PROSPECTUS SUPPLEMENT

(To prospectus dated August 15, 2000)

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-88617

$300,000,000

The Dow Chemical Company

7% Notes due August 15, 2005

We are offering the Notes through an auction that has been used to determine the interest rate to be paid on the

Notes and to allocate the Notes among potential investors. The Notes will bear interest at the rate of 7% per annum. The interest rate was set in the auction as a spread over the yield (as of the conclusion of the auction) of 6 3

/4% U.S. Treasury Notes due May 15, 2005

(CUSIP No. 9128276D9).

The auction of the Notes occurred on August 15, 2000 via the web site http://www.openbook.com.

We will pay interest on the Notes semiannually in arrears on February 15 and August 15 of each year, commencing

February 15, 2001. The Notes will mature on August 15, 2005. The Notes may not be redeemed prior to their stated maturity.

We will issue the Notes only in registered form in denominations of $1,000. The Notes will be delivered in

book-entry form on or about August 18, 2000 only through The Depository Trust Company.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of

these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| |

|

Per Note

|

|

Total

|

| Public offering price(1) |

|

99.554% |

|

$298,662,000 |

| Underwriting discount |

|

.300% |

|

$ 900,000 |

| Proceeds, before expenses, to Dow |

|

99.254% |

|

$297,762,000 |

(1)

|

Plus accrued interest, if any, from August 18, 2000.

|

Auction Platform

OpenBook®

Joint Managers

Bear, Stearns & Co. Inc.

HSBC

|

The Williams Capital Group, L.P.

|

The date of this prospectus supplement is August 15, 2000.

“OpenBook” is a registered service mark of WR Hambrecht + Co.

Prospectus Supplement

| About Dow |

|

S-3 |

| Recent Developments |

|

S-3 |

| Ratio of Earnings to Fixed Charges |

|

S-3 |

| Use of Proceeds |

|

S-3 |

| Description of Notes |

|

S-3 |

| Underwriting |

|

S-5 |

| Validity of Notes |

|

S-12 |

Prospectus

| About this Prospectus |

|

2 |

| The Dow Chemical Company |

|

2 |

| Use of Proceeds |

|

2 |

| Description of Capital Stock |

|

2 |

| Description of Debt Securities |

|

7 |

| Description of Warrants to Purchase Common Stock or Preferred Stock |

|

17 |

| Description of Debt Warrants |

|

18 |

| Plan of Distribution |

|

20 |

| Legal Matters |

|

21 |

| Experts |

|

21 |

| Where You Can Find More Information |

|

21 |

If we use a capitalized term in this prospectus supplement and do not define the term in this document, it is

defined in the accompanying prospectus.

ABOUT DOW

We are a global science and technology based company that develops and manufactures a portfolio of chemicals,

plastics and agricultural products and services for customers in 162 countries around the world. With annual sales of approximately $19 billion, we conduct operations through 14 global businesses employing approximately 39,200 people. We have 123

manufacturing sites in 32 countries and supply more than 2,400 products. We were incorporated in 1947 under Delaware law and are the successor to a Michigan corporation, of the same name, organized in 1897. Our principal executive offices are located at

2030 Dow Center, Midland, Michigan 48674, and our telephone number is 517-636-1000.

RECENT DEVELOPMENTS

On August 4, 1999, we and Union Carbide Corporation announced a definitive merger agreement for a tax-free,

stock-for-stock transaction. Under the agreement, Union Carbide stockholders will receive 0.537 of a share of our stock for each share of Union Carbide stock they own. Based upon our closing price of $124 11

/16 on August 3, 1999, the transaction was

valued at $66.96 per Union Carbide share, or $11.6 billion in the aggregate, including the assumption of $2.3 billion of net debt. According to the agreement, the merger is subject to certain conditions including approval by Union Carbide stockholders and

review by antitrust regulatory authorities in the United States, Europe and Canada. Union Carbide stockholders approved the merger on December 1, 1999. On May 3, 2000, the European Commission approved the merger subject to certain conditions. Antitrust

reviews in the United States and Canada are in progress, with a third quarter 2000 closing anticipated. The transaction is expected to be accounted for as a pooling-of-interests.

RATIO OF EARNINGS TO FIXED CHARGES

| |

|

Six Months

Ended

June 30,

|

|

|

|

|

|

|

|

|

|

|

| |

|

2000

|

|

1999

|

|

1999

|

|

1998

|

|

1997

|

|

1996

|

|

1995

|

| Ratio of Earnings to Fixed Charges |

|

5.2 |

|

4.7 |

|

4.6 |

|

4.0 |

|

5.8 |

|

6.2 |

|

7.0 |

For the purpose of these ratios, earnings consist of income before (i) taxes, (ii) minority interests, (iii)

extraordinary items, (iv) amortization of capitalized interest and (v) fixed charges (adjusted to exclude capitalized interest) and after adjustment for unremitted earnings of 20%-50% owned companies. Fixed charges consist of interest on all indebtedness,

amortization and debt expense, discount or premium and a portion of rentals deemed to represent an interest factor.

USE OF PROCEEDS

We will use the net proceeds from the sale of the Notes for general corporate purposes.

DESCRIPTION OF NOTES

General

The following description of the particular terms of the 7% Notes due August 15, 2005 offered by this prospectus

supplement supplements the description of the general terms and provisions of the debt securities included in the accompanying prospectus. The Notes will be issued under an indenture, dated as of April 1,1992, as supplemented by a supplemental indenture,

dated as of January 1, 1994, and a second supplemental indenture, dated as of October 1, 1999, between us and Bank One Trust Company, NA (as successor in interest to The First National Bank of Chicago), as trustee. The following summary of the Notes is

qualified in its entirety by reference to the description of the debt securities and indenture contained in the accompanying prospectus.

The Notes will mature on August 15, 2005. The Notes will be unsecured obligations and will rank equally with

all of our other unsecured and unsubordinated indebtedness. The Notes will be issued in fully registered form only, in denominations of $1,000 and integral multiples of that amount.

We may, without the consent of the holders of Notes, issue additional notes having the same ranking and the same

interest rate, maturity and other terms as the Notes. Any additional debt securities having such similar terms, together with the Notes, will constitute a single series of debt securities under the indenture.

Interest

We will pay interest on the Notes at a rate of 7% per annum semiannually in arrears on February 15 and August 15

of each year, commencing February 15, 2001, to the persons in whose names the Notes are registered at the close of business on February 1 or August 1, as the case may be (whether or not a Business Day), immediately preceding the relevant interest payment

date. Interest will be computed on the basis of a 360-day year of twelve 30-day months.

If any interest payment date falls on a day that is not a Business Day, the interest payment will be postponed to

the next day that is a Business Day, and no interest on such payment will accrue for the period from and after such interest payment date. If the maturity date of the Notes falls on a day that is not a Business Day, the payment of interest and principal

may be made on the next succeeding Business Day, and no interest on such payment will accrue for the period from and after the maturity date. Interest payments for the Notes will include accrued interest from and including the date of issue or from and

including the last date in respect of which interest has been paid, as the case may be, to, but excluding, the interest payment date or the date of maturity, as the case may be.

As used in this prospectus supplement, “Business Day” means any day, other than a Saturday or Sunday,

that is neither a legal holiday nor a day on which banking institutions are authorized or required by law or regulation to close in The City of New York.

We may not redeem the Notes prior to maturity.

DTC Procedures

Book-entry, Delivery and Form. The Notes will be issued in the form of one or more fully registered notes

which will be deposited with, or on behalf of, DTC and registered in the name of the Cede & Co., DTC’s nominee. Beneficial interests in the Notes will be represented through book-entry accounts of financial institutions acting on behalf of

beneficial owners as direct and indirect participants in DTC. Except as set forth below, the Notes may be transferred, in whole and not in part, only to another nominee of DTC or to a Successor of DTC or its nominee.

DTC has advised us that DTC is a limited-purpose trust company organized under the New York Banking Law, a “

banking organization” within the meaning of the New York Banking Law, a member of the Federal Reserve System, a “clearing corporation” within the meaning of the New York Uniform Commercial Code, and a “clearing agency” registered

pursuant to the provisions of Section 17A of the Securities Exchange Act of 1934, as amended. DTC holds securities deposited with it by its participants and facilitates the settlement of transactions among its participants in those securities through

electronic computerized book-entry changes in accounts of the participants, thereby eliminating the need for physical movement of securities certificates. DTC’s participants include securities brokers and dealers, including the Underwriter, banks,

trust companies, clearing corporations and certain other organizations, some of whom, and/or their representatives, own DTC. Access to the DTC book-entry system is also available to others, such as banks, brokers, dealers and trust companies that clear

through or maintain a custodial relationship with a participant, either directly or indirectly.

According to DTC, the foregoing information with respect to DTC has been provided to the financial community

for informational purposes only and is not intended to serve as a representation, warranty or contract modification of any kind. We make no representation as to the accuracy or completeness of such information.

Individual certificates in respect of the Notes will not be issued in exchange for the Notes, except in very

limited circumstances. If DTC notifies us that it is unwilling or unable to continue as a clearing system in connection with the Notes or ceases to be a clearing agency registered under the Exchange Act, and a successor clearing system is not appointed by

us within 90 days after receiving that notice from DTC or upon becoming aware that DTC is no longer so registered, we will issue or cause to be issued individual certificates in registered form on registration of transfer of, or in exchange for,

book-entry interests in the Notes represented by such Notes upon delivery of such Notes for cancellation.

Title to book-entry interests in the Notes will pass by book-entry registration of the transfer within the

records of DTC, in accordance with its procedures. Book-entry interests in the Notes may be transferred within DTC in accordance with procedures established for this purpose by DTC. A further description of DTC’s procedures with respect to the Notes

is set forth in the prospectus under “Description of Debt Securities—Global Securities”. DTC has confirmed to us, the underwriters and the trustee that it intends to follow those procedures.

Initial settlement for the Notes will be made in immediately available funds. Secondary market trading between

DTC participants will occur in the ordinary way in accordance with DTC’s rules and will be settled in immediately available funds using the DTC’s Same-Day Funds Settlement System.

UNDERWRITING

General

Subject to the terms and conditions of the underwriting agreement between us and the underwriters, we have agreed

to sell to each of Bear, Stearns & Co. Inc., WR Hambrecht + Co, HSBC Securities (USA) Inc. and The Williams Capital Group, L.P., and each such underwriter severally has agreed to purchase from us, $75,000,000 principal amount of the Notes to be

issued. The underwriting agreement provides that the obligations of the underwriters are subject to conditions, including the absence of any material adverse change in our financial condition, and the receipt of certificates, opinions and letters from us

and our counsel and independent accountants. Subject to those conditions, the underwriters are committed to purchase all of the Notes to be issued if any of the Notes are purchased. The underwriters propose to offer the Notes directly to the public at the

offering price set forth on the cover page of this prospectus supplement, and to certain dealers at this price less a concession not in excess of 0.15% of the principal amount of the Notes. Any dealers that participate in the distribution of the Notes may

be deemed to be underwriters within the meaning of the Securities Act of 1933, and any discounts, commissions or concessions received by them, and any provided by the sale of the Notes by them, might be deemed to be underwriting discounts and commissions

under the Securities Act of 1933. After completion of the initial public offering of the Notes, the public offering price and other selling terms may be changed by the underwriters.

The Auction

The method of distribution used by the underwriters in this offering differed from that traditionally employed in

firm commitment underwritten public offerings because the interest rate on the Notes and the allocation of Notes was determined during an auction process conducted by the underwriters participating in this offering.

Potential investors who submitted a bid in the auction were required to meet certain requirements, including

eligibility, account status and size that were established by the underwriters or participating dealers. Conditions for valid conditional offers to purchase, including eligibility standards and account funding requirements of other

underwriters or participating dealers other than Hambrecht, varied. Investors who were approved to participate in the auction were provided with the necessary information, including a password, needed to access the website through which the auction was

conducted. The website provided the following:

|

Ÿ

|

The rules that governed the auction.

|

|

Ÿ

|

Terms applicable to the auction, including:

|

|

Ÿ

|

a reference U.S. Treasury security (the “Benchmark Treasury”);

|

|

Ÿ

|

a minimum and a maximum differential (a “spread”) over the Benchmark Treasury for which bids were accepted;

|

|

Ÿ

|

a maximum rate for the Benchmark Treasury;

|

|

Ÿ

|

the minimum and the maximum principal amount of Notes for which bids could be submitted, and acceptable increments;

|

|

Ÿ

|

the limits within which a bid could be modified without being cancelled; and

|

|

Ÿ

|

the time period during which bids could be made in the auction.

|

|

Ÿ

|

A table that showed other of our outstanding debt securities and the coupons on such debt securities, the year such debt

securities mature and recent market bids for such debt securities presented as spreads over the yields of U.S. Treasuries with comparable maturities. In the alternative, a graph of such information may have been presented which showed the bids for such

debt securities as compared to the remaining term to maturity.

|

|

Ÿ

|

A table that showed debt securities of certain other issuers and the coupons on such debt securities, the year such debt

securities mature, recent market bids for such debt securities presented as spreads to the yields of U.S. Treasuries with comparable maturities and the ratings of such debt securities.

|

|

Ÿ

|

An electronic form for use in submitting a bid, which could have been in either or both of the following two types:

|

|

Ÿ

|

Competitive bids: Investors could specify in a competitive bid two spreads at which they were willing to purchase Notes.

The first spread would have been disclosed in the auction to other bidders on an anonymous basis, whereas the second spread would not have been revealed to other bidders until after the auction ended. This second spread was a conditional offer.

|

|

Ÿ

|

Non-competitive bids: Investors could specify in a non-competitive bid an amount of Notes that they were willing to

purchase and for purposes of such a bid the spread was the minimum spread allowed.

|

|

Ÿ

|

An advisement once a bid was submitted that showed the terms of such bid.

|

|

Ÿ

|

A chart that was updated during the auction showing the total number of bids submitted and the principal amount bid for each

permitted spread.

|

|

Ÿ

|

Notice once the auction was completed by means of an update to the website indicating whether an investor’s bid was accepted.

All Notes sold in the auction bear the same interest rate. This rate was determined by adding the clearing spread to the yield on the Benchmark Treasury at pricing, rounded to an increment determined by the underwriters and us.

|

|

Ÿ

|

After the completion of bidding in the auction, we determined the clearing spread by accepting bids beginning with bids with the

lowest spreads until all the Notes being offered were awarded. The spread on the last bid so accepted was the clearing bid.

|

|

Ÿ

|

If all bids in the auction had been non-competitive and the aggregate principal amount of Notes requested by such bids equaled the

aggregate principal amount of Notes being offered, the clearing spread would have equaled the mid-point between the minimum allowable spread and the maximum allowable spread.

If all bids in the auction had been non-competitive and the aggregate principal amount of Notes requested by such bids had exceeded the aggregate principal amount of Notes being offered, the clearing spread would have equaled the minimum allowable spread.

|

|

Ÿ

|

Once the clearing spread was determined, bids that specified spreads equal to such clearing spread were accepted based on the time

that any such bid was submitted, with earlier bids being accepted first.

|

A bid was considered an agreement to follow and to be bound by the rules governing the auction, and investors

were responsible for all bids made through the use of their password. A bid constituted a conditional offer to purchase the principal amount of Notes specified in such bid at the price indicated on the cover of this prospectus supplement. A conditional

offer to purchase was not binding on a potential investor, and could have been withdrawn at any time until the end of the bidding phase of the auction process. Potential investors were notified after the close of the auction if such conditional offer was

accepted. The underwriters could accept a conditional offer represented by a bid in the auction process once bidding in the auction closed. Upon the closing of the auction, investors whose bids were accepted were notified as soon as is practicable by the

posting of a message to such effect on the auction site or by telephone to inform them that their conditional offers to purchase had been accepted. The principal amount of Notes allocated to an investor who submitted a conditional offer to purchase was

subject to reduction depending on the number of other investors submitting bids with similar terms.

Each participating dealer has agreed with the underwriters to sell the Notes it purchases from the underwriters

in accordance with the auction process described above, unless the underwriters otherwise consent. The underwriters reserve the right to reject bids that they deem manipulative or disruptive in order to facilitate the orderly completion of this offering,

and they reserve the right, in exceptional circumstances, to alter this method of allocation as they deem necessary to ensure a fair and orderly distribution of the Notes. For example, bids may be rejected or reduced by the underwriters or participating

dealers based on eligibility or creditworthiness criteria. In addition, the underwriters or the participating dealers may reject or reduce a bid by a prospective investor who has engaged in practices that could have a manipulative, disruptive or otherwise

adverse effect upon the offering.

In connection with the offering, persons participating in the offering may purchase Notes in the open market.

These transactions may include short sales, stabilizing transactions in accordance with Rule 104 of Regulation M under the Securities Exchange Act of 1934, as amended, and purchases to cover positions created by short sales. Short sales involve the sale

by the underwriters of a greater number of Notes than they are required to purchase in the offering which creates a syndicate short position. Stabilizing transactions consist of certain bids or purchases made for the purpose of preventing or retarding a

decline in the market price of the Notes. The underwriters also may impose a penalty bid. This occurs when a particular underwriter repays to the underwriters a portion of the underwriting discount received by it because the representative has repurchased

Notes sold by or for the account of such underwriter in stabilizing or short covering transactions. These activities by the underwriters may stabilize, maintain or otherwise affect the market price of the Notes. As a result, the price of the Notes may be

higher than the price that otherwise might exist in the open market. If these activities are commenced, they may be discontinued by the underwriters at any time. These transactions may be effected in the over-the-counter market or otherwise.

We estimate that our share of the total expenses of the offering, excluding underwriting discounts and

commissions, will be approximately $128,400.

We have agreed to indemnify the underwriters against certain liabilities, including liabilities under the

Securities Act of 1933, as amended.

Certain underwriters currently intend to act as market makers for the Notes following this offering. However,

such underwriters are not obligated to do so and may discontinue any market making at any time.

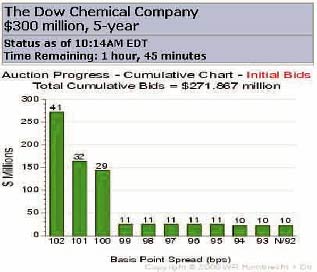

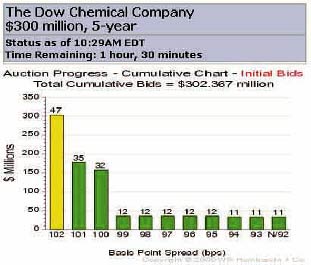

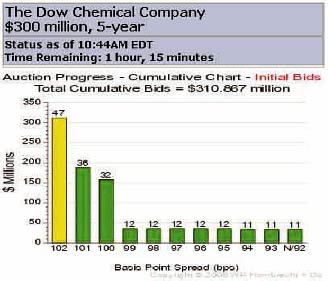

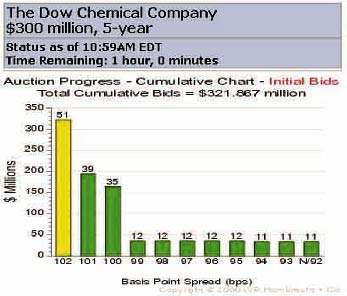

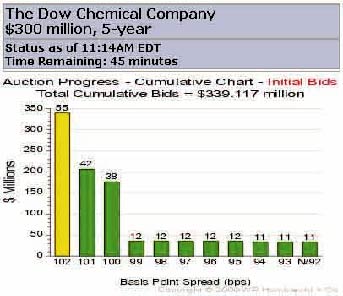

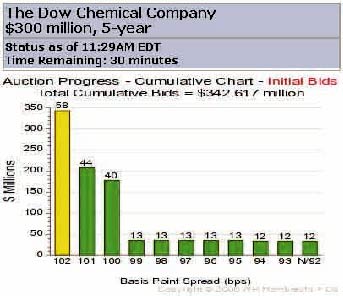

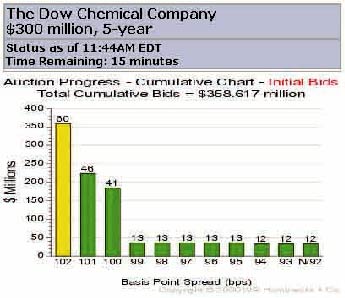

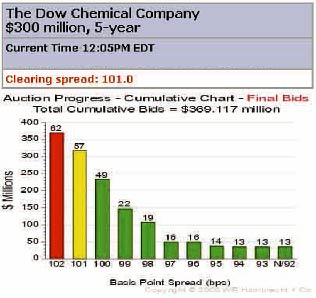

Representative Auction Screens

The auction was conducted from 10:00 a.m. to 12:00 p.m., New York City time, on August 15, 2000. Set forth below

are representative reproductions of the Auction Summary, at 15 minute intervals, which appeared on the Auction Screen.

VALIDITY OF NOTES

The validity of the Notes will be passed upon for Dow by John Scriven, Esq., Dow’s Vice President, General

Counsel and Secretary. Certain legal matters will be passed upon for Dow by Mayer, Brown & Platt, Chicago, Illinois. As of July 31, 2000, Mr. Scriven beneficially owned 36,582 shares, and held options to purchase 415,527 shares, of Dow common stock,

of which options to purchase 220,000 shares of Dow common stock were exercisable. Brown & Wood LLP

, New York, New York, will pass on certain matters for the underwriters.

PROSPECTUS

The Dow Chemical Company

By this prospectus, Dow may offer from time to time a total of up to $2,500,000,000 of securities, which may

include up to:

|

$212,500,000 of common stock

|

|

$212,500,000 of preferred stock

|

|

$212,500,000 of warrants to purchase common stock

|

|

$212,500,000 of warrants to purchase preferred stock

|

|

$1,062,500,000 of debt securities

|

|

$1,062,500,000 of warrants to purchase debt securities

|

Dow will provide you with the specific terms and the public offering prices of these securities in supplements to

this prospectus. You should read this prospectus and the prospectus supplements carefully before you invest. This prospectus may not be used to offer and sell securities unless accompanied by a prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of

these securities or determined if this prospectus is truthful and complete. Any representation to the contrary is a criminal offense.

This prospectus is dated August 15, 2000

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that Dow filed with the Securities and Exchange Commission

under the shelf registration process. Dow may sell common stock, preferred stock, warrants to purchase common stock and warrants to purchase preferred stock for up to $1,650,000,000 and debt securities and warrants to purchase debt securities for up to

$2,500,000,000 under this prospectus. The total sales of all securities sold under this prospectus, however, may not exceed $2,500,000,000. This prospectus provides you with a general description of the securities Dow may offer. Each time Dow sells

securities, Dow will provide a prospectus supplement that will contain specific information about the terms of that offering. The prospectus supplement may also add, update or change information contained in this prospectus. You should read both this

prospectus and any prospectus supplement together with additional information described under the heading “Where You Can Find More Information.”

THE DOW CHEMICAL COMPANY

Dow manufactures and sells chemicals, plastic materials, agricultural and other specialized products and

services. Dow is a global science and technology-based company that develops and manufactures a portfolio of chemicals, plastics and agricultural products and services for customers in 168 countries around the world. Dow conducts its operations through

subsidiaries and 14 global businesses, including 123 manufacturing sites in 32 countries, and supplies more than 3,500 products through the efforts of 39,000 employees. Dow’s corporate offices are located at 2030 Dow Center, Midland, Michigan 48674,

and Dow’s telephone number is (517) 636-1000.

Additional information concerning Dow and its subsidiaries is included in the documents filed with the Securities

and Exchange Commission and incorporated in this prospectus by reference. See the discussion under the heading “Where You Can Find More Information.”

USE OF PROCEEDS

Dow will use the net proceeds from the sale of the securities for general corporate purposes.

DESCRIPTION OF CAPITAL STOCK

The following summary of common stock and preferred stock of Dow does not purport to be complete and is subject

to, and qualified in its entirety by reference to, the relevant provisions of Delaware law, and by Dow’s certificate of incorporation and bylaws, which are incorporated by reference as exhibits to the registration statement of which this prospectus

is a part.

Dow is authorized to issue 1,750,000,000 shares of all classes of stock, 1,500,000,000 of which are shares of

common stock, par value $2.50 per share, and 250,000,000 of which are shares of preferred stock. As of

June 30, 2000, there were 678,216,512 shares of common stock issued and outstanding and no shares of preferred stock issued or outstanding. All issued and outstanding shares of common stock are fully paid and nonassessable. Any additional shares of

common stock and preferred stock that Dow issues will be fully paid and nonassessable. Neither Dow’s common stockholders nor preferred stockholders have preemptive rights.

Common Stock

Dow’s certificate of incorporation provides that, subject to all of the rights of holders of preferred stock

provided for by the board of directors or by Delaware corporate law, the holders of common stock will have full voting rights on all matters requiring stockholder action, with each share of common stock being entitled to one vote and having equal rights

of participation in the dividends and assets of Dow.

Dow’s certificate of incorporation divides Dow’s board of directors into three classes of directors

that are as nearly equal in number as possible with three-year terms. As a result, approximately one-third of Dow’s board of directors is elected each year. A quorum of directors consists of a majority of Dow’s entire board of directors then

holding office.

|

Number, Filling of Vacancies and Removal of Directors

|

Dow’s certificate of incorporation and bylaws provide that its board of directors may not have less than six

or more than twenty-one members. The actual number of directors is determined by a vote of a majority of Dow’s entire board of directors. Currently, Dow has fifteen members on its board of directors. Vacancies on Dow’s board of directors and any

newly created directorships are filled by a vote of the majority of the other directors then in office. Directors elected to fill a vacancy or a new position hold office until the next annual meeting of stockholders. Directors can be removed only for

cause and only by the vote of stockholders holding 80% of the voting power of Dow’s outstanding stock entitled to vote generally in the election of directors, voting together as a single class.

Delaware corporate law generally provides that a corporation, subject to restrictions in its certificate of

incorporation, including preferred stockholders’ rights to receive dividends prior to common stockholders, may declare and pay dividends out of:

|

Ÿ

|

net profits for the fiscal year in which the dividend is declared and/or the preceding fiscal year, if there is no surplus.

|

Dividends may not be paid out of net profits so long as the capital of the corporation is less than the aggregate amount of capital represented by the issued and outstanding

stock of all classes having a preference on the distribution of assets. Dividends on Dow common stock are not cumulative. Dow’s certificate of incorporation does not contain any additional restrictions on the declaration or payment of dividends.

|

Special Meetings of Stockholders

|

Dow’s bylaws provide that a special stockholders’ meeting for any purpose may be called only by the

board of directors by a resolution adopted by a majority of the entire board:

|

Ÿ

|

upon motion of a director; or

|

|

Ÿ

|

upon written request of stockholders holding at least 50% of the voting power of the shares of capital stock outstanding and

entitled to vote generally in the election of directors.

|

Stockholder notices requesting a special meeting must be given to Dow’s secretary. The notice must include,

as to each matter the stockholder proposes to bring before the meeting:

|

Ÿ

|

the name and address of the stockholder;

|

|

Ÿ

|

the class or series and number of shares of capital stock that are beneficially owned by the stockholder;

|

|

Ÿ

|

a brief description of the business to be brought before the meeting, including the text of any proposed amendment to the

certificate of incorporation or bylaws;

|

|

Ÿ

|

a description of all arrangements or understandings between the stockholder and any other persons related to the business proposal;

|

|

Ÿ

|

any material business interests of the stockholder in the business proposal; and

|

|

Ÿ

|

a representation that the stockholder intends to appear in person or by proxy at the meeting to bring the business before the

meeting.

|

|

Advance Notice Provisions for Stockholder Proposals Other than Election of Directors

|

Dow’s bylaws provide that a stockholder may bring business before an annual stockholders’ meeting if

the stockholder is a stockholder on the record date of giving notice and on the record date of the meeting and gives notice to Dow’s secretary of business that is proper to be brought at the meeting under Delaware corporate law:

|

Ÿ

|

no earlier than 120 days or later than 60 days before the anniversary date of the first mailing of proxy materials for the last

annual meeting; or

|

|

Ÿ

|

if the annual meeting is more than 30 days before or after the anniversary date of the last annual meeting, Dow must receive the

stockholder’s notice no later than the close of business on the 10th day after the earlier of the date on which notice of the annual meeting date was mailed or publicly disclosed.

|

The notice must include the same information required to be included in a stockholder’s notice in connection

with requesting a special meeting. See the section of this prospectus captioned “Special Meetings of Stockholders.”

|

Advance Notice Provisions for Stockholder Nominations of Directors at an Annual Meeting

|

Dow’s bylaws provide that a stockholder may nominate a person for election to the board of directors at an

annual stockholders’ meeting if the stockholder gives notice to Dow’s secretary:

|

Ÿ

|

no more than 120 days and no less than 60 days before the anniversary date of the first mailing of proxy materials for the last

annual meeting; or

|

|

Ÿ

|

if the annual meeting is more than 30 days before or after the anniversary date of the last annual meeting, Dow must receive the

stockholder’s notice no later than the close of business on the 10th day after the earlier of the day on which notice of the annual meeting date was mailed or publicly disclosed.

|

The notice must include the following:

|

Ÿ

|

a description of all arrangements or understandings between the stockholder and the nominee and any other person pursuant to which

the nomination is made;

|

|

Ÿ

|

the information regarding the nominee that would have been required to be included in a proxy statement filed under the proxy

rules of the Securities and Exchange Commission if the nominee had been nominated by the board of directors;

|

|

Ÿ

|

the consent of the nominee to serve as a director if he or she is elected; and

|

|

Ÿ

|

the information required to be included in a stockholder’s notice in connection with requesting a special meeting. See the

section of this prospectus captioned “Special Meetings of Stockholders.”

|

|

Advance Notice Provisions for Stockholder Nominations of Directors at a Special Meeting

|

Dow’s bylaws provide that a stockholder may nominate a person for election to the board of directors at a

special meeting of stockholders if the stockholder gives Dow’s secretary notice of the nomination no later than the close of business on the seventh day after notice of the special meeting is first given to stockholders.

In addition to the information required to be included in a stockholder’s notice in connection with a

special meeting, the notice must include the same information that would be required to nominate a person for election as a director at an annual meeting. See the section of this prospectus captioned “Advance Notice Provisions for Stockholder

Nominations of Directors at an Annual Meeting.”

|

Stockholder Action by Written Consent

|

Under Delaware corporate law, unless otherwise provided in a corporation’s certificate of incorporation, any

action required or permitted to be taken at an annual or special stockholders’ meeting may be taken by

written consent, without a meeting, prior notice or a vote. The written consent must be signed by holders of outstanding stock having the minimum number of votes necessary to authorize or take such action at a meeting at which all shares entitled to vote

on the matter were present and voted. Dow’s certificate of incorporation, however, provides that any action required or permitted to be taken by the stockholders must be taken at a duly called annual or special stockholders’ meeting and may not

be taken by written consent.

|

Transactions with Interested Stockholders and a Merger or Sale of Assets

|

Delaware corporate law requires the approval of the board of directors and a majority of a corporation’s

outstanding stock entitled to vote to authorize a merger or consolidation unless the company’s certificate of incorporation requires a greater percentage. Unless required by a corporation’s certificate of incorporation, stockholder approval,

however, is not required in certain cases, such as where:

|

Ÿ

|

either no shares of common stock of the surviving corporation and no shares, securities or obligations convertible into common

stock are to be issued or delivered in the merger; or

|

|

Ÿ

|

the authorized and unissued shares or the treasury shares of common stock of the surviving corporation to be issued or delivered

in the merger, plus those initially issuable upon conversion of any other shares, securities or obligations to be issued or delivered in the merger;

|

do not exceed 20% of the shares of common stock of the corporation outstanding immediately prior to the effective date of the merger. A sale of all or substantially all of a

Delaware corporation’s assets or a voluntary dissolution of a Delaware corporation requires the vote of a majority of the board of directors and a majority of the corporation’s outstanding shares entitled to vote on the matter unless the

company’s certificate of incorporation requires a greater percentage. Dow’s certificate of incorporation does not require a greater percentage, except as described below.

Delaware corporate law generally defines an interested stockholder as a person, other than the corporation and

any direct or indirect majority owned subsidiary of the corporation:

|

Ÿ

|

who is the direct or indirect owner of 15% or more of the outstanding voting stock of the corporation; or

|

|

Ÿ

|

is an affiliate or associate of the corporation and was the direct or indirect owner of 15% or more of the outstanding voting

stock of the corporation at any time within the three-year period immediately prior to the date it asked for determination of its status as an interested stockholder; and

|

|

Ÿ

|

the affiliates and associates of that person.

|

Delaware corporate law prohibits an interested stockholder from engaging in a business combination with the

Delaware corporation for three years following the time of becoming an interested stockholder. This three-year waiting period does not apply when:

|

Ÿ

|

prior to the time of becoming an interested stockholder, the board of directors approves either the business combination or the

transaction that resulted in the stockholder becoming an interested stockholder;

|

|

Ÿ

|

as a result of becoming an interested stockholder, the stockholder owned, excluding shares owned by directors who are also

officers and certain employee stock plans, at least 85% of the outstanding voting stock of the corporation at the time the transaction began; or

|

|

Ÿ

|

at or after the time of becoming an interested stockholder, the business combination is approved by the board of directors and

authorized at a meeting of stockholders by a vote of at least two-thirds of the outstanding voting stock that is not owned by the interested stockholder.

|

These restrictions also do not apply in certain other circumstances, including business combinations with an

interested stockholder that are proposed after a public announcement of and prior to the consummation or abandonment of:

|

Ÿ

|

certain mergers or consolidations;

|

|

Ÿ

|

sales of 50% or more of the aggregate market value of a corporation’s assets or outstanding voting stock; or

|

|

Ÿ

|

tender offers or exchange offers for 50% or more of a corporation’s voting stock.

|

Delaware corporate law allows a corporation to specify in its certificate of incorporation or bylaws that it will

not be governed by the section relating to transactions with interested stockholders. Dow has not made that election in its certificate of incorporation or bylaws.

Dow’s certificate of incorporation provides that, in addition to the vote required pursuant to Delaware

corporate law, the vote of stockholders owning at least 80% of the voting power of the shares of capital stock entitled to vote generally in the election of directors, voting together as a single class, is required to approve any of the following business

combination transactions:

|

Ÿ

|

a merger or consolidation of Dow or a subsidiary of which Dow ultimately owns 50% or more of the capital stock with:

|

|

—

|

an interested stockholder; or

|

|

—

|

any other individual or entity that, after the merger or consolidation, would be an affiliate or associate of an interested

stockholder;

|

|

Ÿ

|

a sale, lease, exchange, mortgage, pledge, transfer or other disposition, in one or more transactions with or on behalf of an

interested stockholder or an affiliate or associate of an interested stockholder, of any assets of Dow or any subsidiary of Dow that constitutes 5% or more of Dow’s total consolidated assets as of the end of the most recent quarter;

|

|

Ÿ

|

the issuance or transfer by Dow or any of its subsidiaries of any securities of Dow or its subsidiaries in one or more

transactions to, or proposed by or on behalf of, an interested stockholder or an affiliate or associate of an interested stockholder in exchange for cash, securities or other property constituting not less than 5% of Dow’s consolidated total assets

as of the end of the most recent quarter;

|

|

Ÿ

|

the adoption of a plan or proposal for liquidation or dissolution of Dow or any spin-off or split-up of any kind of Dow or any

subsidiary of Dow that is proposed by or on behalf of an interested stockholder or an affiliate or associate of an interested stockholder; or

|

|

Ÿ

|

any reclassification of securities or recapitalization of Dow, or any merger or consolidation of Dow with a subsidiary of Dow or

other transaction that has the direct or indirect effect of increasing the percentage of the outstanding shares of:

|

|

—

|

any class of equity securities of Dow or any subsidiary of Dow; or

|

|

—

|

any class of securities of Dow or any subsidiary that are convertible into equity securities of Dow or any subsidiary that are

owned directly or indirectly by an interested stockholder and all of its affiliates and associates.

|

However, the vote of only a majority of the stockholders entitled to vote generally in the election of directors,

voting together as a single class, is required to approve a business combination transaction that:

|

Ÿ

|

has been approved by a majority of continuing directors, even if they constitute less than a quorum; or

|

|

Ÿ

|

meets certain price and consideration conditions and procedures.

|

A “continuing director” is:

|

—

|

any member of the board of directors who is not an interested stockholder involved in a business combination described above or

an affiliate, associate, employee, agent or nominee of an interested stockholder or relative of any of the foregoing persons, and was a member of the board before the interested stockholder became an interested stockholder; or

|

|

—

|

a successor of a director described above who is recommended or elected to succeed a director described above by the vote of a

majority of such directors then on the board.

|

Dow’s certificate of incorporation defines an interested stockholder as any person or entity other than

Dow, any subsidiary of Dow or any employee benefit plan of Dow or a subsidiary of Dow, that:

|

Ÿ

|

is, or was at any time within the two-year period prior to the date in question, the direct or indirect beneficial owner of 10% or

more of the voting power of the then-outstanding voting stock of Dow;

|

|

Ÿ

|

is an affiliate of Dow and, at any time within the two-year period immediately prior to the date in question, was the direct or

indirect beneficial owner of 10% or more of the voting power of the outstanding voting stock of Dow; or

|

|

Ÿ

|

is an assignee of, or has otherwise succeeded to, any shares of voting stock of Dow of which an interested stockholder was the

direct or indirect beneficial owner, at any time within the two-year period immediately prior to the date in question, if such assignment or succession occurred in the course of a transaction or series of transactions not involving a public offering under

the Securities Act of 1933.

|

For purposes of determining whether a person is an interested stockholder, the outstanding voting stock of Dow

includes unissued shares of voting stock of Dow beneficially owned by the interested stockholder but not other shares of voting stock of Dow that may be issuable pursuant to an agreement, arrangement or understanding or upon the exercise of conversion

rights, warrants or options, or otherwise, to any person who is not an interested stockholder.

Preferred Stock

Dow’s board of directors is authorized, subject to Delaware corporate law and without a vote of its

stockholders, to issue shares of preferred stock from time to time in one or more series and to determine the voting rights, designations, preferences and relative, participating, optional or other special rights and qualifications, limitations and

restrictions of any series of preferred stock. The prospectus supplement relating to an offering of shares of Dow’s preferred stock will describe the terms of the series of preferred stock Dow is offering.

DESCRIPTION OF DEBT SECURITIES

The following description of the debt securities summarizes the material terms and provisions of the debt

securities to which a prospectus supplement may relate. Each time Dow offers debt securities, the prospectus supplement related to that offering will describe the terms of the debt securities Dow is offering.

The debt securities will be issued under an indenture, dated as of April 1, 1992, as supplemented by a

supplemental indenture, dated as of January 1, 1994, and a second supplemental indenture dated as of October 1, 1999, between Dow and Bank One Trust Company, NA (successor in interest to The First National Bank of Chicago), as trustee. The indenture as

supplemented by the supplemental indentures is referred to in this section as the “indenture.” The following summary of the debt securities and the indenture does not purport to be complete and is subject to the provisions of the indenture,

including the defined terms. Whenever Dow refers to particular sections, articles or defined terms of the indenture, those sections, articles or defined terms are incorporated by reference in this prospectus and prospectus supplement. You should review

the indenture that is filed as exhibits to the registration statement for additional information.

General

Dow may issue debt securities from time to time in one or more series without limitation as to aggregate

principal amount. The indenture does not limit the amount of other indebtedness or securities which Dow may issue.

The debt securities will be unsecured obligations and will rank equally with all of Dow’s other unsecured

and unsubordinated indebtedness.

The prospectus supplement will describe the following terms of the debt securities Dow is offering:

|

Ÿ

|

the title of the debt securities or the series in which the debt securities will be included;

|

|

Ÿ

|

any limit on the aggregate principal amount of the debt securities of that series;

|

|

Ÿ

|

whether the debt securities may be issued as registered securities or bearer securities or both, whether any of the debt

securities may be issued initially in temporary global form and whether any of the debt securities may be issued in permanent global form;

|

|

Ÿ

|

the price or prices at which the debt securities will be issued;

|

|

Ÿ

|

the date or dates on which the principal amount of the debt securities is payable;

|

|

Ÿ

|

the interest rate or rates, or the formula by which the interest rate or rates will be determined, if any, and the dates from

which any interest will accrue;

|

|

Ÿ

|

the interest payment dates on which any interest will be payable, the regular record date for any interest payable on any debt

securities that are registered securities on any interest payment date, and the extent to which, or the manner in which, any interest payable on a global security on an interest payment date will be paid if different from the manner described below under

the section of this prospectus captioned “Global Securities”;

|

|

Ÿ

|

any mandatory or optional sinking fund or analogous provisions;

|

|

Ÿ

|

each office or agency where the principal of and any premium and interest on the debt securities will be payable and each office

or agency where the debt securities may be presented for registration of transfer or exchange;

|

|

Ÿ

|

the date, if any, after which and the price or prices at which the debt securities may, pursuant to any optional or mandatory

redemption provisions, be redeemed, in whole or in part, and the other detailed terms and provisions of any optional or mandatory redemption provisions;

|

|

Ÿ

|

the denominations in which Dow may issue any debt securities which are registered securities, if other than denominations of

$1,000 and any integral multiple thereof, and the denominations in which Dow may issue any debt securities which are bearer securities, if other than denominations of $5,000;

|

|

Ÿ

|

the currency or currencies of payment of principal of and any premium and interest on the debt securities;

|

|

Ÿ

|

any index used to determine the amount of payments of principal of and any premium and interest on the debt securities;

|

|

Ÿ

|

any additional covenants applicable to the debt securities; and

|

|

Ÿ

|

any other terms and provisions of the debt securities not inconsistent with the terms and provisions of the indenture.

|

The prospectus supplement also will describe any special provisions for the payment of additional amounts with

respect to the debt securities.

If the purchase price of any of the debt securities is denominated in one or more foreign currencies or currency

units or if the principal of, or any premium and interest on, any series of debt securities is payable in one or more foreign currencies or currency units, the restrictions, elections, general tax considerations, specific terms and other information with

respect to such debt securities and such foreign currency or currency units will be set forth in the related prospectus supplement.

Some of the debt securities may be issued as original issue discount securities (bearing no interest or bearing

interest at a rate which at the time of issuance is below market rates) to be sold at a substantial discount below their principal amount. The prospectus supplement will describe the federal income tax considerations and other special considerations which

apply to any original issue discount securities.

Denominations, Registration and Transfer

The debt securities may be issued as registered securities, bearer securities or both. Debt securities may be

issued in the form of one or more global securities, as described below under the section of this prospectus captioned “Global Securities.” Unless otherwise provided in the prospectus supplement, registered securities denominated in U.S. dollars

will be issued only in denominations of $1,000 or any integral multiple thereof and bearer securities denominated in U.S. dollars will be issued only in denominations of $5,000 with coupons attached. A global security will be issued in a denomination

equal to the aggregate principal amount of outstanding debt securities represented by that global security. The prospectus supplement relating to debt securities denominated in a foreign or composite currency will specify the denominations in which the

debt securities will be issued.

During the “restricted period” as defined in Treasury Regulation Section 1.163-5(c)(2)(i)(D)(7), no

bearer security will be mailed or otherwise delivered to any location in the United States and a bearer security may be delivered during such restricted period only if the person entitled to receive the bearer security furnishes proper written

certification that the bearer security is owned by:

|

Ÿ

|

a person that is not a U.S. person;

|

|

Ÿ

|

a qualifying foreign branch of a U.S. financial institution; or

|

|

Ÿ

|

a U.S. person who acquired the obligation through the qualifying foreign branch of a U.S. financial institution and holds the

obligation through that qualifying foreign branch of a U.S. financial institution on the date of certification; or

|

|

Ÿ

|

a financial institution for resale during the restricted period but not for resale directly or indirectly to a U.S. person or to a

person within the United States or its possessions.

|

Registered securities of any series may be exchanged for other registered securities of the same series and of a

like aggregate principal amount and tenor of different authorized denominations. In addition, if debt securities of any series may be issued as both registered securities and as bearer securities, at the option of the holder upon written request, and

subject to the terms of the indenture, bearer securities (with all unmatured coupons, except as provided below, and all matured coupons in default attached) of such series may be exchanged for registered securities of the same series of any authorized

denominations and of a like aggregate principal amount and tenor. Unless otherwise indicated in the prospectus supplement, any bearer security surrendered in exchange for a registered security between a record date and the relevant date for payment of

interest will be surrendered without the coupon relating to the date for payment of interest attached, and interest may be paid only to the holder of such coupon when due in accordance with the terms of the indenture. Except as indicated in the prospectus

supplement, bearer securities will not be issued in exchange for registered securities.

Debt securities may be presented for exchange as described in the previous paragraph, and registered securities,

other than a global security, may be presented for registration of transfer, with the form of transfer duly executed, at the office of the security registrar designated by Dow or at the office of any transfer agent designated by Dow for that purpose,

without service charge and upon payment of any taxes and other governmental charges as described in the indenture. The transfer or exchange will be effected when the security registrar or the transfer agent is satisfied with the documents of title and

identity of the person making the request. Dow has initially appointed the trustee as the security registrar under the indenture. If a prospectus supplement refers to any transfer agent initially designated by Dow with respect to any series of debt

securities, Dow may at any time cancel the designation of the transfer agent or approve a change in the location through which such transfer agent acts, except that:

|

Ÿ

|

if debt securities of a series may be issued only as registered securities, Dow will be required to maintain a transfer agent in

each place of payment for such series; and

|

|

Ÿ

|

if debt securities of a series are issuable as bearer securities, Dow will be required to maintain (in addition to the security

registrar) a transfer agent in a place of payment for such series located outside the United States.

|

Dow may at any time designate additional transfer agents with respect to any series of debt securities.

In the event of any redemption in part, Dow will not be required to:

|

Ÿ

|

issue, register the transfer of or exchange debt securities of any series during a period beginning at the opening of business 15

days before the date of the mailing of a notice of redemption of debt securities of that series selected to be redeemed and ending at the close of business on:

|

|

—

|

if debt securities of the series may be issued only as registered securities, the day of mailing of the relevant notice of

redemption; and

|

|

—

|

if debt securities of the series may be issued as bearer securities, the day of the first publication of the notice of redemption

or, if debt securities of the series also may be issued as registered securities and there is no publication, the mailing of the relevant notice of redemption;

|

|

Ÿ

|

register the transfer of or exchange any registered security or portion of any registered security called for redemption, except

the unredeemed portion of any registered security being redeemed in part; or

|

|

Ÿ

|

exchange any bearer security called for redemption, except to exchange the bearer security for a registered security of that

series and like tenor which is immediately surrendered for redemption.

|

Payments and Paying Agents

Unless otherwise indicated in the prospectus supplement, Dow will pay the principal of and any premium and

interest on registered securities other than a global security at the office of one or more paying agents designated by Dow. At Dow’s option, however, Dow may pay any interest by check mailed to the address of the payee entitled to the interest at

the address which appears in the security register. Unless otherwise indicated in the prospectus supplement, payment of any installment of interest on registered securities will be made to the person in whose name the registered security is registered at

the close of business on the record date for such interest payment.

Unless otherwise indicated in the prospectus supplement, Dow may pay the principal of and any premium and

interest on bearer securities, subject to applicable laws and regulations, at the offices of one or more paying agents outside the United States designated by Dow. At Dow’s option, however, Dow may pay any interest by check or by wire transfer to an

account maintained by the payee outside the United States. Unless otherwise indicated in the prospectus supplement, payment of interest on bearer securities on any interest payment date will be made only upon surrender of the coupon relating to such

interest payment date. No payment with respect to any bearer security will be made at any office or agency of Dow in the United States by check mailed to any address in the United States or by transfer to an account maintained in the United States.

Payments will not be made in respect of bearer securities or coupons related to such bearer securities upon presentation to or any other demand for payment from Dow or its paying agents within the United States. Dow will pay the principal of and any

premium and interest on bearer securities denominated and payable in U.S. dollars, however, at the office of Dow’s paying agent in the United States if, and only if:

|

Ÿ

|

payment of the full amount in U.S. dollars at all offices or agencies outside the United States is illegal or effectively

precluded by exchange controls or other similar restrictions; and

|

|

Ÿ

|

Dow has delivered to the trustee an opinion of counsel to that effect.

|

Unless otherwise indicated in the prospectus supplement, the principal office of the trustee in New York City

will be Dow’s sole paying agent for payments with respect to debt securities which may be issued only as registered securities. Any paying agent outside the United States and any other paying agent in the United States initially designated by Dow for

the debt securities will be named in the prospectus supplement. Dow may at any time designate additional paying agents, or cancel the designation of any paying agent or approve a change in the office through which any paying agent acts, except that:

|

Ÿ

|

if debt securities of a series may be issued only as registered securities, Dow will be required to maintain a paying agent in

each place of payment for such series; and

|

|

Ÿ

|

if debt securities of a series may be issued as bearer securities, Dow will be required to maintain:

|

|

—

|

a paying agent in each place of payment for such series in the United States for payments with respect to any registered

securities of such series and for payments with respect to bearer securities of such series in the circumstances described above;

|

|

—

|

a paying agent in each place of payment located outside the United States where debt securities of such series and any coupons

related to the debt securities may be presented and surrendered for payment, provided that if the debt securities of such series are listed on The International Stock Exchange, London or the Luxembourg Stock Exchange or any other stock exchange located

outside the United States and such stock exchange so requires, Dow will maintain a paying agent in London or Luxembourg City or any other required city located outside the United States for debt securities of such series; and

|

|

—

|

a paying agent in each place of payment located outside the United States where, subject to applicable laws and regulations,

registered securities of such series may be surrendered for registration of transfer or exchange and where notices and demands to or upon Dow may be served.

|

All amounts paid by Dow to a paying agent for the payment of principal of and any premium and interest on any

debt security that remain unclaimed at the end of two years after the principal, premium or interest has become due and payable will be repaid to Dow and after such repayment the holder of the debt security or any coupon related to the debt security may

look only to Dow for the payment of principal of and any premium and interest on any such debt security.

Global Securities

The debt securities of a series may be issued in whole or in part in the form of one or more global securities

that will be deposited with, or on behalf of, a depositary identified in the prospectus supplement. Global securities may be issued in either registered or bearer form and in either temporary or permanent form. Unless and until it is exchanged for debt

securities in definitive form, a temporary global security in registered form may not be transferred except as a whole by:

|

Ÿ

|

the depositary for such global security to a nominee of such depositary;

|

|

Ÿ

|

a nominee of the depositary for such global security to such depositary or another nominee of such depositary; or

|

|

Ÿ

|

the depository for such global security or any such nominee to a successor of such depositary or a nominee of such successor.

|

Unless otherwise indicated in the prospectus supplement, registered debt securities issued in global form will be

represented by one or more global securities deposited with, or on behalf of, The Depository Trust Company, New York, New York, or other depositary Dow appoints and registered in the name of the depository or its nominee. The debt securities will not be

issued in definitive form unless otherwise provided in the prospectus supplement.

DTC will act as securities depository for the securities. The debt securities will be issued as fully-registered

securities registered in the name of Cede & Co. (DTC’s partnership nominee). One fully-registered global security will be issued with respect to each $200 million of principal amount and an additional certificate will be issued with respect to

any remaining principal amount of debt securities.

DTC is a limited-purpose trust company organized under the New York Banking Law, a “banking o

rganization” within the meaning of the New York Banking Law, a member of the Federal Reserve System, a “clearing corporation” within the meaning of the New York Uniform Commercial Code, and a “clearing agency” registered pursuant

to the provisions of Section 17A of the Securities Exchange Act of 1934. DTC holds securities that its participants deposit with DTC. DTC also facilitates the settlement among participants of

securities transactions, such as transfers and pledges, in deposited securities through electronic computerized book-entry changes in participants’ accounts, thereby eliminating the need for physical movement of securities certificates. Direct

participants include securities brokers and dealers, banks, trust companies, clearing corporations, and certain other organizations. DTC is owned by a number of its direct participants and by the New York Stock Exchange, Inc., the American Stock Exchange,

Inc., and the National Association of Securities Dealers, Inc. Access to the DTC system is also available to indirect participants such as securities brokers and dealers, banks, and trust companies that clear through or maintain a custodial relationship

with a direct participant, either directly or indirectly. The rules applicable to DTC and its participants are on file with the SEC.

Purchases of debt securities under the DTC system must be made by or through direct participants, which will

receive a credit for the debt securities on DTC’s records. The ownership interest of each actual purchaser of each debt security is in turn to be recorded on the direct and indirect participants’ records. These beneficial owners will not receive

written confirmation from DTC of their purchase, but beneficial owners are expected to receive a written confirmation providing details of the transaction, as well as periodic statements of their holdings, from the direct or indirect participants through

which the beneficial owner entered into the transaction. Transfers of ownership interests in the debt securities are to be accomplished by entries made on the books of participants acting on behalf of beneficial owners. Beneficial owners will not receive

certificates representing their ownership interests in debt securities, except in the event that use of the book-entry system for the debt securities is discontinued.

To facilitate subsequent transfers, all debt securities deposited by participants with DTC are registered in the

name of DTC’s partnership nominee, Cede & Co. The deposit of debt securities with DTC and their registration in the name of Cede & Co. will effect no change in beneficial ownership. DTC has no knowledge of the actual beneficial owners of the

debt securities; DTC’s records reflect only the identity of the direct participants to whose accounts the debt securities are credited, which may or may not be the beneficial owners. The participants will remain responsible for keeping account of

their holdings on behalf of their customers.

Delivery of notices and other communications by DTC to direct participants, by direct participants to indirect

participants, and by direct participants and indirect participants to beneficial owners will be governed by arrangements among them, subject to any statutory or regulatory requirements as may be in effect from time to time.

Redemption notices will be sent to DTC. If less than all of the debt securities within an issue are being

redeemed, DTC’s practice is to determine by lot the amount of the interest of each direct participant in such issue to be redeemed.

Neither DTC nor Cede & Co will consent or vote with respect to debt securities. Under its usual procedures,

DTC mails an omnibus proxy to Dow as soon as possible after the record date. The omnibus proxy assigns Cede & Co.’s consenting or voting rights to those direct participants to whose accounts the debt securities are credited on the record date

(identified in a listing attached to the omnibus proxy).

Principal and interest payments, if any, on the debt securities will be made to Cede & Co., as nominee of

DTC. DTC’s practice is to credit direct participants’ accounts, upon DTC’s receipt of funds and corresponding detail information from Dow or the trustee, on the applicable payable date in accordance with their respective holdings shown on

DTC’s records. Payments by participants to beneficial owners will be governed by standing instructions and customary practices, as is the case with securities held for the accounts of customers in bearer form or registered in “street name,”

and will be the responsibility of that participant and not of DTC, the trustee or Dow, subject to any statutory or regulatory requirements as may be in effect from time to time. Payment of principal and interest to Cede & Co. is Dow’s

responsibility or the trustee’s, disbursement of payments to direct participants shall be the responsibility of DTC, and disbursement of payments to beneficial owners is the responsibility of direct and indirect participants.

A beneficial owner must give notice to elect to have its debt securities purchased or tendered, through its

participant, to a tender agent, and shall effect delivery of debt securities by causing the direct participants to transfer the participant’s interest in the debt securities, on DTC’s records, to a tender agent. The requirement for physical

delivery of debt securities in connection with an optional tender or a mandatory purchase will be deemed satisfied when the ownership rights in the debt securities are transferred by direct participants on DTC’s records and followed by a book-entry

credit of tendered debt securities to the tender agent’s account.

DTC may discontinue providing its services as securities depository with respect to the debt securities at any

time by giving reasonable notice to Dow or the trustee. Under these circumstances, in the event Dow does not appoint a successor securities depository, debt security certificates will be printed and delivered.

Dow may decide to discontinue use of the system of book-entry transfers through DTC (or a successor securities

depository). In that event, debt security certificates will be printed and delivered.

The information in this section concerning DTC and DTC’s book-entry system has been obtained from sources

that Dow believes to be reliable, but Dow takes no responsibility for their accuracy.

Limitations on Issuance of Bearer Securities

Bearer securities may not be offered, sold, resold or delivered during the “restricted period” as

defined in Treasury Regulation Section 1.163-5(c)(2)(i)(D)(7) in the United States or its possessions or to U.S. persons other than to a qualifying foreign branch of a institution, and any underwriters, participating in the offering of debt securities

must agree that they will not:

|

Ÿ

|

offer any bearer securities for sale or resale in the United States or its possessions or to United States persons, other than a

qualifying foreign branch of a U.S. financial institution); nor

|

|

Ÿ

|

deliver bearer securities within the United States.

|

Bearer securities and any coupons related to bearer securities will bear a legend substantially to the following

effect: “Any United States person who holds this obligation will be subject to limitations under the United States income tax laws, including the limitations provided in Section 165(j) and 1287(a) of the Internal Revenue Code”. Under Sections

165(j) and 1287(a) of the Internal Revenue Code, holders that are U.S. persons, with certain exceptions, will not be entitled to deduct any loss on bearer securities and must treat as ordinary income any gain realized on the sale or other disposition

(including the receipt of principal) of bearer securities.

The term “qualifying foreign branch of a United States financial institution” means a branch located

outside the United States of a U.S. securities clearing organization, bank or other financial institution that holds customers’ securities in the ordinary course of its trade or business and that provides a certificate within a reasonable time, or a

blanket certificate in the year the debt security is issued or either of the preceding two calendar years, stating that it agrees to comply with the requirements of Section 165(j)(3)(A), (B) or (C) of the Internal Revenue Code and its regulations.

The term “U.S. person” means a citizen or resident of the United States, a corporation, partnership or

other entity created or organized in or under the laws of the United States or of any political subdivision of the United States, and an estate or trust the income of which is subject to U.S. federal income taxation regardless of its source.

The term “United States” means the United States of America, including the states and the District of

Columbia.

The term “possessions” includes Puerto Rico, the U.S. Virgin Islands, Guam, American Samoa, Wake Island

and the Northern Mariana Islands.

Certain Covenants of Dow

Subject to the exceptions described below and those set forth under “Exempted Indebtedness,” Dow may

not, and may not permit any restricted subsidiary to create or permit to exist any lien on any principal property, additions to principal property or shares of capital stock of any restricted subsidiary without equally and ratably securing the debt

securities. This restriction will not apply to certain permitted liens, including:

|

Ÿ

|

liens on principal property existing at the time of its acquisition and certain purchase money mortgages;

|

|

Ÿ

|

liens existing on the date of the indenture;

|

|

Ÿ

|

liens on property or shares of capital stock, or arising out of any indebtedness of any corporation existing at the time the

corporation becomes or is merged into Dow or a restricted subsidiary;

|

|

Ÿ

|

liens which secure debt owing to Dow or a subsidiary by a restricted subsidiary;

|

|

Ÿ

|

liens in connection with the issuance of tax-exempt industrial development or pollution control bonds or other similar bonds

issued pursuant to Section 103(b) of the Internal Revenue Code to finance all or any part of the purchase price of or the cost of construction, equipping or improving property, provided that those liens are limited to the property acquired or constructed

or the improvement and to substantially unimproved real property on which such construction or improvement is located; provided further, that Dow and restricted subsidiaries may further secure all or any part of such purchase price or the cost of

construction of such improvements and personal property by an interest on additional property of Dow and restricted subsidiaries only to the extent necessary for the construction, maintenance and operation of, and access to, such property so acquired or