|

|

|

|

|

Previous: ESTERLINE TECHNOLOGIES CORP, 10-K, EX-23.3, 2001-01-19 |

Next: ESTERLINE TECHNOLOGIES CORP, S-3, EX-1.1, 2001-01-19 |

As filed with the Securities and Exchange Commission on January 19, 2001

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Esterline Technologies Corporation

(Exact name of registrant as specified in its charter)

| Delaware | 13-2595091 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

10800 NE 8th Street

Bellevue, Washington 98004

(425) 453-9400

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Robert W. Cremin

Chairman, President and Chief Executive Officer

Esterline Technologies Corporation

10800 NE 8th Street

Bellevue, Washington 98004

(425) 453-9400

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Andrew Bor Perkins Coie LLP 1201 Third Avenue, Suite 4800 Seattle, Washington 98101-3099 (206) 583-8888 |

Jonathan I. Mark Cahill Gordon & Reindel 80 Pine Street New York, New York 10005 (212) 701-3000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. / /

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. / /

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. / /

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. / /

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. / /

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to Be Registered |

Amount to Be Registered (1) |

Proposed Maximum Aggregate Price Per Share (2) |

Proposed Maximum Aggregate Offering Price |

Amount of Registration Fee |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock, $0.20 par value per share (3) | 3,220,000 | $ | 25.03 | $ | 80,596,600 | $ | 20,149.15 | ||||

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | Subject to Completion | January 19, 2001 |

2,800,000 Shares

![]()

Esterline Technologies Corporation

Common Stock

We are offering 2,800,000 shares of our common stock to be sold in this offering.

Our common stock is traded on the New York Stock Exchange under the symbol "ESL." On January 18, 2001, the last reported sale price of our common stock was $27.19 per share.

Investing in our common stock involves risk. See "Risk Factors" beginning on page 7.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| |

Per Share |

Total |

||

|---|---|---|---|---|

| Public offering price | $ | $ | ||

| Underwriting discounts and commissions | $ | $ | ||

| Proceeds, before expenses, to us | $ | $ | ||

The underwriters may also purchase up to an additional 420,000 shares of common stock from us at the public offering price, less the underwriting discounts and commissions, within 30 days from the date of this prospectus to cover over-allotments, if any. If the underwriters exercise the option in full, the total underwriting discounts and commissions will be $ , and the total proceeds, before expenses, to us will be $ .

The underwriters are offering the common stock as set forth under "Underwriting." Delivery of the shares will be made in New York, New York on or about , 2001.

UBS Warburg LLC First Union Securities, Inc.

The date of this prospectus is , 2001

You should rely only on information contained in or incorporated by reference into this prospectus. We have not and the underwriters have not authorized anyone to provide you with information that is different. We are offering to sell and seeking offers to buy shares of common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock.

Table of contents

| Forward-looking statements | 2 | |

| Prospectus summary | 3 | |

| Risk factors | 7 | |

| Use of proceeds | 14 | |

| Price range of common stock | 14 | |

| Dividend policy | 14 | |

| Capitalization | 15 | |

| Selected consolidated financial data | 16 | |

Management's discussion and analysis of financial condition and results of operations |

18 |

|

| Business | 24 | |

| Management | 35 | |

| Principal shareholders | 38 | |

| Underwriting | 40 | |

| Legal matters | 42 | |

| Experts | 42 | |

| Where you can find more information | 42 | |

| Information incorporated by reference | 42 | |

| Financial statements | F-1 |

Forward-looking statements

This prospectus contains forward-looking statements. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as "anticipate," "believe," "continue," "could," "estimate," "expect," "intend," "may," "might," "plan," "potential," "predict," "should" or "will" or the negative of such terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks outlined under "Risk Factors," that may cause our or our industry's actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. You should not place undue reliance on these forward-looking statements. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, performance or achievements.

2

This summary highlights selected information contained elsewhere in this prospectus. This summary may not contain all the information that you should consider before investing in our common stock. You should read the entire prospectus carefully, including "Risk Factors" and the consolidated financial statements included, and incorporated by reference, into this prospectus, before making an investment decision. Except where we state otherwise, the information we present in this prospectus assumes no exercise of the underwriters' over-allotment option. References in this prospectus to "Esterline", "we", "our" and "us" refer to Esterline Technologies Corporation. Our principal executive offices are located at 10800 NE 8th Street, Bellevue, Washington 98004 and our telephone number is (425) 453-9400. Our Internet address is www.esterline.com. Information contained on our Web site does not constitute part of this prospectus.

ESTERLINE TECHNOLOGIES CORPORATION

Overview

Esterline, a Delaware corporation formed in 1967, is a specialized manufacturing company principally serving aerospace and defense customers and electronic equipment manufacturers. We design, manufacture and market highly engineered products and systems for applications within the industries we serve. Our strategic growth plan revolves around the development of three key technologies—sensors and controls, illuminated displays and specialized high-performance materials.

As part of our long-term strategic direction, we strive to anticipate the global needs of our customers and to respond with comprehensive solutions worldwide. This effort has resulted in establishing strategic realignments of operations providing the capability to offer a more extensive product line to each customer through a single contact.

We view and operate our business in three different segments: Aerospace, Advanced Materials and Automation. We primarily serve aerospace and defense customers with manufactured products such as high-end components for avionics, propulsion and guidance systems, and high-performance elastomers and other complex materials in the Aerospace and Advanced Materials segments. The Automation segment serves electronic equipment customers with printed circuit board, PCB, drilling equipment and heavy equipment manufacturing customers with automated machine tools for cutting and punching plate metal.

Market Overview

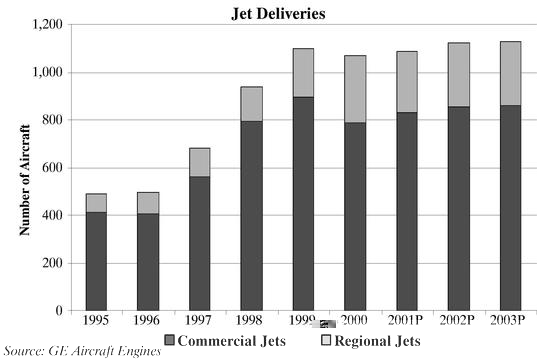

Suppliers to the commercial aerospace industry serve a large and growing market. Over the long term, demand for aircraft is driven by economic growth supporting the demand for air travel and the need to replace aircraft that are removed from service due to age or other concerns. Boeing's publicly released Current Market Outlook 2000 currently estimates that the market for aircraft is

3

approximately $1.5 trillion over 20 years and that the number of aircraft in service is expected to more than double to 31,755 aircraft by 2019. Over this period, Boeing estimates that over 23,100 new aircraft will enter service in order to accommodate this demand. Additionally, orders, deliveries and manufacturers' backlogs of regional jets currently stand at record levels.

The near term outlook for the commercial aerospace industry is also positive, driven by the significant increase in orders at Boeing during 2000, and continued growth at Airbus. Recent activity has been supported by increased orders from Asia, several years of stronger airline operating profits and the retirement of older aircraft. Replacements are being driven by regulations that required noisier aircraft to be replaced or modified by 2000 in the United States and that will require replacement by 2002 in Europe. Pending noise regulations could cause another wave of aircraft replacements. Higher fuel prices also provide incentives to replace older aircraft with newer, more fuel-efficient aircraft.

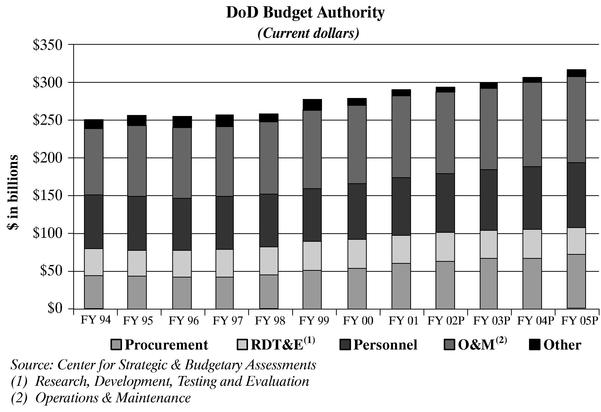

The outlook for defense spending is positive, driven in large measure by the availability of funds due to the projected surplus and broad political support. Key trends include a continued focus on upgrades and modifications of existing weapons systems and the increased use of electronics and technology generally.

The US Department of Defense, DoD, fiscal 2001 budget of approximately $291 billion includes over $60 billion for procurement and over $37 billion for research and development. Both procurement and research and development spending represent the principal source of funds for most defense contractors. The DoD fiscal 2001 budget amount continues the increases that began in 1996.

Business Strategy

One of Esterline's strengths is the proven capability to deliver specialized products designed to perform in demanding applications and in harsh environments. We intend to capitalize on our reputation as a leading supplier of highly engineered products for the aerospace and defense industry. We will take advantage of our strong, specialized niche market positions in a consolidating industry to build shareholder value by growing the business and gaining critical mass, increasing our profitability by offering higher value-added products to our customers and consolidating our position within the aerospace and defense industry. Our strategy for profitable growth includes the following:

4

The offering

The following information assumes that the underwriters do not exercise the over-allotment option we granted to them to purchase additional shares in the offering.

| Common stock we are offering | 2,800,000 shares | |

| Common stock to be outstanding after this offering | 20,227,301 shares | |

| New York Stock Exchange symbol | ESL | |

| Use of proceeds | For general corporate purposes, including potential future acquisitions. |

The number of shares of common stock to be outstanding after this offering is based on the number of shares outstanding as of January 2, 2001, excluding:

5

Summary consolidated financial data

| |

For Fiscal Years |

|||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

1996 |

1997 |

1998 |

1999 |

2000 |

|||||||||||||

| Statement of operations data | (in thousands, except per share amounts) | |||||||||||||||||

| Sales | $ | 352,843 | $ | 390,958 | $ | 453,902 | $ | 460,969 | $ | 490,966 | ||||||||

| Cost of sales | 215,015 | 243,197 | 281,539 | 286,410 | 311,242 | |||||||||||||

| Gross margin | 137,828 | 147,761 | 172,363 | 174,559 | 179,724 | |||||||||||||

| Operating expenses: | ||||||||||||||||||

| Selling, general and administrative | 88,042 | 90,918 | 102,361 | 106,239 | 105,532 | |||||||||||||

| Research, development and engineering | 15,373 | 17,556 | 20,846 | 24,022 | 20,839 | |||||||||||||

| Total expenses | 103,415 | 108,474 | 123,207 | 130,261 | 126,371 | |||||||||||||

| Operating earnings | 34,413 | 39,287 | 49,156 | 44,298 | 53,353 | |||||||||||||

| Other operating (income) expenses: | ||||||||||||||||||

| Gain on sale of business (1) | — | — | — | (7,956 | ) | (2,591 | ) | |||||||||||

| Interest income | (1,989 | ) | (2,397 | ) | (1,594 | ) | (2,859 | ) | (2,205 | ) | ||||||||

| Interest expense | 4,328 | 3,603 | 3,803 | 9,011 | 8,124 | |||||||||||||

| Net other (income) expense | 2,339 | 1,206 | 2,209 | (1,804 | ) | 3,328 | ||||||||||||

| Earnings before income taxes | 32,074 | 38,081 | 46,947 | 46,102 | 50,025 | |||||||||||||

| Income tax expense | 10,720 | 12,760 | 16,863 | 16,240 | 17,438 | |||||||||||||

| Net earnings | $ | 21,354 | $ | 25,321 | $ | 30,084 | $ | 29,862 | $ | 32,587 | ||||||||

| Net income per common share—basic | $ | 1.35 | $ | 1.48 | $ | 1.74 | $ | 1.72 | $ | 1.88 | ||||||||

| Net income per common share—diluted | $ | 1.31 | $ | 1.44 | $ | 1.70 | $ | 1.69 | $ | 1.85 | ||||||||

| Weighted-average common shares outstanding—basic | 15,842 | 17,124 | 17,290 | 17,337 | 17,375 | |||||||||||||

| Weighted-average common shares outstanding—diluted | 16,334 | 17,608 | 17,718 | 17,658 | 17,654 | |||||||||||||

| |

2000 Actual |

As Adjusted(2) |

||||

|---|---|---|---|---|---|---|

| Balance sheet data | (in thousands) | |||||

| Cash and cash equivalents and short-term investments | $ | 50,888 | $ | 122,112 | ||

| Working capital | 121,621 | 192,845 | ||||

| Total assets | 474,339 | 545,563 | ||||

| Long-term debt, net of current maturities | 108,172 | 108,172 | ||||

| Shareholders' equity | 249,695 | 320,919 | ||||

| |

For Fiscal Years |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

1996 |

1997 |

1998 |

1999 |

2000 |

|||||

| Other selected data | (in thousands) | |||||||||

| EBITDA (3) | $50,682 | $56,691 | $67,472 | $65,094 | $75,062 | |||||

| Depreciation and amortization | 16,269 | 17,404 | 18,316 | 20,796 | 21,709 | |||||

| Capital expenditures | 17,203 | 17,390 | 29,773 | 15,641 | 15,489 | |||||

6

You should carefully consider the risks described below together with all of the other information included in or incorporated by reference into this prospectus before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In such an event, the trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment.

RISKS RELATED TO OUR BUSINESS

Our operating results are subject to fluctuations that may cause our stock price to decline.

Our business is susceptible to economic cycles and therefore our operating results have fluctuated widely in the past and are likely to continue to do so. Our revenue is unpredictable and tends to fluctuate based on a number of factors, including domestic and foreign economic conditions and developments affecting the specific industries and customers served. Certain products sold represent capital investment or support for capital investment by either the initial customer or the ultimate end-user. Also, a significant portion of the sales and profitability of some of our businesses is derived from the aerospace, defense, telecommunications, computer and heavy equipment markets as well as government contracts. It is possible that in the future our operating results in a particular quarter or quarters will not meet the expectations of securities analysts or investors, causing the market price of our common stock to decline. We believe that quarter-to-quarter comparisons of our operating results are not a good indication of our future performance and should not be relied upon to predict the future performance of our stock price.

The loss of a significant customer or defense program could have a material adverse effect on our operating results.

Certain segments of our operations are dependent on a relatively small number of customers and defense programs, which change from time to time. Our most significant customers in fiscal 2000, of which sales to any such customer was less than 10.0%, included Boeing, General Dynamics, Snecma and the US Army. There can be no assurance that our current significant customers will continue to buy products at their current levels. Moreover, orders included in backlog are generally subject to cancellation by our customers. The loss of a significant customer or defense program could have a material adverse effect on our operating results if we were unable to replace the related sales.

Our manufacturing operations in California may be adversely affected by power outages in that state.

We have substantial manufacturing operations in California principally related to our Advanced Materials segment, and to a lesser extent to our Automation segment. Recently, our plants have experienced electric power outages due to the difficulties being experienced by the electric utility industry in California. If our California operations were to shut down due to the lack of electric power for extended periods, they might be unable to meet customers' delivery schedules, thereby adversely affecting our revenue. In addition, it is likely that these operations will incur increased electric power costs when they do operate. We are unable to predict how long the difficulties faced by the electric utility industry in California will continue, or how such difficulties will be resolved. To the extent they do continue and our plants experience additional power outages and/or increases in their cost of electric power, our business could be adversely affected.

7

Political and economic instability in foreign markets may have a material adverse effect on our operating results.

Foreign sales represented approximately 31.8% of our total sales in fiscal 2000. Foreign sales are subject to numerous risks, including political and economic instability in foreign markets, restrictive trade policies of foreign governments, economic conditions in local markets, inconsistent product regulation by foreign agencies or governments, the imposition of product tariffs and the burdens of complying with a wide variety of international and US export laws and differing regulatory requirements. To the extent that foreign sales are transacted in a foreign currency, we are subject to the risk of losses due to foreign currency fluctuations. In addition, we have substantial assets denominated in foreign currencies that are not offset by liabilities denominated in such foreign currencies. These net foreign currency investments are subject to material changes in the event of fluctuations in foreign currencies against the US dollar.

The unsuccessful integration of a business or business segment we acquire could have a material adverse effect on our operating results.

One of our key operating strategies is to pursue selective acquisitions. We are reviewing and actively pursuing many possible acquisitions, including some outside our current markets. We do not currently have any commitments, agreements or understandings to acquire any specific businesses or other material assets. Our acquisition strategy will require additional debt or equity financing, resulting in additional leverage and dilution of ownership. We may not be able to finance acquisitions on terms that are satisfactory to us. We cannot assure you that any future acquisition will be consummated, or that if consummated, that we will be able to integrate such acquisition successfully without a material adverse effect on our financial condition or results of operations.

If we are unable to protect our intellectual property rights adequately, the value of our products could be diminished.

Our success is dependent in part on obtaining, maintaining and enforcing our patents and other proprietary rights and our ability to avoid infringing on the proprietary rights of others. While we take precautionary steps to protect our technological advantages and intellectual property and rely in part on patent, trademark, trade secret and copyright laws, we cannot assure you that the precautionary steps we have taken will completely protect our intellectual property rights. Because patent applications in the United States are maintained in secrecy until a patent is issued, there may be third-party patents, patent applications and other intellectual property relevant to our potential products that may block or compete with our products and processes. In the event a competitor successfully challenges our patents or licenses, we could incur substantial litigation costs that could have a material adverse effect on our operating results and financial condition.

In addition to our patent rights, we also rely on unpatented technology, trade secrets and confidential information. Others may independently develop substantially equivalent information and techniques or otherwise gain access to or disclose our technology. We may not be able to protect our rights in unpatented technology, trade secrets and confidential information effectively. We require our new employees, consultants and corporate partners to execute a confidentiality agreement at the commencement of their employment or consulting relationship with us. However, these agreements may not provide effective protection of our information or, in the event of unauthorized use or disclosure, they may not provide adequate remedies.

The market for our products may be affected by our ability to adapt to technological change.

The rapid change of technology continually affects our product applications and may directly impact the performance of any particular product. To succeed in the future, we will need to design, develop,

8

manufacture, assemble, test, market and support new products, and enhancements to our existing products, in a timely and cost-effective manner. Historically, our technology has been developed through both internal research and development expenditures, as well as customer funded research and development programs. There is no guarantee that we will continue to maintain, or benefit from, comparable levels of research and development in the future. We can give you no assurances that our existing products will not require significant modifications in the future in order to maintain their effectiveness, nor can we assure you that we will successfully identify new opportunities and continue to have the needed financial resources to develop new products in a timely or cost-effective manner.

Fixed-price contracts are common in some of our markets and may increase risks of cost overruns or losses on our contracts.

Our customers set demanding specifications for product performance, reliability and cost. Some of our government contracts and subcontracts are firm, fixed-price contracts providing for a predetermined fixed price for the products we make regardless of the costs we incur. Thus, we must make pricing commitments to our customers based on our expectation that we will achieve more cost-effective product designs and automate more of our manufacturing operations. The manufacture of our products requires a complex integration of demanding processes involving unique technical skill sets. We face risks of cost overruns or order cancellations if we fail to achieve forecasted product design and manufacturing efficiencies or if products cost more to produce than expected. The expense of producing products can rise due to increased costs of materials, components, labor, capital equipment or other factors. We may have cost overruns or problems with the performance or reliability of our products in the future, which could result in us incurring losses on contracts which we would have otherwise expected to be profitable.

We depend on the continued contributions of our executive officers and other key management, each of whom would be difficult to replace.

The loss of any of our executive officers or key management personnel would disrupt our operations and divert the time and attention of our remaining personnel. We do not have employment contracts with our key executives nor have we purchased "key-person" insurance on the lives of any of our executive officers or key management personnel to reduce the impact to our company that the loss of any of them would cause.

Our charter documents contain certain provisions that could make a merger, tender offer or proxy contest difficult.

Our Restated Certificate of Incorporation, as amended, and Bylaws, as amended, provide for a classified board of directors and restrict the ability of shareholders to call special meetings. These provisions could delay or impede the removal of incumbent directors and could make it more difficult to effect a merger, tender offer or proxy contest, even if such events might be favorable to our shareholders. In addition, certain agreements to which we are a party, including loan and executive officer agreements, contain provisions that impose increased costs in the event of a change of control.

We are party to a Shareholder Rights Plan designed to cause substantial dilution to any "Acquiring Person" that attempts to merge or consolidate with us, or that takes certain other actions affecting us on terms that are not approved by our board of directors. We are also subject to the "business combination" statute of the Delaware General Corporation Law, that generally prohibits a publicly held Delaware corporation from engaging in various "business combination" transactions with any "interested stockholder" for a period of three years after the date of the transaction in which such

9

person became an "interested stockholder," unless the business combination is approved in a specific manner. These provisions could discourage or make it more difficult to effect a merger, tender offer or other similar transaction, even if it were favorable to our shareholders.

RISKS RELATED TO OUR INDUSTRY

Our business is subject to various laws and regulations that are more restrictive because we are a contractor and subcontractor to the US Government.

As a contractor and subcontractor to the US Government, we are subject to various laws and regulations that are more restrictive than those applicable to non-government contractors. Although only 5.0% of our sales were made directly to the US Government in fiscal 2000, we estimate that our subcontracting activities accounted for an additional 15.0% of sales. Therefore, approximately 20.0% of our sales during that fiscal year were governed by rules favoring the government's contractual position. As a consequence, such contracts may be subject to protest or challenge by unsuccessful bidders or to termination, reduction or modification in the event of changes in government requirements, reductions in federal spending or other factors. The accuracy and appropriateness of certain costs and expenses used to substantiate our direct and indirect costs for the US Government under both cost-plus and fixed-price contracts are subject to extensive regulation and audit by the Defense Contract Audit Agency, an arm of the DoD. Responding to governmental audits, inquiries or investigations may involve significant expense and divert management attention. Also, an adverse finding in any such audit, inquiry or investigation could involve fines, injunctions or other sanctions.

Rapid changes in technology and industry standards could render certain of our products obsolete or noncompetitive.

We are engaged in a field characterized by product performance, which requires extensive research efforts, rapid technological development and service. New developments and product improvements in our field are accelerating. Our competitors may develop technologies and products that are more effective than any we develop or that render our technology and products obsolete or noncompetitive. In addition, our products could become unmarketable if new industry standards emerge. To be successful, we will need to enhance our products and design, develop and market new and improved products that keep pace with new technological and industry developments; however, we cannot assure you that we will be successful in competing against new technologies and keeping up with industry developments.

A downturn in the aircraft market could adversely affect our business.

The aircraft industry is cyclical in nature and affected by many factors beyond our control which could have a material adverse effect on our business, financial condition and operating results.

The principal markets for manufacturers of commercial aircraft are the commercial and regional airlines which are cyclical and adversely affected by a number of factors, including increased fuel and labor costs and intense price competition, all of which can be volatile and are outside our control. Commercial aircraft production may increase or decrease in response to changes in customer demand caused by general economic conditions.

The military aircraft industry is dependent upon the level of equipment expenditures by the armed forces of countries throughout the world, and especially those of the United States. In recent years, this industry has been adversely affected by a number of factors, including the reduction in military spending since the end of the Cold War. Additional decreases in military spending could further depress demand for military aircraft.

10

Any decrease in demand for new aircraft will likely result in a decrease in demand of our products and services, and correspondingly, our revenues, thereby adversely affecting our business, financial condition and results of operations.

Our business is subject to governmental authorizations and approvals.

Governmental agencies throughout the world, including the US Federal Aviation Administration, FAA, highly regulate the repair and overhaul of aircraft engines. Guidelines established by OEMs supplement governmental regulation and generally require that aircraft operators overhaul engines and replace specified engine parts after a certain number of flight hours or cycles (take-offs and landings).

We include with the replacement parts that we sell to our customers documentation certifying that each part complies with applicable regulatory requirements and meets applicable standards of airworthiness established by the FAA or the equivalent regulatory agencies in other countries. Specific regulations vary from country to country, although compliance with FAA requirements generally satisfies regulatory requirements in other countries. The revocation or suspension of any of our material authorizations or approvals would have an adverse effect on our business, financial condition and results of operations. In addition, new and more stringent government regulations, if adopted and enacted, could have a material adverse effect on our business, financial condition and results of operations.

Intense competition among technology companies for experienced engineers and other personnel may affect our ability to sustain our growth expectations.

We depend on, and must attract and retain, competent personnel in all areas of our business, including management, engineering, manufacturing, quality assurance, finance, marketing and support. Our development efforts especially depend on hiring and retaining qualified engineers, that we believe are in high demand. We may not be able to hire and retain these personnel at compensation levels consistent with our existing compensation and salary structure. If we are unable to hire a sufficient number of engineering personnel, we may be unable to support the growth of our business, and as a result, our sales may suffer.

We may be required to defend lawsuits or pay damages in connection with the alleged or actual harm caused by our products.

We face an inherent business risk of exposure to product liability claims in the event that the use of our products is alleged to have resulted in harm to others or to property. Although we maintain general liability and product liability insurance, we may incur significant liability if product liability lawsuits against us are successful. We cannot assure you that such coverage will be adequate to cover all claims that may arise or that it will continue to be available to us on acceptable terms.

We may incur substantial environmental liability arising from our activities involving the use of hazardous materials.

Our business is subject to certain federal, state, local and foreign laws, regulations and ordinances governing the use, manufacture, storage, handling and disposal of hazardous materials and certain waste products. From time to time, our operations have resulted or may result in noncompliance with environmental laws or liability for the costs of investigating and cleaning up, and certain damages resulting from, sites of past spills, disposals or other releases of hazardous materials. In addition, we have been identified as a potentially responsible party pursuant to the federal Comprehensive Environmental Response, Compensation, and Liability Act of 1980, as amended, or under analogous state environmental laws, for the cleanup of contamination resulting from past disposals of hazardous

11

materials at certain sites where we, with others, sent waste in the past. We cannot assure you that such matters, or any similar liabilities that arise in the future, will not exceed our resources, nor can we completely eliminate the risk of accidental contamination or injury from these materials.

We cannot guarantee the accuracy and completeness of the industry and market data included in this prospectus.

Industry and market data used throughout this prospectus is based on the good faith estimates of our management, which estimates are based primarily upon the internal management information and, to the extent available, independent industry publications and other publicly available information. However, the nature of the aerospace industry and competition in our markets results in limited availability of reliable, independent data. Although we believe that the sources we have used are reliable, we do not guarantee, and have not independently verified, the accuracy and completeness of the information.

RISKS RELATED TO THIS OFFERING

Lower trading volume and lower public ownership of our common stock may contribute to its price volatility.

The stock market has from time to time experienced significant price and volume fluctuations that may be unrelated to the operating performance of particular companies. In addition, the market price of our common stock, like that of our competitors, has been and may continue to be volatile. In particular, the volatility of our shares is influenced by lower trading volume and lower public ownership relative to other publicly held competitors. For example, our stock price has ranged from $9.25 per share to $28.38 per share since January 1, 2000. Our average weekly dollar trading volume for the twelve months ended October 27, 2000 was approximately $4.8 million. Having a relatively significant percentage of our shares owned by long-term institutional holders means that our stock is relatively less liquid and thus more susceptible to large price fluctuations.

The following factors, among others, may have a significant impact on the market price of our common stock:

Sales of a substantial number of our shares of common stock in the public market following this offering could adversely affect the market price of our common stock.

Upon completion of this offering, we will have 20,227,301 shares of common stock outstanding (based upon shares outstanding as of January 2, 2001), or 20,647,301 if the underwriters exercise their over-allotment option in full. All of these shares, including the 2,800,000 shares offered hereby (or approximately 3,220,000 shares if the underwriters' over-allotment option is exercised in full) will be freely tradable without restriction or further registration under the Securities Act.

Our executive officers and directors, who together hold 233,258 shares of common stock (all of which are eligible for sale under Rule 144 on the date of this offering), have entered into lock-up agreements with the underwriters pursuant to which the holders have agreed not to offer, sell, contract to sell, grant any option to purchase or otherwise dispose of, directly or indirectly, any of their shares of

12

Common Stock, or any shares that they may acquire through the exercise of stock options or warrants, or to exercise any of their registration rights in respect of their shares of common stock, for a period of 90 days beginning on the date of this offering without the prior written consent of UBS Warburg LLC on behalf of each of the underwriters. This restriction shall not apply to the transfer of any shares of our common stock, or any securities convertible into or exchangeable for common stock, to a broker-dealer for the purpose of sale as permitted by Regulation FD not earlier than 90 days after the date of this Prospectus. See "Underwriting."

As of January 2, 2001, options to purchase a total of 1,519,500 shares of common stock were outstanding under our stock option plans, of which options for a total of 1,022,625 shares were then exercisable. Of the total options exercisable, options for 822,875 shares were held by executive officers and directors subject to the lock-up agreements described above.

We have a Shareholder Rights Plan providing for the distribution of one preferred stock purchase right for each share of common stock held. Each such right entitles the holder to purchase one one-hundredth of a share of our Series A Serial Preferred Stock at an exercise price of $56. These rights are exercisable and transferable apart from the common stock only if a person or group acquires beneficial ownership of 10.0% or more of our common stock or commences a tender offer or exchange offer which would result in a person or group beneficially owning 10.0% or more of our common stock. We can redeem the rights for $0.01 each at any time prior to the tenth day after an announcement that a person or group beneficially owns 10.0% or more of our common stock. When certain events occur, the holder of such a right can purchase, for the then current exercise price of the right, shares of our common stock (or under certain circumstances, as determined by our board of directors, cash, other securities or property) having a value of twice the exercise price of the right. When certain other events occur, the holder of each right would be entitled to purchase, at the exercise price of the right, shares of common stock of a corporation or other entity acquiring us or engaging in certain transactions with us, having a market value of twice the exercise price of the right.

13

We expect to receive approximately $71,230,000 in net proceeds from the sale of the 2,800,000 shares of common stock offered by us in this offering, assuming a public offering price of $27.19 per share (approximately $82,065,000 if the underwriters exercise their over-allotment option in full), after deducting underwriting discounts and commissions and estimated offering expenses payable by us.

We expect to use the net proceeds from this offering for general corporate purposes and potential future acquisitions. Pending use of the net proceeds of this offering, we intend to invest the net proceeds in short-term interest-bearing investment-grade instruments.

Price range of common stock

Our common stock trades on the New York Stock Exchange under the symbol "ESL." The following table sets forth, for the periods indicated, the high and low sale prices per share of our common stock as reported on the New York Stock Exchange.

| |

High |

Low |

|||||

|---|---|---|---|---|---|---|---|

| Fiscal year ended October 31, 1999 | |||||||

| First quarter | $ | 24.13 | $ | 18.25 | |||

| Second quarter | 19.63 | 12.13 | |||||

| Third quarter | 16.75 | 12.38 | |||||

| Fourth quarter | 16.63 | 13.25 | |||||

Fiscal year ended October 27, 2000 |

|||||||

| First quarter | $ | 14.00 | $ | 10.25 | |||

| Second quarter | 13.19 | 9.25 | |||||

| Third quarter | 16.13 | 12.06 | |||||

| Fourth quarter | 22.50 | 14.75 | |||||

Fiscal year ending October 26, 2001 |

|||||||

| First quarter (through January 18, 2001) | $ | 28.38 | $ | 19.38 | |||

On January 18, 2001, the last reported sale price of our common stock on the New York Stock Exchange was $27.19 per share. As of January 18, 2001, there were 793 holders of record of our common stock. Because many of these shares are held by brokers and other institutions on behalf of stockholders, we are unable to estimate the total number of stockholders represented by these record holders.

Dividend policy

We did not declare or pay any dividends on our capital stock during the 1999 and 2000 fiscal years. We currently intend to retain all future earnings for use to expand our business and retire debt obligations. We are restricted from paying dividends under our current credit facility and do not anticipate paying any dividends in the foreseeable future.

14

Capitalization

The following table sets forth our capitalization as of October 27, 2000:

The information set forth below should be read in conjunction with our consolidated financial statements and notes included, and incorporated by reference, into this prospectus.

| |

Actual |

As Adjusted |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

(in thousands) |

|||||||||

| Cash and cash equivalents and short-term investments | $ | 50,888 | $ | 122,112 | ||||||

| Long-term debt, net of current maturities | 108,172 | 108,172 | ||||||||

| Shareholders' equity: | ||||||||||

| Common stock, par value $0.20 per share; 60,000,000 shares authorized; 17,424,853 shares issued and outstanding, actual; 20,224,853 shares issued and outstanding, as adjusted | 3,485 | 4,045 | ||||||||

| Additional paid in capital | 46,952 | 117,616 | ||||||||

| Retained earnings | 211,540 | 211,540 | ||||||||

| Accumulated other comprehensive loss | (12,282 | ) | (12,282 | ) | ||||||

| Total shareholders' equity | 249,695 | 320,919 | ||||||||

| Total capitalization | $ | 357,867 | $ | 429,091 | ||||||

This information does not include 1,574,750 shares reserved for issuance as of October 27, 2000 upon exercise of stock options outstanding under our stock option plans, of which 921,500 options were exercisable at a weighted-average exercise price of $10.199 per share based on the fair market value of our common stock on the date of grant.

15

Selected consolidated financial data

The selected consolidated statement of operations data set forth below for the fiscal years ended October 31, 1998, 1999 and October 27, 2000 as well as the selected consolidated balance sheet data set forth below as of October 31, 1999 and October 27, 2000 are derived from our audited consolidated financial statements, which are included, and incorporated by reference, into this prospectus. The selected consolidated statement of operations data set forth below for the fiscal years ended October 31, 1996 and 1997 as well as the selected consolidated balance sheet data set forth below as of October 31, 1996, 1997 and 1998 are derived from our audited consolidated financial statements, which are not included in this prospectus. The following selected consolidated financial data should be read in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations" included in this prospectus and the consolidated financial statements and related notes in our annual report on Form 10-K for the fiscal year ended October 27, 2000 which is included, and incorporated by reference, into this prospectus.

| |

For Fiscal Years |

|||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

1996 |

1997 |

1998 |

1999 |

2000 |

|||||||||||||

| Statement of operations data | (in thousands, except per share amounts) | |||||||||||||||||

| Sales | $ | 352,843 | $ | 390,958 | $ | 453,902 | $ | 460,969 | $ | 490,966 | ||||||||

| Cost of sales | 215,015 | 243,197 | 281,539 | 286,410 | 311,242 | |||||||||||||

| Gross margin | 137,828 | 147,761 | 172,363 | 174,559 | 179,724 | |||||||||||||

| Operating expenses: | ||||||||||||||||||

| Selling, general and administrative | 88,042 | 90,918 | 102,361 | 106,239 | 105,532 | |||||||||||||

| Research, development and engineering | 15,373 | 17,556 | 20,846 | 24,022 | 20,839 | |||||||||||||

| Total expenses | 103,415 | 108,474 | 123,207 | 130,261 | 126,371 | |||||||||||||

| Operating earnings | 34,413 | 39,287 | 49,156 | 44,298 | 53,353 | |||||||||||||

| Other operating (income) expenses: | ||||||||||||||||||

| Gain on sale of business (1) | — | — | — | (7,956 | ) | (2,591 | ) | |||||||||||

| Interest income | (1,989 | ) | (2,397 | ) | (1,594 | ) | (2,859 | ) | (2,205 | ) | ||||||||

| Interest expense | 4,328 | 3,603 | 3,803 | 9,011 | 8,124 | |||||||||||||

| Net other (income) expense | 2,339 | 1,206 | 2,209 | (1,804 | ) | 3,328 | ||||||||||||

| Earnings before income taxes | 32,074 | 38,081 | 46,947 | 46,102 | 50,025 | |||||||||||||

| Income tax expense | 10,720 | 12,760 | 16,863 | 16,240 | 17,438 | |||||||||||||

| Net earnings | $ | 21,354 | $ | 25,321 | $ | 30,084 | $ | 29,862 | $ | 32,587 | ||||||||

| Net income per common share—basic | $ | 1.35 | $ | 1.48 | $ | 1.74 | $ | 1.72 | $ | 1.88 | ||||||||

| Net income per common share—diluted | $ | 1.31 | $ | 1.44 | $ | 1.70 | $ | 1.69 | $ | 1.85 | ||||||||

| Weighted-average common shares outstanding—basic | 15,842 | 17,124 | 17,290 | 17,337 | 17,375 | |||||||||||||

| Weighted-average common shares outstanding—diluted | 16,334 | 17,608 | 17,718 | 17,658 | 17,654 | |||||||||||||

16

| |

For Fiscal Years |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Balance sheet |

1996 |

1997 |

1998 |

1999 |

2000 |

|||||

| data (at period end) | (in thousands) | |||||||||

| Cash and cash equivalents and short-term investments | $ 46,436 | $ 56,045 | $ 8,897 | $ 80,980 | $ 50,888 | |||||

| Working capital | 73,445 | 99,419 | 70,099 | 140,908 | 121,621 | |||||

| Total assets | 276,646 | 289,847 | 387,179 | 453,082 | 474,339 | |||||

| Long-term debt, net of current maturities | 29,007 | 27,218 | 74,043 | 116,966 | 108,172 | |||||

| Retained earnings | 93,686 | 119,007 | 149,091 | 178,953 | 211,540 | |||||

| Shareholders' equity | 142,304 | 165,718 | 196,376 | 224,620 | 249,695 | |||||

Other selected data |

||||||||||

| EBITDA (2) | $ 50,682 | $ 56,691 | $ 67,472 | $ 65,094 | $ 75,062 | |||||

| Depreciation and amortization | 16,269 | 17,404 | 18,316 | 20,796 | 21,709 | |||||

| Capital expenditures | 17,203 | 17,390 | 29,773 | 15,641 | 15,489 | |||||

17

Management's discussion and analysis of financial condition and results of operations

The following discussion of our financial condition and results of operations should be read in conjunction with the "Selected consolidated financial data" and our financial statements and the notes of those statements included elsewhere in this prospectus. This discussion may contain forward-looking statements that involve risks, uncertainties and assumptions. As a result of many factors, such as those set forth under "Risk factors" and elsewhere in this prospectus, our actual results may differ materially from those anticipated in these forward-looking statements.

OVERVIEW

Our strategic growth plan revolves around the development of three key technologies—sensors and controls, specialized high-performance materials and illuminated displays. We are concentrating our efforts to selectively expand our capabilities in these markets. Our goal is to meet the evolving needs of our customers by providing a broad array of products and services through a single point of contact. We plan to accomplish this through internal development and strategic acquisitions. Internally, we are increasing our market presence by uniting sales forces, combining marketing opportunities and blending manufacturing knowledge and technological expertise.

Over the past several years we have focused on a selective acquisition and divestiture program supporting our long-term strategy to be a leading supplier to aerospace and defense customers throughout the world. Late in fiscal 1999, as a strategic addition to our European aerospace operation, we purchased the aerospace group of Muirhead Vactric and Norcroft Dynamics, Muirhead, a manufacturer of micro motors and motion control components located in the United Kingdom. Also, late in fiscal 1999, we divested Federal Products, an operation not aligned with our long-term direction. In December 1999, we acquired a manufacturer of custom keyboards and other multifunction data input subsystems, Advanced Input Devices Co., A.I.D. This acquisition expanded our high-end illuminated displays and custom panels operations.

We view and operate our business in three different segments: Aerospace, Advanced Materials and Automation. We primarily serve aerospace and defense customers with manufactured products such as high-end components for avionics, propulsion and guidance systems, high-performance elastomers and other complex materials in the Aerospace and Advanced Materials segments. The Automation segment serves electronic equipment customers with PCB drilling equipment and heavy equipment customers with automated machine tools for cutting and punching plate metal for heavy equipment applications.

RESULTS OF OPERATIONS

Fiscal 2000 compared with fiscal 1999

Sales for fiscal 2000 grew 6.5% when compared with the prior year. Sales by segment, were as follows:

| |

1999 |

2000 |

Increase (decrease) from prior year |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

(dollars in thousands) |

|

||||||||

| Aerospace | $ | 183,783 | $ | 236,269 | 28.6% | |||||

| Advanced Materials | 127,920 | 129,386 | 1.1% | |||||||

| Automation | 149,266 | 125,311 | (16.0% | ) | ||||||

| Total | $ | 460,969 | $ | 490,966 | ||||||

18

Aerospace provided our key area of growth in fiscal 2000. Substantially all of this growth was attributable to the acquisitions of Muirhead and A.I.D. Muirhead was included for a full year in fiscal 2000 and only three months in the prior year. In addition, the timing of the A.I.D. acquisition resulted in the inclusion of approximately three quarters of its sales in fiscal 2000. Sales growth in Advanced Materials was affected by customer programs designed to rebalance inventory levels. We believe those inventory levels have been normalized. Order placement activity improved over the last two quarters of fiscal 2000.

The decrease in Automation sales was primarily a result of our October 1999 divestiture of Federal Products. Excluding Federal Products on a comparative basis, Automation sales increased 15.6% due to improved PCB manufacturing equipment business, driven largely by strong performance in the second half of the year. Performance in this area has been difficult to predict and current trends indicate that the improvement may not continue through fiscal 2001. In addition, equipment sales to the heavy equipment markets remained weak throughout fiscal 2000 and are not expected to improve during fiscal 2001.

Sales to foreign customers, including export sales by domestic operations, totaled $156.2 million and $137.3 million, and accounted for 31.8% and 29.8% of our sales for fiscal 2000 and 1999, respectively.

Overall, gross margin as a percentage of sales was 36.6% and 37.9% for fiscal 2000 and 1999, respectively. Gross margin by segment ranged from 35.0% to 37.6% in fiscal 2000, compared with 33.7% to 40.4% in the prior year. Gross margin ranges for fiscal 2000 were lower when compared to fiscal 1999 due to a combination of factors, including lower margins on some recent acquisitions in the Aerospace segment; customer-related inventory rebalancing during the first part of fiscal 2000 in Advanced Materials; and a non-recurring inventory charge in Advanced Materials.

Automation gross margin improved when compared with the prior year primarily due to the PCB equipment revenue increases and cost cutting measures that have been implemented in the operations serving the heavy equipment markets.

Selling, general and administrative expenses (which include corporate expenses) decreased to $105.5 million in fiscal 2000 compared with $106.2 million in the prior year. As a percentage of sales, selling, general and administrative expenses were 21.5% and 23.0% in fiscal 2000 and 1999, respectively. Overall sales volume was weak throughout fiscal 1999 into the first quarter of fiscal 2000 and we focused on tightening selling, general and administrative expenses. In the second quarter of fiscal 2000, sales nearly matched the highest quarter in the prior year and continued to improve throughout the rest of the year. We believe our efficiency improvements have facilitated the absorption of business without significant increases in expenses. However, as an upward trend in sales continues, selling, general and administrative expenses will gradually increase. Long-term selling, general and administrative expense as a percentage of sales is unlikely to remain as low as the 21.5% in fiscal 2000.

Research, development and related engineering spending was $20.8 million, or 4.2% of sales, in fiscal 2000 compared with $24.0 million, or 5.2% of sales, in the prior year. During the year, several projects transitioned from prototype to production and accounted for the lower level of spending in the current fiscal year.

Segment earnings (excluding corporate expenses) increased 14.8% during fiscal year 2000 to $65.4 million compared with $56.9 million in the prior year. By segment, Aerospace earnings increased 31.6% to $32.7 million for fiscal 2000 compared with $24.8 million in the prior year, primarily due to acquisitions. Advanced Materials earnings were $24.8 million for fiscal 2000 compared with

19

$29.2 million for the prior year. The decrease in earnings for Advanced Materials was attributable to the customer-related inventory rebalancing and the write-down of inventory. Automation earnings improved to $7.9 million for fiscal 2000 compared with $2.9 million for the prior year. For fiscal 1999, Automation earnings were attributable to Federal Products—sold at the end of that fiscal year. Excluding Federal Products in a year-over-year comparison, the increase in Automation earnings was primarily related to improvements in business related to PCB markets.

The $2.6 million gain on sale of business relates to the curtailment of retirement benefits for certain Federal Products employees resulting from the October 28, 1999 sale of that operation. This gain was reported during the third quarter when it was first estimable. For purposes of the benefit calculations, credited service under the plan was frozen as of the date of sale. We do not anticipate any further adjustments related to the curtailment.

Interest income decreased to $2.2 million during fiscal 2000 compared with $2.9 million in the prior year. Interest expense decreased to $8.1 million during fiscal 2000 compared with $9.0 million in the prior year.

The effective income tax rate for fiscal 2000 was 34.9% compared with fiscal 1999 at 35.2%. Both years benefited from certain tax credits.

Net earnings in fiscal 2000 were $32.6 million, or $1.85 per share on a diluted basis, compared with $29.9 million, or $1.69 per share, in the prior year.

Orders received in fiscal 2000 increased 12.7% to $536.1 million from $475.7 million in the prior year. The increase is primarily attributable to Aerospace and Advanced Materials. Backlog at the end of fiscal 2000 was $228.3 million compared with $183.2 million at the end of the prior year. Approximately $46.1 million of backlog is scheduled to be delivered after fiscal 2001. Backlog is subject to cancellation until delivery.

Fiscal 1999 compared with fiscal 1998

Sales for fiscal 1999 grew 1.6% when compared with the prior year. Sales by segment were as follows:

| |

1998 |

1999 |

Increase (decrease) from prior year |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

(dollars in thousands) |

|

||||||||

| Aerospace | $ | 171,028 | $ | 183,783 | 7.5% | |||||

| Advanced Materials | 91,498 | 127,920 | 39.8% | |||||||

| Automation | 191,376 | 149,266 | (22.0% | ) | ||||||

| Total | $ | 453,902 | $ | 460,969 | ||||||

Sales in Advanced Materials grew substantially in fiscal 1999. This growth was primarily attributable to Kirkhill Rubber Co., Kirkhill, acquired in August 1998. Kirkhill was included in Advanced Materials for a full year during fiscal 1999 and three months in fiscal 1998. Aerospace continued to see improvements although at a slower rate than in the previous year. Sales in Aerospace were positively impacted by the acquisition of Muirhead. Revenues for this entity were included for the last quarter of the year.

Sales in Automation declined due to a variety of unfavorable market conditions during the year. These included continuing poor worldwide demand for PCB manufacturing equipment as well as soft agriculture and automotive markets. The sale of Tulon Co., Tulon, in late fiscal 1998 also impacted Automation in the year-over-year comparison.

20

Sales to foreign customers, including export sales by domestic operations, totaled $137.3 million and $120.2 million, and accounted for 29.8% and 26.5% of our sales for fiscal 1999 and 1998, respectively.

Gross margin as a percentage of sales was 37.9% and 38.0% for fiscal 1999 and 1998, respectively. Gross margins by segment ranged from 33.7% to 40.4% in fiscal 1999, compared with 33.2% to 42.4% in the prior year. Gross margin in Aerospace decreased slightly due to volumes that were lower than expected. Gross margin for Advanced Materials decreased during the year due to volume decreases and new business included for a full year, primarily Kirkhill. An increase in Automation margin was related primarily to improvements at Federal Products relative to the prior year, and the divestiture of Tulon late in fiscal 1998.

Selling, general and administrative expenses (which include corporate expenses) increased to $106.2 million in fiscal 1999 compared with $102.4 million in the prior year. As a percentage of sales, selling, general and administrative expenses were 23.0% and 22.6% in fiscal 1999 and 1998, respectively.

Research, development and related engineering spending increased to $24.0 million in fiscal 1999 from $20.8 million in fiscal 1998, and as a percentage of sales was 5.2% compared with 4.6% in the prior year. Developments continued in laser technology for Automation; sensors and controls for Aerospace; and fireproofing elastomer for Advanced Materials during fiscal 1999.

Segment earnings (excluding corporate expenses) decreased 5.3% during fiscal 1999 to $56.9 million compared with $60.1 million in the prior year. Aerospace earnings were essentially flat with the prior year. Advanced Materials posted earnings of $29.2 million in fiscal 1999 compared with $24.7 million in fiscal 1998. The improvement was primarily due to Kirkhill's full year of earnings. Automation earnings decreased to $2.9 million in fiscal 1999 compared with $10.7 million in the prior year. This reduction was primarily due to the continued effects of a depressed worldwide PCB equipment market and was compounded in the second half of the year by a significant decline in the agriculture and heavy equipment sector.

Prior to the close of fiscal 1999, we completed the sale of Federal Products to Mahr GmbH. Federal Products was our only measurement business and accounted for less than 10.0% of our sales during fiscal 1999. We recognized an $8.0 million gain on the sale for fiscal 1999.

Interest income increased to $2.9 million during fiscal 1999 compared with $1.6 million in the prior year. Interest expense increased to $9.0 million during fiscal 1999 compared with $3.8 million in the prior year. In November 1998, we completed a $100.0 million private placement of senior notes (1999 Senior Notes). The proceeds of this placement were used to retire an outstanding bridge facility arising from the Kirkhill acquisition. The remainder was invested and utilized to fund other internal expansion and acquisition activities.

The effective income tax rate decreased to 35.2% in fiscal 1999 from 35.9% in fiscal 1998, primarily due to a one-time benefit related to state tax refunds.

Net earnings in fiscal 1999 were $29.9 million, or $1.69 per share on a diluted basis, compared with $30.1 million, or $1.70 per share, in the prior year.

Orders received in fiscal 1999 increased 6.1% to $475.7 million from $448.5 million in the prior year. Backlog at October 31, 1999 was $183.2 million compared with $168.4 million at the end of the prior year.

21

LIQUIDITY AND CAPITAL RESOURCES

Cash and cash equivalents at the end of fiscal 2000 totaled $50.9 million, a decrease of $4.2 million from the prior year. No short-term investments were held at the end of fiscal 2000 compared with $25.9 million at the end of fiscal 1999. Net working capital decreased to $121.6 million at the end of fiscal 2000 from $140.9 million at the end of the prior year. These decreases were primarily attributable to the acquisitions completed during late 1999.

Net accounts receivable were $83.3 million at the end of fiscal 2000 compared with $69.6 million at the end of the prior year. Sales increased $15.1 million when compared with the prior year fourth quarter, resulting in a significant increase in net accounts receivable. Accounts payable were $25.0 million at the end of fiscal 2000 compared with $16.9 million at the end of the prior year. The increase was primarily due to the timing of payments in Automation. Net accounts receivable and accounts payable were also higher due to the inclusion of A.I.D. for the current year. Federal and foreign income taxes payable were $5.5 million at the end of fiscal 2000 compared with $6.3 million at the end of fiscal 1999.

Net property, plant and equipment was $87.4 million at the end of fiscal 2000 compared with $89.3 million at the end of the prior year. Goodwill increased to $138.0 million at the end of fiscal 2000 compared with $105.4 million at the end of the prior year, due to acquisitions completed during the year.

Capital expenditures for fiscal 2000 were $15.5 million (excluding acquisitions) and included machinery and equipment and enhancements to information technology systems. Capital expenditures are anticipated to approximate $21.0 million for fiscal 2001. We will continue to support expansion through investments in infrastructure including machinery, equipment, buildings and information systems.

Total debt decreased $12.0 million from the prior year to $117.4 million at the end of fiscal 2000, principally due to a reduction in outstanding short-term credit facilities and repayment of debt. Total debt outstanding at the end of fiscal 2000 consisted of $100.0 million under our 1999 Senior Notes, $11.4 million under our 8.75% Senior Notes, and $6.0 million under various foreign currency debt agreements, including capital lease obligations. The 8.75% Senior Notes have a scheduled annual payment of $5.7 million, which will continue until maturity on July 30, 2002. The 1999 Senior Notes have maturities ranging from 5 to 10 years and interest rates from 6.00% to 6.77%. Management believes cash on hand, funds generated from operations and other available debt facilities are sufficient to fund operating cash requirements and capital expenditures through fiscal 2001.

SEASONALITY

The timing of our revenues is impacted by the purchasing patterns of our customers and as a result we do not generate revenues evenly throughout the year. Moreover, our first fiscal quarter, November through January, includes significant holiday and vacation periods in both Europe and North America. This leads to decreased order and shipment activity, consequently first quarter results are typically weaker than other quarters and not necessarily indicative of our performance in subsequent quarters.

22

MARKET RISK EXPOSURE

We have financial instruments that are subject to interest rate risk, principally debt obligations issued at a fixed rate. To the extent that sales are transacted in a foreign currency, we are also subject to foreign currency fluctuation risk. Furthermore, we have assets denominated in foreign currencies that are not offset by liabilities in such foreign currencies. Historically, we have not experienced material gains or losses due to interest rate or foreign exchange fluctuations. We own a significant operation in France. During the year, the foreign exchange rate for this country decreased significantly relative to the US dollar, which resulted in an increase in accumulated other comprehensive loss, as a result of the foreign currency translation adjustment.

RECENT ACCOUNTING PRONOUNCEMENTS

In June 1998, the Financial Accounting Standards Board, FASB, issued Statement of Financial Accounting Standards, FAS, No. 133, "Accounting for Derivative Instruments and Hedging Activities." FAS No. 133 establishes standards for derivative instruments and requires an entity to recognize all derivatives as either assets or liabilities and measure those instruments at fair value. In June 1999, the FASB issued FAS No. 137 which deferred the effective date of FAS No. 133. This standard will be effective for us beginning in fiscal 2001. We utilize foreign currency forward contracts primarily to reduce our exposure to fluctuations between the US dollar and the French Franc. At the end of fiscal 2000, we held foreign currency contracts totaling a notional amount of $8.5 million. If FAS No 133 was in effect at the end of fiscal 2000, this would have resulted in a gain of approximately $600,000. We anticipate that future similar foreign currency transactions will qualify for hedge accounting treatment under FAS No. 133.

In December 1999, the Securities and Exchange Commission issued Staff Accounting Bulletin No. 101, SAB No. 101, "Revenue Recognition in Financial Statements." In SAB No. 101, the Commission's staff expressed its views regarding the appropriate recognition of revenue with regard to a variety of circumstances. We will be required to adopt SAB No. 101 for the fourth quarter of fiscal 2001. We are currently evaluating SAB No. 101, however, we believe it will not have a material impact on our consolidated financial statements.

In March 2000, the FASB issued Interpretation No. 44, "Accounting for Certain Transactions Involving Stock Compensation," an interpretation of Accounting Principles Board Opinion 25, "Stock Issued to Employees." We adopted the Interpretation effective July 1, 2000, and it did not have a material impact on the consolidated financial statements.

23

OVERVIEW

Esterline is a specialized manufacturing company principally serving aerospace and defense customers and electronic equipment manufacturers. We design, manufacture and market highly engineered products and systems for applications within the industries we serve. Our strategic growth plan revolves around the development of three key technologies—sensors and controls, illuminated displays and specialized high-performance materials.

As part of our long-term strategic direction, we strive to anticipate the global needs of our customers and to respond with comprehensive solutions worldwide. This effort has resulted in establishing strategic realignments of operations providing the capability to offer a more extensive product line to each customer through a single contact.

We view and operate our business in three different segments: Aerospace, Advanced Materials and Automation. We primarily serve aerospace and defense customers with manufactured products such as high-end components for avionics, propulsion and guidance systems, and high-performance elastomers and other complex materials in the Aerospace and Advanced Materials segments. The Automation segment serves electronic equipment customers with PCB drilling equipment and heavy equipment manufacturing customers with automated machine tools for cutting and punching plate metal.

Sales by segment for the 1998, 1999 and 2000 fiscal years were as follows:

| |

1998 |

|

1999 |

|

2000 |

|

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Sales |

% |

Sales |

% |

Sales |

% |

|||||||||||

| |

(dollars in thousands) |

||||||||||||||||

| Aerospace | $ | 171,028 | 38 | % | $ | 183,783 | 40 | % | $ | 236,269 | 48 | % | |||||

| Advanced Materials | 91,498 | 20 | 127,920 | 28 | 129,386 | 26 | |||||||||||

| Automation | 191,376 | 42 | 149,266 | 32 | 125,311 | 26 | |||||||||||

| Total | $ | 453,902 | 100 | % | $ | 460,969 | 100 | % | $ | 490,966 | 100 | % | |||||

MARKET OVERVIEW

- Aerospace and Defense. The ongoing wave of consolidations in the aerospace and defense industry is significantly reshaping the face of the industry. Suppliers in both the commercial aerospace and defense industries are in the midst of a consolidation process that is expected to continue for several more years. Component suppliers are focusing on becoming suppliers of systems and subsystems in an attempt to provide higher value-added solutions. Consolidation pressure is also coming from industry OEMs as they strive to reduce cycle times, decrease inventories and reduce costs by, among other things, reducing the total number of suppliers with whom they do business. For example, Boeing has publicly stated that one of its long-term goals is to bring down the number of suppliers it uses from approximately 29,000 to approximately 18,000. Successful suppliers will be required to offer a broader range of value-added products and services and to deliver them more cost efficiently. Due to the thousands of suppliers with only a small number of customers, continued industry-wide consolidation is likely.

Suppliers to the commercial aerospace industry serve a large and growing market. In the long term, the demand for aircraft is driven by economic growth supporting the demand for air travel and the need to replace aircraft that are removed from service due to age or other concerns. Boeing's publicly released Current Market Outlook 2000 currently estimates that the market for aircraft is

24

approximately $1.5 trillion over 20 years and that the number of aircraft in service is expected to more than double to 31,755 aircraft by 2019. Over this period, Boeing estimates that over 23,100 new aircraft will enter service in order to accommodate this demand. Additionally, orders, deliveries and manufactures' backlogs of regional jets currently stand at record levels.

The near term outlook for the commercial aerospace industry is also positive, driven by the significant increase in orders at Boeing during 2000, and continued growth at Airbus. Recent activity has been supported by increased orders from Asia, several years of stronger airline operating profits and the retirement of older aircraft. Replacements are being driven by regulations that required noisier aircraft to be replaced or modified by 2000 in the United States and that will require replacement by 2002 in Europe. Pending noise regulations could cause another wave of aircraft replacements. Higher fuel prices also provide incentives to replace older aircraft with newer, more fuel efficient aircraft.

The outlook for defense spending is positive, driven in large measure by the availability of funds due to the projected surplus and broad political support. Key trends include a continued focus on upgrades and modifications of existing weapons systems and the increased use of electronics and technology generally.

25

The DoD fiscal 2001 budget of approximately $291 billion includes over $60 billion for procurement and over $37 billion for research and development. Both these procurement and research and development spending categories represent the principal source of funds for most defense contractors. The DoD fiscal 2001 budget amount continues the increases that began in 1996.

- Automation. Automation equipment suppliers are subject to many global, macroeconomic trends which drive capital spending in the manufacturing industry. In the electronic equipment market, PCBs are used widely in applications ranging from consumer products to high-end commercial electronic equipment. This industry segment is characterized by high growth, rapid technological change and short product life cycles. In the heavy equipment market, spending on construction and agricultural equipment has been hurt by bumper crops, low exports and a weakening in the housing construction arena. Overall, Automation will continue to follow the global, cyclical trends of the end markets it serves.

OUR BUSINESS SEGMENTS

- Aerospace. Principal operations for our Aerospace business segment are conducted through Auxitrol which specializes in the development and manufacture of sensors and controls, and Korry which specializes in cockpit components.

- Sensors and controls

We have important market positions in both the United States and Europe in the manufacture of high-precision temperature and pressure sensing devices, hydraulic controls, micro-motors and motion control sensors used primarily in aerospace applications. In addition, we are the sole source supplier of exhaust gas temperature probes for use on all versions of the GE/Snecma CFM 56 jet engines (over 10,000 of which are currently in use on all new generation Boeing 737 aircraft and most Airbus models). The principal customers for our sensors and controls are jet

26

engine manufacturers, airframe manufacturers, shipbuilders, petroleum companies and electric utilities. Customers for our products include Aerospatiale, Airbus, Aircraft Braking Systems, British Ministry of Defence, General Electric, Honeywell, Parker Hannifin and Snecma.

- Cockpit components

We are a market leader in the development, marketing and manufacturing of sophisticated high reliability components and subsystems. These products include illuminated push button switches, indicators, panels and keyboards that are used in a broad variety of control and display applications. They have been integrated into many existing aircraft designs, including every Boeing commercial aircraft currently in production. This large installed base provides us with a significant spare parts and retrofit business. In addition, we manufacture control sticks, grips and wheels, as well as specialized switching systems. In this area, we primarily serve commercial and military aviation, and airborne and ground-based military equipment manufacturing markets.