen through mediation. In the event the dispute is still not settled, the matter shall be resolved by arbitration in accordance with the Construction Industry Arbitration Rules of the American Arbitration Association, unless the parties agree otherwise. The determination of the arbitrator will be final and may not be appealed to any court. If a dispute arises before completion of the proposed ethanol plant, this lengthy resolution procedure may cause significant delays in the completion of the ethanol plant, which may have a material and adverse impact on our business. Arbitration may not be as favorable to us as a local court in Wisconsin might be.

We may not seek consequential damages for harm arising from the construction of the proposed ethanol plant and if Fagen finishes early, we would pay an early completion bonus.

Fagen is not liable for consequential damages, such as loss of use, lost profits or harm to our business, reputation or financing, in connection with the construction of the ethanol plant. Instead we will be entitled to liquidated damages of $10,000 per day in the event Fagen fails to substantially complete the ethanol plant within 45 days after the scheduled substantial completion date. The substantial completion date is approximately 16-18 months after the closing of this offering. The exact date cannot be determined until we close on this offering. There can be no assurance that we will be able to collect the liquidated damages provided for or if collected, that they will be sufficient to cover the damages suffered. If Fagen finishes the project early and the plant is running at full capacity, then we might be required to pay Fagen a bonus of up to $20,000 per day until 45 days after the scheduled completion date. This means that we may have to pay Fagen up to an additional $1 million if the ethanol plant is running at full capacity by the substantial completion date.

Fagen may terminate the proposed Design-Build Contract if they are not able to perform work on the ethanol plant for an extended period of time due to a government or court order.

If the work on the ethanol plant stops for 60 consecutive days or more than 90 days in total, because of an order from a court or governmental authority having jurisdiction over the construction of the ethanol plant, or due to our failure to procure necessary permits or approvals for which we are responsible, then Fagen may terminate the proposed Design-Build contract. If Fagen terminates the contract, we will be forced to seek another general contract to complete the ethanol plant and pay Fagen a $1,000,000 fee. There can be no assurance that we will be able to engage another general contractor to complete the ethanol plant on terms acceptable to us, or if at all.

We are dependent on a development agreement with the City of Monroe, Wisconsin.

We have entered into a development agreement with the City of Monroe, Wisconsin to purchase at least a 25 acre site for the proposed ethanol plant for $1. Under the agreement, the City must conduct

8

a Phase I environmental study on the property, provide clear title to the property and deliver resolutions adopted by the City Council of Monroe approving the agreement. The City has agreed to provide approximately $1.6 million in tax increment financing to fund improvements to the site and to apply for a $300,000 grant from the Wisconsin Department of Commerce. We have no knowledge of any contamination, or title issues, but the land could have unexpected environmental or title problems that the City must remedy before we can obtain debt financing and begin construction. The City's obligation to deliver the property to us is contingent upon our receipt of financing commitments of at least $7 million. In addition, if the $300,000 grant from the Wisconsin Department of Commerce is not awarded or awarded for less than $300,000, we are obligated to reimburse the City, either in the form of fewer improvements, a cash payment or accept special assessments, for the difference between the $300,000 and the grant awarded. The Department of Commerce has approved the grant for up to $300,000, subject to the following conditions:

If we do not receive our financing and close on this offering by June 1, 2001, the City could terminate the agreement, and we would not receive the land upon which we plan to build our proposed ethanol plant. In that event, we might not be able to find an alternative site on terms as favorable as those offered by Monroe and our business and prospects would be materially harmed. In addition, if the proposed ethanol plant is not substantially complete by June 1, 2002, we may be subject to penalties of up to $280,000 per year.

Monroe has agreed to provide us with tax increment financing, but it must annex the property into the City.

Pursuant to our development agreement, the City of Monroe is in the process of annexing the site where the proposed ethanol plant will be built. The process will be complete when approved by the City. While we are not aware of any opposition to the annexation and the tax increment financing, there can be no assurance that the City will be able to successfully annex the site and provide the property and improvements. The City's policy could change due to, among other things, public objection or changes in the economy or political attitudes toward commercial industrial development. We are dependent upon this agreement and the City's obligations to improve the site. If the City of Monroe does not provide us with at least a 25 acre site and site improvements, our business could be materially harmed.

We are dependent upon improvements that Monroe has agreed to provide that could be delayed.

Under the development agreement, Monroe has agreed to fund important grading, sanitary sewer, water, road work and storm-water runoff work on the site. This work is expected to be financed from $1.6 million in tax increment financing that the City is providing to us and a $300,000 grant from the Wisconsin Department of Commerce. We will pay back this financing though property taxes on the property for 10 years. We cannot begin construction until the improvements are completed. We expect it to be completed in the winter of 2001, but weather conditions could delay this work. If this project is delayed, it would push back our construction time-table.

9

The project could suffer delays that could harm our business.

We have what we consider to be a reasonable timetable for completion of the financing, regulatory permitting, and construction phases of our project. Our schedule depends upon how quickly we can close on this offering by raising the $10 million minimum, and obtaining the senior and subordinated debt financing we are seeking. Our time table also depends upon weather and seasonal factors affecting construction projects generally.

We expect that it will be approximately 16-18 months after we close on this offering before we begin operation of the proposed ethanol plant. While we have no knowledge of any events or circumstances such as permitting delays, construction delays or other events that could delay this schedule, delays often occur in connection with large-scale development and construction projects. The factors and risks described in this "Risk Factors" section, as well as changes in interest rates, changes in weather condition, permitting delays, or changes in political administrations at the federal, state or local level that result in policy change towards ethanol, could cause construction and operation delays. If it takes longer to raise the financing, obtain necessary permits or construct the plant than we anticipate, we could be forced to seek additional sources of capital and our ability to sell ethanol products would be delayed, which would harm our business and reduce the value of your units.

We have very few binding contracts.

Our business plan depends upon arrangements and understandings with various parties which are based on letters of intent that have not been finalized and reflected in formal, binding, executed agreements. For example, Fagen and ICM, who are providing the construction, design and engineering work on the project, are working pursuant to a letter of intent and not a final definitive agreement. Our relationship with Fagen and ICM is not based upon signed formal contracts, and there can be no assurance that formal agreements will ever be finalized. Without a formal contract, these parties could terminate their relationships with us at any time. In addition, the final terms that these parties provide may not be as favorable to us as we have anticipated. If these parties terminate negotiations, or fail to enter into binding agreements with us, or the terms are not what we planned, our business would be materially harmed.

We must build transportation infrastructure for the project.

We must build and maintain a transportation infrastructure, such as roads and rail networks to the ethanol plant to support deliveries of material and corn, and shipments of finished ethanol and animal feeds. These transportation infrastructures have not been built. We have an agreement with the City of Monroe and we are negotiating with the Wisconsin and Southern Railroad Company to assist us with the construction of these infrastructures, but there can be no assurance that these infrastructures can be timely built on terms acceptable to us, or at all.

RISKS RELATED TO OUR OPERATING AGREEMENT

You will be bound by our operating agreement which has been agreed to by our directors.

We will be governed primarily according to the provisions of our operating agreement and the Wisconsin limited liability company statute. Our operating agreement has been negotiated and agreed to by our initial directors, Gary Kramer, John Malchine, Jeff Roskam and Daryl Gillund. This document contains provisions relating to, among other things, election of directors, restrictions on transfers, unit holder voting and other corporate governance matters. If you invest in us, you will be bound by this document, and its provisions may not be amended without the approval a majority of the unit holders. Please see "Description of Operating Agreement."

10

Our board of directors is controlled by our founders, and replacing the board is very difficult to accomplish under our operating agreement.

Under our operating agreement, unit holders' right to elect directors to the board is restricted. Our board has been divided into classes to serve staggered terms. Our founders, Mr. Kramer and Mr. Malchine, have been elected to serve while the proposed ethanol plant is being developed and will continue to serve as directors for a period of five years after substantial completion of the ethanol plant. Two other directors, Mr. Roskam, Senior Vice President of ICM and Mr. Gillund, President of Fagen, have also been elected to serve while the ethanol plant is being developed and will continue to serve for a period of three years after substantial completion of the ethanol plant. Additionally, so long as ICM and Fagen or their affiliates each continue to own at least 250 Class A units, each will be entitled to appoint a director to our board.

Our board will consist of at least five and no more than seven members. Mr. Kramer and Mr. Malchine is expected to name one additional board member at the closing of this offering. That new member will serve while the proposed ethanol plant is being developed and will continue to serve for a period of three years after substantial completion of the ethanol plant. No matter may be submitted to unit holders for approval without the prior approval of the board. This means that our board controls virtually all of our affairs. We do not expect a vacancy to develop on the board for at least three years after substantial completion of the proposed ethanol plant. In addition, nominees for a director's position will be named by our then acting directors. Units holders may make a nomination if a vacancy develops for a director's seat, if the unit holder owns at least 25 Class A units, and provides a nomination to us in accordance with the requirements of our operating agreement. Investors should be aware that our operating agreement is unlike the articles of incorporation and bylaws of typical public companies whose shares trade on Nasdaq or a stock exchange. Our units do not trade on an exchange and we are not governed by rules of the Nasdaq or a stock exchange concerning corporate governance.

We are dependent upon our directors.

We have no employees and no organization, and our directors are instrumental to our success. Our principal promoters, and two members of our board of directors, Mr. Gary Kramer and Mr. John Malchine, are serving as our interim officers and have relatively little experience in raising capital to build and operate an ethanol plant. Mr. Kramer is a practicing veterinarian and Mr. Malchine is chairman of the Wisconsin Agricultural, Trade and Consumer Protection Board. Both of these individuals are experienced in business generally, but they have no experience in raising capital from the public, or in organizing and building an ethanol plant if the offering and debt financing are successful. Neither has any experience in running a public company. This lack of experience could result in difficulties or delays in creating, preparing and reporting our financial records and results. We are also dependent upon a part-time bookkeeper that has other clients other than us.

We are also dependent on the two other members of our board of directors, Mr. Daryl Gillund and Mr. Jeff Roskam. These two individuals serve as representatives of Fagen and ICM, respectively, which are providing construction and engineering services to us. Their service on the board and their assistance to us is invaluable. If any of our directors were to leave, and we were not able to recruit and retain suitable replacements, our business prospects would be materially harmed.

You are relying entirely on our directors to manage our operations.

You will have no right to take part in the management of our limited liability company, except through the exercise of your limited voting rights described in the operating agreement. You should not purchase units unless you are willing to trust our directors to manage our operations. Please see "Description of Operating Agreement."

11

Our directors also have management responsibilities and conflicts of interest with respect to other entities with whom we do business.

All of our directors and officers have conflicts of interests in allocating management time between us and other entities. Our officers are committed to only serving on an interim basis until the proposed plant is operational. We have no employment or other agreements with any of them. It is possible that these officers may discontinue their service with us, in which case we would be forced to recruit and hire qualified personnel to continue with the development and operation of the proposed ethanol plant. There can be no assurance that our officers and directors will continue to serve us for any extended period time, or that we will be able to recruit and hire qualified personnel to develop and operate the proposed ethanol plant. Additionally, Messrs. Gillund and Roskam are principals of Fagen and ICM, respectively. Fagen and ICM are our general contractor and prime subcontractor for the proposed plant. Consequently, these individuals have conflicts of interest when the board as a whole has considered or will consider contracts and agreements that we must enter into with Fagen, ICM or their affiliates to build and operate the proposed ethanol plant.

RISKS RELATED TO ETHANOL PRODUCTION

Federal regulations and tax incentives concerning ethanol could expire or change, which could harm our business.

Congress currently provides certain federal tax incentives for oxygenated fuel producers and marketers, including those who purchase ethanol to blend with gasoline in order to meet federally mandated oxygenated fuel requirements. These tax incentives include, generally, an excise tax exemption from the federal excise tax on gasoline blended with at least 10 percent, 7.7 percent, or 5.7 percent ethanol, and income tax credits for blenders of ethanol mixtures and small ethanol producers. The ethanol industry depends on continuation of the federal ethanol subsidy. Without this subsidy, ethanol production could fall to near zero in Wisconsin and the nation. The federal subsidies and tax incentives are scheduled to expire September 30, 2007. Although these subsidies and tax incentives have been continued beyond their original and rescheduled expiration dates in the past, there can be no assurance that the federal subsidies and tax incentives to the ethanol industry continue beyond their scheduled expiration date or, if they continue, the incentives would continue at the same level. The elimination or reduction of the federal subsidy and tax incentives to the ethanol industry would have a material adverse impact on our business.

Wisconsin state producer incentive payment may not be available or could be modified which could harm our business.

Under a recently enacted Wisconsin producer payment program, the State of Wisconsin will pay certain ethanol producers $0.20 per gallon for up to 15,000,000 gallons of ethanol produced in Wisconsin in each 12 month period. The payments will be prorated if the State of Wisconsin has insufficient funds to pay all eligible ethanol producers $0.20 per gallon. A Wisconsin ethanol producer will be eligible for the payments if it has been producing ethanol in Wisconsin for fewer than 60 months, it produces more than 10,000,000 gallons of ethanol a year and it purchases the corn or other substances from which the ethanol is produced from Wisconsin sources. The maximum subsidy available to an ethanol producer under this program is $3,000,000 annually. We have applied with the Wisconsin Department of Agriculture, Trade and Consumer Protection to qualify for the statutory maximum of these ethanol producer payments. Because we will not be in a position to produce 10 million gallons of ethanol until at least the year 2002, we will not qualify for the payments until that time. Additionally, if another ethanol plant came online and produced 10 million gallons of ethanol, it could qualify for the producer payment which would reduce the funds available to us. The Wisconsin legislature could reduce or eliminate these payments at any time. We intend to partially collateralize a

12

substantial portion of our subordinated debt financing with these payments, and therefore, if these payments were eliminated or reduced, it would be very damaging to our business and prospects.

Operating our proposed ethanol plant may require additional capital.

The processing of corn into ethanol and the marketing of ethanol and its byproducts are capital intensive and require substantial amounts of cash reserves. Even if we successfully build the ethanol plant, we may not generate sufficient operating cash to meet these capital requirements. We will likely need additional financing following the construction and start-up operation of the ethanol plant in order to compete in the ethanol industry. This financing will be senior in priority to the equity of investors, and we could be subject to restrictive covenants that could restrict our ability to pay cash distributions or limit our ability to grow our business by issuing additional securities or debt.

If we obtain additional financing by issuing additional units, investors in this offering would suffer dilution of their units in our limited liability company. This could reduce the value of your units. There can be no assurance that additional financing would be available if required or, if available, that it would be on terms acceptable to us. If future financing were unavailable for any reason, we may be forced to discontinue operations.

The ethanol industry is very competitive.

While the ethanol industry has been growing, there is significant competition among ethanol producers. Nationally, ethanol production is concentrated in a few large companies. Investors should understand that the proposed ethanol plant faces a competitive challenge from larger factories, from plants that can produce a wider range of products than our proposed ethanol plant, and from other plants similar to our proposed ethanol plant.

If constructed, the ethanol plant will be in direct competition with other ethanol producers, many of which have greater resources than we currently have or will have in the future. Large ethanol producers such as Archer Daniels Midland, Minnesota Corn Processors and Cargill, among others, are capable of producing significantly greater quantities than the amount of ethanol we expect to produce. In addition, there are several Minnesota and other Midwestern regional ethanol producers which have recently formed, are in the process of forming, or are under consideration, which are or would be of a similar size and have similar resources to us. In light of such competition, there is no assurance that we can complete our project, or can successfully operate the ethanol plant if constructed.

The proposed ethanol plant will also compete with producers of other gasoline additives having similar octane and oxygenate values as ethanol, such as producers of MTBE, a petrochemical derived from methanol which costs less to produce than ethanol. Many major oil companies produce MTBE and because it is petroleum-based, its use is strongly supported by major oil companies. Alternative fuels, gasoline oxygenates and alternative ethanol production methods are also continually under development. The major oil companies have significantly greater resources than we have to market MTBE, to develop alternative products, and to influence legislation and public perception of MTBE and ethanol. These companies also have sufficient resources to begin production of ethanol should they choose to do so.

To produce ethanol we intend to purchase significant amounts of corn that is subject to disease and other agricultural risks.

Ethanol production at our proposed facility will require corn. Corn, as with most other crops, is affected by weather conditions. A significant reduction in the quantity of corn harvested due to adverse weather conditions, disease or other factors could result in increased corn costs with adverse financial consequences to us. Significant variations in actual growing conditions from normal growing conditions

13

may adversely affect our ability to procure corn for the proposed plant. We also have no definitive agreements with any corn producers to provide corn to the proposed ethanol plant.

The price of corn is influenced by general economic, market and government factors. These factors include weather conditions, farmer planting decisions, domestic and foreign government farm programs and policies, global demand and supply. Changes in the price of corn can significantly affect our business. Generally, rising corn prices produce lower profit margins and therefore represent unfavorable market conditions. This is especially true if market conditions do not allow us to pass along increased corn costs to our customers. The price of corn has fluctuated significantly in the past and may fluctuate significantly in the future. We can not assure that we will be able to offset any increase in the price of corn by increasing the price of our products. If we cannot offset increases in the price of corn, our financial performance may be materially and adversely effected.

To produce ethanol, we will need a significant supply of water.

Water supply and water quality are important requirements to produce ethanol. We anticipate that our water requirements will be supplied through a 350,000 gallon-per-day well that we plan to drill near the ethanol plant. We believe that, based upon the current output of several city wells, there is sufficient groundwater to support this well. In addition, the City of Monroe has agreed to connect a water supply line into the ethanol plant that we may use when we need more water than the well can provide.

We expect that the City and the proposed well will provide all of the water that we will need to operate the proposed ethanol plant, but our estimates regarding water needs could be understated and we could need additional water. If we need more water, we will be forced to find other sources and this could require us to spend additional capital which could harm our business and its prospects. Further, there can be no assurance that we will be able to find alternate sources of water at commercially reasonable prices, or at all.

Interruptions in our supply of energy could have a material adverse impact on our business.

Ethanol production also requires a constant and consistent supply of energy into the ethanol plant. If there is any interruption in our supply of energy or water for whatever reason, such as supply, delivery or mechanical problems, we may be required to halt production. If production is halted for any extended period of time, it will have a material adverse effect on our business. We plan to enter into agreements with local gas and electric utilities to provide our needed energy, but there can be no assurance that those utilities will be able to reliably supply the gas and electricity that we need. If we were to suffer interruptions in our energy supply, either during construction or after we begin operating the ethanol plant, our business would be harmed.

Our success will depend on hiring key personnel.

We have no permanent employees. We expect to hire approximately 5-10 employees in the coming months. Our success will depend in part on our ability to attract and retain competent personnel who will be able to help us achieve our goals. We must hire qualified managers, accounting, human resources and other personnel to staff our business. There can be no assurance that we will be successful in finding and hiring qualified employees at a salary that we will be able to afford. It may also be difficult to attract qualified employees to a rural area. If we are unsuccessful in hiring productive and competent personnel, our business could be harmed.

We are subject to extensive environmental regulation.

Ethanol production involves the emission of various airborne pollutants, including particulate (PM10), carbon monoxide (CO), oxides of nitrogen (N0x) and volatile organic compounds. To construct

14

and operate the proposed ethanol plant, we will need an Air Pollution Operation Permit from the State of Wisconsin. We applied for this permit on September 1, 2000, and expect to receive it on or before January 1, 2001, there can be no assurance that this permit will be granted. Our senior and subordinated debt financing and our ability to commence construction is dependent on our receiving this permit. We also plan to apply for, and obtain a Wisconsin Pollutant Discharge Elimination System Permit to allow us to discharge approximately 65,500 gallons per day of water into a nearby creek. We have not applied for this permit, but anticipate doing so before we begin construction. If this permit is not granted, we will have to dispose of the water through the City of Monroe's disposal system and pay a usage fee. If we are not able to obtain this permit, our financial condition may be adversely affected since we will have to pay usage fees. There can be no assurance that we will receive any of the above permits. In addition, Wisconsin authorities could impose conditions or other restrictions that could harm our business.

Even if we receive all required permits from the State of Wisconsin, we will also be subject to regulations on emissions from the United States Environmental Protection Agency ("EPA"). Currently the EPA's statutes and rules do not require us to obtain EPA approval in connection with construction and operation of the proposed ethanol plant. Additionally, EPA and Wisconsin's environmental regulations are subject to change and often such changes are not favorable to industry. Consequently, even if we have the proper permits at the present time, we may be required to invest or spend considerable resources to comply with future environmental regulations. We also could be subject to environmental nuisance or related claims by employees or property owners or residents in the vicinity of the proposed ethanol plant arising from air or water discharges. Ethanol production has been known to produce an unpleasant odor to which surrounding residents could object. Claims or increased environmental compliance costs could harm our business.

Rail service will be necessary in order to receive grain at our proposed ethanol plant.

We are negotiating with the Wisconsin and Southern Railroad Company ("WSOR") to provide rail service to the facility and for the construction of 3,000 feet of rail track to the site. There can be no assurance that a binding contract will be finalized. If we are unable to reach a definitive agreement with WSOR, we will be forced to pay Fagen or another party to build the necessary rail infrastructure which would be more expensive than we anticipate.

Ethanol production is energy intensive, and we will need significant amounts of electricity and natural gas.

We have engaged U.S. Energy Services, Inc. to help us manage our natural gas and needs and to assist us in negotiating agreements to purchase natural gas. For this service, we are paying U.S. Energy $3,000 a month plus up to $2,500 in expenses. At the present time, we have no contracts, commitments or understandings with any natural gas supplier. There can be no assurance that we will be able to obtain a sufficient supply of natural gas or that we will be able to procure alternative sources of natural gas on terms that are attractive to us. In addition, natural gas and electricity prices have historically fluctuated significantly. Increases in the price of natural gas or electricity would harm our business by increasing our energy costs.

We also need to build approximately 6.5 miles of distribution pipelines for the transportation of natural gas. U.S. Energy has agreed to provide us with engineering cost estimates, route drawings and a project timeline relating to the construction of the pipelines. We have not entered into any agreements for the construction of the pipeline and there can be no assurance that we will be able to procure an agreement on terms acceptable to us, or if at all.

We will also need to purchase significant amounts of electricity to operate the proposed ethanol plant. U.S. Energy has also agreed to provide us with advisory services regarding electric pricing and

15

service agreements. We are negotiating with the electrical utility serving the area, to enter into a binding agreement to provide electrical service, including an approximately $2.3 million loan to build electrical infrastructure for the proposed ethanol plant. We expect that this loan will be repaid over five years. There can be no assurance that any supplier will enter into an agreement on terms that are acceptable to us. If we cannot reach an agreement with an electricity supplier, our business and prospects could be materially harmed.

Our business is not diversified.

Our success depends largely upon our ability to timely complete and profitably operate our proposed ethanol plant. We do not have any other lines of business or other sources of revenue if we are unable to complete the financing, permitting, construction and operation of our proposed ethanol plant.

We only have two interim employees and no sales organization.

We are recently formed and are in the development stage. We have no employees other than two interim officers, and we currently have no sales organization to begin to market ethanol and feed products if we are successful in building the proposed ethanol plant. We do not intend to establish a sales organization and plan to sell all of our ethanol to one distributor pursuant to an output contract. We also intend to contract with ICM Marketing, Inc., an affiliate of ICM, to market our feed products. Our lack of employees and a sales organization will put us at a competitive disadvantage.

We intend to establish an output contract with one distributor who will purchase all of the ethanol we produce; We intend to contract only with ICM Marketing, Inc. for the marketing and distribution of our feed products.

We intend to sell all of the ethanol we produce to one distributor pursuant to an output contract. As a result, we will become dependent on one distributor to sell our ethanol. If this distributor breaches our output contract or is not in the financial position to purchase all of the ethanol we produce, we will not have any readily available means to sell our ethanol and our financial performance will be adversely and materially effected. Our financial performance is dependent upon the financial health of the distributor we contract with. We are currently in discussion with a distributor, but have not entered into any agreements. There can be no assurance that we will be able to procure an agreement with any ethanol distributor on terms acceptable to us, or if at all.

We are also currently in discussions with ICM Marketing regarding the marketing and distribution of our feed products. We will rely solely upon ICM Marketing to market and distribute our feed products. This will not be an output contract and ICM Marketing will only purchase that portion of our feed products that they are able to sell. If ICM Marketing is unable to sell any portion of the feed products we produce, we will be left with feed products that must be disposed of. This may have a material adverse impact on our financial performance.

Further, ICM Marketing or any other third party that we engage as our marketing agent may also have different agreements with respect to compensation in their agreements with other entities that produce the same products that we do. It is possible that ICM's ability or willingness to perform on our behalf could be impaired by the financial agreements that they may have with other entities not related to us. We believe that we will address this issue by creating marketing agreements that have performance incentives, but this may be limited by our lack of knowledge of the financial or operational structure of other agreements that ICM or other agents may have with other entities. We cannot be certain and there can be no assurance that ICM Marketing or another agent will always act in our best interest.

16

Our operating results could fluctuate.

Assuming we construct the proposed ethanol plant, our quarterly operating results could fluctuate significantly in the future as a result of a variety of factors many of which are outside our control. These factors include:

As a result of these factors, and other described in these risk factors, our operating results for any particular quarter may not be indicative of future operating results and you should not rely on them as indications of our future performance.

RISKS RELATED TO THE OFFERING

We have no firm underwriter, and there can be no assurance that the offering will be successful.

We plan to offer the units directly to investors. We plan to advertise in local media and mail information to names provided by the Wisconsin Corn Grower's Association. We also plan to hold one or more informational meetings in and around Monroe, Wisconsin. We will not have an underwriter to purchase the units from us for resale. We also do not have a placement agent to help us sell the units. We will rely on our directors and interim executive officers, Mr. Malchine and Mr. Kramer, both of whom have significant operational responsibilities in addition to trying to raise capital. These individuals have no broker-dealer experience and have never been involved in a public offering of securities. There can be no assurance that our directors will be successful in seeking investors for the offering. In addition, the time that these individuals spend on capital raising could take them away from their important operational responsibilities that could harm our business prospects.

Our ability to sell the units in certain states may be restricted by that state's security laws.

We anticipate selling the units in Wisconsin, Minnesota, Illinois, Iowa and Kansas. These states all have securities laws that may limit or prevent us from selling our units to their residents without prior registration of the units. Registration in these states may be lengthy and costly, and may delay our ability to timely close on this offering. These states could impose restrictions on us or delay our plans. There can be no assurance that we will be able to successfully register or sell our units in any of these states. If the scope of our offering is limited, we may not be able to sell the 10,000 unit minimum.

We may not be able to sell the minimum number of units required to close on this offering.

We must sell at least 10,000 units to close on this offering. Fagen, who has a representative on our board of directors and will serve as our general contractor to design and build our proposed ethanol

17

plant, has orally agreed to purchase up to 900 units for $900,000. ICM, who also has a representative on our board of directors and will serve as a subcontractor to design and build our proposed ethanol plant, has orally agreed purchase up to 900 units if we are unable to sell at least 10,000 units. These sales to affiliates will count toward the achievement of the 10,000 unit minimum. Investors should not assume that the 10,000 unit minimum will be sold only to unaffiliated third party investors. We may be unable to sell the 10,000 minimum units.

If we are not able to close on this offering, we will return your investment to you without interest.

If we cannot close on this offering by September 30, 2001, we will return your investment to you without interest. This means that from the date of your investment up to September 30, 2001, you will not earn any investment return on the money you deposit with us.

Our units have no public market and are subject to transfer restrictions.

Investing in our units should be considered a long-term decision by each prospective investor. Even if we are able to close on the offering, it will take at least 16-18 months from construction to operation of the proposed ethanol plant. We will not generate any revenues until the plant is operational, and we may never generate revenues even if the plant is built. There is no existing market for our units, and it is unlikely that any market will ever develop for the units. In addition, unlike many public companies' shares of common stock, our limited liability units will not trade on any exchange or automatic quotation system such as Nasdaq. This means that it may be difficult or impossible for you to sell your units.

Your ability to transfer units is also restricted by our operating agreement. Until substantial operation of the ethanol plant has commenced, which is expected to occur approximately 16-18 months after we close on this offering, you may not transfer your units unless such transfer is:

To maintain partnership tax status, the units may not be traded on an established securities market or readily tradable on a secondary market. To help ensure that a market does not develop, our operating agreement prohibits transfers without the approval of the board of directors. The board of directors will generally approve transfers so long as the transfers fall within "safe harbors" contained in the publicly-traded partnership rules under the Internal Revenue Code. Permitted transfers also include, transfers by gift, transfers upon death of a member, transfers between family members and other transfers approved by directors during the tax year that in the aggregate do not exceed 2% of the total outstanding units. If any person transfers units in violation of the publicly traded partnership rules or without our prior consent, the transfer will be null and void. These restrictions on transfer could reduce the value of your units.

Your ownership interest will be diluted by the conversion of Class B and Class C units into Class A units.

We have sold Class B and Class C units at prices substantially below the price we are selling Class A units. In May 2000, we issued 1,000 Class C units to our founders, John Malchine and Gary Kramer at a price of $20 per unit. In September 2000, we issued 720 Class B units at $500 per unit to seven investors who are related to our directors. These Class B and Class C units will automatically convert into a total of 1,720 Class A Units upon our completion of the debt financing. The conversion of these units will dilute your ownership interest in us because these earlier investors received a

18

relatively greater share of our company for less consideration than you are paying for Class A units. Please see "Dilution."

Units eligible for future sale could reduce the value of your units.

Our operating agreement permits us to sell up to 20,000 units. We have sold 1,000 Class C units and 720 Class B units, and are selling up to 12,000 Class A units in this offering. Consequently, assuming we sell 12,000 Class A units in this offering, we can sell up to an additional 6,280 Class A units after the offering without seeking unit holder approval. We could be forced to issue warrants to purchase units to a lender in connection with our debt financing plan. If we were to sell additional units or warrants to purchase additional units, the sale or exercise price could be higher or lower than what investors are paying in this offering. If we sell additional units at a lower price, that could lower the value of your units.

RISKS RELATED TO TAX ISSUES IN A LIMITED LIABILITY COMPANY

You may be required to pay taxes on your share of our income, even if we make no distributions, and your ability to deduct losses may be limited.

We expect to be treated as a partnership for federal income tax purposes. This means that we will not pay any federal or state income tax and all profits and losses will "pass-through" to you. You must pay tax on your allocated share of our taxable income every year. It is likely that you may receive allocations of taxable income that exceed any cash distributions we make. This may occur because of various factors, including but not limited to, accounting methodology, lending covenants that restrict our ability to pay cash distributions, or our decision to retain the cash generated by the business to fund our operating activities and obligations. Accordingly, you may be required to pay income tax on your allocated share of our taxable income with personal funds, even if you receive no cash distributions from us.

It is also possible that your interest in us will be treated as a "passive activity." If you are either an individual or a closely held corporation, and your interest is deemed to be "passive activity," then your allocated share of any loss we incur will be deductible only against income or gains you have earned from other passive activities. This situation often arises when limited liability companies and limited partnerships conduct a business in which the holder is not a material participant. Passive activity losses that are disallowed in any taxable year are suspended and may be carried forward and used as an offset against passive activity income in future years. If a taxpayer's entire interest in a "passive activity" is disposed of to an unrelated person in a taxable transaction, suspended losses with respect to that activity may then be deducted. These rules could restrict your ability to deduct any of our losses that pass through to you.

If we lose our "partnership" status we would be taxed as a corporation.

Subject to the publicly traded partnership rules discussed below, we expect to be treated as a "partnership" for federal income tax purposes. If the Internal Revenue Service determined that we should be taxed as a corporation, we would be taxed on our net income at rates of up to 35% for federal income tax purposes. All items of our income, gain, loss, deduction, and credit would be reflected only on our tax returns and would not be passed through to you. If we were treated as a corporation, distributions we make to you will be treated as ordinary dividend income to the extent of our earnings and profits, and the payment of dividends would not be deductible by us, thus resulting in double taxation of our earnings and profits. Please see "Federal Income Tax Consequences—Partnership Status."

19

If we are reclassified as a "publicly traded partnership" we would be taxed as a corporation.

We expect to be taxed as a partnership and not be subject to the "publicly traded partnership" rules. The IRS may determine that we should be treated as a "publicly-traded partnership" if our units are publicly traded or frequently transferred. We have included provisions in our operating agreement designed to avoid this result. Our classification as a "publicly-traded partnership" could result in our being taxed as a corporation, which will subject our earnings and profits to double taxation. Please see "Federal Income Tax Consequences—Partnership Status."

The IRS may challenge our allocations of income, gain, loss, and deduction.

The operating agreement provides for the allocation of income, gain, loss and deduction among the unit holders. The rules regarding partnership allocations are complex. It is possible that the IRS could successfully challenge the allocations provided for in the operating agreement and reallocate items of income, gains, losses or deductions in a manner which reduces deductions or increases income allocable to you, which could result in additional tax liabilities. See "Federal Income Tax Consequences—Allocation of Net Income and Net Loss."

Because we are treated as a partnership for federal income tax purposes, the IRS may audit your tax returns if an audit of our tax returns results in adjustments.

The IRS may audit our tax returns and may disagree with the tax positions taken on our returns. If challenged by the IRS, the courts may not sustain the position we take on our tax returns. An audit of our tax returns could lead to separate audits of your tax returns, especially if adjustments are required, which could result in adjustments on your tax return attributable to non-fund items as well as the fund items. This could result in tax liabilities, penalties and interest to you.

WARNING REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements that involve future events, our future performance and our expected future operations. In some cases you can identify forward-looking statements by the use of words such as "may," "will," "should," "anticipates," "believes," "expects," "plans," "future," "intends," "could," "estimate," "predict," "hope," "potential," "continue," or the negative of these terms or other similar expressions. These forward-looking statements are only our predictions. Our actual results or actions could and likely will differ materially from these forward-looking statements for many reasons, including the risks described above and appearing elsewhere in this prospectus, and to events that are beyond our control. We cannot guarantee future results, levels of activity, performance or achievements. We are under no duty to update any of these forward-looking statements after the date of this prospectus to conform them to actual results or to changes in our expectations.

We estimate that gross proceeds from this offering will be, $10,000,000 if the minimum number of units offered is sold, and $12,000,000 if the maximum is sold, before deducting offering expenses. The net proceeds from this offering will be used primarily to design and construct our proposed ethanol plant.

20

The following table sets forth our capitalization at September 30, 2000 on an actual and pro forma basis to reflect the units offered in this offering. The information shown below does not include Class A units issuable upon conversion of 1,000 Class C and 720 Class B units into 1,720 Class A units at the close of this offering.

| |

September 30, 2000 |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

Pro Forma(1) |

||||||||||

| |

Actual |

Minimum |

Maximum |

|||||||||

| Long term debt | $ | 0 | $ | 0 | $ | 0 | ||||||

| Unit holders' equity: | ||||||||||||

| Class A Units; a minimum of 10,000 units and a maximum of 12,000 units issued and outstanding on an as adjusted basis | 0 | 10,000,000 | 12,000,000 | |||||||||

| Class B Units; 720 units issued and outstanding | 356,972 | 356,972 | 356,972 | |||||||||

| Class C Units; 1,000 units issued and outstanding | 19,822 | 19,822 | 19,822 | |||||||||

| Accumulated deficit | (44,485 | ) | (44,485 | ) | (44,485 | ) | ||||||

| Total unit holder's equity (deficit) | 332,309 | 10,332,309 | 12,332,309 | |||||||||

| Total Capitalization | 332,309 | 10,332,309 | 12,332,309 | |||||||||

21

As of September 30, 2000, we had outstanding 1,000 class C units and 720 class B units (convertible into 1,720 Class A units) having a net tangible book value of $332,309 or $193.20 per unit. The net tangible book value per unit represents total tangible assets, divided by the number of units outstanding on an "as-if converted" basis. The offering price of $1,000 per Class A unit substantially exceeds the net tangible book value per unit of our outstanding class B and class C units. Therefore, all current unit holders will realize an immediate increase of $688.40 in the pro forma net tangible book value of their units held prior to this offering if the minimum is sold, and an increase of $705.66 if the maximum is sold. Purchasers of Class A units in this offering will realize an immediate dilution of $118.40 per unit in the net tangible book value of their Class A units if the minimum is sold, and a decrease of $101.14 if the maximum is sold.