|

|

|

|

Fidelity®

Fund

Semiannual Report

October 31, 2000

(2_fidelity_logos)

|

President's Message |

3 |

Ned Johnson on investing strategies. |

|

Performance |

4 |

How the fund has done over time. |

|

Fund Talk |

7 |

The manager's review of fund performance, strategy and outlook. |

|

Investment Changes |

10 |

A summary of major shifts in the fund's investments over the past six months. |

|

Investments |

11 |

A complete list of the fund's investments with their market values. |

|

Financial Statements |

23 |

Statements of assets and liabilities,

operations, and changes in net assets, |

|

Notes |

27 |

Notes to the financial statements. |

|

|

|

|

To reduce expenses, only one copy of most financial reports and prospectuses may be mailed to households, even if more than one person in the household has an account in the fund. Call Fidelity at 1-800-544-8544 if you need additional copies of financial reports or prospectuses. If you do not want the mailing of these documents to be combined with those for other members of your household, contact Fidelity in writing at P.O. Box 5000, Cincinnati, OH 45273-8692.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

(Recycle graphic) This report is printed on recycled paper using soy-based inks.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

Mutual fund shares are not deposits or obligations of, or guaranteed by, any depository institution. Shares are not insured by the FDIC, Federal Reserve Board or any other agency, and are subject to investment risks, including possible loss of principal amount invested.

Neither the fund nor Fidelity Distributors Corporation is a bank.

For more information on any Fidelity fund, including charges and expenses, call 1-800-544-6666 for a free prospectus. Read it carefully before you invest or send money.

Semiannual Report

(photo_of_Edward_C_Johnson_3d)

Dear Shareholder:

A sixth-straight year of double-digit positive returns for the Dow Jones Industrial Average, NASDAQ and S&P 500® could be in jeopardy unless the U.S. stock market shows marked improvement in the final two months of 2000. Through October, all three indexes had negative year-to-date returns. On the other hand, most fixed-income sectors were solidly in the black. Treasuries and other long-term government securities led the way, returning nearly 14%.

While it's impossible to predict the future direction of the markets with any degree of certainty, there are certain basic principles that can help investors plan for their future needs.

The longer your investment time frame, the less likely it is that you will be affected by short-term market volatility. A 10-year investment horizon appropriate for saving for a college education, for example, enables you to weather market cycles in a long-term fund, which may have a higher risk potential, but also has a higher potential rate of return.

An intermediate-length fund could make sense if your investment horizon is two to four years, while a short-term bond fund could be the right choice if you need your money in one or two years.

If your time horizon is less than a year, you might want to consider moving some of your bond investment into a money market fund. These funds seek income and a stable share price by investing in high-quality, short-term investments. Of course, it's important to remember that an investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although money market funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in these types of funds.

Finally, no matter what your time horizon or portfolio diversity, it makes good sense to follow a regular investment plan, investing a certain amount of money in a fund at the same time each month or quarter and periodically reviewing your overall portfolio. By doing so, you won't get caught up in the excitement of a rapidly rising market, nor will you buy all your shares at market highs. While this strategy - known as dollar cost averaging - won't assure a profit or protect you from a loss in a declining market, it should help you lower the average cost of your purchases. Of course, you should consider your financial ability to continue your purchases through periods of low price levels before undertaking such a strategy.

If you have questions, please call us at 1-800-544-6666, or visit our web site at www.fidelity.com. We are available 24 hours a day, seven days a week to provide you the information you need to make the investments that are right for you.

Best regards,

/s/Edward C. Johnson 3d

Edward C. Johnson 3d

Semiannual Report

There are several ways to evaluate a fund's historical performance. You can look at the total percentage change in value, the average annual percentage change or the growth of a hypothetical $10,000 investment. Total return reflects the change in the value of an investment, assuming reinvestment of the fund's dividend income and capital gains (the profits earned upon the sale of securities that have grown in value). You can also look at the fund's income, as reflected in the fund's yield, to measure performance.

Cumulative Total Returns

|

Periods ended October 31, 2000 |

Past 6 |

Past 1 |

Past 5 |

Past 10 |

|

Fidelity Investment Grade Bond |

5.26% |

6.80% |

31.88% |

118.24% |

|

LB Aggregate Bond |

5.80% |

7.30% |

35.94% |

115.51% |

|

Intermediate Investment Grade Debt |

4.82% |

5.84% |

29.74% |

107.58% |

Cumulative total returns show the fund's performance in percentage terms over a set period - in this case, six months, one year, five years or 10 years. For example, if you had invested $1,000 in a fund that had a 5% return over the past year, the value of your investment would be $1,050. You can compare the fund's returns to the performance of the Lehman Brothers Aggregate Bond Index - a market value-weighted index of investment-grade fixed-rate debt issues, including government, corporate, asset-backed and mortgage-backed securities, with maturities of one year or more. To measure how the fund's performance stacked up against its peers, you can compare it to the intermediate investment grade debt funds average, which reflects the performance of mutual funds with similar objectives tracked by Lipper Inc. The past six months average represents a peer group of 302 mutual funds. These benchmarks reflect reinvestment of dividends and capital gains, if any, and exclude the effect of sales charges.

Average Annual Total Returns

|

Periods ended October 31, 2000 |

Past 1 |

Past 5 |

Past 10 |

|

Fidelity Investment Grade Bond |

6.80% |

5.69% |

8.12% |

|

LB Aggregate Bond |

7.30% |

6.33% |

7.98% |

|

Intermediate Investment Grade Debt |

5.84% |

5.34% |

7.55% |

Average annual total returns take the fund's cumulative return and show you what would have happened if the fund had performed at a constant rate each year. (Note: Lipper calculates average annual total returns by annualizing each fund's total return, then taking an arithmetic average. This may produce a different figure than that obtained by averaging the cumulative total returns and annualizing the result.)

Semiannual Report

Performance - continued

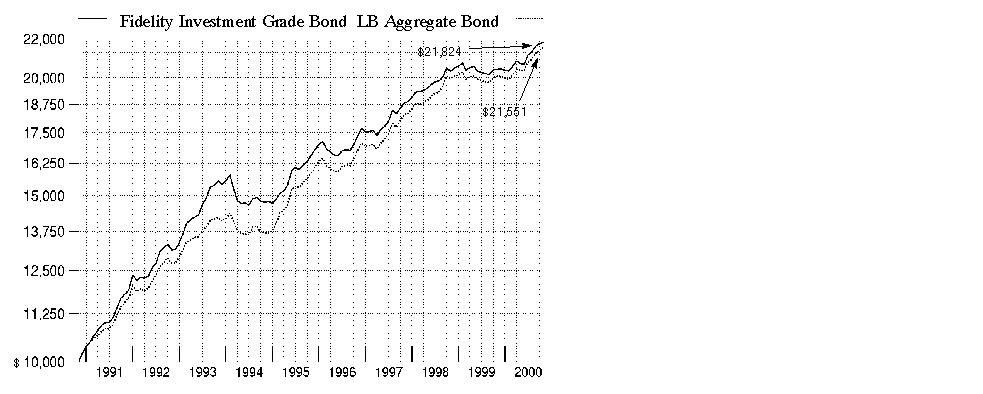

$10,000 Over 10 Years

$10,000 Over 10 Years: Let's say hypothetically that $10,000 was invested in Fidelity Investment Grade Bond Fund on October 31, 1990. As the chart shows, by October 31, 2000, the value of the investment would have grown to $21,824 - a 118.24% increase on the initial investment. For comparison, look at how the Lehman Brothers Aggregate Bond Index did over the same period. With dividends and capital gains, if any, reinvested, the same $10,000 would have grown to $21,551 - a 115.51% increase.

Understanding

Performance

How a fund did yesterday is no guarantee of how it will do tomorrow. Bond prices, for example, generally move in the opposite direction of interest rates. In turn, the share price, return and yield of a fund that invests in bonds will vary. That means if you sell your shares during a market downturn, you might lose money. But if you can ride out the market's ups and downs, you may have a gain.

3Semiannual Report

Performance - continued

Total Return Components

|

|

Six months ended October 31, |

Years ended April 30, |

||||

|

|

2000 |

2000 |

1999 |

1998 |

1997 |

1996 |

|

Dividend returns |

3.36% |

6.09% |

5.85% |

6.55% |

6.70% |

6.77% |

|

Capital returns |

1.90% |

-5.38% |

-0.27% |

3.99% |

-0.28% |

0.85% |

|

Total returns |

5.26% |

0.71% |

5.58% |

10.54% |

6.42% |

7.62% |

Total return components include both dividend returns and capital returns. A dividend return reflects the actual dividends paid by the fund. A capital return reflects both the amount paid by the fund to shareholders as capital gain distributions and changes in the fund's share price. Both returns assume the dividends or capital gains, if any, paid by the fund are reinvested.

Dividends and Yield

|

Periods ended October 31, 2000 |

Past 1 |

Past 6 |

Past 1 |

|

Dividends per share |

3.82¢ |

22.65¢ |

44.64¢ |

|

Annualized dividend rate |

6.42% |

6.48% |

6.45% |

|

30-day annualized yield |

6.61% |

- |

- |

Dividends per share show the income paid by the fund for a set period and do not reflect any tax reclassifications. If you annualize this number, based on an average share price of $7.01 over the past one month, $6.93 over the past six months and $6.92 over the past one year, you can compare the fund's income over these three periods. The 30-day annualized yield is a standard formula for all bond funds based on the yields of the bonds in the fund, averaged over the past 30 days. This figure shows you the yield characteristics of the fund's investments at the end of the period. It also helps you compare funds from different companies on an equal basis.

Semiannual Report

Market Recap

Strong technical factors in the market helped most investment-grade bonds overcome unusually volatile market conditions, enabling them to handily outperform most major U.S. equity indexes during the six-month period that ended October 31, 2000. The Lehman Brothers Aggregate Bond Index - a popular measure of taxable-bond performance - returned 5.80% during this time frame. Treasuries continued their hot streak from the beginning of 2000 thanks to a swelling federal surplus and the U.S. government's decision to buy back increasingly larger amounts of outstanding long-term debt. Anticipation that the Fed was finished raising interest rates following a half-point hike in May, combined with persistent flights-to-safety from risk-averse investors concerned about volatility in equity markets, further bolstered the long bond, helping the Lehman Brothers Treasury Index return 5.50% during the period. Mortgage and agency securities rallied back from their period lows in May to post formidable six-month returns. Discount mortgages were boosted by higher-than-normal prepayment activity supported by a strong housing market. Agencies staged a comeback behind reduced political risk surrounding government-sponsored enterprises. During the past six months, the Lehman Brothers Mortgage-Backed Securities and U.S. Agency indexes returned 6.24% and 6.08%, respectively. The corporate sector was the worst-performing segment of the market, plagued by deteriorating credit conditions and growing supply pressures. The Lehman Brothers Credit Bond Index posted a 5.37% return during the six-month period.

(Portfolio Manager photograph)

An interview with Kevin Grant, Portfolio Manager of Fidelity Investment Grade Bond Fund

Q. How did the fund perform, Kevin?

A. For the six months that ended October 31, 2000, the fund returned 5.26%, outpacing the intermediate investment grade debt funds average tracked by Lipper Inc., which returned 4.82%. The Lehman Brothers Aggregate Bond Index returned 5.80% during this same time frame. For the 12 months that ended October 31, 2000, the fund returned 6.80%, while the Lipper average and Lehman Brothers index returned 5.84% and 7.30%, respectively.

Q. What factors had the most influence on fund performance?

A. The fund's underexposure to agencies hurt, as these securities rebounded nicely during the period after struggling in the spring under a political cloud in Washington that threatened to strip Fannie Mae and Freddie Mac of their implicit government backing. Clearly, owning more agencies would have been a positive for the fund, but I felt there were better opportunities elsewhere. On the plus side, the fund's positioning in Treasuries helped us gain ground on the index. Treasuries led the market during the first half of 2000, spurred by the U.S. government's decision to repurchase outstanding debt as a result of the growing federal surplus. Even though we were underweighted relative to the index at this time, we managed to narrow the performance gap by way of security selection. We benefited by positioning the fund ahead of the buybacks in long-term Treasuries and callable Treasuries. This was an effective strategy for us.

Semiannual Report

Fund Talk: The Manager's Overview - continued

Q. What other strategies worked?

A. Anticipating interest rates rising further earlier in the year, I reduced the fund's overweighting in corporates, particularly its long-standing emphasis on banks - a posture that worked out well for us in the past - because I felt that it would be extremely difficult for these securities to outperform in a more difficult credit environment. This strategy paid off as the market proceeded to punish the group during the spring and early fall. Overall, I became much more defensive in terms of our corporate holdings, reducing our risk exposure through increased diversification. Although we weren't immune to a handful of issues that imploded during the period, the fact that we owned smaller positions than the index - even avoiding some entirely - helped limit our downside. Despite the fact that most corporates lagged the rest of the market, tactical allocations into various subsectors, such as energy, aided relative performance. The fund benefited from buying bonds from high-quality issuers when oil was trading at around $11 per barrel, which offered a tremendous value opportunity, and selling some of them as oil eclipsed the $30 plateau. Owning Yankee bonds - dollar-denominated securities issued by foreign entities - at the expense of banks also helped. Moreover, by investing in other defensive issues, including commercial mortgage-backed securities, we were able to further diversify the portfolio while providing the fund with some additional yield. In hindsight, I wish I had sold all of our credit risk earlier in the year. I trimmed positions as prudently as possible, but I wanted to maintain some sort of yield in the fund. Still, we maintained an edge over our Lipper peers by holding fewer long-term, lower-quality corporate bonds, which underperformed all sectors of the investment-grade market during the period.

Q. How did the fund's mortgage holdings fare?

A. We were rewarded for our emphasis on seasoned discount bonds - mortgages created in 1996 and 1997 - which benefited from strong housing turnover fueled by a robust economy. A red-hot housing market meant higher-than-normal prepayment activity, which resulted in a steady windfall for us as we got prepaid at par, or face value, while market prices were at discounts.

Q. What's your outlook?

A. I feel that investment-grade bonds should continue to produce reasonably attractive absolute returns in the coming months. I think there's a lot of value in non-Treasury markets, especially in the corporate segment where prices haven't been this low in over a decade. By historical standards, investors are currently paid handsomely for taking on additional risk. Since it seems like it will be tougher to make money on Treasuries going forward, I plan to maintain an overweighting in corporate bonds - focusing on the more defensive sectors and adding to the fund's positions while valuations appear attractive.

Semiannual Report

Fund Talk: The Manager's Overview - continued

The views expressed in this report reflect those of the portfolio manager only through the end of the period of the report as stated on the cover and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Fund Facts

Goal: high current income by investing mainly in investment-grade securities

Fund number: 026

Trading symbol: FBNDX

Start date: August 6, 1971

Size: as of October 31, 2000, more than $2.3 billion

Manager: Kevin Grant, since 1997; manager, several Fidelity investment-grade taxable bond funds; joined Fidelity in 1993

3Kevin Grant on the importance of diversification in today's market:

"Diversification has been an important theme for me for quite some time now. The idea is that it's a very tough environment for corporations these days, and it's become increasingly difficult to predict random credit events that besiege companies. The only way, I feel, to truly protect yourself from negative event risk is through diversification.

"It's important to note that diversification works differently for bonds than it does for stocks. Concentrated stock portfolios can work because stocks are capable of doubling, tripling or even rising tenfold. When this happens, it can cover up a lot of duds, or issues that go to zero. However, it's not that easy for bonds, which don't have the luxury of growing in price exponentially. So, if a company gets into trouble, bondholders are left holding the bag. On the other hand, if things work out well, investors are limited to the yield on the bond and, if they're fortunate, a bit of price appreciation to go along with it.

"As a money manager, I want the advantages of owning corporate bonds without being heavily exposed to a small number of issuers. The only way to do that is to own a lot of names. By leveraging the research strength and trading capabilities of Fidelity, we're able to do just that, which gives us the opportunity to succeed."

Semiannual Report

|

Quality Diversification as of October 31, 2000 |

||

|

(Moody's Ratings) |

% of fund's investments |

% of fund's investments |

|

Aaa |

58.0 |

61.1 |

|

Aa |

2.1 |

1.9 |

|

A |

10.7 |

10.5 |

|

Baa |

17.4 |

20.0 |

|

Ba and Below |

0.1 |

0.9 |

|

Table excludes short-term investments. Where Moody's ratings are not available, we have used S&P ® ratings. |

|

Average Years to Maturity as of October 31, 2000 |

||

|

|

|

6 months ago |

|

Years |

9.5 |

8.8 |

|

Average years to maturity is based on the average time remaining until principal payments are expected from each of the fund's bonds, weighted by dollar amount. |

|

Duration as of October 31, 2000 |

||

|

|

|

6 months ago |

|

Years |

4.7 |

5.1 |

|

Duration shows how much a bond fund's price fluctuates with changes in comparable interest rates. If rates rise 1%, for example, a fund with a five-year duration is likely to lose about 5% of its value. Other factors also can influence a bond fund's performance and share price. Accordingly, a bond fund's actual performance may differ from this example. |

|

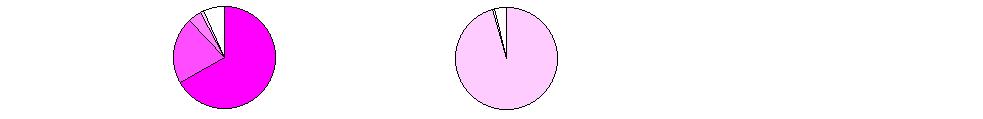

Asset Allocation (% of fund's net assets) |

|||||||

|

As of October 31, 2000 * |

As of April 30, 2000 ** |

||||||

|

Corporate Bonds 27.1% |

|

|

Corporate Bonds 29.7% |

|

||

|

U.S. Government and Government Agency Obligations 55.4% |

|

|

U.S. Government and Government Agency Obligations 58.6% |

|

||

|

Asset-Backed |

|

|

Asset-Backed |

|

||

|

CMOs and Other Mortgage Related Securities 3.6% |

|

|

CMOs and Other Mortgage Related Securities 2.0% |

|

||

|

Other Investments 1.9% |

|

|

Other Investments 2.7% |

|

||

|

Short-Term |

|

|

Short-Term |

|

||

|

* Foreign investments |

7.5% |

|

** Foreign investments |

8.9% |

|

||

Semiannual Report

(Unaudited)

Showing Percentage of Net Assets

|

Nonconvertible Bonds - 27.1% |

|||||

|

Moody's Ratings (unaudited) (a) |

Principal Amount (000s) |

Value (Note 1) (000s) |

|||

|

BASIC INDUSTRIES - 0.1% |

|||||

|

Paper & Forest Products - 0.1% |

|||||

|

Fort James Corp. 6.625% 9/15/04 |

Baa2 |

|

$ 1,060 |

$ 1,010 |

|

|

CONSTRUCTION & REAL ESTATE - 2.0% |

|||||

|

Real Estate - 0.3% |

|||||

|

Cabot Industrial Property LP 7.125% 5/1/04 |

Baa2 |

|

4,005 |

3,889 |

|

|

Duke Realty LP 7.3% 6/30/03 |

Baa1 |

|

4,000 |

3,976 |

|

|

|

7,865 |

||||

|

Real Estate Investment Trusts - 1.7% |

|||||

|

CenterPoint Properties Trust 6.75% 4/1/05 |

Baa2 |

|

2,490 |

2,366 |

|

|

Equity Office Properties Trust: |

|

|

|

|

|

|

6.5% 1/15/04 |

Baa1 |

|

7,290 |

7,068 |

|

|

6.625% 2/15/05 |

Baa1 |

|

7,250 |

6,996 |

|

|

6.75% 2/15/08 |

Baa1 |

|

5,560 |

5,178 |

|

|

ProLogis Trust 6.7% 4/15/04 |

Baa1 |

|

1,715 |

1,663 |

|

|

Spieker Properties LP: |

|

|

|

|

|

|

6.75% 1/15/08 |

Baa2 |

|

15,000 |

14,001 |

|

|

6.8% 5/1/04 |

Baa2 |

|

2,195 |

2,135 |

|

|

|

39,407 |

||||

|

TOTAL CONSTRUCTION & REAL ESTATE |

47,272 |

||||

|

DURABLES - 0.1% |

|||||

|

Autos, Tires, & Accessories - 0.1% |

|||||

|

Daimler-Chrysler North America Holding Corp. 8% 6/15/10 |

A1 |

|

2,300 |

2,336 |

|

|

ENERGY - 2.1% |

|||||

|

Oil & Gas - 2.1% |

|||||

|

Anadarko Petroleum Corp.: |

|

|

|

|

|

|

7% 11/15/27 |

Baa1 |

|

4,815 |

4,376 |

|

|

7.2% 3/15/29 |

Baa1 |

|

7,580 |

7,131 |

|

|

Apache Corp.: |

|

|

|

|

|

|

7.625% 7/1/19 |

Baa1 |

|

2,055 |

2,040 |

|

|

7.7% 3/15/26 |

Baa1 |

|

1,600 |

1,580 |

|

|

Apache Finance Property Ltd. 6.5% 12/15/07 |

Baa1 |

|

800 |

762 |

|

|

Duke Energy Field Services LLC 7.875% 8/16/10 |

Baa2 |

|

8,000 |

8,165 |

|

|

Oryx Energy Co. 8.125% 10/15/05 |

Baa1 |

|

4,285 |

4,461 |

|

|

Petro-Canada 7% 11/15/28 |

A3 |

|

3,850 |

3,475 |

|

|

Nonconvertible Bonds - continued |

|||||

|

Moody's Ratings (unaudited) (a) |

Principal Amount (000s) |

Value (Note 1) (000s) |

|||

|

ENERGY - continued |

|||||

|

Oil & Gas - continued |

|||||

|

Ras Laffan Liquid Natural Gas Co. Ltd. yankee 8.294% 3/15/14 (c) |

Baa3 |

|

$ 6,400 |

$ 6,130 |

|

|

Tosco Corp. 8.125% 2/15/30 |

Baa2 |

|

9,800 |

9,953 |

|

|

|

48,073 |

||||

|

FINANCE - 11.7% |

|||||

|

Banks - 4.9% |

|||||

|

ABN-Amro Bank NV, Chicago 6.625% 10/31/01 |

A1 |

|

3,000 |

2,988 |

|

|

Banc One Corp. 7.25% 8/1/02 |

A1 |

|

2,000 |

2,006 |

|

|

Bank of Montreal 6.1% 9/15/05 |

A1 |

|

4,000 |

3,810 |

|

|

Bank One Capital III 8.75% 9/1/30 |

Aa3 |

|

4,200 |

4,101 |

|

|

Bank One Corp. 7.875% 8/1/10 |

A1 |

|

11,700 |

11,773 |

|

|

BankBoston Corp. 6.625% 2/1/04 |

A3 |

|

4,000 |

3,922 |

|

|

Barclays Bank PLC yankee: |

|

|

|

|

|

|

5.95% 7/15/01 |

A1 |

|

10,100 |

10,041 |

|

|

8.55% 9/29/49 (b)(c) |

Aa2 |

|

7,985 |

8,039 |

|

|

Capital One Bank 6.375% 2/15/03 |

Baa2 |

|

4,550 |

4,415 |

|

|

Capital One Financial Corp. 7.125% 8/1/08 |

Baa3 |

|

5,490 |

5,211 |

|

|

First Tennessee National Corp. 6.75% 11/15/05 |

A3 |

|

1,650 |

1,608 |

|

|

FleetBoston Financial Corp. 7.25% 9/15/05 |

A2 |

|

5,790 |

5,803 |

|

|

HSBC Finance Nederland BV 7.4% 4/15/03 (c) |

A1 |

|

750 |

757 |

|

|

Kansallis-Osake-Pankki (NY Branch) yankee 10% 5/1/02 |

A1 |

|

1,780 |

1,848 |

|

|

Korea Development Bank: |

|

|

|

|

|

|

6.625% 11/21/03 |

Baa2 |

|

4,975 |

4,772 |

|

|

7.125% 4/22/04 |

Baa2 |

|

725 |

705 |

|

|

7.375% 9/17/04 |

Baa2 |

|

3,985 |

3,892 |

|

|

MBNA Corp.: |

|

|

|

|

|

|

6.34% 6/2/03 |

Baa2 |

|

1,800 |

1,738 |

|

|

6.875% 11/15/02 |

Baa2 |

|

8,300 |

8,269 |

|

|

National Westminster Bank PLC yankee 7.375% 10/1/09 |

Aa3 |

|

2,935 |

2,890 |

|

|

Providian National Bank 6.75% 3/15/02 |

Baa3 |

|

4,000 |

3,947 |

|

|

Royal Bank of Scotland Group PLC 9.118% 3/31/49 |

A1 |

|

3,750 |

3,906 |

|

|

Summit Bancorp 8.625% 12/10/02 |

A3 |

|

5,500 |

5,640 |

|

|

Union Planters Corp. 6.75% 11/1/05 |

Baa2 |

|

3,000 |

2,887 |

|

|

Nonconvertible Bonds - continued |

|||||

|

Moody's Ratings (unaudited) (a) |

Principal Amount (000s) |

Value (Note 1) (000s) |

|||

|

FINANCE - continued |

|||||

|

Banks - continued |

|||||

|

Union Planters National Bank 6.81% 8/20/01 |

A3 |

|

$ 4,000 |

$ 3,996 |

|

|

Zions Bancorp 8.625% 10/15/02 |

Baa1 |

|

5,000 |

5,105 |

|

|

|

114,069 |

||||

|

Credit & Other Finance - 6.1% |

|||||

|

Abbey National Capital Trust I 8.963% 12/29/49 (d) |

Aa3 |

|

2,850 |

2,839 |

|

|

Associates Corp. of North America: |

|

|

|

|

|

|

6% 4/15/03 |

A1 |

|

5,500 |

5,379 |

|

|

6% 7/15/05 |

A1 |

|

9,500 |

9,103 |

|

|

Bell Atlantic Financial Service, Inc. 7.6% 3/15/07 |

A1 |

|

3,200 |

3,262 |

|

|

CIT Group, Inc. 5.5% 2/15/04 |

A1 |

|

2,240 |

2,105 |

|

|

Citigroup, Inc. 7.25% 10/1/10 |

Aa3 |

|

9,900 |

9,822 |

|

|

Daimler-Chrysler NA Holding Corp. 6.59% 6/18/02 |

A1 |

|

1,250 |

1,242 |

|

|

ERP Operating LP: |

|

|

|

|

|

|

6.55% 11/15/01 |

A3 |

|

1,900 |

1,885 |

|

|

7.1% 6/23/04 |

A3 |

|

4,000 |

3,953 |

|

|

First Security Capital I 8.41% 12/15/26 |

A3 |

|

1,400 |

1,283 |

|

|

Ford Motor Credit Co. 7.875% 6/15/10 |

A2 |

|

6,550 |

6,568 |

|

|

General Motors Acceptance Corp.: |

|

|

|

|

|

|

7.5% 7/15/05 |

A2 |

|

3,000 |

3,027 |

|

|

7.625% 6/15/04 |

A2 |

|

6,800 |

6,909 |

|

|

7.75% 1/19/10 |

A2 |

|

4,600 |

4,617 |

|

|

GS Escrow Corp. 7.125% 8/1/05 |

Ba1 |

|

2,005 |

1,839 |

|

|

Household Finance Corp. 8% 5/9/05 |

A2 |

|

6,800 |

6,954 |

|

|

HSBC Capital Funding LP: |

|

|

|

|

|

|

9.547% 12/31/49 (b)(c) |

A1 |

|

8,400 |

8,837 |

|

|

10.176% 12/31/49 (b)(c) |

A1 |

|

3,120 |

3,414 |

|

|

Newcourt Credit Group, Inc. 6.875% 2/16/05 |

A1 |

|

4,330 |

4,183 |

|

|

Qwest Capital Funding, Inc.: |

|

|

|

|

|

|

7.75% 8/15/06 (c) |

Baa1 |

|

4,500 |

4,563 |

|

|

7.9% 8/15/10 (c) |

Baa1 |

|

3,700 |

3,754 |

|

|

Sprint Capital Corp.: |

|

|

|

|

|

|

5.7% 11/15/03 |

Baa1 |

|

4,800 |

4,593 |

|

|

5.875% 5/1/04 |

Baa1 |

|

4,405 |

4,193 |

|

|

6.875% 11/15/28 |

Baa1 |

|

10,005 |

8,173 |

|

|

Trizec Finance Ltd. yankee 10.875% 10/15/05 |

Baa3 |

|

2,445 |

2,469 |

|

|

TXU Eastern Funding 6.75% 5/15/09 |

Baa1 |

|

3,980 |

3,583 |

|

|

Nonconvertible Bonds - continued |

|||||

|

Moody's Ratings (unaudited) (a) |

Principal Amount (000s) |

Value (Note 1) (000s) |

|||

|

FINANCE - continued |

|||||

|

Credit & Other Finance - continued |

|||||

|

U.S. West Capital Funding, Inc.: |

|

|

|

|

|

|

6.5% 11/15/18 |

Baa1 |

|

$ 3,355 |

$ 2,927 |

|

|

6.875% 7/15/28 |

Baa1 |

|

2,450 |

2,152 |

|

|

UBS Preferred Funding Trust 1 8.622% 12/29/49 |

Aa2 |

|

5,400 |

5,454 |

|

|

Unicredito Italiano Capital Trust II yankee 9.2% 10/29/49 (b)(c) |

A1 |

|

2,400 |

2,385 |

|

|

Unilever Capital Corp. 6.875% 11/1/05 |

A1 |

|

10,000 |

9,947 |

|

|

|

141,414 |

||||

|

Insurance - 0.3% |

|||||

|

Executive Risk Capital Trust 8.675% 2/1/27 |

Baa3 |

|

7,500 |

7,134 |

|

|

Savings & Loans - 0.3% |

|||||

|

H.F. Ahmanson & Co. 7.875% 9/1/04 |

Baa1 |

|

2,600 |

2,625 |

|

|

Long Island Savings Bank FSB 6.2% 4/2/01 |

Baa3 |

|

3,550 |

3,526 |

|

|

|

6,151 |

||||

|

Securities Industry - 0.1% |

|||||

|

Amvescap PLC yankee 6.6% 5/15/05 |

A2 |

|

3,000 |

2,867 |

|

|

TOTAL FINANCE |

271,635 |

||||

|

INDUSTRIAL MACHINERY & EQUIPMENT - 0.2% |

|||||

|

Tyco International Group SA yankee 6.875% 1/15/29 |

Baa1 |

|

6,000 |

5,232 |

|

|

MEDIA & LEISURE - 3.0% |

|||||

|

Broadcasting - 1.8% |

|||||

|

British Sky Broadcasting Group PLC 8.2% 7/15/09 |

Baa3 |

|

10,750 |

9,953 |

|

|

Continental Cablevision, Inc. 8.3% 5/15/06 |

A2 |

|

3,190 |

3,267 |

|

|

Hearst-Argyle Television, Inc. 7% 1/15/18 |

Baa3 |

|

4,800 |

4,148 |

|

|

TCI Communications, Inc. 9.8% 2/1/12 |

A2 |

|

8,355 |

9,251 |

|

|

TCI Communications Financing III 9.65% 3/31/27 |

A3 |

|

4,500 |

4,786 |

|

|

Time Warner, Inc. 9.125% 1/15/13 |

Baa3 |

|

2,000 |

2,242 |

|

|

USA Networks, Inc./USANi LLC 6.75% 11/15/05 |

Baa3 |

|

7,500 |

7,307 |

|

|

|

40,954 |

||||

|

Publishing - 1.2% |

|||||

|

News America Holdings, Inc. 8% 10/17/16 |

Baa3 |

|

1,000 |

950 |

|

|

Nonconvertible Bonds - continued |

|||||

|

Moody's Ratings (unaudited) (a) |

Principal Amount (000s) |

Value (Note 1) (000s) |

|||

|

MEDIA & LEISURE - continued |

|||||

|

Publishing - continued |

|||||

|

News America, Inc.: |

|

|

|

|

|

|

7.125% 4/8/28 |

Baa3 |

|

$ 7,901 |

$ 6,562 |

|

|

7.3% 4/30/28 |

Baa3 |

|

5,235 |

4,442 |

|

|

Time Warner Entertainment Co. LP: |

|

|

|

|

|

|

8.375% 7/15/33 |

Baa2 |

|

7,300 |

7,600 |

|

|

9.625% 5/1/02 |

Baa2 |

|

8,000 |

8,295 |

|

|

|

27,849 |

||||

|

TOTAL MEDIA & LEISURE |

68,803 |

||||

|

NONDURABLES - 0.7% |

|||||

|

Beverages - 0.2% |

|||||

|

Seagram JE & Sons, Inc. 6.625% 12/15/05 |

Baa3 |

|

5,130 |

5,165 |

|

|

Foods - 0.3% |

|||||

|

ConAgra Foods, Inc. 7.125% 10/1/26 |

Baa1 |

|

5,790 |

5,548 |

|

|

Tobacco - 0.2% |

|||||

|

RJ Reynolds Tobacco Holdings, Inc. 7.375% 5/15/03 |

Baa2 |

|

5,500 |

5,205 |

|

|

TOTAL NONDURABLES |

15,918 |

||||

|

RETAIL & WHOLESALE - 0.3% |

|||||

|

General Merchandise Stores - 0.3% |

|||||

|

Federated Department Stores, Inc. 8.5% 6/15/03 |

Baa1 |

|

7,945 |

7,889 |

|

|

TECHNOLOGY - 0.9% |

|||||

|

Computers & Office Equipment - 0.9% |

|||||

|

Comdisco, Inc.: |

|

|

|

|

|

|

5.95% 4/30/02 |

Baa2 |

|

6,000 |

4,380 |

|

|

6.375% 11/30/01 |

Baa2 |

|

16,000 |

12,640 |

|

|

7.25% 9/1/02 |

Baa2 |

|

4,300 |

3,139 |

|

|

|

20,159 |

||||

|

Nonconvertible Bonds - continued |

|||||

|

Moody's Ratings (unaudited) (a) |

Principal Amount (000s) |

Value (Note 1) (000s) |

|||

|

TRANSPORTATION - 1.0% |

|||||

|

Air Transportation - 0.1% |

|||||

|

Continental Airlines, Inc. pass thru trust certificates: |

|

|

|

|

|

|

7.434% 3/15/06 |

Baa1 |

|

$ 1,735 |

$ 1,702 |

|

|

7.73% 9/15/12 |

Baa1 |

|

639 |

624 |

|

|

|

2,326 |

||||

|

Railroads - 0.9% |

|||||

|

Burlington Northern Santa Fe Corp. 6.53% 7/15/37 |

Baa2 |

|

10,000 |

9,825 |

|

|

Norfolk Southern Corp. 7.05% 5/1/37 |

Baa1 |

|

9,930 |

9,864 |

|

|

|

19,689 |

||||

|

TOTAL TRANSPORTATION |

22,015 |

||||

|

UTILITIES - 5.0% |

|||||

|

Electric Utility - 1.9% |

|||||

|

Avon Energy Partners Holdings: |

|

|

|

|

|

|

6.46% 3/4/08 (c) |

Baa2 |

|

7,200 |

6,495 |

|

|

7.05% 12/11/07 (c) |

Baa2 |

|

8,000 |

7,485 |

|

|

Dominion Resources, Inc.: |

|

|

|

|

|

|

7.6% 7/15/03 |

Baa1 |

|

2,900 |

2,938 |

|

|

8.125% 6/15/10 |

Baa1 |

|

1,535 |

1,583 |

|

|

DR Investments UK PLC yankee 7.1% 5/15/02 (c) |

A2 |

|

8,000 |

7,959 |

|

|

Illinois Power Co. 7.5% 6/15/09 |

Baa1 |

|

5,000 |

4,949 |

|

|

Israel Electric Corp. Ltd.: |

|

|

|

|

|

|

7.75% 12/15/27 (c) |

A3 |

|

10,790 |

9,173 |

|

|

yankee 7.25% 12/15/06 (c) |

A3 |

|

2,000 |

1,871 |

|

|

Texas Utilities Co. 6.375% 1/1/08 |

Baa3 |

|

1,010 |

919 |

|

|

|

43,372 |

||||

|

Gas - 0.4% |

|||||

|

CMS Panhandle Holding Co. 6.125% 3/15/04 |

Baa3 |

|

4,100 |

3,868 |

|

|

Reliant Energy Resources Corp. 8.125% 7/15/05 (c) |

Baa1 |

|

3,000 |

3,036 |

|

|

Sempra Energy 7.95% 3/1/10 |

A2 |

|

2,115 |

2,134 |

|

|

|

9,038 |

||||

|

Telephone Services - 2.7% |

|||||

|

Cable & Wireless Optus Ltd.: |

|

|

|

|

|

|

8% 6/22/10 (c) |

Baa1 |

|

2,400 |

2,478 |

|

|

8.125% 6/15/09 (c) |

Baa1 |

|

11,000 |

11,418 |

|

|

Nonconvertible Bonds - continued |

|||||

|

Moody's Ratings (unaudited) (a) |

Principal Amount (000s) |

Value (Note 1) (000s) |

|||

|

UTILITIES - continued |

|||||

|

Telephone Services - continued |

|||||

|

Deutsche Telekom International Finance BV 8.25% 6/15/30 |

A2 |

|

$ 2,690 |

$ 2,745 |

|

|

Telecomunicaciones de Puerto Rico, Inc. 6.65% 5/15/06 |

Baa2 |

|

5,395 |

5,127 |

|

|

Telefonica Europe BV 8.25% 9/15/30 |

A2 |

|

4,050 |

4,170 |

|

|

Teleglobe Canada, Inc.: |

|

|

|

|

|

|

7.2% 7/20/09 |

Baa1 |

|

9,844 |

9,435 |

|

|

7.7% 7/20/29 |

Baa1 |

|

7,223 |

6,815 |

|

|

WorldCom, Inc.: |

|

|

|

|

|

|

6.95% 8/15/28 |

A3 |

|

12,560 |

11,038 |

|

|

7.75% 4/1/07 |

A3 |

|

1,750 |

1,771 |

|

|

8.875% 1/15/06 |

A3 |

|

8,854 |

9,136 |

|

|

|

64,133 |

||||

|

TOTAL UTILITIES |

116,543 |

||||

|

TOTAL NONCONVERTIBLE BONDS (Cost $645,707) |

626,885 |

||||

|

U.S. Government and Government Agency Obligations - 20.1% |

|||||

|

|

|||||

|

U.S. Government Agency Obligations - 6.4% |

|||||

|

Fannie Mae: |

|

|

|

|

|

|

6.5% 4/29/09 |

Aaa |

|

20,550 |

19,568 |

|

|

7% 7/15/05 |

Aaa |

|

19,285 |

19,650 |

|

|

7.125% 6/15/10 |

Aaa |

|

7,810 |

8,046 |

|

|

7.25% 1/15/10 |

Aaa |

|

20,750 |

21,509 |

|

|

Federal Home Loan Bank 6.75% 2/1/02 |

Aaa |

|

12,140 |

12,178 |

|

|

Financing Corp. - coupon STRIPS 0% 3/7/05 |

Aaa |

|

11,375 |

8,586 |

|

|

Freddie Mac: |

|

|

|

|

|

|

6.45% 4/29/09 |

Aaa |

|

11,000 |

10,440 |

|

|

6.75% 3/15/31 |

Aaa |

|

25,000 |

24,945 |

|

|

6.875% 1/15/05 |

Aaa |

|

5,610 |

5,682 |

|

|

7% 7/15/05 |

Aaa |

|

18,175 |

18,516 |

|

|

TOTAL U.S. GOVERNMENT AGENCY OBLIGATIONS |

149,120 |

||||

|

U.S. Treasury Obligations - 13.7% |

|||||

|

U.S. Treasury Bonds: |

|

|

|

|

|

|

6.125% 8/15/29 |

Aaa |

|

97,760 |

101,242 |

|

|

U.S. Government and Government Agency Obligations - continued |

|||||

|

Moody's Ratings (unaudited) (a) |

Principal Amount (000s) |

Value (Note 1) (000s) |

|||

|

U.S. Treasury Obligations - continued |

|||||

|

U.S. Treasury Bonds: - continued |

|

|

|

|

|

|

8% 11/15/21 |

Aaa |

|

$ 37,390 |

$ 46,212 |

|

|

8.75% 5/15/17 |

Aaa |

|

4,140 |

5,319 |

|

|

8.875% 8/15/17 |

Aaa |

|

20,695 |

26,904 |

|

|

9.875% 11/15/15 |

Aaa |

|

5,230 |

7,217 |

|

|

12% 8/15/13 |

Aaa |

|

33,400 |

45,648 |

|

|

14% 11/15/11 |

Aaa |

|

4,615 |

6,457 |

|

|

U.S. Treasury Notes: |

|

|

|

|

|

|

5.625% 9/30/01 |

Aaa |

|

15,100 |

15,003 |

|

|

6.5% 5/31/02 |

Aaa |

|

37,080 |

37,300 |

|

|

7% 7/15/06 |

Aaa |

|

4,850 |

5,113 |

|

|

U.S. Treasury Notes - Principal Strips 0% 5/15/02 |

Aaa |

|

22,950 |

20,923 |

|

|

TOTAL U.S. TREASURY OBLIGATIONS |

317,338 |

||||

|

TOTAL U.S. GOVERNMENT AND (Cost $461,339) |

466,458 |

||||

|

U.S. Government Agency - Mortgage Securities - 35.3% |

|||||

|

|

|||||

|

Fannie Mae - 30.5% |

|||||

|

5.5% 2/1/11 to 5/1/14 |

Aaa |

|

15,485 |

14,690 |

|

|

6% 3/1/11 to 2/1/29 |

Aaa |

|

74,651 |

70,928 |

|

|

6.5% 8/1/25 to 11/1/28 |

Aaa |

|

184,429 |

177,463 |

|

|

7% 7/1/22 to 2/1/30 |

Aaa |

|

74,763 |

73,415 |

|

|

7.5% 6/1/25 to 11/1/30 |

Aaa |

|

230,900 |

230,622 |

|

|

8% 3/1/24 to 10/1/30 |

Aaa |

|

135,822 |

137,497 |

|

|

9.5% 1/1/17 to 2/1/25 |

Aaa |

|

2,189 |

2,310 |

|

|

12.5% 7/1/11 to 7/1/15 |

Aaa |

|

137 |

154 |

|

|

TOTAL FANNIE MAE |

707,079 |

||||

|

Freddie Mac - 2.2% |

|||||

|

7.5% 11/1/30 |

Aaa |

|

45,000 |

44,972 |

|

|

8.5% 9/1/22 to 9/1/27 |

Aaa |

|

5,078 |

5,202 |

|

|

TOTAL FREDDIE MAC |

50,174 |

||||

|

Government National Mortgage Association - 2.6% |

|||||

|

6% 10/15/08 to 5/15/09 |

Aaa |

|

4,014 |

3,921 |

|

|

U.S. Government Agency - Mortgage Securities - continued |

|||||

|

Moody's Ratings (unaudited) (a) |

Principal Amount (000s) |

Value (Note 1) (000s) |

|||

|

Government National Mortgage Association - continued |

|||||

|

6.5% 3/15/26 to 12/15/28 |

Aaa |

|

$ 35,643 |

$ 34,406 |

|

|

7% 1/15/26 to 10/15/28 |

Aaa |

|

391 |

386 |

|

|

7.5% 10/15/05 to 8/15/28 |

Aaa |

|

19,801 |

19,907 |

|

|

8% 9/15/24 to 10/15/25 |

Aaa |

|

675 |

686 |

|

|

9% 12/15/19 to 4/15/23 |

Aaa |

|

35 |

36 |

|

|

TOTAL GOVERNMENT NATIONAL MORTGAGE ASSOCIATION |

59,342 |

||||

|

TOTAL U.S. GOVERNMENT AGENCY - MORTGAGE SECURITIES (Cost $824,801) |

816,595 |

||||

|

Asset-Backed Securities - 2.9% |

|||||

|

|

|||||

|

American Express Credit Account Master Trust 6.1% 12/15/06 |

A1 |

|

4,600 |

4,488 |

|

|

Capita Equipment Receivables Trust 6.48% 10/15/06 |

Baa2 |

|

4,700 |

4,599 |

|

|

Discover Card Master Trust I 5.85% 11/16/04 |

A2 |

|

5,000 |

4,934 |

|

|

Ford Credit Auto Owner Trust: |

|

|

|

|

|

|

6.2% 12/15/02 |

Aa2 |

|

4,050 |

4,014 |

|

|

6.4% 12/15/02 |

Aa2 |

|

2,370 |

2,358 |

|

|

7.03% 11/15/03 |

Aaa |

|

1,119 |

1,128 |

|

|

JCPenney Master Credit Card Trust 5.5% 6/15/07 |

Aaa |

|

18,000 |

17,370 |

|

|

Key Auto Finance Trust: |

|

|

|

|

|

|

6.3% 10/15/03 |

A2 |

|

468 |

465 |

|

|

6.65% 10/15/03 |

Baa3 |

|

322 |

321 |

|

|

Premier Auto Trust 5.59% 2/9/04 |

Aaa |

|

16,000 |

15,710 |

|

|

Sears Credit Account Master Trust II: |

|

|

|

|

|

|

6.75% 9/16/09 |

Aaa |

|

7,720 |

7,702 |

|

|

7.5% 11/15/07 |

A2 |

|

3,950 |

4,014 |

|

|

TOTAL ASSET-BACKED SECURITIES (Cost $68,063) |

67,103 |

||||

|

Collateralized Mortgage Obligations - 0.4% |

|||||

|

|

|||||

|

U.S. Government Agency - 0.4% |

|||||

|

Freddie Mac REMIC planned amortization class

Series 1669 Class H, 6.5% 7/15/23 |

Aaa |

|

10,122 |

9,660 |

|

|

Commercial Mortgage Securities - 3.2% |

|||||

|

Moody's Ratings (unaudited) (a) |

Principal Amount (000s) |

Value (Note 1) (000s) |

|||

|

CS First Boston Mortgage Securities Corp.: |

|

|

|

|

|

|

Series 1997-C2 Class D, 7.27% 1/17/35 |

Baa2 |

|

$ 5,740 |

$ 5,461 |

|

|

Series 1998-FL1: |

|

|

|

|

|

|

Class D, 7.1188% 12/10/00 (c)(d) |

Aa1 |

|

6,600 |

6,599 |

|

|

Class E, 7.4688% 1/10/13 (c)(d) |

Baa1 |

|

12,080 |

12,294 |

|

|

Series 2000-C1 Class A2, 7.545% 4/15/62 |

AAA |

|

3,700 |

3,793 |

|

|

DLJ Commercial Mortgage Corp. Series 2000-CF1 Class A1B, 7.62% 5/10/10 |

Aaa |

|

10,000 |

10,303 |

|

|

Equitable Life Assurance Society of the United States Series 174: |

|

|

|

|

|

|

Class B1, 7.33% 5/15/06 (c) |

Aa2 |

|

3,400 |

3,434 |

|

|

Class C1, 7.52% 5/15/06 (c) |

A2 |

|

3,500 |

3,511 |

|

|

GS Mortgage Securities Corp. II Series 1998-GLII Class E, 6.9698% 4/13/31 (c)(d) |

Baa3 |

|

5,000 |

4,533 |

|

|

Nomura Asset Securities Corp. Series 1998-D6 Class A1C, 6.69% 3/17/28 |

Aaa |

|

5,000 |

4,787 |

|

|

Prudential Securities Secured Financing Corp. Series 2000-C1 Class A2, 7.727% 2/15/10 |

Aaa |

|

10,000 |

10,431 |

|

|

Thirteen Affiliates of General Growth Properties, Inc. sequential pay Series 1 Class A2, 6.602% 12/15/10 (c) |

Aaa |

|

9,000 |

8,859 |

|

|

TOTAL COMMERCIAL MORTGAGE SECURITIES (Cost $73,495) |

74,005 |

||||

|

Foreign Government and Government Agency Obligations (e) - 1.4% |

|||||

|

|

|||||

|

Korean Republic yankee 8.75% 4/15/03 |

Baa2 |

|

2,345 |

2,397 |

|

|

Quebec Province: |

|

|

|

|

|

|

yankee: |

|

|

|

|

|

|

7.125% 2/9/24 |

A2 |

|

810 |

789 |

|

|

7.5% 7/15/23 |

A2 |

|

2,810 |

2,855 |

|

|

7% 1/30/07 |

A2 |

|

5,000 |

4,988 |

|

|

7.5% 9/15/29 |

A2 |

|

9,420 |

9,550 |

|

|

United Mexican States: |

|

|

|

|

|

|

8.5% 2/1/06 |

Baa3 |

|

4,025 |

4,013 |

|

|

9.875% 2/1/10 |

Baa3 |

|

7,860 |

8,155 |

|

|

TOTAL FOREIGN GOVERNMENT AND (Cost $33,136) |

32,747 |

||||

|

Supranational Obligations - 0.5% |

|||||

|

Moody's Ratings (unaudited) (a) |

Principal Amount (000s) |

Value (Note 1) (000s) |

|||

|

Inter-American Development Bank yankee |

Aaa |

|

$ 12,000 |

$ 11,704 |

|

|

Commercial Paper - 1.1% |

||||

|

|

||||

|

British Telecom PLC 6.8525% 10/9/01 (c)(d) |

|

25,000 |

24,954 |

|

|

Cash Equivalents - 11.1% |

|||

|

Maturity Amount (000s) |

|

||

|

Investments in repurchase agreements (U.S. Government Obligations), in a joint trading account at 6.62%, dated 10/31/00 due

11/1/00 |

$ 256,531 |

256,484 |

|

|

|

2,386,595 |

||

|

TOTAL INVESTMENT PORTFOLIO - 103.1% (Cost $2,409,691) |

2,386,595 |

||

|

NET OTHER ASSETS - (3.1)% |

(71,435) |

||

|

NET ASSETS - 100% |

$ 2,315,160 |

||

|

Legend |

|

(a) S&P credit ratings are used in the absence of a rating by Moody's Investors Service, Inc. |

|

(b) Debt obligation initially issued at one coupon which converts to a higher coupon at a specified date. The rate shown is the rate at period end. |

|

(c) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the period end, the value of these securities amounted to $151,978,000 or 6.6% of net assets. |

|

(d) The coupon rate shown on floating or adjustable rate securities represents the rate at period end. |

|

(e) For foreign government obligations not individually rated by S&P or Moody's, the ratings listed have been assigned by FMR, the fund's investment adviser, based principally on S&P and Moody's ratings of the sovereign credit of the issuing government. |

|

Other Information |

|

The composition of long-term debt holdings as a percentage of total value of investments in securities, is as follows (ratings are unaudited): |

|

Moody's Ratings |

S&P Ratings |

|||

|

Aaa, Aa, A |

70.6% |

|

AAA, AA, A |

63.4% |

|

Baa |

17.4% |

|

BBB |

15.4% |

|

Ba |

0.1% |

|

BB |

1.3% |

|

B |

0.0% |

|

B |

0.0% |

|

Caa |

0.0% |

|

CCC |

0.0% |

|

Ca, C |

0.0% |

|

CC, C |

0.0% |

|

|

|

|

D |

0.0% |

|

Income Tax Information |

|

At October 31, 2000, the aggregate cost of investment securities for income tax purposes was $2,409,765,000. Net unrealized depreciation aggregated $23,170,000, of which $16,078,000 related to appreciated investment securities and $39,248,000 related to depreciated investment securities. |

|

At April 30, 2000, the fund had a capital loss carryforward of approximately $24,617,000 all of which will expire on April 30, 2008. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Statement of Assets and Liabilities

|

Amounts in thousands (except per-share amount) |

October 31, 2000 (Unaudited) |

|

|

Assets |

|

|

|

Investment in securities, at value (including repurchase agreements of $256,484) (cost $2,409,691) - |

|

$ 2,386,595 |

|

Receivable for investments sold |

|

37,160 |

|

Receivable for fund shares sold |

|

2,503 |

|

Interest receivable |

|

27,226 |

|

Total assets |

|

2,453,484 |

|

Liabilities |

|

|

|

Payable for investments purchased |

$ 102,278 |

|

|

Payable for fund shares redeemed |

2,077 |

|

|

Distributions payable |

680 |

|

|

Accrued management fee |

812 |

|

|

Other payables and accrued expenses |

590 |

|

|

Collateral on securities loaned, at value |

31,887 |

|

|

Total liabilities |

|

138,324 |

|

Net Assets |

|

$ 2,315,160 |

|

Net Assets consist of: |

|

|

|

Paid in capital |

|

$ 2,399,566 |

|

Distributions in excess of net investment income |

|

(49) |

|

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions |

|

(61,261) |

|

Net unrealized appreciation (depreciation) on investments |

|

(23,096) |

|

Net Assets, for 331,040 shares outstanding |

|

$ 2,315,160 |

|

Net Asset Value, offering price and redemption price |

|

$6.99 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Statements - continued

Statement of Operations

|

Amounts in thousands |

Six months ended October 31, 2000 (Unaudited) |

|

|

Investment Income Interest |

|

$ 77,570 |

|

Security lending |

|

27 |

|

Total Income |

|

77,597 |

|

Expenses |

|

|

|

Management fee |

$ 4,625 |

|

|

Transfer agent fees |

2,333 |

|

|

Accounting and security lending fees |

226 |

|

|

Non-interested trustees' compensation |

4 |

|

|

Custodian fees and expenses |

63 |

|

|

Registration fees |

53 |

|

|

Audit |

18 |

|

|

Legal |

7 |

|

|

Miscellaneous |

1 |

|

|

Total expenses before reductions |

7,330 |

|

|

Expense reductions |

(116) |

7,214 |

|

Net investment income |

|

70,383 |

|

Realized and Unrealized Gain (Loss) Net realized gain (loss) on investment securities |

|

(14,088) |

|

Change in net unrealized appreciation (depreciation) |

|

55,576 |

|

Net gain (loss) |

|

41,488 |

|

Net increase (decrease) in net assets resulting |

|

$ 111,871 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Statements - continued

Statement of Changes in Net Assets

|

Amounts in thousands |

Six months ended

October 31, 2000 |

Year ended |

|

Increase (Decrease) in Net Assets |

|

|

|

Operations |

$ 70,383 |

$ 130,546 |

|

Net realized gain (loss) |

(14,088) |

(43,530) |

|

Change in net unrealized appreciation (depreciation) |

55,576 |

(76,412) |

|

Net increase (decrease) in net assets resulting |

111,871 |

10,604 |

|

Distributions to shareholders from net investment income |

(71,058) |

(131,083) |

|

Share transactions |

476,079 |

923,981 |

|

Reinvestment of distributions |

67,056 |

122,760 |

|

Cost of shares redeemed |

(399,174) |

(1,098,803) |

|

Net increase (decrease) in net assets resulting |

143,961 |

(52,062) |

|

Total increase (decrease) in net assets |

184,774 |

(172,541) |

|

Net Assets |

|

|

|

Beginning of period |

2,130,386 |

2,302,927 |

|

End of period (including (over) under distribution of net investment income of $(49) and $626, respectively) |

$ 2,315,160 |

$ 2,130,386 |

|

Other Information Shares |

|

|

|

Sold |

68,617 |

132,691 |

|

Issued in reinvestment of distributions |

9,655 |

17,645 |

|

Redeemed |

(57,722) |

(157,384) |

|

Net increase (decrease) |

20,550 |

(7,048) |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights

|

|

Six months ended October 31, 2000 |

Years ended April 30, |

||||

|

|

(Unaudited) |

2000 |

1999 |

1998 |

1997 |

1996 |

|

Selected Per-Share Data |

|

|

|

|

|

|

|

Net asset value, beginning of period |

$ 6.860 |

$ 7.250 |

$ 7.300 |

$ 7.020 |

$ 7.040 |

$ 7.010 |

|

Income from Invest- |

.224 D |

.433 D |

.423 D |

.441 D |

.460 D |

.484 |

|

Net realized and unrealized gain (loss) |

.132 |

(.388) |

(.022) |

.282 |

(.020) |

.047 |

|

Total from investment operations |

.356 |

.045 |

.401 |

.723 |

.440 |

.531 |

|

Less Distributions |

|

|

|

|

|

|

|

From net investment income |

(.226) |

(.435) |

(.410) |

(.443) |

(.460) |

(.471) |

|

From net realized gain |

- |

- |

(.041) |

- |

- |

- |

|

In excess of net realized gain |

- |

- |

- |

- |

- |

(.030) |

|

Total distributions |

(.226) |

(.435) |

(.451) |

(.443) |

(.460) |

(.501) |

|

Net asset value, end of period |

$ 6.990 |

$ 6.860 |

$ 7.250 |

$ 7.300 |

$ 7.020 |

$ 7.040 |

|

Total Return B, C |

5.26% |

0.71% |

5.58% |

10.54% |

6.42% |

7.62% |

|

Ratios and Supplemental Data |

|

|

|

|

|

|

|

Net assets, end of period (in millions) |

$ 2,315 |

$ 2,130 |

$ 2,303 |

$ 1,909 |

$ 1,442 |

$ 1,358 |

|

Ratio of expenses to average net assets |

.67% A |

.70% |

.71% |

.72% |

.76% |

.77% |

|

Ratio of expenses to average net assets after expense reductions |

.66% A, E |

.69% E |

.70% E |

.71% E |

.75% E |

.76% E |

|

Ratio of net invest- |

6.42% A |

6.21% |

5.77% |

6.12% |

6.53% |

6.58% |

|

Portfolio turnover rate |

156% A |

115% |

167% |

207% |

120% |

134% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C The total returns would have been lower had certain expenses not been reduced during the periods shown.

D Net investment income per share has been calculated based on average shares outstanding during the period.

E FMR or the fund has entered into varying arrangements with third parties who either paid or reduced a portion of the fund's expenses.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

For the period ended October 31, 2000 (Unaudited)

1. Significant Accounting Policies.

Fidelity Investment Grade Bond Fund (the fund) is a fund of Fidelity Fixed-Income Trust (the trust) and is authorized to issue an unlimited number of shares. The trust is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company organized as a Massachusetts business trust. The financial statements have been prepared in conformity with generally accepted accounting principles which require management to make certain estimates and assumptions at the date of the financial statements. The following summarizes the significant accounting policies of the fund:

Security Valuation. Securities are valued based upon a computerized matrix system and/or appraisals by a pricing service, both of which consider market transactions and dealer-supplied valuations. Securities (including restricted securities) for which market quotations are not readily available are valued at their fair value as determined in good faith under consistently applied procedures under the general supervision of the Board of Trustees. Short-term securities with remaining maturities of sixty days or less for which quotations are not readily available are valued at amortized cost or original cost plus accrued interest, both of which approximate current value. Investments in open-end investment companies are valued at their net asset value each business day.

Foreign Currency Translation. The accounting records of the fund are maintained in U.S. dollars. Investment securities and other assets and liabilities denominated in a foreign currency are translated into U.S. dollars at the prevailing rates of exchange at period end. Purchases and sales of securities, income receipts and expense payments are translated into U.S. dollars at the prevailing exchange rate on the respective dates of the transactions.

Net realized gains and losses on foreign currency transactions represent net gains and losses from sales and maturities of foreign currency contracts, disposition of foreign currencies, the difference between the amount of net investment income accrued and the U.S. dollar amount actually received, and gains and losses between trade and settlement date on purchases and sales of securities. The effects of changes in foreign currency exchange rates on investments in securities are included with the net realized and unrealized gain or loss on investment securities.

Income Taxes. As a qualified regulated investment company under Subchapter M of the Internal Revenue Code, the fund is not subject to income taxes to the extent that it distributes substantially all of its taxable income for its fiscal year. The schedule of investments includes information regarding income taxes under the caption "Income Tax Information."

Investment Income. Interest income, which includes accretion of original issue discount, is accrued as earned.

Semiannual Report

Notes to Financial Statements (Unaudited) - continued

1. Significant Accounting Policies - continued

Expenses. Most expenses of the trust can be directly attributed to a fund. Expenses which cannot be directly attributed are apportioned among the funds in the trust.

Distributions to Shareholders. Dividends are declared daily and paid monthly from net investment income. Distributions to shareholders from realized capital gains on investments, if any, are recorded on the ex-dividend date.

Income and capital gain distributions are determined in accordance with income tax regulations which may differ from generally accepted accounting principles. These differences, which may result in distribution reclassifications, are primarily due to differing treatments for paydown gains/losses on certain securities, market discount, capital loss carryforwards, and losses deferred due to wash sales and excise tax regulations.

Permanent book and tax basis differences relating to shareholder distributions will result in reclassifications to paid in capital. Distributions in excess of net investment income and accumulated undistributed net realized gain (loss) on investments and foreign currency transactions may include temporary book and tax basis differences which will reverse in a subsequent period. Any taxable income or gain remaining at fiscal year end is distributed in the following year.

Security Transactions. Security transactions are accounted for as of trade date. Gains and losses on securities sold are determined on the basis of identified cost.

2. Operating Policies.

Joint Trading Account. Pursuant to an Exemptive Order issued by the Securities and Exchange Commission, the fund, along with other affiliated entities of Fidelity Management & Research Company (FMR), may transfer uninvested cash balances into one or more joint trading accounts. These balances are invested in one or more repurchase agreements for U.S. Treasury or Federal Agency obligations.

Repurchase Agreements. The underlying U.S. Treasury, Federal Agency, or other obligations found to be satisfactory by FMR are transferred to an account of the fund, or to the Joint Trading Account, at a custodian bank. The securities are marked-to-market daily and maintained at a value at least equal to the principal amount of the repurchase agreement (including accrued interest). FMR, the fund's investment adviser, is responsible for determining that the value of the underlying securities remains in accordance with the market value requirements stated above.

Delayed Delivery Transactions. The fund may purchase or sell securities on a delayed delivery basis. Payment and delivery may take place after the customary settlement period for that security. The price of the underlying securities and the date when the securities will be delivered and paid for are fixed at the time the transaction is negotiated. The fund may receive compensation for interest forgone in the purchase of a delayed delivery security. With respect to purchase commitments, the fund identifies

Semiannual Report

Notes to Financial Statements (Unaudited) - continued

2. Operating Policies - continued

Delayed Delivery Transactions - continued

securities as segregated in its records with a value at least equal to the amount of the commitment. Losses may arise due to changes in the market value of the underlying securities or if the counterparty does not perform under the contract.

Restricted Securities. The fund is permitted to invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. At the end of the period, the fund had no investments in restricted securities (excluding 144A issues).

3. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities, aggregated $1,626,875,000 and $1,609,344,000, respectively, of which U.S. government and government agency obligations aggregated $1,246,328,000 and $1,246,240,000, respectively.

4. Fees and Other Transactions with Affiliates.

Management Fee. As the fund's investment adviser, FMR receives a monthly fee that is calculated on the basis of a group fee rate plus a fixed individual fund fee rate applied to the average net assets of the fund. The group fee rate is the weighted average of a series of rates and is based on the monthly average net assets of all the mutual funds advised by FMR. The rates ranged from .0920% to .3700% for the period. The annual individual fund fee rate is .30%. In the event that these rates were lower than the contractual rates in effect during the period, FMR voluntarily implemented the above rates, as they resulted in the same or a lower management fee. For the period, the management fee was equivalent to an annualized rate of .43% of average net assets.

Sub-Adviser Fee. FMR, on behalf of the fund, has entered into a sub-advisory agreement with Fidelity Investments Money Management, Inc. (FIMM), a wholly owned subsidiary of FMR. For its services, FIMM receives a fee from FMR of 50% of the management fee payable to FMR. The fee is paid prior to any voluntary expense reimbursements which may be in effect.

Transfer Agent Fees. Fidelity Service Company, Inc. (FSC), an affiliate of FMR, is the fund's transfer, dividend disbursing and shareholder servicing agent. FSC receives account fees and asset-based fees that vary according to account size and type of account. FSC pays for typesetting, printing and mailing of all shareholder reports, except proxy statements. For the period, the transfer agent fees were equivalent to an annualized rate of .21% of average net assets.

Semiannual Report

Notes to Financial Statements (Unaudited) - continued

4. Fees and Other Transactions with Affiliates - continued

Accounting and Security Lending Fees. FSC maintains the fund's accounting records and administers the security lending program. The security lending fee is based on the number and duration of lending transactions. The accounting fee is based on the level of average net assets for the month plus out-of-pocket expenses.

5. Security Lending.

The fund lends portfolio securities from time to time in order to earn additional income. The fund receives collateral in the form of U.S. Treasury obligations, letters of credit, and/or cash against the loaned securities, and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of the fund and any additional required collateral is delivered to the fund on the next business day. If the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, the fund could experience delays and costs in recovering the securities loaned or in gaining access to the collateral. At period end, the value of the securities loaned amounted to $31,262,000. The fund received cash collateral of $31,887,000 which was invested in cash equivalents.

6. Expense Reductions.

Through arrangements with the fund's custodian and transfer agent, credits realized as a result of uninvested cash balances were used to reduce a portion of the fund's expenses. During the period, the fund's custodian and transfer agent fees were reduced by $10,000 and $106,000, respectively, under these arrangements.

Semiannual Report

Fidelity offers several ways to conveniently manage your personal investments via your telephone or PC. You can access your account information, conduct trades and research your investments 24 hours a day.

By Phone

Fidelity Automated Service Telephone provides a single toll-free number to access account balances, positions, quotes and trading. It's easy to navigate the service, and on your first call, the system will help you create a personal identification number (PIN) for security.

(phone_graphic)Fidelity Automated

Service Telephone (FAST®)

1-800-544-5555

Press

1 For mutual fund and brokerage trading.

2 For quotes.*

3 For account balances and holdings.

4 To review orders and mutual

fund activity.

5 To change your PIN.

*0 To speak to a Fidelity representative.

By PC

Fidelity's web site on the Internet provides a wide range of information, including daily financial news, fund performance, interactive planning tools and news about Fidelity products and services.

(computer_graphic)Fidelity's Web Site

www.fidelity.com

If you are not currently on the Internet, call EarthLink Sprint at 1-800-288-2967, and be sure to ask for registration number SMD004 to receive a special Fidelity package that includes 30 days of free Internet access. EarthLink is North America's #1 independent Internet access provider.

(computer_graphic)

Fidelity On-line Xpress+®

Fidelity On-line Xpress+ software for Windows combines comprehensive portfolio management capabilities, securities trading and access to research and analysis tools . . . all on your desktop. Call Fidelity at 1-800-544-0240 or visit our web site for more information on how to manage your investments via your PC.

* When you call the quotes line, please remember that a fund's yield and return will vary and, except for money market funds, share price will also vary. This means that you may have a gain or loss when you sell your shares. There is no assurance that money market funds will be able to maintain a stable $1 share price; an investment in a money market fund is not insured or guaranteed by the U.S. government. Total returns are historical and include changes in share price, reinvestment of dividends and capital gains, and the effects of any sales charges.

Semiannual Report

Investment Adviser

Fidelity Management & Research Company

Boston, MA

Investment Sub-Advisers

Fidelity Management & Research

(U.K.) Inc.

Fidelity Management & Research

(Far East) Inc.

Fidelity Investments

Japan Limited

Fidelity Investments Money

Management, Inc.

Officers