|

|

|

|

|

Previous: INTERNATIONAL BANCSHARES CORP, 8-K, EX-99, 2000-12-21 |

Next: ANDREW CORP, 10-K405, 2000-12-21 |

SCHEDULE 14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant /x/ |

|||

| Filed by a Party other than the Registrant / / | |||

Check the appropriate box: |

|||

| / / | Preliminary Proxy Statement | ||

| / / | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

| /x/ | Definitive Proxy Statement | ||

| / / | Definitive Additional Materials | ||

| / / | Soliciting Material Pursuant to §240.14a-12 |

||

Andrew Corporation |

||||

(Name of Registrant as Specified In Its Charter) |

||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| /x/ | No fee required | |||

| / / | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

| / / | Fee paid previously with preliminary materials. | |||

| / / | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

Andrew Corporation

December 21, 2000

Notice of 2001 Annual Meeting of Stockholders and Proxy Statement Annual Meeting |

Meeting Date: Tuesday, February 13, 2001

Andrew Corporation

10500 West 153rd Street

Orland Park, Illinois U.S.A. 60462

December 21, 2000

Dear

Fellow Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of Andrew Corporation at Drury Lane, 100 Drury Lane, Oakbrook Terrace, Illinois on Tuesday, February 13, 2001 at 10:00 a.m. You will find a map to Drury Lane on the back cover of this booklet.

This Notice of Annual Meeting and Proxy Statement describes the business to be transacted at the meeting and provides other information concerning Andrew that you should be aware of when you vote your shares.

The principal business of the Annual Meeting will be to elect directors and to ratify the appointment of Andrew's independent auditors. As in prior years, we plan to review the status of the company's business at the meeting and answer any questions you may have.

This year, Ken Douglas, a director for 11 years, will retire. We especially want to thank Ken for his invaluable advice and counsel over the years.

It is important that your shares are represented at the Annual Meeting whether or not you plan to attend. To ensure that you will be represented, we ask you to sign, date and return the enclosed proxy card or proxy voting instruction form as soon as possible. Instead, you may choose to vote by telephone or over the Internet. If you choose one of those forms of voting, it is not necessary for you to return your proxy card. In any event, please vote as soon as possible.

On behalf of the Board of Directors and management, I would like to express our appreciation for your continued interest in the affairs of Andrew.

| Sincerely, | ||

Floyd L. English Chairman |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Tuesday, February 13, 2001

10:00 a.m.

Drury Lane

100 Drury Lane

Oakbrook Terrace, Illinois

The purpose of our Annual Meeting is to:

You can vote at the Annual Meeting in person or by proxy if you were a stockholder of record on December 15, 2000. Our Annual Report for the fiscal year ended September 30, 2000 is enclosed. You may revoke your proxy at any time prior to its exercise at the Annual Meeting.

By

Order of the Board of Directors,

JAMES F. PETELLE

Vice President and Secretary December 21, 2000

| Questions and Answers | 1 | |

Election of Directors |

3 |

|

Ownership of Andrew Common Stock |

5 |

|

Section 16(a) Beneficial Ownership Reporting Compliance |

7 |

|

Meetings and Committees of the Board of Directors |

7 |

|

Director Compensation |

8 |

|

Executive Compensation |

8 |

|

Report of the Compensation Committee of the Board of Directors |

11 |

|

Report of the Audit Committee of the Board of Directors |

13 |

|

Company Performance |

14 |

|

Appointment of Independent Public Auditors |

15 |

|

Charter—Audit Committee |

Exhibit A |

Annual Report on Form 10-K

You may obtain a free copy of our Annual Report on Form 10-K for the year ended September 30, 2000, including schedules, that we filed with the Securities and Exchange Commission. Please contact Lynn Nickless, Investor Relations, Andrew Corporation, 10500 West 153rd Street, Orland Park, Illinois 60462, or [email protected] by e-mail.

| What am I voting on? | Andrew's Board of Directors is soliciting your vote on: | |||

• |

The election of nine Directors; and |

|||

• |

The ratification of Ernst & Young LLP as Andrew's independent auditors. |

|||

Who is entitled to vote? |

Stockholders at the close of business on December 15, 2000 (the record date) are entitled to vote. On that date, there were 81,262,748 shares of Andrew common stock outstanding and entitled to vote at the Annual Meeting. |

|||

How many votes do I have? |

Each share of Andrew common stock that you own entitles you to one vote. |

|||

How do I vote? |

All stockholders may vote by mail. All stockholders who hold their shares in their own name and most stockholders who hold shares through a bank or broker also may vote by telephone or over the Internet. If one of these options is available to you, we strongly encourage you to use it because it is faster and less costly. To vote by mail, please sign, date and mail your proxy in the postage paid envelope provided. |

|||

If you attend the Annual Meeting in person, you may request a ballot when you arrive. If your shares are held in the name of your broker, bank or other nominee, you need to bring an account statement or letter from the nominee indicating that you were the beneficial owner of the shares on December 15, 2000, the record date for voting. |

||||

What if I return my proxy but do not mark it to show how I am voting? |

If you sign, date and return your proxy card, but do not indicate how you want to vote, you give authority to Floyd L. English and James F. Petelle to cast your vote on the items discussed in these proxy materials. In such a case, your proxy will be voted FOR each of the director nominees and the ratification of our public auditors. |

|||

What if other items come up at the Annual Meeting and I am not there to vote? |

When you return a signed and dated proxy card or provide your voting instructions by telephone or Internet, you give Dr. English and Mr. Petelle the discretionary authority to to vote on your behalf on any other matter that is properly brought at the Annual Meeting. |

|||

Can I change my vote? |

You can change your vote by revoking your proxy at any time before it is exercised in one of four ways: |

|||

• |

notify Andrew's Corporate Secretary in writing before the Annual Meeting that you are revoking your proxy; |

|||

• |

submit another proxy with a later date; |

|||

• |

vote by telephone or Internet after you have given your proxy; or |

|||

• |

vote in person at the Annual Meeting. |

|||

What does it mean if I receive more than one proxy card? |

Your shares are likely registered differently or are in more than one account. You should sign and return all proxy cards to guarantee that all of your shares are voted. If you wish to combine your shareholder accounts in the future, you should contact Andrew's transfer agent, Computershare Investor Services LLC, at (800) 357-1910. Combining accounts reduces excess printing and mailing costs, resulting in savings for the company and for you as a stockholder. |

|||

What constitutes a quorum? |

The presence of the holders of a majority of the shares entitled to vote at the Annual Meeting constitutes a quorum. Presence may be in person or by proxy. Therefore, you will be considered part of the quorum if you return a signed and dated proxy card, if you vote by telephone or Internet, or if you attend the Meeting. |

|||

Abstentions are counted as "shares present" at the Meeting for purposes of determining whether a quorum exists. In the election of directors, abstentions will have no effect on the outcome of the vote. In the vote on the ratification of our independent auditors, abstentions will have the effect of a vote "against" the proposal. Proxies submitted by brokers that do not |

||||

1

indicate a vote for some or all of the proposals because the brokers do not have discretionary voting authority and have not received instructions from you as to how to vote on those proposals (so-called "broker non-votes") are considered "shares present" for purposes of determining whether a quorum exists. However, broker non-votes are not considered to be shares voted and will not affect the outcome of the vote. |

||||

What vote is required to approve each proposal? |

Election of Directors: The nine nominees who receive the most votes will be elected. If you do not want to vote your shares for a particular nominee, you may indicate that in the space provided on the proxy card or withhold authority as prompted during telephone or Internet voting. |

|||

Ratification of Independent Auditors: Although we are not required to submit the appointment of our auditors to a vote of stockholders, we believe that it is appropriate to ask that you ratify the appointment. Ratification of Ernst & Young LLP as our independent auditors requires the affirmative vote of a majority of the shares present or represented by proxy at the Meeting. |

||||

Who pays to prepare, mail and solicit the proxies? |

Andrew will pay all of the costs of preparing, mailing and soliciting these proxies. We will ask banks, brokers and other nominees and fiduciaries to forward the proxy materials to the beneficial owners of Andrew common stock and to obtain the authority to execute proxies. We will reimburse them for their reasonable expenses. |

|||

In addition to mailing proxy materials, our directors, officers and employees may solicit proxies in person, by telephone or otherwise. We also have employed Morrow & Company, Inc. to solicit proxies on our behalf and will pay them approximately $6,500 for their services. |

||||

How do I submit a stockholder proposal for next year's Annual Meeting? |

You must submit a proposal to be included in our proxy statement for the next annual meeting (February 2002) in writing no later than August 23, 2001. Your proposal must comply with the proxy rules of the Securities and Exchange Commission (SEC). |

|||

If you do not want your proposal to be included in the proxy statement but want to raise it at the next annual meeting, then we must receive your proposal no later than November 10, 2001. If you submit a proposal after the November 10 deadline but we choose to consider it at the meeting, then the SEC rules permit the individuals named in the proxies for the meeting to exercise discretionary voting power on that proposal. Under our by-laws, your proposal must contain: (1) a brief description of the business you want to bring before the meeting; (2) your name and address as they appear on Andrew's stock records; (3) the class and number of shares of Andrew that you beneficially own; and (4) a brief description of any interest you may have in the business you want to bring before the meeting. You should send your proposal to the Secretary at our address on the cover of this proxy statement. |

||||

How do I nominate a director for consideration at next year's Annual Meeting? |

Your nominations for directors of Andrew must meet all of the requirements for stockholder proposals discussed above. Our by-laws also require that for each individual you propose to nominate you give: (1) their name, age and home and business addresses; (2) their principal occupation or employment; (3) the class and number of shares of Andrew that they beneficially own; (4) any other information required by the proxy rules of the SEC; and (5) a description of all arrangements or understandings under which you are making the nominations. In addition, you must represent that you plan to appear in person or by proxy at the annual meeting to make the nomination. |

|||

2

Stockholders will elect nine directors at the Annual Meeting. Each director will serve until the next annual meeting, until a qualified successor director has been elected, or until he or she resigns or is removed by the Board. Kenneth J. Douglas is retiring from the Board and will not be standing for re-election.

We will vote your shares as you specify on the enclosed proxy card. If you do not specify how you want your shares voted, we will vote them FOR the election of all the nominees listed below. If unforeseen circumstances (such as death or disability) make it necessary for the Board of Directors to substitute another person for any of the nominees, we will vote your shares FOR that other person. The Board of Directors does not anticipate that any nominee will be unable to serve. The nominees have provided the following information about themselves.

Nominees

|

John G. Bollinger Ph.D. Age: Director Since: Business Experience: Other Directorships: |

65 1984 Dr. Bollinger is the Bascom Professor of Industrial Engineering and Emeritus Dean of the College of Engineering at the University of Wisconsin at Madison. Prior to attaining Emeritus status in 1999, Dr. Bollinger had been Dean of the college of Engineering since 1981. Kohler Corporation; Berber Information Networks Corp.; Cummins Allison Corp. and Bemis Company, Inc. |

||

|

Guy M. Campbell Age: Director Since: Business Experience: |

54 February 2000 Mr. Campbell was elected President of Andrew in February 2000 and Chief Executive Officer in September (effective October 1) 2000. He joined Andrew as Group President, Wireless and In-Building Products in 1999. Previously, Mr. Campbell held a number of executive positions at Ericsson, Inc., a telecommunications equipment manufacturer, from 1973 to 1999, most recently Vice President, Wireless Business Systems. |

||

|

Thomas A. Donahoe Age: Director Since: Business Experience: Other Directorships: |

65 1998 Mr. Donahoe retired in 1996 as Vice Chairman and Midwest Managing Partner of Price Waterhouse LLP, an international accounting, auditing and consulting firm. He first joined Price Waterhouse in 1958 and became a partner of the firm in 1970. BWAY Corporation; Nicor, Inc.; Chairman of the Board of Chicago Botanic Garden; Trustee of Rush-Presbyterian-St. Lukes Medical Center; Kohl's Children's Museum and Executive Service Corps of Chicago. |

||

3

|

Floyd L. English Ph.D. Age: Director Since: Business Experience: Other Directorships: |

66 1982 Dr. English has been Chairman of Andrew Corporation since 1994. He was President and Chief Executive Officer from 1983 through 2000. Dr. English joined Andrew in 1980 as Vice President, Corporate Development and became Vice President, U.S. Operations in February 1981. Executives Club of Chicago and the Illinois Math and Science Academy. |

||

|

Elizabeth A. Fetter Age: Director Since: Business Experience: Other Directorships: |

42 1999 Ms. Fetter has been Chief Executive Officer of NorthPoint Communications Group, Inc., a leading broadband services provider, since March 2000, President since March 1999 and Chief Operating Officer from March 1999 to March 2000. She previously was Vice President and General Manager of the Consumer Services Group at US WEST since 1998 and President, Industry Markets for Pacific Bell since 1997. From 1991 to 1997, Ms. Fetter held a number of executive positions in Finance, Sales, Marketing and General Management at Pacific Bell. NorthPoint Communications Group, Inc.; Datum Corp.; General Magic, Inc.; Union Bank of California; San Francisco State University College of Business Advisory Board; San Francisco Chamber of Commerce Board and Executive Women's Advisory. |

||

|

Jere D. Fluno Age: Director Since: Business Experience: Other Directorships: |

59 1996 Mr. Fluno retired in 2000 as Vice Chairman of W.W. Grainger, Inc., the leading North American provider of maintenance, repair, and operating supplies and related information to businesses and institutions. Mr. Fluno spent 31 years with Grainger in numerous positions. W.W. Grainger, Inc.; the Chicago Stock Exchange subsidiaries, Midwest Clearing Corporation and Midwest Securities Trust Company; the University of Wisconsin Foundation and other not-for-profit boards; Governor of the Chicago Stock Exchange; Trustee of the Museum of Science and Industry and member of the University of Wisconsin School of Business Dean's Advisory Board. |

||

|

William O. Hunt Age: Director Since: Business Experience: Other Directorships: |

66 1999 Mr. Hunt has been Chairman of the Board of Internet America, Inc., an internet service provider, since 1995. Mr. Hunt has also been Chairman of the Board of Intellicall, Inc., a public access telecommunications firm, since 1992 and President and Chief Executive Officer from 1992 until 1998. He was Chairman of the Board, President and Chief Executive Officer of Alliance Telecommunications Corporation, a wireless telecommunications firm, from 1986 to 1992. Mr. Hunt also served as Chairman of the Board of Hogan Systems, Inc., a leading supplier of application software for the worldwide financial and banking industry, from 1990 to 1993 and as Vice Chairman from 1993 to 1996. American Homestar Corporation; Internet America, Inc.; Intellicall Inc.; Digital Convergence.Com; Mobility Electronics, Inc. and Chairman of the Advisory Board of the College of Business Administration at the University of North Texas. |

||

4

|

Charles R. Nicholas Age: Director Since: Business Experience: |

54 September 2000 Mr. Nicholas has been Vice Chairman of Andrew since September 2000. He previously was Executive Vice President, Finance and Administration since 1995, and Chief Financial Officer since 1986. Mr. Nicholas joined Andrew as Treasurer in 1980, and became Vice President, Finance in 1982. |

||

|

Glen O. Toney, Ph.D. Age: Director Since: Business Experience: Other Directorships: |

61 1999 Dr. Toney has been Group Vice President, Corporate Affairs of Applied Materials, Inc., the leading worldwide supplier of semiconductor wafer fabrication equipment, since July 1995. Prior to that date, he was Group Vice President and Vice President, Global Human Resources since 1985. He first joined Applied Materials, Inc. in 1979. AID Technologies Inc.; Motorauction.com; Applied Materials Foundation; Robert Noyce Foundation; National Conference for Community and Justice and Bay Area School Reform Collaborative. Dr. Toney is also a member of the advisory board of the School of Engineering and Computer Science at California State University at Chico and of the Curriculum Redesign Committee at San Jose State University. |

||

Ownership of Andrew Common Stock

Directors and Executive Officers

This table indicates how much Andrew common stock the nominees for director, the named executive officers and all executive officers and directors as a group beneficially owned as of September 30, 2000. The named executive officers include the Chief Executive Officer and the four other most highly compensated executive officers based on compensation earned during the last fiscal year.

Beneficial ownership is a technical term broadly defined by the SEC to mean more than ownership in the usual sense. In general, beneficial ownership includes any shares a director or executive officer can vote or transfer and stock options that are exercisable currently or become exercisable within 60 days. Except as otherwise noted, the stockholders named in this table have sole voting and investment power for all shares shown as beneficially owned by them.

5

| |

Shares of Common Stock Owned |

Options Exercisable Within 60 Days |

Common Stock Equivalents in Director Fee Deferral Plan |

Shares of Common Stock in Profit-Sharing Trust |

Total |

% |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Non-Employee Directors | |||||||||||||

| John G. Bollinger | 7,344 | 88,876 | -0- | -0- | 96,222 | * | |||||||

| Thomas A. Donahoe | 3,000 | 2,400 | 3,530 | -0- | 8,930 | * | |||||||

| Kenneth J. Douglas | 9,618 | 88,876 | 16,253 | -0- | 114,747 | * | |||||||

| Elizabeth A. Fetter | 100 | -0- | 418 | -0- | 518 | * | |||||||

| Jere D. Fluno | 6,000 | 38,250 | 6,839 | -0- | 51,089 | * | |||||||

| William O. Hunt | -0- | -0- | 552 | -0- | 552 | * | |||||||

| Glen O. Toney | -0- | 2,400 | 2,585 | -0- | 4,985 | * | |||||||

Named Executive Officers |

|||||||||||||

| Floyd L. English | 132,222 | (1) | 178,000 | -0- | 95,990 | 406,212 | * | ||||||

| Guy M. Campbell | 9,828 | -0- | -0- | 73 | 9,901 | * | |||||||

| Charles R. Nicholas | 109,076 | 123,000 | -0- | 55,278 | 287,354 | * | |||||||

| Thomas E. Charlton | 154,966 | 148,950 | -0- | 56,503 | 360,419 | * | |||||||

| John B. Scott | 35,253 | 124,563 | -0- | 15,628 | 175,144 | * | |||||||

Directors and Executive Officers as a Group (17 persons) |

511,072 |

1,018,640 |

30,177 |

272,592 |

1,832,481 |

2.3 |

|||||||

Certain Stockholders

This table shows, as of December 15, 2000, all persons we know to be beneficial owners of more than 5% of Andrew common stock.

| Name and Address of Beneficial Owner |

Amount of Beneficial Ownership |

Percent of Class |

||||

|---|---|---|---|---|---|---|

| FMR Corp. (Fidelity Investments) | 8,389,573 | (1) | 10.3 | |||

| 82 Devonshire Street Boston, MA 02109 |

||||||

6

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires that Andrew's executive officers, directors and 10% stockholders file reports of ownership and changes of ownership of Andrew common stock with the SEC and the Nasdaq Stock Market National Market. Based on a review of copies of these reports provided to us during fiscal 2000, we believe that all filing requirements were met.

Meetings and Committees of the Board of Directors

The Board of Directors met eight times during the fiscal year. In addition to meetings of the full Board, directors attended meetings of Board committees. The Board of Directors has standing audit, compensation and human resources/nominating committees. Except for Mr. Hunt, who was unable to attend one Board meeting and two committee meetings, each director attended at least 75% of the meetings of the Board and of the committees on which he or she served. The following table shows the membership of the various committees during the fiscal year.

Committee Membership

| Name |

Audit |

Compensation |

Human Resources/Nominating |

||||

|---|---|---|---|---|---|---|---|

| John G. Bollinger | •* | ||||||

| Guy M. Campbell | |||||||

| Thomas A. Donahoe | • | • | |||||

| Kenneth J. Douglas | • | • | |||||

| Floyd L. English | |||||||

| Elizabeth A. Fetter | • | • | |||||

| Jere D. Fluno | •* | ||||||

| William G. Hunt | • | • | |||||

| Charles A. Nicholas | |||||||

| Glen O. Toney | •* |

Audit Committee: The Audit Committee recommends the independent auditors to the Board and reviews and approves the scope of the audit, the financial statements, and the independent auditors' fees. Additional information on the committee and its activities is set forth in the "Report of the Audit Committee of the Board of Directors." The Audit Committee met four times during the fiscal year.

Compensation Committee: This committee establishes the compensation programs for officers and reviews Andrew's overall compensation and benefit programs. The committee also administers and selects participants for the Management Incentive Program, the Employee Retirement Benefit Restoration Plan and the Executive Severance Benefit Plan, and administers the Employee Stock Purchase Plan. The Compensation Committee met four times during the fiscal year.

Human Resources/Nominating Committee: This committee reviews management development and succession planning, and identifies and recommends candidates for corporate officer positions. This committee also considers and recommends qualifications for directors and identifies and recommends candidates for membership on the Board. Stockholders who wish to submit nominees for director may do so in accordance with the requirements described under the caption "How do I nominate a director for consideration at next year's Annual Meeting?" The Human Resources/Nominating Committee met three times during the fiscal year.

7

Directors who are Andrew employees receive no fees for their services as directors. Non-employee "outside" directors receive an annual retainer of $19,600 and a fee of $1,000 for each Board meeting and each committee meeting they attend. Committee chairmen receive an additional fee of $1,000 for each committee meeting they attend.

Outside directors can defer part or all of their director fees under a deferred compensation plan. In lieu of cash payment, a director's account is credited with share units equal to the value of Andrew common stock at the end of the quarter in which the director elected to defer the fees. Upon leaving the Board, a director will receive the deferred amount in cash, based on the then current value of Andrew common stock. A director may elect to receive the cash payment in a lump sum or in five or fewer equal annual installments. Six of the seven outside directors who served during the last fiscal year deferred some or all of their director fees.

Outside directors also participate in the Andrew Corporation Stock Option Plan for Non-Employee Directors. Under this plan, each eligible director is automatically granted an option to purchase 12,000 shares of Andrew common stock at the Board of Directors' meeting following the annual stockholders' meeting.

Under guidelines adopted by the Board, each non-employee director is expected to own Andrew common stock having a value equal to at least three times annual cash compensation. A director has five years following election to the Board to reach that ownership level. A director who fails to attain or maintain this level of ownership will not be eligible for subsequent grants of stock options.

This table summarizes the before-tax compensation for Floyd L. English, the Chairman and Chief Executive Officer of Andrew, and the four next highest compensated executive officers of Andrew.

Summary Compensation

| |

|

|

|

|

Long-Term Compensation |

|

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Annual Compensation |

Awards |

Payouts |

|

|||||||||||||

| Name and Principal Position |

Fiscal Year |

Salary |

Bonus(3) |

Other Annual Compensation(4) |

Restricted Stock Awards |

Securities Underlying Options |

LTIP Payouts |

All Other Compensation(5) |

|||||||||

| Floyd L. English | 2000 | $504,000 | $1,396,428 | $69,699 | -0- | 111,600 | -0- | $12,943 | |||||||||

| Chairman and Chief Executive Officer(1) |

1999 1998 |

475,400 456,960 |

-0- 1,005,312 |

25,600 10,043 |

-0- -0- |

110,000 74,000 |

-0- -0- |

10,080 23,821 |

|||||||||

| Guy M. Campbell | 2000 | $348,280 | $757,242 | $1,090 | -0- | 90,000 | -0- | $8,143 | |||||||||

| President(1) | 1999 1998 |

105,692 — |

37,640 — |

-0- — |

-0- — |

25,000 — |

-0- -0- |

2,227 — |

|||||||||

| Charles R. Nicholas | 2000 | $320,040 | $477,692 | $3,613 | -0- | 45,000 | -0- | $12,943 | |||||||||

| Exec. Vice President, Chief Financial Officer(2) |

1999 1998 |

297,900 281,700 |

79,965 403,465 |

3,857 4,137 |

-0- -0- |

48,000 32,000 |

-0- -0- |

10,080 23,821 |

|||||||||

| Thomas E. Charlton | 2000 | $318,000 | $371,392 | $5,991 | -0- | 35,000 | -0- | $12,943 | |||||||||

| Group President, Communication Products |

1999 1998 |

300,000 283,700 |

71,400 335,192 |

3,311 5,255 |

-0- -0- |

48,000 32,000 |

-0- -0- |

10,080 23,821 |

|||||||||

| John B. Scott | 2000 | $272,280 | $475,881 | $514 | -0- | 35,000 | -0- | $12,943 | |||||||||

| Group President, Broadband Wireless and Power Amplifiers |

1999 1998 |

256,800 243,000 |

65,484 307,760 |

675 766 |

-0- -0- |

82,000 25,500 |

-0- -0- |

10,080 23,821 |

|||||||||

8

Option Grants in Last Fiscal Year

This table gives information relating to option grants to Dr. English and the four next most highly compensated executive officers in fiscal 2000. The exercise price of the options is based upon the fair market value of Andrew common stock on the date the option is granted. As the SEC requires, the calculation of potential realizable values is based on assumed annualized rates of stock price appreciation of 5% and 10% over the full ten-year term of the options. All options granted during the fiscal year vest at a rate of 25% per year.

| |

|

|

|

|

Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

% of Total Options Granted to Employees in Fiscal Year |

Exercise or Base Price Per Share |

|

||||||||

| |

Securities Underlying Options Granted |

|

||||||||||

| |

Expiration Date |

|||||||||||

| Name |

5% |

10% |

||||||||||

| F. L. English | 111,600 | 10.57 | $23.81 | 2/8/10 | $1,671,096 | $4,234,886 | ||||||

| G. M. Campbell | 90,000 | 8.53 | 23.81 | 2/8/10 | 1,347,658 | 3,415,231 | ||||||

| C. R. Nicholas | 45,000 | 4.26 | 23.81 | 2/8/10 | 673,829 | 1,707,615 | ||||||

| T. E. Charlton | 35,000 | 3.32 | 23.81 | 2/8/10 | 524,089 | 1,328,145 | ||||||

| J. B. Scott | 35,000 | 3.32 | 23.81 | 2/8/10 | 524,089 | 1,328,145 | ||||||

Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

This table provides information regarding the exercise of options during fiscal 2000 by Dr. English and the four next most highly compensated executives. The "value realized" is calculated using the difference between the option exercise price and the price of Andrew common stock on the date of exercise multiplied by the number of shares underlying the option. The "value of unexercised in-the-money options at fiscal year end" is calculated using the difference between the option exercise price and $26.19 (the price of Andrew common stock on that date) multiplied by the number of shares underlying the option. An option is in-the-money if the market value of the common stock subject to the option is greater than the exercise price.

| |

|

|

Securities Underlying Unexercised Options at Fiscal Year-End |

Value of Unexercised In-the-Money Options at Fiscal Year-End |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Shares Acquired on Exercise |

|

||||||||||

| |

Value Realized |

|||||||||||

| Name |

Exercisable |

Unexercisable |

Exercisable |

Unexercisable |

||||||||

| F. L. English | 168,750 | $2,986,538 | 115,125 | 247,975 | $350,545 | $1,069,599 | ||||||

| G. M. Campbell | 6,250 | 94,531 | -0- | 108,750 | -0- | 421,575 | ||||||

| C. R. Nicholas | 27,000 | 411,750 | 95,500 | 104,500 | 461,220 | 458,190 | ||||||

| T. E. Charlton | -0- | -0- | 121,450 | 94,500 | 745,113 | 442,940 | ||||||

| J. B. Scott | -0- | -0- | 102,188 | 114,625 | 720,992 | 762,695 | ||||||

In November 1999, the Compensation Committee extended the terms of certain options held by the officers listed in the above table as described in the "Report of the Compensation Committee" of the Board of Directors under the caption "Options."

9

Long-Term Performance Cash Awards in Last Fiscal Year

Andrew's current long-term performance cash award program covers fiscal years 1999 through 2001. Executive officers are eligible for target payouts ranging from 30% to 120% of their average annual salary during that three-year period if long-term performance goals established by the Compensation Committee for the program are met. Performance goals for the current program include aggregate, three-year (1999, 2000 and 2001) revenue and earnings-per-share. Payments will be made to Andrew executives participating in the program at the threshold amount if return on sales and return on equity exceed established minimums and Andrew achieves either 75% of the earnings per share target or 75% of the revenue target. If maximum earnings per share and revenue are achieved for the three-year period, then payouts are limited to two times the target bonus amounts.

The following table illustrates a range of estimated payouts that could be made early in fiscal 2002 to Dr. English and the four next most highly compensated executives.

| |

|

|

Estimated Future Payouts Under Long-Term Incentive Plan |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

|

Performance Period |

||||||||

| Name |

Targeted Award |

Threshold |

Target |

Maximum |

||||||

| F. L. English | 120% of Average 1999-2001 Salary |

Oct. 1, 1998 Sept. 30, 2001 |

$227,910 | $607,760 | $1,215,520 | |||||

| G. M. Campbell | 80% of Average 1999-2001 Salary |

Oct. 1, 1998 Sept. 30, 2001 |

106,720 | 284,590 | 569,180 | |||||

| C. R. Nicholas | 80% of Average 1999-2001 Salary |

Oct. 1, 1998 Sept. 30, 2001 |

95,400 | 254,400 | 508,800 | |||||

| T. E. Charlton | 80% of Average 1999-2001 Salary |

Oct. 1, 1998 Sept. 30, 2001 |

95,200 | 253,860 | 507,720 | |||||

| J. B. Scott | 80% of Average 1999-2001 Salary |

Oct. 1, 1998 Sept. 30, 2001 |

81,510 | 217,350 | 434,700 | |||||

Executive Severance Benefit Plan

Key executives of Andrew selected by the Compensation Committee receive benefits under the Executive Severance Benefit Plan in the event of termination of employment following a change in control as defined in the Plan.

Andrew must pay benefits to a Plan participant if, within four years after a change in control, his or her employment is terminated for any reason other than death, disability, retirement or cause. Andrew must also pay benefits if, within the four-year period, a participant resigns because his or her compensation or duties are significantly reduced, because he or she must relocate or because Andrew breaches the Plan. Andrew is obligated to pay each affected participant an amount equal to the sum of: (1) 36 months of salary, bonus and Andrew profit sharing and matching contributions, (2) the aggregate spread between the option price and fair market value of Andrew common stock on the severance date for all of the participant's outstanding stock options and (3) up to 36 months of medical, life and similar insurance benefits. These benefits are reduced proportionately if any such termination occurs more than one year, but within four years, after the change in control.

If a participant voluntarily terminates employment within two years after a change in control for reasons other than those stated above, Andrew must pay the participant one-half of the above-described benefits. The Plan also provides for an adjustment in the benefits Andrew must pay if a benefit is considered an "excess parachute payment" under the Internal Revenue Code.

If there had been a change in control and termination of employment of the executives named in the Summary Compensation Table, Andrew would have been required to pay them the following amounts at September 30, 2000: Floyd L. English, $4,134,000; Guy M. Campbell, $1,380,000; Charles R. Nicholas, $2,018,000; Thomas E. Charlton, $1,851,000; and John B. Scott, $1,767,000.

10

Employee Retirement Benefit Restoration Plan

Andrew's Employee Retirement Benefit Restoration Plan provides additional retirement benefits to certain senior executives selected by the Compensation Committee. Because of limitations imposed by the Internal Revenue Service, these executives' benefits from the Andrew Profit Sharing Trust are reduced. In general, executives participating in the Restoration Plan receive benefits that compensate them for the decreased benefits under the Profit Sharing Trust.

A participant is not eligible to receive benefits under the Restoration Plan until the earlier of turning 65 or his or her termination of employment with Andrew by reason of death, disability, retirement or change in control. Generally, the participant can elect to receive benefit payments under the Restoration Plan in a lump sum or in installments over 15 years. Upon a change in control, however, the participant will receive benefit payments in a lump sum.

If there had been a change in control, Andrew would have been required to pay the executives named in the Summary Compensation Table the following amounts at September 30, 2000: Floyd L. English, $489,074; Guy M. Campbell, $11,523; Charles R. Nicholas, $219,786; Thomas E. Charlton, $198,517; and John B. Scott, $176,328.

Other Arrangements

In November 1991, Andrew entered into an agreement that obligates Andrew to retain Mr. Scott as an advisor to the Company for two years after the termination of his employment for a retainer fee of $100,000, a per diem rate of $500 and the reimbursement of expenses.

Report of the Compensation Committee of the Board of Directors

The Compensation Committee establishes Andrew's general compensation policies as well as specific compensation plans, performance goals and compensation levels for executive officers. The Committee selects participants for and administers the Management Incentive Program, the Employee Retirement Benefit Restoration Plan and the Executive Severance Benefit Plan, and administers the Employee Stock Purchase Plan. The Committee is composed of three non-employee directors who have no interlocking relationships.

Compensation Philosophy

The Committee's principal objective is to align executive compensation with stockholder value. To achieve that objective, executive compensation has various components. One component is base salary, which is set below the median for similar positions at comparable companies. Other cash components are annual bonus and long-term performance cash awards, which are linked to aggressive performance factors that relate to stockholder value, such as earnings per share and sales. Stock options further align long-term executive performance with stockholder value. The Committee believes that this multi-faceted approach to compensation provides a particular incentive since executives can receive above-average total compensation if Andrew's performance is exceptional.

Base Salary

The Committee established Dr. English's salary by comparison to the salaries of chief executive officers of comparable companies. An outside consultant compiled salary data for a group of technology companies that are similar to Andrew. Some of these companies are included in the S&P Communications Equipment Manufacturers Index used in the Performance Graph. Based on the salary information provided by the consultant, the Committee set Dr. English's salary for the last three fiscal years below the median for companies comparable to Andrew. Dr. English received a 6% increase in base salary for fiscal 2000.

11

The Committee also used salary survey data compiled by its consultant to determine the salary for Mr. Campbell when he became President of Andrew in February 2000. The same consultant was used to establish salaries for other executive officers. As with Dr. English, the Committee sets the base salaries below the median salaries for similar positions at comparable companies. The Committee also considers other factors, such as relative company performance, the officer's past performance and his or her potential.

Annual Bonus

The Committee determines the CEO's annual cash bonus based on Andrew's growth in earnings per share during the past fiscal year. Each year, the Committee sets a minimum earnings per share target. The bonus is calculated using a formula based on the amount that earnings per share for the year exceeds the target. Earnings per share for fiscal 2000 were $0.98, which exceeded the target. Therefore, Dr. English received a cash bonus of $1,396,428 for fiscal 2000. The Committee has established a similar target and formula for Mr. Campbell for fiscal 2001.

Cash bonuses for other executive officers are based on three factors: (1) earnings per share growth, using the same formula as for the CEO; (2) operating results of the businesses or business functions that report to the executive; and (3) achievement of specified, measurable objectives that relate to the executive's area of responsibility.

Long-Term Performance Cash Award

The long-term performance cash award programs for senior executives are based on objective measurements at a corporate level, which emphasize Andrew's long-term results. Each program covers three fiscal years. The Committee establishes minimum, target and maximum performance goals, which include earnings per share growth over the three years and the level of sales for the third year of the program.

The most recent program covered fiscal years 1997 through 1999. For that program, 50% of the target bonus was based on earnings per share growth during the period and 50% was based on the level of sales in fiscal 1999. Since the minimum targets were not achieved, neither Dr. English nor any of the other executive officers received any payment under that program.

The current program covers fiscal years 1999 through 2001. Under this program, 50% of the target bonus will be based on earnings per share growth and 50% will be based on revenue growth during the period. In addition, Andrew must maintain a minimum average return on equity and return on sales during the three-year period. Any payments under the current program likely will be made in December 2001.

Options

The Committee believes that stock options are an essential element of executive compensation because they focus management's attention on stockholder interests. Through periodic grants of stock options, the Committee intends to encourage executive officers and other key employees to increase stockholder value. Option grants are made at fair market value of Andrew common stock on the grant date. Andrew's stock option plan prohibits the re-pricing of options.

In November 1999, the Compensation Committee extended until November 2004 the terms of options granted in November 1994, which would have expired in November 1999. All stock options granted subsequent to those options have had a term of ten years. At the time of extension, the individuals named in the Summary Compensation Table held 1994 options covering the following number of shares: Floyd L. English, 67,500; Charles R. Nicholas, 27,000; Thomas E. Charlton, 25,950 and John B. Scott, 27,000.

At its meeting on October 23, 2000, the Committee granted Dr. English options on 140,000 shares of Andrew common stock. The Committee also granted options to the other most highly compensated officers as follows: Mr. Campbell, 140,000 shares; Mr. Nicholas, 50,000 shares; Mr. Charlton, 40,000 shares and Mr. Scott, 40,000 shares.

12

Stock Ownership Guidelines

The Chairman and the CEO are expected to own Andrew common stock having a value of five times their annual salary. For each other senior officer the level is three times annual salary. Each officer has five years following election to his or her position to reach that ownership level. An officer who fails to attain or maintain this level of ownership will not be eligible for subsequent grants of stock options.

Deductibility of Executive Compensation

Internal Revenue Code Section 162(m) limits the deductibility by Andrew of compensation in excess of $1,000,000 paid to each of the chief executive officer and the other four most highly compensated executive officers. Certain "performance based compensation" is not included in compensation counted for purposes of the limit. The Committee believes that it has structured Andrew's compensation programs to preserve full deductibility and will continue to assess the impact of Section 162(m) on its compensation practices.

| Compensation Committee John G. Bollinger, Chairman Elizabeth A. Fetter William O. Hunt |

Report of the Audit Committee of the Board of Directors

The Audit Committee is composed of four outside directors who are independent, as defined in Rule 4200(a)(15) of the National Association of Securities Dealers' listing standards. The Committee operates under a written charter adopted by the Board of Directors, a copy of which is included as Exhibit A to this proxy statement.

Management is responsible for Andrew's internal controls and financial reporting process. The independent auditors are responsible for performing an independent audit of Andrew's consolidated financial statements in accordance with generally accepted auditing standards and issuing a report to Andrew's stockholders and Board of Directors on the results of this audit. The Committee's responsibility is to monitor and oversee these processes.

The Committee has met and held discussions with management and Ernst & Young LLP, Andrew's independent auditors. These meetings included sessions at which management was not present. The Committee discussed with Ernst & Young the results of its examination of Andrew's consolidated financial statements, its evaluation of Andrew's internal controls, and its assessment of the overall quality of Andrew's financial controls. Management represented to the Committee that Andrew's consolidated financial statements were prepared in accordance with generally accepted accounting principles. The Committee reviewed and discussed the consolidated financial statements with management and Ernst & Young. The Committee also discussed with Ernst & Young matters related to the financial reporting process required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees).

Ernst & Young also provided to the Committee the written disclosures and the letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and the Committee reviewed with Ernst & Young that firm's independence.

Based on the Committee's discussions with management and Ernst & Young, the Committee's review of the representations of management, and the report of Ernst & Young to the Committee, the Committee recommended that the Board of Directors include the audited consolidated financial statements in Andrew's Annual Report on Form 10-K for the year ended September 30, 2000. The Committee and the Board also have recommended for stockholder approval the retention of Ernst & Young as independent auditors for Fiscal Year 2001.

| Audit Committee Jere D. Fluno, Chairman Thomas A. Donahoe Kenneth J. Douglas Elizabeth A. Fetter |

13

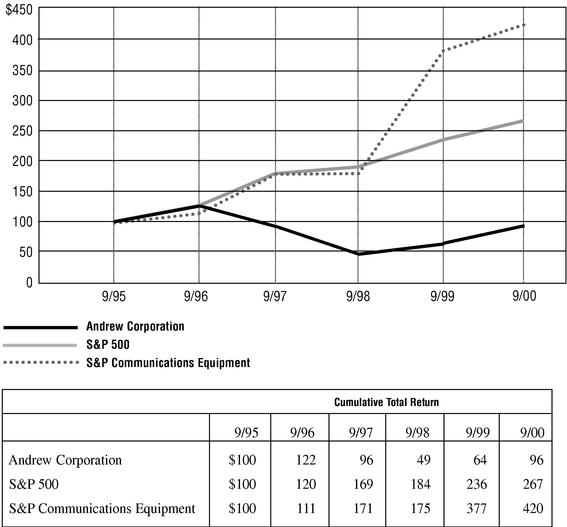

This graph shows a five-year comparison of cumulative total returns for Andrew, the Standard & Poor's (S&P) 500 Composite Index and the S&P Communications Equipment Manufacturers Index. The graph assumes an investment of $100 on September 30, 1995 and the reinvestment of dividends.

14

Appointment of Independent Auditors

The Board of Directors has appointed Ernst & Young LLP, independent auditors, to serve for the fiscal year ending September 30, 2001. Ernst & Young LLP has been employed to perform this function since 1970.

Although we are not required to do so, we believe that it is appropriate to request that stockholders ratify the appointment of Ernst & Young. If stockholders do not ratify the appointment, the Audit Committee will investigate the reasons for the stockholders' rejection and the Board of Directors will reconsider the appointment.

Representatives of Ernst & Young will be at the annual meeting, will be given the opportunity to make a statement and will respond to appropriate questions.

The Board of Directors unanimously recommends a vote FOR

ratification of the appointment of Ernst & Young LLP.

15

EXHIBIT A

Charter of the Audit Committee of the Board of Directors

I. PURPOSE

The primary function of the Audit Committee is to assist the Board of Directors in fulfilling its oversight responsibilities relating to: the auditing, accounting, and reporting practices of the company; the adequacy of the company's systems of internal controls; and the quality and integrity of publicly reported financial disclosures. The Audit Committee's primary duties and responsibilities are to:

The Audit Committee will primarily fulfill these responsibilities by carrying out the activities enumerated in Section IV of this Charter.

II. ORGANIZATION

The Audit Committee shall be comprised solely of at least three independent directors elected annually in February by the Board. Members of the Audit Committee will be considered independent if they have no relationship with the company that could interfere with their independence from management and the company. All members of the Committee will be financially literate, and at least one member will have accounting or related financial management expertise.

III. MEETINGS

The Committee will meet at least twice annually, or more frequently as circumstances dictate, in addition to the conference call to discuss the annual financial statements prior to release of earnings. The Committee will meet either jointly or separately with internal audit and the external auditors in executive sessions at least annually, to discuss any matters that the Committee or each of these groups believes should be discussed privately.

IV. RESPONSIBILITIES AND DUTIES

In carrying out its responsibilities, the Audit Committee believes that its policies and procedures should remain flexible, in order to react to changing conditions and to ensure the effective oversight of the company's reporting process and internal control system.

Specific responsibilities and duties of the Committee:

Documents/Reports Review

16

External Auditors

Internal Auditors

Financial Reporting Processes

17

Ethical and Legal Compliance

General

18

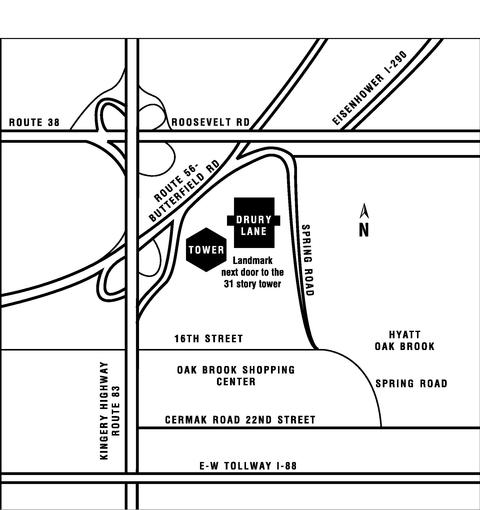

Drury Lane

100 Drury Lane

Oakbrook Terrace, Illinois

630-530-8300

When approaching from the north or south on Route 83:

Exit at Roosevelt/Butterfield Road east (Roosevelt Road is Route 38). Follow the green sign to Drury Lane.

When approaching from the east or west on Roosevelt Road:

Exit Route 83 (Kingery Highway) south to Roosevelt Road (Route 38) east and follow the green sign to Drury Lane.

When approaching from downtown Chicago:

Take the Eisenhower Expressway (I-290) west to the East-West Tollway (I-88), Aurora exit. Immediately after paying the $.40 toll at the Cermak Road/22nd Street tollbooth, exit right and proceed north on Spring Road to Drury Lane.

When approaching from the west on I-88:

Exit at Midwest Road, turn right, proceed north to Butterfield Road (Route 56). Turn right onto Butterfield Road, exit Roosevelt Road (Route 38) east to Drury Lane.

When approaching from I-294 (Tri-State Tollway):

Take I-88 (East-West Tollway) west, to Aurora exit. Immediately after paying the $.40 toll at the Cermak Road/22nd Street tollbooth, exit right and proceed north on Spring Road to Drury Lane.

When coming from O'Hare Airport:

Take I-294 (Tri-State Tollway) south, and follow above instructions.

| Bulletin 10576 (12/00) ©2000 Andrew Corporation, Orland Park, Illinois U.S.A. • Printed in U.S.A. |

19

ANDREW CORPORATION

PROXY SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned Stockholder of ANDREW CORPORATION appoints Floyd L. English and James F. Petelle, or either of them, proxies, with full power of substitution, to vote at the Annual Meeting of Stockholders of the Company to be held at the Drury Lane, Oakbrook Terrace, Illinois at 10:00 A.M., Tuesday, February 13, 2001, and any adjournment or adjournments thereof, the shares of Common Stock of ANDREW CORPORATION which the undersigned is entitled to vote, on all matters that may properly come before the Meeting.

You are urged to cast your vote by marking the appropriate boxes. PLEASE NOTE THAT, UNLESS A CONTRARY DISPOSITION IS INDICATED, THIS PROXY WILL BE VOTED FOR ITEMS 1 AND 2.

PLEASE VOTE, SIGN, DATE AND RETURN THIS PROXY FORM PROMPTLY USING THE ENCLOSED ENVELOPE.

(please sign and date this card on the reverse side)

PLEASE MARK VOTE IN OVAL IN THE FOLLOWING MANNER USING DARK INK ONLY.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" EACH OF THE LISTED PROPOSALS.

| For All |

Withhold All |

For All Except |

||||

| 1. To elect nine Directors for the ensuing year. | / / | / / | / / | |||

| 01-J.G. Bollinger 02-G.M. Campbell 03-T.A. Donahoe 04-F.L. English 05-E.A. Fetter 06-J.D. Fluno 07-W.O. Hunt 08-C.R. Nicholas 09-G.O. Toney |

||||||

Except Nominee(s) written above |

||||||

For |

Against |

Abstain |

||||

| 2. To ratify the appointment of Ernst & Young as independent public auditors for fiscal 2001. | / / | / / | / / | |||

3. In their discretion, the proxies are authorized to vote upon such other business as may properly come before the meeting. |

||||||

Signature(s) |

||||||

| Dated: |

||||||

IMPORTANT: Please sign your name or names exactly as shown hereon and date your proxy in the blank space provided above. For joint accounts, each joint owner must sign. When signing as attorney, executor, administrator, trustee or guardian, please give your full title as such. If the signer is a corporation, please sign full corporate name by duly authorized officer.

|

|