|

|

|

|

|

Previous: PNC MORTGAGE SECURITIES CORP, 424B5, 2000-09-22 |

Next: SHELTER PROPERTIES I LTD PARTNERSHIP, SC TO-T/A, 2000-09-22 |

Class A, Class T, Class B and Class C

Consumer Industries

Cyclical Industries

Financial Services

Health Care

Natural Resources

Technology

Telecommunications &

Utilities Growth (formerly Utilities Growth)

Annual Report

for the year ending

July 31, 2000

and

Prospectus

dated September 28, 2000

|

Performance Overview |

A-4 |

|

|

Consumer Industries |

A-5 |

Performance |

|

|

A-9 |

Fund Talk: The Manager's Overview |

|

|

A-10 |

Investment Summary |

|

|

A-11 |

Ivestments |

|

|

A-14 |

Financial Statements |

|

|

A-18 |

Notes to the Financial Statements |

|

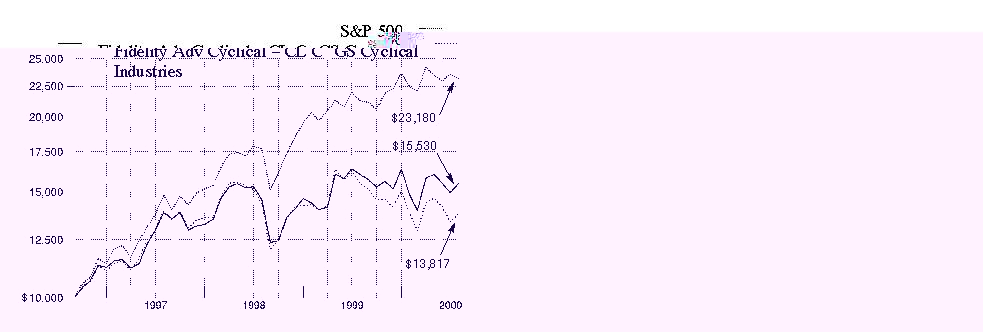

Cyclical Industries |

A-22 |

Performance |

|

|

A-26 |

Fund Talk: The Manager's Overview |

|

|

A-27 |

Investment Summary |

|

|

A-28 |

Ivestments |

|

|

A-31 |

Financial Statements |

|

|

A-35 |

Notes to the Financial Statements |

|

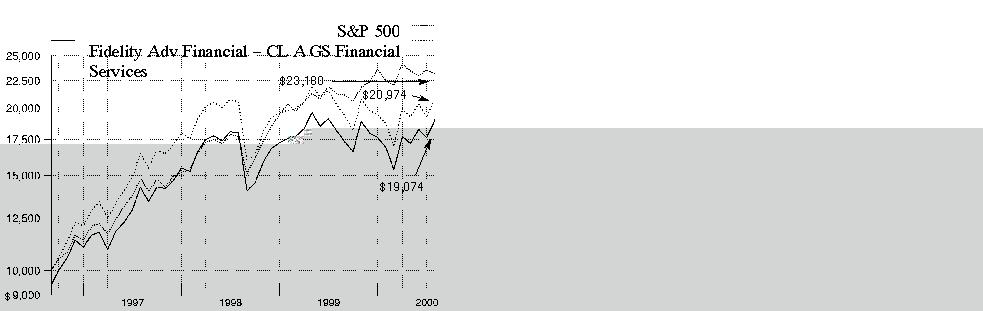

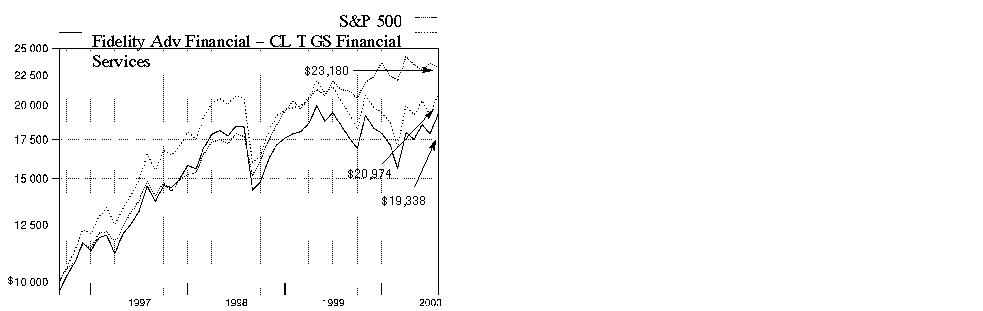

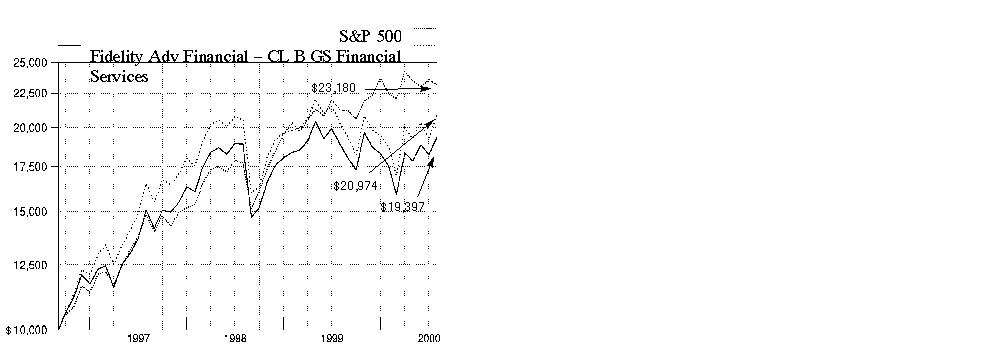

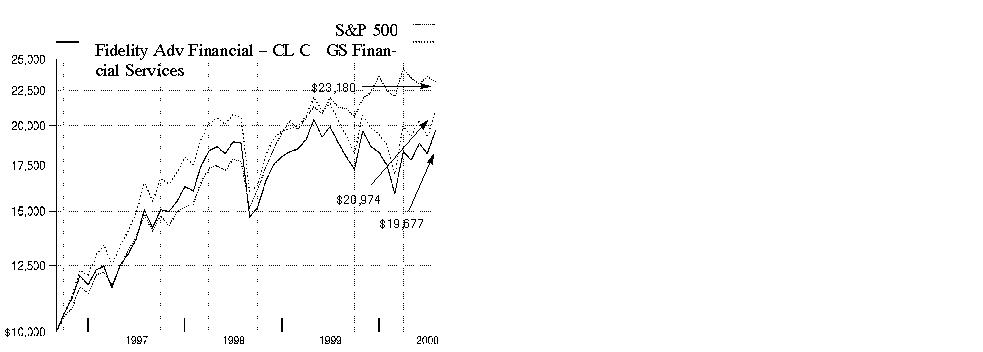

Financial Services |

A-39 |

Performance |

|

|

A-43 |

Fund Talk: The Manager's Overview |

|

|

A-44 |

Investment Summary |

|

|

A-45 |

Ivestments |

|

|

A-47 |

Financial Statements |

|

|

A-51 |

Notes to the Financial Statements |

|

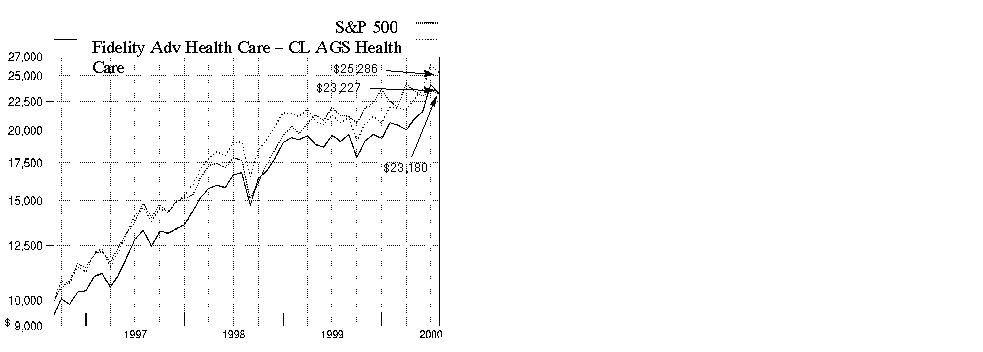

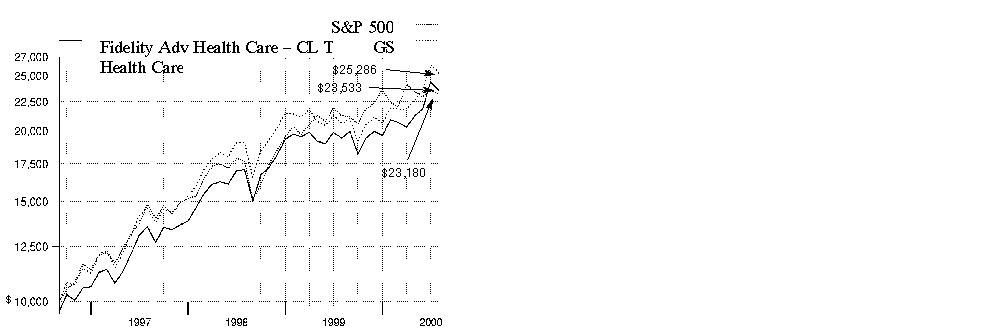

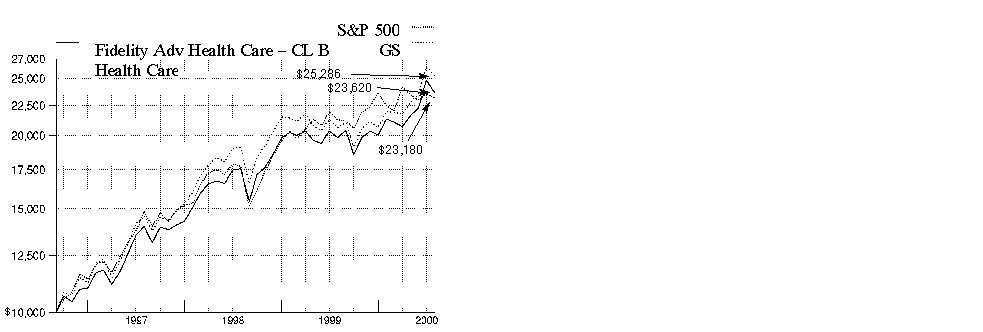

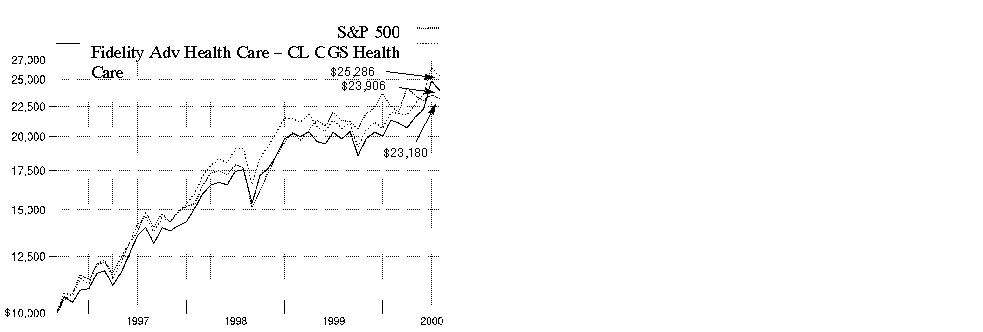

Health Care |

A-55 |

Performance |

|

|

A-59 |

Fund Talk: The Manager's Overview |

|

|

A-60 |

Investment Summary |

|

|

A-61 |

Ivestments |

|

|

A-63 |

Financial Statements |

|

|

A-67 |

Notes to the Financial Statements |

|

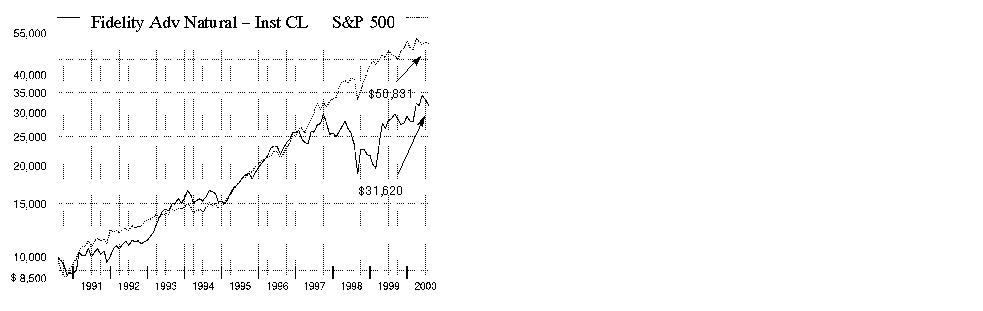

Natural Resources |

A-71 |

Performance |

|

|

A-75 |

Fund Talk: The Manager's Overview |

|

|

A-76 |

Investment Summary |

|

|

A-77 |

Ivestments |

|

|

A-79 |

Financial Statements |

|

|

A-83 |

Notes to the Financial Statements |

|

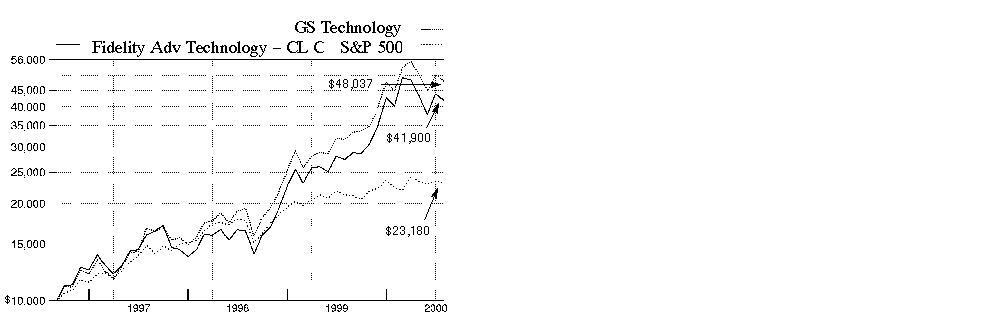

Technology |

A-88 |

Performance |

|

|

A-92 |

Fund Talk: The Manager's Overview |

|

|

A-93 |

Investment Summary |

|

|

A-94 |

Ivestments |

|

|

A-97 |

Financial Statements |

|

|

A-101 |

Notes to the Financial Statements |

|

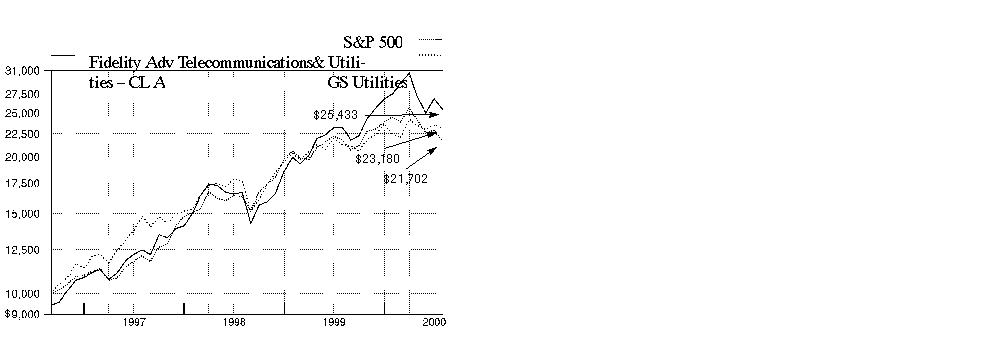

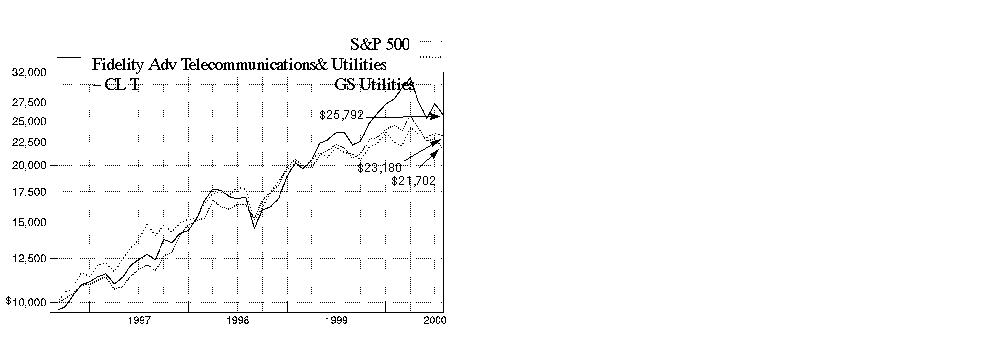

Telecommunications & |

A-105 |

Performance |

|

|

A-109 |

Fund Talk: The Manager's Overview |

|

|

A-110 |

Investment Summary |

|

|

A-111 |

Ivestments |

|

|

A-113 |

Financial Statements |

|

|

A-117 |

Notes to the Financial Statements |

|

Independent Auditors' Report |

A-121 |

The auditors' opinion. |

|

Distributions |

A-122 |

|

|

Prospectus |

P-1 |

|

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

(Recycle graphic) This report is printed on recycled paper using soy-based inks.

The views expressed in this report reflect those of each fund's portfolio manager only through the end of the period of the report as stated on the cover and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the funds. This report is not authorized for distribution to prospective investors in the funds unless preceded or accompanied by an effective prospectus.

Mutual fund shares are not deposits or obligations of, or guaranteed by, any depository institution. Shares are not insured by the FDIC, Federal Reserve Board or any other agency, and are subject to investment risks, including possible loss of principal amount invested.

Neither the funds nor Fidelity Distributors Corporation is a bank.

For more information on any Fidelity Advisor fund, including charges and expenses, contact your investment professional for a free prospectus. Read it carefully before you invest or send money.

Annual Report

The majority of sectors in the U.S. equity market experienced a significant turnaround in investor sentiment during the 12-month period that ended July 31, 2000. Throughout the year, investors progressively flirted, chased and then ultimately retreated from sectors of the new economy, such as technology, wireless telecommunications and biotechnology. At the same time, most had turned their backs on more traditional sectors, such as health, financial services, energy and real estate, to start the period, only to renew their confidence in them again later on.

Going into the period, investors clamored for shares of anything tied to the Internet and technology, driving the prices of unprofitable companies to historically high levels and buoying the capital markets with robust demand for initial public offerings. During this Internet stock boom, investors turned phrases such as "dot-com," "B2B" and "cyberspace" into the daily lexicon of everyone from Wall Street strategists to plumbers.

Meanwhile, lacking the price appreciation of technology and telecommunications stocks, investors soured on more traditional companies early on, resulting in the overall poor performance of value stocks during the third and fourth quarters of 1999. Brisk outflows from value-oriented mutual funds and huge inflows to growth funds - many of which had loaded up on technology stocks - exacerbated the trend.

During the second half of the period, however, the equity markets struggled to break free from the grip of the Federal Reserve Board, whose effort to cool the overheated domestic economy was delivered via a series of five interest-rate hikes. With every clench of its fist, the Fed's effort - which raised the federal funds rate by a total of 1.50% during the period - gradually tempered the optimism toward stocks as the period progressed. Most of the effect of the Fed's tightening, coupled with the market's concerns about corporate earnings, took its toll in the first and second quarters of 2000. The Dow Jones Industrial Average - a benchmark of blue chip stocks - returned 0.27% during the past year, but has declined 7.65% in the first seven months of 2000. Similarly, the Standard & Poor's 500 SM Index, an index of 500 larger companies, returned 8.98% for the 12-month period, but feeling the impact of the Fed's action, has lost 1.98% so far in 2000. Even the seemingly invincible NASDAQ Composite Index, which finished the period with a 43.08% gain, has given back 7.33% year to date. Growing concerns about a potential slowdown in the economy during the second half of the period also affected small-cap stocks, as evidenced by the Russell 2000®'s 13.77% advance for the year, compared to its weak -0.28% return so far in 2000.

The equity sector rotation was fueled in part by a correction in technology stocks. After crossing the 5000 mark early in March, the tech-heavy NASDAQ Composite Index gave back nearly all of its year-to-date gains by the end of the month, then tumbled another 25% during a single week in April. The sell-off in technology was due to overvaluation concerns by notable Wall Street analysts, the federal government's evolving antitrust case against software giant Microsoft, and slower growth forecasts for several tech subsectors, such as semiconductors. Despite the sector's troubles in 2000, the Goldman Sachs Technology Index - an index of 221 stocks designed to measure the performance of companies in the tech sector - returned 51.95% during the 12-month period. The ensuing volatility in technology stocks forced many investors to the sidelines, as evidenced by the exceedingly light trading volume in the second quarter of 2000 and the Goldman Sachs Technology Index's 0.72% year-to-date gain. Investors also began to look toward other areas of the market - such as health and real estate - for steadier growth, changing the investing landscape dramatically from earlier in the period.

Among other sectors, the performance of stocks in the consumer industries sector was hurt by rising interest rates and, toward the end of the period, reports of missed earnings estimates and slower growth from some high-profile companies, including Costco and Office Depot. Still, with growth slowing and share prices dropping, many large food companies went on a buying spree. Philip Morris agreed to purchase Nabisco Holdings and Anglo-Dutch group Unilever snapped up Bestfoods, Slim-Fast Foods and Ben & Jerry's.

In the financial services sector, bank stocks suffered from rising interest rates while brokerage stocks rallied on higher trading volumes. Many investors expected a wave of consolidation in the sector after the government leveled the playing field for all financial services firms in late 1999 by making changes to the Depression-era Glass-Steagall Act - which had prohibited banks and brokerages from operating under the same corporate roof - but it never occurred. The Goldman Sachs Financial Services Index rose 3.20% during the 12-month period.

Higher fuel costs and concerns about a slowdown in the economy plagued the cyclical industries sector. A focus on productivity-boosting, cost-cutting technology in business spending, rather than on traditional ways of manufacturing goods, put pricing pressures on commodities and subsequently dampened the earnings growth of cyclical companies.

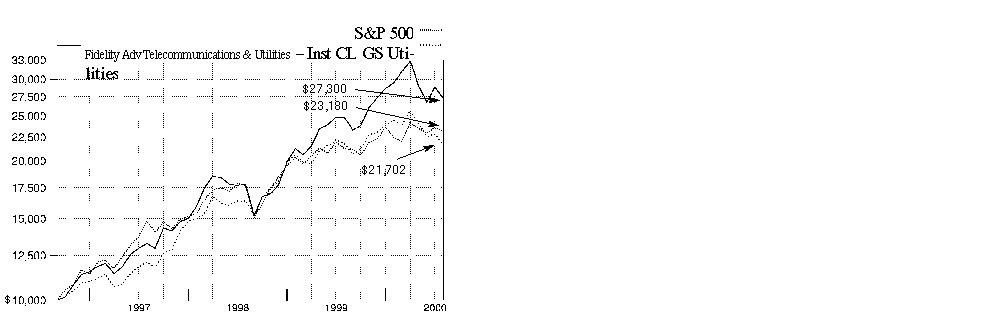

Growing demand for their products enabled wireless and cable services to stand out as top-performing industries in the utilities sector. Early on, a wave of consolidation and increasing demand for wireless products fueled strong gains in telecommunications stocks, while electric utilities were hurt by rising interest rates and long-term profitability concerns. The Goldman Sachs Utilities Index returned -0.53% during the 12-month period.

On the positive side of the marketplace, several pharmaceutical stocks in the health sector returned to favor in the latter part of the period on positive earnings and new product reports. Additionally, public and private programs to sequence the human genome were completed in the second quarter of 2000, helping to restore investor confidence in biotech stocks. The Goldman Sachs Health Care Index rose 22.57% in the 12-month period.

Overall, the natural resources sector had good results. For the majority of the period, OPEC's decision to maintain lower oil production, combined with increased demand, helped push the price of oil above $30 per barrel for weeks. Higher prices helped energy services stocks as well as large integrated oil producers. A favorable supply and demand environment also helped push natural gas prices to record levels.

Annual Report

Performance

There are several ways to evaluate historical performance. You can look at the total percentage change in value, the average annual percentage change or the growth of a hypothetical $10,000 investment. Total return reflects the change in the value of an investment, assuming reinvestment of dividend income and capital gains (the profits earned upon the sale of securities that have grown in value). If Fidelity had not reimbursed certain class expenses, the total returns would have been lower.

Cumulative Total Returns

|

Periods ended July 31, 2000 |

|

Past 1 |

Life of |

|

Fidelity® Adv Consumer - CL A |

|

-4.48% |

87.51% |

|

Fidelity Adv Consumer - CL A |

|

-9.97% |

76.73% |

|

S&P 500® |

|

8.98% |

131.80% |

|

GS Consumer Industries |

|

-4.55% |

76.30% |

Cumulative total returns show Class A shares' performance in percentage terms over a set period - in this case, one year or since the fund started on September 3, 1996. You can compare Class A shares' returns to the performance of both the Standard & Poor's 500 Index - a market capitalization-weighted index of common stocks - and the Goldman Sachs Consumer Industries Index - a market capitalization-weighted index of 295 stocks designed to measure the performance of companies in the consumer industries sector. Issues in the index include providers of consumer services and products, including producers of beverages - alcoholic and non-alcoholic, food, personal care, household products and tobacco companies. These benchmarks include reinvested dividends and capital gains, if any, and exclude the effect of sales charges.

Average Annual Total Returns

|

Periods ended July 31, 2000 |

|

Past 1 |

Life of |

|

Fidelity Adv Consumer - CL A |

|

-4.48% |

17.44% |

|

Fidelity Adv Consumer - CL A |

|

-9.97% |

15.68% |

|

S&P 500 |

|

8.98% |

23.99% |

|

GS Consumer Industries |

|

-4.55% |

15.61% |

Average annual returns take Class A shares' cumulative return and show you what would have happened if Class A shares had performed at a constant rate each year.

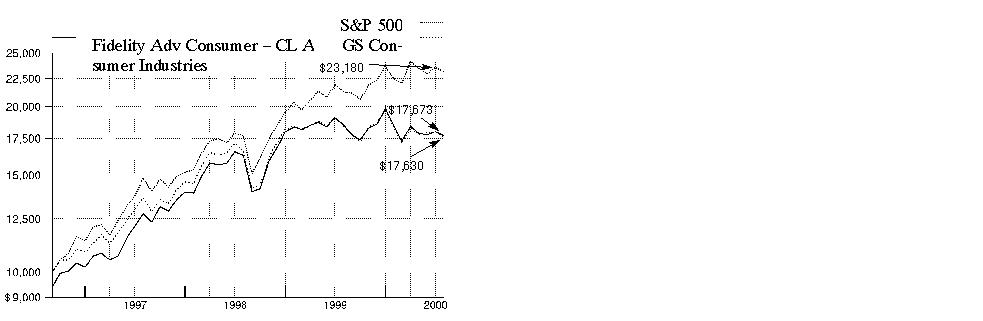

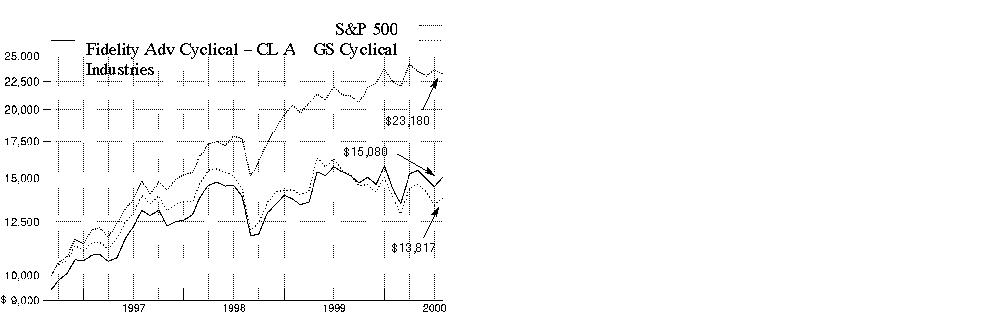

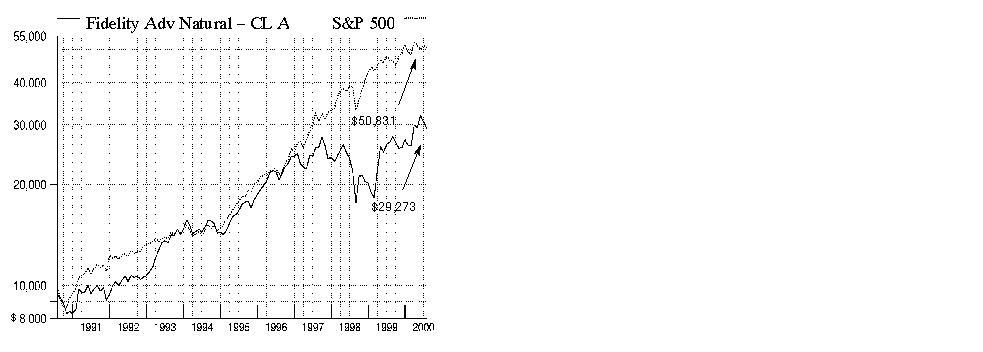

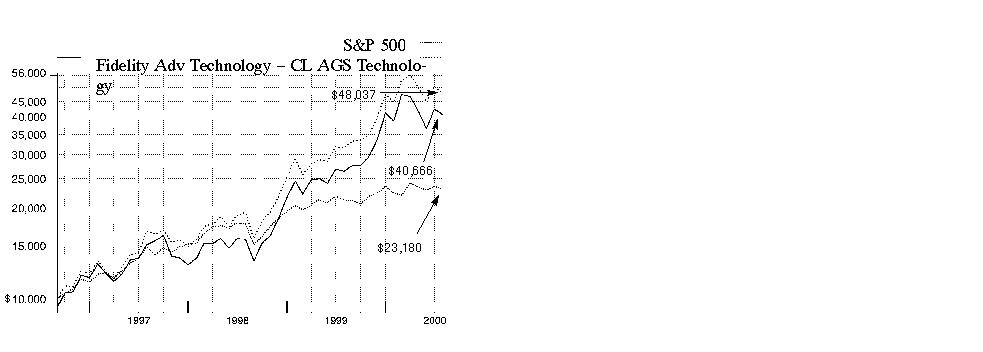

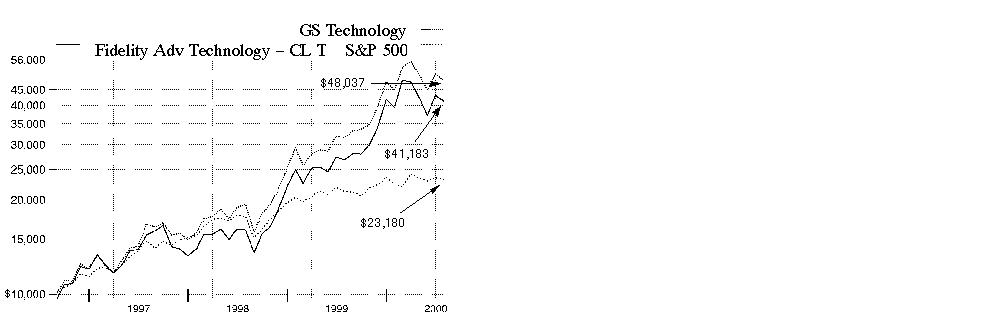

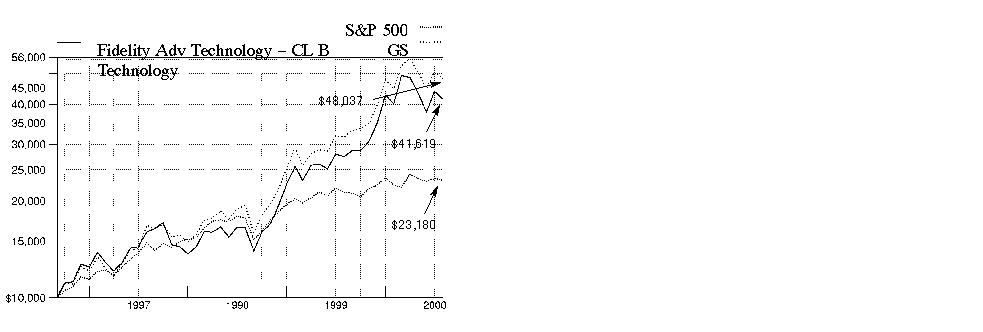

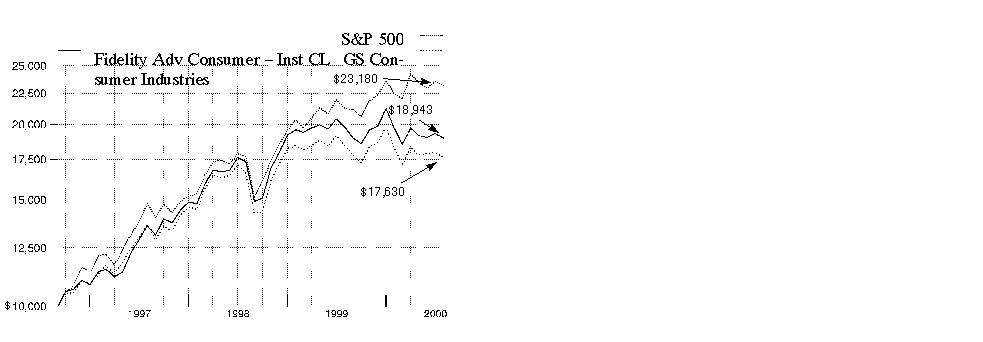

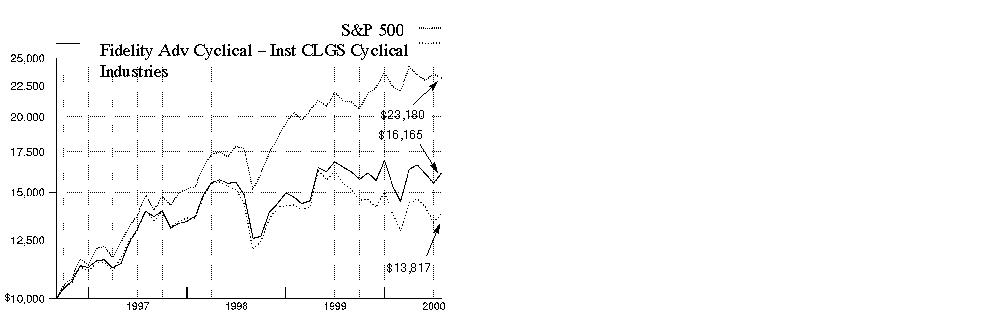

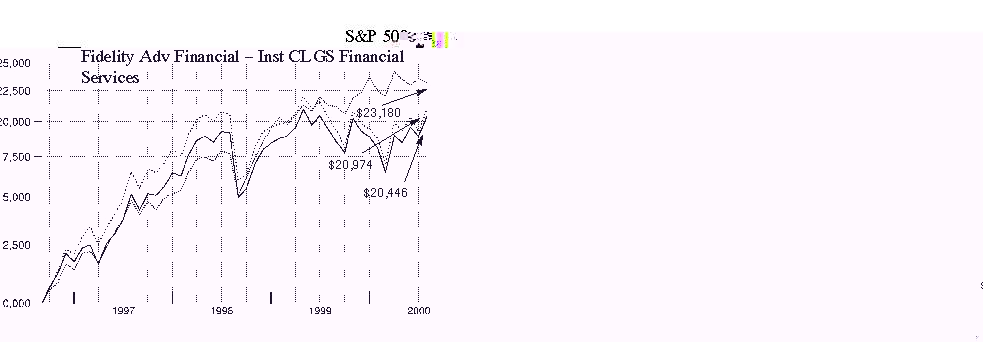

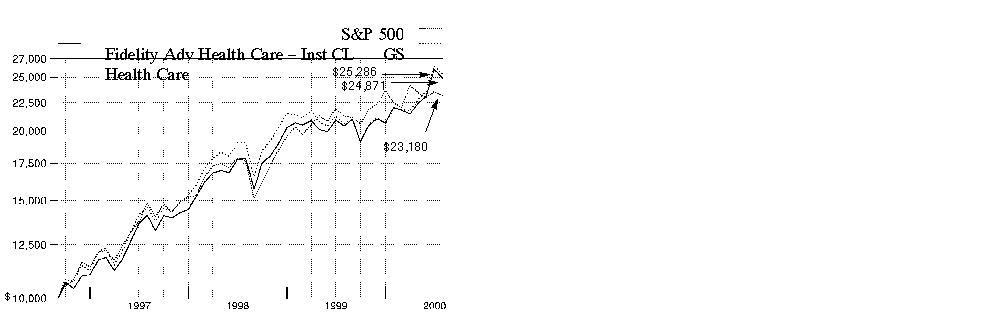

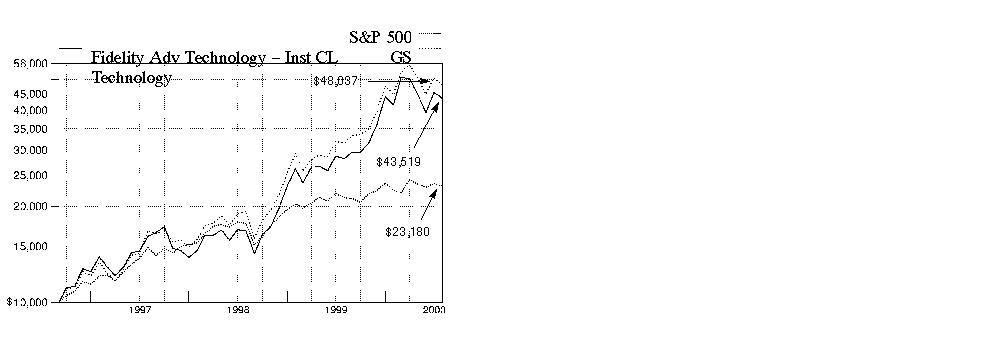

$10,000 Over Life of Fund

$10,000 Over Life of Fund: Let's say hypothetically that $10,000 was invested in Fidelity Advisor Consumer Industries - Class A on September 3, 1996, when the fund started, and the current 5.75% sales charge was paid. As the chart shows, by July 31, 2000, the value of the investment would have grown to $17,673 - a 76.73% increase on the initial investment. For comparison, look at how the Standard & Poor's 500 Index did over the same period. With dividends and capital gains, if any, reinvested, the same $10,000 investment would have grown to $23,180 - a 131.80% increase. If $10,000 was invested in the Goldman Sachs Consumer Industries Index, it would have grown to $17,630 - a 76.30% increase.

Understanding Performance

How a fund did yesterday is no guarantee of how it will do tomorrow. The stock market, for example, has a history of long-term growth and short-term volatility. Unlike the broader market, however, some sectors may not have a history of growth in the long run. And, as with all stock funds, the share price and return of a fund that invests in a sector will vary.

3Annual Report

Performance

There are several ways to evaluate historical performance. You can look at the total percentage change in value, the average annual percentage change or the growth of a hypothetical $10,000 investment. Total return reflects the change in the value of an investment, assuming reinvestment of dividend income and capital gains (the profits earned upon the sale of securities that have grown in value). If Fidelity had not reimbursed certain class expenses, the total returns would have been lower.

Cumulative Total Returns

|

Periods ended July 31, 2000 |

|

Past 1 |

Life of |

|

Fidelity Adv Consumer - CL T |

|

-4.69% |

85.21% |

|

Fidelity Adv Consumer - CL T |

|

-8.03% |

78.73% |

|

S&P 500 |

|

8.98% |

131.80% |

|

GS Consumer Industries |

|

-4.55% |

76.30% |

Cumulative total returns show Class T shares' performance in percentage terms over a set period - in this case, one year or since the fund started on September 3, 1996. You can compare Class T shares' returns to the performance of both the Standard & Poor's 500 Index - a market capitalization-weighted index of common stocks - and the Goldman Sachs Consumer Industries Index - a market capitalization-weighted index of 295 stocks designed to measure the performance of companies in the consumer industries sector. Issues in the index include providers of consumer services and products, including producers of beverages - alcoholic and non-alcoholic, food, personal care, household products and tobacco companies. These benchmarks include reinvested dividends and capital gains, if any, and exclude the effect of sales charges.

Average Annual Total Returns

|

Periods ended July 31, 2000 |

|

Past 1 |

Life of |

|

Fidelity Adv Consumer - CL T |

|

-4.69% |

17.07% |

|

Fidelity Adv Consumer - CL T |

|

-8.03% |

16.01% |

|

S&P 500 |

|

8.98% |

23.99% |

|

GS Consumer Industries |

|

-4.55% |

15.61% |

Average annual returns take Class T shares' cumulative return and show you what would have happened if Class T shares had performed at a constant rate each year.

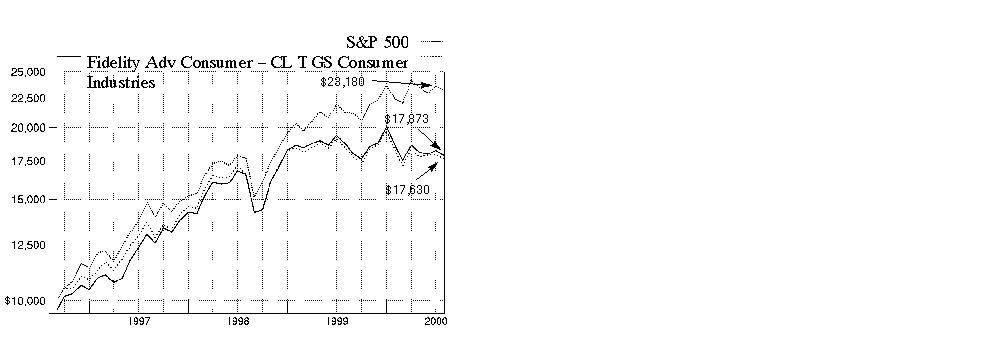

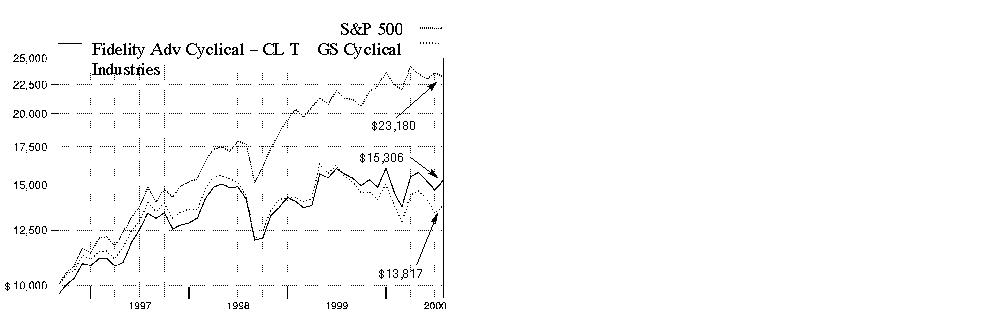

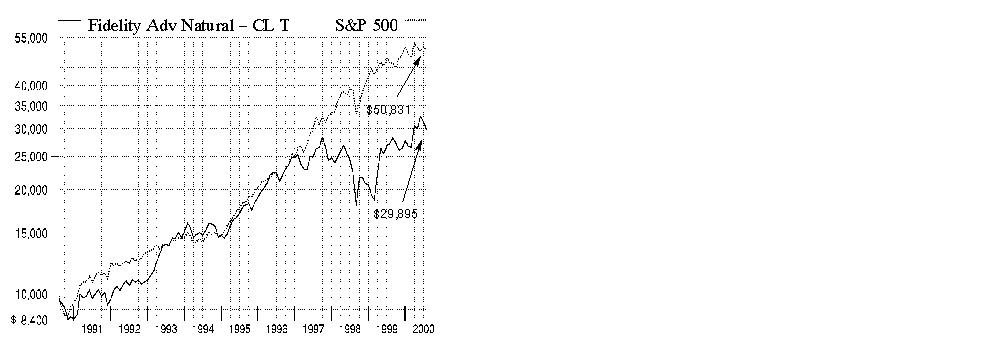

$10,000 Over Life of Fund

$10,000 Over Life of Fund: Let's say hypothetically that $10,000 was invested in Fidelity Advisor Consumer Industries - Class T on September 3, 1996, when the fund started, and the current 3.50% sales charge was paid. As the chart shows, by July 31, 2000, the value of the investment would have grown to $17,873 - a 78.73% increase on the initial investment. For comparison, look at how the Standard & Poor's 500 Index did over the same period. With dividends and capital gains, if any, reinvested, the same $10,000 investment would have grown to $23,180 - a 131.80% increase. If $10,000 was invested in the Goldman Sachs Consumer Industries Index, it would have grown to $17,630 - a 76.30% increase.

Understanding Performance

How a fund did yesterday is no guarantee of how it will do tomorrow. The stock market, for example, has a history of long-term growth and short-term volatility. Unlike the broader market, however, some sectors may not have a history of growth in the long run. And, as with all stock funds, the share price and return of a fund that invests in a sector will vary.

3Annual Report

Performance

There are several ways to evaluate historical performance. You can look at the total percentage change in value, the average annual percentage change or the growth of a hypothetical $10,000 investment. Total return reflects the change in the value of an investment, assuming reinvestment of dividend income and capital gains (the profits earned upon the sale of securities that have grown in value). The initial offering of Class B shares took place on March 3, 1997. Class B shares bear a 1.00% 12b-1 fee. Returns prior to March 3, 1997 are those of Class T which bears a 0.50% 12b-1 fee. Had Class B shares' 12b-1 fee been reflected, returns prior to March 3, 1997 would have been lower. Class B shares' contingent deferred sales charge included in the past one year and life of fund total return figures are 5% and 3%, respectively. If Fidelity had not reimbursed certain class expenses, the total returns would have been lower.

Cumulative Total Returns

|

Periods ended July 31, 2000 |

|

Past 1 |

Life of |

|

Fidelity Adv Consumer - CL B |

|

-5.19% |

82.13% |

|

Fidelity Adv Consumer - CL B |

|

-9.86% |

79.13% |

|

S&P 500 |

|

8.98% |

131.80% |

|

GS Consumer Industries |

|

-4.55% |

76.30% |

Cumulative total returns show Class B shares' performance in percentage terms over a set period - in this case, one year or since the fund started on September 3, 1996. You can compare Class B shares' returns to both the performance of the Standard & Poor's 500 Index - a market capitalization-weighted index of common stocks - and the Goldman Sachs Consumer Industries Index - a market capitalization-weighted index of 295 stocks designed to measure the performance of companies in the consumer industries sector. Issues in the index include providers of consumer services and products, including producers of beverages - alcoholic and non-alcoholic, food, personal care, household products and tobacco companies. These benchmarks include reinvested dividends and capital gains, if any, and exclude the effect of sales charges.

Average Annual Total Returns

|

Periods ended July 31, 2000 |

Past 1 |

Life of |

|

Fidelity Adv Consumer - CL B |

-5.19% |

16.57% |

|

Fidelity Adv Consumer - CL B |

-9.86% |

16.08% |

|

S&P 500 |

8.98% |

23.99% |

|

GS Consumer Industries |

-4.55% |

15.61% |

Average annual returns take Class B shares' cumulative return and show you what would have happened if Class B shares had performed at a constant rate each year.

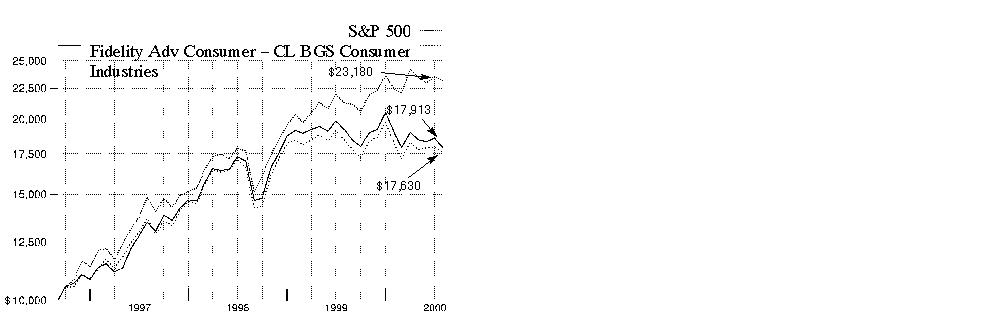

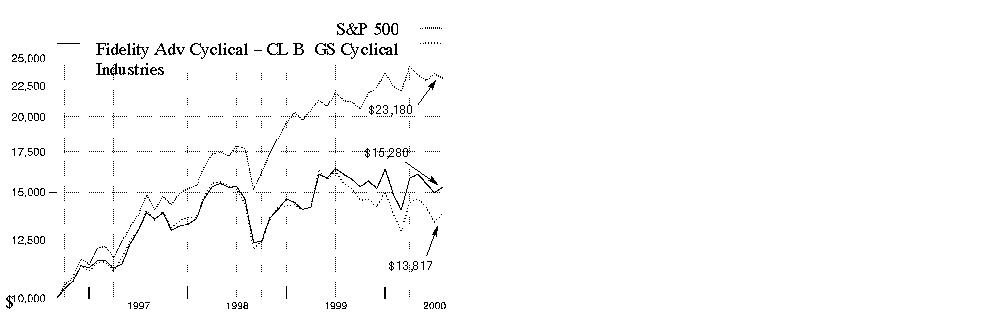

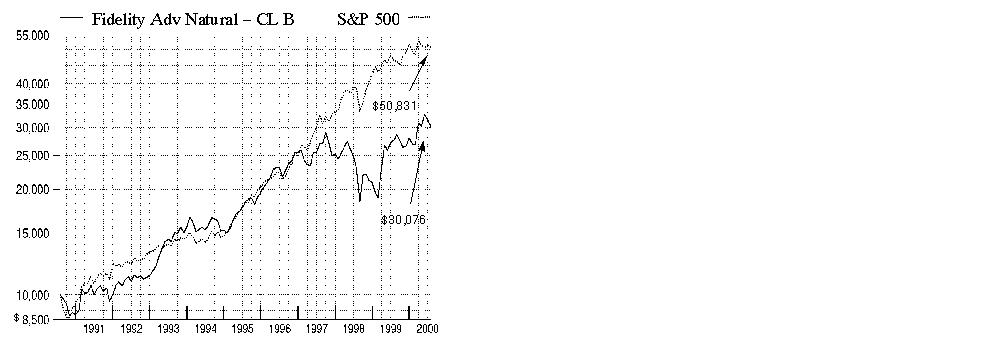

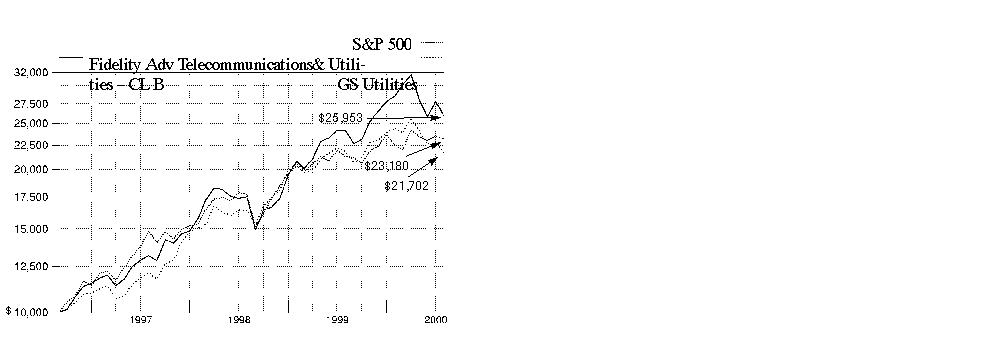

$10,000 Over Life of Fund

$10,000 Over Life of Fund: Let's say hypothetically that $10,000 was invested in Fidelity Advisor Consumer Industries - Class B on September 3, 1996, when the fund started. As the chart shows, by July 31, 2000, the value of the investment, including the effect of the contingent deferred sales charge, would have grown to $17,913 - a 79.13% increase on the initial investment. For comparison, look at how the Standard & Poor's 500 Index did over the same period. With dividends and capital gains, if any, reinvested, the same $10,000 investment would have grown to $23,180 - a 131.80% increase. If $10,000 was invested in the Goldman Sachs Consumer Industries Index, it would have grown to $17,630 - a 76.30% increase.

Understanding Performance

How a fund did yesterday is no guarantee of how it will do tomorrow. The stock market, for example, has a history of long-term growth and short-term volatility. Unlike the broader market, however, some sectors may not have a history of growth in the long run. And, as with all stock funds, the share price and return of a fund that invests in a sector will vary.

3Annual Report

Performance

There are several ways to evaluate historical performance. You can look at the total percentage change in value, the average annual percentage change or the growth of a hypothetical $10,000 investment. Total return reflects the change in the value of an investment, assuming reinvestment of dividend income and capital gains (the profits earned upon the sale of securities that have grown in value). The initial offering of Class C shares took place on November 3, 1997. Class C shares bear a 1.00% 12b-1 fee. Returns between March 3, 1997 and November 3, 1997 are those of Class B shares and reflect Class B shares' 1.00% 12b-1 fee. Returns prior to March 3, 1997 are those of Class T which bears a 0.50% 12b-1 fee. Had Class C shares' 12b-1 fee been reflected, returns prior to March 3, 1997 would have been lower. Class C shares' contingent deferred sales charge included in the past one year and life of fund total return figures are 1% and 0%, respectively. If Fidelity had not reimbursed certain class expenses, the total returns would have been lower.

Cumulative Total Returns

|

Periods ended July 31, 2000 |

|

Past 1 |

Life of |

|

Fidelity Adv Consumer - CL C |

|

-5.19% |

82.18% |

|

Fidelity Adv Consumer - CL C |

|

-6.12% |

82.18% |

|

S&P 500 |

|

8.98% |

131.80% |

|

GS Consumer Industries |

|

-4.55% |

76.30% |

Cumulative total returns show Class C shares' performance in percentage terms over a set period - in this case, one year or since the fund started

on September 3, 1996. You can compare Class C shares' returns to both the performance of the Standard & Poor's 500 Index - a market

capitalization-weighted index of common stocks

- and the Goldman Sachs Consumer Industries Index - a market capitalization-weighted index of 295 stocks designed to measure the performance of

companies in the consumer industries sector. Issues in the index include providers of consumer services and products, including producers of beverages

- alcoholic and non-alcoholic, food, personal care, household products and tobacco companies. These benchmarks include reinvested dividends

and capital gains, if any, and exclude the effect of sales charges.

Average Annual Total Returns

|

Periods ended July 31, 2000 |

Past 1 |

Life of |

|

Fidelity Adv Consumer - CL C |

-5.19% |

16.58% |

|

Fidelity Adv Consumer - CL C |

-6.12% |

16.58% |

|

S&P 500 |

8.98% |

23.99% |

|

GS Consumer Industries |

-4.55% |

15.61% |

Average annual returns take Class C shares' cumulative return and show you what would have happened if Class C shares had performed at a constant rate each year.

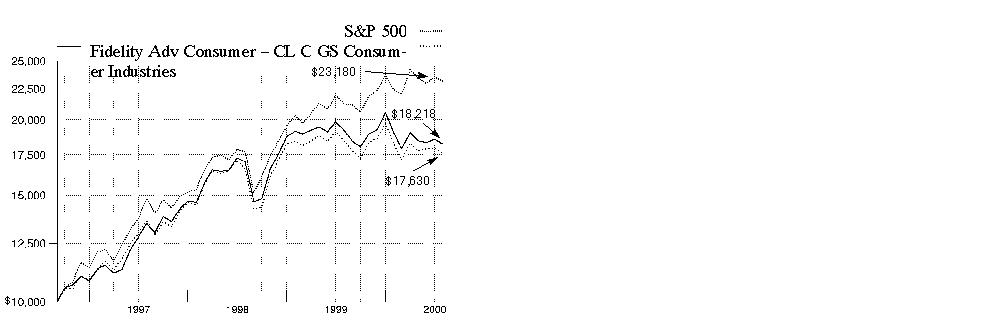

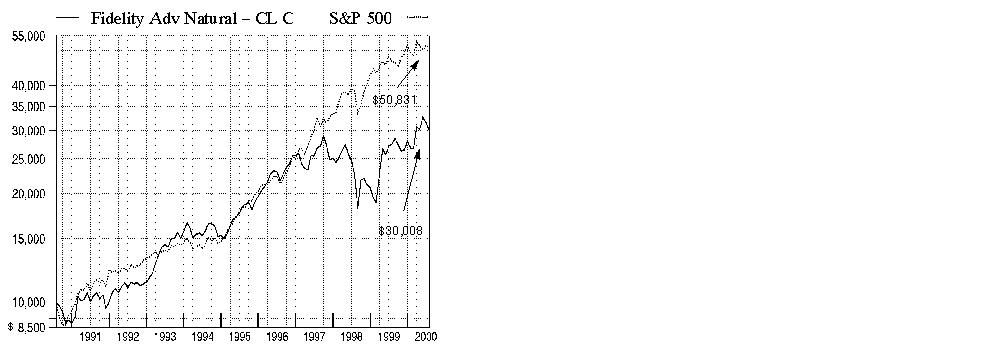

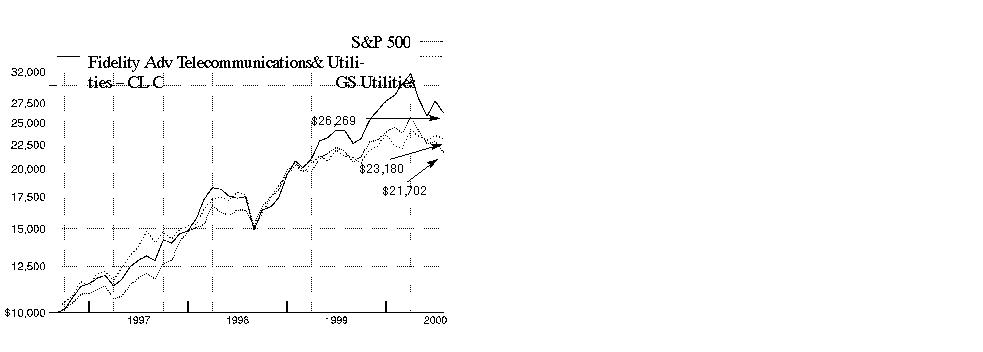

$10,000 Over Life of Fund

$10,000 Over Life of Fund: Let's say hypothetically that $10,000 was invested in Fidelity Advisor Consumer Industries - Class C on September 3, 1996, when the fund started. As the chart shows, by July 31, 2000, the value of the investment would have grown to $18,218 - an 82.18% increase on the initial investment. For comparison, look at how the Standard & Poor's 500 Index did over the same period. With dividends and capital gains, if any, reinvested, the same $10,000 investment would have grown to $23,180 - a 131.80% increase. If $10,000 was invested in the Goldman Sachs Consumer Industries Index, it would have grown to $17,630 - a 76.30% increase.

Understanding Performance

How a fund did yesterday is no guarantee of how it will do tomorrow. The stock market, for example, has a history of long-term growth and short-term volatility. Unlike the broader market, however, some sectors may not have a history of growth in the long run. And, as with all stock funds, the share price and return of a fund that invests in a sector will vary.

3Annual Report

(Portfolio Manager photograph)

An interview with

John Porter, Portfolio Manager of Fidelity Advisor Consumer Industries Fund

Q. How did the fund perform, John?

A. During the 12-month period that ended July 31, 2000, the fund's Class A, Class T, Class B and Class C shares had returns of -4.48%, -4.69%, -5.19% and -5.19%, respectively. This performance was in line with the performance of the Goldman Sachs Consumer Industries Index - an index of 295 stocks designed to measure the performance of companies in the consumer industries sector - which lost 4.55% during the same 12-month period. The fund lagged the Standard & Poor's 500 Index's return of 8.98% during the same period.

A. During the 12-month period that ended July 31, 2000, the fund's Institutional Class shares returned -4.20. This return was slightly ahead of the performance of the Goldman Sachs Consumer Industries Index-an index of 295 stocks designed to measure the performance of companies in the consumer industries sector -which lost 4.55% during the same 12-month period. The fund lagged the Standard & Poor's 500 Index's return of 8.98% during the same period.

Q. What factors kept the fund in line with the performance of the Goldman Sachs index during the period?

A. I think the main reason the fund's performance generally was in line with or slightly ahead of the index was because there weren't any specific areas to steer the fund toward during the past year that delivered consistent outperformance. I break down the consumer industries sector into three main subsectors: consumer products; media, including entertainment and advertising; and retail. At different points throughout the year, each of those different subsectors performed well, but none of them consistently outperformed the other. As the period progressed, different subsectors would take the spotlight, making it extremely difficult to participate successfully in an overweighted buy-and-hold trend due to the volatility.

Q. Did you make any adjustments to your strategy during the period?

A. During the past three months, I positioned the fund defensively with regard to retail, underweighting that subsector because I believed the economy began to slow. The decline of price-to-earnings multiples of several retail stocks reflected the market's cynicism toward these companies, and we saw some of the retailers, such as Costco, which was sold off entirely during the period, experience growth problems. Meanwhile, the top-tier retailers - such as Wal-Mart and Home Depot - continued to execute very well through the end of the period. Within the retail sector, I marginally added to the fund's positions in supermarkets - such as Safeway - and drug stores - such as Walgreens - to exploit consumers' needs to purchase staple products. At the same time, I began increasing the fund's weighting in consumer products stocks, such as Coca-Cola, Procter & Gamble and Gillette, which are defensive in nature. Additionally, I believed these stocks became attractively valued and could benefit from having a significant multi-national presence should foreign economies improve and currencies strengthen.

Q. How did the fund's investments in other areas of consumer industries influence performance?

A. Our overweighted position in media and advertising stocks throughout the period served us well. The fund's focus on advertising-driven media, such as AMFM and Disney - via its ownership of the ABC network broadcast operation - as well as advertising agencies, remained one of the fund's best growth sectors. Elsewhere, the fund's underweighted position in the soft drink industry, specifically Coca-Cola, made the largest positive contribution to the fund's performance. However, the fund's restaurant positions - including McDonald's, which suffered slower sales and analyst downgrades in May - detracted from performance.

Q. What specific stocks performed well? Which disappointed?

A. Wal-Mart, the fund's largest holding, stood out as the top relative contributor to performance based on solid earnings, steady same-store sales growth and a successful overseas acquisition. Investors reacted favorably to Viacom's acquisition of CBS, as well as the fiscal discipline implemented at its Paramount film unit. On the down side, the fund's overweighting of Procter & Gamble hurt performance after the company pre-announced an earnings shortfall in the first quarter, sparking a sell-off across consumer stocks. Ongoing concerns over product liability suits plagued top-10 holding Philip Morris.

Q. What's your outlook?

A. I don't believe the slowing of the economy is accurately reflected in the prices people are paying for retail and consumer products stocks. Consumer products stocks are beaten down and the market is not rewarding them for the relative stability they can provide. In retail, I don't think the current price multiples reflect how slow things can get in a slowing economy - even for some of the best retailers. Meanwhile, I am very enthusiastic about many of the media-related sectors in which the fund invests. So going forward, I will continue to position the fund defensively to weather an economic slowdown, while keeping an eye on consumer expenditure patterns.

The views expressed in this report reflect those of the portfolio manager only through the end of the period of the report as stated on the cover. The manager's views are subject to change at any time based on market or other conditions. For more information, see page A-3.

Fund Facts

Start date: September 3, 1996

Size: as of July 31, 2000, more than

$30 million

Manager: John Porter, since 1999; joined Fidelity in 1995

3Annual Report

Advisor Consumer Industries Fund

|

Top Ten Stocks as of July 31, 2000 |

|

|

|

% of fund's |

|

Wal-Mart Stores, Inc. |

6.7 |

|

Home Depot, Inc. |

4.9 |

|

The Coca-Cola Co. |

4.8 |

|

Walt Disney Co. |

4.2 |

|

Viacom, Inc. Class B (non-vtg.) |

3.7 |

|

Procter & Gamble Co. |

3.1 |

|

Time Warner, Inc. |

3.0 |

|

Kimberly-Clark Corp. |

2.3 |

|

PepsiCo, Inc. |

2.2 |

|

Philip Morris Companies, Inc. |

2.1 |

|

|

37.0 |

|

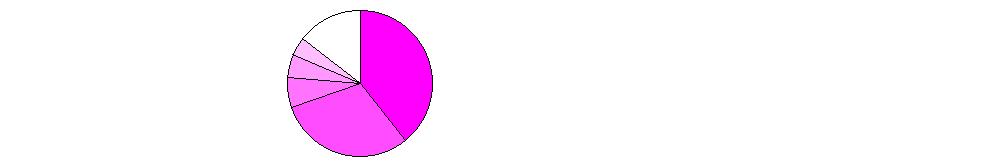

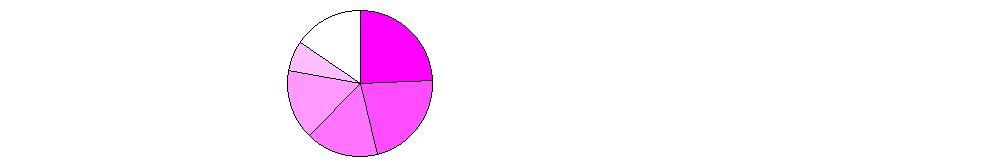

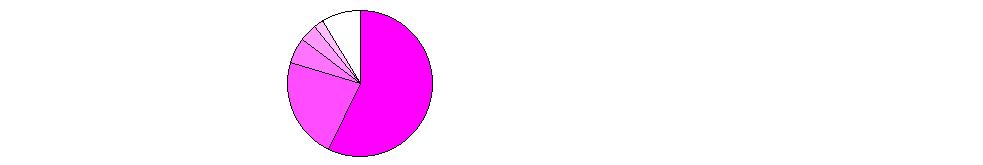

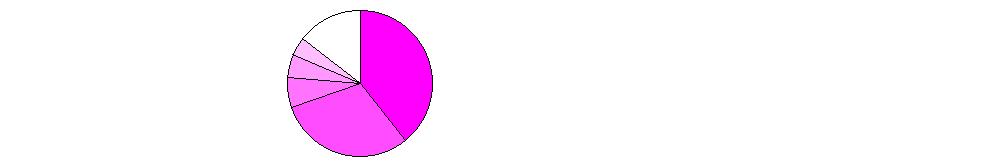

Top Industries as of July 31, 2000 |

|

|

% of fund's net assets |

||

|

Broadcasting |

11.9% |

|

Household Products |

10.2% |

|

Entertainment |

10.2% |

|

General Merchandise Stores |

8.8% |

|

Beverages |

8.6% |

|

All Others* |

50.3% |

|

* Includes short-term investments and net other assets. |

Annual Report

Advisor Consumer Industries Fund

Showing Percentage of Net Assets

|

Common Stocks - 91.2% |

|||

|

Shares |

Value (Note 1) |

||

|

ADVERTISING - 1.4% |

|||

|

Omnicom Group, Inc. |

3,850 |

$ 327,250 |

|

|

TMP Worldwide, Inc. (a) |

500 |

36,000 |

|

|

Young & Rubicam, Inc. |

1,100 |

62,150 |

|

|

|

425,400 |

||

|

APPAREL STORES - 2.8% |

|||

|

American Eagle Outfitters, Inc. (a) |

1,100 |

16,363 |

|

|

AnnTaylor Stores Corp. (a) |

1,700 |

48,025 |

|

|

Claire's Stores, Inc. |

1,800 |

30,375 |

|

|

Gap, Inc. |

13,568 |

485,904 |

|

|

Talbots, Inc. |

900 |

45,450 |

|

|

The Limited, Inc. |

7,480 |

152,873 |

|

|

TJX Companies, Inc. |

2,300 |

38,525 |

|

|

Venator Group, Inc. (a) |

2,600 |

36,725 |

|

|

|

854,240 |

||

|

AUTOS, TIRES, & ACCESSORIES - 0.1% |

|||

|

AutoNation, Inc. |

6,400 |

44,400 |

|

|

BEVERAGES - 8.6% |

|||

|

Adolph Coors Co. Class B |

1,400 |

88,200 |

|

|

Anheuser-Busch Companies, Inc. |

6,200 |

499,100 |

|

|

Canandaigua Brands, Inc. Class A (a) |

1,500 |

74,063 |

|

|

Coca-Cola Enterprises, Inc. |

3,600 |

69,075 |

|

|

Panamerican Beverages, Inc. Class A |

1,600 |

29,600 |

|

|

Pepsi Bottling Group, Inc. |

3,300 |

100,856 |

|

|

Seagram Co. Ltd. |

5,200 |

291,528 |

|

|

The Coca-Cola Co. |

23,800 |

1,459,238 |

|

|

|

2,611,660 |

||

|

BROADCASTING - 11.9% |

|||

|

Adelphia Communications Corp. |

750 |

26,438 |

|

|

American Tower Corp. Class A (a) |

2,900 |

124,338 |

|

|

AMFM, Inc. (a) |

6,400 |

457,200 |

|

|

AT&T Corp. - Liberty Media Group |

28,200 |

627,450 |

|

|

Cablevision Systems Corp. Class A (a) |

1,350 |

88,847 |

|

|

Chris-Craft Industries, Inc. |

200 |

13,375 |

|

|

Clear Channel Communications, Inc. (a) |

3,950 |

300,941 |

|

|

Comcast Corp. Class A (special) (a) |

9,700 |

329,952 |

|

|

Cox Communications, Inc. Class A (a) |

3,200 |

118,200 |

|

|

E.W. Scripps Co. Class A |

400 |

19,750 |

|

|

EchoStar Communications Corp. |

2,800 |

110,425 |

|

|

Entercom Communications Corp. |

1,200 |

46,575 |

|

|

Infinity Broadcasting Corp. Class A (a) |

8,300 |

292,575 |

|

|

Time Warner, Inc. |

12,094 |

927,459 |

|

|

UnitedGlobalCom, Inc. Class A (a) |

900 |

44,156 |

|

|

|

|||

|

Shares |

Value (Note 1) |

||

|

Univision Communications, Inc. |

300 |

$ 37,275 |

|

|

USA Networks, Inc. (a) |

3,300 |

69,506 |

|

|

|

3,634,462 |

||

|

CELLULAR - 1.1% |

|||

|

Crown Castle International Corp. (a) |

3,400 |

115,600 |

|

|

Nextel Communications, Inc. Class A (a) |

900 |

50,344 |

|

|

SBA Communications Corp. Class A |

3,200 |

144,400 |

|

|

|

310,344 |

||

|

COMPUTER SERVICES & SOFTWARE - 1.1% |

|||

|

Amazon.com, Inc. (a) |

2,000 |

60,250 |

|

|

America Online, Inc. (a) |

600 |

31,988 |

|

|

Circle.com (a) |

600 |

1,875 |

|

|

CMGI, Inc. (a) |

700 |

26,513 |

|

|

eBay, Inc. (a) |

600 |

30,000 |

|

|

Microsoft Corp. (a) |

2,050 |

143,116 |

|

|

Priceline.com, Inc. (a) |

2,100 |

49,613 |

|

|

|

343,355 |

||

|

COMPUTERS & OFFICE EQUIPMENT - 0.2% |

|||

|

Pitney Bowes, Inc. |

900 |

31,163 |

|

|

Xerox Corp. |

3,100 |

46,113 |

|

|

|

77,276 |

||

|

CONSUMER ELECTRONICS - 0.8% |

|||

|

Black & Decker Corp. |

800 |

29,750 |

|

|

Gemstar-TV Guide International, Inc. (a) |

2,094 |

127,341 |

|

|

General Motors Corp. Class H (a) |

2,900 |

75,038 |

|

|

|

232,129 |

||

|

DRUG STORES - 1.9% |

|||

|

Walgreen Co. |

18,700 |

583,206 |

|

|

ENTERTAINMENT - 10.2% |

|||

|

Carnival Corp. |

6,900 |

128,944 |

|

|

Fox Entertainment Group, Inc. Class A (a) |

4,800 |

147,000 |

|

|

Hollywood Entertainment Corp. (a) |

1,300 |

11,863 |

|

|

Mandalay Resort Group (a) |

3,100 |

75,756 |

|

|

MGM Grand, Inc. |

2,300 |

82,656 |

|

|

Park Place Entertainment Corp. (a) |

2,400 |

30,150 |

|

|

SFX Entertainment, Inc. Class A (a) |

2,150 |

98,900 |

|

|

Viacom, Inc.: |

|

|

|

|

Class A (a) |

1,600 |

106,700 |

|

|

Class B (non-vtg.) (a) |

17,105 |

1,134,275 |

|

|

Walt Disney Co. |

32,900 |

1,272,819 |

|

|

|

3,089,063 |

||

|

Common Stocks - continued |

|||

|

Shares |

Value (Note 1) |

||

|

FOODS - 6.9% |

|||

|

American Italian Pasta Co. Class A (a) |

2,000 |

$ 39,500 |

|

|

Bestfoods |

5,050 |

351,606 |

|

|

Corn Products International, Inc. |

1,789 |

44,725 |

|

|

Dean Foods Co. |

800 |

27,850 |

|

|

Earthgrains Co. |

3,600 |

72,000 |

|

|

H.J. Heinz Co. |

1,800 |

71,888 |

|

|

Hormel Foods Corp. |

1,800 |

29,138 |

|

|

IBP, Inc. |

2,400 |

34,650 |

|

|

Keebler Foods Co. |

3,500 |

154,438 |

|

|

Kellogg Co. |

2,300 |

59,656 |

|

|

Nabisco Group Holdings Corp. |

3,600 |

95,400 |

|

|

Nabisco Holdings Corp. Class A |

1,400 |

74,025 |

|

|

PepsiCo, Inc. |

14,400 |

659,700 |

|

|

Quaker Oats Co. |

3,300 |

221,925 |

|

|

Sysco Corp. |

4,100 |

161,438 |

|

|

|

2,097,939 |

||

|

GENERAL MERCHANDISE STORES - 8.8% |

|||

|

Ames Department Stores, Inc. (a) |

3,100 |

22,088 |

|

|

BJ's Wholesale Club, Inc. (a) |

1,900 |

56,881 |

|

|

Consolidated Stores Corp. (a) |

6,140 |

73,296 |

|

|

Dollar General Corp. |

4,531 |

83,257 |

|

|

Dollar Tree Stores, Inc. (a) |

1,275 |

54,267 |

|

|

JCPenney Co., Inc. |

1,800 |

29,025 |

|

|

Kohls Corp. (a) |

3,900 |

221,325 |

|

|

Neiman Marcus Group, Inc. Class A (a) |

1,400 |

46,200 |

|

|

Target Corp. |

2,000 |

58,000 |

|

|

Wal-Mart Stores, Inc. |

37,100 |

2,038,164 |

|

|

|

2,682,503 |

||

|

GROCERY STORES - 3.1% |

|||

|

Albertson's, Inc. |

2,521 |

76,103 |

|

|

Hain Celestial Group, Inc. (a) |

7,369 |

196,200 |

|

|

Kroger Co. (a) |

10,400 |

215,150 |

|

|

Safeway, Inc. (a) |

8,850 |

398,803 |

|

|

Whole Foods Market, Inc. (a) |

800 |

35,750 |

|

|

Winn-Dixie Stores, Inc. |

600 |

8,588 |

|

|

|

930,594 |

||

|

HOME FURNISHINGS - 0.2% |

|||

|

Linens'n Things, Inc. (a) |

2,500 |

74,844 |

|

|

HOUSEHOLD PRODUCTS - 10.2% |

|||

|

Avon Products, Inc. |

15,250 |

605,234 |

|

|

Clorox Co. |

8,498 |

351,074 |

|

|

Colgate-Palmolive Co. |

6,900 |

384,244 |

|

|

Estee Lauder Companies, Inc. Class A |

7,030 |

309,320 |

|

|

Gillette Co. |

17,000 |

496,188 |

|

|

|

|||

|

Shares |

Value (Note 1) |

||

|

Procter & Gamble Co. |

16,685 |

$ 948,959 |

|

|

Yankee Candle Co., Inc. |

700 |

14,613 |

|

|

|

3,109,632 |

||

|

LEISURE DURABLES & TOYS - 1.0% |

|||

|

Brunswick Corp. |

900 |

16,931 |

|

|

Callaway Golf Co. |

3,100 |

38,944 |

|

|

Harley-Davidson, Inc. |

5,300 |

237,838 |

|

|

|

293,713 |

||

|

LODGING & GAMING - 0.4% |

|||

|

International Game Technology (a) |

1,200 |

35,625 |

|

|

Prime Hospitality Corp. (a) |

2,100 |

19,950 |

|

|

Starwood Hotels & Resorts Worldwide, Inc. unit |

1,600 |

54,600 |

|

|

|

110,175 |

||

|

PACKAGING & CONTAINERS - 0.2% |

|||

|

Tupperware Corp. |

2,700 |

52,481 |

|

|

PAPER & FOREST PRODUCTS - 2.3% |

|||

|

Kimberly-Clark Corp. |

12,300 |

706,481 |

|

|

PHOTOGRAPHIC EQUIPMENT - 0.4% |

|||

|

Eastman Kodak Co. |

2,000 |

109,750 |

|

|

PRINTING - 0.3% |

|||

|

R.R. Donnelley & Sons Co. |

2,400 |

53,400 |

|

|

Valassis Communications, Inc. (a) |

800 |

26,900 |

|

|

|

80,300 |

||

|

PUBLISHING - 2.8% |

|||

|

Dow Jones & Co., Inc. |

500 |

32,969 |

|

|

Gannett Co., Inc. |

1,100 |

59,263 |

|

|

Harcourt General, Inc. |

1,150 |

63,466 |

|

|

Harte Hanks Communications, Inc. |

1,900 |

48,094 |

|

|

Houghton Mifflin Co. |

700 |

33,163 |

|

|

Knight-Ridder, Inc. |

700 |

36,488 |

|

|

McGraw-Hill Companies, Inc. |

3,700 |

219,919 |

|

|

Meredith Corp. |

2,000 |

63,625 |

|

|

Playboy Enterprises, Inc. Class B (non-vtg.) (a) |

2,700 |

32,569 |

|

|

Reader's Digest Association, Inc. Class A (non-vtg.) |

2,200 |

83,188 |

|

|

The New York Times Co. Class A |

2,600 |

107,088 |

|

|

Tribune Co. |

2,400 |

78,000 |

|

|

|

857,832 |

||

|

REAL ESTATE INVESTMENT TRUSTS - 0.6% |

|||

|

Pinnacle Holdings, Inc. (a) |

3,200 |

179,800 |

|

|

RESTAURANTS - 2.2% |

|||

|

Brinker International, Inc. (a) |

1,500 |

42,844 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value (Note 1) |

||

|

RESTAURANTS - CONTINUED |

|||

|

CEC Entertainment, Inc. (a) |

1,350 |

$ 37,631 |

|

|

Darden Restaurants, Inc. |

1,900 |

30,994 |

|

|

Jack in the Box, Inc. (a) |

2,700 |

57,881 |

|

|

McDonald's Corp. |

9,800 |

308,700 |

|

|

Outback Steakhouse, Inc. (a) |

4,150 |

95,191 |

|

|

Papa John's International, Inc. (a) |

600 |

14,288 |

|

|

Starbucks Corp. (a) |

800 |

30,000 |

|

|

Wendy's International, Inc. |

2,500 |

42,344 |

|

|

|

659,873 |

||

|

RETAIL & WHOLESALE, MISCELLANEOUS - 6.6% |

|||

|

Alberto-Culver Co. Class A |

2,800 |

71,050 |

|

|

Bed Bath & Beyond, Inc. (a) |

3,200 |

117,800 |

|

|

Best Buy Co., Inc. (a) |

900 |

65,475 |

|

|

Circuit City Stores, Inc. - |

800 |

18,350 |

|

|

Home Depot, Inc. |

28,600 |

1,480,050 |

|

|

Lowe's Companies, Inc. |

1,400 |

59,063 |

|

|

Office Depot, Inc. (a) |

2,300 |

14,375 |

|

|

Pier 1 Imports, Inc. |

2,900 |

34,619 |

|

|

Staples, Inc. (a) |

7,450 |

102,903 |

|

|

Tiffany & Co., Inc. |

400 |

13,700 |

|

|

Williams-Sonoma, Inc. (a) |

800 |

31,000 |

|

|

Zale Corp. (a) |

400 |

14,950 |

|

|

|

2,023,335 |

||

|

SERVICES - 1.8% |

|||

|

ACNielsen Corp. (a) |

1,800 |

44,100 |

|

|

Cendant Corp. (a) |

5,700 |

73,031 |

|

|

Macrovision Corp. (a) |

400 |

30,200 |

|

|

Manpower, Inc. |

2,400 |

92,850 |

|

|

Modis Professional Services, Inc. (a) |

300 |

2,288 |

|

|

Robert Half International, Inc. (a) |

1,000 |

34,375 |

|

|

True North Communications |

3,500 |

170,844 |

|

|

Viad Corp. |

3,700 |

96,431 |

|

|

|

544,119 |

||

|

TELEPHONE SERVICES - 0.3% |

|||

|

AT&T Corp. |

3,336 |

103,208 |

|

|

TEXTILES & APPAREL - 0.7% |

|||

|

Liz Claiborne, Inc. |

1,200 |

46,800 |

|

|

Mohawk Industries, Inc. (a) |

800 |

21,350 |

|

|

NIKE, Inc. Class B |

3,000 |

131,250 |

|

|

Pacific Sunwear of California, Inc. (a) |

500 |

7,563 |

|

|

|

206,963 |

||

|

|

|||

|

Shares |

Value (Note 1) |

||

|

TOBACCO - 2.3% |

|||

|

Philip Morris Companies, Inc. |

25,200 |

$ 636,300 |

|

|

RJ Reynolds Tobacco Holdings, Inc. |

2,800 |

79,450 |

|

|

|

715,750 |

||

|

TOTAL COMMON STOCKS (Cost $22,860,481) |

27,744,827 |

||

|

Cash Equivalents - 8.4% |

|||

|

|

|

|

|

|

Fidelity Cash Central Fund, 6.57% (b) |

2,115,133 |

2,115,133 |

|

|

Fidelity Securities Lending Cash Central Fund, 6.65% (b) |

434,060 |

434,060 |

|

|

TOTAL CASH EQUIVALENTS (Cost $2,549,193) |

2,549,193 |

||

|

TOTAL INVESTMENT PORTFOLIO - 99.6% (Cost $25,409,674) |

30,294,020 |

||

|

NET OTHER ASSETS - 0.4% |

108,159 |

||

|

NET ASSETS - 100% |

$ 30,402,179 |

||

|

Legend |

|

(a) Non-income producing |

|

(b) The rate quoted is the annualized seven-day yield of the fund at |

|

Income Tax Information |

|

At July 31, 2000, the aggregate cost of investment securities for income |

|

The fund hereby designates approximately $653,000 as a capital gain dividend for the purpose of the dividend paid deduction. |

|

At July 31, 2000, the fund had a capital loss carryforward of approximately $435,000 all of which will expire on July 31, 2008. |

|

The fund intends to elect to defer to its fiscal year ending July 31, 2001 approximately $204,000 of losses recognized during the period |

See accompanying notes which are an integral part of the financial statements.

Consumer Industries

Statement of Assets and Liabilities

|

|

July 31, 2000 |

|

|

Assets |

|

|

|

Investment in securities, at value |

|

$ 30,294,020 |

|

Cash |

|

1,316 |

|

Receivable for investments sold |

|

927,688 |

|

Receivable for fund shares sold |

|

6,528 |

|

Dividends receivable |

|

15,678 |

|

Interest receivable |

|

11,835 |

|

Other receivables |

|

219 |

|

Total assets |

|

31,257,284 |

|

Liabilities |

|

|

|

Payable for investments purchased |

$ 311,873 |

|

|

Payable for fund shares redeemed |

48,326 |

|

|

Accrued management fee |

10,644 |

|

|

Distribution fees payable |

17,008 |

|

|

Other payables and accrued expenses |

33,194 |

|

|

Collateral on securities loaned, |

434,060 |

|

|

Total liabilities |

|

855,105 |

|

Net Assets |

|

$ 30,402,179 |

|

Net Assets consist of: |

|

|

|

Paid in capital |

|

$ 26,500,308 |

|

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions |

|

(982,312) |

|

Net unrealized appreciation (depreciation) on investments |

|

4,884,183 |

|

Net Assets |

|

$ 30,402,179 |

|

Calculation of Maximum |

|

$15.04 |

|

Maximum offering price per share |

|

$15.96 |

|

Class T: |

|

$14.93 |

|

Maximum offering price per share |

|

$15.47 |

|

Class B: |

|

$14.69 |

|

Class C: |

|

$14.71 |

|

Institutional Class: |

|

$15.18 |

A Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

Statement of Operations

|

|

Year ended July 31, 2000 |

|

|

Investment Income Dividends |

|

$ 314,716 |

|

Interest |

|

128,878 |

|

Security lending |

|

1,659 |

|

Total income |

|

445,253 |

|

Expenses |

|

|

|

Management fee |

$ 205,909 |

|

|

Transfer agent fees |

116,996 |

|

|

Distribution fees |

211,231 |

|

|

Accounting and security lending fees |

60,358 |

|

|

Non-interested trustees' compensation |

108 |

|

|

Custodian fees and expenses |

7,791 |

|

|

Registration fees |

71,659 |

|

|

Audit |

23,105 |

|

|

Legal |

315 |

|

|

Miscellaneous |

2,493 |

|

|

Total expenses before reductions |

699,965 |

|

|

Expense reductions |

(46,778) |

653,187 |

|

Net investment income (loss) |

|

(207,934) |

|

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: |

|

|

|

Investment securities |

(840,883) |

|

|

Foreign currency transactions |

(508) |

(841,391) |

|

Change in net unrealized appreciation (depreciation) on: |

|

|

|

Investment securities |

(865,491) |

|

|

Assets and liabilities in |

(167) |

(865,658) |

|

Net gain (loss) |

|

(1,707,049) |

|

Net increase (decrease) in net assets resulting from operations |

|

$ (1,914,983) |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Advisor Consumer Industries Fund

Financial Statements - continued

Statement of Changes in Net Assets

|

Increase (Decrease) in Net Assets |

Year ended |

Year ended |

|

Operations |

$ (207,934) |

$ (162,801) |

|

Net realized gain (loss) |

(841,391) |

807,597 |

|

Change in net unrealized appreciation (depreciation) |

(865,658) |

3,190,674 |

|

Net increase (decrease) in net assets resulting from operations |

(1,914,983) |

3,835,470 |

|

Distributions to shareholders |

|

|

|

From net realized gain |

(498,458) |

(1,579,052) |

|

In excess of net realized gain |

(154,415) |

- |

|

Total distributions |

(652,873) |

(1,579,052) |

|

Share transactions - net increase (decrease) |

(10,822,065) |

13,658,707 |

|

Redemption fees |

29,843 |

14,605 |

|

Total increase (decrease) in net assets |

(13,360,078) |

15,929,730 |

|

Net Assets |

|

|

|

Beginning of period |

43,762,257 |

27,832,527 |

|

End of period |

$ 30,402,179 |

$ 43,762,257 |

Financial Highlights - Class A

|

Years ended July 31, |

2000 |

1999 |

1998 |

1997 E |

|

Selected Per-Share Data |

|

|

|

|

|

Net asset value, beginning of period |

$ 16.01 |

$ 15.08 |

$ 13.48 |

$ 10.00 |

|

Income from Investment Operations |

|

|

|

|

|

Net investment income (loss) D |

(.04) |

(.03) |

(.06) |

(.05) |

|

Net realized and unrealized gain (loss) |

(.68) |

1.80 |

3.31 |

3.60 |

|

Total from investment operations |

(.72) |

1.77 |

3.25 |

3.55 |

|

Less Distributions |

|

|

|

|

|

From net realized gain |

(.20) |

(.85) |

(1.68) |

(.07) |

|

In excess of net realized gain |

(.06) |

- |

- |

- |

|

Total distributions |

(.26) |

(.85) |

(1.68) |

(.07) |

|

Redemption fees added to paid in capital |

.01 |

.01 |

.03 |

- |

|

Net asset value, end of period |

$ 15.04 |

$ 16.01 |

$ 15.08 |

$ 13.48 |

|

Total Return B, C |

(4.48)% |

13.49% |

27.48% |

35.68% |

|

Ratios and Supplemental Data |

|

|

|

|

|

Net assets, end of period (000 omitted) |

$ 3,609 |

$ 3,504 |

$ 2,220 |

$ 944 |

|

Ratio of expenses to average net assets |

1.50% F |

1.55% F |

1.75% F |

1.75% A, F |

|

Ratio of expenses to average net assets after expense reductions |

1.49% G |

1.54% G |

1.73% G |

1.73% A, G |

|

Ratio of net investment income (loss) to average net assets |

(.24)% |

(.19)% |

(.47)% |

(.50)% A |

|

Portfolio turnover |

69% |

80% |

144% |

203% A |

|

A Annualized B The total returns would have been lower had certain expenses not been reduced during the periods shown. C Total returns do not include the one time sales charge and for periods of less than one year are not annualized. D Net investment income (loss) per share has been calculated based on average shares outstanding during the period. E For the period September 3, 1996 (commencement of sale of Class A shares) to July 31, 1997. F FMR agreed to reimburse a portion of the class' expenses during the period. Without this reimbursement, the class' expense ratio would have been higher. G FMR or the fund has entered into varying arrangements with third parties who either paid or reduced a portion of the class' expenses. |

||||

See accompanying notes which are an integral part of the financial statements.

Consumer Industries

Financial Highlights - Class T

|

Years ended July 31, |

2000 |

1999 |

1998 |

1997 E |

|

Net asset value, beginning of period |

$ 15.93 |

$ 15.00 |

$ 13.45 |

$ 10.00 |

|

Income from Investment Operations |

|

|

|

|

|

Net investment income (loss) D |

(.08) |

(.06) |

(.10) |

(.09) |

|

Net realized and unrealized gain (loss) |

(.67) |

1.79 |

3.28 |

3.60 |

|

Total from investment operations |

(.75) |

1.73 |

3.18 |

3.51 |

|

Less Distributions |

|

|

|

|

|

From net realized gain |

(.20) |

(.81) |

(1.66) |

(.06) |

|

In excess of net realized gain |

(.06) |

- |

- |

- |

|

Total distributions |

(.26) |

(.81) |

(1.66) |

(.06) |

|

Redemption fees added to paid in capital |

.01 |

.01 |

.03 |

- |

|

Net asset value, end of period |

$ 14.93 |

$ 15.93 |

$ 15.00 |

$ 13.45 |

|

Total Return B, C |

(4.69)% |

13.20% |

26.93% |

35.25% |

|

Ratios and Supplemental Data |

|

|

|

|

|

Net assets, end of period (000 omitted) |

$ 13,275 |

$ 21,714 |

$ 13,989 |

$ 7,314 |

|

Ratio of expenses to average net assets |

1.75% F |

1.79% F |

2.00% F |

2.00% A, F |

|

Ratio of expenses to average net assets after expense reductions |

1.73% G |

1.77% G |

1.98% G |

1.97% A, G |

|

Ratio of net investment income (loss) to average net assets |

(.49)% |

(.42)% |

(.71)% |

(.83)% A |

|

Portfolio turnover |

69% |

80% |

144% |

203% A |

|

A Annualized B The total returns would have been lower had certain expenses not been reduced during the periods shown. C Total returns do not include the one time sales charge and for periods of less than one year are not annualized. D Net investment income (loss) per share has been calculated based on average shares outstanding during the period. E For the period September 3, 1996 (commencement of sale of Class T shares) to July 31, 1997. F FMR agreed to reimburse a portion of the class' expenses during the period. Without this reimbursement, the class' expense ratio would have been higher. G FMR or the fund has entered into varying arrangements with third parties who either paid or reduced a portion of the class' expenses. |

||||

Financial Highlights - Class B

|

Years ended July 31, |

2000 |

1999 |

1998 |

1997 E |

|

Net asset value, beginning of period |

$ 15.76 |

$ 14.91 |

$ 13.42 |

$ 11.46 |

|

Income from Investment Operations |

|

|

|

|

|

Net investment income (loss) D |

(.15) |

(.14) |

(.17) |

(.08) |

|

Net realized and unrealized gain (loss) |

(.67) |

1.79 |

3.26 |

2.04 |

|

Total from investment operations |

(.82) |

1.65 |

3.09 |

1.96 |

|

Less Distributions |

|

|

|

|

|

From net realized gain |

(.20) |

(.81) |

(1.64) |

- |

|

In excess of net realized gain |

(.06) |

- |

- |

- |

|

Total distributions |

(.26) |

(.81) |

(1.64) |

- |

|

Redemption fees added to paid in capital |

.01 |

.01 |

.04 |

- |

|

Net asset value, end of period |

$ 14.69 |

$ 15.76 |

$ 14.91 |

$ 13.42 |

|

Total Return B, C |

(5.19)% |

12.71% |

26.30% |

17.10% |

|

Ratios and Supplemental Data |

|

|

|

|

|

Net assets, end of period (000 omitted) |

$ 9,021 |

$ 9,832 |

$ 5,419 |

$ 596 |

|

Ratio of expenses to average net assets |

2.25% F |

2.31% F |

2.50% F |

2.50% A, F |

|

Ratio of expenses to average net assets after expense reductions |

2.24% G |

2.30% G |

2.48% G |

2.46% A, G |

|

Ratio of net investment income (loss) to average net assets |

(.99)% |

(.95)% |

(1.23)% |

(1.60)% A |

|

Portfolio turnover |

69% |

80% |

144% |

203% A |

|

A Annualized B The total returns would have been lower had certain expenses not been reduced during the periods shown. C Total returns do not include the contingent deferred sales charge and for periods of less than one year are not annualized. D Net investment income (loss) per share has been calculated based on average shares outstanding during the period. E For the period March 3, 1997 (commencement of sale of Class B shares) to July 31, 1997. F FMR agreed to reimburse a portion of the class' expenses during the period. Without this reimbursement, the class' expense ratio would have been higher. G FMR or the fund has entered into varying arrangements with third parties who either paid or reduced a portion of the class' expenses. |

||||

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Class C

|

Years ended July 31, |

2000 |

1999 |

1998 E |

|

Net asset value, beginning of period |

$ 15.78 |

$ 14.95 |

$ 12.66 |

|

Income from Investment Operations |

|

|

|

|

Net investment income (loss) D |

(.15) |

(.15) |

(.13) |

|

Net realized and unrealized gain (loss) |

(.67) |

1.80 |

2.87 |

|

Total from investment operations |

(.82) |

1.65 |

2.74 |

|

Less Distributions |

|

|

|

|

From net realized gain |

(.20) |

(.83) |

(.49) |

|

In excess of net realized gain |

(.06) |

- |

- |

|

Total distributions |

(.26) |

(.83) |

(.49) |

|

Redemption fees added to paid in capital |

.01 |

.01 |

.04 |

|

Net asset value, end of period |

$ 14.71 |

$ 15.78 |

$ 14.95 |

|

Total Return B, C |

(5.19)% |

12.72% |

22.67% |

|

Ratios and Supplemental Data |

|

|

|

|

Net assets, end of period (000 omitted) |

$ 3,048 |

$ 2,758 |

$ 1,461 |

|

Ratio of expenses to average net assets |

2.25% F |

2.32% F |

2.50% A, F |

|

Ratio of expenses to average net assets after expense reductions |

2.24% G |

2.30% G |

2.48% A, G |

|

Ratio of net investment income (loss) to average net assets |

(.99)% |

(.95)% |

(1.27)% A |

|

Portfolio turnover |

69% |

80% |

144% |

|

A Annualized B The total returns would have been lower had certain expenses not been reduced during the periods shown. C Total returns do not include the contingent deferred sales charge and for periods of less than one year are not annualized. D Net investment income (loss) per share has been calculated based on average shares outstanding during the period. E For the period November 3, 1997 (commencement of sale of Class C shares) to July 31, 1998. F FMR agreed to reimburse a portion of the class' expenses during the period. Without this reimbursement, the class' expense ratio would have been higher. G FMR or the fund has entered into varying arrangements with third parties who either paid or reduced a portion of the class' expenses. |

|||

Financial Highlights - Institutional Class

|

Years ended July 31, |

2000 |

1999 |

1998 |

1997 E |

|

Net asset value, beginning of period |

$ 16.11 |

$ 15.12 |

$ 13.51 |

$ 10.00 |

|

Income from Investment Operations |

|

|

|

|

|

Net investment income (loss) D |

(.00) |

.02 |

(.03) |

(.01) |

|

Net realized and unrealized gain (loss) |

(.69) |

1.81 |

3.31 |

3.59 |

|

Total from investment operations |

(.69) |

1.83 |

3.28 |

3.58 |

|

Less Distributions |

|

|

|

|

|

From net realized gain |

(.20) |

(.85) |

(1.70) |

(.07) |

|

In excess of net realized gain |

(.06) |

- |

- |

- |

|

Total distributions |

(.26) |

(.85) |

(1.70) |

(.07) |

|

Redemption fees added to paid in capital |

.02 |

.01 |

.03 |

- |

|

Net asset value, end of period |

$ 15.18 |

$ 16.11 |

$ 15.12 |

$ 13.51 |

|

Total Return B, C |

(4.20)% |

13.87% |

27.70% |

35.98% |

|

Ratios and Supplemental Data |

|

|

|

|

|

Net assets, end of period (000 omitted) |

$ 1,449 |

$ 5,954 |

$ 4,745 |

$ 1,333 |

|

Ratio of expenses to average net assets |

1.25% F |

1.26% F |

1.50% F |

1.50% A, F |

|

Ratio of expenses to average net assets after expense reductions |

1.24% G |

1.24% G |

1.48% G |

1.48% A, G |

|

Ratio of net investment income (loss) to average net assets |

.01% |

.11% |

(.20)% |

(.13)% A |

|

Portfolio turnover |

69% |

80% |

144% |

203% A |

|

A Annualized B The total returns would have been lower had certain expenses not been reduced during the periods shown. C Total returns for periods of less than one year are not annualized. D Net investment income (loss) per share has been calculated based on average shares outstanding during the period. E For the period September 3, 1996 (commencement of sale of Institutional Class shares) to July 31, 1997. F FMR agreed to reimburse a portion of the class' expenses during the period. Without this reimbursement, the class' expense ratio would have been higher. G FMR or the fund has entered into varying arrangements with third parties who either paid or reduced a portion of the class' expenses. |

||||

See accompanying notes which are an integral part of the financial statements.

Consumer Industries

For the period ended July 31, 2000

1. Significant Accounting Policies.

Fidelity Advisor Consumer Industries Fund (the fund) is a fund of Fidelity Advisor Series VII (the trust) and is authorized to issue an unlimited number of shares. The trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust.

The fund offers Class A, Class T, Class B, Class C, and Institutional Class shares, each of which has equal rights as to assets and voting privileges. Each class has exclusive voting rights with respect to matters that affect that class. Class B shares will automatically convert to Class A shares after a holding period of seven years from the initial date of purchase. Investment income, realized and unrealized capital gains and losses, the common expenses of the fund, and certain fund-level expense reductions, if any, are allocated on a pro rata basis to each class based on the relative net assets of each class to the total net assets of the fund. Each class of shares differs in its respective distribution, transfer agent, and certain other class-specific fees, expenses, and expense reductions.

The financial statements have been prepared in conformity with generally accepted accounting principles which require management to make certain estimates and assumptions at the date of the financial statements. The following summarizes the significant accounting policies of the fund:

Security Valuation. Securities for which exchange quotations are readily available are valued at the last sale price, or if no sale price, at the closing bid price. Foreign securities are valued based on quotations from the principal market in which such securities are normally traded. If trading or events occurring in other markets after the close of the principal market in which foreign securities are traded, and before the close of the business of the fund, are expected to materially affect the value of those securities, then they are valued at their fair value taking this trading or these events into account. Fair value is determined in good faith under consistently applied procedures under the general supervision of the Board of Trustees. Securities for which exchange quotations are not readily available (and in certain cases debt securities which trade on an exchange) are valued primarily using dealer-supplied valuations or at their fair value. Short-term securities with remaining maturities of sixty days or less for which quotations are not readily available are valued at amortized cost or original cost plus accrued interest, both of which approximate current value.

Foreign Currency Translation. The accounting records of the fund are maintained in U.S. dollars. Investment securities and other assets and liabilities denominated in a foreign currency are translated into U.S. dollars at the prevailing rates of exchange at period end. Purchases and sales of securities, income receipts and expense payments are translated into U.S. dollars at the prevailing exchange rate on the respective dates of the transactions.

Net realized gains and losses on foreign currency transactions represent net gains and losses from sales and maturities of foreign currency contracts, disposition of foreign currencies, the difference between the amount of net investment income accrued and the U.S. dollar amount actually received, and gains and losses between trade and settlement date on purchases and sales of securities. The effects of changes in foreign currency exchange rates on investments in securities are included with the net realized and unrealized gain or loss on investment securities.

Income Taxes. As a qualified regulated investment company under Subchapter M of the Internal Revenue Code, the fund is not subject to income taxes to the extent that it distributes substantially all of its taxable income for its fiscal year. The schedule of investments includes information regarding income taxes under the caption "Income Tax Information."

Investment Income. Dividend income is recorded on the ex-dividend date, except certain dividends from foreign securities where the ex-dividend date may have passed, are recorded as soon as the fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Interest income is accrued as earned. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

Expenses. Most expenses of the trust can be directly attributed to a fund. Expenses which cannot be directly attributed are apportioned among the funds in the trust.

Distributions to Shareholders. Distributions are recorded on the ex-dividend date. Income dividends and capital gain distributions are declared separately for each class.

Income and capital gain distributions are determined in accordance with income tax regulations which may differ from generally accepted accounting principles. These differences, which may result in distribution reclassifications, are primarily due to differing treatments for foreign currency transactions, net operating losses and losses deferred due to wash sales and excise tax regulations.

Permanent book and tax basis differences relating to shareholder distributions will result in reclassifications to paid in capital. Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions may include temporary book and tax basis differences which will reverse in a subsequent period. Any taxable income or gain remaining at fiscal year end is distributed in the following year.

Annual Report

Notes to Financial Statements - continued

1. Significant Accounting

Policies - continued

Short-Term Trading (Redemption) Fees. Shares held in the fund less than 60 days are subject to a short-term trading fee equal to 1% of the proceeds of the redeemed shares. The fee, which is retained by the fund, is accounted for as an addition to paid in capital.

Security Transactions. Security transactions are accounted for as of trade date. Gains and losses on securities sold are determined on the basis of identified cost.

2. Operating Policies.

Foreign Currency Contracts. The fund generally uses foreign currency contracts to facilitate transactions in foreign-denominated securities. Losses may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms. The U.S. dollar value of foreign currency contracts is determined using contractual currency exchange rates established at the time of each trade.

Joint Trading Account. Pursuant to an Exemptive Order issued by the Securities and Exchange Commission (the SEC), the fund, along with other affiliated entities of Fidelity Management & Research Company (FMR), may transfer uninvested cash balances into one or more joint trading accounts. These balances are invested in one or more repurchase agreements for U.S. Treasury or Federal Agency obligations.

Repurchase Agreements. The underlying U.S. Treasury, Federal Agency, or other obligations found to be satisfactory by FMR are transferred to an account of the fund, or to the Joint Trading Account, at a custodian bank. The securities are marked-to-market daily and maintained at a value at least equal to the principal amount of the repurchase agreement (including accrued interest). FMR, the fund's investment adviser, is responsible for determining that the value of the underlying securities remains in accordance with the market value requirements stated above.