|

|

|

|

|

|

|

Previous: STRUCTURED ASSET SEC CORP COMM MORT PAS THR CERT SER 2000 C5, 8-K, EX-99.1, 2001-01-05 |

Next: DNA SCIENCES INC, S-1, EX-4.2, 2001-01-05 |

As filed with the Securities and Exchange Commission on January 5, 2001

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER THE

SECURITIES ACT OF 1933

DNA SCIENCES, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 8731 | 77-0490090 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

DNA Sciences, Inc.

6540 Kaiser Drive

Fremont, CA 94555

(510) 494-4000

(Address, including zip code, and telephone number, including

area code, of registrant's principal executive offices)

Hugh Y. Rienhoff, Jr., M.D.

Chairman of the Board and Chief Executive Officer

DNA Sciences, Inc.

6540 Kaiser Drive

Fremont, CA 94555

(510) 494-4000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Robert L. Jones, Esq. Laura A. Berezin, Esq. Cooley Godward LLP Five Palo Alto Square 3000 El Camino Real Palo Alto, CA 94306-2155 Phone: (650) 843-5000 Facsimile: (650) 849-7400 |

Thomas W. Christopher, Esq. Fried, Frank, Harris, Shriver & Jacobson One New York Plaza New York, NY 10004 Phone: (212) 859-8000 Facsimile: (212) 859-4000 |

Approximate date of commencement of proposed sale to the public:

As soon as possible after the effective date of this registration statement

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. / /

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. / /

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. / /

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. / /

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. / /

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price (1)(2) |

Registration Fee |

||

|---|---|---|---|---|

| Common Stock, $.001 par value | $125,000,000 | $31,250 | ||

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the commission, acting pursuant to said section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, dated January 5, 2001

PROSPECTUS

Shares

[LOGO]

Common Stock

This is our initial public offering of shares of common stock. We are offering shares. No public market currently exists for our common stock.

We have applied to have our common stock approved for quotation on the Nasdaq National Market under the symbol "DNAS." We anticipate the public offering price to be between $ and $ per share.

Investing in the shares involves risks. "Risk factors" begin on page 8.

| |

Per Share |

Total |

||||

|---|---|---|---|---|---|---|

| Public Offering Price | $ | $ | ||||

| Underwriting Discount | $ | $ | ||||

| Proceeds, before expenses, to DNA Sciences. | $ | $ | ||||

We have granted the underwriters a 30-day option to purchase up to shares of common stock on the same terms and conditions as set forth above to cover over-allotments, if any.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Lehman Brothers, on behalf of the underwriters, expects to deliver the shares on or about , 2001.

LEHMAN BROTHERS

CIBC WORLD MARKETS

DAIN RAUSCHER WESSELS

, 2001

—Text: "DNA Sciences' facility in Fremont, California"

—Text: "DNA Sciences' website"

—Text: "A DNA Sciences researcher"

| Prospectus Summary | 3 | |

| Risk Factors | 8 | |

| Forward-Looking Statements | 17 | |

| Use of Proceeds | 18 | |

| Dividend Policy | 18 | |

| Capitalization | 19 | |

| Dilution | 20 | |

| Selected Historical and Pro Forma Financial Data | 22 | |

| Management's Discussion and Analysis of Financial Condition and Results Of Operations |

24 | |

| Business | 31 | |

| Management | 52 | |

| Related Party Transactions | 64 | |

| Principal Stockholders | 67 | |

| Description of Capital Stock | 70 | |

| Shares Eligible for Future Sale | 73 | |

| Underwriting | 75 | |

| Legal Matters | 78 | |

| Experts | 78 | |

| Where You Can Find More Information | 78 | |

| Index to Financial Statements | F-1 |

Until , 2001 (25 days after the date of this prospectus), all dealers selling shares of our common stock, whether or not participating in this offering, may be required to deliver a prospectus. This delivery requirement is in addition to the obligation of dealers to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus. This prospectus is not an offer to sell or a solicitation of an offer to buy our common stock in any jurisdiction where it is unlawful. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of common stock.

DNA SciencesSM, the DNA Sciences logoSM, The DNA Sciences Gene Trust ProjectSM, and The Gene Trust logoSM are servicemarks of DNA Sciences, Inc. Other trade names and trademarks appearing in this prospectus are the property of their respective holders.

The following summary is qualified in its entirety by the more detailed information and the financial statements and the notes to those financial statements appearing elsewhere in this prospectus.

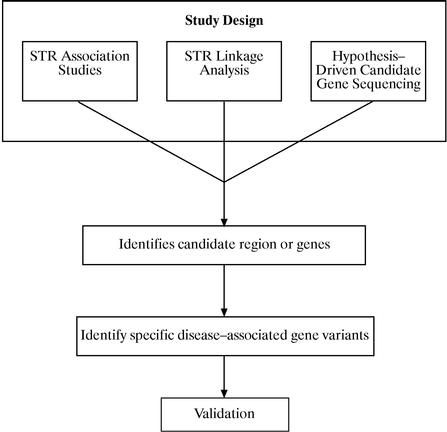

We are a genetics discovery company focused on identifying the genetic basis of disease susceptibility, disease progression and response to drug treatment. We believe that the recent completion of the human genome sequence enables the discovery of previously unidentified variants in genes which contribute to disease. We refer to these variants as disease-associated gene variants. We believe that our innovative scientific approach will allow us to take advantage of the map of the human genome to find disease-associated gene variants both more quickly and with a higher rate of success than past efforts by others. Our scientific approach utilizes various study designs depending on what we know about a disease and its genetic basis. Our discovery efforts are enhanced by our team of accomplished geneticists, our strategy for recruiting patients and obtaining DNA samples and our state-of-the-art sequencing and genotyping facility. This facility has the capacity to sequence the equivalent of an entire human genome in fewer than 100 days. In addition, we have developed a prototype microchannel DNA sequencer that we believe will accelerate the ability to obtain human DNA sequence. We have licensed our technology and intellectual property which the DNA sequencer utilizes to Amersham Pharmacia Biotech in exchange for cash payments, research support, royalties, reagents at reduced cost and early access to the DNA sequencer.

We are focusing on diseases that have a significant genetic component, including cancer, asthma, inflammatory bowel disease, osteoporosis and diabetes. Many of these diseases are associated with gene variants that are difficult to find, most likely because they are only partially penetrant. This means that the gene variants do not always cause the disease in the person who inherits them. We believe that we are the only company focused on the discovery of partially penetrant gene variants. In addition to studying diseases with a known genetic component, we are examining diseases such as sudden infant death syndrome, or SIDS, that are suspected of having a genetic basis. Once we have identified disease-associated gene variants, we plan to develop diagnostic tests and, in the longer term, therapeutic products based on our discoveries.

In December 2000, we acquired PPGx, Inc., a company that provides genetic discovery services for pharmaceutical companies with a focus on gene variants that influence drug metabolism. This acquisition provides us with a government certified laboratory, results from genetic association studies in various diseases and access to more than 21,500 DNA samples on which these studies were based. Most of these samples were collected and analyzed by Sequana Therapeutics, Inc. and were contributed to PPGx by Axys Pharmaceuticals, Inc.

Our Approach

We use multiple methods to identify and validate disease-associated gene variants. These methods are intended to identify the region of the genome in which a disease-associated gene variant is present and to explore this region in detail. The method we select depends on a variety of factors, including the suspected penetrance of the gene variants we seek, the availability of DNA samples and the extent to which prior genetic studies have implicated specific genes or regions of the genome. We use genetic association studies involving large kinships of distantly related individuals to identify moderately penetrant genes. For more highly penetrant genes, we study multi-generational families with a recognizable pattern of inheritance. For diseases that share clinical similarities, such as sudden cardiac death in adults and SIDS, and where a specific genetic cause for one of the diseases has been established, we will explore these same genes in patients with the other disease. Once we have localized a region of DNA, we seek to identify all genes and their variants in that region. Using DNA sequencing, we plan to identify the specific disease-associated gene variants. We plan to validate our

3

findings by confirming the association between these identified gene variants and the disease in a large and diverse population of unrelated individuals.

We are using various means to recruit patients and obtain DNA samples. One approach is to identify kinships using the Utah Population Database and determine the prevalence of disease in those kinships using clinical histories. Another approach is to obtain DNA samples, candidate genes and data derived from family-based linkage analyses performed by third parties. We plan to use our Internet-based Gene Trust project to recruit patients for our validation studies and potentially to recruit affected families in order to identify disease-associated gene variants.

Our Commercial Focus

We intend to commercialize our discoveries of disease-associated gene variants by developing proprietary diagnostic tests and, where possible, therapeutic products. We expect our diagnostic tests will allow patients and healthcare providers to:

To date, we have initiated discovery and validation programs in multiple disease areas. Our most advanced effort is in SIDS, where we are currently sequencing five genes in 120 DNA samples to identify any gene variant that might be associated with the disease. In our cancer programs, we are currently identifying affected individuals and their kin through the Utah Population Database and the Utah Cancer Registry. The next step in these programs will be to recruit these individuals and begin an initial examination of their genomes. In our asthma, inflammatory bowel disease, osteoporosis and type II diabetes programs, we are currently undertaking a detailed examination of the genes and gene variants in the regions of the genome where a genetic link has been identified.

Our Strategy

Our goal is to become the world's leading genetics discovery company. To accomplish this goal, our strategy is to:

We were incorporated in May 1998 and changed our name to DNA Sciences, Inc. in May 2000. Our principal executive offices are located at 6540 Kaiser Drive, Fremont, California, and our telephone number is (510) 494-4000.

4

Unless otherwise indicated, information in this prospectus assumes that the underwriters do not exercise their over-allotment option and assumes the conversion of all of our preferred stock into common stock upon completion of the offering.

| Common stock we are offering | shares | |

Common stock to be outstanding immediately after this offering |

shares |

|

Use of proceeds |

To continue and expand our genetic discovery programs, maintain and expand our genetic database, commercialize diagnostic tests under development, purchase subscriptions to genomic databases from third parties, make capital expenditures, and for general corporate purposes, including working capital. See "Use of Proceeds." |

|

Proposed Nasdaq National Market symbol |

DNAS |

The number of shares of common stock to be outstanding after this offering is based on the number of shares outstanding as of December 29, 2000, and excludes:

5

The following table summarizes our financial data. You should read this information together with the financial statements and the notes to those statements appearing elsewhere in this prospectus and the information under "Selected Historical and Pro Forma Financial Data" and "Management's Discussion and Analysis of Financial Condition and Results of Operations."

The statements of operations data displayed in the "Pro forma PPGx acquisition 1999" column for the year ended December 31, 1999 and in the "Pro forma PPGx acquisition 2000" column for the nine months ended September 30, 2000 are derived from the unaudited pro forma combined condensed financial statements included elsewhere in this prospectus. These pro forma data give effect to the PPGx acquisition as if it had taken place on January 1, 1999 and is based on our historical operating results and those of PPGx for the periods presented, giving effect to the amortization of tangible and intangible assets related to the acquisition. The pro forma information is not necessarily indicative of what actual financial results would have been had the acquisition taken place on January 1, 1999 and does not purport to indicate the results of future operations.

| |

|

|

|

|

|

|

Period from May 11, 1998 (inception) through September 30, |

|||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Period from May 11, 1998 (inception) through December 31, 1998 |

Year Ended December 31, |

Nine Months Ended September 30, |

|||||||||||||||||||||

| |

|

Pro forma PPGx acquisition 1999 |

|

|

Pro forma PPGx acquisition 2000 |

|||||||||||||||||||

| |

1999 |

1999 |

2000 |

2000 |

||||||||||||||||||||

| |

(in thousands, except share and per share data) |

|||||||||||||||||||||||

| Statements of Operations Data: | ||||||||||||||||||||||||

| Revenues | $ | — | $ | 79 | $ | 966 | $ | — | $ | 500 | $ | 1,672 | $ | 579 | ||||||||||

| Operating expenses: | ||||||||||||||||||||||||

| Cost of revenues | — | — | 1,030 | — | — | 1,243 | — | |||||||||||||||||

| Research and development | 20 | 4,901 | 7,022 | 3,809 | 14,602 | 17,108 | 19,523 | |||||||||||||||||

| General and administrative | 309 | 2,700 | 6,518 | 1,995 | 4,652 | 8,109 | 7,661 | |||||||||||||||||

| Stock-based compensation | — | 418 | 530 | 129 | 5,985 | 6,069 | 6,403 | |||||||||||||||||

| Amortization of samples, goodwill and acquisition related intangibles | — | — | 9,158 | — | — | 6,869 | — | |||||||||||||||||

| Total operating expenses | 329 | 8,019 | 24,258 | 5,933 | 25,239 | 39,398 | 33,587 | |||||||||||||||||

| Loss from operations | (329 | ) | (7,940 | ) | (23,292 | ) | (5,933 | ) | (24,739 | ) | (37,726 | ) | (33,008 | ) | ||||||||||

| Interest income (expense), net | (19 | ) | 103 | 20 | 85 | 1,282 | 895 | 1,366 | ||||||||||||||||

| Net loss | $ | (348 | ) | $ | (7,837 | ) | $ | (23,272 | ) | $ | (5,848 | ) | $ | (23,457 | ) | $ | (36,831 | ) | $ | (31,642 | ) | |||

| Basic and diluted net loss per share | — | $ | (16.01 | ) | $ | (46.95 | ) | $ | (13.43 | ) | $ | (16.59 | ) | $ | (25.93 | ) | ||||||||

| Shares used in computing basic and diluted net loss per share | — | 489,382 | 495,686 | 435,342 | 1,413,990 | 1,420,294 | ||||||||||||||||||

| Pro forma basic and diluted net loss per share | $ | (1.49 | ) | $ | (1.56 | ) | ||||||||||||||||||

| Shares used in computing pro forma basic and diluted net loss per share | 5,243,896 | 15,011,622 | ||||||||||||||||||||||

6

The pro forma balance sheet data summarized below reflects:

The pro forma as adjusted balance sheet data summarized below includes the effect of the above adjustments and reflects:

| |

As of September 30, 2000 |

||||||||

|---|---|---|---|---|---|---|---|---|---|

| |

Actual |

Pro Forma |

Pro Forma As Adjusted |

||||||

(in thousands) |

|||||||||

| Balance Sheet Data: | |||||||||

| Cash and cash equivalents | $ | 40,882 | $ | 72,734 | |||||

| Total assets | 61,453 | 129,886 | |||||||

| Working capital | 31,148 | 60,910 | |||||||

| Total long-term liabilities | 5,520 | 5,520 | |||||||

| Redeemable convertible preferred stock | 69,809 | 135,320 | |||||||

| Deferred stock compensation | (15,205 | ) | (15,654 | ) | |||||

| Total stockholders' equity (net capital deficiency) | (24,263 | ) | (23,989 | ) | |||||

7

An investment in our common stock is risky. You should carefully consider the following risks as well as the other information contained in this prospectus. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Related to Our Business

We have a limited operating history. We have not developed any products for commercial sale and we may not be able to do so.

Our company was founded in 1998, and we are still in an early stage of development. Accordingly, we have a limited operating history from which you can evaluate our business prospects. We cannot be certain that we will successfully develop and commercialize diagnostic and therapeutic products and services. Other than revenues derived from providing genotyping services, we have no revenues from the sale of products and services. We intend to develop diagnostic tests to help healthcare providers and patients assess susceptibility to particular diseases, the course of diseases and the appropriate treatment. However, we may be unable to successfully develop these products and services. Even if we are successful in developing these products and services, we do not expect our diagnostic tests to be available for commercial sale for many years. In addition, there may be no market for our diagnostic tests because of lack of patient or physician acceptance, competition or regulatory or reimbursement issues. For example, we may not be able to commercialize our diagnostic tests under development if those tests do not establish a significantly greater risk of disease susceptibility in order to justify their cost. If we cannot successfully develop or market our products, we may never become profitable.

We have a history of losses and negative cash flows, and anticipate continued losses for the foreseeable future.

We have incurred losses since our inception. On a pro forma basis, after giving effect to our acquisition of PPGx in December 2000, we had net losses of $36.8 million for the nine months ended September 30, 2000 and $23.3 million for the year ended December 31, 1999. As of September 30, 2000, we had an accumulated deficit of $31.6 million. We have not generated any revenue from the sale of products. We expect that in the near term any revenue will be derived from the sale of genotyping services, collaborations and grants. We expect to spend significant amounts over the next several years to discover disease-associated gene variants, further develop and commercialize our diagnostic tests, upgrade our production genotyping and informatics capabilities, improve and expand our facilities, complete the integration of PPGx and attract and retain skilled research, marketing and administrative personnel. In addition, in March 2000, we entered into an agreement with WebMD under which we are obligated to make payments to WebMD totaling $35.0 million over five years. As a result of our limited revenue and our expected expenses, we expect to incur operating losses and negative cash flows for the foreseeable future. We do not know when, if ever, we will achieve profitability or positive cash flows.

If our assumptions about our approach for discovering disease-associated gene variants are incorrect, we will be unable to successfully develop our diagnostic tests and other products and services.

Our approach for discovering and validating disease-associated gene variants is new and unproven, and to date, we have not discovered or validated any gene variants using it. This approach is based on scientific and statistical assumptions about how genetic variants are passed down from one generation to the next. Our approach also assumes that there is some association between genetic markers and gene variants responsible for a particular disease, and that we can discover this association. However, if the assumptions underlying our gene discovery methods prove incorrect, our approach may not be

8

successful in discovering disease-associated gene variants. If our approach fails, we will be unable to successfully develop diagnostic tests or therapeutics.

In addition to the assumptions upon which our approach is based, the fields of gene discovery, genomics and genetics are all based on the assumption that information about genes may help scientists better understand complex disease processes. Scientists generally have a limited understanding of the role of genes in diseases, and few products based on gene discoveries have been developed. We may discover that we are unable to determine the genetic basis for any particular disease. As a result, we cannot be certain that we will be able to develop any products based on discoveries of gene variants.

If we are not able to obtain sufficient additional funding to meet our expanding capital requirements, we may be forced to curtail or terminate our research programs and product development.

We have used and continue to use substantial amounts of cash to fund our activities. We expect our capital and operating expenditures to increase substantially over the next several years as we seek to discover disease-associated gene variants, develop and commercialize our diagnostic tests, upgrade our production technologies and facilities, complete the integration of PPGx and attract and retain skilled research, marketing and administrative personnel. Many factors will influence our future capital needs, including:

We believe that our current cash balances, together with the net proceeds of this offering and revenues to be derived from additional research services, collaborative research studies and genetic testing services, will be sufficient to fund our operations through 2002. To the extent our capital resources are insufficient to meet our future capital requirements, we will need to raise additional capital or incur new debt to fund our operations. We cannot be certain that additional equity or debt financing will be available on acceptable terms, or at all. If we are unable to obtain additional capital, we may be required to delay or reduce the scope of our genetic discovery programs or relinquish rights to technologies or products that we might otherwise seek to develop or commercialize.

The integration of PPGx will be expensive and may distract our management team from developing our products and services.

In December 2000, we acquired PPGx, and we are in the process of integrating this business into our existing operations. PPGx operates five facilities in different locations and employs 52 individuals. We expect that the integration of PPGx into our current operations will require us to make significant expenditures. We may encounter difficulties in assimilating the operations, personnel and services of PPGx with our own and operating a new business. For example, distance and cultural differences may make it difficult for us to successfully assimilate PPGx's operations located in five facilities in four states and England with our existing operations in Fremont, California. In addition, this acquisition may expose us to various unknown liabilities and may result in the loss of key employees of PPGx. In

9

addition, this integration effort may divert our management's attention from the development of our products and services.

Ethical, legal and social issues related to the use of genetic information and genetic testing may cause less demand for our products.

The prospect of more extensive genetic testing has focused public attention on the appropriate uses of the resulting information. For example, individuals might use genetic testing to decide whether or not to take out life or health insurance on themselves or their families, making insurance more costly for those who elect coverage. Likewise, concerns have been expressed that insurance carriers might use such tests to establish rates for individuals or groups, raising premiums to prohibitive levels. In either case, the prospect of health or life insurance rate setting or policy issuance based on genetic profiling could result in barriers to the acceptance of such tests by consumers. If so, demand for our diagnostic products could be significantly reduced. Similarly, use of genetic profiling by employers or by governmental authorities could create a backlash that might result in new laws that limit the use of information derived from genetic testing. Any of these scenarios could reduce or delay the development of the potential markets for our products.

Concerns about privacy of genetic information provided to us or about our informed consent procedures may limit participation in our Gene Trust project, which could cause a delay in the completion of our genetic studies or subject us to liabilities.

The success of our business depends, in part, on our ability to acquire patient populations for our genetic studies. One of our sources of patient populations is our Gene Trust project. The success of this project depends on the participation of volunteers through our DNA.com website. We may be unable to attract a sufficient number of participants to the project because of concerns regarding the privacy of genetic and personal information provided to us over the Internet. If we are unable to attract a sufficient number of participants, our studies could be delayed while we seek additional patients to validate our results.

Furthermore, some third parties have publicly raised concerns regarding the privacy and informed consent procedures we follow in recruiting volunteers for studies over the Internet. While our study protocol has received institutional review board approval, we cannot be certain that third parties will not continue to raise concerns about our programs. These concerns may harm our reputation or affect the willingness of visitors to DNA.com to participate in our Gene Trust project.

In addition, numerous state and federal laws govern the collection, dissemination, use, access to and confidentiality of patient health information. All states have laws and regulations that protect the confidentiality of medical records or medical information, and many states have laws that specifically regulate genetic testing and the privacy of genetic information. In addition, the federal Department of Health and Human Services has recently published final regulations implementing the Health Insurance Portability and Accountability Act of 1996, or HIPAA, concerning the confidentiality of individually identifiable health information that will affect our use of samples collected by healthcare providers. The application of these laws to the information we collect and disseminate could create potential liability under these laws. We have designed our informed consent process to comply with applicable state and federal laws, and have designed our network and data management procedures to protect the identity of participants and maintain the security of our data. However, in the event that confidential information about any participant is inadvertently disclosed, we may be liable for damages that occur as a result of this disclosure and may be subject to regulatory actions under state or federal laws.

10

Regulation of the Internet could impact the way in which we collect DNA samples from participants in the Gene Trust project.

Internet user privacy has become an issue both in the United States and abroad. Whether and how existing privacy and consumer protection laws in various jurisdictions apply to the Internet is uncertain and may take years to resolve. Any legislation or regulation of this nature could affect the way we conduct our business, particularly in our collection of DNA samples through the Gene Trust project. Furthermore, activities involving the use of the Internet in the healthcare arena have come under increased investigation by the Federal Trade Commission, or FTC, and state consumer protection agencies. In fact, many Internet-based healthcare companies have received requests for information from the FTC concerning website privacy policies and practices. Although we have not ourselves received any inquiry from the FTC or other governmental entities, future government inquiries could divert our attention from our business matters, create unfavorable publicity and harm our reputation.

We depend on third parties, such as the University of Utah, to obtain access to patients for our genetic studies. If we fail to maintain these relationships and develop new relationships, we may be unable to complete our genetic studies and develop our diagnostic tests.

We have entered into a research agreement with the University of Utah to collaborate with University researchers to determine the gene variants which contribute to diseases we are studying. Working with us, these researchers will access the Utah Population Database to identify kinships with disproportionate occurrences of disease. The Utah Population Database is critical to our approach to discovering gene variants that contribute to disease and represents the largest source of patients for our studies. We believe that there are very few other databases in the world that are as useful to genetic studies. Our access to the database or any collaborative efforts with University researchers can be terminated by the University of Utah upon 30 days notice. If we fail to maintain our relationship with the University of Utah for access to this database, we may be unable to gain access to a similar database that identifies similar kinships. If we are unable to access a comparable database, our genetic studies and development of our diagnostic tests would be delayed.

Furthermore, if we fail to maintain our relationships with our sponsored researchers at the University of Utah Medical Center, it will be necessary to retain other sponsored researchers to conduct our studies at the University, including the use of the database. Identifying and retaining new consultants capable of using the database would be time consuming and may be expensive. As a result, we may experience delays in our studies.

We are establishing collaborations with other academic institutions and investigators to recruit patients of specific ethnicities or with particular diseases or special clinical information. If we fail to establish these collaborations, our product development efforts could be delayed.

We may be required to obtain licenses from or make payments to third parties in order to use some of the DNA samples acquired from PPGx which could limit the revenues we generate from these samples or harm our ability to commercialize these products.

Some of the DNA samples we acquired from PPGx or data derived from these samples may be subject to contractual rights of third parties under the terms of the original transfer agreements to Sequana Therapeutics. These rights may require us to obtain licenses from or make payments to these third parties to commercialize products or services based on the use of these samples. Also, our rights to use some of the DNA samples from asthma patients and derivative data derived from these samples may be terminated. If any of these events were to occur, our revenues could be limited or our ability to commercialize products and services based on these samples could be harmed.

11

We may not be able to compete successfully with biotechnology companies and established pharmaceutical companies in the development and marketing of products based on gene variants contributing to disease.

A number of companies are attempting to rapidly identify and patent gene variants that cause disease or an increased susceptibility to disease. Competition in this field is intense and is expected to increase. We have numerous competitors, including major pharmaceutical and diagnostic companies, specialized biotechnology firms, universities and other research institutions and the Human Genome Project and other government-sponsored entities. Our competitors may develop new technologies to allow them to identify genes and gene variants that contribute to disease before we do. We also face competition in the development of our diagnostic products from larger and more established diagnostic companies. In addition, genotyping technology companies may enter the gene discovery business. Competition is also intense in the genetic database area. Companies may in the future direct their efforts to developing databases containing clinical and genetic information that would compete with our own database. In addition, PPGx faces competition in providing genotyping services from universities and laboratory service and biotechnology companies. If other companies are able to discover gene variants that contribute to disease, develop diagnostic products or services or develop proprietary databases before we do, our business may not succeed.

Many of our competitors have considerably greater capital resources, research and development staffs and facilities and technical and other resources than we do. In addition, the barriers to entry in the area of gene discovery are relatively low, and the patent protection available for our products and discoveries is unclear. We believe our approach to the discovery of disease-associated gene variants may be replicated by competitors. Moreover, because access to the Utah Population Database is not licensed to us on an exclusive basis, competitors may obtain access to this database to conduct studies that cover the same diseases that we are studying. We may also face competition from other entities in gaining access to other sources of DNA samples used for research and development purposes.

Competitors have established, and in the future may establish, patent positions with respect to gene sequences or variants that are included in our genetic studies. These patent positions or the public availability of gene sequences comprising substantial portions of the human genome could decrease the commercial value of the results of our studies, making it more difficult for us to compete. In addition, if any of our competitors discover gene variants that contribute to disease, they may obtain patent protection for those gene variants or any derivative products.

We may not be able to protect the proprietary rights that are critical to our success.

We have filed U.S. patents covering technology for identifying gene variants, methods of genetic analysis using gene variants and business methods relating to the acquisition and transfer of information regarding gene variants over the Internet. We intend to protect our proprietary position by filing United States and foreign patent applications related to our proprietary technology, inventions and improvements that are important to the development of our business. Specifically, we intend to file patent applications relating to gene variants we discover and to newly identified associations between gene variants and traits.

Our commercial success will depend in part on obtaining patent protection for gene variants, associations between gene variants and diseases and related subject matter, such as diagnostic tests. Patent law relating to the scope of claims in the area of genetics and gene discovery is generally uncertain and still evolving and involves complex legal and factual considerations. There is substantial uncertainty regarding the patentability of genes or gene fragments without known functions. The U.S. Patent and Trademark Office initially rejected a patent application by the National Institutes of Health on partial genes. There is also uncertainty regarding the patentability of Internet-based business methods. Accordingly, the degree of future protection is uncertain, and we cannot predict the breadth of claims allowed in any patents issued to us or others. We cannot be sure that any of our pending or

12

future patent applications will result in issued patents or that we will develop additional proprietary technologies that are patentable. In addition, any patents issued to us may not serve as a basis for commercially viable products or provide us with any competitive advantages or will not be challenged by third parties.

We are aware that third parties are engaged in sequencing of human DNA, discovery of gene variants, characterization of gene function and determining associations between gene variants and disease. Numerous patent applications have been filed and will in the future be filed by other entities directed to genes, partial gene sequences, gene variants, their uses and related subject matter. Many of these have issued as patents in the United States and other countries. We expect that some of the genes or gene variants that we use in our genetic studies and the development of our products are or will be subject to patent coverage of others. In addition, we are aware of several issued patents by third parties directed to technology for detection of gene variants. Any claim of patent infringement that is successfully asserted against us could subject us to liability for damages or result in an injunction prohibiting the sale of our products and services. We could also incur substantial costs in litigation if we are required to defend ourselves in patent suits brought by third parties or if we initiate suits to assert or protect our intellectual property rights.

In addition, third parties may develop products that are similar or identical to our products. We cannot be certain that our patent applications will have priority over patent applications of others. Even if we are granted patents, we cannot be sure that they would be valid and enforceable against third parties. If human DNA sequence, gene variants, gene functions and associations are the subject of patent filings by others, or become publicly available before we apply for patent protection, our ability to obtain patent protection for this subject matter could be adversely affected. Further, a patent does not provide the patent holder with freedom to operate in a way that infringes the patent rights of others. Defense of patent infringement claims, even if successful, would likely be expensive and time consuming. In addition, we may need to obtain a license in order to continue to market our products and services or, alternatively, modify our products and services to avoid patent coverage. We cannot be certain that any license required under any patent would be made available on commercially acceptable terms, if at all. If licenses are not available, we may be required to cease conducting our studies or marketing our products or services.

While we require employees, academic collaborators and consultants to enter into confidentiality agreements where appropriate, others may gain access to our proprietary information. If this occurs, our competitive position would suffer.

If we are unable to obtain regulatory approvals for diagnostic or therapeutic products resulting from our gene discovery programs, we will not be able to derive revenues from these products.

The manufacture and sale of medical diagnostic devices intended for commercial use are subject to extensive government regulation in the United States and other countries. The process of obtaining FDA and other required regulatory approvals can be time-consuming, expensive and uncertain, frequently requiring several years from the commencement of clinical trials to the receipt of regulatory approval. We may not be able to obtain necessary regulatory approvals or clearances or comply with regulatory requirements applicable to in vitro diagnostic tests in the United States or internationally on a timely basis, or at all. Noncompliance with applicable requirements can result in failure of the government to grant premarket clearance or approval for devices, withdrawal of clearances or approvals, total or partial suspension of production, fines, injunctions, civil penalties, recall or seizure of products and criminal prosecution. We intend to commercialize our diagnostic products and services either by selling diagnostic test kits to physicians, laboratories and hospitals or by performing diagnostic test services ourselves. Development and performance of diagnostic test services within a clinical laboratory is currently not subject to FDA regulation. However, it is possible that the FDA will choose to regulate such testing services in the future. Additionally, if we choose to sell these kits to physicians,

13

hospitals and laboratories, they would be considered medical devices for which we would be required to obtain FDA approval. The regulatory process can take many years and require substantial resources. We cannot predict whether this regulatory approval would be obtained. Furthermore, regulatory approval may impose limitations on the use of our diagnostic products. After initial regulatory approval, a marketed product and its manufacturer are subject to continuing review. We could be required to withdraw any diagnostic product from the market if we discover previously unknown problems. The FDA's regulatory requirements for drugs and biological products is as extensive or more extensive than that for medical devices requiring pre-market approval. The regulatory process can take many years and require substantial resources. We may not be able to obtain all required regulatory approvals.

In connection with performing clinical testing services, we operate a facility registered under the Clinical Laboratory Improvement Act of 1967 and the Clinical Laboratory Improvement Amendments of 1988. These laws are collectively referred to as CLIA. CLIA is intended to ensure the quality and reliability of clinical laboratories in the United States. Many states also impose laboratory licensure requirements. While our facility is currently certified under CLIA, we may not be able to maintain our CLIA certification or able to obtain and maintain all necessary state laboratory authorizations. If we lose our certification, or fail to obtain or maintain all necessary state laboratory authorizations, we would be unable to perform these services.

Currently, as a matter of its enforcement discretion, FDA does not regulate diagnostic tests developed in CLIA laboratories certified to conduct high complexity testing. Although FDA views such tests to be medical devices subject to the agency's authority, FDA has chosen through an exercise of its enforcement discretion to not require laboratories developing such tests, referred to as "home brew" or "in-house developed" tests, to seek approval or clearance of those tests at the present time. FDA has developed its home brew policy to permit laboratories meeting certain, specific operating criteria to continue to operate. FDA may change these criteria or end its home brew policy. If FDA chooses to regulate such tests, we could be required to obtain FDA approval to market our home brew tests. We cannot be certain that this regulatory approval would be obtained.

Our inability to obtain adequate reimbursement for our products could seriously harm our business, financial condition and results of operations.

Our ability to successfully commercialize diagnostic and therapeutic products developed by us may depend on the extent to which such products are reimbursed by third-party payers. Increasingly, third-party payers are limiting reimbursement for healthcare products and services. There can be no assurance that any third-party insurance coverage will be available for any products developed by us. If adequate coverage and reimbursement levels are not provided for our products, the market acceptance of these products may be reduced, which may have a material adverse effect on our business, financial condition and results of operations.

If we fail to maintain or obtain rights to third-party technology, our ability to discover disease-associated gene variants or to develop commercial products based on those discoveries could be delayed.

As we seek to identify disease-associated gene variants, we expect to subscribe to genomics databases from third parties. If we fail to obtain access to these databases, the progress of our gene discovery programs may be delayed. Additionally, our success is dependent on our ability to enter into licensing arrangements with commercial or academic entities for technology that is advantageous or necessary to the development and commercialization of our technologies. We may not be able to negotiate additional license agreements in the future on acceptable terms, or at all.

We may be unable to hire and retain the key personnel upon whom our success depends.

We depend on Hugh Y. Rienhoff, Jr., Founder, Chairman and Chief Executive Officer, and Ray White, Chief Scientific Officer. If either of these individuals leaves DNA Sciences, our genetic discovery programs will likely be delayed. Our future success also depends on our ability to attract, hire and retain additional personnel, particularly experienced geneticists. There is intense competition for qualified personnel and the turnover rate for personnel in our industry is high. As a result, we cannot be certain that we will be able to continue to attract and retain needed personnel. If we fail to attract and retain key personnel, our ability to compete could be jeopardized.

14

Use of any diagnostic products developed by us may result in liability claims.

Patients who have received a diagnostic test developed from our gene discovery programs may bring product liability claims against us if the results of our test are found to be inaccurate. For example, a claim could be based on allegations that one of our tests failed to identify, in a particular patient, a gene variant associated with a particular disease and as a consequence, the patient failed to take appropriate action to prevent or manage the condition. We currently do not carry liability insurance to cover these claims. We are not certain that we will be able to obtain this insurance or, if obtained, that sufficient coverage can be acquired at a reasonable cost. If we cannot protect against these potential liability claims, we may find it difficult or impossible to commercialize our products. A liability claim or product recall could have a material adverse effect on our financial condition.

Our operations involve a risk of injury and contamination from hazardous materials, which could be very expensive to us.

Our activities involve the generation, use and disposal of hazardous materials and wastes, including various chemicals. The risk of accidental contamination or injury from these materials cannot be completely eliminated. If an accident involving these substances occurs, we could be liable for any damages that result, which could seriously harm our business. We are subject to laws and regulations governing the use, storage, handling and disposal of these materials, including standards prescribed by the U.S. Environmental Protection Agency. If we were found not to be in compliance with these regulations or if additional regulations were issued, we may be required to incur significant compliance costs, which could have a material adverse effect on our operations.

We are in the process of moving our genotyping facilities and principal executive offices to a new facility, which could cause delays in the development and commercialization of our products.

We are currently moving most of our operations to a new facility in Fremont, California. Our schedule calls for this move to be completed in the first quarter of 2001. If the process of moving our genotyping equipment and setting up our operations in this new facility is delayed, the development and commercialization of our technologies may be interrupted or delayed.

Risks Related to the Offering

The interests of our controlling stockholders may conflict with our interests and the interests of our other stockholders.

Immediately after this offering, our executive officers, directors and principal stockholders, and their respective affiliates, will beneficially own approximately % of our outstanding common stock. These stockholders, if acting together, would be able to control substantially all matters requiring approval by our stockholders, including the election of all directors and approval of significant corporate transactions. This could have the effect of delaying or preventing a change of control and will make some transactions difficult or impossible without the support of these stockholders. See "Principal Stockholders" for details on our stock ownership.

Our right to issue preferred stock and anti-takeover provisions could make a third-party acquisition of us difficult and otherwise adversely affect common stockholders.

Upon the closing of this offering, our board of directors will be authorized to designate and issue up to 5,000,000 shares of preferred stock and determine the price, rights, preferences and privileges of those shares without any further vote or action by our stockholders. If you own common stock, your ownership rights will be subject to, and may be adversely affected by, the rights of the owners of preferred stock that we may issue in the future. As a result, the issuance of preferred stock could have a material adverse effect on the market value of the common stock. In addition, issuances of preferred

15

stock could make it more difficult for a third party to acquire a majority of our outstanding voting stock.

Upon the closing of this offering, our certificate of incorporation will provide that our board of directors will be divided into three classes, each serving staggered three-year terms. Accordingly, stockholders may elect only a minority of our board at any annual meeting, which may have the effect of delaying or preventing a change in management or control of DNA Sciences.

Further, we are subject to the anti-takeover provisions of Section 203 of the Delaware General Corporation Law. Under this law, if anyone becomes an "interested stockholder" in DNA Sciences, we may not enter into a "business combination" with that person for three years without special approval. These provisions could delay or prevent a change of control. Certain other provisions of our certificate of incorporation and bylaws could also delay or prevent changes of control or management. These provisions could adversely affect the market price of the common stock.

Our common stock has never been publicly traded and we cannot predict the extent to which a trading market will develop.

Before this offering, there has been no public market for our common stock. We cannot predict the extent to which an active public market for the common stock will develop or be sustained after this offering. We will negotiate the initial public offering price with the representatives of the underwriters. The initial public offering price of our common stock may not be indicative of future market prices.

Market prices of emerging biotechnology companies have been highly volatile, and the market for our stock may exhibit volatility as well.

The market price of our common stock is likely to be highly volatile. In addition to various risks described elsewhere in this prospectus, the following factors could also cause price volatility:

Extreme price and volume fluctuations occur in the stock market from time to time and can particularly affect the prices of technology and biotechnology stocks. These extreme fluctuations are often unrelated to the actual performance of the affected issuers. These broad market fluctuations may adversely affect the market price of our common stock.

Future sales by our current stockholders may adversely affect our stock price and our ability to raise funds in new stock offerings.

Sales of our common stock by our current stockholders in the public market after this offering could cause the market price of our stock to fall. Sales may also make it more difficult for us to sell equity securities or equity-related securities in the future at a time and price that our management deems acceptable, or at all. Upon the completion of this offering, we will have shares of common stock outstanding, assuming no exercise of options or warrants after December 29, 2000 and

16

assuming no exercise of the underwriters' over-allotment option. Of these outstanding shares of common stock, the shares sold in this offering will be freely tradable, without restriction under the Securities Act of 1933, unless purchased by our "affiliates." The remaining 26,193,788 shares of common stock held by existing stockholders are "restricted securities" and may be resold in the United States public market only if registered or pursuant to an exemption from registration.

Immediately following the completion of this offering, holders of 21,460,689 shares of common stock and warrants to purchase an aggregate of 254,000 shares of common stock will be entitled to certain registration rights. Upon registration, these shares may be freely sold in the public market.

All of our current stockholders have agreed that they will not sell any shares of common stock for a period of 180 days after the date of this prospectus without the prior written consent of the underwriters.

Upon expiration of the lock-up agreements:

Purchasers in this offering will suffer immediate dilution.

If you purchase common stock in this offering, you will experience dilution, which means that the value of your shares based upon our actual book value will immediately be less than the offering price you paid. Based upon the pro forma net tangible book value of the common stock at September 30, 2000, your shares will be worth $ less per share than the price you paid in the offering. If options and warrants we previously granted are exercised, additional dilution is likely to occur. Following the completion of this offering, options to purchase 4,573,364 shares of common stock at a weighted average exercise price of $1.58 per share and warrants to purchase 254,000 shares of common stock at a weighted average price of $7.50 per share will be outstanding.

This prospectus contains forward-looking statements. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as "may," "will," "should," "could," "expect," "plan," "anticipate," "believe," "estimate," "predict," "intend," "potential" or "continue," the negative of such terms or other comparable terminology. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed, implied or forecasted in the forward-looking statements. In addition, the forward-looking events discussed in this prospectus might not occur. These risks and uncertainties include, among others, those described in "Risk Factors" and elsewhere in this prospectus. Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect our management's view only as of the date of this prospectus. Except as required by law, we undertake no obligation to update any forward-looking statement, whether as a result of new information, future events or otherwise.

17

We estimate that we will receive net proceeds from this offering of about $ million, or about $ million if the underwriters exercise their over-allotment option in full, at an assumed initial public offering price of $ per share, after deducting the underwriting discount and estimated offering expenses.

We expect to use approximately $ million to continue and expand our genetic discovery programs, maintain and expand our genetic database, commercialize diagnostic tests under development and to purchase subscriptions to genomic databases from third parties.

We also intend to spend approximately $ million of the net proceeds of this offering for capital expenditures. These expenditures will include the development or purchase of:

The remainder of the net proceeds are expected to be used for working capital and general corporate purposes. We may also use a portion of the net proceeds to acquire businesses, technologies, or products complementary to our business; however, we do not currently have any specific plans to do so.

Pending use of the net proceeds for the purposes described above, we intend to invest the net proceeds in short-term, interest-bearing, investment-grade securities.

We have never declared or paid any dividends on our capital stock. We currently expect to retain future earnings, if any, for use in the operation and expansion of our business and do not anticipate paying any cash dividends in the foreseeable future.

18

The following table sets forth our capitalization as of September 30, 2000:

This table should be read with "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our financial statements and notes appearing elsewhere in this prospectus.

| |

As of September 30, 2000 |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Actual |

Pro Forma |

Pro Forma As Adjusted |

|||||||||

| |

(in thousands) |

|||||||||||

| Long-term portion of equipment financing obligations | $ | 5,520 | $ | 5,520 | $ | 5,520 | ||||||

| Redeemable convertible preferred stock, $0.001 par value; 22,000,000 shares authorized, actual and pro forma; 5,000,000 shares authorized, pro forma as adjusted; 15,382,006 and 21,461,014 shares issued and outstanding, actual and pro forma, respectively; no shares outstanding pro forma as adjusted | 69,809 | 135,320 | — | |||||||||

| Stockholders' equity (net capital deficiency): | ||||||||||||

| Common Stock, $0.001 par value; 40,000,000 shares authorized, actual and pro forma; 75,000,000 shares authorized, pro forma as adjusted; 4,075,708 shares issued and outstanding, actual; 4,082,012 shares issued and outstanding, pro forma; shares issued and outstanding, pro forma, as adjusted | 4 | 4 | ||||||||||

| Additional paid-in capital | 22,824 | 25,247 | ||||||||||

| Notes receivable from stockholders | (244 | ) | (244 | ) | (244 | ) | ||||||

| Deferred stock compensation | (15,205 | ) | (15,654 | ) | (15,654 | ) | ||||||

| Deficit accumulated during the development stage | (31,642 | ) | (33,342 | ) | (33,342 | ) | ||||||

| Total stockholders' equity (net capital deficiency) | (24,263 | ) | (23,989 | ) | ||||||||

| Total capitalization | $ | 51,066 | $ | 116,851 | $ | |||||||

This table excludes the following shares as of December 29, 2000:

19

If you invest in our common stock, your interest will be diluted to the extent of the difference between the public offering price per share of our common stock and the pro forma as adjusted net tangible book value per share of common stock after this offering. Pro forma net tangible book value per share represents the amount of our pro forma total tangible assets less total liabilities, divided by the pro forma number of shares of common stock outstanding. As of September 30, 2000, our pro forma net tangible book value was approximately $93.2 million or $3.65 per share of common stock after giving effect to:

Without taking into account any other changes in our net tangible book value after September 30, 2000, other than to give effect to this offering of shares of common stock at an assumed initial offering price of $ per share, less the underwriting discount and estimated offering expenses, our pro forma as adjusted net tangible book value, at September 30, 2000, would have been approximately $ or $ per share. This represents an immediate increase in the pro forma net tangible book value of $ per share of our common stock to current stockholders and an immediate dilution of $ per share to new investors. The following table illustrates this dilution on a per share basis:

| Assumed initial public offering price per share | $ | ||||||

| Pro forma net tangible book value per share at September 30, 2000 | $ | 3.65 | |||||

| Increase per share attributable to new investors | |||||||

| Pro forma as adjusted net tangible book value per share after this offering | |||||||

| Dilution per share to new investors | $ | ||||||

The following table summarizes, on a pro forma basis as of September 30, 2000 after giving effect to the sale of Series C preferred stock and Series C-1 preferred stock, and the issuance of Series D preferred stock and common stock in connection with the acquisition of PPGx in December 2000, the differences between the number of shares purchased from us, the total consideration paid and the average price per share paid by the existing and the new investors. We have assumed an initial public offering price of $ per share, no exercise of the underwriters' over-allotment option and we have not deducted the underwriting discount and estimated offering expenses in our calculations.

| |

Shares Purchased |

Total Consideration |

|

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Average Price Per Share |

||||||||||||

| |

Number |

Percent |

Amount |

Percent |

|||||||||

| Existing shareholders | 25,543,426 | $ | 138,496,000 | $ | 5.42 | ||||||||

| New investors | |||||||||||||

| Total | 100.0 | % | $ | 100.0 | % | $ | |||||||

The number of shares of common stock outstanding in the table above is based on the number of shares outstanding as of December 29, 2000, and excludes:

20

The exercise of outstanding options and warrants having an exercise price less than the initial public offering price would increase the dilutive effect to new investors.

21

SELECTED HISTORICAL AND PRO FORMA FINANCIAL DATA

The following selected financial data should be read in conjunction with the financial statements and the notes to those statements included elsewhere in this prospectus, and "Management's Discussion and Analysis of Financial Condition and Results of Operations." The statements of operations data for the period from May 11, 1998 (inception) to December 31, 1998 and the fiscal year ended December 31, 1999 and the balance sheet data at December 31, 1998 and 1999 are derived from our financial statements included elsewhere in this prospectus that have been audited by Ernst & Young LLP, independent auditors. The statements of operations data for the nine-month periods ended September 30, 1999 and September 30, 2000 and the balance sheet data as of September 30, 2000 are derived from unaudited financial statements included elsewhere in this prospectus. Historical results are not necessarily indicative of future results.

The statements of operations data displayed in the "Pro Forma PPGx Acquisition 1999" column for the year ended December 31, 1999 and in the "Pro Forma PPGx Acquisition 2000" column for the nine months ended September 30, 2000 are derived from the unaudited pro forma combined condensed financial statements included elsewhere in this prospectus. These pro forma data give effect to the PPGx acquisition as if it had taken place as of January 1, 1999 and is based on our historical operating results and those of PPGx for the periods presented, giving effect to the amortization of intangible assets related to the acquisition. These amortization amounts have also been derived from our unaudited combined condensed financial statements included elsewhere in this prospectus. The pro forma information is not necessarily indicative of what actual financial results would have been had the acquisition taken place on January 1, 1999 and does not purport to indicate the results of future operations.

| |

|

Year Ended December 31, |

|

|

|

|

||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Period from May 11, 1998 (inception) through December 31, 1998 |

Nine Months Ended September 30, |

Period from May 11, 1998 (inception) through September 30, 2000 |

|||||||||||||||||||||

| |

1999 |

Pro forma PPGx acquisition 1999 |

1999 |

2000 |

Pro forma PPGx acquisition 2000 |

|||||||||||||||||||

| |

(in thousands, except share and per share data) |

|||||||||||||||||||||||

Statements of Operations Data: |

||||||||||||||||||||||||

| Revenues | $ | — | $ | 79 | $ | 966 | $ | — | $ | 500 | $ | 1,672 | $ | 579 | ||||||||||

| Operating expenses: | ||||||||||||||||||||||||

| Cost of revenues | — | — | 1,030 | — | — | 1,243 | — | |||||||||||||||||

| Research and development | 20 | 4,901 | 7,022 | 3,809 | 14,602 | 17,108 | 19,523 | |||||||||||||||||

| General and administrative | 309 | 2,700 | 6,518 | 1,995 | 4,652 | 8,109 | 7,661 | |||||||||||||||||

| Stock-based compensation | — | 418 | 530 | 129 | 5,985 | 6,069 | 6,403 | |||||||||||||||||

| Amortization of samples, goodwill and acquisition related intangibles | — | — | 9,158 | — | — | 6,869 | — | |||||||||||||||||

| Total operating expenses | 329 | 8,019 | 24,258 | 5,933 | 25,239 | 39,398 | 33,587 | |||||||||||||||||

| Loss from operations | (329 | ) | (7,940 | ) | (23,292 | ) | (5,933 | ) | (24,739 | ) | (37,726 | ) | (33,008 | ) | ||||||||||

| Interest income (expense), net | (19 | ) | 103 | 20 | 85 | 1,282 | 895 | 1,366 | ||||||||||||||||

| Net loss | $ | (348 | ) | $ | (7,837 | ) | $ | (23,272 | ) | $ | (5,848 | ) | $ | (23,457 | ) | $ | (36,831 | ) | $ | (31,642 | ) | |||

| Basic and diluted net loss per share | $ | — | $ | (16.01 | ) | $ | (46.95 | ) | $ | (13.43 | ) | $ | (16.59 | ) | $ | (25.93 | ) | |||||||

| Shares used in computing basic and diluted net loss per share | — | 489,382 | 495,686 | 435,342 | 1,413,990 | 1,420,294 | ||||||||||||||||||

| Pro forma basic and diluted net loss per share | $ | (1.49 | ) | $ | (1.56 | ) | ||||||||||||||||||

| Shares used in computing pro forma basic and diluted net loss per share | 5,243,896 | 15,011,622 | ||||||||||||||||||||||

22

The balance sheet data displayed in the "Pro forma PPGx acquisition 2000" column reflects the pro forma effects of the acquisition of PPGx as if it had taken place on September 30, 2000.

| |

|

|

September 30, |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

As of December 31, |

||||||||||||

| |

|

Pro Forma PPGx Acquisition 2000 |

|||||||||||

| |

1998 |

1999 |

2000 |

||||||||||

| |

(in thousands) |

||||||||||||

Balance Sheet Data: |

|||||||||||||

| Cash and cash equivalents | $ | 1,077 | $ | 3,483 | $ | 40,882 | $ | 41,234 | |||||

| Total assets | 1,150 | 8,026 | 61,453 | 98,386 | |||||||||

| Working capital (deficit) | (421 | ) | 791 | 31,148 | 29,410 | ||||||||

| Total long-term liabilities | — | 1,582 | 5,520 | 5,520 | |||||||||

| Redeemable convertible preferred stock | — | 11,345 | 69,809 | 103,820 | |||||||||

| Deferred stock compensation | — | (3,047 | ) | (15,205 | ) | (15,654 | ) | ||||||

| Total stockholders' equity (net capital deficiency) | (348 | ) | (7,750 | ) | (24,263 | ) | (23,989 | ) | |||||

23

MANAGEMENT'S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis should be read with "Selected Financial Data" and our financial statements and notes included elsewhere in this prospectus. The discussion in this prospectus contains forward-looking statements that involve risks and uncertainties, such as statements of our plans, objectives, expectations and intentions. The cautionary statements made in this prospectus should be read as applying to all related forward-looking statements wherever they appear in this prospectus. Our actual results could differ materially from those discussed here. Factors that could cause or contribute to these differences include those discussed in "Risk Factors," as well as those discussed elsewhere.

Overview

We are a genetics discovery company focused on identifying the genetic basis of disease susceptibility, disease progression and response to drug treatment. We were incorporated in May 1998 and in May 2000 changed our name from KIVA Genetics, Inc. to DNA Sciences, Inc. For the period from our inception to December 31, 1998, we were primarily focused on fundraising and start-up activities. In 1999, we focused primarily on the development of our microchannel DNA sequencer, which incorporates technology that we licensed from University of California, Berkeley in 1998 and Amersham Pharmacia Biotech. During 1999 we also developed software to manage genetic information. Beginning in 2000, we expanded our business to focus on research and development efforts for our gene discovery programs and commenced building our genotyping and sequencing facility. We plan to develop diagnostic tests and, in the longer term, therapeutic products based on gene variants we identify through our discovery programs. Revenues from these products and services will not be realized for several years, if ever.

To date, we have derived our revenues almost entirely from a $2.0 million grant under the United States Department of Commerce's Advanced Technology Program. This grant was awarded to fund development of our microchannel DNA sequencer. Our acquisition of PPGx in December 2000 will add revenues from genotyping services performed for pharmaceutical companies, including Eli Lilly & Co., Pharmacia Corp. and Bristol Myers Squibb Company. In December 2000, we entered into a contract with Amersham Pharmacia Biotech under which we licensed our technology and intellectual property which the DNA sequencer utilizes to Amersham in exchange for, among other things, cash payments totaling $7.5 million over three years commencing in 2001.

Our operating costs and expenses consist primarily of research and development expenses, information technology development and expenses associated with our website, and general and administrative expenses. Our research and development expenses include salaries, supplies, the cost of recruiting patients and obtaining DNA samples, machine and reagent use and related facilities and information technology expenses. Patient recruitment costs include the cost of our DNA.com website, payments under our collaboration agreement with WebMD and other related promotion costs. Our general and administrative expenses include compensation related to executive, business development, finance and other administrative personnel, related facilities costs, insurance and legal support. Our total full time employees increased to 72 individuals as of September 30, 2000 from 40 as of December 31, 1999 and four as of December 31, 1998. As our headcount has increased, our operating expenses have increased accordingly.

We anticipate that our results of operations will fluctuate for the foreseeable future due to numerous factors, including the progress of our genetic discovery programs, market evaluation and acceptance of our products and services, patent requirements and the introduction of new products by our competitors. The sales cycle for genotyping services is highly variable and dependent upon the simultaneous availability of production capacity and research project demand. We expect that it may

24

take between six weeks and six months to progress from initial contact to execution of a contract services agreement.

We have a limited operating history. Since inception we have incurred significant losses. On a pro forma basis, after giving effect to our acquisition of PPGx in December 2000, we had net losses of $36.8 million for the nine months ended September 30, 2000 and $23.3 million for the year ended December 31, 1999. As of September 30, 2000, we had an accumulated deficit of $31.6 million. We anticipate incurring additional and increasing losses for many years as we expand our genetic discovery efforts, increase our genotyping production capabilities and develop commercial products and services. Our limited history and the limited history of PPGx make accurate forecasts of future operations difficult.

Deferred Stock Compensation

Deferred stock compensation represents the difference between the fair value of our common stock for financial reporting purposes and the exercise price of options on their date of grant. We are amortizing the deferred stock compensation to expense as these options vest, generally over four to five years. During the period ended December 31, 1999, we recognized stock compensation expense totaling $418,000. Additional deferred stock compensation expense totaling $6.0 million was recognized during the nine months ended September 30, 2000. As of September 30, 2000, there was approximately $15.2 million of deferred stock compensation to be amortized in future periods. In addition to deferred stock compensation related to grants of stock options to our employees and directors, we also recognize expense for the value of options and warrants granted to non-employee consultants and service providers. During the year ended December 31, 1999 and the nine months ended September 30, 2000 we recognized expense of $66,000 and $2.6 million, respectively, related to such grants. The value of grants to non-employees is measured as they are earned over their vesting periods.

In the period from September 30, 2000 through December 31, 2000 we granted employees and consultants additional stock options to purchase 2,574,790 shares of common stock at exercise prices ranging from $0.75 to $2.05 per share. We will record additional deferred stock-based compensation of approximately $22.3 million in the quarter ending December 31, 2000 to account for the difference between the exercise price of option grants to employees and the fair value for financial reporting purposes of the common stock on the date of grant. In addition, we have granted stock options and purchase rights to non-employees which will be remeasured and recognized as expense over their vesting periods.

As of December 31, 2000 total deferred stock compensation will be amortized as follows:

Acquisition of PPGx, Inc.

In December 2000, we acquired PPGx, Inc., a joint venture between Pharmaceutical Product Development, Inc., or PPD, and Axys Pharmaceuticals, Inc. PPGx was incorporated on January 25, 1999. PPGx performs genetic testing and contract research services for pharmaceutical companies. PPGx has 49 full time employees located primarily in its facilities in Research Triangle Park, North Carolina and La Jolla, California. PPGx also employs three persons in its certified laboratory in Cambridge, England. Upon the closing of the acquisition, PPGx amended and restated its distributor

25