|

|

|

|

|

Previous: ENERGY CONVERSION DEVICES INC, DEF 14A, EX-20, 2001-01-19 |

Next: ESTERLINE TECHNOLOGIES CORP, 10-K, 2001-01-19 |

SCHEDULE 14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant /x/ | ||

| Filed by a Party other than the Registrant / / | ||

Check the appropriate box: |

||

| / / | Preliminary Proxy Statement | |

| / / | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| /x/ | Definitive Proxy Statement | |

| / / | Definitive Additional Materials | |

| / / | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12 |

|

ESTERLINE TECHNOLOGIES CORPORATION |

||||

(Name of Registrant as Specified In Its Charter) |

||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| /x/ | No fee required | |||

| / / | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

| / / | Fee paid previously with preliminary materials. | |||

| / / | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

NOTICE OF ANNUAL MEETING AND PROXY STATEMENT

ESTERLINE TECHNOLOGIES CORPORATION

10800 NE 8th Street

Bellevue, Washington 98004

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held March 07, 2001

To the Shareholders of Esterline Technologies Corporation:

NOTICE IS HEREBY GIVEN that the 2001 annual meeting of shareholders for ESTERLINE TECHNOLOGIES CORPORATION, a Delaware corporation (the "Company"), will be held on Wednesday, March 7, 2001 at 10:00 a.m., at the Hyatt Regency Hotel, 900 Bellevue Way NE, Bellevue, Washington, for the following purposes:

The Board of Directors has fixed the close of business on January 2, 2001 as the record date for determination of shareholders entitled to notice of and to vote at the meeting or any adjournment or postponement thereof.

The Company's Annual Report for fiscal year 2000 is enclosed for your convenience.

| By order of the Board of Directors | |

|

|

| ROBERT D. GEORGE Vice President, Chief Financial Officer, Secretary and Treasurer |

|

January 19, 2001 |

Your vote is important. Please sign and date the enclosed proxy card and return it promptly in the enclosed envelope to ensure that your shares will be represented at the annual meeting. Holders of a majority of the outstanding shares must be present either in person or by proxy for the meeting to be held. If you attend the meeting and vote your shares personally, any previous proxies will be revoked.

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

To Be Held March 7, 2001

This proxy statement, which is first being mailed to shareholders on or about January 19, 2001, has been prepared in connection with the solicitation by the Board of Directors of Esterline Technologies Corporation (the "Company") of proxies in the accompanying form to be voted at the 2001 annual meeting of shareholders of the Company to be held on Wednesday, March 7, 2001 at 10:00 a.m., at the Hyatt Regency Hotel, 900 Bellevue Way NE, Bellevue, Washington, and at any adjournment or postponement thereof. The Company's principal executive office is at 10800 NE 8th Street, Bellevue, Washington 98004.

The cost of this solicitation will be borne by the Company. In addition to solicitation by mail, officers and employees of the Company may, without additional compensation, solicit the return of proxies by telephone, telegram, messenger, facsimile transmission or personal interview. Arrangements may also be made with brokerage houses and other custodians, nominees and fiduciaries to send proxies and proxy material to their principals, and the Company may reimburse such persons for their expenses in so doing. Furthermore, the Company has retained MacKenzie Partners, Inc. to provide proxy solicitation services for a fee of $5,000 plus reimbursement of its out-of-pocket expenses.

Any proxy given pursuant to the solicitation may be revoked at any time prior to being voted. A proxy may be revoked by the record holder or other person entitled to vote (a) by attending the meeting in person and voting the shares, (b) by executing another proxy dated as of a later date or (c) by notifying the Secretary of the Company in writing, at the Company's address set forth on the notice of the meeting, provided that such notice is received by the Secretary prior to the meeting date. All shares represented by valid proxies will be voted at the meeting. Proxies will be voted in accordance with the specification made therein or, in the absence of specification, in accordance with the provisions of the proxy.

The Board of Directors has fixed the close of business on January 2, 2001, as the record date for determination of holders of common stock of the Company (the "Common Stock") entitled to notice of and to vote at the annual meeting. At the close of business on the record date there were outstanding and entitled to vote 17,427,301 shares of Common Stock, which are entitled to one vote per share on all matters which properly come before the annual meeting. A plurality of the shares of Common Stock present in person or represented by proxy at the meeting is required for the election of directors. Shareholders are not entitled to cumulate votes in electing directors. An affirmative vote of a majority of the shares of Common Stock present in person or represented by proxy and entitled to vote at the meeting is required for approval of the amendment(s) to the Company's 1997 Stock Option Plan. The presence in person or by proxy of the holders of record of a majority of the outstanding shares of Common Stock entitled to vote is required to constitute a quorum for the transaction of business at the meeting. The Common Stock is listed for trading on the New York Stock Exchange.

Votes cast by proxy or in person at the annual meeting will be tabulated by the inspectors of election appointed for the annual meeting. The inspectors of election will determine whether or not a quorum is present at the annual meeting. The inspectors of election will treat abstentions as shares of Common Stock that are present and entitled to vote for purposes of determining the presence of a quorum. Under certain circumstances, a broker or other nominee may have discretionary authority to vote certain shares of Common Stock if instructions have not been received from the beneficial owner or other person entitled to vote. If a broker or other nominee indicates on the proxy that it does not have instructions or discretionary authority to vote certain shares of Common Stock on a particular matter, those shares will not be considered as present for purposes of determining whether a quorum is present or whether a matter has been approved.

1

Two directors are to be elected at the 2001 annual meeting of shareholders to serve three-year terms expiring at the 2004 annual meeting or until their successors are elected and qualified. In addition, one of the directors is to be reclassified from the class of directors whose term expires in 2002 to the class of directors whose term expires in 2004. The Board of Directors recommends a vote FOR the director nominees named below.

Directors of the Company are elected for three-year terms that are staggered such that one-third of the directors are elected each year. The current directors whose terms expire at the 2001 annual meeting are Richard R. Albrecht, John F. Clearman, and Paul G. Schloemer. Mr. Schloemer advised the board that he will retire as a director immediately after the conclusion of the 2001 annual meeting of shareholders and will not stand for re-election.

In connection with Mr. Schloemer's retirement, by resolution of the Board of Directors effective as of his retirement, the authorized number of board members will be reduced to nine. The Company's Amended and Restated Certificate of Incorporation, as amended (the "Certificate of Incorporation"), requires that a reduction in the authorized number of board members be allocated among the classes so as to make them as equal as possible. To comply with the Certificate of Incorporation, the Board of Directors has approved a reclassification of Mr. Jerry D. Leitman from the class of directors whose term expires in 2002 to the class of directors whose term expires at the 2001 annual meeting. If elected, Mr. Leitman will no longer be a member of the class of directors whose term expires in 2002, and his term will expire at the 2004 annual meeting. If re-elected, Messrs. Albrecht and Clearman will serve for a three-year term which expires at the 2004 annual meeting. As a result of the reclassification, and upon the election of Messrs. Albrecht, Clearman and Leitman, each of the classes of the board of directors will contain three members.

Information as to each nominee and each director whose term will continue after the 2001 annual meeting is provided below. In the election of directors, any action other than a vote FOR the nominee will have the practical effect of voting against the nominee. Unless otherwise instructed, it is the intention of the persons named in the accompanying proxy to vote shares represented by properly executed proxies FOR the election of the nominees named below. The Board of Directors knows of no reason why any of the nominees will be unable or unwilling to serve. If any nominee becomes unavailable to serve, the Board of Directors intends for the persons named as proxies to vote for the election of such other persons, if any, as the Board of Directors may recommend.

Nominees:

Richard R. Albrecht

Executive Vice President (Retired), Commercial Airplane Group, The Boeing Company. Age 68.

Prior to August 1997, Mr. Albrecht was Executive Vice President of the Commercial Airplane Group for The Boeing Company (an aerospace company), having held such position from 1984 to

1997. He has been a director of the Company since 1997.

John F. Clearman

Chief Financial Officer, Milliman & Robertson. Age 63.

Mr. Clearman has been the Chief Financial Officer of Milliman & Robertson (an actuarial consulting firm) since October 1998. He is the former President and Chief Executive Officer

of NC Machinery Co., having held such positions from 1986 through 1994. He is also a director for several other companies including Oberto Sausage Inc., Washington Federal Savings, Inc.,

Barclay Dean Interiors, GT Development, Lang Manufacturing and Pinnacle Publishing. He has been a director of the Company since 1989.

Jerry D. Leitman

President and Chief Executive Officer of FuelCell Energy, Inc. Age 58.

Mr. Leitman has served as President and Chief Executive Officer of FuelCell Energy, Inc. (a fuel cell company) since August 1997. Previously, he was President of

Jaydell, Inc. from January 1995 through August 1997, and President of ABB Air Pollution Control from October 1992 through December 1994. He is also Chairman of

Evercel, Inc. He has been a director of the Company since 1998.

2

Continuing Directors:

Ross J. Centanni

Chairman, President and Chief Executive Officer, Gardner Denver, Inc. Age 55.

Mr. Centanni is the Chairman, President and Chief Executive Officer of Gardner Denver, Inc. (a manufacturer of industrial compressors and blowers). He was elected Chairman in

November 1998 and has served as President and Chief Executive Officer since November 1993. He is also a director of Denman Services, Inc., Petroleum Equipment Suppliers

Association and Quincy University. He has been a director of the Company since 1999 and his term expires in 2003.

Robert S. Cline

Chairman and Chief Executive Officer, Airborne Freight Corporation. Age 63.

Mr. Cline is the Chairman and Chief Executive Officer of Airborne Freight Corporation (an air express company), having held such positions since 1984. He is also a director of Safeco

Corporation. He has been a director of the Company since 1999 and his term expires in 2003.

Robert W. Cremin

Chairman, President and Chief Executive Officer, Esterline Technologies. Age 60.

Mr. Cremin became Chairman as of January 19, 2001. He continues to serve as Chief Executive Officer and President, having held those positions since January 1999 and

September 1997, respectively. From January 1991 to September 1997, he served in various executive positions including Chief Operating Officer, Executive Vice President, Senior

Vice President and Group Executive. He is also the Chairman of the President's Council of Manufacturers Alliance/MAPI. He has been a director of the Company since 1998 and his term expires in 2002.

E. John Finn

Chairman (Retired), Dorr-Oliver Incorporated. Age 69.

Mr. Finn is the retired Chairman and Partner of Dorr-Oliver Incorporated (a process engineering and equipment company), having held such positions from 1988 to 1995. He is also a

director of Advanced Refractory Technologies, Inc., Pro Air, Inc. and Stantec, Inc. He has been a director of the Company since 1989 and his term expires in 2002.

Robert F. Goldhammer

Chairman, ImClone Systems, Incorporated. Age 69.

Mr. Goldhammer has been the Chairman of ImClone Systems, Incorporated (a biotechnology company) since 1984. Previously, he was a Partner and Vice Chairman of the Executive Committee of Kidder,

Peabody & Co. Incorporated. He is also President and a Partner at Concord International Investments Group L.L.P. He has been a director of the Company since 1974 and his term expires in 2002.

Wendell P. Hurlbut

Chairman (Retired), Esterline Technologies. Age 69.

Mr. Hurlbut served as Chairman of the Company from January 1993 through January 2001. Previously, he served as Chief Executive Officer of the Company from September 1997

through January 1999 and President and Chief Executive Officer from January 1993 through September 1997. Mr. Hurlbut is a retired member of the Board of Directors of the

National Association of Manufacturers. He has been a director of the Company since 1989 and his term expires in 2003.

3

OTHER INFORMATION AS TO DIRECTORS

Director Compensation

The Company pays, in cash, non-employee directors an annual retainer fee of $20,000 for services on the Board and all committees thereof, a fee of $1,000 for each special meeting attended and a fee of $200 for each telephonic meeting in which they participate (and reimburses such directors for out-of-pocket expenses incurred therewith). The Company also pays non-employee committee chairmen an annual fee of $5,000. Pursuant to an agreement between the Company and Mr. Hurlbut effective January 19, 1999, Mr. Hurlbut served as Chairman of the Board for the two-year period following his retirement. On January 19, 2001, Mr. Cremin commenced service as Chairman of the Board, and Mr. Hurlbut will continue serving as a director. While Mr. Hurlbut continues service as a director, his compensation will be consistent with all other non-employee directors.

In addition, the Company pays non-employee directors additional compensation in the form of an annual issuance to each director of $10,000 worth of fully-paid Common Stock and reimburses each such director in cash for the payment of income taxes ($6,556.29 at current Federal income tax rates) on this stock. Employees of the Company serving on the Board and committees thereof receive no additional compensation for such service. There were five meetings of the Board of Directors during fiscal 2000.

Board Committees

The Audit Committee, currently consisting of Messrs. Clearman (Chairman), Albrecht, Centanni, Cline, and Schloemer, recommends to the Board the independent auditors to be selected to audit the Company's annual financial statements and reviews the fees charged for audits and for any non-audit assignments. This Committee also reviews: (1) the scope and results of the annual audit by the independent auditors, any recommendations of the independent auditors resulting therefrom and management's response thereto, (2) the independence of the outside auditors, (3) the accounting principles being applied by the Company in financial reporting, (4) the activities of the Company's internal auditors and the adequacy of internal accounting controls, (5) the Company's environmental compliance practices, pending litigation, taxation matters, risk management programs and other management systems, and (6) such other related matters as it deems appropriate. The Audit Committee met seven times during 2000.

The Compensation & Stock Option Committee, currently consisting of Messrs. Goldhammer (Chairman), Finn and Leitman, recommends the form and level of compensation for officers of the Company. The Compensation & Stock Option Committee has also been appointed by the Board of Directors to administer the Company's stock option plans and incentive compensation plans. The Compensation & Stock Option Committee met four times during 2000.

The Executive Committee, currently consisting of Messrs. Hurlbut (Chairman), Albrecht, Cremin, Finn and Goldhammer, reviews situations that might, at some future time, become items for consideration of the entire Board of Directors and acts on behalf of the entire Board of Directors between its meetings. The Executive Committee met once during 2000.

The Nominating Committee, currently consisting of Messrs. Finn (Chairman), Cline, Cremin, and Schloemer, recommends individuals to be presented to the shareholders of the Company for election or re-election to the Board of Directors. Written proposals from shareholders for nominees for directors to be elected at the 2001 annual meeting, which were submitted to the Secretary of the Company by September 21, 2000, and which contained sufficient background information concerning the nominee to enable a proper judgment to be made as to his or her qualifications, were considered by the Nominating Committee. The Nominating Committee met once during 2000.

During fiscal 2000, each director attended at least 78% of the total number of meetings of the Board of Directors and Board committees of which he was a member.

4

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding beneficial ownership of shares of Common Stock as of January 2, 2001 by (i) each person or entity who is known by the Company to beneficially own more than 5% of the Common Stock, (ii) each of the Company's directors, (iii) each of the Company's named executive officers and (iv) all directors and executive officers of the Company as a group.

| Name and Address of Beneficial Owner (1) |

Amount and Nature of Beneficial Ownership (2) |

Percent of Class |

|||

|---|---|---|---|---|---|

| Alliance Capital Management L.P. 1345 Avenue of the Americas, New York, NY 10105 |

1,334,837 | (3) | 7.7 | % | |

| J. L. Kaplan Associates, LLC 222 Berkeley Street, Suite 2010, Boston, MA 02116 |

1,296,630 | (4) | 7.4 | % | |

| Dimensional Fund Advisors Inc. 1299 Ocean Avenue, 11th Floor, Santa Monica, CA 90401 |

1,162,600 | (5) | 6.7 | % | |

| Robert W. Cremin | 278,431 | (6) | 1.6 | % | |

| Larry A. Kring | 269,775 | (6) | 1.5 | % | |

| Stephen R. Larson | 155,500 | (6) | * | ||

| Wendell P. Hurlbut | 129,625 | (6) | * | ||

| James J. Cich, Jr. | 105,950 | (6) | * | ||

| E. John Finn | 38,880 | * | |||

| Robert D. George | 38,250 | (6) | * | ||

| Robert F. Goldhammer | 29,380 | * | |||

| John F. Clearman | 12,880 | * | |||

| Paul G. Schloemer | 4,880 | (7) | * | ||

| Richard R. Albrecht | 3,370 | * | |||

| Robert S. Cline | 2,838 | * | |||

| Jerry D. Leitman | 1,136 | * | |||

| Ross J. Centanni | 838 | * | |||

| Directors, nominees and executive officers as a group (15 persons) | 1,134,133 | (6)(7) | 6.2 | % |

5

The following table summarizes compensation paid or accrued during fiscal years 2000, 1999, and 1998 for services in all capacities to the Company by the persons who, at October 27, 2000, were the Chief Executive Officer and the four other most highly compensated executive officers of the Company (collectively, the "Named Executive Officers"):

Summary Compensation Table

| |

|

|

|

Long-Term Compensation |

|

|||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

Annual Compensation |

Awards |

|

|

|||||||

| |

|

Payouts |

|

|||||||||

| |

|

Securities Underlying Options (#) |

|

|||||||||

| Name and Principal Position |

Year |

Salary ($) |

Bonus ($) |

LTIP Payouts ($) |

All Other Compensation ($) (1) |

|||||||

| Robert W. Cremin (2) Chairman, President and Chief Executive Officer |

2000 1999 1998 |

409,167 373,333 340,000 |

329,327 187,758 225,709 |

35,000 50,000 20,000 |

319,825 220,275 300,000 |

2,550 2,400 2,400 |

||||||

James J. Cich, Jr. (3) Group Vice President |

2000 1999 1998 |

221,667 200,000 184,375 |

119,034 56,311 68,799 |

15,000 10,000 20,000 |

104,670 72,090 90,000 |

2,550 2,400 2,400 |

||||||

Robert D. George (4) Vice President, Chief Financial Officer, Secretary and Treasurer |

2000 1999 1998 |

222,500 180,833 152,500 |

126,970 51,881 46,772 |

40,000 35,000 8,000 |

104,670 40,050 60,000 |

2,550 2,400 2,400 |

||||||

Larry A. Kring Group Vice President |

2000 1999 1998 |

297,500 282,500 267,500 |

158,712 93,879 130,356 |

22,500 15,000 15,000 |

104,670 72,090 135,000 |

2,550 2,400 2,400 |

||||||

Stephen R. Larson (5) Vice President, Strategy & Technology |

2000 1999 1998 |

255,833 248,333 238,667 |

135,963 82,350 115,872 |

15,000 10,000 13,000 |

104,670 72,090 135,000 |

2,550 2,400 2,400 |

||||||

6

Options Granted in the Fiscal Year Ended October 27, 2000

| |

Individual Grants |

|

|

|

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

% of Total Options Granted to Employees in Fiscal Year |

|

|

Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term (2) |

|||||||||

| |

Number of Securities Underlying Options Granted (#) (1) |

|

|

|||||||||||

| |

Exercise Price ($/Share) |

|

||||||||||||

| Name |

Expiration Date |

0% ($) |

5% ($) |

10% ($) |

||||||||||

| Robert W. Cremin | 35,000 | 11 | % | 11.375 | December 2009 | 0 | 250,379 | 634,509 | ||||||

| James J. Cich, Jr. | 15,000 | 5 | % | 11.375 | December 2009 | 0 | 107,305 | 271,932 | ||||||

| Robert D. George | 15,000 25,000 |

(3) |

5 8 |

% % |

11.375 14.750 |

December 2009 June 2010 |

0 0 |

107,305 231,905 |

271,932 587,693 |

|||||

| Larry A. Kring | 22,500 | 7 | % | 11.375 | December 2009 | 0 | 160,958 | 407,898 | ||||||

| Stephen R. Larson | 15,000 | 5 | % | 11.375 | December 2009 | 0 | 107,305 | 271,932 | ||||||

7

Aggregated Option Exercises in the Fiscal Year Ended October 27, 2000,

and Fiscal Year End Option Values

| |

|

|

Number of Securities Underlying Unexercised Options at Fiscal Year End (#) (3) |

|

|

|||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

|

Value of Unexercised, In-the-Money Options at Fiscal Year End ($) (4) |

|||||||||

| |

Shares Acquired on Exercise (#) (1) |

|

||||||||||

| |

Value Realized ($) (2) |

|||||||||||

| Name |

Exercisable |

Unexercisable |

Exercisable |

Unexercisable |

||||||||

| Robert W. Cremin | — | — | 240,000 | 95,000 | 2,537,766 | 541,234 | ||||||

| James J. Cich, Jr. | — | — | 50,000 | 45,000 | 340,313 | 295,625 | ||||||

| Robert D. George | — | — | 27,750 | 75,250 | 124,750 | 517,875 | ||||||

| Larry A. Kring | — | — | 231,250 | 46,250 | 3,653,906 | 322,813 | ||||||

| Stephen R. Larson | 30,000 | 277,500 | 139,000 | 34,000 | 1,964,906 | 235,219 | ||||||

Long-Term Incentive Plans—Awards in the Fiscal Year Ended October 27, 2000

| |

|

Performance or Other Period Until Maturation or Payout |

Estimated Future Annual Payouts under Non-Stock Price-Based Plans($) (1) |

|||||

|---|---|---|---|---|---|---|---|---|

| |

Number of Shares, Units or Other Rights |

|||||||

| Name |

Target |

Maximum |

||||||

| Robert W. Cremin | — | 2000-2002 | 275,000 | 412,500 | ||||

| James J. Cich, Jr. | — | 2000-2002 | 90,000 | 135,000 | ||||

| Robert D. George | — | 2000-2002 | 90,000 | 135,000 | ||||

| Larry A. Kring | — | 2000-2002 | 90,000 | 135,000 | ||||

| Stephen R. Larson | — | 2000-2002 | 90,000 | 135,000 | ||||

8

Retirement Benefits

The Named Executive Officers are covered by a tax-qualified defined benefit retirement plan (which covers substantially all U.S. employees of the Company) and a Supplemental Executive Retirement Plan ("SERP") which requires an employee contribution of 1% of annual compensation. Under the plans, benefits accrue until retirement, subject to a 30-year maximum, with normal retirement at age 65. Under the tax-qualified defined benefit retirement plan, retirees are entitled to receive an annuity computed under a five-year average compensation formula, which includes salary, amounts earned under annual and long-term incentive compensation plans and amounts realized upon exercise of stock options, less expected Social Security benefits. The SERP provides benefits in excess of statutory limits and entitles retirees to receive an annuity computed under a restricted version of the five-year average compensation formula, which excludes amounts earned under the long-term incentive compensation plan and amounts realized upon exercise of stock options. The SERP also provides that Mr. Cremin receive retirement plan service maximums at age 65. The retirees may select either a life annuity or one of several alternative forms of payment with an equivalent actuarial value.

The approximate annual annuity payable upon retirement to the Named Executive Officers is shown in the following table. The amounts shown are for retirement at age 65. Benefits are integrated with Social Security based on the career average Social Security wage base in effect in 2000. To the extent the Social Security wage base is increased after 2000, the benefits payable under the retirement plan would be lower than the amounts shown.

Pension Plan Table

| |

Years of Credited Service at Retirement |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Average Compensation |

10 |

15 |

20 |

25 |

30 |

||||||||||

| $ 100,000 | $ | 13,200 | $ | 19,900 | $ | 26,500 | $ | 33,100 | $ | 39,700 | |||||

| 250,000 | 37,200 | 55,900 | 74,500 | 93,100 | 111,700 | ||||||||||

| 400,000 | 61,200 | 91,800 | 122,500 | 153,100 | 183,700 | ||||||||||

| 550,000 | 85,200 | 127,900 | 170,500 | 213,100 | 255,700 | ||||||||||

| 700,000 | 109,200 | 163,900 | 218,500 | 273,100 | 327,700 | ||||||||||

| 850,000 | 133,200 | 199,900 | 266,500 | 333,100 | 399,700 | ||||||||||

| 1,000,000 | 157,200 | 235,900 | 314,500 | 393,100 | 471,700 | ||||||||||

| 1,150,000 | 181,200 | 271,900 | 362,500 | 453,100 | 543,700 | ||||||||||

The Named Executive Officers currently have the following completed years of credited service for purposes of the defined benefit retirement plan: Mr. Cremin, 23; Mr. Cich, 3; Mr. George, 3; Mr. Kring, 7; and Mr. Larson, 21.

Termination Agreements

The Company has entered into termination protection agreements with the Named Executive Officers which are designed to induce them to remain in the employ of the Company or any successor company in the event of certain changes in ownership or control by assuring compensation benefits if an officer is terminated "Without Cause" or resigns for "Good Reason," as defined in the agreements. In the event of such termination within two years after a change in ownership or control, the agreements provide for lump sum payments equal to three times the average compensation received during the prior two years, payment of certain legal fees and expenses associated with the termination and insurance benefits for the remainder of the initial two-year period, or until other full-time employment is accepted.

9

The Audit Committee of the Company's Board of Directors consists entirely of non-employee directors who are independent, as that term is defined in Sections 303.01(B)(2)(a) and (3) of the New York Stock Exchange Listing Standards. The Audit Committee adopted a written charter during fiscal 2000, a copy of which is attached to this proxy statement as Annex A.

Management has the primary responsibility for the financial statements and the reporting process, including the systems of internal controls. The Audit Committee is responsible for overseeing the Company's financial reporting processes—on behalf of the Board of Directors. In fulfilling its oversight responsibilities, the Audit Committee reviewed with management the audited financial statements relating to the fiscal year ended October 27, 2000 and discussed with management the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the financial statements.

The Audit Committee discussed with the independent auditors, who are responsible for expressing an opinion on the conformity of those audited financial statements with generally accepted accounting principles, their judgments as to the quality, not just the acceptability, of the Company's accounting principles and such other matters relating to the audit required to be discussed by Statements of Auditing Standards 61. In addition, the Audit Committee has discussed with the independent auditors the auditors' independence from management and the Company and received the written disclosures from the independent auditors required by the Independence Standards Board Standard No. 1.

The Audit Committee discussed with the Company's internal and independent auditors the overall scope and plans for their respective audits. The Audit Committee met with the internal and independent auditors, with and without management present, to discuss the results of their examinations, their evaluations of the Company's internal controls, and the overall quality of the Company's financial reporting.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors (and the Board has approved) that the audited financial statements be included in the Annual Report on Form 10-K for the year ended October 27, 2000 for filing with the Securities and Exchange Commission. The Audit Committee and the Board have also recommended the selection of the Company's independent auditors.

Respectfully Submitted,

JOHN

F. CLEARMAN, CHAIRMAN

RICHARD R. ALBRECHT

ROSS J. CENTANNI

ROBERT S. CLINE

PAUL G. SCHLOEMER

10

COMPENSATION & STOCK OPTION COMMITTEE REPORT

Executive Compensation Principles

The Compensation & Stock Option Committee (the "Committee") is responsible for administering the compensation program for the executive officers of the Company. The Committee is composed exclusively of non-employee directors who are not eligible to participate in any of the Company's executive compensation programs.

The Company's executive compensation practices are based on principles designed to align executive compensation with Company objectives, business strategy, management initiatives and financial performance. In applying these principles the Committee has established a program to:

Executive Compensation Program

Each executive's total compensation consists of both cash and equity-based compensation. The cash portion consists of salary, an annual incentive plan and a long-term incentive plan. The equity portion consists of awards under the Company's stock option plans.

Salary:

The Committee determines the initial salary for key executive officers based upon surveys of salaries for positions of comparable responsibility, taking into account competitive norms and the experience of the person being considered. Subsequent salary changes are based upon individual performance or changes in responsibilities.

Annual Incentive Plan:

Award amounts payable under the annual incentive plan are initially computed at the beginning of the fiscal year based on the achievement of certain performance measurement goals and a "target" amount (stated as a percentage of the executive's base salary). The award amount can range from 0% to 150% of each executive's "target" award amount.

After award amounts are computed, the Committee may, at its discretion, adjust the actual amount paid to each executive upward or downward by as much as 25% of the greater of the executive's computed award and the executive's target award amount. The ability of the Committee to make subjective adjustments to award amounts reflects the Committee's desire that the performance of the Company measured against the goals established at the beginning of the year reflect as fully as possible the achievements of management. No award may exceed 112.5% of the executive's base salary.

For 2000, the Committee selected earnings per share as the sole performance goal. Award amounts computed under the plan formula ranged from 40% to 79% of base salary. No adjustments under the discretionary formula were made.

11

Long-Term Incentive Plan:

The long-term incentive compensation plan covers the three fiscal year period ending in October 2002 and is based on three groups of objectives: Group I establishes target earnings per share growth and target return on shareholders equity; Group II establishes strategic operating performance objectives for the Committee to monitor which may be altered from time to time by the Committee; and Group III establishes relative earnings per share and return on equity performance measurements compared to a peer group of companies and industries. Each of the three groups of objectives is weighted equally and the plan provides for annual updating of objectives when the Committee deems appropriate.

The plan contemplates partial payouts after the close of each fiscal year based on Committee evaluation of performance and based upon certain dollar targets established for each participant at the beginning of each fiscal year. These partial payouts are limited to 150% of base salary for each year an executive receives payments under the plan. For fiscal 2000, no earned payout to a plan participant exceeded 77% of base salary.

Stock Options:

The portion of the long-term incentive provided from stock options contemplates annual awards of stock options roughly equal in market value to the current salary of each senior executive. The Committee regularly reviews each executive's situation and periodically grants additional options. In December 1999 and 2000, the Committee awarded the officers options to purchase, in the aggregate, 114,500 and 55,000 shares, respectively, of the Company's Common Stock with an exercise price equal to the fair market value on the date of grant.

Chief Executive Officer Compensation

The Compensation Committee believes the CEO's compensation should be structured so that the payouts from the annual incentive plan and the long-term incentive plan relate closely to the Company's performance. It has generally followed a policy of providing the CEO with a compensation package which, in addition to base salary, would pay cash incentives under both of the incentive plans of up to 125% of salary for target Company performance. In 2000, the CEO's award under the annual incentive plan was $329,327 (79% of base salary), the earned portion of the long-term incentive plan was $319,825 (77% of base salary) and the CEO's base salary was $415,000 (effective January 1, 2000). In January 1999, upon promotion, the Committee awarded the CEO options to purchase 25,000 shares of the Company's Common Stock at fair market value on the date of grant. In December 1999, the Committee awarded the CEO options to purchase 35,000 shares of the Company's Common Stock at fair market value on the date of grant.

Each year, the Committee separately reviews the CEO's salary and participation levels in both the annual incentive plan and long-term incentive plan.

The Company's general policy is to provide compensation payable under its executive compensation plans and arrangements that will be deductible under the million dollar limit on deductible compensation provided under Section 162(m) of the Internal Revenue Code. However, exceptions may be made on a case-by-case basis.

Respectfully submitted,

ROBERT

F. GOLDHAMMER, CHAIRMAN

E. JOHN FINN

JERRY D. LEITMAN

12

COMMON STOCK PRICE PERFORMANCE GRAPH

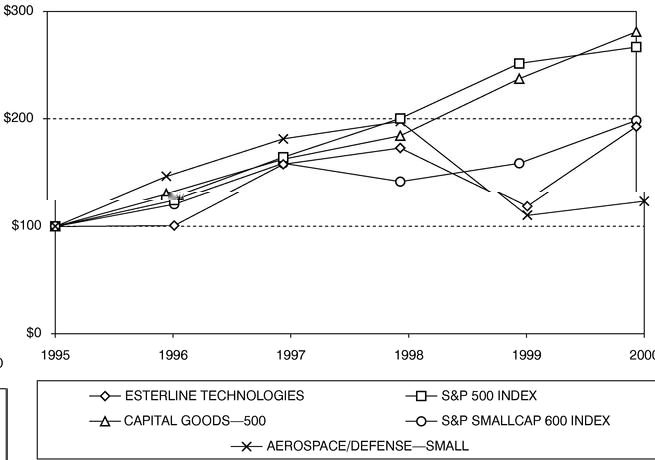

The following graph compares the cumulative total return to shareholders on the Common Stock during the years 1995 through 2000 with the cumulative total return of the Standard & Poor's 500 Stock Index, the Aerospace & Defense Smallcap Index, the Standard & Poor's Smallcap 600 Index and the Standard & Poor's Capital Goods Index. The cumulative total return on the Company's Common Stock and each index assumes the value of each investment was $100 on October 31, 1995, and that all dividends were reinvested. The measurement dates plotted below indicate the last trading date of each fiscal year shown. The stock price performance shown in the graph is not necessarily indicative of future price performance.

AMENDMENT TO THE COMPANY'S 1997 STOCK OPTION PLAN

Amendment to Increase the Number of Reserved Shares

The Board is seeking shareholder approval of an amendment to the Esterline Technologies Corporation 1997 Stock Option Plan (the "1997 Plan") to increase by 500,000 shares the total number of shares of common stock available for granting options. As of December 31, 2000, forty-eight of the Company's employees were participating in the 1997 Plan. At that date, options to purchase an aggregate of 744,750 shares of common stock were outstanding under the 1997 Plan, and 46,500 shares of common stock remained available for grant. The board believes the amendment is necessary to enable the Company to continue to attract and retain valuable employees.

13

Amendment to Qualify the 1997 Plan for Exemption Under Section 162(m)

of the Internal Revenue Code

Under Section 162(m) of the Internal Revenue Code of 1986, as amended (the "Code"), publicly held companies may not deduct compensation paid to certain executive officers to the extent that such compensation exceeds $1 million in any one year for each such officer. The Code provides an exception for "performance-based" compensation. The Board is now seeking shareholder approval of limits to qualify grants under Section 162(m) of the Code that establish that not more than 325,000 shares of common stock may be made subject to awards under the 1997 Plan to any individual in the aggregate in any one fiscal year, except that the Company may make additional one-time grants of up to 650,000 shares to newly hired or newly promoted individuals.

A copy of the 1997 Plan, as proposed to be amended, is attached to this proxy statement as Annex B and is incorporated herein by reference. The following description of the 1997 Plan as amended is a summary and does not purport to be a complete description. See Annex B for more detailed information.

DESCRIPTION OF THE PLAN. On September 18, 1996, the Board of Directors adopted the 1997 Plan, which provides for the grant of non-qualified stock options to officers (including officers who are directors) and other key employees of the Company and its subsidiaries. The Company's shareholders approved the 1997 Plan in March 1997. If the amendment to the plan is approved by shareholders, a total of 1,300,000 shares of common stock will be reserved for issuance pursuant to awards under the 1997 Plan.

The purposes of the 1997 Plan are to further the long-term growth in earnings of the Company by providing a special incentive to selected officers and other key employees of the Company and its subsidiaries who are responsible for such growth; to facilitate the ownership of shares of Common Stock by such individuals, thereby increasing the identity of their interests with those of the Company's shareholders; and to assist the Company in attracting and retaining such individuals with experience and ability.

PLAN ADMINISTRATION. The 1997 Plan may be administered by the Company's Board of Directors or a committee thereof consisting solely of two or more directors of the Company who are "outside directors" within the meaning of Section 162(m) of the Code and "non-employee directors" within the meaning of Rule 16b-3 under the Exchange Act (such Board or committee sometimes referred to herein as the "plan administrator"). The Compensation & Stock Option Committee currently serves as the plan administrator. Plan administrators do not receive any remuneration under the 1997 Plan in their capacity as administrators of the plan. The 1997 Plan provides that no plan administrator will be liable for any action or determination taken or made in good faith with respect to the plan or any option granted thereunder.

Subject to the terms of the 1997 Plan, the plan administrator has the right to grant options to eligible recipients and to determine the terms and conditions of the stock option agreements evidencing the grant of such options, including the vesting schedule and exercise price of such options, except that the exercise price will not be less than the fair market value of the Common Stock on the date of grant.

SECURITIES SUBJECT TO THE 1997 PLAN. There are reserved for issuance under the 1997 Plan an aggregate of 1,300,000 treasury or authorized but unissued shares of Common Stock. The aggregate number of shares of Common Stock as to which options may be granted to any participant during the term of the 1997 Plan may not, subject to adjustment as set forth below, exceed 325,000 shares of Common Stock in any one fiscal year of the Company, except that the Company may make one-time grants of up to 650,000 shares to newly hired or newly promoted individuals.

14

The 1997 Plan provides that, in the event of changes in the Common Stock by reason of a merger, reorganization, recapitalization, common stock dividend, stock split or similar change, the plan administrator will make appropriate adjustments to (i) the aggregate number of shares available for issuance under the 1997 Plan, (ii) the purchase price to be paid and/or the number of shares issuable upon the exercise thereafter of any option previously granted and (iii) the limits on the number of shares that can be granted to an individual in any year.

ELIGIBILITY. Discretionary grants of options may be made to any officer (including officers who are directors) or other key employee of the Company or its direct and indirect subsidiaries who is determined by the plan administrator to be in a position to contribute to the long-term growth in earnings of the Company.

EXERCISE OF OPTIONS. Options will vest and become exercisable according to a schedule established by the plan administrator. In the case of options exercisable by installment, options not exercised during any one year may be accumulated and exercised at prescribed times during the remaining years of the option. Options that are not exercised within ten years from the date of grant will expire without value. Typically options vest at the rate of 25% per year.

Notwithstanding the foregoing, all options granted under the 1997 Plan will vest and become immediately exercisable upon the approval by the Board of Directors of a sale(s) or other disposition(s) aggregating, during any twelve-month period, 30% or more of the equity book value of the Company as measured at the month-end immediately preceding the first such sale or disposition. In addition, the 1997 Plan provides that options granted to officers will accelerate and become immediately exercisable upon the occurrence of certain events constituting a "change in control" of the Company, including (i) the acquisition by certain persons of 30% or more of the Company's voting shares, (ii) a merger or other consolidation pursuant to which the Company's shareholders do not retain at least 70% of the voting power of the stock of the surviving entity, (iii) certain changes in the composition of the Company's Board of Directors, (iv) the liquidation or dissolution of the Company or (v) the sale of all or substantially all its assets other than a sale to an entity, at least 70% of the combined voting power of the voting securities of which are owned by the shareholders of the Company in substantially the same proportions as their ownership of the Company immediately prior to such sale.

All options granted, which have not as yet become exercisable, will terminate immediately upon termination of employment for any reason. All rights to exercise vested options terminate not more than three months after the option holder's employment terminates for any reason other than death, disability, or in certain cases, retirement. In no event may any option be exercisable more than ten years from the date it is granted.

Options are not transferable, other than by will or the laws of descent and distribution, and are exercisable during the recipient's lifetime only by the recipient. Upon the exercise of any option, the purchase price must be fully paid in cash or, at the discretion of the plan administrator, by delivery of Common Stock owned at least six months equal in market value to the exercise price, or through a cashless exercise procedure, or by a combination of cash, delivery of Common Stock and a cashless exercise procedure. Participants may also use a cashless exercise procedure to pay the amount necessary to meet tax withholding requirements.

AMENDMENT AND TERMINATION. The Plan will remain in effect for a period of from March 5, 1997 until March 5, 2007. The Board of Directors may terminate or amend the 1997 Plan at any time, except that shareholder approval is required for any amendment to (i) increase the maximum number of shares of stock which may be issued under the 1997 Plan (except for adjustments set forth in the 1997 Plan), (ii) change the class of individuals eligible to participate in the 1997 Plan or (iii) extend the

15

term of the 1997 Plan, in each case only to the extent required by Section 162(m) of the Code or other applicable law with respect to the material amendment of any employee benefit plan maintained by the Company. Termination or amendment of the 1997 Plan will not affect previously granted NSOs, which will continue in effect in accordance with their terms.

PAYMENT OF TAXES. Participants are required, not later than the date as of which the value of an award first becomes includable in the gross income of the participant for Federal income tax purposes, to pay to the Company, or make arrangements satisfactory to the plan administrator regarding payment of any Federal, state, or local taxes of any kind required by law to be withheld with respect to the award. The obligations of the Company under the 1997 Plan are conditional on the making of such payments or arrangements and the Company will have the right, to the extent permitted by law, to deduct any such taxes from any payment of any kind otherwise due to the participant. Participants may pay the Company cash, have shares equal to the value of the tax deducted from their exercise (up to the employer's minimum required tax withholding rate) or surrender Common Stock already held by the Participant (up to the employer's minimum required tax withholding rate) to the extent the participant has held the shares for less than six months if to pay the amount necessary to meet the tax withholding requirements.

CERTAIN FEDERAL INCOME TAX EFFECTS.

THE FOLLOWING IS A GENERAL DESCRIPTION OF THE FEDERAL INCOME TAX CONSEQUENCES TO PARTICIPANTS AND THE COMPANY RELATING TO OPTIONS THAT MAY BE GRANTED UNDER THE PLAN. THIS DISCUSSION DOES NOT PURPORT TO COVER ALL TAX CONSEQUENCES RELATING TO OPTIONS.

A participant will generally not be taxed upon the grant of a nonqualified stock option, which is the only type of option that may be granted under the 1997 Plan. Rather, at the time of exercise of such option, the participant will recognize ordinary income for Federal income tax purposes in an amount equal to the excess of the fair market value of the shares purchased over the option price. The Company will generally be entitled to a tax deduction at such time and in the same amount that the participant recognizes ordinary income, provided that the deduction is not disallowed under Section 162(m) of the Code. The 1997 Plan is designed to comply with the requirements for "performance-based compensation" under Section 162(m) of the Code.

If shares acquired upon exercise of an option are later sold or exchanged, then the difference between the sales price and the fair market value of such stock on the date that ordinary income was recognized with respect thereto will generally be taxable as long-term or short-term capital gain or loss (if the stock is a capital asset of the participant) depending upon whether the stock has been held for more than one year after such date.

According to a published ruling of the Internal Revenue Service, a participant who pays the option price upon exercise of an option, in whole or in part, by delivering shares of the Company's Common Stock already owned by him/her will recognize no gain or loss for Federal income tax purposes on the shares surrendered, but otherwise will be taxed according to the rules described above for options. With respect to shares acquired upon exercise which are equal in number to the shares surrendered, the basis of such shares will be equal to the basis of the shares surrendered, and the holding period of the shares acquired will include the holding period of the shares surrendered. The basis of additional shares received upon exercise will be equal to the fair market value of such shares on the date which governs the determination of the participant's ordinary income, and the holding period for such additional shares will commence on such date.

16

The closing market price of the Company's Common Stock on the New York Stock Exchange as reported on January 2, 2001, was $24.75 per share.

SELECTION OF INDEPENDENT AUDITORS

On April 19, 2000, the Board of Directors of the Company, on the recommendation of the Audit Committee and management, approved the appointment of Ernst & Young LLP as the Company's independent auditors to audit its consolidated financial statements for the year ending October 27, 2000. The Company's auditors for the fiscal years ending October 31, 1999 and October 31, 1998 were Deloitte & Touche LLP.

During the two most recent fiscal years and the subsequent interim period preceding the change in independent auditors, there were no reportable events within the meaning of Item 304(a)(v) of Regulation S-K. There were no disagreements between the Company and Deloitte & Touche LLP on any matters of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Deloitte & Touche LLP, would have caused such firm to make a reference to the subject matter of the disagreements in connection with its reports. Also, during the last two fiscal years, reports from Deloitte & Touche LLP on the financial statements contained no adverse opinions or disclaimers of opinion and have not been qualified or modified as to uncertainty, audit scope, or accounting principles.

The Company provided Deloitte & Touche LLP and Ernst & Young LLP with a copy of this disclosure. Deloitte & Touche LLP furnished a letter addressed to the Commission stating that Deloitte & Touche LLP agrees with the above statements.

Representatives of Ernst & Young LLP will be present at the 2001 annual meeting, will be given the opportunity to make a statement if they wish to do so, and will be available to respond to appropriate questions.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, generally requires the Company's directors and executive officers to send reports of their ownership of Common Stock and of changes in such ownership to the SEC. SEC regulations also require the Company to identify in this proxy statement any person subject to this requirement who did not file a Section 16 report on a timely basis. Based solely upon a review of such reports furnished to the Company and written representations from the executive officers and directors that no other reports were required, the Company believes that all such reports were filed on a timely basis during fiscal 2000, except the following: Mr. Goldhammer, director, inadvertently reported two purchases of stock 80 days and 19 days late, respectively. Mr. Hurlbut, director, filed two statements of changes in beneficial ownership on Form 4, each of which required an amendment due to an administrative oversight. Mr. Hurlbut filed the amendments in December 2000.

As of the date of this proxy statement, the only matters which management intends to present at the meeting are those set forth in the notice of meeting and in this proxy statement. Management knows of no other matters that may come before the meeting. However, if any other matters properly come before the meeting, it is intended that proxies in the accompanying form will be voted in respect thereof in accordance with the judgment of the person or persons voting as proxies.

17

The 2000 Annual Report of the Company was mailed to shareholders with this proxy statement. The Company will furnish without charge a copy of the Company's Annual Report on Form 10-K for the fiscal year ended October 27, 2000 to any shareholder who makes a request. Contact Esterline Technologies, Attn: Corporate Communications, 10800 NE 8th Street, Bellevue, WA 98004 or call (425) 453-9400. This proxy statement and the 2000 Annual Report are also available at the Company's Web site, http://www.esterline.com.

SHAREHOLDER PROPOSALS FOR 2002

An eligible shareholder who wants to have a qualified proposal considered for inclusion in the proxy statement for the 2002 annual meeting must notify the Secretary of the Company. The proposal must be received at the Company's executive office no later than September 21, 2001. A shareholder must have been a registered or beneficial owner of at least one percent of the outstanding shares of Common Stock or shares of Common Stock with a market value of $2,000 for at least one year prior to submitting the proposal and the shareholder must continue to own such stock through the date on which the meeting is held. In addition, if the Company receives notice of a shareholder proposal after December 7, 2001, the persons named as proxies in the proxy statement for the 2002 annual meeting will have discretionary voting authority to vote on such proposal at the 2002 annual meeting.

| By order of the Board of Directors | ||

|

||

ROBERT D. GEORGE Vice President, Chief Financial Officer, Secretary and Treasurer January 19, 2001 |

18

ANNEX A

It is the policy of this corporation to have an audit committee to function on behalf of the board of directors with certain responsibilities as granted by the board of directors.

Composition, Role and Independence

The audit committee of the board of directors assists the board in fulfilling its responsibility for oversight of the quality and integrity of the accounting, auditing and reporting practices of the corporation and other such duties as directed by the board. The membership of the committee shall consist of at least three directors. In the business judgment of the Board, each member shall be generally knowledgeable in financial and auditing matters, and at least one member shall have accounting or related financial management expertise. Each member shall be free of any relationship that, in the opinion of the board, would interfere with his or her individual exercise of independent judgement, and shall meet the director independence requirements for serving on audit committees as set forth in the corporate governance standards of the New York Stock Exchange ("NYSE"), as the same may be amended or supplemented from time to time. The committee is expected to maintain free and open communication (including private executive sessions at least annually) with the independent accountants, the internal auditors and the management of the corporation. In discharging this oversight role, the committee is empowered to investigate any matter brought to its attention, with full power to retain outside counsel or other experts for this purpose. The outside accountants are ultimately accountable to the board of directors and the audit committee.

The board of directors shall appoint one member of the audit committee as chairperson. He or she shall be responsible for leadership of the committee, including preparing the agenda, presiding over the meetings, making committee assignments and reporting to the board of directors. The chairperson will also maintain regular liaison with the CEO, CFO, the lead independent audit partner and the director of internal audit.

Responsibilities

The audit committee's primary responsibilities include:

Recommending to the board the independent accountant to be selected or retained to audit the financial statements of the corporation. Together with the board, the audit committee is ultimately responsible for the selection, evaluation and, as necessary, the replacement of the outside accountants. In so doing, the committee will ensure that the outside accountants submit on a periodic basis a formal written statement delineating all relationships between the outside accountants and the company and an affirmation that the auditor is in fact independent, actively engage in dialogue with the outside accountants regarding any relationships or services that may impact the outside accountants' objectivity and independence, and recommend to the board actions appropriate to satisfy itself of the outside accountants' independence.

Overseeing the independent auditor relationship by discussing with the auditor the nature and rigor of the audit process, receiving and reviewing audit reports, and providing the auditor full access to the committee (and the board) to report on any and all appropriate matters.

A-1

Providing guidance and oversight to the internal audit activities of the corporation including reviewing the organization, plans and results of such activity.

Reviewing the audited financial statements and discussing them with management and the independent auditor. These discussions shall include consideration of the quality of the Company's accounting principles as applied in its financial reporting, including review of estimates, reserves and accruals, review of judgmental areas, review of audit adjustments whether or not recorded and such other inquiries as may be appropriate. Based on the review, the committee shall make its recommendation to the board as to the inclusion of the Company's audited financial statements in the Company's annual report on Form 10-K.

Reviewing with management and the independent auditor the quarterly financial information prior to the Company's filing of Form 10-Q.

Discussing with management, the internal auditors and the external auditors the quality and adequacy of the Company's internal controls.

Discussing with management the status of: pending litigation; taxation matters; environmental compliance practices; risk management program; and other legal and compliance areas as may be appropriate.

Reporting audit committee activities to the full board and issuing annually a report to be included in the proxy statement (including appropriate oversight conclusions) for submission to the shareholders, which report shall include the information required by applicable SEC and NYSE rules, as amended and supplemented from time to time.

Annual Review

The audit committee shall review and reassess this charter and agenda annually.

A-2

ANNEX B

ESTERLINE TECHNOLOGIES CORPORATION AMENDED AND RESTATED 1997

STOCK OPTION PLAN

1. PURPOSE

The name of this plan is the Esterline Technologies Corporation Amended and Restated 1997 Stock Option Plan (the "Plan"). The purpose of the Plan is to enable the Company to attract and retain highly qualified personnel who will contribute to the Company's success by their ability, ingenuity and industry and to provide incentives to the participating officers (including officers who are directors) and other key employees that are linked directly to increases in shareholder value and will therefore inure to the benefit of all shareholders of the Company.

2. DEFINITIONS

2.1 "ADMINISTRATOR" means the Board, or if and to the extent the Board does not administer the Plan, the Committee in accordance with Section 3.

2.2 "AFFILIATE" shall have the meaning set forth in Rule 12b-2 promulgated under Section 12 of the Exchange Act.

2.3 "BENEFICIAL OWNER" shall have the meaning set forth in Rule 13d-3 under the Exchange Act.

2.4 "BOARD" means the Board of Directors of the Company.

2.5 "CODE" means the Internal Revenue Code of 1986, as amended from time to time, or any successor thereto.

2.6 "COMMITTEE" means the Compensation and Stock Option Committee of the Board or any Committee the Board may subsequently appoint to administer the Plan. To the extent applicable, the Committee shall be composed entirely of individuals who meet the qualifications referred to in Section 162(m) of the Code and Rule 16b-3 under the Exchange Act.

2.7 "COMPANY" means Esterline Technologies Corporation, a Delaware corporation (or any successor corporation), and its subsidiaries and divisions.

2.8 "DISABILITY" means the inability of a Participant to perform substantially such Participant's duties and responsibilities to the Company by reason of a physical or mental disability or infirmity (i) for a continuous period of six months or (ii) at such earlier time as the Participant submits medical evidence satisfactory to the Administrator that the Participant has a physical or mental disability or infirmity which will likely prevent the Participant from returning to the performance of the Participant's work duties for six months or longer. The date of such Disability shall be the last day of such six-month period or the day on which the Participant submits such satisfactory medical evidence, as the case may be.

2.9 "DISINTERESTED PERSON" means a person who, at a given meeting of the Committee or Board of Directors, is not being considered to receive a grant of an Option hereunder.

2.10 "EFFECTIVE DATE" shall mean March 5, 1997.

B-1

2.11 "ELIGIBLE RECIPIENT" means selected officers (including officers who are directors) and other key employees of the Company.

2.12 "EXCHANGE ACT" shall mean the Securities Exchange Act of 1934, as amended from time to time.

2.13 "FAIR MARKET VALUE" means, as of any given date, with respect to any awards granted hereunder, (a) if the Stock is publicly traded, the closing sale price of the Stock on such date as reported in the Western Edition of the Wall Street Journal, or the average of the closing price of the Stock on each day on which the Stock was traded over a period of up to twenty trading days immediately prior to such date, (b) the fair market value of the Stock as determined in accordance with a method prescribed in the agreement evidencing any award hereunder or (c) the fair market value of the Stock as otherwise determined by the Administrator in the good faith exercise of its discretion.

2.14 "OPTION" means any option to purchase shares of Stock granted pursuant to Section 7 that is not intended to qualify as an incentive stock option as that term is defined in Section 422 of the Code.

2.15 "PARTICIPANT" means any Eligible Recipient selected by the Administrator, pursuant to the Administrator's authority in Section 3 below, to receive grants of Options.

2.16 "PERSON" shall have the meaning given in Section 3(a)(9) of the Exchange Act, as modified and used in Sections 13(d) and 14(d) thereof, except that such term shall not include (i) the Company, (ii) a trustee or other fiduciary holding securities under an employee benefit plan of the Company, (iii) an underwriter temporarily holding securities pursuant to an offering of such securities or (iv) a corporation owned, directly or indirectly, by the shareholders of the Company in substantially the same proportions as their ownership of stock of the Company.

2.17 "STOCK" means the common stock of the Company, par value $.20 per share.

2.18 "SUBSIDIARY" means any corporation (other than the Company) in an unbroken chain of corporations beginning with the Company, if each of the corporations (other than the last corporation) in the unbroken chain owns stock possessing 50% or more of the total combined voting power of all classes of stock in one of the other corporations in the chain.

3. ADMINISTRATION

The Plan shall be administered in accordance with the requirements of Section 162(m) of the Code (but only to the extent necessary to maintain qualification of the Plan under Section 162(m) of the Code) and, to the extent applicable, Rule 16b-3 under the Exchange Act ("Rule 16b-3") by the Board or by the Committee which shall be appointed by the Board and which shall serve at the pleasure of the Board.

Pursuant to the terms of the Plan, the Administrator shall have the power and authority to grant Options to Eligible Recipients. Directors of the Company who are either eligible to be granted Options or to whom Options have been granted may vote on any matters affecting the administration of the Plan or the granting of Options under the Plan; provided, however, that no Option may be granted to a director under the Plan except by:

B-2

In particular, the Administrator shall have the authority: (a) to select those Eligible Recipients who shall be Participants; (b) to determine whether and to what extent Options are to be granted hereunder to Participants; (c) to determine the number of shares of Stock to be covered by each such Option granted hereunder; (d) to determine the terms and conditions, not inconsistent with the terms of the Plan, of any Option granted hereunder; and (e) to determine the terms and conditions, not inconsistent with the terms of the Plan, which shall govern all written instruments evidencing the Options granted hereunder to Participants.

The Administrator shall have the authority, in its discretion, (a) to adopt, alter and repeal such administrative rules, guidelines and practices governing the Plan as it shall from time to time deem advisable; (b) to interpret the terms and provisions of the Plan and any Option issued under the Plan (and any agreements relating thereto); (c) to waive compliance either generally or in any one or more particular instances by an optionee with the requirements of any such rule or regulation or any Option, subject to the provisions of the Plan and any other applicable requirements; (d) to decide all questions and settle all controversies and disputes which may arise in connection with the Plan; (e) to interpret the Plan and to make all other determinations deemed necessary or advisable for the administration of the Plan; and (f) to otherwise supervise the administration of the Plan.

A majority of the members of the Committee shall constitute a quorum. All decisions, interpretations and determinations made by the Administrator pursuant to the provisions of the Plan shall be final and binding on all persons, including the Company and the Participants. Any determination of the Committee under the Plan may be made without notice or a meeting of the Committee by a written consent signed by all of the Committee members.

4. SHARES SUBJECT TO THE PLAN

The total number of shares of Stock reserved and available for issuance under the Plan shall be 1,300,000. Such shares may consist, in whole or in part, of authorized and unissued shares or treasury shares. Consistent with the provisions of Section 162(m) of the Code, as from time to time applicable, to the extent that an Option expires or is otherwise terminated without being exercised, such shares shall again be available for issuance in connection with future awards under the Plan. Subject to adjustment from time to time as provided in Section 11(a), not more than 325,000 shares of Stock may be made subject to an Option under the Plan to any individual in the aggregate in any one fiscal year of the Company, except that the Company may make one-time grants of up to 650,000 shares to newly hired or newly promoted individuals, such limitation to be applied in a manner consistent with the requirements of, and only to the extent required for compliance with, the exclusion from the limitation on deductibility of compensation under Section 162(m) of the Code.

5. ELIGIBILITY

Key employees of the Company (including officers and directors who are employees) shall be eligible for selection by the Committee as optionees under the Plan. In selecting the individuals to whom Options shall be granted, as well as in determining the number of shares subject to each Option, the Committee shall take into consideration the recommendations of the members of the senior management of the Company and such factors as it shall deem relevant in connection with accomplishing the purposes of the Plan. An individual who has been granted an Option may, if such individual is otherwise eligible, be granted an additional Option or Options.

6. LIMITATION ON GRANTING OF OPTIONS

No Option shall be granted under the Plan more than ten (10) years after the Effective Date.

B-3

7. TERMS AND CONDITIONS OF OPTIONS

All Options granted under the Plan shall be subject to the following terms and conditions and to such other terms and conditions as the Committee shall determine to be appropriate to accomplish the purposes of the Plan:

(a) OPTION PRICE. The option price per share of Stock purchasable under an Option shall be determined by the Administrator in its sole discretion at the time of grant but shall not be less than 100% of the Fair Market Value of the Stock on such date pursuant to paragraph (b) below. The proceeds of sales of Stock subject to Options are to be added to the general funds of the Company and used for such corporate purposes as the Board may determine.

(b) TIME OF GRANTING OPTIONS. The date of grant of an Option under the Plan shall, for all purposes, be the date on which the Committee completes the corporate action relating to the grant of such Option. Notice of the determination shall be given to each employee to whom an Option is so granted within a reasonable time after the date of such grant.

(c) OPTION TERM. The term of each Option shall be fixed by the Administrator, but no Option shall be exercisable more than ten years after the date such Option is granted. In addition, and except as provided in Section 8 hereof, an Option shall not be exercisable unless the holder thereof shall, at the time of exercise, be an employee of the Company or a Subsidiary or an Affiliate of the Company.

(d) EXERCISABILITY. Options shall be exercisable at such time or times and subject to such terms and conditions as shall be determined by the Administrator at or after grant. The Administrator may provide, in its discretion, that any Option shall be exercisable only in installments, and the Administrator may waive such installment exercise provisions at any time in whole or in part based on such factors as the Administrator may determine. Notwithstanding the foregoing, the Options granted to each of the Company's officers shall become 100% vested and exercisable as of the day before the first to occur of the following events: (1) any Person is or becomes the Beneficial Owner, directly or indirectly, of securities of the Company (not including in the securities beneficially owned by such Person any securities acquired directly from the Company or its Affiliates other than in connection with the acquisition by the Company or its Affiliates of a business) representing 30% or more of the combined voting power of the Company's then outstanding securities; (2) the following individuals cease for any reason to constitute a majority of the number of directors then serving: individuals who, on the Effective Date of the plan, constitute the Board of Directors of the Company and any new director (other than a director whose initial assumption of office is in connection with an actual or threatened election contest, including but not limited to a consent solicitation, relating to the election of directors of the Company) whose appointment or election by the Board or nomination for election by the Company's shareholders was approved or recommended by a vote of at least two-thirds (2/3) of the directors then still in office who either were directors on the date hereof or whose appointment, election or nomination for election was previously so approved or recommended; (3) the shareholders of the Company approve a merger or consolidation of the Company or any direct or indirect Subsidiary of the Company with any other corporation, other than (i) a merger or consolidation which would result in the voting securities of the Company outstanding immediately prior to such merger or consolidation continuing to represent

B-4

(either by remaining outstanding or by being converted into voting securities of the surviving entity or any parent thereof), in combination with the ownership of any trustee or other fiduciary holding securities under an employee benefit plan of the Company or any Affiliate at least 70% of the combined voting power of the securities of the Company or such surviving entity or any parent thereof outstanding immediately after such merger or consolidation, or (ii) a merger or consolidation effected to implement a recapitalization of the Company (or similar transaction) in which no Person is or becomes the Beneficial Owner, directly or indirectly, of securities of the Company (not including in the securities Beneficially Owned by such Person any securities acquired directly from the Company or its Affiliates other than in connection with the acquisition by the Company or its Affiliates of a business) representing 30% or more of the combined voting power of the Company's then outstanding securities; or (4) the shareholders of the Company approve a plan of complete liquidation or dissolution of the Company or there is consummated an agreement for the sale or disposition by the Company of all or substantially all of the Company's assets, other than a sale or disposition by the Company of all or substantially all of the Company's assets to an entity, at least 70% of the combined voting power of the voting securities of which are owned by shareholders of the Company in substantially the same proportions as their ownership of the Company immediately prior to such sale. In addition, all Options granted hereunder shall become 100% vested and exercisable as of the day before approval by the Board of Directors of a sale or other disposition which, when aggregated with any other such sale(s) or disposition(s) occurring within 12 months of such sale or disposition, relates to 30% or more of the equity book value of the Company as measured as of the fiscal month-end immediately preceding the first such sale or disposition.

(e) METHOD OF EXERCISE. Options may be exercised in whole or in part at any time during the option period, by giving written notice of exercise to the Company specifying the number of shares of Stock to be purchased, accompanied by payment in full of the purchase price in cash or check acceptable to the Administrator. As determined by the Administrator, in its sole discretion, payment in whole or in part may also be made (i) by means of any cashless exercise procedure approved by the Administrator, or (ii) in the form of shares of Stock already owned by the optionee for at least six months (or any shorter period necessary to avoid a charge to the Company's earnings for financial reporting purposes).

8. EARLY TERMINATION OF OPTIONS

All Options granted which have not as yet become exercisable shall terminate immediately upon termination of employment or death. All exercisable Options that have not been exercised shall terminate as follows: