|

|

|

|

|

Previous: FARMLAND INDUSTRIES INC, 424B3, 2000-10-17 |

Next: FIRST NATIONAL BANK OF OMAHA, 13F-HR, 2000-10-17 |

Spartan®

Fund

Annual Report

August 31, 2000

(2_fidelity_logos)(Registered_Trademark)

|

President's Message |

Ned Johnson on investing strategies. |

|

|

Performance |

How the fund has done over time. |

|

|

Fund Talk |

The manager's review of fund performance, strategy and outlook. |

|

|

Investment Changes |

A summary of major shifts in the fund's investments over the past six months. |

|

|

Investments |

A complete list of the fund's investments with their market values. |

|

|

Financial Statements |

Statements of assets and liabilities,

operations, and changes in net assets, |

|

|

Notes |

Notes to the financial statements. |

|

|

Report of Independent Accountants |

The auditors' opinion. |

|

|

Distributions |

|

|

|

Proxy Voting Results |

|

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

(Recycle graphic) This report is printed on recycled paper using soy-based inks.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

Mutual fund shares are not deposits or obligations of, or guaranteed by, any depository institution. Shares are not insured by the FDIC, the Federal Reserve Board, or any other agency, and are subject to investment risks, including possible loss of principal amount invested.

Neither the fund nor Fidelity Distributors Corporation is a bank.

For more information on any Fidelity fund, including charges and expenses, call 1-800-544-6666 for a free prospectus. Read it carefully before you invest or send money.

Annual Report

(photo_of_Edward_C_Johnson_3d)

Dear Shareholder:

A slowing U.S. economy triggered an equity market rally during the later stages of summer, boosting most major stock indexes back into positive territory for calendar year 2000. One notable exception, however, was the Dow Jones Industrial Average, which posted a negative return during that timeframe. Fixed-income markets - particularly Treasuries - continued their yearlong trend of strong performance, as nearly every bond sector outperformed the stock market on a year-to-date basis.

While it's impossible to predict the future direction of the markets with any degree of certainty, there are certain basic principles that can help investors plan for their future needs.

The longer your investment time frame, the less likely it is that you will be affected by short-term market volatility. A 10-year investment horizon appropriate for saving for a college education, for example, enables you to weather market cycles in a long-term fund, which may have a higher risk potential, but also has a higher potential rate of return.

An intermediate-length fund could make sense if your investment horizon is two to four years, while a short-term bond fund could be the right choice if you need your money in one or two years.

If your time horizon is less than a year, you might want to consider moving some of your bond investment into a money market fund. These funds seek income and a stable share price by investing in high-quality, short-term investments. Of course, it's important to remember that an investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although money market funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in these types of funds.

Finally, no matter what your time horizon or portfolio diversity, it makes good sense to follow a regular investment plan, investing a certain amount of money in a fund at the same time each month or quarter and periodically reviewing your overall portfolio. By doing so, you won't get caught up in the excitement of a rapidly rising market, nor will you buy all your shares at market highs. While this strategy - known as dollar cost averaging - won't assure a profit or protect you from a loss in a declining market, it should help you lower the average cost of your purchases. Of course, you should consider your financial ability to continue your purchases through periods of low price levels before undertaking such a strategy.

If you have questions, please call us at 1-800-544-6666, or visit our web site at www.fidelity.com. We are available 24 hours a day, seven days a week to provide you the information you need to make the investments that are right for you.

Best regards,

/s/Edward C. Johnson 3d

Edward C. Johnson 3d

Annual Report

There are several ways to evaluate a fund's historical performance. You can look at the total percentage change in value, the average annual percentage change or the growth of a hypothetical $10,000 investment. Total return reflects the change in the value of an investment, assuming reinvestment of the fund's dividend income and capital gains (the profits earned upon the sale of securities that have grown in value). You can also look at the fund's income, as reflected in the fund's yield, to measure performance. If Fidelity had not reimbursed certain fund expenses, the past five year and life of fund total returns would have been lower.

Cumulative Total Returns

|

Periods ended August 31, 2000 |

|

Past 1 |

Past 5 |

Life of |

|

Spartan MD Municipal Income |

|

6.53% |

31.16% |

47.34% |

|

LB Maryland 4 Plus Year Enhanced Municipal Bond |

|

6.17% |

31.82% |

n/a* |

|

Maryland Municipal Debt Funds Average |

|

4.90% |

26.75% |

n/a* |

Cumulative total returns show the fund's performance in percentage terms over a set period - in this case, one year, five years or since the fund started on April 22, 1993. For example, if you had invested $1,000 in a fund that had a 5% return over the past year, the value of your investment would be $1,050. You can compare the fund's returns to the performance of the Lehman Brothers Maryland 4 Plus Year Enhanced Municipal Bond Index - a market value-weighted index of Maryland investment-grade municipal bonds with maturities of four years or more. To measure how the fund's performance stacked up against its peers, you can compare it to the Maryland municipal debt funds average, which reflects the performance of mutual funds with similar objectives tracked by Lipper Inc. The past one year average represents a peer group of 38 mutual funds. These benchmarks include reinvested dividends and capital gains, if any, and exclude the effect of sales charges.

Average Annual Total Returns

|

Periods ended August 31, 2000 |

|

Past 1 |

Past 5 |

Life of Fund |

|

Spartan MD Municipal Income |

|

6.53% |

5.57% |

5.40% |

|

LB Maryland 4 Plus Year Enhanced Municipal Bond |

|

6.17% |

5.68% |

n/a* |

|

Maryland Municipal Debt Funds Average |

|

4.90% |

4.85% |

n/a* |

Average annual total returns take the fund's cumulative return and show you what would have happened if the fund had performed at a constant rate each year. (Note: Lipper calculates average annual total returns by annualizing each fund's total return, then taking an arithmetic average. This may produce a different figure than that obtained by averaging the cumulative total returns and annualizing the result.)

* Not available

Annual Report

Performance - continued

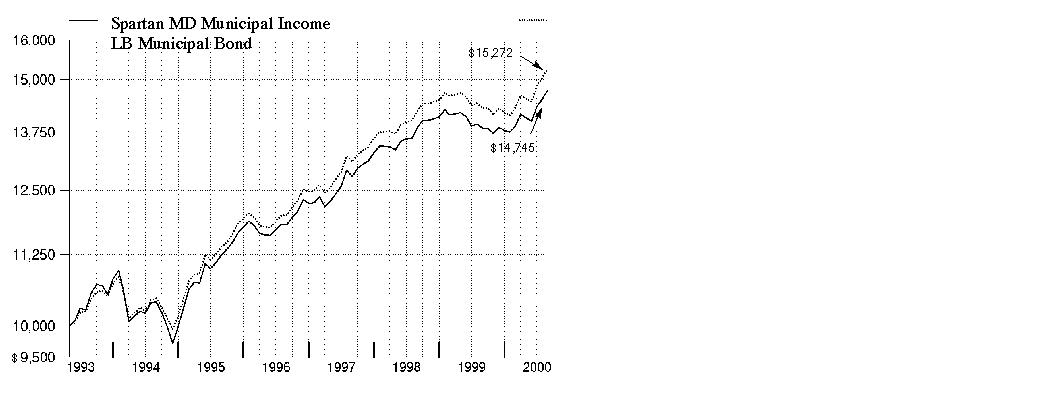

$10,000 Over Life of Fund

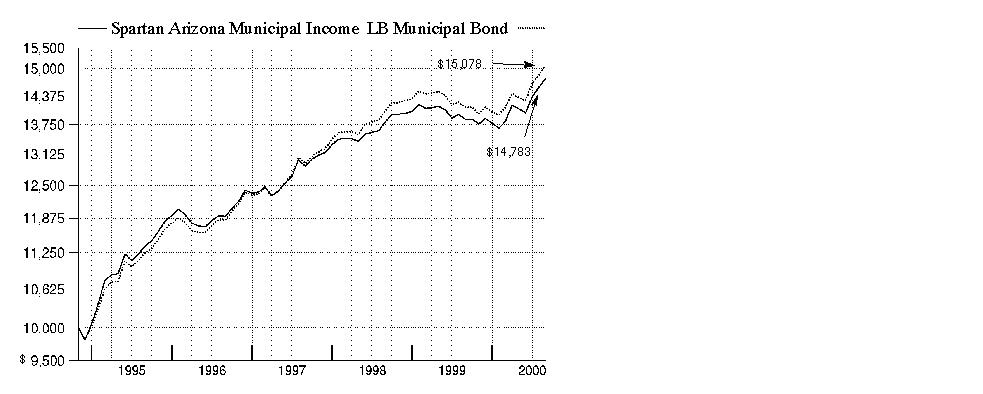

$10,000 Over Life of Fund: Let's say hypothetically that $10,000 was invested in Spartan Maryland Municipal Income Fund on April 30, 1993, shortly after the fund started. As the chart shows, by August 31, 2000, the value of the investment would have grown to $14,745 - a 47.45% increase on the initial investment. For comparison, look at how the Lehman Brothers Municipal Bond Index - a market-value oriented index of investment-grade municipal bonds with maturities of one year or more - did over the same period. With dividends and capital gains, if any, reinvested, the same $10,000 would have grown to $15,272 - a 52.72% increase.

Understanding

Performance

How a fund did yesterday is no guarantee of how it will do tomorrow. Bond prices, for example, generally move in the opposite direction of interest rates. In turn, the share price, return and yield of a fund that invests in bonds will vary. That means if you sell your shares during a market downturn, you might lose money. But if you can ride out the market's ups and downs, you may have a gain.

3Annual Report

Performance - continued

Total Return Components

|

|

|

Years ended August 31, |

||||

|

|

|

2000 |

1999 |

1998 |

1997 |

1996 |

|

Dividend returns |

|

4.94% |

4.21% |

4.69% |

4.89% |

5.02% |

|

Capital returns |

|

1.59% |

-4.36% |

3.74% |

3.28% |

0.10% |

|

Total returns |

|

6.53% |

-0.15% |

8.43% |

8.17% |

5.12% |

Total return components include both dividend returns and capital returns. A dividend return reflects the actual dividends paid by the fund. A capital return reflects both the amount paid by the fund to shareholders as capital gain distributions and changes in the fund's share price. Both returns assume the dividends or capital gains, if any, paid by the fund are reinvested.

Dividends and Yield

|

Periods ended August 31, 2000 |

Past 1 |

Past 6 |

Past 1 |

|

Dividends per share |

4.15¢ |

24.26¢ |

47.56¢ |

|

Annualized dividend rate |

4.78% |

4.80% |

4.77% |

|

30-day annualized yield |

4.68% |

- |

- |

|

30-day annualized tax-equivalent yield |

7.94% |

- |

- |

Dividends per share show the income paid by the fund for a set period. If you annualize this number, based on an average share price of $10.21 over the past one month, $10.02 over the past six months and $9.98 over the past one year, you can compare the fund's income over these three periods. The 30-day annualized yield is a standard formula for all bond funds based on the yields of the bonds in the fund, averaged over the past 30 days. This figure shows you the yield characteristics of the fund's investments at the end of the period. It also helps you compare funds from different companies on an equal basis. The tax-equivalent yield shows what you would have to earn on a taxable investment to equal the fund's tax-free yield, if you're in the 41.03% combined effective 2000 federal and state income tax bracket. The tax-equivalent yield also reflects that a portion of the fund's income was subject to state taxes, but does not reflect the payment of the federal alternative minimum tax, if applicable.

Annual Report

Market Recap

After struggling in the first half of the 12-month period ending August 31, 2000, municipal bonds roared back to life in the second half. At the period's outset, muni performance was tempered by a series of interest-rate hikes by the Federal Reserve Board. Munis also had to compete with record-setting equity performance and a strong rally in Treasuries. Beginning in February, however, bargain-hunting investors became attracted to the generally higher yields municipal bonds offered, and the muni market rallied. Demand continued to grow in March as equity markets tumbled. A number of investors, seeking to protect their gains in stocks, reinvested assets into the relative safety of muni bonds. But as demand grew, supply tapered off. Many municipal bond issuers, such as U.S. state and local governments, limited their issuance, partly because higher interest rates discouraged borrowing. The resulting supply/demand imbalance boosted municipal bond prices. The market received another lift in the summer of 2000 when it became apparent that the U.S. economy was slowing and the Fed bypassed opportunities to hike rates in June and August. For the overall 12-month period, the Lehman Brothers Municipal Bond Index - an index of over 35,000 investment-grade, fixed-rate, tax-exempt bonds - returned 6.77%. The overall taxable-bond market, as measured by the Lehman Brothers Aggregate Bond Index, gained 7.56% in the same time frame.

(Portfolio Manager photograph)

An interview with George Fischer, Portfolio Manager of Spartan Maryland Municipal Income Fund

Q. How did the fund perform, George?

A. For the 12-month period that ended August 31, 2000, the fund had a total return of 6.53%. To get a sense of how the fund did relative to its competitors, the Maryland municipal debt funds average returned 4.90% for the same 12-month period, according to Lipper Inc. Additionally, the Lehman Brothers Maryland 4 Plus Year Enhanced Municipal Bond Index returned 6.17%.

Q. After struggling last fall and winter, municipals rallied in the spring and summer of 2000. What was behind these changing conditions, and how did they affect the fund's performance?

A. When the period began, investors feared that the Federal Reserve Board would continue to raise interest rates in order to slow economic growth and curtail inflationary pressures. That forced bond yields higher and their prices, which move in the opposite direction, lower. In response, those worries and the fact that the Fed did raise rates on several occasions caused the fund's share price to fall. Since May, however, conditions have improved. Even though the Fed continued to raise interest rates in an effort to cool the economy and the stock market, municipal bond prices rose. That's primarily because investors began to anticipate that the Fed might be close to the end of its interest-rate hike cycle. Part of that optimism stemmed from several economic indicators that pointed to a slowdown in the economy. Those indicators, coupled with municipals' attractive prices and yields, helped them to rally in June, July and August. Against that backdrop, the fund's total return for the year reflects the combination of price gains or losses plus the income generated by its holdings during the period.

Annual Report

Fund Talk: The Manager's Overview - continued

Q. What helped the fund perform better than its peers during the past year?

A. A big factor was the fund's larger-than-average stake in premium coupon bonds - those that pay interest rates above prevailing rates. Because they generally were protected against the unfavorable tax treatment that can hurt some bonds when interest rates change, premium coupon bonds outperformed discount coupon and par coupon bonds, which carry interest rates below and at prevailing market rates, respectively. Also, the fund's relatively large weighting in longer-term bonds helped the fund outpace its peers. Longer-term bond yields fell the most during the past six months, pushing their prices up and helping them to outpace their short- and intermediate-term counterparts.

Q. Were there any disappointments?

A. Health care bonds continued to languish due to lower reimbursements from HMOs and the federal government and from increased pressure to cut costs. Despite their recent struggles, I held on to some bonds issued by selected hospitals that Fidelity's research indicated were in good financial shape and fundamentally sound.

Q. What's your outlook for the municipal market and the Maryland economy?

A. If the Fed continues to push rates higher, as it has for more than a year now, there may be more volatility ahead. If, on the other hand, the Fed really is at the end of its campaign to cool the economy and stave off inflationary pressures by raising interest rates, the bond markets should benefit. As for municipals, they are priced attractively relative to Treasury securities. Additionally, for investors in the highest national tax bracket, municipals offer yields above 9.00% on a tax-adjusted basis. Attractive prices and yields could bode well for municipals' near-term performance. As for the fund, I'll continue to approach the market fairly cautiously in terms of credit quality. We'll remain vigilant, looking for potential problems that could occur if the economy slows. As for the Maryland economy, I'm reasonably optimistic. The federal budget is running a surplus, which may translate into rising expenditures on defense and health research - two large components of Maryland's economy.

The views expressed in this report reflect those of the portfolio manager only through the end of the period of the report as stated on the cover and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Fund Talk: The Manager's Overview - continued

Fund Facts

Goal: high level of current income exempt from federal and Maryland state and county income taxes

Fund number: 429

Trading symbol: SMDMX

Start date: April 22, 1993

Size: as of August 31, 2000, more than $54 million

Manager: George Fischer, since 1998; manager, various Fidelity and Spartan municipal income funds; joined Fidelity in 1989

3George Fischer on the fund's interest-rate sensitivity:

"The main source of volatility in this fund's shares is fluctuations in the general level of interest rates. Municipal interest rates are affected by inflation, Federal Reserve Board policy and new-issue supply, among other factors. One way that we estimate how sensitive a bond - or a fund - is to such shifts is to calculate its duration. The higher the duration a bond or a municipal bond fund has, the more sensitive it will be to changes in interest rates.

"As of August 31, 2000, Spartan Maryland Municipal Income Fund had a duration of 6.5 years. This means that the fund's net asset value would rise approximately 6.5% when bond yields fall 1%, and fall approximately 6.5% when bond yields rise 1%, all else being equal. The value of funds with a shorter duration would change less in response to interest-rate changes, and the value of funds with a longer duration would change more."

Annual Report

|

Top Five Sectors as of August 31, 2000 |

||

|

|

% of fund's |

% of fund's net assets |

|

General Obligations |

39.5 |

35.3 |

|

Special Tax |

14.8 |

9.1 |

|

Escrowed/Pre-Refunded |

12.0 |

13.9 |

|

Education |

7.1 |

6.3 |

|

Industrial Development |

5.4 |

6.4 |

|

Average Years to Maturity as of August 31, 2000 |

||

|

|

|

6 months ago |

|

Years |

14.0 |

13.8 |

|

Average years to maturity is based on the average time remaining until principal payments are expected from each of the fund's bonds, weighted by dollar amount. |

|

Duration as of August 31, 2000 |

||

|

|

|

6 months ago |

|

Years |

6.5 |

6.9 |

|

Duration shows how much a bond fund's price fluctuates with changes in comparable interest rates. |

|

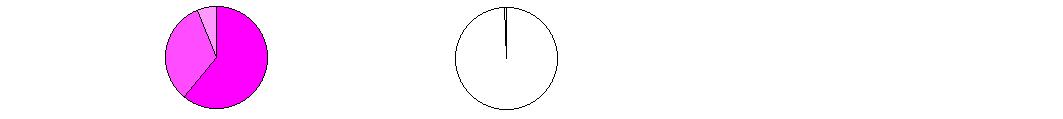

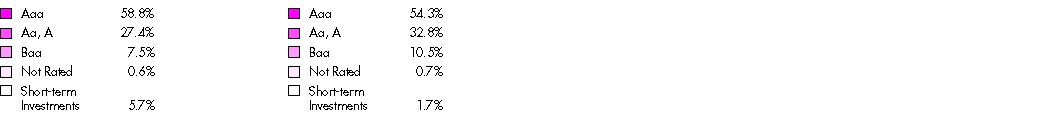

Quality Diversification (Moody's Ratings) |

As of August 31, 2000 As of February 29, 2000

|

Where Moody's ratings are not available, we have used S&P ® ratings. Amounts shown are as a percentage of the fund's investments. |

Annual Report

Showing Percentage of Net Assets

|

Municipal Bonds - 96.7% |

|||||

|

Moody's Ratings (unaudited) (a) |

Principal Amount |

Value |

|||

|

Maryland - 88.9% |

|||||

|

Anne Arundel County (Consolidated Wtr. & |

Aa2 |

|

$ 550,000 |

$ 599,297 |

|

|

Baltimore County Metro. District (Spl. Assessment

Proj.) 63rd Issue, 6.125% 7/1/07 |

Aaa |

|

850,000 |

892,390 |

|

|

Baltimore Gen. Oblig.: |

|

|

|

|

|

|

(Consolidated Pub. Impt. Proj.) Series A: |

|

|

|

|

|

|

5.5% 10/15/11 (FGIC Insured) |

Aaa |

|

1,000,000 |

1,049,370 |

|

|

5.5% 10/15/14 (FGIC Insured) |

Aaa |

|

500,000 |

516,695 |

|

|

5.625% 10/15/13 (FGIC Insured) |

Aaa |

|

1,460,000 |

1,524,240 |

|

|

7% 10/15/09 (MBIA Insured) |

Aaa |

|

500,000 |

584,165 |

|

|

Rfdg. (Cap. Appreciation) (Consolidated |

Aaa |

|

2,000,000 |

1,475,500 |

|

|

Baltimore Gen. Oblig. Proj. Rev. Rfdg. (Wtr. Proj.) Series A, 5% 7/1/24 (FGIC Insured) |

Aaa |

|

1,100,000 |

1,030,161 |

|

|

Baltimore Port Facilities Rev. (Consolidated Coal Sales Co. Proj.) 6.5% 12/1/10 |

Aa3 |

|

2,000,000 |

2,108,637 |

|

|

Frederick County Gen. Oblig. Rfdg. |

Aa2 |

|

1,000,000 |

1,018,400 |

|

|

Maryland Cmnty. Dev. Administration Dept. |

|

|

|

|

|

|

(Single Family Mtg. Prog.) Series 7, 7.25% 4/1/19 (b) |

Aa2 |

|

500,000 |

523,300 |

|

|

Rfdg. (Residential Proj.) Series B, 5.05% 9/1/19 (b) |

Aa2 |

|

865,000 |

863,400 |

|

|

Maryland Gen. Oblig. (State & Local Facilities Ln. Prog.): |

|

|

|

|

|

|

First Series: |

|

|

|

|

|

|

4.5% 3/1/01 |

Aaa |

|

615,000 |

615,843 |

|

|

5.5% 2/1/06 |

Aaa |

|

1,000,000 |

1,031,700 |

|

|

Second Series: |

|

|

|

|

|

|

5% 7/15/11 |

Aaa |

|

1,500,000 |

1,519,470 |

|

|

5% 8/1/12 |

Aaa |

|

1,000,000 |

1,005,840 |

|

|

5.25% 7/15/12 |

Aaa |

|

2,000,000 |

2,048,640 |

|

|

5.25% 7/15/13 |

Aaa |

|

1,500,000 |

1,524,600 |

|

|

Maryland Health & Higher Edl. Facilities Auth. Rev.: |

|

|

|

|

|

|

(Charity Oblig. Group Proj.) Series D, |

Aa2 |

|

970,000 |

977,304 |

|

|

Municipal Bonds - continued |

|||||

|

Moody's Ratings (unaudited) (a) |

Principal Amount |

Value |

|||

|

Maryland - continued |

|||||

|

Maryland Health & Higher Edl. Facilities Auth. Rev.: - continued |

|

|

|

|

|

|

(Good Samaritan Hosp. Proj.): |

|

|

|

|

|

|

5.75% 7/1/13 (AMBAC Insured) |

Aaa |

|

$ 145,000 |

$ 153,597 |

|

|

5.75% 7/1/13 (Escrowed to Maturity) (c) |

A1 |

|

240,000 |

254,230 |

|

|

(John Hopkins Univ. Issue Proj.) 6% 7/1/39 |

Aa2 |

|

1,000,000 |

1,042,280 |

|

|

(Loyola College Issue Proj.) 5% 10/1/39 |

A2 |

|

2,000,000 |

1,784,820 |

|

|

(Univ. of Maryland Med. Sys. Proj.) 6.75% 7/1/30 |

Baa1 |

|

500,000 |

508,295 |

|

|

Rfdg.: |

|

|

|

|

|

|

(Good Samaritan Hosp. Proj.) 5.7% 7/1/09 (Escrowed to Maturity) (c) |

A1 |

|

1,000,000 |

1,072,190 |

|

|

(Helix Health Proj.) 5% 7/1/17 (AMBAC Insured) (Escrowed to Maturity) (c) |

Aaa |

|

1,000,000 |

964,470 |

|

|

(Howard County Gen. Hosp. Proj.) 5.5% 7/1/13 (Escrowed to Maturity) (c) |

Aaa |

|

1,000,000 |

1,018,990 |

|

|

(John Hopkins Univ. Proj.) 6% 7/1/10 |

Aa2 |

|

500,000 |

550,405 |

|

|

Maryland Ind. Dev. Fing. Auth. Econ. Dev. Rev.

(Holy Cross Health Sys. Corp. Proj.) |

Aa3 |

|

1,150,000 |

1,150,127 |

|

|

Maryland Ind. Dev. Fing. Auth. Rev. Rfdg. (Holy Cross Health Sys. Corp. Proj.) 5.7% 12/1/10 |

Aa3 |

|

1,000,000 |

1,049,690 |

|

|

Maryland Trans. Auth. Rev.: |

|

|

|

|

|

|

(Trans. Facilities Projs.) 6.8% 7/1/16 (Escrowed to Maturity) (c) |

Aaa |

|

1,015,000 |

1,168,346 |

|

|

Rfdg. (Trans. Facilities Projs.) 5.8% 7/1/06 |

Aa2 |

|

500,000 |

531,765 |

|

|

Rfdg. (Cap. Appreciation) (Trans. Facilities Projs.) 0% 7/1/04 (FGIC Insured) |

Aaa |

|

2,500,000 |

2,102,150 |

|

|

Montgomery County Gen. Oblig.: |

|

|

|

|

|

|

(Consolidated Pub. Impt. Proj.) Series A: |

|

|

|

|

|

|

5.375% 5/1/05 |

Aaa |

|

1,000,000 |

1,038,880 |

|

|

5.375% 5/1/12 |

Aaa |

|

1,000,000 |

1,033,990 |

|

|

5.625% 10/1/06 |

Aaa |

|

1,000,000 |

1,058,730 |

|

|

Series A, 6.3% 4/1/04 |

Aaa |

|

500,000 |

530,370 |

|

|

Montgomery County Hsg. Opportunity Commission Single Family Mtg. Rev. Series A, 6.6% 7/1/14 |

Aa2 |

|

980,000 |

1,032,861 |

|

|

Northeast Maryland Waste Disp. Auth. Resource Recovery Rev.: |

|

|

|

|

|

|

(Baltimore Resco Retrofit Proj.) 4.75% 1/1/12 (b) |

BBB+ |

|

1,000,000 |

820,760 |

|

|

Municipal Bonds - continued |

|||||

|

Moody's Ratings (unaudited) (a) |

Principal Amount |

Value |

|||

|

Maryland - continued |

|||||

|

Northeast Maryland Waste Disp. Auth. Resource Recovery Rev.: - continued |

|

|

|

|

|

|

Rfdg. (Southwest Resource Recovery Facilities Proj.) 7.2% 1/1/05 (MBIA Insured) |

Aaa |

|

$ 1,235,000 |

$ 1,355,944 |

|

|

Northeast Maryland Waste Disp. Auth. Solid Waste Rev. (Montgomery County Resource Recovery Proj.) Series A: |

|

|

|

|

|

|

5.9% 7/1/05 (b) |

A2 |

|

760,000 |

796,579 |

|

|

6% 7/1/07 (b) |

A2 |

|

500,000 |

525,270 |

|

|

Prince Georges County (Consolidated Pub. Impts. Proj.) 5.5% 3/15/16 (MBIA Insured) |

Aaa |

|

1,000,000 |

1,015,350 |

|

|

Prince Georges County Ctfs. of Prtn. (Cap.

Appreciation) Series A, 0% 6/30/11 |

Aaa |

|

2,400,000 |

1,394,880 |

|

|

Prince Georges County Hsg. Auth. Rev. |

AAA |

|

365,000 |

380,162 |

|

|

Univ. of Maryland Sys. Auxiliary Facility & Tuition Rev. Series A, 5.6% 4/1/16 |

Aa3 |

|

500,000 |

507,860 |

|

|

Washington D.C. Metro. Area Trans. Auth. Gross Rev. Rfdg. 6% 7/1/10 (FGIC Insured) |

Aaa |

|

1,570,000 |

1,737,409 |

|

|

Washington D.C. Suburban Sanitation District Rfdg. Second Series, 8% 1/1/02 |

Aa1 |

|

1,000,000 |

1,045,690 |

|

|

|

48,535,042 |

||||

|

Puerto Rico - 7.8% |

|||||

|

Puerto Rico Commonwealth Hwy. & Trans. |

Aaa |

|

1,000,000 |

1,018,830 |

|

|

Puerto Rico Commonwealth Hwy. & Trans. |

|

|

|

|

|

|

4.75% 7/1/38 (MBIA Insured) |

Aaa |

|

1,000,000 |

879,830 |

|

|

Municipal Bonds - continued |

|||||

|

Moody's Ratings (unaudited) (a) |

Principal Amount |

Value |

|||

|

Puerto Rico - continued |

|||||

|

Puerto Rico Commonwealth Hwy. & Trans. Auth. Rev. Series A: - continued |

|

|

|

|

|

|

5% 7/1/38 |

Baa1 |

|

$ 2,000,000 |

$ 1,818,300 |

|

|

Puerto Rico Commonwealth Infrastructure Fing. Auth. Spl. Tax Rev. Series A, 5% 7/1/28 (AMBAC Insured) |

Aaa |

|

600,000 |

562,392 |

|

|

|

4,279,352 |

||||

|

TOTAL INVESTMENT PORTFOLIO - 96.7% (Cost $51,930,918) |

52,814,394 |

||

|

NET OTHER ASSETS - 3.3% |

1,781,040 |

||

|

NET ASSETS - 100% |

$ 54,595,434 |

||

|

Legend |

|

(a) S&P credit ratings are used in the absence of a rating by Moody's Investors Service, Inc. |

|

(b) Private activity obligations whose interest is subject to the federal alternative minimum tax for individuals. |

|

(c) Security collateralized by an amount sufficient to pay interest and principal. |

|

Other Information |

|

The composition of long-term debt holdings as a percentage of total value of investments in securities, is as follows (ratings are unaudited): |

|

Moody's Ratings |

S&P Ratings |

|||

|

Aaa, Aa, A |

93.3% |

|

AAA, AA, A |

88.5% |

|

Baa |

4.4% |

|

BBB |

1.6% |

|

Ba |

0.0% |

|

BB |

0.0% |

|

B |

0.0% |

|

B |

0.0% |

|

Caa |

0.0% |

|

CCC |

0.0% |

|

Ca, C |

0.0% |

|

CC, C |

0.0% |

|

|

|

|

D |

0.0% |

|

The distribution of municipal securities by revenue source, as a percentage of total net assets, is as follows: |

|

General Obligations |

39.5% |

|

Special Tax |

14.8 |

|

Escrowed/Pre-Refunded |

12.0 |

|

Education |

7.1 |

|

Industrial Development |

5.4 |

|

Housing |

5.1 |

|

Resource Recovery |

5.0 |

|

Others* (individually less than 5%) |

11.1 |

|

|

100.0% |

|

* Includes net other assets. |

|

Income Tax Information |

|

At August 31, 2000, the aggregate cost |

|

At August 31, 2000, the fund had a capital loss carryforward of approximately $942,000 of which $924,000 and $18,000 will expire on August 31, 2004 and 2008, respectively. |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Assets and Liabilities

|

|

August 31, 2000 |

|

|

Assets |

|

|

|

Investment in securities, at value (cost $51,930,918) - |

|

$ 52,814,394 |

|

Cash |

|

1,213,861 |

|

Receivable for fund shares sold |

|

40,000 |

|

Interest receivable |

|

611,714 |

|

Other receivables |

|

17,202 |

|

Total assets |

|

54,697,171 |

|

Liabilities |

|

|

|

Payable for fund shares redeemed |

$ 20,554 |

|

|

Distributions payable |

56,259 |

|

|

Accrued management fee |

24,924 |

|

|

Total liabilities |

|

101,737 |

|

Net Assets |

|

$ 54,595,434 |

|

Net Assets consist of: |

|

|

|

Paid in capital |

|

$ 54,887,082 |

|

Undistributed net interest income |

|

18,021 |

|

Accumulated undistributed net realized |

|

(1,193,145) |

|

Net unrealized appreciation (depreciation) on investments |

|

883,476 |

|

Net Assets, for 5,326,291 shares outstanding |

|

$ 54,595,434 |

|

Net Asset Value, offering price and redemption price per share ($54,595,434 ÷ 5,326,291 shares) |

|

$10.25 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Statements - continued

Statement of Operations

|

|

Year ended August 31, 2000 |

|

|

Interest Income |

|

$ 2,516,542 |

|

Expenses |

|

|

|

Management fee |

$ 265,468 |

|

|

Non-interested trustees' compensation |

146 |

|

|

Total expenses before reductions |

265,614 |

|

|

Expense reductions |

(46,359) |

219,255 |

|

Net interest income |

|

2,297,287 |

|

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: |

|

|

|

Investment securities |

(260,099) |

|

|

Futures contracts |

(8,118) |

(268,217) |

|

Change in net unrealized appreciation (depreciation) |

|

1,126,641 |

|

Net gain (loss) |

|

858,424 |

|

Net increase (decrease) in net assets resulting |

|

$ 3,155,711 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Statements - continued

Statement of Changes in Net Assets

|

|

Year ended |

Year ended |

|

Increase (Decrease) in Net Assets |

|

|

|

Operations |

$ 2,297,287 |

$ 2,057,235 |

|

Net realized gain (loss) |

(268,217) |

116,867 |

|

Change in net unrealized appreciation (depreciation) |

1,126,641 |

(2,304,700) |

|

Net increase (decrease) in net assets resulting |

3,155,711 |

(130,598) |

|

Distributions to shareholders from net interest income |

(2,289,088) |

(2,057,235) |

|

Share transactions |

15,892,379 |

14,363,034 |

|

Reinvestment of distributions |

1,665,421 |

1,517,501 |

|

Cost of shares redeemed |

(12,459,301) |

(8,904,888) |

|

Net increase (decrease) in net assets resulting |

5,098,499 |

6,975,647 |

|

Redemption fees |

4,681 |

5,057 |

|

Total increase (decrease) in net assets |

5,969,803 |

4,792,871 |

|

Net Assets |

|

|

|

Beginning of period |

48,625,631 |

43,832,760 |

|

End of period (including undistributed net interest |

$ 54,595,434 |

$ 48,625,631 |

|

Other Information Shares |

|

|

|

Sold |

1,593,231 |

1,372,122 |

|

Issued in reinvestment of distributions |

166,668 |

145,212 |

|

Redeemed |

(1,253,279) |

(853,528) |

|

Net increase (decrease) |

506,620 |

663,806 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights

|

Years ended August 31, |

2000 |

1999 |

1998 |

1997 |

1996 |

|

Selected Per-Share Data |

|

|

|

|

|

|

Net asset value, |

$ 10.090 |

$ 10.550 |

$ 10.170 |

$ 9.850 |

$ 9.840 |

|

Income from Investment Operations |

.474 B |

.451 |

.461 |

.466 |

.488 |

|

Net realized and unrealized gain (loss) |

.161 |

(.461) |

.380 |

.323 |

.009 |

|

Total from investment operations |

.635 |

(.010) |

.841 |

.789 |

.497 |

|

Less Distributions |

|

|

|

|

|

|

From net interest income |

(.476) |

(.451) |

(.461) |

(.466) |

(.488) |

|

In excess of net realized gain |

- |

- |

- |

(.003) |

- |

|

Total distributions |

(.476) |

(.451) |

(.461) |

(.469) |

(.488) |

|

Redemption fees added to |

.001 |

.001 |

.000 |

.000 |

.001 |

|

Net asset value, end of period |

$ 10.250 |

$ 10.090 |

$ 10.550 |

$ 10.170 |

$ 9.850 |

|

Total Return A |

6.53% |

(0.15)% |

8.43% |

8.17% |

5.12% |

|

Ratios and Supplemental Data |

|

|

|

|

|

|

Net assets, end of period |

$ 54,595 |

$ 48,626 |

$ 43,833 |

$ 40,231 |

$ 45,359 |

|

Ratio of expenses to average |

.55% |

.55% |

.55% |

.55% |

.40% C |

|

Ratio of expenses to average net assets after expense reductions |

.45% D |

.49% D |

.53% D |

.54% D |

.39% D |

|

Ratio of net interest income to average net assets |

4.76% |

4.34% |

4.44% |

4.65% |

4.91% |

|

Portfolio turnover rate |

27% |

12% |

23% |

41% |

74% |

A The total returns would have been lower had certain expenses not been reduced during the periods shown.

B Net interest income per share has been calculated based on average shares outstanding during the period.

C FMR agreed to reimburse a portion of the fund's expenses during the period. Without this reimbursement, the fund's expense ratio would have been higher.

D FMR or the fund has entered into varying arrangements with third parties who either paid or reduced a portion of the fund's expenses.

See accompanying notes which are an integral part of the financial statements.

Annual Report

For the period ended August 31, 2000

1. Significant Accounting Policies.

Spartan Maryland Municipal Income Fund (the fund) is a fund of Fidelity Union Street Trust (the trust) and is authorized to issue an unlimited number of shares. The trust is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company organized as a Massachusetts business trust.The fund may be affected by economic and political developments in the state of Maryland. The financial statements have been prepared in conformity with generally accepted accounting principles which require management to make certain estimates and assumptions at the date of the financial statements. The following summarizes the significant accounting policies of the fund:

Security Valuation. Securities are valued based upon a computerized matrix system and/or appraisals by a pricing service, both of which consider market transactions and dealer-supplied valuations. Securities for which quotations are not readily available are valued at their fair value as determined in good faith under consistently applied procedures under the general supervision of the Board of Trustees. Short-term securities with remaining maturities of sixty days or less for which quotations are not readily available are valued at amortized cost or original cost plus accrued interest, both of which approximate current value.

Income Taxes. As a qualified regulated investment company under Subchapter M of the Internal Revenue Code, the fund is

not subject to income taxes to the extent that it distributes substantially all of its taxable income for its fiscal year. The schedule of investments includes information regarding income taxes under the caption "Income Tax Information."

Interest Income. Interest income, which includes amortization of premium and accretion of original issue discount, is accrued as earned.

Expenses. Most expenses of the trust can be directly attributed to a fund. Expenses which cannot be directly attributed are apportioned among the funds in the trust.

Distributions to Shareholders. Distributions are declared daily and paid monthly from net interest income. Distributions from realized gains, if any, are recorded on the ex-dividend date.

Income and capital gain distributions are determined in accordance with income tax regulations which may differ from generally accepted accounting principles. These differences, which may result in distribution reclassifications, are primarily due to differing treatments for futures transactions, market discount, capital loss carryforwards and losses deferred due to excise tax regulations. The fund also utilized earnings and profits distributed to shareholders on redemption of shares as a part of the dividends paid deduction for income tax purposes.

Permanent book and tax basis differences relating to shareholder distributions will result in reclassifications to paid in capital. Undistributed net interest income and

Annual Report

Notes to Financial Statements - continued

1. Significant Accounting Policies - continued

Distributions to Shareholders -

continued

accumulated undistributed net realized gain (loss) on investments may include temporary book and tax basis differences which will reverse in a subsequent period. Any taxable gain remaining at fiscal year end is distributed in the following year.

Short-Term Trading (Redemption) Fees. Shares held in the fund less than 180 days are subject to a short-term trading fee equal to .50% of the proceeds of the redeemed shares. The fee, which is retained by the fund, is accounted for as an addition to paid in capital.

Security Transactions. Security transactions are accounted for as of trade date. Gains and losses on securities sold are determined on the basis of identified cost.

2. Operating Policies.

Fidelity Municipal Cash Central Fund. Pursuant to an Exemptive Order issued by the Securities and Exchange Commission, the fund may invest in the Fidelity Municipal Cash Central Fund (the Cash Fund) managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of Fidelity Management & Research Company (FMR). The Cash Fund is an open-end money market fund available only to investment companies and other accounts managed by FMR and its affiliates. The Cash Fund seeks preservation of capital, liquidity, and current income by

investing in high-quality, short-term municipal securities of various states and municipalities. Income distributions from the Cash Fund are declared daily and paid monthly from net interest income. Income distributions earned by the fund are recorded as interest income in the accompanying financial statements.

Futures Contracts. The fund may use futures contracts to manage its exposure to the bond market and to fluctuations in interest rates. Buying futures tends to increase the fund's exposure to the underlying instrument, while selling futures tends to decrease the fund's exposure to the underlying instrument or hedge other fund investments. Losses may arise from changes in the value of the underlying instruments or if the counterparties do not perform under the contracts' terms. Gains (losses) are realized upon the expiration or closing of the futures contracts. Futures contracts are valued at the settlement price established each day by the board of trade or exchange on which they are traded.

3. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities, aggregated $16,183,903 and $12,527,678, respectively.

The market value of futures contracts opened and closed during the period amounted to $1,584,153 and $1,576,035, respectively.

Annual Report

Notes to Financial Statements - continued

4. Fees and Other Transactions with Affiliates.

Management Fee. As the fund's investment adviser, FMR receives a fee that is computed daily at an annual rate of .55% of the fund's average net assets. FMR pays all other expenses, except the compensation of the non-interested Trustees and certain exceptions such as interest, taxes, brokerage commissions and extraordinary expenses. The management fee paid to FMR by the fund is reduced by an amount equal to the fees and expenses paid by the fund to the non-interested Trustees.

Sub-Adviser Fee. FMR, on behalf of the fund, has entered into a sub-advisory agreement with FIMM, a wholly owned subsidiary of FMR. For its services, FIMM receives a fee from FMR of 50% of the management fee payable to FMR. The fee is paid prior to any voluntary expense reimbursements which may be in effect.

5. Expense Reductions.

Through arrangements with the fund's custodian and transfer agent, credits realized as a result of uninvested cash balances were used to reduce a portion of the fund's expenses. During the period, the fund's custodian, transfer agent and accounting fees were reduced by $46,359 under these arrangements.

Annual Report

To the Trustees of Fidelity Union Street Trust and the Shareholders of Spartan Maryland Municipal Income Fund:

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Spartan Maryland Municipal Income Fund (a fund of Fidelity Union Street Trust) at August 31, 2000, and the results of its operations, the changes in its net assets and the financial highlights for the periods indicated, in conformity with accounting principles generally accepted in the United States. These financial statements and financial highlights (hereafter referred to as "financial statements") are the responsibility of the Spartan Maryland Municipal Income Fund's management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with auditing standards generally accepted in the United States which require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at August 31, 2000 by correspondence with the custodian, provide a reasonable basis for the opinion expressed above.

/s/PricewaterhouseCoopers LLP

PricewaterhouseCoopers LLP

Boston, Massachusetts

October 6, 2000

Annual Report

During fiscal year ended 2000, 100% of the fund's income dividends was free from federal income tax, and 9.75% of the fund's income dividends was subject to the federal alternative minimum tax.

The fund will notify shareholders in January 2001 of amounts for use in preparing 2000 income tax returns.

Annual Report

A special meeting of fund's shareholders was held on September 13, 2000. The results of votes taken among shareholders on proposals before them are reported below. Each vote reported represents one dollar of net asset value held on the record date for the meeting.

PROPOSAL 1

To elect as Trustees the following twelve nominees.*

|

|

# of |

% of |

|

J. Michael Cook |

||

|

Affirmative |

719,905,794.09 |

94.672 |

|

Withheld |

40,517,203.69 |

5.328 |

|

TOTAL |

760,422,997.78 |

100.000 |

|

Ralph F. Cox |

||

|

Affirmative |

719,013,933.36 |

94,554 |

|

Withheld |

41,409,064.42 |

5.446 |

|

TOTAL |

760,422,997.78 |

100.000 |

|

Phyllis Burke Davis |

||

|

Affirmative |

718,961,403.49 |

94.548 |

|

Withheld |

41,461,594.29 |

5.452 |

|

TOTAL |

760,422,997.78 |

100.000 |

|

Robert M. Gates |

||

|

Affirmative |

719,482,012.45 |

94.616 |

|

Withheld |

40,940,985.33 |

5.384 |

|

TOTAL |

760,422,997.78 |

100.000 |

|

Edward C. Johnson 3d |

||

|

Affirmative |

719,048,405.90 |

94.559 |

|

Withheld |

41,374,591.88 |

5.441 |

|

TOTAL |

760,422,997.78 |

100.000 |

|

Donald J. Kirk |

||

|

Affirmative |

719,305,522.72 |

94.593 |

|

Withheld |

41,117,475.06 |

5.407 |

|

TOTAL |

760,422,997,78 |

100.000 |

|

|

# of |

% of |

|

Marie L. Knowles |

||

|

Affirmative |

720,009,886.09 |

94.685 |

|

Withheld |

40,413,111.69 |

5.315 |

|

TOTAL |

760,422,997.78 |

100.000 |

|

Ned C. Lautenbach |

||

|

Affirmative |

719,749,038.52 |

94.651 |

|

Withheld |

40,673,959.26 |

5.349 |

|

TOTAL |

760,422,997.78 |

100.000 |

|

Peter S. Lynch |

||

|

Affirmative |

715,851,375.12 |

94.139 |

|

Withheld |

44,571,622.66 |

5.861 |

|

TOTAL |

760,422,997.78 |

100.000 |

|

William O. McCoy |

||

|

Affirmative |

718,919,774.43 |

94.542 |

|

Withheld |

41,503,223.35 |

5.458 |

|

TOTAL |

760,422,997.78 |

100.000 |

|

Marvin L. Mann |

||

|

Affirmative |

719,517,282.26 |

94.621 |

|

Withheld |

40,905,715.52 |

5.379 |

|

TOTAL |

760,422,997.78 |

100.000 |

|

Robert C. Pozen |

||

|

Affirmative |

719,858,604.16 |

94.666 |

|

Withheld |

40,564,393.62 |

5.334 |

|

TOTAL |

760,422,997.78 |

100.000 |

|

PROPOSAL 2 |

||

|

To ratify the selection of PricewaterhouseCoopers LLP as independent accounts of the fund. |

||

|

|

# of |

% of |

|

Affirmative |

25,197,715.34 |

96.228 |

|

Against |

112,490.17 |

0.429 |

|

Abstain |

875,292.97 |

3.343 |

|

TOTAL |

26,185,498.48 |

100.000 |

|

PROPOSAL 3 |

||

|

To authorize the Trustees to adopt an Amended and Restated Declaration of Trust.* |

||

|

|

# of |

% of |

|

Affirmative |

676,198,304.03 |

89.494 |

|

Against |

27,996,750.36 |

3.706 |

|

Abstain |

51,382,916.46 |

6.800 |

|

TOTAL |

755,577,970.85 |

100.000 |

|

Broker |

4,845,026.93 |

|

|

PROPOSAL 4 |

||

|

To amend Spartan Maryland Municipal Income Fund's fundamental investment limitation concerning the concentration of its investments in a single industry. |

||

|

|

# of |

% of |

|

Affirmative |

22,539,542.01 |

86.121 |

|

Against |

2,429,533.85 |

9.283 |

|

Abstain |

1,202,983.26 |

4.596 |

|

TOTAL |

26,172,059.12 |

100.000 |

|

Broker |

13,439.36 |

|

|

PROPOSAL 5 |

||

|

To amend Spartan Maryland Municipal Income Fund's fundamental investment limitation concerning underwriting. |

||

|

|

# of |

% of |

|

Affirmative |

22,584,602.21 |

86.293 |

|

Against |

2,080,442.69 |

7.949 |

|

Abstain |

1,507,014.22 |

5.758 |

|

TOTAL |

26,172,059.12 |

100.000 |

|

Broker |

13,439.36 |

|

*Denotes trust-wide proposals and voting results.

Annual Report

Fidelity offers several ways to conveniently manage your personal investments via your telephone or PC. You can access your account information, conduct trades and research your investments 24 hours a day.

By Phone

Fidelity Automated Service Telephone provides a single toll-free number to access account balances, positions, quotes and trading. It's easy to navigate the service, and on your first call, the system will help you create a personal identification number (PIN) for security.

(phone_graphic)

Fidelity Automated

Service Telephone (FAST®)

1-800-544-5555

Press

1 For mutual fund and brokerage trading.

2 For quotes.*

3 For account balances and holdings.

4 To review orders and mutual

fund activity.

5 To change your PIN.

*0 To speak to a Fidelity representative.

By PC

Fidelity's web site on the Internet provides a wide range of information, including daily financial news, fund performance, interactive planning tools and news about Fidelity products and services.

(computer_graphic)

Fidelity's Web Site

www.fidelity.com

If you are not currently on the Internet, call EarthLink Sprint at 1-800-288-2967, and be sure to ask for registration number SMD004 to receive a special Fidelity package that includes 30 days of free Internet access. EarthLink is North America's #1 independent Internet access provider.

(computer_graphic)

Fidelity On-line Xpress+®

Fidelity On-line Xpress+ software for Windows combines comprehensive portfolio management capabilities, securities trading and access to research and analysis tools . . . all on your desktop. Call Fidelity at 1-800-544-0240 or visit our web site for more information on how to manage your investments via your PC.

* When you call the quotes line, please remember that a fund's yield and return will vary and, except for money market funds, share price will also vary. This means that you may have a gain or loss when you sell your shares. There is no assurance that money market funds will be able to maintain a stable $1 share price; an investment in a money market fund is not insured or guaranteed by the U.S. government. Total returns are historical and include changes in share price, reinvestment of dividends and capital gains, and the effects of any sales charges.

Annual Report

If more than one address is listed, please locate the address that is closest to you. We'll give your correspondence immediate attention and send you written confirmation upon completion of your request.

(letter_graphic)

Making Changes

To Your Account

(such as changing name, address, bank, etc.)

Fidelity Investments

P.O. Box 770001

Cincinnati, OH 45277-0002

(letter_graphic)

For Non-Retirement

Accounts

Buying shares

Fidelity Investments

P.O. Box 770001

Cincinnati, OH 45277-0003

Overnight Express

Fidelity Investments

2300 Litton Lane - KH1A

Hebron, KY 41048

Selling shares

Fidelity Investments

P.O. Box 660602

Dallas, TX 75266-0602

Overnight Express

Fidelity Investments

Attn: Redemptions - CP6I

400 East Las Colinas Blvd.

Irving, TX 75039-5587

General Correspondence

Fidelity Investments

P.O. Box 500

Merrimack, NH 03054-0500

(letter_graphic)

For Retirement

Accounts

Buying shares

Fidelity Investments

P.O. Box 770001

Cincinnati, OH 45277-0003

Selling shares

Fidelity Investments

P.O. Box 660602

Dallas, TX 75266-0602

Overnight Express

Fidelity Investments

Attn: Redemptions - CP6R

400 East Las Colinas Blvd.

Irving, TX 75039-5587

General Correspondence

Fidelity Investments

P.O. Box 500

Merrimack, NH 03054-0500

Annual Report

For directions and hours,

please call 1-800-544-9797.

Arizona

7373 N. Scottsdale Road

Scottsdale, AZ

California

815 East Birch Street

Brea, CA

851 East Hamilton Avenue

Campbell, CA

527 North Brand Boulevard

Glendale, CA

19200 Von Karman Avenue

Irvine, CA

10100 Santa Monica Blvd.

Los Angeles, CA

251 University Avenue

Palo Alto, CA

1760 Challenge Way

Sacramento, CA

7676 Hazard Center Drive

San Diego, CA

8 Montgomery Street

San Francisco, CA

950 Northgate Drive

San Rafael, CA

1400 Civic Drive

Walnut Creek, CA

6300 Canoga Avenue

Woodland Hills, CA

Colorado

1625 Broadway

Denver, CO

Connecticut

48 West Putnam Avenue

Greenwich, CT

265 Church Street

New Haven, CT

300 Atlantic Street

Stamford, CT

29 South Main Street

West Hartford, CT

Delaware

222 Delaware Avenue

Wilmington, DE

Florida

4400 N. Federal Highway

Boca Raton, FL

90 Alhambra Plaza

Coral Gables, FL

4090 N. Ocean Boulevard

Ft. Lauderdale, FL

1907 West State Road 434

Longwood, FL

8880 Tamiami Trail, North

Naples, FL

2401 PGA Boulevard

Palm Beach Gardens, FL

8065 Beneva Road

Sarasota, FL

1502 N. Westshore Blvd.

Tampa, FL

Georgia

3445 Peachtree Road, N.E.

Atlanta, GA

1000 Abernathy Road

Atlanta, GA

Illinois

One North Franklin Street

Chicago, IL

1415 West 22nd Street

Oak Brook, IL

1700 East Golf Road

Schaumburg, IL

3232 Lake Avenue

Wilmette, IL

Indiana

4729 East 82nd Street

Indianapolis, IN

Maine

Three Canal Plaza

Portland, ME

Maryland

7401 Wisconsin Avenue

Bethesda, MD

One W. Pennsylvania Ave.

Towson, MD

Massachusetts

801 Boylston Street

Boston, MA

155 Congress Street

Boston, MA

25 State Street

Boston, MA

300 Granite Street

Braintree, MA

44 Mall Road

Burlington, MA

416 Belmont Street

Worcester, MA

Annual Report

Michigan

280 Old N. Woodward Ave.

Birmingham, MI

29155 Northwestern Hwy.

Southfield, MI

Minnesota

7600 France Avenue South

Edina, MN

Missouri

700 West 47th Street

Kansas City, MO

8885 Ladue Road

Ladue, MO

New Jersey

150 Essex Street

Millburn, NJ

56 South Street

Morristown, NJ

501 Route 17, South

Paramus, NJ

New York

1055 Franklin Avenue

Garden City, NY

999 Walt Whitman Road

Melville, L.I., NY

1271 Avenue of the Americas

New York, NY

71 Broadway

New York, NY

350 Park Avenue

New York, NY

North Carolina

4611 Sharon Road

Charlotte, NC

Ohio

600 Vine Street

Cincinnati, OH

28699 Chagrin Boulevard

Woodmere Village, OH

Oregon

16850 SW 72nd Avenue

Tigard, OR

Pennsylvania

1735 Market Street

Philadelphia, PA

439 Fifth Avenue

Pittsburgh, PA

Rhode Island

47 Providence Place

Providence, RI

Tennessee

6150 Poplar Avenue

Memphis, TN

Texas

10000 Research Boulevard

Austin, TX

4017 Northwest Parkway

Dallas, TX

1155 Dairy Ashford Street

Houston, TX

2701 Drexel Drive

Houston, TX

400 East Las Colinas Blvd.

Irving, TX

14100 San Pedro

San Antonio, TX

19740 IH 45 North

Spring, TX

Utah

215 South State Street

Salt Lake City, UT

Virginia

1861 International Drive

McLean, VA

Washington

411 108th Avenue, N.E.

Bellevue, WA

511 Pine Street

Seattle, WA

Washington, DC

1900 K Street, N.W.

Washington, DC

Wisconsin

595 North Barker Road

Brookfield, WI

Fidelity Brokerage Services, Inc., 100 Summer St., Boston, MA 02110 Member NYSE/SIPC

Annual Report

Annual Report

Annual Report

Investment Adviser

Fidelity Management & Research Company

Boston, MA

Investment Sub-Adviser

Fidelity Investments

Money Management, Inc.

Officers

Edward C. Johnson 3d, President

Robert C. Pozen, Senior Vice President

Dwight D. Churchill, Vice President

Boyce I. Greer, Vice President

George A. Fischer, Vice President

Stanley N. Griffith, Assistant Vice President

Eric D. Roiter, Secretary

Robert A. Dwight, Treasurer

Maria F. Dwyer, Deputy Treasurer

John H. Costello, Assistant Treasurer

Thomas J. Simpson, Assistant Treasurer

Board of Trustees

Ralph F. Cox *

Phyllis Burke Davis *

Robert M. Gates *

Edward C. Johnson 3d

Donald J. Kirk *

Ned C. Lautenbach *

Peter S. Lynch

Marvin L. Mann *

William O. McCoy *

Gerald C. McDonough *

Robert C. Pozen

Thomas R. Williams *

Advisory Board

J. Michael Cook

Marie L. Knowles

General Distributor

Fidelity Distributors Corporation

Boston, MA

* Independent trustees

Transfer and Shareholder

Servicing Agents

Citibank, N.A.

New York, NY

and

Fidelity Service Company, Inc.

Boston, MA

Custodian

Citibank, N.A.

New York, NY

Fidelity's Municipal Bond Funds

Spartan(automated graphic) Arizona Municipal Income

Spartan California Municipal Income

Spartan Connecticut Municipal Income

Spartan Florida Municipal Income

Spartan Intermediate Municipal Income

Spartan Maryland Municipal Income

Spartan Massachusetts Municipal Income

Spartan Michigan Municipal Income

Spartan Minnesota Municipal Income

Spartan Municipal Income

Spartan New Jersey Municipal Income

Spartan New York Municipal Income

Spartan Ohio Municipal Income

Spartan Pennsylvania Municipal Income

Spartan Short-Intermediate

Municipal Income

The Fidelity Telephone Connection

Mutual Fund 24-Hour Service

Exchanges/Redemptions

and Account Assistance 1-800-544-6666

Product Information 1-800-544-6666

Retirement Accounts 1-800-544-4774 (8 a.m. - 9 p.m.)

TDD Service 1-800-544-0118

for the deaf and hearing impaired

(9 a.m. - 9 p.m. Eastern time)

Fidelity Automated Service

Telephone (FAST®) (automated graphic) 1-800-544-5555

(automated graphic) Automated line for quickest service

SMD-ANN-1000 113175

1.536791.103

(Fidelity Investment logo)(registered trademark)

Corporate Headquarters

82 Devonshire St., Boston, MA 02109

www.fidelity.com

Spartan®

Fund

Annual Report

August 31, 2000

(2_fidelity_logos)(Registered_Trademark)

|

President's Message |

Ned Johnson on investing strategies. |

|

|

Performance |

How the fund has done over time. |

|

|

Fund Talk |

The manager's review of fund performance, strategy and outlook. |

|

|

Investment Changes |

A summary of major shifts in the fund's investments over the past six months. |

|

|

Investments |

A complete list of the fund's investments with their market values. |

|

|

Financial Statements |

Statements of assets and liabilities,

operations, and changes in net assets, |

|

|

Notes |

Notes to the financial statements. |

|

|

Report of Independent Accountants |

The auditors' opinion. |

|

|

Distributions |

|

|

|

Proxy Voting Results |

|

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

(Recycle graphic) This report is printed on recycled paper using soy-based inks.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the funds. This report is not authorized for distribution to prospective investors in the funds unless preceded or accompanied by an effective prospectus.

Mutual fund shares are not deposits or obligations of, or guaranteed by, any depository institution. Shares are not insured by the FDIC, Federal Reserve Board or any other agency, and are subject to investment risks, including possible loss of principal amount invested.

Neither the funds nor Fidelity Distributors Corporation is a bank.

For more information on any Fidelity fund, including charges and expenses, call 1-800-544-6666 for a free prospectus. Read it carefully before you invest or send money.

Annual Report

(photo_of_Edward_C_Johnson_3d)

Dear Shareholder:

A slowing U.S. economy triggered an equity market rally during the later stages of summer, boosting most major stock indexes back into positive territory for calendar year 2000. One notable exception, however, was the Dow Jones Industrial Average, which posted a negative return during that timeframe. Fixed-income markets - particularly Treasuries - continued their yearlong trend of strong performance, as nearly every bond sector outperformed the stock market on a year-to-date basis.

While it's impossible to predict the future direction of the markets with any degree of certainty, there are certain basic principles that can help investors plan for their future needs.

The longer your investment time frame, the less likely it is that you will be affected by short-term market volatility. A 10-year investment horizon appropriate for saving for a college education, for example, enables you to weather market cycles in a long-term fund, which may have a higher risk potential, but also has a higher potential rate of return.

An intermediate-length fund could make sense if your investment horizon is two to four years, while a short-term bond fund could be the right choice if you need your money in one or two years.

If your time horizon is less than a year, you might want to consider moving some of your bond investment into a money market fund. These funds seek income and a stable share price by investing in high-quality, short-term investments. Of course, it's important to remember that an investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although money market funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in these types of funds.

Finally, no matter what your time horizon or portfolio diversity, it makes good sense to follow a regular investment plan, investing a certain amount of money in a fund at the same time each month or quarter and periodically reviewing your overall portfolio. By doing so, you won't get caught up in the excitement of a rapidly rising market, nor will you buy all your shares at market highs. While this strategy - known as dollar cost averaging - won't assure a profit or protect you from a loss in a declining market, it should help you lower the average cost of your purchases. Of course, you should consider your financial ability to continue your purchases through periods of low price levels before undertaking such a strategy.

If you have questions, please call us at 1-800-544-6666, or visit our web site at www.fidelity.com. We are available 24 hours a day, seven days a week to provide you the information you need to make the investments that are right for you.

Best regards,

/s/Edward C. Johnson 3d

Edward C. Johnson 3d

Annual Report

There are several ways to evaluate a fund's historical performance. You can look at the total percentage change in value, the average annual percentage change or the growth of a hypothetical $10,000 investment. Total return reflects the change in the value of an investment, assuming reinvestment of the fund's dividend income and capital gains (the profits earned upon the sale of securities that have grown in value). You can also look at the fund's income, as reflected in the fund's yield, to measure performance. If Fidelity had not reimbursed certain fund expenses, the total returns and dividends would have been lower.

Cumulative Total Returns

|

Periods ended August 31, 2000 |

|

Past 1 |

Past 5 |

Past 10 |

|

Spartan Short-Intermediate Municipal Income |

|

4.45% |

23.39% |

66.85% |

|

LB 1-6 Year Municipal Bond |

|

4.89% |

25.81% |

n/a* |

|

Short-Intermediate Municipal Debt |

|

3.98% |

21.23% |

67.77% |

Cumulative total returns show the fund's performance in percentage terms over a set period - in this case, one year, five years or 10 years. For example, if you had invested $1,000 in a fund that had a 5% return over the past year, the value of your investment would be $1,050. You can compare the fund's returns to the performance of the Lehman Brothers 1-6 Year Municipal Bond Index - a market value-weighted index of investment-grade municipal bonds with maturities between one and six years. To measure how the fund's performance stacked up against its peers, you can compare it to the short-intermediate municipal debt funds average, which reflects the performance of mutual funds with similar objectives tracked by Lipper Inc. The past one year average represents a peer group of 40 mutual funds. These benchmarks include reinvested dividends and capital gains, if any, and exclude the effect of sales charges.

Average Annual Total Returns

|

Periods ended August 31, 2000 |

Past 1 |

Past 5 |

Past 10 |

|

Spartan Short-Intermediate Municipal Income |

4.45% |

4.29% |

5.25% |

|

LB 1-6 Year Municipal Bond |

4.89% |

4.70% |

n/a* |

|

Short-Intermediate Municipal Debt |

3.98% |

3.92% |

5.31% |

Average annual total returns take the fund's cumulative return and show you what would have happened if the fund had performed at a constant rate each year. (Note: Lipper calculates average annual total returns by annualizing each fund's total return, then taking an arithmetic average. This may produce a different figure than that obtained by averaging the cumulative total returns and annualizing the result.)

* Not available

Annual Report

Performance - continued

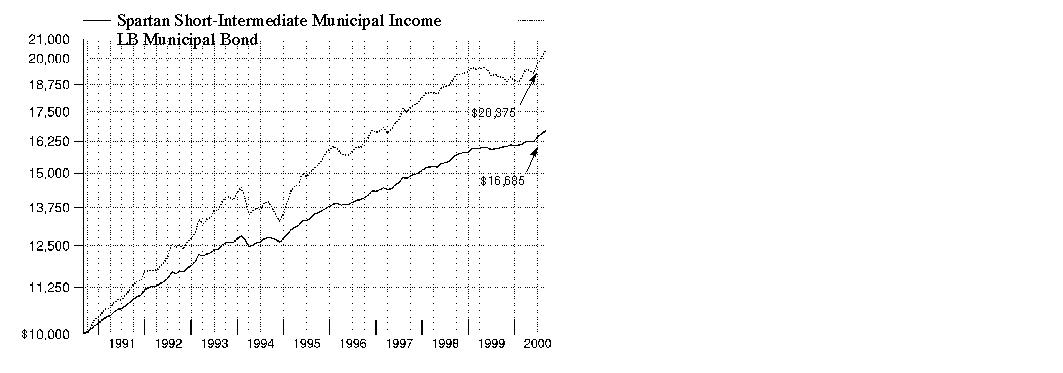

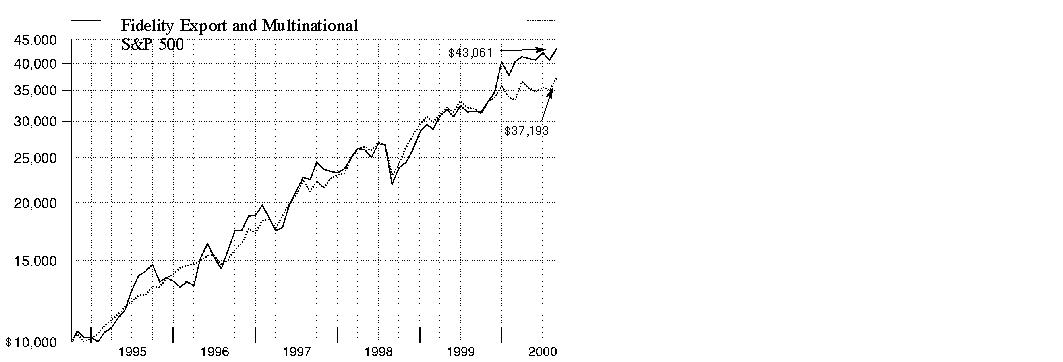

$10,000 Over 10 Years

$10,000 Over 10 Years: Let's say hypothetically that $10,000 was invested in Spartan Short-Intermediate Municipal Income Fund on August 31, 1990. As the chart shows, by August 31, 2000, the value of the investment would have grown to $16,685 - a 66.85% increase on the initial investment. For comparison, look at how the Lehman Brothers Municipal Bond Index - a market value-weighted index of investment-grade municipal bonds with maturities of one year or more - did over the same period. With dividends and capital gains, if any, reinvested, the same $10,000 would have grown to $20,375 - a 103.75% increase.

Understanding

Performance

How a fund did yesterday is no guarantee of how it will do tomorrow. Bond prices, for example, generally move in the opposite direction of interest rates. In turn, the share price, return and yield of a fund that invests in bonds will vary. That means if you sell your shares during a market downturn, you might lose money. But if you can ride out the market's ups and downs, you may have a gain.

3Annual Report

Performance - continued

Total Return Components

|

|

|

Years ended August 31, |

||||

|

|

|

2000 |

1999 |

1998 |

1997 |

1996 |

|

Dividend returns |

|

4.12% |

3.92% |

4.27% |

4.38% |

4.25% |

|

Capital returns |

|

0.33% |

-1.48% |

1.10% |

1.11% |

-0.50% |

|

Total returns |

|

4.45% |

2.44% |

5.37% |

5.49% |

3.75% |

Total return components include both dividend returns and capital returns. A dividend return reflects the actual dividends paid by the fund. A capital return reflects both the amount paid by the fund to shareholders as capital gain distributions and changes in the fund's share price. Both returns assume the dividends or capital gains, if any, paid by the fund are reinvested.

Dividends and Yield

|

Periods ended August 31, 2000 |

Past 1 |

Past 6 |

Past 1 |

|

Dividends per share |

3.53¢ |

20.46¢ |

40.04¢ |

|

Annualized dividend rate |

4.15% |

4.08% |

4.03% |

|

30-day annualized yield |

4.09% |

- |

- |

|

30-day annualized tax-equivalent yield |

6.39% |

- |

- |

Dividends per share show the income paid by the fund for a set period. If you annualize this number, based on an average share price of $10.02 over the past one month, $9.94 over the past six months and $9.94 over the past one year, you can compare the fund's income over these three periods. The 30-day annualized yield is a standard formula for all bond funds based on the yields of the bonds in the fund, averaged over the past 30 days. This figure shows you the yield characteristics of the fund's investments at the end of the period. It also helps you compare funds from different companies on an equal basis. The tax-equivalent yield shows what you would have to earn on a taxable investment to equal the fund's tax-free yield, if you're in the 36% federal tax bracket, but does not reflect payment of the federal alternative minimum tax, if applicable. If Fidelity had not reimbursed certain fund expenses the yield and tax-equivalent yield would have been 4.05% and 6.33%, respectively.

Annual Report

Market Recap

After struggling in the first half of the 12-month period ending August 31, 2000, municipal bonds roared back to life in the second half. At the period's outset, muni performance was tempered by a series of interest-rate hikes by the Federal Reserve Board. Munis also had to compete with record-setting equity performance and a strong rally in Treasuries. Beginning in February, however, bargain-hunting investors became attracted to the generally higher yields municipal bonds offered, and the muni market rallied. Demand continued to grow in March as equity markets tumbled. A number of investors, seeking to protect their gains in stocks, reinvested assets into the relative safety of muni bonds. But as demand grew, supply tapered off. Many municipal bond issuers, such as U.S. state and local governments, limited their issuance, partly because higher interest rates discouraged borrowing. The resulting supply/demand imbalance boosted municipal bond prices. The market received another lift in the summer of 2000 when it became apparent that the U.S. economy was slowing and the Fed bypassed opportunities to hike rates in June and August. For the overall 12-month period, the Lehman Brothers Municipal Bond Index - an index of over 35,000 investment-grade, fixed-rate, tax-exempt bonds - returned 6.77%. The overall taxable-bond market, as measured by the Lehman Brothers Aggregate Bond Index, gained 7.56% in the same time frame.

(Portfolio Manager photograph)

Note to shareholders: Christine Thompson became Portfolio Manager of Spartan Short-Intermediate Municipal Income Fund on July 1, 2000.