|

|

|

|

|

Previous: CENTENNIAL TAX EXEMPT TRUST /CO/, 497, 2000-10-31 |

Next: SOUTH TEXAS DRILLING & EXPLORATION INC, 8-K/A, 2000-10-31 |

Fidelity®

Portfolios®

Air Transportation

Automotive

Banking

Biotechnology

Brokerage and Investment Management

Business Services and Outsourcing

Chemicals

Computers

Construction and Housing

Consumer Industries

Cyclical Industries

Defense and Aerospace

Developing Communications

Electronics

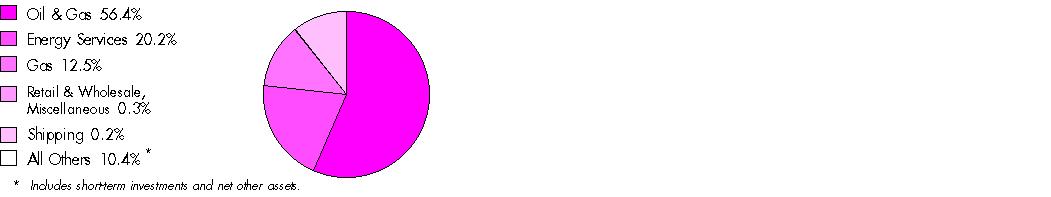

Energy

Energy Service

Environmental Services

Financial Services

Food and Agriculture

Gold

Health Care

Home Finance

Industrial Equipment

Industrial Materials

Insurance

Leisure

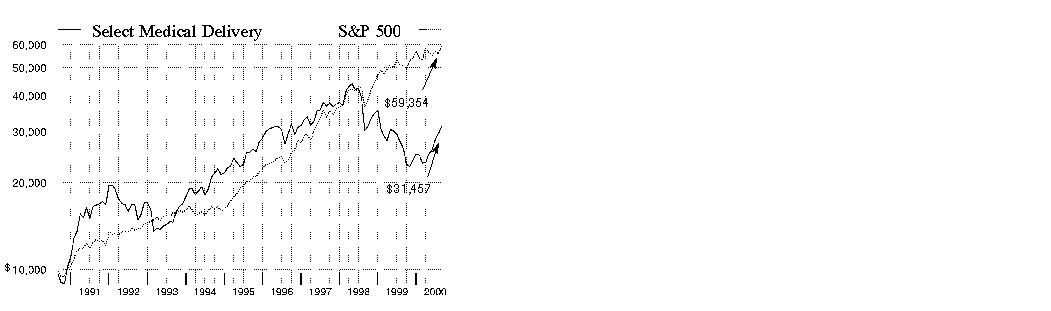

Medical Delivery

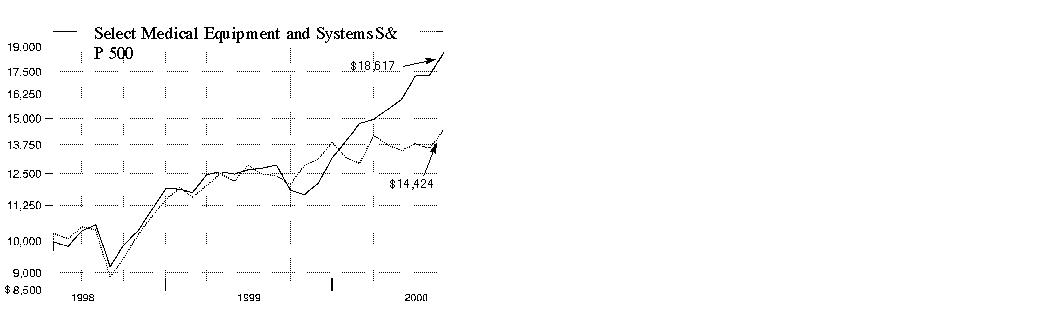

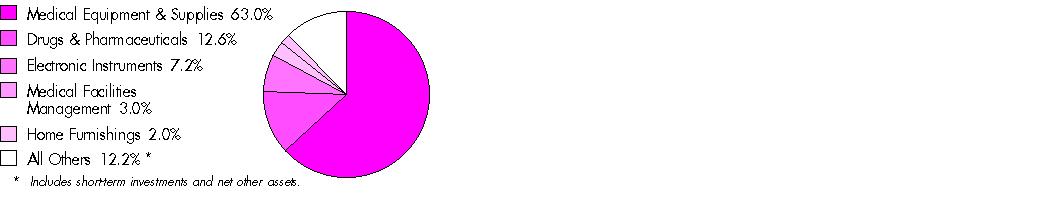

Medical Equipment and Systems

Money Market

Multimedia

Natural Gas

Natural Resources

Paper and Forest Products

Retailing

Software and Computer Services

Technology

Telecommunications

Transportation

Utilities Growth

Semiannual Report

August 31, 2000

(2_fidelity_logos) (Registered_Trademark)

|

Contents Performance Overview |

4 |

|

|

Fund Updates* |

|

|

|

Consumer Sector |

7 |

Consumer Industries |

|

|

14 |

Food and Agriculture |

|

|

20 |

Leisure |

|

|

26 |

Multimedia |

|

|

32 |

Retailing |

|

Cyclicals Sector |

37 |

Air Transportation |

|

|

43 |

Automotive |

|

|

48 |

Chemicals |

|

|

53 |

Construction and Housing |

|

|

59 |

Cyclical Industries |

|

|

66 |

Defense and Aerospace |

|

|

72 |

Environmental Services |

|

|

77 |

Industrial Equipment |

|

|

83 |

Industrial Materials |

|

|

89 |

Paper and Forest Products |

|

|

94 |

Transportation |

|

Financial Services Sector |

100 |

Banking |

|

|

105 |

Brokerage and Investment Management |

|

|

111 |

Financial Services |

|

|

117 |

Home Finance |

|

|

112 |

Insurance |

|

Health Care Sector |

127 |

Biotechnology |

|

|

133 |

Health Care |

|

|

139 |

Medical Delivery |

|

|

145 |

Medical Equipment and Systems |

|

Natural Resources Sector |

150 |

Energy |

|

|

156 |

Energy Service |

|

|

161 |

Gold |

|

|

167 |

Natural Resources |

|

|

|

|

* Fund updates for each Select Portfolio include: Performance and Investment Summary, Manager's Overview, Investments, and Financial Statements.

|

Technology Sector |

173 |

Business Services and Outsourcing |

|

|

179 |

Computers |

|

|

185 |

Developing Communications |

|

|

191 |

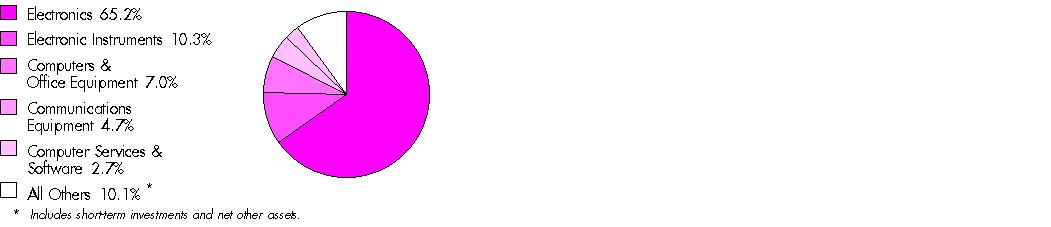

Electronics |

|

|

197 |

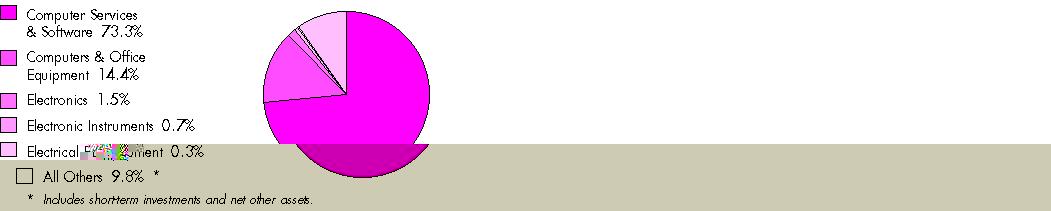

Software and Computer Services |

|

|

203 |

Technology |

|

Utilities Sector |

210 |

Natural Gas |

|

|

216 |

Telecommunications |

|

|

222 |

Utilities Growth |

|

|

228 |

Money Market |

|

Notes to Financial Statements |

235 |

Footnotes to the Financial Statements |

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by

Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

(Recycle graphic) This report is printed on recycled paper using soy-based inks.

The views expressed in this report reflect those of each fund's portfolio manager only through the end of the period of the report as stated on the cover and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Because of their narrow focus, sector funds tend to be more volatile than funds that diversify across many sectors and companies.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the funds. This report is not authorized for distribution to prospective investors in the funds unless preceded or accompanied by an effective prospectus.

Mutual fund shares are not deposits or obligations of, or guaranteed by, any depository institution. Shares are not insured by the FDIC, Federal Reserve Board or any other agency, and are subject to investment risks, including possible loss of principal amount invested.

Neither the funds nor Fidelity Distributors Corporation is a bank.

Dear Shareholder:

Market leadership changed hands during the six-month period ending August 31, 2000, as the leaders of the "new economy" - technology, wireless and biotechnology stocks - gave way to the "old economy" financial services, natural resources and health care sectors. The technology sector reached its apex shortly after the period began, on March 10, when the NASDAQ Composite Index closed at a record high 5048.62. But that was followed by a 10-week, 30% freefall in the index - a decline sparked in large part by excessive valuations and the Federal Reserve Board's preemptive strikes against inflation. For the overall six-month period, the NASDAQ fell 10.36%. As the Fed's series of rate hikes began to take hold, investors flocked to sectors such as health care that traditionally deliver consistent, proven earnings in a more moderate-growth economy. The finance sector also emerged as a winner, thanks in part to strong capital markets activity. The natural resources sector benefited from rising oil and gas prices due to limited supplies of the commodities and heightened demand. The Standard & Poor's 500SM Index - a large-capitalization index of 500 widely held stocks - returned 11.73% during the six-month period. Blue chips, as measured by the Dow Jones Industrial Average, returned 11.60%. A heavy concentration in technology hurt the small-cap oriented Russell 2000® Index, which declined 6.38% during the period.

Amidst the period's volatility, more than half of the 38 Select equity portfolios beat their sector benchmarks. Twenty topped the S&P 500's six-month return, while 21 beat their respective Goldman Sachs indexes - which are performance measurements of companies in the Select Portfolios' sector concentrations. The best performer was Select Insurance, which gained 54.78%. Select Telecommunications posted the lowest return, falling 15.23%. On September 26, after the end of the period covered by this report, two new Fidelity Select Portfolios were launched: Fidelity Select Wireless Portfolio and Fidelity Select Networking and Infrastructure Portfolio.

Turning to individual sectors, the Fed's rate hikes and the decelerating U.S. economy had varying effects on Select Portfolios in the consumer sector. Food and Agriculture did well, as cautious investors turned to the defensive nature of food and supermarket stocks. Conversely, both Leisure and Multimedia posted negative returns as stocks in these sectors typically underperform in an economic slowdown. Retail and Consumer Industries were hurt by the same trend of potential moderation in consumer spending.

The healthy U.S. economy was generally a positive factor for the cyclical sector, although fears of a slowdown tempered gains later in the period. Air Transportation recorded the largest return of the 11 Select cyclical Portfolios, as strong demand and slower growth in seating capacity boosted airline stocks. Transportation benefited from the same circumstances. Defense and Aerospace prospered as projected federal defense budget increases were greeted enthusiastically by investors. Improved fundamentals for solid waste stocks keyed the strong return of Environmental Services , while good stock selection and low exposure to interest-rate sensitive stocks spurred Cyclical Industries . Automotive had a solid six months, thanks in part to the stabilization of interest rates in the latter half of the period. The performance of Construction and Housing was right in line with its Goldman Sachs benchmark, although higher raw material and labor costs detracted from the industry's profit margins. The prospect of a slowing economy was a significant factor in the single-digit returns of Industrial Materials and Industrial Equipment . A weak euro and rising commodity prices held back Chemicals , while Paper and Forest Products also underperformed due in part to a high inventory/low demand imbalance.

The financial services sector posted its best six-month performance in recent memory, and each of the five Select Portfolios in this segment had strong returns. Insurance had the best performance based on improvements in the property and casualty industry's ability to command higher prices. Attractive stock valuations and strong capital markets activity helped Brokerage and Investment Management best the Goldman Sachs index. Financial Services and Home Finance each returned more than 30%, boosted by the perception that the Fed's rate hikes were at an end. The Banking Portfolio, despite strong absolute performance, trailed its benchmark due to increased credit risk in the banking sector.

It was a good period for the health care sector with the exception of the spring biotechnology sell-off, which tempered Select Biotechnology 's return. Medical Delivery was an outperformer, as improving fundamentals in the field and steady earnings streams enhanced performance. Medical Equipment and Systems similarly benefited to beat the Goldman Sachs Health Care Index. On the other hand, the Health Care Portfolio's overweighing in biotech caused it to marginally underperform the benchmark.

The natural resources sector continued to rally behind higher oil and natural gas prices, increased exploration and demand, and restricted supply. Natural Resources , Energy and Energy Service all benefited from this environment, and each outperformed the Goldman Sachs Natural Resources Index. Gold , however, underperformed as the price of the precious metal continued to be weak.

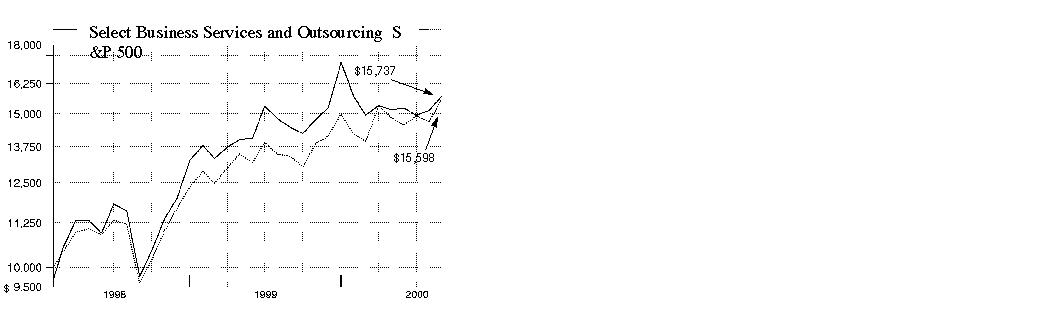

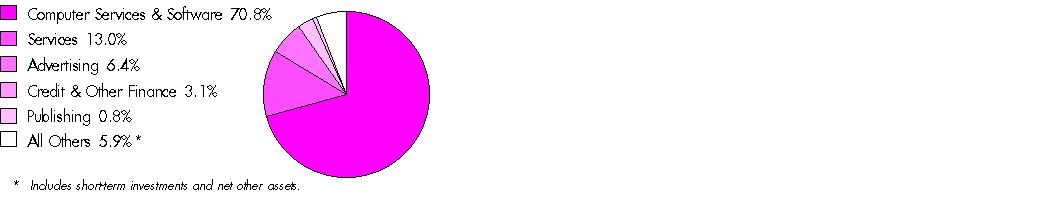

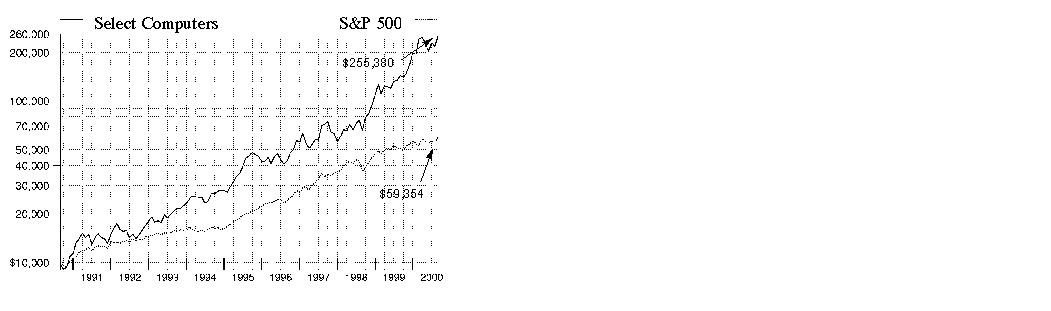

Technology, the top-performing sector six months ago, fell from grace for much of the past six months. Still, Business Services and Outsourcing had a solid return. Its lack of exposure to poor-performing Internet stocks was a prime contributor; Computers profited from the same lack of exposure. Electronics topped the Goldman Sachs Technology Index by way of solid picks in the semiconductor arena. An emphasis on higher quality names helped Software and Computer Services also edge the benchmark. But valuation concerns and earnings worries held back Technology , while exposure to the slumping wireless sector restrained Developing Communications.

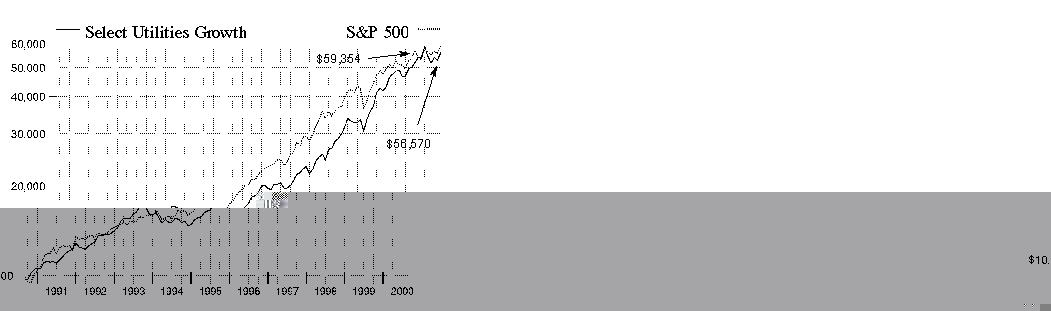

Within the utilities sector, the Natural Gas Portfolio was the best performer, as limited supplies of and robust demand for the fuel boosted stock prices in the sector. Utilities Growth 's emphasis on strong-performing independent power producers helped it beat its benchmark. Telecommunications struggled as deregulation and increased competition pervaded the market segment.

In the pages that follow, you'll find detailed summaries for each of the Select Portfolios. We hope that you find them informative and useful for evaluating your investments. Thank you very much for your continued interest in the Fidelity Select Portfolios.

Sincerely,

/s/ William R. Ebsworth

William R. Ebsworth

Group Leader, FMR Research

Select Group Leader

Semiannual Report

Cumulative Total Returns

For the six months ended August 31, 2000

Past performance is no guarantee of future results. Total returns include changes in a fund's share price, plus reinvestment of any dividends and capital gains but do not include Select's 3% sales charge, and certain fees paid by shareholders upon exchange or redemption. Figures for the Standard & Poor's 500 Index, a market capitalization-weighted index of common stocks, include reinvestment of dividends. S&P 500 is a registered trademark of Standard & Poor's. All performance numbers are historical; each equity fund's share price and return will vary and shareholders may have a gain or loss when they sell their shares. If FMR had not reimbursed certain fund expenses for some of the funds, those returns would have been lower.

Semiannual Report

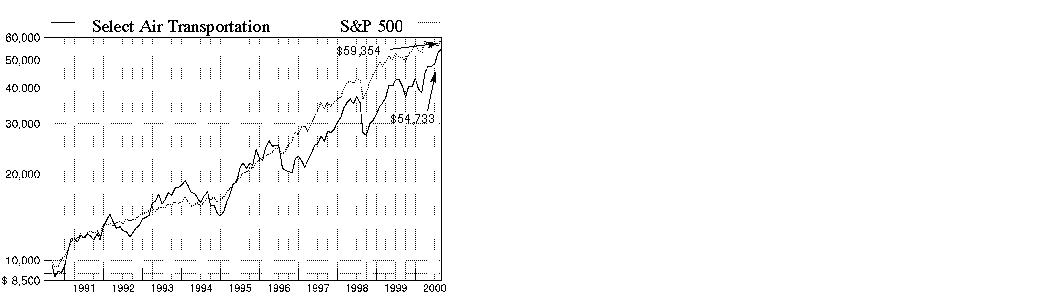

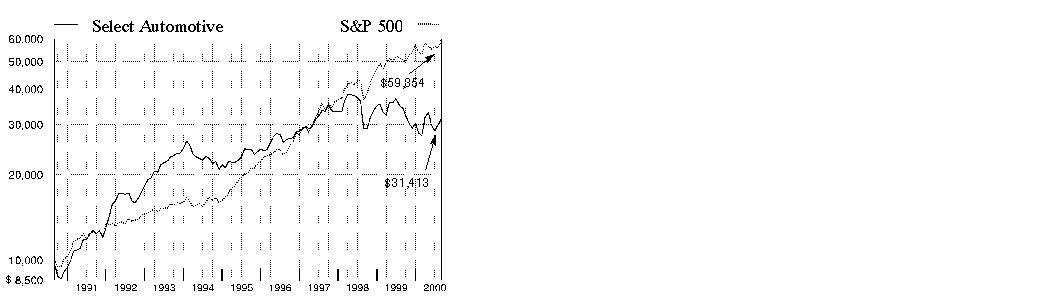

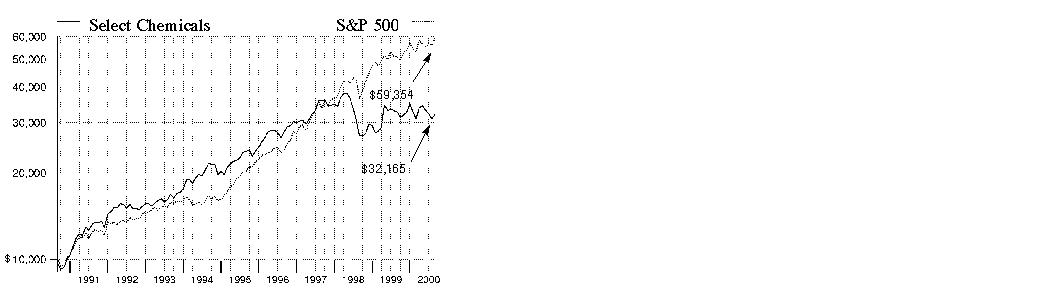

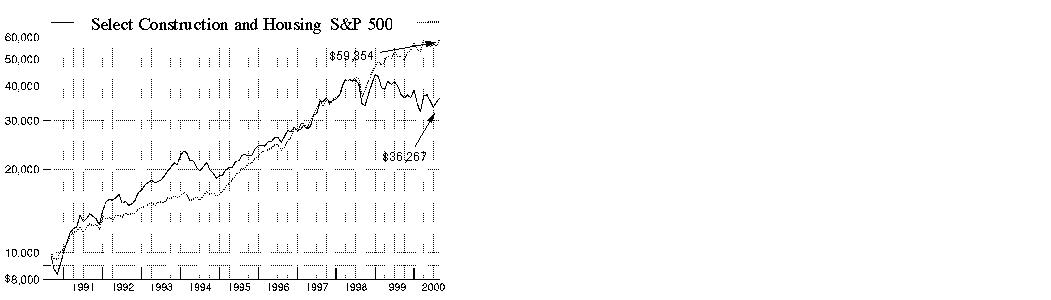

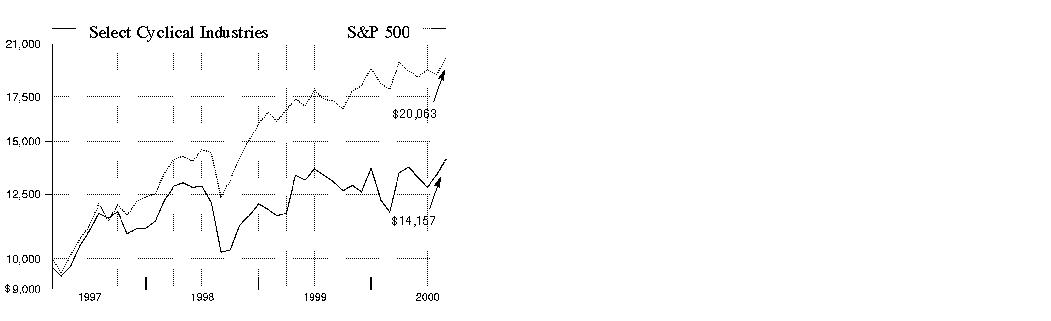

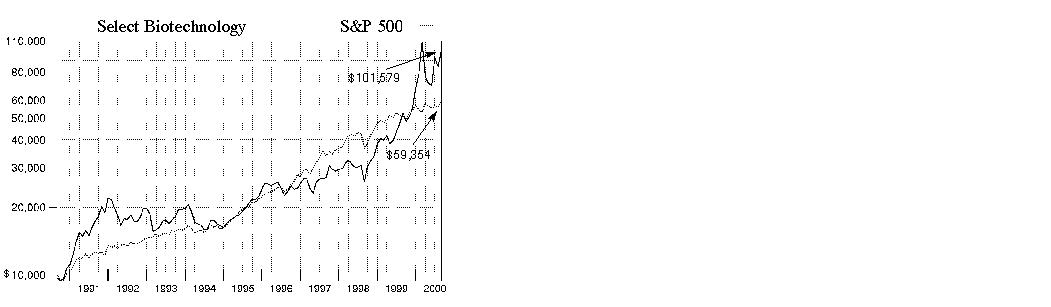

Performance

There are several ways to evaluate a fund's historical performance. You can look at the total percentage change in value, the average annual percentage change or the growth of a hypothetical $10,000 investment. Total return reflects the change in the value of an investment, assuming reinvestment of the fund's dividend income and capital gains (the profits earned upon the sale of securities that have grown in value). Load adjusted returns include a 3.00% sales charge and the effect of a $7.50 long-term trading fee for shares held 30 days or more. Effective September 28, 2000, the $7.50 long-term trading fee was eliminated. If Fidelity had not reimbursed certain fund expenses, the past five year and 10 year total returns would have been lower.

Cumulative Total Returns

|

Periods ended |

Past 6 |

Past 1 |

Past 5 |

Past 10 |

|

|

Select Consumer Industries |

0.81% |

-1.75% |

119.96% |

363.77% |

|

|

Select Consumer Industries (load adj.) |

-2.29% |

-4.77% |

113.29% |

349.78% |

|

|

S&P 500 |

11.73% |

16.32% |

193.58% |

493.54% |

|

|

GS Consumer Industries |

1.71% |

-1.83% |

n/a** |

n/a** |

|

Cumulative total returns show the fund's performance in percentage terms over a set period - in this case, six months, one year, five years or 10 years. You can compare the fund's returns to the performance of both the Standard & Poor's 500SM Index - a market capitalization-weighted index of common stocks - and the Goldman Sachs Consumer Industries Index - a market capitalization-weighted index of 295 stocks designed to measure the performance of companies in the consumer industries sector. These benchmarks include reinvestment of dividends and capital gains, if any, and exclude the effect of sales charges.

Average Annual Total Returns

|

Periods ended |

Past 1 |

Past 5 |

Past 10 |

|

Select Consumer Industries |

-1.75% |

17.08% |

16.58% |

|

Select Consumer Industries |

-4.77% |

16.36% |

16.23% |

|

S&P 500 |

16.32% |

24.04% |

19.49% |

|

GS Consumer Industries |

-1.83% |

n/a** |

n/a** |

Average annual returns take the fund's cumulative return and show you what would have happened if the fund had performed at a constant rate each year.

** Not available

Understanding Performance

How a fund did yesterday is no guarantee of how it will do tomorrow. The stock market, for example, has a history of long-term growth and short-term volatility. Unlike the broader market, however, some sectors may not have a history of growth in the long run. And, as with all stock funds, the share price and return of a fund that invests in a sector will vary.

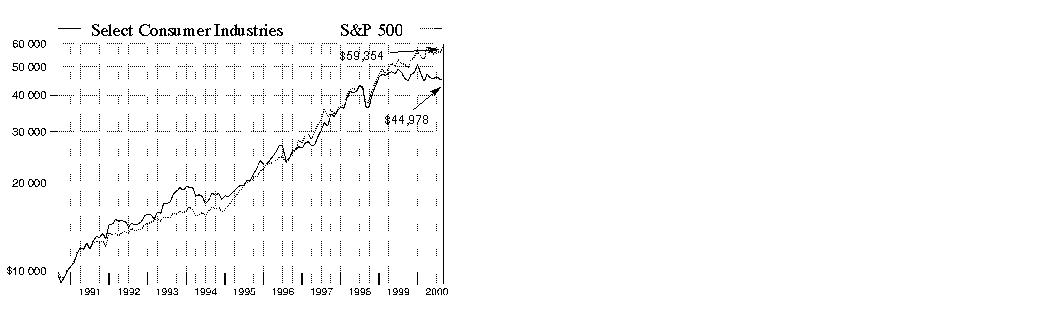

3$10,000 Over 10 Years

$10,000 Over 10 Years: Let's say hypothetically that $10,000 was invested in Fidelity Select Consumer Industries Portfolio on August 31, 1990, and the current 3.00% sales charge was paid. As the chart shows, by August 31, 2000, the value of the investment would have grown to $44,978 - a 349.78% increase on the initial investment - and includes the effect of a $7.50 long-term trading fee. For comparison, look at how the Standard & Poor's 500 Index did over the same period. With dividends and capital gains, if any, reinvested, the same $10,000 investment would have grown to $59,354 - a 493.54% increase.

Investment Summary

|

Top Ten Stocks as of August 31, 2000 |

|

|

|

% of fund's |

|

Wal-Mart Stores, Inc. |

6.0 |

|

Home Depot, Inc. |

4.7 |

|

The Coca-Cola Co. |

4.4 |

|

Walt Disney Co. |

4.4 |

|

Procter & Gamble Co. |

4.4 |

|

Viacom, Inc. Class B (non-vtg.) |

3.9 |

|

Philip Morris Companies, Inc. |

3.3 |

|

Time Warner, Inc. |

3.0 |

|

Clear Channel Communications, Inc. |

2.8 |

|

Kimberly-Clark Corp. |

2.5 |

|

|

39.4 |

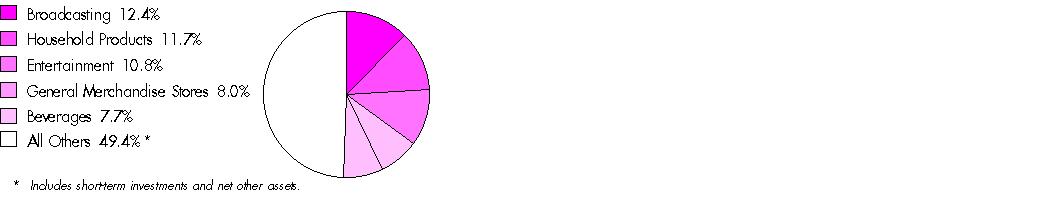

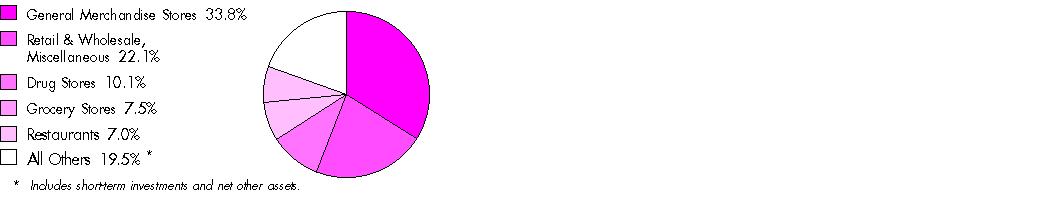

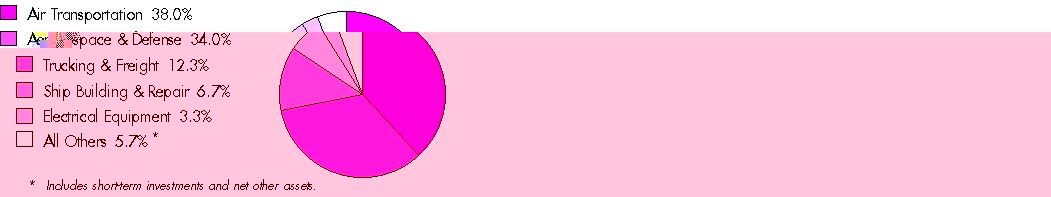

Top Industries as of August 31, 2000

% of fund's net assets

Semiannual Report

(Portfolio Manager photograph)

John Porter,

Portfolio Manager of

Fidelity Select Consumer

Industries Portfolio

Q. How did the fund perform, John?

A. During the six-month period that ended August 31, 2000, the fund returned 0.81%. In comparison, the Goldman Sachs Consumer Industries Index - an index of 295 stocks designed to measure the performance of companies in the consumer industries sector - gained 1.71%. During the same period, the Standard & Poor's 500 Index returned 11.73%. For the 12-month period that ended August 31, 2000, the fund returned -1.75%, while the Goldman Sachs index and the S&P 500 index returned -1.83% and 16.32%, respectively.

Q. What factors kept the fund's performance roughly in line with its Goldman Sachs benchmark during the six-month period?

A. I think the main reason the fund's performance was generally on par with the index was because there weren't any specific areas to steer the fund toward during the past six months that delivered consistent outperformance. I break down the consumer industries sector into three main subsectors: consumer products; media, including entertainment and advertising; and retail. At different points throughout the year, each of those different subsectors performed well, but none consistently outperformed the other. As the period progressed, different subsectors would take the spotlight, making it extremely difficult to participate successfully in an overweighted buy-and-hold strategy due to the volatility.

Q. Did you make any adjustments to your strategy during the period?

A. In the second half of the period, I positioned the fund defensively with regard to retail, underweighting that subsector because I believed the economy began to slow. The decline of the price-to-earnings multiples of several retail stocks reflected the market's cynicism toward these companies, and we saw some of the retailers, such as Costco, experience growth problems. Within the retail sector, I marginally added to the fund's weighting in supermarkets - such as Safeway - to exploit consumers' needs to purchase staple products. At the same time, I began increasing the fund's weighting in consumer products stocks, such as Gillette. I believed these stocks became attractively valued and could benefit from their significant multinational presence.

Q. How did the fund's investments in other areas of consumer industries influence performance?

A. Our overweighted position in media and advertising stocks throughout the period served us well. Advertising-driven media, such as AMFM and Walt Disney - via its ownership of the ABC network broadcast operation - as well as advertising agencies, remained among the fund's best growth sectors. Elsewhere, the fund's underweighted position in the soft drink industry hurt performance when these stocks rebounded in the summer. An overweighted position in retail home centers, such as Home Depot, also detracted from performance.

Q. What specific stocks performed well? Which disappointed?

A. Shares of top-10 holding Philip Morris, the fund's top contributor, rose sharply in August as investor concerns about litigation issues subsided and business fundamentals improved. Philip Morris also said it would increase its quarterly dividend by 10% during the month. Investors reacted favorably to Viacom's acquisition of CBS, as well as the fiscal discipline implemented by its Paramount film unit. On the down side, overweighting Procter & Gamble hurt performance after the company pre-announced an earnings shortfall, sparking a sell-off among consumer stocks. A slowdown in sales and a weaker-than-expected earnings report hurt the performance of retail fashion outlet, Gap.

Q. What's your outlook?

A. I don't believe the slowing of the economy is accurately reflected in the prices investors are paying for consumer products and retail stocks, but for different reasons. On the one hand, consumer products stocks are beaten down and the market is not rewarding them for the relative stability they can provide. On the other hand, I don't think the current price multiples of retail stocks reflect how slow things can get in a slowing economy - even for some of the best retailers. At the same time, I am very enthusiastic about many of the media-related sectors in which the fund invests. So going forward, I will continue to position the fund defensively to weather an economic slowdown, while keeping an eye on consumer expenditure patterns.

The views expressed in this report reflect those of the portfolio manager only through the end of the period of the report as stated on the cover. The manager's views are subject to change at any time based on market or other conditions. For more information, see page 3.

Fund Facts

Start date: June 29, 1990

Fund number: 517

Trading symbol: FSCPX

Size: as of August 31, 2000, more than

$19 million

Manager: John Porter, since 1999; manager, Fidelity Advisor Consumer Industries Fund, since 1999; several Fidelity Select Portfolios, 1996-1999; joined Fidelity in 1995

3Semiannual Report

Consumer Industries Portfolio

(Unaudited)

Showing Percentage of Net Assets

|

Common Stocks - 93.5% |

|||

|

Shares |

Value (Note 1) |

||

|

ADVERTISING - 1.3% |

|||

|

Omnicom Group, Inc. |

2,800 |

$ 233,625 |

|

|

TMP Worldwide, Inc. (a) |

300 |

20,756 |

|

|

TOTAL ADVERTISING |

254,381 |

||

|

APPAREL STORES - 2.3% |

|||

|

American Eagle Outfitters, Inc. (a) |

900 |

26,831 |

|

|

AnnTaylor Stores Corp. (a) |

1,200 |

43,200 |

|

|

Claire's Stores, Inc. |

1,400 |

27,563 |

|

|

Gap, Inc. |

7,037 |

157,893 |

|

|

Talbots, Inc. |

600 |

40,163 |

|

|

The Limited, Inc. |

5,102 |

102,040 |

|

|

TJX Companies, Inc. |

1,800 |

33,863 |

|

|

Venator Group, Inc. (a) |

1,900 |

26,600 |

|

|

TOTAL APPAREL STORES |

458,153 |

||

|

AUTOS, TIRES, & ACCESSORIES - 0.1% |

|||

|

AutoNation, Inc. |

4,500 |

29,250 |

|

|

BEVERAGES - 7.7% |

|||

|

Adolph Coors Co. Class B |

900 |

53,606 |

|

|

Anheuser-Busch Companies, Inc. |

3,800 |

299,488 |

|

|

Panamerican Beverages, Inc. Class A |

1,200 |

22,275 |

|

|

Pepsi Bottling Group, Inc. |

2,300 |

73,025 |

|

|

Seagram Co. Ltd. |

3,500 |

210,656 |

|

|

The Coca-Cola Co. |

16,900 |

889,363 |

|

|

Whitman Corp. |

1 |

13 |

|

|

TOTAL BEVERAGES |

1,548,426 |

||

|

BROADCASTING - 12.4% |

|||

|

Adelphia Communications Corp. |

500 |

16,750 |

|

|

American Tower Corp. Class A (a) |

2,000 |

72,625 |

|

|

AT&T Corp. - Liberty Media Group |

19,700 |

421,088 |

|

|

Cablevision Systems Corp. Class A (a) |

700 |

47,075 |

|

|

Clear Channel Communications, Inc. (a) |

7,650 |

553,669 |

|

|

Comcast Corp. Class A (special) (a) |

6,600 |

245,850 |

|

|

Cox Communications, Inc. Class A (a) |

2,200 |

78,238 |

|

|

E.W. Scripps Co. Class A |

300 |

15,206 |

|

|

EchoStar Communications Corp. |

2,000 |

97,500 |

|

|

Entercom Communications Corp. |

800 |

33,050 |

|

|

Infinity Broadcasting Corp. Class A (a) |

6,500 |

246,188 |

|

|

Time Warner, Inc. |

7,090 |

606,195 |

|

|

UnitedGlobalCom, Inc. Class A (a) |

600 |

22,988 |

|

|

Univision Communications, Inc. |

400 |

17,650 |

|

|

TOTAL BROADCASTING |

2,474,072 |

||

|

|

|||

|

Shares |

Value (Note 1) |

||

|

CELLULAR - 1.1% |

|||

|

Crown Castle International Corp. (a) |

2,400 |

$ 83,250 |

|

|

Nextel Communications, Inc. Class A (a) |

600 |

33,263 |

|

|

SBA Communications Corp. Class A (a) |

2,200 |

98,175 |

|

|

TOTAL CELLULAR |

214,688 |

||

|

COMPUTER SERVICES & SOFTWARE - 1.1% |

|||

|

Amazon.com, Inc. (a) |

1,500 |

62,250 |

|

|

Circle.com (a) |

400 |

1,350 |

|

|

eBay, Inc. (a) |

400 |

24,800 |

|

|

Microsoft Corp. (a) |

1,350 |

94,247 |

|

|

Priceline.com, Inc. (a) |

1,500 |

40,781 |

|

|

TOTAL COMPUTER SERVICES & SOFTWARE |

223,428 |

||

|

COMPUTERS & OFFICE EQUIPMENT - 0.3% |

|||

|

Pitney Bowes, Inc. |

700 |

25,594 |

|

|

Xerox Corp. |

2,200 |

35,338 |

|

|

TOTAL COMPUTERS & OFFICE EQUIPMENT |

60,932 |

||

|

CONSUMER ELECTRONICS - 1.1% |

|||

|

Black & Decker Corp. |

600 |

24,038 |

|

|

Gemstar-TV Guide International, Inc. (a) |

1,428 |

128,877 |

|

|

General Motors Corp. Class H |

2,000 |

66,250 |

|

|

TOTAL CONSUMER ELECTRONICS |

219,165 |

||

|

DRUG STORES - 2.1% |

|||

|

Walgreen Co. |

12,700 |

417,513 |

|

|

ENTERTAINMENT - 10.8% |

|||

|

Carnival Corp. |

4,700 |

93,706 |

|

|

Fox Entertainment Group, Inc. Class A (a) |

4,200 |

121,538 |

|

|

Mandalay Resort Group (a) |

2,800 |

77,875 |

|

|

MGM Grand, Inc. |

2,400 |

82,500 |

|

|

Park Place Entertainment Corp. (a) |

1,800 |

26,438 |

|

|

Six Flags, Inc. (a) |

2,300 |

34,356 |

|

|

Viacom, Inc.: |

|

|

|

|

Class A (a) |

1,100 |

74,525 |

|

|

Class B (non-vtg.) (a) |

11,610 |

781,498 |

|

|

Walt Disney Co. |

22,400 |

872,200 |

|

|

TOTAL ENTERTAINMENT |

2,164,636 |

||

|

FOODS - 6.4% |

|||

|

Bestfoods |

3,400 |

240,125 |

|

|

Corn Products International, Inc. |

1,250 |

31,406 |

|

|

Earthgrains Co. |

2,400 |

42,300 |

|

|

H.J. Heinz Co. |

2,600 |

99,125 |

|

|

Keebler Foods Co. |

2,400 |

109,950 |

|

|

Kellogg Co. |

1,600 |

37,100 |

|

|

PepsiCo, Inc. |

10,300 |

439,038 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value (Note 1) |

||

|

FOODS - CONTINUED |

|||

|

Quaker Oats Co. |

2,400 |

$ 163,050 |

|

|

Sysco Corp. |

2,900 |

122,706 |

|

|

TOTAL FOODS |

1,284,800 |

||

|

GENERAL MERCHANDISE STORES - 8.0% |

|||

|

Ames Department Stores, Inc. (a) |

2,400 |

12,150 |

|

|

BJ's Wholesale Club, Inc. (a) |

1,400 |

47,425 |

|

|

Consolidated Stores Corp. (a) |

4,128 |

56,244 |

|

|

Dollar General Corp. |

3,168 |

65,142 |

|

|

Dollar Tree Stores, Inc. (a) |

900 |

36,506 |

|

|

Kohls Corp. (a) |

2,200 |

123,200 |

|

|

Neiman Marcus Group, Inc. Class A (a) |

1,000 |

33,563 |

|

|

Target Corp. |

1,400 |

32,550 |

|

|

Wal-Mart Stores, Inc. |

25,200 |

1,195,409 |

|

|

TOTAL GENERAL MERCHANDISE STORES |

1,602,189 |

||

|

GROCERY STORES - 2.7% |

|||

|

Albertson's, Inc. |

1,823 |

39,195 |

|

|

Kroger Co. (a) |

7,100 |

161,081 |

|

|

Safeway, Inc. (a) |

6,000 |

295,875 |

|

|

Whole Foods Market, Inc. (a) |

500 |

25,250 |

|

|

Winn-Dixie Stores, Inc. |

600 |

8,363 |

|

|

TOTAL GROCERY STORES |

529,764 |

||

|

HOME FURNISHINGS - 0.2% |

|||

|

Linens'n Things, Inc. (a) |

1,800 |

48,600 |

|

|

HOUSEHOLD PRODUCTS - 11.7% |

|||

|

Avon Products, Inc. |

10,900 |

427,144 |

|

|

Clorox Co. |

3,156 |

114,208 |

|

|

Colgate-Palmolive Co. |

5,300 |

269,969 |

|

|

Estee Lauder Companies, Inc. Class A |

4,800 |

196,500 |

|

|

Gillette Co. |

15,100 |

453,000 |

|

|

Procter & Gamble Co. |

14,100 |

871,556 |

|

|

TOTAL HOUSEHOLD PRODUCTS |

2,332,377 |

||

|

LEISURE DURABLES & TOYS - 1.2% |

|||

|

Brunswick Corp. |

1,100 |

20,625 |

|

|

Callaway Golf Co. |

2,300 |

33,206 |

|

|

Harley-Davidson, Inc. |

3,600 |

179,325 |

|

|

TOTAL LEISURE DURABLES & TOYS |

233,156 |

||

|

LODGING & GAMING - 0.4% |

|||

|

Harrah's Entertainment, Inc. (a) |

600 |

17,025 |

|

|

International Game Technology (a) |

800 |

23,200 |

|

|

Starwood Hotels & Resorts |

1,200 |

38,400 |

|

|

TOTAL LODGING & GAMING |

78,625 |

||

|

|

|||

|

Shares |

Value (Note 1) |

||

|

PACKAGING & CONTAINERS - 0.2% |

|||

|

Tupperware Corp. |

1,900 |

$ 38,356 |

|

|

PAPER & FOREST PRODUCTS - 2.5% |

|||

|

Kimberly-Clark Corp. |

8,700 |

508,950 |

|

|

PHOTOGRAPHIC EQUIPMENT - 1.0% |

|||

|

Eastman Kodak Co. |

3,100 |

192,975 |

|

|

PRINTING - 0.2% |

|||

|

R.R. Donnelley & Sons Co. |

1,700 |

43,775 |

|

|

PUBLISHING - 2.5% |

|||

|

Gannett Co., Inc. |

700 |

39,638 |

|

|

Harcourt General, Inc. |

800 |

47,450 |

|

|

Harte Hanks Communications, Inc. |

1,300 |

32,663 |

|

|

Houghton Mifflin Co. |

500 |

24,594 |

|

|

McGraw-Hill Companies, Inc. |

2,500 |

154,844 |

|

|

Meredith Corp. |

1,400 |

38,238 |

|

|

Playboy Enterprises, Inc. Class B (non-vtg.) (a) |

2,000 |

29,375 |

|

|

Reader's Digest Association, Inc. Class A (non-vtg.) |

1,500 |

57,750 |

|

|

The New York Times Co. Class A |

1,900 |

74,456 |

|

|

TOTAL PUBLISHING |

499,008 |

||

|

REAL ESTATE INVESTMENT TRUSTS - 0.7% |

|||

|

Pinnacle Holdings, Inc. (a) |

3,300 |

132,825 |

|

|

RESTAURANTS - 2.4% |

|||

|

Brinker International, Inc. (a) |

1,000 |

31,750 |

|

|

CEC Entertainment, Inc. (a) |

1,000 |

28,875 |

|

|

Darden Restaurants, Inc. |

1,400 |

24,763 |

|

|

Jack in the Box, Inc. (a) |

1,800 |

39,713 |

|

|

McDonald's Corp. |

9,000 |

268,875 |

|

|

Outback Steakhouse, Inc. (a) |

1,200 |

27,525 |

|

|

Papa John's International, Inc. (a) |

500 |

11,313 |

|

|

Starbucks Corp. (a) |

500 |

18,313 |

|

|

Wendy's International, Inc. |

1,700 |

32,088 |

|

|

TOTAL RESTAURANTS |

483,215 |

||

|

RETAIL & WHOLESALE, MISCELLANEOUS - 6.7% |

|||

|

Alberto-Culver Co. Class A |

1,900 |

45,600 |

|

|

Bed Bath & Beyond, Inc. (a) |

4,600 |

80,788 |

|

|

Best Buy Co., Inc. (a) |

600 |

37,050 |

|

|

Circuit City Stores, Inc. - |

600 |

15,563 |

|

|

Home Depot, Inc. |

19,400 |

932,413 |

|

|

Lowe's Companies, Inc. |

1,000 |

44,813 |

|

|

Office Depot, Inc. (a) |

5,550 |

40,584 |

|

|

Pier 1 Imports, Inc. |

2,100 |

24,675 |

|

|

Staples, Inc. (a) |

5,075 |

78,028 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value (Note 1) |

||

|

RETAIL & WHOLESALE, MISCELLANEOUS - CONTINUED |

|||

|

Tiffany & Co., Inc. |

200 |

$ 8,325 |

|

|

Williams-Sonoma, Inc. (a) |

600 |

21,563 |

|

|

TOTAL RETAIL & WHOLESALE, MISCELLANEOUS |

1,329,402 |

||

|

SERVICES - 2.0% |

|||

|

ACNielsen Corp. (a) |

1,300 |

31,281 |

|

|

Cendant Corp. (a) |

4,000 |

52,750 |

|

|

Macrovision Corp. (a) |

300 |

31,988 |

|

|

Manpower, Inc. |

1,700 |

61,519 |

|

|

Modis Professional Services, Inc. (a) |

300 |

2,063 |

|

|

Robert Half International, Inc. (a) |

600 |

19,088 |

|

|

Snyder Communications, Inc. (SNC) |

1 |

27 |

|

|

True North Communications |

2,800 |

129,850 |

|

|

Viad Corp. |

2,600 |

76,213 |

|

|

TOTAL SERVICES |

404,779 |

||

|

TELEPHONE SERVICES - 0.4% |

|||

|

AT&T Corp. |

2,377 |

74,876 |

|

|

TEXTILES & APPAREL - 0.4% |

|||

|

NIKE, Inc. Class B |

2,000 |

79,125 |

|

|

TOBACCO - 3.6% |

|||

|

Philip Morris Companies, Inc. |

22,000 |

651,750 |

|

|

RJ Reynolds Tobacco Holdings, Inc. |

2,000 |

71,750 |

|

|

TOTAL TOBACCO |

723,500 |

||

|

TOTAL COMMON STOCKS (Cost $14,374,407) |

18,684,941 |

||

|

Cash Equivalents - 6.6% |

|||

|

|

|

|

|

|

Fidelity Cash Central Fund, 6.59% (b) |

1,284,724 |

1,284,724 |

|

|

Fidelity Securities Lending Cash Central Fund, 6.64% (b) |

40,600 |

40,600 |

|

|

TOTAL CASH EQUIVALENTS (Cost $1,325,324) |

1,325,324 |

||

|

TOTAL INVESTMENT PORTFOLIO - 100.1% (Cost $15,699,731) |

20,010,265 |

||

|

NET OTHER ASSETS - (0.1)% |

(16,663) |

||

|

NET ASSETS - 100% |

$ 19,993,602 |

||

|

Legend |

|

(a) Non-income producing |

|

(b) The rate quoted is the annualized seven-day yield of the fund at |

|

Other Information |

|

Purchases and sales of securities, other than short-term securities, aggregated $10,287,831 and $51,048,975, respectively. |

|

The fund placed a portion of its portfolio transactions with brokerage firms which are affiliates of Fidelity Management & Research Company. The commissions paid to these affiliated firms were $5,133 for the period. |

|

The fund participated in the security lending program. At period end, the value of securities loaned amounted to $38,063. The fund received cash collateral of $40,600 which was invested in cash equivalents. |

|

Income Tax Information |

|

At August 31, 2000, the aggregate cost of investment securities for income tax purposes was $16,033,013. Net unrealized appreciation aggregated $3,977,252, of which $5,134,850 related to appreciated investment securities and $1,157,598 related to depreciated investment securities. |

See accompanying notes which are an integral part of the financial statements.

Consumer Sector

Statement of Assets and Liabilities

|

|

August 31, 2000 (Unaudited) |

|

|

Assets |

|

|

|

Investment in securities, at value |

|

$ 20,010,265 |

|

Receivable for investments sold |

|

82,845 |

|

Receivable for fund shares sold |

|

29,285 |

|

Dividends receivable |

|

13,097 |

|

Interest receivable |

|

7,915 |

|

Redemption fees receivable |

|

45 |

|

Other receivables |

|

7,630 |

|

Total assets |

|

20,151,082 |

|

Liabilities |

|

|

|

Payable for investments purchased |

$ 2,830 |

|

|

Payable for fund shares redeemed |

72,116 |

|

|

Accrued management fee |

10,067 |

|

|

Other payables and accrued expenses |

31,867 |

|

|

Collateral on securities loaned, |

40,600 |

|

|

Total liabilities |

|

157,480 |

|

Net Assets |

|

$ 19,993,602 |

|

Net Assets consist of: |

|

|

|

Paid in capital |

|

$ 12,429,944 |

|

Accumulated net investment (loss) |

|

(59,687) |

|

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions |

|

3,312,811 |

|

Net unrealized appreciation (depreciation) on investments |

|

4,310,534 |

|

Net Assets, for 696,962 shares outstanding |

|

$ 19,993,602 |

|

Net Asset Value and redemption price per share ($19,993,602 ÷ 696,962 shares) |

|

$28.69 |

|

Maximum offering price per share (100/97.00 of $28.69) |

|

$29.58 |

Statement of Operations

|

|

Six months ended August 31, 2000 (Unaudited) |

|

|

Investment Income Dividends |

|

$ 122,128 |

|

Interest |

|

47,329 |

|

Security lending |

|

1,291 |

|

Total income |

|

170,748 |

|

Expenses |

|

|

|

Management fee |

$ 73,885 |

|

|

Transfer agent fees |

88,803 |

|

|

Accounting and security lending fees |

30,453 |

|

|

Non-interested trustees' compensation |

62 |

|

|

Custodian fees and expenses |

12,712 |

|

|

Registration fees |

16,479 |

|

|

Audit |

10,949 |

|

|

Legal |

142 |

|

|

Miscellaneous |

34 |

|

|

Total expenses before reductions |

233,519 |

|

|

Expense reductions |

(3,084) |

230,435 |

|

Net investment income (loss) |

|

(59,687) |

|

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: |

|

|

|

Investment securities |

3,905,681 |

|

|

Foreign currency transactions |

(393) |

3,905,288 |

|

Change in net unrealized appreciation (depreciation) on: |

|

|

|

Investment securities |

(5,052,358) |

|

|

Assets and liabilities in |

89 |

(5,052,269) |

|

Net gain (loss) |

|

(1,146,981) |

|

Net increase (decrease) in net assets resulting from operations |

|

$ (1,206,668) |

|

Other Information |

|

|

|

Sales charges paid to FDC |

|

$ 32,278 |

|

Deferred sales charges withheld by FDC |

|

$ 72 |

|

Exchange fees withheld by FSC |

|

$ 2,970 |

|

Expense reductions |

|

|

|

Directed brokerage arrangements |

|

$ 3,084 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Consumer Industries Portfolio

Financial Statements - continued

Statement of Changes in Net Assets

|

Increase (Decrease) in Net Assets |

Six months ended |

Year ended |

|

Operations |

$ (59,687) |

$ 41,337 |

|

Net realized gain (loss) |

3,905,288 |

4,505,335 |

|

Change in net unrealized appreciation (depreciation) |

(5,052,269) |

(7,292,511) |

|

Net increase (decrease) in net assets resulting from operations |

(1,206,668) |

(2,745,839) |

|

Distributions to shareholders |

- |

(42,261) |

|

From net realized gain |

- |

(4,852,121) |

|

Total distributions |

- |

(4,894,382) |

|

Share transactions |

9,012,662 |

32,937,853 |

|

Reinvestment of distributions |

- |

4,772,156 |

|

Cost of shares redeemed |

(51,198,854) |

(49,036,030) |

|

Net increase (decrease) in net assets resulting from share transactions |

(42,186,192) |

(11,326,021) |

|

Redemption fees |

55,812 |

52,792 |

|

Total increase (decrease) in net assets |

(43,337,048) |

(18,913,450) |

|

Net Assets |

|

|

|

Beginning of period |

63,330,650 |

82,244,100 |

|

End of period (including accumulated net investment loss of $59,687 and $0, respectively) |

$ 19,993,602 |

$ 63,330,650 |

|

Other Information Shares |

|

|

|

Sold |

306,654 |

1,041,150 |

|

Issued in reinvestment of distributions |

- |

149,653 |

|

Redeemed |

(1,834,626) |

(1,551,354) |

|

Net increase (decrease) |

(1,527,972) |

(360,551) |

Financial Highlights

|

|

Six months ended |

Years ended February 28, |

||||

|

Selected Per-Share Data |

(Unaudited) |

2000 H |

1999 |

1998 |

1997 |

1996 H |

|

Net asset value, beginning of period |

$ 28.46 |

$ 31.81 |

$ 27.31 |

$ 20.66 |

$ 17.84 |

$ 13.91 |

|

Income from Investment Operations |

|

|

|

|

|

|

|

Net investment income (loss) D |

(.07) |

.02 E |

(.04) |

(.22) |

(.22) |

.08 |

|

Net realized and unrealized gain (loss) |

.24 I |

(1.29) |

5.41 |

8.34 |

2.93 |

3.97 |

|

Total from investment operations |

.17 |

(1.27) |

5.37 |

8.12 |

2.71 |

4.05 |

|

Less Distributions |

|

|

|

|

|

|

|

From net investment income |

- |

(.02) |

- |

- |

- |

(.02) |

|

From net realized gain |

- |

(2.08) |

(.90) |

(1.52) |

- |

(.01) |

|

In excess of net realized gain |

- |

- |

- |

- |

- |

(.20) |

|

Total distributions |

- |

(2.10) |

(.90) |

(1.52) |

- |

(.23) |

|

Redemption fees added to paid in capital |

.06 |

.02 |

.03 |

.05 |

.11 |

.11 |

|

Net asset value, end of period |

$ 28.69 |

$ 28.46 |

$ 31.81 |

$ 27.31 |

$ 20.66 |

$ 17.84 |

|

Total Return B, C |

0.81% |

(4.55)% |

20.18% |

40.36% |

15.81% |

30.01% |

|

Ratios and Supplemental Data |

|

|

|

|

|

|

|

Net assets, end of period (000 omitted) |

$ 19,994 |

$ 63,331 |

$ 82,244 |

$ 72,152 |

$ 18,392 |

$ 22,362 |

|

Ratio of expenses to average net assets |

1.77% A |

1.27% |

1.34% |

2.01% |

2.49% |

1.53% F |

|

Ratio of expenses to average net assets after |

1.74% A, G |

1.25% G |

1.32% G |

1.97% G |

2.44% G |

1.48% G |

|

Ratio of net investment income (loss) to average net assets |

(.45)% A |

.06% |

(.15)% |

(.90)% |

(1.13)% |

.46% |

|

Portfolio turnover rate |

74% A |

96% |

150% |

199% |

340% |

601% |

|

A Annualized B The total returns would have been lower had certain expenses not been reduced during the periods shown. C Total returns do not include the one time sales

charge and for periods of less than one year are not annualized. D Net investment income (loss) per share has

been calculated based on average shares outstanding during the period. E Investment income per share reflects a special dividend which amounted to $.04 per share. F FMR agreed to reimburse a portion of the fund's

expenses during the period. Without this reimbursement,

the fund's expense ratio would have been higher. G FMR or the fund has entered into varying arrangements with third parties who either paid or reduced a portion of the fund's expenses. |

||||||

See accompanying notes which are an integral part of the financial statements.

Consumer Sector

Performance

There are several ways to evaluate a fund's historical performance. You can look at the total percentage change in value, the average annual percentage change or the growth of a hypothetical $10,000 investment. Total return reflects the change in the value of an investment, assuming reinvestment of the fund's dividend income and capital gains (the profits earned upon the sale of securities that have grown in value). Load adjusted returns include a 3.00% sales charge and the effect of a $7.50 long-term trading fee for shares held 30 days or more. Effective September 28, 2000, the $7.50 long-term trading fee was eliminated.

Cumulative Total Returns

|

Periods ended |

Past 6 |

Past 1 |

Past 5 |

Past 10 |

|

Select Food and |

24.50% |

-3.91% |

67.64% |

250.69% |

|

Select Food and |

20.69% |

-6.86% |

62.54% |

240.10% |

|

S&P 500 |

11.73% |

16.32% |

193.58% |

493.54% |

|

GS Consumer Industries |

1.71% |

-1.83% |

n/a** |

n/a** |

Cumulative total returns show the fund's performance in percentage terms over a set period - in this case, six months, one year, five years or 10 years. You can compare the fund's returns to the performance of both the Standard & Poor's 500 Index - a market capitalization-weighted index of common stocks - and the Goldman Sachs Consumer Industries Index - a market capitalization-weighted index of 295 stocks designed to measure the performance of companies in the consumer industries sector. These benchmarks include reinvestment of dividends and capital gains, if any, and exclude the effect of sales charges.

Average Annual Total Returns

|

Periods ended |

Past 1 |

Past 5 |

Past 10 |

|

Select Food and Agriculture |

-3.91% |

10.89% |

13.37% |

|

Select Food and Agriculture |

-6.86% |

10.20% |

13.02% |

|

S&P 500 |

16.32% |

24.04% |

19.49% |

|

GS Consumer Industries |

-1.83% |

n/a** |

n/a** |

Average annual returns take the fund's cumulative return and show you what would have happened if the fund had performed at a constant rate each year.

** Not available

Understanding Performance

How a fund did yesterday is no guarantee of how it will do tomorrow. The stock market, for example, has a history of long-term growth and short-term volatility. Unlike the broader market, however, some sectors may not have a history of growth in the long run. And, as with all stock funds, the share price and return of a fund that invests in a sector will vary.

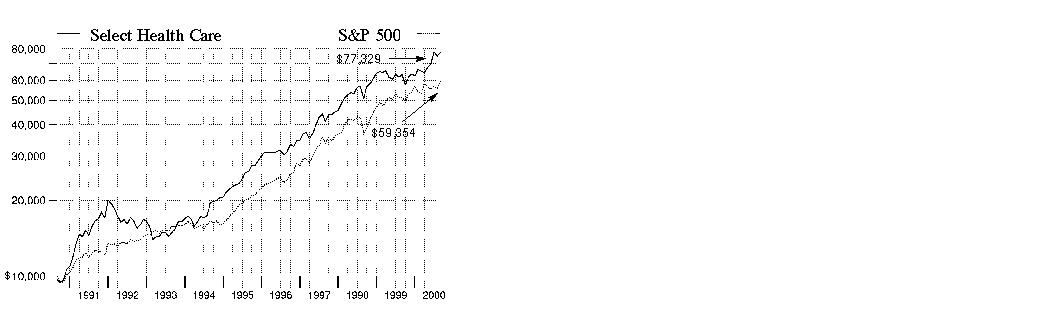

3$10,000 Over 10 Years

$10,000 Over 10 Years: Let's say hypothetically that $10,000 was invested in Fidelity Select Food and Agriculture Portfolio on August 31, 1990, and the current 3.00% sales charge was paid. As the chart shows, by August 31, 2000, the value of the investment would have grown to $34,010 - a 240.10% increase on the initial investment - and includes the effect of a $7.50 long-term trading fee. For comparison - look at how the Standard & Poor's 500 Index did over the same period. With dividends and capital gains, if any, reinvested, the same $10,000 investment would have grown to $59,354 - a 493.54% increase.

Investment Summary

|

Top Ten Stocks as of August 31, 2000 |

|

|

|

% of fund's |

|

Safeway, Inc. |

7.3 |

|

Anheuser-Busch Companies, Inc. |

6.3 |

|

Philip Morris Companies, Inc. |

5.7 |

|

Kroger Co. |

5.4 |

|

The Coca-Cola Co. |

5.2 |

|

PepsiCo, Inc. |

4.2 |

|

Quaker Oats Co. |

3.9 |

|

McDonald's Corp. |

3.7 |

|

Keebler Foods Co. |

3.5 |

|

Sara Lee Corp. |

3.0 |

|

|

48.2 |

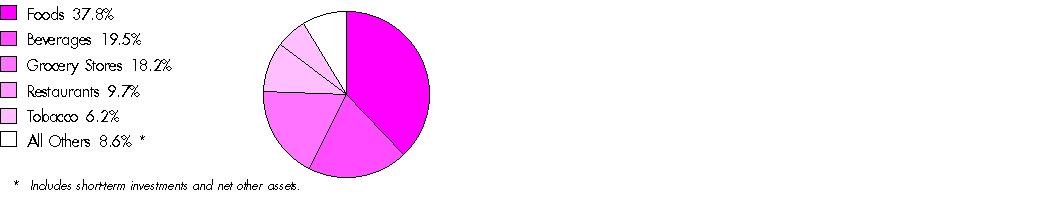

Top Industries as of August 31, 2000

% of fund's net assets

Semiannual Report

(Portfolio Manager photograph)

Matthew Fruhan,

Portfolio Manager of Fidelity Select Food and Agriculture Portfolio

Q. How did the fund perform, Matthew?

A. For the six months that ended August 31, 2000, the fund returned 24.50%. By comparison, the Goldman Sachs Consumer Industries Index - an index of 295 stocks designed to measure the performance of companies in the consumer industries sector - returned 1.71%. During the same period, the Standard & Poor's 500 Index returned 11.73%. For the 12 months that ended August 31, 2000, the fund lost 3.91%, while the Goldman Sachs index lost 1.83% and the S&P 500 returned 16.32%.

Q. How was the fund able to outpace both indexes and generate such strong returns during the six-month period?

A. Food and agriculture stocks rebounded sharply during the past six months. Investors sought defensive, "safe haven" names - such as food companies and supermarket stocks - when the technology-laden NASDAQ index plunged beginning in March. As a result, many of the fund's holdings that were beaten down in 1999 skyrocketed in the second quarter of 2000. Strong stock picking within these industries also boosted the fund's returns versus its benchmarks.

Q. What market factors affected the performance of food and agriculture stocks?

A. A flurry of merger and acquisition activity bolstered the prices of many food stocks during the period. The fund held a large position in companies with good business fundamentals that I thought would be attractive acquisition candidates. Supermarkets overcame many of their acquisition-integration problems of 1999 and have rallied this year. In addition, the tide turned in the battle between traditional supermarkets and e-commerce grocers. Investors turned their backs on e-commerce grocers during the period as they began to question the viability of their economic models. As those stock prices fell, many e-commerce grocers were hurt further because their growth plans are predicated on raising capital from the stock market.

Q. Which of the fund's holdings performed well over

the past six months?

A. Bestfoods, which signed an agreement to be acquired by Unilever, and Nabisco, which agreed to be purchased by Philip Morris, were both beneficiaries of industry consolidation and helped the fund's returns. Acceleration in the sales growth of supermarkets, along with the market factors I mentioned earlier, helped boost the returns of Safeway and Kroger, two of the fund's top-10 holdings. Another big contributor was Keebler Foods, whose stock price rallied when it was put on the selling block. In addition, Anheuser-Busch benefited from strong pricing, PepsiCo enjoyed rising sales of its Frito-Lay brand and Quaker Oats benefited from the popularity of its Gatorade sports drinks. Finally, Philip Morris fared better this period as a result of some favorable tobacco rulings.

Q. Which stocks were the most disappointing?

A. One of the biggest disappointments was Coca-Cola Enterprises. The bottling company did not realize the sales volume growth that the market had anticipated. Another detractor was McDonald's. The company had trouble with its sales line and its exposure to the weak euro. Finally, Albertson's was one supermarket stock that performed poorly during the period. The company, which had been raising prices for years to mask declining volume growth, witnessed a deterioration of its customer base and lowered its long-term earnings growth targets.

Q. What's your outlook?

A. Although many packaged food stocks soared during the period as investors sought safe havens, I think the honeymoon may be over. Acquisition activity slowed and weak business fundamentals had not improved by the end of the period. As a result, I think valuations in this sector may begin to drift back down. I also think growth among supermarket stocks may begin to slow as Wal-Mart becomes more aggressive in the food industry. However, I expect brewers to continue increasing prices, which may help their future earnings growth. Finally, I think restaurant stocks may perform well because valuations at the end of the period were quite low based on fears of a recession. Overall, I expect a mixed bag for food and agriculture stocks, and I don't think we'll see many of the dramatic rallies that we saw during the past six months.

The views expressed in this report reflect those of the portfolio manager only through the end of the period of the report as stated on the cover. The manager's views are subject to change at any time based on market or other conditions. For more information, see page 3.

Fund Facts

Start date: July 29, 1985

Fund number: 009

Trading symbol: FDFAX

Size: as of August 31, 2000, more than

$100 million

Manager: Matthew Fruhan, since 1999; analyst, food industry, since 1999; joined Fidelity in 1995

3Semiannual Report

Food and Agriculture Portfolio

(Unaudited)

Showing Percentage of Net Assets

|

Common Stocks - 94.1% |

|||

|

Shares |

Value (Note 1) |

||

|

BEVERAGES - 19.5% |

|||

|

Adolph Coors Co. Class B |

47,400 |

$ 2,823,263 |

|

|

Anheuser-Busch Companies, Inc. |

80,600 |

6,352,288 |

|

|

Brown-Forman Corp. Class B (non-vtg.) |

12,100 |

641,300 |

|

|

Canandaigua Brands, Inc. Class A (a) |

24,300 |

1,309,163 |

|

|

Coca-Cola Enterprises, Inc. |

84,400 |

1,571,950 |

|

|

Panamerican Beverages, Inc. Class A |

24,700 |

458,494 |

|

|

Pepsi Bottling Group, Inc. |

32,600 |

1,035,050 |

|

|

The Coca-Cola Co. |

99,554 |

5,239,029 |

|

|

Whitman Corp. |

6,500 |

85,719 |

|

|

TOTAL BEVERAGES |

19,516,256 |

||

|

CHEMICALS & PLASTICS - 0.5% |

|||

|

IMC Global, Inc. |

21,000 |

308,438 |

|

|

Scotts Co. Class A (a) |

6,500 |

201,500 |

|

|

TOTAL CHEMICALS & PLASTICS |

509,938 |

||

|

FOODS - 37.8% |

|||

|

Archer-Daniels-Midland Co. |

62,637 |

551,989 |

|

|

Bestfoods |

37,600 |

2,655,500 |

|

|

ConAgra, Inc. |

85,979 |

1,574,490 |

|

|

Corn Products International, Inc. |

16,975 |

426,497 |

|

|

Dean Foods Co. |

2,300 |

71,875 |

|

|

Earthgrains Co. |

24,600 |

433,575 |

|

|

Flowers Industries, Inc. |

21,000 |

456,750 |

|

|

General Mills, Inc. |

43,500 |

1,397,438 |

|

|

H.J. Heinz Co. |

65,200 |

2,485,750 |

|

|

Hershey Foods Corp. |

16,500 |

704,344 |

|

|

Hormel Foods Corp. |

11,400 |

175,988 |

|

|

IBP, Inc. |

4,200 |

67,463 |

|

|

Interstate Bakeries Corp. |

13,600 |

243,950 |

|

|

Keebler Foods Co. |

77,400 |

3,545,888 |

|

|

Kellogg Co. |

31,500 |

730,406 |

|

|

McCormick & Co., Inc. (non-vtg.) |

7,400 |

215,988 |

|

|

Nabisco Group Holdings Corp. |

61,500 |

1,725,844 |

|

|

Nestle SA ADR (Reg.) |

25,200 |

2,709,000 |

|

|

PepsiCo, Inc. |

98,900 |

4,215,613 |

|

|

Quaker Oats Co. |

57,900 |

3,933,581 |

|

|

Ralston Purina Co. |

64,600 |

1,461,575 |

|

|

Sara Lee Corp. |

161,900 |

3,015,388 |

|

|

Smithfield Foods, Inc. (a) |

23,700 |

629,531 |

|

|

Suiza Foods Corp. (a) |

4,400 |

220,000 |

|

|

Sysco Corp. |

68,900 |

2,915,331 |

|

|

Tootsie Roll Industries, Inc. |

4,078 |

164,140 |

|

|

Universal Foods Corp. |

9,000 |

184,500 |

|

|

Wm. Wrigley Jr. Co. |

14,000 |

1,036,875 |

|

|

TOTAL FOODS |

37,949,269 |

||

|

GENERAL MERCHANDISE STORES - 0.3% |

|||

|

Wal-Mart Stores, Inc. |

6,000 |

284,625 |

|

|

|

|||

|

Shares |

Value (Note 1) |

||

|

GROCERY STORES - 18.2% |

|||

|

Albertson's, Inc. |

70,886 |

$ 1,524,049 |

|

|

Hain Celestial Group, Inc. (a) |

24,718 |

772,438 |

|

|

Koninklijke Ahold NV sponsored ADR |

64,000 |

1,824,000 |

|

|

Kroger Co. (a) |

237,600 |

5,390,550 |

|

|

Ruddick Corp. |

8,000 |

98,000 |

|

|

Safeway, Inc. (a) |

148,200 |

7,308,104 |

|

|

SUPERVALU, Inc. |

17,800 |

265,888 |

|

|

Weis Markets, Inc. |

9,700 |

329,800 |

|

|

Whole Foods Market, Inc. (a) |

12,900 |

651,450 |

|

|

Wild Oats Markets, Inc. (a) |

11,500 |

123,625 |

|

|

TOTAL GROCERY STORES |

18,287,904 |

||

|

HOUSEHOLD PRODUCTS - 1.9% |

|||

|

Unilever NV (NY Shares) |

40,278 |

1,903,136 |

|

|

RESTAURANTS - 9.7% |

|||

|

Brinker International, Inc. (a) |

7,000 |

222,250 |

|

|

CEC Entertainment, Inc. (a) |

64,800 |

1,871,100 |

|

|

Darden Restaurants, Inc. |

27,700 |

489,944 |

|

|

Jack in the Box, Inc. (a) |

12,700 |

280,194 |

|

|

McDonald's Corp. |

123,400 |

3,686,575 |

|

|

Outback Steakhouse, Inc. (a) |

56,300 |

1,291,381 |

|

|

Papa John's International, Inc. (a) |

13,400 |

303,175 |

|

|

Tricon Global Restaurants, Inc. (a) |

30,200 |

879,575 |

|

|

Wendy's International, Inc. |

36,300 |

685,163 |

|

|

TOTAL RESTAURANTS |

9,709,357 |

||

|

TOBACCO - 6.2% |

|||

|

Philip Morris Companies, Inc. |

192,200 |

5,693,925 |

|

|

RJ Reynolds Tobacco Holdings, Inc. |

14,700 |

527,363 |

|

|

TOTAL TOBACCO |

6,221,288 |

||

|

TOTAL COMMON STOCKS (Cost $86,364,101) |

94,381,773 |

||

|

Cash Equivalents - 10.9% |

|||

|

Shares |

Value (Note 1) |

||

|

Fidelity Cash Central Fund, 6.59% (b) |

6,504,019 |

$ 6,504,019 |

|

|

Fidelity Securities Lending Cash Central Fund, 6.64% (b) |

4,417,900 |

4,417,900 |

|

|

TOTAL CASH EQUIVALENTS (Cost $10,921,919) |

10,921,919 |

||

|

TOTAL INVESTMENT PORTFOLIO - 105.0% (Cost $97,286,020) |

105,303,692 |

|

NET OTHER ASSETS - (5.0)% |

(5,025,341) |

||

|

NET ASSETS - 100% |

$ 100,278,351 |

||

|

Legend |

|

(a) Non-income producing |

|

(b) The rate quoted is the annualized seven-day yield of the fund at |

|

Other Information |

|

Purchases and sales of securities, other than short-term securities, aggregated $41,754,648 and $41,208,450, respectively. |

|

The fund placed a portion of its portfolio transactions with brokerage firms which are affiliates of Fidelity Management & Research Company. The commissions paid to these affiliated firms were $8,493 for the period. |

|

The fund participated in the security lending program. At period end, the value of securities loaned amounted to $4,195,338. The fund received cash collateral of $4,417,900 which was invested in cash equivalents. |

|

Income Tax Information |

|

At August 31, 2000, the aggregate cost of investment securities for income tax purposes was $97,773,067. Net unrealized appreciation aggregated $7,530,625, of which $15,179,028 related to appreciated investment securities and $7,648,403 related to depreciated investment securities. |

|

The fund intends to elect to defer to its fiscal year ending February 28, 2001 approximately $1,232,000 of losses recognized during the period November 1, 1999 to February 29, 2000. |

See accompanying notes which are an integral part of the financial statements.

Consumer Sector

Statement of Assets and Liabilities

|

|

August 31, 2000 (Unaudited) |

|

|

Assets |

|

|

|

Investment in securities, at value |

|

$ 105,303,692 |

|

Receivable for investments sold |

|

635,809 |

|

Receivable for fund shares sold |

|

107,996 |

|

Dividends receivable |

|

140,561 |

|

Interest receivable |

|

41,107 |

|

Redemption fees receivable |

|

485 |

|

Other receivables |

|

2,104 |

|

Total assets |

|

106,231,754 |

|

Liabilities |

|

|

|

Payable for investments purchased |

$ 607,420 |

|

|

Payable for fund shares redeemed |

814,470 |

|

|

Accrued management fee |

49,989 |

|

|

Other payables and accrued expenses |

63,624 |

|

|

Collateral on securities loaned, |

4,417,900 |

|

|

Total liabilities |

|

5,953,403 |

|

Net Assets |

|

$ 100,278,351 |

|

Net Assets consist of: |

|

|

|

Paid in capital |

|

$ 93,254,304 |

|

Undistributed net investment income |

|

596,856 |

|

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions |

|

(1,589,432) |

|

Net unrealized appreciation (depreciation) on investments |

|

8,016,623 |

|

Net Assets, for 2,526,351 |

|

$ 100,278,351 |

|

Net Asset Value and redemption price per share ($100,278,351 ÷ 2,526,351 shares) |

|

$39.69 |

|

Maximum offering price per share (100/97.00 of $39.69) |

|

$40.92 |

Statement of Operations

|

|

Six months ended August 31, 2000 (Unaudited) |

|

|

Investment Income Dividends |

|

$ 985,998 |

|

Interest |

|

251,882 |

|

Security lending |

|

18,267 |

|

Total income |

|

1,256,147 |

|

Expenses |

|

|

|

Management fee |

$ 287,935 |

|

|

Transfer agent fees |

311,583 |

|

|

Accounting and security lending fees |

34,128 |

|

|

Non-interested trustees' compensation |

223 |

|

|

Custodian fees and expenses |

6,507 |

|

|

Registration fees |

22,600 |

|

|

Audit |

7,033 |

|

|

Legal |

175 |

|

|

Miscellaneous |

49 |

|

|

Total expenses before reductions |

670,233 |

|

|

Expense reductions |

(10,941) |

659,292 |

|

Net investment income |

|

596,855 |

|

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: |

|

|

|

Investment securities |

(62,703) |

|

|

Foreign currency transactions |

(3,296) |

(65,999) |

|

Change in net unrealized appreciation (depreciation) on: |

|

|

|

Investment securities |

19,123,625 |

|

|

Assets and liabilities in |

189 |

19,123,814 |

|

Net gain (loss) |

|

19,057,815 |

|

Net increase (decrease) in net assets resulting from operations |

|

$ 19,654,670 |

|

Other Information |

|

|

|

Sales charges paid to FDC |

|

$ 87,215 |

|

Deferred sales charges withheld by FDC |

|

$ 1,382 |

|

Exchange fees withheld by FSC |

|

$ 4,800 |

|

Expense reductions |

|

|

|

Directed brokerage arrangements |

|

$ 10,692 |

|

Custodian credits |

|

38 |

|

Transfer agent credits |

|

211 |

|

|

|

$ 10,941 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Food and Agriculture Portfolio

Financial Statements - continued

Statement of Changes in Net Assets

|

Increase (Decrease) in Net Assets |

Six months ended |

Year ended |

|

Operations |

$ 596,855 |

$ 1,514,152 |

|

Net realized gain (loss) |

(65,999) |

2,903,853 |

|

Change in net unrealized appreciation (depreciation) |

19,123,814 |

(45,267,235) |

|

Net increase (decrease) in net assets resulting from operations |

19,654,670 |

(40,849,230) |

|

Distributions to shareholders |

- |

(1,366,746) |

|

From net realized gain |

- |

(6,551,980) |

|

In excess of net realized gain |

- |

(752,061) |

|

Total distributions |

- |

(8,670,787) |

|

Share transactions |

60,914,668 |

25,160,713 |

|

Reinvestment of distributions |

- |

8,301,729 |

|

Cost of shares redeemed |

(58,700,164) |

(111,774,157) |

|

Net increase (decrease) in net assets resulting from share transactions |

2,214,504 |

(78,311,715) |

|

Redemption fees |

121,385 |

112,538 |

|

Total increase (decrease) in net assets |

21,990,559 |

(127,719,194) |

|

Net Assets |

|

|

|

Beginning of period |

78,287,792 |

206,006,986 |

|

End of period (including undistributed net investment income of $596,856 and $381,112, respectively) |

$ 100,278,351 |

$ 78,287,792 |

|

Other Information Shares |

|

|

|

Sold |

1,624,368 |

602,218 |

|

Issued in reinvestment of distributions |

- |

205,962 |

|

Redeemed |

(1,553,438) |

(2,743,334) |

|

Net increase (decrease) |

70,930 |

(1,935,154) |

Financial Highlights

|

|

Six months ended |

Years ended February 28, |

||||

|

Selected Per-Share Data |

(Unaudited) |

2000 F |

1999 |

1998 |

1997 |

1996 F |

|

Net asset value, beginning of period |

$ 31.88 |

$ 46.92 |

$ 48.81 |

$ 44.53 |

$ 42.15 |

$ 32.53 |

|

Income from Investment Operations |

|

|

|

|

|

|

|

Net investment income D |

.22 |

.42 G |

.21 |

.33 |

.42 |

.37 |

|

Net realized and unrealized gain (loss) |

7.54 |

(13.07) |

3.50 |

9.22 |

4.91 |

11.61 |

|

Total from investment operations |

7.76 |

(12.65) |

3.71 |

9.55 |

5.33 |

11.98 |

|

Less Distributions |

|

|

|

|

|

|

|

From net investment income |

- |

(.42) |

(.16) |

(.37) |

(.24) |

(.20) |

|

From net realized gain |

- |

(1.79) |

(5.47) |

(4.95) |

(2.77) |

(2.20) |

|

In excess of net realized gain |

- |

(.21) |

- |

- |

- |

- |

|

Total distributions |

- |

(2.42) |

(5.63) |

(5.32) |

(3.01) |

(2.40) |

|

Redemption fees added to paid in capital |

.05 |

.03 |

.03 |

.05 |

.06 |

.04 |

|

Net asset value, end of period |

$ 39.69 |

$ 31.88 |

$ 46.92 |

$ 48.81 |

$ 44.53 |

$ 42.15 |

|

Total Return B, C |

24.50% |

(27.86)% |

7.83% |

23.58% |

13.59% |

37.92% |

|

Ratios and Supplemental Data |

|

|

|

|

|

|

|

Net assets, end of period (000 omitted) |

$ 100,278 |

$ 78,288 |

$ 206,007 |

$ 250,567 |

$ 223,423 |

$ 301,102 |

|

Ratio of expenses to average net assets |

1.31% A |

1.31% |

1.31% |

1.49% |

1.52% |

1.43% |

|

Ratio of expenses to average net assets after |

1.29% A, E |

1.29% E |

1.29% E |

1.48% E |

1.50% E |

1.42% E |

|

Ratio of net investment income to average net assets |

1.16% A |

1.00% |

.45% |

.73% |

1.01% |

.99% |

|

Portfolio turnover rate |

88% A |

38% |

68% |

74% |

91% |

124% |

|

A Annualized B The total returns would have been lower had certain expenses not been reduced during the periods shown. C Total returns do not include the one time sales

charge and for periods of less than one year are not annualized. |

||||||

See accompanying notes which are an integral part of the financial statements.

Consumer Sector

Performance

There are several ways to evaluate a fund's historical performance. You can look at the total percentage change in value, the average annual percentage change or the growth of a hypothetical $10,000 investment. Total return reflects the change in the value of an investment, assuming reinvestment of the fund's dividend income and capital gains (the profits earned upon the sale of securities that have grown in value). Load adjusted returns include a 3.00% sales charge and the effect of a $7.50 long-term trading fee for shares held 30 days or more. Effective September 28, 2000, the $7.50 long-term trading fee was eliminated.

Cumulative Total Returns

|

Periods ended |

Past 6 |

Past 1 |

Past 5 |

Past 10 |

|

Select Leisure |

-3.14% |

6.95% |

159.57% |

576.51% |

|

Select Leisure |

-6.12% |

3.67% |

151.71% |

556.15% |

|

S&P 500 |

11.73% |

16.32% |

193.58% |

493.54% |

|

GS Consumer Industries |

1.71% |

-1.83% |

n/a** |

n/a** |

Cumulative total returns show the fund's performance in percentage terms over a set period - in this case, six months, one year, five years or 10 years. You can compare the fund's returns to the performance of both the Standard & Poor's 500 Index - a market capitalization-weighted index of common stocks - and the Goldman Sachs Consumer Industries Index - a market capitalization-weighted index of 295 stocks designed to measure the performance of companies in the consumer industries sector. These benchmarks include reinvestment of dividends and capital gains, if any, and exclude the effect of sales charges.

Average Annual Total Returns

|

Periods ended |

Past 1 |

Past 5 |

Past 10 |

|

Select Leisure |

6.95% |

21.02% |

21.07% |

|

Select Leisure |

3.67% |

20.28% |

20.70% |

|

S&P 500 |

16.32% |

24.04% |

19.49% |

|

GS Consumer Industries |

-1.83% |

n/a** |

n/a** |

Average annual returns take the fund's cumulative return and show you what would have happened if the fund had performed at a constant rate each year.

** Not available

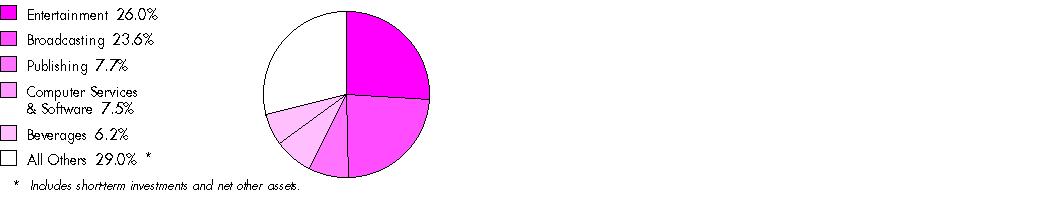

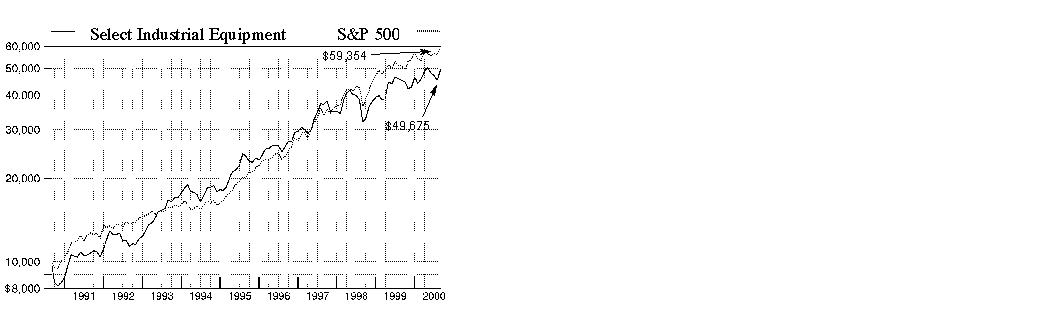

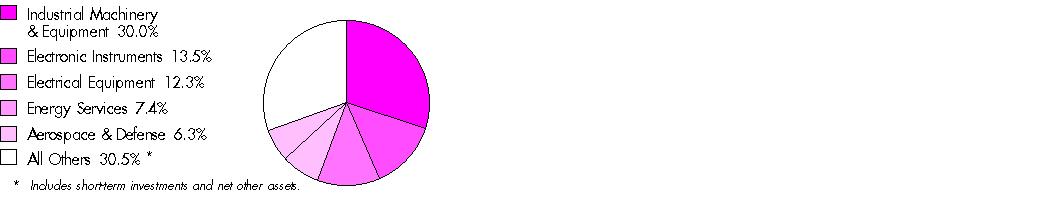

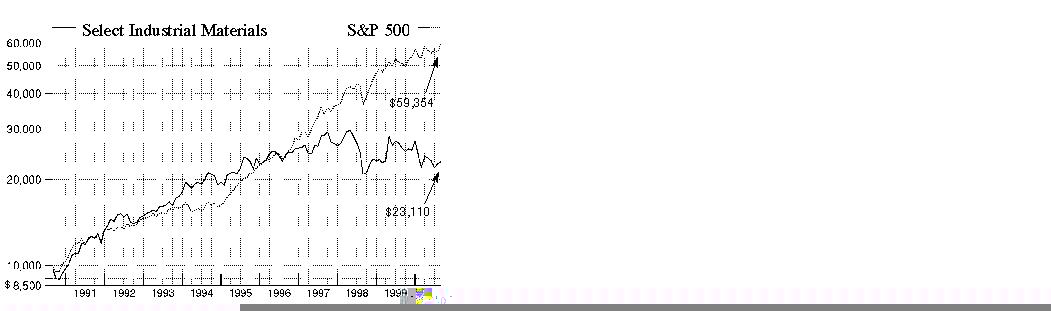

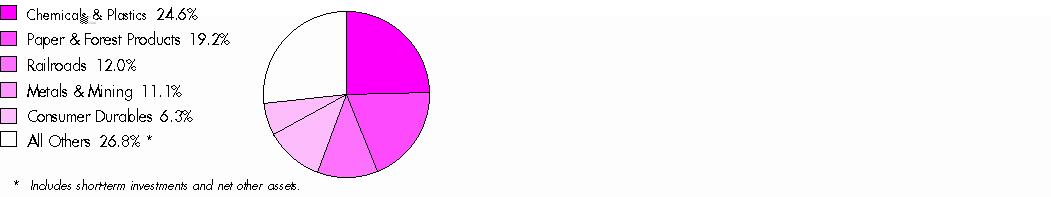

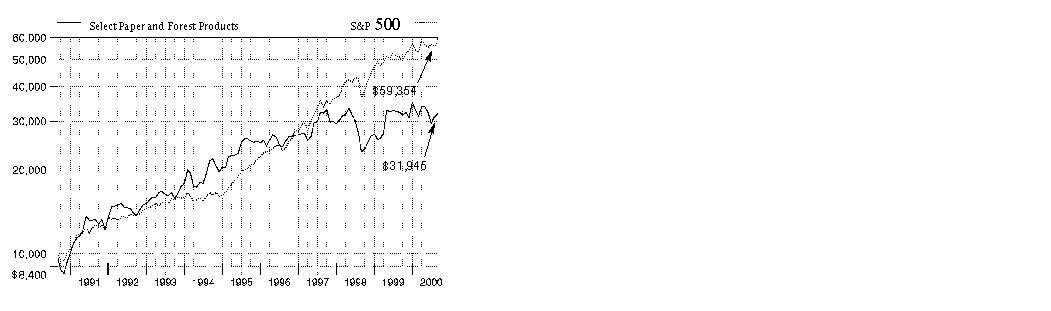

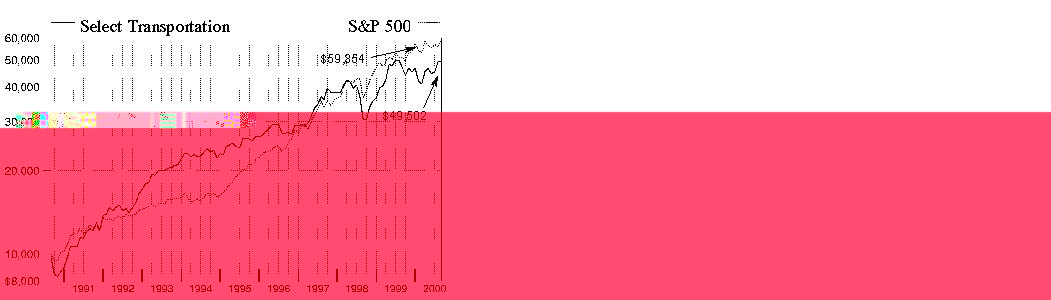

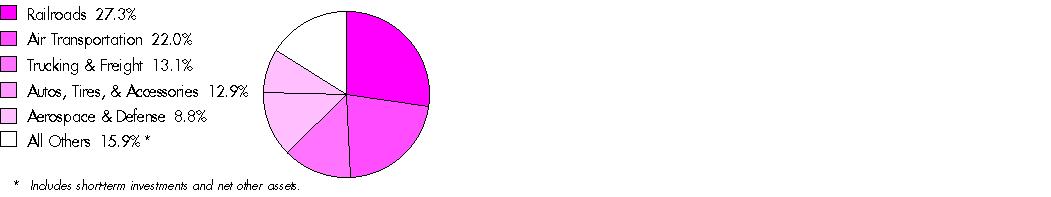

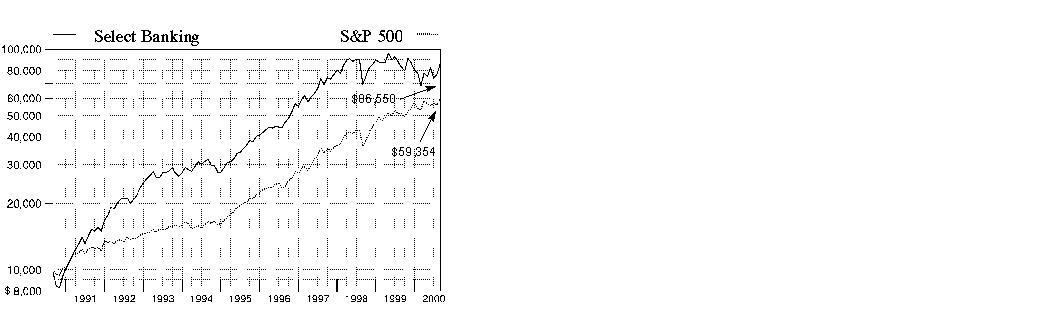

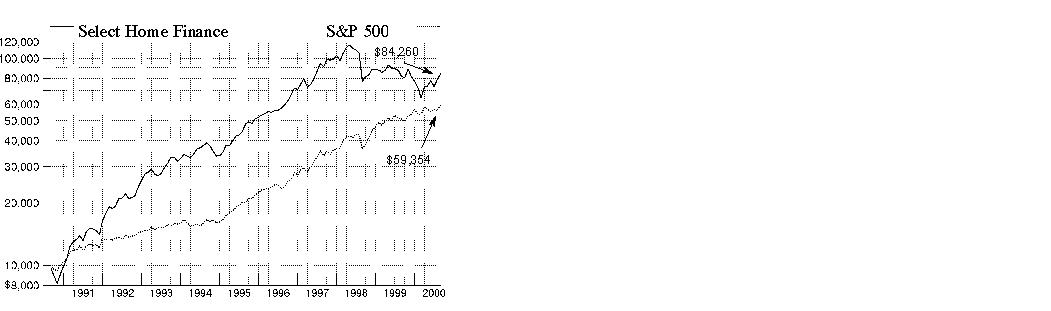

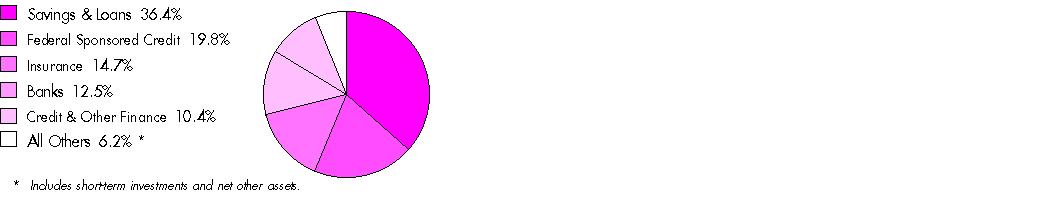

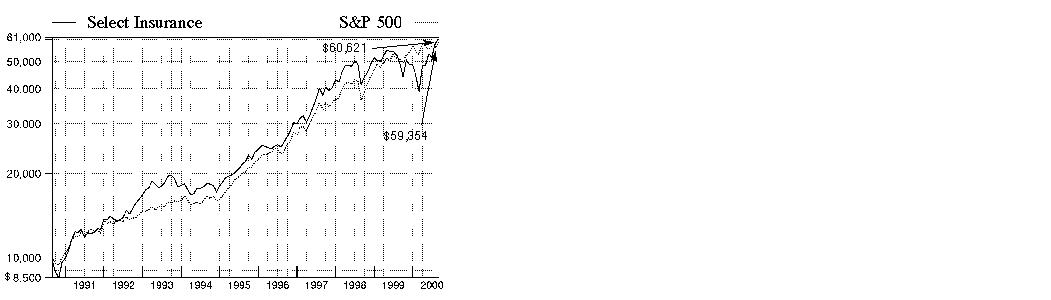

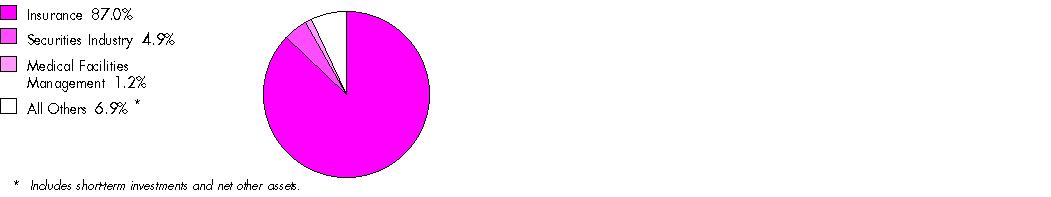

Understanding Performance