|

|

|

|

|

Previous: MFS SUN LIFE SERIES TRUST, PRES14A, 2001-01-17 |

Next: HORIZON HEALTH CORP, SC 13G, 2001-01-17 |

Like securities of all mutual funds, these securities have not been approved or disapproved by the Securities and Exchange Commission, and the Securities and Exchange Commission has not determined if this prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

Fidelity®

Fund

(fund number 662)

Prospectus

dated

January 29, 2001

and

Annual Report

for the period ending November 30, 2000

(fidelity_logo_graphic)

82 Devonshire Street, Boston, MA 02109

|

Performance |

How the fund has done over time. |

|

|

Fund Talk |

The manager's review of fund performance, strategy and outlook. |

|

|

Investment Changes |

A summary of major shifts in the fund's investments over the past six months. |

|

|

Investments |

A complete list of the fund's investments with their market values. |

|

|

Financial Statements |

Statements of assets and liabilities,

operations, and changes in net assets, |

|

|

Notes |

Notes to the financial statements. |

|

|

Report of Independent Accountants |

The auditors' opinion. |

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

Mutual fund shares are not deposits or obligations of, or guaranteed by, any depository institution. Shares are not insured by the FDIC, the Federal Reserve Board, or any other agency, and are subject to investment risks, including possible loss of principal amount invested.

Neither the fund nor Fidelity Distributors Corporation is a bank.

For more information on any Fidelity fund, including charges and expenses, call 1-800-544-6666 for a free prospectus. Read it carefully before you invest or send money.

Annual Report

There are several ways to evaluate a fund's historical performance. You can look at the total percentage change in value, the average annual percentage change or the growth of a hypothetical $100,000 investment. Total return reflects the change in the value of an investment, assuming reinvestment of the fund's dividend income and capital gains (the profits earned upon the sale of securities that have grown in value). You can also look at the fund's income, as reflected in the fund's yield, to measure performance. If Fidelity had not reimbursed certain fund expenses, the past five year and the past 10 year total returns would have been lower.

Cumulative Total Returns

|

Periods ended November 30, 2000 |

|

Past 1 |

Past 5 |

Past 10 |

|

Fidelity Inst Sht-Int Govt |

|

7.70% |

32.58% |

87.99% |

|

LB 1-5 Year US Government Bond |

|

7.43% |

33.37% |

92.87% |

|

Short-Intermediate US Government |

|

6.83% |

28.19% |

86.49% |

Cumulative total returns show the fund's performance in percentage terms over a set period - in this case, one year, five years or 10 years. For example, if you had invested $1,000 in a fund that had a 5% return over the past year, the value of your investment would be $1,050. You can compare the fund's returns to the performance of the Lehman Brothers 1-5 Year U.S. Government Bond Index - a market value-weighted index of government fixed-rate debt issues with maturities between one and five years. To measure how the fund's performance stacked up against its peers, you can compare it to the short-intermediate U.S. government funds average, which reflects the performance of mutual funds with similar objectives tracked by Lipper Inc. The past one year average represents a peer group of 95 mutual funds. These benchmarks reflect reinvestment of dividends and capital gains, if any, and exclude the effect of sales charges.

Average Annual Total Returns

|

Periods ended November 30, 2000 |

Past 1 |

Past 5 |

Past 10 |

|

Fidelity Inst Sht-Int Govt |

7.70% |

5.80% |

6.52% |

|

LB 1-5 Year US Government Bond |

7.43% |

5.93% |

6.79% |

|

Short-Intermediate US Government |

6.83% |

5.08% |

6.43% |

Average annual total returns take the fund's cumulative return and show you what would have happened if the fund had performed at a constant rate each year. (Note: Lipper calculates average annual total returns by annualizing each fund's total return, then taking an arithmetic average. This may produce a different figure than that obtained by averaging the cumulative total returns and annualizing the result.)

Annual Report

Performance - continued

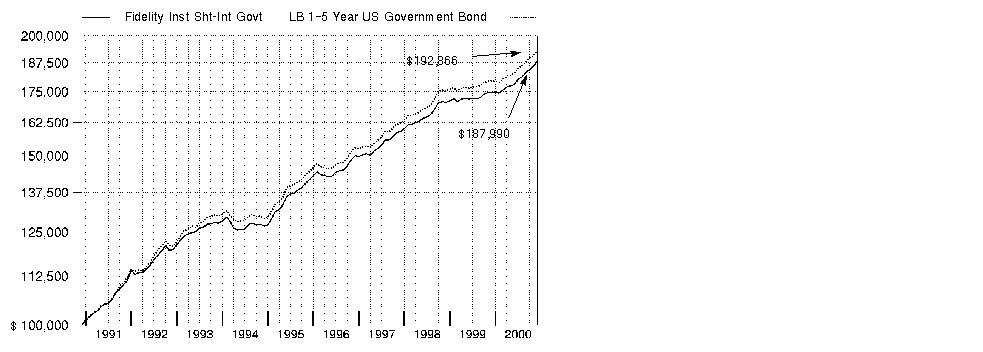

$100,000 Over 10 Years

$100,000 Over 10 Years: Let's say hypothetically that $100,000 was invested in Fidelity Institutional Short-Intermediate Government Fund on November 30, 1990. As the chart shows, by November 30, 2000, the value of the investment would have grown to $187,990 - an 87.99% increase on the initial investment. For comparison, look at how the Lehman Brothers 1-5 Year U.S. Government Bond Index did over the same period. With dividends and capital gains, if any, reinvested, the same $100,000 would have grown to $192,866 - a 92.87% increase.

Understanding

Performance

How a fund did yesterday is no guarantee of how it will do tomorrow. Bond prices, for example, generally move in the opposite direction of interest rates. In turn, the share price, return and yield of a fund that invests in bonds will vary. That means if you sell your shares during a market downturn, you might lose money. But if you can ride out the market's ups and downs, you may have a gain.

3Annual Report

Performance - continued

Total Return Components

|

|

|

Years ended November 30, |

||||

|

|

|

2000 |

1999 |

1998 |

1997 |

1996 |

|

Dividend returns |

|

6.82% |

6.27% |

6.54% |

6.83% |

6.90% |

|

Capital returns |

|

0.88% |

-3.90% |

0.64% |

-0.84% |

-1.04% |

|

Total returns |

|

7.70% |

2.37% |

7.18% |

5.99% |

5.86% |

Total return components include both dividend returns and capital returns. A dividend return reflects the actual dividends paid by the fund. A capital return reflects both the amount paid by the fund to shareholders as capital gain distributions and changes in the fund's share price. Both returns assume the dividends or capital gains, if any, paid by the fund are reinvested.

Dividends and Yield

|

Periods ended November 30, 2000 |

Past 1 |

Past 6 |

Past 1 |

|

Dividends per share |

4.97¢ |

30.04¢ |

59.49¢ |

|

Annualized dividend rate |

6.62% |

6.58% |

6.57% |

|

30-day annualized yield |

6.34% |

- |

- |

Dividends per share show the income paid by the fund for a set period. If you annualize this number, based on an average share price of $9.14 over the past one month, $9.10 over the past six months and $9.06 over the past one year, you can compare the fund's income over these three periods. The 30-day annualized yield is a standard formula for all bond funds based on the yields of the bonds in the fund, averaged over the past 30 days. This figure shows you the yield characteristics of the fund's investments at the end of the period. It also helps you compare funds from different companies on an equal basis.

Annual Report

Market Recap

Many bondholders had plenty to be thankful for as unique technical factors in the market, coupled with generally declining interest rates, propelled investment-grade bonds past stocks during the 12-month period that ended November 30, 2000. In its strongest showing since 1995, the Lehman Brothers Aggregate Bond Index - a proxy for taxable-bond performance - returned 9.06% during this time frame. Early in 2000, Treasuries assumed market leadership from the spread sectors - corporate bonds, mortgage and agency securities - a position it never relinquished. A growing federal budget surplus spurred the U.S. government in January to begin buying back outstanding debt and reducing future issuance. The scarcity premium created by a shrinking supply of long-dated Treasuries sent prices soaring and yields plummeting. Anticipation that the Fed was finished raising interest rates following a half-point hike in May, combined with persistent flights to safety from risk-averse investors concerned about volatility in equity markets, further bolstered the long bond, helping the Lehman Brothers Treasury Index return 10.65% during the period. It was a photo finish for second with the Lehman Brothers Mortgage-Backed Securities and U.S. Agency indexes returning 9.13% and 9.11%, respectively. Discount mortgages surged on higher-than-normal prepayment activity due to a strong housing market, while agencies staged a relief rally behind reduced political risk surrounding government-sponsored enterprises. Corporates lagged behind, plagued by deteriorating credit conditions and growing supply pressures. The Lehman Brothers Credit Bond Index closed out the period up 6.74%.

(Portfolio Manager photograph)

An interview with Andrew Dudley, Portfolio Manager of Fidelity Institutional Short-Intermediate Government Fund

Q. How did the fund perform, Andy?

A. For the 12 months that ended November 30, 2000, the fund returned 7.70%. In comparison, the Lehman Brothers 1-5 Year U.S. Government Bond Index returned 7.43%, while the short-intermediate U.S. government funds average returned 6.83%, as tracked by Lipper Inc.

Q. What factors helped the fund outperform both the Lehman Brothers index and the Lipper peer group?

A. Throughout the fund's fiscal year, we maintained large overweightings in both government agency and mortgage securities, and this was a major factor in outperforming the index and the Lipper group. During the period, the spreads - or differences in yields - between agency and Treasury securities remained stable. When agency yield spreads remain consistent, agencies should outperform Treasuries simply because of the yield advantage that agencies offer. At the end of the 12-month period, U.S. government agency securities accounted for 52.2% of fund net assets, compared to a 31% weighting in the Lehman Brothers index. Mortgage-backed securities, which are not included in the Lehman Brothers index, accounted for 29.6% of fund net assets.

Annual Report

Fund Talk: The Manager's Overview - continued

Q. What other factors influenced the fund's performance?

A. The fund's relatively short duration - or interest-rate sensitivity - helped performance relative to the competitive universe. Consistent with our policy, our duration was about even with the Lehman Brothers index. I do not try to place bets on the direction of interest-rate changes. At the end of the period, the fund's duration was 2.1 years, while the average duration of the Lipper group was 3.3 years. The shorter-maturity securities experienced less price volatility than longer maturities; therefore, the lower volatility and higher yields of agencies and mortgages combined to help the fund outperform the Lipper group. Fund performance also benefited from my decision to harvest some of the gains in agency securities and invest in mortgage-backed securities that offered very attractive yields. I tried to emphasize mortgage securities structured to limit prepayment risk.

Q. Why did you have such a significant underweighting in Treasury securities, which accounted for just under 14% of net assets on November 30, 2000 versus a 69% position in the Lehman Brothers index?

A. It is not unusual for this fund to have a very low weighting in Treasuries. In the long run, I believe that short-term government agency securities offer better total return potential than short-term Treasuries. While Treasuries may outperform agencies for short periods, over the longer term the price movements of Treasuries become less important and the yield advantages of agencies become more important. With this belief, I usually have a higher yielding portfolio than the Lehman index. At the end of the period, the portfolio's yield advantage was 0.44% - or 44 basis points - over the index. At the beginning of the period, I thought the prices of agencies and mortgages overstated the downside risks they carried as a result of the political debate about the implied government guarantee of agency securities. I thought investors were well-compensated to take on the limited risks of agencies and mortgages, so it made sense to overweight them. I also thought that despite short-term technical factors that created a shortage of Treasuries, the yield advantages of non-Treasuries gave them better long-term total return potential.

Q. What is your outlook for government securities?

A. I don't know if we have reached equilibrium, but we seem to be closer to it between the prices of agencies and Treasuries. One of the negatives that affected agencies earlier in the year was questioning by some government leaders about the implied government guarantees of some federal agencies. I think that greater oversight of the credit risks taken on by these agencies probably will result from this debate. Better oversight should make agency securities more attractive in the longer term. The situation is somewhat different with mortgages. The recent rally in Treasuries increases the possibility that the prepayment risks of mortgage securities will increase as homeowners refinance to take advantage of lower interest rates. I will watch the mortgage market very carefully and be prepared to move out of higher-coupon mortgages if prepayment risks start increasing.

Annual Report

Fund Talk: The Manager's Overview - continued

The views expressed in this report reflect those of the portfolio manager only through the end of the period of the report as stated on the cover and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Fund Facts

Goal: seeks a high level of current income in a manner consistent with preserving principal

Start date: November 10, 1986

Size: as of November 30, 2000, more than $341 million

Manager: Andrew Dudley, since 1998; manager, various Fidelity bond funds; joined Fidelity in 1996

3Andrew Dudley on the bond market's perceptions of the national elections:

"From the perspective of fixed-income investors, the most important outcome of the elections is that there does not appear to be any broad, sweeping mandate for change. The results of both the presidential election and the fight for control of Congress were so close that it will be difficult for anyone to make dramatic shifts in policy. The financial markets like that result. They don't like the prospect of broad, sweeping changes that create uncertainty in the market.

"The new Congress will be almost evenly split between Republicans and Democrats. That means that the defection of just one member, for any reason, can jeopardize the outcome of a vote on any issue. That is not an environment for major change, particularly when you also have a president who has been narrowly elected. The bond market was most fearful of a Republican president with a sweeping mandate for cutting taxes and clear Republican control in both houses of Congress. That would have increased the potential for large tax cuts, which could reduce or eliminate the federal surplus, causing an increase in the issuance of Treasury securities, higher interest rates and greater volatility in the bond market. To the extent there is no broad, sweeping mandate, there should be less uncertainty for the bond market to worry about."

Annual Report

|

Coupon Distribution as of November 30, 2000 |

||

|

|

% of fund's investments |

% of fund's investments |

|

Zero coupon bonds |

1.5 |

2.0 |

|

5 - 5.99% |

7.8 |

12.0 |

|

6 - 6.99% |

41.7 |

40.6 |

|

7 - 7.99% |

15.4 |

12.5 |

|

8 - 8.99% |

12.6 |

11.6 |

|

9 - 9.99% |

4.7 |

6.7 |

|

10 - 10.99% |

3.9 |

4.4 |

|

11 - 11.99% |

3.6 |

3.8 |

|

12% and over |

3.5 |

1.8 |

|

Coupon distribution shows the range of stated interest rates on the fund's investments, excluding short-term investments. |

|

Average Years to Maturity as of November 30, 2000 |

||

|

|

|

6 months ago |

|

Years |

3.7 |

3.7 |

|

Average years to maturity is based on the average time remaining until principal payments are expected from each of the fund's bonds, weighted by dollar amount. |

|

Duration as of November 30, 2000 |

||

|

|

|

6 months ago |

|

Years |

2.1 |

2.0 |

|

Duration shows how much a bond fund's price fluctuates with changes in comparable interest rates. If rates rise 1%, for example, a fund with a five-year duration is likely to lose about 5% of its value. Other factors also can influence a bond fund's performance and share price. Accordingly, a bond fund's actual performance may differ from this example. |

|

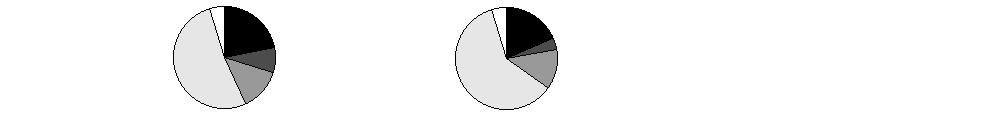

Asset Allocation (% of fund's net assets) |

|||||||

|

As of November 30, 2000 |

As of May 31, 2000 |

||||||

|

Mortgage |

|

|

Mortgage |

|

||

|

CMOs and Other Mortgage Related Securities 7.8% |

|

|

CMOs and Other Mortgage Related Securities 3.5% |

|

||

|

U.S. Treasury |

|

|

U.S. Treasury |

|

||

|

U.S. Government |

|

|

U.S. Government |

|

||

|

Short-Term |

|

|

Short-Term |

|

||

Annual Report

Showing Percentage of Net Assets

|

U.S. Government and Government Agency Obligations - 65.8% |

||||

|

|

Principal Amount |

Value |

||

|

U.S. Government Agency Obligations - 52.2% |

||||

|

Fannie Mae: |

|

|

|

|

|

6.375% 10/15/02 |

|

$ 5,500,000 |

$ 5,527,500 |

|

|

6.5% 8/15/04 |

|

10,000,000 |

10,093,700 |

|

|

6.5% 4/29/09 |

|

4,290,000 |

4,178,331 |

|

|

Federal Home Loan Bank: |

|

|

|

|

|

6% 8/15/02 |

|

17,000,000 |

16,933,530 |

|

|

6.375% 11/15/02 |

|

1,600,000 |

1,606,752 |

|

|

6.75% 2/1/02 |

|

8,200,000 |

8,247,396 |

|

|

6.75% 5/1/02 |

|

28,500,000 |

28,727,149 |

|

|

6.875% 8/15/03 |

|

1,400,000 |

1,424,724 |

|

|

Financing Corp. - coupon STRIPS 0% 4/6/01 |

|

2,500,000 |

2,442,675 |

|

|

Freddie Mac: |

|

|

|

|

|

7% 2/15/03 |

|

13,300,000 |

13,536,873 |

|

|

7% 7/15/05 |

|

7,970,000 |

8,210,375 |

|

|

7.375% 5/15/03 |

|

7,000,000 |

7,196,840 |

|

|

Government Loan Trusts (assets of Trust guaranteed |

|

2,259,083 |

2,383,423 |

|

|

Government Trust Certificates (assets of Trust guaranteed by U.S. Government through Defense Security Assistance Agency): |

|

|

|

|

|

Class 1-C, 9.25% 11/15/01 |

|

10,360,696 |

10,555,787 |

|

|

Class 2-E, 9.4% 5/15/02 |

|

478,260 |

486,807 |

|

|

Class 3-T, 9.625% 5/15/02 |

|

1,049,778 |

1,069,556 |

|

|

Guaranteed Export Trust Certificates (assets of Trust guaranteed by U.S. Government through Export- |

|

|

|

|

|

Series 1993-C, 5.2% 10/15/04 |

|

364,800 |

356,825 |

|

|

Series 1993-D, 5.23% 5/15/05 |

|

333,191 |

325,038 |

|

|

Series 1994-F, 8.187% 12/15/04 |

|

15,942,561 |

16,364,608 |

|

|

Series 1995-A, 6.28% 6/15/04 |

|

2,818,824 |

2,811,935 |

|

|

Guaranteed Trade Trust Certificates (assets of Trust guaranteed by U.S. Government through Export- |

|

|

|

|

|

Series 1992-A, 7.02% 9/1/04 |

|

4,173,000 |

4,159,813 |

|

|

Series 1997-A, 6.104% 7/15/03 |

|

3,650,000 |

3,634,670 |

|

|

Israel Export Trust Certificates (assets of Trust guaranteed by U.S. Government through Export- |

|

5,556,176 |

5,550,676 |

|

|

Overseas Private Investment Corp. U.S. Government guaranteed participation certificates: |

|

|

|

|

|

Series 1994-195, 6.08% 8/15/04 (callable) |

|

2,127,038 |

2,128,845 |

|

|

6.77% 11/15/13 |

|

1,700,000 |

1,702,125 |

|

|

U.S. Government and Government Agency Obligations - continued |

||||

|

|

Principal Amount |

Value |

||

|

U.S. Government Agency Obligations - continued |

||||

|

Private Export Funding Corp. secured: |

|

|

|

|

|

5.65% 3/15/03 |

|

$ 403,929 |

$ 398,536 |

|

|

5.8% 2/1/04 |

|

4,207,000 |

4,145,788 |

|

|

6.86% 4/30/04 |

|

1,365,175 |

1,375,655 |

|

|

State of Israel (guaranteed by U.S. Government through Agency for International Development): |

|

|

|

|

|

5.625% 9/15/03 |

|

10,271,000 |

10,132,855 |

|

|

6.625% 8/15/03 |

|

2,500,000 |

2,519,225 |

|

|

TOTAL U.S. GOVERNMENT AGENCY OBLIGATIONS |

178,228,012 |

|||

|

U.S. Treasury Obligations - 13.6% |

||||

|

U.S. Treasury Bonds: |

|

|

|

|

|

10.75% 8/15/05 |

|

9,300,000 |

11,270,391 |

|

|

11.75% 2/15/10 (callable) |

|

8,298,000 |

10,135,260 |

|

|

12% 8/15/13 |

|

7,500,000 |

10,433,175 |

|

|

U.S. Treasury Notes: |

|

|

|

|

|

5.5% 5/31/03 |

|

5,200,000 |

5,188,612 |

|

|

6.5% 8/31/01 |

|

3,089,000 |

3,096,228 |

|

|

6.625% 4/30/02 |

|

1,700,000 |

1,717,527 |

|

|

7.875% 8/15/01 |

|

2,000,000 |

2,023,120 |

|

|

U.S. Treasury Notes - coupon STRIPS: |

|

|

|

|

|

0% 3/31/01 |

|

422,000 |

413,796 |

|

|

0% 9/30/01 |

|

87,000 |

82,842 |

|

|

0% 10/31/01 |

|

142,000 |

134,785 |

|

|

0% 3/31/02 |

|

1,034,000 |

961,403 |

|

|

0% 9/30/02 |

|

834,000 |

753,035 |

|

|

0% 10/31/02 |

|

142,000 |

127,800 |

|

|

0% 11/30/02 |

|

207,000 |

185,921 |

|

|

TOTAL U.S. TREASURY OBLIGATIONS |

46,523,895 |

|||

|

TOTAL U.S. GOVERNMENT AND (Cost $225,908,278) |

224,751,907 |

|||

|

U.S. Government Agency - Mortgage Securities - 21.8% |

||||

|

|

||||

|

Fannie Mae - 12.9% |

||||

|

5.5% 1/1/09 |

|

1,163,080 |

1,122,011 |

|

|

6% 9/1/08 to 10/1/14 |

|

16,660,599 |

16,315,855 |

|

|

6.5% 7/1/08 to 12/1/30 |

|

9,287,110 |

9,030,256 |

|

|

7% 1/1/10 to 9/1/29 |

|

3,907,973 |

3,869,962 |

|

|

7.5% 12/1/29 |

|

232,601 |

234,127 |

|

|

U.S. Government Agency - Mortgage Securities - continued |

||||

|

|

Principal Amount |

Value |

||

|

Fannie Mae - continued |

||||

|

7.5% 12/1/30 (a) |

|

$ 7,100,000 |

$ 7,144,375 |

|

|

8% 6/1/02 to 8/1/09 |

|

254,267 |

258,306 |

|

|

8.25% 12/1/01 |

|

1,780,461 |

1,785,745 |

|

|

9% 2/1/13 to 8/1/21 |

|

1,268,983 |

1,322,430 |

|

|

9.5% 5/1/09 to 11/1/21 |

|

146,992 |

152,926 |

|

|

10% 1/1/17 to 1/1/20 |

|

296,762 |

315,747 |

|

|

10.5% 5/1/10 to 8/1/20 |

|

207,152 |

221,921 |

|

|

11% 11/1/10 to 9/1/14 |

|

958,265 |

1,053,114 |

|

|

11.5% 11/1/15 to 7/15/19 |

|

920,201 |

1,025,265 |

|

|

12% 4/1/15 |

|

56,612 |

62,397 |

|

|

12.5% 3/1/16 |

|

76,216 |

86,575 |

|

|

12.75% 10/1/13 |

|

26,371 |

30,191 |

|

|

|

44,031,203 |

|||

|

Freddie Mac - 2.7% |

||||

|

6.25% 1/1/03 |

|

263,763 |

259,226 |

|

|

6.5% 7/1/03 to 5/1/08 |

|

499,168 |

495,787 |

|

|

7.5% 11/1/12 |

|

1,207,767 |

1,224,373 |

|

|

8% 9/1/07 to 12/1/09 |

|

1,244,380 |

1,267,921 |

|

|

8.5% 5/1/06 to 6/1/14 |

|

1,123,789 |

1,144,140 |

|

|

9% 12/1/07 to 3/1/22 |

|

646,040 |

670,448 |

|

|

9.5% 1/1/17 to 12/1/22 |

|

1,734,920 |

1,831,071 |

|

|

10% 1/1/09 to 6/1/20 |

|

523,130 |

551,416 |

|

|

10.25% 12/1/09 |

|

20,981 |

22,077 |

|

|

10.5% 9/1/16 to 5/1/21 |

|

313,581 |

337,532 |

|

|

11% 12/1/11 to 1/1/19 |

|

33,544 |

36,477 |

|

|

11.5% 10/1/15 |

|

37,150 |

40,704 |

|

|

12% 9/1/11 to 11/1/19 |

|

80,215 |

89,184 |

|

|

12.25% 11/1/14 |

|

32,572 |

36,767 |

|

|

12.5% 8/1/10 to 6/1/19 |

|

1,160,200 |

1,303,496 |

|

|

|

9,310,619 |

|||

|

Government National Mortgage Association - 6.2% |

||||

|

8% 11/15/09 to 9/15/30 |

|

11,164,711 |

11,452,144 |

|

|

8.5% 5/15/16 to 7/15/30 |

|

8,564,615 |

8,815,221 |

|

|

10.5% 1/15/16 to 1/15/18 |

|

692,216 |

751,190 |

|

|

11% 10/20/13 |

|

15,280 |

16,385 |

|

|

12.5% 11/15/14 |

|

111,196 |

127,010 |

|

|

13% 8/15/14 |

|

45,949 |

52,467 |

|

|

13.5% 7/15/11 |

|

32,487 |

37,272 |

|

|

|

21,251,689 |

|||

|

TOTAL U.S. GOVERNMENT AGENCY - MORTGAGE SECURITIES (Cost $74,032,536) |

74,593,511 |

|||

|

Collateralized Mortgage Obligations - 7.8% |

||||

|

|

Principal Amount |

Value |

||

|

U.S. Government Agency - 7.8% |

||||

|

Fannie Mae REMIC planned amortization class: |

|

|

|

|

|

Series 1993-224 Class PG, 6.5% 9/25/21 |

|

$ 4,000,000 |

$ 3,981,240 |

|

|

Series 1999-25 Class PA, 6% 2/25/20 |

|

2,643,916 |

2,622,421 |

|

|

Series 1999-5 Class PB, 5.75% 2/25/16 |

|

2,800,000 |

2,763,236 |

|

|

Freddie Mac: |

|

|

|

|

|

REMIC accretion directed Series 1462 Class PT, 7.5% 1/15/03 |

|

1,276,969 |

1,285,345 |

|

|

REMIC planned amortization class: |

|

|

|

|

|

Series 1639 Class J, 6% 12/15/08 |

|

1,631,270 |

1,614,435 |

|

|

Series 1995 Class PB, 6.5% 9/20/25 |

|

3,123,837 |

3,122,837 |

|

|

Series 2134 Class PC, 5.725% 4/15/11 |

|

2,417,129 |

2,385,392 |

|

|

sequential pay: |

|

|

|

|

|

Series 2134 Class H, 6.5% 12/15/24 |

|

1,925,908 |

1,925,908 |

|

|

Series 2166 Class AE, 6.5% 10/15/25 |

|

3,019,707 |

2,975,708 |

|

|

Series 2257 Class VA, 7% 9/15/07 |

|

3,925,115 |

4,002,361 |

|

|

TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS (Cost $26,501,725) |

26,678,883 |

|||

|

Cash Equivalents - 5.4% |

|||

|

Maturity Amount |

|

||

|

Investments in repurchase agreements (U.S. Government Obligations), in a joint trading account at 6.55%, dated 11/30/00 due

12/1/00 |

$ 18,483,365 |

18,480,000 |

|

|

TOTAL INVESTMENT PORTFOLIO - 100.8% (Cost $344,922,539) |

344,504,301 |

|

|

NET OTHER ASSETS - (0.8)% |

(2,726,228) |

|

|

NET ASSETS - 100% |

$ 341,778,073 |

|

|

Legend |

|

(a) Security purchased on a delayed delivery or when-issued basis. |

|

Income Tax Information |

|

At November 30, 2000, the aggregate cost of investment securities for income tax purposes was $345,103,782. Net unrealized depreciation aggregated $599,481, of which $3,118,472 related to appreciated investment securities and $3,717,953 related to depreciated investment securities. |

|

At November 30, 2000, the fund had a capital loss carryforward of approximately $31,646,000 of which $14,003,000, $3,288,000, $4,169,000, $101,000, $5,916,000 and $4,169,000 will expire on November 30, 2002, 2003, 2004, 2005, 2007 and 2008, respectively. |

|

A total of 34.25% of the dividends distributed during the fiscal year was derived from interest on U.S. Government securities which is generally exempt from state income tax. The fund will notify shareholders in January 2001 of amounts for use in preparing 2000 income tax returns (unaudited). |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Assets and Liabilities

|

|

November 30, 2000 |

|

|

Assets |

|

|

|

Investment in securities, at value (including repurchase agreements of $18,480,000) (cost $344,922,539) - See accompanying schedule |

|

$ 344,504,301 |

|

Cash |

|

107,810 |

|

Receivable for investments sold |

|

9,182,628 |

|

Receivable for fund shares sold |

|

787,557 |

|

Interest receivable |

|

4,286,501 |

|

Total assets |

|

358,868,797 |

|

Liabilities |

|

|

|

Payable for investments purchased |

$ 9,192,768 |

|

|

Delayed delivery |

7,102,219 |

|

|

Payable for fund shares redeemed |

569,878 |

|

|

Distributions payable |

95,668 |

|

|

Accrued management fee |

127,569 |

|

|

Other payables and accrued expenses |

2,622 |

|

|

Total liabilities |

|

17,090,724 |

|

Net Assets |

|

$ 341,778,073 |

|

Net Assets consist of: |

|

|

|

Paid in capital |

|

$ 373,424,303 |

|

Undistributed net investment income |

|

418,048 |

|

Accumulated undistributed net realized gain (loss) |

|

(31,646,040) |

|

Net unrealized appreciation (depreciation) on investments |

|

(418,238) |

|

Net Assets |

|

$ 341,778,073 |

|

Net Asset Value, offering price and redemption price |

|

$9.19 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Statements - continued

Statement of Operations

|

|

Year ended November 30, 2000 |

|

|

Investment Income Interest |

|

$ 25,467,239 |

|

Security lending |

|

29,803 |

|

Total Income |

|

25,497,042 |

|

Expenses |

|

|

|

Management fee |

$ 1,635,757 |

|

|

Non-interested trustees' compensation |

1,329 |

|

|

Total expenses before reductions |

1,637,086 |

|

|

Expense reductions |

(53,205) |

1,583,881 |

|

Net investment income |

|

23,913,161 |

|

Realized and Unrealized Gain (Loss) Net realized gain (loss) on investment securities |

|

(4,094,184) |

|

Change in net unrealized appreciation (depreciation) on investment securities |

|

5,735,765 |

|

Net gain (loss) |

|

1,641,581 |

|

Net increase (decrease) in net assets resulting |

|

$ 25,554,742 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Statements - continued

Statement of Changes in Net Assets

|

|

Year ended

November 30, |

Year ended

November 30, |

|

Increase (Decrease) in Net Assets |

|

|

|

Operations |

$ 23,913,161 |

$ 25,505,068 |

|

Net realized gain (loss) |

(4,094,184) |

(6,331,174) |

|

Change in net unrealized appreciation (depreciation) |

5,735,765 |

(9,569,757) |

|

Net increase (decrease) in net assets resulting |

25,554,742 |

9,604,137 |

|

Distributions to shareholders from net investment income |

(23,805,639) |

(25,770,056) |

|

Share transactions |

|

|

|

Net proceeds from sales of shares |

117,072,453 |

204,472,069 |

|

Reinvestment of distributions |

21,968,436 |

23,438,270 |

|

Cost of shares redeemed |

(214,733,895) |

(175,575,782) |

|

Net increase (decrease) in net assets resulting |

(75,693,006) |

52,334,557 |

|

Total increase (decrease) in net assets |

(73,943,903) |

36,168,638 |

|

Net Assets |

|

|

|

Beginning of period |

415,721,976 |

379,553,338 |

|

End of period (including undistributed net investment income of $418,048 and $247,359, respectively) |

$ 341,778,073 |

$ 415,721,976 |

|

Other information |

|

|

|

Shares |

12,927,492 |

21,982,347 |

|

Issued in reinvestment of distributions |

2,424,108 |

2,531,302 |

|

Redeemed |

(23,761,009) |

(18,926,299) |

|

Net increase (decrease) |

(8,409,409) |

5,587,350 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights

|

Years ended November 30, |

2000 |

1999 |

1998 |

1997 |

1996 |

|

Selected Per-Share Data |

|

|

|

|

|

|

Net asset value, |

$ 9.110 |

$ 9.480 |

$ 9.420 |

$ 9.500 |

$ 9.600 |

|

Income from Investment Operations |

|

|

|

|

|

|

Net investment income |

.596 B |

.579 B |

.611 B |

.637 B |

.641 |

|

Net realized and unrealized gain (loss) |

.079 |

(.362) |

.045 |

(.090) |

(.102) |

|

Total from investment operations |

.675 |

.217 |

.656 |

.547 |

.539 |

|

Less Distributions |

|

|

|

|

|

|

From net investment income |

(.595) |

(.587) |

(.596) |

(.627) |

(.639) |

|

Net asset value, end of period |

$ 9.190 |

$ 9.110 |

$ 9.480 |

$ 9.420 |

$ 9.500 |

|

Total Return A |

7.70% |

2.37% |

7.18% |

5.99% |

5.86% |

|

Ratios and Supplemental Data |

|

|

|

|

|

|

Net assets, end of period |

$ 341,778 |

$ 415,722 |

$ 379,553 |

$ 357,144 |

$ 337,131 |

|

Ratio of expenses to average |

.45% |

.45% |

.45% |

.45% |

.42% C |

|

Ratio of expenses to average |

.44% D |

.44% D |

.44% D |

.44% D |

.41% D |

|

Ratio of net investment income |

6.57% |

6.26% |

6.47% |

6.79% |

6.95% |

|

Portfolio turnover rate |

91% |

85% |

210% |

147% |

141% |

A The total returns would have been lower had certain expenses not been reduced during the periods shown.

B Net investment income per share has been calculated based on average shares outstanding during the period.

C FMR agreed to reimburse a portion of the fund's expenses during the period. Without this reimbursement, the fund's expense ratio would have been higher.

D FMR or the fund has entered into varying arrangements with third parties who either paid or reduced a portion of the fund's expenses.

See accompanying notes which are an integral part of the financial statements.

Annual Report

For the period ended November 30, 2000

1. Significant Accounting Policies.

Fidelity Institutional Short-Intermediate Government Fund (the fund) is a fund of Fidelity Advisor Series IV (the trust) and is authorized to issue an unlimited number of shares. The trust is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company organized as a Massachusetts business trust. The financial statements have been prepared in conformity with generally accepted accounting principles which require management to make certain estimates and assumptions at the date of the financial statements. The following summarizes the significant accounting policies of the fund:

Security Valuation. Securities are valued based upon a computerized matrix system and/or appraisals by a pricing service, both of which consider market transactions and dealer-supplied valuations. Securities for which market quotations are not readily available are valued at their fair value as determined in good faith under consistently applied procedures under the general supervision of the Board of Trustees. Short-term securities with remaining maturities of sixty days or less for which quotations are not readily available are valued at amortized cost or original cost plus accrued interest, both of which approximate current value. Investments in open-end investment companies are valued at their net asset value each business day.

Income Taxes. As a qualified regulated investment company under Subchapter M of the Internal Revenue Code, the fund is not subject to income taxes to the extent that it distributes substantially all of its taxable income for its fiscal year. The schedule of investments includes information regarding income taxes under the caption "Income Tax Information."

Investment Income. Interest income, which includes accretion of original issue discount, is accrued as earned.

Expenses. Most expenses of the trust can be directly attributed to a fund. Expenses which cannot be directly attributed are apportioned among the funds in the trust.

Distributions to Shareholders. Distributions are declared daily and paid monthly from net investment income. Distributions from realized gains, if any, are recorded on the ex-dividend date.

Income and capital gain distributions are determined in accordance with income tax regulations which may differ from generally accepted accounting principles. These differences, which may result in distribution reclassifications, are primarily due to differing treatments for paydown gains/losses on certain securities, market discount, capital loss carryforwards, and losses deferred due to wash sales.

Permanent book and tax basis differences relating to shareholder distributions will result in reclassifications to paid in capital. Undistributed net investment income and accumulated undistributed net realized gain (loss) on investments may include temporary book and tax basis differences which will reverse in a subsequent period. Any taxable income or gain remaining at fiscal year end is distributed in the following year.

Annual Report

Notes to Financial Statements - continued

1. Significant Accounting Policies - continued

Security Transactions. Security transactions are accounted for as of trade date. Gains and losses on securities sold are determined on the basis of identified cost.

Change in Accounting Principle. Effective December 1, 2001, the fund will adopt the provisions of the AICPA Audit and Accounting Guide for Investment Companies and will begin amortizing premium and discount on all debt securities, as required. Upon the effective date this accounting principle change will not have an impact on total net assets but will result in an increase or decrease on cost of securities held and a corresponding change in net investment income.

The cumulative effect of this change in accounting principle will not have an impact on total net assets but will result in an increase or decrease on cost of securities held and a corresponding change in net unrealized appreciation (depreciation), based on securities held on December 1, 2001.

2. Operating Policies.

Joint Trading Account. Pursuant to an Exemptive Order issued by the Securities and Exchange Commission, the fund, along with other affiliated entities of Fidelity Management & Research Company (FMR), may transfer uninvested cash balances into one or more joint trading accounts. These balances are invested in one or more repurchase agreements for U.S. Treasury or Federal Agency obligations.

Repurchase Agreements. The underlying U.S. Treasury, Federal Agency, or other obligations found to be satisfactory by FMR are transferred to an account of the fund, or to the Joint Trading Account, at a custodian bank. The securities are marked-to-market daily and maintained at a value at least equal to the principal amount of the repurchase agreement (including accrued interest). FMR, the fund's investment adviser, is responsible for determining that the value of the underlying securities remains in accordance with the market value requirements stated above.

Delayed Delivery Transactions. The fund may purchase or sell securities on a delayed delivery basis. Payment and delivery may take place after the customary settlement period for that security. The price of the underlying securities and the date when the securities will be delivered and paid for are fixed at the time the transaction is negotiated. The market values of the securities purchased on a delayed delivery basis are identified as such in the fund's schedule of investments. The fund may receive compensation for interest forgone in the purchase of a delayed delivery security. With respect to purchase commitments, the fund identifies securities as segregated in its records with a value at least equal to the amount of the commitment. Losses may arise due to changes in the market value of the underlying securities or if the counterparty does not perform under the contract.

Restricted Securities. The fund is permitted to invest in securities that are subject to legal or contractual restrictions on

Annual Report

Notes to Financial Statements - continued

2. Operating Policies - continued

Restricted Securities - continued

resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. At the end of the period, the fund had no investments in restricted securities.

3. Purchases and Sales of Investments.

Purchases and sales of long-term U.S. government and government agency obligations aggregated $319,169,042 and $399,264,282, respectively.

4. Fees and Other Transactions with Affiliates.

Management Fee. As the fund's investment adviser, FMR receives a fee that is computed daily at an annual rate of .45% of the fund's average net assets. FMR pays all other expenses, except the compensation of the non-interested Trustees and certain exceptions such as interest, taxes, brokerage commissions and extraordinary expenses. The management fee paid to FMR by the fund is reduced by an amount equal to the fees and expenses paid by the fund to the non-interested Trustees.

Sub-Adviser Fee. FMR, on behalf of the fund, has entered into a sub-advisory agreement with Fidelity Investments Money Management, Inc. (FIMM), a wholly owned subsidiary of FMR. For its services, FIMM receives a fee from FMR of 50% of the management fee payable to FMR. The fee is paid prior to any voluntary expense reimbursements which may be in effect.

5. Security Lending.

The fund lends portfolio securities from time to time in order to earn additional income. The fund receives collateral in the form of U.S. Treasury obligations, letters of credit, and/or cash against the loaned securities, and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of the fund and any additional required collateral is delivered to the fund on the next business day. If the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, the fund could experience delays and costs in recovering the securities loaned or in gaining access to the collateral. At period end there were no security loans outstanding.

6. Expense Reductions.

Through arrangements with the fund's custodian and transfer agent, credits realized as a result of uninvested cash balances were used to reduce a portion of the fund's expenses. During the period, the fund's expenses were reduced by $53,205 under these arrangements.

7. Beneficial Interest.

At the end of the period, one shareholder was record owner of approximately 21% of the total outstanding shares of the fund.

Annual Report

To the Trustees of Fidelity Advisor Series IV and the Shareholders of Fidelity Institutional Short-Intermediate Government Fund:

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Fidelity Institutional Short-Intermediate Government Fund (a fund of Fidelity Advisor Series IV) at November 30, 2000, and the results of its operations, the changes in its net assets and the financial highlights for the periods indicated, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as "financial statements") are the responsibility of the Fidelity Institutional Short-Intermediate Government Fund's management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with auditing standards generally accepted in the United States of America which require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at November 30, 2000 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

/s/PricewaterhouseCoopers LLP

PricewaterhouseCoopers LLP

Boston, Massachusetts

January 12, 2001

Annual Report

Annual Report

Annual Report

Investment Adviser

Fidelity Management & Research Company

Boston, MA

Investment Sub-Adviser

Fidelity Investments Money

Management, Inc.

Officers

Edward C. Johnson 3d, President

Robert C. Pozen, Senior Vice President

Dwight D. Churchill, Vice President

Andrew J. Dudley, Vice President

David L. Murphy, Vice President

Stanley N. Griffith, Assistant Vice President

Eric D. Roiter, Secretary

Robert A. Dwight, Treasurer

Maria F. Dwyer, Deputy Treasurer

John H. Costello, Assistant Treasurer

Thomas J. Simpson, Assistant Treasurer

Board of Trustees

Ralph F. Cox *

Phyllis Burke Davis *

Robert M. Gates *

Edward C. Johnson 3d

Donald J. Kirk *

Ned C. Lautenbach *

Peter S. Lynch

Marvin L. Mann *

William O. McCoy *

Gerald C. McDonough *

Robert C. Pozen

Thomas R. Williams *

Advisory Board

J. Michael Cook

Abigail P. Johnson

Marie L. Knowles

William S. Stavropoulos

* Independent trustees

General Distributor

Fidelity Distributors Corporation

Boston, MA

Transfer and Shareholder Servicing Agent

Fidelity Investments Institutional Operations Company, Inc.

Boston, MA

Custodian

The Bank of New York

New York, NY

ISIG-PRO-0101 122356

1.539335.103

(Fidelity Investment logo)(registered trademark)

Corporate Headquarters

82 Devonshire St., Boston, MA 02109

www.fidelity.com

|

|