|

|

|

|

|

Previous: XTRA CORP /DE/, DEF 14A, 2000-12-20 |

Next: ROCK TENN CO, 10-K, 2000-12-20 |

Fidelity®

Fund

Semiannual Report

October 31, 2000

(2_fidelity_logos)(registered_trademark)

|

President's Message |

Ned Johnson on investing strategies. |

|

|

Performance |

How the fund has done over time. |

|

|

Fund Talk |

The manager's review of fund performance, strategy and outlook. |

|

|

Investment Changes |

A summary of major shifts in the fund's investments over the past six months. |

|

|

Investments |

A complete list of the fund's investments with their market values. |

|

|

Financial Statements |

Statements of assets and liabilities,

operations, and changes in net assets, |

|

|

Notes |

Notes to the financial statements. |

|

|

Report of Independent Accountants |

The auditors' opinion. |

To reduce expenses, only one copy of most financial reports and prospectuses may be mailed to households, even if more than one person in the household has an account in the fund. Call Fidelity at 1-800-544-8544 if you need additional copies of financial reports or prospectuses. If you do not want the mailing of these documents to be combined with those for other members of your household, contact Fidelity in writing at P.O. Box 5000, Cincinnati, OH 45273-8692.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

(Recycle graphic) This report is printed on recycled paper using soy-based inks.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

Mutual fund shares are not deposits or obligations of, or guaranteed by, any depository institution. Shares are not insured by the FDIC, Federal Reserve Board or any other agency, and are subject to investment risks, including possible loss of principal amount invested.

Neither the fund nor Fidelity Distributors Corporation is a bank.

For more information on any Fidelity fund, including charges and expenses, call 1-800-544-6666 for a free prospectus. Read it carefully before you invest or send money.

Semiannual Report

(photo_of_Edward_C_Johnson_3d)

Dear Shareholder:

A sixth-straight year of double-digit positive returns for the Dow Jones Industrial Average, NASDAQ and S&P 500® could be in jeopardy unless the U.S. stock market shows marked improvement in the final two months of 2000. Through October, all three indexes had negative year-to-date returns. On the other hand, most fixed-income sectors were solidly in the black. Treasuries and other long-term government securities led the way, returning nearly 14%.

While it's impossible to predict the future direction of the markets with any degree of certainty, there are certain basic principles that can help investors plan for their future needs.

The longer your investment time frame, the less likely it is that you will be affected by short-term market volatility. A 10-year investment horizon appropriate for saving for a college education, for example, enables you to weather market cycles in a long-term fund, which may have a higher risk potential, but also has a higher potential rate of return.

An intermediate-length fund could make sense if your investment horizon is two to four years, while a short-term bond fund could be the right choice if you need your money in one or two years.

If your time horizon is less than a year, you might want to consider moving some of your bond investment into a money market fund. These funds seek income and a stable share price by investing in high-quality, short-term investments. Of course, it's important to remember that an investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although money market funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in these types of funds.

Finally, no matter what your time horizon or portfolio diversity, it makes good sense to follow a regular investment plan, investing a certain amount of money in a fund at the same time each month or quarter and periodically reviewing your overall portfolio. By doing so, you won't get caught up in the excitement of a rapidly rising market, nor will you buy all your shares at market highs. While this strategy - known as dollar cost averaging - won't assure a profit or protect you from a loss in a declining market, it should help you lower the average cost of your purchases. Of course, you should consider your financial ability to continue your purchases through periods of low price levels before undertaking such a strategy.

If you have questions, please call us at 1-800-544-6666, or visit our web site at www.fidelity.com. We are available 24 hours a day, seven days a week to provide you the information you need to make the investments that are right for you.

Best regards,

/s/Edward C. Johnson 3d

Edward C. Johnson 3d

Semiannual Report

There are several ways to evaluate a fund's historical performance. You can look at the total percentage change in value, the average annual percentage change or the growth of a hypothetical $10,000 investment. Total return reflects the change in the value of an investment, assuming reinvestment of the fund's dividend income and capital gains (the profits earned upon the sale of securities that have grown in value). You can also look at the fund's income, as reflected in the fund's yield, to measure performance. Prior to December 30, 1990, Fidelity Capital & Income Fund operated under a different investment objective. Accordingly, the fund's historical performance may not represent its current investment policies.

Cumulative Total Returns

|

Periods ended October 31, 2000 |

Past 6 |

Past 1 |

Past 5 |

Past 10 |

|

Fidelity Capital & Income |

-4.60% |

-1.70% |

45.52% |

244.58% |

|

ML High Yield Master II |

-1.93% |

-1.68% |

31.76% |

199.32% |

|

High Current Yield Funds Average |

-3.83% |

-2.77% |

25.45% |

173.70% |

Cumulative total returns show the fund's performance in percentage terms over a set period - in this case, six months, one year, five years or 10 years. For example, if you had invested $1,000 in a fund that had a 5% return over the past year, the value of your investment would be $1,050. You can compare the fund's returns to the performance of the Merrill Lynch High Yield Master II Index - a market value-weighted index of all domestic and yankee high-yield bonds, including deferred interest bonds and payment-in-kind securities. Issues included in the index have maturities of one year or more and have a credit rating lower than BBB-/Baa3, but are not in default. To measure how the fund's performance stacked up against its peers, you can compare it to the high current yield funds average, which reflects the performance of mutual funds with similar objectives tracked by Lipper Inc. The past six month average represents a peer group of 382 mutual funds. These benchmarks reflect reinvestment of dividends and capital gains, if any, and exclude the effect of sales charges.

Average Annual Total Returns

|

Periods ended October 31, 2000 |

Past 1 |

Past 5 |

Past 10 |

|

Fidelity Capital & Income |

-1.70% |

7.79% |

13.17% |

|

ML High Yield Master II |

-1.68% |

5.67% |

11.59% |

|

High Current Yield Funds Average |

-2.77% |

4.55% |

10.51% |

Average annual total returns take the fund's cumulative return and show you what would have happened if the fund had performed at a constant rate each year. (Note: Lipper calculates average annual total returns by annualizing each fund's total return, then taking an arithmetic average. This may produce a different figure than that obtained by averaging the cumulative total returns and annualizing the result.)

Semiannual Report

Performance - continued

$10,000 Over 10 Years

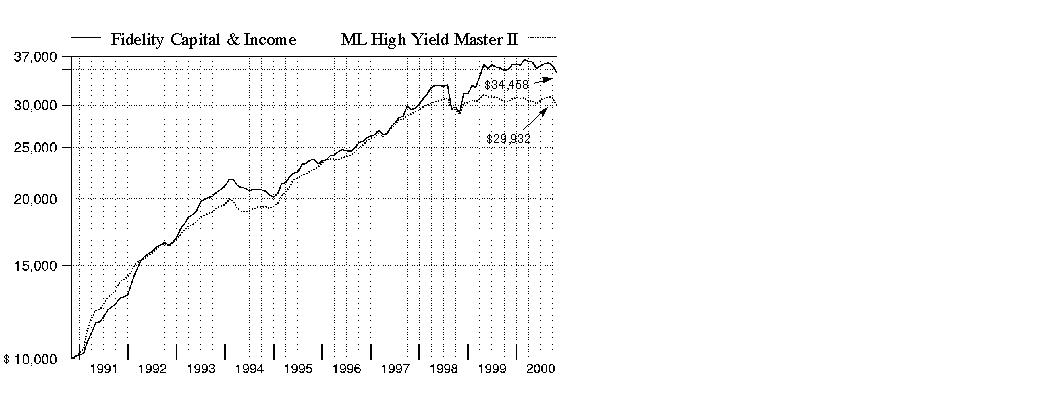

$10,000 Over 10 Years: Let's say hypothetically that $10,000 was invested in Fidelity Capital & Income Fund on October 31, 1990. As the chart shows, by October 31, 2000, the value of the investment would have grown to $34,458 - a 244.58% increase on the initial investment. For comparison, look at how the Merrill Lynch High Yield Master II Index did over the same period. With dividends and capital gains, if any, reinvested, the same $10,000 would have grown to $29,932 - a 199.32% increase.

Understanding

Performance

How a fund did yesterday is no guarantee of how it will do tomorrow. Bond prices, for example, generally move in the opposite direction of interest rates. In turn, the share price, return and yield of a fund that invests in bonds will vary. That means if you sell your shares during a market downturn, you might lose money. But if you can ride out the market's ups and downs, you may have a gain.

3Semiannual Report

Performance - continued

Total Return Components

|

|

Six months |

Years ended April 30, |

||||

|

|

2000 |

2000 |

1999 |

1998 |

1997 |

1996 |

|

Dividend returns |

3.93% |

8.28% |

10.19% |

8.50% |

8.52% |

9.87% |

|

Capital returns |

-8.53% |

-7.34% |

-0.85% |

15.09% |

-0.64% |

1.85% |

|

Total returns |

-4.60% |

0.94% |

9.34% |

23.59% |

7.88% |

11.72% |

Total return components include both dividend returns and capital returns. A dividend return reflects the actual dividends paid by the fund. A capital return reflects both the amount paid by the fund to shareholders as capital gain distributions and changes in the fund's share price. Both returns assume the dividends or capital gains, if any, paid by the fund are reinvested.

Dividends and Yield

|

Periods ended October 31, 2000 |

Past 1 |

Past 6 |

Past 1 |

|

Dividends per share |

6.05¢ |

36.96¢ |

74.61¢ |

|

Annualized dividend rate |

8.41% |

8.30% |

8.22% |

|

30-day annualized yield |

10.89% |

- |

- |

Dividends per share show the income paid by the fund for a set period and do not reflect any tax reclassifications. If you annualize this number, based on an average share price of $8.47 over the past one month, $8.83 over the past six months and $9.08 over the past one year, you can compare the fund's income over these three periods. The 30-day annualized yield is a standard formula based on the yields of the securities in the fund, averaged over the past 30 days. This figure shows you the yield characteristics of the fund's investments at the end of the period. It also helps you compare funds from different companies on an equal basis.

Semiannual Report

Market Recap

While the six-month period ending October 31, 2000, was one that most high-yield investors would just as soon forget, positive signs about the market's prospects emerged toward the end of the period. During the past six months, the Merrill Lynch High Yield Master II Index - a broad measure of high-yield market performance - fell 1.93%. This return lagged the overall U.S. taxable bond market as measured by the Lehman Brothers Aggregate Bond Index, which gained 5.80% during the same time frame. A number of adverse conditions held back high-yield performance, including a struggling telecommunications sector - which makes up a large portion of the high-yield debt market - and an increasing default rate that led to decreasing demand. In a flight to safety, many high-yield investors turned to the relative security of the Treasury market, this year's best-performing fixed-income sector through the end of October. One potential catalyst for improved performance in the high-yield market could be a continued increase in merger and acquisition activity. From July to August, $90 billion in M&A activity took place where the target company was in the high-yield universe. Not only do these deals reduce the supply of high-yield credits, they also establish benchmark valuations for some sectors of the market.

(Portfolio Manager photograph)

An interview with David Glancy, Portfolio Manager of Fidelity

Capital & Income Fund

Q. David, how did the fund perform?

A. For the six months that ended October 31, 2000, the fund had a total return of -4.60%. The high-yield market, as measured by the Merrill Lynch High Yield Master II Index, fell 1.93%, while the high current yield funds average tracked by Lipper Inc. returned -3.83%. During the 12 months that ended October 31, 2000, the fund returned -1.70%, while the Merrill Lynch High Yield Master II Index returned -1.68% and the Lipper high current yield funds average returned -2.77%.

Q. What market factors caused the fund to lag its benchmark and peers during the past six months?

A. It was a tough six-month period for the high-yield market, marked by high interest rates, difficulties encountered by individual companies and very little liquidity in the financial markets. High interest rates sparked by the Federal Reserve Board's desire to head off inflation increased borrowing costs for high-yield companies and slowed economic growth. These developments accelerated the overall default risk in the market. The "tech wreck" that knocked the wind out of the NASDAQ index also hurt the high-yield market, where one finds a significant number of telecommunications companies. These firms' access to capital was constricted at a time when they needed funding to continue building out their networks. The fund's telecom position was the primary reason for its relative underperformance. In addition, the fund was hurt by its large position in the stock of EchoStar, the direct-broadcast satellite company.

Semiannual Report

Fund Talk: The Manager's Overview - continued

Q. What moves did you make with the fund in response to this difficult situation?

A. I sought to insulate the fund from further difficulties by investing in shorter-maturity, higher-quality bonds. In addition, for the first time in quite a while I turned some attention to distressed securities, those that are characterized by uncertain or troubling financial situations. Previously, opportunities were few and far between because the area was characterized by poorly run companies with bad balance sheets and poor prospects. However, with all of the difficulties encountered by the high-yield market, some companies started trading at distressed prices despite favorable prospects and solid management. Because I maintained a fairly significant stake in cash equivalents through this bear market - at the end of the period, for example, more than 12% of the fund's net assets were invested in cash equivalents - I was able to buy some of these securities at very attractive prices. The large cash holdings also enabled me to make other well-timed purchases and insulated the fund somewhat from even further downdrafts. I also maintained a small but important portion of the fund in leveraged equities - common stocks of companies that have high-yield bonds outstanding.

Q. Were there any investments or areas that provided positive performance during the period?

A. There weren't very many areas that performed well during this time frame. Nevertheless, the fund did benefit from the positive performance of some of its holdings in the health care, energy and cable TV industries. Higher energy prices were the force behind the improvement in some energy securities, and the recurring revenues earned by cable TV operators through their monthly fees were an attractive attribute during a period of market instability.

Q. What's your outlook?

A. The high-yield market could be choppy for at least the next couple of months, though it appears that most of the damage to the market has been done. A significant number of bonds are trading at very attractive prices, so I anticipate using the fund's cash position to continue adding bonds of companies with favorable prospects selling at cheap prices. If history is a guide, the high-yield market will ultimately attract buyers from across a broad spectrum and enjoy a recovery like we saw in 1990, after its last protracted period of difficulty.

Semiannual Report

Fund Talk: The Manager's Overview - continued

The views expressed in this report reflect those of the portfolio manager only through the end of the period of the report as stated on the cover and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Fund Facts

Goal: seeks income and capital growth

Fund number: 038

Trading symbol: FAGIX

Start date: November 1, 1977

Size: as of October 31, 2000, more than $3.0 billion

Manager: David Glancy, since 1996; manager, Fidelity Advisor High Income Fund, since 1999; Spartan High Income Fund, 1993-1996; joined Fidelity in 1990

3David Glancy on

the high-yield market:

"The volatility in the high-yield market doesn't necessarily reflect the underlying fundamentals of the companies in the fund, even though it may temporarily affect the fund's net asset value (NAV). Buyers of high-yield bonds have become so scarce that many attractive securities are trading from 20 to 70 cents on the dollar and therefore offer some upside potential. In contrast, when these bonds are trading at face value, there's no place for them to go but down. With Fidelity's resources and credit skills, we should be able to locate significant opportunities in this market for capital appreciation and earn a very attractive coupon, or interest rate. When things get as bad as they have been within the high-yield market, many investors follow a lemming mentality and seek to get out of it on its way down. My approach is to take advantage of desperate sellers and continue buying until the market eventually reaches the bottom in order to position the fund for a strong rebound when the market turns. In that way, like in 1990, I hope to reap the benefits when the market recovers and the winners start outnumbering the losers."

Semiannual Report

|

Top Five Holdings as of October 31, 2000 |

||

|

(by issuer, excluding cash equivalents) |

% of fund's |

% of fund's net assets |

|

Nextel Communications, Inc. |

8.0 |

8.9 |

|

EchoStar Communications Corp. |

6.1 |

4.7 |

|

XO Communications, Inc. |

3.4 |

3.9 |

|

EchoStar DBS Corp. |

2.8 |

2.8 |

|

CSC Holdings, Inc. |

2.6 |

2.3 |

|

|

22.9 |

22.6 |

|

Top Five Market Sectors as of October 31, 2000 |

||

|

|

% of fund's |

% of fund's net assets |

|

Media & Leisure |

32.5 |

30.5 |

|

Utilities |

28.1 |

31.3 |

|

Technology |

4.6 |

7.2 |

|

Industrial Machinery & Equipment |

3.4 |

4.2 |

|

Finance |

3.2 |

4.3 |

|

Quality Diversification as of October 31, 2000 |

||

|

(Moody's Ratings) |

% of fund's investments |

% of fund's investments |

|

Aaa, Aa, A |

0.0 |

1.0 |

|

Baa |

0.5 |

0.1 |

|

Ba |

6.1 |

4.1 |

|

B |

51.2 |

55.7 |

|

Caa, Ca, C |

5.3 |

9.3 |

|

D |

0.2 |

0.0 |

|

Not Rated |

2.0 |

3.9 |

|

Table excludes short-term investments. Where Moody's ratings are not available, we have used |

|

Asset Allocation (% of fund's net assets) |

|||||||

|

As of October 31, 2000 * |

As of April 30, 2000 * * |

||||||

|

Nonconvertible |

|

|

Nonconvertible |

|

||

|

Convertible Bonds, Preferred Stocks 12.4% |

|

|

Convertible Bonds, Preferred Stocks 12.3% |

|

||

|

Common Stocks 9.9% |

|

|

Common Stocks 8.2% |

|

||

|

Other Investments 2.1% |

|

|

Other Investments 2.4% |

|

||

|

Short-Term |

|

|

Short-Term |

|

||

|

* Foreign investments |

10.8% |

|

** Foreign investments |

11.2% |

|

||

Semiannual Report

Showing Percentage of Net Assets

|

Corporate Bonds - 62.1% |

|||||

|

Moody's Ratings (unaudited) (b) |

Principal Amount (000s) (d) |

Value (Note 1) (000s) |

|||

|

Convertible Bonds - 0.9% |

|||||

|

HEALTH - 0.7% |

|||||

|

Medical Facilities Management - 0.7% |

|||||

|

Sunrise Assisted Living, Inc. 5.5% 6/15/02 |

B2 |

|

$ 1,970 |

$ 1,812 |

|

|

Tenet Healthcare Corp. 6% 12/1/05 |

B1 |

|

8,950 |

7,608 |

|

|

Total Renal Care Holdings, Inc.: |

|

|

|

|

|

|

7% 5/15/09 |

B3 |

|

8,890 |

6,579 |

|

|

7% 5/15/09 (g) |

B3 |

|

7,550 |

5,587 |

|

|

|

21,586 |

||||

|

MEDIA & LEISURE - 0.2% |

|||||

|

Lodging & Gaming - 0.2% |

|||||

|

Hilton Hotels Corp. 5% 5/15/06 |

Ba2 |

|

6,920 |

5,605 |

|

|

RETAIL & WHOLESALE - 0.0% |

|||||

|

Apparel Stores - 0.0% |

|||||

|

Merry-Go-Round Enterprises, Inc. 0% 5/16/97 (c)(i) |

- |

|

8,914 |

0 |

|

|

Retail & Wholesale, Miscellaneous - 0.0% |

|||||

|

Sunglass Hut International, Inc. 5.25% 6/15/03 |

B3 |

|

1,880 |

1,441 |

|

|

TOTAL CONVERTIBLE BONDS |

28,632 |

||||

|

Nonconvertible Bonds - 61.2% |

|||||

|

BASIC INDUSTRIES - 1.0% |

|||||

|

Chemicals & Plastics - 0.7% |

|||||

|

Huntsman Corp.: |

|

|

|

|

|

|

9.5% 7/1/07 (g) |

B2 |

|

16,820 |

10,092 |

|

|

9.5% 7/1/07 (g) |

B2 |

|

1,970 |

1,182 |

|

|

Huntsman ICI Holdings LLC 0% 12/31/09 |

B3 |

|

7,490 |

2,172 |

|

|

Lyondell Chemical Co. 9.875% 5/1/07 |

Ba3 |

|

5,815 |

5,670 |

|

|

Sterling Chemicals, Inc. 11.75% 8/15/06 |

Caa3 |

|

2,725 |

1,499 |

|

|

|

20,615 |

||||

|

Metals & Mining - 0.0% |

|||||

|

Better Minerals & Aggregates Co. 13% 9/15/09 |

B3 |

|

2,590 |

2,124 |

|

|

Packaging & Containers - 0.2% |

|||||

|

Gaylord Container Corp.: |

|

|

|

|

|

|

9.375% 6/15/07 |

Caa1 |

|

985 |

640 |

|

|

Corporate Bonds - continued |

|||||

|

Moody's Ratings (unaudited) (b) |

Principal Amount (000s) (d) |

Value (Note 1) (000s) |

|||

|

Nonconvertible Bonds - continued |

|||||

|

BASIC INDUSTRIES - continued |

|||||

|

Packaging & Containers - continued |

|||||

|

Gaylord Container Corp.: - continued |

|

|

|

|

|

|

9.75% 6/15/07 |

Caa1 |

|

$ 8,280 |

$ 5,548 |

|

|

9.875% 2/15/08 |

Caa3 |

|

995 |

299 |

|

|

|

6,487 |

||||

|

Paper & Forest Products - 0.1% |

|||||

|

Container Corp. of America gtd. 11.25% 5/1/04 |

B2 |

|

1,960 |

1,965 |

|

|

Crown Paper Co. 11% 9/1/05 (c) |

Ca |

|

5,450 |

654 |

|

|

|

2,619 |

||||

|

TOTAL BASIC INDUSTRIES |

31,845 |

||||

|

CONSTRUCTION & REAL ESTATE - 1.1% |

|||||

|

Building Materials - 0.3% |

|||||

|

Atrium Companies, Inc. 10.5% 5/1/09 |

B3 |

|

3,940 |

3,339 |

|

|

Building Materials Corp. of America 8% 12/1/08 |

Ba3 |

|

4,955 |

1,487 |

|

|

Nortek, Inc. 9.875% 3/1/04 |

B3 |

|

1,980 |

1,802 |

|

|

Numatics, Inc. 9.625% 4/1/08 |

B3 |

|

4,592 |

3,536 |

|

|

|

10,164 |

||||

|

Construction - 0.1% |

|||||

|

Lennar Corp. 9.95% 5/1/10 |

Ba1 |

|

1,980 |

1,980 |

|

|

Engineering - 0.1% |

|||||

|

Anteon Corp. 12% 5/15/09 |

B3 |

|

3,000 |

2,640 |

|

|

Real Estate - 0.4% |

|||||

|

LNR Property Corp. 9.375% 3/15/08 |

B1 |

|

13,175 |

11,858 |

|

|

Real Estate Investment Trusts - 0.2% |

|||||

|

Ocwen Asset Investment Corp. 11.5% 7/1/05 |

- |

|

10,320 |

8,050 |

|

|

TOTAL CONSTRUCTION & REAL ESTATE |

34,692 |

||||

|

DURABLES - 0.5% |

|||||

|

Autos, Tires, & Accessories - 0.0% |

|||||

|

Federal-Mogul Corp. 7.5% 1/15/09 |

Ba3 |

|

2,955 |

739 |

|

|

Home Furnishings - 0.0% |

|||||

|

Omega Cabinets Ltd. 10.5% 6/15/07 |

B3 |

|

650 |

598 |

|

|

Corporate Bonds - continued |

|||||

|

Moody's Ratings (unaudited) (b) |

Principal Amount (000s) (d) |

Value (Note 1) (000s) |

|||

|

Nonconvertible Bonds - continued |

|||||

|

DURABLES - continued |

|||||

|

Textiles & Apparel - 0.5% |

|||||

|

Levi Strauss & Co. 6.8% 11/1/03 |

Ba3 |

|

$ 675 |

$ 554 |

|

|

Polymer Group, Inc.: |

|

|

|

|

|

|

8.75% 3/1/08 |

B3 |

|

1,400 |

987 |

|

|

9% 7/1/07 |

B3 |

|

8,590 |

6,185 |

|

|

St. John Knits International, Inc. 12.5% 7/1/09 |

B3 |

|

6,235 |

5,767 |

|

|

|

13,493 |

||||

|

TOTAL DURABLES |

14,830 |

||||

|

ENERGY - 1.6% |

|||||

|

Energy Services - 0.5% |

|||||

|

Cliffs Drilling Co.: |

|

|

|

|

|

|

Class B, 10.25% 5/15/03 |

Ba3 |

|

7,120 |

7,280 |

|

|

Class D, 10.25% 5/15/03 |

Ba3 |

|

985 |

1,007 |

|

|

Parker Drilling Co. 9.75% 11/15/06 |

B1 |

|

4,000 |

3,920 |

|

|

R&B Falcon Corp. 9.125% 12/15/03 |

Ba3 |

|

1,970 |

2,004 |

|

|

|

14,211 |

||||

|

Oil & Gas - 1.1% |

|||||

|

Belden & Blake Corp. 9.875% 6/15/07 |

Caa3 |

|

10,000 |

8,400 |

|

|

Chesapeake Energy Corp. 7.875% 3/15/04 |

B2 |

|

7,297 |

6,932 |

|

|

Gothic Production Corp. 11.125% 5/1/05 |

B3 |

|

4,905 |

5,150 |

|

|

Kelley Oil & Gas Corp. 14% 4/15/03 |

B3 |

|

4,413 |

4,590 |

|

|

Nuevo Energy Co. 9.375% 10/1/10 (g) |

B1 |

|

3,000 |

2,985 |

|

|

Petsec Energy, Inc. 9.5% 6/15/07 (c) |

D |

|

14,090 |

7,397 |

|

|

|

35,454 |

||||

|

TOTAL ENERGY |

49,665 |

||||

|

FINANCE - 2.1% |

|||||

|

Credit & Other Finance - 2.1% |

|||||

|

Abraxas Petroleum Corp./Canadian Abraxas Petroleum Ltd. Series A, 11.5% 11/1/04 |

Caa3 |

|

3,500 |

3,045 |

|

|

Delta Financial Corp. 9.5% 8/1/04 |

Caa2 |

|

13,527 |

6,087 |

|

|

GS Escrow Corp.: |

|

|

|

|

|

|

6.75% 8/1/01 |

Ba1 |

|

14,450 |

14,183 |

|

|

7% 8/1/03 |

Ba1 |

|

21,140 |

20,030 |

|

|

7.125% 8/1/05 |

Ba1 |

|

3,985 |

3,656 |

|

|

Corporate Bonds - continued |

|||||

|

Moody's Ratings (unaudited) (b) |

Principal Amount (000s) (d) |

Value (Note 1) (000s) |

|||

|

Nonconvertible Bonds - continued |

|||||

|

FINANCE - continued |

|||||

|

Credit & Other Finance - continued |

|||||

|

Macsaver Financial Services, Inc.: |

|

|

|

|

|

|

7.4% 2/15/02 (c) |

Ca |

|

$ 990 |

$ 119 |

|

|

7.875% 8/1/03 (c) |

Ca |

|

9,650 |

1,158 |

|

|

Metris Companies, Inc.: |

|

|

|

|

|

|

10% 11/1/04 |

Ba3 |

|

9,028 |

8,486 |

|

|

10.125% 7/15/06 |

Ba3 |

|

7,000 |

6,580 |

|

|

|

63,344 |

||||

|

Insurance - 0.0% |

|||||

|

ITT Corp. 6.75% 11/15/03 |

Ba1 |

|

1,480 |

1,371 |

|

|

TOTAL FINANCE |

64,715 |

||||

|

HEALTH - 0.5% |

|||||

|

Medical Facilities Management - 0.5% |

|||||

|

Columbia/HCA Healthcare Co.: |

|

|

|

|

|

|

8.12% 8/4/03 |

Ba2 |

|

4,875 |

4,802 |

|

|

8.125% 8/4/03 |

Ba2 |

|

2,960 |

2,916 |

|

|

Fountain View, Inc. 11.25% 4/15/08 |

Caa1 |

|

9,350 |

1,870 |

|

|

Tenet Healthcare Corp.: |

|

|

|

|

|

|

8.125% 12/1/08 |

Ba3 |

|

1,950 |

1,877 |

|

|

8.625% 1/15/07 |

Ba3 |

|

2,980 |

2,950 |

|

|

|

14,415 |

||||

|

INDUSTRIAL MACHINERY & EQUIPMENT - 3.3% |

|||||

|

Electrical Equipment - 1.2% |

|||||

|

Loral Space & Communications Ltd. 9.5% 1/15/06 |

B1 |

|

52,625 |

37,364 |

|

|

Industrial Machinery & Equipment - 0.6% |

|||||

|

Dunlop Standard Aero Holdings PLC 11.875% 5/15/09 |

B3 |

|

1,000 |

995 |

|

|

Exide Corp. 10% 4/15/05 |

B1 |

|

3,970 |

2,858 |

|

|

Thermadyne Holdings Corp. 0% 6/1/08 (e) |

Caa1 |

|

17,105 |

5,132 |

|

|

Thermadyne Manufacturing LLC 9.875% 6/1/08 |

B3 |

|

12,930 |

9,310 |

|

|

|

18,295 |

||||

|

Corporate Bonds - continued |

|||||

|

Moody's Ratings (unaudited) (b) |

Principal Amount (000s) (d) |

Value (Note 1) (000s) |

|||

|

Nonconvertible Bonds - continued |

|||||

|

INDUSTRIAL MACHINERY & EQUIPMENT - continued |

|||||

|

Pollution Control - 1.5% |

|||||

|

Allied Waste North America, Inc. 10% 8/1/09 |

B2 |

|

$ 37,975 |

$ 32,184 |

|

|

Browning-Ferris Industries, Inc. 6.1% 1/15/03 |

Ba3 |

|

14,440 |

13,285 |

|

|

|

45,469 |

||||

|

TOTAL INDUSTRIAL MACHINERY & EQUIPMENT |

101,128 |

||||

|

MEDIA & LEISURE - 23.4% |

|||||

|

Broadcasting - 22.0% |

|||||

|

360networks, Inc. 13% 5/1/08 |

B3 |

|

20,655 |

16,421 |

|

|

ACME Television LLC/ACME Financial Corp. 10.875% 9/30/04 |

B3 |

|

14,070 |

13,015 |

|

|

Adelphia Communications Corp.: |

|

|

|

|

|

|

7.5% 1/15/04 |

B2 |

|

13,000 |

11,765 |

|

|

9.25% 10/1/02 |

B2 |

|

43,105 |

42,027 |

|

|

10.875% 10/1/10 |

B2 |

|

9,950 |

9,254 |

|

|

Ascent Entertainment Group, Inc. 0% 12/15/04 (e) |

Ba1 |

|

22,490 |

18,554 |

|

|

Century Communications Corp.: |

|

|

|

|

|

|

Series B, 0% 1/15/08 |

B2 |

|

7,070 |

2,687 |

|

|

0% 3/15/03 |

B2 |

|

2,470 |

1,865 |

|

|

9.5% 3/1/05 |

B2 |

|

2,875 |

2,638 |

|

|

9.75% 2/15/02 |

B2 |

|

10,010 |

9,810 |

|

|

Comcast UK Cable Partners Ltd. 0% 11/15/07 (e) |

B2 |

|

13,180 |

11,862 |

|

|

Diamond Cable Communications PLC yankee: |

|

|

|

|

|

|

0% 12/15/05 (e) |

B2 |

|

41,000 |

37,003 |

|

|

0% 2/15/07 (e) |

B2 |

|

9,997 |

7,498 |

|

|

13.25% 9/30/04 |

B2 |

|

14,800 |

15,170 |

|

|

EchoStar DBS Corp.: |

|

|

|

|

|

|

9.25% 2/1/06 |

B1 |

|

27,450 |

26,901 |

|

|

9.375% 2/1/09 |

B1 |

|

60,765 |

59,550 |

|

|

Golden Sky DBS, Inc. 0% 3/1/07 (e) |

Caa1 |

|

24,830 |

16,884 |

|

|

Golden Sky Systems, Inc. 12.375% 8/1/06 |

B3 |

|

12,350 |

13,276 |

|

|

Impsat Fiber Networks, Inc. 13.75% 2/15/05 |

B3 |

|

15,000 |

10,800 |

|

|

International Cabletel, Inc.: |

|

|

|

|

|

|

Series A, 12.75% 4/15/05 |

B2 |

|

23,238 |

23,006 |

|

|

0% 2/1/06 (e) |

B2 |

|

52,493 |

46,194 |

|

|

Knology Holding, Inc. 0% 10/15/07 (e) |

- |

|

4,955 |

1,536 |

|

|

Corporate Bonds - continued |

|||||

|

Moody's Ratings (unaudited) (b) |

Principal Amount (000s) (d) |

Value (Note 1) (000s) |

|||

|

Nonconvertible Bonds - continued |

|||||

|

MEDIA & LEISURE - continued |

|||||

|

Broadcasting - continued |

|||||

|

NTL Communications Corp.: |

|

|

|

|

|

|

0% 10/1/08 (e) |

B3 |

|

$ 10,500 |

$ 6,011 |

|

|

11.5% 10/1/08 |

B3 |

|

10,925 |

9,778 |

|

|

11.875% 10/1/10 (g) |

B2 |

|

4,930 |

4,560 |

|

|

Olympus Communications LP/Olympus Capital Corp. 10.625% 11/15/06 |

B2 |

|

5,990 |

5,601 |

|

|

Pegasus Communications Corp.: |

|

|

|

|

|

|

9.625% 10/15/05 |

B3 |

|

23,995 |

23,395 |

|

|

9.75% 12/1/06 |

B3 |

|

8,200 |

7,995 |

|

|

Pegasus Media & Communications, Inc. 12.5% 7/1/05 |

B3 |

|

3,700 |

3,848 |

|

|

Satelites Mexicanos SA de CV: |

|

|

|

|

|

|

10.125% 11/1/04 |

B3 |

|

79,065 |

49,811 |

|

|

11.28% 6/30/04 (g)(h) |

B1 |

|

30,576 |

26,754 |

|

|

Telewest PLC 11% 10/1/07 |

B1 |

|

79,625 |

71,663 |

|

|

United International Holdings, Inc. 0% 2/15/08 (e) |

B3 |

|

31,455 |

18,244 |

|

|

United Pan-Europe Communications NV: |

|

|

|

|

|

|

0% 2/1/10 (e) |

B2 |

|

38,800 |

14,356 |

|

|

10.875% 11/1/07 |

B2 |

|

4,890 |

3,814 |

|

|

10.875% 8/1/09 |

B2 |

|

10,280 |

7,453 |

|

|

11.25% 2/1/10 |

B2 |

|

3,425 |

2,569 |

|

|

11.5% 2/1/10 |

B2 |

|

23,690 |

18,004 |

|

|

|

671,572 |

||||

|

Entertainment - 0.4% |

|||||

|

Alliance Gaming Corp. 10% 8/1/07 |

Caa1 |

|

7,070 |

3,889 |

|

|

Mandalay Resort Group: |

|

|

|

|

|

|

9.5% 8/1/08 |

Ba2 |

|

3,000 |

3,060 |

|

|

10.25% 8/1/07 |

Ba3 |

|

4,925 |

5,048 |

|

|

|

11,997 |

||||

|

Leisure Durables & Toys - 0.0% |

|||||

|

Hedstrom Corp. 10% 6/1/07 (c) |

Caa3 |

|

9,915 |

198 |

|

|

Lodging & Gaming - 0.8% |

|||||

|

Courtyard by Marriott II LP/Courtyard II Finance Co. 10.75% 2/1/08 |

B- |

|

10,710 |

10,630 |

|

|

Florida Panthers Holdings, Inc. 9.875% 4/15/09 |

B2 |

|

6,650 |

6,268 |

|

|

Corporate Bonds - continued |

|||||

|

Moody's Ratings (unaudited) (b) |

Principal Amount (000s) (d) |

Value (Note 1) (000s) |

|||

|

Nonconvertible Bonds - continued |

|||||

|

MEDIA & LEISURE - continued |

|||||

|

Lodging & Gaming - continued |

|||||

|

International Game Technology 7.875% 5/15/04 |

Ba1 |

|

$ 1,970 |

$ 1,921 |

|

|

ITT Corp. 6.25% 11/15/00 |

Ba1 |

|

7,745 |

7,706 |

|

|

|

26,525 |

||||

|

Publishing - 0.2% |

|||||

|

American Lawyer Media Holdings, Inc. 9.75% 12/15/07 |

B2 |

|

5,915 |

5,264 |

|

|

Maxwell Communication Corp. PLC euro 5% 6/16/10 (c) |

- |

CHF |

4 |

0 |

|

|

|

5,264 |

||||

|

TOTAL MEDIA & LEISURE |

715,556 |

||||

|

NONDURABLES - 0.5% |

|||||

|

Foods - 0.3% |

|||||

|

SFC New Holdings, Inc. 11.25% 8/15/01 |

CCC |

|

9,999 |

9,824 |

|

|

Household Products - 0.2% |

|||||

|

AKI, Inc. 10.5% 7/1/08 |

B2 |

|

4,870 |

3,847 |

|

|

TOTAL NONDURABLES |

13,671 |

||||

|

RETAIL & WHOLESALE - 0.8% |

|||||

|

Apparel Stores - 0.1% |

|||||

|

Merry-Go-Round Enterprises, Inc. |

- |

|

7,500 |

0 |

|

|

Norton McNaughton, Inc. 12.5% 6/1/05 |

B2 |

|

2,995 |

2,688 |

|

|

|

2,688 |

||||

|

Drug Stores - 0.6% |

|||||

|

Rite Aid Corp.: |

|

|

|

|

|

|

6% 12/15/00 (g) |

B3 |

|

19,330 |

18,750 |

|

|

10.5% 9/15/02 (g) |

- |

|

645 |

400 |

|

|

|

19,150 |

||||

|

Retail & Wholesale, Miscellaneous - 0.1% |

|||||

|

National Vision Association Ltd. 12.75% 10/15/05 (c) |

Ca |

|

9,625 |

3,658 |

|

|

TOTAL RETAIL & WHOLESALE |

25,496 |

||||

|

Corporate Bonds - continued |

|||||

|

Moody's Ratings (unaudited) (b) |

Principal Amount (000s) (d) |

Value (Note 1) (000s) |

|||

|

Nonconvertible Bonds - continued |

|||||

|

TECHNOLOGY - 4.3% |

|||||

|

Computer Services & Software - 2.8% |

|||||

|

Colo.com 13.875% 3/15/10 unit (g) |

- |

|

$ 5,000 |

$ 3,750 |

|

|

Concentric Network Corp. 12.75% 12/15/07 |

B |

|

1,780 |

1,771 |

|

|

Covad Communications Group, Inc.: |

|

|

|

|

|

|

0% 3/15/08 (e) |

B3 |

|

18,296 |

4,940 |

|

|

12% 2/15/10 |

B3 |

|

6,875 |

3,197 |

|

|

12.5% 2/15/09 |

B3 |

|

13,190 |

6,463 |

|

|

Exodus Communications, Inc.: |

|

|

|

|

|

|

10.75% 12/15/09 |

B3 |

|

32,270 |

29,688 |

|

|

11.25% 7/1/08 |

B3 |

|

8,060 |

7,617 |

|

|

11.625% 7/15/10 (g) |

B3 |

|

21,215 |

19,942 |

|

|

PSINet, Inc.: |

|

|

|

|

|

|

10% 2/15/05 |

B3 |

|

10,755 |

5,324 |

|

|

10.5% 12/1/06 |

B3 |

|

2,620 |

1,258 |

|

|

|

83,950 |

||||

|

Computers & Office Equipment - 0.7% |

|||||

|

Dictaphone Corp. 11.75% 8/1/05 |

B3 |

|

17,907 |

13,430 |

|

|

Globix Corp. 12.5% 2/1/10 |

B- |

|

15,095 |

8,302 |

|

|

|

21,732 |

||||

|

Electronic Instruments - 0.2% |

|||||

|

Telecommunications Techniques Co. LLC 9.75% 5/15/08 |

B3 |

|

7,855 |

6,991 |

|

|

Electronics - 0.5% |

|||||

|

Aavid Thermal Technologies, Inc. 12.75% 2/1/07 |

B2 |

|

2,420 |

2,105 |

|

|

ChipPAC International Ltd. 12.75% 8/1/09 |

B3 |

|

9,270 |

9,247 |

|

|

Micron Technology, Inc. 6.5% 9/30/05 (i) |

B3 |

|

4,000 |

3,320 |

|

|

|

14,672 |

||||

|

Photographic Equipment - 0.1% |

|||||

|

IMAX Corp. 7.875% 12/1/05 |

Ba2 |

|

4,055 |

2,311 |

|

|

TOTAL TECHNOLOGY |

129,656 |

||||

|

TRANSPORTATION - 1.9% |

|||||

|

Air Transportation - 0.9% |

|||||

|

US Air, Inc. 9.625% 2/1/01 |

B3 |

|

28,522 |

28,237 |

|

|

Corporate Bonds - continued |

|||||

|

Moody's Ratings (unaudited) (b) |

Principal Amount (000s) (d) |

Value (Note 1) (000s) |

|||

|

Nonconvertible Bonds - continued |

|||||

|

TRANSPORTATION - continued |

|||||

|

Railroads - 1.0% |

|||||

|

Transtar Holdings LP/Transtar Capital Corp. 13.375% 12/15/03 |

B- |

|

$ 29,525 |

$ 29,820 |

|

|

TOTAL TRANSPORTATION |

58,057 |

||||

|

UTILITIES - 20.2% |

|||||

|

Cellular - 6.5% |

|||||

|

Echostar Broadband Corp. 10.375% 10/1/07 (g) |

B3 |

|

40,470 |

40,470 |

|

|

Globalstar LP/Globalstar Capital Corp. 11.5% 6/1/05 |

Caa1 |

|

1,970 |

236 |

|

|

Leap Wireless International, Inc.: |

|

|

|

|

|

|

0% 4/15/10 (e) |

- |

|

10,900 |

2,616 |

|

|

12.5% 4/15/10 |

Caa2 |

|

12,465 |

8,227 |

|

|

McCaw International Ltd. 0% 4/15/07 (e) |

Caa1 |

|

38,693 |

27,085 |

|

|

Nextel Communications, Inc.: |

|

|

|

|

|

|

0% 10/31/07 (e) |

B1 |

|

2,000 |

1,525 |

|

|

0% 2/15/08 (e) |

B1 |

|

19,835 |

14,678 |

|

|

9.375% 11/15/09 |

B1 |

|

31,845 |

30,730 |

|

|

12% 11/1/08 |

B1 |

|

12,000 |

12,720 |

|

|

Nextel International, Inc.: |

|

|

|

|

|

|

0% 4/15/08 (e) |

Caa1 |

|

14,260 |

8,556 |

|

|

12.75% 8/1/10 (g) |

Caa1 |

|

24,850 |

22,862 |

|

|

Nextel Partners, Inc.: |

|

|

|

|

|

|

11% 3/15/10 (g) |

B3 |

|

7,275 |

7,275 |

|

|

11% 3/15/10 |

B3 |

|

6,985 |

6,985 |

|

|

Orbital Imaging Corp.: |

|

|

|

|

|

|

11.625% 3/1/05 |

CCC |

|

8,580 |

1,630 |

|

|

11.625% 3/1/05 |

CCC |

|

3,380 |

642 |

|

|

Orion Network Systems, Inc. 11.25% 1/15/07 |

B2 |

|

7,625 |

2,669 |

|

|

Triton PCS, Inc. 0% 5/1/08 (e) |

B3 |

|

1,860 |

1,400 |

|

|

US Unwired, Inc. 0% 11/1/09 (e) |

Caa1 |

|

14,050 |

6,674 |

|

|

|

196,980 |

||||

|

Electric Utility - 0.3% |

|||||

|

CMS Energy Corp. 8.125% 5/15/02 |

Ba3 |

|

8,870 |

8,726 |

|

|

Telephone Services - 13.4% |

|||||

|

Allegiance Telecom, Inc. 0% 2/15/08 (e) |

B3 |

|

23,945 |

16,283 |

|

|

Asia Global Crossing Ltd. 13.375% 10/15/10 (g) |

B2 |

|

15,960 |

14,923 |

|

|

Corporate Bonds - continued |

|||||

|

Moody's Ratings (unaudited) (b) |

Principal Amount (000s) (d) |

Value (Note 1) (000s) |

|||

|

Nonconvertible Bonds - continued |

|||||

|

UTILITIES - continued |

|||||

|

Telephone Services - continued |

|||||

|

FirstWorld Communications, Inc. 0% 4/15/08 (e) |

- |

|

$ 10,160 |

$ 1,727 |

|

|

Flag Telecom Holdings Ltd. 11.625% 3/30/10 |

B2 |

|

3,000 |

2,490 |

|

|

Focal Communications Corp. 11.875% 1/15/10 |

B3 |

|

19,855 |

15,090 |

|

|

Hyperion Telecommunications, Inc.: |

|

|

|

|

|

|

0% 4/15/03 (e) |

B3 |

|

6,835 |

5,195 |

|

|

12.25% 9/1/04 |

B3 |

|

12,370 |

10,267 |

|

|

ICG Services, Inc. 0% 5/1/08 (e) |

Caa1 |

|

19,930 |

3,189 |

|

|

Intermedia Communications, Inc.: |

|

|

|

|

|

|

0% 5/15/06 (e) |

B2 |

|

34,400 |

32,508 |

|

|

0% 7/15/07 (e) |

B2 |

|

17,466 |

14,409 |

|

|

KMC Telecom Holdings, Inc.: |

|

|

|

|

|

|

0% 2/15/08 (e) |

Caa2 |

|

1,500 |

210 |

|

|

13.5% 5/15/09 |

Caa2 |

|

6,870 |

2,130 |

|

|

Level 3 Communications, Inc.: |

|

|

|

|

|

|

0% 12/1/08 (e) |

B3 |

|

9,430 |

5,187 |

|

|

11% 3/15/08 |

B3 |

|

36,955 |

33,352 |

|

|

McLeodUSA, Inc.: |

|

|

|

|

|

|

0% 3/1/07 (e) |

B1 |

|

10,290 |

8,361 |

|

|

8.375% 3/15/08 |

B1 |

|

2,715 |

2,389 |

|

|

9.25% 7/15/07 |

B1 |

|

6,105 |

5,586 |

|

|

Metromedia Fiber Network, Inc.: |

|

|

|

|

|

|

10% 11/15/08 |

B2 |

|

1,190 |

1,047 |

|

|

10% 12/15/09 |

B2 |

|

19,450 |

17,116 |

|

|

NEXTLINK Communications LLC 12.5% 4/15/06 |

B2 |

|

1,980 |

1,871 |

|

|

NEXTLINK Communications, Inc.: |

|

|

|

|

|

|

0% 4/15/08 (e) |

B2 |

|

13,785 |

7,720 |

|

|

0% 6/1/09 (e) |

B2 |

|

32,998 |

17,159 |

|

|

0% 12/1/09 (e) |

B2 |

|

9,645 |

4,533 |

|

|

9.625% 10/1/07 |

B2 |

|

10,000 |

8,450 |

|

|

10.75% 11/15/08 |

B3 |

|

12,175 |

10,714 |

|

|

10.75% 6/1/09 |

B2 |

|

35,345 |

31,104 |

|

|

Qwest Communications International, Inc. 10.875% 4/1/07 |

Baa1 |

|

13,500 |

14,648 |

|

|

Rhythms NetConnections, Inc.: |

|

|

|

|

|

|

Series B, 14% 2/15/10 |

B3 |

|

9,435 |

4,340 |

|

|

0% 5/15/08 (e) |

B3 |

|

3,390 |

746 |

|

|

12.75% 4/15/09 |

B3 |

|

10,725 |

4,934 |

|

|

Rochester Telephone Corp. 8.77% 4/16/01 |

Ba2 |

|

12,900 |

12,803 |

|

|

Corporate Bonds - continued |

|||||

|

Moody's Ratings (unaudited) (b) |

Principal Amount (000s) (d) |

Value (Note 1) (000s) |

|||

|

Nonconvertible Bonds - continued |

|||||

|

UTILITIES - continued |

|||||

|

Telephone Services - continued |

|||||

|

Teligent, Inc. 11.5% 12/1/07 |

Caa1 |

|

$ 23,864 |

$ 9,546 |

|

|

Versatel Telecom International NV: |

|

|

|

|

|

|

11.875% 7/15/09 |

B3 |

|

8,940 |

6,526 |

|

|

13.25% 5/15/08 |

B3 |

|

2,140 |

1,626 |

|

|

Viatel, Inc. 11.5% 3/15/09 |

B3 |

|

2,960 |

1,480 |

|

|

WinStar Communications, Inc.: |

|

|

|

|

|

|

0% 4/15/10 (e) |

B3 |

|

14,711 |

4,708 |

|

|

12.5% 4/15/08 |

B3 |

|

33,375 |

24,531 |

|

|

12.75% 4/15/10 |

B3 |

|

59,874 |

43,109 |

|

|

Worldwide Fiber, Inc. 12% 8/1/09 |

B3 |

|

10,355 |

7,818 |

|

|

|

409,825 |

||||

|

TOTAL UTILITIES |

615,531 |

||||

|

TOTAL NONCONVERTIBLE BONDS |

1,869,257 |

||||

|

TOTAL CORPORATE BONDS (Cost $2,247,466) |

1,897,889 |

||||

|

Asset-Backed Securities - 0.1% |

|||||

|

|

|||||

|

Airplanes pass through trust 10.875% 3/15/19 |

Ba2 |

|

4,869 |

3,603 |

|

|

Commercial Mortgage Securities - 1.2% |

|||||

|

|

|||||

|

Danmall Finance, Inc. Series 1 Class D, 13.12% 10/21/24 |

- |

|

7,232 |

7,260 |

|

|

First Chicago/Lennar Trust I Series 1997-CHL1 Class E, 8.0835% 4/1/39 (h) |

- |

|

9,200 |

7,012 |

|

|

Mortgage Capital Funding, Inc. Series 1998-MC3 Class F, 7.3172% 11/18/31 (g)(h) |

Ba1 |

|

3,000 |

2,321 |

|

|

Nationslink Funding Corp. Series 1998-2 Class F, 7.105% 8/20/30 |

BB |

|

4,500 |

3,481 |

|

|

Nomura Asset Securities Corp. Series 1998-D6 Class B1, 6% 3/15/30 |

BB+ |

|

4,347 |

2,927 |

|

|

Commercial Mortgage Securities - continued |

|||||

|

Moody's Ratings (unaudited) (b) |

Principal Amount (000s) (d) |

Value (Note 1) (000s) |

|||

|

Nomura Depositor Trust: |

|

|

|

|

|

|

floater Series 1998-ST1A Class B2, 10.8713% 1/15/03 (g)(h) |

- |

|

$ 7,171 |

$ 6,658 |

|

|

Series 1998-ST1A Class B1A, 9.3713% 1/15/03 (g)(h) |

- |

|

3,398 |

3,200 |

|

|

Structured Asset Securities Corp. Series 1995-C1 Class F, 7.375% 9/25/24 (g) |

- |

|

5,344 |

4,359 |

|

|

TOTAL COMMERCIAL MORTGAGE SECURITIES (Cost $36,955) |

37,218 |

||||

|

Common Stocks - 9.9% |

|||

|

Shares |

|

||

|

BASIC INDUSTRIES - 0.4% |

|||

|

Chemicals & Plastics - 0.1% |

|||

|

Georgia Gulf Corp. |

14,800 |

198 |

|

|

Lyondell Chemical Co. |

24,700 |

355 |

|

|

Sterling Chemicals Holdings, Inc. warrants 8/15/08 (a) |

6,690 |

40 |

|

|

Trivest 1992 Special Fund Ltd. (j) |

11.4 |

678 |

|

|

|

1,271 |

||

|

Packaging & Containers - 0.3% |

|||

|

Packaging Corp. of America |

656,700 |

9,645 |

|

|

TOTAL BASIC INDUSTRIES |

10,916 |

||

|

CONSTRUCTION & REAL ESTATE - 0.0% |

|||

|

Real Estate Investment Trusts - 0.0% |

|||

|

Swerdlow Real Estate Group, Inc.: |

|

|

|

|

Class A (i) |

79,800 |

0 |

|

|

Class B (i) |

19,817 |

0 |

|

|

|

0 |

||

|

DURABLES - 0.5% |

|||

|

Textiles & Apparel - 0.5% |

|||

|

Arena Brands Holdings Corp. Class B |

659,302 |

16,483 |

|

|

ENERGY - 0.0% |

|||

|

Oil & Gas - 0.0% |

|||

|

Abraxas Petroleum Corp. (a) |

288,092 |

864 |

|

|

FINANCE - 0.5% |

|||

|

Banks - 0.5% |

|||

|

Provident Financial Group, Inc. |

549,168 |

16,612 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value (Note 1) (000s) |

||

|

FINANCE - continued |

|||

|

Credit & Other Finance - 0.0% |

|||

|

Abraxas Petroleum Corp./Canadian Abraxas Petroleum Ltd. rights 6/30/01 (a) |

298,092 |

$ 3 |

|

|

Associates First Capital Corp. (a) |

531,600 |

11 |

|

|

Delta Financial Corp. (a) |

800 |

0 |

|

|

|

14 |

||

|

TOTAL FINANCE |

16,626 |

||

|

INDUSTRIAL MACHINERY & EQUIPMENT - 0.1% |

|||

|

Industrial Machinery & Equipment - 0.0% |

|||

|

Exide Corp. |

20,900 |

210 |

|

|

Pollution Control - 0.1% |

|||

|

Allied Waste Industries, Inc. (a) |

299,100 |

2,767 |

|

|

TOTAL INDUSTRIAL MACHINERY & EQUIPMENT |

2,977 |

||

|

MEDIA & LEISURE - 6.1% |

|||

|

Broadcasting - 6.1% |

|||

|

EchoStar Communications Corp. Class A (a) |

4,095,549 |

185,316 |

|

|

Sirius Satellite Radio, Inc. (a) |

7,000 |

352 |

|

|

UIH Australia/Pacific, Inc. warrants 5/15/06 (a) |

7,450 |

37 |

|

|

|

185,705 |

||

|

Entertainment - 0.0% |

|||

|

Clubhaus PLC (a) |

98,600 |

59 |

|

|

Leisure Durables & Toys - 0.0% |

|||

|

Brunswick Corp. |

4,600 |

89 |

|

|

TOTAL MEDIA & LEISURE |

185,853 |

||

|

RETAIL & WHOLESALE - 2.2% |

|||

|

Apparel Stores - 0.0% |

|||

|

Merry-Go-Round Enterprises, Inc. (a) |

1,258,700 |

0 |

|

|

Grocery Stores - 2.2% |

|||

|

Pathmark Stores, Inc. (a)(f) |

3,995,220 |

62,675 |

|

|

Pathmark Stores, Inc. warrants 9/19/10 (a) |

762,628 |

3,432 |

|

|

TOTAL RETAIL & WHOLESALE |

66,107 |

||

|

Common Stocks - continued |

|||

|

Shares |

Value (Note 1) (000s) |

||

|

TECHNOLOGY - 0.0% |

|||

|

Electronics - 0.0% |

|||

|

Aavid Thermal Technologies, Inc. warrants 2/1/07 (a)(g) |

2,420 |

$ 0 |

|

|

Photographic Equipment - 0.0% |

|||

|

IMAX Corp. (a) |

197,200 |

971 |

|

|

TOTAL TECHNOLOGY |

971 |

||

|

UTILITIES - 0.1% |

|||

|

Cellular - 0.1% |

|||

|

Leap Wireless International, Inc.: |

|

|

|

|

warrants 4/15/10 (CV ratio 2.503) (a)(g) |

12,465 |

125 |

|

|

warrants 4/15/10 (CV ratio 5.146) (a)(g) |

10,900 |

109 |

|

|

Loral Orion Network Systems, Inc.: |

|

|

|

|

warrants 1/15/07 (CV ratio .47) (a) |

10,000 |

23 |

|

|

warrants 1/15/07 (CV ratio .6) (a) |

5,000 |

16 |

|

|

McCaw International Ltd. warrants 4/16/07 (a)(g) |

55,220 |

828 |

|

|

Orbital Imaging Corp. warrants 3/1/05 (a)(g) |

8,580 |

43 |

|

|

|

1,144 |

||

|

Electric Utility - 0.0% |

|||

|

CMS Energy Corp. |

24,700 |

667 |

|

|

Telephone Services - 0.0% |

|||

|

KMC Telecom Holdings, Inc. warrants 4/15/08 (a)(g) |

2,500 |

5 |

|

|

TOTAL UTILITIES |

1,816 |

||

|

TOTAL COMMON STOCKS (Cost $372,146) |

302,613 |

||

|

Preferred Stocks - 11.5% |

|||

|

|

|

|

|

|

Convertible Preferred Stocks - 0.0% |

|||

|

INDUSTRIAL MACHINERY & EQUIPMENT - 0.0% |

|||

|

Electrical Equipment - 0.0% |

|||

|

Loral Space & Communications Ltd. $3.00 (g) |

80,000 |

1,460 |

|

|

Nonconvertible Preferred Stocks - 11.5% |

|||

|

CONSTRUCTION & REAL ESTATE - 0.3% |

|||

|

Real Estate Investment Trusts - 0.3% |

|||

|

Swerdlow Real Estate Group, Inc.: |

|

|

|

|

junior (i) |

19,817 |

0 |

|

|

mezzanine (i) |

79,800 |

29 |

|

|

senior (i) |

79,800 |

8,816 |

|

|

|

8,845 |

||

|

Preferred Stocks - continued |

|||

|

Shares |

Value (Note 1) (000s) |

||

|

Nonconvertible Preferred Stocks - continued |

|||

|

FINANCE - 0.6% |

|||

|

Credit & Other Finance - 0.0% |

|||

|

American Annuity Group Capital Trust I $2.3125 |

72,565 |

$ 1,742 |

|

|

Insurance - 0.6% |

|||

|

American Annuity Group Capital Trust II 8.875% |

18,557 |

17,682 |

|

|

TOTAL FINANCE |

19,424 |

||

|

MEDIA & LEISURE - 2.8% |

|||

|

Broadcasting - 2.8% |

|||

|

CSC Holdings, Inc. Series M, 11.125% pay-in-kind |

735,606 |

77,974 |

|

|

NTL, Inc. 13% pay-in-kind |

7,355 |

6,472 |

|

|

|

84,446 |

||

|

TECHNOLOGY - 0.3% |

|||

|

Computers & Office Equipment - 0.3% |

|||

|

Ampex Corp. 8% non-cumulative |

6,150 |

9,594 |

|

|

UTILITIES - 7.5% |

|||

|

Cellular - 6.0% |

|||

|

Nextel Communications, Inc.: |

|

|

|

|

11.125% pay-in-kind |

173,702 |

160,674 |

|

|

Series D, 13% pay-in-kind |

22,538 |

22,425 |

|

|

|

183,099 |

||

|

Telephone Services - 1.5% |

|||

|

Intermedia Communications, Inc. 13.5% pay-in-kind |

26,233 |

22,298 |

|

|

XO Communications, Inc.: |

|

|

|

|

$7.00 pay-in-kind |

313,668 |

12,547 |

|

|

13% pay-in-kind |

13,841 |

9,966 |

|

|

|

44,811 |

||

|

TOTAL UTILITIES |

227,910 |

||

|

TOTAL NONCONVERTIBLE PREFERRED STOCKS |

350,219 |

||

|

TOTAL PREFERRED STOCKS (Cost $378,595) |

351,679 |

||

|

Floating Rate Loans - 0.8% |

|||||

|

Moody's Ratings (unaudited) (b) |

Principal Amount (000s) (d) |

Value (Note 1) (000s) |

|||

|

BASIC INDUSTRIES - 0.1% |

|||||

|

Chemicals & Plastics - 0.1% |

|||||

|

Lyondell Chemical Co. sr. secured Tranche E term loan 10.515% 5/17/06 (h) |

- |

|

$ 2,343 |

$ 2,413 |

|

|

CONSTRUCTION & REAL ESTATE - 0.2% |

|||||

|

Building Materials - 0.1% |

|||||

|

Flowserve Corp. Tranche B term loan 10.25% 6/30/08 (h) |

- |

|

1,700 |

1,713 |

|

|

Construction - 0.1% |

|||||

|

Blount, Inc. Tranche B term loan 10.7222% 6/30/06 (h) |

B1 |

|

3,961 |

3,941 |

|

|

TOTAL CONSTRUCTION & REAL ESTATE |

5,654 |

||||

|

DURABLES - 0.1% |

|||||

|

Textiles & Apparel - 0.1% |

|||||

|

Synthetic Industries, Inc. term loan 14.9% 12/13/00 (h) |

- |

|

4,000 |

3,680 |

|

|

HEALTH - 0.1% |

|||||

|

Medical Facilities Management - 0.1% |

|||||

|

Total Renal Care Holdings, Inc. term loan 9.9956% 3/31/03 (h) |

- |

|

4,280 |

4,216 |

|

|

RETAIL & WHOLESALE - 0.0% |

|||||

|

Apparel Store - 0.0% |

|||||

|

Merry-Go-Round Enterprises, Inc. trade claim (c) |

- |

|

7,996 |

0 |

|

|

Merry-Go-Round Enterprises, Inc. term loan (c) |

- |

|

4,129 |

0 |

|

|

|

0 |

||||

|

UTILITIES - 0.3% |

|||||

|

Cellular - 0.1% |

|||||

|

Cook Inlet/Voicestream Op Co. LLC Tranche B term loan 10.63% 12/31/08 (h) |

B2 |

|

4,000 |

4,040 |

|

|

Telephone Services - 0.2% |

|||||

|

McLeodUSA, Inc. Tranche B term loan 9.62% 5/31/08 (h) |

Ba2 |

|

4,900 |

4,894 |

|

|

TOTAL UTILITIES |

8,934 |

||||

|

TOTAL FLOATING RATE LOANS (Cost $35,317) |

24,897 |

||||

|

Cash Equivalents - 12.7% |

|||

|

Maturity Amount (000s) |

Value (Note 1) (000s) |

||

|

Investments in repurchase agreements (U.S. Treasury Obligations), in a joint trading account at: |

|

|

|

|

6.55%, dated 10/31/00 due 11/1/00 |

$ 2,216 |

$ 2,216 |

|

|

6.56%, dated 10/31/00 due 11/1/00 |

384,012 |

383,942 |

|

|

TOTAL CASH EQUIVALENTS (Cost $386,158) |

386,158 |

||

|

TOTAL INVESTMENT PORTFOLIO - 98.3% (Cost $3,460,265) |

3,004,057 |

||

|

NET OTHER ASSETS - 1.7% |

50,846 |

||

|

NET ASSETS - 100% |

$ 3,054,903 |

||

|

Currency Abbreviations |

||

|

CHF |

- |

Swiss franc |

|

Legend |

|

(a) Non-income producing |

|

(b) S&P credit ratings are used in the absence of a rating by Moody's Investors Service, Inc. |

|

(c) Non-income producing - issuer filed for protection under the Federal Bankruptcy Code or is in default of interest payment. |

|

(d) Principal amount is stated in United States dollars unless otherwise noted. |

|

(e) Debt obligation initially issued in zero coupon form which converts to coupon form at a specified rate and date. The rate shown is the rate at period end. |

|

(f) Affiliated company |

|

(g) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the period end, the value of these securities amounted to $198,640,000 or 6.5% of net assets. |

|

(h) The coupon rate shown on floating or adjustable rate securities represents the rate at period end. |

|

(i) Restricted securities - Investment in securities not registered under the Securities Act of 1933. |

|

Additional information on each holding |

|

Security |

Acquisition Date |

Acquisition Cost (000s) |

|

Merry-Go-Round Enterprises, Inc.: 0% 5/16/98 |

3/1/94 - 3/24/94 |

$ 7,680 |

|

7.09% 9/1/03 |

3/21/94 |

$ 6,450 |

|

Micron Technology, Inc. 6.5% 9/30/05 |

3/3/99 |

$ 3,096 |

|

Swerdlow |

1/15/99 |

$ 11 |

|

Class B |

1/15/99 |

$ 3 |

|

junior |

1/15/99 |

$ 3 |

|

mezzanine |

1/15/99 |

$ 79 |

|

senior |

1/15/99 |

$ 7,619 |

|

(j) Share amount represents number of units held. |

|

Other Information |

|

The composition of long-term debt holdings as a percentage of total value of investments in securities, is as follows (ratings are unaudited): |

|

Moody's Ratings |

S&P Ratings |

|||

|

Aaa, Aa, A |

0.0% |

|

AAA, AA, A |

0.0% |

|

Baa |

0.5% |

|

BBB |

0.8% |

|

Ba |

5.9% |

|

BB |

5.0% |

|

B |

49.6% |

|

B |

48.1% |

|

Caa |

4.7% |

|

CCC |

6.8% |

|

Ca, C |

0.2% |

|

CC, C |

0.1% |

|

|

|

|

D |

0.3% |

|

The percentage not rated by Moody's or S&P amounted to 2.0%. FMR has determined that unrated debt securities that are lower quality account for 2.0% of the total value of investment in securities. |

|

Distribution of investments by country of issue, as a percentage of total net assets, is as follows: |

|

United States of America |

89.2% |

|

United Kingdom |

4.2 |

|

Mexico |

2.5 |

|

Bermuda |

1.8 |

|

Netherlands |

1.7 |

|

Others (individually less than 1%) |

0.6 |

|

|

100.0% |

|

Income Tax Information |

|

At October 31, 2000, the aggregate cost of investment securities for income tax purposes was $3,461,503,000. Net unrealized depreciation aggregated $457,446,000, of which $36,102,000 related to appreciated investment securities and $493,548,000 related to depreciated investment securities. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Statement of Assets and Liabilities

|

Amounts in thousands (except per-share amount) |

October 31, 2000 |

|

|

Assets |

|

|

|

Investment in securities, at value (including repurchase agreements of $386,158) (cost $3,460,265) - |

|

$ 3,004,057 |

|

Receivable for investments sold |

|

34,735 |

|

Receivable for fund shares sold |

|

12,385 |

|

Dividends receivable |

|

493 |

|

Interest receivable |

|

48,745 |

|

Redemption fees receivable |

|

2 |

|

Other receivables |

|

673 |

|

Total assets |

|

3,101,090 |

|

Liabilities |

|

|

|

Payable to custodian bank |

$ 1,442 |

|

|

Payable for investments purchased |

9,982 |

|

|

Payable for fund shares redeemed |

26,835 |

|

|

Distributions payable |

2,958 |

|

|

Accrued management fee |

1,495 |

|

|

Other payables and accrued expenses |

3,475 |

|

|

Total liabilities |

|

46,187 |

|

Net Assets |

|

$ 3,054,903 |

|

Net Assets consist of: |

|

|

|

Paid in capital |

|

$ 3,544,726 |

|

Undistributed net investment income |

|

83,303 |

|

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions |

|

(116,923) |

|

Net unrealized appreciation (depreciation) on investments |

|

(456,203) |

|

Net Assets, for 365,482 shares outstanding |

|

$ 3,054,903 |

|

Net Asset Value, offering price and redemption price |

|

$8.36 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Statements - continued

Statement of Operations

|

Amounts in thousands |

Six months ended October 31, 2000 |

|

|

Investment Income Dividends |

|

$ 19,033 |

|

Interest |

|

147,588 |

|

Security lending |

|

3 |

|

Total income |

|

166,624 |

|

Expenses |

|

|

|

Management fee |

$ 9,097 |

|

|

Transfer agent fees |

2,598 |

|

|

Accounting and security lending fees |

381 |

|

|

Non-interested trustees' compensation |

10 |

|

|

Custodian fees and expenses |

42 |

|

|

Registration fees |

59 |

|

|

Audit |

72 |

|

|

Legal |

73 |

|

|

Interest |

1 |

|

|

Miscellaneous |

40 |

|

|

Total expenses before reductions |

12,373 |

|

|

Expense reductions |

(261) |

12,112 |

|

Net investment income |

|

154,512 |

|

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: |

|

|

|

Investment securities (including realized gain |

(109,425) |

|

|

Foreign currency transactions |

(5) |

(109,430) |

|

Change in net unrealized appreciation (depreciation) on investment securities |

|

(196,620) |

|

Net gain (loss) |

|

(306,050) |

|

Net increase (decrease) in net assets resulting |

|

$ (151,538) |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Statements - continued

Statement of Changes in Net Assets

|

Amounts in thousands |

Six months ended

October 31, |

Year ended |

|

Increase (Decrease) in Net Assets |

|

|

|

Operations |

$ 154,512 |

$ 252,756 |

|

Net realized gain (loss) |

(109,430) |

136,088 |

|

Change in net unrealized appreciation (depreciation) |

(196,620) |

(363,597) |

|

Net increase (decrease) in net assets resulting |

(151,538) |

25,247 |

|

Distributions to shareholders |

(132,238) |

(214,705) |

|

From net realized gain |

- |

(137,243) |

|

Total distributions |

(132,238) |

(351,948) |

|

Share transactions |

517,053 |

1,166,434 |

|

Reinvestment of distributions |

115,810 |

313,113 |

|

Cost of shares redeemed |

(474,396) |

(564,990) |

|

Net increase (decrease) in net assets resulting |

158,467 |

914,557 |

|

Redemption fees |

1,421 |

2,149 |

|

Total increase (decrease) in net assets |

(123,888) |

590,005 |

|

Net Assets |

|

|

|

Beginning of period |

3,178,791 |

2,588,786 |

|

End of period (including undistributed net investment income of $83,303 and $61,029, respectively) |

$ 3,054,903 |

$ 3,178,791 |

|

Other Information Shares |

|

|

|

Sold |

58,340 |

122,983 |

|

Issued in reinvestment of distributions |

13,233 |

32,855 |

|

Redeemed |

(54,027) |

(59,531) |

|

Net increase (decrease) |

17,546 |

96,307 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights

|

|

Six months ended October 31, |

Years ended April 30, |

||||

|

|

2000 |

2000 |

1999 |

1998 |

1997 |

1996 |

|

Selected Per-Share Data |

|

|

|

|

|

|

|

Net asset value,

beginning |

$ 9.140 |

$ 10.290 |

$ 10.680 |

$ 9.280 |

$ 9.340 |

$ 9.170 |

|

Income from Invest- |

.432 D |

.872 D |

.863 D |

.721 D |

.605 D |

.902 |

|

Net realized |

(.846) |

(.799) |

(.024) |

1.385 |

.093 |

.119 |

|