|

|

|

|

|

Previous: MINNESOTA MINING & MANUFACTURING CO, S-8, EX-24, 2000-08-29 |

Next: PRUDENTIAL MONEYMART ASSETS INC, NSAR-A, 2000-08-29 |

| Page |

||

|---|---|---|

| To Our Shareholders | 2-11 | |

| Statement of Assets and Liabilities as of June 30, 2000 | 12 | |

| MML Equity Fund | ||

| MML Money Market Fund | ||

| MML Managed Bond Fund | ||

| MML Blend Fund | ||

| Statement of Operations For the Six Months Ended June 30, 2000 | 13 | |

| MML Equity Fund | ||

| MML Money Market Fund | ||

| MML Managed Bond Fund | ||

| MML Blend Fund | ||

|

Statement of Changes in Net Assets For the Six Months Ended June 30, 2000 and For the Year Ended

December 31, 1999 |

14 | |

| MML Equity Fund | ||

| MML Money Market Fund | ||

| MML Managed Bond Fund | ||

| MML Blend Fund | ||

| Financial Highlights | ||

| MML Equity Fund | 15 | |

| MML Money Market Fund | 16 | |

| MML Managed Bond Fund | 17 | |

| MML Blend Fund | 18 | |

| Schedule of Investments as of June 30, 2000 | ||

| MML Equity Fund | 19-20 | |

| MML Money Market Fund | 21 | |

| MML Managed Bond Fund | 22-24 | |

| MML Blend Fund | 25-29 | |

| Notes to Financial Statements | 30-35 | |

| MML Series Investment Fund – Letter to Shareholders

|

| |

| MassMutual Expands Fund Offerings

|

| I’d like to announce some exciting additions to the MML Series Investment Fund. Through our comprehensive due diligence

process, we’ve uncovered significant investor demand for a number of fund types and managers that were not previously addressed by our selections. As a result, we’ve added three new funds, listed as follows, with their managers (sub-advisers) in

parentheses: Large Cap Value (Davis Selected Advisers), OTC 100 (Deutsche Asset Management/Bankers Trust Company), and Emerging Growth (RS Investment Management). These new choices span a broad range of investment styles and market sectors—value vs.

growth, active vs. indexed, and large-cap vs. emerging growth. All of our new managers have produced excellent long-term track records, and have passed through our extensive selection process. We will continue to monitor all of our funds carefully so that

you can be assured of access to top-flight investment management talent.

|

| MML Equity Fund

|

Ÿ

|

achieve high total returns over the long term while minimizing risk

|

Ÿ

|

invest in a diversified portfolio of equity securities of larger, well-established companies (generally companies with market

capitalization over $2.0 billion)

|

Ÿ

|

utilize a value-oriented strategy in making investment decisions

|

Ÿ

|

utilize Fundamental analysis to identify companies which

|

| -are of high investment quality

|

| -offer above-average dividend growth potential

|

| -are attractively valued in the marketplace

|

| MML Equity Fund (Continued)

|

What are some examples of stocks you bought and sold?

Alcatel, a European telecommunications equipment manufacturer, was an example of a recent purchase that contributed positively to performance. The company stands to reap substantial benefits from the ongoing expansion of the Internet’s infrastructure in Europe. Liberty Media Group, the video programming arm of AT&T, was also an addition, joining the Fund’s 10 largest holdings. Headed by media titan John Malone, this company has both profitable established lines of business and a track record of creating promising startup media companies. News Corp., Radio Shack, and Micron Technology are some other recent purchases.On the sell side, we liquidated or reduced positions in Albertson’s, Engelhard, Illinois Tool Works, Crown, Cork & Seal, and Delphi, among others. It made little sense to us to own a stock like Albertson’s given that the company’s business lies directly in the path of expansion of a retail juggernaut like Wal-Mart. Delphi exemplified a company whose earnings appeared better than they really were. As a former subsidiary of General Motors, Delphi is obliged to plow a significant portion of its earnings back into supporting the subcontracting business of GM.

What is your outlook?

The consensus view at the end of the period was that the Fed was finished raising interest rates for the time being. We are not entirely comfortable with this view. While the recent numbers on consumer spending and other data indicate that an economic slowdown might be starting, we believe that those numbers were influenced in part by a seasonal shortage of cash in the second quarter due to income tax payments. The pattern during the past few years has been for spending to pick up again in the third quarter. Consequently, we have positioned the Fund defensively as a precaution against more rate hikes later in 2000. We are comfortable with most of the Fund’s holdings and sector weightings roughly as they are, and we anticipate much lower turnover in the second half of the year.

| Year to

Date |

One Year | Five Year | Ten Year | ||||||

|---|---|---|---|---|---|---|---|---|---|

| 1/1/00 -

6/30/00 |

7/1/99 -

6/30/00 |

Average

Annual 7/1/95 - 6/30/00 |

Average

Annual 6/30/90 - 6/30/00 |

||||||

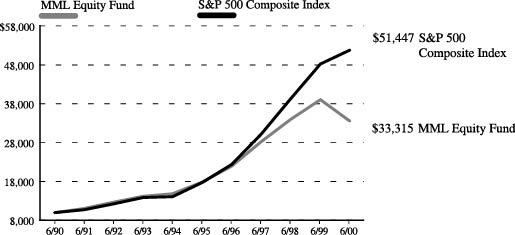

| MML Equity Fund | -4.17% | -14.22% | 13.33% | 12.78% | |||||

| S&P’s 500

Composite Index |

-0.42% | 7.25% | 23.81% | 17.80% | |||||

| The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the

Fund, when redeemed, may be worth more or less than their original cost. Investors should note that the Fund is a professionally managed mutual fund, while the S&P’s 500 Composite Index is unmanaged and does not incur expenses, and cannot be

purchased directly by investors. The Fund’s return reflects changes in the net asset value per share without the deduction of any product charges. The inclusion of these charges would have reduced the performance shown here. Past performance is no

indication of future results.

|

| MML Money Market Fund

|

Ÿ maximize current income to the extent consistent with

liquidity and the preservation of capital

Ÿ invest in a diversified portfolio of money market instruments

Ÿ invest in high quality debt instruments with remaining maturity not to exceed 397 days

| MML Money Market Fund (Continued)

|

| MML Money Market Fund (Continued)

|

| MML Series Investment Fund | |||||||||

|---|---|---|---|---|---|---|---|---|---|

|

Total Return

|

Year to

Date |

One Year | Five Year | Ten Year | |||||

| 1/1/00 -

6/30/00 |

7/1/99 -

6/30/00 |

Average

Annual 7/1/95 - 6/30/00 |

Average

Annual 6/30/90 - 6/30/00 |

||||||

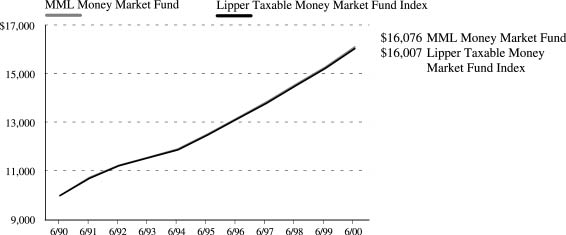

| MML Money

Market Fund |

2.82% | 5.38% | 5.14% | 4.86% | |||||

| |

|||||||||

| Lipper Taxable Money

Market Fund Index |

2.80% | 5.33% | 5.11% | 4.80% | |||||

| The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the

Fund, when redeemed, may be worth more or less than their original cost. Investors should note that the Fund is a professionally managed mutual fund, while the Lipper Taxable Money Market Fund Index is unmanaged and does not incur expenses, and cannot be

purchased directly by investors. The Fund’s return reflects changes in the net asset value per share without the deduction of any product charges. The inclusion of these charges would have reduced the performance shown here. Past performance is no

indication of future results.

|

| MML Managed Bond Fund

|

Ÿ

|

achieve a high total return consistent with prudent investment risk and the preservation of capital

|

Ÿ

|

invest primarily in a diversified portfolio of investment grade, fixed income securities

|

Ÿ

|

maintain duration in a targeted range from four to seven years

|

Ÿ

|

diversify investments by industry, sector, maturity, issuer class, and quality sectors to reduce risk of capital erosion

|

| MML Managed Bond Fund (Continued)

|

| MML Series Investment Fund

Total Return

|

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| Year to

Date |

One Year | Five Year | Ten Year | ||||||

| 1/1/00 -

6/30/00 |

7/1/99 -

6/30/00 |

Average

Annual 7/1/95 - 6/30/00 |

Average

Annual 6/30/90 - 6/30/00 |

||||||

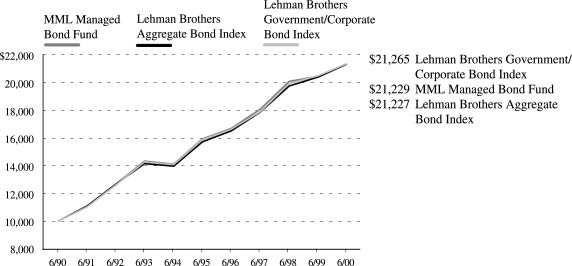

| MML Managed

Bond Fund |

4.12% | 4.24% | 5.97% | 7.81% | |||||

| |

|||||||||

| Lehman Brothers

Aggregate Bond Index |

3.99% | 4.56% | 6.25% | 7.82% | |||||

| MML Blend Fund

|

Ÿ

|

achieve a high total rate of return over an extended period of time consistent with the preservation of capital values

|

Ÿ

|

invest in a diversified portfolio of equity securities, fixed-income securities and money market instruments

|

Ÿ

|

manage the allocation of investments, under normal circumstances, in three sectors with the following ranges:

|

| Money Market segment at least 25% of net assets

|

| Bond segment no more than 50% of net assets

|

| Equity segment no more than 90% of net assets

|

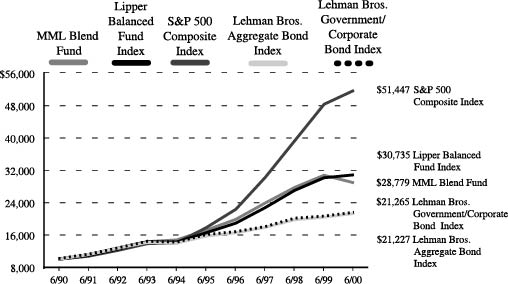

While the Fund’s absolute return was disappointing, relative performance improved markedly from the previous period. For the six months ended June 30, 2000, the Fund’s shares returned -0.51%, about in line with the -0.12% return of the Lipper Balanced Fund Index, an unmanaged index of stock and bond portfolios. A modest gain in the Fund’s bond portfolio was offset by a negative return on the equity side. The Fund’s return reflects changes in the net asset value per share without the deduction of any product charges. The inclusion of these charges would have reduced the performance shown here. Past performance is no indication of future results.

What was the Fund's asset allocation strategy during the period?

We increased the Fund’s equity allocation twice—once in March and once in April. We felt that the correction in stocks created some attractive values and tried to position the Fund to take advantage of them. On the other hand, we decreased the Fund’s bond allocation in April and June. Continued upward pressure on interest rates and a still-vibrant U.S. economy contributed to our decision to de-emphasize the bond portion of the portfolio. At the end of the period, our target allocations of stocks, bonds, and money market securities were 57.0%, 27.5%, and 15.5%, respectively.| MML Blend Fund (Continued)

|

| MML Blend Fund (Continued)

|

| Growth of a $10,000 Investment

|

| Year to

Date |

One Year | Five Year | Ten Year | ||||||

|---|---|---|---|---|---|---|---|---|---|

| 1/1/00 -

6/30/00 |

7/1/99 -

6/30/00 |

Average

Annual 7/1/95 - 6/30/00 |

Average

Annual 6/30/90 - 6/30/00 |

||||||

| MML

Blend Fund |

-0.51% | -6.06% | 10.99% | 11.14% | |||||

| Lipper Balanced

Fund Index |

-0.12% | 2.51% | 13.35% | 11.88% | |||||

| S&P’s 500

Composite Index |

-0.42% | 7.25% | 23.81% | 17.80% | |||||

| Lehman Brothers

Aggregate Bond Index |

3.99% | 4.56% | 6.25% | 7.82% | |||||

| The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the

Fund, when redeemed, may be worth more or less than their original cost. Investors should note that the Fund is a professionally managed mutual fund, while the Lipper Balanced Fund Index, the Lehman Brothers Aggregate Bond Index, and the S&P’s

500 Composite Index are unmanaged and do not incur expenses, and cannot be purchased directly by investors. The Fund’s return reflects changes in the net asset value per share without the deduction of any product charges. The inclusion of these

charges would have reduced the performance shown here. Past performance is no indication of future results.

|

| MML

Equity Fund |

MML

Money Market Fund |

MML

Managed Bond Fund |

MML

Blend Fund |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

| ASSETS: | ||||||||||

| Investments, at value (cost $1,620,159,861, $0, $210,760,246, $1,467,227,018) (Note 2) | $ 2,252,311,156 | $ - | $ 205,241,674 | $ 1,912,872,565 | ||||||

| Short-term investments, at amortized cost (Note 2) | 50,016,610 | 181,570,068 | 15,837,760 | 257,380,103 | ||||||

| Total investments | 2,302,327,766 | 181,570,068 | 221,079,434 | 2,170,252,668 | ||||||

| Cash | - | 639 | 4,672 | 50,314 | ||||||

| Receivables from: | ||||||||||

| Investments sold | 27,725,155 | - | 1,025,503 | 28,456,537 | ||||||

| Interest and dividends | 2,868,342 | 792 | 2,736,502 | 8,884,434 | ||||||

| Foreign taxes withheld | 64,390 | - | - | 40,434 | ||||||

| Total assets | 2,332,985,653 | 181,571,499 | 224,846,111 | 2,207,684,387 | ||||||

| LIABILITIES: | ||||||||||

| Payables for: | ||||||||||

| Investments purchased | 18,182,949 | - | - | 11,495,439 | ||||||

| Securities on loan (Note 2) | 50,016,610 | - | 11,606,171 | 107,727,822 | ||||||

| Dividends payable (Note 2) | - | 948,361 | - | - | ||||||

| Directors’ fees and expenses (Note 3) | 1,410 | 811 | 819 | 1,227 | ||||||

| Affiliates (Note 3): | ||||||||||

| Investment management fees | 711,843 | 73,148 | 82,945 | 657,352 | ||||||

| Due to Custodian | 9,225,213 | - | - | - | ||||||

| Accrued expenses and other liabilities | 15,335 | 23,652 | 9,403 | 29,431 | ||||||

| Total liabilities | 78,153,360 | 1,045,972 | 11,699,338 | 119,911,271 | ||||||

| NET ASSETS | $ 2,254,832,293 | $ 180,525,527 | $ 213,146,773 | $ 2,087,773,116 | ||||||

| Net assets consist of: | ||||||||||

| Paid-in capital | $ 1,382,598,351 | $ 180,523,437 | $ 219,448,946 | $ 1,461,678,548 | ||||||

| Undistributed net investment income | 21,616,248 | 16,538 | 3,570,196 | 18,169,858 | ||||||

| Accumulated net realized gain (loss) on investments | 218,466,399 | (14,448 | ) | (4,353,797 | ) | 162,279,163 | ||||

| Net unrealized appreciation (depreciation) on investments | 632,151,295 | - | (5,518,572 | ) | 445,645,547 | |||||

| $ 2,254,832,293 | $ 180,525,527 | $ 213,146,773 | $ 2,087,773,116 | |||||||

| Shares outstanding: | 64,366,795 | 180,525,527 | 17,942,587 | 90,108,842 | ||||||

| Net asset value, offering price and redemption price per share: | $ 35.03 | $ 1.00 | $ 11.88 | $ 23.17 | ||||||

| MML

Equity Fund |

MML

Money Market Fund |

MML

Managed Bond Fund |

MML

Blend Fund |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Investment income: (Note 2) | |||||||||||

| Dividends (net of withholding tax of $126,579, $0, $0, $78,304) | $ 25,388,511 | $ - | $ - | $ 15,074,899 | |||||||

| Interest (including securities lending income of $18,895, $0, $6,195, $25,409) | 804,531 | 5,850,581 | 7,936,994 | 29,699,488 | |||||||

| Total investment income | 26,193,042 | 5,850,581 | 7,936,994 | 44,774,387 | |||||||

| Expenses: (Note 3) | |||||||||||

| Investment management fees (Note 3) | 4,520,975 | 456,229 | 529,767 | 4,324,395 | |||||||

| Custody fees | 56,150 | 6,989 | - | 58,926 | |||||||

| Audit and legal fees | 47,250 | 11,491 | 12,389 | 44,205 | |||||||

| Directors’ fees (Note 3) | 8,419 | 7,915 | 7,921 | 8,450 | |||||||

| Other expenses | 2,730 | 2,730 | - | 2,820 | |||||||

| Total expenses | 4,635,524 | 485,354 | 550,077 | 4,438,796 | |||||||

| Net investment income | 21,557,518 | 5,365,227 | 7,386,917 | 40,335,591 | |||||||

| Realized and unrealized gain (loss): | |||||||||||

| Net realized gain (loss) on investments | 218,466,399 | - | (2,366,261 | ) | 162,473,031 | ||||||

| Net change in unrealized appreciation (depreciation) on investments | (362,291,737 | ) | - | 3,973,770 | (225,642,995 | ) | |||||

| Net realized and unrealized gain (loss) | (143,825,338 | ) | - | 1,607,509 | (63,169,964 | ) | |||||

| Net increase (decrease) in net assets resulting from operations | $(122,267,820 | ) | $ 5,365,227 | $ 8,994,426 | $ (22,834,373 | ) | |||||

| Six months ended June 30, 2000 (Unaudited) |

Year ended December 31, 1999 |

|||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| MML

Equity Fund |

MML

Money Market Fund |

MML

Managed Bond Fund |

MML

Blend Fund |

MML

Equity Fund |

MML

Money Market Fund |

MML

Managed Bond Fund |

MML

Blend Fund |

|||||||||||||||||

| Increase (Decrease) in Net Assets: | ||||||||||||||||||||||||

| Operations: | ||||||||||||||||||||||||

| Net investment income | $ 21,557,518 | $ 5,365,227 | $ 7,386,917 | $ 40,335,591 | $ 53,666,623 | $ 8,721,660 | $ 15,791,736 | $ 96,536,711 | ||||||||||||||||

| Net realized gain (loss) on

investment transactions |

218,466,399 | - | (2,366,261 | ) | 162,473,031 | 32,212,209 | (2,451 | ) | (1,987,536 | ) | 49,460,859 | |||||||||||||

| Net change in unrealized

appreciation (depreciation) on investments |

(362,291,737 | ) | - | 3,973,770 | (225,642,995 | ) | (199,732,667 | ) | - | (18,606,086 | ) | (178,772,580 | ) | |||||||||||

| Net increase (decrease) in net

assets resulting from operations |

(122,267,820 | ) | 5,365,227 | 8,994,426 | (22,834,373 | ) | (113,853,835 | ) | 8,719,209 | (4,801,886 | ) | (32,775,010 | ) | |||||||||||

| Distributions to shareholders:

(Note 2) |

||||||||||||||||||||||||

| From net investment income: | - | (5,365,227 | ) | (3,866,691 | ) | (22,216,285 | ) | (53,615,000 | ) | (8,719,209 | ) | (15,861,796 | ) | (96,568,344 | ) | |||||||||

| From net realized gains: | - | - | - | (193,868 | ) | (32,524,676 | ) | - | - | (49,654,848 | ) | |||||||||||||

| - | (5,365,227 | ) | (3,866,691 | ) | (22,410,153 | ) | (86,139,676 | ) | (8,719,209 | ) | (15,861,796 | ) | (146,223,192 | ) | ||||||||||

| Net fund share transactions (Note 5) | (371,055,220 | ) | (20,044,384 | ) | (31,890,524 | ) | (503,303,194 | ) | 10,041,380 | 22,136,154 | 6,464,564 | 630,128 | ||||||||||||

| Total increase (decrease) in net

assets |

(493,323,040 | ) | (20,044,384 | ) | (26,762,789 | ) | (548,547,720 | ) | (189,952,131 | ) | 22,136,154 | (14,199,118 | ) | (178,368,074 | ) | |||||||||

| NET ASSETS: | ||||||||||||||||||||||||

| Beginning of period | 2,748,155,333 | 200,569,911 | 239,909,562 | 2,636,320,836 | 2,938,107,464 | 178,433,757 | 254,108,680 | 2,814,688,910 | ||||||||||||||||

| End of period | $ 2,254,832,293 | $ 180,525,527 | $ 213,146,773 | $ 2,087,773,116 | $ 2,748,155,333 | $ 200,569,911 | $ 239,909,562 | $ 2,636,320,836 | ||||||||||||||||

| Undistributed net investment

income included in net assets at end of period |

$ 21,616,248 | $ 16,538 | $ 3,570,196 | $ 18,169,858 | $ 58,730 | $ 16,538 | $ 49,970 | $ 50,552 | ||||||||||||||||

| *

|

Annualized

|

**

|

Percentage represents results for the period and are not annualized.

|

@

|

Total return information shown in the Financial Highlights tables does not reflect expenses that apply at the separate account level or to

related insurance products. Inclusion of these charges would reduce the total return figures for all periods shown.

|

*

|

Annualized

|

**

|

Percentage represents results for the period and are not annualized.

|

@

|

Total return information shown in the Financial Highlights tables does not reflect expenses that apply at the separate account level or to

related insurance products. Inclusion of these charges would reduce the total return figures for all periods shown.

|

*

|

Annualized

|

**

|

Percentage represents results for the period and are not annualized.

|

@

|

Total return information shown in the Financial Highlights tables does not reflect expenses that apply at the separate account level or to

related insurance products. Inclusion of these charges would reduce the total return figures for all periods shown.

|

*

|

Annualized

|

**

|

Percentage represents results for the period and are not annualized.

|

***

|

Distribution from net realized gains was less that $0.01 per share.

|

| @

|

Total return information shown in the Financial Highlights tables does not reflect expenses that apply at the separate account level or to

related insurance products. Inclusion of these charges would reduce the total return figures for all periods shown.

|

| Number

of Shares |

Market Value |

|||

|---|---|---|---|---|

| EQUITIES - 99.9% | ||||

| Aerospace & Defense - 6.5% | ||||

| Boeing Co. | 1,755,000 | $ 73,380,937 | ||

| Honeywell International, Inc. | 1,301,625 | 43,848,492 | ||

| TRW, Inc. | 700,000 | 30,362,500 | ||

| 147,591,929 | ||||

| Automotive & Parts - 2.3% | ||||

| Ford Motor Company | 500,000 | 21,500,000 | ||

| General Motors Corp. | 504,900 | 29,315,756 | ||

| Visteon Corp.* | 65,467 | 793,783 | ||

| 51,609,539 | ||||

| Banking, Savings & Loans - 7.1% | ||||

| The Bank of New York

Company, Incorporated |

1,320,000 | 61,380,000 | ||

| Chase Manhattan Corp. | 378,000 | 17,411,625 | ||

| Fleet Boston Financial Corp. | 609,953 | 20,738,402 | ||

| Wachovia Corp. | 544,300 | 29,528,275 | ||

| Wells Fargo & Company | 782,000 | 30,302,500 | ||

| 159,360,802 | ||||

| Beverages - 1.1% | ||||

| Brown-Forman Corporation

Cl. B |

463,000 | 24,886,250 | ||

| Broadcasting, Publishing & Printing - 3.7% | ||||

| The McGraw-Hill

Companies, Inc. |

1,000,000 | 54,000,000 | ||

| News Corporation Limited

Sponsored† |

527,200 | 28,732,400 | ||

| 82,732,400 | ||||

| Chemicals - 2.1% | ||||

| Rohm & Haas Company | 1,385,900 | 47,813,550 | ||

| Communications - 6.3% | ||||

| Alcatel SA Sponsored† | 374,300 | 24,890,950 | ||

| GTE Corporation | 946,800 | 58,938,300 | ||

| SBC Communications, Inc. | 1,352,824 | 58,509,638 | ||

| 142,338,888 | ||||

| Computer Integrated Systems Design - 2.1% | ||||

| Computer Sciences Corp.* | 634,400 | 47,381,750 | ||

| Number

of Shares |

Market Value |

|||

|---|---|---|---|---|

| Computers & Information - 2.3% | ||||

| Compaq Computer Corp. | 954,600 | $ 24,401,962 | ||

| Jabil Circuit, Inc.* | 540,000 | 26,797,500 | ||

| 51,199,462 | ||||

| Computers & Office Equipment - 1.2% | ||||

| International Business

Machines Corporation |

237,400 | 26,010,137 | ||

| Containers - 1.9% | ||||

| Sealed Air Corp.* | 567,400 | 29,717,575 | ||

| Temple-Inland, Inc. | 330,000 | 13,860,000 | ||

| 43,577,575 | ||||

| Cosmetics & Personal Care - 2.2% | ||||

| Kimberly-Clark Corporation | 863,400 | 49,537,575 | ||

| Electric Utilities - 2.4% | ||||

| Dominion Resources, Inc. | 840,000 | 36,015,000 | ||

| Teco Energy, Inc. | 904,700 | 18,150,544 | ||

| 54,165,544 | ||||

| Electrical Equipment & Electronics - 6.4% | ||||

| General Electric Company | 1,878,700 | 99,571,100 | ||

| Micron Technology, Inc.* | 352,500 | 31,042,032 | ||

| SCI Systems, Inc.* | 354,600 | 13,895,887 | ||

| 144,509,019 | ||||

| Energy - 12.9% | ||||

| Apache Corporation | 714,200 | 42,003,887 | ||

| BP Amoco PLC Sponsored† | 1,202,732 | 68,029,529 | ||

| Burlington Resources, Inc. | 850,000 | 32,512,500 | ||

| Chevron Corporation | 350,000 | 29,684,375 | ||

| Coastal Corp. | 398,500 | 24,258,687 | ||

| Conoco, Inc. Cl. A | 843,400 | 18,554,800 | ||

| Exxon Mobil Corp. | 726,082 | 56,997,437 | ||

| Total Fina Elf SA

Sponsored† |

235,050 | 18,054,778 | ||

| 290,095,993 | ||||

| Entertainment & Leisure - 2.5% | ||||

| AT&T - Liberty Media Group* | 2,317,900 | 56,209,075 | ||

| Number

of Shares |

Market Value |

|||

|---|---|---|---|---|

| Financial Services - 3.8% | ||||

| American Express Company | 900,000 | $ 46,912,500 | ||

| American General

Corporation |

634,900 | 38,728,900 | ||

| 85,641,400 | ||||

| Foods - 2.9% | ||||

| Bestfoods | 493,000 | 34,140,250 | ||

| General Mills, Inc. | 800,000 | 30,600,000 | ||

| 64,740,250 | ||||

| Forest Products & Paper - 0.9% | ||||

| Weyerhaeuser Company | 480,500 | 20,661,500 | ||

| Healthcare - 4.2% | ||||

| Becton, Dickinson and

Company |

1,388,600 | 39,835,463 | ||

| Schering-Plough Corp. | 1,100,000 | 55,550,000 | ||

| 95,385,463 | ||||

| Industrial - Diversified - 2.2% | ||||

| Illinois Tool Works, Inc. | 450,000 | 25,650,000 | ||

| Tyco International Ltd. | 492,808 | 23,346,779 | ||

| 48,996,779 | ||||

| Insurance - 5.1% | ||||

| The Hartford Financial

Services Group, Inc. |

745,100 | 41,679,031 | ||

| Marsh & McLennan

Companies, Inc. |

700,000 | 73,106,250 | ||

| MBIA, Inc. | 3,000 | 144,563 | ||

| 114,929,844 | ||||

| Miscellaneous - 1.4% | ||||

| Avery-Dennison Corp. | 471,600 | 31,656,180 | ||

| Pharmaceuticals - 6.5% | ||||

| American Home Products

Corporation |

750,000 | 44,062,500 | ||

| Merck & Co., Inc. | 676,800 | 51,859,800 | ||

| Pharmacia Corp. | 1,000,222 | 51,698,975 | ||

| 147,621,275 | ||||

| Restaurants - 1.6% | ||||

| McDonald’s Corp. | 1,086,900 | 35,799,769 | ||

| Number

of Shares |

Market Value |

|||||

|---|---|---|---|---|---|---|

| Retail - 2.3% | ||||||

| RadioShack Corporation | 565,200 | $ 26,776,350 | ||||

| Target Corporation | 430,000 | 24,940,000 | ||||

| 51,716,350 | ||||||

| Retail-Grocery - 1.4% | ||||||

| Albertson’s, Inc. | 938,366 | 31,200,670 | ||||

| Telephone Utilities - 1.4% | ||||||

| BellSouth Corporation | 755,100 | 32,186,138 | ||||

| Tobacco - 1.2% | ||||||

| Fortune Brands, Inc. | 1,200,000 | 27,675,000 | ||||

| Transportation - 2.0% | ||||||

| Burlington Northern

Santa Fe Corp. |

1,038,600 | 23,822,888 | ||||

| Galileo International, Inc. | 220,200 | 4,596,675 | ||||

| Norfolk Southern

Corporation |

1,120,100 | 16,661,487 | ||||

| 45,081,050 | ||||||

| TOTAL EQUITIES

(Cost $1,620,159,861) |

2,252,311,156 | |||||

| Principal

Amount |

||||||

| SHORT-TERM INVESTMENTS - 2.2% | ||||||

| Cash Equivalents | ||||||

| Bank of America Bank Note** | ||||||

| 6.670% 03/22/2001 | $ 1,071,571 | $ 1,071,571 | ||||

| Bank of Montreal Bank Note** | ||||||

| 6.630% 08/16/2000 | 1,551,234 | 1,551,234 | ||||

| Bank of Nova Scotia

Eurodollar Time Deposit** |

||||||

| 7.000% 07/03/2000 | 2,143,153 | 2,143,153 | ||||

| Credit Agricole Bank

Eurodollar Time Deposit** |

||||||

| 6.750% 07/06/2000 | 7,143,843 | 7,143,843 | ||||

|

Principal Amount |

Market Value |

|||

|---|---|---|---|---|

| Cash Equivalents (Continued) | ||||

| Credit Agricole Bank

Eurodollar Time Deposit** |

||||

| 6.750% 07/07/2000 | $ 1,071,572 | $ 1,071,572 | ||

| Den Danske Bank

Eurodollar Time Deposit** |

||||

| 6.810% 07/05/2000 | 3,929,112 | 3,929,112 | ||

| First Union Bank Note** | ||||

| 6.900% 05/09/2001 | 1,071,567 | 1,071,567 | ||

| Fleet National Bank

Eurodollar Time Deposit** |

||||

| 7.260% 10/31/2000 | 6,533,609 | 6,533,609 | ||

| HypoVereinsbank

Eurodollar Time Deposit** |

||||

| 6.750% 07/05/2000 | 8,929,802 | 8,929,802 | ||

| Merrimac Money Market

Fund** |

||||

| 6.440% 07/03/2000 | 10,715,827 | 10,715,827 | ||

| Morgan Stanley Dean

Witter & Co.** |

||||

| 6.890% 07/17/2000 | 1,569,014 | 1,569,014 | ||

| Paribas Bank Eurodollar

Time Deposit** |

||||

| 6.750% 07/05/2000 | 4,286,306 | 4,286,306 | ||

| 50,016,610 | ||||

| TOTAL SHORT-TERM INVESTMENTS | ||||

| (At Amortized Cost) | 50,016,610 | |||

| TOTAL INVESTMENTS - 102.1% | 2,302,327,766 | |||

| (Cost $1,670,176,471)*** | ||||

| Other Assets/(Liabilities) - (2.1%) | (47,495,473) | |||

| NET ASSETS - 100.0% | $2,254,832,293 | |||

*

|

Non-income producing security.

|

**

|

Represents investment of security lending collateral. (Note 2).

|

***

|

Aggregate cost for Federal tax purposes. (Note 7).

|

†

|

American Depository Receipt.

|

| Principal

Amount |

Market Value |

|||

|---|---|---|---|---|

| SHORT-TERM INVESTMENTS - 100.6% | ||||

| Commercial Paper | ||||

| Alcoa, Inc. | ||||

| 6.560% 09/21/2000 | $ 2,455,000 | $ 2,418,317 | ||

| Alcoa, Inc. | ||||

| 6.580% 09/29/2000 | 2,380,000 | 2,340,849 | ||

| American Greetings Corp. | ||||

| 6.520% 08/01/2000 | 1,460,000 | 1,451,803 | ||

| American Greetings Corp. | ||||

| 6.580% 09/18/2000 | 6,000,000 | 5,913,363 | ||

| Anheuser-Busch Companies, Inc. | ||||

| 6.120% 07/10/2000 | 4,500,000 | 4,493,115 | ||

| Anheuser-Busch Companies, Inc. | ||||

| 6.500% 09/22/2000 | 1,900,000 | 1,871,527 | ||

| Bellsouth Corporation | ||||

| 6.530% 08/11/2000 | 3,970,000 | 3,940,475 | ||

| Bemis Company, Inc. | ||||

| 6.550% 08/10/2000 | 3,725,000 | 3,697,890 | ||

| Bestfoods | ||||

| 5.980% 07/14/2000 | 4,365,000 | 4,355,574 | ||

| Campbell Soup Company | ||||

| 6.130% 07/12/2000 | 5,275,000 | 5,265,120 | ||

| Caterpillar Financial Services | ||||

| 6.120% 11/14/2000 | 7,045,000 | 6,882,120 | ||

| The Clorox Company | ||||

| 6.080% 07/10/2000 | 2,480,000 | 2,476,230 | ||

| Coca-Cola Company, The | ||||

| 6.570% 10/13/2000 | 1,950,000 | 1,912,989 | ||

| Coca-Cola Company, The | ||||

| 6.600% 09/15/2000 | 3,825,000 | 3,771,705 | ||

| Duke Energy Corporation | ||||

| 6.540% 09/08/2000 | 1,630,000 | 1,609,568 | ||

| Duke Energy Corporation | ||||

| 6.540% 09/12/2000 | 5,625,000 | 5,550,403 | ||

| E. I. du Pont de Nemours

and Company |

||||

| 5.530% 08/28/2000 | 2,520,000 | 2,497,548 | ||

| Principal

Amount |

Market Value |

|||

|---|---|---|---|---|

| E. I. du Pont de Nemours

and Company |

||||

| 6.290% 10/03/2000 | $ 2,960,000 | $ 2,911,386 | ||

| Eastman Kodak Co. | ||||

| 6.580% 08/14/2000 | 5,700,000 | 5,654,159 | ||

| Florida Power Corporation | ||||

| 6.550% 08/25/2000 | 5,915,000 | 5,855,809 | ||

| Ford Motor Credit

Corporation |

||||

| 6.570% 10/16/2000 | 4,340,000 | 4,255,251 | ||

| Fortune Brands, Inc. | ||||

| 6.100% 07/20/2000 | 7,000,000 | 6,977,464 | ||

| Gap, Inc. | ||||

| 6.540% 08/21/2000 | 4,085,000 | 4,047,153 | ||

| Gap, Inc. | ||||

| 6.580% 08/28/2000 | 3,200,000 | 3,166,077 | ||

| General Electric Capital

Corporation |

||||

| 5.820% 09/29/2000 | 1,600,000 | 1,576,720 | ||

| General Electric Capital

Corporation |

||||

| 6.150% 08/31/2000 | 2,435,000 | 2,409,625 | ||

| General Mills, Inc. | ||||

| 6.480% 07/07/2000 | 6,645,000 | 6,637,823 | ||

| General Motors Acceptance

Corporation |

||||

| 5.900% 07/21/2000 | 2,035,000 | 2,028,329 | ||

| General Motors Acceptance

Corporation |

||||

| 6.360% 08/31/2000 | 2,030,000 | 2,008,123 | ||

| General Motors Acceptance

Corporation |

||||

| 6.660% 10/05/2000 | 3,080,000 | 3,025,299 | ||

| GTE Funding Corporation | ||||

| 6.620% 07/06/2000 | 7,700,000 | 7,692,920 | ||

| Heinz (H. J.) Company | ||||

| 6.540% 08/07/2000 | 4,000,000 | 3,973,113 | ||

| Honeywell International, Inc. | ||||

| 6.530% 07/11/2000 | 5,710,000 | 5,699,643 | ||

| Principal

Amount |

Market Value |

||||||

|---|---|---|---|---|---|---|---|

| Honeywell International, Inc. | |||||||

| 6.630% 12/22/2000 | $ 1,700,000 | $ 1,645,524 | |||||

| Kimberly-Clark Corporation | |||||||

| 6.520% 08/16/2000 | 6,360,000 | 6,307,014 | |||||

| Lucent Technologies, Inc. | |||||||

| 6.600% 08/15/2000 | 6,475,000 | 6,421,581 | |||||

| Minnesota Mining &

Manufacturing Company |

|||||||

| 6.280% 07/18/2000 | 1,585,000 | 1,580,299 | |||||

| Minnesota Mining &

Manufacturing Company |

|||||||

| 6.500% 08/22/2000 | 6,000,000 | 5,943,667 | |||||

| Motorola, Inc. | |||||||

| 6.080% 07/05/2000 | 4,400,000 | 4,397,028 | |||||

| Motorola, Inc. | |||||||

| 6.590% 09/27/2000 | 3,100,000 | 3,050,062 | |||||

| Nestle Capital Corp. | |||||||

| 5.480% 09/22/2000 | 3,650,000 | 3,603,884 | |||||

| Toyota Motor Credit

Corporation |

|||||||

| 6.520% 07/28/2000 | 5,130,000 | 5,104,914 | |||||

| Unilever Capital Corp. | |||||||

| 5.990% 07/13/2000 | 3,560,000 | 3,552,891 | |||||

| Walt Disney Company, The | |||||||

| 6.580% 10/11/2000 | 6,300,000 | 6,182,547 | |||||

| Wisconsin Electric Power | |||||||

| 6.570% 08/17/2000 | 5,460,000 | 5,413,167 | |||||

| 181,570,068 | |||||||

| TOTAL SHORT-TERM INVESTMENTS | |||||||

| (At Amortized Cost)* | 181,570,068 | ||||||

| TOTAL INVESTMENTS - 100.6% | |||||||

| Other Assets/(Liabilities) - (0.6%) | (1,044,541 | ) | |||||

| NET ASSETS - 100.0% | $ 180,525,527 | ||||||

| Notes to Portfolio of Investments | ||||||||

| * Aggregate cost for Federal tax purposes.

(Note 7). |

||||||||

| Principal

Amount |

Market Value |

|||

|---|---|---|---|---|

| BONDS & NOTES - 96.3% | ||||

| Asset Backed Securities - 7.5% | ||||

| California Infrastructure

SCE-1, 1997-1, Class A5 |

||||

| 6.280% 09/25/2005 | $ 300,000 | $ 294,006 | ||

| California Infrastructure

SDG&E-1, 1997-1, Class A5 |

||||

| 6.190% 09/25/2005 | 250,000 | 244,477 | ||

| Case Equipment Loan Trust

1998-A, Class A4 |

||||

| 5.830% 02/15/2005 | 1,279,877 | 1,260,372 | ||

| Chase Manhattan Auto

Owner Trust 1998-A, Class A4 |

||||

| 5.800% 12/16/2002 | 1,500,000 | 1,481,655 | ||

| Chase Manhattan RV Owner

Trust 1997-A, Class A7 |

||||

| 6.140% 10/16/2006 | 2,000,000 | 1,981,240 | ||

| Metlife Capital Equipment

Loan Trust Series 1997-A, Class A |

||||

| 6.850% 05/20/2008 | 1,000,000 | 991,460 | ||

| Peco Energy Transition

Trust Series 1999-A, Class A6 |

||||

| 6.050% 03/01/2009 | 1,000,000 | 933,790 | ||

| Peco Energy Transition Trust

Series 1999-A, Class A7 |

||||

| 6.130% 03/01/2009 | 500,000 | 460,930 | ||

| Premier Auto Trust Series

1998-4, Class A3 |

||||

| 5.690% 06/08/2002 | 1,456,362 | 1,447,857 | ||

| Premier Auto Trust Series

1998-5, Class A3 |

||||

| 5.070% 07/08/2002 | 1,000,000 | 987,420 | ||

| Railcar Trust No. 1992-1 | ||||

| 7.750% 06/01/2004 | 984,760 | 986,001 | ||

| Rental Car Finance Corp.

Series 1999-1A, Class A† |

||||

| 5.900% 02/25/2007 | 750,000 | 715,920 | ||

| Textron Financial Corporation

Series 1998-A, Class A2† |

||||

| 5.890% 01/15/2005 | 1,500,000 | 1,474,500 | ||

| Principal

Amount |

Market Value |

||||||||

|---|---|---|---|---|---|---|---|---|---|

| Toyota Auto Lease Trust

Series 1998-B, Class A1 |

|||||||||

| 5.350% 07/25/2002 | $ 1,500,000 | $ 1,492,200 | |||||||

| Travelers Funding Ltd. Class

A-1† |

|||||||||

| 6.300% 02/18/2014 | 1,400,000 | 1,232,000 | |||||||

| Total Asset Backed Securities | |||||||||

| (Cost $16,460,522) | 15,983,828 | ||||||||

| Corporate Debt - 48.4% | |||||||||

| AirTouch Communications,

Inc. |

|||||||||

| 7.500% 07/15/2006 | 1,500,000 | 1,483,920 | |||||||

| Alcan Aluminum Limited | |||||||||

| 6.250% 11/01/2008 | 800,000 | 740,783 | |||||||

| America West Airlines, Inc.

1996-1, Class A |

|||||||||

| 6.850% 07/02/2009 | 1,655,233 | 1,540,575 | |||||||

| American Airlines 1994-A

Pass Through Trusts, Class A4 |

|||||||||

| 9.780% 11/26/2011 | 1,611,131 | 1,684,936 | |||||||

| American General Finance

Corporation |

|||||||||

| 5.750% 11/01/2003 | 1,000,000 | 944,950 | |||||||

| AMR Corporation | |||||||||

| 9.000% 08/01/2012 | 1,000,000 | 983,700 | |||||||

| Associates Corporation of

North America |

|||||||||

| 7.875% 09/30/2001 | 2,000,000 | 2,011,160 | |||||||

| AT&T - Liberty Media Group | |||||||||

| 8.250% 02/01/2030 | 1,000,000 | 918,263 | |||||||

| Atlantic Richfield Series

MTNB |

|||||||||

| 7.770% 02/13/2002 | 3,000,000 | 3,023,184 | |||||||

| Barrick Gold Corporation | |||||||||

| 7.500% 05/01/2007 | 2,000,000 | 1,935,180 | |||||||

| BellSouth Capital Funding

Corporation |

|||||||||

| 7.750% 02/15/2010 | 1,000,000 | 1,000,040 | |||||||

| BHP Finance (USA) Limited | |||||||||

| 6.420% 03/01/2026 | 2,000,000 | 1,934,160 | |||||||

| Boston Scientific Corporation | |||||||||

| 6.625% 03/15/2005 | 2,500,000 | 2,273,500 | |||||||

| Capitol Records, Inc.† | |||||||||

| 8.375% 08/15/2009 | 2,000,000 | 2,048,080 | |||||||

| Principal

Amount |

Market Value |

|||

|---|---|---|---|---|

| Celulosa Arauco y

Constitucion, S.A. |

||||

| 6.950% 09/15/2005 | $ 1,000,000 | $ 945,100 | ||

| Champion International

Corporation |

||||

| 6.400% 02/15/2026 | 1,500,000 | 1,392,570 | ||

| The Charles Schwab

Corporation |

||||

| 6.250% 01/23/2003 | 2,000,000 | 1,933,179 | ||

| The CIT Group, Inc. | ||||

| 5.625% 10/15/2003 | 1,000,000 | 936,880 | ||

| The Columbia Gas System,

Inc. |

||||

| 6.610% 11/28/2002 | 2,000,000 | 1,943,920 | ||

| Comcast Cable

Communications, Inc. |

||||

| 8.375% 05/01/2007 | 1,250,000 | 1,287,862 | ||

| Commercial Credit Company | ||||

| 7.750% 03/01/2005 | 3,000,000 | 3,024,750 | ||

| ConAgra, Inc. | ||||

| 7.000% 10/01/2028 | 1,250,000 | 999,825 | ||

| Continental Airlines, Inc.,

Series 1996-2B |

||||

| 8.560% 07/02/2014 | 905,275 | 925,396 | ||

| Continental Airlines, Inc.,

Series 1996-B |

||||

| 7.820% 04/15/2015 | 1,330,837 | 1,309,130 | ||

| Crown Cork & Seal

Company, Inc. |

||||

| 7.125% 09/01/2002 | 1,300,000 | 1,241,252 | ||

| CSX Corporation | ||||

| 7.050% 05/01/2002 | 1,000,000 | 983,670 | ||

| CSX Corporation | ||||

| 7.250% 05/01/2027 | 2,000,000 | 1,888,700 | ||

| Donnelley (R.R.) & Sons | ||||

| 6.625% 04/15/2029 | 1,000,000 | 831,320 | ||

| Dover Corporation | ||||

| 6.250% 06/01/2008 | 750,000 | 661,110 | ||

| Duke Capital Corp. | ||||

| 7.500% 10/01/2009 | 800,000 | 788,128 | ||

| Emerald Investment Grade

CBO† |

||||

| 7.553% 05/24/2011 | 1,000,000 | 1,000,000 | ||

| ERAC USA Finance

Company† |

||||

| 6.750% 05/15/2007 | 2,000,000 | 1,857,720 | ||

| Principal

Amount |

Market Value |

|||

|---|---|---|---|---|

| FBG Finance Limited | ||||

| 7.875% 06/01/2016 | $ 1,250,000 | $ 1,289,025 | ||

| Fletcher Challenge Capital

Canada, Inc. |

||||

| 6.750% 03/24/2005 | 500,000 | 460,830 | ||

| Fletcher Challenge Capital

Canada, Inc. |

||||

| 7.750% 06/20/2006 | 1,500,000 | 1,447,425 | ||

| Ford Motor Credit

Corporation |

||||

| 7.375% 10/28/2009 | 1,000,000 | 967,270 | ||

| General American

Transportation Corporation |

||||

| 6.750% 03/01/2006 | 2,000,000 | 1,877,580 | ||

| General Electric Capital

Corporation |

||||

| 8.750% 05/21/2007 | 1,000,000 | 1,084,860 | ||

| General Electric Capital

Corporation Series MTNA |

||||

| 5.500% 04/15/2002 | 1,000,000 | 972,330 | ||

| General Mills, Inc. | ||||

| 8.900% 06/15/2006 | 1,000,000 | 1,087,020 | ||

| Goodyear Tire & Rubber

Company |

||||

| 8.500% 03/15/2007 | 1,300,000 | 1,333,696 | ||

| Heller Financial, Inc. | ||||

| 6.250% 03/01/2001 | 1,000,000 | 990,670 | ||

| Heller Financial, Inc. | ||||

| 7.375% 11/01/2009 | 1,000,000 | 943,460 | ||

| Hershey Foods Corporation | ||||

| 7.200% 08/15/2027 | 1,500,000 | 1,431,000 | ||

| Household Finance

Corporation |

||||

| 6.500% 11/15/2008 | 1,000,000 | 909,800 | ||

| ICI Wilmington, Inc. | ||||

| 7.050% 09/15/2007 | 750,000 | 700,830 | ||

| IMC Global, Inc. | ||||

| 6.625% 10/15/2001 | 1,000,000 | 980,070 | ||

| IMCERA Group, Inc. | ||||

| 6.000% 10/15/2003 | 2,000,000 | 1,872,460 | ||

| Interpool, Inc. | ||||

| 7.350% 08/01/2007 | 500,000 | 407,526 | ||

| Jet Equipment Trust Series

1995-A,† |

||||

| 8.235% 11/01/2012 | 1,766,724 | 1,772,730 | ||

| The Kroger Co. | ||||

| 7.000% 05/01/2018 | 500,000 | 433,670 | ||

| Principal

Amount |

Market Value |

|||

|---|---|---|---|---|

| LASMO (USA), Inc. | ||||

| 6.750% 12/15/2007 | $ 2,000,000 | $ 1,858,828 | ||

| Leucadia National

Corporation |

||||

| 7.750% 08/15/2013 | 2,000,000 | 1,956,340 | ||

| Marsh & McLennan

Companies, Inc. |

||||

| 7.125% 06/15/2009 | 750,000 | 718,415 | ||

| Meritor Automotive, Inc. | ||||

| 6.800% 02/15/2009 | 1,000,000 | 860,600 | ||

| Millipore Corporation | ||||

| 7.500% 04/01/2007 | 1,000,000 | 948,300 | ||

| Mobil Corporation | ||||

| 8.625% 08/15/2021 | 2,000,000 | 2,201,920 | ||

| Morgan Stanley Dean Witter

& Co. |

||||

| 5.625% 01/20/2004 | 1,300,000 | 1,225,926 | ||

| Newmont Mining Corporation | ||||

| 8.625% 04/01/2002 | 2,000,000 | 1,999,220 | ||

| News America Holdings, Inc. | ||||

| 9.250% 02/01/2013 | 2,000,000 | 2,161,220 | ||

| Norfolk Southern Corporation | ||||

| 7.050% 05/01/2037 | 2,500,000 | 2,443,400 | ||

| Pepsi Bottling Holdings,

Inc.† |

||||

| 5.625% 02/17/2009 | 700,000 | 615,494 | ||

| Raytheon Company | ||||

| 6.550% 03/15/2010 | 750,000 | 671,685 | ||

| Raytheon Company | ||||

| 6.750% 08/15/2007 | 500,000 | 469,765 | ||

| Republic Services, Inc. | ||||

| 7.125% 05/15/2009 | 1,000,000 | 896,739 | ||

| Ryder System, Inc. | ||||

| 6.600% 11/15/2005 | 750,000 | 700,995 | ||

| Scholastic Corporation | ||||

| 7.000% 12/15/2003 | 1,500,000 | 1,461,795 | ||

| Sears Roebuck Acceptance

Corp. |

||||

| 6.750% 09/15/2005 | 1,500,000 | 1,430,115 | ||

| Sprint Capital Corporation | ||||

| 6.125% 11/15/2008 | 750,000 | 668,527 | ||

| Sprint Capital Corporation | ||||

| 6.900% 05/01/2019 | 750,000 | 666,870 | ||

| SuperValu, Inc. | ||||

| 7.875% 08/01/2009 | 1,000,000 | 982,168 | ||

| Thomas & Betts Corporation | ||||

| 8.250% 01/15/2004 | 1,500,000 | 1,505,175 | ||

| Principal

Amount |

Market Value |

|||

|---|---|---|---|---|

| Time Warner, Inc. Pass-Thru

Asset Trust 1997-1† |

||||

| 6.100% 12/30/2001 | $ 500,000 | $ 490,455 | ||

| Times Mirror Co. | ||||

| 7.450% 10/15/2009 | 1,300,000 | 1,267,876 | ||

| TRW, Inc. | ||||

| 8.750% 05/15/2006 | 2,000,000 | 2,037,436 | ||

| Union Tank Car Co. | ||||

| 6.790% 05/01/2010 | 2,000,000 | 1,831,257 | ||

| United Air Lines, Inc. | ||||

| 10.110% 02/19/2006 | 329,559 | 335,979 | ||

| US Air, Inc., Class B | ||||

| 7.500% 10/15/2009 | 902,414 | 826,611 | ||

| Valero Energy Corporation | ||||

| 7.375% 03/15/2006 | 1,000,000 | 965,448 | ||

| Vulcan Materials Company | ||||

| 6.000% 04/01/2009 | 800,000 | 714,221 | ||

| WPP Finance (USA) Corporation | ||||

| 6.625% 07/15/2005 | 900,000 | 853,674 | ||

| Total Corporate Debt | ||||

| (Cost $107,610,237) | 103,201,649 | |||

| Non-U.S. Government Agency Obligations - 3.1% | ||||

| Collateralized Mortgage Obligations | ||||

| Asset Securitization

Corporation Series 1995-MD4, Class A1 |

||||

| 7.100% 08/13/2029 | 2,302,808 | 2,277,730 | ||

| CS First Boston Mortgage

Securities Corp. Series 1998-C2, Class A1 |

||||

| 5.960% 12/15/2007 | 908,126 | 860,534 | ||

| Merrill Lynch Mortgage

Investors, Inc., Series 1997-Cl-CTL, A-1 |

||||

| 6.310% 11/15/2026 | 1,424,731 | 1,353,160 | ||

| Salomon Brothers Mortgage

Securities 1997-TZH, Class B† |

||||

| 7.491% 03/25/2022 | 1,250,000 | 1,228,912 | ||

| Starwood Commercial

Mortgage Trust Series 1999-C1A, Class B† |

||||

| 6.920% 02/05/2009 | 1,000,000 | 907,500 | ||

| Total Non-U.S. Government

Agency Obligations |

||||

| (Cost $7,073,646) | 6,627,836 | |||

| Principal

Amount |

Market Value |

|||

|---|---|---|---|---|

| U.S. Government Agency Obligations - 19.0% | ||||

| Federal Home Loan Mortgage Corporation

(FHLMC) - 2.3% |

||||

| Collateralized Mortgage Obligations - 1.3% | ||||

| FHLMC Series 1322 Class G | ||||

| 7.500% 02/15/2007 | $ 823,253 | $ 826,596 | ||

| FHLMC Series 1460 Class H | ||||

| 7.000% 05/15/2007 | 2,000,000 | 1,988,740 | ||

| 2,815,336 | ||||

| Pass-Through Securities - 1.0% | ||||

| FHLMC | ||||

| 6.420% 12/01/2005 | 2,084,928 | 2,007,786 | ||

| FHLMC | ||||

| 9.000% 03/01/2017 | 70,033 | 72,237 | ||

| 2,080,023 | ||||

| 4,895,359 | ||||

| Federal National Mortgage Association (FNMA) - 10.0% | ||||

| Collateralized Mortgage Obligations - 6.3% | ||||

| FNMA Series 1993-134

Class GA |

||||

| 6.500% 02/25/2007 | 2,000,000 | 1,978,740 | ||

| FNMA Series 1993-186

Class G |

||||

| 6.250% 03/25/2008 | 3,438,102 | 3,399,424 | ||

| FNMA Series 1993-221

Class D |

||||

| 6.000% 12/25/2008 | 1,000,000 | 965,000 | ||

| FNMA Series 1993-231,

Class M |

||||

| 6.000% 12/25/2008 | 3,322,000 | 3,182,875 | ||

| FNMA Series 1996-54

Class C |

||||

| 6.000% 09/25/2008 | 4,000,000 | 3,832,480 | ||

| 13,358,519 | ||||

| Pass-Through Securities - 3.7% | ||||

| FNMA | ||||

| 6.000% 11/01/2028 | 1,836,785 | 1,681,227 | ||

| FNMA 7.500% | ||||

| 09/01/2029 - 04/01/2030 | 5,282,251 | 5,206,292 | ||

| FNMA 8.000% | ||||

| 12/01/2029 - 05/01/2030 | 998,645 | 1,002,699 | ||

| FNMA | ||||

| 9.000% 05/01/2009 | 119,534 | 122,715 | ||

| 8,012,933 | ||||

| 21,371,452 | ||||

| Principal

Amount |

Market Value |

|||

|---|---|---|---|---|

| Government National Mortgage Association

(GNMA) - 6.7% |

||||

| Pass-Through Securities | ||||

| GNMA 6.000% | ||||

| 11/20/2025 - 11/20/2027 | $ 567,269 | $ 566,936 | ||

| GNMA 7.000% | ||||

| 09/15/2023 - 09/15/2029 | 7,145,914 | 6,949,998 | ||

| GNMA 7.500% | ||||

| 03/15/2017 - 06/15/2024 | 2,856,974 | 2,855,891 | ||

| GNMA 8.000% | ||||

| 12/15/2003 - 01/15/2009 | 3,791,219 | 3,858,265 | ||

| 14,231,090 | ||||

| Total U.S. Government

Agency Obligations |

||||

| (Cost $41,214,757) | 40,497,901 | |||

| U.S. Treasury Obligations - 18.3% | ||||

| U.S. Treasury Bonds - 2.2% | ||||

| U.S. Treasury Bond | ||||

| 7.125% 02/15/2023 | 1,000,000 | 1,111,410 | ||

| U.S. Treasury Bond | ||||

| 7.500% 11/15/2016 | 3,225,000 | 3,642,218 | ||

| 4,753,628 | ||||

| U.S. Treasury Notes - 11.1% | ||||

| U.S. Treasury Note | ||||

| 5.500% 05/15/2009 | 3,150,000 | 3,014,141 | ||

| U.S. Treasury Note | ||||

| 6.500% 10/15/2006 | 20,380,000 | 20,625,171 | ||

| 23,639,312 | ||||

| U.S. Treasury Strip - 5.0% | ||||

| U.S. Treasury Strip -

Principal Only |

||||

| 0.000% 05/15/2016 | 28,000,000 | 10,537,520 | ||

| Total U.S. Treasury Obligations | ||||

| (Cost $38,401,084) | 38,930,460 | |||

| TOTAL BONDS & NOTES | ||||

| (Cost $210,760,246) | 205,241,674 | |||

| SHORT-TERM INVESTMENTS - 7.4% | ||||

| Cash Equivalents - 5.4% | ||||

| Bank of America Bank Note* | ||||

| 6.670% 03/22/2001 | 248,658 | 248,658 | ||

| Bank of Montreal Bank Note* | ||||

| 6.630% 08/16/2000 | 399,553 | 399,553 | ||

| Bank of Nova Scotia

Eurodollar Time Deposit* |

||||

| 7.000% 07/03/2000 | 497,311 | 497,311 | ||

| Principal

Amount |

Market Value |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Credit Agricole Bank

Eurodollar Time Deposit* |

|||||||||||

| 6.750% 07/06/2000 | $ 1,657,698 | $ 1,657,698 | |||||||||

| Credit Agricole Bank

Eurodollar Time Deposit* |

|||||||||||

| 6.750% 07/07/2000 | 248,655 | 248,655 | |||||||||

| Den Danske Bank Eurodollar

Time Deposit* |

|||||||||||

| 6.810% 07/05/2000 | 911,736 | 911,736 | |||||||||

| First Union Bank Note* | |||||||||||

| 6.900% 05/09/2001 | 248,655 | 248,655 | |||||||||

| Fleet National Bank

Eurodollar Time Deposit* |

|||||||||||

| 7.260% 10/31/2000 | 761,484 | 761,484 | |||||||||

| HypoVereinsbank Eurodollar

Time Deposit* |

|||||||||||

| 6.750% 07/05/2000 | 2,072,128 | 2,072,128 | |||||||||

| Merrimac Money Market

Fund* |

|||||||||||

| 6.440% 07/03/2000 | 2,902,592 | 2,902,592 | |||||||||

| Morgan Stanley Dean Witter

& Co.* |

|||||||||||

| 6.890% 07/17/2000 | 497,311 | 497,311 | |||||||||

| Morgan Stanley Dean Witter

& Co.* |

|||||||||||

| 6.910% 11/22/2000 | 165,769 | 165,769 | |||||||||

| Paribas Bank Eurodollar

Time Deposit* |

|||||||||||

| 6.750% 07/05/2000 | 994,621 | 994,621 | |||||||||

| 11,606,171 | |||||||||||

| Commercial Paper - 2.0% | |||||||||||

| Maytag Corp. | |||||||||||

| 7.250% 07/05/2000 | 4,235,000 | 4,231,589 | |||||||||

| TOTAL SHORT-TERM INVESTMENTS | |||||||||||

| (At Amortized Cost) | 15,837,760 | ||||||||||

| TOTAL INVESTMENTS - 103.7% | |||||||||||

| (Cost $226,598,006)** | 221,079,434 | ||||||||||

| Other Assets/(Liabilities) - (3.7%) | (7,932,661 | ) | |||||||||

| NET ASSETS - 100.0% | $ 213,146,773 | ||||||||||

| Notes to Portfolio of Investments | ||||||

*

|

Represents investment of security lending collateral. (Note 2).

|

**

|

Aggregate cost for Federal tax purposes. (Note 7).

|

†

|

Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt

from registration, normally to qualified institutional buyers.

|

| Number

of Shares |

Market Value |

|||

|---|---|---|---|---|

| EQUITIES - 67.6% | ||||

| Aerospace & Defense - 4.6% | ||||

| Boeing Co. | 1,107,500 | $ 46,307,344 | ||

| Honeywell International,

Inc. |

821,387 | 27,670,475 | ||

| TRW, Inc. | 496,600 | 21,540,025 | ||

| 95,517,844 | ||||

| Automotive & Parts - 1.5% | ||||

| Ford Motor Company | 282,300 | 12,138,900 | ||

| General Motors Corp. | 316,500 | 18,376,781 | ||

| Visteon Corp.* | 36,962 | 448,170 | ||

| 30,963,851 | ||||

| Banking, Savings & Loans - 5.0% | ||||

| The Bank of New York

Company, Incorporated |

920,200 | 42,789,300 | ||

| Chase Manhattan Corp. | 235,050 | 10,826,991 | ||

| Fleet Boston Financial

Corp. |

378,860 | 12,881,240 | ||

| Wachovia Corp. | 338,400 | 18,358,200 | ||

| Wells Fargo & Company | 508,300 | 19,696,625 | ||

| 104,552,356 | ||||

| Beverages - 1.0% | ||||

| Brown-Forman

Corporation Cl. B |

382,500 | 20,559,375 | ||

| Broadcasting, Publishing & Printing - 2.7% | ||||

| The McGraw-Hill

Companies, Inc. |

700,000 | 37,800,000 | ||

| News Corporation Limited

Sponsored†† |

333,100 | 18,153,950 | ||

| 55,953,950 | ||||

| Chemicals - 1.4% | ||||

| Rohm & Haas Company | 865,000 | 29,842,500 | ||

| Communications - 3.8% | ||||

| Alcatel SA Sponsored†† | 235,000 | 15,627,500 | ||

| GTE Corporation | 494,400 | 30,776,400 | ||

| SBC Communications,

Inc. |

750,036 | 32,439,057 | ||

| 78,842,957 | ||||

| Number

of Shares |

Market Value |

|||

|---|---|---|---|---|

| Computer Integrated Systems Design - 1.4% | ||||

| Computer Sciences Corp.* | 401,700 | $ 30,001,969 | ||

| Computers & Information - 1.5% | ||||

| Compaq Computer Corp. | 597,300 | 15,268,481 | ||

| Jabil Circuit, Inc.* | 336,600 | 16,703,775 | ||

| 31,972,256 | ||||

| Computers & Office Equipment - 0.8% | ||||

| International Business

Machines Corporation |

146,500 | 16,050,906 | ||

| Containers - 1.2% | ||||

| Sealed Air Corp.* | 352,600 | 18,467,425 | ||

| Temple-Inland, Inc. | 140,600 | 5,905,200 | ||

| 24,372,625 | ||||

| Cosmetics & Personal Care - 1.7% | ||||

| Kimberly-Clark

Corporation |

615,900 | 35,337,262 | ||

| Electric Utilities - 1.3% | ||||

| Dominion Resources, Inc. | 388,000 | 16,635,500 | ||

| Teco Energy, Inc. | 541,300 | 10,859,831 | ||

| 27,495,331 | ||||

| Electrical Equipment & Electronics - 4.8% | ||||

| General Electric Company | 1,350,000 | 71,550,000 | ||

| Micron Technology, Inc.* | 222,600 | 19,602,713 | ||

| SCI Systems, Inc.* | 222,100 | 8,703,544 | ||

| 99,856,257 | ||||

| Energy - 8.7% | ||||

| Apache Corporation | 350,000 | 20,584,375 | ||

| BP Amoco PLC

Sponsored†† |

800,358 | 45,270,249 | ||

| Burlington Resources, Inc. | 500,500 | 19,144,125 | ||

| Chevron Corporation | 200,000 | 16,962,500 | ||

| Coastal Corp. | 251,700 | 15,322,237 | ||

| Conoco, Inc. Cl. A | 600,000 | 13,200,000 | ||

| Exxon Mobil Corp. | 500,099 | 39,257,772 | ||

| Total Fina Elf SA

Sponsored†† |

147,600 | 11,337,525 | ||

| 181,078,783 | ||||

| Number

of Shares |

Market Value |

|||

|---|---|---|---|---|

| Entertainment & Leisure - 1.7% | ||||

| AT&T - Liberty Media Group* | 1,463,400 | $ 35,487,450 | ||

| Financial Services - 2.5% | ||||

| American Express

Company |

547,200 | 28,522,800 | ||

| American General

Corporation |

400,000 | 24,400,000 | ||

| 52,922,800 | ||||

| Foods - 1.9% | ||||

| Bestfoods | 318,200 | 22,035,350 | ||

| General Mills, Inc. | 469,400 | 17,954,550 | ||

| 39,989,900 | ||||

| Forest Products & Paper - 0.6% | ||||

| Weyerhaeuser Company | 299,700 | 12,887,100 | ||

| Healthcare - 2.8% | ||||

| Becton, Dickinson and

Company |

907,900 | 26,045,381 | ||

| Schering-Plough Corp. | 629,400 | 31,784,700 | ||

| 57,830,081 | ||||

| Industrial - Diversified - 1.5% | ||||

| Illinois Tool Works, Inc. | 300,000 | 17,100,000 | ||

| Tyco International Ltd. | 311,162 | 14,741,300 | ||

| 31,841,300 | ||||

| Insurance - 3.6% | ||||

| The Hartford Financial

Services Group, Inc. |

481,100 | 26,911,531 | ||

| Marsh & McLennan

Companies, Inc. |

458,300 | 47,863,706 | ||

| MBIA, Inc. | 2,100 | 101,194 | ||

| 74,876,431 | ||||

| Miscellaneous - 1.0% | ||||

| Avery-Dennison Corp. | 308,900 | 20,734,912 | ||

| Pharmaceuticals - 4.0% | ||||

| American Home Products

Corporation |

453,100 | 26,619,625 | ||

| Merck & Co., Inc. | 422,700 | 32,389,387 | ||

| Pharmacia Corp. | 494,088 | 25,538,174 | ||

| 84,547,186 | ||||

| Number

of Shares |

Market Value |

||||||||

|---|---|---|---|---|---|---|---|---|---|

| Restaurants - 1.1% | |||||||||

| McDonald’s Corp. | 685,800 | $ 22,588,537 | |||||||

| Retail - 1.5% | |||||||||

| RadioShack Corporation | 354,900 | 16,813,387 | |||||||

| Target Corporation | 269,000 | 15,602,000 | |||||||

| 32,415,387 | |||||||||

| Retail - Grocery - 0.9% | |||||||||

| Albertson’s, Inc. | 590,702 | 19,640,842 | |||||||

| Telephone Utilities - 1.0% | |||||||||

| BellSouth Corporation | 476,500 | 20,310,813 | |||||||

| Tobacco - 0.7% | |||||||||

| Fortune Brands, Inc. | 600,000 | 13,837,500 | |||||||

| Transportation - 1.4% | |||||||||

| Burlington Northern

Santa Fe Corp. |

667,000 | 15,299,313 | |||||||

| Galileo International, Inc. | 132,300 | 2,761,763 | |||||||

| Norfolk Southern

Corporation |

730,200 | 10,861,725 | |||||||

| 28,922,801 | |||||||||

| TOTAL EQUITIES | |||||||||

| (Cost $949,543,828) | 1,411,231,262 | ||||||||

|

Principal Amount |

|||||||||

| BONDS & NOTES - 24.0% | |||||||||

| Asset Backed Securities - 1.8% | |||||||||

| California Infrastructure SCE-1,

1997-1, Class A5 |

|||||||||

| 6.280% 09/25/2005 | $ 650,000 | 637,013 | |||||||

| California Infrastructure SDG&E-1,

1997-1, Class A5 |

|||||||||

| 6.190% 09/25/2005 | 500,000 | 488,955 | |||||||

| Case Equipment Loan Trust

1998-A, Class A4 |

|||||||||

| 5.830% 02/15/2005 | 2,986,379 | 2,940,867 | |||||||

| Caterpillar Financial Asset Trust,

1997-B, Class A3 |

|||||||||

| 6.160% 09/25/2003 | 1,220,659 | 1,216,753 | |||||||

|

Principal Amount |

Market Value |

|||

|---|---|---|---|---|

| Chase Manhattan Auto Owner Trust

1998-A, Class A4 |

||||

| 5.800% 12/16/2002 | $ 3,750,000 | $ 3,704,137 | ||

| Chase Manhattan RV Owner Trust

1997-A, Class A7 |

||||

| 6.140% 10/16/2006 | 4,500,000 | 4,457,790 | ||

| Metlife Capital Equipment Loan Trust Series

1997-A, Class A |

||||

| 6.850% 05/20/2008 | 2,500,000 | 2,478,650 | ||

| Peco Energy Transition Trust Series

1999-A, Class A6 |

||||

| 6.050% 03/01/2009 | 2,450,000 | 2,287,785 | ||

| Peco Energy Transition Trust Series

1999-A, Class A7 |

||||

| 6.130% 03/01/2009 | 1,300,000 | 1,198,418 | ||

| Premier Auto Trust Series

1998-4, Class A3 |

||||

| 5.690% 06/08/2002 | 3,883,633 | 3,860,952 | ||

| Premier Auto Trust Series

1998-5, Class A3 |

||||

| 5.070% 07/08/2002 | 2,000,000 | 1,974,840 | ||

| Railcar Trust No. 1992-1 | ||||

| 7.750% 06/01/2004 | 891,208 | 892,331 | ||

| Rental Car Finance Corp. Series

1999-1A, Class A† |

||||

| 5.900% 02/25/2007 | 2,400,000 | 2,290,944 | ||

| Textron Financial Corporation Series

1998-A, Class A2† |

||||

| 5.890% 01/15/2005 | 3,500,000 | 3,440,500 | ||

| Toyota Auto Lease Trust Series

1998-B, Class A1 |

||||

| 5.350% 07/25/2002 | 3,500,000 | 3,481,800 | ||

| Travelers Funding Ltd.

Class A-1† |

||||

| 6.300% 02/18/2014 | 3,400,000 | 2,992,000 | ||

| Total Asset Backed Securities | ||||

| (Cost $39,449,221) | 38,343,735 | |||

| Corporate Debt - 12.2% | ||||

| AirTouch Communications, Inc. | ||||

| 7.500% 07/15/2006 | 4,000,000 | 3,957,120 | ||

| Alcan Aluminum Limited | ||||

| 6.250% 11/01/2008 | 2,500,000 | 2,314,947 | ||

| America West Airlines, Inc.

1996-1, Class A |

||||

| 6.850% 07/02/2009 | 4,019,852 | 3,741,397 | ||

|

Principal Amount |

Market Value |

|||

|---|---|---|---|---|

| American Airlines 1994-A Pass Through

Trusts, Class A4 |

||||

| 9.780% 11/26/2011 | $ 4,027,826 | $ 4,212,341 | ||

| American General Finance Corporation | ||||

| 5.750% 11/01/2003 | 2,000,000 | 1,889,900 | ||

| AMR Corporation | ||||

| 9.000% 08/01/2012 | 2,000,000 | 1,967,400 | ||

| Associates Corporation of North America | ||||

| 6.750% 08/01/2001 | 4,000,000 | 3,973,400 | ||

| AT&T - Liberty Media Group | ||||

| 8.250% 02/01/2030 | 5,695,000 | 5,229,508 | ||

| Barrick Gold Corporation | ||||

| 7.500% 05/01/2007 | 4,250,000 | 4,112,257 | ||

| BellSouth Capital Funding Corporation | ||||

| 7.750% 02/15/2010 | 2,000,000 | 2,000,080 | ||

| BHP Finance (USA) Limited | ||||

| 6.420% 03/01/2026 | 4,500,000 | 4,351,860 | ||

| Bombardier Capital, Inc.† | ||||

| 6.000% 01/15/2002 | 4,000,000 | 3,905,164 | ||

| Boston Scientific Corporation | ||||

| 6.625% 03/15/2005 | 6,050,000 | 5,501,870 | ||

| Celulosa Arauco y Constitucion, S.A. | ||||

| 6.950% 09/15/2005 | 2,500,000 | 2,362,750 | ||

| Champion International Corporation | ||||

| 6.400% 02/15/2026 | 3,500,000 | 3,249,330 | ||

| The Charles Schwab Corporation | ||||

| 6.250% 01/23/2003 | 2,500,000 | 2,416,473 | ||

| The CIT Group, Inc. | ||||

| 5.625% 10/15/2003 | 2,500,000 | 2,342,200 | ||

| The CIT Group, Inc. | ||||

| 6.375% 10/01/2002 | 4,000,000 | 3,892,360 | ||

| The Columbia Gas System, Inc. | ||||

| 6.610% 11/28/2002 | 3,000,000 | 2,915,880 | ||

| Comcast Cable Communications, Inc. | ||||

| 8.375% 05/01/2007 | 2,500,000 | 2,575,725 | ||

| Commercial Credit Company | ||||

| 7.750% 03/01/2005 | 2,500,000 | 2,520,625 | ||

| ConAgra, Inc. | ||||

| 7.000% 10/01/2028 | 3,000,000 | 2,399,580 | ||

| Continental Airlines, Inc.,

Series 1996-2B |

||||

| 8.560% 07/02/2014 | 1,584,231 | 1,619,443 | ||

| Continental Airlines, Inc.,

Series 1996-B |

||||

| 7.820% 04/15/2015 | 1,774,450 | 1,745,506 | ||

| Principal

Amount |

Market Value |

|||

|---|---|---|---|---|

| Corporate Debt (Continued) | ||||

| Crown Cork & Seal Company, Inc. | ||||

| 7.125% 09/01/2002 | $ 3,200,000 | $ 3,055,389 | ||

| CSX Corporation | ||||

| 7.050% 05/01/2002 | 2,000,000 | 1,967,340 | ||

| CSX Corporation | ||||

| 7.250% 05/01/2027 | 4,500,000 | 4,249,575 | ||

| Donnelley (R.R.) & Sons | ||||

| 6.625% 04/15/2029 | 3,000,000 | 2,493,960 | ||

| Dover Corporation | ||||

| 6.250% 06/01/2008 | 2,000,000 | 1,762,960 | ||

| Duke Capital Corp. | ||||

| 7.500% 10/01/2009 | 3,800,000 | 3,743,608 | ||

| The E.W. Scripps Company | ||||

| 6.625% 10/15/2007 | 5,000,000 | 4,751,250 | ||

| Emerald Investment Grade CBO† | ||||

| 7.553% 05/24/2011 | 3,000,000 | 3,000,000 | ||

| ERAC USA Finance Company† | ||||

| 6.750% 05/15/2007 | 6,000,000 | 5,573,160 | ||

| FBG Finance Limited† | ||||

| 7.875% 06/01/2016 | 4,000,000 | 4,124,880 | ||

| Fletcher Challenge Capital Canada, Inc. | ||||

| 6.750% 03/24/2005 | 2,000,000 | 1,843,320 | ||

| Fletcher Challenge Capital Canada, Inc. | ||||

| 7.750% 06/20/2006 | 2,000,000 | 1,929,900 | ||

| Ford Motor Credit Corp. Variable Rate | ||||

| 6.400% 07/15/2006 | 1,500,000 | 1,497,570 | ||

| Ford Motor Credit Corporation | ||||

| 7.375% 10/28/2009 | 3,000,000 | 2,901,810 | ||

| General American Transportation Corporation | ||||

| 6.750% 03/01/2006 | 3,000,000 | 2,816,370 | ||

| General Electric Capital Corporation | ||||

| 8.750% 05/21/2007 | 1,500,000 | 1,627,290 | ||

| General Electric Capital Corporation Series MTNA | ||||

| 5.500% 04/15/2002 | 5,000,000 | 4,861,650 | ||

| General Mills, Inc. | ||||

| 8.900% 06/15/2006 | 2,250,000 | 2,445,795 | ||

| The Goldman Sachs Group, L.P.† | ||||

| 6.200% 02/15/2001 | 4,000,000 | 3,971,160 | ||

| Goodyear Tire & Rubber Company | ||||

| 8.500% 03/15/2007 | 3,350,000 | 3,436,832 | ||

| Halliburton Company | ||||

| 5.625% 12/01/2008 | 1,500,000 | 1,344,088 | ||

| Heller Financial, Inc. | ||||

| 6.250% 03/01/2001 | 2,500,000 | 2,476,675 | ||

| Principal

Amount |

Market Value |

|||

|---|---|---|---|---|

| Heller Financial, Inc. | ||||

| 7.375% 11/01/2009 | $ 2,500,000 | $ 2,358,650 | ||

| Hershey Foods Corporation | ||||

| 7.200% 08/15/2027 | 5,300,000 | 5,056,200 | ||

| Household Finance Corporation | ||||

| 6.500% 11/15/2008 | 2,500,000 | 2,274,500 | ||

| ICI Wilmington, Inc. | ||||

| 7.050% 09/15/2007 | 2,500,000 | 2,336,100 | ||

| IMC Global, Inc. | ||||

| 6.625% 10/15/2001 | 2,500,000 | 2,450,175 | ||

| Interpool, Inc. | ||||

| 7.350% 08/01/2007 | 2,000,000 | 1,630,104 | ||

| The Kroger Co. | ||||

| 7.000% 05/01/2018 | 2,000,000 | 1,734,680 | ||

| LASMO (USA), Inc. | ||||

| 6.750% 12/15/2007 | 2,000,000 | 1,858,828 | ||

| Leucadia National Corporation | ||||

| 7.750% 08/15/2013 | 3,000,000 | 2,934,510 | ||

| Marsh & McLennan Companies, Inc. | ||||

| 7.125% 06/15/2009 | 2,000,000 | 1,915,774 | ||

| Meritor Automotive, Inc. | ||||

| 6.800% 02/15/2009 | 4,000,000 | 3,442,400 | ||

| Midway Airlines Corp. Pass Through

Certificates Class B† |

||||

| 8.140% 01/02/2013 | 2,427,966 | 2,170,238 | ||

| Millipore Corporation | ||||

| 7.500% 04/01/2007 | 4,250,000 | 4,030,275 | ||

| Mobil Corporation | ||||

| 8.625% 08/15/2021 | 4,500,000 | 4,954,320 | ||

| Morgan Stanley Dean Witter & Co. | ||||

| 5.625% 01/20/2004 | 5,000,000 | 4,715,100 | ||

| Newmont Mining Corporation | ||||

| 8.625% 04/01/2002 | 5,000,000 | 4,998,050 | ||

| News America Holdings, Inc. | ||||

| 9.250% 02/01/2013 | 4,000,000 | 4,322,440 | ||

| Norfolk Southern Corporation | ||||

| 7.050% 05/01/2037 | 6,000,000 | 5,864,160 | ||

| North Finance (Bermuda) Limited† | ||||

| 7.000% 09/15/2005 | 4,000,000 | 3,890,200 | ||

| Pepsi Bottling Holdings, Inc.† | ||||

| 5.625% 02/17/2009 | 2,250,000 | 1,978,373 | ||

| Raytheon Company | ||||

| 6.550% 03/15/2010 | 1,750,000 | 1,567,265 | ||

| Raytheon Company | ||||

| 6.750% 08/15/2007 | 2,700,000 | 2,536,731 | ||

| Principal

Amount |

Market Value |

|||

|---|---|---|---|---|

| Republic Services, Inc. | ||||

| 7.125% 05/15/2009 | $ 3,000,000 | $ 2,690,216 | ||

| Ryder System, Inc. | ||||

| 6.600% 11/15/2005 | 3,500,000 | 3,271,310 | ||

| Scholastic Corporation | ||||

| 7.000% 12/15/2003 | 3,000,000 | 2,923,590 | ||

| Sprint Capital Corporation | ||||

| 6.125% 11/15/2008 | 2,000,000 | 1,782,740 | ||

| Sprint Capital Corporation | ||||

| 6.900% 05/01/2019 | 2,000,000 | 1,778,320 | ||

| SuperValu, Inc. | ||||

| 7.875% 08/01/2009 | 3,000,000 | 2,946,504 | ||

| Texaco, Inc. | ||||

| 5.500% 01/15/2009 | 4,000,000 | 3,534,304 | ||

| Thomas & Betts Corporation | ||||

| 8.250% 01/15/2004 | 1,000,000 | 1,003,450 | ||

| Time Warner, Inc. Pass-Thru Asset Trust

1997-1† |

||||

| 6.100% 12/30/2001 | 4,750,000 | 4,659,322 | ||

| Times Mirror Co. | ||||

| 7.450% 10/15/2009 | 3,600,000 | 3,511,043 | ||

| TRW, Inc. | ||||

| 8.750% 05/15/2006 | 5,500,000 | 5,602,949 | ||

| Union Tank Car Co. | ||||

| 6.790% 05/01/2010 | 4,000,000 | 3,662,513 | ||

| US Air, Inc., Class B | ||||

| 7.500% 10/15/2009 | 902,414 | 826,611 | ||

| Valero Energy Corporation | ||||

| 7.375% 03/15/2006 | 2,000,000 | 1,930,896 | ||

| Vulcan Materials Company | ||||

| 6.000% 04/01/2009 | 3,500,000 | 3,124,715 | ||

| WPP Finance (USA) Corporation | ||||

| 6.625% 07/15/2005 | 2,250,000 | 2,134,186 | ||

| Total Corporate Debt | ||||

| (Cost $267,212,469) | 255,473,440 | |||

| Non-U.S. Government Agency Obligations - 0.8% | ||||

| Collateralized Mortgage Obligations | ||||

| Asset Securitization Corporation Series

1995-MD4, Class A1 |

||||

| 7.100% 08/13/2029 | 5,976,472 | 5,911,388 | ||

| CS First Boston Mortgage Securities Corp.

Series 1998-C2, Class A1 |

||||

| 5.960% 12/15/2007 | 2,724,377 | 2,581,603 | ||

| Principal

Amount |

Market Value |

|||

|---|---|---|---|---|

| Collateralized Mortgage Obligations (Continued) | ||||

| Merrill Lynch Mortgage Investors, Inc.,

Series 1997- Cl-CTL, A-1 |

||||

| 6.310% 11/15/2026 | $ 3,663,047 | $ 3,479,034 | ||

| Salomon Brothers Mortgage Securities

1997-TZH, Class B† |

||||

| 7.491% 03/25/2022 | 3,000,000 | 2,949,390 | ||

| Starwood Commercial Mortgage Trust

Series 1999-C1A, Class B† |

||||

| 6.920% 02/05/2009 | 3,000,000 | 2,722,500 | ||

| Total Non-U.S. Government Agency Obligations | ||||

| (Cost $18,842,666) | 17,643,915 | |||

| U.S. Government Agency Obligations - 5.1% | ||||

| Federal Home Loan Mortgage Corporation

(FHLMC) - 0.7% |

||||

| Collateralized Mortgage Obligations - 0.4% | ||||

| FHLMC Series 1322 Class G | ||||

| 7.500% 02/15/2007 | 2,058,134 | 2,066,490 | ||

| FHLMC Series 1460 Class H | ||||

| 7.000% 05/15/2007 | 1,789,000 | 1,778,928 | ||

| FHLMC Series 1490 Class PG | ||||

| 6.300% 05/15/2007 | 5,000,000 | 4,975,000 | ||

| 8,820,418 | ||||

| Pass-Through Securities - 0.3% | ||||

| FHLMC | ||||

| 6.420% 12/01/2005 | 5,382,905 | 5,183,738 | ||

| FHLMC | ||||

| 9.000% 03/01/2017 | 210,100 | 216,710 | ||

| 5,400,448 | ||||

| 14,220,866 | ||||

| Federal National Mortgage Association (FNMA) - 2.9% | ||||

| Collateralized Mortgage Obligations - 1.6% | ||||

| FNMA Series 1993-107 Class E | ||||

| 6.500% 06/25/2008 | 5,000,000 | 4,878,100 | ||

| FNMA Series 1993-134 Class GA | ||||

| 6.500% 02/25/2007 | 5,000,000 | 4,946,850 | ||

| FNMA Series 1993-175 Class PU | ||||

| 6.350% 09/25/2008 | 7,015,000 | 6,795,781 | ||

| FNMA Series 1993-186 Class G | ||||

| 6.250% 03/25/2008 | 4,646,086 | 4,593,817 | ||

| Principal

Amount |

Market Value |

|||

|---|---|---|---|---|

| FNMA Series 1993-71 Class PG | ||||

| 6.250% 07/25/2007 | $ 8,000,000 | $ 7,940,000 | ||

| FNMA Series 1996-54 Class C | ||||

| 6.000% 09/25/2008 | 4,000,000 | 3,832,480 | ||

| 32,987,028 | ||||

| Pass-Through Securities - 1.3% | ||||

| FNMA 6.000% | ||||

| 11/01/2028 – 12/01/2028 | 5,504,143 | 5,037,997 | ||

| FNMA 7.500% | ||||

| 09/01/2029 – 05/01/2030 | 18,094,528 | 17,834,546 | ||

| FNMA 8.000% | ||||

| 05/01/2013 – 05/01/2030 | 4,540,943 | 4,555,455 | ||

| 27,427,998 | ||||

| 60,415,026 | ||||

| Government National Mortgage Association

(GNMA) - 1.2% |

||||

| Pass-Through Securities | ||||

| GNMA 6.500% | ||||

| 10/15/2028 – 03/15/2029 | 14,516,487 | 13,778,552 | ||

| GNMA 7.000% | ||||

| 04/15/2023 – 11/15/2023 | 3,240,485 | 3,161,483 | ||

| GNMA 7.500% | ||||

| 09/15/2016 – 10/15/2017 | 2,021,587 | 2,021,184 | ||

| GNMA 8.000% | ||||

| 01/15/2004 – 01/15/2009 | 5,078,768 | 5,169,508 | ||

| GNMA 9.000% | ||||

| 08/15/2008 – 09/15/2009 | 830,096 | 862,995 | ||

| 24,993,722 | ||||

| U.S. Government Guaranteed Notes - 0.3% | ||||

| 1991-A Caguas, PR | ||||

| 8.740% 08/01/2001 | 280,000 | 285,057 | ||

| 1991-A Cncl. Bluffs, IA | ||||

| 8.740% 08/01/2001 | 155,000 | 157,799 | ||

| 1991-A Fairfax County, VA | ||||

| 8.740% 08/01/2001 | 85,000 | 86,535 | ||

| 1991-A Fajardo, PR | ||||

| 8.740% 08/01/2001 | 210,000 | 213,793 | ||

| 1991-A Gadsden, AL | ||||

| 8.740% 08/01/2001 | 100,000 | 101,806 | ||

| 1991-A Lorain, OH | ||||

| 8.740% 08/01/2001 | 30,000 | 30,542 | ||

| Principal

Amount |

Market Value |

||||||||

|---|---|---|---|---|---|---|---|---|---|

| 1991-A Mayaguez, PR | |||||||||

| 8.740% 08/01/2001 | $ 150,000 | $ 152,709 | |||||||

| 1991-A Rochester, NY | |||||||||

| 8.650% 08/01/2000 | 4,295,000 | 4,299,123 | |||||||

| 5,327,364 | |||||||||

| Total U.S. Government Agency Obligations | |||||||||

| (Cost $106,797,151) | 104,956,978 | ||||||||

| U.S. Treasury Obligations - 4.1% | |||||||||

| U.S. Treasury Bonds - 2.9% | |||||||||

| U.S. Treasury Bond | |||||||||

| 7.500% 11/15/2016 | 8,598,000 | 9,710,323 | |||||||

| U.S. Treasury Bond | |||||||||

| 8.750% 05/15/2017 | 40,100,000 | 50,507,153 | |||||||

| 60,217,476 | |||||||||

| U.S. Treasury Notes - 1.2% | |||||||||

| U.S. Treasury Note | |||||||||

| 6.500% 08/15/2005 | 17,500,000 | 17,680,425 | |||||||

| U.S. Treasury Note | |||||||||

| 6.500% 10/15/2006 | 6,460,000 | 6,537,714 | |||||||

| 24,218,139 | |||||||||

| U.S. Treasury Strip - 0.0% | |||||||||

| U.S. Treasury Strip - Principal Only | |||||||||

| 0.000% 08/15/2015 | 2,000,000 | 787,620 | |||||||

| Total U.S. Treasury Obligations | |||||||||

| (Cost $85,381,683) | 85,223,235 | ||||||||

| TOTAL BONDS & NOTES | |||||||||

| (Cost $517,683,190) | 501,641,303 | ||||||||

| SHORT-TERM INVESTMENTS - 12.4% | |||||||||

| Cash Equivalents - 5.2% | |||||||||

| Bank of America Bank Note** | |||||||||

| 6.670% 03/22/2001 | 2,308,010 | 2,308,010 | |||||||

| Bank of Montreal Bank Note** | |||||||||

| 6.630% 08/16/2000 | 4,115,222 | 4,115,222 | |||||||

| Bank of Nova Scotia Eurodollar

Time Deposit** |

|||||||||

| 7.000% 07/03/2000 | 4,616,010 | 4,616,010 | |||||||

| Credit Agricole Bank Eurodollar

Time Deposit** |

|||||||||

| 6.750% 07/06/2000 | 17,654,388 | 17,654,388 | |||||||

| Principal

Amount |

Market Value |

|||

|---|---|---|---|---|

| Cash Equivalents (Continued) | ||||

| Credit Agricole Bank Eurodollar

Time Deposit** |

||||

| 6.750% 07/07/2000 | $ 2,308,006 | $ 2,308,006 | ||

| Den Danske Bank Eurodollar

Time Deposit** |

||||

| 6.810% 07/05/2000 | 9,662,684 | 9,662,684 | ||

| First Union Bank Note** | ||||

| 6.900% 05/09/2001 | 2,308,013 | 2,308,013 | ||

| Fleet National Bank Eurodollar

Time Deposit** |

||||

| 7.260% 10/31/2000 | 6,272,569 | 6,272,569 | ||

| HypoVereinsbank Eurodollar

Time Deposit** |

||||

| 6.750% 07/05/2000 | 19,233,373 | 19,233,373 | ||

| Merrimac Money Market Fund** | ||||

| 6.440% 07/03/2000 | 27,657,120 | 27,657,120 | ||

| Morgan Stanley Dean Witter & Co.** | ||||

| 6.890% 07/17/2000 | 464,475 | 464,475 | ||

| Morgan Stanley Dean Witter & Co.** | ||||

| 6.910% 11/22/2000 | 1,895,935 | 1,895,935 | ||

| Paribas Bank Eurodollar Time Deposit** | ||||

| 6.750% 07/05/2000 | 9,232,017 | 9,232,017 | ||

| 107,727,822 | ||||

| Commercial Paper - 7.2% | ||||

| Appalachian Power Company | ||||