|

|

|

|

|

Previous: INTEGRAL SYSTEMS INC /MD/, 8-K, EX-99.1, 2000-09-15 |

Next: CONSOLIDATED CAPITAL INSTITUTIONAL PROPERTIES 2, DEFC14A, 2000-09-15 |

Semiannual Report

July 31, 2000

(2_fidelity_logos)(Registered_Trademark)

|

President's Message |

3 |

Ned Johnson on investing strategies |

|

Spartan New York Municipal Income Fund |

||

|

|

4 |

Performance |

|

|

7 |

Fund Talk: The Manager's Overview |

|

|

10 |

Investment Changes |

|

|

11 |

Investments |

|

|

24 |

Financial Statements |

|

Spartan New York Municipal Money Market Fund |

||

|

|

28 |

Performance |

|

|

30 |

Fund Talk: The Manager's Overview |

|

|

32 |

Investment Changes |

|

|

33 |

Investments |

|

|

42 |

Financial Statements |

|

Fidelity New York Municipal Money Market Fund |

||

|

|

46 |

Performance |

|

|

48 |

Fund Talk: The Manager's Overview |

|

|

50 |

Investment Changes |

|

|

51 |

Investments |

|

|

62 |

Financial Statements |

|

Notes |

66 |

Notes to the financial statements |

|

|

|

|

|

|

|

|

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

(Recycle graphic) This report is printed on recycled paper using soy-based inks.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the funds. This report is not authorized for distribution to prospective investors in the funds unless preceded or accompanied by an effective prospectus.

Mutual fund shares are not deposits or obligations of, or guaranteed by, any depository institution. Shares are not insured by the FDIC, Federal Reserve Board or any other agency, and are subject to investment risks, including possible loss of principal amount invested.

Neither the funds nor Fidelity Distributors Corporation is a bank.

For more information on any Fidelity fund, including charges and expenses, call 1-800-544-6666 for a free prospectus. Read it carefully before you invest or send money.

Semiannual Report

(photo_of_Edward_C_Johnson_3d)Dear Shareholder:

The Federal Reserve Board's effort to keep inflation in check without over-cooling the U.S. economy has taken a toll on the stock market. Through July 2000, bellwether equity indexes such as the Dow Jones Industrial Average, NASDAQ and S&P 500® have negative returns for the year. On the other hand, fixed-income markets are enjoying strong performance. Except for high-yield, most bond sectors - corporates, mortgages, Treasuries and agencies - have returned 4%-6% year to date.

While it's impossible to predict the future direction of the markets with any degree of certainty, there are certain basic principles that can help investors plan for their future needs.

The longer your investment time frame, the less likely it is that you will be affected by short-term market volatility. A 10-year investment horizon appropriate for saving for a college education, for example, enables you to weather market cycles in a long-term fund, which may have a higher risk potential, but also has a higher potential rate of return.

An intermediate-length fund could make sense if your investment horizon is two to four years, while a short-term bond fund could be the right choice if you need your money in one or two years.

If your time horizon is less than a year, you might want to consider moving some of your bond investment into a money market fund. These funds seek income and a stable share price by investing in high-quality, short-term investments. Of course, it's important to remember that an investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although money market funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in these types of funds.

Finally, no matter what your time horizon or portfolio diversity, it makes good sense to follow a regular investment plan, investing a certain amount of money in a fund at the same time each month or quarter and periodically reviewing your overall portfolio. By doing so, you won't get caught up in the excitement of a rapidly rising market, nor will you buy all your shares at market highs. While this strategy - known as dollar cost averaging - won't assure a profit or protect you from a loss in a declining market, it should help you lower the average cost of your purchases. Of course, you should consider your financial ability to continue your purchases through periods of low price levels before undertaking such a strategy.

If you have questions, please call us at 1-800-544-6666, or visit our web site at www.fidelity.com. We are available 24 hours a day, seven days a week to provide you the information you need to make the investments that are right for you.

Best regards,

/s/Edward C. Johnson 3d

Edward C. Johnson 3d

Semiannual Report

Spartan New York Municipal Income Fund

Performance: The Bottom Line

There are several ways to evaluate historical performance. You can look at the total percentage change in value, the average annual percentage change, or the growth of a hypothetical $10,000 investment. Total return reflects the change in value of an investment, assuming reinvestment of the fund's dividend income and capital gains (the profits earned upon the sale of securities that have grown in value). You can also look at the fund's income, as reflected in its yield, to measure performance. If Fidelity had not reimbursed certain fund expenses, the past five year and past 10 year total returns would have been lower.

Cumulative Total Returns

|

Periods ended July 31, 2000 |

Past 6 |

Past 1 |

Past 5 |

Past 10 |

|

Spartan NY Municipal Income |

6.91% |

4.35% |

33.20% |

92.84% |

|

LB New York 4 Plus Year Municipal Bond |

7.32% |

4.41% |

36.77% |

n/a* |

|

New York Municipal Debt Funds Average |

6.61% |

2.35% |

27.39% |

84.99% |

Cumulative total returns show the fund's performance in percentage terms over a set period - in this case, six months, one year, five years or 10 years. For example, if you had invested $1,000 in a fund that had a 5% return over the past year, the value of your investment would be $1,050. You can compare the fund's returns to the performance of the Lehman Brothers New York 4 Plus Year Municipal Bond Index - a market value-weighted index of New York investment-grade municipal bonds with maturities of four years or more. To measure how the fund's performance stacked up against its peers, you can compare it to the New York municipal debt funds average, which reflects the performance of mutual funds with similar objectives tracked by Lipper Inc. The past six months average represents a peer group of 105 mutual funds. These benchmarks include reinvested dividends and capital gains, if any, and exclude the effect of sales charges.

Average Annual Total Returns

|

Periods ended July 31, 2000 |

|

Past 1 |

Past 5 |

Past 10 |

|

Spartan NY Municipal Income |

|

4.35% |

5.90% |

6.79% |

|

LB New York 4 Plus Year Municipal Bond |

|

4.41% |

6.46% |

n/a* |

|

New York Municipal Debt Funds Average |

|

2.35% |

4.93% |

6.29% |

Average annual total returns take the fund's cumulative return and show you what would have happened if the fund had performed at a constant rate each year. (Note: Lipper calculates average annual total returns by annualizing each fund's total return, then taking an arithmetic average. This may produce a different figure than that obtained by averaging the cumulative total returns and annualizing the result.)

* Not available

Semiannual Report

Spartan New York Municipal Income Fund

Performance - continued

$10,000 Over 10 Years

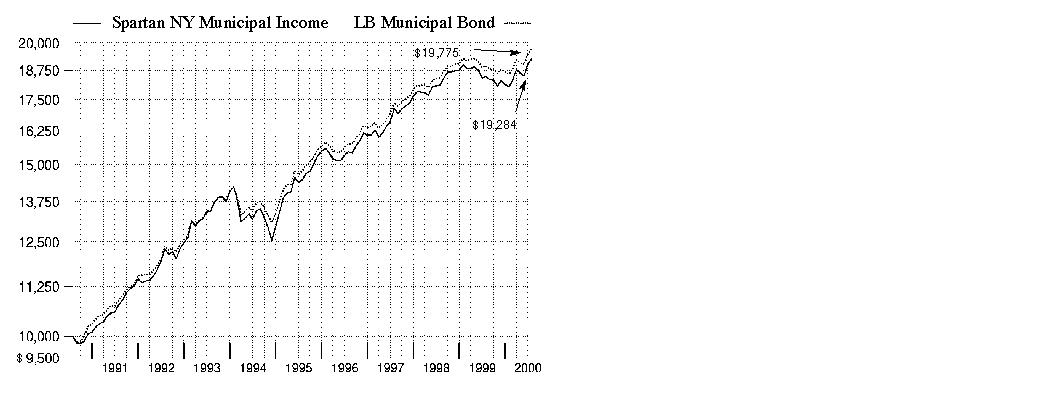

$10,000 Over 10 Years: Let's say hypothetically that $10,000 was invested in Spartan New York Municipal Income Fund on July 31, 1990. As the chart shows, by July 31, 2000, the value of the investment would have grown to $19,284 - a 92.84% increase on the initial investment. For comparison, look at how the Lehman Brothers Municipal Bond Index - a market value-weighted index of investment-grade municipal bonds with maturities of one year or more - did over the same period. With dividends reinvested, the same $10,000 would have grown to $19,775 - a 97.75% increase.

Understanding

Performance

How a fund did yesterday is no guarantee of how it will do tomorrow. Bond prices, for example, generally move in the opposite direction of interest rates. In turn, the share price, return and yield of a fund that invests in bonds will vary. That means if you sell your shares during a market downturn, you might lose money. But if you can ride out the market's ups and downs, you may have a gain.

3Semiannual Report

Spartan New York Municipal Income Fund

Performance - continued

Total Return Components

|

|

Six months ended July 31, |

Years ended January 31, |

||||

|

|

2000 |

2000 |

1999 |

1998 |

1997 |

1996 |

|

Dividend returns |

2.65% |

4.44% |

4.81% |

5.36% |

5.20% |

5.93% |

|

Capital returns |

4.26% |

-9.47% |

1.64% |

5.46% |

-1.98% |

10.36% |

|

Total returns |

6.91% |

-5.03% |

6.45% |

10.82% |

3.22% |

16.29% |

Total return components include both dividend returns and capital returns. A dividend return reflects the actual dividends paid by the fund. A capital return reflects both the amount paid by the fund to shareholders as capital gain distributions and changes in the fund's share price. Both returns assume the dividends or capital gains, if any, paid by the fund are reinvested.

Dividends and Yield

|

Periods ended July 31, 2000 |

Past 1 |

Past 6 |

Past 1 |

|

Dividends per share |

5.19 ¢ |

30.28 ¢ |

59.98 ¢ |

|

Annualized dividend rate |

5.00% |

5.06% |

5.00% |

|

30-day annualized yield |

4.94% |

- |

- |

|

30-day annualized tax-equivalent yield |

8.64% |

- |

- |

Dividends per share show the income paid by the fund for a set period. If you annualize this number, based on an average share price of $12.22 over the past one month, $11.99 over the past six months and $12.00 over the past one year, you can compare the fund's income over these three periods. The 30-day annualized yield is a standard formula for all bond funds based on the yields of the bonds in the fund, averaged over the past 30 days. This figure shows you the yield characteristics of the fund's investments at the end of the period. It also helps you compare funds from different companies on an equal basis. The tax-equivalent yield shows what you would have to earn on a taxable investment to equal the fund's tax-free yield, if you're in the 42.80% combined effective 2000 federal, state and New York City tax bracket, but does not reflect the payment of the federal alternative minimum tax, if applicable.

Semiannual Report

Spartan New York Municipal Income Fund

Market Recap

Favorable technical conditions in the municipal bond market overcame three more interest-rate hikes by the Federal Reserve Board during the six-month period ending July 31, 2000, helping municipal bonds outperform most other investments in both the fixed-income and equity markets. Municipal bond yields in the neighborhood of 6%, a diminished supply of new issues coming to market, attractive prices and strong demand from individual investors spurred the Lehman Brothers Municipal Bond Index - an index of over 35,000 investment-grade, fixed-rate, tax-exempt bonds - to a six-month return of 6.39%. That outperformed the overall taxable-bond market, as measured by the Lehman Brothers Aggregate Bond Index, which gained 5.28% in the same time frame. In fact, the six-month municipal bond return was higher than the return of corporate, mortgage, government, Treasury and agency bonds, according to their respective Lehman Brothers benchmarks. On a tax-equivalent yield basis, municipal bond outperformance was even more significant. The muni market, along with most other fixed-income sectors, also benefited from increased volatility in the equity markets, and from economic data demonstrating evidence that the Fed's effort to cool down the U.S. economy was working, perhaps signaling an end to the Fed's rate hikes for the remainder of 2000.

(Portfolio Manager photograph)

Note to shareholders: George Fischer became Portfolio Manager of Spartan New York Municipal Income Fund on July 1, 2000.

Q. How did the fund perform, George?

A. For the six-month period that ended July 31, 2000, the fund had a total return of 6.91%. To get a sense of how the fund did relative to its competitors, the New York municipal debt funds average returned 6.61% for the same six-month period, according to Lipper Inc. Additionally, the Lehman Brothers New York 4 Plus Year Municipal Bond Index, which tracks the types of securities in which the fund invests, returned 7.32%. For the 12-month period that ended July 31, 2000, the fund had a total return of 4.35%. In comparison, the New York municipal debt funds average returned 2.35% and the Lehman Brothers index returned 4.41% for the same 12-month period.

Q. The municipal market enjoyed a fairly significant turnaround during the past six-month period. Can you tell us what prompted it and how it affected the fund's performance?

A. Sure. Even though the Federal Reserve Board continued to raise interest rates in an effort to cool the economy and the stock market, municipal bond prices ended the period higher than they began it. That's primarily because investors began to anticipate that the Fed's interest-rate increases might be nearing an end. Part of their optimism stemmed from some indicators that pointed to a slowdown in the economy. Somewhat weaker economic signals, coupled with municipals' attractive prices and yields, helped them to rally in June and July. Longer-term bond yields fell the most during the period, causing them to outpace their short- and intermediate-term counterparts. Against that backdrop, the fund's total return for the six months reflects the combination of those recent price gains plus the income generated by its holdings during the period.

Semiannual Report

Spartan New York Municipal Income Fund

Fund Talk: The Manager's Overview - continued

Q. What helped the fund perform better than its peers during the six-month period?

A. The fund's relatively large weighting in longer-term bonds was one factor, for the reason I just mentioned. Also, the fund's larger-than-average stake in premium coupon bonds - those that pay interest rates above prevailing rates - helped the fund outpace its peers. Premium coupon bonds generally outperformed discount coupon and par coupon bonds, which offer interest rates below and at prevailing market rates, respectively.

Q. In terms of credit quality, what was your approach?

A. I focused on higher-quality investment-grade bonds, those rated A, Aa or Aaa. They made up 81.3% of the fund's investments at the end of the period. Those ratings are a current assessment of the creditworthiness of an issuer with respect to a specific bond offering. Aaa-rated bonds, which are the highest rated, are judged to have an extremely strong ability to pay interest and repay principal. At the other end of the investment-grade spectrum, Baa-rated bonds, which are the lowest-rated of the bonds deemed investment grade, are judged to have an adequate capacity to pay interest and principal. Bonds rated below Baa are regarded as speculative because they face large uncertainties or major risk exposure under adverse conditions.

Q. Were there any disappointments?

A. Health care bonds continued to languish due to lower reimbursements from HMOs and the federal government and from increased pressure to cut costs. Despite their short-term struggles, I held onto some bonds issued by selected hospitals that were in good financial shape and were fundamentally sound.

Q. What's ahead for the municipal market and the fund?

A. If the Fed continues to push rates higher, as it has for more than a year now, there may be more volatility ahead. If, on the other hand, the Fed really is at the end of its campaign to cool the economy and stave off inflationary pressures by raising interest rates, the bond markets should benefit. As for municipals, they are priced attractively relative to Treasury securities. Additionally, for investors in the highest federal income tax bracket, municipals offer yields above 9.00% on a tax-equivalent yield basis. Attractive prices and yields could bode well for municipals' near-term performance. As for the fund, I'll continue to approach the market fairly cautiously in terms of credit quality. The economy has been good for so long that it's easy to get lulled into complacency. We'll remain vigilant, looking for potential problems that could occur if the economy slows.

Semiannual Report

Spartan New York Municipal Income Fund

Fund Talk: The Manager's Overview - continued

The views expressed in this report reflect those of the portfolio manager only through the end of the period of the report as stated on the cover and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Fund Facts

Goal: high current income free from federal, state and New York City income taxes by normally investing in investment-grade debt securities

Fund number: 071

Trading symbol: FTFMX

Start date: July 10, 1984

Size: as of July 31, 2000, more than $1.0 billion

Manager: George Fischer, since July 2000; manager, various Fidelity and Spartan municipal income funds; joined Fidelity in 1989

3George Fischer on

managing the fund's

interest-rate sensitivity:

"The main source of volatility in this fund's shares is fluctuations in the general level of interest rates. Municipal interest rates are affected by inflation, Federal Reserve policy and new issue supply, among other things. One way that we estimate how sensitive a bond - or a fund - is to such shifts is to calculate its duration. The higher the duration a bond or a fund has, the more sensitive it will be to changes in interest rates. Spartan New York Municipal Bond Fund has a duration of about seven years. This means that the fund's net asset value would rise approximately 7% when bond yields fall 1%, and fall approximately 7% when bond yields rise 1%, all else being equal. The value of funds with a shorter duration would change less in response to interest-rate changes, and the value of funds with a longer duration would change more."

Semiannual Report

Spartan New York Municipal Income Fund

|

Top Five Sectors as of July 31, 2000 |

||

|

|

% of fund's |

% of fund's net assets |

|

General Obligations |

36.5 |

37.7 |

|

Transportation |

18.7 |

16.9 |

|

Special Tax |

12.8 |

15.0 |

|

Water & Sewer |

12.0 |

8.9 |

|

Education |

6.1 |

5.5 |

|

Average Years to Maturity as of July 31, 2000 |

||

|

|

|

6 months ago |

|

Years |

15.8 |

15.0 |

|

Average years to maturity is based on the average time remaining until principal payments are expected from each of the fund's bonds, weighted by dollar amount. |

|

Duration as of July 31, 2000 |

||

|

|

|

6 months ago |

|

Years |

7.5 |

7.8 |

|

Duration shows how much a bond fund's price fluctuates with changes in comparable interest rates. |

|

Quality Diversification (Moody's Ratings) |

As of July 31, 2000 As of January 31, 2000

|

Where Moody's ratings are not available, we have used S&P ratings. Amounts shown are as a percentage of the fund's investments. |

Semiannual Report

Spartan New York Municipal Income Fund

(Unaudited)

Showing Percentage of Net Assets

|

Municipal Bonds - 96.9% |

|||||

|

Moody's Ratings |

Principal Amount |

Value |

|||

|

New York - 92.5% |

|||||

|

Albany County Gen. Oblig. 5.85% 6/1/13 (FGIC Insured) |

Aaa |

|

$ 1,275,000 |

$ 1,316,450 |

|

|

Buffalo Swr. Auth. Rev. Rfdg. (Swr. Sys. Proj.) Series G, 5% 7/1/12 (FGIC Insured) |

Aaa |

|

2,700,000 |

2,648,997 |

|

|

Cherry Valley Springfield Central School District: |

|

|

|

|

|

|

7.8% 5/1/14 (MBIA Insured) |

Aaa |

|

435,000 |

542,045 |

|

|

7.8% 5/1/15 (MBIA Insured) |

Aaa |

|

435,000 |

545,220 |

|

|

7.8% 5/1/16 (MBIA Insured) |

Aaa |

|

435,000 |

546,317 |

|

|

7.8% 5/1/17 (MBIA Insured) |

Aaa |

|

435,000 |

547,400 |

|

|

7.8% 5/1/18 (MBIA Insured) |

Aaa |

|

434,000 |

546,736 |

|

|

Dutchess County Indl. Dev. Agcy. Civic Facility Rev. (Bard College Civic Facility Proj.) 5.75% 9/1/30 |

A3 |

|

7,000,000 |

6,824,580 |

|

|

Erie County Gen. Oblig. Series A: |

|

|

|

|

|

|

6% 2/1/04 (FGIC Insured) |

Aaa |

|

1,100,000 |

1,149,907 |

|

|

6% 2/1/05 (FGIC Insured) |

Aaa |

|

1,000,000 |

1,054,180 |

|

|

6% 2/1/06 (FGIC Insured) |

Aaa |

|

1,030,000 |

1,094,427 |

|

|

Erie County Wtr. Auth. Impt. & Extension Rev. Series 3, 6.1% 12/1/04 (Escrowed to Maturity) (d) |

AA |

|

2,000,000 |

2,077,280 |

|

|

Long Island Pwr. Auth. Elec. Sys. Rev.: |

|

|

|

|

|

|

Series A, 5.75% 12/1/24 |

Baa1 |

|

25,000,000 |

24,612,250 |

|

|

Sub Series 8D, 4.5%, tender 4/1/04 |

Aaa |

|

10,000,000 |

9,946,100 |

|

|

Metro. Trans. Auth. Commuter Facilities Rev.: |

|

|

|

|

|

|

Rfdg.: |

|

|

|

|

|

|

(Svc. Contract Proj.): |

|

|

|

|

|

|

Series 8, 5.25% 7/1/17 |

Baa1 |

|

8,000,000 |

7,635,600 |

|

|

Series R, 5.4% 7/1/10 |

Baa1 |

|

2,960,000 |

3,029,205 |

|

|

Series D, 5.125% 7/1/22 (MBIA Insured) |

Aaa |

|

3,000,000 |

2,764,170 |

|

|

Series A: |

|

|

|

|

|

|

5.625% 7/1/27 (MBIA Insured) |

Aaa |

|

6,000,000 |

5,922,480 |

|

|

5.75% 7/1/21 (MBIA Insured) |

Aaa |

|

5,300,000 |

5,333,443 |

|

|

6% 7/1/24 |

Baa1 |

|

5,000,000 |

5,076,150 |

|

|

Series B: |

|

|

|

|

|

|

4.75% 7/1/26 (FGIC Insured) |

Aaa |

|

6,000,000 |

5,140,080 |

|

|

5.125% 7/1/24 (AMBAC Insured) |

Aaa |

|

5,080,000 |

4,682,134 |

|

|

Series E, 5.5% 7/1/09 (AMBAC Insured) |

Aaa |

|

2,705,000 |

2,821,504 |

|

|

Metro. Trans. Auth. Dedicated Tax Fund Series A: |

|

|

|

|

|

|

4.75% 4/1/28 (FGIC Insured) |

Aaa |

|

5,445,000 |

4,639,848 |

|

|

5% 4/1/23 (FGIC Insured) |

Aaa |

|

6,000,000 |

5,409,060 |

|

|

5% 4/1/29 (FSA Insured) |

Aaa |

|

10,000,000 |

8,875,300 |

|

|

5.25% 4/1/26 (MBIA Insured) |

Aaa |

|

5,580,000 |

5,193,585 |

|

|

Municipal Bonds - continued |

|||||

|

Moody's Ratings |

Principal Amount |

Value |

|||

|

New York - continued |

|||||

|

Metro. Trans. Auth. Svc. Contract Rev.: |

|

|

|

|

|

|

(Commuter Facilities Proj.): |

|

|

|

|

|

|

Series 3, 7.375% 7/1/08 |

Baa1 |

|

$ 5,400,000 |

$ 6,000,210 |

|

|

Series O, 5.75% 7/1/13 |

Baa1 |

|

3,000,000 |

3,109,770 |

|

|

(Trans. Facilities Proj.): |

|

|

|

|

|

|

Series 3, 7.375% 7/1/08 |

Baa1 |

|

1,830,000 |

2,033,405 |

|

|

Series P, 5.75% 7/1/15 |

Baa1 |

|

6,000,000 |

6,055,980 |

|

|

Rfdg. (Trans. Facilities Proj.): |

|

|

|

|

|

|

Series 5, 6.9% 7/1/05 |

Baa1 |

|

4,100,000 |

4,262,770 |

|

|

Series 7: |

|

|

|

|

|

|

5.45% 7/1/07 |

Baa1 |

|

4,930,000 |

5,075,139 |

|

|

5.625% 7/1/16 |

Baa1 |

|

3,000,000 |

3,004,350 |

|

|

Rfdg. (Cap. Appreciation) (Trans. Facilities Proj.) Series 7, 0% 7/1/10 |

Baa1 |

|

9,500,000 |

5,655,730 |

|

|

Metro. Trans. Auth. Trans. Facilities Rev.: |

|

|

|

|

|

|

Rfdg.: |

|

|

|

|

|

|

(Cap. Appreciation) Series N, 0% 7/1/11 (FGIC Insured) |

Aaa |

|

5,980,000 |

3,386,175 |

|

|

(Svc. Contract Proj.): |

|

|

|

|

|

|

Series 8: |

|

|

|

|

|

|

5.375% 7/1/21 (FSA Insured) |

Aaa |

|

3,000,000 |

2,877,840 |

|

|

5.375% 7/1/21 (MBIA Insured) |

Aaa |

|

3,000,000 |

2,895,600 |

|

|

Series R: |

|

|

|

|

|

|

5.3% 7/1/09 |

Baa1 |

|

4,000,000 |

4,071,600 |

|

|

5.4% 7/1/10 |

Baa1 |

|

3,000,000 |

3,070,140 |

|

|

Series 8, 5.25% 7/1/17 |

Baa1 |

|

3,000,000 |

2,863,350 |

|

|

Series A: |

|

|

|

|

|

|

4.75% 7/1/21 (MBIA Insured) |

Aaa |

|

2,000,000 |

1,747,400 |

|

|

4.75% 7/1/24 (MBIA Insured) |

Aaa |

|

5,000,000 |

4,311,100 |

|

|

Series C, 4.75% 7/1/16 (FSA Insured) |

Aaa |

|

3,000,000 |

2,721,390 |

|

|

Series K, 6.3% 7/1/06 (MBIA Insured) |

Aaa |

|

10,150,000 |

10,977,327 |

|

|

Series A: |

|

|

|

|

|

|

5.75% 7/1/21 (MBIA Insured) |

Aaa |

|

14,500,000 |

14,591,495 |

|

|

6% 7/1/16 (FSA Insured) |

Aaa |

|

9,090,000 |

9,478,961 |

|

|

6% 7/1/24 |

Baa1 |

|

2,000,000 |

2,030,460 |

|

|

6.125% 7/1/29 |

Baa1 |

|

25,000,000 |

25,543,740 |

|

|

Series B, 4.75% 7/1/26 (FGIC Insured) |

Aaa |

|

8,500,000 |

7,281,780 |

|

|

Monroe County Gen. Oblig.: |

|

|

|

|

|

|

(Pub. Impt. Proj.): |

|

|

|

|

|

|

6.1% 3/1/04 (MBIA Insured) |

Aaa |

|

870,000 |

894,621 |

|

|

6.5% 6/1/04 |

Aa2 |

|

65,000 |

69,496 |

|

|

6.5% 6/1/05 |

Aa2 |

|

115,000 |

124,561 |

|

|

Municipal Bonds - continued |

|||||

|

Moody's Ratings |

Principal Amount |

Value |

|||

|

New York - continued |

|||||

|

Monroe County Gen. Oblig.: - continued |

|

|

|

|

|

|

(Pub. Impt. Proj.): |

|

|

|

|

|

|

6.5% 6/1/06 |

Aa2 |

|

$ 120,000 |

$ 131,466 |

|

|

6.5% 6/1/07 (AMBAC Insured) |

Aaa |

|

50,000 |

55,324 |

|

|

7% 6/1/03 (FGIC Insured) |

Aaa |

|

1,000,000 |

1,063,150 |

|

|

7% 6/1/04 (FGIC Insured) |

Aaa |

|

2,150,000 |

2,326,687 |

|

|

6% 6/1/04 |

Aa2 |

|

1,510,000 |

1,584,383 |

|

|

6% 6/1/05 |

Aa2 |

|

2,155,000 |

2,279,516 |

|

|

Monroe Woodbury Central School District: |

|

|

|

|

|

|

5.625% 5/15/22 (MBIA Insured) |

Aaa |

|

1,245,000 |

1,237,904 |

|

|

5.625% 5/15/24 (MBIA Insured) |

Aaa |

|

2,645,000 |

2,619,185 |

|

|

Muni. Assistance Corp. for New York City Rfdg.: |

|

|

|

|

|

|

Series D, 6% 7/1/05 (AMBAC Insured) |

Aaa |

|

10,000,000 |

10,587,200 |

|

|

Series L, 6% 7/1/07 |

Aa2 |

|

5,000,000 |

5,364,150 |

|

|

Nassau County Gen. Oblig.: |

|

|

|

|

|

|

Rfdg.: |

|

|

|

|

|

|

(Combined Swr. District Proj.) Series F, 5.3% 7/1/07 (MBIA Insured) |

Aaa |

|

350,000 |

359,114 |

|

|

Series A: |

|

|

|

|

|

|

6% 7/1/09 (FGIC Insured) |

Aaa |

|

3,320,000 |

3,549,611 |

|

|

6.5% 5/1/07 (FGIC Insured) |

Aaa |

|

4,000,000 |

4,375,240 |

|

|

Series D, 5.25% 9/1/03 (FSA Insured) |

Aaa |

|

2,500,000 |

2,543,175 |

|

|

Series P, 6.3% 11/1/03 (FGIC Insured) |

Aaa |

|

1,000,000 |

1,054,620 |

|

|

Series R, 5.125% 11/1/05 (FGIC Insured) |

Aaa |

|

2,065,000 |

2,100,725 |

|

|

Series T, 5.2% 9/1/11 (FGIC Insured) |

Aaa |

|

2,695,000 |

2,691,523 |

|

|

Series U: |

|

|

|

|

|

|

5.125% 11/1/04 (AMBAC Insured) |

Aaa |

|

1,505,000 |

1,530,254 |

|

|

5.25% 11/1/11 (AMBAC Insured) |

Aaa |

|

1,500,000 |

1,502,970 |

|

|

5.25% 11/1/15 (AMBAC Insured) |

Aaa |

|

2,150,000 |

2,074,922 |

|

|

New York City Edl. Construction Fund Sr. |

Aaa |

|

1,895,000 |

1,987,571 |

|

|

New York City Gen. Oblig.: |

|

|

|

|

|

|

Rfdg.: |

|

|

|

|

|

|

Series A: |

|

|

|

|

|

|

5.3% 8/1/12 |

A3 |

|

6,000,000 |

6,010,920 |

|

|

6.25% 8/1/08 |

A3 |

|

1,000,000 |

1,076,120 |

|

|

7% 8/1/03 |

A3 |

|

2,000,000 |

2,127,100 |

|

|

Series B: |

|

|

|

|

|

|

5.7% 8/15/02 |

A3 |

|

2,260,000 |

2,309,901 |

|

|

5.7% 8/15/02 (Escrowed to Maturity) (d) |

A3 |

|

75,000 |

76,846 |

|

|

6.2% 8/15/06 |

A3 |

|

2,195,000 |

2,341,407 |

|

|

Municipal Bonds - continued |

|||||

|

Moody's Ratings |

Principal Amount |

Value |

|||

|

New York - continued |

|||||

|

New York City Gen. Oblig.: - continued |

|

|

|

|

|

|

Rfdg.: |

|

|

|

|

|

|

Series C: |

|

|

|

|

|

|

5.7% 8/15/02 |

A3 |

|

$ 1,310,000 |

$ 1,338,925 |

|

|

6% 2/1/22 |

A3 |

|

3,500,000 |

3,553,305 |

|

|

Series E: |

|

|

|

|

|

|

6% 8/1/26 |

A3 |

|

3,455,000 |

3,500,986 |

|

|

6.5% 2/15/06 |

A3 |

|

1,000,000 |

1,078,470 |

|

|

Series F, 6% 8/1/16 |

A3 |

|

7,750,000 |

7,983,198 |

|

|

Series G: |

|

|

|

|

|

|

5.25% 8/1/11 |

A3 |

|

5,000,000 |

5,023,450 |

|

|

5.35% 8/1/13 |

A3 |

|

5,000,000 |

4,993,750 |

|

|

Series H, 6% 8/1/17 |

A3 |

|

1,000,000 |

1,028,850 |

|

|

Series I, 5.875% 3/15/12 |

A3 |

|

10,000,000 |

10,368,700 |

|

|

Series J, 6.125% 8/1/12 |

A3 |

|

1,000,000 |

1,058,790 |

|

|

Series B: |

|

|

|

|

|

|

5.875% 8/15/13 |

A3 |

|

3,870,000 |

3,996,356 |

|

|

6.5% 8/15/11 |

A3 |

|

1,000,000 |

1,112,170 |

|

|

7.5% 2/1/02 |

A3 |

|

1,000,000 |

1,041,420 |

|

|

7.5% 2/1/03 |

A3 |

|

5,000,000 |

5,273,450 |

|

|

7.5% 2/1/07 |

A3 |

|

5,500,000 |

5,795,075 |

|

|

Series C, 6.4% 8/1/03 |

A3 |

|

6,000,000 |

6,279,900 |

|

|

Series D: |

|

|

|

|

|

|

5.25% 8/1/13 |

A3 |

|

2,500,000 |

2,473,675 |

|

|

5.25% 8/1/21 (MBIA Insured) |

Aaa |

|

5,000,000 |

4,714,450 |

|

|

5.375% 8/1/17 |

A3 |

|

2,500,000 |

2,422,400 |

|

|

5.75% 2/15/08 |

A3 |

|

1,000,000 |

1,038,460 |

|

|

Series E, 6% 8/1/26 (Pre-Refunded to |

A3 |

|

295,000 |

318,824 |

|

|

Series F, 5.75% 2/1/15 |

A3 |

|

2,500,000 |

2,534,825 |

|

|

Series G: |

|

|

|

|

|

|

6% 10/15/26 |

A3 |

|

4,950,000 |

5,023,706 |

|

|

6% 10/15/26 (Pre-Refunded to |

A3 |

|

50,000 |

54,254 |

|

|

Series H: |

|

|

|

|

|

|

5.5% 8/1/12 |

A3 |

|

9,000,000 |

9,154,980 |

|

|

7% 2/1/05 |

A3 |

|

665,000 |

695,936 |

|

|

7% 2/1/06 |

A3 |

|

280,000 |

293,026 |

|

|

7% 2/1/06 (Pre-Refunded to |

A3 |

|

140,000 |

147,134 |

|

|

Municipal Bonds - continued |

|||||

|

Moody's Ratings |

Principal Amount |

Value |

|||

|

New York - continued |

|||||

|

New York City Gen. Oblig.: - continued |

|

|

|

|

|

|

Series I: |

|

|

|

|

|

|

6.125% 4/15/11 |

A3 |

|

$ 17,510,000 |

$ 18,598,772 |

|

|

6.125% 4/15/11 (Pre-Refunded to 4/15/07 @ 101) (d) |

A3 |

|

7,490,000 |

8,147,098 |

|

|

Series J, 5.875% 2/15/19 |

A3 |

|

4,000,000 |

4,037,280 |

|

|

Series L, 5.75% 8/1/12 |

A3 |

|

3,700,000 |

3,823,950 |

|

|

New York City Ind. Dev. Agcy. Ind. Dev. Rev. (Japan Airlines Co. Ltd. Proj.) Series 1991, 6% 11/1/15 (FSA Insured) (c) |

Aaa |

|

2,805,000 |

2,964,997 |

|

|

New York City Ind. Dev. Agcy. Spl. Facilities Rev. (Term. One Group Assoc. Proj.): |

|

|

|

|

|

|

5.7% 1/1/04 (c) |

A3 |

|

1,500,000 |

1,535,790 |

|

|

6% 1/1/08 (c) |

A3 |

|

500,000 |

519,435 |

|

|

New York City Muni. Wtr. Fin. Auth. Wtr. & Swr. Sys. Rev.: |

|

|

|

|

|

|

Series B: |

|

|

|

|

|

|

5.375% 6/15/07 (AMBAC Insured) |

Aaa |

|

355,000 |

363,147 |

|

|

5.375% 6/15/07 (AMBAC Insured) (Pre-Refunded to 6/15/04 @ 101) (d) |

Aaa |

|

145,000 |

150,617 |

|

|

5.5% 6/15/27 (MBIA Insured) |

Aaa |

|

7,525,000 |

7,289,242 |

|

|

5.75% 6/15/26 (MBIA Insured) |

Aaa |

|

5,000,000 |

5,009,050 |

|

|

5.75% 6/15/29 (MBIA Insured) |

Aaa |

|

4,000,000 |

3,997,200 |

|

|

5.875% 6/15/26 |

Aa3 |

|

21,250,000 |

21,418,513 |

|

|

6% 6/15/33 |

Aa3 |

|

20,735,000 |

21,307,701 |

|

|

Series C, 7% 6/15/16 (FGIC Insured) (Pre-Refunded to 6/15/01 @ 101.5) (d) |

Aaa |

|

500,000 |

518,775 |

|

|

New York City Transitional Fin. Auth. Rev.: |

|

|

|

|

|

|

Second Series B, 5.125% 11/1/14 |

Aa3 |

|

4,000,000 |

3,897,960 |

|

|

Series A: |

|

|

|

|

|

|

5% 8/15/15 |

Aa3 |

|

3,375,000 |

3,222,889 |

|

|

5.125% 8/15/21 |

Aa3 |

|

23,000,000 |

21,335,490 |

|

|

Series B: |

|

|

|

|

|

|

4.75% 11/15/16 |

Aa3 |

|

11,470,000 |

10,394,917 |

|

|

4.75% 11/1/23 |

Aa3 |

|

9,000,000 |

7,760,790 |

|

|

6% 11/15/29 |

Aa3 |

|

3,000,000 |

3,080,190 |

|

|

New York City Trust Cultural Resources Rev.: |

|

|

|

|

|

|

(American Museum of Natural History Proj.) Series A, 5.65% 4/1/22 (MBIA Insured) |

Aaa |

|

4,850,000 |

4,837,487 |

|

|

(New York Botanical Garden Proj.) 5.75% 7/1/16 (MBIA Insured) |

Aaa |

|

1,250,000 |

1,271,888 |

|

|

Municipal Bonds - continued |

|||||

|

Moody's Ratings |

Principal Amount |

Value |

|||

|

New York - continued |

|||||

|

New York State Dorm. Auth. Lease Rev. |

Aaa |

|

$ 3,150,000 |

$ 2,974,640 |

|

|

New York State Dorm. Auth. Rev.: |

|

|

|

|

|

|

(Barnard College Proj.) 5.25% 7/1/26 (AMBAC Insured) |

Aaa |

|

4,625,000 |

4,315,264 |

|

|

(Champlain Valley Physicians Proj.): |

|

|

|

|

|

|

6% 7/1/08 (AMBAC Insured) |

AAA |

|

600,000 |

641,670 |

|

|

6% 7/1/09 (AMBAC Insured) |

AAA |

|

370,000 |

398,346 |

|

|

6% 7/1/10 (AMBAC Insured) |

AAA |

|

250,000 |

269,433 |

|

|

(City Univ. Sys. Consolidation Proj.): |

|

|

|

|

|

|

Series A, 5.5% 7/1/05 |

Baa1 |

|

1,000,000 |

1,029,450 |

|

|

Series D, 7% 7/1/09 |

Baa1 |

|

6,000,000 |

6,597,540 |

|

|

(City Univ. Sys. Proj.) Series C, 7.5% 7/1/10 |

Baa1 |

|

4,000,000 |

4,575,520 |

|

|

(Ithaca College Proj.) 5.25% 7/1/26 |

Aaa |

|

9,805,000 |

9,148,359 |

|

|

(Judicial Facilities Lease Prog.) Series B, 7% 4/15/16 |

Baa1 |

|

2,000,000 |

2,067,160 |

|

|

(Mental Health Svcs. Facilities Impt. Proj.): |

|

|

|

|

|

|

Series A, 5.75% 8/15/11 |

A3 |

|

3,000,000 |

3,119,220 |

|

|

Series D, 4.75% 2/15/25 (MBIA Insured) |

Aaa |

|

10,000,000 |

8,575,500 |

|

|

Series F, 4.5% 8/15/28 (AMBAC Insured) |

Aaa |

|

5,000,000 |

4,057,200 |

|

|

(New York Hosp. Med. Ctr. Proj.) 5.25% 2/1/07 (AMBAC Insured) |

Aaa |

|

4,500,000 |

4,591,125 |

|

|

(New York Univ. Proj.) Series A: |

|

|

|

|

|

|

5.75% 7/1/15 (MBIA Insured) |

Aaa |

|

1,250,000 |

1,311,125 |

|

|

5.75% 7/1/27 (MBIA Insured) |

Aaa |

|

5,000,000 |

5,104,100 |

|

|

(Saint Joseph's Hosp. Health Ctr. Proj.) 6% 7/1/08 (MBIA Insured) |

Aaa |

|

1,260,000 |

1,343,248 |

|

|

(Saint Vincent's Hosp. & Med. Ctr. Proj.): |

|

|

|

|

|

|

6% 2/1/03 (AMBAC Insured) |

Aaa |

|

1,820,000 |

1,878,531 |

|

|

6% 8/1/03 (AMBAC Insured) |

Aaa |

|

1,875,000 |

1,946,588 |

|

|

(State Univ. Edl. Facilities Proj.) Series A, 4.75% 5/15/25 (MBIA Insured) |

Aaa |

|

3,000,000 |

2,584,770 |

|

|

Rfdg.: |

|

|

|

|

|

|

(City Univ. Sys. Consolidation Proj.) Series A, 5.75% 7/1/07 |

Baa1 |

|

500,000 |

523,415 |

|

|

(City Univ. Sys. Proj. Third Gen. |

Aaa |

|

2,500,000 |

2,507,875 |

|

|

(City Univ. Sys. Proj.) Series U, 6.25% 7/1/03 |

Baa1 |

|

525,000 |

546,294 |

|

|

Municipal Bonds - continued |

|||||

|

Moody's Ratings |

Principal Amount |

Value |

|||

|

New York - continued |

|||||

|

New York State Dorm. Auth. Rev.: - continued |

|

|

|

|

|

|

Rfdg.: |

|

|

|

|

|

|

(Colgate Univ. Proj.): |

|

|

|

|

|

|

6% 7/1/16 (MBIA Insured) |

Aaa |

|

$ 1,900,000 |

$ 2,039,289 |

|

|

6% 7/1/21 (MBIA Insured) |

Aaa |

|

2,500,000 |

2,644,500 |

|

|

(FIT Student Hsg. Proj.): |

|

|

|

|

|

|

5.75% 7/1/03 (AMBAC Insured) |

Aaa |

|

1,590,000 |

1,640,530 |

|

|

5.75% 7/1/04 (AMBAC Insured) |

Aaa |

|

1,680,000 |

1,747,754 |

|

|

5.75% 7/1/05 (AMBAC Insured) |

Aaa |

|

1,650,000 |

1,728,210 |

|

|

5.75% 7/1/06 (AMBAC Insured) |

Aaa |

|

1,500,000 |

1,580,100 |

|

|

(Jamaica Hosp. Med. Ctr. Proj.) Series F, 5.1% 2/15/12 (MBIA Insured) |

Aaa |

|

3,605,000 |

3,554,061 |

|

|

(Jamaica Med. Hosp. Proj.) Series F, 5.2% 2/15/13 (MBIA Insured) |

Aaa |

|

6,585,000 |

6,481,352 |

|

|

(Mental Health Svcs. Facilities Proj.) Series B, 5.75% 2/15/11 |

A3 |

|

2,550,000 |

2,651,337 |

|

|

(New York & Presbyterian Hosp. Proj.) 4.4% 8/1/13 (AMBAC Insured) (Fed. Hsg. Administration Insured) |

Aaa |

|

5,000,000 |

4,897,700 |

|

|

(Rochester Institute of Technology Proj.) 5.25% 7/1/22 (MBIA Insured) |

Aaa |

|

4,875,000 |

4,567,144 |

|

|

(State Univ. Edl. Facilities Proj.): |

|

|

|

|

|

|

Series A: |

|

|

|

|

|

|

6.5% 5/15/05 |

A3 |

|

5,080,000 |

5,442,864 |

|

|

6.5% 5/15/06 |

A3 |

|

3,400,000 |

3,673,632 |

|

|

Series B, 7.5% 5/15/11 |

A2 |

|

3,500,000 |

4,033,680 |

|

|

5.5% 5/15/09 |

A2 |

|

3,000,000 |

3,101,580 |

|

|

(Univ. of Rochester Proj.) Series A, 5% 7/1/27 (MBIA Insured) |

Aaa |

|

16,475,000 |

14,658,302 |

|

|

Series E, 5% 2/15/10 (MBIA Insured) |

Aaa |

|

3,500,000 |

3,482,430 |

|

|

Rfdg. (Cap. Appreciation) (Manhattanville College Proj.) 0% 7/1/10 (MBIA Insured) |

Aaa |

|

2,175,000 |

1,313,809 |

|

|

New York State Energy Research & Dev. Auth. Facilities Rev. Rfdg. (Consolidated Edison Co. Proj.) Series A, 6.1% 8/15/20 |

A1 |

|

10,600,000 |

10,679,712 |

|

|

New York State Energy Research & Dev. Auth. Gas Facilities Rev. Rfdg. (Brooklyn Union Gas Co. Proj.) Series A, 5.5% 1/1/21 (MBIA Insured) |

Aaa |

|

1,000,000 |

980,660 |

|

|

New York State Energy Research & Dev. Auth. Poll. Cont. Rev. Rfdg. (New York State Elec. & Gas Corp. Proj.) Series E, 5.9% 12/1/06 (MBIA Insured) |

Aaa |

|

1,000,000 |

1,064,830 |

|

|

Municipal Bonds - continued |

|||||

|

Moody's Ratings |

Principal Amount |

Value |

|||

|

New York - continued |

|||||

|

New York State Envir. Facilities Corp. Clean Wtr. & Drinking Wtr. Rev.: |

|

|

|

|

|

|

(State Wtr. Revolving Funds Prog.): |

|

|

|

|

|

|

Series C, 5% 6/15/19 |

Aa1 |

|

$ 4,000,000 |

$ 3,681,920 |

|

|

Series F: |

|

|

|

|

|

|

4.875% 6/15/18 |

Aa1 |

|

3,000,000 |

2,728,530 |

|

|

4.875% 6/15/20 |

Aa1 |

|

3,555,000 |

3,191,608 |

|

|

5% 6/15/15 |

Aa1 |

|

3,000,000 |

2,877,420 |

|

|

Series F, 5.25% 6/15/13 |

Aa1 |

|

3,980,000 |

3,974,746 |

|

|

New York State Envir. Facilities Corp. Poll. Cont. Rev.: |

|

|

|

|

|

|

(State Wtr. Revolving Fund Pooled Ln. Prog.): |

|

|

|

|

|

|

Series B, 5.2% 5/15/14 |

Aaa |

|

2,220,000 |

2,227,903 |

|

|

Series C, 5.85% 7/15/15 |

Aaa |

|

3,060,000 |

3,156,665 |

|

|

(State Wtr. Revolving Fund Prog.) Series D: |

|

|

|

|

|

|

5% 6/15/11 |

Aa1 |

|

3,645,000 |

3,631,149 |

|

|

5% 6/15/12 |

Aa1 |

|

2,000,000 |

1,976,220 |

|

|

5.125% 6/15/19 |

Aa1 |

|

5,000,000 |

4,735,650 |

|

|

(State Wtr. Revolving Fund-New York City Muni. Wtr. Proj.): |

|

|

|

|

|

|

Series A: |

|

|

|

|

|

|

6.8% 6/15/01 |

Aa2 |

|

2,000,000 |

2,042,300 |

|

|

6.9% 6/15/02 |

Aaa |

|

265,000 |

275,473 |

|

|

6.9% 6/15/02 (Pre-Refunded to |

Aaa |

|

835,000 |

869,678 |

|

|

7% 6/15/12 |

Aaa |

|

190,000 |

197,784 |

|

|

Series B, 5.25% 6/15/14 |

Aa1 |

|

3,180,000 |

3,148,009 |

|

|

Series D: |

|

|

|

|

|

|

6.3% 5/15/05 |

Aaa |

|

2,000,000 |

2,139,180 |

|

|

6.3% 11/15/05 |

Aaa |

|

2,725,000 |

2,932,482 |

|

|

Series E: |

|

|

|

|

|

|

6.25% 6/15/05 |

Aa1 |

|

1,200,000 |

1,283,100 |

|

|

6.5% 6/15/14 |

Aaa |

|

130,000 |

133,879 |

|

|

Rfdg. (State Wtr. Revolving Fund-New York City Muni. Wtr. Proj.) Series A, 5.75% 6/15/11 |

Aa1 |

|

5,000,000 |

5,322,150 |

|

|

New York State Hsg. Fin. Agcy. Rev.: |

|

|

|

|

|

|

Rfdg. (Nursing Home & Health Care Proj.) Series A, 4.6% 11/1/06 (MBIA Insured) |

Aaa |

|

3,890,000 |

3,847,443 |

|

|

8.25% 5/1/09 (e) |

Aa3 |

|

4,215,000 |

4,215,000 |

|

|

New York State Local Govt. Assistance Corp.: |

|

|

|

|

|

|

Rfdg. Series E, 5.25% 4/1/16 |

A3 |

|

23,600,000 |

23,295,796 |

|

|

Series C, 5.5% 4/1/22 |

A3 |

|

6,375,000 |

6,240,105 |

|

|

Series D, 5.375% 4/1/14 |

A3 |

|

4,000,000 |

4,001,440 |

|

|

Municipal Bonds - continued |

|||||

|

Moody's Ratings |

Principal Amount |

Value |

|||

|

New York - continued |

|||||

|

New York State Med. Care Facilities Fin. Agcy. Rev.: |

|

|

|

|

|

|

(Long-Term. Health Care Proj.) Series A, 6.8% 11/1/14 (FSA Insured) |

Aaa |

|

$ 1,170,000 |

$ 1,221,503 |

|

|

(Mental Health Svcs. Facilities Proj.): |

|

|

|

|

|

|

Series A: |

|

|

|

|

|

|

7.5% 2/15/21 |

A3 |

|

50,000 |

51,593 |

|

|

7.5% 2/15/21 (Pre-Refunded to 2/15/01 @ 102) (d) |

Aaa |

|

85,000 |

88,102 |

|

|

Series D, 7.4% 2/15/18 |

A3 |

|

450,000 |

473,877 |

|

|

Rfdg.: |

|

|

|

|

|

|

(Mental Health Svcs. Facilities Proj.) |

A3 |

|

1,660,000 |

1,665,345 |

|

|

(Presbyterian Hosp. Proj.) Series A, 5.25% 8/15/14 |

Aa2 |

|

3,000,000 |

2,919,750 |

|

|

Series A, 7.25% 11/1/11 (MBIA Insured) |

Aaa |

|

890,000 |

913,523 |

|

|

New York State Mtg. Agcy. (Homeowner Mtg. Prog.): |

|

|

|

|

|

|

Series 53, 5.9% 10/1/17 |

Aa2 |

|

2,000,000 |

2,021,200 |

|

|

Series 69, 4.7% 4/1/24 (c) |

Aa2 |

|

5,900,000 |

5,834,097 |

|

|

5.5% 4/1/19 (AMBAC Insured) (c) |

Aaa |

|

4,500,000 |

4,480,830 |

|

|

New York State Pwr. Auth. Rev. & Gen. Purp. Rfdg. Series W, 6.5% 1/1/08 (Escrowed to Maturity) (d) |

Aaa |

|

250,000 |

273,633 |

|

|

New York State Thruway Auth. Gen. Rev.: |

|

|

|

|

|

|

Rfdg. Series E, 5.25% 1/1/12 |

Aa3 |

|

5,410,000 |

5,442,947 |

|

|

Series D, 5.375% 1/1/27 |

Aa3 |

|

3,000,000 |

2,848,110 |

|

|

New York State Thruway Auth. Hwy. & Bridge Trust Fund: |

|

|

|

|

|

|

Series A, 5.25% 4/1/16 (AMBAC Insured) |

Aaa |

|

5,175,000 |

5,054,733 |

|

|

Series B1: |

|

|

|

|

|

|

5.75% 4/1/14 (FGIC Insured) |

AAA |

|

3,000,000 |

3,104,880 |

|

|

5.75% 4/1/15 (FGIC Insured) |

AAA |

|

4,000,000 |

4,120,120 |

|

|

New York State Thruway Auth. Svc. Contract Rev.: |

|

|

|

|

|

|

(Local Hwy. & Bridge Proj.): |

|

|

|

|

|

|

Series A2, 5.375% 4/1/10 (MBIA Insured) |

Aaa |

|

12,940,000 |

13,371,290 |

|

|

5.75% 4/1/16 |

Baa1 |

|

13,700,000 |

13,842,343 |

|

|

Rfdg. (Local Hwy. & Bridge Proj.) 6% 4/1/11 |

Baa1 |

|

4,000,000 |

4,235,560 |

|

|

New York State Urban Dev. Corp. Rev.: |

|

|

|

|

|

|

(Correctional Cap. Facilities Proj.) Series 5, 5.9% 1/1/08 |

Baa1 |

|

1,455,000 |

1,525,000 |

|

|

Municipal Bonds - continued |

|||||

|

Moody's Ratings |

Principal Amount |

Value |

|||

|

New York - continued |

|||||

|

New York State Urban Dev. Corp. Rev.: - continued |

|

|

|

|

|

|

(Sports Facilities Assistance Prog.) Series A, 6.25% 4/1/06 (MBIA Insured) |

Aaa |

|

$ 15,000 |

$ 16,139 |

|

|

Rfdg.: |

|

|

|

|

|

|

(Correctional Cap. Facilities Proj.) Series A, 6.3% 1/1/03 |

Baa1 |

|

700,000 |

724,570 |

|

|

(Correctional Facilities Proj.) 5.625% 1/1/07 (AMBAC Insured) |

Aaa |

|

2,000,000 |

2,065,520 |

|

|

(Syracuse Univ. Ctr. Proj.) 5.2% 1/1/03 |

Baa1 |

|

1,000,000 |

1,010,770 |

|

|

Niagara Falls Gen. Oblig.: |

|

|

|

|

|

|

(Pub. Impt. Proj.): |

|

|

|

|

|

|

7.5% 3/1/08 (MBIA Insured) |

Aaa |

|

995,000 |

1,156,508 |

|

|

7.5% 3/1/10 (MBIA Insured) |

Aaa |

|

1,155,000 |

1,375,986 |

|

|

7.5% 3/1/11 (MBIA Insured) |

Aaa |

|

1,245,000 |

1,498,943 |

|

|

7.5% 3/1/16 (MBIA Insured) |

Aaa |

|

1,060,000 |

1,302,539 |

|

|

7.5% 3/1/17 (MBIA Insured) |

Aaa |

|

1,200,000 |

1,476,672 |

|

|

(Wtr. Treatment Plant Proj.) 7% 11/1/13 (MBIA Insured) (c) |

Aaa |

|

1,000,000 |

1,088,490 |

|

|

North Hempstead Gen. Oblig. Rfdg. Series B, 6.1% 4/1/06 (FGIC Insured) |

Aaa |

|

500,000 |

534,545 |

|

|

Rensselaer County Indl. Dev. Auth. Civic Facilities Rev. (Polytechnic Institute Proj.) Series B, 5% 8/1/09 (AMBAC Insured) |

Aaa |

|

1,500,000 |

1,513,275 |

|

|

Rockland County Gen. Oblig. 6% 8/15/05 (AMBAC Insured) |

Aaa |

|

1,475,000 |

1,563,618 |

|

|

Suffolk County Gen. Oblig. Series A, 6% 8/1/05 (AMBAC Insured) |

Aaa |

|

3,380,000 |

3,581,685 |

|

|

Suffolk County Ind. Dev. Agcy. Civic Facility |

BBB |

|

925,000 |

954,804 |

|

|

Suffolk County Wtr. Auth. Wtrwks. Rev. Rfdg. Series C, 5.75% 6/1/10 (AMBAC Insured) (Pre-Refunded to 6/1/02 @ 102) (d) |

Aaa |

|

30,000 |

31,272 |

|

|

Triborough Bridge & Tunnel Auth. Rev. (Convention Ctr. Proj.) Series E: |

|

|

|

|

|

|

6% 1/1/11 |

Baa1 |

|

4,000,000 |

4,266,120 |

|

|

7.25% 1/1/10 |

Baa1 |

|

9,870,000 |

11,058,447 |

|

|

Triborough Bridge & Tunnel Auth. Revs.: |

|

|

|

|

|

|

Rfdg.: |

|

|

|

|

|

|

Series A, 5.25% 1/1/28 |

Aa3 |

|

9,500,000 |

8,823,790 |

|

|

Series B, 5% 1/1/14 |

Aa3 |

|

2,000,000 |

1,936,600 |

|

|

Series Q, 6.75% 1/1/09 |

Aa3 |

|

1,000,000 |

1,109,580 |

|

|

Series Y, 6% 1/1/12 |

Aa3 |

|

16,610,000 |

17,959,396 |

|

|

Municipal Bonds - continued |

|||||

|

Moody's Ratings |

Principal Amount |

Value |

|||

|

New York - continued |

|||||

|

Triborough Bridge & Tunnel Auth. Revs.: - continued |

|

|

|

|

|

|

Series A, 6% 1/1/11 |

Aa3 |

|

$ 500,000 |

$ 540,390 |

|

|

Series B: |

|

|

|

|

|

|

5.2% 1/1/22 |

Aa3 |

|

7,870,000 |

7,385,916 |

|

|

5.5% 1/1/30 |

Aa3 |

|

2,015,000 |

1,946,833 |

|

|

Triborough Bridge & Tunnel Auth. Spl. Oblig.: |

|

|

|

|

|

|

Rfdg. Series A: |

|

|

|

|

|

|

5% 1/1/15 (FGIC Insured) |

Aaa |

|

2,200,000 |

2,105,554 |

|

|

5.125% 1/1/11 (MBIA Insured) |

Aaa |

|

3,000,000 |

3,014,160 |

|

|

5.125% 1/1/12 (MBIA Insured) |

Aaa |

|

1,000,000 |

996,570 |

|

|

5.25% 1/1/11 (FGIC Insured) |

Aaa |

|

3,000,000 |

3,040,620 |

|

|

Upper Mohawk Valley Reg'l. Wtr. Fin. Auth. Wtr. Sys. Rev. Rfdg. Series A, 5.125% 10/1/26 (FSA Insured) |

Aaa |

|

5,000,000 |

4,579,550 |

|

|

Yonkers Gen. Oblig. Series A: |

|

|

|

|

|

|

6% 8/1/04 (FGIC Insured) |

Aaa |

|

1,020,000 |

1,068,532 |

|

|

6% 8/1/05 (FGIC Insured) |

Aaa |

|

1,080,000 |

1,139,519 |

|

|

|

975,402,293 |

||||

|

New York & New Jersey - 2.8% |

|||||

|

Port Auth. New York & New Jersey: |

|

|

|

|

|

|

Rfdg. Series 107, 6% 10/15/06 (c) |

A1 |

|

1,530,000 |

1,623,728 |

|

|

Series 109, 5.375% 1/15/32 |

A1 |

|

12,500,000 |

11,875,375 |

|

|

Series 73, 6.75% 10/15/06 (c) |

A1 |

|

2,000,000 |

2,046,100 |

|

|

Series 77, 6.25% 1/15/27 (c) |

A1 |

|

2,000,000 |

2,032,680 |

|

|

Series 85: |

|

|

|

|

|

|

5.2% 9/1/15 |

A1 |

|

2,400,000 |

2,338,152 |

|

|

5.2% 9/1/16 |

A1 |

|

2,000,000 |

1,948,500 |

|

|

Series 99, 7% 11/1/04 (FGIC Insured) (c) |

Aaa |

|

5,040,000 |

5,478,631 |

|

|

Port Auth. New York & New Jersey Spl. Oblig. Rev. (JFK Int'l. Air Term. Spl. Proj.) Series 6, 5.75% 12/1/25 (MBIA Insured) (c) |

Aaa |

|

2,000,000 |

1,998,500 |

|

|

|

29,341,666 |

||||

|

Puerto Rico - 1.6% |

|||||

|

Puerto Rico Commonwealth Hwy. & Trans. Auth. Trans. Rev. Series A, 4.75% 7/1/38 |

Baa1 |

|

1,400,000 |

1,194,466 |

|

|

Municipal Bonds - continued |

|||||

|

Moody's Ratings |

Principal Amount |

Value |

|||

|

Puerto Rico - continued |

|||||

|

Puerto Rico Commonwealth Urban Renewal & Hsg. Corp. Rfdg. 7.875% 10/1/04 |

Baa |

|

$ 6,270,000 |

$ 6,365,931 |

|

|

Puerto Rico Tel. Auth. Rev. 5.45% 1/16/15 (MBIA Insured) (Pre-Refunded to 1/1/03 @ 101.5) (d) |

Aaa |

|

9,600,000 |

9,944,064 |

|

|

|

17,504,461 |

||||

|

TOTAL MUNICIPAL BONDS (Cost $1,010,315,381) |

1,022,248,420 |

||||

|

Municipal Notes - 2.1% |

|||

|

|

|

|

|

|

New York - 2.1% |

|||

|

New York City Gen. Oblig.: |

|

|

|

|

Series 1994 A4, 4.1%, LOC Chase Manhattan Bank, VRDN (b) |

6,900,000 |

6,900,000 |

|

|

Series B2 B5, 4.2% (MBIA Insured), VRDN (b) |

4,700,000 |

4,700,000 |

|

|

New York City Muni. Wtr. Fin. Auth. Wtr. & Swr. Sys. Rev. Series 2000 C, 4.25% (Liquidity Facility Dexia Cr. Local |

10,000,000 |

10,000,000 |

|

|

TOTAL MUNICIPAL NOTES (Cost $21,600,000) |

21,600,000 |

||

|

TOTAL INVESTMENT PORTFOLIO - 99.0% (Cost $1,031,915,381) |

1,043,848,420 |

||

|

NET OTHER ASSETS - 1.0% |

10,919,389 |

||

|

NET ASSETS - 100% |

$ 1,054,767,809 |

||

|

Security Type Abbreviation |

|

VRDN - VARIABLE RATE DEMAND NOTE |

|

Legend |

|

(a) S&P credit ratings are used in the absence of a rating by Moody's Investors Service, Inc. |

|

(b) The coupon rate shown on floating or adjustable rate securities represents the rate at period end. |

|

(c) Private activity obligations whose interest is subject to the federal alternative minimum tax for individuals. |

|

(d) Security collateralized by an amount sufficient to pay interest and principal. |

|

(e) Restricted securities - Investment in securities not registered under the Securities Act of 1933. |

|

Additional information on each holding is as follows: |

|

Security |

Acquisition Date |

Acquisition Cost |

|

New York State Hsg. Fin. Agcy. Rev. 8.25% 5/1/09 |

5/1/86 |

$ 4,341,450 |

|

Other Information |

|

The composition of long-term debt holdings as a percentage of total value of investments in securities, is as follows (ratings are unaudited): |

|

Moody's Ratings |

S&P Ratings |

|||

|

Aaa, Aa, A |

80.3% |

|

AAA, AA, A |

93.2% |

|

Baa |

16.5% |

|

BBB |

1.7% |

|

Ba |

0.0% |

|

BB |

0.0% |

|

B |

0.0% |

|

B |

0.0% |

|

Caa |

0.0% |

|

CCC |

0.0% |

|

Ca, C |

0.0% |

|

CC, C |

0.0% |

|

|

|

|

D |

0.0% |

|

The fund invested in securities that are not registered under the Securities Act of 1933. These securities are subject to legal or contractual restrictions on resale. At the end of the period, restricted securities (excluding Rule 144A issues) amounted to $4,215,000 or 0.4% of net assets. |

|

The distribution of municipal securities by revenue source, as a percentage of total net assets, is as follows: |

|

General Obligations |

36.5% |

|

Transportation |

18.7 |

|

Special Tax |

12.8 |

|

Water & Sewer |

12.0 |

|

Education |

6.1 |

|

Others* (individually less than 5%) |

13.9 |

|

|

100.0% |

|

* Includes net other assets. |

|

Income Tax Information |

|

At July 31, 2000, the aggregate cost |

|

At January 31, 2000, the fund had a capital loss carryforward of approximately $2,776,000 all of which will expire on January 31, 2008. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Spartan New York Municipal Income Fund

Statement of Assets and Liabilities

|

|

July 31, 2000 (Unaudited) |

|

|

Assets |

|

|

|

Investment in securities, at value (cost $1,031,915,381) - See accompanying schedule |

|

$ 1,043,848,420 |

|

Cash |

|

6,198,296 |

|

Receivable for fund shares sold |

|

636,203 |

|

Interest receivable |

|

13,207,023 |

|

Other receivables |

|

26,596 |

|

Total assets |

|

1,063,916,538 |

|

Liabilities |

|

|

|

Payable for investments purchased |

$ 6,857,599 |

|

|

Payable for fund shares redeemed |

861,716 |

|

|

Distributions payable |

1,102,924 |

|

|

Accrued management fee |

326,490 |

|

|

Total liabilities |

|

9,148,729 |

|

Net Assets |

|

$ 1,054,767,809 |

|

Net Assets consist of: |

|

|

|

Paid in capital |

|

$ 1,051,584,299 |

|

Distributions in excess of net interest income |

|

(298,825) |

|

Accumulated undistributed net realized gain (loss) |

|

(8,450,704) |

|

Net unrealized appreciation (depreciation) on investments |

|

11,933,039 |

|

Net Assets, for 86,141,919 shares outstanding |

|

$ 1,054,767,809 |

|

Net Asset Value, offering price and redemption price |

|

$12.24 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Spartan New York Municipal Income Fund

Financial Statements - continued

Statement of Operations

|

|

Six months ended July 31, 2000 (Unaudited) |

|

|

Interest Income |

|

$ 28,087,037 |

|

Expenses |

|

|

|

Management fee |

$ 1,918,277 |

|

|

Transfer agent fees |

407,681 |

|

|

Accounting fees and expenses |

129,889 |

|

|

Non-interested trustees' compensation |

1,955 |

|

|

Custodian fees and expenses |

10,427 |

|

|

Registration fees |

23,392 |

|

|

Audit |

16,079 |

|

|

Legal |

10,354 |

|

|

Reports to shareholders |

12,393 |

|

|

Miscellaneous |

607 |

|

|

Total expenses before reductions |

2,531,054 |

|

|

Expense reductions |

(252,466) |

2,278,588 |

|

Net interest income |

|

25,808,449 |

|

Realized and Unrealized Gain (Loss) Net realized gain (loss) on investment securities |

|

(3,650,394) |

|

Change in net unrealized appreciation (depreciation) on investment securities |

|

46,708,534 |

|

Net gain (loss) |

|

43,058,140 |

|

Net increase (decrease) in net assets resulting |

|

$ 68,866,589 |

|

Other information |

|

|

|

Expense reductions: |

|

$ 8,326 |

|

Transfer agent credits |

|

227,765 |

|

Accounting credits |

|

16,375 |

|

|

|

$ 252,466 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Spartan New York Municipal Income Fund

Financial Statements - continued

Statement of Changes in Net Assets

|

|

Six months ended

July 31, 2000 |

Year ended

January 31, |

|

Increase (Decrease) in Net Assets |

|

|

|

Operations |

$ 25,808,449 |

$ 54,485,450 |

|

Net realized gain (loss) |

(3,650,394) |

(3,481,379) |

|

Change in net unrealized appreciation (depreciation) |

46,708,534 |

(110,200,928) |

|

Net increase (decrease) in net assets resulting |

68,866,589 |

(59,196,857) |

|

Distributions to shareholders |

(25,800,326) |

(54,350,673) |

|

From net realized gain |

- |

(603,460) |

|

In excess of net realized gain |

- |

(1,354,809) |

|

Total distributions |

(25,800,326) |

(56,308,942) |

|

Share transactions |

96,803,456 |

227,054,112 |

|

Reinvestment of distributions |

19,342,941 |

43,201,504 |

|

Cost of shares redeemed |

(111,891,417) |

(347,394,370) |

|

Net increase (decrease) in net assets resulting |

4,254,980 |

(77,138,754) |

|

Total increase (decrease) in net assets |

47,321,243 |

(192,644,553) |

|

Net Assets |

|

|

|

Beginning of period |

1,007,446,566 |

1,200,091,119 |

|

End of period (including distributions in excess of |

$ 1,054,767,809 |

$ 1,007,446,566 |

|

Other Information Shares |

|

|

|

Sold |

8,085,465 |

18,303,331 |

|

Issued in reinvestment of distributions |

1,607,738 |

3,511,447 |

|

Redeemed |

(9,336,960) |

(28,383,532) |

|

Net increase (decrease) |

356,243 |

(6,568,754) |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights

|

|

Six months ended July 31, 2000 |

Years ended January 31, |

||||

|

|

(Unaudited) |

2000 |

1999 |

1998 |

1997 |

1996 |

|

Selected Per-Share Data |

|

|

|

|

|

|

|

Net asset value, beginning of period |

$ 11.740 |

$ 12.990 |

$ 12.940 |

$ 12.290 |

$ 12.540 |

$ 11.370 |

|

Income from

Investment

Operations |

.303 D |

.590 D |

.602 |

.624 |

.629 |

.635 |

|

Net realized and

unrealized |

.500 |

(1.230) |

.205 |

.670 |

(.246) |

1.177 |

|

Total from investment operations |

.803 |

(.640) |

.807 |

1.294 |

.383 |

1.812 |

|

Less Distributions |

|

|

|

|

|

|

|

From net interest income |

(.303) |

(.589) |

(.602) |

(.624) |

(.631) |

(.642) |

|

From net |

- |

(.006) |

(.155) |

(.020) |

(.002) |

- |

|

In excess of net realized gain |

- |

(.015) |

- |

- |

- |

- |

|

Total distributions |

(.303) |

(.610) |

(.757) |

(.644) |

(.633) |

(.642) |

|

Net asset value, |

$ 12.240 |

$ 11.740 |

$ 12.990 |

$ 12.940 |

$ 12.290 |

$ 12.540 |

|

Total Return B, C |

6.91% |

(5.03)% |

6.45% |

10.82% |

3.22% |

16.29% |

|

Ratios and Supplemental Data |

|

|

|

|

|

|

|

Net assets, |

$ 1,054,768 |

$ 1,007,447 |

$ 1,200,091 |

$ 1,133,668 |

$ 401,071 |

$ 433,678 |

|

Ratio of expenses to average net assets |

.50% A |

.49% |

.53% E |

.55% E |

.59% |

.59% |

|

Ratio of expenses to average net assets after expense reductions |

.45% A, F |

.49% |

.53% |

.55% |

.59% |

.58% F |

|

Ratio of net interest income to average net assets |

5.08% A |

4.78% |

4.67% |

4.97% |

5.15% |

5.26% |

|

Portfolio turnover rate |

26% A |

19% |

25% |

43% |

44% |

83% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C The total returns would have been lower had certain expenses not been reduced during the periods shown.

D Net interest income per share has been calculated based on average shares outstanding during the period.

E FMR agreed to reimburse a portion of the fund's expenses during the period. Without this reimbursement, the fund's expense ratio would have been higher.

F FMR or the fund has entered into varying arrangements with third parties who either paid or reduced a portion of the fund's expenses.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Spartan New York Municipal Money Market Fund

Performance: The Bottom Line

To evaluate a money market fund's historical performance, you can look at either total return or yield. Total return reflects the change in value of an investment, assuming reinvestment of the fund's dividend income and does not include the effect of the fund's $5 account closeout fee on an average-sized account. Yield measures the income paid by a fund. Since a money market fund tries to maintain a $1 share price, yield is an important measure of performance. If Fidelity had not reimbursed certain fund expenses, the past 10 year total returns would have been lower.

Cumulative Total Returns

|

Periods ended July 31, 2000 |

Past 6 |

Past 1 |

Past 5 |

Past 10 |

|

Spartan NY Municipal Money Market |

1.78% |

3.35% |

16.71% |

36.39% |

|

New York Tax-Free Retail |

1.68% |

3.12% |

15.45% |

32.55% |