As filed with the Securities and Exchange Commission on June 1,

2000

Securities Act

File No. 2-82766

Investment Company

Act File No. 811-3703

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

FORM

N-1A

| REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933 |

|

x |

| Pre-Effective

Amendment No.

|

|

¨ |

| Post-Effective

Amendment No. 19 |

|

x |

| and/or |

|

|

REGISTRATION

STATEMENT UNDER THE

INVESTMENT COMPANY ACT OF 1940 |

|

x |

| Amendment No.

22 |

|

x |

| (Check

appropriate box or boxes) |

|

|

CBA® MONEY

FUND

(Exact Name of

Registrant as Specified in Charter)

800 Scudders Mill

Road

Plainsboro, New

Jersey 08536

(Address of

Principal Executive Offices)

(609)

282-2800

(Registrant’s

Telephone Number, including Area Code)

TERRY K.

GLENN

CBA® Money

Fund

800 Scudders Mill

Road, Plainsboro, New Jersey

Mailing

Address:

P.O. Box 9011,

Princeton, New Jersey 08543-9011

(Name and Address

of Agent for Service)

Copies

to:

| Counsel for the

Fund:

BROWN & WOOD

LLP

One World Trade

Center

New York, New

York 10048-0557

Attention:

Thomas R. Smith, Jr., Esq.

|

|

Michael J.

Hennewinkel, Esq.

FUND ASSET

MANAGEMENT, L.P.

P.O. Box

9011

Princeton, New

Jersey

08543-9011

|

|

Jeffrey S.

Alexander, Esq.

MERRILL LYNCH,

PIERCE, FENNER & SMITH INCORPORATED

222 Broadway (14th

Floor)

New York, New York

10038

It is proposed that

this filing will become effective (check appropriate box)

|

x

|

immediately upon

filing pursuant to paragraph (b)

|

|

¨

|

on (date) pursuant

to paragraph (b)

|

|

¨

|

60 days after

filing pursuant to paragraph (a) (1)

|

|

¨

|

on (date) pursuant

to paragraph (a) (1)

|

|

¨

|

75 days after

filing pursuant to paragraph (a) (2)

|

|

¨

|

on (date) pursuant

to paragraph (a) (2) of Rule 485

|

If appropriate, check

the following box:

|

¨

|

This post-effective

amendment designates a new effective date for a previously filed

post-effective amendment.

|

Title of

Securities Being Registered: Shares of Beneficial Interest, Par Value $.10

Per Share

Prospectus

[LOGO] Merrill

Lynch

June 1, 2000

|

This Prospectus contains

information you should know before investing, including information about

risks. Please read it before you invest and keep it for future

reference.

|

|

The Securities and

Exchange Commission has not approved or disapproved these securities or

passed upon the adequacy of this Prospectus. Any representation to the

contrary is a criminal offense.

|

Table of Contents

CBA MONEY

FUND

[GRAPHIC] Key

Facts

In an effort to help you

better understand the many concepts involved in making an investment

decision, we have defined the highlighted terms in this prospectus in

the sidebar.

Short Term

Securities —

securities with maturities of not more than 762 days (25 months) in the

case of U.S. Government and agency securities.

Direct U.S.

Government Obligations — obligations that are issued

or have their principal and interest guaranteed and backed by the full

faith and credit of the United States.

CBA® MONEY FUND AT A GLANCE

What are the

Fund’s investment objectives?

The investment

objectives of the Fund are to seek current income, preservation of

capital and liquidity available from investing in a diversified

portfolio of short term money market securities.

What are the Fund’s

main investment strategies?

The Fund intends

to achieve its investment objectives by investing in a diversified

portfolio of U.S. dollar-denominated short term

securities. These securities consist primarily of direct

U.S. Government obligations, U.S. Government agency securities,

obligations of domestic and foreign banks, commercial paper and other

short term debt securities issued by U.S. and foreign entities and

repurchase agreements. Other than U.S. Government and certain U.S.

Government agency securities, the Fund only invests in short term

securities of issuers with one of the two highest short term ratings

from a nationally recognized credit rating organization or unrated

instruments which, in the opinion of Fund management, are of similar

quality.

Fund management

decides which of these securities to buy and sell based on its

assessment of the relative values of different securities and future

interest rates. Fund management seeks to improve the Fund’s yield

by taking advantage of yield differentials that regularly occur between

securities of a similar kind. We cannot guarantee that the Fund will

achieve its objectives.

What are the main risks

of investing in the Fund?

An investment in

the Fund is not insured or guaranteed by the Federal Deposit Insurance

Corporation or any other government agency. The Fund could lose money

if the issuer of an instrument held by the Fund defaults or if short

term interest rates rise sharply in a manner not anticipated by Fund

management. Although the Fund seeks to preserve the value of your

investment at $1.00 per share, it is possible to lose money by

investing in the Fund.

Who should

invest?

Shares of the

Fund are offered to participants in the Capital Builder

SM

Account

Service, to participants in certain other central asset account

programs (each, a “Service”) and to investors maintaining

accounts directly with the Transfer Agent.

The Fund may be

an appropriate investment for you if you:

|

Ÿ

|

Are looking

for preservation of capital.

|

|

Ÿ

|

Are investing

with short term goals in mind.

|

|

Ÿ

|

Are looking

for current income and liquidity.

|

CBA MONEY

FUND

3

[GRAPHIC] Key

Facts

Yield — the

income generated by an investment in the Fund.

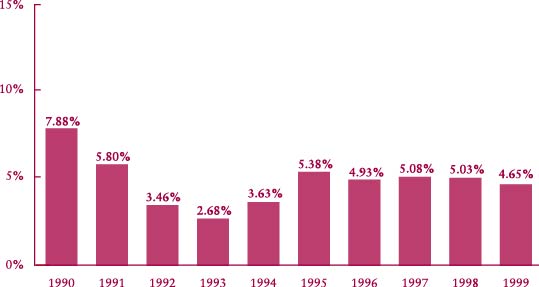

The bar chart and table shown below provide an indication of the risks of

investing in the Fund. The bar chart shows changes in the Fund’s

performance for the past ten calendar years. The table shows the

average annual total returns of the Fund for one, five and ten years.

How the Fund performed in the past is not necessarily an indication of

how the Fund will perform in the future.

[BAR CHART]

1990 1991 1992 1993 1994 1995 1996 1997 1998 1999

---- ---- ---- ---- ---- ---- ---- ---- ---- ----

7.88% 5.80% 3.46% 2.68% 3.63% 5.38% 4.93% 5.08% 5.03% 4.65%

During the ten year

period shown in the bar chart, the highest return for a quarter was

1.93% (quarter ended December 31, 1999) and the lowest return for a

quarter was 0.64% (quarter ended June 30, 1993). The Fund’s

year-to-date return as of March 31, 2000 was 1.32%.

Average Annual Total

Returns (as of the

calendar year ended

December 31, 1999) |

|

Past

One Year |

|

Past

5 Years |

|

Past

10 Years |

|

| CBA® Money Fund |

|

4.65% |

|

5.01% |

|

4.84% |

|

Yield

Information

The yield

on Fund shares normally will go up and down on a daily basis.

Therefore, yields for any given past periods are not an indication or

representation of future yields. The Fund’s yield is affected by

changes in interest rates, average portfolio maturity and operating

expenses. Current yield information may not provide the basis for a

comparison with bank deposits or other investments, which pay a fixed

yield over a stated period of time.

CBA MONEY

FUND

4

UNDERSTANDING

EXPENSES

Fund investors pay

various fees and expenses, either directly or indirectly. Listed below

are some of the main types of expenses, which all mutual funds may

charge:

Expenses paid

indirectly by the shareholder:

Annual Fund Operating

Expenses — expenses that cover the costs of operating

the Fund.

Management

Fee — a fee

paid to the Manager for managing the Fund.

Distribution

Fees — fees

used to support the Fund’s marketing and distribution efforts,

such as compensating financial consultants, advertising and

promotion.

This table

shows the different fees and expenses that you may pay if you buy and

hold shares of the Fund. Future expenses may be greater or less than

those indicated below.

| Shareholder Fees (fees paid directly by the

shareholder) |

|

| Maximum Account

Fee(a) |

|

$65 |

|

Annual Fund Operating Expenses (expenses

that are deducted from Fund assets) |

|

| Management

Fee |

|

0.41% |

|

| Distribution (12b-1)

Fees(b) |

|

0.13% |

|

| Other Expenses (including transfer

agency fees)(c) |

|

0.16% |

|

| Total

Annual Fund Operating Expenses |

|

0.70% |

|

(a)

|

Merrill Lynch

charges this annual program participation fee for the Capital

Builder

SM

Account

Service. Other programs through which Fund investments may be made

charge different annual fees, as described below.

|

(b)

|

The Fund is

authorized to pay Merrill Lynch and Broadcort distribution fees of

0.125% each year under a distribution plan that the Fund has adopted

under rule 12b-1. For the fiscal year ended February 29, 2000,

$3,021,428 was paid to Merrill Lynch and Broadcort pursuant to the

distribution plan.

|

(c)

|

The Fund pays

the Transfer Agent $10.00 for each shareholder account and reimburses

the Transfer Agent’s out-of-pocket expenses. For the fiscal year

ended February 29, 2000, the Fund paid the Transfer Agent fees

totaling $3,490,738. The Manager provides accounting services to the

Fund at its cost. For the fiscal year ended February 29, 2000, the

Fund reimbursed the Manager $184,424 for these services.

|

Example:

This example is

intended to help you compare the cost of investing in the Fund with the

cost of investing in other money market funds.

This example

assumes that you invest $10,000 in the Fund for the time periods

indicated, that your investment has a 5% return each year and that the

Fund’s operating expenses remain the same. This assumption is not

meant to indicate that you will receive a 5% annual rate of return.

Your annual return may be more or less than the 5% used in this

example. Although your actual costs may be higher or lower, based on

these assumptions your costs would be:

| 1 Year |

|

3 Years |

|

5 Years |

|

10 Years |

|

| $72 |

|

$224 |

|

$390 |

|

$871 |

|

CBA MONEY

FUND

5

[GRAPHIC] Key

Facts

FEES AND

EXPENSES

This example

does not take into account annual program participation fees charged by

Merrill Lynch or its affiliates for the Services listed below. See each

Service’s program description brochure for details. Shareholders

of the Fund whose accounts are maintained directly with the Fund’s

Transfer Agent and who are not subscribers to any of the Services will

not be charged a program fee but will not receive any of the additional

services available to subscribers.

| Service |

|

Current Annual

Fee |

|

| Capital Builder

SM

Account |

|

$65 |

|

| Life Management Service

SM

|

|

$114† |

|

| Merrill Lynch Emerging Investor

Account

SM

|

|

$24† |

|

| Medical Savings Account |

|

$100 |

|

| Broadcort Capital

Account†† |

|

$75 |

|

†

|

Subject to

rebate or waiver in certain circumstances.

|

††

|

Fee charged by

Broadcort Capital Corp., an affiliate of Merrill Lynch.

|

CBA MONEY

FUND

6

Maturity — the time at which the full

principal amount of a fixed income security is scheduled to be returned

to investors.

U.S. Government

agencies — entities that are part of

or sponsored by the federal government, such as the Government National

Mortgage Administration, the Tennessee Valley Authority or the Federal

Housing Administration.

[GRAPHIC] Details About

the Fund

The Fund seeks

current income, preservation of capital and liquidity. The Fund tries

to achieve its goals by investing in a diversified portfolio of short

term money market securities.

In seeking to

achieve the Fund’s objective, Fund management varies the kinds of

money market securities in the portfolio and the average

maturity. Fund management decides which securities to buy

and sell based on its assessment of the relative values of different

securities and future interest rates. Fund management seeks to improve

the Fund’s yield by taking advantage of yield differentials that

regularly occur between securities of a similar kind. For example,

market conditions frequently result in similar securities trading at

different prices. Fund management seeks to improve the Fund’s

yield by buying and selling securities based on these yield

differences.

Among the money

market obligations the Fund may buy are:

U.S. Government

Securities — Debt securities issued or guaranteed as to

principal and interest by the U.S. Government and supported by the full

faith and credit of the United States.

U.S. Government

Agency Securities — Debt securities issued or guaranteed as to

principal and interest by U.S. Government agencies,

U.S. Government-sponsored enterprises or U.S. Government

instrumentalities that are not direct obligations of the United

States but involve U.S. Government sponsorship or guarantees by U.S.

Government.

Bank Money

Instruments — Obligations of commercial banks, savings

banks, savings and loan associations, or other depository institutions,

such as certificates of deposit, bankers’ acceptances, bank notes

and time deposits. The savings banks and savings and loan associations

must be organized and operating in the United States. The obligations

of commercial banks may be Eurodollar obligations or

Yankeedollar obligations. The Fund may invest in Eurodollar

obligations only if they, by their terms, are general obligations of

the U.S. parent bank.

CBA MONEY

FUND

7

[GRAPHIC] Details About

the Fund

U.S.

Government-sponsored enterprises — private corporations

sponsored by the Federal government which have the legal status of

government agencies, such as the Federal Home Loan Mortgage Corporation

(“Freddie Mac”), the Student Loan Marketing Association

(“Sallie Mae”) or the Federal National Mortgage Association

(“Fannie Mae”).

U.S. Government

instrumentalities — supranational entities

sponsored by the U.S.

Eurodollar — obligations issued by

foreign branches or subsidiaries of U.S. banks.

Yankeedollar — obligations issued by U.S.

branches of subsidiaries of foreign banks.

ABOUT THE

PORTFOLIO

MANAGER

Robert Sabatino is the

portfolio manager and Vice President of the Fund. Mr. Sabatino has been

a Vice President of Merrill Lynch Asset Management since 1998 and has

been employed by MLAM since 1995.

ABOUT THE

MANAGER

The Fund is managed by

Fund Asset Management.

Commercial Paper

and Other Short Term Obligations — Commercial paper (including master notes,

funding agreements, and mortgage backed or asset backed securities)

with no more than 397 days (13 months) remaining to maturity at the

date of purchase.

Foreign Bank Money

Instruments — U.S. dollar-denominated obligations of foreign

depository institutions and their foreign branches and subsidiaries,

such as certificates of deposit, bankers’ acceptances, time

deposits, bank notes and deposit notes. Payment on securities of

foreign branches and subsidiaries may be a general obligation of the

parent bank or may be an obligation only of the issuing branch or

subsidiary. The Fund will invest in these securities only if Fund

management determines they are of comparable quality to other

investments permissible for the Fund. The Fund will not invest more

than 25% of its total assets (taken at market value at the time of each

investment) in these obligations.

Foreign Short Term

Debt Instruments — U.S. dollar-denominated commercial paper and

other short term obligations issued by foreign entities. The Fund may

purchase these securities only if Fund management determines they are

of comparable quality to the Fund’s U.S. investments.

Repurchase

Agreements — In a repurchase agreement the Fund buys a

security from another party, which agrees to buy it back at an agreed

upon time and price. The Fund may invest in repurchase agreements

involving the money market securities described above or U.S.

Government and agency securities with longer maturities.

Reverse Repurchase

Agreements — In a reverse repurchase agreement the Fund

sells a security to another party and agrees to buy it back at a

specific time and price. The Fund may invest in reverse repurchase

agreements involving the money market securities described

above.

Forward

Commitments — The Fund may buy

or sell money market securities on a forward commitment basis. In these

transactions, the Fund buys the securities at an established price with

payment and delivery taking place in the future. The value of the

security on the delivery date may be more or less than its purchase

price.

CBA MONEY

FUND

8

This section

contains a summary discussion of the general risks of investing in the

Fund. As with any mutual fund, there can be no guarantee that the Fund

will meet its goals or that the Fund’s performance will be

positive for any period of time.

Credit

Risk — Credit risk is the risk that the issuer of a

security owned by the Fund will be unable to pay the interest or

principal when due. The degree of credit risk depends on both the

financial condition of the issuer and the terms of the obligation.

While the Fund invests only in money market securities of highly rated

issuers, those issuers may still default on their

obligations.

Selection

Risk — Selection risk is the risk that the securities

that Fund management selects will underperform other funds with similar

investment objectives and investment strategies.

Interest Rate

Risk — Interest rate risk is the risk that prices of

securities owned by the Fund generally increase when interest rates go

down and decrease when interest rates go up. Prices of longer term

securities generally change more in response to interest rate changes

than prices of shorter term securities.

Share Reduction

Risk — In order to maintain a constant net asset

value of $1.00 per share, the Fund may reduce the number of shares held

by its shareholders.

Borrowing

Risk — The Fund may borrow only to meet redemptions.

Borrowing may exaggerate changes in the net asset value of Fund shares

and in the yield on the Fund’s portfolio. Borrowing will cost the

Fund interest expense and other fees. The cost of borrowing money may

reduce the Fund’s return.

Repurchase

Agreement Risk — If the other party to a repurchase agreement

defaults on its obligation under the agreement, the Fund may suffer

delays and incur costs or even lose money in exercising its rights

under the agreement.

Reverse Repurchase

Agreement and Securities Lending Risk — The Fund may enter into reverse repurchase

agreements with financial institutions. Reverse repurchase agreements

and securities lending involve the risk that the counterparty may fail

to return the securities

in a timely

manner or at all. The Fund could lose money if it is unable to recover

its security and the value of the collateral held by the Fund is less

than the value of the security. These events could trigger adverse tax

consequences to the Fund.

Foreign Market

Risk — The Fund may invest in U.S. dollar denominated

money market instruments and other short term debt obligations issued

by foreign banks and similar institutions. Although the Fund will

invest in these securities only if Fund management determines they are

of comparable quality to the Fund’s U.S. investments, investing in

securities of foreign issuers involves some additional risks. These

risks include the possibly higher costs of foreign investing, and the

possibility of adverse political, economic or other

developments.

European Economic

and Monetary Union (“EMU”) — A number of European countries have entered

into EMU in an effort to reduce trade barriers between themselves and

eliminate fluctuations in their currencies. EMU has established a

single European currency (the euro), which was introduced on January 1,

1999 and is expected to replace the existing national currencies of all

initial EMU participants by July 1, 2002. Certain securities (beginning

with government and corporate bonds) were redenominated in the euro.

These securities trade and make dividend and other payments only in

euros. Like other investment companies and business organizations,

including the companies in which the Fund invests, the Fund could be

adversely affected if the transition to the euro, or EMU as a whole,

does not proceed as planned.

STATEMENT OF ADDITIONAL

INFORMATION

If you would

like further information about the Fund, including how it invests,

please see the Statement of Additional Information.

CBA MONEY

FUND

10

[GRAPHIC] Your

Account

HOW TO BUY, SELL AND TRANSFER SHARES

The chart below summarizes how to buy, sell and transfer shares through

Merrill Lynch or other securities dealers. You may also buy shares

through the Transfer Agent. To learn more about buying shares through

the Transfer Agent, call 1-800-MER-FUND. Because the selection of a

mutual fund involves many considerations, your Merrill Lynch Financial

Consultant may help you with this decision.

CBA MONEY

FUND

11

[GRAPHIC] Your

Account

| If You Want

To |

|

Your

Choices |

|

Information

Important for You to Know |

|

| Buy Shares |

|

Determine the amount of

your investment |

|

If you are a Service

subscriber, there is no minimum initial

investment for Fund shares. |

| |

| |

|

|

|

If you are not a

Service subscriber, the minimum initial investment

for the Fund is $5,000. |

|

| |

|

Have cash balances from

your account automatically

invested in shares |

|

If you are a Service

subscriber and you choose to have your cash

balances automatically invested in the Fund, they will be invested

as follows: |

| |

|

|

|

Ÿ Except as

described below, cash balances in a Service account

are automatically invested in shares of the Fund at the next

determined net asset value not later than the first business day

of each week on which both the New York Stock Exchange and

New York banks are open, which will usually be a Monday. |

| |

|

|

|

Ÿ Cash balances

from (i) a sale of securities that does not settle on

the day the sale is made, (ii) a sale of securities that settles on a

same day basis, (iii) a repayment of principal on debt securities

held in the Service account or (iv) a sale of shares of Merrill

Lynch Ready Assets Trust or Merrill Lynch U.S.A. Government

Reserves will be invested in shares of the Fund at the next

determined net asset value on the business day following the

day on which proceeds of the transaction are received by the

Service account. |

| |

|

|

|

Ÿ A cash deposit

to the Service account, other than a manual

investment placed through your Merrill Lynch Financial

Consultant, must be delivered prior to the cashiering deadline in

the brokerage office in which the deposit is made at least one

business day prior to the next weekly sweep to be invested in

shares of the Fund in the next weekly sweep. Check with your

Merrill Lynch Financial Consultant regarding the cashiering

deadline in his or her branch. |

|

| |

|

Have your Merrill Lynch

Financial Consultant or

securities dealer submit

your purchase order |

|

If you are a Service

subscriber, you may make manual investments

of $1,000 or more from cash balances in your account which arise

from cash deposits or other activity. |

|

| |

|

|

|

Generally, manual

purchases placed through Merrill Lynch will be

effective on the day following the day the order is placed. Manual

purchases of $500,000 or more can be made effective on the same

day the order is placed provided certain requirements are

met. |

| |

| |

|

|

|

The Fund may reject

any order to buy shares and may suspend the

sale of shares at any time. |

| |

| |

|

|

|

Merrill Lynch,

Broadcort and the securities dealers reserve the right

to terminate a subscriber’s participation in the respective

Service at

any time. |

| |

| |

|

|

|

When purchasing shares

as a Service subscriber, you will be subject

to the applicable annual program participation fee. To receive all

the services available as a Service subscriber, you must complete

the account opening process, including completing or supplying

requested documentation. |

|

CBA MONEY

FUND

12

| If You Want

To |

|

Your

Choices |

|

Information

Important for You to Know |

|

Buy Shares

(continued) |

|

Or contact the Transfer

Agent |

|

If you maintain an

account directly with the Transfer Agent, and

are not a Service subscriber, you may call the Transfer Agent at

1-800-MER-FUND and request a purchase application. Mail the

completed purchase application to the Transfer Agent at the

address on the inside back cover of this prospectus. |

|

Add to Your

Investment |

|

Purchase additional

shares |

|

The minimum investment

for additional purchases (other than

automatic purchases) is $1,000 for all accounts. |

|

| |

|

Acquire additional

shares

through the automatic

dividend reinvestment plan |

|

All dividends are

automatically reinvested daily in the form of

additional shares at net asset value. |

|

Transfer Shares to

Another Securities

Dealer |

|

Transfer to a

participating

securities dealer |

|

You may transfer your

Fund shares only to another securities

dealer that has entered into an agreement with Merrill Lynch.

Certain shareholder services may not be available for the

transferred shares. You may only purchase additional shares of

funds previously owned before the transfer. All future trading of

these assets must be coordinated by the receiving firm. |

|

| |

|

Transfer to a non-

participating securities

dealer |

|

You must either:

Ÿ Transfer your

shares to an account with the Transfer Agent; or

Ÿ Sell your

shares. |

|

| Sell Your

Shares |

|

Automatic

Redemption |

|

The Fund has

instituted an automatic redemption procedure for

subscribers in a Service who have elected to have cash balances in

their accounts automatically invested in shares of the Fund. For

these subscribers, unless directed otherwise, Merrill Lynch or

Broadcort will redeem a sufficient number of shares of the Fund to

satisfy debit balances in the account (i) created by activity therein

or (ii) created by Visa® card purchases, cash advances or checks

written against the Visa® account. Each account of a subscriber will

be automatically scanned for debits each business day prior to 12

noon, Eastern time. After application of any cash balances in the

account to these debits, shares of the Fund will be redeemed at

net asset value at the 12 noon, Eastern time, pricing to satisfy

remaining debits. |

|

CBA MONEY

FUND

13

[GRAPHIC] Your

Account

| If You Want

To |

|

Your

Choices |

|

Information

Important for You to Know |

|

Sell Your Shares

(continued) |

|

Have your Merrill Lynch

Financial Consultant or

securities dealer submit

your sales order |

|

If you are a Service

subscriber, you may redeem your shares

directly by submitting a written notice of redemption to Merrill

Lynch or the securities dealer, respectively, which will submit the

request to the Transfer Agent. Cash proceeds from the redemption

generally will be mailed to you at your address of record, or upon

request, mailed or wired (if more than $10,000) to your bank

account. Redemption requests should not be sent to the Fund or

its Transfer Agent. If inadvertently sent to the Fund or the Transfer

Agent, redemption requests will be forwarded to Merrill Lynch or

Broadcort. All shareholders on the account must sign the

letter. |

| |

| |

|

|

|

Redemptions of Fund

shares will be confirmed to Service

subscribers (rounded to the nearest share) in their monthly

transaction statements. |

|

| |

|

Sell through the

Transfer

Agent |

|

You may sell shares

held at the Transfer Agent by writing to the

Transfer Agent at the address on the inside back cover of this

prospectus. All shareholders on the account must sign the letter. A

signature guarantee will generally be required but may be waived

in certain limited circumstances. You can obtain a signature

guarantee from a bank, securities dealer, securities broker, credit

union, savings association, national securities exchange and

registered securities association. A notary public seal will not be

acceptable. Redemption requests should not be sent to the Fund

or Merrill Lynch. The Transfer Agent will normally mail redemption

proceeds within seven days following receipt of a properly

completed request. If you make a redemption request before the

Fund has collected payment for the purchase of shares, the Fund

or the Transfer Agent may delay mailing your proceeds. This delay

will usually not exceed ten days. |

| |

| |

|

|

|

Check with the

Transfer Agent or your Merrill Lynch Financial

Consultant for details. |

|

CBA MONEY

FUND

14

Net Asset

Value — the

market value of the Fund’s total assets after deducting

liabilities, divided by the number of shares outstanding.

Dividends — ordinary income and capital gains paid to

shareholders. Dividends may be reinvested in additional Fund shares as

they are paid.

When you buy shares, you pay the net asset value (normally

$1.00 per share) without a sales charge. The “penny-rounding”

method is used in calculating net asset value, meaning that the

calculation is rounded to the nearest whole cent. This is the offering

price. Shares are also redeemed at their net asset value. The Fund

calculates its net asset value at 12 noon Eastern time on each business

day that the NYSE or New York banks are open, immediately after the

daily declaration of dividends. The net asset value used in determining

your price is the one calculated after your purchase or redemption

order becomes effective. Share purchase orders are effective on the

date federal funds become available to the Fund.

Dividends are declared and reinvested daily in the

form of additional shares at net asset value. You will begin accruing

dividends on the day following the date your purchase becomes

effective. Shareholders will receive statements monthly as to such

reinvestments. Shareholders redeeming their holdings will receive all

dividends declared and reinvested through the date of redemption. The

Fund intends to make distributions most of which will be taxed as

ordinary income although the Fund may distribute capital gains as well.

Capital gains paid by the Fund, if any, may be taxable to you at

different rates, depending, in part, on how long the Fund has held the

assets sold.

You will pay tax

on dividends from the Fund whether you receive them in cash or

additional shares. If you redeem Fund shares or exchange them for

shares of another fund, you generally will be treated as having sold

your shares and any gain on the transaction may be subject to tax.

Capital gains are generally taxed at different rates than ordinary

income dividends.

If the value of

assets held by the Fund declines, the Trustees may authorize a

reduction in the number of outstanding shares in shareholders’

accounts so as to preserve a net asset value of $1.00 per share. After

such a reduction, the basis of your eliminated shares would be added to

the basis of your remaining Fund shares, and you could recognize a

capital loss if you disposed of your shares at that time. Dividends

from the Fund, including dividends reinvested in additional shares of

the Fund, will nonetheless be fully taxable, even if the number of

shares in your account has been reduced as described above.

CBA MONEY

FUND

15

[GRAPHIC] Your

Account

If you are neither a lawful permanent resident nor a citizen of the U.S.

or if you are a foreign entity, the Fund’s ordinary income

dividends (which include distributions of net short term capital gains)

will generally be subject to a 30% U.S. withholding tax, unless a lower

treaty rate applies.

Dividends and

interest received by the Fund may give rise to withholding and other

taxes imposed by foreign countries. Tax conventions between certain

countries and the United States may reduce or eliminate such

taxes.

By law, the Fund

must withhold 31% of your dividends and redemption proceeds if you have

not provided a taxpayer identification number or social security

number.

This section

summarizes some of the consequences under current Federal tax law of an

investment in the Fund. It is not a substitute for personal tax advice.

Consult your personal tax adviser about the potential tax consequences

of an investment in the Fund under all applicable tax laws.

CBA MONEY

FUND

16

[GRAPHIC] Management of

the Fund

Fund Asset

Management, the Fund’s Manager, manages the Fund’s

investments and its business operations under the overall supervision

of the Fund’s Board of Trustees. The Manager has the

responsibility for making all investment decisions for the Fund. The

Fund pays the Manager a fee at the annual rate of 0.500% of the

Fund’s average daily net assets not exceeding $500 million; 0.425%

of the average daily net assets exceeding $500 million but not

exceeding $1 billion; and 0.375% of the average daily net assets

exceeding $1 billion.

Fund Asset

Management is part of Merrill Lynch Asset Management Group, which had

approximately $240 billion in investment company and other portfolio

assets under management as of April 2000. This amount includes assets

managed for Merrill Lynch affiliates.

CBA MONEY

FUND

17

[GRAPHIC] Management of

the Fund

The Financial

Highlights table is intended to help you understand the Fund’s

financial performance for the past five years. Certain information

reflects financial results for a single Fund share. The total returns

in the table represent the rate an investor would have earned on an

investment in the Fund (assuming reinvestment of all dividends). This

information has been audited by Deloitte & Touche LLP, whose report,

along with the Fund’s financial statements, are included in the

Fund’s annual report to shareholders, which is available upon

request.

| |

|

For the

Year Ended

February 29,

2000 |

|

For the Year Ended

February 28,

|

|

For the

Year Ended

February 29,

1996 |

| Increase (Decrease)

to Net Asset Value: |

|

|

1999 |

|

1998 |

|

1997 |

|

| Per Share Operating

Performance: |

|

| Net asset value,

beginning of year |

|

$

1.00 |

|

|

$

1.00 |

|

|

$

1.00 |

|

|

$

1.00 |

|

|

$

1.00 |

|

|

| Investment

income — net |

|

.0473 |

|

|

.0478 |

|

|

.0497 |

|

|

.0475 |

|

|

.0524 |

|

|

| Realized and

unrealized gain (loss) on investments

— net |

|

(.0003 |

) |

|

(.0002 |

) |

|

.0001 |

|

|

— |

† |

|

.0001 |

|

|

| Total from investment

operations |

|

.0470 |

|

|

.0476 |

|

|

.0498 |

|

|

.0475 |

|

|

.0525 |

|

|

| Less dividends and

distributions: |

| Investment

income — net |

|

(.0473 |

) |

|

(.0478 |

) |

|

(.0497 |

) |

|

(.0475 |

) |

|

(.0524 |

) |

|

| Total dividends and

distributions |

|

(.0473 |

) |

|

(.0479 |

) |

|

(.0498 |

) |

|

(.0475 |

) |

|

(.0525 |

) |

|

| Net asset value, end

of year |

|

$

1.00 |

|

|

$

1.00 |

|

|

$

1.00 |

|

|

$

1.00 |

|

|

$

1.00 |

|

|

| Total Investment

Return: |

|

5.09 |

% |

|

4.91 |

% |

|

5.10 |

% |

|

4.87 |

% |

|

5.39 |

% |

|

| Ratios to Average Net

Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Expenses, net of

reimbursement |

|

.70 |

% |

|

.70 |

% |

|

.70 |

% |

|

.69 |

% |

|

.75 |

% |

| Expenses |

|

.70 |

% |

|

.73 |

% |

|

.74 |

% |

|

.73 |

% |

|

.79 |

% |

|

| Investment income and

realized gain on investments — net |

|

4.68 |

% |

|

4.79 |

% |

|

4.98 |

% |

|

4.71 |

% |

|

5.22 |

% |

|

| Supplemental

Data: |

|

| Net assets, end of

year (in thousands) |

|

$2,425,888 |

|

|

$2,557,289 |

|

|

$2,360,682 |

|

|

$2,236,660 |

|

|

$1,988,000 |

|

|

†

|

Amount is less

than $.0001 per share.

|

CBA MONEY

FUND

18

------------------------------

POTENTIAL

-------------- INVESTORS ----------

| Open an account (two options). |

| ------------------------------ |

\1/ \2/

----------------------- ----------------------------------------------

SERVICE SUBSCRIBERS' NON - SERVICE

MERRILL LYNCH SUBSCRIBERS'

FINANCIAL CONSULTANT TRANSFER AGENT

or SECURITIES DEALER

Financial Data Services, Inc.

Advises shareholders on

their Fund investments. ADMINISTRATIVE OFFICES

----------------------- 4800 Deer Lake Drive East

/|\ Jacksonville, Florida 32246-6484

|

| MAILING ADDRESS

| P.O. Box 45289

| Jacksonville, Florida 32232-5289

| Performs recordkeeping and reporting services.

| ----------------------------------------------

| / \

| |

| ------------------------------------ |

| DISTRIBUTORS |

| |

| Merrill Lynch, Pierce, Fenner & Smith |

| Incorporated |

| North Tower |

| World Financial Center |

| 250 Vesey Street |

_______\ New York, New York 10080 /______

/ \

Broadcort Capital Corp.

100 Church Street

New York, New York 10007

Arranges for the sale of Fund shares.

------------------------------------

|

|

---------------------------------- | ----------------------------------------

COUNSEL | CUSTODIAN

|

Brown & Wood LLP | State Street Bank and Trust Company

One World Trade Center | P.O. Box 1713

New York, New York 10048-0557 | Boston, Massachusetts 02101

|

Provides legal advice to the Fund. | Holds the Fund's assets for safekeeping.

---------------------------------- | ----------------------------------------

| | |

| | |

| | |

| \ / |

| ----------------------- |

_________\ /________

/ THE FUND \

_________\ The Board of Directors /_______

| / oversees the Fund. \ |

| ----------------------- |

| |

| |

| |

----------------------------------- ---------------------------------

INDEPENDENT AUDITORS MANAGER

Deloitte & Touche LLP Fund Asset Management, L.P.

Princeton Forrestal Village

116-300 Village Boulevard ADMINISTRATIVE OFFICES

Princeton, New Jersey 08540-6400 800 Scudders Mill Road

Plainsboro, New Jersey 08543-9011

Audits the financial

statements of the Fund on behalf of MAILING ADDRESS

the shareholders. P.O. Box 9011

----------------------------------- Princeton, New Jersey 08543-9011

TELEPHONE NUMBER

1-800-MER-FUND

Manages the Fund's

day-to-day activities.

--------------------------------

CBA MONEY

FUND

[GRAPHIC] For More

Information

|

Additional information

about the Fund’s investments is available in the Fund’s

annual and semi-annual reports to shareholders. You may obtain these

reports at no cost by calling 1-800-221-7210.

|

|

The Fund will send you

one copy of each shareholder report and certain other mailings,

regardless of the number of Fund accounts you have. To receive

separate shareholder reports for each account, call your Merrill

Lynch Financial Consultant or write to the Transfer Agent at its

mailing address. Include your name, address, tax identification

number and Merrill Lynch brokerage or mutual fund account number. If

you have any questions, please call your Merrill Lynch Financial

Consultant or the Transfer Agent at 1-800-221-7210.

|

|

Statement of Additional Information

|

|

The Fund’s

Statement of Additional Information contains further information

about the Fund and is incorporated by reference (legally considered

to be part of this Prospectus). You

|

may request a free copy

by writing the Fund at Financial Data Services, Inc., P.O. Box 45289,

Jacksonville, Florida 32232-5289 or by calling

1-800-MER-FUND.

Contact your Merrill

Lynch Financial Consultant or the Fund at the telephone number or

address indicated above if you have any questions.

Information about the

Fund (including the Statement of Additional Information) can be

reviewed and copied at the SEC’s Public Reference Room in

Washington, D.C. Call 1-202-942-8090 for information on the operation

of the public reference room. This information is also available on the

SEC’s Internet site at http://www.sec.gov and copies may be

obtained upon payment of a duplicating fee by electronic request at the

following E-mail address: [email protected] or by writing the Public

Reference Section of the SEC, Washington, D.C. 20549-0102.

You should rely only

on the information contained in this Prospectus. No one is authorized

to provide you with information that is different from the information

contained in this Prospectus.

Investment Company Act

file #811-3703

Code

#10126-06-00

©

Fund Asset Management, L.P.

Prospectus

[LOGO] Merrill

Lynch

June 1, 2000

STATEMENT OF

ADDITIONAL INFORMATION

CBA®

Money Fund

P.O. Box 9011,

Princeton, New Jersey 08543-9011 Ÿ Phone No. (609) 282-2800

CBA® Money

Fund (the “Fund”) is a no-load money market fund, whose

shares are offered to subscribers to the Capital Builder

SM

Account

service, the Life Management Service

SM

, the Merrill

Lynch Emerging Investor Account

SM

service and the

Medical Savings Account service of Merrill Lynch, Pierce, Fenner &

Smith Incorporated (“Merrill Lynch”), to subscribers to the

Broadcort Capital Account service of Broadcort Capital Corp.

(“Broadcort”) (the Capital Builder

SM

Account

service, Life Management Service

SM

, Merrill Lynch

Emerging Investor Account

SM

service and the

Medical Savings Account service are collectively referred to as the

“Services”) and to investors maintaining accounts directly

with the Fund’s Transfer Agent. Each Service consists of a

conventional securities cash or margin account (“Securities

Account”) maintained at Merrill Lynch or Broadcort, as applicable,

which is presently linked to the Fund and to a Visa® card/check

account (“Visa® Account”). The Life Management Service

also may be linked to insurance, home financing and other services. The

investment objectives of the Fund are to seek current income,

preservation of capital and liquidity available from investing in a

diversified portfolio of short term money market

securities.

A customer of

Merrill Lynch and a customer of a securities firm that has entered into

a selected dealer agreement with Broadcort may subscribe to one of the

Services, as applicable, as set forth in the description of the

respective Services discussed below. Subject to the conditions

described in the Prospectus, free credit balances in the Securities

Account of Service participants will be periodically invested in shares

of the Fund. This permits the subscriber to earn a return on such funds

pending further investment through other aspects of the respective

Service or utilization through the Visa® Account. The shares of the

Fund also may be purchased by investors maintaining accounts directly

with the Fund’s Transfer Agent. Such investors will not receive

any of the additional services available to Service subscribers, such

as the Visa® Account or the automatic investment of free credit

balances.

Merrill Lynch

charges an annual program participation fee (presently $65) for the

Capital Builder

SM

Account service

and charges an annual program participation fee (presently $114,

subject to rebate in certain circumstances) for the Life Management

Service

SM

. See the Life

Management Service

SM

program

description booklet for details. Merrill Lynch charges an annual

program participation fee (presently $24, subject to fee waiver in

certain circumstances) for the Merrill Lynch Emerging Investor

Account

SM

. See the

Merrill Lynch Emerging Investor Account

SM

brochure for

details. Merrill Lynch charges an annual program participation fee

(presently $100) for the Medical Savings Account service. Broadcort

charges an annual fee (presently $75) for the Broadcort Capital Account

service. Information with respect to the respective Services is set

forth in the description of such Service or accompanying material

furnished to all Service subscribers. Merrill Lynch and Broadcort

reserve the right to change the respective fees at any

time.

This Statement

of Additional Information of the Fund is not a prospectus and should be

read in conjunction with the Prospectus of the Fund, dated June 1, 2000

(the “Prospectus”), which has been filed with the Securities

and Exchange Commission (the “Commission”) and can be

obtained, without charge, by calling (800) MER-FUND or by writing the

Fund at the above address. The Prospectus is incorporated by reference

into this Statement of Additional Information, and this Statement of

Additional Information is incorporated by reference into the

Prospectus. The Fund’s audited financial statements are

incorporated in this Statement of Additional Information by reference

to its 2000 annual report to shareholders. You may request a copy of

the annual report at no charge by calling (800) 456-4587 ext. 789

between 8:00 a.m. and 8:00 p.m. on any business day.

Fund Asset

Management—Manager

The date of this

Statement of Additional Information is June 1, 2000.

TABLE OF

CONTENTS

INVESTMENT OBJECTIVES AND POLICIES

The investment

objectives of the Fund are to seek current income, preservation of

capital and liquidity available from investing in a diversified

portfolio of short term money market securities. There can be no

assurance that the Fund’s investment objectives will be achieved.

The investment objectives are fundamental policies of the Fund that may

not be changed without the approval of the holders of the Fund’s

outstanding securities (as defined below). Reference is made to

“How the Fund Invests” and “Investment Risks” in

the Prospectus.

The Fund’s

investments in short term “Government Securities” and

Government agency securities will be in instruments with a remaining

maturity of 762 days (25 months) or less. The Fund’s other

investments will be in instruments with a remaining maturity of 397

days (13 months) or less that have received a short term rating or that

have been issued by issuers that have received a short term rating with

respect to a class of debt obligations that are comparable in priority

and security with the instruments, from the requisite nationally

recognized statistical rating organizations (“NRSROs”) in one

of the two highest short term rating categories or, if neither the

instrument nor its issuer is so rated, will be of comparable quality as

determined by the Trustees of the Fund (or by Fund Asset Management,

L.P. (the “Manager” or “FAM”) pursuant to delegated

authority). Currently, there are five NRSROs: Duff & Phelps Credit

Rating Co., Fitch IBCA, Inc., Thomson BankWatch, Inc., Moody’s

Investors Service, Inc. and Standard & Poor’s. The Fund will

determine the remaining maturity of its investments in accordance with

Commission regulations. The dollar-weighted average maturity of the

Fund’s portfolio will not exceed 90 days. During the Fund’s

fiscal year ended February 29, 2000, the average maturity of its

portfolio ranged from 53 days to 81 days.

Investment in

Fund shares offers several potential benefits. The Fund seeks to

provide as high a yield potential as is available through investment in

short term money market securities utilizing professional money market

management, block purchases of securities and yield improvement

techniques. It provides high liquidity because of its redemption

features and seeks the reduced risk that generally results from

diversification of assets. There can be no assurance that the

investment objectives of the Trust will be realized. Certain expenses

are borne by investors, including advisory and management fees,

administrative costs and operational costs.

In managing the

Fund, the Manager will employ a number of professional money management

techniques, including varying the composition of investments and the

average maturity of the portfolio based on its assessment of the

relative values of the various securities and future interest rate

patterns. These assessments will respond to changing economic and money

market conditions and to shifts in fiscal and monetary policy. The

Manager also will seek to improve yield by taking advantage of yield

disparities that regularly occur in the money market. For example,

market conditions frequently result in similar securities trading at

different prices. Also, there frequently are differences in yields

between the various types of money market securities. The Fund seeks to

enhance yield by purchasing and selling securities based on these yield

differences.

The following is

a description of some of the types of money market securities in which

the Fund may invest:

U.S.

Government Securities. Marketable securities

issued by or guaranteed as to principal and interest by the U.S.

Government and supported by the full faith and credit of the United

States.

U.S.

Government Agency Securities. Debt

securities issued by U.S. Government-sponsored enterprises, Federal

agencies and certain international institutions that are not direct

obligations of the United States but involve U.S. Government

sponsorship or guarantees by U.S. Government agencies or enterprises.

The U.S. Government is not obligated to provide financial support to

these instrumentalities.

Bank Money

Instruments. Obligations of commercial

banks, savings banks, savings and loan associations or other depository

institutions such as certificates of deposit, including variable rate

certificates of deposit, time deposits, deposit notes, bank notes and

bankers’ acceptances. The savings banks and savings and loan

associations must be organized and operating in the United States. The

obligations of commercial banks may be issued by U.S. banks, foreign

branches of U.S. banks (“Eurodollar” obligations) or U.S.

branches of foreign banks (“Yankeedollar” obligations).

Eurodollar and Yankeedollar obligations may be general obligations of

the parent bank or may be limited to the issuing branch by the terms of

the specific obligations or by government regulation.

Eurodollar and

Yankeedollar obligations, as well as obligations of foreign depository

institutions and short term obligations issued by other foreign

entities, involve additional investment risks from the risks of

obligations of U.S. issuers. Such investment risks include adverse

political and economic developments, the possible imposition of

withholding taxes on interest income payable on such obligations, the

possible seizure or nationalization of foreign deposits and the

possible establishment of exchange controls or other foreign

governmental laws or restrictions which might adversely affect the

payment of principal and interest. Generally the issuers of such

obligations are subject to few or none of the U.S. regulatory

requirements applicable to U.S. issuers. Foreign branches of U.S. banks

may be subject to less stringent reserve requirements than U.S. banks.

U.S. branches of foreign banks are subject to the reserve requirements

of the states in which they are located. There may be less publicly

available information about a U.S. branch or subsidiary of a foreign

bank or other issuer than about a U.S. bank or other issuer, and such

entities may not be subject to the same accounting, auditing and

financial record keeping standards and requirements as U.S. issuers.

Evidence of ownership of Eurodollar and foreign obligations may be held

outside the United States, and the Fund may be subject to the risks

associated with the holding of such property overseas. Eurodollar and

foreign obligations of the Fund held overseas will be held by foreign

branches of the Fund’s custodian or by other U.S. or foreign banks

under subcustodian arrangements complying with the requirements of the

Investment Company Act of 1940, as amended (the “Investment

Company Act”).

The Manager will

carefully consider the above factors in making investments in

Eurodollar obligations, Yankeedollar obligations of foreign depository

institutions and other foreign short term obligations and will not

knowingly purchase obligations which, at the time of purchase, are

subject to exchange controls or withholding taxes. Generally, the Fund

will limit its Yankeedollar investments to obligations of banks

organized in Canada, France, Germany, Japan, the Netherlands,

Switzerland, the United Kingdom and other industrialized nations. As

discussed in the Prospectus, the Fund may also invest in U.S.

dollar-denominated commercial paper and other short term obligations

issued by foreign entities. Such investments are subject to quality

standards similar to those applicable to investments in comparable

obligations of domestic issues. Investments in foreign entities

generally involve the same risks as those described above in connection

with investments in Eurodollar and Yankeedollar obligations and

obligations of foreign depository institutions and their foreign

branches and subsidiaries.

Bank money

instruments in which the Fund invests must be issued by depository

institutions with total assets of at least $1 billion, except that up

to 10% of the Fund’s total assets (taken at market value) may be

invested in certificates of deposit of smaller institutions if such

certificates of deposit are Federally insured.

Commercial

Paper and Other Short Term

Obligations. Commercial paper (including

master notes and funding agreements), which refers to short term

unsecured promissory notes issued by corporations, partnerships, trusts

or other entities to finance short term credit needs and

non-convertible debt securities (e.g., bonds and debentures)

with no more than 397 days (13 months) remaining to maturity at the

date of purchase. Short term obligations issued by trusts,

corporations, partnerships or other entities include mortgage-related

or asset-backed debt instruments, including pass-through certificates

such as participations in, or bonds and notes backed by, pools of

mortgage, credit card, automobile or other types of receivables. These

structured financings will be supported by sufficient collateral and

other credit enhancements, including letters of credit, insurance,

reserve funds and guarantees by third parties, to enable such

instruments to obtain the requisite quality rating by an

NRSRO.

Foreign Bank

Money Instruments. U.S. dollar-denominated

obligations of foreign depository institutions and their foreign

branches and subsidiaries, such as certificates of deposit,

bankers’ acceptances, time deposits and deposit notes. The

obligations of such foreign branches and subsidiaries may be the

general obligation of the parent bank or may be limited to the issuing

branch or subsidiary by the terms of the specific obligation or by

government regulation. Such investments will only be made if determined

to be of comparable quality to other investments permissible for the

Fund. The Fund will not invest more than 25% of its total assets (taken

at market value at the time of each investment) in these

obligations.

Foreign Short

Term Debt Instruments. U.S.

dollar-denominated commercial paper and other short term obligations

issued by foreign entities. Such investments are subject to quality

standards similar to those applicable to investments in comparable

obligations of domestic issuers.

The following is a

description of other types of investments or investment practices in

which the Fund may invest or engage:

Repurchase

Agreements; Purchase and Sale Contracts. The

Fund may invest in the money market securities described above pursuant

to repurchase agreements. Under such agreements, the counterparty

agrees, upon entering into the contract, to repurchase the security at

a mutually agreed upon time and price, thereby determining the yield

during the term of the agreement. This results in a fixed rate of

return insulated from market fluctuations during such

period.

Such agreements

usually cover short periods, such as under a week. The Fund will

require the seller to provide additional collateral if the market value

of the securities falls below the repurchase price at any time during

the term of the repurchase agreement. In the event of a default by the

seller, the Fund ordinarily will retain ownership of the securities

underlying the repurchase agreement, and instead of a contractually

fixed rate of return, the rate of return to the Fund shall be dependent

upon intervening fluctuations of the market value of such securities

and the accrued interest on the securities. In such event, the Fund

would have rights against the seller for breach of contract with

respect to any losses arising from market fluctuations following the

failure of the seller to perform. In certain circumstances, repurchase

agreements may be construed to be collateralized loans by the purchaser

to the seller secured by the securities transferred to the purchaser.

In the event of default by the seller under a repurchase agreement

construed to be a collateralized loan, the underlying securities are

not owned by the Fund but only constitute collateral for the

seller’s obligation to pay the repurchase price. Therefore, the

Fund may suffer time delays and incur costs or possible losses in

connection with the disposition of the collateral. From time to time

the Fund also may invest in money market securities pursuant to

purchase and sale contracts. While purchase and sale contracts are

similar to repurchase agreements, purchase and sale contracts are

structured so as to be in substance more like a purchase and sale of

the underlying security than is the case with repurchase

agreements.

Reverse

Repurchase Agreements. The Fund may enter

into reverse repurchase agreements that involve the sale of money

market securities held by the Fund, with an agreement to repurchase the

securities at an agreed-upon price, date and interest payment. During

the time a reverse repurchase agreement is outstanding, the Fund will

maintain a segregated custodial account containing U.S. Government or

other appropriate high-grade debt securities having a value equal to

the repurchase price.

Lending of

Portfolio Securities. The Fund may lend

securities with a value not exceeding 33 1

/3% of its total

assets. In return, the Fund receives collateral in an amount equal to

at least 100% of the current market value of the loaned securities in

cash or securities issued or guaranteed by the U.S. Government. This

limitation is a fundamental policy and it may not be changed without

the approval of the holders of a majority of the Fund’s

outstanding voting securities, as defined in the Investment Company

Act. The Fund receives securities as collateral for the loaned

securities and the Fund and the borrower negotiate a rate for the loan

premium to be received by the Fund for the loaned securities, which

increases the Fund’s yield. The Fund may receive a flat fee for

its loans. The loans are terminable at any time and the borrower, after

notice, is required to return borrowed securities within five business

days. The Fund may pay reasonable finder’s, administrative and

custodial fees in connection with its loans. In the event that the

borrower defaults on its obligation to return borrowed securities

because of insolvency or for any other reason, the Fund could

experience delays and costs in gaining access to the collateral and

could suffer a loss to the extent the value of the collateral falls

below the market value of the borrowed securities.

Forward

Commitments. The Fund may purchase or sell

money market securities on a forward commitment basis at fixed purchase

or sale terms. The purchase of money market securities on a forward

commitment basis involves the risk that the yields available in the

market when the delivery takes place may actually be higher than those

obtained in the transaction itself; if yields increase, the value of

the securities purchased on a forward commitment basis will generally

decrease. A separate account of the Fund will be established with the

Fund’s custodian consisting of cash or liquid money market

securities having a market value at all times at least equal to the

amount of the forward purchase commitment. The Fund may also sell money

market securities on a forward commitment basis. By doing so, the Fund

forgoes the opportunity to sell such securities at a higher price

should they increase in value between the trade and settlement

dates.

There can be no

assurance that a security purchased or sold through a forward

commitment will be delivered. The value of securities in these

transactions on the delivery date may be more or less than the

Fund’s purchase price. The Fund may bear the risk of a decline in

the value of the security in these transactions and may not benefit

from an appreciation in the value of the security during the commitment

period.

Preservation of

capital is a prime investment objective of the Fund, and while the

types of money market securities in which the Fund invests generally

are considered to have low principal risk, such securities are not

completely risk free. There is a risk of the failure of issuers to meet

their principal and interest obligations. With respect to repurchase

agreements, purchase and sale contracts, reverse repurchase agreements

and the lending of portfolio securities by the Fund, there is also the

risk of the failure of the parties involved to repurchase at the

agreed-upon price or to return the securities involved in such

transactions, in which event the Fund may suffer time delays and incur

costs or possible losses in connection with such

transactions.

Rule 2a-7 under

the Investment Company Act presently limits investments by the Fund in

securities issued by any one issuer (other than the U.S. Government,

its agencies or instrumentalities) ordinarily to not more than 5% of

its total assets, or, in the event that such securities are not First

Tier Securities (as defined in the Rule), not more than 1%. In

addition, Rule 2a-7 requires that not more than 5% of the Fund’s

total assets be invested in Second Tier Securities (as defined in the

Rule). The Rule requires the Fund to be diversified (as defined in the

Rule) other than with respect to government securities and securities

subject to guarantee issued by a non-controlled person (as defined in

the Rule).

Investment

Restrictions. The Fund has adopted a number

of restrictions and policies relating to the investment of its assets

and its activities, which are fundamental policies and may not be

changed without the approval of the holders of a majority of the

Fund’s outstanding voting securities (which for this purpose means

the lesser of (i) 67% of the shares represented at a meeting at which

more than 50% of the outstanding shares are represented or (ii) more

than 50% of the outstanding shares). Among the more significant

restrictions, the Fund may not:

|

(1)

purchase any securities other than (i) money market securities

and (ii) other securities described under “Investment Objectives

and Policies”;

|

|

(2)

invest more than 25% of its total assets (taken at market value

at the time of each investment) in the securities of issuers in any

particular industry (other than U.S. Government securities, U.S.

Government agency securities or domestic bank money

instruments);

|

|

(3)

purchase the securities of any one issuer, other than the U.S.

Government, its agencies or instrumentalities, if immediately after

the purchase, more than 5% of the value of its total assets (taken at

market value) would be invested in that issuer, except that, with

respect to 25% of the value of the Fund’s total assets, the Fund

may invest up to 10% of its total assets in bank money instruments or

repurchase agreements with any one bank;

|

|

(4)

purchase more than 10% of the outstanding securities of an

issuer except that this restriction shall not apply to U.S.

Government or Government agency securities, bank money instruments

and repurchase agreements; or

|

|

(5)

enter into repurchase agreements if, as a result, more than 10%

of its total assets (taken at market value at the time of each

investment) would be subject to repurchase agreements maturing in

more than seven days.

|

In addition, the

Fund has adopted the following other fundamental restrictions and

policies relating to the investment of its assets and its activities.

The Fund may not:

|

(1)

make investments for the purpose of exercising control or

management;

|

|

(2)

underwrite securities issued by other persons;

|

|

(3)

purchase securities of other investment companies, except in

connection with a merger, consolidation, acquisition or

reorganization;

|

|

(4)

purchase or sell real estate (other than money market

securities secured by real estate or interests therein or money

market securities issued by companies which invest in real estate or

interests therein), commodities or commodity contracts, interests in

oil, gas or other mineral exploration or development

programs;

|

|

(5)

purchase any securities on margin, except for the use of short

term credit necessary for clearance of purchase and sales of

portfolio securities;

|

|

(6)

make short sales of securities or maintain a short position or

write, purchase or sell puts, calls, straddles, spreads or

combinations thereof;

|

|

(7)

make loans to other persons, provided that the Fund may

purchase money market securities or enter into repurchase agreements

or purchase and sale contracts and lend securities owned or held by

it pursuant to (8) below;

|

|

(8)

lend its portfolio securities in excess of 33 1

/3% of its total

assets, taken at market value, provided that such loans are made

according to the guidelines set forth below;

|

|

(9)

borrow amounts in excess of 20% of its total assets, taken at

market value (including the amount borrowed), and then only from

banks as a temporary measure for extraordinary or emergency purposes

(the borrowing provisions shall not apply to reverse repurchase

agreements). (Usually only “leveraged” investment companies

may borrow in excess of 5% of their assets; however, the Fund will

not borrow to increase income but only to meet redemption requests

which might otherwise require untimely dispositions of portfolio

securities. The Fund will not purchase securities while borrowings

are outstanding. Interest paid on such borrowings will reduce net

income.);

|

|

(10)

mortgage, pledge, hypothecate or in any manner transfer

(except as provided in (8) above) as security for indebtedness any

securities owned or held by the Fund except as may be necessary in

connection with borrowings referred to in investment restriction (9)

above, and then such mortgaging, pledging or hypothecating may not

exceed 10% of the Fund’s net assets, taken at market

value;

|

|

(11)

invest in securities with legal or contractual

restrictions on resale (except for repurchase agreements) or for

which no readily available market exists if, regarding all such

securities, more than 10% of its net assets (taken at market value)

would be invested in such securities;

|

|

(12)

invest in securities of issuers (other than U.S.

Government agency securities) having a record, together with

predecessors, of less than three years of continuous operation if,

regarding all such securities, more than 5% of its total assets

(taken at market value) would be invested in such

securities;

|

|

(13)

invest in securities or investments referred to in

investment restrictions (11) above and investment restriction (5) on

the previous page if, regarding all such securities and investments,

more than 10% of the Fund’s total assets (taken at market value)

would be invested in such securities or investments;

|

|

(14)

enter into reverse repurchase agreements if, as a result

thereof, the Fund’s obligations with respect to reverse

repurchase agreements would exceed one-third of its net assets

(defined to be total assets, taken at market value, less liabilities

other than reverse repurchase agreements);

|

|

(15)

purchase or retain the securities of any issuer, if those

individual officers and Trustees of the Fund, Merrill Lynch Asset