|

|

|

|

|

Previous: FARMLAND INDUSTRIES INC, 10-K, EX-27, 2000-11-22 |

Next: FIFTH THIRD BANCORP, 425, 2000-11-22 |

Fidelity®

DestinySM

Portfolios:

Destiny I - Class N

Destiny II - Class N

Annual Report

Annual Report

|

Performance |

How the funds have done over time. |

|

|

Fund Talk |

The managers' review of the funds' performance, strategy and outlook. |

|

|

Investment Changes |

A summary of major shifts in the funds' investments over |

|

|

Destiny I |

|

|

|

Investments |

A complete list of the fund's investments with their market values. |

|

|

Financial Statements |

Statements of assets and liabilities, operations, and changes in net assets, as well as financial highlights. |

|

|

Destiny II |

|

|

|

Investments |

A complete list of the fund's investments with their market values. |

|

|

Financial Statements |

Statements of assets and liabilities, operations, and changes in net assets, as well as financial highlights. |

|

|

Notes |

Notes to the financial statements. |

|

|

Independent Auditors' Report |

The auditors' opinion. |

|

|

Distributions |

|

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity

Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

(Recycle graphic) This report is printed on recycled paper using soy-based inks.

The views expressed in this report reflect those of each fund's portfolio manager only through the end of the period of the report as stated on the cover and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the funds. This report is not authorized for distribution to prospective investors in the funds unless preceded or accompanied by an effective prospectus.

Mutual fund shares are not deposits or obligations of, or guaranteed by, any bank or depository institution. Shares are not insured by the FDIC, Federal Reserve Board or any other agency, and are subject to investment risks, including possible loss of principal amount invested.

Neither the funds nor Fidelity Distributors Corporation is a bank.

Annual Report

Fidelity Destiny Portfolios: Destiny I: Class N

Performance: The Bottom Line

$10,000 Over 10 Years

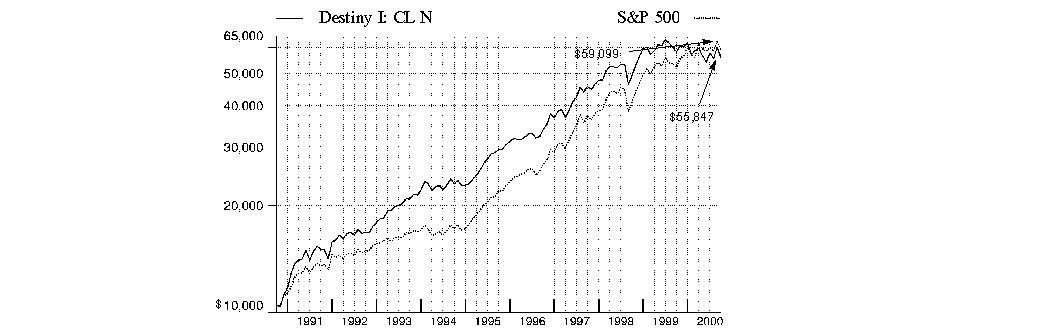

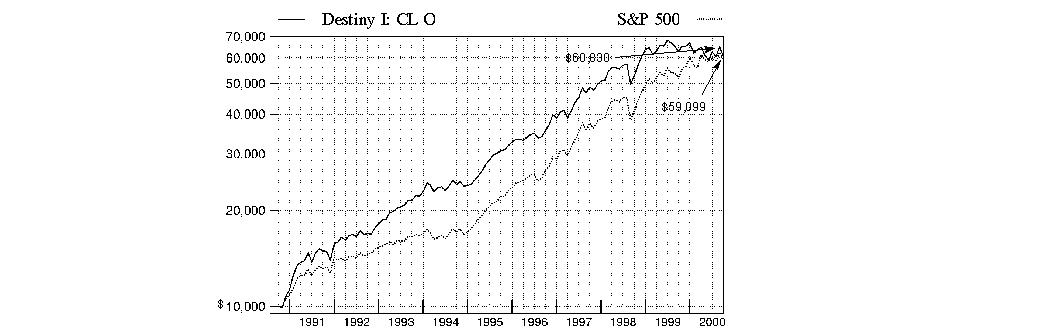

$10,000 Over 10 Years: Let's say hypothetically that $10,000 was invested in Destiny I: Class N on September 30, 1990. As the chart shows, by September 30, 2000, the value of the investment would have grown to $55,847 - a 458.47% increase on the initial investment. For comparison, look at how the S&P 500 ® did over the same period. With dividends and capital gains, if any, reinvested, the same $10,000 investment would have grown to $59,099 - a 490.99% increase.

Cumulative Total Returns

|

Periods ended |

|

Past 1 |

Past 5 |

Past 10 |

|

Destiny I: CL N |

|

-3.98% |

89.78% |

458.47% |

|

S&P 500 |

|

13.28% |

166.82% |

490.99% |

|

Lipper Growth |

|

26.19% |

153.59% |

475.51% |

Average Annual Total Returns

|

Periods ended |

Past 1 |

Past 5 |

Past 10 |

|

Destiny I: CL N |

-3.98% |

13.67% |

18.77% |

|

$50/month 15-Year Plan |

-52.01% |

11.29% |

18.16% |

|

S&P 500 |

13.28% |

21.69% |

19.44% |

|

Lipper Growth |

26.19% |

19.89% |

18.55% |

Destiny I began offering Class N shares on April 30, 1999. The total returns for Class N reported for periods prior to April 30, 1999 are those of Class O, restated to reflect the higher 12b-1 and transfer agent fees applicable to Class N.

The charts above show Destiny I: Class N total returns, which include changes in share price and reinvestment of dividends and capital gains. The fund's cumulative total returns and average annual total returns do not include the effects of the separate sales charges assessed through Destiny Plans I: N (the Plans); the figures provided for a "$50/month 15-year plan" illustrate the fund's performance adjusted to reflect fees and sales charges assessed by the Plans. The illustrations assume an initial investment at the beginning of each period shown. Because the illustrations assume yearly lump sum investments, they do not reflect what investors would have earned had they made regular monthly investments over the period. As shares of the funds may be acquired only through the Plans, investors should consult the Plans' prospectus for more complete information on the impact of the separate charges and fees applicable to each Plan. The rate (%) of deductions decreases as Plan sizes increase. Figures for the S&P 500, a market capitalization-weighted index of common stocks, include reinvestment of dividends. To measure how the funds' performance stacked up against its peers, you can compare it to the growth funds average, which reflects the performance of mutual funds with similar objectives tracked by Lipper Inc. The past one year average represents a peer group of 1,326 mutual funds. These benchmarks include reinvested dividends and capital gains, if any, and exclude the effect of sales charges. Lipper has created new comparison categories that group funds according to portfolio characteristics and capitalization, as well as by capitalization only. These averages are listed below. (dagger)

All performance numbers are historical; the fund's share price and return will vary and you may have a gain or loss when you sell your shares. (Note: Lipper calculates average annual total returns by annualizing each fund's total return, then taking an arithmetic average. This may produce a different figure than that obtained by averaging the cumulative total returns and annualizing the result.)

(dagger) The Lipper large cap value funds average reflects the performance (excluding sales charges) of mutual funds with similar portfolio characteristics and capitalization. The Lipper large cap supergroup average reflects the performance (excluding sales charges) of mutual funds with similar capitalization. As of September 30, 2000, the one year, five year, and 10 year cumulative total returns for the large cap value funds average were, 17.80%, 148.49%, and 428.07%, respectively; and the one year, five year, and 10 year average annual total returns were 17.80%, 19.84%, and 17.89%, respectively. The one year, five year and 10 year cumulative total returns for the large cap supergroup average were, 20.47%, 153.64%, and 454.26%, respectively; and the one year, five year and 10 year average annual total returns were 20.47%, 20.11%, and 18.37%, respectively.

Annual Report

Fidelity Destiny Portfolios: Destiny II: Class N

Performance: The Bottom Line

$10,000 Over 10 Years

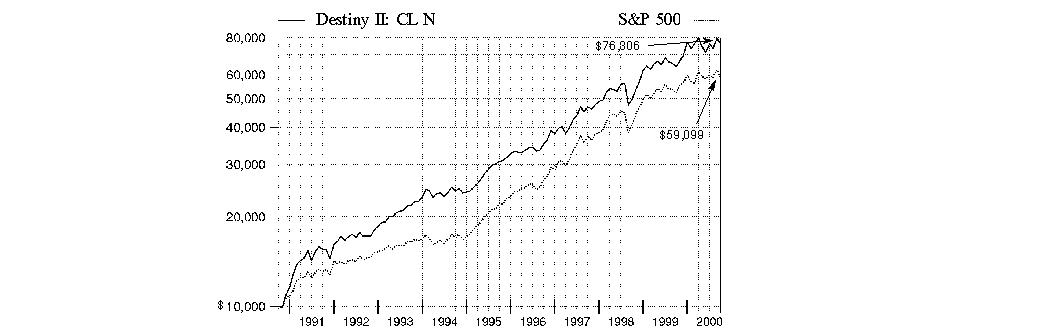

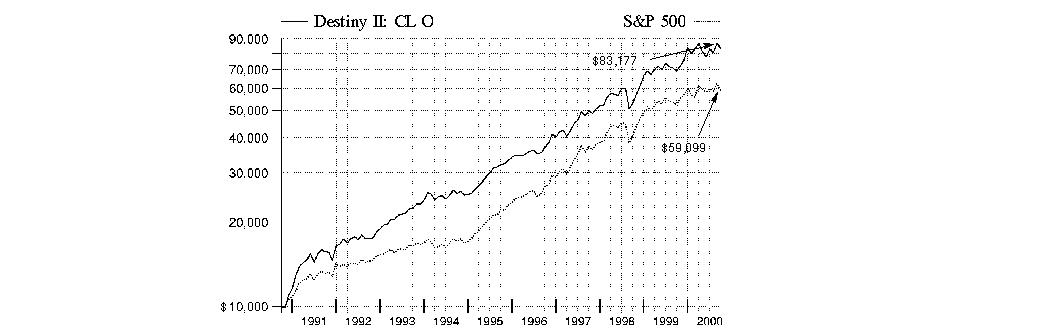

$10,000 Over 10 Years: Let's say hypothetically that $10,000 was invested in Destiny II: Class N on September 30, 1990. As the chart shows, by September 30, 2000, the value of the investment would have grown to $76,306 - a 663.06% increase on the initial investment. For comparison, look at how the S&P 500 did over the same period. With dividends and capital gains, if any, reinvested, the same $10,000 investment would have grown to $59,099 - a 490.99% increase.

Cumulative Total Returns

|

Periods ended |

|

Past 1 |

Past 5 |

Past 10 |

|

Destiny II: CL N |

|

19.13% |

148.44% |

663.06% |

|

S&P 500 |

|

13.28% |

166.82% |

490.99% |

|

Lipper Growth |

|

26.19% |

153.59% |

475.51% |

Average Annual Total Returns

|

Periods ended |

Past 1 |

Past 5 |

Past 10 |

|

Destiny II: CL N |

19.13% |

19.96% |

22.53% |

|

$50/month 15-Year Plan |

-40.43% |

17.46% |

21.91% |

|

S&P 500 |

13.28% |

21.69% |

19.44% |

|

Lipper Growth |

26.19% |

19.89% |

18.55% |

Destiny II began offering Class N shares on April 30, 1999. The total returns for Class N reported for periods prior to April 30, 1999 are those of Class O, restated to reflect the higher 12b-1 and transfer agent fee applicable to Class N.

The charts above show Destiny II: Class N total returns, which include changes in share price and reinvestment of dividends and capital gains. The fund's cumulative total returns and average annual total returns do not include the effects of the separate sales charges assessed through Destiny Plans II: N (the Plans); the figures provided for a "$50/month 15-year plan" illustrate the fund's performance adjusted to reflect fees and sales charges assessed by the Plans. The illustrations assume an initial investment at the beginning of each period shown. Because the illustrations assume yearly lump sum investments, they do not reflect what investors would have earned had they made regular monthly investments over the period. As shares of the funds may be acquired only through the Plans, investors should consult the Plans' prospectus for more complete information on the impact of the separate charges and fees applicable to each Plan. The rate (%) of deductions decreases as Plan sizes increase. Figures for the S&P 500, a market capitalization-weighted index of common stocks, include reinvestment of dividends. To measure how the funds' performance stacked up against its peers, you can compare it to the growth funds average, which reflects the performance of mutual funds with similar objectives tracked by Lipper Inc. The past one year average represents a peer group of 1,326 mutual funds. These benchmarks include reinvested dividends and capital gains, if any, and exclude the effect of sales charges. Lipper has created new comparison categories that group funds according to portfolio characteristics and capitalization, as well as by capitalization only. These averages are listed below. (dagger)

All performance numbers are historical; the fund's share price and return will vary and you may have a gain or loss when you sell your shares. (Note: Lipper calculates average annual total returns by annualizing each fund's total return, then taking an arithmetic average. This may produce a different figure than that obtained by averaging the cumulative total returns and annualizing the result.)

(dagger) The Lipper large cap core funds average reflects the performance (excluding sales charges) of mutual funds with similar portfolio characteristics and capitalization. The Lipper large cap supergroup average reflects the performance (excluding sales charges) of mutual funds with similar capitalization. As of September 30, 2000, the one year, five year, and 10 year cumulative total returns for the large cap core funds average were, 17.80%, 148.49%, and 428.07%, respectively; and the one year, five year, and 10 year average annual total returns were 17.80%, 19.84%, and 17.89%, respectively. The one year, five year and 10 year cumulative total returns for the large cap supergroup average were, 20.47%, 153.64%, and 454.26%, respectively; and the one year, five year and 10 year average annual total returns were 20.47%, 20.11%, and 18.37%, respectively.

Annual Report

Fidelity Destiny Portfolios: Destiny I

Fund Talk: The Manager's Overview

Market Recap

For the most part, the rise and fall of the U.S. equity markets during the 12 months ending September 30, 2000, was predicated on the fortunes of the technology sector. At the period's outset, technology began its meteoric rise as investors rallied behind the sector's growth potential in light of the Internet's accelerating power to reshape how businesses and consumers work and communicate. That euphoria reached its apex in mid-March, when the NASDAQ Composite Index - the bellwether benchmark for the technology sector - broke through the 5,000 point barrier, only four months after first crossing the 3,000 point threshold. But just days later, the tech sector began a 30% descent over a 10-week period. With the Federal Reserve Board continuing to hike interest rates, investors finally realized that technology stock valuations could not be sustained in the event of an economic slowdown. Given its one-third weighting in technology, the Standard & Poor's 500SM Index also suffered, albeit to a lesser extent, as did the blue chips' proxy Dow Jones Industrial Average. Retreating from technology in droves, investors shifted their assets into segments of the market that traditionally perform better in a more moderate-growth economy, such as health care and energy. During the summer months, technology returned to favor to some extent, but investors generally targeted large, steady earnings growers, leaving smaller and more speculative tech stocks to flounder. But come September, more bad news was in store for technology, as the highest oil prices in a decade and a weak European currency combined to dampen the global economy. For the overall 12-month period ending September 30, 2000, the Dow returned 4.62%, the S&P 500 gained 13.28%, and the NASDAQ gained 34.01%. Those numbers can be somewhat misleading, however; all three indexes had negative returns through the first nine months of 2000.

(Portfolio Manager photograph)

An interview with

Karen Firestone, Portfolio Manager of Destiny I

Q. How did the fund perform, Karen?

A. For the 12-month period that ended September 30, 2000, the fund's Class N shares returned -3.98%, trailing the Standard & Poor's 500 Index, which returned 13.28%. Fund performance also lagged the growth funds average tracked by Lipper Inc., which returned 26.19% during this same time frame.

Q. Why did the fund lag its benchmark and peer group during the past 12 months?

A. It had a lot to do with timing. Not owning enough technology stocks during their impressive run-up late in 1999 and early 2000 played a big part in the fund's underperformance. On top of that, shifting the fund's emphasis to growth stocks, particularly technology - at the expense of financial and cyclical, or economically sensitive, stocks - after taking over the fund in February left us overexposed to the sharp correction in the NASDAQ Composite Index during the spring. Investors collectively turned their backs on growth - despite a pair of short-lived rallies in June and August - and assumed a more defensive posture. Even though we owned a lot of the higher-quality larger-cap tech names, such as Cisco and Intel, during the second-half of the period, momentum for these stocks - along with much of their price appreciation - vanished as the market grew increasingly concerned about how a slowing economy would affect the earnings of tech firms. Since we didn't own as many of the smaller-cap tech stocks - a group that produced many of the period's finest performers - as our Lipper peers did on average, we lost ground on a competitive basis.

Q. What other factors influenced fund returns?

A. The fund's positioning in financial stocks dragged on performance. Growing euphoria surrounding tech stocks, coupled with steadily rising interest rates and increased competition, spelled trouble for large bank holdings such as FleetBoston early on in the period. Moreover, we paid the price for not increasing the fund's weighting in banks when the market fled for safety in mid-March. Having significant stakes in home loan financers Fannie Mae and Freddie Mac also hurt, as these issues wilted in the face of proposed legislation threatening to cut their lines of credit with the federal government. Not holding enough of the higher-growth financials, such as Citigroup and Morgan Stanley Dean Witter, which shined during the period, further widened the performance gap. Poor timing in terms of raising the fund's exposure to media stocks also worked against us. Cable stocks, such as Time Warner, struggled with rising rates and the emergence of satellite broadcasters that threatened cable's dominance over local service markets. Most media companies also suffered from concerns about a slowdown in advertising spending by dot-com companies. On a brighter note, the fund's underexposure to traditional incumbent telecommunications companies - namely AT&T - helped. Many of these issues fell in response to pricing pressures applied by new entrants in the consumer long-distance business.

Annual Report

Fidelity Destiny Portfolios: Destiny I

Fund Talk: The Manager's Overview - continued

Q. Could you mention some stocks that fared well and some others that didn't?

A. Sure. Hospital stocks, along with most areas of the health sector, offered a safe haven for jittery tech investors during the period. With Medicare and third-party reimbursements improving and balance sheets stabilizing, investors shrugged off fears of increased government regulation and bid up the prices of stocks such as HCA Healthcare. We also owned some biotechnology firms that performed well, most notably Human Genome, reflecting renewed enthusiasm for the industry following historic advances in gene research. Favorable energy prices resulting from supply shortages lifted stocks such as Calpine and Schlumberger. On the tech front, our emphasis on Internet infrastructure produced some big winners, including Juniper, EMC and Corning. However, we were punished for holding a number of disappointments, namely Microsoft, Philip Morris, Citrix, Texas Instruments and Motorola. The fund no longer held Citrix at the close of the period.

Q. What's your outlook?

A. The market remains volatile and extremely unforgiving, as seen in the recent declines of stocks that failed to beat the Street's earnings expectations. It's become as important as ever to own the stocks that are expected to make their numbers over not just the following quarter, but two to three quarters down the road. With that said, I'll continue to put a premium on earnings and maintain a focus on uncovering exciting new growth opportunities in the marketplace. By sticking with a balanced approach, which allows us to be aggressive and defensive at the same time, we should be able to smooth out some of the turbulence expected over the coming months.

The views expressed in this report reflect those of the portfolio manager only through the end of the period of the report as stated on the cover. The manager's views are subject to change at any time based on market or other conditions. For more information, see page <Click Here>.

Fund Facts

Goal: seeks capital growth

Start date: July 10, 1970

Size: as of September 30, 2000, more than $6.1 billion

Manager: Karen Firestone, since February 2000; manager, Fidelity Advisor Large Cap Stock Fund, since 1998; Fidelity Large Cap Stock Fund, since 1998; several Fidelity Select Portfolios, 1986-1997; joined Fidelity in 1983

3Karen Firestone reviews

her investment philosophy:

"I'm very revenue-growth oriented. I'm certainly more product and sales growth driven than I am guided by cost-control, turnaround and restructuring stories. The fund's former manager, George Vanderheiden, to his credit, had a keen eye for restructuring situations that would emerge over the long term, calling it right countless times during his career. In contrast, I'd say my success has been tied more to short-term results over the next product cycle, or the next year for that matter. I'm a big believer in certain sectors of the market, such as health and media, where I've seen growth work throughout the years. So, my bias has been and will continue to be toward growth, but I overlay some valuation parameters on it. I'm just not willing to pay any price for growth; there are constraints. Comparatively, I'd say that George's tolerance level was even lower than mine in that regard, which is perfectly reasonable. But, even though we share a similar aversion to inordinate risk, I'm willing to pay a little bit more for a stock if I feel that the growth is coming with it.

"During the period's volatility, I stayed the course with many of the fund's technology and media holdings that suffered significant losses. I simply couldn't justify selling stocks that I believed in and whose long-term prospects were solid, and then replace them with unknown commodities. Many of the stocks that declined were purchased at a time when there was a lot of euphoria in the market and prices were unusually high. So I have little choice but to be patient and wait for them to come back. Of course, in hindsight, I wish I had delayed making any significant changes to the portfolio until around May, which would have helped us avoid this problem to begin with. Unfortunately, as many investors know too well, it's not that easy to predict when the market will turn."

Annual Report

Fidelity Destiny Portfolios: Destiny II

Fund Talk: The Manager's Overview

Market Recap

For the most part, the rise and fall of the U.S. equity markets during the 12 months ending September 30, 2000, was predicated on the fortunes of the technology sector. At the period's outset, technology began its meteoric rise as investors rallied behind the sector's growth potential in light of the Internet's accelerating power to reshape how businesses and consumers work and communicate. That euphoria reached its apex in mid-March, when the NASDAQ Composite Index - the bellwether benchmark for the technology sector - broke through the 5,000 point barrier, only four months after first crossing the 3,000 point threshold. But just days later, the tech sector began a 30% descent over a 10-week period. With the Federal Reserve Board continuing to hike interest rates, investors finally realized that technology stock valuations could not be sustained in the event of an economic slowdown. Given its one-third weighting in technology, the Standard & Poor's 500SM Index also suffered, albeit to a lesser extent, as did the blue chips' proxy Dow Jones Industrial Average. Retreating from technology in droves, investors shifted their assets into segments of the market that traditionally perform better in a more moderate-growth economy, such as health care and energy. During the summer months, technology returned to favor to some extent, but investors generally targeted large, steady earnings growers, leaving smaller and more speculative tech stocks to flounder. But come September, more bad news was in store for technology, as the highest oil prices in a decade and a weak European currency combined to dampen the global economy. For the overall 12-month period ending September 30, 2000, the Dow returned 4.62%, the S&P 500 gained 13.28%, and the NASDAQ gained 34.01%. Those numbers can be somewhat misleading, however; all three indexes had negative returns through the first nine months of 2000.

(Portfolio Manager photograph)

Note to shareholders: Adam Hetnarski became Portfolio Manager of

Destiny II on June 1, 2000.

Q. How did the fund perform, Adam?

A. For the 12-month period that ended September 30, 2000, the fund's Class N shares returned 19.13%. The fund outperformed the 13.28% return of the Standard & Poor's 500 Index, but lagged the Lipper growth funds average, which returned 26.19%.

Q. What helped the fund outperform the index during the past year?

A. The fund's overweighted position in technology - a sector that experienced tremendous gains during the first half of the period - was the biggest factor in its strong performance relative to the S&P index. Out-of-benchmark holdings in stocks such as Juniper Networks, i2 Technologies, Nokia and Ariba, the last three of which were added to the fund during the second quarter of 2000, helped significantly. Stock selection in the health care sector, particularly out-of-benchmark biotechnology holdings Human Genome and Genentech, also boosted returns. Additionally, the fund's underweighted position in some large-cap stocks that did poorly - namely Microsoft, Lucent, AT&T and Samsung - enhanced performance. The fund suffered from not owning enough of certain stocks that performed well, such as Oracle and Nortel, while owning too much of others that declined, such as Lexmark and Dell.

Q. What adjustments did you make to the fund since taking over in June?

A. I reduced technology, utilities and international holdings. During this repositioning, I also reduced the number of stocks to roughly 150 names from more than 200. In technology, I reduced the fund's stake in the sector because I didn't want to make that big of a bet in an area where fundamentals were decelerating. I also reduced or eliminated some technology stocks and replaced them with others I felt more strongly about - such as Ariba, a leading business-to-business e-commerce network services provider. In the utilities sector, I reduced exposure to wireless cellular carriers, given the higher-than-expected costs to obtain new spectrum licensing and increased levels of subscriber churn - or customers switching carriers. I also positioned the fund to take advantage of the increased use of wireless technology via stock selection in companies such as - Aether Systems - that are developing software platforms to harness the next generation of wireless transmission. I reduced our international exposure due to slowing economies and the declining value of the euro. Names such as Samsung Electronics, Vodafone AirTouch and Hutchison Whampoa were either significantly reduced or eliminated from the fund. Elsewhere, I boosted the fund's holdings of financial stocks. I felt the slowing of the economy and a diminished threat of interest-rate hikes presented a more positive environment for these stocks. Finally, my repositioning also caused the fund to own more small- and mid-cap stocks with higher growth prospects, such as Juniper.

Annual Report

Fidelity Destiny Portfolios: Destiny II

Fund Talk: The Manager's Overview - continued

Q. What specific stocks worked well for the fund?

A. General Electric was a top performer. Investors seeking less risk during volatile market conditions embraced General Electric's steady growth. Most of the fund's top performers came from the technology sector. Data storage provider EMC, Sun Microsystems and Ariba all performed well due to their strategic positioning in the development of the Internet's architecture.

Q. What stocks disappointed?

A. Holdings in the personal computer (PC) area hurt the fund, as a result of slower-than-expected demand. Printer manufacturer Lexmark experienced problems executing its business model and suffered a slowdown in corporate orders for laser printers. Worldwide PC leader Dell pre-announced a third-quarter profit warning in September, which hurt its stock.

Q. What's your outlook, Adam?

A. Despite the recent pullback in technology stocks, I'm optimistic that this sector is going to perform well, both in the short and long term - hence the fund's large weighting in that area. At the end of the period, there was some overcapacity in the telecommunications space and in the semiconductor industry, but I think the demand for new and better technology is increasing, not decreasing. When I walk around the city, for instance, I see more and more people with the latest wireless handsets and the latest personal digital assistants (PDAs). Turning to the economy, I believe that interest rates have peaked and that the economic slowdown will bottom out, potentially delivering a strong period for the market during the next six months.

The views expressed in this report reflect those of the portfolio manager only through the end of the period of the report as stated on the cover. The manager's views are subject to change at any time based on market or other conditions. For more information, see page <Click Here>.

Fund Facts

Goal: seeks capital growth

Start date: December 30, 1985

Size: as of September 30, 2000, more than $6.2 billion

Manager: Adam Hetnarski, since June 2000; manager, Contrafund II, since February 2000; Fidelity Export and Multinational Fund, 1998-2000; Fidelity Select Technology Portfolio, 1996-1998; analyst, networking and electronics industries, 1994-1996; joined Fidelity in 1991

3Adam Hetnarski on the personal computer market:

"Despite recent warnings of slower growth, I believe that PC unit growth is going to accelerate over the next two years. Entering 2000, the market expected annual growth in the range of 15%-18%. At the end of the third quarter, unit growth appears to be between 13%-15%. I believe that much of the perceived slowdown is actually an oversupply problem and not as dire of a demand issue as it first appeared.

"Going forward, I think PC unit growth will accelerate due to increasing demand. In the first half of 2001, I expect to see a significant replacement cycle when Microsoft's new operating system - Windows 2000 - gains momentum. The new Windows 2000 product requires a faster processor than previous Microsoft operating systems, which could force a percentage of users to upgrade their hardware - or PCs - if they want access to the new operating system and new applications.

"For most of the past year, systems departments within corporations have been evaluating Windows 2000, making sure the operating system functions smoothly within each organization. As more systems managers become satisfied with its functionality and begin deploying the operating system throughout their companies, I expect them to purchase additional hardware to run it. That said, I don't think the majority of corporations reached an adequate level of comfort with Windows 2000 through the third quarter of this year, but those perceptions should begin to change in the next six months."

Annual Report

Top Ten Equity Holdings - Destiny I

|

as of September 30, 2000 |

as of March 31, 2000 |

|

General Electric Co. |

Cisco Systems, Inc. |

|

Cisco Systems, Inc. |

Microsoft Corp. |

|

Intel Corp. |

Intel Corp. |

|

Pfizer, Inc. |

General Electric Co. |

|

Microsoft Corp. |

Fannie Mae |

|

Fannie Mae |

Lucent Technologies, Inc. |

|

EMC Corp. |

Texas Instruments, Inc. |

|

Merck & Co., Inc. |

Home Depot, Inc. |

|

Wal-Mart Stores, Inc. |

Wal-Mart Stores, Inc. |

|

Sun Microsystems, Inc. |

Bristol-Myers Squibb Co. |

Top Ten Equity Holdings - Destiny II

|

as of September 30, 2000 |

as of March 31, 2000 |

|

General Electric Co. |

General Electric Co. |

|

Cisco Systems, Inc. |

Cisco Systems, Inc. |

|

Fannie Mae |

Microsoft Corp. |

|

Microsoft Corp. |

Texas Instruments, Inc. |

|

EMC Corp. |

Chase Manhattan Corp. |

|

Exxon Mobil Corp. |

Nokia AB sponsored ADR |

|

Bristol-Myers Squibb Co. |

Home Depot, Inc. |

|

Freddie Mac |

Sun Microsystems, Inc. |

|

Viacom, Inc. Class B (non-vtg.) |

American Express Co. |

|

Dell Computer Corp. |

Warner-Lambert Co. |

Top Five Market Sectors - Destiny I

|

as of September 30, 2000 |

% of fund's net assets |

as of March 31, 2000 |

% of fund's net assets |

|

Technology |

34.0% |

Technology |

40.8% |

|

Health |

16.2% |

Health |

11.3% |

|

Finance |

10.8% |

Media & Leisure |

10.1% |

|

Media & Leisure |

9.2% |

Finance |

10.0% |

|

Industrial Machinery & Equipment |

7.2% |

Industrial Machinery & Equipment |

6.7% |

Top Five Market Sectors - Destiny II

|

as of September 30, 2000 |

% of fund's net assets |

as of March 31, 2000 |

% of fund's net assets |

|

Technology |

34.9% |

Technology |

37.1% |

|

Finance |

13.8% |

Utilities |

12.2% |

|

Health |

12.1% |

Finance |

11.0% |

|

Industrial Machinery & Equipment |

7.6% |

Media & Leisure |

8.6% |

|

Energy |

6.5% |

Health |

8.0% |

Annual Report

Fidelity Destiny Portfolios: Destiny I

Showing Percentage of Net Assets

|

Common Stocks - 97.7% |

|||

|

Shares |

Value (Note 1) |

||

|

AEROSPACE & DEFENSE - 0.6% |

|||

|

Rockwell International Corp. |

504,800 |

$ 15,270,200 |

|

|

United Technologies Corp. |

320,400 |

22,187,700 |

|

|

TOTAL AEROSPACE & DEFENSE |

37,457,900 |

||

|

BASIC INDUSTRIES - 0.3% |

|||

|

Chemicals & Plastics - 0.2% |

|||

|

Union Carbide Corp. |

288,800 |

10,902,200 |

|

|

Packaging & Containers - 0.1% |

|||

|

Tupperware Corp. |

481,450 |

8,666,100 |

|

|

TOTAL BASIC INDUSTRIES |

19,568,300 |

||

|

DURABLES - 1.0% |

|||

|

Consumer Durables - 0.3% |

|||

|

Minnesota Mining & Manufacturing Co. |

178,200 |

16,238,475 |

|

|

Consumer Electronics - 0.7% |

|||

|

Sony Corp. sponsored ADR |

250,900 |

25,325,219 |

|

|

The Swatch Group AG (Reg.) |

69,700 |

20,590,246 |

|

|

|

45,915,465 |

||

|

TOTAL DURABLES |

62,153,940 |

||

|

ENERGY - 4.7% |

|||

|

Energy Services - 2.8% |

|||

|

Global Marine, Inc. (a) |

516,000 |

15,931,500 |

|

|

Halliburton Co. |

833,100 |

40,769,831 |

|

|

Noble Drilling Corp. (a) |

791,700 |

39,782,925 |

|

|

Schlumberger Ltd. (NY Shares) |

878,700 |

72,327,994 |

|

|

|

168,812,250 |

||

|

Oil & Gas - 1.9% |

|||

|

Chevron Corp. |

327,700 |

27,936,425 |

|

|

Devon Energy Corp. |

507,100 |

30,502,065 |

|

|

Exxon Mobil Corp. |

664,900 |

59,259,213 |

|

|

|

117,697,703 |

||

|

TOTAL ENERGY |

286,509,953 |

||

|

FINANCE - 10.8% |

|||

|

Banks - 1.5% |

|||

|

FleetBoston Financial Corp. |

1,169,869 |

45,624,891 |

|

|

Mellon Financial Corp. |

540,000 |

25,042,500 |

|

|

State Street Corp. |

181,500 |

23,595,000 |

|

|

|

94,262,391 |

||

|

Credit & Other Finance - 2.4% |

|||

|

American Express Co. |

885,400 |

53,788,050 |

|

|

Citigroup, Inc. |

1,697,366 |

91,763,849 |

|

|

|

145,551,899 |

||

|

|

|||

|

Shares |

Value (Note 1) |

||

|

Federal Sponsored Credit - 3.1% |

|||

|

Fannie Mae |

1,994,400 |

$ 142,599,600 |

|

|

Freddie Mac |

890,100 |

48,121,031 |

|

|

|

190,720,631 |

||

|

Insurance - 2.8% |

|||

|

American International Group, Inc. |

1,106,364 |

105,865,205 |

|

|

MetLife, Inc. |

1,623,500 |

42,515,406 |

|

|

The Chubb Corp. |

250,500 |

19,820,813 |

|

|

|

168,201,424 |

||

|

Securities Industry - 1.0% |

|||

|

Charles Schwab Corp. |

695,100 |

24,676,050 |

|

|

Morgan Stanley Dean Witter & Co. |

289,100 |

26,434,581 |

|

|

Nomura Securities Co. Ltd. |

520,000 |

11,297,032 |

|

|

|

62,407,663 |

||

|

TOTAL FINANCE |

661,144,008 |

||

|

HEALTH - 16.2% |

|||

|

Drugs & Pharmaceuticals - 13.2% |

|||

|

Alkermes, Inc. (a) |

278,800 |

10,768,650 |

|

|

Amgen, Inc. (a) |

690,600 |

48,223,303 |

|

|

Andrx Corp. - Andrx Group (a) |

230,700 |

21,541,613 |

|

|

ARIAD Pharmaceuticals, Inc. (a) |

518,900 |

6,518,681 |

|

|

ArQule, Inc. (a) |

10,900 |

185,981 |

|

|

Bristol-Myers Squibb Co. |

1,757,700 |

100,408,613 |

|

|

Cambridge Antibody Technology Group PLC (a) |

209,800 |

12,450,497 |

|

|

Eli Lilly & Co. |

658,600 |

53,428,925 |

|

|

Geneva Proteomics (c) |

262,000 |

1,441,000 |

|

|

Human Genome Sciences, Inc. (a) |

66,800 |

11,564,750 |

|

|

ImClone Systems, Inc. (a) |

144,200 |

16,880,413 |

|

|

Merck & Co., Inc. |

1,659,000 |

123,491,813 |

|

|

Millennium Pharmaceuticals, Inc. (a) |

174,800 |

25,531,725 |

|

|

Mylan Laboratories, Inc. |

785,000 |

21,145,938 |

|

|

PE Corp. - Celera Genomics Group (a) |

217,200 |

21,638,550 |

|

|

Pfizer, Inc. |

3,986,725 |

179,153,455 |

|

|

Protein Design Labs, Inc. (a) |

165,000 |

19,882,500 |

|

|

Schering-Plough Corp. |

1,776,400 |

82,602,600 |

|

|

Shire Pharmaceuticals Group PLC ADR (a) |

281,700 |

14,542,763 |

|

|

Vertex Pharmaceuticals, Inc. (a) |

168,700 |

14,255,150 |

|

|

Watson Pharmaceuticals, Inc. (a) |

330,500 |

21,441,188 |

|

|

|

807,098,108 |

||

|

Medical Equipment & Supplies - 1.8% |

|||

|

Johnson & Johnson |

458,700 |

43,089,131 |

|

|

Medtronic, Inc. |

1,121,000 |

58,081,813 |

|

|

Novoste Corp. (a) |

278,700 |

11,844,750 |

|

|

|

113,015,694 |

||

|

Common Stocks - continued |

|||

|

Shares |

Value (Note 1) |

||

|

HEALTH - continued |

|||

|

Medical Facilities Management - 1.2% |

|||

|

HCA - The Healthcare Co. |

1,081,000 |

$ 40,132,125 |

|

|

Tenet Healthcare Corp. |

838,330 |

30,494,254 |

|

|

|

70,626,379 |

||

|

TOTAL HEALTH |

990,740,181 |

||

|

INDUSTRIAL MACHINERY & EQUIPMENT - 7.2% |

|||

|

Electrical Equipment - 6.8% |

|||

|

Emerson Electric Co. |

430,900 |

28,870,300 |

|

|

General Electric Co. |

6,398,900 |

369,136,531 |

|

|

Omron Corp. |

553,000 |

14,544,559 |

|

|

|

412,551,390 |

||

|

Industrial Machinery & Equipment - 0.4% |

|||

|

Illinois Tool Works, Inc. |

171,900 |

9,604,913 |

|

|

Ingersoll-Rand Co. |

469,900 |

15,917,863 |

|

|

|

25,522,776 |

||

|

TOTAL INDUSTRIAL MACHINERY & EQUIPMENT |

438,074,166 |

||

|

MEDIA & LEISURE - 9.2% |

|||

|

Broadcasting - 4.9% |

|||

|

AT&T Corp. - Liberty Media Group |

1,653,584 |

29,764,512 |

|

|

Carlton Communications PLC |

981,333 |

7,639,513 |

|

|

Comcast Corp. Class A (special) (a) |

1,016,300 |

41,604,781 |

|

|

Cox Communications, Inc. Class A (a) |

760,700 |

29,096,775 |

|

|

EchoStar Communications Corp. Class A (a) |

455,590 |

24,032,373 |

|

|

Grupo Televisa SA de CV sponsored GDR |

588,400 |

33,943,325 |

|

|

Infinity Broadcasting Corp. Class A (a) |

360,300 |

11,889,900 |

|

|

Pegasus Communications Corp. (a) |

340,750 |

16,462,484 |

|

|

RTL Group |

157,345 |

17,044,872 |

|

|

Time Warner, Inc. |

787,600 |

61,629,700 |

|

|

Univision Communications, Inc. Class A (a) |

711,000 |

26,573,625 |

|

|

|

299,681,860 |

||

|

Entertainment - 3.5% |

|||

|

Fox Entertainment Group, Inc. Class A (a) |

925,200 |

24,517,800 |

|

|

MGM Mirage, Inc. |

685,300 |

26,169,894 |

|

|

Ticketmaster Online CitySearch, Inc. |

532,400 |

9,017,525 |

|

|

Viacom, Inc. Class B (non-vtg.) (a) |

880,165 |

51,489,653 |

|

|

Walt Disney Co. |

2,649,300 |

101,335,725 |

|

|

|

212,530,597 |

||

|

Publishing - 0.6% |

|||

|

The New York Times Co. Class A |

955,200 |

37,551,300 |

|

|

|

|||

|

Shares |

Value (Note 1) |

||

|

Restaurants - 0.2% |

|||

|

McDonald's Corp. |

459,600 |

$ 13,874,175 |

|

|

TOTAL MEDIA & LEISURE |

563,637,932 |

||

|

NONDURABLES - 5.3% |

|||

|

Beverages - 2.6% |

|||

|

Anheuser-Busch Companies, Inc. |

966,200 |

40,882,338 |

|

|

Heineken NV |

391,700 |

21,768,904 |

|

|

The Coca-Cola Co. |

1,761,500 |

97,102,688 |

|

|

|

159,753,930 |

||

|

Foods - 0.6% |

|||

|

Quaker Oats Co. |

502,700 |

39,776,138 |

|

|

Household Products - 1.2% |

|||

|

Clorox Co. |

37,800 |

1,495,463 |

|

|

Gillette Co. |

842,100 |

25,999,838 |

|

|

Luxottica Group Spa sponsored ADR |

574,200 |

9,258,975 |

|

|

Procter & Gamble Co. |

581,300 |

38,947,100 |

|

|

|

75,701,376 |

||

|

Tobacco - 0.9% |

|||

|

Philip Morris Companies, Inc. |

1,787,200 |

52,610,700 |

|

|

TOTAL NONDURABLES |

327,842,144 |

||

|

RETAIL & WHOLESALE - 4.6% |

|||

|

Drug Stores - 0.1% |

|||

|

CVS Corp. |

94,000 |

4,353,375 |

|

|

General Merchandise Stores - 2.5% |

|||

|

Costco Wholesale Corp. (a) |

158,100 |

5,523,619 |

|

|

Kohls Corp. (a) |

504,400 |

29,097,575 |

|

|

Target Corp. |

235,800 |

6,042,375 |

|

|

Wal-Mart Stores, Inc. |

2,356,400 |

113,401,750 |

|

|

|

154,065,319 |

||

|

Retail & Wholesale, Miscellaneous - 2.0% |

|||

|

Best Buy Co., Inc. (a) |

302,750 |

19,262,469 |

|

|

Home Depot, Inc. |

1,913,400 |

101,529,788 |

|

|

|

120,792,257 |

||

|

TOTAL RETAIL & WHOLESALE |

279,210,951 |

||

|

SERVICES - 1.0% |

|||

|

Advertising - 1.0% |

|||

|

DoubleClick, Inc. (a) |

304,900 |

9,756,800 |

|

|

TMP Worldwide, Inc. (a) |

309,300 |

24,898,650 |

|

|

WPP Group PLC sponsored ADR |

465,800 |

27,627,763 |

|

|

|

62,283,213 |

||

|

TECHNOLOGY - 34.0% |

|||

|

Communications Equipment - 5.7% |

|||

|

Cisco Systems, Inc. (a) |

4,705,800 |

259,995,450 |

|

|

Corning, Inc. |

143,400 |

42,589,800 |

|

|

Lucent Technologies, Inc. |

438,100 |

13,389,431 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value (Note 1) |

||

|

TECHNOLOGY - continued |

|||

|

Communications Equipment - continued |

|||

|

Nortel Networks Corp. |

394,300 |

$ 23,485,494 |

|

|

UTStarcom, Inc. |

535,200 |

11,205,750 |

|

|

|

350,665,925 |

||

|

Computer Services & Software - 9.1% |

|||

|

Affymetrix, Inc. (a) |

377,000 |

18,802,875 |

|

|

Amazon.com, Inc. (a) |

336,500 |

12,934,219 |

|

|

America Online, Inc. (a) |

1,302,600 |

70,014,750 |

|

|

Automatic Data Processing, Inc. |

1,180,400 |

78,939,250 |

|

|

BEA Systems, Inc. (a) |

218,200 |

16,992,325 |

|

|

Cadence Design Systems, Inc. (a) |

809,900 |

20,804,306 |

|

|

CNET Networks, Inc. (a) |

496,000 |

12,082,250 |

|

|

First Data Corp. |

277,000 |

10,820,313 |

|

|

Microsoft Corp. (a) |

2,557,600 |

154,255,250 |

|

|

Oracle Corp. (a) |

657,600 |

51,786,000 |

|

|

Synopsys, Inc. (a) |

134,800 |

5,105,550 |

|

|

VeriSign, Inc. (a) |

220,100 |

44,584,006 |

|

|

VERITAS Software Corp. (a) |

214,500 |

30,459,000 |

|

|

Yahoo!, Inc. (a) |

348,200 |

31,686,200 |

|

|

|

559,266,294 |

||

|

Computers & Office Equipment - 9.9% |

|||

|

Brocade Communications Systems, Inc. (a) |

53,900 |

12,720,400 |

|

|

CDW Computer Centers, Inc. (a) |

337,200 |

23,266,800 |

|

|

Comdisco, Inc. |

216,400 |

4,125,125 |

|

|

Compaq Computer Corp. |

1,049,700 |

28,950,726 |

|

|

Dell Computer Corp. (a) |

1,486,500 |

45,802,781 |

|

|

EMC Corp. (a) |

1,378,000 |

136,594,250 |

|

|

Extreme Networks, Inc. (a) |

86,700 |

9,927,150 |

|

|

Gateway, Inc. (a) |

267,000 |

12,482,250 |

|

|

Hewlett-Packard Co. |

413,500 |

40,109,500 |

|

|

International Business Machines Corp. |

941,600 |

105,930,000 |

|

|

Juniper Networks, Inc. (a) |

153,100 |

33,519,331 |

|

|

Lexmark International Group, Inc. Class A (a) |

271,300 |

10,173,750 |

|

|

Palm, Inc. |

540,000 |

28,586,250 |

|

|

Sun Microsystems, Inc. (a) |

931,400 |

108,740,950 |

|

|

Symbol Technologies, Inc. |

129,800 |

4,664,688 |

|

|

|

605,593,951 |

||

|

Electronic Instruments - 1.2% |

|||

|

Agilent Technologies, Inc. |

290,005 |

14,192,120 |

|

|

Applied Materials, Inc. (a) |

308,800 |

18,315,700 |

|

|

Kudelski SA (a) |

8,850 |

13,558,996 |

|

|

|

|||

|

Shares |

Value (Note 1) |

||

|

LAM Research Corp. (a) |

859,600 |

$ 17,997,875 |

|

|

Novellus Systems, Inc. (a) |

236,400 |

11,007,375 |

|

|

|

75,072,066 |

||

|

Electronics - 8.1% |

|||

|

Altera Corp. (a) |

464,400 |

22,175,100 |

|

|

Analog Devices, Inc. (a) |

356,500 |

29,433,531 |

|

|

Chartered Semiconductor Manufacturing |

292,900 |

17,775,369 |

|

|

GlobeSpan, Inc. (a) |

223,300 |

27,242,600 |

|

|

Intel Corp. |

4,525,100 |

188,074,469 |

|

|

International Rectifier Corp. (a) |

249,900 |

12,635,569 |

|

|

JDS Uniphase Corp. (a) |

318,000 |

30,110,625 |

|

|

Linear Technology Corp. |

251,700 |

16,297,575 |

|

|

LSI Logic Corp. (a) |

425,200 |

12,437,100 |

|

|

Micron Technology, Inc. (a) |

281,340 |

12,941,640 |

|

|

Motorola, Inc. |

732,100 |

20,681,825 |

|

|

PMC-Sierra, Inc. (a) |

51,800 |

11,149,950 |

|

|

SDL, Inc. (a) |

45,900 |

14,197,444 |

|

|

Texas Instruments, Inc. |

1,646,900 |

77,713,094 |

|

|

|

492,865,891 |

||

|

TOTAL TECHNOLOGY |

2,083,464,127 |

||

|

TRANSPORTATION - 0.2% |

|||

|

Trucking & Freight - 0.2% |

|||

|

United Parcel Service, Inc. Class B |

230,300 |

12,983,163 |

|

|

UTILITIES - 2.6% |

|||

|

Cellular - 0.9% |

|||

|

QUALCOMM, Inc. (a) |

269,200 |

19,180,500 |

|

|

Sprint Corp. - PCS Group Series 1 (a) |

450,800 |

15,806,175 |

|

|

Vodafone Group PLC |

5,973,984 |

22,103,781 |

|

|

|

57,090,456 |

||

|

Electric Utility - 0.8% |

|||

|

AES Corp. (a) |

287,900 |

19,721,150 |

|

|

Calpine Corp. (a) |

294,100 |

30,696,688 |

|

|

|

50,417,838 |

||

|

Telephone Services - 0.9% |

|||

|

AT&T Corp. |

335,178 |

9,845,854 |

|

|

DDI Corp. |

1,059 |

6,951,003 |

|

|

McLeodUSA, Inc. Class A (a) |

682,300 |

9,765,419 |

|

|

Metromedia Fiber Network, Inc. Class A (a) |

547,000 |

13,298,938 |

|

|

Qwest Communications International, Inc. (a) |

270,900 |

13,020,131 |

|

|

|

52,881,345 |

||

|

TOTAL UTILITIES |

160,389,639 |

||

|

TOTAL COMMON STOCKS (Cost $5,179,064,482) |

5,985,459,617 |

||

|

Cash Equivalents - 3.9% |

|||

|

Shares |

Value (Note 1) |

||

|

Fidelity Cash Central Fund, 6.60% (b) |

239,922,694 |

$ 239,922,694 |

|

|

|

|

||

|

TOTAL INVESTMENT PORTFOLIO - 101.6% (Cost $5,418,987,176) |

6,225,382,311 |

||

|

NET OTHER ASSETS - (1.6)% |

(101,028,082) |

||

|

NET ASSETS - 100% |

$ 6,124,354,229 |

||

|

Legend |

|

(a) Non-income producing |

|

(b) The rate quoted is the annualized seven-day yield of the fund at period end. A complete listing of the fund's holdings as of its most recent fiscal year end is available upon request. |

|

(c) Restricted securities - Investment in securities not registered under the Securities Act of 1933. |

|

Additional information on each holding is as follows: |

|

Security |

Acquisition Date |

Acquisition Cost |

|

Geneva Proteomics |

7/7/00 |

$ 1,441,000 |

|

Other Information |

|

Purchases and sales of securities, other than short-term securities, aggregated $9,375,176,143 and $9,687,929,601, respectively, of which long-term U.S. government and government agency obligations aggregated $0 and $513,842,688, respectively. |

|

The fund invested in securities that are not registered under the Securities Act of 1933. These securities are subject to legal or contractual restrictions on resale. At the end of the period, restricted securities (excluding Rule 144A issues) amounted to $1,441,000 or 0.0% of net assets. |

|

The fund participated in the security lending program. At period end, the value of securities loaned amounted to $131,799,001. The fund received cash collateral of $140,470,800 which was invested in cash equivalents. |

|

Income Tax Information |

|

At September 30, 2000, the aggregate cost of investment securities for income tax purposes was $5,318,034,092. Net unrealized appreciation aggregated $907,348,219, of which $1,455,155,384 related to appreciated investment securities and $547,807,165 related to depreciated investment securities. |

|

The fund hereby designates approximately $942,283,000 as a capital gain dividend for the purpose of the dividend paid deduction. |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Fidelity Destiny Portfolios: Destiny I

Statement of Assets and Liabilities

|

September 30, 2000 |

||

|

Assets |

|

|

|

Investment in securities, at value |

|

$ 6,225,382,311 |

|

Receivable for investments sold |

|

129,548,835 |

|

Receivable for fund shares sold |

|

432,914 |

|

Dividends receivable |

|

4,575,392 |

|

Interest receivable |

|

1,248,116 |

|

Other receivables |

|

39,007 |

|

Total assets |

|

6,361,226,575 |

|

Liabilities |

|

|

|

Payable for investments purchased |

$ 92,895,859 |

|

|

Payable for fund shares redeemed |

1,615,142 |

|

|

Accrued management fee |

1,213,075 |

|

|

Distribution fees payable |

648 |

|

|

Other payables and accrued expenses |

676,822 |

|

|

Collateral on securities loaned, at value |

140,470,800 |

|

|

Total liabilities |

|

236,872,346 |

|

Net Assets |

|

$ 6,124,354,229 |

|

Net Assets consist of: |

|

|

|

Paid in capital |

|

$ 4,205,152,065 |

|

Undistributed net investment income |

|

26,831,597 |

|

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions |

|

1,086,012,042 |

|

Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies |

|

806,358,525 |

|

Net Assets |

|

$ 6,124,354,229 |

|

Class O: |

|

$22.09 |

|

Class N: |

|

$21.90 |

Statement of Operations

|

|

Year ended September 30, 2000 |

|

|

Investment Income Dividends |

|

$ 51,610,297 |

|

Interest |

|

20,719,388 |

|

Security lending |

|

858,474 |

|

Total income |

|

73,188,159 |

|

Expenses |

|

|

|

Management fee |

$ 29,697,889 |

|

|

Performance adjustment |

(13,259,333) |

|

|

Transfer agent fees |

427,389 |

|

|

Distribution fees |

3,366 |

|

|

Accounting and security lending fees |

807,517 |

|

|

Non-interested trustees' compensation |

25,229 |

|

|

Custodian fees and expenses |

231,786 |

|

|

Registration fees |

26,826 |

|

|

Audit |

50,169 |

|

|

Legal |

18,860 |

|

|

Interest |

3,396 |

|

|

Miscellaneous |

39,127 |

|

|

Total expenses before reductions |

18,072,221 |

|

|

Expense reductions |

(1,618,145) |

16,454,076 |

|

Net investment income |

|

56,734,083 |

|

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: |

|

|

|

Investment securities |

1,114,577,420 |

|

|

Foreign currency transactions |

(230,884) |

1,114,346,536 |

|

Change in net unrealized appreciation (depreciation) on: |

|

|

|

Investment securities |

(1,365,920,944) |

|

|

Assets and liabilities in |

(39,517) |

(1,365,960,461) |

|

Net gain (loss) |

|

(251,613,925) |

|

Net increase (decrease) in net assets resulting from operations |

|

$ (194,879,842) |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Fidelity Destiny Portfolios: Destiny I

Financial Statements - continued

Statement of Changes in Net Assets

|

|

Year ended

September 30, |

Year ended

September 30, |

|

Increase (Decrease) in Net Assets |

|

|

|

Operations |

$ 56,734,083 |

$ 111,568,555 |

|

Net realized gain (loss) |

1,114,346,536 |

979,781,946 |

|

Change in net unrealized appreciation (depreciation) |

(1,365,960,461) |

90,347,540 |

|

Net increase (decrease) in net assets resulting from operations |

(194,879,842) |

1,181,698,041 |

|

Distributions to shareholders |

(114,858,565) |

(105,484,207) |

|

From net realized gain |

(897,912,414) |

(544,915,685) |

|

Total distributions |

(1,012,770,979) |

(650,399,892) |

|

Share transactions - net increase (decrease) |

354,594,496 |

240,053,910 |

|

Total increase (decrease) in net assets |

(853,056,325) |

771,352,059 |

|

Net Assets |

|

|

|

Beginning of period |

6,977,410,554 |

6,206,058,495 |

|

End of period (including undistributed net investment income of $26,831,597 and $88,705,313, respectively) |

$ 6,124,354,229 |

$ 6,977,410,554 |

Financial Highlights - Class O

|

Years ended September 30, |

2000 |

1999 |

1998 |

1997 |

1996 |

|

Selected Per-Share Data |

|

|

|

|

|

|

Net asset value, beginning of period |

$ 26.54 |

$ 24.58 |

$ 25.08 |

$ 20.41 |

$ 18.78 |

|

Income from Investment Operations |

|

|

|

|

|

|

Net investment income |

.20 C |

.42 C |

.44 C |

.49 C |

.45 |

|

Net realized and unrealized gain (loss) |

(.77) |

4.13 |

1.56 |

6.36 |

2.42 |

|

Total from investment operations |

(.57) |

4.55 |

2.00 |

6.85 |

2.87 |

|

Less Distributions |

|

|

|

|

|

|

From net investment income |

(.44) |

(.42) |

(.47) |

(.45) |

(.43) |

|

From net realized gain |

(3.44) |

(2.17) |

(2.03) |

(1.73) |

(.81) |

|

Total distributions |

(3.88) |

(2.59) |

(2.50) |

(2.18) |

(1.24) |

|

Net asset value, end of period |

$ 22.09 |

$ 26.54 |

$ 24.58 |

$ 25.08 |

$ 20.41 |

|

Total Return A, B |

(3.23)% |

18.99% |

8.72% |

36.29% |

16.04% |

|

Ratios and Supplemental Data |

|

|

|

|

|

|

Net assets, end of period (000 omitted) |

$ 6,121,273 |

$ 6,977,155 |

$ 6,206,058 |

$ 5,960,742 |

$ 4,565,482 |

|

Ratio of expenses to average net assets |

.27% |

.32% |

.33% |

.39% |

.65% |

|

Ratio of expenses to average net assets after expense reductions |

.25% D |

.31% D |

.33% |

.38% D |

.65% |

|

Ratio of net investment income to average net assets |

.85% |

1.55% |

1.71% |

2.20% |

2.40% |

|

Portfolio turnover |

145% |

36% |

27% |

32% |

42% |

|

A The total returns would have been lower had certain expenses not been reduced during the periods shown. B Total returns do not include the effects of the separate sales charge and other fees assessed through Fidelity Systematic Investment Plans. C Net investment income per share has been calculated based on average shares outstanding during the period. D FMR or the fund has entered into varying arrangements with third parties who either paid or reduced a portion of the class' expenses. |

|||||

See accompanying notes which are an integral part of the financial statements.

Annual Report

Fidelity Destiny Portfolios: Destiny I

Financial Statements - continued

Financial Highlights - Class N

|

Years ended September 30, |

2000 |

1999 F |

|

Selected Per-Share Data |

|

|

|

Net asset value, beginning of period |

$ 26.45 |

$ 27.76 |

|

Income from Investment Operations |

|

|

|

Net investment income (loss) D |

(.01) |

.08 |

|

Net realized and unrealized gain (loss) |

(.74) |

(1.39) G |

|

Total from investment operations |

(.75) |

(1.31) |

|

Less Distributions |

|

|

|

From net investment income |

(.36) |

- |

|

From net realized gain |

(3.44) |

- |

|

Total distributions |

(3.80) |

- |

|

Net asset value, end of period |

$ 21.90 |

$ 26.45 |

|

Total Return B, C |

(3.98)% |

(4.72)% |

|

Ratios and Supplemental Data |

|

|

|

Net assets, end of period (000 omitted) |

$ 3,081 |

$ 256 |

|

Ratio of expenses to average net assets |

1.14% |

1.18% A |

|

Ratio of expenses to average net assets after expense reductions |

1.12% E |

1.17% A, E |

|

Ratio of net investment income (loss) to average net assets |

(.02)% |

.68% A |

|

Portfolio turnover |

145% |

36% |

|

A Annualized B The total returns would have been lower had certain expenses not been reduced during the periods shown. C Total returns do not include the effects of the separate sales charge and other fees assessed through Fidelity Systematic Investment Plans and for periods of less than one year are not annualized. D Net investment income (loss) per share has been calculated based on average shares outstanding during the period. E FMR or the fund has entered into varying arrangements with third parties who either paid or reduced a portion of the class' expenses. F For the period April 30, 1999 (commencement of sale of Class N shares) to September 30, 1999. G The amount shown for a share outstanding does not correspond with the aggregate net gain on investments for the period due to the timing of sales and repurchases of class shares in relation to fluctuating market values of the investments of the fund. |

||

See accompanying notes which are an integral part of the financial statements.

Annual Report

Fidelity Destiny Portfolios: Destiny II

Showing Percentage of Net Assets

|

Common Stocks - 95.1% |

|||

|

Shares |

Value (Note 1) |

||

|

AEROSPACE & DEFENSE - 0.4% |

|||

|

Ship Building & Repair - 0.4% |

|||

|

General Dynamics Corp. |

367,600 |

$ 23,089,875 |

|

|

BASIC INDUSTRIES - 0.5% |

|||

|

Iron & Steel - 0.1% |

|||

|

Bethlehem Steel Corp. (a) |

2,000,000 |

6,000,000 |

|

|

Metals & Mining - 0.4% |

|||

|

Martin Marietta Materials, Inc. |

625,000 |

23,925,000 |

|

|

TOTAL BASIC INDUSTRIES |

29,925,000 |

||

|

CONSTRUCTION & REAL ESTATE - 1.1% |

|||

|

Building Materials - 0.2% |

|||

|

Florida Rock Industries, Inc. |

375,700 |

14,816,669 |

|

|

Construction - 0.5% |

|||

|

D.R. Horton, Inc. |

600,000 |

10,312,500 |

|

|

Lennar Corp. |

700,000 |

20,781,250 |

|

|

|

31,093,750 |

||

|

Real Estate Investment Trusts - 0.4% |

|||

|

Pinnacle Holdings, Inc. (a) |

900,500 |

23,975,813 |

|

|

TOTAL CONSTRUCTION & REAL ESTATE |

69,886,232 |

||

|

DURABLES - 0.2% |

|||

|

Consumer Electronics - 0.2% |

|||

|

Sony Corp. |

100,000 |

10,093,750 |

|

|

ENERGY - 6.5% |

|||

|

Energy Services - 2.2% |

|||

|

BJ Services Co. (a) |

300,000 |

18,337,500 |

|

|

Halliburton Co. |

700,000 |

34,256,250 |

|

|

Nabors Industries, Inc. (a) |

600,000 |

31,440,000 |

|

|

Noble Drilling Corp. (a) |

900,000 |

45,225,000 |

|

|

Weatherford International, Inc. |

300,000 |

12,900,000 |

|

|

|

142,158,750 |

||

|

Oil & Gas - 4.3% |

|||

|

BP Amoco PLC sponsored ADR |

307,812 |

16,314,036 |

|

|

Cabot Oil & Gas Corp. Class A |

775,600 |

15,802,850 |

|

|

Cooper Cameron Corp. (a) |

165,000 |

12,158,438 |

|

|

Exxon Mobil Corp. |

1,949,766 |

173,772,895 |

|

|

Grant Prideco, Inc. (a) |

349,500 |

7,667,156 |

|

|

Royal Dutch Petroleum Co. (NY Shares) |

700,000 |

41,956,250 |

|

|

|

267,671,625 |

||

|

TOTAL ENERGY |

409,830,375 |

||

|

FINANCE - 13.6% |

|||

|

Banks - 1.4% |

|||

|

Bank of New York Co., Inc. |

625,040 |

35,041,305 |

|

|

Bank One Corp. |

1,400,000 |

54,075,000 |

|

|

|

89,116,305 |

||

|

|

|||

|

Shares |

Value (Note 1) |

||

|

Credit & Other Finance - 2.4% |

|||

|

American Express Co. |

1,600,000 |

$ 97,200,000 |

|

|

Citigroup, Inc. |

999,933 |

54,058,878 |

|

|

|

151,258,878 |

||

|

Federal Sponsored Credit - 6.1% |

|||

|

Fannie Mae |

3,250,000 |

232,375,000 |

|

|

Freddie Mac |

2,765,000 |

149,482,813 |

|

|

|

381,857,813 |

||

|

Insurance - 2.6% |

|||

|

AFLAC, Inc. |

320,200 |

20,512,813 |

|

|

AMBAC Financial Group, Inc. |

300,000 |

21,975,000 |

|

|

American International Group, Inc. |

1,282,981 |

122,765,244 |

|

|

|

165,253,057 |

||

|

Securities Industry - 1.1% |

|||

|

Bear Stearns Companies, Inc. |

175,000 |

11,025,000 |

|

|

Daiwa Securities Group, Inc. |

2,377,000 |

27,841,905 |

|

|

Nikko Securities Co. Ltd. |

3,114,000 |

27,636,497 |

|

|

|

66,503,402 |

||

|

TOTAL FINANCE |

853,989,455 |

||

|

HEALTH - 12.1% |

|||

|

Drugs & Pharmaceuticals - 10.8% |

|||

|

Amgen, Inc. (a) |

335,200 |

23,406,388 |

|

|

Bristol-Myers Squibb Co. |

3,000,872 |

171,424,813 |

|

|

Decode Genetics, Inc. |

250,100 |

6,424,444 |

|

|

Eli Lilly & Co. |

1,500,000 |

121,687,500 |

|

|

Genentech, Inc. (a) |

275,000 |

51,064,063 |

|

|

Geneva Proteomics (f) |

255,000 |

1,402,500 |

|

|

Human Genome Sciences, Inc. (a) |

225,000 |

38,953,125 |

|

|

Immunex Corp. (a) |

825,000 |

35,887,500 |

|

|

Pfizer, Inc. |

1,624,975 |

73,022,314 |

|

|

Schering-Plough Corp. |

2,163,000 |

100,579,500 |

|

|

Vertex Pharmaceuticals, Inc. (a) |

200,000 |

16,900,000 |

|

|

Watson Pharmaceuticals, Inc. (a) |

500,000 |

32,437,500 |

|

|

|

673,189,647 |

||

|

Medical Equipment & Supplies - 1.3% |

|||

|

Biomet, Inc. |

915,325 |

32,036,375 |

|

|

Cardinal Health, Inc. |

569,954 |

50,262,818 |

|

|

|

82,299,193 |

||

|

TOTAL HEALTH |

755,488,840 |

||

|

INDUSTRIAL MACHINERY & EQUIPMENT - 7.6% |

|||

|

Electrical Equipment - 6.4% |

|||

|

Alcatel SA sponsored ADR |

685,000 |

43,069,375 |

|

|

Furukawa Electric Co. Ltd. |

300,000 |

8,278,635 |

|

|

General Electric Co. |

6,032,000 |

347,970,990 |

|

|

|

399,319,000 |

||

|

Common Stocks - continued |

|||

|

Shares |

Value (Note 1) |

||

|

INDUSTRIAL MACHINERY & EQUIPMENT - continued |

|||

|

Industrial Machinery & Equipment - 1.2% |

|||

|

Caterpillar, Inc. |

1,125,000 |

$ 37,968,750 |

|

|

Tyco International Ltd. |

700,000 |

36,312,500 |

|

|

|

74,281,250 |

||

|

TOTAL INDUSTRIAL MACHINERY & EQUIPMENT |

473,600,250 |

||

|

MEDIA & LEISURE - 5.6% |

|||

|

Broadcasting - 2.0% |

|||

|

AT&T Corp. - Liberty Media Group |

699,984 |

12,599,712 |

|

|

Clear Channel Communications, Inc. (a) |

500,000 |

28,250,000 |

|

|

Grupo Televisa SA de CV sponsored GDR |

650,000 |

37,496,875 |

|

|

Infinity Broadcasting Corp. Class A (a) |

1,150,000 |

37,950,000 |

|

|

Radio One, Inc. Class D (non-vtg.) (a) |

129,700 |

916,006 |

|

|

Time Warner, Inc. |

129,962 |

10,169,527 |

|

|

|

127,382,120 |

||

|

Entertainment - 2.5% |

|||

|

MGM Mirage, Inc. |

700,000 |

26,731,250 |

|

|

Viacom, Inc. Class B (non-vtg.) (a) |

2,201,030 |

128,760,255 |

|

|

|

155,491,505 |

||

|

Publishing - 1.1% |

|||

|

McGraw-Hill Companies, Inc. |

1,050,000 |

66,740,625 |

|

|

TOTAL MEDIA & LEISURE |

349,614,250 |

||

|

NONDURABLES - 5.4% |

|||

|

Beverages - 2.1% |

|||

|

Anheuser-Busch Companies, Inc. |

1,550,000 |

65,584,375 |

|

|

The Coca-Cola Co. |

1,250,000 |

68,906,250 |

|

|

|

134,490,625 |

||

|

Foods - 1.1% |

|||

|

Keebler Foods Co. |

300,000 |

12,600,000 |

|

|

Quaker Oats Co. |

700,000 |

55,387,500 |

|

|

|

67,987,500 |

||

|

Tobacco - 2.2% |

|||

|

Philip Morris Companies, Inc. |

3,000,000 |

88,312,500 |

|

|

RJ Reynolds Tobacco Holdings, Inc. |

550,000 |

17,737,500 |

|

|

UST, Inc. |

1,250,000 |

28,593,750 |

|

|

|

134,643,750 |

||

|

TOTAL NONDURABLES |

337,121,875 |

||

|

PRECIOUS METALS - 0.2% |

|||

|

Homestake Mining Co. |

2,866,600 |

14,870,488 |

|

|

RETAIL & WHOLESALE - 2.6% |

|||

|

Apparel Stores - 0.4% |

|||

|

Abercrombie & Fitch Co. Class A (a) |

1,500,000 |

28,593,750 |

|

|

|

|||

|

Shares |

Value (Note 1) |

||

|

General Merchandise Stores - 0.9% |

|||

|

Kohls Corp. (a) |

200,000 |

$ 11,537,500 |

|

|

Wal-Mart Stores, Inc. |

950,800 |

45,757,250 |

|

|

|

57,294,750 |

||

|

Retail & Wholesale, Miscellaneous - 1.3% |

|||

|

eToys, Inc. (a) |

100,000 |

534,375 |

|

|

Home Depot, Inc. |

1,474,950 |

78,264,534 |

|

|

|

78,798,909 |

||

|

TOTAL RETAIL & WHOLESALE |

164,687,409 |

||

|

SERVICES - 0.3% |

|||

|

Advertising - 0.3% |

|||

|

Omnicom Group, Inc. |

300,000 |

21,881,250 |

|

|

TECHNOLOGY - 34.8% |

|||

|

Communications Equipment - 5.5% |

|||

|

Ciena Corp. (a) |

120,000 |

14,737,500 |

|

|

Cisco Systems, Inc. (a) |

4,915,000 |

271,553,750 |

|

|

Nokia AB sponsored ADR |

1,250,000 |

49,765,625 |

|

|

Telefonaktiebolaget LM Ericsson |

575,000 |

8,517,188 |

|

|

|

344,574,063 |

||

|

Computer Services & Software - 16.1% |

|||

|

Aether Systems, Inc. |

330,000 |

34,815,000 |

|

|

Affymetrix, Inc. (a) |

250,000 |

12,468,750 |

|

|

Amazon.com, Inc. (a) |

600,000 |

23,062,500 |

|

|

Ariba, Inc. (a) |

840,000 |

120,343,125 |

|

|

BEA Systems, Inc. (a) |

678,100 |

52,807,038 |

|

|

BMC Software, Inc. (a) |

350,000 |

6,693,750 |

|

|

Cadence Design Systems, Inc. (a) |

1,690,600 |

43,427,288 |

|

|

Computer Associates International, Inc. |

950,000 |

23,928,125 |

|

|

i2 Technologies, Inc. (a) |

555,000 |

103,819,688 |

|

|

Internap Network Services Corp. |

894,100 |

28,890,606 |

|

|

Interwoven, Inc. |

185,000 |

20,916,563 |

|

|

Intuit, Inc. (a) |

771,800 |

43,992,600 |

|

|

J.D. Edwards & Co. (a) |

250,000 |

6,468,750 |

|

|

Microsoft Corp. (a) |

3,600,000 |

217,125,000 |

|

|

NaviSite, Inc. |

60,400 |

1,627,025 |

|

|

Oracle Corp. (a) |

425,000 |

33,468,750 |

|

|

Phone.com, Inc. (a) |

220,000 |

24,997,500 |

|

|

Software.com, Inc. (a) |

277,400 |

50,330,763 |

|

|

VERITAS Software Corp. (a) |

895,700 |

127,189,400 |

|

|

Vignette Corp. (a) |

773,300 |