|

|

|

|

Fidelity®

Annual Report

October 31, 2000

(2_fidelity_logos)

|

President's Message |

3 |

Ned Johnson on investing strategies. |

|

Performance |

4 |

How the fund has done over time. |

|

Fund Talk |

6 |

The manager's review of fund performance, strategy and outlook. |

|

Investment Changes |

9 |

A summary of major shifts in the fund's investments over the past six months. |

|

Investments |

10 |

A complete list of the fund's investments with their market values. |

|

Financial Statements |

18 |

Statements of assets and liabilities,

operations, and changes in net assets, |

|

Notes |

22 |

Notes to the financial statements. |

|

Independent Auditors' Report |

26 |

The auditors' opinion. |

|

Distributions |

27 |

|

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

(Recycle graphic) This report is printed on recycled paper using soy-based inks.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

Mutual fund shares are not deposits or obligations of, or guaranteed by, any depository institution. Shares are not insured by the FDIC, Federal Reserve Board or any other agency, and are subject to investment risks, including possible loss of principal amount invested.

Neither the fund nor Fidelity Distributors Corporation is a bank.

For more information on any Fidelity fund, including charges and expenses, call 1-800-544-6666 for a free prospectus. Read it carefully before you invest or send money.

Annual Report

(Photograph of Edward C. Johnson 3d.)

Dear Shareholder:

A sixth-straight year of double-digit positive returns for the Dow Jones Industrial Average, NASDAQ and S&P 500® could be in jeopardy unless the U.S. stock market shows marked improvement in the final two months of 2000. Through October, all three indexes had negative year-to-date returns. On the other hand, most fixed-income sectors were solidly in the black. Treasuries and other long-term government securities led the way, returning nearly 14%.

While it's impossible to predict the future direction of the markets with any degree of certainty, there are certain basic principles that can help investors plan for their future needs.

First, investors are encouraged to take a long-term view of their portfolios. If you can afford to leave your money invested through the inevitable up and down cycles of the financial markets, you will greatly reduce your vulnerability to any single decline. We know from experience, for example, that stock prices have gone up over longer periods of time, have significantly outperformed other types of investments and have stayed ahead of inflation.

Second, you can further manage your investing risk through diversification. A stock mutual fund, for instance, is already diversified, because it invests in many different companies. You can increase your diversification further by investing in a number of different stock funds, or in such other investment categories as bonds. If you have a short investment time horizon, you might want to consider moving some of your investment into a money market fund, which seeks income and a stable share price by investing in high-quality, short-term investments. Of course, it's important to remember that an investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although money market funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in these types of funds.

Finally, no matter what your time horizon or portfolio diversity, it makes good sense to follow a regular investment plan, investing a certain amount of money in a fund at the same time each month or quarter and periodically reviewing your overall portfolio. By doing so, you won't get caught up in the excitement of a rapidly rising market, nor will you buy all your shares at market highs. While this strategy - known as dollar cost averaging - won't assure a profit or protect you from a loss in a declining market, it should help you lower the average cost of your purchases. Of course, you should consider your financial ability to continue your purchases through periods of low price levels before undertaking such a strategy.

If you have questions, please call us at 1-800-544-6666, or visit our web site at www.fidelity.com. We are available 24 hours a day, seven days a week to provide you the information you need to make the investments that are right for you.

Best regards,

/s/Edward C. Johnson 3d

Edward C. Johnson 3d

Annual Report

There are several ways to evaluate a fund's historical performance. You can look at the total percentage change in value, the average annual percentage change or the growth of a hypothetical $10,000 investment. Total return reflects the change in the value of an investment, assuming reinvestment of the fund's dividend income and capital gains (the profits earned upon the sale of securities that have grown in value).

Cumulative Total Returns

|

Periods ended October 31, 2000 |

|

Past 1 |

Past 5 |

Past 10 |

|

Fidelity Stock Selector |

|

11.54% |

118.83% |

552.27% |

|

S&P 500 ® |

|

6.09% |

166.65% |

491.03% |

|

Growth Funds Average |

|

15.32% |

149.69% |

469.58% |

Cumulative total returns show the fund's performance in percentage terms over a set period - in this case, one year, five years or 10 years. For example, if you had invested $1,000 in a fund that had a 5% return over the past year, the value of your investment would be $1,050. You can compare the fund's returns to the performance of the Standard & Poor's 500SM Index - a market capitalization-weighted index of common stocks. To measure how the fund's performance stacked up against its peers, you can compare it to the growth funds average, which reflects the performance of mutual funds with similar objectives tracked by Lipper Inc. The past one year average represents a peer group of 1,351 mutual funds. These benchmarks include reinvested dividends and capital gains, if any, and exclude the effect of sales charges. Lipper has created new comparison categories that group funds according to portfolio characteristics and capitalization, as well as by capitalization only. These averages are listed on page 5 of this report.(dagger)

Average Annual Total Returns

|

Periods ended October 31, 2000 |

|

Past 1 |

Past 5 |

Past 10 |

|

Fidelity Stock Selector |

|

11.54% |

16.96% |

20.63% |

|

S&P 500 |

|

6.09% |

21.67% |

19.44% |

|

Growth Funds Average |

|

15.32% |

19.59% |

18.47% |

Average annual total returns take the fund's cumulative return and show you what would have happened if the fund had performed at a constant rate each year. (Note: Lipper calculates average annual total returns by annualizing each fund's total return, then taking an arithmetic average. This may produce a different figure than that obtained by averaging the cumulative total returns and annualizing the result.)

Annual Report

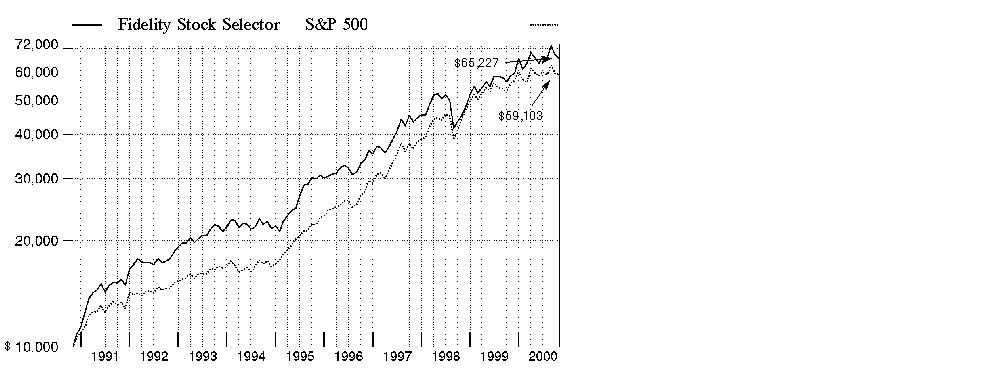

$10,000 Over 10 Years

$10,000 Over 10 Years: Let's say hypothetically that $10,000 was invested in Fidelity Stock Selector on October 31, 1990. As the chart shows, by October 31, 2000, the value of the investment would have grown to $65,227 - a 552.27% increase on the initial investment. For comparison, look at how the Standard & Poor's 500 Index did over the same period. With dividends and capital gains, if any, reinvested, the same $10,000 would have grown to $59,103 - a 491.03% increase.

Understanding

Performance

How a fund did yesterday is no guarantee of how it will do tomorrow. The stock market, for example, has a history of long-term growth and short-term volatility. In turn, the share price and return of a fund that invests in stocks will vary. That means if you sell your shares during a market downturn, you might lose money. But if you can ride out the market's ups and downs, you may have a gain.

3* The Lipper multi-cap core funds average reflects the performance (excluding sales charges) of mutual funds with similar portfolio characteristics and capitalization. The Lipper multi-cap supergroup average reflects the performance (excluding sales charges) of mutual funds with similar capitalization. As of October 31, 2000, the one year, five year, and 10 year cumulative total returns for the multi-cap core funds average were 14.61%, 135.22%, and 441.13%, respectively; and the one year, five year, and 10 year average annual total returns were 14.61%, 18.38%, and 17.96%, respectively. The one year, five year, and 10 year cumulative total returns for the multi-cap supergroup average were 19.65%, 141.87%, and 463.06%, respectively; and the one year, five year, and 10 year average annual total returns were 19.65%, 18.73%, and 18.22%, respectively.

Annual Report

Market Recap

The U.S. equity markets went from hot to cold during the 12-month period that ended October 31, 2000. At the period's onset, strong enthusiasm for technology and telecommunication stocks lifted the performance of those and other stocks related to the so-called "new economy." In March and April, a sharp correction in those sectors nudged investors toward more traditional industries, such as pharmaceuticals and financials. However, the broadening of the market was brief. In May, the Federal Reserve Board raised key interest rates to their highest levels in nine years in a move designed to prevent inflation. It was the Fed's fourth consecutive rate hike during the period. Higher rates, coupled with the highest oil prices in a decade and the declining value of the euro, collectively exacted a toll on corporate profits. This slowdown was particularly evident in the third quarter, as many companies revised earnings on the downside. The emergence of these factors during the past six months hampered the one-year returns of the major U.S. equity indices. The NASDAQ Composite Index ended the 12-month period with a 13.81% gain. Small-cap stocks, as represented by the Russell 2000® Index, returned 17.41%. The Standard & Poor's 500SM Index, an index of 500 larger companies, advanced 6.09%. Investors were less enamored with blue-chip industrial stocks, as the Dow Jones Industrial Average rose 3.82%.

(Portfolio Manager photograph)

An interview with Bob Kuo, Portfolio Manager of Fidelity Stock Selector Fund

Q. How did the fund perform, Bob?

A. For the 12 months ending October 31, 2000, the fund returned 11.54%. During the same period, the Standard & Poor's 500 Index returned 6.09% and the growth funds average tracked by Lipper Inc. returned 15.32%.

Q. Why did the fund outperform the S&P 500 but trail its peers?

A. The answer lies in the strong performance of the technology sector during the first half of the period. The fund overweighted technology compared to the index, which led to the fund's outperformance of the S&P 500. During the last six months of the period, when technology stocks were hit hard, the fund made up ground versus the peer group, which overweighted technology stocks relative to the fund. However, the fund was unable to overcome the strong results of its peers during the first six months.

Q. Were there any specific sectors that helped or hurt the fund?

A. Despite the technology sell-off, our strong stock selection in the sector helped performance during the past 12 months. Since the NASDAQ reached a high of over 5000 in March, it dropped more than 30% in about a 10-week period and hasn't really recovered since. In this kind of environment success lies in avoiding the big losers, as opposed to picking the winners. Fortunately, the fund was underweighted or completely out of many of the large technology companies that announced negative earnings surprises, so when the value of those stocks declined dramatically, the fund's downside was limited. In the utilities sector, I overweighted the traditional electric and gas companies, which performed well as demand for electricity skyrocketed during a hot summer and deregulation in some states caused some sources of supply to become disrupted. Within the finance sector, the fund's overweighted positions in brokerage firms added to performance due to a strong capital markets environment and increased trading volumes. In the energy sector, the big story was the increase in oil prices to nearly $40 a barrel by mid-September, which positively affected the sector overall and helped the fund's energy picks.

Annual Report

Fund Talk: The Manager's Overview - continued

Q. Which stocks added to the fund's performance?

A. We overweighted Merrill Lynch, which turned out to be one of the top performers for the fund. The company benefited from its brokerage and trading businesses as a result of heavy stock market activity, strong investment banking revenues and the implementation of a cost-cutting program to improve margins. Qualcomm, which in our report to shareholders six months ago was the fund's top contributor, dropped considerably since then because of concerns about whether its technology would be adopted overseas. I successfully reduced the holding from an overweighted position near the high, and got out of it entirely before the stock went bad. Similarly, Applied Materials, a semiconductor equipment manufacturer, also was a stellar performer for the first six months of the period, at which point I sold most of the stock. As a result, Qualcomm and Applied Materials added to the fund's relative performance over the course of the year.

Q. What stocks detracted from performance?

A. Oracle performed well for most of the year but got caught in the September/October market correction. The company reported good earnings numbers but fell short of growth estimates for licensing its new suite of Internet applications. Likewise, Intel lost about half its value in the same two-month period after being up for most of the year. Both Intel and Hewlett-Packard, another significant detractor from performance, were affected by concerns that demand was slowing for computers and the chips that go in them.

Q. What is your outlook, Bob?

A. I don't expect that the volatility in the stock market will end any time soon. At the end of the third quarter, we saw a large number of companies announce that they would not meet their earnings projections. These reports caused the stocks of those companies to drop, sparking more fear and uncertainty about other companies that will report their earnings later in the season. Adding to the mix is the uncertainty about the outcome of the presidential election and the impact of the next president's fiscal policies on the economy. In the stock market, uncertainty breeds volatility.

The views expressed in this report reflect those of the portfolio manager only through the end of the period of the report as stated on the cover and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Fund Talk: The Manager's Overview - continued

Fund Facts

Goal: to increase the value of the fund's shares by investing mainly in a diversified portfolio of common stocks that the manager determines, using quantitative and fundamental research, to be undervalued compared to others in their industries

Fund number: 320

Trading symbol: FDSSX

Start date: September 28, 1990

Size: as of October 31, 2000, more than $1.6 billion

Manager: Bob Kuo, since May 2000; subportfolio manager, U.S. equities, 1998-2000; quantitative analyst, 1994-1998; joined Fidelity in 1994

3Bob Kuo on the bursting of the Internet bubble and its effect on the fund:

"During the past few years, we saw a once-in-a-generation phenomenon. Much like railroads, the telegraph and radio before it, the Internet promised to revolutionize all aspects of our lives. Many Internet companies that sprang up were able to attract millions of dollars worth of funding with nothing more than an idea. They were able to go public and become valued at billions of dollars despite having little revenue or profits. Traditional valuation measures flew out the window.

"Then in March, these high-flying companies fell back to earth. Investors began to wonder when, if ever, these companies would become profitable. Many of these companies quickly lost over 90% of their value, as investors realized that their business plans were fundamentally flawed and that traditional valuations did apply after all.

"This return to sanity in the market benefits the fund. Our computer models are based on hundreds of thousands of historical data observations. When the Internet mania hit, our models shunned those stocks because they didn't conform to the picture of a successful company. For a while, as our peers outperformed us by making big bets on the Internet, it seemed as though our models were outmoded. The passage of time has assured us that this is not the case, bringing to mind the old adage, ´The more things change, the more they stay the same.'"

Annual Report

|

Top Ten Stocks as of October 31, 2000 |

||

|

|

% of fund's |

% of fund's net assets |

|

General Electric Co. |

4.7 |

4.4 |

|

Merrill Lynch & Co., Inc. |

3.0 |

2.1 |

|

Cisco Systems, Inc. |

3.0 |

2.5 |

|

Microsoft Corp. |

2.9 |

2.9 |

|

Exxon Mobil Corp. |

2.6 |

2.5 |

|

Citigroup, Inc. |

2.5 |

2.0 |

|

Merck & Co., Inc. |

2.4 |

0.0 |

|

Sun Microsystems, Inc. |

2.3 |

1.4 |

|

Pfizer, Inc. |

2.1 |

0.6 |

|

EMC Corp. |

1.9 |

1.1 |

|

|

27.4 |

19.5 |

|

Top Five Market Sectors as of October 31, 2000 |

||

|

|

% of fund's |

% of fund's net assets |

|

Technology |

27.7 |

37.8 |

|

Health |

16.3 |

3.0 |

|

Finance |

16.1 |

13.8 |

|

Utilities |

8.8 |

2.7 |

|

Energy |

8.6 |

13.1 |

|

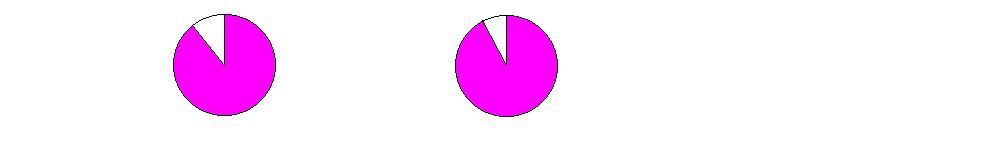

Asset Allocation (% of fund's net assets) |

|||||||

|

As of October 31, 2000 * |

As of April 30, 2000 ** |

||||||

|

Stocks and |

|

|

Stocks and |

|

||

|

Short-Term |

|

|

Short-Term |

|

||

|

* Foreign investments |

2.5% |

|

** Foreign investments |

5.5% |

|

||

Annual Report

Showing Percentage of Net Assets

|

Common Stocks - 95.5% |

|||

|

Shares |

Value (Note 1) (000s) |

||

|

AEROSPACE & DEFENSE - 2.2% |

|||

|

Aerospace & Defense - 1.9% |

|||

|

Boeing Co. |

160,000 |

$ 10,850 |

|

|

Lockheed Martin Corp. |

210,000 |

7,529 |

|

|

Precision Castparts Corp. |

54,500 |

2,057 |

|

|

United Technologies Corp. |

145,000 |

10,123 |

|

|

|

30,559 |

||

|

Defense Electronics - 0.3% |

|||

|

Anaren Microwave, Inc. (a) |

50,000 |

5,200 |

|

|

TOTAL AEROSPACE & DEFENSE |

35,759 |

||

|

CONSTRUCTION & REAL ESTATE - 0.6% |

|||

|

Construction - 0.6% |

|||

|

Centex Corp. |

160,000 |

5,920 |

|

|

D.R. Horton, Inc. |

100,000 |

1,850 |

|

|

Lennar Corp. |

80,000 |

2,570 |

|

|

|

10,340 |

||

|

DURABLES - 0.0% |

|||

|

Textiles & Apparel - 0.0% |

|||

|

Coach, Inc. |

900 |

21 |

|

|

ENERGY - 8.6% |

|||

|

Energy Services - 1.1% |

|||

|

BJ Services Co. (a) |

68,000 |

3,566 |

|

|

Noble Drilling Corp. (a) |

136,000 |

5,653 |

|

|

Patterson Energy, Inc. (a) |

55,000 |

1,547 |

|

|

Smith International, Inc. (a) |

100,000 |

7,050 |

|

|

|

17,816 |

||

|

Oil & Gas - 7.5% |

|||

|

Amerada Hess Corp. |

149,970 |

9,298 |

|

|

Anadarko Petroleum Corp. |

122,304 |

7,834 |

|

|

Apache Corp. |

75,000 |

4,148 |

|

|

BP Amoco PLC sponsored ADR |

77,060 |

3,925 |

|

|

Devon Energy Corp. |

61,500 |

3,100 |

|

|

EOG Resources, Inc. |

250,000 |

9,844 |

|

|

Exxon Mobil Corp. |

465,000 |

41,472 |

|

|

Louis Dreyfus Natural Gas Corp. (a) |

45,000 |

1,443 |

|

|

Noble Affiliates, Inc. |

45,000 |

1,651 |

|

|

Ocean Energy, Inc. (a) |

110,000 |

1,526 |

|

|

Phillips Petroleum Co. |

135,000 |

8,336 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value (Note 1) (000s) |

||

|

ENERGY - continued |

|||

|

Oil & Gas - continued |

|||

|

Royal Dutch Petroleum Co. (NY Shares) |

225,000 |

$ 13,359 |

|

|

USX - Marathon Group |

261,000 |

7,096 |

|

|

Valero Energy Corp. |

140,000 |

4,629 |

|

|

Vintage Petroleum, Inc. |

100,000 |

2,113 |

|

|

|

119,774 |

||

|

TOTAL ENERGY |

137,590 |

||

|

FINANCE - 16.1% |

|||

|

Banks - 0.0% |

|||

|

UnionBanCal Corp. |

32 |

1 |

|

|

Credit & Other Finance - 3.3% |

|||

|

Citigroup, Inc. |

779,666 |

41,030 |

|

|

Greenpoint Financial Corp. |

100,000 |

2,975 |

|

|

MBNA Corp. |

250,000 |

9,391 |

|

|

|

53,396 |

||

|

Federal Sponsored Credit - 0.8% |

|||

|

Fannie Mae |

90,000 |

6,930 |

|

|

USA Education, Inc. |

90,000 |

5,029 |

|

|

|

11,959 |

||

|

Insurance - 5.9% |

|||

|

AFLAC, Inc. |

348,100 |

25,433 |

|

|

American International Group, Inc. |

300,000 |

29,400 |

|

|

CIGNA Corp. |

200,000 |

24,390 |

|

|

Hartford Financial Services Group, Inc. |

140,000 |

10,421 |

|

|

MGIC Investment Corp. |

80,000 |

5,450 |

|

|

|

95,094 |

||

|

Securities Industry - 6.1% |

|||

|

Bear Stearns Companies, Inc. |

200,000 |

12,125 |

|

|

Lehman Brothers Holdings, Inc. |

260,000 |

16,770 |

|

|

Merrill Lynch & Co., Inc. |

688,000 |

48,160 |

|

|

Morgan Stanley Dean Witter & Co. |

255,000 |

20,480 |

|

|

|

97,535 |

||

|

TOTAL FINANCE |

257,985 |

||

|

Common Stocks - continued |

|||

|

Shares |

Value (Note 1) (000s) |

||

|

HEALTH - 16.3% |

|||

|

Drugs & Pharmaceuticals - 9.8% |

|||

|

Allergan, Inc. |

230,000 |

$ 19,334 |

|

|

Alpharma, Inc. Class A |

130,000 |

5,046 |

|

|

Andrx Corp. - Andrx Group (a) |

60,000 |

4,320 |

|

|

Bristol-Myers Squibb Co. |

250,000 |

15,234 |

|

|

Cell Therapeutics, Inc. (a) |

45,000 |

3,010 |

|

|

Eli Lilly & Co. |

55,000 |

4,916 |

|

|

Forest Laboratories, Inc. (a) |

95,000 |

12,588 |

|

|

IDEC Pharmaceuticals Corp. (a) |

25,000 |

4,903 |

|

|

IVAX Corp. (a) |

250,000 |

10,875 |

|

|

Merck & Co., Inc. |

425,000 |

38,223 |

|

|

Mylan Laboratories, Inc. |

159,400 |

4,463 |

|

|

Pfizer, Inc. |

801,640 |

34,621 |

|

|

|

157,533 |

||

|

Medical Equipment & Supplies - 1.9% |

|||

|

Biomet, Inc. |

150,000 |

5,428 |

|

|

Johnson & Johnson |

200,000 |

18,425 |

|

|

Varian Medical Systems, Inc. (a) |

130,000 |

6,354 |

|

|

|

30,207 |

||

|

Medical Facilities Management - 4.6% |

|||

|

HCA - The Healthcare Co. |

300,000 |

11,981 |

|

|

Oxford Health Plans, Inc. (a) |

210,000 |

7,088 |

|

|

Tenet Healthcare Corp. |

245,000 |

9,632 |

|

|

Trigon Healthcare, Inc. (a) |

60,000 |

4,301 |

|

|

UnitedHealth Group, Inc. |

200,000 |

21,875 |

|

|

Universal Health Services, Inc. Class B (a) |

140,000 |

11,743 |

|

|

Wellpoint Health Networks, Inc. (a) |

55,000 |

6,432 |

|

|

|

73,052 |

||

|

TOTAL HEALTH |

260,792 |

||

|

INDUSTRIAL MACHINERY & EQUIPMENT - 6.3% |

|||

|

Electrical Equipment - 5.5% |

|||

|

C&D Technologies, Inc. |

75,000 |

4,434 |

|

|

General Electric Co. |

1,375,000 |

75,358 |

|

|

Scientific-Atlanta, Inc. |

130,000 |

8,897 |

|

|

|

88,689 |

||

|

Common Stocks - continued |

|||

|

Shares |

Value (Note 1) (000s) |

||

|

INDUSTRIAL MACHINERY & EQUIPMENT - continued |

|||

|

Industrial Machinery & Equipment - 0.8% |

|||

|

Tyco International Ltd. |

209,600 |

$ 11,882 |

|

|

TOTAL INDUSTRIAL MACHINERY & EQUIPMENT |

100,571 |

||

|

MEDIA & LEISURE - 1.1% |

|||

|

Entertainment - 0.3% |

|||

|

MGM Mirage, Inc. |

150,000 |

5,184 |

|

|

Publishing - 0.3% |

|||

|

Reader's Digest Association, Inc. Class A (non-vtg.) |

126,000 |

4,623 |

|

|

Restaurants - 0.5% |

|||

|

Darden Restaurants, Inc. |

375,000 |

8,438 |

|

|

TOTAL MEDIA & LEISURE |

18,245 |

||

|

NONDURABLES - 4.1% |

|||

|

Beverages - 2.0% |

|||

|

Adolph Coors Co. Class B |

77,200 |

4,917 |

|

|

Anheuser-Busch Companies, Inc. |

456,400 |

20,880 |

|

|

Pepsi Bottling Group, Inc. |

200,000 |

6,925 |

|

|

|

32,722 |

||

|

Foods - 2.1% |

|||

|

Keebler Foods Co. |

100,000 |

4,050 |

|

|

PepsiCo, Inc. |

200,000 |

9,688 |

|

|

Quaker Oats Co. |

105,000 |

8,564 |

|

|

Sysco Corp. |

200,000 |

10,438 |

|

|

|

32,740 |

||

|

TOTAL NONDURABLES |

65,462 |

||

|

RETAIL & WHOLESALE - 3.0% |

|||

|

Apparel Stores - 0.8% |

|||

|

Talbots, Inc. |

48,000 |

3,795 |

|

|

The Limited, Inc. |

200,000 |

5,050 |

|

|

The Men's Wearhouse, Inc. (a) |

140,000 |

4,095 |

|

|

|

12,940 |

||

|

Common Stocks - continued |

|||

|

Shares |

Value (Note 1) (000s) |

||

|

RETAIL & WHOLESALE - continued |

|||

|

General Merchandise Stores - 2.2% |

|||

|

Kohls Corp. (a) |

300,000 |

$ 16,256 |

|

|

Wal-Mart Stores, Inc. |

415,000 |

18,831 |

|

|

|

35,087 |

||

|

TOTAL RETAIL & WHOLESALE |

48,027 |

||

|

SERVICES - 0.3% |

|||

|

Robert Half International, Inc. (a) |

150,000 |

4,575 |

|

|

TECHNOLOGY - 27.7% |

|||

|

Communications Equipment - 7.1% |

|||

|

Cable Design Technologies Corp. (a) |

75,000 |

1,730 |

|

|

Cisco Systems, Inc. (a) |

875,000 |

47,141 |

|

|

Comverse Technology, Inc. (a) |

50,000 |

5,588 |

|

|

Corning, Inc. |

360,000 |

27,540 |

|

|

Jabil Circuit, Inc. (a) |

95,000 |

5,421 |

|

|

Natural MicroSystems Corp. (a) |

40,000 |

1,808 |

|

|

Nortel Networks Corp. |

460,000 |

20,930 |

|

|

Tollgrade Communications, Inc. (a) |

40,000 |

3,830 |

|

|

|

113,988 |

||

|

Computer Services & Software - 7.7% |

|||

|

Actuate Software Corp. (a) |

75,000 |

2,114 |

|

|

Adobe Systems, Inc. |

290,000 |

22,058 |

|

|

America Online, Inc. (a) |

94,900 |

4,786 |

|

|

Cerner Corp. (a) |

30,000 |

1,858 |

|

|

Informax, Inc. |

500 |

14 |

|

|

Microsoft Corp. (a) |

670,000 |

46,146 |

|

|

Netegrity, Inc. (a) |

500 |

39 |

|

|

NetIQ Corp. (a) |

400 |

34 |

|

|

Oracle Corp. (a) |

900,000 |

29,700 |

|

|

Rational Software Corp. (a) |

60,000 |

3,581 |

|

|

Siebel Systems, Inc. (a) |

65,000 |

6,821 |

|

|

Sybase, Inc. (a) |

110,000 |

2,303 |

|

|

TIBCO Software, Inc. (a) |

70,000 |

4,410 |

|

|

|

123,864 |

||

|

Computers & Office Equipment - 7.0% |

|||

|

Advanced Switching Communication, Inc. |

800 |

8 |

|

|

Brocade Communications Systems, Inc. (a) |

42,000 |

9,550 |

|

|

EMC Corp. (a) |

350,000 |

31,172 |

|

|

Hewlett-Packard Co. |

310,000 |

14,396 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value (Note 1) (000s) |

||

|

TECHNOLOGY - continued |

|||

|

Computers & Office Equipment - continued |

|||

|

International Business Machines Corp. |

80,000 |

$ 7,880 |

|

|

Juniper Networks, Inc. (a) |

40,000 |

7,800 |

|

|

Sun Microsystems, Inc. (a) |

330,000 |

36,589 |

|

|

Tech Data Corp. (a) |

100,000 |

4,163 |

|

|

|

111,558 |

||

|

Electronic Instruments - 0.5% |

|||

|

Ixia |

500 |

12 |

|

|

KLA-Tencor Corp. (a) |

36,500 |

1,234 |

|

|

Newport Corp. |

20,000 |

2,284 |

|

|

Tektronix, Inc. |

70,000 |

4,988 |

|

|

|

8,518 |

||

|

Electronics - 5.4% |

|||

|

Altera Corp. (a) |

130,000 |

5,322 |

|

|

Arrow Electronics, Inc. (a) |

55,000 |

1,760 |

|

|

Avnet, Inc. |

60,000 |

1,613 |

|

|

AVX Corp. |

175,000 |

5,009 |

|

|

Integrated Device Technology, Inc. (a) |

155,000 |

8,728 |

|

|

Intel Corp. |

510,000 |

22,950 |

|

|

International Rectifier Corp. (a) |

150,000 |

6,694 |

|

|

KEMET Corp. (a) |

150,000 |

4,181 |

|

|

Linear Technology Corp. |

130,000 |

8,393 |

|

|

Oplink Communications, Inc. |

1,500 |

37 |

|

|

PMC-Sierra, Inc. (a) |

42,000 |

7,119 |

|

|

SDL, Inc. (a) |

30,000 |

7,778 |

|

|

Silicon Storage Technology, Inc. (a) |

80,000 |

1,820 |

|

|

Vishay Intertechnology, Inc. (a) |

135,000 |

4,050 |

|

|

|

85,454 |

||

|

TOTAL TECHNOLOGY |

443,382 |

||

|

TRANSPORTATION - 0.4% |

|||

|

Trucking & Freight - 0.4% |

|||

|

Expeditors International of Washington, Inc. |

120,000 |

6,225 |

|

|

UTILITIES - 8.8% |

|||

|

Electric Utility - 3.0% |

|||

|

Ameren Corp. |

165,000 |

6,559 |

|

|

Calpine Corp. (a) |

185,000 |

14,603 |

|

|

Entergy Corp. |

300,000 |

11,494 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value (Note 1) (000s) |

||

|

UTILITIES - continued |

|||

|

Electric Utility - continued |

|||

|

FPL Group, Inc. |

140,000 |

$ 9,240 |

|

|

PPL Corp. |

175,000 |

7,208 |

|

|

TNPC, Inc. |

3,000 |

50 |

|

|

|

49,154 |

||

|

Gas - 4.1% |

|||

|

Columbia Energy Group |

75,000 |

5,395 |

|

|

Dynegy, Inc. Class A |

366,000 |

16,950 |

|

|

El Paso Energy Corp. |

100,000 |

6,269 |

|

|

Enron Corp. |

215,000 |

17,643 |

|

|

KeySpan Corp. |

250,000 |

8,797 |

|

|

Kinder Morgan, Inc. |

45,900 |

1,770 |

|

|

Williams Companies, Inc. |

200,000 |

8,363 |

|

|

|

65,187 |

||

|

Telephone Services - 1.7% |

|||

|

BellSouth Corp. |

115,000 |

5,556 |

|

|

SBC Communications, Inc. |

200,000 |

11,538 |

|

|

Verizon Communications |

170,000 |

9,828 |

|

|

|

26,922 |

||

|

TOTAL UTILITIES |

141,263 |

||

|

TOTAL COMMON STOCKS (Cost $1,294,956) |

1,530,237 |

||

|

Investment Companies - 0.1% |

|||

|

|

|

|

|

|

Kemper International Research Fund Class A |

78,509 |

1,025 |

|

|

Cash Equivalents - 4.4% |

|||

|

Shares |

Value (Note 1) |

||

|

Fidelity Cash Central Fund, 6.61% (b) |

68,585,994 |

$ 68,586 |

|

|

Fidelity Securities Lending Cash Central Fund, 6.66% (b) |

1,656,900 |

1,657 |

|

|

TOTAL CASH EQUIVALENTS (Cost $70,243) |

70,243 |

||

|

TOTAL INVESTMENT PORTFOLIO - 100.0% (Cost $1,366,053) |

1,601,505 |

||

|

NET OTHER ASSETS - 0.0% |

376 |

||

|

NET ASSETS - 100% |

$ 1,601,881 |

||

|

Legend |

|

(a) Non-income producing |

|

(b) The rate quoted is the annualized seven-day yield of the fund at period end. A complete listing of the fund's holdings as of its most recent fiscal year end is available upon request. |

|

Income Tax Information |

|

At October 31, 2000, the aggregate cost of investment securities for income tax purposes was $1,366,614,000. Net unrealized appreciation aggregated $234,891,000, of which $276,832,000 related to appreciated investment securities and $41,941,000 related to depreciated investment securities. |

|

The fund hereby designates approximately $125,196,000 as a capital gain dividend for the purpose of the dividend paid reduction. |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Assets and Liabilities

|

Amounts in thousands (execpt per-share amount) |

October 31, 2000 |

|

|

Assets |

|

|

|

Investment in securities, at value (cost $1,366,053) - |

|

$ 1,601,505 |

|

Receivable for investments sold |

|

36,698 |

|

Receivable for fund shares sold |

|

925 |

|

Dividends receivable |

|

308 |

|

Interest receivable |

|

536 |

|

Other receivables |

|

233 |

|

Total assets |

|

1,640,205 |

|

Liabilities |

|

|

|

Payable for investments purchased |

$ 34,788 |

|

|

Payable for fund shares redeemed |

1,271 |

|

|

Accrued management fee |

460 |

|

|

Other payables and accrued expenses |

148 |

|

|

Collateral on securities loaned, at value |

1,657 |

|

|

Total liabilities |

|

38,324 |

|

Net Assets |

|

$ 1,601,881 |

|

Net Assets consist of: |

|

|

|

Paid in capital |

|

$ 1,053,704 |

|

Undistributed net investment income |

|

6,042 |

|

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions |

|

306,686 |

|

Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies |

|

235,449 |

|

Net Assets, for 50,369 shares outstanding |

|

$ 1,601,881 |

|

Net Asset Value, offering price and redemption price per share ($1,601,881 ÷ 50,369 shares) |

|

$31.80 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Statements - continued

Statement of Operations

|

Amounts in thousands |

Year ended October 31, 2000 |

|

|

Investment Income Dividends |

|

$ 13,392 |

|

Interest |

|

4,709 |

|

Security lending |

|

79 |

|

Total income |

|

18,180 |

|

Expenses |

|

|

|

Management fee |

$ 9,693 |

|

|

Performance adjustment |

(3,249) |

|

|

Transfer agent fees |

3,083 |

|

|

Accounting and security lending fees |

401 |

|

|

Non-interested trustees' compensation |

6 |

|

|

Custodian fees and expenses |

42 |

|

|

Registration fees |

50 |

|

|

Audit |

34 |

|

|

Legal |

22 |

|

|

Reports to shareholders |

128 |

|

|

Miscellaneous |

2 |

|

|

Total expenses before reductions |

10,212 |

|

|

Expense reductions |

(716) |

9,496 |

|

Net investment income |

|

8,684 |

|

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: |

|

|

|

Investment securities |

304,532 |

|

|

Foreign currency transactions |

48 |

304,580 |

|

Change in net unrealized appreciation (depreciation) on: |

|

|

|

Investment securities |

(128,039) |

|

|

Assets and liabilities in foreign currencies |

(3) |

(128,042) |

|

Net gain (loss) |

|

176,538 |

|

Net increase (decrease) in net assets resulting |

|

$ 185,222 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Statements - continued

Statement of Changes in Net Assets

|

Amounts in thousands |

Year ended

October 31, |

Year ended

October 31, |

|

Increase (Decrease) in Net Assets |

|

|

|

Operations |

$ 8,684 |

$ 11,194 |

|

Net realized gain (loss) |

304,580 |

239,295 |

|

Change in net unrealized appreciation (depreciation) |

(128,042) |

178,971 |

|

Net increase (decrease) in net assets resulting |

185,222 |

429,460 |

|

Distributions to shareholders |

(6,090) |

(17,339) |

|

From net realized gain |

(194,930) |

(111,551) |

|

Total distributions |

(201,020) |

(128,890) |

|

Share transactions |

206,394 |

271,759 |

|

Reinvestment of distributions |

190,868 |

122,322 |

|

Cost of shares redeemed |

(433,698) |

(650,854) |

|

Net increase (decrease) in net assets resulting |

(36,436) |

(256,773) |

|

Total increase (decrease) in net assets |

(52,234) |

43,797 |

|

Net Assets |

|

|

|

Beginning of period |

1,654,115 |

1,610,318 |

|

End of period (including undistributed net investment income of $6,042 and $6,875, respectively) |

$ 1,601,881 |

$ 1,654,115 |

|

Other Information Shares |

|

|

|

Sold |

6,436 |

8,955 |

|

Issued in reinvestment of distributions |

6,392 |

4,580 |

|

Redeemed |

(13,693) |

(21,746) |

|

Net increase (decrease) |

(865) |

(8,211) |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights

|

Years ended October 31, |

2000 |

1999 |

1998 |

1997 |

1996 |

|

Selected Per-Share Data |

|

|

|

|

|

|

Net asset value, beginning |

$ 32.29 |

$ 27.09 |

$ 29.40 |

$ 24.99 |

$ 24.25 |

|

Income from Investment Operations |

|

|

|

|

|

|

Net investment income |

.16 B |

.20 B |

.32 B |

.33 B |

.24 |

|

Net realized and unrealized gain (loss) |

3.31 |

7.23 |

1.02 |

6.23 |

2.78 |

|

Total from investment operations |

3.47 |

7.43 |

1.34 |

6.56 |

3.02 |

|

|

|

|

|

|

|

|

Less Distributions |

|

|

|

|

|

|

From net investment income |

(.12) |

(.30) |

(.33) |

(.23) |

(.20) |

|

From net realized gain |

(3.84) |

(1.93) |

(3.32) |

(1.92) |

(2.08) |

|

Total distributions |

(3.96) |

(2.23) |

(3.65) |

(2.15) |

(2.28) |

|

Net asset value, end of period |

$ 31.80 |

$ 32.29 |

$ 27.09 |

$ 29.40 |

$ 24.99 |

|

Total Return A |

11.54% |

29.15% |

4.40% |

28.20% |

13.51% |

|

Ratios and Supplemental Data |

|

|

|

|

|

|

Net assets, end of period |

$ 1,602 |

$ 1,654 |

$ 1,610 |

$ 1,827 |

$ 1,586 |

|

Ratio of expenses to average |

.61% |

.62% |

.68% |

.74% |

.89% |

|

Ratio of expenses to average net assets after expense reductions |

.56% C |

.59% C |

.64% C |

.69% C |

.84% C |

|

Ratio of net investment income |

.52% |

.67% |

1.10% |

1.24% |

1.07% |

|

Portfolio turnover rate |

164% |

106% |

122% |

117% |

247% |

|

A The total returns would have been lower had certain expenses not been reduced during the periods shown. B Net investment income per share has been calculated based on average shares outstanding during the period. C FMR or the fund has entered into varying arrangements with third parties who either paid or reduced a portion of the fund's expenses. |

|||||

See accompanying notes which are an integral part of the financial statements.

Annual Report

For the period ended October 31, 2000

1. Significant Accounting Policies.

Fidelity Stock Selector (the fund) is a fund of Fidelity Capital Trust (the trust) and is authorized to issue an unlimited number of shares. The trust is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company organized as a Massachusetts business trust. The financial statements have been prepared in conformity with generally accepted accounting principles which require management to make certain estimates and assumptions at the date of the financial statements. The following summarizes the significant accounting policies of the fund:

Security Valuation. Securities for which exchange quotations are readily available are valued at the last sale price, or if no sale price, at the closing bid price. Foreign securities are valued based on quotations from the principal market in which such securities are normally traded. If trading or events occurring in other markets after the close of the principal market in which foreign securities are traded, and before the close of business of the fund, are expected to materially affect the value of those securities, then they are valued at their fair value taking this trading or these events into account. Fair value is determined in good faith under consistently applied procedures under the general supervision of the Board of Trustees. Securities for which exchange quotations are not readily available (and in certain cases debt securities which trade on an exchange) are valued primarily using dealer-supplied valuations or at their fair value. Short-term securities with remaining maturities of sixty days or less for which quotations are not readily available are valued at amortized cost or original cost plus accrued interest, both of which approximate current value. Investments in open-end investment companies are valued at their net asset value each business day.

Foreign Currency Translation. The accounting records of the fund are maintained in U.S. dollars. Investment securities and other assets and liabilities denominated in a foreign currency are translated into U.S. dollars at the prevailing rates of exchange at period end. Purchases and sales of securities, income receipts and expense payments are translated into U.S. dollars at the prevailing exchange rate on the respective dates of the transactions.

Net realized gains and losses on foreign currency transactions represent net gains and losses from sales and maturities of foreign currency contracts, disposition of foreign currencies, the difference between the amount of net investment income accrued and the U.S. dollar amount actually received, and gains and losses between trade and settlement date on purchases and sales of securities. The effects of changes in foreign currency exchange rates on investments in securities are included with the net realized and unrealized gain or loss on investment securities.

Income Taxes. As a qualified regulated investment company under Subchapter M of the Internal Revenue Code, the fund is not subject to income taxes to the extent

Annual Report

Notes to Financial Statements - continued

1. Significant Accounting Policies - continued

Income Taxes - continued

that it distributes substantially all of its taxable income for its fiscal year. The schedule of investments includes information regarding income taxes under the caption "Income Tax Information."

Investment Income. Dividend income is recorded on the ex-dividend date, except certain dividends from foreign securities where the ex-dividend date may have passed, are recorded as soon as the fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Interest income is accrued as earned. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

Expenses. Most expenses of the trust can be directly attributed to a fund. Expenses which cannot be directly attributed are apportioned among the funds in the trust.

Distributions to Shareholders. Distributions are recorded on the ex-dividend date.

Income and capital gain distributions are determined in accordance with income tax regulations which may differ from generally accepted accounting principles. These differences, which may result in distribution reclassifications, are primarily due to differing treatments for litigation proceeds, foreign currency transactions, passive foreign investment companies (PFIC), non-taxable dividends, and losses deferred due to wash sales. The fund also utilized earnings and profits distributed to shareholders on redemption of shares as a part of the dividends paid deduction for income tax purposes.

Permanent book and tax basis differences relating to shareholder distributions will result in reclassifications to paid in capital. Undistributed net investment income and accumulated undistributed net realized gain (loss) on investments and foreign currency transactions may include temporary book and tax basis differences which will reverse in a subsequent period. Any taxable income or gain remaining at fiscal year end is distributed in the following year.

2. Operating Policies.

Foreign Currency Contracts. The fund generally uses foreign currency contracts to facilitate transactions in foreign-denominated securities. Losses may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms. The U.S. dollar value of foreign currency contracts is determined using contractual currency exchange rates established at the time of each trade.

Joint Trading Account. Pursuant to an Exemptive Order issued by the Securities and Exchange Commission (the SEC), the fund, along with other affiliated entities of Fidelity Management & Research Company (FMR), may transfer uninvested cash balances into one or more joint trading accounts. These balances are invested in one or more repurchase agreements for U.S. Treasury or Federal Agency obligations.

Annual Report

Notes to Financial Statements - continued

2. Operating Policies - continued

Repurchase Agreements. The underlying U.S. Treasury, Federal Agency, or other obligations found to be satisfactory by FMR are transferred to an account of the fund, or to the Joint Trading Account, at a custodian bank. The securities are marked-to-market daily and maintained at a value at least equal to the principal amount of the repurchase agreement (including accrued interest). FMR, the fund's investment adviser, is responsible for determining that the value of the underlying securities remains in accordance with the market value requirements stated above.

3. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities, aggregated $2,649,273,000 and $2,935,724,000, respectively.

4. Fees and Other Transactions with Affiliates.

Management Fee. As the fund's investment adviser, FMR receives a monthly basic fee that is calculated on the basis of a group fee rate plus a fixed individual fund fee rate applied to the average net assets of the fund. The group fee rate is the weighted average of a series of rates and is based on the monthly average net assets of all the mutual funds advised by FMR. The rates ranged from .2167% to .5200% for the period. The annual individual fund fee rate is .30%. In the event that these rates were lower than the contractual rates in effect during the period, FMR voluntarily implemented the above rates, as they resulted in the same or a lower management fee. The basic fee is subject to a performance adjustment (up to a maximum of ±.20% of the fund's average net assets over the performance period) based on the fund's investment performance as compared to the appropriate index over a specified period of time. For the period, the management fee was equivalent to an annual rate of .38% of average net assets after the performance adjustment.

Sub-Adviser Fee. Beginning January 1, 2001, FMR Co.(FMRC) will serve as sub-adviser for the fund. FMRC is a wholly owned subsidiary of FMR and will receive a fee from FMR of 50% of the management fee payable to FMR with respect to that portion of the funds assets that will be managed by FMRC.

Transfer Agent Fees. Fidelity Service Company, Inc. (FSC), an affiliate of FMR, is the fund's transfer, dividend disbursing and shareholder servicing agent. FSC receives account fees and asset-based fees that vary according to account size and type of account. FSC pays for typesetting, printing and mailing of all shareholder reports, except proxy statements. For the period, the transfer agent fees were equivalent to an annual rate of .18% of average net assets.

Accounting and Security Lending Fees. FSC maintains the fund's accounting records and administers the security lending program. The security lending fee is based on the number and duration of lending

Annual Report

Notes to Financial Statements - continued

4. Fees and Other Transactions with Affiliates - continued

Accounting and Security Lending Fees - continued

transactions. The accounting fee is based on the level of average net assets for the month plus out-of-pocket expenses.

Cash Central Funds. Pursuant to an Exemptive Order issued by the SEC, the fund may invest in the Fidelity Cash Central Fund and the Fidelity Securities Lending Cash Central Fund (the Cash Funds) managed by Fidelity Investments Money Management, Inc., an affiliate of FMR. The Cash Funds are open-end money market funds available only to investment companies and other accounts managed by FMR and its affiliates. The Cash Funds seek preservation of capital, liquidity, and current income. Income distributions from the Cash Funds are declared daily and paid monthly from net investment income. Income distributions earned by the fund are recorded as either interest income or security lending income in the accompanying financial statements.

Brokerage Commissions. The fund placed a portion of its portfolio transactions with brokerage firms which are affiliates of FMR. The commissions paid to these affiliated firms were $97,000 for the period.

5. Security Lending.

The fund lends portfolio securities from time to time in order to earn additional income. The fund receives collateral in the form of U.S. Treasury obligations, letters of credit, and/or cash against the loaned securities, and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of the fund and any additional required collateral is delivered to the fund on the next business day. If the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, the fund could experience delays and costs in recovering the securities loaned or in gaining access to the collateral. At period end, the value of the securities loaned amounted to $1,795,000 . The fund received cash collateral of $1,657,000 which was invested in cash equivalents.

6. Expense Reductions.

FMR has directed certain portfolio trades to brokers who paid a portion of the fund's expenses. For the period, the fund's expenses were reduced by $684,000 under this arrangement.

In addition, through arrangements with the fund's custodian and transfer agent, credits realized as a result of uninvested cash balances were used to reduce a portion of the fund's expenses. During the period, the fund's custodian and transfer agent fees were reduced by $31,000, and $1,000, respectively, under these arrangements.

Annual Report

To the Trustees of Fidelity Capital Trust and Shareholders of Fidelity Stock Selector:

We have audited the accompanying statement of assets and liabilities of Fidelity Stock Selector, (the Fund), a fund of Fidelity Capital Trust (the Trust), including the portfolio of investments, as of October 31, 2000, and the related statements of operations, changes in net assets, and financial highlights for the year then ended. These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audit. The statement of changes in net assets for the year ended October 31, 1999, and the financial highlights for each of the four years in the period then ended were audited by other auditors whose report, dated December 7, 1999, expressed an unqualified opinion on those statements and financial highlights.

We conducted our audit in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of October 31, 2000 by correspondence with the custodian and brokers; where replies were not received from brokers, we performed other auditing procedures. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Fidelity Stock Selector as of October 31, 2000, the results of its operations, the changes in its net assets, and its financial highlights for the year then ended, in conformity with accounting principles generally accepted in the United States of America.

/s/DELOITTE & TOUCHE LLP

DELOITTE & TOUCHE LLP

Boston, Massachusetts

December 8, 2000

Annual Report

The Board of Trustees of Fidelity Stock Selector voted to pay on December 11, 2000, to shareholders of record at the opening of business on December 8, 2000, a distribution of $4.94 per share derived from capital gains realized from sales of portfolio securities and a dividend of $.13 per share from net investment income.

A total of 13% of the dividends distributed during the fiscal year qualifies for the dividends-received deduction for corporate shareholders.

The fund hereby designates 100% of the long-term capital gain dividends distributed during the fiscal year as 20%-rate capital gain dividends.

The fund will notify shareholders in January 2001 of amounts for use in preparing 2000 income tax returns.

Annual Report

Fidelity offers several ways to conveniently manage your personal investments via your telephone or PC. You can access your account information, conduct trades and research your investments 24 hours a day.

By Phone

Fidelity Automated Service Telephone provides a single toll-free number to access account balances, positions, quotes and trading. It's easy to navigate the service, and on your first call, the system will help you create a personal identification number (PIN) for security.

(phone_graphic)Fidelity Automated

Service Telephone (FAST®)

1-800-544-5555

Press

1 For mutual fund and brokerage trading.

2 For quotes.*

3 For account balances and holdings.

4 To review orders and mutual

fund activity.

5 To change your PIN.

*0 To speak to a Fidelity representative.

By PC

Fidelity's web site on the Internet provides a wide range of information, including daily financial news, fund performance, interactive planning tools and news about Fidelity products and services.

(computer_graphic)Fidelity's Web Site

www.fidelity.com

If you are not currently on the Internet, call EarthLink Sprint at 1-800-288-2967, and be sure to ask for registration number SMD004 to receive a special Fidelity package that includes 30 days of free Internet access. EarthLink is North America's #1 independent Internet access provider.

(computer_graphic)

Fidelity On-line Xpress+®

Fidelity On-line Xpress+ software for Windows combines comprehensive portfolio management capabilities, securities trading and access to research and analysis tools . . . all on your desktop. Call Fidelity at 1-800-544-0240 or visit our web site for more information on how to manage your investments via your PC.

* When you call the quotes line, please remember that a fund's yield and return will vary and, except for money market funds, share price will also vary. This means that you may have a gain or loss when you sell your shares. There is no assurance that money market funds will be able to maintain a stable $1 share price; an investment in a money market fund is not insured or guaranteed by the U.S. government. Total returns are historical and include changes in share price, reinvestment of dividends and capital gains, and the effects of any sales charges.

Annual Report

If more than one address is listed, please locate the address that is closest to you. We'll give your correspondence immediate attention and send you written confirmation upon completion of your request.

(letter_graphic)Making Changes

To Your Account

(such as changing name, address, bank, etc.)

Fidelity Investments

P.O. Box 770001

Cincinnati, OH 45277-0002

(letter_graphic)For Non-Retirement

Accounts

Buying shares

Fidelity Investments

P.O. Box 770001

Cincinnati, OH 45277-0003

Overnight Express

Fidelity Investments

2300 Litton Lane - KH1A

Hebron, KY 41048

Selling shares

Fidelity Investments

P.O. Box 660602

Dallas, TX 75266-0602

Overnight Express

Fidelity Investments

Attn: Redemptions - CP6I

400 East Las Colinas Blvd.

Irving, TX 75039-5587

General Correspondence

Fidelity Investments

P.O. Box 500

Merrimack, NH 03054-0500

(letter_graphic)For Retirement

Accounts

Buying shares

Fidelity Investments

P.O. Box 770001

Cincinnati, OH 45277-0003

Selling shares

Fidelity Investments

P.O. Box 660602

Dallas, TX 75266-0602

Overnight Express

Fidelity Investments

Attn: Redemptions - CP6R

400 East Las Colinas Blvd.

Irving, TX 75039-5587

General Correspondence

Fidelity Investments

P.O. Box 500

Merrimack, NH 03054-0500

Annual Report

For directions and hours,

please call 1-800-544-9797.

Arizona

7373 N. Scottsdale Road

Scottsdale, AZ

California

815 East Birch Street

Brea, CA

851 East Hamilton Avenue

Campbell, CA

527 North Brand Boulevard

Glendale, CA

19200 Von Karman Avenue

Irvine, CA

10100 Santa Monica Blvd.

Los Angeles, CA

251 University Avenue

Palo Alto, CA

1760 Challenge Way

Sacramento, CA

7676 Hazard Center Drive

San Diego, CA

8 Montgomery Street

San Francisco, CA

950 Northgate Drive

San Rafael, CA

1400 Civic Drive

Walnut Creek, CA

6300 Canoga Avenue

Woodland Hills, CA

Colorado

1625 Broadway

Denver, CO

Connecticut

48 West Putnam Avenue

Greenwich, CT

265 Church Street

New Haven, CT

300 Atlantic Street

Stamford, CT

29 South Main Street

West Hartford, CT

Delaware

222 Delaware Avenue

Wilmington, DE

Florida

4400 N. Federal Highway

Boca Raton, FL

90 Alhambra Plaza

Coral Gables, FL

4090 N. Ocean Boulevard

Ft. Lauderdale, FL

1907 West State Road 434

Longwood, FL

8880 Tamiami Trail, North

Naples, FL

2401 PGA Boulevard

Palm Beach Gardens, FL

8065 Beneva Road

Sarasota, FL

1502 N. Westshore Blvd.

Tampa, FL

Georgia

3445 Peachtree Road, N.E.

Atlanta, GA

1000 Abernathy Road

Atlanta, GA

Illinois

One North Franklin Street

Chicago, IL

1415 West 22nd Street

Oak Brook, IL

1700 East Golf Road

Schaumburg, IL

3232 Lake Avenue

Wilmette, IL

Indiana

4729 East 82nd Street

Indianapolis, IN

Maine

Three Canal Plaza

Portland, ME

Maryland

7401 Wisconsin Avenue

Bethesda, MD

One W. Pennsylvania Ave.

Towson, MD

Massachusetts

801 Boylston Street

Boston, MA

155 Congress Street

Boston, MA

25 State Street

Boston, MA

300 Granite Street

Braintree, MA

44 Mall Road

Burlington, MA

416 Belmont Street

Worcester, MA

Annual Report

Michigan

280 Old N. Woodward Ave.

Birmingham, MI

29155 Northwestern Hwy.

Southfield, MI

Minnesota

7600 France Avenue South

Edina, MN

Missouri

700 West 47th Street

Kansas City, MO

8885 Ladue Road

Ladue, MO

New Jersey

150 Essex Street

Millburn, NJ

56 South Street

Morristown, NJ

501 Route 17, South

Paramus, NJ

New York

1055 Franklin Avenue

Garden City, NY

999 Walt Whitman Road

Melville, L.I., NY

1271 Avenue of the Americas

New York, NY

71 Broadway

New York, NY

350 Park Avenue

New York, NY

North Carolina

4611 Sharon Road

Charlotte, NC

Ohio

600 Vine Street

Cincinnati, OH

28699 Chagrin Boulevard

Woodmere Village, OH

Oregon

16850 SW 72nd Avenue

Tigard, OR

Pennsylvania

1735 Market Street

Philadelphia, PA

439 Fifth Avenue

Pittsburgh, PA

Rhode Island

47 Providence Place

Providence, RI

Tennessee

6150 Poplar Avenue

Memphis, TN

Texas

10000 Research Boulevard

Austin, TX

4017 Northwest Parkway

Dallas, TX

1155 Dairy Ashford Street

Houston, TX

2701 Drexel Drive

Houston, TX

400 East Las Colinas Blvd.

Irving, TX

14100 San Pedro

San Antonio, TX

19740 IH 45 North

Spring, TX

Utah

215 South State Street

Salt Lake City, UT

Virginia

1861 International Drive

McLean, VA

Washington

411 108th Avenue, N.E.

Bellevue, WA

511 Pine Street

Seattle, WA

Washington, DC

1900 K Street, N.W.

Washington, DC

Wisconsin

595 North Barker Road

Brookfield, WI

Fidelity Brokerage Services, Inc., 100 Summer St., Boston, MA 02110 Member NYSE/SIPC

Annual Report

Investment Adviser

Fidelity Management & Research Company

Boston, MA

Investment Sub-Advisers

Fidelity Management & Research

(U.K.) Inc.

Fidelity Management & Research

(Far East) Inc.

Fidelity Investments Japan Limited

Officers

Edward C. Johnson 3d, President

Robert C. Pozen, Senior Vice President

Robert A. Lawrence, Vice President

Eric D. Roiter, Secretary

Robert A. Dwight, Treasurer

Maria F. Dwyer, Deputy Treasurer

John H. Costello, Assistant Treasurer

Board of Trustees

Ralph F. Cox *

Phyllis Burke Davis *

Robert M. Gates *

Edward C. Johnson 3d

Donald J. Kirk *

Ned C. Lautenbach *

Peter S. Lynch

Marvin L. Mann *

William O. McCoy *

Gerald C. McDonough *

Robert C. Pozen

Thomas R. Williams *

Thomas J. Simpson

Advisory Board

J. Michael Cook

Marie L. Knowles

General Distributor

Fidelity Distributors Corporation

Boston, MA

Transfer and Shareholder

Servicing Agent

Fidelity Service Company, Inc.

Boston, MA

* Independent trustees

Custodian

Brown Brothers Harriman & Co.

Boston, MA

Fidelity's Growth Funds

Aggressive Growth Fund

Blue Chip Growth Fund

Capital Appreciation Fund

Contrafund ®

Contrafund ® II

Disciplined Equity Fund

Dividend Growth Fund

Export and Multinational Fund

Fidelity Fifty ®

Growth Company Fund

Large Cap Stock Fund

Low-Priced Stock Fund

Magellan® Fund

Mid-Cap Stock Fund

New Millennium Fund®

OTC Portfolio

Retirement Growth Fund

Small Cap Selector

Small Cap Stock Fund

Stock Selector

Tax Managed Stock Fund

TechnoQuant® Growth Fund

Trend Fund

Value Fund

The Fidelity Telephone Connection

Mutual Fund 24-Hour Service

Exchanges/Redemptions

and Account Assistance 1-800-544-6666

Product Information 1-800-544-6666

Retirement Accounts 1-800-544-4774

(8 a.m. - 9 p.m.)

TDD Service 1-800-544-0118

for the deaf and hearing impaired

(9 a.m. - 9 p.m. Eastern time)

Fidelity Automated Service

Telephone (FAST®) (automated graphic) 1-800-544-5555

(automated graphic) Automated line for quickest service

Fidelity®

Annual Report

October 31, 2000

(2_fidelity_logos)

|

President's Message |

3 |

Ned Johnson on investing strategies. |

|

Performance |

4 |

How the fund has done over time. |

|

Fund Talk |

6 |

The manager's review of fund performance, strategy and outlook. |

|

Investment Changes |

9 |

A summary of major shifts in the fund's investments over the past six months. |

|

Investments |

10 |

A complete list of the fund's investments with their market values. |

|

Financial Statements |

21 |

Statements of assets and liabilities, operations, and changes in net assets, as well as financial highlights. |

|

Notes |

25 |

Notes to the financial statements. |

|

Independent |

30 |

The auditors' opinion. |

|

Distributions |

31 |

|

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

(Recycle graphic) This report is printed on recycled paper using soy-based inks.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

Mutual fund shares are not deposits or obligations of, or guaranteed by, any depository institution. Shares are not insured by the FDIC, Federal Reserve Board or any other agency, and are subject to investment risks, including possible loss of principal amount invested.

Neither the fund nor Fidelity Distributors Corporation is a bank.

For more information on any Fidelity fund, including charges and expenses, call 1-800-544-6666 for a free prospectus. Read it carefully before you invest or send money.

Annual Report

(Photograph of Edward C. Johnson 3d.)

Dear Shareholder:

A sixth-straight year of double-digit positive returns for the Dow Jones Industrial Average, NASDAQ and S&P 500® could be in jeopardy unless the U.S. stock market shows marked improvement in the final two months of 2000. Through October, all three indexes had negative year-to-date returns. On the other hand, most fixed-income sectors were solidly in the black. Treasuries and other long-term government securities led the way, returning nearly 14%.

While it's impossible to predict the future direction of the markets with any degree of certainty, there are certain basic principles that can help investors plan for their future needs.

First, investors are encouraged to take a long-term view of their portfolios. If you can afford to leave your money invested through the inevitable up and down cycles of the financial markets, you will greatly reduce your vulnerability to any single decline. We know from experience, for example, that stock prices have gone up over longer periods of time, have significantly outperformed other types of investments and have stayed ahead of inflation.

Second, you can further manage your investing risk through diversification. A stock mutual fund, for instance, is already diversified, because it invests in many different companies. You can increase your diversification further by investing in a number of different stock funds, or in such other investment categories as bonds. If you have a short investment time horizon, you might want to consider moving some of your investment into a money market fund, which seeks income and a stable share price by investing in high-quality, short-term investments. Of course, it's important to remember that an investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although money market funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in these types of funds.

Finally, no matter what your time horizon or portfolio diversity, it makes good sense to follow a regular investment plan, investing a certain amount of money in a fund at the same time each month or quarter and periodically reviewing your overall portfolio. By doing so, you won't get caught up in the excitement of a rapidly rising market, nor will you buy all your shares at market highs. While this strategy - known as dollar cost averaging - won't assure a profit or protect you from a loss in a declining market, it should help you lower the average cost of your purchases. Of course, you should consider your financial ability to continue your purchases through periods of low price levels before undertaking such a strategy.

If you have questions, please call us at 1-800-544-6666, or visit our web site at www.fidelity.com. We are available 24 hours a day, seven days a week to provide you the information you need to make the investments that are right for you.

Best regards,

/s/Edward C. Johnson 3d

Edward C. Johnson 3d

Annual Report

There are several ways to evaluate a fund's historical performance. You can look at the total percentage change in value, the average annual percentage change or the growth of a hypothetical $10,000 investment. Total return reflects the change in the value of an investment, assuming reinvestment of the fund's dividend income and capital gains (the profits earned upon the sale of securities that have grown in value).

Cumulative Total Returns