|

|

|

|

|

Previous: CAPITAL RESEARCH & MANAGEMENT CO, SC 13G/A, 2000-12-12 |

Next: GENESCO INC, 10-Q, 2000-12-12 |

CASCADE NATURAL GAS CORPORATION

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

to be held January 25, 2001

TO THE HOLDERS OF COMMON STOCK OF

CASCADE NATURAL GAS CORPORATION:

Cascade Natural Gas Corporation's Annual Meeting of Shareholders will take place at the offices of the Company located at 230 Fairview Avenue North, Seattle, Washington 98109, on Thursday, January 25, 2001, at 1:30 p.m. for the following purposes:

Shareholders of record at the close of business November 22, 2000 are qualified to vote at the Annual Meeting and are entitled to vote on all matters presented in this notice.

By Order of the Board of Directors

LARRY

C. ROSOK

Corporate Secretary

Seattle,

Washington

December 4, 2000

IMPORTANT

Each vote is important. To vote your shares, please complete, sign and return the enclosed proxy card promptly, using the accompanying postage prepaid and addressed envelope. If you prefer, you may submit your voting instructions via internet or telephone as described on the proxy card. To vote by internet, go to http://proxy.shareholder.com/cgc and follow the instructions provided. To vote by telephone, dial on a touch-tone phone, 800-479-8718 and follow the instructions provided. When using the internet or phone, be sure to have your proxy card with your control number in hand.

CASCADE NATURAL GAS CORPORATION

222 FAIRVIEW AVENUE NORTH, SEATTLE, WA 98109

PROXY STATEMENT

TO THE SHAREHOLDERS OF CASCADE NATURAL GAS CORPORATION

The Cascade Natural Gas Corporation Board of Directors is soliciting your proxy to vote at the Annual Meeting of Shareholders ("Annual Meeting") to be held on Thursday, January 25, 2001, for the purposes presented in the accompanying Notice of Annual Meeting. This Proxy Statement will be mailed on or about December 15, 2000.

A proxy form is enclosed for use at the meeting. You have the power to revoke a proxy at any time before its exercise. A proxy may be revoked by delivering written notice of revocation to Larry C. Rosok, Corporate Secretary, Cascade Natural Gas Corporation, 222 Fairview Avenue North, Seattle, Washington 98109, or by submitting a later-dated proxy card. The powers of the proxy holders will be suspended if the person executing the proxy is present at the meeting and elects to vote in person.

If you vote by proxy card, phone or internet, your proxy (one of the individuals named on the proxy card) will vote your shares as you have instructed. If you do not give instructions on how to vote your shares, your proxy will vote your shares for the slate of directors listed below and in his/her discretion with regard to other items of business.

The "record date" for the Annual Meeting is November 22, 2000. If you held Cascade Natural Gas Corporation Common Stock in your name at the close of business on November 22, 2000, you are entitled to vote at the Annual Meeting. On November 22, 2000, the Company had 11,045,095 outstanding shares of $1 par value Common Stock ("Common Stock"). A majority of the shares entitled to vote, represented in person or by proxy, will constitute a quorum at the meeting. You are entitled to one vote for each share held and to cumulate votes in the election of directors.

Nine directors will be elected at the Annual Meeting, each to hold office until the next Annual Meeting or until his or her successor is elected and qualified. The nominees receiving the largest number of votes cast by all shares entitled to vote will be elected. All of the nominees listed below are presently serving as directors and were elected at the 2000 Annual Meeting by over 98% of the shares present and voting at the meeting. In the event any of the nominees becomes unable to serve, the proxy holders may vote for substitute nominees. No circumstances are presently known which would cause any nominee to become unavailable.

You have the right to cumulate votes in the election of directors. This means you are entitled to as many votes as you have shares, multiplied by the number of directors to be elected (in this case, nine). You may allocate your total number of votes among the nominees in any way you decide, including casting all your votes for one nominee. If you wish to cumulate your votes, mark the proxy card in any way you like to (i) indicate clearly that you are exercising the right to cumulate votes and (ii) specify how the votes are to be allocated among the nominees for director. For example, you may write the number of votes you wish to allocate to a specific nominee next to the name of that nominee. The exercise of cumulative voting rights is not subject to any conditions.

1

Unless you instruct otherwise on the proxy card, it will be voted to elect all or as many of the nominees listed as possible. If either of the "For All Nominees Listed Above" or "Exception" boxes is marked or no instructions are given, the named proxies will have discretionary authority to allocate votes among the nominees as they deem appropriate (except for any nominee specifically excepted by the Shareholder), including not casting any votes for one or more nominees.

The age, principal occupation, business experience and other information provided by each nominee and the year in which he or she first became a director is listed below.

CARL

BURNHAM, JR. Director since 1990

Attorney at Law

Yturri Rose LLP

Mr. Burnham, 61, is an attorney and, since 1967, has been a partner of Yturri Rose LLP of Ontario, Oregon, one of the Company's Oregon counsel.

MELVIN

C. CLAPP Director since 1981

Retired

Mr. Clapp, 67, was Chairman and Chief Executive Officer of the Company from December 1988 until he retired February 1, 1995. From August 1981 to December 1988 he was Executive Vice President. Mr. Clapp joined the Company in 1956 and held positions in district management until moving to the general office in 1969.

THOMAS

E. CRONIN Director since 1996

President

Whitman College

Dr. Cronin, 60, has served as President of Whitman College since the summer of 1993. Prior to that, he held the McHugh Professorship of American Institutions and Leadership at the Colorado College in Colorado Springs. In 1991, he served as acting President of the Colorado College. He is the author or co-author of ten books on American Government.

DAVID

A. EDERER Director since 1991

Partner

Ederer Investment Company

Mr. Ederer, 57, has been the managing partner since 1974 in Ederer Investment Company, which invests in privately owned West Coast companies. Since 1978, he has been the owner or part owner and officer of several privately owned manufacturing and property management companies.

HOWARD

L. HUBBARD Director since 1981

Retired

Mr. Hubbard, 69, was President and a director of Washington Federal Savings Bank in Hillsboro, Oregon from April 1982 until he retired in December 1991. From 1975 to 1982, Mr. Hubbard was President and a director of Equitable Savings & Loan Association, Portland, Oregon.

W.

BRIAN MATSUYAMA Director since 1988

Chairman, President and Chief Executive Officer

Cascade Natural Gas Corporation

Mr. Matsuyama, 54, Chairman and Chief Executive Officer since February 1, 1995, was also appointed President on October 1, 1998, an office he previously held from 1988 to 1995. From 1987 to 1988, he was Vice President and General Counsel of the Company. Prior to 1987, he was a member of the law firm of Jones Grey & Bayley, P.S., Seattle, Washington, with his principal client representation being on behalf of the Company.

2

LARRY L. PINNT Director since 1995

Retired

Mr. Pinnt, 65, was Chief Financial Officer of US WEST Communications, Inc. from 1979 until he retired in September 1989. Mr. Pinnt currently serves on the Boards of Trustees of the following publicly held mutual fund trusts: SAFECO Common Stock Trust, SAFECO Tax-Exempt Bond Trust, SAFECO Money Market Trust, SAFECO Resource Series Trust, and SAFECO Managed Bond Trust.

BROOKS

G. RAGEN Director since 1984

President

Manzanita Capital Inc.

Mr. Ragen, 67, is President of Manzanita Capital Inc., a financial services firm. He was a Director of Ragen MacKenzie Incorporated, an investment banking firm headquartered in Seattle, Washington from 1986 to 1998. From 1988 until 1996, he served as Chairman and Chief Executive Officer of Ragen MacKenzie Incorporated. From 1987 to 1988 he was President of Cable, Howse & Ragen, the predecessor to Ragen MacKenzie Incorporated and was Managing Partner of Cable, Howse & Ragen from 1982 to 1987.

MARY

A. WILLIAMS Director since 1983

Retired

Mrs. Williams, 66, has been retired since 1996. From 1983 to 1996, she was a consultant. She was a Vice President of Seattle Trust & Savings Bank from 1977 to 1983.

The Board of Directors met five times during the fiscal year ended September 30, 2000. The Executive Committee of the Board met three times during the fiscal year ended September 30, 2000. Each Director standing for election attended all of the meetings of the Board and committees on which he or she served during fiscal 2000.

The Board has established an Executive Committee, an Audit Committee, a Nominating and Compensation Committee, a Long Range Planning Committee and a Pension Committee, whose members are as follows:

| Executive |

Audit |

Nominating and Compensation |

Pension |

Long Range Planning |

||||

|---|---|---|---|---|---|---|---|---|

| W. Brian Matsuyama, Ch. | Larry L. Pinnt, Ch. | David A. Ederer, Ch. | Howard L. Hubbard, Ch. | W. Brian Matsuyama, Ch. | ||||

| M. C. Clapp | Thomas E. Cronin | Carl Burnham, Jr. | M. C. Clapp | Carl Burnham, Jr. | ||||

| David A. Ederer | Brooks G. Ragen | Brooks G. Ragen | Thomas E. Cronin | M.C. Clapp | ||||

| Brooks G. Ragen | Mary A. Williams | Mary A. Williams | Larry L. Pinnt | Howard Hubbard | ||||

| Mary A. Williams | Brooks G. Ragen |

The Audit Committee, which met five times during the fiscal year ended September 30, 2000, reviews the adequacy of the Company's financial, accounting, and reporting control processes as well as the scope and results of audits performed by independent accountants and internal auditors.

The Nominating and Compensation Committee, which held four meetings during the fiscal year ended September 30, 2000, is responsible for recommending candidates for seats on the Board of Directors, as well as recommending compensation for officers and directors. The Committee will consider nominees for director recommended by Shareholders for the 2002 Annual Meeting if the nominations are received at the Company's executive offices by August 6, 2001, provided that such nominations are accompanied by a description of the nominee's qualifications, relevant biographical information and the nominee's consent to be nominated and to serve if elected.

3

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table shows certain information regarding the beneficial ownership, as of November 22, 2000, of the Company's Common Stock by (a) each director, the Chief Executive Officer and the other four most highly paid executive officers of the Company and (b) all current directors and executive officers as a group. As of that date, no individual director or other executive officer mentioned above owned any of the Company's outstanding preferred shares. The Company is not aware of any beneficial owner of 5% or more of the Common Stock. Except as otherwise indicated in the table, the Company believes the beneficial owners of the shares listed below have sole investment and voting power with respect to the shares.

| Directors and Executive Officers |

Current Beneficial Holdings(1) |

Shares Subject to Exercisable Options |

Total |

Percentage of Common Stock |

||||

|---|---|---|---|---|---|---|---|---|

| Larry E. Anderson | 2,002 | 1,333 | 3,335 | * | ||||

| Carl Burnham, Jr. | 9,267 | 9,267 | * | |||||

| Melvin C. Clapp | 20,393 | 20,393 | * | |||||

| Thomas E. Cronin | 2,700 | 2,700 | * | |||||

| David A. Ederer | 36,760 | (2) | 36,760 | * | ||||

| Howard L. Hubbard | 27,000 | 27,000 | * | |||||

| W. Brian Matsuyama | 18,815 | 5,333 | 24,148 | * | ||||

| King C. Oberg | 1,238 | 1,333 | 2,571 | * | ||||

| Larry L. Pinnt | 7,658 | 7,658 | * | |||||

| Brooks G. Ragen | 7,372 | (2) | 7,372 | * | ||||

| Jon T. Stoltz | 4,046 | 1,333 | 5,379 | * | ||||

| J.D. Wessling | 2,887 | 1,333 | 4,220 | * | ||||

| Mary A. Williams | 9,924 | 9,924 | * | |||||

| All directors and officers as a group (17 persons) | 157,636 | 13,164 | 170,800 | 1.55% |

| Name |

Shares Held in 401K Plan |

|

|---|---|---|

| W. Brian Matsuyama | 6,181 | |

| Jon T. Stoltz | 3,509 | |

| J.D. Wessling | 2,682 | |

| King C. Oberg | 1,238 | |

| Larry E. Anderson | 2,002 |

Section 16 (a) Beneficial Ownership Reporting Compliance

Under Section 16(a) of the Securities Exchange Act of 1934, holders of more than 10 percent of the Common Stock and directors and certain officers of the Company are required to file reports ("Section 16(a) Statements") of beneficial ownership of Common Stock and changes in such ownership with the Securities and Exchange Commission. The Company is required to identify in its proxy statements those persons who, to the Company's knowledge, were required to file Section 16(a) Statements and did not do so on a timely basis. Based solely on a review of copies of Section 16(a) Statements furnished to the Company during and regarding its most recent fiscal year and on written

4

representations from reporting persons, the Company believes that each person who at any time during the most recent fiscal year was a reporting person filed all required Section 16(a) Statements on a timely basis.

REPORT OF THE NOMINATING AND COMPENSATION COMMITTEE TO SHAREHOLDERS

The Nominating and Compensation Committee of the Board of Directors is responsible for reviewing the compensation levels for all officers of the Company and making recommendations to the Board concerning officer salary levels. The Committee is composed of four independent non-employee directors.

The Committee's review includes an assessment of the overall management of the Company and the officers' ability to achieve a reasonable net income for the Company under a variety of conditions. The Committee applies policies and principles, which are essentially subjective in nature, rather than embodying specific criteria when recommending officer compensation levels. These policies and principles may be summarized as follows: officer compensation should be comparable with compensation paid to officers of similar companies, particularly those the Company must compete with in attracting and retaining skilled and competent individuals. An officer should also be compensated for his or her contributions to the performance of the Company. In evaluating performance, the Committee considers the Company's net income and factors affecting that net income. The Committee also considers the officers' progress toward achieving corporate goals when recommending compensation levels.

The Committee approved and the Board granted incentive stock options to officers of the Company in March 2000. The incentive stock option grants were extended in fiscal 2000 to include department directors and district managers. These options directly align the interests of key employees with those of Shareholders in increasing Shareholder value.

The Committee recommended and the Board approved an incentive compensation program for fiscal 2000 that applied to officers and other salaried employees. It provided for cash payments to participating employees, based on their base salaries, if certain target levels of pre-tax earnings were achieved.

The Committee anticipates recommending expanded use of stock options and/or other forms of incentive compensation for officers and other employees in the future as part of a program to better align employee and Shareholder interests.

The Committee considered the following contributions by Mr. Matsuyama in establishing his salary and stock option grant: influence on the direction and performance of the Company and overall effectiveness in areas critical to the Company's success; enhancement of Shareholder value; effect on net income; management of the demands of rapid growth; and attainment of corporate goals.

Due to the Company's compensation structure, the Committee has not deemed it necessary thus far to adopt a policy regarding the deductibility of certain executive compensation under federal tax laws.

| David A. Ederer, Chairman | Brooks G. Ragen | |||

| Carl Burnham, Jr. | Mary A. Williams |

REPORT OF THE AUDIT COMMITTEE TO THE SHAREHOLDERS

The Audit Committee of the board of directors, composed entirely of independent directors, met five times in fiscal year 2000. The Committee assists the board in fulfilling its responsibility for oversight of the quality and integrity of the accounting, auditing and reporting practices of the

5

Company and such other duties as directed by the board. The full responsibilities of the Committee are set forth in its charter, which is reviewed and updated annually, and approved by the board. A copy of the Charter is attached as Appendix A to this proxy statement.

In fulfilling its responsibilities, the Committee recommended to the board the selection of Deloitte & Touche LLP as the Company's outside auditor. The Committee:

The Committee provided guidance and oversight to the internal audit function of the Company including review of the organization, plans and results of this activity. Both the chief internal auditor and the outside accountant were afforded the routine opportunity to meet privately with the Committee and were encouraged to discuss any matters they desired.

The Committee also met with selected members of management and the auditors to review financial statements, including quarterly reports, discussing such matters as the quality of earnings; estimates, reserves and accruals; suitability of accounting principles; highly judgmental areas; and audit adjustments, whether or not recorded.

Management's responsibility for financial reporting and the report and opinion of Deloitte & Touche LLP are filed separately in the annual report and should be read in conjunction with this letter and review of the financial statements. The Company's audited financial statements included in the annual report on Form 10-K were, after the Committee's review, approved by the board of directors for filing with the Securities and Exchange Commission.

Based upon its work and the information received in the inquiries outlined above, the Committee is satisfied that its responsibilities under the charter for the period ending September 30, 2000, were met and the financial reporting and audit processes of the Company are functioning effectively.

Larry

L. Pinnt, Chairman

Thomas E. Cronin

Brooks G. Ragen

Mary A. Williams

6

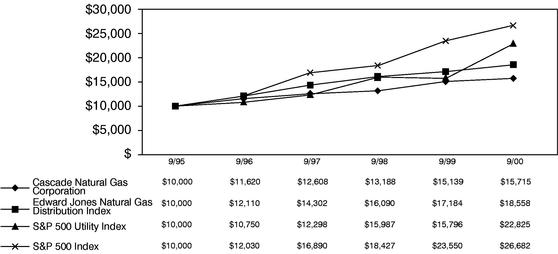

The following graph compares the total cumulative returns to investors in the Company's Common Stock, the Edward Jones Natural Gas Distribution Index, the Standard & Poor's 500 Utility Index and the Standard & Poor's 500 Index for the period from October 1, 1995 through September 30, 2000. The graph assumes that $10,000 was invested on September 30, 1995, in the Common Stock and in each of the above-mentioned indices and that all dividends were reinvested. The total returns for the 31 companies (of which the Company is one) included in the Edward Jones Natural Gas Distribution Index have been weighted by their respective market capitalizations.

Cascade Natural Gas Corporation, Edward Jones Natural Gas Distribution

Index, S & P 500 Utility Index, and S & P 500 Index (Dividends Reinvested)

7

Summary Compensation Table. The following table shows compensation paid to the Chief Executive Officer and each of the other four most highly compensated executive officers of the Company for the years indicated.

| |

|

|

|

|

Long Term Compensation Awards |

|

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

|

Annual Compensation |

|

||||||||||||

| Name and Principal Position |

Years of Service |

Fiscal Year |

Securities Underlying Options(#) |

All Other Compensation(c) |

||||||||||||

| Salary(a) |

Bonus(b) |

|||||||||||||||

| W. Brian Matsuyama | 13 | 2000 | $ | 226,314 | $ | 13,404.11 | 4,000 | $ | 7,746 | |||||||

| Chairman, President | 1999 | 219,020 | 8,688.23 | 16,000 | 7,506 | |||||||||||

| and Chief Executive | 1998 | 212,370 | 7,401 | |||||||||||||

| Officer | ||||||||||||||||

| Jon T. Stoltz | 26 | 2000 | $ | 152,296 | $ | 8,933.68 | 4,000 | $ | 6,853 | |||||||

| Senior Vice President | 1999 | 149,762 | 5,699.46 | 4,000 | 3,734 | |||||||||||

| Planning, Regulatory & | 1998 | 120,960 | 0 | |||||||||||||

| Consumer Affairs | ||||||||||||||||

| J.D. Wessling | 6 | 2000 | $ | 147,205 | $ | 8,718.67 | 5,000 | $ | 6,624 | |||||||

| Senior Vice President | 1999 | 140,411 | 5,451.36 | 4,000 | 6,267 | |||||||||||

| Finance & Chief | 1998 | 113,790 | 5,121 | |||||||||||||

| Financial Officer | ||||||||||||||||

| King C. Oberg | 11 | 2000 | $ | 120,032 | $ | 7,109.25 | 4,000 | $ | 3,601 | |||||||

| Vice President | 1999 | 117,547 | 4,563.68 | 4,000 | 3,518 | |||||||||||

| Gas Supply | 1998 | 110,490 | 3,315 | |||||||||||||

| Larry E. Anderson | 26 | 2000 | $ | 119,127 | $ | 7,055.61 | 4,000 | $ | 900 | |||||||

| Vice President | 1999 | 117,698 | 4,569.56 | 4,000 | 900 | |||||||||||

| Operations | 1998 | 109,620 | 900 | |||||||||||||

Officers voluntarily declined to participate in normal base salary increases in fiscal 1999 as a way to demonstrate their commitment to achieving the Company's financial goals. Comparisons of fiscal 1999 and fiscal 1998 salary levels are affected by increases granted in the middle of fiscal 1998.

8

Option Grants In Last Fiscal Year

The following table shows the number of shares of the Company's Common Stock subject to stock options granted in 2000 to the executive officers listed in the Summary Compensation Table.

| |

Individual Grants(1) |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Name |

Number of Securities Underlying Options Granted |

Percent of Total Options Granted To Employees in Fiscal Year |

Exercise Price ($/Share) |

Expiration Date |

Grant Date Present Value(2) |

||||||

| W. Brian Matsuyama | 4,000 | 7.5 | 14.94 | 3/23/05 | $ | 10,240 | |||||

| Jon T. Stoltz | 4,000 | 7.5 | 14.94 | 3/23/05 | $ | 10,240 | |||||

| J.D. Wessling | 5,000 | 9.4 | 14.94 | 3/23/05 | $ | 12,800 | |||||

| King C. Oberg | 4,000 | 7.5 | 14.94 | 3/23/05 | $ | 10,240 | |||||

| Larry E. Anderson | 4,000 | 7.5 | 14.94 | 3/23/05 | $ | 10,240 | |||||

Aggregated Option Exercises In Last Fiscal Year And Fiscal Year-End Values (a)

| |

Number of Shares Underlying Unexercised Options at Year-End(#) |

Value of Unexercised In-The-Money Options at Fiscal Year-End(b) |

|||

|---|---|---|---|---|---|

| Name |

Exercisable/ Unexercisable |

Exercisable/ Unexercisable |

|||

| W. Brian Matsuyama | 5,333 | $ | 5,333 | ||

| 14,667 | $ | 20,907 | |||

| Jon T. Stoltz | 1,333 | $ | 1,333 | ||

| 6,777 | $ | 12,907 | |||

| J.D. Wessling | 1,333 | $ | 1,333 | ||

| 7,777 | $ | 15,467 | |||

| King C. Oberg | 1,333 | $ | 1,333 | ||

| 6,777 | $ | 12,907 | |||

| Larry E. Anderson | 1,333 | $ | 1,333 | ||

| 6,777 | $ | 12,907 | |||

9

The Company has a noncontributory retirement plan for its employees. To be eligible for participation in the plan, an employee must complete one year of service and be at least 21 years of age. Each participant's benefits are fully vested after 5 years of employment. The level of benefits is determined by a formula, described below, related to years of service and average monthly earnings over certain time periods. Covered earnings include straight salary or hourly compensation, 75% of commissions and, for hourly employees, 30% of overtime pay. Covered compensation levels for executive officers are slightly less than, but at least 90% of, the amounts listed under "Salary" in the summary compensation table shown above. Benefits are not subject to reduction for Social Security or any other benefits. Accruals to the plan are computed on an actuarial basis and aggregated $1,701,000 for all participants for the fiscal year ended September 30, 2000.

The amount of the monthly past service benefit under the plan is equal to 1.5% of the participant's average monthly earnings for the five-year period ended December 31, 1998, multiplied by the participant's years of service before 1995. The benefit for each year of future service after 1998 is 2% of monthly compensation in lieu of the previous 1.5%. The Company from time to time has updated the average monthly earnings used to compute the benefit, and the plan may be similarly amended in the future.

10

EXECUTIVE SUPPLEMENTAL RETIREMENT INCOME PLAN

The Company has a plan to provide executive officers, including those listed in the summary compensation table above, with retirement, death and disability benefits supplementing the coverage payable under the Company's retirement plan. This plan was established to enable the Company to attract and retain highly competent persons in key executive positions. The supplemental plan is designed for each participant to receive retirement plan payments, primary Social Security benefits and supplemental plan payments each year equal, in the aggregate, to 70% of the participant's highest annual salary during any of the five years preceding the participant's retirement. Accruals for the plan are computed on an actuarial basis and totaled $92,000 for the 2000 fiscal year.

The plan also includes provisions for early retirement and permanent disability. The Board of Directors may approve early retirement under the plan without the normally required reduction in the amount of the supplemental benefit. Participants whose age and number of years of service, when added together, equal at least 90 are automatically eligible for early retirement benefits without reduction.

If a participant dies before receiving 120 monthly payments from the plan, the participant's designated beneficiaries will receive the remaining balance of the 120 payments. The amount of the monthly payment will be equal to the amount the participant was receiving or was entitled to receive before death, or, if the participant was employed by the Company at death and the resulting payment amount would be larger, the monthly amount would range from $4,000 to $12,000, depending on the officer. This monthly death benefit will be reduced by any monthly benefit payable to the participant's surviving spouse. The surviving spouse is entitled to a monthly benefit for life equal to one-half of the benefit the participant was entitled to before death.

Vesting for the plan is determined by years of participation in the plan, beginning with the date an employee becomes a participant. The plan also provides for partial vesting on a stepped basis, with full vesting based on age and years of employment. An executive becomes fully vested when one of the following occurs: the executive reaches age 55 and has completed five years of participation under the plan or seventeen years of employment with the Company; upon death; or upon a change in control of the Company (as defined). The plan also provides for severance benefits that would otherwise be payable under the employment agreements (described below) following a change in control of the Company.

The following table shows the estimated combined annual benefits that the executives named in the summary compensation table above would receive under the Company's Retirement Plan and the Executive Supplemental Retirement Income Plan, assuming that annual salaries increase at the annual rate of 5% until retirement and that they retire at age 65. Amounts shown have been reduced by the estimated amount of Social Security benefits.

| Name |

Present Age |

Estimated Combined Annual Benefit |

|||

|---|---|---|---|---|---|

| W. Brian Matsuyama | 54 | $ | 247,000 | ||

| Jon T. Stoltz | 53 | $ | 162,000 | ||

| J. D. Wessling | 57 | $ | 128,000 | ||

| King C. Oberg | 59 | $ | 90,000 | ||

| Larry E. Anderson | 52 | $ | 134,000 | ||

The Company has employment agreements with seven of the Company's executive officers, including Messrs. Matsuyama, Stoltz and Andersen who are named in the summary compensation table above. Messrs. Wessling and Oberg do not have employment agreements, but are fully vested in the

11

Executive Supplemental Retirement Plan which has provisions similar to the Employment Agreements. The agreements assure that key management personnel will continue to function effectively and without distraction if uncertainties regarding the future control of the Company should arise. Upon a change in control of the Company or during the pendency of certain offers for a change in control, as these terms are defined in the agreements, each such officer is entitled to receive the severance benefits described below if the Company terminates the officer's employment other than for cause as defined in the agreements. In addition, the officer is entitled to receive severance benefits for three years after a change in control of the Company if the Company terminates the officer's employment other than for cause or if the officer terminates his or her employment with good reason. The severance payments are equal to three times the officer's base salary and incentive compensation at the time the change in control occurs, but are reduced to the extent required to avoid subjecting the payments to penalty taxes on excess parachute payments. In addition, the employee is entitled to continue to participate in health, life, and disability plans for which he or she was eligible when employment terminated. Severance payments will terminate when the officer's benefits are vested under the Executive Supplemental Retirement Income Plan. Severance payments will be made under the Executive Supplemental Retirement Income Plan, rather than under the employment agreements.

Each agreement is automatically extended one year on December 31 of each year unless either party elects not to extend the term by giving 30 days' notice prior to year end. The term of the agreements is extended automatically for three years upon a change in control of the Company. Each agreement terminates if the employment of the officer under the agreement is terminated before a change in control occurs and while there is no offer pending for a change in control, except as noted above.

Although not obligated to do so, the Company has established a trust to fund some of the benefits which may be payable under the Executive Supplemental Retirement Income Plan. The trust also funds severance benefits which may be payable under the above described employment agreements with certain executives.

The Company is obligated to pay any benefits not paid out of the trust. The Company may be obligated to fund the trust with additional amounts in the case of certain events, including a change in control, as defined, for some or all of the following purposes: to permit payment of benefits from the supplemental plan and the employment agreements due in the following 12 months; to fund separate subtrusts for legal expenses (including certain legal expenses incurred to enforce the Company's obligation to make required contributions to the trust); and to permit payment of insurance premiums and policy loan interest.

For the fiscal year ended September 30, 2000, the Company paid each non-employee director an annual stipend of $5,000 as well as a fee of $500 for each Board or Committee meeting attended or a Committee fee of $250 if the Committee meeting was held on the same day as a Board meeting. Employee directors receive no additional compensation for serving as directors. Each non-employee director was also entitled to receive 500 shares of the Company's Common Stock for service in fiscal 2000 pursuant to the 2000 Director Stock Award Plan. Pursuant to the plan, each non-employee director may elect to defer receipt of his or her shares until he or she is no longer a member of the Board of Directors. Mr. Ederer elected to defer receipt of his shares for 2000. Pursuant to a policy adopted by the Board of Directors in 1995, each non-employee director is to use his or her annual stipend to purchase the Company's Common Stock.

12

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

During fiscal 2000, Messrs. Burnham, Ederer and Ragen and Mrs. Williams served on the Nominating and Compensation Committee.

Carl Burnham, Jr., a director, is a partner in the law firm of Yturri Rose LLP, one of the Company's Oregon counsel. Yturri Rose LLP received $78.58 in 2000 for legal services to the Company.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Mr. H. Paul Gilbert, the spouse of Ms. Linda Cies, Vice President—Information Technology for the Company, is the Managing Director of the William M. Mercer, Incorporated Seattle office. William M. Mercer, Incorporated provides consulting and actuarial services for the Company and received $161,600 for its services in fiscal 2000.

INDEPENDENT PUBLIC ACCOUNTANTS

The firm of Deloitte & Touche LLP is the Company's principal independent public accountant for the current year. Deloitte & Touche LLP and its predecessor Touche Ross & Co. have served as the Company's principal independent accountant since 1953. Representatives of Deloitte & Touche LLP will be present at the annual meeting. They will be given the opportunity to make a statement if they desire to do so and will be available to respond to questions from Shareholders.

Proxies will be solicited principally by mail. Following the original mail solicitation, the Company will arrange with banks, brokerage houses, and other custodians, nominees and fiduciaries, to forward copies of the proxy card, proxy statement and annual report to persons for whom they hold stock of the Company and to request authority for the execution of proxies. In these cases, the Company will reimburse such banks, brokerage houses, custodians, nominees and fiduciaries for their expenses incurred in connection with these requests. The Company will pay the entire cost of soliciting proxies. The Company may also use its regular employees to solicit proxies from Shareholders personally, or by telephone or letter without additional compensation.

The Company's annual report for the fiscal year ended September 30, 2000 is enclosed. The report presents information for fiscal years 2000, 1999 and 1998.

The Company must receive shareholder proposals by August 6, 2001, in order to be included in the Company's proxy statement and proxy form for the 2002 Annual Meeting of Shareholders. Proposals must also comply with the requirements of the Securities and Exchange Commission relating to proposals of security holders.

For any proposal that is not submitted for inclusion in next year's proxy statement (as described in the preceding paragraph) but is instead sought to be presented directly at next year's annual meeting, Securities and Exchange Commission rules permit management to vote proxies in its discretion if (a) the Company receives notice of the proposal before the close of business on October 22, 2001 and advises stockholders in next year's proxy statement about the nature of the matter and how management intends to vote on such matter, or (b) does not receive notice of the proposal prior to the close of business on October 22, 2001.

13

Notices of intention to present proposals at the 2002 meeting should be addressed to the Corporate Secretary at 222 Fairview Avenue North, Seattle, Washington 98109. The Company reserves the right to reject, rule out of order, or take other appropriate action with respect to any proposal that does not comply with these and other applicable requirements.

The Company does not know of any matters which will be brought before the meeting, other than those listed in this proxy statement. If any further business is presented to the meeting, the individuals named on the enclosed proxy form will have discretion to vote the proxies they hold.

By Order of the Board of Directors

LARRY

C. ROSOK

Corporate Secretary

Seattle,

Washington

December 4, 2000

CASCADE

NATURAL GAS CORPORATION

222 Fairview Avenue North

Seattle, Washington 98109

14

Appendix A

CASCADE NATURAL GAS CORPORATION

AUDIT COMMITTEE OF

THE BOARD OF DIRECTORS

CHARTER

Organization

Cascade Natural Gas Corporation has an Audit Committee of the Board of Directors composed of at least three directors independent of Company management and free of any relationship that, in the opinion of the Board of Directors, would interfere with their exercise of independent judgment as a committee member. Members of the Audit Committee have a working familiarity with basic finance and accounting practices, and at least one member has accounting or related financial management experience.

Statement of Policy

The Audit Committee assists Cascade's Board of Directors in fulfilling their responsibility to Shareholders, potential Shareholders, and the investment community relating to corporate accounting, reporting practices, and the quality and integrity of the financial reports of the Company. In so doing, it is the Audit Committee's responsibility to maintain free and open communication with directors, independent accountants, internal auditors, and financial and accounting management of the Company.

Responsibilities

The Audit Committee has the following principal responsibilities:

15

16

| W.B. MATSUYAMA CHAIRMAN, PRESIDENT & CEO CASCADE NATURAL GAS CORPORATION |

Dear Shareholders:

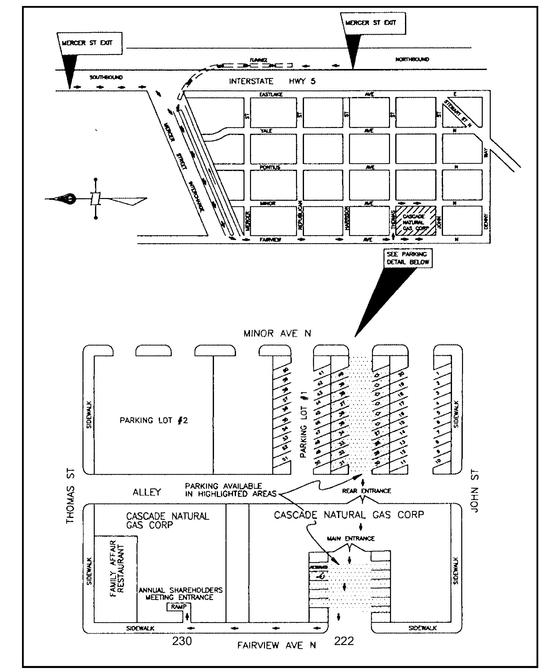

It is my pleasure to invite you to the Annual Meeting of Shareholders of Cascade Natural Gas Corporation. The meeting will be held at 1:30 p.m. on Thursday, January 25, 2001 at the offices of the Corporation, 230 Fairview Avenue North, Seattle, Washington. Limited parking is available at our 222 Fairview Avenue North building, next door to the meeting location.

A map is printed on the reverse side of the Proxy Card to assist you in locating our office and the available parking areas.

The Notice of the meeting and the Proxy Statement on the following pages cover the formal business of the meeting, which includes election of Directors, and any other business to properly come before the meeting.

It is important that your shares are represented at this meeting, whether or not you attend the meeting in person, and regardless of the number of shares you own. To be sure your shares are represented, we urge you to complete and mail the attached proxy card as soon as possible.

| Sincerely, | ||

| |

|

/s/ W. BRIAN MATSUYAMA W. Brian Matsuyama |

| December 4, 2000 |

| Cascade Natural Gas Corporation |

Two New Ways to Vote VOTE BY INTERNET OR TELEPHONE 24 Hours a Day - 7 Days a Week Save your Company Money - It's Fast and Convenient |

|||

| TELEPHONE |

|

INTERNET |

|

MAIL |

||||

|---|---|---|---|---|---|---|---|---|

| 800-479-8718 | http://proxy.shareholder.com/cgc | |||||||

| • Use any touch-tone telephone. • Have your Proxy Form in hand. • Enter the Control Number located in the box below. • Follow the simple recorded instructions. |

|

OR |

|

• Go to the website address listed above. • Have your Proxy Form in hand. • Enter your Control Number, located in the box below. • Follow the simple instructions. |

|

OR |

|

• Mark, sign and date your proxy card. • Detach card from Proxy Form. • Return the card in the postage-paid envelope provided. |

| CALL TOLL-FREE TO VOTE • 800-479-8718 | ||

| Your telephone or internet vote authorizes the named proxies to vote your shares in the same manner as if you marked, signed and returned the proxy card. If you have submitted your proxy by telephone or the internet there is no need for you to mail back your proxy. | CONTROL NUMBER FOR TELEPHONE/INTERNET VOTING |

DETACH PROXY CARD HERE IF YOU ARE NOT VOTING BY TELEPHONE OR INTERNET

| 1. Election of Directors |

|

FOR all nominees / / listed below |

|

WITHHOLD AUTHORITY to vote / / for all nominees listed below |

|

*EXCEPTIONS / / |

|

| Nominees: C. Burnham, Jr., M. C. Clapp, T. E. Cronin, D. A. Ederer, H. L. Hubbard, W. B. Matsuyama, L. L. Pinnt, B. G. Ragen, and M. A. Williams |

|

||||||

| *(INSTRUCTIONS: To withhold authority to vote for any individual nominee, mark the "Exceptions" box and strike a line through that nominee's name.) | |||||||

| 2. Transaction of such other business as may properly come before the meeting or any adjournments thereof. |

|

||||||

| Change of Address and / / or Comments Mark Here |

Please Detach Here You Must Detach This Portion of the Proxy Card Before Returning it in the Enclosed Envelope |

||||

| |

|

Please Read Other Side Before Signing. |

|

|

|

| |

|

Sign exactly as name appears hereon. Attorneys-in-fact, executors, trustees, guardians, corporate officers, etc. should give full title. If shares are held jointly, each holder should sign. |

|

|

|

| |

|

Dated |

|

|

|

| |

|

(Signature) |

|

||

| |

|

(Signature) |

|

||

| PLEASE MARK, DATE, SIGN AND RETURN THIS PROXY PROMPTLY. |

|

Votes MUST be indicated (x) in Black or Blue ink. |

/x/ |

|

|

CASCADE NATURAL GAS CORPORATION

222 Fairview Avenue North, Seattle, Washington 98109

This Proxy is Solicited on Behalf of the Board of Directors

The undersigned hereby appoints Larry C. Rosok and W. Brian Matsuyama, and each or any of them proxies for the undersigned, with power of substitution, to vote with the same force and effect as the undersigned at the Annual Meeting of the Common Shareholders of Cascade Natural Gas Corporation, 230 Fairview Avenue North, Seattle, Washington, on Thursday, January 25, 2001, and at any adjournments thereof, upon the matters more fully set forth in the accompanying Notice of Annual Meeting.

THE SHARES REPRESENTED BY THIS PROXY WHEN PROPERLY EXECUTED WILL BE VOTED IN THE MANNER DIRECTED ON THE OTHER SIDE BY THE UNDERSIGNED SHAREHOLDER. IF NO DIRECTION IS MADE, THIS PROXY WILL BE VOTED FOR THE ELECTION OF DIRECTORS. If any other business properly comes before the meeting, the proxies named above will have discretionary authority to vote thereon in accordance with their best judgment.

CASCADE

NATURAL GAS CORPORATION

P.O. BOX 11297

NEW YORK, NY 10203-0297

(Continued and to be MARKED, DATED AND SIGNED on the other side)

|

|