|

|

|

|

|

Previous: SOUTH TEXAS DRILLING & EXPLORATION INC, 10-Q, EX-27, 2000-11-20 |

Next: CROWN JEWEL RESOURCES CORP, 10QSB, 2000-11-20 |

Spartan®

Fund

Annual Report

September 30, 2000

(2_fidelity_logos)(Registered_Trademark)

|

President's Message |

Ned Johnson on investing strategies. |

|

|

Performance |

How the fund has done over time. |

|

|

Fund Talk |

The manager's review of fund performance, strategy and outlook. |

|

|

Investment Changes |

A summary of major shifts in the fund's investments over the past six months. |

|

|

Investments |

A complete list of the fund's investments with their market values. |

|

|

Financial Statements |

Statements of assets and liabilities, operations, and changes in net assets, as well as financial highlights. |

|

|

Notes |

Notes to the financial statements. |

|

|

Independent Auditors' Report |

The auditors' opinion. |

|

|

Distributions |

|

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

(Recycle graphic) This report is printed on recycled paper using soy-based inks.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

Mutual fund shares are not deposits or obligations of, or guaranteed by, any depository institution. Shares are not insured by the FDIC, Federal Reserve Board or any other agency, and are subject to investment risks, including possible loss of principal amount invested.

Neither the fund nor Fidelity Distributors Corporation is a bank.

For more information on any Fidelity fund, including charges and expenses, call 1-800-544-6666 for a free prospectus. Read it carefully before you invest or send money.

Annual Report

(photo_of_Edward_C_Johnson_3d)

Dear Shareholder:

Disappointing third quarter corporate earnings announcements resulted in negative performance for many major U.S. equity indexes through the first nine months of 2000. A weak euro and the highest oil prices in 10 years frightened many investors into selling shares of large U.S. corporations with multinational presence. In fixed-income markets, 30-year Treasury prices also dropped, and these securities outyielded 10-year Treasury notes for the first time since January.

While it's impossible to predict the future direction of the markets with any degree of certainty, there are certain basic principles that can help investors plan for their future needs.

The longer your investment time frame, the less likely it is that you will be affected by short-term market volatility. A 10-year investment horizon appropriate for saving for a college education, for example, enables you to weather market cycles in a long-term fund, which may have a higher risk potential, but also has a higher potential rate of return.

An intermediate-length fund could make sense if your investment horizon is two to four years, while a short-term bond fund could be the right choice if you need your money in one or two years.

If your time horizon is less than a year, you might want to consider moving some of your bond investment into a money market fund. These funds seek income and a stable share price by investing in high-quality, short-term investments. Of course, it's important to remember that an investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although money market funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in these types of funds.

Finally, no matter what your time horizon or portfolio diversity, it makes good sense to follow a regular investment plan, investing a certain amount of money in a fund at the same time each month or quarter and periodically reviewing your overall portfolio. By doing so, you won't get caught up in the excitement of a rapidly rising market, nor will you buy all your shares at market highs. While this strategy - known as dollar cost averaging - won't assure a profit or protect you from a loss in a declining market, it should help you lower the average cost of your purchases. Of course, you should consider your financial ability to continue your purchases through periods of low price levels before undertaking such a strategy.

If you have questions, please call us at 1-800-544-6666, or visit our web site at www.fidelity.com. We are available 24 hours a day, seven days a week to provide you the information you need to make the investments that are right for you.

Best regards,

/s/Edward C. Johnson 3d

Edward C. Johnson 3d

Annual Report

There are several ways to evaluate a fund's historical performance. You can look at the total percentage change in value, the average annual percentage change or the growth of a hypothetical $10,000 investment. Total return reflects the change in the value of an investment, assuming reinvestment of the fund's dividend income and capital gains (the profits earned upon the sale of securities that have grown in value). You can also look at the fund's income, as reflected in the fund's yield, to measure performance. If Fidelity had not reimbursed certain fund expenses, the total returns and dividends would have been lower.

Cumulative Total Returns

|

Periods ended September 30, 2000 |

|

Past 1 |

Past 5 |

Life of |

|

Spartan ® Inv. Grade Bond |

|

6.63% |

35.36% |

71.45% |

|

LB Aggregate Bond |

|

6.99% |

36.81% |

65.22% |

|

Intermediate Investment Grade |

|

5.75% |

31.03% |

n/a* |

Cumulative total returns show the fund's performance in percentage terms over a set period - in this case, one year, five years or since the fund started on October 1, 1992. For example, if you had invested $1,000 in a fund that had a 5% return over the past year, the value of your investment would be $1,050. You can compare the fund's returns to the performance of the Lehman Brothers Aggregate Bond Index - a market value-weighted index of investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities, with maturities of one year or more. To measure how the fund's performance stacked up against its peers, you can compare it to the intermediate investment grade debt funds average, which reflects the performance of mutual funds with similar objectives tracked by Lipper Inc. The past one year average represents a peer group of 287 mutual funds. These benchmarks include reinvested dividends and capital gains, if any, and exclude the effect of sales charges.

Average Annual Total Returns

|

Periods ended September 30, 2000 |

Past 1 |

Past 5 |

Life of |

|

Spartan Inv. Grade Bond |

6.63% |

6.24% |

6.97% |

|

LB Aggregate Bond |

6.99% |

6.47% |

6.48% |

|

Intermediate Investment Grade |

5.75% |

5.54% |

n/a* |

Average annual total returns take the fund's cumulative return and show you what would have happened if the fund had performed at a constant rate each year. (Note: Lipper calculates average annual total returns by annualizing each fund's total return, then taking an arithmetic average. This may produce a different figure than that obtained by averaging the cumulative total returns and annualizing the result.)

* Not available

Annual Report

Performance - continued

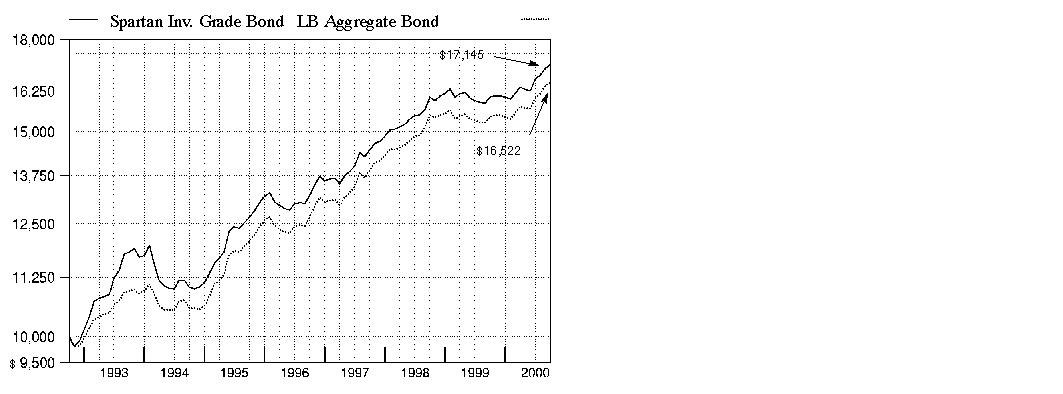

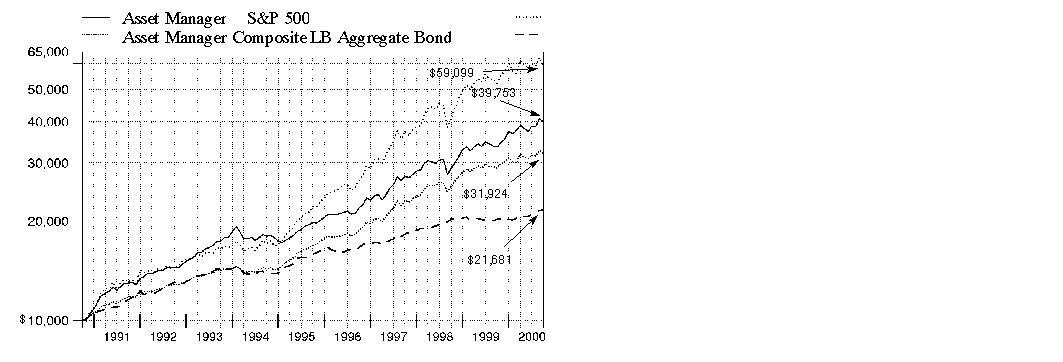

$10,000 Over Life of Fund

$10,000 Over Life of Fund: Let's say hypothetically that $10,000 was invested in Spartan Investment Grade Bond Fund on October 1, 1992, when the fund started. As the chart shows, by September 30, 2000, the value of the investment would have grown to $17,145 - a 71.45% increase on the initial investment. For comparison, look at how the Lehman Brothers Aggregate Bond Index did over the same period. With dividends and capital gains, if any, reinvested, the same $10,000 would have grown to $16,522 - a 65.22% increase.

Understanding

Performance

How a fund did yesterday is no guarantee of how it will do tomorrow. Bond prices, for example, generally move in the opposite direction of interest rates. In turn, the share price, return and yield of a fund that invests in bonds will vary. That means if you sell your shares during a market downturn, you might lose money. But if you can ride out the market's ups and downs, you may have a gain.

3Annual Report

Performance - continued

Total Return Components

|

|

|

Years ended September 30, |

||||

|

|

|

2000 |

1999 |

1998 |

1997 |

1996 |

|

Dividend returns |

|

6.73% |

5.83% |

6.56% |

6.72% |

6.33% |

|

Capital returns |

|

-0.10% |

-5.73% |

4.39% |

2.71% |

-1.87% |

|

Total returns |

|

6.63% |

0.10% |

10.95% |

9.43% |

4.46% |

Total return components include both dividend returns and capital returns. A dividend return reflects the actual dividends paid by the fund. A capital return reflects both the amount paid by the fund to shareholders as capital gain distributions and changes in the fund's share price. Both returns assume the dividends or capital gains, if any, paid by the fund are reinvested.

Dividends and Yield

|

Periods ended September 30, 2000 |

Past 1 |

Past 6 |

Past 1 |

|

Dividends per share |

5.41¢ |

32.32¢ |

64.46¢ |

|

Annualized dividend rate |

6.60% |

6.54% |

6.54% |

|

30-day annualized yield |

6.73% |

- |

- |

Dividends per share show the income paid by the fund for a set period. If you annualize this number, based on an average share price of $9.97 over the past one month, $9.86 over the past six months and $9.86 over the past one year, you can compare the fund's income over these three periods. The 30-day annualized yield is a standard formula for all bond funds based on the yields of the bonds in the fund, averaged over the past 30 days. This figure shows you the yield characteristics of the fund's investments at the end of the period. It also helps you compare funds from different companies on an equal basis. If Fidelity had not reimbursed certain fund expenses during the periods shown, the yield would have been 6.59%.

Annual Report

Market Recap

Most investment-grade bonds overcame sharply rising interest rates and unusually volatile market conditions en route to posting positive returns during the 12-month period that ended September 30, 2000. The Lehman Brothers Aggregate Bond Index - a widely followed measure of taxable-bond performance - returned 6.99% during this time frame. Treasuries struggled the most early on, as investors pursued more attractive alternatives in high-flying stocks and higher-yielding spread sector securities - namely mortgage bonds, government agency issues and corporate bonds. However, the struggle was short-lived, as conditions changed abruptly beginning in January with the announcement by the U.S. Treasury of its intention to reduce new borrowing and use government surplus proceeds to repurchase outstanding debt. Treasury prices jumped in response and, with the help of rising short-term interest rates, induced an inverted yield curve - which occurs when short-term bonds outyield longer-dated securities. Spread sectors recoiled on the news, with their yield spreads widening out relative to Treasuries. Anticipation that the Fed was finished raising rates, combined with persistent flights-to-safety from risk-averse investors concerned about volatility in equity markets, helped further bolster the long bond during the period. The Lehman Brothers Treasury Index returned 7.29%. Mortgages recovered nicely behind reduced interest-rate volatility and stronger-than-anticipated prepayment activity. Similarly, agencies and corporates staged late rallies and outperformed most major U.S. equity indexes through the first nine months of 2000. For the overall 12-month period, the Lehman Brothers Mortgage-Backed Securities, U.S. Agency and Credit Bond indexes returned 7.42%, 6.73% and 5.87%, respectively.

(Portfolio Manager photograph)

An interview with Kevin Grant, Portfolio Manager of Spartan Investment Grade Bond Fund

Q. How did the fund perform, Kevin?

A. For the 12-month period that ended September 30, 2000, the fund returned 6.63%, outpacing the intermediate investment grade debt funds average tracked by Lipper Inc., which returned 5.75%. The Lehman Brothers Aggregate Bond Index returned 6.99% during this same time frame.

Q. What factors had the most influence on fund performance?

A. A big factor was our positioning in corporate bonds. Early in the period, there was a lot of concern in the marketplace about oversupply heading into the Y2K changeover, which caused many corporates to cheapen considerably. Since we really didn't believe the supply scare to begin with, we viewed it as an opportunity to add bonds that we liked, bringing the corporate weighting in the fund to around 40%. The supply fears ultimately proved unfounded, which caused prices to rebound nicely during the fourth quarter of 1999. As it became clear to me early in 2000 that the Federal Reserve Board was going to continue to raise interest rates, I decided to reduce the fund's stake in corporates to around 30% and, in doing so, lock in some profits. My focus was on reducing a long-standing overweighting in banks - a posture that worked out well for us in the past - because I felt that it would be extremely difficult for these securities to outperform in a more difficult credit environment. This strategy paid off as the market proceeded to punish the group during the spring.

Annual Report

Fund Talk: The Manager's Overview - continued

Q. What other strategies worked?

A. Overall, I became much more defensive in terms of our corporate holdings, reducing our risk exposure through increased diversification. Despite the fact that most corporates lagged the rest of the market, tactical allocations into various subsectors, such as energy, aided relative performance. The fund benefited from buying bonds from high-quality issuers when oil was trading at around $11 per barrel, which offered a tremendous value opportunity, and selling some of them as oil eclipsed the $30 plateau. Owning Yankee bonds - dollar-denominated securities issued by foreign entities - at the expense of banks also helped. Moreover, by investing in other defensive issues, including commercial mortgage-backed securities, we were able to further diversify the portfolio while providing the fund with some additional yield. In hindsight, I wish I had sold all of our credit risk earlier in the year. I trimmed positions as prudently as possible, but I wanted to maintain some sort of yield in the fund. Still, we maintained an edge over our Lipper peers by holding fewer long-term, lower-quality corporate bonds, which underperformed all sectors of the market during the period.

Q. How did the fund's mortgage holdings fare?

A. We were rewarded for our emphasis on seasoned discount bonds - mortgages created in 1996 and 1997 - which benefited from strong housing turnover fueled by a robust economy. A red-hot housing market meant higher-than-normal prepayment activity, which resulted in a steady windfall for us as we got prepaid at par, or face value, while market prices were at discounts.

Q. How did your decision to remain underweighted in Treasuries and agency securities play out for the fund?

A. It worked to our advantage. Treasuries led the market during the first half of 2000, spurred by the U.S. government's decision to repurchase outstanding debt as a result of the growing federal surplus. Even though we were underweighted relative to the index at this time, we managed to gain ground by way of security selection. We benefited by positioning the fund ahead of the buybacks in long-term Treasuries and callable Treasuries, the latter of which also were repurchased. This strategy worked out nicely for us. The fund's underexposure to agencies also helped, as these securities retreated in response to rumblings in Washington threatening to strip Fannie Mae and Freddie Mac of their implicit government backing.

Q. What's your outlook?

A. I feel that investment-grade bonds should continue to produce reasonably attractive absolute returns in the coming months. I think there's a lot of value in non-Treasury markets, especially in the corporate segment where prices haven't been this low in over a decade. By historical standards, investors are currently paid handsomely for taking on additional risk. Since it seems like it will be tougher to make money on Treasuries going forward, I plan to maintain an overweighting in corporate bonds - focusing on the more defensive sectors and adding to the fund's position while valuations appear attractive.

Annual Report

Fund Talk: The Manager's Overview - continued

The views expressed in this report reflect those of the portfolio manager only through the end of the period of the report as stated on the cover and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Fund Facts

Goal: high current income

Fund number: 448

Trading symbol: FSIBX

Start date: October 1, 1992

Size: as of September 30, 2000, more than $1.8 billion

Manager: Kevin Grant, since 1997; manager, several Fidelity investment-grade taxable bond funds; joined Fidelity in 1993

3Kevin Grant on the importance of diversification in today's market:

"Diversification has been an important theme for me for quite some time now. The idea is that it's a very tough environment for corporations these days, and it's become increasingly difficult to predict random credit events that besiege companies. The only way, I feel, to truly protect yourself from negative event risk is through diversification.

"It's important to note that diversification works differently for bonds than it does for stocks. Concentrated stock portfolios can work because stocks are capable of doubling, tripling or even rising tenfold. When this happens, it can cover up a lot of duds, or issues that go to zero. However, it's not that easy for bonds, which don't have the luxury of growing in price exponentially. So, if a company gets into trouble, bondholders are left holding the bag. On the other hand, if things work out well investors are limited to the yield on the bond and, if they're fortunate, a bit of price appreciation to go along with it.

"As a money manager, I want the advantages of owning corporate bonds without being heavily exposed to a small number of issuers. The only way to do that is to own a lot of names. By leveraging the research strength and trading capabilities of Fidelity, we're able to do just that, which gives us the opportunity to succeed."

Annual Report

|

Quality Diversification as of September 30, 2000 |

||

|

(Moody's Ratings) |

% of fund's investments |

% of fund's investments |

|

Aaa |

65.9 |

61.4 |

|

Aa |

1.2 |

1.5 |

|

A |

9.7 |

9.0 |

|

Baa |

17.6 |

20.3 |

|

Ba and Below |

0.2 |

0.8 |

|

Table excludes short-term investments. Where Moody's ratings are not available, we have used S&P ® ratings. |

|

Average Years to Maturity as of September 30, 2000 |

||

|

|

|

6 months ago |

|

Years |

9.7 |

9.0 |

|

Average years to maturity is based on the average time remaining until principal payments are expected from each of the fund's bonds, weighted by dollar amount. |

|

Duration as of September 30, 2000 |

||

|

|

|

6 months ago |

|

Years |

4.9 |

5.2 |

|

Duration shows how much a bond fund's price fluctuates with changes in comparable interest rates. If rates rise 1%, for example, a fund with a five-year duration is likely to lose about 5% of its value. Other factors also can influence a bond fund's performance and share price. Accordingly, a bond fund's actual performance may differ from this example. |

|

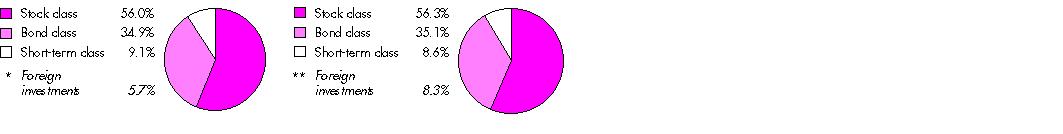

Asset Allocation (% of fund's net assets) |

|||||||

|

As of September 30, 2000 * |

As of March 31, 2000 ** |

||||||

|

Corporate Bonds 24.2% |

|

|

Corporate Bonds 28.0% |

|

||

|

U.S. Government |

|

|

U.S. Government |

|

||

|

Asset-Backed |

|

|

Asset-Backed |

|

||

|

CMOs and Other Mortgage Related Securities 2.9% |

|

|

CMOs and Other Mortgage Related Securities 1.2% |

|

||

|

Other Investments 3.1% |

|

|

Other Investments 3.4% |

|

||

|

Short-Term Investments

and Net |

|

|

Short-Term Investments

and Net |

|

||

|

* Foreign investments |

7.1% |

|

** Foreign investments |

8.8% |

|

||

Annual Report

Showing Percentage of Net Assets

|

Nonconvertible Bonds - 24.2% |

|||||

|

Moody's Ratings |

Principal Amount (000s) |

Value (Note 1) (000s) |

|||

|

AEROSPACE & DEFENSE - 0.1% |

|||||

|

Defense Electronics - 0.1% |

|||||

|

Raytheon Co. 7.9% 3/1/03 (c) |

Baa2 |

|

$ 1,420 |

$ 1,431 |

|

|

BASIC INDUSTRIES - 0.0% |

|||||

|

Paper & Forest Products - 0.0% |

|||||

|

Fort James Corp. 6.625% 9/15/04 |

Baa2 |

|

595 |

574 |

|

|

CONSTRUCTION & REAL ESTATE - 2.7% |

|||||

|

Real Estate - 0.3% |

|||||

|

Cabot Industrial Property LP 7.125% 5/1/04 |

Baa2 |

|

2,280 |

2,207 |

|

|

Duke Realty LP 7.3% 6/30/03 |

Baa1 |

|

4,000 |

3,985 |

|

|

|

6,192 |

||||

|

Real Estate Investment Trusts - 2.4% |

|||||

|

CenterPoint Properties Trust 6.75% 4/1/05 |

Baa2 |

|

1,100 |

1,043 |

|

|

Equity Office Properties Trust: |

|

|

|

|

|

|

6.5% 1/15/04 |

Baa1 |

|

4,040 |

3,929 |

|

|

6.625% 2/15/05 |

Baa1 |

|

8,010 |

7,748 |

|

|

6.75% 2/15/08 |

Baa1 |

|

6,270 |

5,859 |

|

|

7.25% 2/15/18 |

Baa1 |

|

5,200 |

4,607 |

|

|

Merry Land & Investment Co., Inc. 7.25% 6/15/05 |

A3 |

|

3,150 |

3,062 |

|

|

ProLogis Trust 6.7% 4/15/04 |

Baa1 |

|

970 |

939 |

|

|

Spieker Properties LP: |

|

|

|

|

|

|

6.75% 1/15/08 |

Baa2 |

|

5,750 |

5,367 |

|

|

6.8% 5/1/04 |

Baa2 |

|

5,250 |

5,111 |

|

|

6.9% 1/15/04 |

Baa2 |

|

1,650 |

1,620 |

|

|

Spieker Properties, Inc. 7.125% 7/1/09 |

Baa2 |

|

5,000 |

4,733 |

|

|

|

44,018 |

||||

|

TOTAL CONSTRUCTION & REAL ESTATE |

50,210 |

||||

|

DURABLES - 0.1% |

|||||

|

Autos, Tires, & Accessories - 0.1% |

|||||

|

Daimler-Chrysler North America Holding Corp. 8% 6/15/10 |

A1 |

|

1,990 |

2,046 |

|

|

ENERGY - 2.6% |

|||||

|

Oil & Gas - 2.6% |

|||||

|

Anadarko Petroleum Corp.: |

|

|

|

|

|

|

7% 11/15/27 |

Baa1 |

|

3,785 |

3,308 |

|

|

7.2% 3/15/29 |

Baa1 |

|

8,200 |

7,617 |

|

|

Nonconvertible Bonds - continued |

|||||

|

Moody's Ratings |

Principal Amount (000s) |

Value (Note 1) (000s) |

|||

|

ENERGY - continued |

|||||

|

Oil & Gas - continued |

|||||

|

Apache Corp.: |

|

|

|

|

|

|

7.625% 7/1/19 |

Baa1 |

|

$ 1,535 |

$ 1,513 |

|

|

7.7% 3/15/26 |

Baa1 |

|

900 |

886 |

|

|

Apache Finance Property Ltd. 6.5% 12/15/07 |

Baa1 |

|

1,600 |

1,518 |

|

|

Duke Energy Field Services LLC 7.875% 8/16/10 |

Baa2 |

|

6,000 |

6,104 |

|

|

Oryx Energy Co.: |

|

|

|

|

|

|

8.125% 10/15/05 |

Baa1 |

|

4,640 |

4,821 |

|

|

8.375% 7/15/04 |

Baa1 |

|

5,000 |

5,181 |

|

|

Petro-Canada 7% 11/15/28 |

A3 |

|

4,105 |

3,662 |

|

|

Ras Laffan Liquid Natural Gas Co. Ltd. yankee 8.294% 3/15/14 (c) |

Baa3 |

|

5,200 |

4,971 |

|

|

Tosco Corp. 8.125% 2/15/30 |

Baa2 |

|

7,200 |

7,226 |

|

|

|

46,807 |

||||

|

FINANCE - 8.9% |

|||||

|

Banks - 3.8% |

|||||

|

ABN-Amro Bank NV, Chicago 6.625% 10/31/01 |

A1 |

|

5,750 |

5,730 |

|

|

Banc One Corp. 7.25% 8/1/02 |

A1 |

|

2,000 |

2,011 |

|

|

Bank of Montreal 6.1% 9/15/05 |

A1 |

|

3,000 |

2,848 |

|

|

Bank of Tokyo-Mitsubishi Ltd. 8.4% 4/15/10 |

A3 |

|

1,500 |

1,527 |

|

|

Bank One Capital III 8.75% 9/1/30 |

Aa3 |

|

3,400 |

3,390 |

|

|

Bank One Corp. 7.875% 8/1/10 |

A1 |

|

9,700 |

9,841 |

|

|

Barclays Bank PLC yankee: |

|

|

|

|

|

|

5.95% 7/15/01 |

A1 |

|

4,450 |

4,419 |

|

|

8.55% 9/29/49 (b)(c) |

Aa2 |

|

1,800 |

1,815 |

|

|

Capital One Bank 6.375% 2/15/03 |

Baa2 |

|

2,400 |

2,339 |

|

|

Capital One Financial Corp. 7.125% |

Baa3 |

|

2,900 |

2,728 |

|

|

Fleet/Norstar Financial Group, Inc. 9% |

A3 |

|

370 |

379 |

|

|

FleetBoston Financial Corp. 7.25% 9/15/05 |

A2 |

|

4,730 |

4,746 |

|

|

HSBC Finance Nederland BV 7.4% |

A1 |

|

250 |

252 |

|

|

Kansallis-Osake-Pankki (NY Branch) yankee |

A1 |

|

430 |

448 |

|

|

Korea Development Bank: |

|

|

|

|

|

|

6.625% 11/21/03 |

Baa2 |

|

2,775 |

2,703 |

|

|

7.125% 4/22/04 |

Baa2 |

|

400 |

394 |

|

|

7.375% 9/17/04 |

Baa2 |

|

3,060 |

3,032 |

|

|

Nonconvertible Bonds - continued |

|||||

|

Moody's Ratings |

Principal Amount (000s) |

Value (Note 1) (000s) |

|||

|

FINANCE - continued |

|||||

|

Banks - continued |

|||||

|

MBNA Corp.: |

|

|

|

|

|

|

6.34% 6/2/03 |

Baa2 |

|

$ 800 |

$ 772 |

|

|

6.875% 11/15/02 |

Baa2 |

|

3,600 |

3,583 |

|

|

Providian National Bank: |

|

|

|

|

|

|

6.25% 5/7/01 |

Baa3 |

|

5,590 |

5,539 |

|

|

6.75% 3/15/02 |

Baa3 |

|

2,160 |

2,134 |

|

|

Sanwa Finance Aruba AEC 8.35% 7/15/09 |

Baa1 |

|

6,000 |

5,965 |

|

|

Sumitomo Bank International Finance NV 8.5% 6/15/09 |

Baa1 |

|

1,100 |

1,121 |

|

|

Summit Bancorp 8.625% 12/10/02 |

A3 |

|

1,000 |

1,024 |

|

|

Union Planters Corp. 6.75% 11/1/05 |

Baa2 |

|

1,200 |

1,152 |

|

|

Union Planters National Bank 6.81% 8/20/01 |

A3 |

|

1,000 |

998 |

|

|

|

70,890 |

||||

|

Credit & Other Finance - 4.7% |

|||||

|

Associates Corp. of North America: |

|

|

|

|

|

|

6% 4/15/03 |

A1 |

|

2,400 |

2,355 |

|

|

6% 7/15/05 |

A1 |

|

5,000 |

4,816 |

|

|

Bell Atlantic Financial Service, Inc. 7.6% 3/15/07 |

A1 |

|

2,500 |

2,546 |

|

|

CIT Group, Inc. 5.5% 2/15/04 |

A1 |

|

980 |

928 |

|

|

Daimler-Chrysler NA Holding Corp. 6.59% 6/18/02 |

A1 |

|

575 |

571 |

|

|

ERP Operating LP: |

|

|

|

|

|

|

6.55% 11/15/01 |

A3 |

|

1,000 |

992 |

|

|

7.1% 6/23/04 |

A3 |

|

4,000 |

3,949 |

|

|

First Security Capital I 8.41% 12/15/26 |

A3 |

|

4,420 |

4,069 |

|

|

Ford Motor Credit Co.: |

|

|

|

|

|

|

7.5% 3/15/05 |

A2 |

|

8,000 |

8,066 |

|

|

7.875% 6/15/10 |

A2 |

|

2,210 |

2,233 |

|

|

General Motors Acceptance Corp.: |

|

|

|

|

|

|

7.5% 7/15/05 |

A2 |

|

4,000 |

4,050 |

|

|

7.625% 6/15/04 |

A2 |

|

5,400 |

5,497 |

|

|

7.75% 1/19/10 |

A2 |

|

3,700 |

3,737 |

|

|

GS Escrow Corp. 7.125% 8/1/05 |

Ba1 |

|

1,860 |

1,731 |

|

|

Household Finance Corp. 8% 5/9/05 |

A2 |

|

5,300 |

5,476 |

|

|

HSBC Capital Funding LP: |

|

|

|

|

|

|

9.547% 12/31/49 (b)(c) |

A1 |

|

1,900 |

2,012 |

|

|

10.176% 12/31/49 (b)(c) |

A1 |

|

775 |

854 |

|

|

Newcourt Credit Group, Inc. 6.875% |

A1 |

|

1,850 |

1,823 |

|

|

Nonconvertible Bonds - continued |

|||||

|

Moody's Ratings |

Principal Amount (000s) |

Value (Note 1) (000s) |

|||

|

FINANCE - continued |

|||||

|

Credit & Other Finance - continued |

|||||

|

Qwest Capital Funding, Inc.: |

|

|

|

|

|

|

7.75% 8/15/06 (c) |

Baa1 |

|

$ 3,700 |

$ 3,751 |

|

|

7.9% 8/15/10 (c) |

Baa1 |

|

3,100 |

3,164 |

|

|

Sprint Capital Corp.: |

|

|

|

|

|

|

5.7% 11/15/03 |

Baa1 |

|

2,800 |

2,678 |

|

|

5.875% 5/1/04 |

Baa1 |

|

290 |

277 |

|

|

6.875% 11/15/28 |

Baa1 |

|

5,670 |

4,894 |

|

|

Trizec Finance Ltd. yankee 10.875% 10/15/05 |

Baa3 |

|

1,385 |

1,406 |

|

|

TXU Eastern Funding 6.75% 5/15/09 |

Baa1 |

|

4,200 |

3,804 |

|

|

U.S. West Capital Funding, Inc.: |

|

|

|

|

|

|

6.5% 11/15/18 |

Baa1 |

|

1,450 |

1,276 |

|

|

6.875% 7/15/28 |

Baa1 |

|

8,800 |

7,868 |

|

|

Unicredito Italiano Capital Trust II yankee 9.2% 10/29/49 (b)(c) |

A1 |

|

1,950 |

1,962 |

|

|

|

86,785 |

||||

|

Insurance - 0.1% |

|||||

|

Executive Risk Capital Trust 8.675% 2/1/27 |

Baa3 |

|

1,750 |

1,725 |

|

|

Savings & Loans - 0.1% |

|||||

|

Long Island Savings Bank FSB 6.2% 4/2/01 |

Baa3 |

|

1,550 |

1,538 |

|

|

Securities Industry - 0.2% |

|||||

|

Amvescap PLC yankee: |

|

|

|

|

|

|

6.375% 5/15/03 |

A3 |

|

1,500 |

1,453 |

|

|

6.6% 5/15/05 |

A3 |

|

1,750 |

1,666 |

|

|

|

3,119 |

||||

|

TOTAL FINANCE |

164,057 |

||||

|

INDUSTRIAL MACHINERY & EQUIPMENT - 0.3% |

|||||

|

Tyco International Group SA: |

|

|

|

|

|

|

yankee 6.875% 1/15/29 |

Baa1 |

|

5,000 |

4,313 |

|

|

yankee 6.375% 6/15/05 |

Baa1 |

|

1,830 |

1,778 |

|

|

TOTAL INDUSTRIAL MACHINERY & EQUIPMENT |

6,091 |

||||

|

MEDIA & LEISURE - 2.4% |

|||||

|

Broadcasting - 1.9% |

|||||

|

British Sky Broadcasting Group PLC 8.2% 7/15/09 |

Baa3 |

|

7,750 |

7,359 |

|

|

Clear Channel Communications, Inc. 6.875% 6/15/18 |

Baa3 |

|

5,000 |

4,379 |

|

|

Nonconvertible Bonds - continued |

|||||

|

Moody's Ratings |

Principal Amount (000s) |

Value (Note 1) (000s) |

|||

|

MEDIA & LEISURE - continued |

|||||

|

Broadcasting - continued |

|||||

|

Continental Cablevision, Inc. 8.3% 5/15/06 |

A2 |

|

$ 1,775 |

$ 1,839 |

|

|

TCI Communications, Inc. 9.8% 2/1/12 |

A2 |

|

4,700 |

5,359 |

|

|

TCI Communications Financing III 9.65% 3/31/27 |

A3 |

|

2,500 |

2,699 |

|

|

Time Warner, Inc. 9.125% 1/15/13 |

Baa3 |

|

3,000 |

3,366 |

|

|

USA Networks, Inc./USANi LLC 6.75% 11/15/05 |

Baa3 |

|

10,000 |

9,764 |

|

|

|

34,765 |

||||

|

Publishing - 0.5% |

|||||

|

News America Holdings, Inc. 8% 10/17/16 |

Baa3 |

|

6,000 |

5,782 |

|

|

News America, Inc. 7.125% 4/8/28 |

Baa3 |

|

1,500 |

1,280 |

|

|

Time Warner Entertainment Co. LP: |

|

|

|

|

|

|

8.875% 10/1/12 |

Baa2 |

|

750 |

812 |

|

|

10.15% 5/1/12 |

Baa2 |

|

500 |

588 |

|

|

|

8,462 |

||||

|

TOTAL MEDIA & LEISURE |

43,227 |

||||

|

NONDURABLES - 0.6% |

|||||

|

Beverages - 0.3% |

|||||

|

Seagram JE & Sons, Inc. 6.625% 12/15/05 |

Baa3 |

|

5,320 |

5,188 |

|

|

Foods - 0.1% |

|||||

|

ConAgra, Inc. 7.125% 10/1/26 |

Baa1 |

|

2,040 |

2,004 |

|

|

Tobacco - 0.2% |

|||||

|

RJ Reynolds Tobacco Holdings, Inc. 7.375% 5/15/03 |

Baa2 |

|

3,100 |

2,938 |

|

|

TOTAL NONDURABLES |

10,130 |

||||

|

RETAIL & WHOLESALE - 0.4% |

|||||

|

Drug Stores - 0.2% |

|||||

|

Rite Aid Corp.: |

|

|

|

|

|

|

6.5% 12/15/05 (c) |

Caa1 |

|

6,780 |

2,305 |

|

|

7.125% 1/15/07 |

Caa1 |

|

970 |

320 |

|

|

|

2,625 |

||||

|

Nonconvertible Bonds - continued |

|||||

|

Moody's Ratings |

Principal Amount (000s) |

Value (Note 1) (000s) |

|||

|

RETAIL & WHOLESALE - continued |

|||||

|

General Merchandise Stores - 0.2% |

|||||

|

Federated Department Stores, Inc.: |

|

|

|

|

|

|

6.79% 7/15/27 |

Baa1 |

|

$ 2,000 |

$ 1,928 |

|

|

8.5% 6/15/03 |

Baa1 |

|

2,275 |

2,322 |

|

|

|

4,250 |

||||

|

TOTAL RETAIL & WHOLESALE |

6,875 |

||||

|

TECHNOLOGY - 1.0% |

|||||

|

Computers & Office Equipment - 1.0% |

|||||

|

Comdisco, Inc.: |

|

|

|

|

|

|

5.95% 4/30/02 |

Baa1 |

|

4,200 |

3,965 |

|

|

6.375% 11/30/01 |

Baa1 |

|

6,000 |

5,798 |

|

|

7.23% 8/16/01 |

Baa1 |

|

7,000 |

7,003 |

|

|

7.25% 9/1/02 |

Baa1 |

|

1,000 |

962 |

|

|

|

17,728 |

||||

|

TRANSPORTATION - 1.1% |

|||||

|

Air Transportation - 0.3% |

|||||

|

Continental Airlines, Inc. pass thru trust certificates: |

|

|

|

|

|

|

7.434% 3/15/06 |

Baa1 |

|

995 |

980 |

|

|

7.73% 9/15/12 |

Baa1 |

|

365 |

358 |

|

|

Delta Air Lines, Inc. equipment trust certificate 8.54% 1/2/07 |

Baa1 |

|

2,202 |

2,131 |

|

|

United Air Lines, Inc.: |

|

|

|

|

|

|

9% 12/15/03 |

Baa3 |

|

2,000 |

1,997 |

|

|

10.25% 7/15/21 |

Baa3 |

|

1,000 |

1,034 |

|

|

|

6,500 |

||||

|

Railroads - 0.8% |

|||||

|

Burlington Northern Santa Fe Corp.: |

|

|

|

|

|

|

6.53% 7/15/37 |

Baa2 |

|

10,000 |

9,818 |

|

|

6.875% 12/1/27 |

Baa2 |

|

2,000 |

1,719 |

|

|

Norfolk Southern Corp. 7.05% 5/1/37 |

Baa1 |

|

2,510 |

2,498 |

|

|

|

14,035 |

||||

|

TOTAL TRANSPORTATION |

20,535 |

||||

|

Nonconvertible Bonds - continued |

|||||

|

Moody's Ratings |

Principal Amount (000s) |

Value (Note 1) (000s) |

|||

|

UTILITIES - 4.0% |

|||||

|

Electric Utility - 1.1% |

|||||

|

Avon Energy Partners Holdings: |

|

|

|

|

|

|

6.46% 3/4/08 (c) |

Baa2 |

|

$ 3,200 |

$ 2,886 |

|

|

7.05% 12/11/07 (c) |

Baa2 |

|

6,000 |

5,612 |

|

|

Dominion Resources, Inc.: |

|

|

|

|

|

|

7.6% 7/15/03 |

Baa1 |

|

2,400 |

2,417 |

|

|

8.125% 6/15/10 |

Baa1 |

|

1,200 |

1,236 |

|

|

DR Investments UK PLC yankee 7.1% 5/15/02 (c) |

A2 |

|

2,000 |

1,991 |

|

|

Hydro-Quebec yankee 8% 2/1/13 |

A2 |

|

250 |

265 |

|

|

Israel Electric Corp. Ltd.: |

|

|

|

|

|

|

7.75% 12/15/27 (c) |

A3 |

|

4,445 |

3,939 |

|

|

yankee 7.25% 12/15/06 (c) |

A3 |

|

1,000 |

978 |

|

|

Texas Utilities Co. 6.375% 1/1/08 |

Baa3 |

|

1,065 |

974 |

|

|

|

20,298 |

||||

|

Gas - 0.5% |

|||||

|

CMS Panhandle Holding Co.: |

|

|

|

|

|

|

6.125% 3/15/04 |

Baa3 |

|

2,350 |

2,249 |

|

|

7% 7/15/29 |

Baa3 |

|

1,800 |

1,518 |

|

|

Reliant Energy Resources Corp. 8.125% 7/15/05 (c) |

Baa1 |

|

3,000 |

3,045 |

|

|

Sempra Energy 7.95% 3/1/10 |

A2 |

|

1,650 |

1,647 |

|

|

|

8,459 |

||||

|

Telephone Services - 2.4% |

|||||

|

Cable & Wireless Optus Ltd.: |

|

|

|

|

|

|

8% 6/22/10 (c) |

Baa1 |

|

5,900 |

6,145 |

|

|

8.125% 6/15/09 (c) |

Baa1 |

|

4,000 |

4,077 |

|

|

Deutsche Telekom International Finance BV 8.25% 6/15/30 |

Aa2 |

|

5,895 |

6,049 |

|

|

GTE Corp. 7.83% 5/1/23 |

A2 |

|

1,000 |

962 |

|

|

Koninklijke KPN NV yankee 8% 10/1/10 (c) |

A3 |

|

680 |

680 |

|

|

Telecomunicaciones de Puerto Rico, Inc. 6.65% 5/15/06 |

Baa2 |

|

3,075 |

2,937 |

|

|

Telefonica Europe BV 8.25% 9/15/30 |

A2 |

|

4,800 |

4,917 |

|

|

Teleglobe Canada, Inc.: |

|

|

|

|

|

|

7.2% 7/20/09 |

Baa1 |

|

7,900 |

7,653 |

|

|

7.7% 7/20/29 |

Baa1 |

|

7,556 |

7,209 |

|

|

Nonconvertible Bonds - continued |

|||||

|

Moody's Ratings |

Principal Amount (000s) |

Value (Note 1) (000s) |

|||

|

UTILITIES - continued |

|||||

|

Telephone Services - continued |

|||||

|

WorldCom, Inc.: |

|

|

|

|

|

|

6.95% 8/15/28 |

A3 |

|

$ 3,735 |

$ 3,373 |

|

|

7.75% 4/1/07 |

A3 |

|

1,000 |

1,025 |

|

|

|

45,027 |

||||

|

TOTAL UTILITIES |

73,784 |

||||

|

TOTAL NONCONVERTIBLE BONDS (Cost $456,465) |

443,495 |

||||

|

U.S. Government and Government Agency Obligations - 26.2% |

|||||

|

|

|||||

|

U.S. Government Agency Obligations - 5.0% |

|||||

|

Fannie Mae: |

|

|

|

|

|

|

6.5% 4/29/09 |

Aaa |

|

22,010 |

20,854 |

|

|

7% 7/15/05 |

Aaa |

|

17,005 |

17,292 |

|

|

7.125% 6/15/10 |

Aaa |

|

6,070 |

6,221 |

|

|

7.25% 1/15/10 |

Aaa |

|

14,600 |

15,056 |

|

|

Federal Home Loan Bank 6.75% 2/1/02 |

Aaa |

|

9,370 |

9,392 |

|

|

Financing Corp. - coupon STRIPS |

Aaa |

|

5,606 |

4,451 |

|

|

Freddie Mac: |

|

|

|

|

|

|

6.45% 4/29/09 |

Aaa |

|

9,000 |

8,509 |

|

|

6.875% 1/15/05 |

Aaa |

|

4,020 |

4,063 |

|

|

7% 7/15/05 |

Aaa |

|

5,500 |

5,590 |

|

|

TOTAL U.S. GOVERNMENT AGENCY OBLIGATIONS |

91,428 |

||||

|

U.S. Treasury Obligations - 21.2% |

|||||

|

U.S. Treasury Bonds: |

|

|

|

|

|

|

6.125% 8/15/29 |

Aaa |

|

78,935 |

80,625 |

|

|

8% 11/15/21 |

Aaa |

|

29,775 |

36,363 |

|

|

8.75% 5/15/17 |

Aaa |

|

11,220 |

14,263 |

|

|

8.875% 8/15/17 |

Aaa |

|

41,710 |

53,656 |

|

|

12% 8/15/13 |

Aaa |

|

14,580 |

19,861 |

|

|

14% 11/15/11 |

Aaa |

|

1,170 |

1,635 |

|

|

U.S. Treasury Notes: |

|

|

|

|

|

|

4.75% 11/15/08 |

Aaa |

|

1,760 |

1,629 |

|

|

5.5% 2/15/08 |

Aaa |

|

9,000 |

8,765 |

|

|

5.625% 9/30/01 |

Aaa |

|

38,600 |

38,347 |

|

|

U.S. Government and Government Agency Obligations - continued |

|||||

|

Moody's Ratings |

Principal Amount (000s) |

Value (Note 1) (000s) |

|||

|

U.S. Treasury Obligations - continued |

|||||

|

U.S. Treasury Notes: - continued |

|

|

|

|

|

|

6.5% 5/31/02 |

Aaa |

|

$ 104,640 |

$ 105,294 |

|

|

7% 7/15/06 |

Aaa |

|

780 |

820 |

|

|

U.S. Treasury Notes - stripped principal 0% 5/15/02 |

Aaa |

|

31,510 |

28,599 |

|

|

TOTAL U.S. TREASURY OBLIGATIONS |

389,857 |

||||

|

TOTAL U.S. GOVERNMENT AND (Cost $479,555) |

481,285 |

||||

|

U.S. Government Agency - Mortgage Securities - 34.7% |

|||||

|

|

|||||

|

Fannie Mae - 31.9% |

|||||

|

5.5% 1/1/09 to 4/1/11 |

Aaa |

|

10,361 |

9,808 |

|

|

6% 4/1/13 to 2/1/29 |

Aaa |

|

39,107 |

36,713 |

|

|

6.5% 12/1/25 to 2/1/30 |

Aaa |

|

250,169 |

240,393 |

|

|

7% 3/1/23 to 1/1/29 |

Aaa |

|

36,209 |

35,570 |

|

|

7.5% 7/1/25 to 9/1/30 |

Aaa |

|

154,489 |

154,226 |

|

|

8% 7/1/13 to 9/1/30 |

Aaa |

|

107,455 |

108,889 |

|

|

9.5% 4/1/17 to 12/1/18 |

Aaa |

|

545 |

566 |

|

|

TOTAL FANNIE MAE |

586,165 |

||||

|

Freddie Mac - 0.2% |

|||||

|

8.5% 5/1/25 to 8/1/27 |

Aaa |

|

3,051 |

3,135 |

|

|

Government National Mortgage Association - 2.6% |

|||||

|

6% 10/15/08 to 5/15/09 |

Aaa |

|

2,220 |

2,172 |

|

|

6.5% 10/15/27 to 4/15/29 (g) |

Aaa |

|

32,993 |

31,776 |

|

|

6.5% 10/15/27 (d) |

Aaa |

|

3,215 |

3,105 |

|

|

7% 10/15/27 |

Aaa |

|

235 |

231 |

|

|

7.5% 12/15/05 to 10/15/27 |

Aaa |

|

9,789 |

9,851 |

|

|

TOTAL GOVERNMENT NATIONAL MORTGAGE ASSOCIATION |

47,135 |

||||

|

TOTAL U.S. GOVERNMENT AGENCY - MORTGAGE SECURITIES (Cost $642,764) |

636,435 |

||||

|

Asset-Backed Securities - 2.2% |

|||||

|

Moody's Ratings |

Principal Amount (000s) |

Value (Note 1) (000s) |

|||

|

American Express Credit Account Master Trust 6.1% 12/15/06 |

A1 |

|

$ 2,600 |

$ 2,533 |

|

|

Capita Equipment Receivables Trust 6.48% 10/15/06 |

Baa2 |

|

1,760 |

1,710 |

|

|

Discover Card Master Trust I 5.85% 11/16/04 |

A2 |

|

4,000 |

3,924 |

|

|

Ford Credit Auto Owner Trust: |

|

|

|

|

|

|

6.2% 12/15/02 |

Aa2 |

|

1,790 |

1,772 |

|

|

6.4% 12/15/02 |

Aa2 |

|

1,020 |

1,012 |

|

|

7.03% 11/15/03 |

Aaa |

|

424 |

425 |

|

|

JCPenney Master Credit Card Trust 5.5% 6/15/07 |

Aaa |

|

13,400 |

12,908 |

|

|

Key Auto Finance Trust: |

|

|

|

|

|

|

6.3% 10/15/03 |

A2 |

|

204 |

203 |

|

|

6.65% 10/15/03 |

Baa3 |

|

133 |

132 |

|

|

Premier Auto Trust 5.59% 2/9/04 |

Aaa |

|

10,000 |

9,816 |

|

|

Sears Credit Account Master Trust II 6.75% 9/16/09 |

Aaa |

|

6,300 |

6,267 |

|

|

TOTAL ASSET-BACKED SECURITIES (Cost $41,475) |

40,702 |

||||

|

Collateralized Mortgage Obligations - 0.5% |

|||||

|

|

|||||

|

U.S. Government Agency - 0.5% |

|||||

|

Freddie Mac REMIC planned amortization class

Series 1669 Class H, 6.5% 7/15/23 |

Aaa |

|

10,000 |

9,566 |

|

|

Commercial Mortgage Securities - 2.4% |

|||||

|

|

|||||

|

CS First Boston Mortgage Securities Corp.: |

|

|

|

|

|

|

Series 1997-C2 Class D, 7.27% 1/17/35 |

Baa2 |

|

2,200 |

2,074 |

|

|

Series 1998-FL1: |

|

|

|

|

|

|

Class D, 7.12% 12/10/00 (c)(e) |

Aa1 |

|

3,800 |

3,797 |

|

|

Class E, 7.47% 1/10/13 (c)(e) |

Baa1 |

|

5,260 |

5,249 |

|

|

Series 2000-C1 Class A2, 7.545% 4/15/62 |

AAA |

|

3,100 |

3,166 |

|

|

DLJ Commercial Mortgage Corp. Series 2000-CF1 Class A1B, 7.62% 5/10/10 |

Aaa |

|

8,000 |

8,216 |

|

|

Equitable Life Assurance Society of the United States Series 174: |

|

|

|

|

|

|

Class B1, 7.33% 5/15/06 (c) |

Aa2 |

|

1,000 |

1,010 |

|

|

Class C1, 7.52% 5/15/06 (c) |

A2 |

|

1,000 |

1,003 |

|

|

GS Mortgage Securities Corp. II Series 1998-GLII Class E, 7.1905% 4/13/31 (c)(e) |

Baa3 |

|

2,000 |

1,768 |

|

|

Commercial Mortgage Securities - continued |

|||||

|

Moody's Ratings |

Principal Amount (000s) |

Value (Note 1) (000s) |

|||

|

Nomura Asset Securities Corp. Series 1998-D6 Class A1C, 6.69% 3/17/28 |

Aaa |

|

$ 6,000 |

$ 5,733 |

|

|

Prudential Securities Secured Financing Corp. Series 2000-C1 Class A2, 7.727% 2/15/10 |

Aaa |

|

7,830 |

8,045 |

|

|

Thirteen Affiliates of General Growth Properties, Inc. sequential pay Series 1 Class A2, 6.602% 12/15/10 (c) |

Aaa |

|

3,000 |

2,951 |

|

|

TOTAL COMMERCIAL MORTGAGE SECURITIES (Cost $42,701) |

43,012 |

||||

|

Foreign Government and Government Agency Obligations (f) - 2.7% |

|||||

|

|

|||||

|

Korean Republic yankee 8.75% 4/15/03 |

Baa2 |

|

1,310 |

1,347 |

|

|

New Brunswick Province yankee 7.625% 2/15/13 |

A1 |

|

500 |

518 |

|

|

Ontario Province 7%, 8/4/05 |

Aa3 |

|

2,000 |

2,024 |

|

|

Quebec Province: |

|

|

|

|

|

|

yankee: |

|

|

|

|

|

|

7.125% 2/9/24 |

A2 |

|

480 |

461 |

|

|

7.5% 7/15/23 |

A2 |

|

15,480 |

15,501 |

|

|

7% 1/30/07 |

A2 |

|

4,000 |

4,004 |

|

|

7.5% 9/15/29 |

A2 |

|

14,570 |

14,554 |

|

|

Saskatchewan Province yankee 8.5% 7/15/22 |

A1 |

|

300 |

333 |

|

|

United Mexican States: |

|

|

|

|

|

|

8.5% 2/1/06 |

Baa3 |

|

3,325 |

3,315 |

|

|

9.875% 2/1/10 |

Baa3 |

|

5,930 |

6,315 |

|

|

TOTAL FOREIGN GOVERNMENT AND (Cost $49,681) |

48,372 |

||||

|

Supranational Obligations - 0.4% |

|||||

|

|

|||||

|

Inter-American Development Bank |

Aaa |

|

8,000 |

7,799 |

|

|

Cash Equivalents - 5.4% |

|||

|

Maturity Amount (000s) |

Value (Note 1) (000s) |

||

|

Investments in repurchase agreements (U.S. Government Obligations), in a joint trading account at 6.66%, dated 9/29/00 due 10/2/00 |

$ 99,538 |

$ 99,483 |

|

|

TOTAL INVESTMENT PORTFOLIO - 98.7% (Cost $1,829,741) |

1,810,149 |

||

|

NET OTHER ASSETS - 1.3% |

24,601 |

||

|

NET ASSETS - 100% |

$ 1,834,750 |

||

|

Legend |

|

(a) S&P credit ratings are used in the absence of a rating by Moody's Investors Service, Inc. |

|

(b) Debt obligation initially issued at one coupon which converts to a higher coupon at a specified date. The rate shown is the rate at period end. |

|

(c) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the period end, the value of these securities amounted to $67,648,000 or 3.7% of net assets. |

|

(d) Security purchased on a delayed delivery or when-issued basis. |

|

(e) The coupon rate shown on floating or adjustable rate securities represents the rate at period end. |

|

(f) For foreign government obligations not individually rated by S&P or Moody's, the ratings listed have been assigned by FMR, the fund's investment adviser, based principally on S&P and Moody's ratings of the sovereign credit of the issuing government. |

|

(g) A portion of this security is subject to a forward commitment to sell. |

|

Other Information |

|

The composition of long-term debt holdings as a percentage of total value of investments in securities, is as follows (ratings are unaudited): |

|

Moody's Ratings |

S&P Ratings |

|||

|

Aaa, Aa, A |

76.5% |

|

AAA, AA, A |

71.0% |

|

Baa |

17.6% |

|

BBB |

16.2% |

|

Ba |

0.1% |

|

BB |

1.4% |

|

B |

0.0% |

|

B |

0.1% |

|

Caa |

0.1% |

|

CCC |

0.0% |

|

Ca, C |

0.0% |

|

CC, C |

0.0% |

|

|

|

|

D |

0.0% |

|

Income Tax Information |

|

At September 30, 2000, the aggregate cost of investment securities for income tax purposes was $1,830,236,000. Net unrealized depreciation aggregated $20,087,000, of which $12,580,000 related to appreciated investment securities and $32,667,000 related to depreciated investment securities. |

|

At September 30, 2000, the fund had a capital loss carryforward of approximately $12,553,000 all of which will expire on September 30, 2008. |

|

The fund intends to elect to defer to its fiscal year ending September 30, 2001 approximately $20,215,000 of losses recognized during the period November 1, 1999 to September 30, 2000. |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Assets and Liabilities

|

Amounts in thousands (except per-share amount) |

September 30, 2000 |

|

|

Assets |

|

|

|

Investment in securities, at value (including repurchase agreements of $99,483) (cost $1,829,741) - |

|

$ 1,810,149 |

|

Commitment to sell securities on a delayed delivery basis |

$ (3,083) |

|

|

Receivable for securities sold on a delayed delivery basis |

3,066 |

(17) |

|

Receivable for investments sold, regular delivery |

|

18,837 |

|

Receivable for fund shares sold |

|

1,852 |

|

Interest receivable |

|

20,451 |

|

Total assets |

|

1,851,272 |

|

Liabilities |

|

|

|

Payable for investments purchased |

10,834 |

|

|

Delayed delivery |

3,099 |

|

|

Payable for fund shares redeemed |

899 |

|

|

Distributions payable |

937 |

|

|

Accrued management fee |

753 |

|

|

Total liabilities |

|

16,522 |

|

Net Assets |

|

$ 1,834,750 |

|

Net Assets consist of: |

|

|

|

Paid in capital |

|

$ 1,887,209 |

|

Undistributed net investment income |

|

730 |

|

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions |

|

(33,580) |

|

Net unrealized appreciation (depreciation) on investments |

|

(19,609) |

|

Net Assets, for 183,506 shares outstanding |

|

$ 1,834,750 |

|

Net Asset Value, offering price and redemption price |

|

$10.00 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Statements - continued

Statement of Operations

|

Amounts in thousands |

Year ended September 30, 2000 |

|

|

Investment Income Interest |

|

$ 115,461 |

|

Security lending |

|

136 |

|

Total income |

|

115,597 |

|

Expenses |

|

|

|

Management fee |

$ 9,907 |

|

|

Non-interested trustees' compensation |

5 |

|

|

Total expenses before reductions |

9,912 |

|

|

Expense reductions |

(1,669) |

8,243 |

|

Net investment income |

|

107,354 |

|

Realized and Unrealized Gain (Loss) Net realized gain (loss) on investment securities |

|

(21,054) |

|

Change in net unrealized appreciation (depreciation) on: |

|

|

|

Investment securities |

23,985 |

|

|

Delayed delivery commitments |

(17) |

23,968 |

|

Net gain (loss) |

|

2,914 |

|

Net increase (decrease) in net assets resulting |

|

$ 110,268 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Statements - continued

Statement of Changes in Net Assets

|

Amounts in thousands |

Year ended

September 30, |

Year ended

September 30, |

|

Increase (Decrease) in Net Assets |

|

|

|

Operations |

$ 107,354 |

$ 84,523 |

|

Net realized gain (loss) |

(21,054) |

(1,742) |

|

Change in net unrealized appreciation (depreciation) |

23,968 |

(79,841) |

|

Net increase (decrease) in net assets resulting |

110,268 |

2,940 |

|

Distributions to shareholders |

(108,036) |

(84,467) |

|

From net realized gain |

- |

(2,620) |

|

In excess of net realized gain |

- |

(6,924) |

|

Total distributions |

(108,036) |

(94,011) |

|

Share transactions |

660,195 |

1,197,543 |

|

Reinvestment of distributions |

96,721 |

81,973 |

|

Cost of shares redeemed |

(561,952) |

(771,182) |

|

Net increase (decrease) in net assets resulting |

194,964 |

508,334 |

|

Total increase (decrease) in net assets |

197,196 |

417,263 |

|

Net Assets |

|

|

|

Beginning of period |

1,637,554 |

1,220,291 |

|

End of period (including undistributed net investment income of $730 and $474, respectively) |

$ 1,834,750 |

$ 1,637,554 |

|

Other Information Shares |

|

|

|

Sold |

66,969 |

116,572 |

|

Issued in reinvestment of distributions |

9,802 |

7,968 |

|

Redeemed |

(56,927) |

(74,907) |

|

Net increase (decrease) |

19,844 |

49,633 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights

|

Years ended September 30, |

2000 |

1999 |

1998 |

1997 |

1996 |

|

Selected Per-Share Data |

|

|

|

|

|

|

Net asset value, |

$ 10.010 |

$ 10.700 |

$ 10.250 |

$ 9.980 |

$ 10.170 |

|

Income from Investment Operations |

.640 B |

.620 B |

.634 B |

.640 B |

.655 |

|

Net realized and unrealized gain (loss) |

(.005) |

(.610) |

.453 |

.273 |

(.211) |

|

Total from investment operations |

.635 |

.010 |

1.087 |

.913 |

.444 |

|

Less Distributions |

|

|

|

|

|

|

From net investment income |

(.645) |

(.620) |

(.637) |

(.643) |

(.634) |

|

From net realized gain |

- |

(.022) |

- |

- |

- |

|

In excess of net realized gain |

- |

(.058) |

- |

- |

- |

|

Total distributions |

(.645) |

(.700) |

(.637) |

(.643) |

(.634) |

|

Net asset value, end of period |

$ 10.000 |

$ 10.010 |

$ 10.700 |

$ 10.250 |

$ 9.980 |

|

Total Return A |

6.63% |

0.10% |

10.95% |

9.43% |

4.46% |

|

Ratios and Supplemental Data |

|

|

|

|

|

|

Net assets, end of period |

$ 1,835 |

$ 1,638 |

$ 1,220 |

$ 551 |

$ 344 |

|

Ratio of expenses to average |

.50% C |

.47% C |

.38% C |

.48% C |

.65% |

|

Ratio of net investment income to average net assets |

6.50% |

6.04% |

6.11% |

6.36% |

6.35% |

|

Portfolio turnover rate |

122% |

148% |

222% |

194% |

169% |

A The total returns would have been lower had certain expenses not been reduced during the periods shown.

B Net investment income per share has been calculated based on average shares outstanding during the period.

C FMR agreed to reimburse a portion of the fund's expenses during the period. Without this reimbursement, the fund's expense ratio would have been higher.

See accompanying notes which are an integral part of the financial statements.

Annual Report

For the period ended September 30, 2000

1. Significant Accounting Policies.

Spartan Investment Grade Bond Fund (the fund) is a fund of Fidelity Charles Street Trust (the trust) and is authorized to issue an unlimited number of shares. The trust is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company organized as a Massachusetts business trust. The financial statements have been prepared in conformity with generally accepted accounting principles which require management to make certain estimates and assumptions at the date of the financial statements. The following summarizes the significant accounting policies of the fund:

Security Valuation. Securities are valued based upon a computerized matrix system and/or appraisals by a pricing service, both of which consider market transactions and dealer-supplied valuations. Securities (including restricted securities) for which quotations are not readily available are valued at their fair value as determined in good faith under consistently applied procedures under the general supervision of the Board of Trustees. Short-term securities with remaining maturities of sixty days or less for which quotations are not readily available are valued at amortized cost or original cost plus accrued interest, both of which approximate current value. Investments in open-end investment companies are valued at their net asset value each business day.

Income Taxes. As a qualified regulated investment company under Subchapter M of the Internal Revenue Code, the fund is not subject to income taxes to the extent that it distributes substantially all of its taxable income for its fiscal year. The schedule of investments includes information regarding income taxes under the caption "Income Tax Information."

Investment Income. Interest income, which includes accretion of original issue discount, is accrued as earned.

Expenses. Most expenses of the trust can be directly attributed to a fund. Expenses which cannot be directly attributed are apportioned among the funds in the trust.

Distributions to Shareholders. Distributions are declared daily and paid monthly from net investment income. Distributions from realized gains, if any, are recorded on the ex-dividend date.

Income and capital gain distributions are determined in accordance with income tax regulations which may differ from generally accepted accounting principles. These differences, which may result in distribution reclassifications, are primarily due to differing treatments for paydown gains/losses on certain securities, market discount and losses deferred due to wash sales, futures transactions and excise tax regulations.

Permanent book and tax basis differences relating to shareholder distributions will result in reclassifications to paid in capital. Undistributed net investment income and accumulated undistributed net realized

Annual Report

Notes to Financial Statements - continued

1. Significant Accounting

Policies - continued

Distributions to Shareholders -

continued

gain (loss) on investments and foreign currency transactions may include temporary book and tax basis differences which will reverse in a subsequent period. Any taxable income or gain remaining at fiscal year end is distributed in the following year.

Security Transactions. Security transactions are accounted for as of trade date. Gains and losses on securities sold are determined on the basis of identified cost.

2. Operating Policies.

Joint Trading Account. Pursuant to an Exemptive Order issued by the Securities and Exchange Commission (the SEC), the fund, along with other affiliated entities of Fidelity Management & Research Company (FMR), may transfer uninvested cash balances into one or more joint trading accounts. These balances are invested in one or more repurchase agreements for U.S. Treasury or Federal Agency obligations.

Repurchase Agreements. The underlying U.S. Treasury, Federal Agency, or other obligations found to be satisfactory by FMR are transferred to an account of the fund, or to the Joint Trading Account, at a custodian bank. The securities are marked-to-market daily and maintained at a value at least equal to the principal amount of the repurchase agreement (including accrued interest). FMR, the fund's investment adviser, is responsible for determining that the value of the underlying securities remains in accordance with the market value requirements stated above.

Interfund Lending Program. Pursuant to an Exemptive Order issued by the SEC, the fund, along with other registered investment companies having management contracts with FMR, may participate in an interfund lending program. This program provides an alternative credit facility allowing the fund to borrow from, or lend money to, other participating funds.

Delayed Delivery Transactions. The fund may purchase or sell securities on a delayed delivery basis. Payment and delivery may take place after the customary settlement period for that security. The price of the underlying securities and the date when the securities will be delivered and paid for are fixed at the time the transaction is negotiated. The market values of the securities purchased on a delayed delivery basis are identified as such in the fund's schedule of investments. The fund may receive compensation for interest forgone in the purchase of a delayed delivery security. With respect to purchase commitments, the fund identifies securities as segregated in its records with a value at least equal to the amount of the commitment. Losses may arise due to changes in the market value of the underlying securities or if the counterparty does not perform under the contract.

Restricted Securities. The fund is permitted to invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities

Annual Report

Notes to Financial Statements - continued

2. Operating Policies - continued

Restricted Securities - continued

are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. At the end of the period, the fund had no investments in restricted securities (excluding 144A issues).

3. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities, aggregated $2,042,356,000 and $1,937,146,000, respectively, of which U.S. government and government agency obligations aggregated $1,608,913,000 and $1,385,321,000, respectively.

4. Fees and Other Transactions with Affiliates.

Management Fee. As the fund's investment adviser, FMR receives a fee that is computed daily at an annual rate of .60% of the fund's average net assets. FMR pays all other expenses, except the compensation of the non-interested Trustees and certain exceptions such as interest, taxes, brokerage commissions and extraordinary expenses. The management fee paid to FMR by the fund is reduced by an amount equal to the fees and expenses paid by the fund to the non-interested Trustees.

Sub-Adviser Fee. FMR, on behalf of the fund, has entered into a sub-advisory agreement with Fidelity Investments Money

Management, Inc. (FIMM), a wholly owned subsidiary of FMR. For its services, FIMM receives a fee from FMR of 50% of the management fee payable to FMR. The fee is paid prior to any voluntary expense reimbursements which may be in effect.

5. Interfund Lending Program.

The fund participated in the interfund lending program as a lender. The average daily loan balance during the period for which loans were outstanding amounted to $17,334,000. The weighted average interest rate was 5.73%. Interest earned from the interfund lending program amounted to $75,000 and is included in interest income on the Statement of Operations. At period end there were no interfund loans outstanding.

6. Security Lending.

The fund lends portfolio securities from time to time in order to earn additional income. The fund receives collateral in the form of U.S. Treasury obligations, letters of credit, and/or cash against the loaned securities, and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of the fund and any additional required collateral is delivered to the fund on the next business day. If the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, the fund could experience delays and costs in recovering the securities loaned or in gaining access to the collateral. At period end there were no security loans outstanding.

Annual Report

Notes to Financial Statements - continued

7. Expense Reductions.

FMR voluntarily agreed to reimburse the fund's operating expenses (excluding interest, taxes, brokerage commissions and extraordinary expenses, if any) above an annual rate of .50% of average net assets. For the period, the reimbursement reduced the expenses by $1,652,000.

In addition, through arrangements with the fund's custodian and transfer agent, credits realized as a result of uninvested cash balances were used to reduce a portion of the fund's expenses. During the period, the fund's expenses were reduced by $17,000 under these arrangements.

Annual Report

To the Trustees of Fidelity Charles Street Trust and Shareholders of Spartan Investment Grade Bond Fund:

We have audited the accompanying statement of assets and liabilities of Spartan Investment Grade Bond Fund, (the Fund), a series of Fidelity Charles Street Trust, including the portfolio of investments, as of September 30, 2000, and the related statements of operations, changes in net assets, and financial highlights for the year then ended. These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audit. The statement of changes in net assets for the year ended September 30, 1999, and the financial highlights for each of the four years in the period then ended were audited by other auditors whose report, dated November 8, 1999, expressed an unqualified opinion on those statements and financial highlights.

We conducted our audit in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of September 30, 2000, by correspondence with the custodian and brokers; where replies were not received from brokers, we performed other auditing procedures. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Spartan Investment Grade Bond Fund as of September 30, 2000, the results of its operations, the changes in its net assets, and the financial highlights for the year then ended, in conformity with accounting principles generally accepted in the United States of America.

/s/DELOITTE & TOUCHE LLP

DELOITTE & TOUCHE LLP