|

|

|

|

|

Previous: MORGAN STANLEY DEAN WITTER SE EQ TR SEL 10 IND PORT 2001-1, 497J, 2001-01-08 |

Next: MLMI RESECURITIZATION PASS THROUGH CERT SER 2000-WM1, 8-K, 2001-01-08 |

|

|

Choosing investments to support your financial objectives can be difficult. While many mutual funds and money managers follow a "growth stock" investment style, there is no generally accepted definition of a

growth stock and no easy way to select one. That's why Defined Asset Funds® developed a portfolio designed to provide definition and discipline to aggressive growth stock investing with our...

Select Growth Portfolio |

|

|

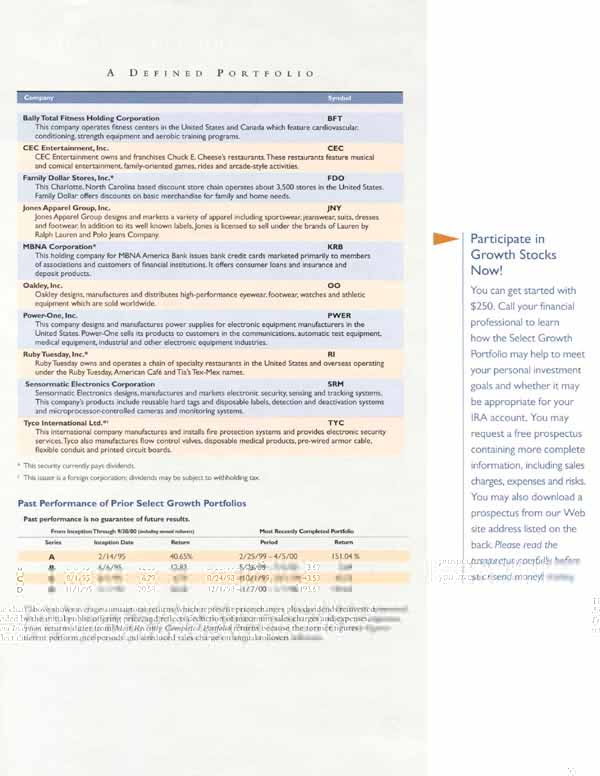

Growth Stock Investing If you're interested in adding aggressive growth stocks to your portfolio, the Select Growth Portfolio offers you a screened portfolio of ten stocks with just one investment. It is designed for investors whose primary objective is aggressive long-term growth with the potential for greater rewards over time, and who have the will and ability to withstand the extreme price volatility of aggressive growth stocks. The Screening Process Netfolios, Inc. (formerly known as O'Shaughnessy Capital Management, Inc.), a registered investment advisor (the "Portfolio Consultant"), developed a quantitative selection model that screens a universe of over 5,000 stocks to identify growth stocks believed to be reasonably priced and to have attractive growth potential. Growth — select stocks with consensus expected earnings per share growth of 20% for the next fiscal year. Then, to give a longerterm view and to avoid short-term run-ups, the Portfolio Consultant screens for a 20% annual consensus expected earnings-per-share growth rate for the next three to five years. |

Value — select growth stocks with price-to-earnings ratios not exceeding their estimated three-to-five year earnings growth rates. Relative Strength — identify stocks with strong relative price performance over the prior six months. The Portfolio Consultant eliminates smaller companies (market capitalizations below $750 million). Finally, the Defined Asset Funds Research Group selects the ten stocks considered most attractive. A Defined Strategy The Select Growth Portfolio is based on the Strategy of buying ten screened growth stocks and holding them for about a year. At the end of that time, we intend to reapply the Strategy and offer a new Select Growth Portfolio. At that time, you can choose to either redeem your investment, or roll your proceeds into the next Portfolio, if available, at a reduced sales charge. Although this is a one-year investment, it is designed to be part of a longer-term strategy. We recommend following this Strategy for at least three to five years for potentially more consistent results. |

|

|

|

|

| QUANTITATIVE RESEARCH

& INDEX

Institutional Holdings Portfolio S&P Market Cap Plus Portfolio S&P 500 Trust S&P MidCap Trust Select S&P Industrial Portfolio Select Growth Portfolio Select Large-Cap Growth Portfolio Select Ten Portfolio (DJIA) Standard & Poor's Industry Turnaround Portfolio Standard & Poor's Intrinsic Value Portfolio United Kingdom Portfolio (Financial Times Index) SECTOR

FUNDAMENTAL RESEARCH

FIXED INCOME

|

|

|

Defining Your Risks Please keep in mind the following factors when considering this investment. Your financial professional will be happy to answer any questions you may have. |

|

|

|

|

Tax Considerations Generally, dividends and any net capital gains will be subject to tax each year, whether or not reinvested. By holding this Fund for more than one year, individuals may be eligible for favorable federal tax rates on net long-term capital gains (currently no more than 20%). Please consult your tax advisor concerning state and local taxation. Defining Your Costs You will pay an initial sales charge of about 1% the first time you buy. In addition, you'll pay a deferred sales charge of $15.00 per 1,000 units. |

|

| Unitholder Fees | Maximum as

a % of the Amount Invested |

||

|

|

|||

| Creation and Development Fee (0.250% of net assets) |

0.30% | ||

| Sales Charges | 2.50% |

||

| Total Maximum Sales Charges (including Creation and Development Fee) |

2.80% | ||

|

|

|||

| If you sell your units before termination, any remaining balance of your deferred sales charge will be deducted, along with the estimated costs of selling Portfolio securities, from the proceeds you receive. If you roll over

to a successor Portfolio, if available, the initial sales charge on that Portfolio will be waived.You will only pay the deferred sales charge. |

|||

| Portfolio Expenses | Amount per 1,000 Units |

|

|

|

| Estimated Annual Operating Expenses (0.242% of net assets) |

$2.40 |

| Estimated Organization Costs | $2.60 |

|

|

|

| Volume Purchase Discounts

For larger purchases, the initial sales charge (but not the Creation and Development Fee) is reduced to put more of your investment dollars to work for you. The deferred sales charge will not change. |

| If You

Invest: |

Your Initial Sales Charge (as a % of your investment) Will Be:‡ |

|

|

|

||

| Less than $50,000 | 1.00% | |

| $50,000 to $99,999 | 0.75% | |

| $100,000 to $249,999 | 0.25% | |

| $250,000 to $999,999 | 0.00% | |

|

|

||

If you invest $1,000,000 or more, you will pay an aggregate sales charge of 0.75%. You will not pay any initial sales charge, and you will be credited with additional units which will effectively reduce your deferred sales charge. |

| ‡ | These percentages are based on a unit price of $1,000 per 1,000 units and will vary as the unit price changes. |

| The information in this brochure is not complete and may be changed. We may not sell the securities of the next Portfolio until the registration statement filed with the Securities and Exchange Commission is effective.

This brochure is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where their offer or sale is not permitted.

|  |

Printed on Recycled Paper | 11591BR-12/00 |

|

© 2000 Merrill Lynch, Pierce, Fenner & Smith Incorporated. Member SIPC. Defined Asset Funds is a registered service mark of Merrill Lynch & Co., Inc. |

|

|