|

|

|

|

|

|

|

Previous: AXP VARIABLE PORTFOLIO INVESTMENT SERIES INC, 40-17F2, 2000-11-22 |

Next: FIDELITY CHARLES STREET TRUST, 485BPOS, EX-99.ACHARTER, 2000-11-22 |

|

SECURITIES AND EXCHANGE COMMISSION |

||||

|

Washington, D.C. 20549 |

||||

|

FORM N-1A |

||||

|

|

||||

|

REGISTRATION STATEMENT (No. 2-73133) |

||||

|

|

UNDER THE SECURITIES ACT OF 1933 |

[X] |

||

|

|

Pre-Effective Amendment No. |

[ ] |

||

|

|

Post-Effective Amendment No. 71 |

[X] |

||

|

and |

||||

|

REGISTRATION STATEMENT (No. 811-3221) |

||||

|

|

UNDER THE INVESTMENT COMPANY ACT OF 1940 |

[X] |

||

|

|

Amendment No. 71 |

[X] |

||

|

|

||||

|

Fidelity Charles Street Trust |

||||

|

(Exact Name of Registrant as Specified in Charter) |

||||

|

|

||||

|

82 Devonshire St., Boston, Massachusetts 02109 |

||||

|

(Address Of Principal Executive Offices) (Zip Code) |

||||

|

|

||||

|

Registrant's Telephone Number: 617-563-7000 |

||||

|

|

||||

|

Eric D. Roiter, Secretary |

||||

|

82 Devonshire Street |

||||

|

Boston, Massachusetts 02109 |

||||

|

(Name and Address of Agent for Service) |

||||

|

|

||||

|

It is proposed that this filing will become effective |

||||

|

|

( ) |

immediately upon filing pursuant to paragraph (b). |

||

|

|

(X) |

on (November 27, 2000) pursuant to paragraph (b). |

||

|

|

( ) |

60 days after filing pursuant to paragraph (a)(1). |

||

|

|

( ) |

on ( ) pursuant to paragraph (a)(1) of Rule 485. |

||

|

|

( ) |

75 days after filing pursuant to paragraph (a)(2). |

||

|

|

( ) |

on ( ) pursuant to paragraph (a)(2) of Rule 485. |

||

|

|

||||

|

If appropriate, check the following box: |

||||

|

|

( ) |

this post-effective amendment designates a new effective date for a previously filed post-effective amendment. |

||

Like securities of all mutual funds, these securities have not been approved or disapproved by the Securities and Exchange Commission, and the Securities and Exchange Commission has not determined if this prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

Fidelity®

(fund number 314, trading symbol FASMX)

Prospectus

November 27, 2000

(fidelity_logo_graphic)

82 Devonshire Street, Boston, MA 02109

|

Fund Summary |

Investment Summary |

|

|

|

Performance |

|

|

|

Fee Table |

|

|

Fund Basics |

Investment Details |

|

|

|

Valuing Shares |

|

|

Shareholder Information |

Buying and Selling Shares |

|

|

|

Exchanging Shares |

|

|

|

Account Features and Policies |

|

|

|

Dividends and Capital Gain Distributions |

|

|

|

Tax Consequences |

|

|

Fund Services |

Fund Management |

|

|

|

Fund Distribution |

|

|

Appendix |

Financial Highlights |

Prospectus

Investment Objective

Asset ManagerSM seeks high total return with reduced risk over the long term by allocating its assets among stocks, bonds, and short-term instruments.

Principal Investment Strategies

Fidelity Management & Research Company (FMR)'s principal investment strategies include:

Principal Investment Risks

The fund is subject to the following principal investment risks:

An investment in the fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

When you sell your shares of the fund, they could be worth more or less than what you paid for them.

Prospectus

Fund Summary - continued

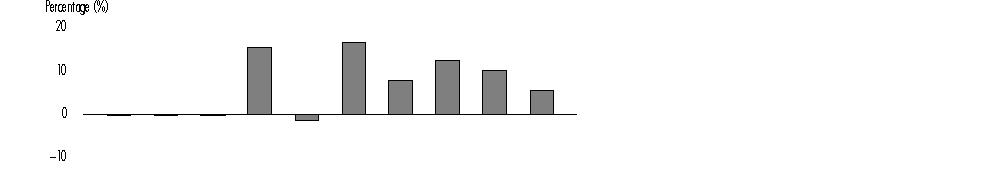

The following information illustrates the changes in the fund's performance from year to year and compares the fund's performance to the performance of a market index and a combination of market indexes over various periods of time. Returns are based on past results and are not an indication of future performance.

|

<R>Asset Manager</R> |

||||||||||

|

<R>Calendar Years |

1990 |

1991 |

1992 |

1993 |

1994 |

1995 |

1996 |

1997 |

1998 |

1999</R> |

|

<R> |

5.38% |

23.64% |

12.75% |

23.29% |

-6.60% |

18.16% |

12.73% |

22.27% |

16.09% |

13.59%</R> |

<R>

</R>

<R>During the periods shown in the chart for Asset Manager, the highest return for a quarter was </R>14.05%<R> (quarter ended </R>December 31, 1998<R>) and the lowest return for a quarter was </R>-5.83%<R> (quarter ended </R>September 30, 1998).

The year-to-date return as of September 30, 2000 for Asset Manager was <R>6.43</R>%.

|

<R>For the periods ended |

Past 1 |

Past 5 |

Past 10 |

|

<R>Asset Manager |

13.59% |

16.52% |

13.77%</R> |

|

<R>S&P 500® |

21.04% |

28.56% |

18.21%</R> |

|

<R>Fidelity Asset Manager Composite Index |

10.42% |

16.69% |

11.96%</R> |

S&P 500 is a market capitalization-weighted index of common stocks.

Fidelity Asset Manager Composite Index is a hypothetical representation of the performance of the fund's three asset classes according to their respective weightings in the fund's neutral mix (50% stocks, 40% bonds, and 10% short-term/money market instruments). The following indexes are used to calculate the composite index: stocks - the Standard & Poor's 500SM Index (S&P 500®), bonds - the Lehman Brothers Aggregate Bond Index, and short-term/money market instruments - the Lehman Brothers 3-Month Treasury Bill Index. Prior to January 1, 1997, the Lehman Brothers U.S. Treasury Index was used for the bond class. The index weightings of the composite index are rebalanced monthly.

Prospectus

Fund Summary - continued

The Lehman Brothers Aggregate Bond Index is a market value-weighted index of investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities, with maturities of one year or more.

The Lehman Brothers 3-Month Treasury Bill Index represents the average of Treasury Bill rates for each of the prior three months, adjusted to a bond equivalent yield basis (short-term and money market instruments).

<R>The</R> Lehman Brothers U.S. Treasury Index is a market value-weighted index of public obligations of the U.S. Treasury with maturities of one year or more.

The following table describes the fees and expenses that are incurred when you buy, hold, or sell shares of the fund. The annual fund operating expenses provided below for the fund do not reflect the effect of any reduction of certain expenses during the period.

Shareholder fees (paid by the investor directly)

|

Sales charge (load) on purchases and reinvested distributions |

None |

|

Deferred sales charge (load) on redemptions |

None |

|

Annual account maintenance fee (for accounts under $2,500) |

$12.00 |

Annual fund operating expenses (paid from fund assets)

|

<R>Management fee |

0.53%</R> |

|

Distribution and Service (12b-1) fee |

None |

|

<R>Other expenses |

0.20%</R> |

|

<R>Total annual fund operating expenses |

0.73%</R> |

A portion of the brokerage commissions that the fund pays is used to reduce the fund's expenses. In addition, through arrangements with the fund's custodian and transfer agent, credits realized as a result of uninvested cash balances are used to reduce custodian and transfer agent expenses. Including these reductions, the total fund operating expenses would have been <R>0.71</R>%.

This example helps you compare the cost of investing in the fund with the cost of investing in other mutual funds.

Let's say, hypothetically, that the fund's annual return is 5% and that your shareholder fees and the fund's annual operating expenses are exactly as described in the fee table. This example illustrates the effect of fees and expenses, but is not meant to suggest actual or expected fees and expenses or returns, all of which may vary. For every $10,000 you invested, here's how much you would pay in total expenses if you close your account at the end of each time period indicated:

Prospectus

Fund Summary - continued

|

<R>1 year |

$ 75</R> |

|

<R>3 years |

$ 233</R> |

|

<R>5 years |

$ 406</R> |

|

<R>10 years |

$ 906</R> |

Prospectus

Investment Objective

Asset Manager seeks high total return with reduced risk over the long term by allocating its assets among stocks, bonds, and short-term instruments.

Principal Investment Strategies

FMR allocates the fund's assets among the following classes, or types, of investments. The stock class includes equity securities of all types. The bond class includes all varieties of fixed-income securities, including lower-quality debt securities, maturing in more than one year. The short-term/money market class includes all types of short-term and money market instruments.

FMR may use its judgment to place a security in the most appropriate class based on its investment characteristics. Fixed-income securities may be classified in the bond or short-term/money market class according to interest rate sensitivity as well as maturity. FMR may invest the fund's assets in these classes by investing in other funds. FMR may also invest the fund's assets in other instruments that do not fall within these classes.

FMR has the ability to allocate the fund's assets within specified ranges. The fund's neutral mix represents the benchmark for its combination of investments in each asset class over time. FMR may change the neutral mix from time to time. The approximate neutral mix and range for each asset class are shown below:

FMR will not try to pinpoint the precise moment when a major reallocation should be made. Instead, FMR regularly reviews the fund's allocation and makes

changes gradually to favor investments that it believes will provide the most favorable outlook for achieving the fund's objective.

FMR may invest the fund's assets in securities of foreign issuers in addition to securities of domestic issuers.

In buying and selling securities for the fund, FMR generally analyzes the issuer of a security using fundamental factors (e.g., growth potential, earnings estimates, and management) and/or quantitative factors (e.g., historical earnings, dividend yield, and earnings per share) and evaluates each security's current price relative to its estimated long-term value.

FMR may lend the fund's securities to broker-dealers or other institutions to earn income for the fund.

FMR may use various techniques, such as buying and selling futures contracts, to increase or decrease the fund's exposure to changing security prices, interest rates, or other factors that affect security values. If FMR's strategies do not work as intended, the fund may not achieve its objective.

Prospectus

Fund Basics - continued

Description of Principal Security Types

Equity securities represent an ownership interest, or the right to acquire an ownership interest, in an issuer. Different types of equity securities provide different voting and dividend rights and priority in the event of the bankruptcy of the issuer. Equity securities include common stocks, preferred stocks, convertible securities, and warrants.

Debt securities are used by issuers to borrow money. The issuer usually pays a fixed, variable, or floating rate of interest, and must repay the amount borrowed at the maturity of the security. Some debt securities, such as zero coupon bonds, do not pay current interest but are sold at a discount from their face values. Debt securities include corporate bonds, government securities, and mortgage and other asset-backed securities.

Money market securities are high-quality, short-term securities that pay a fixed, variable, or floating interest rate. Securities are often specifically structured so that they are eligible investments for a money market fund. For example, in order to satisfy the maturity restrictions for a money market fund, some money market securities have demand or put features, which have the effect of shortening the security's maturity. Money market securities include bank certificates of deposit, <R>bankers</R>' acceptances, bank time deposits, notes, commercial paper, and U.S. Government securities.

Principal Investment Risks

Many factors affect the fund's performance. The fund's share price and yield change daily based on changes in market conditions and interest rates and in response to other economic, political, or financial developments. The fund's reaction to these developments will be affected by the types and maturities of securities in which the fund invests, the financial condition, industry and economic sector, and geographic location of an issuer, and the fund's level of investment in the securities of that issuer. When you sell your shares of the fund, they could be worth more or less than what you paid for them.

The following factors can significantly affect the fund's performance:

Stock Market Volatility. The value of equity securities fluctuates in response to issuer, political, market, and economic developments. In the short term, equity prices can fluctuate dramatically in response to these developments. Different parts of the market and different types of equity securities can react differently to these developments. For example, large cap stocks can react differently from small cap stocks, and "growth" stocks can react differently from "value" stocks. Issuer, political, or economic developments can affect a single issuer, issuers within an industry or economic sector or geographic region, or the market as a whole.

Interest Rate Changes. Debt securities have varying levels of sensitivity to changes in interest rates. In general, the price of a debt security can fall when interest rates rise and can rise when interest rates fall. Securities with longer maturities and mortgage securities can be more sensitive to interest rate changes. In other words, the longer the maturity of a security, the greater the impact a change in interest rates could have on the security's price. In addition, short-term and long-term interest rates do not necessarily move in the same amount or the same direction. Short-term securities tend to react to changes in short-term interest rates, and long-term securities tend to react to changes in long-term interest rates.

Prospectus

Fund Basics - continued

Foreign Exposure. Foreign securities, foreign currencies, and securities issued by U.S. entities with substantial foreign operations can involve additional risks relating to political, economic, or regulatory conditions in foreign countries. These risks include fluctuations in foreign currencies; withholding or other taxes; trading, settlement, custodial, and other operational risks; and the less stringent investor protection and disclosure standards of some foreign markets. All of these factors can make foreign investments, especially those in emerging markets, more volatile and potentially less liquid than U.S. investments. In addition, foreign markets can perform differently from the U.S. market.

Prepayment. Many types of debt securities, including mortgage securities, are subject to prepayment risk. Prepayment occurs when the issuer of a security can repay principal prior to the security's maturity. Securities subject to prepayment can offer less potential for gains during a declining interest rate environment and similar or greater potential for loss in a rising interest rate environment. In addition, the potential impact of prepayment features on the price of a debt security can be difficult to predict and result in greater volatility.

Issuer-Specific Changes. Changes in the financial condition of an issuer, changes in specific economic or political conditions that affect a particular type of security or issuer, and changes in general economic or political conditions can affect the credit quality or value of an issuer's securities. The value of securities of smaller, less well-known issuers can be more volatile than that of larger issuers. Lower-quality debt securities (those of less than investment-grade quality) <R>and certain types of other securities </R>tend to be particularly sensitive to these changes.

Lower-quality debt securities <R>and certain types of other securities</R> involve greater risk of default or price changes due to changes in the credit quality of the issuer. The value of lower-quality debt securities and certain types of other securities often fluctuates in response to company, political, or economic developments and can decline significantly over short periods of time or during periods of general or regional economic difficulty.

In response to market, economic, political, or other conditions, FMR may temporarily use a different investment strategy for defensive purposes. If FMR does so, different factors could affect the fund's performance and the fund may not achieve its investment objective.

Prospectus

Fund Basics - continued

Fundamental Investment Policies

The policy discussed below is fundamental, that is, subject to change only by shareholder approval.

Asset Manager seeks high total return with reduced risk over the long term by allocating its assets among stocks, bonds, and short-term instruments.

The fund is open for business each day the New York Stock Exchange (NYSE) is open.

The fund's net asset value per share (NAV) is the value of a single share. Fidelity normally calculates the fund's NAV as of the close of business of the NYSE, normally 4:00 p.m. Eastern time. However, NAV may be calculated earlier if trading on the NYSE is restricted or as permitted by the Securities and Exchange Commission (SEC). The fund's assets are valued as of this time for the purpose of computing the fund's NAV.

To the extent that the fund's assets are traded in other markets on days when the NYSE is closed, the value of the fund's assets may be affected on days when the fund is not open for business. In addition, trading in some of the fund's assets may not occur on days when the fund is open for business.

The fund's assets are valued primarily on the basis of market quotations or on the basis of information furnished by a pricing service. Certain short-term securities are valued on the basis of amortized cost. If market quotations or information furnished by a pricing service is not readily available <R>or does not accurately reflect fair value for a security </R>or if a security's value has been materially affected by events occurring after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), that security may be valued by another method that the Board of Trustees believes accurately reflects fair value. A security's valuation may differ depending on the method used for determining value.

Prospectus

Fidelity Investments was established in 1946 to manage one of America's first mutual funds. Today, Fidelity is the largest mutual fund company in the country, and is known as an innovative provider of high-quality financial services to individuals and institutions.

In addition to its mutual fund business, the company operates one of America's leading discount brokerage firms, <R>Fidelity Brokerage Services LLC (FBS LLC)</R>. Fidelity is also a leader in providing tax-advantaged retirement plans for individuals investing on their own or through their employer.

For account, product<R>, and service information, please use the following w</R>eb site and phone numbers:

Please use the following addresses:

Buying Shares

Fidelity Investments

P.O. Box 770001

Cincinnati, OH 45277-0002

Overnight Express

Fidelity Investments

2300 Litton Lane - KH1A

Hebron, KY 41048

Selling Shares

Fidelity Investments

P.O. Box 660602

Dallas, TX 75266-0602

Overnight Express

Fidelity Investments

Attn: Redemptions - CP6I

400 East Las Colinas Blvd.

Irving, TX 75039-5587

You may buy or sell shares of the fund through a retirement account or an investment professional. If you invest through a retirement account or an investment professional, the procedures for buying, selling, and exchanging shares of the fund and the account features and policies may differ. Additional fees may also apply to your investment in the fund, including a transaction fee if you buy or sell shares of the fund through a broker or other investment professional.

Certain methods of contacting Fidelity, such as by telephone or electronically, may be unavailable or delayed (for example, during periods of unusual market activity). In addition, the level and type of service available may be restricted based on criteria established by Fidelity.

Prospectus

Shareholder Information - continued

The different ways to set up (register) your account with Fidelity are listed in the following table.

|

Ways to Set Up Your Account |

|

Individual or Joint Tenant For your general investment needs |

|

Retirement For tax-advantaged retirement savings |

|

|

|

|

|

|

|

|

|

|

|

Gifts or Transfers to a Minor (UGMA, UTMA) To invest for a child's education or other future needs |

|

Trust For money being invested by a trust |

|

<R>Business or Organization </R> For investment needs of corporations, associations, partnerships, or other groups |

The price to buy one share of the fund is the fund's NAV. The fund's shares are sold without a sales charge.

Your shares will be bought at the next NAV calculated after your investment is received in proper form.

Short-term or excessive trading into and out of the fund may harm performance by disrupting portfolio management strategies and by increasing expenses. Accordingly, the fund may reject any purchase orders, including exchanges, particularly from market timers or investors who, in FMR's opinion, have a pattern of short-term or excessive trading or whose trading has been or may be disruptive to the fund. For these purposes, FMR may consider an investor's trading history in the fund or other Fidelity funds, and accounts under common ownership or control.

The fund may stop offering shares completely or may offer shares only on a limited basis, for a period of time or permanently.

When you place an order to buy shares, note the following:

Prospectus

Shareholder Information - continued

Certain financial institutions that have entered into sales agreements with Fidelity Distributors Corporation (FDC) may enter confirmed purchase orders on behalf of customers by phone, with payment to follow no later than the time when the fund is priced on the following business day. If payment is not received by that time, the order will be canceled and the financial institution could be held liable for resulting fees or losses.

Minimums

|

To Open an Account |

$2,500 |

|

For certain Fidelity retirement accountsA |

$500 |

|

To Add to an Account |

$250 |

|

Through regular investment plans |

$100 |

|

Minimum Balance |

$2,000 |

|

For certain Fidelity retirement accountsA |

$500 |

A Fidelity Traditional IRA, Roth IRA, Rollover IRA, SEP-IRA, and Keogh accounts.

These minimums may be lower for purchases through a Fidelity GoalPlannerSM account. There is no minimum account balance or initial or subsequent purchase minimum for investments through Portfolio Advisory ServicesSM , a qualified state tuition program, certain Fidelity retirement accounts funded through salary deduction, or accounts opened with the proceeds of distributions from such retirement accounts. In addition, the fund may waive or lower purchase minimums in other circumstances.

|

Key Information |

|

|

<R>Phone |

To Open an Account</R>

To Add to an Account

|

|

Internet |

To Open an Account

To Add to an Account

|

|

Mail |

To Open an Account

To Add to an Account

|

|

In Person |

To Open an Account

To Add to an Account

|

|

<R>Wire |

To Open an Account</R>

To Add to an Account

|

|

Automatically |

To Open an Account

To Add to an Account

|

The price to sell one share of the fund is the fund's NAV.

Your shares will be sold at the next NAV calculated after your order is received in proper form.

Certain requests must include a signature guarantee. It is designed to protect you and Fidelity from fraud. Your request must be made in writing and include a signature guarantee if any of the following situations apply:

You should be able to obtain a signature guarantee from a bank, broker (including Fidelity Investor Centers), dealer, credit union (if authorized under state law), securities exchange or association, clearing agency, or savings association. A notary public cannot provide a signature guarantee.

Prospectus

Shareholder Information - continued

When you place an order to sell shares, note the following:

<R>To sell shares issued with certificates, call Fidelity for instructions. The fund no longer issues share certificates.</R>

|

Key Information |

|

|

<R>Phone |

|

|

Internet |

|

|

Mail |

Individual, Joint Tenant, Sole Proprietorship, UGMA, UTMA

Retirement Account

Trust

Business or Organization

Executor, Administrator, Conservator, Guardian

|

|

In Person |

Individual, Joint Tenant, Sole Proprietorship, UGMA, UTMA

Retirement Account

Trust

Business or Organization

Executor, Administrator, Conservator, Guardian

|

|

Automatically |

|

An exchange involves the redemption of all or a portion of the shares of one fund and the purchase of shares of another fund.

As a shareholder, you have the privilege of exchanging shares of the fund for shares of other Fidelity funds.

Prospectus

Shareholder Information - continued

However, you should note the following policies and restrictions governing exchanges:

The fund may terminate or modify the exchange privilege in the future.

Other funds may have different exchange restrictions, and may impose trading fees of up to <R>2.00</R>% of the amount exchanged. Check each fund's prospectus for details.

The following features are available to buy and sell shares of the fund.

Automatic Investment and Withdrawal Programs. Fidelity offers convenient services that let you automatically transfer money into your account, between accounts, or out of your account. While automatic investment programs do not guarantee a profit and will not protect you against loss in a declining market, they can be an excellent way to invest for retirement, a home, educational expenses, and other long-term financial goals. Automatic withdrawal or exchange programs can be a convenient way to provide a consistent income flow or to move money between your investments.

Prospectus

Shareholder Information - continued

|

Fidelity Automatic Account Builder |

||

|

<R>Minimum $100 |

Frequency Monthly or quarterly |

Procedures</R>

|

|

Direct Deposit |

||

|

<R>Minimum $100 |

Frequency Every pay period |

Procedures</R>

|

|

A Because its share price fluctuates, the fund may not be an appropriate choice for direct deposit of your entire check. |

||

|

Fidelity Automatic Exchange Service |

||

|

Minimum $100 |

Frequency Monthly, bimonthly, quarterly, or annually |

Procedures

|

|

Personal Withdrawal Service |

||

|

Frequency Monthly |

Procedures

|

|

Prospectus

Shareholder Information - continued

Other Features. The following other features are also available to buy and sell shares of the fund.

|

Wire |

|

|

Fidelity Money Line |

|

|

Fidelity On-Line Xpress+® |

|

<R>Call 1-800-544-0240 or visit Fidelity's web site for more information.</R>

|

|

<R>Fidelity Online Trading |

|

|

FAST |

|

Call 1-800-544-5555.

|

The following policies apply to you as a shareholder.

Statements and reports that Fidelity sends to you include the following:

To reduce expenses, only one copy of most financial reports and prospectuses may be mailed to households<R>, even if more than one person in the household holds shares of the fund</R>. Call Fidelity at 1-800-544-8544 if you need additional copies of financial reports or prospectuses. If you do not want the mailing of these documents to be combined with those for other members of your household, contact Fidelity in writing at P.O. Box 5000, Cincinnati, Ohio 45273-8692.

Electronic copies of most financial reports and prospectuses are available at Fidelity's <R>w</R>eb site. To participate in Fidelity's electronic delivery program, call Fidelity or visit Fidelity's <R>w</R>eb site for more information.

You may initiate many transactions by telephone or electronically. Fidelity will not be responsible for any losses resulting from unauthorized transactions if it follows reasonable security procedures designed to verify the identity of the investor. Fidelity will request personalized security codes or other information, and may also record calls. For transactions conducted through the Internet, Fidelity recommends the use of an Internet browser with 128-bit encryption. You should verify the accuracy of your confirmation statements immediately after you receive them. If you do not want the ability to sell and exchange by telephone, call Fidelity for instructions.

When you sign your account application, you will be asked to certify that your social security or taxpayer identification number is correct and that you are not subject to 31% backup withholding for failing to report income to the IRS. If you violate IRS regulations, the IRS can require the fund to withhold 31% of your taxable distributions and redemptions.

Prospectus

Shareholder Information - continued

Fidelity may deduct an annual maintenance fee of $12.00 from accounts with a value of less than $2,500, subject to an annual maximum charge of $24.00 per shareholder. It is expected that accounts will be valued on the second Friday in November of each year. Accounts opened after September 30 will not be subject to the fee for that year. The fee, which is payable to Fidelity, is designed to offset in part the relatively higher costs of servicing smaller accounts. This fee will not be deducted from Fidelity brokerage accounts, retirement accounts (except non-prototype retirement accounts), accounts using regular investment plans, or if total assets with Fidelity exceed $30,000. Eligibility for the $30,000 waiver is determined by aggregating accounts with Fidelity maintained by Fidelity Service Company, Inc. or <R>FBS LLC </R>which are registered under the same social security number or which list the same social security number for the custodian of a Uniform Gifts/Transfers to Minors Act account.

If your account balance falls below $2,000 (except accounts not subject to account minimums), you will be given 30 days' notice to reestablish the minimum balance. If you do not increase your balance, Fidelity may close your account and send the proceeds to you. Your shares will be sold at the NAV on the day your account is closed.

Fidelity may charge a fee for certain services, such as providing historical account documents.

Dividends and Capital Gain Distributions

The fund earns dividends, interest, and other income from its investments, and distributes this income (less expenses) to shareholders as dividends. The fund also realizes capital gains from its investments, and distributes these gains (less any losses) to shareholders as capital gain distributions.

The fund normally pays dividends in March, June, September<R>, </R>and December and capital gain distri-butions in December.

When you open an account, specify on your application how you want to receive your distributions. The following options may be available for the fund's distributions:

1. Reinvestment Option. Your dividends and capital gain distributions will be automatically reinvested in additional shares of the fund. If you do not indicate a choice on your application, you will be assigned this option.

2. Income-Earned Option. Your capital gain distributions will be automatically reinvested in additional shares of the fund. Your dividends will be paid in cash.

3. Cash Option. Your dividends and capital gain distributions will be paid in cash.

Prospectus

Shareholder Information - continued

4. Directed Dividends® Option. Your dividends will be automatically invested in shares of another identically registered Fidelity fund. Your capital gain distributions will be automatically invested in shares of another identically registered Fidelity fund, automatically reinvested in additional shares of the fund, or paid in cash.

Not all distribution options are available for every account. If the option you prefer is not listed on your account application, or if you want to change your current option, call Fidelity.

If you elect to receive distributions paid in cash by check and the U.S. Postal Service does not deliver your checks, your distribution option may be converted to the Reinvestment Option. You will not receive interest on amounts represented by uncashed distribution checks.

As with any investment, your investment in the fund could have tax consequences for you. If you are not investing through a tax-advantaged retirement account, you should consider these tax consequences.

Taxes on distributions. Distributions you receive from the fund are subject to federal income tax, and may also be subject to state or local taxes.

For federal tax purposes, the fund's dividends and distributions of short-term capital gains are taxable to you as ordinary income, while the fund's distributions of long-term capital gains are taxable to you generally as capital gains.

If you buy shares when a fund has realized but not yet distributed income or capital gains, you will be "buying a dividend" by paying the full price for the shares and then receiving a portion of the price back in the form of a taxable distribution.

Any taxable distributions you receive from the fund will normally be taxable to you when you receive them, regardless of your distribution option.

Taxes on transactions. Your redemptions, including exchanges, may result in a capital gain or loss for federal tax purposes. A capital gain or loss on your investment in the fund generally is the difference between the cost of your shares and the price you receive when you sell them.

Prospectus

Asset Manager is a mutual fund, an investment that pools shareholders' money and invests it toward a specified goal.

FMR is the fund's manager.

As of March <R>31, 2000</R>, FMR had approximately $<R>639.1</R> billion in discretionary assets under management.

As the manager, FMR is responsible for choosing the fund's investments and handling its business affairs.

Affiliates assist FMR with foreign investments:

Fidelity Investments Money Management, Inc. (FIMM), in Merrimack, New Hampshire, serves as a sub-adviser for the fund. FIMM is primarily responsible for choosing certain types of investments for the fund.

FIMM is an affiliate of FMR. As of March <R>31, 2000</R>, FIMM had approximately $<R>206.8</R> billion in discretionary assets under management.

<R>Beginning January 1, 2001, FMR Co., Inc. (FMRC) will serve as a sub-adviser for the fund. FMRC will be primarily responsible for choosing certain types of investments for the fund. FMRC is a wholly-owned subsidiary of FMR.</R>

<R>Dick Habermann is vice president and lead manager of Asset Manager, which he has managed since March 1996. Other Fidelity investment professionals assist Mr. Habermann in selecting investments within each asset class for the fund. He also manages other Fidelity funds. Since joining Fidelity in 1968, Mr. Habermann has worked as a research analyst and manager.</R>

From time to time a manager, analyst, or other Fidelity employee may express views regarding a particular company, security, industry, or market sector. The views expressed by any such person are the views of only that individual as of the time expressed and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Prospectus

Fund Services - continued

The fund pays a management fee to FMR. The management fee is calculated and paid to FMR every month. The fee is calculated by adding a group fee rate to an individual fund fee rate, dividing by twelve, and multiplying the result by the fund's average net assets throughout the month.

The group fee rate is based on the average net assets of all the mutual funds advised by FMR. This rate cannot rise above 0.52%, and it drops as total assets under management increase.

For September <R>2000</R>, the group fee rate was <R>0.2738</R>%. The individual fund fee rate is 0.25%.

The total management fee for the fiscal year ended September 30, <R>2000</R>, was <R>0.53</R>% of the fund's average net assets.

FMR pays FIMM, FMR U.K.<R>, </R>and FMR Far East for providing <R>sub-advisory</R> services. FMR Far East in turn pays FIJ for providing sub-advisory services.

<R>FMR will pay FMRC for providing sub-advisory services.</R>

FMR may, from time to time, agree to reimburse the fund for management fees and other expenses above a specified limit. FMR retains the ability to be repaid by the fund if expenses fall below the specified limit prior to the end of the fiscal year. Reimbursement arrangements, which may be discontinued by FMR at any time, can decrease the fund's expenses and boost its performance.

FDC distributes the fund's shares.

The fund has adopted a Distribution and Service Plan pursuant to Rule 12b-1 under the Investment Company Act of 1940 that recognizes that FMR may use its management fee revenues, as well as its past profits or its resources from any other source, to pay FDC for expenses incurred in connection with providing services intended to result in the sale of fund shares and/or shareholder support services. FMR, directly or through FDC, may pay <R>significant amounts to</R> intermediaries, such as banks, broker-dealers, and other service-providers, that provide those services. Currently, the Board of Trustees of the fund has authorized such payments.

<R>If payments made by FMR to FDC or to intermediaries under the Distribution and Service Plan were considered to be paid out of the fund's assets on an on-going basis, they might increase the cost of your investment and might cost you more than paying other types of sales charges.</R>

To receive payments made pursuant to a Distribution and Service Plan, intermediaries must sign the appropriate agreement with FDC in advance.

<R>From time to time, FDC may offer special promotional programs to investors who purchase shares of Fidelity funds. For example, FDC may offer merchandise, discounts, vouchers, or similar items to investors who purchase shares of certain Fidelity funds during certain periods. To determine if you qualify for any such programs, contact Fidelity or visit our web site at www.fidelity.com.</R>

Prospectus

Fund Services - continued

FMR may allocate brokerage transactions in a manner that takes into account the sale of shares of the fund, provided that the fund receives brokerage services and commission rates comparable to those of other broker-dealers.

No dealer, sales representative, or any other person has been authorized to give any information or to make any representations, other than those contained in this prospectus and in the related statement of additional information (SAI), in connection with the offer contained in this prospectus. If given or made, such other information or representations must not be relied upon as having been authorized by the fund or FDC. This prospectus and the related SAI do not constitute an offer by the fund or by FDC to sell shares of the fund to or to buy shares of the fund from any person to whom it is unlawful to make such offer.

Prospectus

The financial highlights table is intended to help you understand the fund's financial history for the past 5 years. Certain information reflects financial results for a single fund share. The total returns in the table represent the rate that an investor would have earned (or lost) on an investment in the fund (assuming reinvestment of all dividends and distributions). This information has been audited by <R>Deloitte & Touche LLP (2000 annual information only), independent accountants, whose report, along with the fund's financial highlights and financial statements, are included in the fund's annual report. Annual information prior to 2000 was audited by PricewaterhouseCoopers LLP</R>. A free copy of the annual report is available upon request.

<R>Selected Per-Share Data and Ratios</R>

|

<R>Years ended September 30, |

2000 |

1999 |

1998 |

1997 |

1996</R> |

|

<R>Selected Per-Share Data |

|

|

|

|

</R> |

|

<R>Net asset value, beginning of period |

$ 17.28 |

$ 18.24 |

$ 19.01 |

$ 16.49 |

$ 15.47</R> |

|

<R>Income from Investment Operations |

|

|

|

|

</R> |

|

<R> Net investment income |

.61 B |

.54 B |

.61 B |

.59 B |

.62</R> |

|

<R> Net realized and unrealized gain (loss) |

2.53 |

2.23 |

.37 |

3.35 |

.96</R> |

|

<R> Total from investment operations |

3.14 |

2.77 |

.98 |

3.94 |

1.58</R> |

|

<R>Less Distributions |

|

|

|

|

</R> |

|

<R> From net investment income |

(.58) |

(.56) |

(.64) |

(.67) |

(.56)</R> |

|

<R> From net realized gain |

(.73) |

(3.17) |

(1.11) |

(.75) |

-</R> |

|

<R> Total distributions |

(1.31) |

(3.73) |

(1.75) |

(1.42) |

(.56)</R> |

|

<R>Net asset value, end of period |

$ 19.11 |

$ 17.28 |

$ 18.24 |

$ 19.01 |

$ 16.49</R> |

|

<R>Total Return A |

18.73% |

16.12% |

5.34% |

25.15% |

10.37%</R> |

|

<R>Ratios and Supplemental Data |

|

|

|

|

</R> |

|

<R>Net assets, end of period (in millions) |

$ 13,570 |

$ 12,223 |

$ 11,576 |

$ 11,866 |

$ 10,674</R> |

|

<R>Ratio of expenses to average net assets |

.73% |

.75% |

.76% |

.79% |

.95%</R> |

|

<R>Ratio of expenses to average net assets |

.71% C |

.73%C |

.74%C |

.78% C |

.93% C</R> |

|

<R>Ratio of net investment income to |

3.32% |

3.01% |

3.19% |

3.39% |

3.64%</R> |

|

<R>Portfolio turnover rate |

109% |

104% |

136% |

79% |

131%</R> |

<R>A The total returns would have been lower had certain expenses not been reduced during the periods shown.</R>

<R>B Net investment income per share has been calculated based on average shares outstanding during the period.</R>

<R>C FMR or the fund has entered into varying arrangements with third parties who either paid or reduced a portion of the fund's expenses.</R>

Prospectus

Notes

Notes

Notes

Notes

Notes

You can obtain additional information about the fund. The fund's SAI includes more detailed information about the fund and its investments. The SAI is incorporated herein by reference (legally forms a part of the prospectus). The fund's annual and semi-annual reports include a discussion of the fund's holdings and recent market conditions and the fund's investment strategies that affected performance.

For a free copy of any of these documents or to request other information or ask questions about the fund, call Fidelity at 1-800-544<R>-8544</R>. In addition, you may visit Fidelity's <R>w</R>eb site at www.fidelity.com for a free copy of a prospectus or an annual or semi-annual report or to request other information.

|

<R>The SAI, the fund's annual and semi-annual reports and other related materials are available from the Electronic Data Gathering, Analysis, and Retrieval (EDGAR) Database on the SEC's web site (http://www.sec.gov). You can obtain copies of this information, after paying a duplicating fee, by sending a request by e-mail to [email protected] or by writing the Public Reference Section of the SEC, Washington, D.C. 20549-0102. You can also review and copy information about the fund, including the fund's SAI, at the SEC's Public Reference Room in Washington, D.C. Call 1-202-942-8090 for information on the operation of the SEC's Public Reference Room.</R> Investment Company Act of 1940, File Number, 811-3221. |

Fidelity, Fidelity Investments & (Pyramid) Design, <R>FAST</R>, Fidelity Money Line, Fidelity Automatic Account Builder, Fidelity On-Line Xpress+, and Directed Dividends Option are registered trademarks of FMR Corp.

Asset Manager, <R>Fidelity </R>GoalPlanner, and Portfolio Advisory Services are service marks of FMR Corp.

The third party marks appearing above are the marks of their respective owners.

<R>1.702387.103 FAA-pro-</R>1100

Like securities of all mutual funds, these securities have not been approved or disapproved by the Securities and Exchange Commission, and the Securities and Exchange Commission has not determined if this prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

Fidelity®

(fund number 347, trading symbol <R>FAMRX</R>)

Prospectus

November 27, 2000

(fidelity_logo_graphic)

82 Devonshire Street, Boston, MA 02109

|

Fund Summary |

Investment Summary |

|

|

|

Performance |

|

|

|

Fee Table |

|

|

Fund Basics |

Investment Details |

|

|

|

Valuing Shares |

|

|

Shareholder Information |

Buying and Selling Shares |

|

|

|

Exchanging Shares |

|

|

|

Account Features and Policies |

|

|

|

Dividends and Capital Gain Distributions |

|

|

|

Tax Consequences |

|

|

Fund Services |

Fund Management |

|

|

|

Fund Distribution |

|

|

<R>Appendix |

Financial Highlights</R> |

Prospectus

Investment Objective

Asset Manager: Aggressive<R>SM</R> seeks to maximize total return over the long term by allocating its assets among stocks, bonds, short-term instruments, and other investments.

Principal Investment Strategies

Fidelity Management & Research Company (FMR)'s principal investment strategies include:

Principal Investment Risks

The fund is subject to the following principal investment risks:

An investment in the fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

When you sell your shares of the fund, they could be worth more or less than what you paid for them.

Performance history will be available for the fund after the fund has been in operation for one calendar year.

Prospectus

Fund Summary - continued

<R>The following table describes the fees and expenses that are incurred when you buy, hold, or sell shares of the fund. The annual fund operating expenses provided below for the fund do not reflect the effect of any reduction of certain expenses during the period.</R>

Shareholder fees (paid by the investor directly)

|

Sales charge (load) on purchases and reinvested distributions |

None |

|

Deferred sales charge (load) on redemptions |

None |

|

Annual account maintenance fee (for accounts under $2,500) |

$12.00 |

Annual fund operating expenses (paid from fund assets)

|

<R>Management fee |

0.57%</R> |

|

Distribution and Service (12b-1) fee |

None |

|

<R>Other expenses |

0.39%</R> |

|

<R>Total annual fund operating expensesA |

0.96%</R> |

A Effective September 22, 1999, FMR has voluntarily agreed to reimburse the fund to the extent <R>that </R>total operating expenses (excluding interest, taxes, <R>certain</R> securities lending <R>costs</R>, brokerage commissions, and extraordinary expenses), as a percentage of its average net assets, exceed 1.20%. This arrangement can be discontinued by FMR at any time.

<R>A portion of the brokerage commissions that the fund pays is used to reduce the fund's expenses. In addition, through arrangements with the fund's custodian and transfer agent, credits realized as a result of uninvested cash balances are used to reduce custodian and transfer agent expenses. Including these reductions, the total fund operating expenses would have been 0.90%.</R>

This example helps you compare the cost of investing in the fund with the cost of investing in other mutual funds.

Let's say, hypothetically, that the fund's annual return is 5% and that your shareholder fees and the fund's annual operating expenses are exactly as described in the fee table. This example illustrates the effect of fees and expenses, but is not meant to suggest actual or expected fees and expenses or returns, all of which may vary. For every $10,000 you invested, here's how much you would pay in total expenses if you close your account <R>at</R> the end <R>of each time period</R> indicated:

|

<R>1 year |

$ 98</R> |

|

<R>3 years |

$ 306</R> |

|

<R>5 years |

$ 531</R> |

|

<R>10 years |

$ 1,178</R> |

Prospectus

Investment Objective

Asset Manager: Aggressive seeks to maximize total return over the long term by allocating its assets among stocks, bonds, short-term instruments, and other investments.

Principal Investment Strategies

FMR allocates the fund's assets <R>between</R> the following classes, or types, of investments. The stock class includes equity securities of all types. The bond and short-term/money market class includes all varieties of fixed-income securities, including lower-quality debt securities, maturing in more than one year and all types of short-term and money market instruments.

FMR may use its judgment to place a security in the most appropriate class based on its investment characteristics. FMR may invest the fund's assets in these classes by investing in other funds. FMR may also invest the fund's assets in other instruments that do not fall within these classes.

FMR has the ability to allocate the fund's assets within specified ranges. The fund's neutral mix represents the benchmark for its combination of investments in each asset class over time. FMR may change the neutral mix from time to time. The approximate neutral mix and range for each asset class are shown below:

FMR will not try to pinpoint the precise moment when a major reallocation should be made. Instead, FMR regularly reviews the fund's allocation and makes changes gradually to favor investments that it believes will provide the most favorable outlook for achieving the fund's objective.

FMR may invest the fund's assets in securities of foreign issuers in addition to securities of domestic issuers.

In buying and selling securities for the fund, FMR generally analyzes the issuer of a security using fundamental factors (e.g., growth potential, earnings estimates, and management) and/or quantitative factors (e.g., historical earnings, dividend yield, and earnings per share) and evaluates each security's current price relative to its estimated long-term value.

FMR may lend the fund's securities to broker-dealers or other institutions to earn income for the fund.

FMR may use various techniques, such as buying and selling futures contracts, to increase or decrease the fund's exposure to changing security prices, interest rates<R>,</R> or other factors that affect security values. If FMR's strategies do not work as intended, the fund may not achieve its objective.

Description of Principal Security Types

Equity securities represent an ownership interest, or the right to acquire an ownership interest, in an issuer. Different types of equity securities provide different voting and dividend rights and priority in the event of the bankruptcy of the issuer. Equity securities include common stocks, preferred stocks, convertible securities, and warrants.

Prospectus

Fund Basics - continued

Debt securities are used by issuers to borrow money. The issuer usually pays a fixed, variable<R>,</R> or floating rate of interest, and must repay the amount borrowed at the maturity of the security. Some debt securities, such as zero coupon bonds, do not pay current interest butare sold at a discount from their face values. Debt securities include corporate bonds, government securities, and mortgage and other asset-backed securities.

Money market securities are high-quality, short-term securities that pay a fixed, variable<R>,</R> or floating interest rate. Securities are often specifically structured so that they are eligible investments for a money market fund. For example, in order to satisfy the maturity restrictions for a money market fund, some money market securities have demand or put features<R>,</R> which have the effect of shortening the security's maturity. Money market securities include bank certificates of deposit, bank<R>ers'</R> acceptances, bank time deposits, notes, commercial paper<R>,</R> and U.S. Government securities.

Principal Investment Risks

Many factors affect the fund's performance. The fund's share price and yield change daily based on changes in market conditions and interest rates and in response to other economic, political<R>,</R> or financial developments. The fund's reaction to these developments will be affected by the types and maturities of securities in which the fund invests, the financial condition, industry and economic sector, and geographic location of an issuer, and the fund's level of investment in the securities of that issuer. When you sell your shares of the fund, they could be worth more or less than what you paid for them.

The following factors <R>can</R> significantly affect the fund's performance:

Stock Market Volatility. The value of equity securities fluctuates in response to issuer, political, market<R>, </R>and economic developments. In the short term, equity prices can fluctuate dramatically in response to these developments. Different parts of the market and different types of equity securities can react differently to these developments. For example, large cap stocks can react differently<R> from</R> small cap stocks, and "growth" stocks can react differently <R>from</R> "value" stocks. Issuer, political<R>, </R>or economic developments can affect a single issuer, issuers within an industry or economic sector or geographic region, or the market as a whole.

Interest Rate Changes. Debt securities have varying levels of sensitivity to changes in interest rates. In general, the price of a debt security can fall when interest rates rise and can rise when interest rates fall. Securities with longer maturities and mortgage securities can be more sensitive to interest rate changes. In other words, the longer the maturity of a security, the greater the impact a change in interest rates could have on the security's price. In addition, short-term and long-term interest rates do not necessarily move in the same amount or the same direction. Short-term securities tend to react to changes in short-term interest rates, and long-term securities tend to react to changes in long-term interest rates.

Prospectus

Fund Basics - continued

Foreign Exposure. Foreign securities, foreign currencies, and securities issued by U.S. entities with substantial foreign operations can involve additional risks relating to political, economic<R>,</R> or regulatory conditions in foreign countries. These risks include fluctuations in foreign currencies; withholding or other taxes; trading, settlement, custodial, and other operational risks; and the less stringent investor protection and disclosure standards of some foreign markets. All of these factors can make foreign investments, especially those in emerging markets, more volatile and potentially less liquid than U.S. investments. In addition, foreign markets can perform differently <R>from</R> the U.S. market.

Prepayment. Many types of debt securities, including mortgage securities, are subject to prepayment risk. Prepayment occurs when the issuer of a security can repay principal prior to the security's maturity. Securities subject to prepayment <R>can</R> offer less potential for gains during a declining interest rate environment and similar or greater potential for loss in a rising interest rate environment. In addition, the potential impact of prepayment features on the price of a debt security can be difficult to predict and result in greater volatility.

Issuer-Specific Changes. Changes in the financial condition of an issuer, changes in specific economic or political conditions that affect a particular type of security or issuer, and changes in general economic or political conditions can affect the credit quality or value of an issuer's securities. The value of securities of smaller, less well-known issuers can be more volatile than that of larger issuers. Lower-quality debt securities (those of less than investment-grade quality) <R>and certain types of other securities</R> tend to be <R>particularly</R> sensitive to these changes.

Lower-quality debt securities <R>and certain types of other securities</R> involve greater risk of default or price changes due to changes in the credit quality of the issuer. The value of lower-quality <R>debt securities and certain types</R> of other securities often fluctuates in response to company, political<R>,</R> or economic developments and can decline significantly over short periods of time or during periods of general or regional economic difficulty.

In response to market, economic, political<R>,</R> or other conditions, FMR may temporarily use a different investment strategy for defensive purposes. If FMR does so, different factors could affect the fund's performance and the fund may not achieve its investment objective.

Fundamental Investment Policies

The policy discussed below is fundamental, that is, subject to change only by shareholder approval.

Asset Manager: Aggressive seeks to maximize total return over the long term by allocating its assets among stocks, bonds, short-term instruments, and other investments.

Prospectus

Fund Basics - continued

The fund is open for business each day the New York Stock Exchange (NYSE) is open.

The fund's net asset value per share (NAV) is the value of a single share. Fidelity normally calculates the fund's NAV as of the close of business of the NYSE, normally 4:00 p.m. Eastern time. However, NAV may be calculated earlier if trading on the NYSE is restricted or as permitted by the Securities and Exchange Commission (SEC). The fund's assets are valued as of this time for the purpose of computing the fund's NAV.

To the extent that the fund's assets are traded in other markets on days when the NYSE is closed, the value of the fund's assets may be affected on days when the fund is not open for business. In addition, trading in some of the fund's assets may not occur on days when the fund is open for business.

The fund's assets are valued primarily on the basis of market quotations or on the basis of information furnished by a pricing service. Certain short-term securities are valued on the basis of amortized cost. If market quotations or information furnished by a pricing service is not readily available <R>or does not accurately reflect fair value</R> for a security or if a security's value has been materially affected by events occurring after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), that security may be valued by another method that the Board of Trustees believes accurately reflects fair value. A security's valuation may differ depending on the method used for determining value.

Prospectus

Fidelity Investments was established in 1946 to manage one of America's first mutual funds. Today, Fidelity is the largest mutual fund company in the country, and is known as an innovative provider of high-quality financial services to individuals and institutions.

In addition to its mutual fund business, the company operates one of America's leading discount brokerage firms, Fidelity Brokerage Services LLC (FBS LLC). Fidelity is also a leader in providing tax-advantaged retirement plans for individuals investing on their own or through their employer.

For account, product<R>,</R> and service information, please use the following web site and phone numbers:

Please use the following addresses:

Buying Shares

Fidelity Investments

P.O. Box 770001

Cincinnati, OH 45277-0002

Overnight Express

Fidelity Investments

2300 Litton Lane - KH1A

Hebron, KY 41048

Selling Shares

Fidelity Investments

P.O. Box 660602

Dallas, TX 75266-0602

Overnight Express

Fidelity Investments

Attn: Redemptions - CP6I

400 East Las Colinas Blvd.

Irving, TX 75039-5587

You may buy or sell shares of the fund through a retirement account or an investment professional. If you invest through a retirement account or an investment professional, the procedures for buying, selling, and exchanging shares of the fund and the account features and policies may differ. Additional fees may also apply to your investment in the fund, including a transaction fee if you buy or sell shares of the fund through a broker or other investment professional.

Certain methods of contacting Fidelity, such as by telephone or electronically, may be unavailable or delayed (for example, during periods of unusual market activity). In addition, the level and type of service available may be restricted based on criteria established by Fidelity.

Prospectus

Shareholder Information - continued

The different ways to set up (register) your account with Fidelity are listed in the following table.

|

Ways to Set Up Your Account |

|

Individual or Joint Tenant For your general investment needs |

|

Retirement For tax-advantaged retirement savings |

|

|

|

|

|

|

|

|

|

|

|

Gifts or Transfers to a Minor (UGMA, UTMA) To invest for a child's education or other future needs |

|

Trust For money being invested by a trust |

|

Business or Organization For investment needs of corporations, associations, partnerships, or other groups |

The price to buy one share of the fund is the fund's NAV. The fund's shares are sold without a sales charge.

Your shares will be bought at the next NAV calculated after your investment is received in proper form.

Short-term or excessive trading into and out of the fund may harm performance by disrupting portfolio management strategies and by increasing expenses. Accordingly, the fund may reject any purchase orders, including exchanges, particularly from market timers or investors who, in FMR's opinion, have a pattern of short-term or excessive trading or whose trading has been or may be disruptive to the fund. For these purposes, FMR may consider an investor's trading history in the fund or other Fidelity funds, and accounts under common ownership or control.

The fund may stop offering shares completely or may offer shares only on a limited basis, for a period of time or permanently.

When you place an order to buy shares, note the following:

Prospectus

Shareholder Information - continued

Certain financial institutions that have entered into sales agreements with Fidelity Distributors Corporation (FDC) may enter confirmed purchase orders on behalf of customers by phone, with payment to follow no later than the time when the fund is priced on the following business day. If payment is not received by that time, the order will be canceled and the financial institution could be held liable for resulting fees or losses.

Minimums

|

To Open an Account |

$2,500 |

|

For certain Fidelity retirement accountsA |

$500 |

|

To Add to an Account |

$250 |

|

Through regular investment plans |

$100 |

|

Minimum Balance |

$2,000 |

|

For certain Fidelity retirement accountsA |

$500 |

A Fidelity Traditional IRA, Roth IRA, Rollover IRA, SEP-IRA, and Keogh accounts.

These minimums may be lower for purchases through a Fidelity GoalPlannerSM account. There is no minimum account balance or initial or subsequent purchase minimum for investments through Portfolio Advisory ServicesSM , a qualified state tuition program, certain Fidelity retirement accounts funded through salary deduction, or accounts opened with the proceeds of distributions from such retirement accounts. In addition, the fund may waive or lower purchase minimums in other circumstances.

|

Key Information |

|

|

<R>Phone |

To Open an Account</R>

To Add to an Account

|

|

Internet |

To Open an Account

To Add to an Account

|

|

Mail |

To Open an Account

To Add to an Account

|

|

In Person |

To Open an Account

To Add to an Account

|

|

<R>Wire |

To Open an Account</R>

To Add to an Account

|

|

Automatically |

To Open an Account

To Add to an Account

|

The price to sell one share of the fund is the fund's NAV.

Your shares will be sold at the next NAV calculated after your order is received in proper form.

Certain requests must include a signature guarantee. It is designed to protect you and Fidelity from fraud. Your request must be made in writing and include a signature guarantee if any of the following situations apply:

You should be able to obtain a signature guarantee from a bank, broker (including Fidelity Investor Centers), dealer, credit union (if authorized under state law), securities exchange or association, clearing agency, or savings association. A notary public cannot provide a signature guarantee.

Prospectus

Shareholder Information - continued

When you place an order to sell shares, note the following:

|

Key Information |

|

|

<R>Phone |

|

|

Internet |

|

|

Mail |

Individual, Joint Tenant, Sole Proprietorship, UGMA, UTMA

Retirement Account

Trust

Business or Organization

Executor, Administrator, Conservator, Guardian

|

|

In Person |

Individual, Joint Tenant, Sole Proprietorship, UGMA, UTMA

Retirement Account

Trust

Business or Organization

Executor, Administrator, Conservator, Guardian

|

|

Automatically |

|

An exchange involves the redemption of all or a portion of the shares of one fund and the purchase of shares of another fund.

As a shareholder, you have the privilege of exchanging shares of the fund for shares of other Fidelity funds.

However, you should note the following policies and restrictions governing exchanges:

Prospectus

Shareholder Information - continued

The fund may terminate or modify the exchange privilege in the future.

Other funds may have different exchange restrictions, and may impose trading fees of up to <R>2.00%</R> of the amount exchanged. Check each fund's prospectus for details.

The following features are available to buy and sell shares of the fund.

Automatic Investment and Withdrawal Programs. Fidelity offers convenient services that let you automatically transfer money into your account, between accounts, or out of your account. While automatic investment programs do not guarantee a profit and will not protect you against loss in a declining market, they can be an excellent way to invest for retirement, a home, educational expenses, and other long-term financial goals. Automatic withdrawal or exchange programs can be a convenient way to provide a consistent income flow or to move money between your investments.

Prospectus

Shareholder Information - continued

|

Fidelity Automatic Account Builder |

||

|

<R>Minimum $100 |

Frequency Monthly or quarterly |

Procedures</R>

|

|

Direct Deposit |

||

|

<R>Minimum $100 |

Frequency Every pay period |

Procedures</R>

|

|

A Because its share price fluctuates, the fund may not be an appropriate choice for direct deposit of your entire check. |

||

|

Fidelity Automatic Exchange Service |

||

|

Minimum $100 |

Frequency Monthly, bimonthly, quarterly, or annually |

Procedures

|

|

Personal Withdrawal Service |

||

|

Frequency Monthly |

Procedures

|

|

Prospectus

Shareholder Information - continued

Other Features. The following other features are also available to buy and sell shares of the fund.

|

Wire |

|

|

Fidelity Money Line |

|

|

Fidelity On-Line Xpress+® |

|

Call 1-800-544-0240 or visit Fidelity's web site for more information.

|

|

Fidelity Online Trading |

|

|

FAST |

|

Call 1-800-544-5555.

|

The following policies apply to you as a shareholder.

Statements and reports that Fidelity sends to you include the following:

Prospectus

Shareholder Information - continued

To reduce expenses, only one copy of most financial reports and prospectuses <R>may </R>be mailed to <R>households</R>, even if more than one <R>person</R> in <R>the household holds shares </R>of the fund. Call Fidelity at 1-800-544-8544 if you need additional copies of financial reports or prospectuses. <R>If you do not want the mailing of these documents to be combined with those for other members of your household, contact Fidelity in writing at P.O. Box 5000, Cincinnati, Ohio 45273-8692</R>.

Electronic copies of most financial reports and prospectuses are available at Fidelity's <R>w</R>eb site. To participate in Fidelity's electronic delivery program, call Fidelity or visit Fidelity's <R>w</R>eb site for more information.

You may initiate many transactions by telephone or electronically. Fidelity will not be responsible for any losses resulting from unauthorized transactions if it follows reasonable security procedures designed to verify the identity of the investor. Fidelity will request personalized security codes or other information, and may also record calls. For transactions conducted through the Internet, Fidelity recommends the use of an Internet browser with 128-bit encryption. You should verify the accuracy of your confirmation statements immediately after you receive them. If you do not want the ability to sell and exchange by telephone, call Fidelity for instructions.

When you sign your account application, you will be asked to certify that your social security or taxpayer identification number is correct and that you are not subject to 31% backup withholding for failing to report income to the IRS. If you violate IRS regulations, the IRS can require the fund to withhold 31% of your taxable distributions and redemptions.

Fidelity may deduct an annual maintenance fee of $12.00 from accounts with a value of less than $2,500, subject to an annual maximum charge of $24.00 per shareholder. It is expected that accounts will be valued on the second Friday in November of each year. Accounts opened after September 30 will not be subject to the fee for that year. The fee, which is payable to Fidelity, is designed to offset in part the relatively higher costs of servicing smaller accounts. This fee will not be deducted from Fidelity brokerage accounts, retirement accounts (except non-prototype retirement accounts), accounts using regular investment plans, or if total assets with Fidelity exceed $30,000. Eligibility for the $30,000 waiver is determined by aggregating accounts with Fidelity maintained by Fidelity Service Company, Inc. or FBS LLC which are registered under the same social security number or which list the same social security number for the custodian of a Uniform Gifts/Transfers to Minors Act account.

If your account balance falls below $2,000 (except accounts not subject to account minimums), you will be given 30 days' notice to reestablish the minimum balance. If you do not increase your balance, Fidelity may close your account and send the proceeds to you. Your shares will be sold at the NAV on the day your account is closed.

Prospectus

Shareholder Information - continued

Fidelity may charge a fee for certain services, such as providing historical account documents.

Dividends and Capital Gain Distributions

The fund earns dividends, interest, and other income from its investments, and distributes this income (less expenses) to shareholders as dividends. The fund also realizes capital gains from its investments, and distributes these gains (less any losses) to shareholders as capital gain distributions.

The fund normally pays dividends and capital gain distributions in December.

When you open an account, specify on your application how you want to receive your distributions. The following options may be available for the fund's distributions:

1. Reinvestment Option. Your dividends and capital gain distributions will be automatically reinvested in additional shares of the fund. If you do not indicate a choice on your application, you will be assigned this option.

2. Income-Earned Option. Your capital gain distributions will be automatically reinvested in additional shares of the fund. Your dividends will be paid in cash.

3. Cash Option. Your dividends and capital gain distributions will be paid in cash.

4. Directed Dividends® Option. Your dividends will be automatically invested in shares of another identically registered Fidelity fund. Your capital gain distributions will be automatically invested in shares of another identically registered Fidelity fund, automatically reinvested in additional shares of the fund, or paid in cash.

Not all distribution options are available for every account. If the option you prefer is not listed on your account application, or if you want to change your current option, call Fidelity.

If you elect to receive distributions paid in cash by check and the U.S. Postal Service does not deliver your checks, your distribution option may be converted to the Reinvestment Option. You will not receive interest on amounts represented by uncashed distribution checks.

As with any investment, your investment in the fund could have tax consequences for you. If you are not investing through a tax-advantaged retirement account, you should consider these tax consequences.

Taxes on distributions. Distributions you receive from the fund are subject to federal income tax, and may also be subject to state or local taxes.

For federal tax purposes, the fund's dividends and distributions of short-term capital gains are taxable to you as ordinary <R>income, while the</R> fund's distributions of long-term capital gains are taxable to you generally as capital gains.

Prospectus

Shareholder Information - continued

If you buy shares when a fund has realized but not yet distributed income or capital gains, you will be "buying a dividend" by paying the full price for the shares and then receiving a portion of the price back in the form of a taxable distribution.