|

|

|

|

|

Previous: NICOR INC, 8-K, 2000-09-14 |

Next: NORDSTROM INC, 10-Q, 2000-09-14 |

Exhibit 99.01

1

Good afternoon. Thank you for joining us today and for your interest in Nicor.

I'm Kathy Halloran, Executive Vice President Finance and Administration. With me today is Mark Knox, Director of Investor Relations.

We're here today to review with you our objectives and strategies for building shareholder value at Nicor and to update you on recent developments.

Before I get started, I want to state that in view of the Securities and Exchange Commission's concerns about selective disclosure and in light of the SEC's recent enactment of Regulation FD, we will address only questions concerning matters that have been previously made public and broadly disseminated. We ask that you bear this in mind when asking your questions and in considering our responses.

I also want to mention that I know the mercury situation we have been dealing with the last few weeks is in all of your minds. In that regard, we have prepared remarks that will cover the situation as it currently stands.

2

Let me begin by describing for you what I believe to be the value proposition that Nicor has to offer investors.

First, we are dedicated to achieving consistent, low-risk earnings per share growth. Specifically, we are targeting mid to high single-digit growth at Nicor over the next several years and believe that is an achievable objective.

In addition, we are committed to maintaining the quality of that earnings growth, and will continue striving for high returns on invested capital. As you know, our returns have historically been among the best in the industry.

We are also committed to growing our dividend, while maintaining the financial flexibility necessary to pursue our growth objectives. In fact, our dividend has grown at twice the rate of the industry average over the past five years.

Finally, the strength of our core businesses and our strategic location in the U.S. gas supply grid provide an exceptional platform for growth and set us apart, I believe, from many of our peers.

3

Our strategy is focused on building off of our core competencies and assets. Specifically, we intend to continue creating value from our four growth platforms — gas distribution operations, asset-backed energy ventures, energy products and services, and containerized shipping. These are the areas of growth that we have been telling you about for several years now, and we are seeing continuous progress in each one of them.

I will be telling you more about that progress shortly, but first, I would like to briefly cover financial highlights.

4

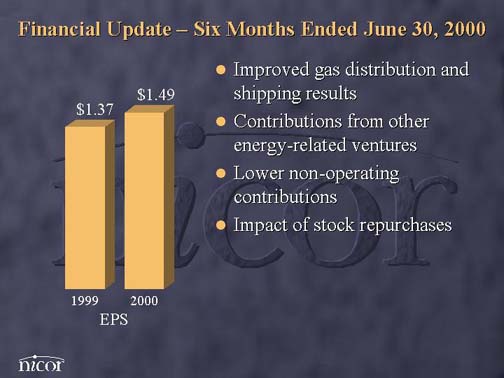

Let me start off by saying that we are very pleased with the financial results in the first half of the year, and we believe it is indicative of our operating capabilities going forward. During the first six months, earnings per share improved by approximately 9% over the prior year period. The improvement can be attributable to the increased operating results in our various business segments, which more than offset a number of favorable non-operating items included in last year's results.

Before I get into our segment results, I would like to say a few words concerning the potential financial impact from the mercury situation we are dealing with. I will also talk about it more generally later. Over the past few weeks we have begun an inspection process that could potentially affect up to 10% of our customers. In addition, many of you may know that a few lawsuits have been filed on behalf of customers where mercury was found in their homes. Facilities where we handled mercury regulators and scrap yards where we disposed of them are also being inspected and a few require some clean-up. However, it is still too early in the process and would be premature for us to develop projections. Therefore, the financial impact associated with our mercury efforts has not been assessed since the costs to complete the inspection program and repair damage, as well as the magnitude of insurance recovery, are still uncertain. However, we are working to identify estimates for our third quarter disclosure. To assist us in estimating the financial impact of all of this we have retained a consulting firm who specializes in estimating such things as potential contingent liabilities, accounting reserve valuations and potential recoveries from third-parties and insurers.

Aside from this, while we believe that on a recurring basis the full year published First Call earnings consensus is reasonable, we expect that our third quarter recurring earnings will be several cents better than the comparable consensus estimate.

5

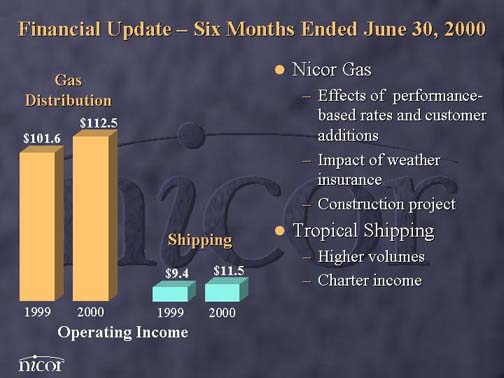

Our expected recurring earnings improvement in the third quarter is primarily attributable to results at Nicor Gas, due mostly to positive contributions from our performance-based rate program. Nicor Gas' operating income for the six-month period increased over 10% from last year, due primarily to customer additions, contributions from our gas cost performance-based rate plan, weather insurance, and income related to a significant construction project. As you may recall, the weather insurance that we purchased last December protects our earnings from weather that is more than about 6.5% warmer than normal. We expect that the positive earnings at Nicor Gas thus far in 2000 will continue, and we expect a very good year at the utility despite another year of warm weather.

Tropical Shipping's operating income for the six-month period increased 22% from last year. Our volumes shipped continue to grow, and profitability on the cargo has improved in the Bahamas and Virgin Islands. This year, two vessels are also generating charter revenue. As with our distribution business, we are very encouraged by the trends we are seeing at Tropical this year.

Six-month results also reflect significant contributions from our other energy-related ventures, including the Chicago Hub, technology and consulting services and retail energy business. These improvements helped to offset various non-operating items included in our 1999 results.

6

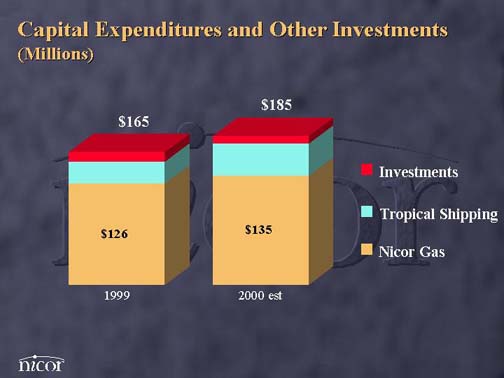

Turning briefly to capital expenditures — this year’s utility expenditures are projected to be about $135 million, up from last year, as we continue to enhance our information technology infrastructure. However, Tropical Shipping expenditures are likely to be slightly lower than originally projected, or about $40 million. Shipping expenditures include progress payments for two new vessels, a new Miami warehouse facility, which became operational this month, information technology projects, and equipment replacements.

7

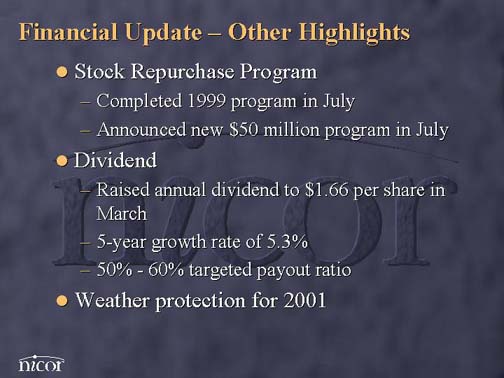

One other note — we announced a new $50 million stock repurchase program in July. Since 1990, we have repurchased over $380 million, or 23 percent of our outstanding common stock. However, as we have said many times in the past, our preference remains to re-invest free cash flow in new growth businesses — how quickly we complete the current program will depend upon the need for capital to fund new growth initiatives.

In regard to our dividend, in March we raised our annual dividend rate over 6%, to $1.66 per share, representing our 13th consecutive annual increase and resulting in a five-year dividend growth rate more than double the industry average. Our dividend payout ratio also remains low relative to the industry and is typically targeted at 50% — 60% of earnings.

Finally, regarding weather protection for 2001, we recently entered into an agreement with Aquila Energy that will protect our earnings and cash flow if weather for the year is warmer than 5,700 heating degree days for our utility service territory — that’s the same level of coverage we have in 2000. The cost of this type of hedge has gone up due to a third consecutive winter of very warm weather. Therefore, to partially offset the cost of next year’s weather protection, we've also entered into an agreement with Aquila Energy to pay them if weather for 2001 is greater than 6,100 heating degree days on an annual basis. As a result, the net cost of the weather protection is similar to last year. The purchase of this weather hedge for 2001 demonstrates our continuing commitment to provide our shareholders with earnings growth, with minimal effect from large variations in weather.

That concludes my remarks on our financial highlights. I will now provide you with an update on our operating business and growth plans.

8

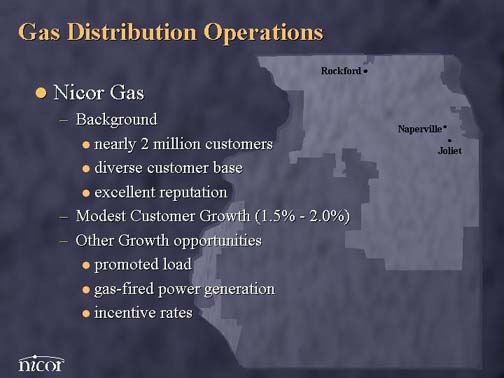

Since some of you may not be as familiar with Nicor as others, I will give a little background on our businesses, as well as our plans for growing the businesses in the future. I will begin by discussing our distribution operations, namely, our largest subsidiary, Nicor Gas. Nicor Gas serves nearly 2 million customers in the northern third of Illinois. We have a diverse customer base and a credible reputation.

As we've said in the past, we expect to continue seeing modest traditional customer growth at Nicor Gas — about 1.5% — 2.0% per year. In addition, we continue to promote expansion of deliveries to existing customers, such as cogeneration and gas air conditioning load.

On the cost side of the equation, a fundamental strategy of our company is to be absolutely the lowest cost provider in everything we do. Our operating cost per customer continues to be the lowest in the industry — and not just by a little. At about $79 a year per customer, it is less than half the average for gas utilities in the U.S., and we remain committed to continuous improvements in productivity through a combination of employing new technologies and cost reduction programs.

Upside from the gas distribution business could come from several areas, including new gas-fired power generation being built in Illinois and incentive-based rates. As far as gas-fired generation is concerned, we have added over 15 Bcf of new gas load associated with electric generation in the past two years. Our objective is not only to provide transportation services to these plants, but more importantly, premium supply services such as storage and supply balancing. With Nicor’s highly integrated, high capacity transmission and storage system, we are uniquely situated to provide these services. Over 20 new plants have been announced in our territory. We may not serve all of them, but we'll get our share.

9

In regard to performance based rates, in January we implemented the first performance-based rate (or PBR) program for gas supply costs in Illinois. The plan compares actual gas supply costs — both commodity and pipeline costs — against a market benchmark established on the basis of our historical performance. The difference between our costs and the benchmark is shared on a 50/50 basis between customers and shareholders.

Through the first six months of this year, we have booked a little over $2 million pre-tax income from the program. Our success thus far can be attributed primarily to our ability to manage our storage requirements in unique ways and maximize the value of our pipeline capacity. I would like to add, however, that the financial results from this program will vary from quarter to quarter. As we are gaining experience with new techniques for managing the commodity and related costs, we are increasingly confident that our financial benefits will continue to improve. Obviously, there are some risks to the PBR as well, but to improve our likelihood of success, we've engaged outside firms with trading experience to advise us along the way.

10

Before I leave Nicor Gas, I would like to take a minute to update you on the mercury clean-up activities in our service territory. As background, we discontinued installing mercury regulators in 1961, and, over time, have been replacing them as we've done normal system upgrade work. This occurs in conjunction with routine main and service replacements throughout our service territory. In late July, we discovered that mercury was spilled inside a few of the homes where mercury regulators were replaced by a contractor we hired. Because of the health risk associated with mercury, we voluntarily decided to identify and screen all homes that either have a mercury regulator inside the home or ever had one inside. That inspection program is now in progress. Where mercury is found, we perform any necessary mercury removal or restoration work in the homes.

As I mentioned earlier, at this time the financial impact associated with these efforts has not been assessed. History and daily updates are available on our website, where we've put together a special mercury section.

11

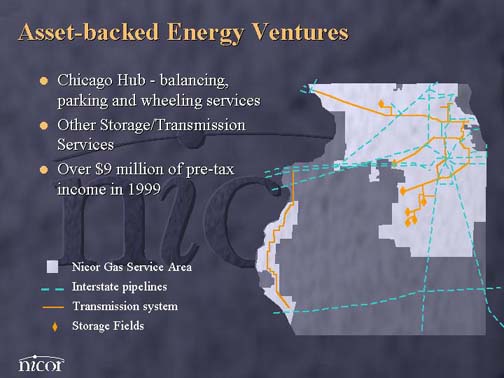

Let me turn now to the second growth platform — our asset-backed energy ventures. The first of these is the Chicago Hub, which was established in 1994. Using utility assets, the Hub provides balancing, parking, and wheeling services on an interruptible basis to interstate pipeline shippers. The key to the Hub’s success is the extensive integration of our distribution system with the multiple interstate pipelines intersecting our service area (seven in all) and our natural gas storage capabilities, which at 130+ Bcf is among the largest in the country.

The reach and breadth of the Chicago Hub will continue to grow as the unregulated gas market continues to evolve and as new interstate pipelines are built into and out of the Chicago market. To assure the ongoing success of the Hub, we will continue to find creative ways to manage these assets and increase their overall capabilities and, at the same time, continue to grow our asset portfolio to support the expected growth of this business.

Aside from the Hub, Nicor Gas also continues to provide firm storage and transportation services. These opportunities also exist by virtue of our strategic location and integrated storage and transmission system. Like the Hub, we will continue to explore ways to expand our capabilities and identify opportunities to broaden our scope in the region.

Taken together, the Hub and our firm storage and transportation services generated over $9 million in non-traditional pre-tax income for Nicor Gas last year, and we have booked over $4 million through the first six months of this year.

12

Another asset-backed energy venture at Nicor involves our unregulated wholesale marketing affiliate, Nicor Enerchange. Enerchange was formed two years ago, and its principal business is wholesale marketing and trading of natural gas supply services around the Chicago Hub and other Midwest supply assets. It also administers the Chicago Hub for a fee. I should emphasize that our focus in this business is the Midwest, where we try to identify niche opportunities that are below the radar screens of the large national wholesalers and that allow us to take advantage of our knowledge of gas movement in and around Illinois.

Enerchange contributed nearly $2 million to pre-tax earnings last year and $0.5 million through the first six months of this year. We are working hard to add the tools and expertise to further expand this business.

13

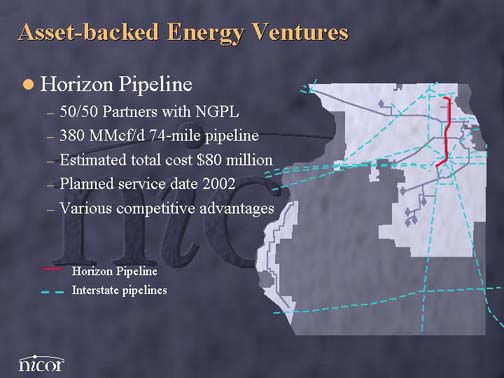

A final asset-related venture that I want to update all of you on today is the Horizon Pipeline. As announced last Spring, the Horizon Pipeline project, a 50-50 joint venture with Natural Gas Pipeline Company of America, involves the construction and operation of a 74-mile pipeline from Joliet, Illinois, north to a point near the Illinois/Wisconsin border. It will have an initial capacity of 380 MMcf/d and will cost an estimated $80 million. So far the FERC review process and environmental work is going very well. Assuming FERC approval, the pipeline is planned to be in-service in 2002.

The market rationale for this project is three-fold — first, it reinforces high-pressure capacity constraints in an area of rapid demand growth and significant gas-fired power generation potential. Second, it positions us to expand into Wisconsin, which today is held captive to a single pipeline for the most part, and therefore does not benefit from competition. Third, it provides us with further opportunities to provide gas supply services to markets beyond our traditional territory.

We believe the Horizon Pipeline will be successful for a number of reasons, the most important of which is that it will be the low cost provider relative to competing projects on the drawing board. In addition, Nicor Gas is the anchor customer, having contracted for the majority of the capacity thus far. Finally, it utilizes existing pipeline and utility right-of-way for more than 90% of the distance of the line, thus reducing the environmental issues associated with so many pipeline projects these days.

Today, we continue to move through the FERC approval process, which thus far has been uneventful. We are negotiating certain sections of right-of-way and are also in the process of completing design work. Construction could begin as early as next Spring.

14

I will now turn to our third growth platform — energy services. The principal business developed to date off of this platform is our retail energy services business — Nicor Energy. Nicor Energy was formed as a 50-50 joint venture with Dynegy in 1997. Today it is one of the largest and most successful retail natural gas and electric marketers in the Midwest. As of August 31st, Nicor Energy had already secured in excess of 100,000 gas customers and approximately 2,000 electric customers. As you know, most other retail energy service businesses have lost money. After a close to breakeven year in 1999, we expect Nicor Energy to be modestly profitable in 2000.

The potential market for Nicor Energy includes over 6 million gas and electric customers in Northern Illinois alone. Including other surrounding states in the Midwest, this market potential exceeds 21 million customers. We believe we can continue to capture a dominant market share in Illinois and can also build a solid market share in other states as those markets provide open access.

15

Much of Nicor Energy’s success thus far can be tied to the unbundling efforts at Nicor Gas. Today, approximately ¼ of Nicor Gas’ 2 million customers have the right to choose an alternative gas supplier, and over 100,000 have made that choice. In August we filed with the Illinois Commerce Commission for full unbundling and intend to begin offering all customers choice by the spring of 2001, which should provide Nicor Energy the opportunity to achieve the growth targets noted in the previous slide. The Illinois Commerce Commission is expected to rule on this filing by the end of this month.

16

Our strategy thus far has been to focus on selling the commodity. In addition, the potential exists to introduce new products and services as the market evolves. Our success thus far can be attributable to many factors, including an experienced management team, limited competition, relatively low customer acquisition costs, solid margins and the strength of the Nicor brand. We believe that economies of scale will allow us to improve profitability rapidly as we grow the customer base over the next several years.

I’ve covered three of our four growth platforms. I’ll now talk about the fourth platform — containerized shipping.

17

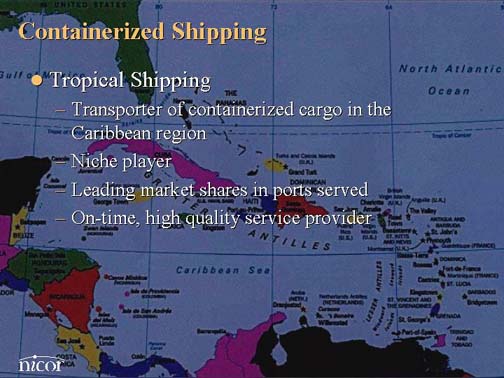

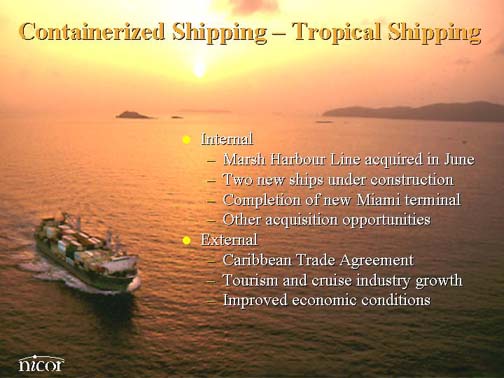

As many of you may know, Tropical Shipping is the leading carrier of U.S. exports from the East Coast to the Caribbean and one of the largest transporters of containerized cargo in the Caribbean region. The company is a niche player, with the leading market share in most of the ports it serves. Its competitive advantage is its reputation for delivery of on-time, high quality service.

18

Many of you know that we've owned Tropical since 1982. Why do we like the business? This table illustrates one good reason. Last year, Tropical was ranked second in the world in terms of profit margin by American Shipper magazine, and number one in terms of international carriers — this despite a difficult year for the company. Tropical also generates good cash flow, has an experienced and capable management team, and continues to have favorable long-term growth potential. Most of this growth thus far can be attributed to our ability to consistently increase volumes shipped. Over each of the past four years, Tropical has posted record volumes. We are continuing that trend this year, as volumes through the first six months are nearly 9% higher than a year ago.

19

I want to update you on a few recent developments at Tropical. In June, we completed the acquisition of a small shipping line in the Bahamas for approximately $2 million. The company, Marsh Harbour Shipping, has annual revenues of about $4 million and adds the Abacos Islands as a new port in our Bahamas service. As we have discussed with you before, this type of acquisition demonstrates our continuing efforts to look for opportunities to augment Tropical's growth in the Caribbean.

We also continue the construction of two new vessels, which will be used to replace charter vessels used in our current fleet. Delivery of these vessels is scheduled for late next year and early 2002. The total investment is estimated at about $40 million. We also have completed the construction of a new Miami terminal, which will improve our efficiencies for handling and receiving smaller shipments.

Finally, from an external standpoint, several factors should have a positive influence on Tropical's business going forward. For example the Caribbean Trade Act, which was passed by Congress in May, should give the Caribbean market parity with NAFTA in regard to offshore manufacturing and trade incentives. In addition, the tourism market and cruise industry continue to be solid, and economic conditions are strong throughout much of the Caribbean region.

That concludes my remarks on our Shipping business.

20

As I noted earlier, we're very pleased with the operating results of our business through the first six months of the year, and we anticipate a significant improvement in fiscal year 2000 recurring earnings per share. While the mercury situation is taking a lot of our attention and added resources, I want to assure you that we are continuing to focus on running our core businesses and executing our strategies.

Furthermore, I believe that our disciplined, systematic approach of growing our core businesses and building off of our core competencies and assets will result in sustained earnings growth in the years to come.

The key to our long-term success will be in our ability to continue building upon the growth platforms we mentioned today — gas distribution, asset-backed energy ventures, energy services, and containerized shipping. We will also need to expand the size of those platforms and enhance their capabilities to sustain growth in the long run.

In the final analysis, however, the old cliché is still true — it all comes down to people. I believe that Nicor today has the right people in place to get the job done and grow shareholder value. We have a mix of young and experienced personnel, both home grown and imported, and we’re constantly looking for more talent. Great assets with great people is, in my estimation, the key combination. Thank you and I will now open the floor for questions.

21

22

|

|