|

|

|

|

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrant /x/ | ||

| Filed by a Party other than the Registrant / / | ||

Check the appropriate box: |

||

| /x/ | Preliminary Proxy Statement | |

| / / | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| / / | Definitive Proxy Statement | |

| / / | Definitive Additional Materials | |

| / / | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12 | |

HEWLETT-PACKARD COMPANY |

|

| (Name of Registrant as Specified In Its Charter) | |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| /x/ | No fee required. | |||

| / / | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

/ / |

Fee paid previously with preliminary materials. |

|||

/ / |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

(1) |

Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

| Carleton S. Fiorina President and Chief Executive Officer |

|

Hewlett-Packard Company 3000 Hanover Street Palo Alto, California 94304 |

To our Shareowners:

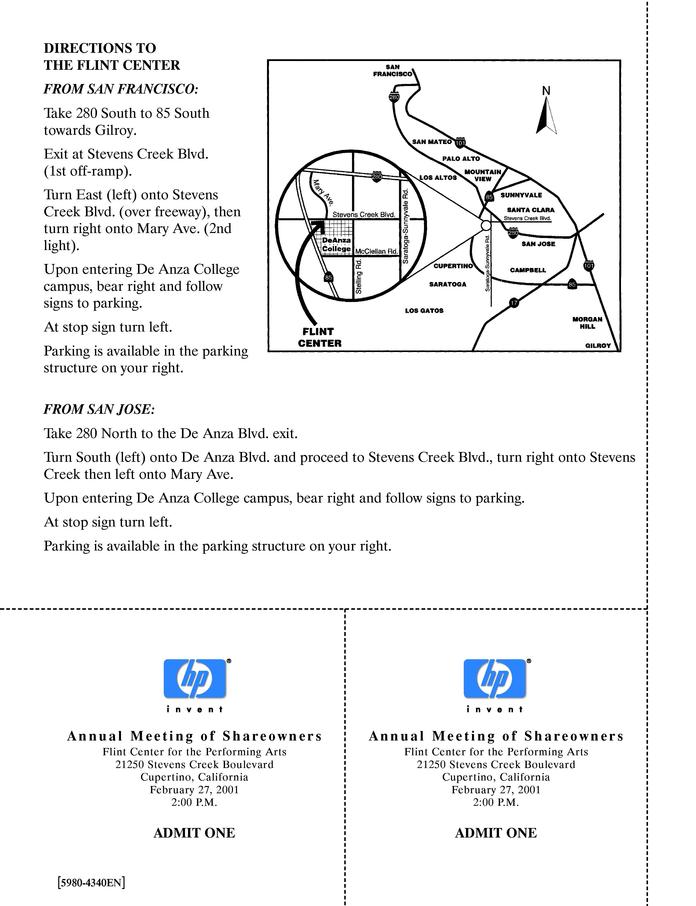

I am pleased to invite you to attend the annual meeting of shareowners of Hewlett-Packard Company to be held on Tuesday, February 27, 2001 at 2:00 p.m. at the Flint Center for the Performing Arts located at 21250 Stevens Creek Boulevard, Cupertino, California.

Details regarding admission to the meeting and the business to be conducted are more fully described in the accompanying Notice of Annual Meeting and Proxy Statement.

If you are unable to attend the meeting in person, you may listen to audio highlights, which will be posted soon after the meeting on our investor relations Web site located at http://www.hp.com/go/financials.

Your vote is important. Whether or not you plan to attend the annual meeting, I hope you will vote as soon as possible. You may vote over the Internet, as well as by telephone or by mailing a proxy card. Voting over the Internet, by phone or by written proxy will ensure your representation at the annual meeting if you do not attend in person. Please review the instructions on the proxy card regarding each of these voting options.

Thank you for your ongoing support of and continued interest in Hewlett-Packard Company.

Sincerely,

2001 ANNUAL MEETING OF SHAREOWNERS

NOTICE OF ANNUAL MEETING AND PROXY STATEMENT

TABLE OF CONTENTS

| NOTICE OF ANNUAL MEETING | 1 | |||

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE ANNUAL MEETING |

2 |

|||

| Why am I receiving these materials? | 2 | |||

| What information is contained in these materials? | 2 | |||

| What proposals will be voted on at the meeting? | 2 | |||

| What is HP's voting recommendation? | 2 | |||

| What shares can I vote? | 2 | |||

| What is the difference between holding shares as a shareowner of record and as a beneficial owner? | 2 | |||

| How can I vote my shares in person at the meeting? | 3 | |||

| How can I vote my shares without attending the meeting? | 3 | |||

| Can I change my vote? | 3 | |||

| How are votes counted? | 3 | |||

| What is the voting requirement to approve each of the proposals? | 4 | |||

| What does it mean if I receive more than one proxy or voting instruction card? | 4 | |||

| How can I obtain an admission ticket for the meeting? | 4 | |||

| Where can I find the voting results of the meeting? | 4 | |||

| What happens if additional proposals are presented at the meeting? | 4 | |||

| What classes of shares are entitled to be voted? | 4 | |||

| What is the quorum requirement for the meeting? | 4 | |||

| Is cumulative voting permitted for the election of directors? | 5 | |||

| Who will count the votes? | 5 | |||

| Is my vote confidential? | 5 | |||

| Who will bear the cost of soliciting votes for the meeting? | 5 | |||

| May I propose actions for consideration at next year's annual meeting of shareowners or nominate individuals to serve as directors? | 5 | |||

BOARD STRUCTURE AND COMPENSATION |

7 |

|||

DIRECTOR COMPENSATION ARRANGEMENTS AND STOCK OWNERSHIP GUIDELINES |

9 |

|||

PROPOSALS TO BE VOTED ON |

10 |

|||

| PROPOSAL NO. 1 Election of Directors | 10 | |||

| PROPOSAL NO. 2 Amendment of the Company's Certificate of Incorporation to Increase the Number of Authorized Shares | 12 | |||

| PROPOSAL NO. 3 Amendment of the Company's Certificate of Incorporation to Decrease the Number of Directors | 14 | |||

| PROPOSAL NO. 4 Shareowner Proposal | 15 | |||

COMMON STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

18 |

|||

| Beneficial Ownership Table | 18 | |||

| Section 16(a) Beneficial Ownership Reporting Compliance | 22 | |||

EXECUTIVE COMPENSATION |

23 |

|||

| Summary Compensation Table | 23 | |||

| Option Grants in Last Fiscal Year | 28 | |||

| Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values | 30 | |||

| Employment Contracts, Termination of Employment and Change in Control Arrangements | 31 | |||

| Pension Plans | 33 | |||

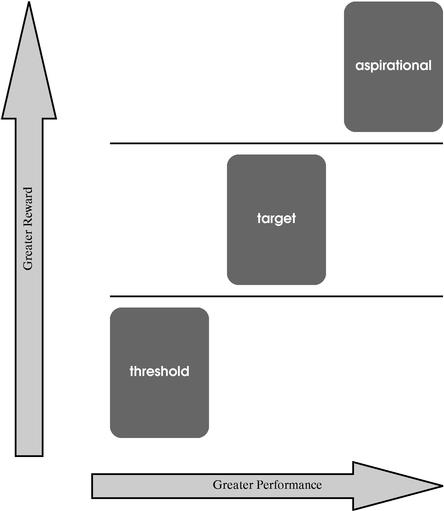

| Report of the Compensation Committee of the Board of Directors on Executive Compensation | 35 | |||

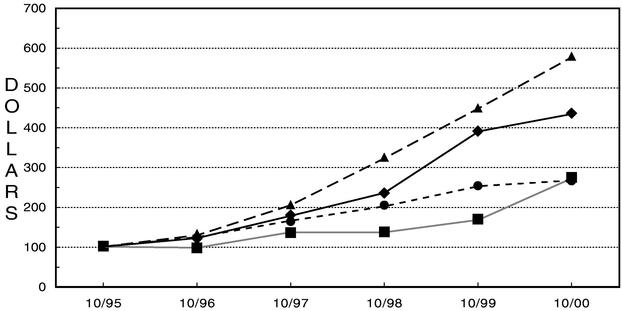

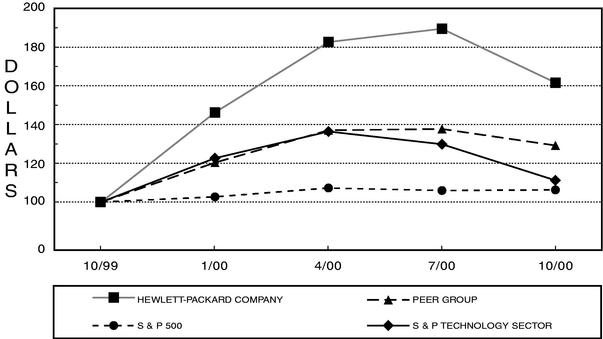

| Stock Performance Graphs | 39 | |||

INDEPENDENT PUBLIC ACCOUNTANTS |

40 |

|||

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS |

41 |

|||

APPENDIX A: HEWLETT-PACKARD COMPANY BOARD OF DIRECTORS AUDIT COMMITTEE CHARTER |

A-1 |

|||

HEWLETT-PACKARD COMPANY

3000 Hanover Street

Palo Alto, California 94304

(650) 857-1501

Notice of Annual Meeting of Shareowners

| TIME | 2:00 p.m. on Tuesday, February 27, 2001 | |||

PLACE |

Flint Center for the Performing Arts 21250 Stevens Creek Boulevard Cupertino, California |

|||

ITEMS OF BUSINESS |

(1) |

To elect directors |

||

(2) |

To amend the Certificate of Incorporation to increase the number of authorized shares |

|||

(3) |

To amend the Certificate of Incorporation to decrease the number of directors |

|||

(4) |

To consider a shareowner proposal entitled "US Business Principles for Human Rights of Workers in China" |

|||

(5) |

To consider such other business as may properly come before the meeting |

|||

RECORD DATE |

You are entitled to vote if you were a shareowner at the close of business on Friday, December 29, 2000. |

|||

MEETING ADMISSION |

Two cut-out admission tickets are included on the back cover of this proxy statement. Please contact the HP Corporate Secretary at our headquarters if you need additional tickets. The meeting will begin promptly at 2 o'clock. |

|||

VOTING BY PROXY |

Please submit a proxy as soon as possible so that your shares can be voted at the meeting in accordance with your instructions. You may submit your proxy (1) over the Internet, (2) by telephone, or (3) by mail. For specific instructions, please refer to the Questions and Answers beginning on page 2 of this proxy statement and the instructions on the proxy card. |

|||

| |

|

|---|---|

| By Order of the Board of Directors, | |

| ANN O. BASKINS Vice President, General Counsel and Secretary |

This notice of meeting and proxy statement and accompanying proxy card are being distributed on or about

January , 2001.

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE ANNUAL MEETING

Q: Why am I receiving these materials?

A: The Board of Directors (the "Board") of Hewlett-Packard Company, a Delaware corporation (sometimes referred to as the "Company" or "HP"), is providing these proxy materials for you in connection with HP's annual meeting of shareowners, which will take place on February 27, 2001. As a shareowner, you are invited to attend the meeting and are entitled to and requested to vote on the proposals described in this proxy statement.

Q: What information is contained in these materials?

A: The information included in this proxy statement relates to the proposals to be voted on at the meeting, the voting process, the compensation of directors and our most highly paid officers, and certain other required information. Our 2000 Annual Report and our 2000 Form 10-K, including our full 2000 consolidated financial statements, are also enclosed.

Q: What proposals will be voted on at the meeting?

A: There are four proposals scheduled to be voted on at the meeting:

Q: What is HP's voting recommendation?

A: Our Board of Directors recommends that you vote your shares "FOR" each of the nominees to the Board, "FOR" the amendments to our Certificate of Incorporation to increase the number of authorized shares and decrease the number of directors, respectively, and "AGAINST" the shareowner proposal.

Q: What shares can I vote?

A: All shares owned by you as of the close of business on December 29, 2000, the Record Date, may be voted by you. These shares include (1) shares held directly in your name as the shareowner of record, including shares purchased through HP's Dividend Reinvestment Plan and HP's Employee Stock Purchase Plan, and (2) shares held for you as the beneficial owner through a stockbroker or bank or shares purchased through HP's 401(k) plan, the Tax Saving Capital Accumulation Plan ("TAXCAP").

Q: What is the difference between holding shares as a shareowner of record and as a beneficial owner?

A: Most HP shareowners hold their shares through a stockbroker, bank or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

Shareowner of Record

If your shares are registered directly in your name with HP's transfer agent, Computershare Investor Services, you are considered, with respect to those shares, the shareowner of record, and these proxy materials are being sent directly to you by HP. As the shareowner of record, you have the right to grant your voting proxy directly to HP or to vote in person at the meeting. HP has enclosed or sent a proxy card for you to use.

Beneficial Owner

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in street name, and these proxy materials are being forwarded to you by your broker or nominee which is considered, with respect to those shares, the shareowner of record. As the beneficial owner, you have the right to direct

2

your broker how to vote and are also invited to attend the meeting. However, since you are not the shareowner of record, you may not vote these shares in person at the meeting unless you obtain a signed proxy from the record holder giving you the right to vote the shares. Your broker or nominee has enclosed or provided a voting instruction card for you to use in directing the broker or nominee how to vote your shares.

Q: How can I vote my shares in person at the meeting?

A: Shares held directly in your name as the shareowner of record may be voted in person at the annual meeting. If you choose to do so, please bring the enclosed proxy card or proof of identification.

Even if you currently plan to attend the annual meeting, we recommend that you also submit your proxy as described below so that your vote will be counted if you later decide not to attend the meeting. Shares held in street name may be voted in person by you only if you obtain a signed proxy from the record holder giving you the right to vote the shares.

Q: How can I vote my shares without attending the meeting?

A: Whether you hold shares directly as the shareowner of record or beneficially in street name, you may direct your vote without attending the meeting. You may vote by granting a proxy or, for shares held in street name, by submitting voting instructions to your broker or nominee. In most instances, you will be able to do this over the Internet, by telephone or by mail. Please refer to the summary instructions below and those included on your proxy card or, for shares held in street name, the voting instruction card included by your broker or nominee.

By Internet—If you have Internet access, you may submit your proxy from any location in the world by following the "Vote by Internet" instructions on the proxy card.

By Telephone—If you live in the United States or Canada, you may submit your proxy by following the "Vote by Phone" instructions on the proxy card.

By Mail—You may do this by signing your proxy card or, for shares held in street name, the voting instruction card included by your broker or nominee and mailing it in the accompanying enclosed, postage prepaid and addressed envelope. If you provide specific voting instructions, your shares will be voted as you instruct. If you sign but do not provide instructions, your shares will be voted as described below in "How are votes counted?"

Q: Can I change my vote?

A: You may change your proxy instructions at any time prior to the vote at the annual meeting. For shares held directly in your name, you may accomplish this by granting a new proxy bearing a later date (which automatically revokes the earlier proxy) or by attending the annual meeting and voting in person. Attendance at the meeting will not cause your previously granted proxy to be revoked unless you specifically so request. For shares held beneficially by you, you may accomplish this by submitting new voting instructions to your broker or nominee.

Q: How are votes counted?

A: In the election of directors, you may vote "FOR" all of the nominees or your vote may be "WITHHELD" with respect to one or more of the nominees. For the other proposals, you may vote "FOR," "AGAINST" or "ABSTAIN." If you "ABSTAIN," it has the same effect as a vote "AGAINST." If you sign your proxy card or broker voting instruction card with no further instructions, your shares will be voted in accordance with the recommendations of the Board ("FOR" all of the Company's nominees to the Board, "FOR" the amendments to the Certificate of Incorporation and "AGAINST" the shareowner proposal and in the discretion of the proxy holders on any other matters that properly come before the meeting), except that any shares you hold in TAXCAP will be

3

voted in proportion to the way the other TAXCAP participants vote their shares.

Q: What is the voting requirement to approve each of the proposals?

A: In the election of directors, the nine persons receiving the highest number of "FOR" votes will be elected. All other proposals require the affirmative "FOR" vote of a majority of those shares present and entitled to vote. If you are a beneficial owner and do not provide the shareowner of record with voting instructions, your shares may constitute broker non-votes, as described in "What is the quorum requirement for the meeting?" below. In tabulating the voting result for any particular proposal, shares that constitute broker non-votes are not considered entitled to vote on that proposal.

Q: What does it mean if I receive more than one proxy or voting instruction card?

A: It means your shares are registered differently or are in more than one account. Please provide voting instructions for all proxy and voting instruction cards you receive.

Q: How can I obtain an admission ticket for the meeting?

A: Two cut-out admission tickets are included on the back of this proxy statement. A limited number of tickets are available for additional joint owners. To request additional tickets, please contact the HP Corporate Secretary at our headquarters. If you forget to bring an admission ticket, you will be admitted to the meeting only if you are listed as a shareowner of record as of the close of business on December 29, 2000 and bring proof of identification. If you hold your shares through a stockbroker or other nominee and fail to bring an admission ticket, you will need to provide proof of ownership by bringing either a copy of the voting instruction card provided by your broker or a copy of a brokerage statement showing your share ownership as of December 29, 2000.

Q: Where can I find the voting results of the meeting?

A: We will announce preliminary voting results at the meeting and publish final results in our quarterly report on Form 10-Q for the second quarter of fiscal year 2001.

Q: What happens if additional proposals are presented at the meeting?

A: Other than the four proposals described in this proxy statement, we do not expect any matters to be presented for a vote at the annual meeting. If you grant a proxy, the persons named as proxy holders, Carleton S. Fiorina, HP's Chairman, President and Chief Executive Officer, and Ann O. Baskins, HP's Vice President, General Counsel and Secretary, will have the discretion to vote your shares on any additional matters properly presented for a vote at the meeting. If for any unforeseen reason any of our nominees is not available as a candidate for director, the persons named as proxy holders will vote your proxy for such other candidate or candidates as may be nominated by the Board of Directors.

Q: What classes of shares are entitled to be voted?

A: Each share of our common stock outstanding as of the close of business on December 29, 2000, the Record Date, is entitled to vote on all items being voted upon at the annual meeting. On the Record Date, we had approximately 1,932,347,155 shares of common stock issued and outstanding.

Q: What is the quorum requirement for the meeting?

A: The quorum requirement for holding the meeting and transacting business is a majority of the outstanding shares present in person or represented by proxy and entitled to be voted. Both abstentions and broker non-votes are counted as present for the purpose of determining the presence of a quorum. Abstentions are also counted as shares present and entitled to be voted. Broker non-votes, however, are not counted as shares present and entitled to be voted with respect to the matter on which the broker has expressly not voted. Thus, broker non-votes

4

will not affect the outcome of any of the matters being voted upon at the meeting. Generally, broker non-votes occur when shares held by a broker for a beneficial owner are not voted with respect to a particular proposal because (1) the broker has not received voting instructions from the beneficial owner, and (2) the broker lacks discretionary voting power to vote such shares.

Q: Is cumulative voting permitted for the election of directors?

A: In the election of directors, you may elect to cumulate your vote. Cumulative voting will allow you to allocate, as you see fit, the total number of votes equal to the number of director positions to be filled multiplied by the number of shares held by you. Thus, if you own 1 share of stock, you could allocate 9 "FOR" votes (9x1) to as few or as many persons you choose. Cumulative voting only applies to the election of directors. For all other matters, each share of common stock outstanding as of the close of business on the Record Date is entitled to one vote. If you choose to cumulate your votes for the election of directors, you will need to make an explicit statement of your intent to do so, either by so indicating in writing on the proxy card or by stating so when voting at the annual meeting.

Q: Who will count the votes?

A: A representative of Computershare Investor Services, HP's transfer agent, will tabulate the votes and act as the inspector of election.

Q: Is my vote confidential?

A: Proxy instructions, ballots and voting tabulations that identify individual shareowners are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within HP or to third parties except (1) as necessary to meet applicable legal requirements, (2) to allow for the tabulation of votes and certification of the vote, or (3) to facilitate a successful proxy solicitation by our Board. Occasionally, shareowners provide written comments on their proxy card, which are then forwarded to HP management.

Q: Who will bear the cost of soliciting votes for the meeting?

A: HP is making this solicitation and will pay the entire cost of preparing, assembling, printing, mailing and distributing these proxy materials. If you choose to access the proxy materials and/or vote over the Internet, however, you are responsible for Internet access charges you may incur. In addition to the mailing of these proxy materials, the solicitation of proxies or votes may be made in person, by telephone or by electronic communication by our directors, officers and employees, who will not receive any additional compensation for such solicitation activities. We also have hired Corporate Investor Communications, Inc. ("CIC") to assist us in the distribution of proxy materials and the solicitation of votes. We will pay CIC a fee of $16,000 plus expenses for these services. We will also reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to shareowners.

Q: May I propose actions for consideration at next year's annual meeting of shareowners or nominate individuals to serve as directors?

A: You may submit proposals for consideration at future shareowner meetings, including director nominations.

Shareowner Proposals: In order for a shareowner proposal to be considered for inclusion in HP's proxy statement for next year's annual meeting, the written proposal must be received by HP no later than September , 2001. Such proposals also will need to comply with Securities and Exchange Commission regulations regarding the inclusion of shareowner proposals in company-sponsored proxy materials. Similarly, in order for a shareowner proposal to be raised from the floor during next year's annual meeting, written notice must be

5

received by HP no later than September , 2001 and shall contain such information as required under our Bylaws.

Nomination of Director Candidates: You may propose director candidates for consideration by our Board's Nominating and Governance Committee. Any such recommendations should be directed to the HP Corporate Secretary at our headquarters. In addition, our Bylaws permit shareowners to nominate directors at a shareowner meeting. In order to make a director nomination at a shareowner meeting, it is necessary that you notify HP not fewer than 120 days in advance of the day specified as the mailing date in our proxy statement for the prior year's annual meeting of shareowners. Thus, since January , 2001 is specified as the mailing date in this year's proxy statement, in order for any such nomination notice to be timely for next year's annual meeting, it must be received by HP no later than September , 2001. In addition, the notice must meet all other requirements contained in our Bylaws.

Copy of Bylaw Provisions: You may contact the HP Corporate Secretary at our headquarters for a copy of the relevant Bylaw provisions regarding the requirements for making shareowner proposals and nominating director candidates.

6

BOARD STRUCTURE AND COMPENSATION

Our Board has 10 directors and the following five committees: (1) Audit, (2) Compensation, (3) Executive, (4) Finance and Investment, and (5) Nominating and Governance. The membership and the function of each committee are described below. During fiscal year 2000, the Board held 14 meetings and each director other than Susan P. Orr attended at least 75% of all Board and applicable committee meetings.

| Name of Director |

Audit |

Compensation |

Executive |

Finance and Investment |

Nominating and Governance |

|||||

|---|---|---|---|---|---|---|---|---|---|---|

| Non-Employee Directors:(1) | ||||||||||

| Philip M. Condit(2) | X* | X | ||||||||

| Patricia C. Dunn(3) | X | X* | ||||||||

| Sam Ginn(4) | X | X* | ||||||||

| Richard A. Hackborn(3)(6) | X | X | ||||||||

| Walter B. Hewlett(5) | X | X | ||||||||

| Dr. George A. Keyworth II | X* | X | ||||||||

| Robert E. Knowling, Jr.(5) | X | X | ||||||||

| Susan Packard Orr(2) | X | |||||||||

| Employee Directors | ||||||||||

| Carleton S. Fiorina(6) | X* | X | ||||||||

| Robert P. Wayman | X | X | ||||||||

| Number of Meetings in Fiscal Year 2000 | 5 | 4 | 0(7) | 6 | 6 |

X = Committee member; * = Chair

7

The Audit Committee

The Audit Committee reviews our auditing, accounting, financial reporting and internal control functions and selects our independent accountants. In discharging its duties, the committee:

The Audit Committee operates under a written charter adopted by the Board of Directors of HP, a copy of which is attached as Appendix A to this proxy statement.

Compensation Committee

The Compensation Committee determines, and approves and reports to the Board on, all elements of compensation for our elected officers including bonuses, as described below in pages 35 through 38 of this proxy statement.

Executive Committee

The Executive Committee meets or takes written action when the Board is not otherwise meeting and has the same level of authority as the Board, except that it cannot amend HP's Bylaws, recommend any action that requires the approval of the shareowners or take any other action not permitted to be delegated to a committee under Delaware law.

Finance and Investment Committee

The Finance and Investment Committee supervises the investment of all assets held by HP's employee benefit plans and funds and reviews the investment results of HP's international subsidiaries' pension plans. It also establishes and reviews policies regarding the investment of general corporate assets, HP's capital structure and the issuance of debt, as well as the use of derivative investments to manage currency and interest rate exposure. In addition, the committee provides oversight and guidance to the Board regarding significant financial matters, including the payment of dividends.

Nominating and Governance Committee

The Nominating and Governance Committee proposes a slate of directors for election by our shareowners at each annual meeting and candidates to fill any vacancies on the Board. It is also responsible for approving management succession plans and addressing Board organizational and governance issues.

8

DIRECTOR COMPENSATION ARRANGEMENTS

AND STOCK OWNERSHIP GUIDELINES

The following table provides information on HP's compensation and reimbursement practices during fiscal year 2000 for non-employee directors, as well as the range of compensation paid to non-employee directors who served the entire 2000 fiscal year. Directors who are employed by HP, Ms. Fiorina and Mr. Wayman, do not receive any compensation for their Board activities.

| DIRECTOR COMPENSATION TABLE FOR FISCAL YEAR 2000(1) |

||

| Annual Director Retainer | $100,000 | |

| Minimum Percentage of Annual Retainer to be Paid in HP Stock(2) | 75% | |

| Additional Retainer for Committee Chair | $5,000 | |

| Reimbursement for Expenses Attendant to Board Membership | Yes | |

| Range of Total Compensation Paid to Directors (for the year) | $100,000—$105,000(3) | |

In addition to the amounts disclosed above, on June 5, 2000 all then-current non-employee directors received a one-time grant of an option to purchase 20,000 shares (40,000 shares as adjusted to reflect the Company's two for one stock split effective October 27, 2000) at the fair market value on date of grant, exercisable 25% after the first year, 50% after the second year, 75% after the third year, and 100% after the fourth year. In connection with his joining the Board, on July 21, 2000, Mr. Knowling received a one-time grant of an option to purchase 20,000 shares (40,000 shares, as adjusted) at the fair market value on the date of grant, subject to the vesting provisions described above. Under the Company's stock ownership guidelines for directors, all directors are required to accumulate over time shares of HP stock equal in value to at least twice the value of the annual director retainer.

Mr. Lewis E. Platt, who resigned from the Board effective December 31, 1999 and served as President and Chief Executive Officer through July 31, 1999, entered into an individual Transition Agreement with HP on May 20, 1999. Mr. Platt received a transition payment of 1.5 times his base salary and a variable compensation amount payable under the agreement because he resigned from his position as Chairman on December 31, 1999. Including this amount and certain other amounts payable in connection with his retirement, Mr. Platt received $5,235,700 from HP during fiscal year 2000. As a condition of receiving this transition payment, Mr. Platt agreed that, for 18 months following the termination of his employment with HP, he will not compete with HP, solicit its employees, or violate his confidentiality obligations to HP.

9

There are nine nominees for election to our Board this year. All of the nominees have served as directors since the last annual meeting, except for Robert E. Knowling Jr., who was elected a director by our Board on July 21, 2000 and will stand for election as a director by our shareowners for the first time at this year's annual meeting. Director Susan P. Orr is not standing for re-election. Information regarding the business experience of each nominee is provided below. All directors are elected annually to serve until the next annual meeting and until their respective successors are elected. There are no family relationships among our executive officers and directors except as described below.

Our Board of Directors recommends a vote FOR the election to the Board of each of the following nominees.

Vote Required

The nine persons receiving the highest number of votes represented by outstanding shares of common stock present or represented by proxy and entitled to vote will be elected.

| Philip M. Condit Director since 1998 Age 58 |

Mr. Condit has been Chairman of The Boeing Company since February 1997, its Chief Executive Officer since April 1996 and a member of its board since 1992. He served as President of The Boeing Company from August 1992 until becoming Chairman. | |

Patricia C. Dunn Director since 1998 Age 47 |

Ms. Dunn has been Global Chief Executive of Barclays Global Investors since 1998 and its Co-Chairman since October 1995. Ms. Dunn oversees the activities and strategy of BGI, the world's largest institutional investment manager, having joined the firm's predecessor organization, Wells Fargo Investment Advisors, in 1978. |

|

Carleton S. Fiorina Director since 1999 Age 46 |

Ms. Fiorina became Chairman of the Board in September 2000 and was named President, Chief Executive Officer and director of HP in July 1999. From October 1997 until she joined HP, Ms. Fiorina was Group President of the Global Services Provider Business of Lucent Technologies, Inc., a communications systems and technology company. From October 1996 to October 1997, she was President of Lucent Technologies' Consumer Products Business, and from January to October 1996 she was Executive Vice President, Corporate Operations. Ms. Fiorina is a member of the Board of Directors of the Kellogg Company and Merck & Co., and also serves on the U.S. China Board of Trade. |

|

Sam Ginn Director since 1996 Age 63 |

Mr. Ginn served as Chairman of Vodafone AirTouch Plc from 1999, following the merger of Vodafone and AirTouch, until his retirement in May 2000. He was Chairman of the Board and Chief Executive Officer of AirTouch from December 1993 to June 1999. Mr. Ginn is also a director of Chevron Corporation. |

|

10

Richard A. Hackborn Director since 1992 Age 63 |

Mr. Hackborn served as Chairman of the Board from January 2000 to September 2000. He was HP's Executive Vice President, Computer Products Organization from 1990 until his retirement in 1993 after a 33-year career with our company. He is a director of the William and Flora Hewlett Foundation and the Boise Art Museum. |

|

Walter B. Hewlett Director since 1987 Age 56 |

Mr. Hewlett has been an independent software developer involved with computer applications in the humanities for more that five years. In 1997, Mr. Hewlett was elected to the Board of Overseers of Harvard University. In 1994, Mr. Hewlett participated in the formation of Vermont Telephone Company of Springfield, Vermont and currently serves as its Chairman. Mr. Hewlett founded the Center for Computer Assisted Research in the Humanities in 1984, for which he serves as a director. Mr. Hewlett has been a trustee of The William and Flora Hewlett Foundation since its founding in 1966 and currently serves as its Chairman. Mr. Hewlett has served as a director of Agilent Technologies, Inc. since 1999. He is the son of HP co-founder William R. Hewlett. |

|

George A. Keyworth II Director since 1986 Age 61 |

Dr. Keyworth has been Chairman and Senior Fellow with The Progress & Freedom Foundation, a public policy research institute, since 1995. He is a director of General Atomics, Vepotronics, Inc., and Bravo Labs. Dr. Keyworth holds various honorary degrees and is an honorary professor at Fudan University in Shanghai, People's Republic of China. |

|

Robert E. Knowling, Jr. Director Since 2000 Age 45 |

Mr. Knowling was President and Chief Executive Officer of Covad Communications Company, a national broadband service provider of high-speed Internet and network access using DSL technology, from July 1998 through November 2000. He also served as Chairman of Covad from September 1999 to November 2000. From 1997 though July 1998, Mr. Knowling served as the Executive Vice President of Operations and Technologies at US WEST Communications, Inc. From November 1994 through March 1996, he served as Vice President of Network Operations for Ameritech Corporation. Mr. Knowling is a member of the Board of Directors of Ariba, Inc., Heidrich & Struggles International, Inc. and the Juvenile Diabetes Foundation International. He also serves as a member of the advisory board for both Northwestern University's Kellogg Graduate School of Management and the University of Michigan Graduate School of Business. |

|

Robert P. Wayman Director since 1993 Age 55 |

Mr. Wayman has served as an Executive Vice President responsible for finance and administration since December 1992 and Chief Financial Officer since 1984. Mr. Wayman is director of CNF Transportation, Inc., Sybase Inc., and Portal Software, Inc. He also serves as a member of the Kellogg Advisory Board to Northwestern University School of Business and is Chairman of the Private Sector Council. |

11

AMENDMENT OF THE COMPANY'S CERTIFICATE OF INCORPORATION TO

INCREASE THE NUMBER OF AUTHORIZED SHARES

The company's Certificate of Incorporation currently authorizes the issuance of four billion eight hundred million (4,800,000,000) shares of common stock, with a par value of one cent ($.01) per share, and 300,000,000 shares of preferred stock, with a par value of one cent ($.01) per share. In November 2000, the Board of Directors adopted a resolution proposing that the Certificate of Incorporation be amended to increase the authorized number of shares of common stock to nine billion six hundred million (9,600,000,000), subject to stockholder approval of the amendment.

Our Board of Directors recommends a vote FOR the approval of the amendment of the company's Certificate of Incorporation to increase the number of authorized shares.

Vote Required

Approval of the proposal requires the affirmative vote of the majority of shares of common stock present or represented by proxy and entitled to vote at the meeting.

Proposed Amendment

As of December 29, 2000, the company had approximately 1,932,347,155 shares of common stock outstanding and approximately million shares reserved for future issuance under the company's employee stock plans, of which approximately million shares are covered by outstanding options and approximately million shares are available for grant. In addition, the company has approximately 13,585,937 shares reserved for issuance upon the consummation of the acquisition of Bluestone Software, Inc. and approximately 21,816,800 shares reserved for issuance upon conversion of the company's Liquid Yield Option Notes due 2017 and outstanding warrants. Based upon the foregoing number of outstanding and reserved shares of common stock, the company currently has approximately shares remaining available for other purposes.

The following is the text of the first paragraph of Article IV of the Certificate of Incorporation of the company, including the proposed amendment to the second sentence thereof:

The Corporation is authorized to issue two classes of stock to be designated, respectively, Preferred Stock, par value $0.01 per share ("Preferred"), and Common Stock, par value $0.01 per share ("Common"). The total number of shares of Common that the Corporation shall have authority to issue is 9,600,000,000. The total number of shares of Preferred that the Corporation shall have authority to issue is 300,000,000. The Preferred Stock may be issued from time to time in one or more series.

Purpose and Effect of the Proposed Amendment

The Board of Directors believes that the availability of additional authorized but unissued shares will provide the company with the flexibility to issue common stock for a variety of corporate purposes, such as to effect future stock splits in the form of stock dividends, to make acquisitions through the use of stock, to raise equity capital, to adopt additional employee benefit plans or to reserve additional shares for issuance under such plans and under plans of acquired companies.

Increasing the number of shares of common stock that the company is authorized to issue would give the company additional flexibility with respect to future stock splits and stock dividends. On seven occasions the company has effected either a stock split or a stock dividend in the form of a stock split. The last such action was a 2-for-1 stock split in the form of a stock dividend payable in October 2000. Also in 2000, the company agreed to issue approximately 13,585,937 shares of

12

common stock to acquire Bluestone Software, Inc. The Board of Directors believes that the proposed increase in authorized common stock would facilitate the company's ability to accomplish stock splits in the form of a stock dividend and other business and financial objectives in the future without the necessity of delaying such activities for further shareowner approval, except as may be required in particular cases by the company's charter documents, applicable law or the rules of any stock exchange or national securities association trading system on which the company's securities may then be listed. Other than as permitted or required under the company's employee benefit plans and under outstanding options, warrants and other securities convertible into common stock, and the acquisition described above, the Board of Directors has no immediate plans, understandings, agreements or commitments to issue additional common stock for any purposes. Whether or not the company's shareowners approve this proposal will not impact the company's existing agreements to issue stock, including pursuant to the acquisition described above. No additional action or authorization by the company's shareowners would be necessary prior to the issuance of such additional shares, unless required by applicable law or the rules of any stock exchange or national securities association trading system on which the common stock is then listed or quoted. The company reserves the right to seek a further increase in authorized shares from time to time in the future as considered appropriate by the Board of Directors.

Under the company's Certificate of Incorporation, the company's shareowners do not have preemptive rights with respect to common stock. Thus, should the Board of Directors elect to issue additional shares of common stock, existing shareowners would not have any preferential rights to purchase such shares. If the Board of Directors elects to issue additional shares of common stock, such issuance could have a dilutive effect on the earnings per share, book value per share voting power and shareholdings of current shareowners.

The proposal could have an anti-takeover effect, although that is not its intention. For example, if the company were the subject of a hostile takeover attempt, it could try to impede the takeover by issuing shares of common stock, thereby diluting the voting power of the other outstanding shares and increasing the potential cost of the takeover. The availability of this defensive strategy to the company could discourage unsolicited takeover attempts, thereby limiting the opportunity for the company's shareowners to realize a higher price for their shares than is generally available in the public markets. The Board of Directors is not aware of any attempt, or contemplated attempt, to acquire control of the company, and this proposal is not being presented with the intent that it be utilized as a type of anti-takeover device. In addition to the company's common stock, the company's Certificate currently empowers the Board of Directors to authorize the issuance of one or more series of preferred stock without shareowner approval. No shares of preferred stock of the Company are issued or outstanding. No change to the Company's preferred stock authorization is requested by the Amendment.

If the proposed amendment is adopted, it will become effective upon filing of a Certificate of Amendment to the company's Certificate of Incorporation with the Delaware Secretary of State. However, if the company's shareowners approve the proposed amendment to the company's Certificate of Incorporation, the Board retains discretion under Delaware law not to implement the proposed amendment. If the Board exercised such discretion, the number of authorized shares would remain at current levels.

13

AMENDMENT OF THE COMPANY'S CERTIFICATE OF INCORPORATION TO

DECREASE THE NUMBER OF DIRECTORS

The Company's Certificate of Incorporation currently provides that the number of directors of the corporation shall be not less than eleven nor more that twenty-one. In November 2000, the Board of Directors adopted a resolution proposing that the Certificate of Incorporation be amended to decrease the authorized number of directors to be not less than eight nor more than seventeen, subject to stockholder approval of the amendment. In accordance with the proposed amendment, there are nine nominees for election to our Board at this year's annual meeting. Proxies cannot be voted for a greater number of persons than the number of nominees named.

Our Board of Directors recommends a vote FOR the approval of the amendment of the company's Certificate of Incorporation to decrease the number of directors.

Vote Required

Approval of the proposal requires the affirmative vote of a majority of the shares of common stock present or represented by proxy and entitled to vote at the meeting.

Proposed Amendment

The following is a text of Section A of Article VI of the Certificate of Incorporation of HP, including the proposed amendment to the second sentence thereof:

A. The management of the business and the conduct of the affairs of the Corporation shall be vested in its Board of Directors. The number of Directors of this Corporation shall be not less than eight nor more than seventeen. The exact number of directors shall be fixed and may be changed from time to time, within the limits specified above, by an amendment to the Bylaws duly adopted by the stockholders or by the Board of Directors.

Reducing the minimum number of authorized directors would provide HP with greater flexibility to manage the size of its Board and to meet the evolving needs of the Company in the context of ongoing industry and market changes.

The changes that are proposed to the Certificate of Incorporation conform to the Board size requirements in the Company's Bylaws. Within these limits, the exact number of directors will be as fixed from time to time by the Board of Directors. There may be an indefinite number of directors, or the definite number of directors may be changed by an amendment to the Bylaws approved by either the shareholders or the directors, provided the new number falls within the range set forth in the Articles of Incorporation.

If the proposed amendment is adopted, it will become effective upon filing of a Certificate of Amendment to the company's Certificate of Incorporation with the Delaware Secretary of State. However, if the company's shareowners approve the proposed amendment to the company's Certificate of Incorporation, the Board retains discretion under Delaware law not to implement the proposed amendment, in which case the number of directors would remain at current levels.

14

Occasionally, we receive suggestions from our shareowners. Some are received as formal shareowner proposals. All are given attention by HP, and, in the past, management has adopted a number of suggestions made.

HP has received a shareowner proposal. The author and proponent of the following shareowner resolution is John C. Harrington, P.O. Box 6108, Napa, California 94581-1108 (the "Proponent"). The Proponent has requested the Company to include the following proposal and supporting statement in its Proxy Statement for the Annual Meeting of Shareowners. Mr. Harrington beneficially owns 100 shares of HP's common stock. The shareowner proposal is quoted verbatim in italics, below.

Management of HP disagrees strongly with the adoption of the resolution proposed below and asks shareowners to review Management's response, which follows the shareowner proposal.

Our Board of Directors recommends a vote AGAINST the shareowner proposal.

Vote Required

Approval of the shareowner proposal requires the affirmative vote of a majority of the shares of common stock present or represented by proxy and entitled to vote at the meeting.

Proponents' Proposal:

"U.S. BUSINESS PRINCIPLES FOR HUMAN RIGHTS OF WORKERS IN CHINA

WHEREAS: our company's business practices in China respect human and labor rights of workers. The eleven principles below were designed to commit a company to a widely accepted and thorough set of human and labor rights standards for China. They were defined by the International Labor Organization, the United Nations Covenants on Economic, Social and Cultural Rights, and Civil, and Political Rights. They have been signed by the Chinese government and China's national laws.

(1) No goods or products produced within our company's facilities or those of suppliers shall be manufactured by bonded labor, forced labor, within prison camps or as part of reform-through-labor or reeducation-through-labor programs.

(2) Our facilities and suppliers shall adhere to wages that meet workers' basic needs, fair and decent working hours, and at a minimum, to the wage and hour guidelines provided by China's national labor laws.

(3) Our facilities and suppliers shall prohibit the use of corporal punishment, any physical, sexual or verbal abuse or harassment of workers.

(4) Our facilities and suppliers shall use production methods that do not negatively affect the worker's occupational safety and health.

(5) Our facilities and suppliers shall prohibit any police or military presence designed to prevent workers from exercising their rights.

(6) We shall undertake to promote the following freedoms among our employees and the employees of our suppliers: freedom of association and assembly, including the rights to form unions and bargain collectively; freedom of expression, and freedom from arbitrary arrest or detention.

(7) Company employees and those of our suppliers shall not face discrimination in hiring, remuneration or promotion based on age, gender, marital status, pregnancy, ethnicity or region of origin.

(8) Company employees and those of our suppliers shall not face discrimination in hiring, remuneration or promotion based on labor, political or religious activity, or on involvement in demonstrations, past records of arrests or internal exile for peaceful protest, or membership in organizations committed to non-violent social or political change.

(9) Our facilities and suppliers shall use environmentally responsible methods of production that

15

have minimum adverse impact on land, air and water quality.

(10) Our facilities and suppliers shall prohibit child labor, at a minimum comply with guidelines on minimum age for employment within China's national labor laws.

(11) We will issue annual statements to the Human Rights for Workers in China Working Group detailing our efforts to uphold these principles and to promote these basic freedoms.

RESOLVED: Shareowners request the Board of Directors to make all possible lawful efforts to implement and/or increase activity on each of the principles named above in the People's Republic of China.

SUPPORTING STATEMENT: As U.S. companies import more goods, consumer and shareholder concern is growing about working conditions in China that fall below basic standards of fair and humane treatment. We hope that our company can prove to be a leader in its industry and embrace these principles."

MANAGEMENT STATEMENT IN OPPOSITION TO SHAREOWNER PROPOSAL

Since HP's earliest days, HP has demonstrated its commitment to its employees and the environment. Today, as HP's business operations have become more dependent upon relationships with suppliers and other third parties, the situation has become more complex, but HP's commitment to labor and environmental issues remains very much intact. Our labor and environmental policies and practices in China and worldwide show that we take this responsibility seriously and that we support the general intent of the stockholder proposal submitted by John Harrington, known as the China principles. However, after careful review of these principles and HP's policies and practices in China, we believe that the proposal is unnecessary, vague, and costly, as described below.

16

management. Submitting statements to the Human Rights for Workers in China Working Group or any other third party non-governmental organization would impair the ability of HP's management to manage operations in China and to control the scope and timing of disclosures of sensitive business information.

Promotion of fair labor and environmental practices is a key component of HP's citizenship objectives, and we continue to build a strong record on these issues. Adoption of the China principles would not improve our ability to address our responsibilities relating to our employees and operations in China, and forced disclosure of HP's policies and standards to a third party may actually harm HP's ability to address these issues constructively.

Because the new data-gathering and reporting requirements would be very costly in terms of both time and money, and for the other reasons described above, we recommend a vote AGAINST this proposal.

17

COMMON STOCK OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information, as of December 29, 2000, concerning:

Unless otherwise indicated, the address of each beneficial owner of more than 5% of HP's common stock is care of HP at HP's address.

The table begins with certain ownership information of the families of HP's founders and their related entities: (1) the foundation of the late Mr. David Packard, a related charitable institution and other related persons, and (2) Mr. William R. Hewlett, a family foundation and other related persons.

The number of shares beneficially owned by each entity, person, director or executive officer is determined under rules of the Securities and Exchange Commission, and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rules, beneficial ownership includes any shares as to which the individual has the sole or shared voting power or investment power and also any shares that the individual has the right to acquire as of February 27, 2001 (60 days after the record date of December 29, 2000) through the exercise of any stock option or other right. Unless otherwise indicated, each person has sole investment and voting power (or shares such powers with his or her spouse) with respect to the shares set forth in the following table.

Unless otherwise indicated, option and restricted stock amounts outstanding on May 2, 2000 (the record date with respect to the distribution of Agilent shares) have been adjusted in order to restore their intrinsic value for the impact of HP's common stock market value from the Agilent Technologies, Inc. spin-off. Holders of options that were exercised and shares of restricted stock that were released prior to May 2, 2000 received shares of Agilent Technologies in connection with the spin-off. All share, option, restricted stock and restricted stock unit amounts have also been adjusted to reflect the two-for-one stock split in the form of a stock dividend effective October 27, 2000.

| Name and Address of Beneficial Owner |

Amount and Nature of Beneficial Ownership(1)(2) |

Percent of Class |

|||||

|---|---|---|---|---|---|---|---|

| The David and Lucile Packard Foundation (the "Packard Foundation")(3) 300 Second Street, Suite 200 Los Altos, CA 94022 |

201,279,656 | 10.4 | % | ||||

The Packard Humanities Institute ("PHI")(4) 300 Second Street, Suite 201 Los Altos, CA 94022 |

25,760,000 |

1.3 |

% |

||||

Susan P. Orr(5) |

948 4,836,736 4,837,684 |

Direct Indirect(6) |

(1) |

||||

18

| Name and Address of Beneficial Owner |

Amount and Nature of Beneficial Ownership(1)(2) |

Percent of Class |

|||||

|---|---|---|---|---|---|---|---|

| The William R. Hewlett Revocable Trust dated February 3, 1995 (the "Hewlett Trust")(7) 1501 Page Mill Road Palo Alto, CA 94304 |

106,724,882 | 5.5 | % | ||||

William R. Hewlett, Co-founder, Director Emeritus 1501 Page Mill Rd. Palo Alto, CA 94304 |

3,453,184 2,173,412 5,626,596 |

Direct(8) Indirect(8)(9) |

(1) |

||||

The William and Flora Hewlett Foundation (the "Hewlett Foundation")(10) 525 Middlefield Road, Suite 200 Menlo Park, CA 94025 |

1,121,053 |

* |

|||||

Walter B. Hewlett(11) |

401,896 20,198 20,980 443,074 |

Direct Vested Options Indirect(8)(12) |

(1) |

||||

Edwin E. van Bronkhorst(13) 1501 Page Mill Road Palo Alto, CA 94304 |

176 2,000,400 2,000,576 |

Direct Indirect(8)(14) |

(1) |

||||

All Other Directors and Named Executive Officers Not Listed Above: |

|||||||

Phillip M. Condit |

6,520 |

Direct |

* |

||||

Patricia C. Dunn |

16,953 |

Direct |

* |

||||

Carleton S. Fiorina |

495,446 383,952 879,398 |

Direct Vested Options |

* |

||||

Sam Ginn |

6,664 6,232 12,896 |

Direct Vested Options |

* |

||||

Richard A. Hackborn |

15,374 |

Direct(10) |

* |

||||

George A. Keyworth II |

8,080 10,098 18,178 |

Direct Vested Options |

* |

||||

Robert E. Knowling, Jr |

4,000 |

* |

|||||

19

| Name and Address of Beneficial Owner |

Amount and Nature of Beneficial Ownership(1)(2) |

Percent of Class |

||||

|---|---|---|---|---|---|---|

Ann Livermore |

230,055 288,345 518,400 |

Direct Vested Options |

* |

|||

Antonio M. Perez |

146,960 161,261 308,221 |

Direct Vested Options |

* |

|||

Carolyn M. Ticknor |

166,362 310,357 1,400 478,119 |

Direct Vested Options Indirect(15) |

* |

|||

Robert P. Wayman |

333,141 803,082 120 1,136,343 |

Direct Vested Options Indirect(16) |

* |

|||

Duane Zitzner |

167,070 327,315 494,385 |

Direct Vested Options |

* |

|||

| All Current Directors and Executive Officers as a Group ( persons) | (17)(18) | |||||

20

21

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires our directors, executive officers and holders of more than 10% of our common stock to file with the Securities and Exchange Commission reports regarding their ownership and changes in ownership of our securities. HP believes that, during fiscal year 2000, its directors, executive officers and 10% shareowners complied with all Section 16(a) filing requirements with the following exceptions: two late reports for Carleton Fiorina relating to restricted stock units; a late report for Pradeep Jotwani regarding a surrendered share certificate; a late report for Bill Russell regarding a grant of restricted stock; a late report for Carolyn Ticknor regarding a sale of shares held by her son; a late report for Duane Zitzner regarding a sale of shares; and a late report filed in connection with restricted stock grants to each of Philip Condit, Patricia Dunn, Richard Hackborn, Walter Hewlett and Susan Orr. In making this statement, HP has relied upon examination of the copies of Forms 3, 4 and 5 provided to the Company and the written representations of its directors, executive officers and 10% shareowners.

22

The following table discloses compensation received by HP's Chief Executive Officer during fiscal year 2000 and HP's four other most highly paid executive officers ("named executive officers") during fiscal year 2000 as well as their compensation for each of the fiscal years ending October 31, 1999 and October 31, 1998.

Unless otherwise indicated, option, restricted stock and restricted stock unit amounts outstanding on May 2, 2000 (the record date with respect to the distribution of Agilent shares) have been adjusted in order to restore their intrinsic value for the impact of HP's common stock market value from the Agilent Technologies, Inc. spin-off. Holders of options that were exercised and shares of restricted stock that were released prior to May 2, 2000 received shares of Agilent Technologies in connection with the spin-off. Although adjustments were made to the number of shares of restricted stock and restricted stock units as described above, the dollar values of restricted stock and restricted stock unit awards represent the dollar value on the date originally granted in order to reflect the intrinsic value of the compensation received at the time of grant. All option, restricted stock and restricted stock unit amounts have also been adjusted to reflect the two-for-one stock split in the form of a stock dividend effective October 27, 2000.

| |

|

|

|

|

Long Term Compensation |

|

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

Annual Compensation |

Awards |

Payouts |

|

|||||||||||

| (a) |

(b) |

(c) |

(d) |

(e) |

(f) |

(g) |

(h) |

(i) |

||||||||

| Name and Principal Position |

Year |

Salary ($) |

Bonus ($)(3) |

Other Annual Compensation ($)(4) |

Restricted Stock Award(s) ($)(5) |

Securities Underlying Options/ SARs(#) |

LTIP Payouts ($)(6) |

All Other Compensation ($)(7)(8) |

||||||||

| Carleton S. Fiorina Chairman, President and Chief Executive Officer(1) |

2000 1999 |

$1,000,000 287,933 |

$1,766,250 366,438 |

$205,113 * |

0 $65,557,400 |

1,280,042 1,535,810 |

N/A N/A |

$755,266 3,551,678 |

||||||||

| Robert P. Wayman Executive Vice President, Chief Financial Officer and Director |

2000 1999 1998 |

845,250 930,000 997,625 |

402,633 471,590 147,804 |

* * * |

41,048 4,208,840 1,289,516 |

358,576 294,362 179,176 |

$450,057 0 -674,550 |

6,885 264,384 6,491 |

||||||||

| Carolyn M. Ticknor President—Imaging and Printing Systems |

2000 1999 1998 |

613,334 603,125 629,250 |

273,900 310,773 34,612 |

* * * |

28,706 1,897,088 1,185,025 |

887,918 281,564 38,394 |

N/A N/A N/A |

6,749 9,303 6,283 |

||||||||

| Duane E. Zitzner President— Computing Systems |

2000 1999 1998 |

575,000 449,500 502,125 |

273,900 364,991 27,590 |

* * * |

26,522 1,428,002 1,270,548 |

1,015,902 255,968 31,996 |

N/A N/A N/A |

6,885 6,485 6,395 |

||||||||

| Ann M. Livermore President—Business Customer Organization |

2000 1999 1998 |

527,084 499,313 500,875 |

273,900 187,721 27,482 |

* * * |

24,540 4,713,851 1,894,901 |

785,532 255,968 38,394 |

N/A N/A N/A |

6,085 5,799 5,813 |

||||||||

| Antonio M. Perez(2) Former President— Consumer Business Organization |

2000 1999 1998 |

587,500 530,875 600,875 |

273,900 431,066 33,055 |

* * * |

25,702 1,301,374 926,250 |

375,982 217,572 30,716 |

N/A N/A N/A |

117,510 6,485 6,491 |

||||||||

23

The Pay-for-Results Plan permits the Compensation Committee to designate a portion of the annual cash compensation planned for certain executive officers as variable pay. Under the Pay-for-Results Plan, the percentage of the targeted variable amount to be paid was dependent upon the degree to which performance metrics defined on a semi-annual basis were met. In November 1999 and May 2000, the Compensation Committee established the performance metrics for the first and second halves of fiscal year 2000, respectively. These metrics varied for each participant, but at least a portion of each person's pay was dependent on company-wide revenue and net profit metrics. For the following periods in fiscal year 2000, the Compensation Committee determined that the following variable compensation for the named executive officers other than the chief executive officer had been earned:

| |

Nov. 1. 1999— Apr. 30, 2000 ($) (1st Half FY00) |

May 1—Oct 31, 2000 ($) (2nd Half FY00) |

||

|---|---|---|---|---|

| Robert P. Wayman | $402,633 | $0 | ||

| Carolyn M. Ticknor | 273,900 | 0 | ||

| Duane E. Zitzner | 273,900 | 0 | ||

| Ann M. Livermore | 273,900 | 0 | ||

| Antonio M. Perez | 273,900 | 0 |

For fiscal year 2000, pursuant to the terms of her employment contract, Ms. Fiorina was entitled to receive a minimum guaranteed bonus of $1,250,000. During the second half of fiscal year 2000, Ms. Fiorina received a prorated portion of the minimum annual guaranteed bonus, or $625,000, in accordance with normal payroll practices. Both of these amounts are reflected in this column. In light of the Company falling short of meeting its net profit objectives for the second half of fiscal year 2000, resulting in no payout to the other named executive officers and Executive Council members, Ms. Fiorina initiated a dialogue with the Compensation Committee and recommended that her guaranteed bonus for the second half of fiscal year 2000 be zero. The Compensation Committee agreed with Ms. Fiorina's recommendation and modified Ms. Fiorina's FY2001 bonus opportunity by reducing it by $625,000. In the first half of fiscal year 2000, the Compensation Committee determined that Ms. Fiorina earned a short-term bonus of $1,141,250.

During fiscal years 1999 and 1998, the cash profit-sharing plan was available to all employees of HP. Under the cash profit-sharing plan, a portion of HP's earnings for each half of its fiscal year was paid to all employees. The amount paid was based upon HP's performance as measured by return on assets and revenue growth. The amounts shown in this column which are not associated with bonuses payable under the Pay-for-Results Plan are payments pursuant to the cash profit-sharing plan.

24

| Name |

Performance-based Restricted Stock #shares ($ amount) |

Time-based Restricted Stock # shares ($ amount) |

Employment/Transition Agreement Awards # shares ($ amount) |

Employee Stock Purchase Plan # shares ($ amount) |

||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Carleton S. Fiorina | ||||||||||

| 2000 | ||||||||||

| 1999 | 1,486,336 ($65,557,400 | ) | ||||||||

| 1998 | ||||||||||

| Robert P. Wayman | ||||||||||

| 2000 | 840 ($41,048 | ) | ||||||||

| 1999 | 23,062 ($532,710 | ) | 98,148 ($3,614,754 | ) | 1,896 ($61,376 | ) | ||||

| 1998 | 51,252 ($1,235,000 | ) | 2,237 ($54,516 | ) | ||||||

| Carolyn M. Ticknor | ||||||||||

| 2000 | 589 ($28,706 | ) | ||||||||

| 1999 | 15,374 ($355,140 | ) | 40,898 ($1,506,305 | ) | 1,097 ($35,643 | ) | ||||

| 1998 | 47,408 ($1,155,175 | ) | 1,238 ($29,850 | ) | ||||||

| Duane E. Zitzner | ||||||||||

| 2000 | 543 ($26,522 | ) | ||||||||

| 1999 | 10,250 ($236,760 | ) | 31,622 ($1,164,649 | ) | 817 ($26,593 | ) | ||||

| 1998 | 51,252 ($1,247,800 | ) | 951 ($22,748 | ) | ||||||

| Ann M. Livermore | ||||||||||

| 2000 | 505 ($24,540 | ) | ||||||||

| 1999 | 17,938 ($414,330 | ) | 64,066 ($2,699,250 | ) | 42,590 ($1,568,596 | ) | 978 ($31,675 | ) | ||

| 1998 | 76,876 ($1,871,700 | ) | 966 ($23,201 | ) | ||||||

| Antonio Perez | ||||||||||

| 2000 | 516 ($25,720 | ) | ||||||||

| 1999 | 10,250 ($236,760 | ) | 28,008 ($1,031,573 | ) | 1,017 ($33,041 | ) | ||||

| 1998 | 38,438 ($926,250 | ) | 1,168 ($28,120 | ) | ||||||

As shown above, in connection with her employment as President and Chief Executive Officer, during fiscal year 1999 Ms. Fiorina received 743,168 shares of restricted stock and 743,168 shares of restricted stock units which vest annually over a three-year period with an aggregate value of $65,557,400 at the time of grant. These shares were provided in order to compensate her partially for stock and options that she forfeited upon the termination of her employment with Lucent Technologies, Inc. and are reflected in this column. Ms. Fiorina's employment arrangements are described more fully under "Employment Contracts, Termination of Employment and Change-in-Control Arrangements" below.

The performance-based restricted stock shown above will vest only to the extent that HP achieves stated performance goals with respect to earnings per share and return on assets over a three-year period ending October 31, 2002, and 2001 for the performance-based restricted stock granted in fiscal years 1999 and 1998, respectively, and vests at the end of the three-year period. The time-based restricted shares granted to each of Ms. Ticknor, Mr. Zitzner, Ms. Livermore and Mr. Perez is not subject to performance-based goals and vests at the end of a three-year period. The employment/transition agreement awards granted to Mr. Wayman, Ms. Ticknor, Mr. Zitzner, Ms. Livermore and Mr. Perez in 1999 were based on a Transition Agreement with each named executive officer, as described more fully in "Employment Contracts, Termination of Employment and Change-in-Control Arrangements." The amounts set forth above for restricted stock awards (other than for the ESPP) are based on the average stock price for HP common stock on the date of grant.

The ESPP is a broad-based plan which is available to all HP employees. Under the terms of the ESPP in effect during the fiscal years shown, matching shares were provided that vest two years after HP's

25

contributions, which occur on a rolling fiscal quarter basis, and are subject to forfeiture during the two-year period in the event of termination or certain other events. The named executive officers receive non-preferential dividends on these restricted shares. The ESPP was replaced with a new ESPP effective November 1, 2000 that will not provide matching shares in the future.

At the end of fiscal year 2000, the aggregate share amount and dollar value of the restricted stock (and, in the case of Ms. Fiorina, restricted stock units) held by the named executive officers was as follows:

| |

Number of Shares |

$ Value |

||

|---|---|---|---|---|

| Carleton S. Fiorina | 1,244,278 | $57,858,927 | ||

| Robert P. Wayman | 77,052 | 3,582,918 | ||

| Carolyn M. Ticknor | 136,116 | 6,329,394 | ||

| Duane E. Zitzner | 112,424 | 5,227,716 | ||

| Ann M. Livermore | 213,204 | 9,913,986 | ||

| Antonio Perez | 111,544 | 5,186,796 |

In November 1999, the Compensation Committee reviewed the results for the three-year performance period ended October 31, 1999 and determined that the performance objectives associated with performance-based restricted stock granted in fiscal year 1997 had been met at target. Therefore, no adjustments to the stock grants were made and the amount in the LTIP Payouts column is correspondingly $0.

In November 1998, the Compensation Committee reviewed the results for the three-year performance period ended October 31, 1998 and determined that the performance objectives associated with performance-based restricted stock granted in fiscal year 1996 had not been met at target. Therefore, Mr. Wayman was required to forfeit 75% of the performance-based restricted stock granted to him in 1996. The value of the forfeiture is reflected in the table above as a negative LTIP pay-out in fiscal year 1998 based upon the value of HP stock as of the date of the grant in fiscal year 1996.

26

| Name |

401(k) (TAXCAP) |

Term-Life Insurance Payment |

Accrued Sick Leave Payment for Discontinued Plan |

||||

|---|---|---|---|---|---|---|---|

| Carleton S. Fiorina | |||||||

| 2000 | $6,000 | $85 | |||||

| 1999 | 0 | 24 | N/A | ||||

| Robert P. Wayman | |||||||

| 2000 | 6,800 | 85 | |||||

| 1999 | 6,400 | 85 | $257,899 | ||||

| 1998 | 6,400 | 91 | |||||

| Carolyn M. Ticknor | |||||||

| 2000 | 6,664 | 85 | |||||

| 1999 | 6,400 | 85 | 2,818 | ||||

| 1998 | 6,192 | 91 | |||||

| Duane E. Zitzner | |||||||

| 2000 | 6,800 | 85 | |||||

| 1999 | 6,400 | 85 | N/A | ||||

| 1998 | 6,296 | 91 | |||||

| Ann M. Livermore | |||||||

| 2000 | 6,000 | 85 | |||||

| 1999 | 5,714 | 85 | 0 | ||||

| 1998 | 5,714 | 91 | |||||

| Antonio M. Perez | |||||||

| 2000 | 6,800 | 85 | |||||

| 1999 | 6,400 | 85 | 0 | ||||

| 1998 | 6,400 | 91 | |||||

For Ms. Fiorina, this column also includes a sign-on bonus of $3,000,000 payable in fiscal year 1999 and the following company-sponsored relocation expenses: $218,104 fiscal 2000 relocation tax reimbursement, $203,520 fiscal 2000 mortgage assistance, $327,557 other fiscal 2000 relocation expenses, $187,500 fiscal 1999 relocation allowance, $156,257 fiscal 1999 relocation tax reimbursement, $36,343 fiscal 1999 mortgage assistance and $171,554 other fiscal 1999 relocation expenses. For Mr. Perez, the balance of this column for fiscal 2000 consists of payments in connection with his retirement.

27

OPTION GRANTS IN LAST FISCAL YEAR

The following table provides information on option grants in fiscal 2000 to each of the named executive officers. HP did not grant any stock appreciation rights to the named executive officers during fiscal year 2000.

| Name |

Number of Securities Underlying Options Granted(1)(2)(3) |

% of Total Options Granted to Employees in Fiscal Year(3)(4) |

Exercise Price ($/Share)(3)(5) |

Market Value on Grant Date (If different than exercise price)(3) |

Expiration Date |

Grant Date Present Value ($)(6) |

||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Carleton S. Fiorina | 1,279,842 200 |

1.5 | % | $53.81 59.58 |

April 2010 June 2010 |

$28,669,872 4,961 |

||||||

| Robert P. Wayman | 204,774 25,618 127,984 200 |

0.4 | % | 35.13 26.35 53.81 59.58 |

$35.13 |

Nov. 2010 Nov. 2010 Apr. 2010 June 2010 |

2,994,742 374,653 2,866,983 4,961 |

|||||

| Carolyn M. Ticknor | 358,354 17,428 511,936 200 |

1.0 | % | 35.13 26.35 53.81 59.58 |

35.13 |

Nov. 2010 Nov. 2010 Apr. 2010 June 2010 |

5,240,791 254,878 11,467,931 4,961 |

|||||

| Duane E. Zitzner | 358,354 17,428 639,920 200 |

1.2 | % | 35.13 26.35 53.81 59.58 |

35.13 |

Nov. 2010 Nov. 2010 Apr. 2010 June 2010 |

5,240,791 254,878 14,334,914 4,961 |

|||||

| Ann M. Livermore | 255,968 17,428 511,936 200 |

0.9 | % | 35.13 26.35 53.81 59.58 |

35.13 |

Nov. 2010 Nov. 2010 Apr. 2010 June 2010 |

3,743,434 254,878 11,467,931 4,961 |

|||||

| Antonio Perez | 358,354 17,428 200 |

0.4 | % | 35.13 26.35 59.58 |

35.13 |

Nov. 2010 Nov. 2010 June 2010 |

5,240,791 254,878 4,961 |

28

29

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR AND

FISCAL YEAR-END OPTION VALUES

The following table provides information on option exercises in fiscal 2000 by each of the named executive officers and the values of each of such officer's unexercised options at October 31, 2000. There were no stock appreciation rights exercised or outstanding.

| |

Number of Shares Acquired on Exercise(1) |

|

Number of Securities Underlying Unexercised Options at Fiscal Year-End(1)(2)(3) |

|

|

|||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

Value of Unexercised In-the- Money Options at Fiscal Year-End(3) |

||||||||||

| |

Value Realized |

|||||||||||

| Name |

Exercisable |

Unexercisable |

Exercisable |

Unexercisable |

||||||||

| Carleton S. Fiorina | 0 | $0 | 383,952 | 2,431,900 | $898,449 | $2,695,323 | ||||||

| Robert P. Wayman | 387,794 | 19,041,884 | 604,708 | 697,732 | 18,388,651 | 10,759,120 | ||||||

| Carolyn M. Ticknor | 30,716 | 1,397,824 | 127,982 | 1,131,086 | 3,072,783 | 10,125,860 | ||||||

| Duane E. Zitzner | 40,510 | 2,203,095 | 159,017 | 1,230,595 | 4,580,806 | 9,447,559 | ||||||

| Ann M. Livermore | 26,874 | 1,592,640 | 144,364 | 1,003,104 | 3,725,586 | 8,346,179 | ||||||

| Antonio Perez | 131,818 | 4,922,503 | 2 | 564,118 | 50 | 8,834,960 | ||||||

30

EMPLOYMENT CONTRACTS, TERMINATION OF EMPLOYMENT

AND CHANGE-IN-CONTROL ARRANGEMENTS

HP entered into an employment agreement with Ms. Fiorina, President and Chief Executive Officer of HP, as of July 17, 1999. The agreement provides for an initial base salary of $1,000,000 per year. It also provides for a targeted annual incentive award of $1,250,000 per year, with an opportunity to earn up to an additional $2,500,000 per year in annual variable compensation. This variable pay is guaranteed at target for the 2000 fiscal year and was prorated at the target level for the portion of the 1999 fiscal year during which Ms. Fiorina was employed. Ms. Fiorina is entitled to participate at a level commensurate with her position in all HP employee benefit programs and equity plans and is also entitled to all perquisites that other senior executives are entitled to receive and as are otherwise suitable to her position.

In accordance with her employment agreement, Ms. Fiorina was also granted HP restricted stock, HP restricted stock units and HP non-qualified stock options in order to compensate her for stock and options that she forfeited upon the termination of her employment with Lucent Technologies and that were scheduled to vest in the short-term. Details of these grants follow:

1. Ms. Fiorina was granted 743,168 shares (as adjusted to reflect the distribution of shares of Agilent Technologies and the two-for-one stock split) of HP restricted stock. Subject to earlier vesting, as described below, and continued employment, the restricted stock vests one-third per year on each anniversary date of employment.

2. Ms. Fiorina was also granted 743,168 shares (on an adjusted basis) of HP restricted stock units. Subject to earlier vesting, as described below, and continued employment, the restricted stock units vest one-third per year on each anniversary date of employment. Payment of the restricted stock units will occur on the first to occur of the fifth anniversary of employment, the date of any termination of employment or a change of control of HP, whether by merger or asset sale or acquisition of 35% or more of HP's voting securities.

3. Ms. Fiorina was granted an option to purchase, within 10 years, 1,535,810 shares (on an adjusted basis) of HP common stock at a purchase price of $44.16 per share (on an adjusted basis). Subject to earlier vesting, as described below, and continued employment, such options will vest as to 25% of the shares on each anniversary of employment.