|

|

|

|

|

Previous: TRIMEDYNE INC, S-2, EX-23, 2000-09-18 |

Next: MERRILL LYNCH PHOENIX FUND INC, N-30D, 2000-09-18 |

Spartan®

Semiannual Report

July 31, 2000

(2_fidelity_logos)((Registered_Trademark)

|

President's Message |

3 |

Ned Johnson on investing strategies |

|

Spartan Massachusetts Municipal Income Fund |

||

|

|

4 |

Performance |

|

|

7 |

Fund Talk: The Manager's Overview |

|

|

10 |

Investment Changes |

|

|

11 |

Investments |

|

|

23 |

Financial Statements |

|

Spartan Massachusetts Municipal Money Market Fund |

||

|

|

27 |

Performance |

|

|

29 |

Fund Talk: The Manager's Overview |

|

|

31 |

Investment Changes |

|

|

32 |

Investments |

|

|

40 |

Financial Statements |

|

Fidelity Massachusetts Municipal Money Market Fund |

||

|

|

44 |

Performance |

|

|

46 |

Fund Talk: The Manager's Overview |

|

|

48 |

Investment Changes |

|

|

49 |

Investments |

|

|

59 |

Financial Statements |

|

Notes |

63 |

Notes to the financial statements |

|

|

|

|

|

|

|

|

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

(Recycle graphic) This report is printed on recycled paper using soy-based inks.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the funds. This report is not authorized for distribution to prospective investors in the funds unless preceded or accompanied by an effective prospectus.

Mutual fund shares are not deposits or obligations of, or guaranteed by, any depository institution. Shares are not insured by the FDIC, Federal Reserve Board or any other agency, and are subject to investment risks, including possible loss of principal amount invested.

Neither the funds nor Fidelity Distributors Corporation is a bank.

For more information on any Fidelity fund, including charges and expenses, call 1-800-544-6666 for a free prospectus. Read it carefully before you invest or send money.

Semiannual Report

(photo_of_Edward_C_Johnson_3d)

Dear Shareholder:

The Federal Reserve Board's effort to keep inflation in check without over-cooling the U.S. economy has taken a toll on the stock market. Through July 2000, bellwether equity indexes such as the Dow Jones Industrial Average, NASDAQ and S&P 500® have negative returns for the year. On the other hand, fixed-income markets are enjoying strong performance. Except for high-yield, most bond sectors - corporates, mortgages, Treasuries and agencies - have returned 4%-6% year to date.

While it's impossible to predict the future direction of the markets with any degree of certainty, there are certain basic principles that can help investors plan for their future needs.

The longer your investment time frame, the less likely it is that you will be affected by short-term market volatility. A 10-year investment horizon appropriate for saving for a college education, for example, enables you to weather market cycles in a long-term fund, which may have a higher risk potential, but also has a higher potential rate of return.

An intermediate-length fund could make sense if your investment horizon is two to four years, while a short-term bond fund could be the right choice if you need your money in one or two years.

If your time horizon is less than a year, you might want to consider moving some of your bond investment into a money market fund. These funds seek income and a stable share price by investing in high-quality, short-term investments. Of course, it's important to remember that an investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although money market funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in these types of funds.

Finally, no matter what your time horizon or portfolio diversity, it makes good sense to follow a regular investment plan, investing a certain amount of money in a fund at the same time each month or quarter and periodically reviewing your overall portfolio. By doing so, you won't get caught up in the excitement of a rapidly rising market, nor will you buy all your shares at market highs. While this strategy - known as dollar cost averaging - won't assure a profit or protect you from a loss in a declining market, it should help you lower the average cost of your purchases. Of course, you should consider your financial ability to continue your purchases through periods of low price levels before undertaking such a strategy.

If you have questions, please call us at 1-800-544-6666, or visit our web site at www.fidelity.com. We are available 24 hours a day, seven days a week to provide you the information you need to make the investments that are right for you.

Best regards,

/s/Edward C. Johnson 3d

Edward C. Johnson 3d

Semiannual Report

Spartan Massachusetts Municipal Income Fund

Performance: The Bottom Line

There are several ways to evaluate a fund's historical performance. You can look at the total percentage change in value, the average annual percentage change or the growth of a hypothetical $10,000 investment. Total return reflects the change in the value of an investment, assuming reinvestment of the fund's dividend income and capital gains (the profits earned upon the sale of securities that have grown in value). You can also look at the fund's income, as reflected in its yield, to measure performance.

Cumulative Total Returns

|

Periods ended July 31, 2000 |

Past 6 |

Past 1 |

Past 5 |

Past 10 |

|

Spartan MA Municipal Income |

6.08% |

4.00% |

32.18% |

93.89% |

|

LB Massachusetts 3 Plus Year Enhanced |

6.93% |

4.20% |

n/a* |

n/a* |

|

Massachusetts Municipal Debt Funds Average |

6.42% |

2.15% |

27.07% |

86.64% |

Cumulative total returns show the fund's performance in percentage terms over a set period - in this case, six months, one year, five years or 10 years. For example, if you had invested $1,000 in a fund that had a 5% return over the past year, the value of your investment would be $1,050. You can compare the fund's returns to the performance of the Lehman Brothers Massachusetts 3 Plus Year Enhanced Municipal Bond Index - a market value-weighted index of Massachusetts investment-grade municipal bonds with maturities of three years or more. To measure how the fund's performance stacked up against its peers, you can compare it to the Massachusetts municipal debt funds average, which reflects the performance of mutual funds with similar objectives tracked by Lipper Inc. The past six months average represents a peer group of 57 mutual funds. These benchmarks include reinvested dividends and capital gains, if any, and exclude the effect of sales charges.

Average Annual Total Returns

|

Periods ended July 31, 2000 |

|

Past 1 |

Past 5 |

Past 10 |

|

Spartan MA Municipal Income |

|

4.00% |

5.74% |

6.85% |

|

LB Massachusetts 3 Plus Year Enhanced |

|

4.20% |

n/a* |

n/a* |

|

Massachusetts Municipal Debt Funds Average |

|

2.15% |

4.90% |

6.43% |

Average annual total returns take the fund's cumulative return and show you what would have happened if the fund had performed at a constant rate each year. (Note: Lipper calculates average annual total returns by annualizing each fund's total return, then taking the arithmetic average. This may produce a different figure than that obtained by averaging the cumulative total returns and annualizing the result.)

* Not available

Semiannual Report

Spartan Massachusetts Municipal Income Fund

Performance - continued

$10,000 Over 10 Years

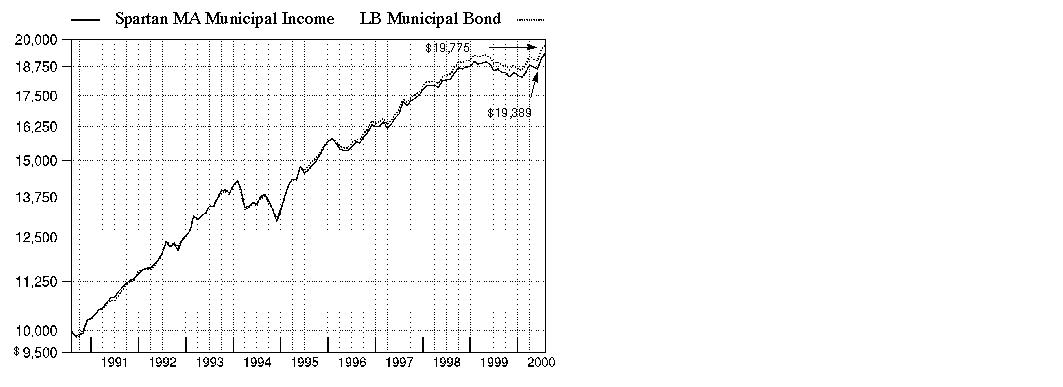

$10,000 Over 10 Years: Let's say hypothetically that $10,000 was invested in Spartan Massachusetts Municipal Income Fund on July 31, 1990. As the chart shows, by July 31, 2000, the value of the investment would have grown to $19,389 - a 93.89% increase on the initial investment. For comparison, look at how the Lehman Brothers Municipal Bond Index - a market value-weighted index of investment-grade municipal bonds with maturities of one year or more - did over the same period. With dividends and capital gains, if any, reinvested, the same $10,000 would have grown to $19,775 - a 97.75% increase.

Understanding

Performance

How a fund did yesterday is no guarantee of how it will do tomorrow. Bond prices, for example, generally move in the opposite direction of interest rates. In turn, the share price, return, and yield of a fund that invests in bonds will vary. That means if you sell your shares during a market downturn, you might lose money. But if you can ride out the market's ups and downs, you may have a gain.

3Semiannual Report

Spartan Massachusetts Municipal Income Fund

Performance - continued

Total Return Components

|

|

Six months ended July 31, |

Years ended January 31, |

||||

|

|

2000 |

2000 |

1999 |

1998 |

1997 |

1996 |

|

Dividend returns |

2.63% |

4.57% |

4.92% |

5.47% |

5.33% |

6.41% |

|

Capital returns |

3.45% |

-8.27% |

0.84% |

4.74% |

-2.27% |

8.35% |

|

Total returns |

6.08% |

-3.70% |

5.76% |

10.21% |

3.06% |

14.76% |

Total return components include both dividend returns and capital returns. A dividend return reflects the actual dividends paid by the fund. A capital return reflects both the amount paid by the fund to shareholders as capital gain distributions and changes in the fund's share price. Both returns assume the dividends or capital gains, if any, paid by the fund are reinvested.

Dividends and Yield

|

Periods ended July 31, 2000 |

Past 1 |

Past 6 |

Past 1 |

|

Dividends per share |

4.84 ¢ |

28.25 ¢ |

56.44 ¢ |

|

Annualized dividend rate |

5.02% |

5.07% |

5.03% |

|

30-day annualized yield |

5.02% |

- |

- |

|

30-day annualized tax-equivalent yield |

8.34% |

- |

- |

Dividends per share show the income paid by the fund for a set period. If you annualize this number, based on an average share price of $11.36 over the past one month, $11.18 over the past six months and $11.21 over the past one year, you can compare the fund's income over these three periods. The 30-day annualized yield is a standard formula for all bond funds based on the yields of the bonds in the fund, averaged over the past 30 days. This figure shows you the yield characteristics of the fund's investments at the end of the period. It also helps you compare funds from different companies on an equal basis. The tax-equivalent yield shows what you would have to earn on a taxable investment to equal the fund's tax-free yield, if you're in the 39.74% combined 2000 federal and state tax bracket, but does not reflect the payment of the federal alternative minimum tax, if applicable.

Semiannual Report

Spartan Massachusetts Municipal Income Fund

Fund Talk: The Manager's Overview

Market Recap

Favorable technical conditions in the municipal bond market overcame three more interest-rate hikes by the Federal Reserve Board during the six-month period ending July 31, 2000, helping municipal bonds outperform most other investments in both the fixed-income and equity markets. Municipal bond yields in the neighborhood of 6%, a diminished supply of new issues coming to market, attractive prices and strong demand from individual investors spurred the Lehman Brothers Municipal Bond Index - an index of over 35,000 investment-grade, fixed-rate, tax-exempt bonds - to a six-month return of 6.39%. That outperformed the overall taxable-bond market, as measured by the Lehman Brothers Aggregate Bond Index, which gained 5.28% in the same time frame. In fact, the six-month municipal bond return was higher than the return of corporate, mortgage, government, Treasury and agency bonds, according to their respective Lehman Brothers benchmarks. On a tax-equivalent yield basis, municipal bond outperformance was even more significant. The muni market, along with most other fixed-income sectors, also benefited from increased volatility in the equity markets, and from economic data demonstrating evidence that the Fed's effort to cool down the U.S. economy was working, perhaps signaling an end to the Fed's rate hikes for the remainder of 2000.

(Portfolio Manager photograph)

An interview with Christine Thompson, Portfolio Manager of Spartan Massachusetts Municipal Income Fund

Q. How did the fund perform, Christine?

A. For the six-month period that ended July 31, 2000, the fund had a total return of 6.08%. To get a sense of how the fund did relative to its competitors, the Massachusetts municipal debt funds average returned 6.42% for the same six-month period, according to Lipper Inc. The fund's new benchmark, the Lehman Brothers Massachusetts 3 Plus Year Enhanced Municipal Bond Index, returned 6.93%. The fund is managed to have similar overall interest-rate risk to this benchmark, which includes Massachusetts investment-grade municipal bonds with maturities of three years or more. The new benchmark was effective on July 27, 2000. It has a slightly longer duration than the previous benchmark and is more representative of the fund's investment universe. For the 12-month period that ended July 31, 2000, the fund had a total return of 4.00%. In comparison, the Massachusetts municipal debt funds average returned 2.15% and the Lehman Brothers Massachusetts 3 Plus Year Enhanced Municipal Bond Index returned 4.20% for the same 12-month period.

Semiannual Report

Spartan Massachusetts Municipal Income Fund

Fund Talk: The Manager's Overview - continued

Q. What were some of the main forces behind the fund's performance during the past six months?

A. A recent municipal bond market rally boosted municipal bond returns into positive territory for the period, despite the fact that short-term interest rates were on the rise. Beginning in the spring of 2000, investors began to anticipate that the Federal Reserve Board's yearlong campaign to stave off inflation by raising interest rates was nearing a close. Whether or not that actually proves to be the case will depend on the direction of the economy. Furthermore, demand for municipals strengthened as bargain-hunting investors sought their attractive prices and relatively high yields. In addition, the supply of municipals diminished. In Massachusetts, the supply of municipals was down 11% between January and July 2000, compared to the same seven-month period a year earlier. As a result of this supply/demand imbalance and the anticipation that rate hikes were behind us, municipal bond prices moved higher. The fund's total return was the result of better municipal bond prices plus the income generated by its holdings.

Q. What factors caused the fund to lag its peers during the six-month period?

A. The fund generally had less interest-rate sensitivity, as measured by its somewhat shorter duration, than many of its peers for the six-month period. I didn't lengthen or shorten duration based on where I thought interest rates would be at some point down the road. Instead, I positioned the fund to emphasize the best value opportunities based on their performance potential under a variety of possible interest-rate scenarios. My approach is to manage the fund's duration to be in line with the Massachusetts municipal market as a whole, an approach that may cause short-term performance comparisons to lag, but which has generated competitive long-term results.

Q. What factors aided performance?

A. The fund's focus on premium coupon bonds, which pay interest rates above face - or par - value, helped. One appealing aspect of premiums was that they were somewhat insulated from unfavorable tax treatment that negatively affected the prices of lower coupon bonds, or "discounts," as rates rose.

Q. In terms of credit quality, what choices did you make?

A. As of July 31, 2000, more than 45% of the fund's investments were in bonds with the highest credit rating of Aaa; roughly one-third of those were insured. The fund's focus on these higher-quality bonds reflected the fact that I generally didn't feel that lower-quality bonds offered enough incentive by way of additional yield for owning them.

Q. What's your outlook for municipal bonds over the next six months or so?

A. The primary factor, as always, will be the direction of interest rates. Supply and demand also will play a role. The supply of municipals has continued to decline in response to rising interest rates. Many issuers now find it too expensive to issue new or refinance old debt. As municipal bond yields rose above 6%, we saw renewed buying from individual investors. In general, municipals were cheap relative to Treasury securities, although they were more or less fairly valued compared to other types of taxable bonds. To the extent that supply remains low and demand stays firm, municipal bonds could benefit.

Semiannual Report

Spartan Massachusetts Municipal Income Fund

Fund Talk: The Manager's Overview - continued

The views expressed in this report reflect those of the portfolio manager only through the end of the period of the report as stated on the cover and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Fund Facts

Goal: to provide high current income exempt from federal income tax and Massachusetts personal income tax

Fund number: 070

Trading symbol: FDMMX

Start date: November 10, 1983

Size: as of July 31, 2000, more than $1.3 billion

Manager: Christine Thompson, since 1998; manager, various Fidelity and Spartan municipal income funds; joined Fidelity in 1985

3Christine Thompson on the strength of Massachusetts' economy:

"The Massachusetts economy was quite strong during the past six months. The unemployment rate remained very low and continued to fall, while employment growth - particularly in high-growth industries such as high tech - was quite good. Massachusetts continued to add more high-paying jobs than many other states. It also benefited from a number of other favorable trends. Personal income growth - fueled mainly by strong job markets and some pockets of labor shortages - was strong, and the commercial and residential real estate markets were tight. Exports with the state's two leading trading partners - Canada and Western Europe - also accelerated.

"One of the developments that may affect the credit quality of the state down the road is the infrastructure enhancements that are underway across the state. Much attention has been paid to the funding of cost overruns associated with the Central Artery Project in Boston, commonly known as the ´Big Dig.' For that project, most of the overruns will be paid for by the state, rather than the federal, government. Other projects, including the expansion of Route 3, are beginning to employ more creative means of financing to contain costs. We'll closely monitor these and other developments to determine their potential effect on the state's credit quality."

Semiannual Report

Spartan Massachusetts Municipal Income Fund

|

Top Five Sectors as of July 31, 2000 |

||

|

|

% of fund's |

% of fund's net assets |

|

General Obligations |

22.0 |

21.7 |

|

Education |

19.7 |

16.4 |

|

Health Care |

17.1 |

18.1 |

|

Transportation |

12.4 |

8.8 |

|

Water & Sewer |

8.6 |

9.7 |

|

Average Years to Maturity as of July 31, 2000 |

||

|

|

|

6 months ago |

|

Years |

16.7 |

13.6 |

|

Average years to maturity is based on the average time remaining until principal payments are expected from each of the fund's bonds, weighted by dollar amount. |

|

Duration as of July 31, 2000 |

||

|

|

|

6 months ago |

|

Years |

6.9 |

6.4 |

|

Duration shows how much a bond fund's price fluctuates with changes in comparable interest rates. |

|

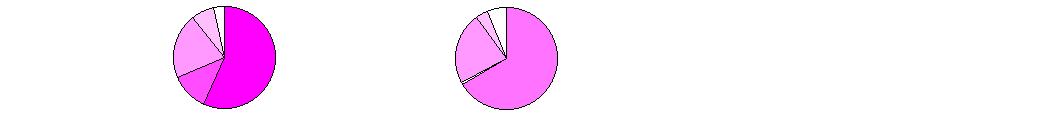

Quality Diversification (Moody's Ratings) |

As of July 31, 2000 As of January 31, 2000

|

Where Moody's ratings are not available, we have used S&P ® ratings. Amounts shown are as a percentage of the fund's investments. |

Semiannual Report

Spartan Massachusetts Municipal Income Fund

(Unaudited)

Showing Percentage of Net Assets

|

Municipal Bonds - 97.4% |

|||||

|

Moody's Ratings |

Principal Amount |

Value |

|||

|

Guam - 0.2% |

|||||

|

Guam Pwr. Auth. Rev. Rfdg. Series A, 4.25% 10/1/00 |

Baa3 |

|

$ 2,950,000 |

$ 2,946,785 |

|

|

Massachusetts - 96.6% |

|||||

|

Barnstable Gen. Oblig. 5% 3/15/14 |

Aa3 |

|

2,370,000 |

2,287,406 |

|

|

Barnstable Ind. Dev. Fing. Auth. Ind. Dev. Rev. (Whitehall Pavilion Proj.) 10.125% 2/15/26 (Fed. Hsg. Administration Insured) |

AA- |

|

2,855,000 |

2,927,917 |

|

|

Boston Economic Dev. & Ind. Corp. |

- |

|

3,660,000 |

3,692,391 |

|

|

Boston Gen. Oblig. Series A: |

|

|

|

|

|

|

5.75% 2/1/14 |

Aa3 |

|

4,190,000 |

4,323,996 |

|

|

5.75% 2/1/15 |

Aa3 |

|

4,190,000 |

4,308,242 |

|

|

5.75% 2/1/17 |

Aa3 |

|

2,460,000 |

2,505,584 |

|

|

Boston Hsg. Dev. Corp. Mtg. Rev. Rfdg. Series A, 5.15% 7/1/08 (MBIA Insured) |

Aaa |

|

2,700,000 |

2,693,115 |

|

|

Boston Wtr. & Swr. Commission Rev.: |

|

|

|

|

|

|

Rfdg. Sr. Series A, 5.75% 11/1/13 |

A1 |

|

1,575,000 |

1,656,617 |

|

|

Sr. Series A, 5.25% 11/1/19 |

A1 |

|

10,100,000 |

9,684,789 |

|

|

Sr. Series C, 5.2% 11/1/21 (FGIC Insured) |

Aaa |

|

4,000,000 |

3,743,040 |

|

|

Sr. Series D, 5% 11/1/28 (FGIC Insured) |

Aaa |

|

9,250,000 |

8,177,463 |

|

|

Brockton Gen. Oblig.: |

|

|

|

|

|

|

5% 4/1/13 (MBIA Insured) |

Aaa |

|

1,165,000 |

1,144,170 |

|

|

5.1% 4/1/12 (MBIA Insured) |

Aaa |

|

1,550,000 |

1,549,132 |

|

|

Brockton Hsg. Dev. Corp. Multi-family Rev. |

AAA |

|

7,895,000 |

8,130,903 |

|

|

Chelsea Gen. Oblig. Rfdg.: |

|

|

|

|

|

|

5% 6/15/13 (AMBAC Insured) |

Aaa |

|

2,390,000 |

2,346,813 |

|

|

5.125% 6/15/16 (AMBAC Insured) |

Aaa |

|

1,750,000 |

1,689,608 |

|

|

Fitchburg Gen. Oblig. 5.125% 2/15/14 |

Aaa |

|

2,355,000 |

2,314,800 |

|

|

Foxborough Stadium Infrastructure Impt.: |

|

|

|

|

|

|

5.75% 6/1/25 |

Aa2 |

|

10,000,000 |

10,042,600 |

|

|

6% 6/1/15 |

Aa2 |

|

2,545,000 |

2,691,261 |

|

|

6% 6/1/16 |

Aa2 |

|

3,015,000 |

3,170,453 |

|

|

6% 6/1/17 |

Aa2 |

|

3,195,000 |

3,349,031 |

|

|

6% 6/1/18 |

Aa2 |

|

3,390,000 |

3,539,262 |

|

|

6% 6/1/19 |

Aa2 |

|

3,590,000 |

3,736,149 |

|

|

6% 6/1/20 |

Aa2 |

|

3,785,000 |

3,923,417 |

|

|

Haverhill Gen. Oblig. Rfdg. Series A: |

|

|

|

|

|

|

6.4% 9/1/03 (AMBAC Insured) |

Aaa |

|

1,600,000 |

1,658,448 |

|

|

6.5% 9/1/04 (AMBAC Insured) |

Aaa |

|

1,595,000 |

1,656,120 |

|

|

Municipal Bonds - continued |

|||||

|

Moody's Ratings |

Principal Amount |

Value |

|||

|

Massachusetts - continued |

|||||

|

Holyoke Gen. Oblig.: |

|

|

|

|

|

|

(Muni. Purp. Ln. Prog.) Series A: |

|

|

|

|

|

|

5.5% 6/15/16 (FSA Insured) |

Aaa |

|

$ 2,100,000 |

$ 2,109,198 |

|

|

6% 6/15/05 (FSA Insured) |

Aaa |

|

1,350,000 |

1,426,181 |

|

|

(School Ln. Act Proj.): |

|

|

|

|

|

|

7.35% 8/1/02 (Pre-Refunded to 8/1/01 |

Baa1 |

|

1,265,000 |

1,312,311 |

|

|

7.65% 8/1/09 (Pre-Refunded to 8/1/01 |

Baa1 |

|

2,205,000 |

2,316,220 |

|

|

Rfdg. Series B, 6% 6/15/06 (FSA Insured) |

Aaa |

|

1,400,000 |

1,490,538 |

|

|

Ipswich Gen. Oblig.: |

|

|

|

|

|

|

5.5% 11/15/18 (FGIC Insured) |

Aaa |

|

2,460,000 |

2,458,745 |

|

|

5.75% 11/15/14 (FGIC Insured) |

Aaa |

|

1,100,000 |

1,149,456 |

|

|

Lowell Gen. Oblig.: |

|

|

|

|

|

|

Rfdg. Series A, 5.5% 1/15/10 (FSA Insured) |

Aaa |

|

2,000,000 |

2,054,240 |

|

|

5.8% 4/1/08 (FSA Insured) |

Aaa |

|

1,195,000 |

1,260,163 |

|

|

8.4% 1/15/09 (Pre-Refunded to 1/15/01 |

Aa3 |

|

1,250,000 |

1,295,213 |

|

|

Lowell Hsg. Dev. Corp. Multi-family Rev. Rfdg. Series A: |

|

|

|

|

|

|

7.875% 11/1/00 |

AAA |

|

130,000 |

130,389 |

|

|

7.875% 11/1/24 |

AAA |

|

5,440,000 |

5,562,998 |

|

|

Massachusetts Bay Trans. Auth.: |

|

|

|

|

|

|

Rfdg.: |

|

|

|

|

|

|

Series A: |

|

|

|

|

|

|

5.5% 3/1/12 |

Aa2 |

|

4,350,000 |

4,491,245 |

|

|

5.75% 3/1/26 (FGIC Insured) |

Aa2 |

|

5,500,000 |

5,501,485 |

|

|

6.25% 3/1/12 |

Aa2 |

|

1,500,000 |

1,650,240 |

|

|

7% 3/1/07 |

Aa2 |

|

5,000,000 |

5,610,700 |

|

|

7% 3/1/08 |

Aa2 |

|

1,000,000 |

1,134,360 |

|

|

Series B, 6.2% 3/1/16 |

Aa2 |

|

27,500,000 |

30,005,250 |

|

|

Series 1997 D, 5% 3/1/27 |

Aa2 |

|

17,135,000 |

15,224,105 |

|

|

Series 1998 B, 5% 3/1/28 |

Aa2 |

|

10,000,000 |

8,846,900 |

|

|

Series A: |

|

|

|

|

|

|

5% 3/1/23 (FGIC Insured) |

Aaa |

|

6,430,000 |

5,854,001 |

|

|

5.375% 3/1/19 |

Aa2 |

|

5,000,000 |

4,887,200 |

|

|

5.7% 3/1/09 |

Aa2 |

|

5,000,000 |

5,288,900 |

|

|

5.8% 3/1/11 |

Aa2 |

|

7,435,000 |

7,903,108 |

|

|

5.8% 3/1/12 |

Aa2 |

|

3,000,000 |

3,178,020 |

|

|

7% 3/1/21 |

Aa2 |

|

1,500,000 |

1,744,740 |

|

|

Municipal Bonds - continued |

|||||

|

Moody's Ratings |

Principal Amount |

Value |

|||

|

Massachusetts - continued |

|||||

|

Massachusetts Bay Trans. Auth.: - continued |

|

|

|

|

|

|

Series B: |

|

|

|

|

|

|

5.375% 3/1/25 (AMBAC Insured) |

Aaa |

|

$ 13,060,000 |

$ 12,452,318 |

|

|

5.5% 3/1/21 |

Aa3 |

|

4,835,000 |

4,752,708 |

|

|

6% 3/1/12 |

Aa3 |

|

7,180,000 |

7,437,475 |

|

|

Series C: |

|

|

|

|

|

|

5% 3/1/24 |

Aa2 |

|

9,900,000 |

8,958,807 |

|

|

5.5% 3/1/08 |

Aa2 |

|

2,000,000 |

2,086,760 |

|

|

5.5% 3/1/13 (FGIC Insured) |

Aaa |

|

3,000,000 |

3,095,250 |

|

|

Series D, 5% 3/1/22 |

Aa2 |

|

5,750,000 |

5,246,415 |

|

|

Massachusetts College Bldg. Auth. Proj. Rev. Rfdg. Series A, 7.5% 5/1/05 |

Aa2 |

|

3,000,000 |

3,353,520 |

|

|

Massachusetts Dev. Fin. Agcy. Rev.: |

|

|

|

|

|

|

(Eastern Nazarene College Proj.): |

|

|

|

|

|

|

5.625% 4/1/19 |

BBB- |

|

1,800,000 |

1,676,124 |

|

|

5.625% 4/1/29 |

BBB- |

|

2,000,000 |

1,802,780 |

|

|

(Higher Ed.-Smith College Issue Proj.) 5.75% 7/1/29 |

Aa1 |

|

7,000,000 |

7,013,370 |

|

|

(Regis College Proj.): |

|

|

|

|

|

|

5.25% 10/1/18 |

BBB- |

|

2,240,000 |

2,006,883 |

|

|

5.5% 10/1/28 |

BBB- |

|

5,660,000 |

5,017,873 |

|

|

Rfdg. (Clark Univ. Issue Proj.) 5% 7/1/28 |

A3 |

|

2,000,000 |

1,701,900 |

|

|

Massachusetts Ed. Ln. Auth. Ed. Ln. Rev. Series B Issue E, 5.75% 7/1/07 (AMBAC Insured) (b) |

Aaa |

|

4,235,000 |

4,340,663 |

|

|

Massachusetts Edl. Fing. Auth. Ed. Ln. Rev.: |

|

|

|

|

|

|

Issue G, 4.4% 12/1/04 (MBIA Insured) (b) |

Aaa |

|

2,950,000 |

2,837,458 |

|

|

Rfdg.: |

|

|

|

|

|

|

Issue E: |

|

|

|

|

|

|

4.85% 7/1/02 (AMBAC Insured) (b) |

Aaa |

|

925,000 |

925,296 |

|

|

5.25% 7/1/06 (AMBAC Insured) (b) |

Aaa |

|

1,815,000 |

1,813,112 |

|

|

Series A Issue E: |

|

|

|

|

|

|

4.3% 7/1/06 (AMBAC Insured) (b) |

AAA |

|

4,000,000 |

3,752,880 |

|

|

4.4% 7/1/07 (AMBAC Insured) (b) |

AAA |

|

6,275,000 |

5,869,447 |

|

|

4.55% 7/1/09 (AMBAC Insured) (b) |

AAA |

|

2,000,000 |

1,858,140 |

|

|

4.65% 7/1/10 (AMBAC Insured) (b) |

AAA |

|

4,745,000 |

4,411,332 |

|

|

4.75% 7/1/11 (AMBAC Insured) (b) |

AAA |

|

4,000,000 |

3,705,200 |

|

|

4.8% 7/1/12 (AMBAC Insured) (b) |

AAA |

|

2,110,000 |

1,947,636 |

|

|

4.95% 7/1/14 (AMBAC Insured) (b) |

AAA |

|

4,000,000 |

3,676,000 |

|

|

5% 7/1/15 (AMBAC Insured) (b) |

AAA |

|

1,880,000 |

1,723,434 |

|

|

Series A Issue G, 5.45% 12/1/06 |

AAA |

|

6,945,000 |

7,001,046 |

|

|

Municipal Bonds - continued |

|||||

|

Moody's Ratings |

Principal Amount |

Value |

|||

|

Massachusetts - continued |

|||||

|

Massachusetts Edl. Fing. Auth. Ed. Ln. Rev.: - continued |

|

|

|

|

|

|

Series A Issue G, 5% 12/1/11 |

Aaa |

|

$ 3,815,000 |

$ 3,629,820 |

|

|

Series C Issue G, 4.9% 12/1/11 |

AAA |

|

4,815,000 |

4,529,856 |

|

|

Massachusetts Gen. Oblig.: |

|

|

|

|

|

|

(Cap. Appreciation) (Consolidated Ln. Prog.) Series B: |

|

|

|

|

|

|

0% 6/1/02 (FGIC Insured) |

Aaa |

|

1,105,000 |

1,014,865 |

|

|

0% 7/1/02 |

Aa2 |

|

12,250,000 |

11,207,158 |

|

|

(Consolidated Ln. Prog.): |

|

|

|

|

|

|

Series A, 7.5% 6/1/04 |

Aa2 |

|

4,830,000 |

5,204,180 |

|

|

Series B: |

|

|

|

|

|

|

5.75% 6/1/20 |

Aa2 |

|

10,045,000 |

10,151,778 |

|

|

6% 6/1/14 |

Aa2 |

|

5,000,000 |

5,286,250 |

|

|

6% 6/1/15 |

Aa2 |

|

7,500,000 |

7,882,275 |

|

|

Series D: |

|

|

|

|

|

|

5% 11/1/14 |

Aa2 |

|

3,000,000 |

2,906,790 |

|

|

5.25% 11/1/12 |

Aa2 |

|

4,500,000 |

4,529,925 |

|

|

Series A: |

|

|

|

|

|

|

5.25% 6/15/09 |

Aa3 |

|

3,190,000 |

3,274,567 |

|

|

5.25% 6/15/12 |

Aa3 |

|

5,000,000 |

5,057,250 |

|

|

5.5% 6/15/14 |

Aa3 |

|

3,000,000 |

3,048,210 |

|

|

Series B: |

|

|

|

|

|

|

5.125% 12/15/11 |

Aa3 |

|

10,030,000 |

10,102,216 |

|

|

5.125% 12/15/12 |

Aa3 |

|

5,480,000 |

5,486,960 |

|

|

Massachusetts Health & Edl. Facilities Auth. Rev.: |

|

|

|

|

|

|

(1st Mtg. Fairview Extended Care Proj.) |

Aaa |

|

5,355,000 |

5,595,225 |

|

|

(Anna Jaques Hosp. Proj.) Series B: |

|

|

|

|

|

|

6% 10/1/00 |

Baa1 |

|

985,000 |

986,576 |

|

|

6.875% 10/1/12 |

Baa1 |

|

3,250,000 |

3,294,753 |

|

|

(Baystate Med. Ctr. Proj.): |

|

|

|

|

|

|

Series D, 5.5% 7/1/16 (FGIC Insured) |

Aaa |

|

6,400,000 |

6,384,896 |

|

|

Series E: |

|

|

|

|

|

|

6% 7/1/04 (FSA Insured) |

Aaa |

|

1,290,000 |

1,347,818 |

|

|

6% 7/1/05 (FSA Insured) |

Aaa |

|

1,385,000 |

1,458,239 |

|

|

6% 7/1/06 (FSA Insured) |

Aaa |

|

1,425,000 |

1,510,244 |

|

|

(Blood Research Institute Proj.) Series A, 6.5% 2/1/22 |

- |

|

14,475,000 |

14,715,575 |

|

|

Municipal Bonds - continued |

|||||

|

Moody's Ratings |

Principal Amount |

Value |

|||

|

Massachusetts - continued |

|||||

|

Massachusetts Health & Edl. Facilities Auth. Rev.: - continued |

|

|

|

|

|

|

(Brandeis Univ. Proj.) Series I: |

|

|

|

|

|

|

5.25% 10/1/14 (MBIA Insured) |

Aaa |

|

$ 2,780,000 |

$ 2,765,322 |

|

|

5.25% 10/1/16 (MBIA Insured) |

Aaa |

|

1,000,000 |

981,580 |

|

|

(Cape Cod Health Sys. Proj.) Series A, 5.25% 11/15/13 (AMBAC Insured) |

AAA |

|

3,500,000 |

3,455,795 |

|

|

(Caritas Christi Oblig. Group Proj.) Series A: |

|

|

|

|

|

|

5.25% 7/1/01 |

Baa2 |

|

2,000,000 |

1,997,020 |

|

|

5.25% 7/1/02 |

Baa2 |

|

2,000,000 |

1,970,400 |

|

|

5.25% 7/1/03 |

Baa2 |

|

2,000,000 |

1,951,220 |

|

|

(Dana Farber Cancer Proj.) Series G1: |

|

|

|

|

|

|

5.5% 12/1/27 |

A1 |

|

18,600,000 |

16,601,244 |

|

|

6.25% 12/1/14 |

A1 |

|

3,000,000 |

3,061,080 |

|

|

(Falmouth Hosp. Proj.) Series C, 5.5% 7/1/08 (MBIA Insured) |

Aaa |

|

1,000,000 |

1,024,170 |

|

|

(Faulkner Hosp. Proj.) Series C: |

|

|

|

|

|

|

6% 7/1/13 (Pre-Refunded to 7/1/03 @ 102) (c) |

Baa1 |

|

9,745,000 |

10,291,207 |

|

|

6% 7/1/23 (Pre-Refunded to 7/1/03 @ 102) (c) |

Baa1 |

|

6,010,000 |

6,346,861 |

|

|

(Harvard Univ. Issue Proj.) Series W, 6% 7/1/35 |

Aaa |

|

11,825,000 |

12,359,017 |

|

|

(Lahey Clinic Med. Ctr. Proj.) Series B, 5.25% 7/1/10 (MBIA Insured) |

Aaa |

|

14,120,000 |

14,217,004 |

|

|

(Lowell Gen. Hosp. Proj.) Series A, 8.4% 6/1/11 (Pre-Refunded to 6/1/01 @ 102) (c) |

A3 |

|

2,565,000 |

2,696,738 |

|

|

(Med. Academic & Scientific Proj.) Series A: |

|

|

|

|

|

|

6.25% 1/1/05 |

BBB- |

|

1,160,000 |

1,180,787 |

|

|

6.625% 1/1/15 |

BBB- |

|

5,150,000 |

5,249,344 |

|

|

(MIT Proj.) Series I1, 5.2% 1/1/28 |

Aaa |

|

7,000,000 |

6,591,550 |

|

|

(Mount Auburn Hosp. Proj.) Series B1: |

|

|

|

|

|

|

6.25% 8/15/14 (MBIA Insured) |

Aaa |

|

1,250,000 |

1,307,075 |

|

|

6.3% 8/15/24 (MBIA Insured) |

Aaa |

|

5,000,000 |

5,155,250 |

|

|

(New England Med. Ctr. Hosp. Proj.): |

|

|

|

|

|

|

Series F, 6.625% 7/1/25 (FGIC Insured) |

Aaa |

|

4,850,000 |

5,022,127 |

|

|

Series G, 5.375% 7/1/24 (MBIA Insured) |

Aaa |

|

1,000,000 |

936,730 |

|

|

(Notre Dame Health Care Ctr. Proj.) Series A: |

|

|

|

|

|

|

7.25% 10/1/01 |

- |

|

260,000 |

262,925 |

|

|

7.875% 10/1/22 |

- |

|

5,000,000 |

5,171,250 |

|

|

Municipal Bonds - continued |

|||||

|

Moody's Ratings |

Principal Amount |

Value |

|||

|

Massachusetts - continued |

|||||

|

Massachusetts Health & Edl. Facilities Auth. Rev.: - continued |

|

|

|

|

|

|

(Partners Health Care Sys. Proj.) Series A: |

|

|

|

|

|

|

5.25% 7/1/04 (FSA Insured) |

Aaa |

|

$ 2,000,000 |

$ 2,033,080 |

|

|

5.375% 7/1/24 (MBIA Insured) |

Aaa |

|

7,600,000 |

7,212,780 |

|

|

5.5% 7/1/05 (FSA Insured) |

Aaa |

|

2,000,000 |

2,058,020 |

|

|

(Simmons College Proj.) Series C, 5% 10/1/19 (MBIA Insured) |

Aaa |

|

4,190,000 |

3,882,035 |

|

|

(South Shore Hosp. Proj.): |

|

|

|

|

|

|

Series 1999 F, 5.5% 7/1/12 |

A2 |

|

2,165,000 |

2,065,843 |

|

|

Series F: |

|

|

|

|

|

|

4.75% 7/1/05 |

A2 |

|

1,275,000 |

1,214,718 |

|

|

5.125% 7/1/08 |

A2 |

|

2,000,000 |

1,898,380 |

|

|

5.25% 7/1/09 |

A2 |

|

2,120,000 |

2,017,604 |

|

|

5.625% 7/1/19 |

A2 |

|

1,000,000 |

926,890 |

|

|

5.75% 7/1/29 |

A2 |

|

3,600,000 |

3,261,060 |

|

|

(UMass Memorial Issue Proj.) Series A: |

|

|

|

|

|

|

5% 7/1/18 (AMBAC Insured) |

Aaa |

|

3,000,000 |

2,752,050 |

|

|

5.25% 7/1/14 (AMBAC Insured) |

Aaa |

|

1,000,000 |

984,160 |

|

|

(Univ. of Massachusetts Proj.) Series A, 5.875% 10/1/29 (FGIC Insured) |

Aaa |

|

5,000,000 |

5,060,700 |

|

|

(Wellesley College Proj.) Series F, 5.125% 7/1/39 |

Aa1 |

|

16,550,000 |

14,880,602 |

|

|

(Williams College Issue Proj.): |

|

|

|

|

|

|

Series F, 5.75% 7/1/19 |

Aaa |

|

3,000,000 |

3,032,160 |

|

|

Series G, 5.5% 7/1/14 |

Aaa |

|

3,665,000 |

3,726,462 |

|

|

Rfdg.: |

|

|

|

|

|

|

(Amherst College Proj.) Series G: |

|

|

|

|

|

|

5% 11/1/23 |

Aa1 |

|

5,720,000 |

5,206,973 |

|

|

5% 11/1/28 |

Aa1 |

|

8,960,000 |

7,969,293 |

|

|

5.25% 11/1/17 |

Aa1 |

|

4,670,000 |

4,549,981 |

|

|

(Boston College Issue Proj.) Series L: |

|

|

|

|

|

|

4.75% 6/1/31 |

Aa3 |

|

16,300,000 |

13,763,557 |

|

|

5% 6/1/26 |

Aa3 |

|

6,250,000 |

5,578,438 |

|

|

(Boston College Proj.) Series K, 5.375% 6/1/14 |

Aa3 |

|

8,945,000 |

9,068,441 |

|

|

(Emerson Hosp. Proj.) Series D, 5.7% 8/15/12 (FSA Insured) |

Aaa |

|

9,475,000 |

9,705,148 |

|

|

(Eye & Ear Infirmary Proj.) Series B: |

|

|

|

|

|

|

5.25% 7/1/08 (American Cap. Access Corp. Insured) |

A |

|

2,000,000 |

1,996,120 |

|

|

5.25% 7/1/09 (American Cap. Access Corp. Insured) |

A |

|

2,540,000 |

2,534,920 |

|

|

Municipal Bonds - continued |

|||||

|

Moody's Ratings |

Principal Amount |

Value |

|||

|

Massachusetts - continued |

|||||

|

Massachusetts Health & Edl. Facilities Auth. Rev.: - continued |

|

|

|

|

|

|

Rfdg.: - continued |

|

|

|

|

|

|

(Eye & Ear Infirmary Proj.) Series B: - continued |

|

|

|

|

|

|

5.25% 7/1/10 (American Cap. Access Corp. Insured) |

A |

|

$ 2,000,000 |

$ 1,988,240 |

|

|

5.25% 7/1/11 (American Cap. Access Corp. Insured) |

A |

|

3,025,000 |

2,993,843 |

|

|

(Fairview Extended Care Proj.) Series B, 4.55% 1/1/21 (MBIA Insured) |

Aaa |

|

6,400,000 |

6,346,112 |

|

|

(Harvard Univ. Proj.) Series P: |

|

|

|

|

|

|

5.6% 11/1/14 |

Aaa |

|

1,000,000 |

1,017,720 |

|

|

5.625% 11/1/28 |

Aaa |

|

1,500,000 |

1,499,310 |

|

|

(Massachusetts Gen. Hosp. Proj.) Series F, 6.25% 7/1/12 (AMBAC Insured) |

Aaa |

|

4,750,000 |

5,244,855 |

|

|

(Morton Hosp. & Med. Ctr. Proj.) Series B, 5.25% 7/1/08 (AMBAC Insured) |

AAA |

|

2,800,000 |

2,837,464 |

|

|

(Newton-Wellesley Hosp. Proj.) Series G: |

|

|

|

|

|

|

6% 7/1/12 (MBIA Insured) |

Aaa |

|

4,070,000 |

4,312,409 |

|

|

6.125% 7/1/15 (MBIA Insured) |

Aaa |

|

4,500,000 |

4,709,520 |

|

|

(Partners Health Care Sys. Proj.) Series B: |

|

|

|

|

|

|

3.85% 7/1/02 |

A1 |

|

1,000,000 |

972,260 |

|

|

3.95% 7/1/03 |

A1 |

|

1,000,000 |

957,110 |

|

|

(Wheaton College Proj.) Series C: |

|

|

|

|

|

|

5.125% 7/1/09 |

A2 |

|

1,130,000 |

1,125,740 |

|

|

5.25% 7/1/14 |

A2 |

|

2,655,000 |

2,605,298 |

|

|

5.25% 7/1/19 |

A2 |

|

2,000,000 |

1,891,840 |

|

|

5.95% 8/15/18 (FGIC Insured) |

Aaa |

|

7,900,000 |

7,997,012 |

|

|

6.55% 6/23/22 (AMBAC Insured) |

Aaa |

|

20,000,000 |

21,127,400 |

|

|

Massachusetts Hsg. Fin. Agcy. Hsg. Rev.: |

|

|

|

|

|

|

Rfdg.: |

|

|

|

|

|

|

Series 53, 5.2% 12/1/21 (MBIA Insured) (b) |

Aaa |

|

1,135,000 |

1,137,486 |

|

|

Series A, 6% 12/1/13 (MBIA Insured) |

Aaa |

|

5,525,000 |

5,659,865 |

|

|

Series 29, 6.75% 6/1/26 (b) |

Aa |

|

2,465,000 |

2,547,134 |

|

|

Series 40: |

|

|

|

|

|

|

6.6% 12/1/24 (b) |

Aa |

|

19,375,000 |

19,967,875 |

|

|

6.65% 12/1/27 (b) |

Aa |

|

6,930,000 |

7,157,304 |

|

|

Massachusetts Ind. Fin. Agcy. Poll. Cont. Rev. Rfdg. (Boston Edison Co. Proj.) Series A, 5.75% 2/1/14 |

A1 |

|

9,900,000 |

9,702,297 |

|

|

Municipal Bonds - continued |

|||||

|

Moody's Ratings |

Principal Amount |

Value |

|||

|

Massachusetts - continued |

|||||

|

Massachusetts Ind. Fin. Agcy. Resource Recovery Rev. Rfdg. (Ogden Haverhill Proj.) Series 1992 A: |

|

|

|

|

|

|

4.7% 12/1/03 |

BBB |

|

$ 3,000,000 |

$ 2,913,450 |

|

|

4.8% 12/1/04 |

BBB |

|

3,570,000 |

3,437,624 |

|

|

Massachusetts Ind. Fin. Agcy. Rev.: |

|

|

|

|

|

|

(Babson College Proj.) Series A, 5.6% 10/1/06 (MBIA Insured) |

Aaa |

|

515,000 |

538,865 |

|

|

(Cap. Appreciation) (Massachusetts Biomedical Research Corp. Proj.): |

|

|

|

|

|

|

Series A1, 0% 8/1/02 |

A1 |

|

3,650,000 |

3,319,894 |

|

|

Series A2: |

|

|

|

|

|

|

0% 8/1/03 |

A1 |

|

1,000,000 |

864,800 |

|

|

0% 8/1/05 |

A1 |

|

24,600,000 |

19,182,586 |

|

|

0% 8/1/07 |

A+ |

|

25,000,000 |

17,522,500 |

|

|

0% 8/1/08 |

A+ |

|

15,000,000 |

9,963,150 |

|

|

(Concord Academy Proj.) 6.9% 9/1/21 |

Aaa |

|

1,370,000 |

1,433,226 |

|

|

(Groton School Proj.) Series A, 5% 3/1/28 |

Aa2 |

|

5,000,000 |

4,452,650 |

|

|

(Tufts Univ. Proj.) Series H, 4.75% 2/15/28 (MBIA Insured) |

Aaa |

|

10,000,000 |

8,552,000 |

|

|

(Whitehead Institute Biomedical Research Proj.) 5.125% 7/1/26 |

Aa1 |

|

14,600,000 |

13,284,102 |

|

|

Rfdg.: |

|

|

|

|

|

|

(Lesley College Proj.) Series A, 6.3% 7/1/15 (AMBAC Insured) |

AAA |

|

2,525,000 |

2,660,264 |

|

|

(Milton Academy Proj.) Series B, 5.25% 9/1/19 (MBIA Insured) |

Aaa |

|

2,500,000 |

2,406,325 |

|

|

(Worcester Polytechnic Institute Proj.): |

|

|

|

|

|

|

5.75% 9/1/05 (MBIA Insured) |

Aaa |

|

1,340,000 |

1,404,253 |

|

|

5.75% 9/1/06 (MBIA Insured) |

Aaa |

|

1,115,000 |

1,174,831 |

|

|

5.75% 9/1/07 (MBIA Insured) |

Aaa |

|

1,000,000 |

1,057,610 |

|

|

Massachusetts Muni. Wholesale Elec. Co. Pwr. Supply Sys. Rev.: |

|

|

|

|

|

|

Rfdg.: |

|

|

|

|

|

|

Series A: |

|

|

|

|

|

|

5.1% 7/1/08 (AMBAC Insured) |

Aaa |

|

1,000,000 |

1,017,600 |

|

|

6% 7/1/18 (MBIA Insured) |

Aaa |

|

10,000,000 |

10,079,900 |

|

|

6.75% 7/1/08 |

Baa2 |

|

3,000,000 |

3,143,370 |

|

|

Series B: |

|

|

|

|

|

|

4.75% 7/1/11 (MBIA Insured) |

Aaa |

|

2,000,000 |

1,884,960 |

|

|

6.5% 7/1/02 (MBIA Insured) |

Aaa |

|

2,000,000 |

2,073,100 |

|

|

6.625% 7/1/04 |

Baa2 |

|

7,925,000 |

8,321,488 |

|

|

Municipal Bonds - continued |

|||||

|

Moody's Ratings |

Principal Amount |

Value |

|||

|

Massachusetts - continued |

|||||

|

Massachusetts Muni. Wholesale Elec. Co. Pwr. Supply Sys. Rev.: - continued |

|

|

|

|

|

|

Series B: - continued |

|

|

|

|

|

|

6.75% 7/1/08 |

Baa2 |

|

$ 6,000,000 |

$ 6,286,740 |

|

|

Series C, 6.6% 7/1/05 |

Baa2 |

|

2,075,000 |

2,175,160 |

|

|

Series B, 6.75% 7/1/17 |

Baa2 |

|

9,050,000 |

9,320,957 |

|

|

Series C, 6.625% 7/1/18 (MBIA Insured) |

Aaa |

|

10,000,000 |

10,399,600 |

|

|

Series D: |

|

|

|

|

|

|

6% 7/1/06 |

Baa2 |

|

1,000,000 |

1,036,150 |

|

|

6% 7/1/11 (MBIA Insured) |

Aaa |

|

2,000,000 |

2,067,280 |

|

|

Series E: |

|

|

|

|

|

|

6% 7/1/06 |

Baa2 |

|

1,640,000 |

1,699,286 |

|

|

6% 7/1/11 (MBIA Insured) |

Aaa |

|

3,000,000 |

3,100,920 |

|

|

Massachusetts Port Auth. Rev.: |

|

|

|

|

|

|

(Spl. Facilities-US Air Proj.) Series A, 5.5% 9/1/10 (MBIA Insured) (b) |

Aaa |

|

2,030,000 |

2,085,987 |

|

|

Rfdg. Series A: |

|

|

|

|

|

|

5% 7/1/13 |

Aa3 |

|

5,000,000 |

4,891,150 |

|

|

5% 7/1/23 |

Aa3 |

|

8,750,000 |

7,854,613 |

|

|

5.5% 7/1/09 |

Aa3 |

|

3,160,000 |

3,240,548 |

|

|

5.5% 7/1/17 |

Aa3 |

|

2,105,000 |

2,103,842 |

|

|

Series B: |

|

|

|

|

|

|

5.5% 7/1/10 (FSA Insured) (b) |

Aaa |

|

11,470,000 |

11,844,610 |

|

|

5.5% 7/1/11 (FSA Insured) (b) |

Aaa |

|

5,500,000 |

5,647,400 |

|

|

5.5% 7/1/12 (FSA Insured) (b) |

Aaa |

|

4,000,000 |

4,080,400 |

|

|

5.5% 7/1/14 (FSA Insured) (b) |

Aaa |

|

5,335,000 |

5,358,474 |

|

|

Series C, 5.75% 7/1/29 |

Aa3 |

|

5,000,000 |

4,997,350 |

|

|

5.625% 7/1/12 (Escrowed to Maturity) (c) |

Aaa |

|

1,755,000 |

1,818,320 |

|

|

Massachusetts Tpk. Auth. Metro. Hwy. Sys. Rev. Series A: |

|

|

|

|

|

|

5% 1/1/37 (MBIA Insured) |

Aaa |

|

60,750,000 |

53,419,288 |

|

|

5.125% 1/1/23 (MBIA Insured) |

Aaa |

|

10,000,000 |

9,240,700 |

|

|

Massachusetts Tpk. Auth. Western Tpk. |

Aaa |

|

52,360,000 |

52,256,327 |

|

|

Massachusetts Wtr. Poll. Abatement Trust Rev. |

|

|

|

|

|

|

Series 3: |

|

|

|

|

|

|

5.4% 2/1/10 |

Aaa |

|

1,700,000 |

1,755,165 |

|

|

5.5% 2/1/13 |

Aaa |

|

6,715,000 |

6,848,091 |

|

|

Series 4: |

|

|

|

|

|

|

5.125% 8/1/11 |

Aaa |

|

3,245,000 |

3,267,683 |

|

|

5.125% 8/1/14 |

Aaa |

|

2,205,000 |

2,166,589 |

|

|

Municipal Bonds - continued |

|||||

|

Moody's Ratings |

Principal Amount |

Value |

|||

|

Massachusetts - continued |

|||||

|

Massachusetts Wtr. Poll. Abatement Trust Wtr. Poll. Abatement Rev. (MWRA Ln. Prog.) Series A: |

|

|

|

|

|

|

5% 8/1/15 |

Aa1 |

|

$ 50,000 |

$ 47,949 |

|

|

5% 8/1/15 (Escrowed to Maturity) (c) |

Aa1 |

|

950,000 |

919,809 |

|

|

5.25% 8/1/12 |

Aa1 |

|

565,000 |

571,305 |

|

|

5.25% 8/1/13 |

Aa1 |

|

330,000 |

330,350 |

|

|

5.375% 8/1/16 |

Aa1 |

|

125,000 |

123,720 |

|

|

5.45% 2/1/13 |

Aa1 |

|

140,000 |

141,267 |

|

|

5.45% 2/1/13 (Escrowed to Maturity) (c) |

Aa1 |

|

1,960,000 |

2,013,684 |

|

|

Massachusetts Wtr. Resources Auth. Rev.: |

|

|

|

|

|

|

Rfdg.: |

|

|

|

|

|

|

Series A, 5.75% 8/1/39 (FGIC Insured) |

Aaa |

|

15,250,000 |

15,243,900 |

|

|

Series B: |

|

|

|

|

|

|

5% 3/1/22 |

A1 |

|

13,000,000 |

11,727,040 |

|

|

5.5% 8/1/15 (FSA Insured) |

Aaa |

|

1,500,000 |

1,539,855 |

|

|

5.5% 8/1/16 (FSA Insured) |

Aaa |

|

1,425,000 |

1,452,146 |

|

|

5.875% 11/1/04 |

A1 |

|

1,975,000 |

2,059,313 |

|

|

6% 11/1/08 |

A1 |

|

4,500,000 |

4,688,235 |

|

|

6.25% 11/1/10 |

A1 |

|

4,930,000 |

5,156,731 |

|

|

Series C, 4.75% 12/1/23 |

A1 |

|

13,000,000 |

11,234,470 |

|

|

Series A, 6.5% 7/15/19 |

A1 |

|

16,960,000 |

18,897,510 |

|

|

Mendon Upton Reg'l. School District 5.25% 6/1/11 (FGIC Insured) |

Aaa |

|

1,435,000 |

1,457,429 |

|

|

Methuen Gen. Oblig. 5% 11/1/16 |

Aaa |

|

1,500,000 |

1,427,415 |

|

|

Nantucket Gen. Oblig. Rfdg. 5% 7/15/17 (MBIA Insured) |

Aaa |

|

5,000,000 |

4,725,550 |

|

|

New England Ed. Ln. Marketing Corp.

Massachusetts Rfdg. (Student Ln. Prog.) |

Aa2 |

|

15,555,000 |

15,950,253 |

|

|

New England Ed. Ln. Marketing Corp. Massachusetts Student Ln. Rev.: |

|

|

|

|

|

|

Issue A, 5.8% 3/1/02 |

Aaa |

|

37,155,000 |

37,722,728 |

|

|

Sub Issue C, 6.75% 9/1/02 (b) |

A |

|

1,250,000 |

1,282,188 |

|

|

North Attleborough Gen. Oblig. Rfdg. 5.25% 11/1/13 (AMBAC Insured) |

Aaa |

|

1,000,000 |

1,001,850 |

|

|

Pentucket Reg'l. School District: |

|

|

|

|

|

|

5.1% 2/15/13 (MBIA Insured) |

Aaa |

|

575,000 |

570,067 |

|

|

5.1% 2/15/14 (MBIA Insured) |

Aaa |

|

525,000 |

516,773 |

|

|

Randolph Gen. Oblig. 5.5% 4/1/20 |

Aaa |

|

1,600,000 |

1,590,256 |

|

|

Municipal Bonds - continued |

|||||

|

Moody's Ratings |

Principal Amount |

Value |

|||

|

Massachusetts - continued |

|||||

|

South Essex Swr. District Rfdg. Series A: |

|

|

|

|

|

|

5.25% 6/15/24 (MBIA Insured) |

Aaa |

|

$ 2,810,000 |

$ 2,649,437 |

|

|

6% 6/15/05 (MBIA Insured) |

Aaa |

|

1,175,000 |

1,241,305 |

|

|

6% 6/15/06 (MBIA Insured) |

Aaa |

|

2,305,000 |

2,454,064 |

|

|

Southern Berkshire Reg'l. School District 7% 4/15/11 (MBIA Insured) |

Aaa |

|

4,000,000 |

4,241,160 |

|

|

Taunton Ind. Dev. Fin. Auth. Ind. Dev. Rev. |

A1 |

|

2,400,000 |

2,464,176 |

|

|

Westfield Gen. Oblig. (Muni. Purp. Ln. Prog.) 5% 9/1/13 (FSA Insured) |

Aaa |

|

750,000 |

736,320 |

|

|

Winchendon School Proj. Ln. 6.05% 3/15/12 (AMBAC Insured) |

Aaa |

|

1,275,000 |

1,325,771 |

|

|

Woods Hole Martha's Vineyard & Nantucket Steamship Rfdg. Series A, 5.125% 3/1/11 |

Aa2 |

|

1,100,000 |

1,099,901 |

|

|

Worcester Gen. Oblig. (Muni. Purp. Ln. Prog.) Series A: |

|

|

|

|

|

|

5.5% 4/1/11 (FSA Insured) |

Aaa |

|

1,350,000 |

1,408,010 |

|

|

5.75% 4/1/12 (FSA Insured) |

Aaa |

|

2,935,000 |

3,107,079 |

|

|

|

1,294,441,285 |

||||

|

Puerto Rico - 0.6% |

|||||

|

Puerto Rico Commonwealth Gen. Oblig. |

Aaa |

|

5,500,000 |

5,079,745 |

|

|

Puerto Rico Commonwealth Hwy. & Trans. Auth. Trans. Rev. Series B, 6% 7/1/39 |

Baa1 |

|

3,000,000 |

3,088,110 |

|

|

|

8,167,855 |

||||

|

TOTAL INVESTMENT PORTFOLIO - 97.4% (Cost $1,289,602,081) |

1,305,555,925 |

|

|

NET OTHER ASSETS - 2.6% |

34,689,055 |

|

|

NET ASSETS - 100% |

$ 1,340,244,980 |

|

|

Legend |

|

(a) S&P credit ratings are used in the absence of a rating by Moody's Investors Service, Inc. |

|

(b) Private activity obligations whose interest is subject to the federal alternative minimum tax for individuals. |

|

(c) Security collateralized by an amount sufficient to pay interest and principal. |

|

Other Information |

|

The composition of long-term debt holdings as a percentage of total value of investments in securities, is as follows (ratings are unaudited): |

|

Moody's Ratings |

S&P Ratings |

|||

|

Aaa, Aa, A |

83.4% |

|

AAA, AA, A |

82.7% |

|

Baa |

5.2% |

|

BBB |

4.9% |

|

Ba |

0.0% |

|

BB |

0.0% |

|

B |

0.0% |

|

B |

0.0% |

|

Caa |

0.0% |

|

CCC |

0.0% |

|

Ca, C |

0.0% |

|

CC, C |

0.0% |

|

|

|

|

D |

0.0% |

|

The percentage not rated by Moody's or S&P amounted to 1.8%. |

|

The distribution of municipal securities by revenue source, as a percentage of total net assets, is as follows: |

|

General Obligations |

22.0% |

|

Education |

19.7 |

|

Health Care |

17.1 |

|

Transportation |

12.4 |

|

Water & Sewer |

8.6 |

|

Electric Utilities |

5.7 |

|

Others* (individually less than 5%) |

14.5 |

|

|

100.0% |

|

* Includes short-term investments |

|

Income Tax Information |

|

At July 31, 2000, the aggregate cost |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Spartan Massachusetts Municipal Income Fund

Statement of Assets and Liabilities

|

|

July 31, 2000 (Unaudited) |

|

|

Assets |

|

|

|

Investment in securities, at value (cost $1,289,602,081) - See accompanying schedule |

|

$ 1,305,555,925 |

|

Cash |

|

33,196,092 |

|

Receivable for investments sold |

|

9,627,929 |

|

Receivable for fund shares sold |

|

1,054,119 |

|

Interest receivable |

|

15,666,697 |

|

Other receivables |

|

49,335 |

|

Total assets |

|

1,365,150,097 |

|

Liabilities |

|

|

|

Payable for investments purchased |

$ 22,010,694 |

|

|

Payable for fund shares redeemed |

932,580 |

|

|

Distributions payable |

1,554,080 |

|

|

Accrued management fee |

407,763 |

|

|

Total liabilities |

|

24,905,117 |

|

Net Assets |

|

$ 1,340,244,980 |

|

Net Assets consist of: |

|

|

|

Paid in capital |

|

$ 1,331,798,577 |

|

Distributions in excess of net interest income |

|

(385,046) |

|

Accumulated undistributed net realized gain (loss) |

|

(7,122,395) |

|

Net unrealized appreciation (depreciation) on investments |

|

15,953,844 |

|

Net Assets, for 117,570,865 shares outstanding |

|

$ 1,340,244,980 |

|

Net Asset Value, offering price and redemption price per share ($1,340,244,980 ÷ 117,570,865 shares) |

|

$11.40 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Spartan Massachusetts Municipal Income Fund

Financial Statements - continued

Statement of Operations

|

|

Six months ended July 31, 2000 (Unaudited) |

|

|

Interest Income |

|

$ 35,351,580 |

|

Expenses |

|

|

|

Management fee |

$ 2,391,493 |

|

|

Transfer agent fees |

474,883 |

|

|

Accounting fees and expenses |

155,012 |

|

|

Non-interested trustees' compensation |

2,207 |

|

|

Custodian fees and expenses |

13,316 |

|

|

Registration fees |

23,067 |

|

|

Audit |

17,753 |

|

|

Legal |

16,052 |

|

|

Miscellaneous |

11,305 |

|

|

Total expenses before reductions |

3,105,088 |

|

|

Expense reductions |

(259,773) |

2,845,315 |

|

Net interest income |

|

32,506,265 |

|

Realized and Unrealized Gain (Loss) Net realized gain (loss) on investment securities |

|

(585,654) |

|

Change in net unrealized appreciation (depreciation) |

|

44,217,533 |

|

Net gain (loss) |

|

43,631,879 |

|

Net increase (decrease) in net assets resulting |

|

$ 76,138,144 |

|

Other information |

|

|

|

Expense reductions: |

|

$ 12,185 |

|

Transfer agent credits |

|

226,639 |

|

Accounting credits |

|

20,949 |

|

|

|

$ 259,773 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Spartan Massachusetts Municipal Income Fund

Financial Statements - continued

Statement of Changes in Net Assets

|

|

Six months ended

July 31, 2000 |

Year ended

January 31, |

|

Increase (Decrease) in Net Assets |

|

|

|

Operations |

$ 32,506,265 |

$ 66,743,817 |

|

Net realized gain (loss) |

(585,654) |

2,731,736 |

|

Change in net unrealized appreciation (depreciation) |

44,217,533 |

(121,641,113) |

|

Net increase (decrease) in net assets resulting |

76,138,144 |

(52,165,560) |

|

Distributions to shareholders |

(32,223,647) |

(65,874,659) |

|

From net realized gain |

- |

(2,917,419) |

|

Total distributions |

(32,223,647) |

(68,792,078) |

|

Share transactions |

240,038,235 |

428,856,656 |

|

Reinvestment of distributions |

23,037,351 |

50,405,206 |

|

Cost of shares redeemed |

(217,194,460) |

(502,589,047) |

|

Net increase (decrease) in net assets resulting |

45,881,126 |

(23,327,185) |

|

Total increase (decrease) in net assets |

89,795,623 |

(144,284,823) |

|

Net Assets |

|

|

|

Beginning of period |

1,250,449,357 |

1,394,734,180 |

|

End of period (including distributions in excess |

$ 1,340,244,980 |

$ 1,250,449,357 |

|

Other Information Shares |

|

|

|

Sold |

21,465,203 |

37,090,556 |

|

Issued in reinvestment of distributions |

2,055,530 |

4,390,234 |

|

Redeemed |

(19,469,595) |

(43,811,523) |

|

Net increase (decrease) |

4,051,138 |

(2,330,733) |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

|

Financial Highlights |

Six months ended July 31, 2000 |

Years ended January 31, |

||||

|

|

(Unaudited) |

2000 |

1999 |

1998 |

1997 |

1996 |

|

Selected Per-Share Data |

|

|

|

|

|

|

|

Net asset value, beginning of period |

$ 11.020 |

$ 12.040 |

$ 11.970 |

$ 11.430 |

$ 11.700 |

$ 10.800 |

|

Income from Investment Operations |

.285 D |

.565 D |

.571 |

.593 |

.605 |

.652 |

|

Net realized and unrealized |

.378 |

(1.000) |

.100 |

.542 |

(.266) |

.902 |

|

Total from investment operations |

.663 |

(.435) |

.671 |

1.135 |

.339 |

1.554 |

|

Less Distributions |

|

|

|

|

|

|

|

From net interest income |

(.283) |

(.560) |

(.571) |

(.593) |

(.605) |

(.654) |

|

From net realized gain |

- |

(.025) |

(.030) |

(.002) |

(.004) |

- |

|

Total distributions |

(.283) |

(.585) |

(.601) |

(.595) |

(.609) |

(.654) |

|

Net asset value, end of period |

$ 11.400 |

$ 11.020 |

$ 12.040 |

$ 11.970 |

$ 11.430 |

$ 11.700 |

|

Total Return B, C |

6.08% |

(3.70)% |

5.76% |

10.21% |

3.06% |

14.76% |

|

Ratios and Supplemental Data |

|

|

|

|

|

|

|

Net assets, end of period (000 omitted) |

$ 1,340,245 |

$ 1,250,449 |

$ 1,394,734 |

$ 1,232,151 |

$ 1,127,851 |

$ 1,170,207 |

|

Ratio of expenses to average net assets |

.49% A |

.49% |

.51% |

.53% |

.56% |

.55% |

|

Ratio of expenses to average net assets after expense reductions |

.45% A, E |

.48% E |

.51% |

.53% |

.56% |

.54% E |

|

Ratio of net interest income to average net assets |

5.13% A |

4.91% |

4.80% |

5.10% |

5.29% |

5.80% |

|

Portfolio turnover rate |

34% A |

22% |

12% |

21% |

44% |

33% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C The total returns would have been lower had certain expenses not been reduced during the periods shown.

D Net interest income per share has been calculated based on average shares outstanding during the period.

E FMR or the fund has entered into varying arrangements with third parties who either paid or reduced a portion of the fund's expenses.

See accompanying notes which are an integral part of the financial statements.

Spartan Massachusetts Municipal Money Market Fund

Performance: The Bottom Line

To evaluate a money market fund's historical performance, you can look at either total return or yield. Total return reflects the change in the value of an investment, assuming reinvestment of the fund's dividend income, and does not include the effect of the fund's $5 account closeout fee on an average size account. Yield measures the income paid by a fund. Since a money market fund tries to maintain a $1 share price, yield is an important measure of performance. If Fidelity had not reimbursed certain fund expenses, the life of fund total returns would have been lower.

Cumulative Total Returns

|

Periods ended July 31, 2000 |

Past 6 |

Past 1 |

Past 5 |

Life of |

|

Spartan MA Municipal Money Market |

1.75% |

3.29% |

16.41% |

31.64% |

|

Massachusetts Tax-Free Retail |

1.66% |

3.08% |

15.56% |

n/a* |

Cumulative total returns show the fund's performance in percentage terms over a set period - in this case, six months, one year, five years or since the fund started on March 4, 1991. For example, if you had invested $1,000 in a fund that had a 5% return over the past year, the value of your investment would be $1,050. To measure how the fund's performance stacked up against its peers, you can compare it to the Massachusetts tax-free retail money market funds average, which reflects the performance of tax-free retail money market funds with similar objectives tracked by iMoneyNet, Inc. The past six months average represents a peer group of 11 money market funds.

Average Annual Total Returns

|

Periods ended July 31, 2000 |

|

Past 1 |

Past 5 |

Life of |

|

Spartan MA Municipal Money Market |

|

3.29% |

3.09% |

2.96% |

|

Massachusetts Tax-Free Retail |

|

3.08% |

2.93% |

n/a* |

Average annual total returns take the fund's cumulative return and show you what would have happened if the fund had performed at a constant rate each year.

* Not available

Semiannual Report

Spartan Massachusetts Municipal Money Market Fund

Performance - continued

Yields

|

|

7/31/00 |

5/1/00 |

1/31/00 |

11/1/99 |

8/2/99 |

|

|

|

|

|

|

|

|

Spartan Massachusetts |

3.63% |

4.00% |

2.85% |

2.95% |

2.63% |

|

|

|

|

|

|

|

|

Massachusetts |

3.47% |

3.49% |

2.61% |

2.68% |

2.46% |

|

|

|

|

|

|

|

|

Spartan Massachusetts |

6.05% |

6.66% |

4.73% |

4.90% |

4.37% |

|

|

|

|

|

|

|

|

Portion of fund's income |

7.70% |

3.66% |

4.15% |

7.28% |

4.08% |

Yield refers to the income paid by the fund over a given period. Yields for money market funds are usually for seven-day periods, expressed as annual percentage rates. A yield that assumes income earned is reinvested or compounded is called an effective yield. The table above shows the fund's current seven-day yield at quarterly intervals over the past year. You can compare these yields to the Massachusetts tax-free retail money market funds average as tracked by iMoneyNet, Inc. Or you can look at the fund's tax-equivalent yield, which is based on a combined effective 2000 federal and state income tax rate of 39.74%. The fund's yields mentioned above reflect that a portion of the fund's income was subject to state taxes. A portion of the fund's income may be subject to the federal alternative minimum tax.

A money market fund's total returns and yields will vary, and reflect past results rather than predict future performance.

Comparing

Performance

Yields on tax-free investments are usually lower than yields on taxable investments. However, a straight comparison between the two may be misleading because it ignores the way taxes reduce taxable returns. Tax-equivalent yield - the yield you'd have to earn on a similar taxable investment to match the tax-free yield - makes the comparison more meaningful. Keep in mind that the U.S. government neither insures nor guarantees a money market fund. In fact, there is no assurance that a money market fund will maintain a $1 share price.

3Semiannual Report

Spartan Massachusetts Municipal Money Market Fund

Fund Talk: The Manager's Overview

Note to shareholders: Norm Lind became Portfolio Manager of Spartan Massachusetts Municipal Money Market Fund on July 1, 2000.

(Portfolio Manager photograph)