|

|

|

|

|

Previous: BANK OF AMERICA CORP /DE/, 424B2, 2000-08-16 |

Next: NORTHROP GRUMMAN CORP, 11-K, 2000-08-16 |

SCHEDULE 14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant /x/ |

||

| Filed by a Party other than the Registrant / / | ||

| Check the appropriate box: |

||

| / / | Preliminary Proxy Statement | |

| / / | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| /x/ | Definitive Proxy Statement | |

| / / | Definitive Additional Materials | |

| / / | Soliciting Material Pursuant to §240.14a-12 |

|

| NORSTAN, INC. |

||||

(Name of Registrant as Specified In Its Charter) |

||||

| |

||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| /x/ | No fee required | |||

| / / | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

| / / | Fee paid previously with preliminary materials. | |||

| / / | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

5101 Shady Oak Road

5101 Shady Oak Road

Minnetonka, Minnesota 55343

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD SEPTEMBER 14, 2000

TO THE SHAREHOLDERS OF NORSTAN, INC.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of the Shareholders of Norstan, Inc., a Minnesota corporation, will be held on Thursday, September 14, 2000, at 2:00 p.m., at 5101 Shady Oak Road, Minnetonka, Minnesota 55343, for the following purposes:

Only shareholders of record at the close of business on July 17, 2000, are entitled to notice of and to vote at the Annual Meeting and any adjournment thereof.

Each of you is invited and urged to attend the Annual Meeting in person if possible. Whether or not you are able to attend in person, you are requested to date, sign and return promptly the enclosed proxy in the envelope provided, or vote electronically or by telephone, at your earliest convenience.

By Order of the Board of Directors

/s/ Neil I. Sell, Secretary

/s/ Neil I. Sell, Secretary

August 14, 2000

PROXY STATEMENT

For Annual Meeting of Shareholders of

NORSTAN, INC.

5101 Shady Oak Road

Minnetonka, Minnesota 55343

To be held September 14, 2000

The enclosed proxy is solicited by and on behalf of the Board of Directors of Norstan, Inc. (the "Company") for use at the Annual Meeting of Shareholders on September 14, 2000, and any adjournment thereof. The approximate date on which this Proxy Statement and form of proxy will first be sent or given to shareholders is August 17, 2000.

The expense of the solicitation of proxies for this Annual Meeting, including the cost of mailing, has been borne by the Company. Arrangements will be made with brokerage houses and other custodian nominees and fiduciaries to send proxies and proxy materials to their principals and the Company will reimburse them for their expense in so doing. In addition to solicitation by mail, proxies may be solicited by telephone, telegraph or personally.

VOTING AND REVOCATION OF PROXY

General

Only shareholders of record at the close of business on July 17, 2000, are entitled to notice of and to vote at the Annual Meeting. Each share so held entitles the holder to one vote upon each matter to be voted upon. On July 17, 2000, the Company had outstanding 11,271,003 shares of common stock. A quorum, consisting of a majority of the outstanding shares of the common stock entitled to vote at the Annual Meeting, must be present in person or represented by proxy before action may be taken at the Annual Meeting.

Voting by Proxy

All shares represented by proxies which have been properly executed and returned will be voted at the meeting. Where a specification is made by the shareholder as provided in the form of proxy, the shares will be voted in accordance with such specification. If no specification is made, the shares will be voted (i) FOR the election of the nominees for directors named in this Proxy Statement, (ii) FOR the proposed amendment to the Norstan, Inc. 1995 Long-Term Incentive Plan to increase the number of shares issuable thereunder from 2,400,000 to 2,900,000 shares; (iii) FOR the proposed amendment to the Norstan, Inc. Restated Non-Employee Directors' Stock Plan to increase the number of shares issuable thereunder from 150,000 to 250,000 shares; (iv) FOR the proposed amendment to the 2000 Employee Stock Purchase Plan of Norstan, Inc. to increase the number of shares issuable thereunder from 400,000 to 800,000 shares; and (v) FOR the ratification of the appointment of Arthur Andersen LLP as independent auditors for the fiscal year ending April 30, 2001.

Any proxy given pursuant to this solicitation may be revoked by the person giving the proxy at any time before it is voted. Proxies may be revoked by (a) giving written notice of such revocation to the Secretary of the Company, (b) giving another written proxy bearing a later date, or (c) attending the Annual Meeting and voting in person (although attendance at the Annual Meeting will not in and of itself constitute a revocation of a proxy).

Votes cast by proxy or in person at the Annual Meeting will be tabulated by the inspectors of election appointed for the meeting and will determine if a quorum is present. If an executed proxy card is returned and the shareholder has abstained from voting on any matter, the shares represented by such proxy will be considered present at the meeting for purposes of determining a quorum and for purposes of calculating the vote, but will not be considered to have been voted in favor of such matter. If an executed proxy is returned by a broker holding shares in street name which indicates that the broker does not have discretionary authority as to certain shares to vote on one or more matters, such shares will be considered present at the meeting for purposes of determining a quorum, but will not be considered to be represented at the meeting for purposes of calculating the vote with respect to such matter.

Voting Electronically or by Telephone

Registered shareholders may vote electronically through the Internet or by telephone by following the instructions included with their proxy card. Shareholders whose shares are registered in the name of a bank or brokerage firm may be eligible to vote electronically through the Internet or by telephone. A large number of banks and brokerage firms are participating in the ADP Investor Communication Services online program. This program provides eligible shareholders the opportunity to vote via the Internet or by telephone. Voting forms will provide instructions for shareholders whose bank or brokerage firm is participating in ADP's program. Shareholders not wishing to vote electronically through the Internet or whose form does not reference Internet or telephone voting information should complete and return the enclosed paper proxy card.

If you vote by telephone or electronically using the Internet, please do not mail your proxy.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The property, affairs and business of the Company are managed under the direction of the Board of Directors. The Bylaws of the Company provide that the number of directors shall be not less than three nor more than fifteen, with the number to be determined by the Board of Directors. The Board of Directors has fixed the number of directors at eight for the ensuing year, and eight directors will be elected at the Annual Meeting for a term of one year. Each of the nominees named below is now a director of the Company and has served continuously as a director of the Company since the year indicated. All nominees have indicated a willingness to serve if elected.

All shares represented by proxies which have been properly executed and returned will be voted for the election of the seven nominees named below, unless other instructions are indicated thereon. In the event any one or more of such nominees should for any reason be unable to serve as a director, it is intended that the enclosed proxy will be voted for such person or persons as may be selected in accordance with the best judgment of the proxy holders named therein. The Board of Directors knows of no reason to anticipate that any of the nominees named herein will be unable or unwilling to serve.

2

Directors are elected by a plurality of the votes cast for the election of directors at the Annual Meeting.

| Name of Director Nominee |

Position with the Company |

Age |

Director Since |

|||

|---|---|---|---|---|---|---|

| Paul Baszucki | Chairman of the Board, President and Chief Executive Officer | 60 | 1975 | |||

| Richard Cohen | Chief Financial Officer, Vice Chairman of the Board and Director | 56 | 1971 | |||

| Constance M. Levi | Director | 60 | 1993 | |||

| Alan L. Mendelson | Director | 57 | 2000 | |||

| Gerald D. Pint | Director | 64 | 1983 | |||

| Dr. Jagdish N. Sheth | Director | 61 | 1995 | |||

| Herbert F. Trader | Director | 63 | 1983 | |||

| Mercedes Walton | Director | 46 | 2000 |

The Board of Directors recommends a vote for the election of each of the nominees named above.

INFORMATION CONCERNING DIRECTORS,

NOMINEES AND EXECUTIVE OFFICERS

Directors and Nominees

Certain information concerning the directors and nominees of the Company is set forth below.

PAUL BASZUCKI was named Chief Executive Officer of the Company in December 1999, has been Chairman of the Board of the Company since May 1997 and has served as a director since 1975. Mr. Baszucki also served as Chief Executive Officer of the Company from 1986 to May 1997. Mr. Baszucki was Co-Chairman of the Board of Directors of the Company from June 1995 to May 1997 and Vice Chairman of the Board of Directors of the Company from 1987 to June 1995. Prior to 1984, Mr. Baszucki was Chief Executive Officer of Norstan Communications, Inc. Mr. Baszucki is also a director of Washington Scientific Industries, Inc. and G & K Services, Inc.

RICHARD COHEN was named Chief Financial Officer of the Company in December 1999, has been Vice Chairman of the Board of the Company since 1984 and has served as a director since 1971. Mr. Cohen served as the Company's Treasurer from 1971 to June 1997 and as Chief Financial Officer of the Company from May 1991 to June 1997.

CONSTANCE M. LEVI has served as a director since 1993. She was President of the Greater Minneapolis Chamber of Commerce from August 1988 until her retirement in 1994. Ms. Levi is a Trustee of the Lutheran Brotherhood Family of Funds. Ms. Levi was formerly the chairperson of Hamline University Board, Chair of the Ethics Division of the Amdahl Commission and Majority Leader of the Minnesota House of Representatives. Ms. Levi has served as a director or member of numerous governmental, public service, and nonprofit boards and organizations.

ALAN L. MENDELSON was elected to the Company's Board of Directors in May 2000. Since January 1999, Mr. Mendelson has occupied the position of Chief Executive Officer of The Phillips Group, a technology industry consulting firm. During the period from 1990 to January 1999, Mr. Mendelson served as Chief Executive Officer of two predecessor firms of The Phillips Group. Prior to 1990, Mr. Mendelson was employed in various sales and marketing positions, including approximately 18 years with AT&T.

GERALD D. PINT has served as a director since 1983. Since 1993, he has been a telecommunications consultant. He was the Group Vice President for the Telecom Systems Group of 3M from 1989 until his retirement from 3M in 1993. Mr. Pint was Group Vice President for

3

ElectroTelecommunications Group of 3M Company from 1982 to 1989. Mr. Pint is also a director of Inventronics, Ltd. and Communications Systems, Inc.

DR. JAGDISH N. SHETH has served as a director since 1995. He has been the Charles H. Kellstadt Professor of Marketing in the Goizueta Business School, Emory University since 1991. Prior to Dr. Sheth's present position, he was the Robert E. Brooker Professor of Marketing at the University of Southern California (7 years), the Walter H. Stellner Distinguished Professor of Marketing at the University of Illinois (15 years), and on the faculty of Columbia University (5 years), as well as the Massachusetts Institute of Technology (2 years).

HERBERT F. TRADER has served as a director since 1983. Mr. Trader has been a consultant specializing in international marketing and management and telecommunication delivered computer services since 1995. From January 1991 to January 1995, Mr. Trader was Vice President and Director, International Programs of William C. Norris Institute, a nonprofit corporation which promotes the use of computer technology to enhance education and information exchange on an international level. From 1987 until his retirement in January 1991, Mr. Trader served as Vice President, Training and Education Group for Control Data Corporation, a computer company. Mr. Trader was President of Business Development Group for Control Data Corporation from 1985 to 1987. Mr. Trader serves as a director of Jump Tech, Inc., a development stage e-commerce company.

MERCEDES WALTON was elected to the Company's Board of Directors in May 2000. Ms. Walton was employed by AT&T from 1985 to March 2000. Ms. Walton served as AT&T's Vice President- Corporate Strategy and Business Development from January 1999 to March 2000, and as its Business Development Vice President—Corporate Strategy from March 1996 to December 1998.

The Company knows of no arrangements or understandings between a director or nominee and any other person pursuant to which any person has been selected as a director or nominee. There is no family relationship between any of the nominees, directors or executive officers of the Company.

Board Actions and Committees

During the fiscal year ended April 30, 2000, the Company's Board of Directors met eleven times. All of the directors attended at least 75 percent of the aggregate number of meetings of the Board of Directors and the committees of the board on which he or she served.

The Board of Directors has an Audit Committee, consisting of three non-employee directors, Constance M. Levi, Herbert F. Trader and Gerald D. Pint. The Audit Committee, which met on five occasions during the fiscal year ended April 30, 2000, reviews and reports to the Board with respect to various auditing and accounting matters, including the engagement of independent auditors, the scope of audit procedures, the scope, frequency and results of internal audits, and the adequacy of internal accounting controls. The report of the Audit Committee is set forth below. The Audit Committee Charter appears as Exhibit A to this Proxy Statement.

The Board of Directors has a Compensation and Stock Option Committee, consisting of two non-employee directors, Gerald D. Pint and Jagdish Sheth. The Compensation and Stock Option Committee, which met nine times during the fiscal year ended April 30, 2000, grants stock options and other awards, reviews salary levels, bonuses and other matters and makes recommendations to the Board of Directors in connection therewith. The report of the Compensation and Stock Option Committee appears on page 6 of this Proxy Statement.

The Board of Directors established a Succession Planning Committee in March 2000 for the purpose of recruiting executive personnel. Messrs. Baszucki, Trader and Pint currently serve on the Succession Planning Committee, which has had one meeting.

The Board of Directors does not have a nominating committee.

4

Report of the Audit Committee

The Audit Committee has reviewed the Company's audited financial statements for the last fiscal year and discussed them with management.

The Audit Committee has discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61, Communication with Audit Committees, as amended, by the Auditing Standards Board of the American Institute of Certified Public Accountants.

We have received and reviewed the written disclosures and the letter from the independent auditors required by independence Standard No. 1, Independence Discussions with Audit Committees, as amended, by the Independence Standards Board, and have discussed with the auditors the auditors' independence.

The Audit Committee, based on the review and discussions described above, has recommended to the Board of Directors that the audited financial statements be included in the Company's Annual Report on Form 10-K for the last fiscal year.

Compensation of Directors

Non-employee directors receive an annual retainer fee of $13,500 payable in shares of the Company's common stock. Non-employee directors also receive a per meeting fee of $1,500 for each regularly scheduled Board of Directors' meeting attended. Non-employee directors do not receive additional compensation for attendance at special meetings. Non-employee directors receive $1,000 per meeting for any committee on which they serve. Employee directors do not receive any fees for serving on the Board of Directors or on any board committee. Directors are entitled to reimbursement for out-of-pocket expenses in connection with attendance at board and committee meetings.

Under the Norstan, Inc. Restated Non-Employee Directors' Plan, each director of the Company who was not an employee of the Company or a subsidiary receives a 20,000 share option upon his or her initial election as a director. The exercise price of the option is equal to the market price on the date of grant. The Restated Non-Employee Directors' Plan provides that options generally become exercisable in installments over a four-year period. If a person ceases to be a director, he or she may exercise the option within two years after ceasing to be a director to the extent it is otherwise exercisable at the date of termination.

In September 1999 and March 2000, respectively, non-employee directors received option grants covering the aggregate of 12,000 and 12,000 shares of the Company's common stock. These options were fully vested on the dates of grant.

As of July 31, 2000, options to purchase 134,500 shares were outstanding under the Restated Directors' Plan and 10,920 shares are available for grant, excluding 100,000 additional shares which may be made available for grant pursuant to Proposal No. 3.

5

Executive Officers Who Are Not Directors

Certain information concerning current executive officers of the Company who are not directors is set forth below.

| Name of Executive |

Positions with the Company |

Age |

Executive Officer Since |

|||

|---|---|---|---|---|---|---|

| Michael E. Laughlin | Executive Vice President of Communication Services | 48 | 2000 | |||

| Barry R. Rubin | President of Norstan Consulting | 54 | 2000 | |||

| Peter E. Stilson | Executive Vice President of Communication Solutions | 47 | 1999 | |||

| Michael J. Theisen | Executive Vice President of Convergence Services | 47 | 2000 | |||

| Roger D. Van Beusekom | Executive Vice President of Financial Services | 61 | 1996 |

MICHAEL E. LAUGHLIN has been Executive Vice President of Communication Services since May 1999. Previously, Mr. Laughlin was Senior Vice President and Executive Vice President of Customer Support and Customer Services, respectively, beginning in May 1996. Prior to those positions, Mr. Laughlin was Vice President of Customer Support Centers as of May 1994. Mr. Laughlin joined Norstan in 1976 and has held a variety of executive and management positions during that time.

BARRY R. RUBIN has been President of Norstan Consulting since May 2000 when he joined Norstan. Prior to joining Norstan, Mr. Rubin was employed as Executive Vice President and Chief Executive Officer for Weisman Enterprises beginning in February 1996. Previously, Mr. Rubin was President of Schweitzer, Rubin, Karon & Bremer, a firm of Certified Public Accountants he joined in October 1971.

PETER E. STILSON has been Executive Vice President of Communication Solutions since December 1998. Mr. Stilson has been employed by Norstan since July 1987. From February 1998 to December 1998, Mr. Stilson served as Vice President of Sales for Canada. From May 1996 to February 1998, Mr. Stilson was vice President/General Manager of the Southern (U.S.) Area. Mr. Stilson was Director of Sales for the South Region from January 1994 to May 1996. Previously, Mr. Stilson held several Norstan sales management positions.

MICHAEL J. THEISEN has been Executive Vice President of Convergence Services since February 2000. Previously, Mr. Theisen was Vice President, Multiserve Networking Solutions, beginning in May 1999. He was Senior Director and Managing Partner of the Call Center Solutions Group beginning in August 1997, and Vice President/General Manager of the Wisconsin branch, commencing in September 1994. Mr. Theisen has been with Norstan since 1982 in a variety of sales and sales management positions prior to his executive roles.

ROGER D. VAN BEUSEKOM has been Executive Vice President of Financial Services since February 1996. Mr. Van Beusekom served in various managerial capacities with Financial Services from 1986 to 1992.

Report of the Compensation and Stock Option Committee

The Compensation and Stock Option Committee ("Committee") of the Board of Directors is composed entirely of non-employee directors. The Committee is responsible for developing and making recommendations to the Board of Directors with respect to the Company's compensation policies, including the compensation of executive officers. The base salaries and bonus formulas for Paul Baszucki and David Richard, each of whom served as Chief Executive Officer of the Company during the year ended April 30, 2000, were determined by the Board of Directors acting on the

6

recommendations of the Committee. Mr. Baszucki annually reviews and establishes the base salaries and bonus formulas for all other executive officers who are not directors of the Company.

The components of the Company's executive compensation program which are subject to the discretion of the Committee on an individual basis include (a) base salaries, (b) performance based bonuses, (c) stock options, (d) restricted stock grants and (e) other awards.

The Committee intends to utilize direct compensation as a tool to attract and retain the high-quality executive talent needed to grow and develop the Company's businesses. Compensation is also intended to motivate increased performance within the Company and to reward sustained performance of individuals who achieve and exceed performance goals. The Company's compensation programs strive to encourage results that foster higher levels of individual performance and teamwork, provide value-added products and services to customers and enhance shareholder value. For senior-level executives, the Company's compensation programs are designed to link executive compensation to the Company's financial performance. The programs also align executives toward common goals and tie their rewards significantly to the creation of value for shareholders.

The Company's executive officers are eligible for annual cash bonuses under a performance bonus program. The program provides for the establishment of various annual performance goals which, if achieved, result in the payment to participants of cash compensation over and above their base salary. The program is intended to focus management attention on key business goals and to reward superior performance. Goals under the program generally include corporate performance objectives and business unit performance objectives. The target level of pretax earnings is assigned a greater weight than the weight assigned to each of the remaining factors. At the beginning of the fiscal year ended April 30, 2000, performance goals for purposes of determining annual incentive compensation were determined based on strategic and financial measurements including a target level of pretax earnings. For fiscal 2000, the Company's executive officers were eligible to receive a specified percentage of their base salary as a bonus payable upon achievement of established Company performance goals. Mr. Theisen and Mr. Van Beusekom, respectively, received bonuses of $17,980 and $49,549. No other executive officer received a bonus during fiscal 2000.

Long-Term Compensation Program

The Norstan, Inc. 1995 Long-Term Incentive Plan (the "1995 Plan") provides for grants of stock options, restricted stock grants, stock appreciation rights, performance awards and other stock based awards. Through stock grants and awards under this plan, executives will receive significant equity appreciation opportunities which provides an incentive to build long-term shareholder value.

Stock Options and Restricted Stock Awards

Stock options reward and encourage effective leadership that contribute to the Company's long-term financial success, as measured by the appreciation in its stock price. Stock options only have value for the executives when the price of the Company's stock appreciates in value from the date the stock options are granted. All shareholders will benefit from such increases in the Company's stock price.

Executives are considered for stock option grants consistent with the Company's goal to include in total compensation a long-term equity appreciation opportunity for executives. This approach also provides a greater opportunity for reward when long-term performance is consistently achieved. Generally, stock options are granted at an exercise price equal to the fair market value of the Company's common stock on the date of grant, have ten-year terms, and have exercise restrictions which lapse over a three to five year period. Restricted stock awards generally have restrictions that lapse over a three to five year period. The annual bonus and long-term incentives impose considerable risk upon the total executive compensation package. These elements are variable, may fluctuate significantly from year to year and are directly tied to the Company's financial and stock price performance.

7

Chief Executive Officer Compensation

The salary and bonus of the Chief Executive Officer is set by and subject to the discretion of the Committee with Board approval. The compensation for David Richard and Paul Baszucki, each of whom served as Chief Executive Officer during portions of fiscal 2000, was determined by using a process and applying a philosophy similar to that employed for other executive officers. The Committee considers its members' views as to comparative compensation for like positions at other businesses, together with its own assessment of the performance of the Company's Chief Executive Officer, recommending a salary and performance bonus formula for the Board of Directors' approval. During fiscal 2000, the Company did not achieve its performance objectives and neither David Richard nor Paul Baszucki received a bonus.

Compensation Committee Interlocks and Insider Participation

There are no interlocking relationships, as defined in the regulations of the Securities and Exchange Commission, involving members of the Board of Directors, or its Compensation and Stock Option Committee.

General

The Committee has reviewed the provisions of Section 162(m) of the Internal Revenue Code of 1986, as amended, relating to the deductibility of annual executive compensation in excess of $1,000,000. The Committee currently does not have a policy with respect to Section 162(m) because it is unlikely that such limit will apply to compensation paid by the Company to any of the Company's executive officers in the near future.

The purpose of this report is to inform shareholders of the responsibilities and the philosophy of the Committee with respect to executive compensation. Neither this report nor the Performance Graph are intended to be used for any other purpose or to be incorporated by reference in any of the Company's past or future filings with the Securities and Exchange Commission.

| August 14, 2000 | Compensation and Stock Option Committee Gerald D. Pint Dr. Jagdish N. Sheth |

Employment Contracts and Termination of Employment and Change-in-Control Arrangements

Messrs. Baszucki and Cohen (the "Executives") have entered into employment agreements with the Company (collectively, the "Agreements"). The Agreements expire on April 30, 2002, subject to automatic renewal for an additional 24 month period each May 1, unless the Company provides the Executive with prior written notice to the contrary. The Agreements provide that Executives are entitled to participate in all employee benefit plans and fringe benefit programs maintained by the Company for its executive officers. In the event of death or other termination of employment without "cause" (as defined in the Agreements) during the term of the Agreements, each Executive is entitled to receive his base salary for a period of 12 months thereafter. Current base salaries are $400,000 and $200,000, respectively, for Messrs. Baszucki and Cohen. Each Agreement also contains a provision designed to encourage the Executives to carry out their employment duties in the event of a change of control (as defined below). Such provisions state that upon a change of control, the Executive's period of employment under the Agreement is automatically extended to the date that is 36 months from the date of the change in control. In addition, if after a change in control the Executive's employment is terminated by the Company without cause or by the Executive within 18 months after the change in control or by him during the term of the Agreement as a result of (i) changes in his duties, compensation, benefits or work location, (ii) a risk of mental or physical illness posed by contractual

8

performance of his duties, or (iii) "good reason" (as defined in the Agreement), the Executive will receive as compensation twice his annual salary and incentive payment, the vesting of all shares of restricted stock, performance awards, stock appreciation rights and stock options and certain other benefits.

Summary Compensation Table

The following table sets forth the cash and noncash compensation for each of the last three fiscal years awarded to or earned by the Chief Executive Officer of the Company and each other executive officer of the Company as of April 30, 2000, whose total annual salary and bonus compensation for the most recent fiscal year exceeded $100,000.

| |

|

|

|

|

Long-Term Compensation Awards |

|

||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

Annual Compensation(1) |

|

|||||||||||

| |

|

|

Restricted Stock Awards ($)(2)(3) |

|

||||||||||

| Name and Principal Position |

Fiscal Year |

Salary($) |

Bonus($) |

Other Annual Compensation($) |

Securities Underlying Options |

All Other Compensation ($)(4) |

||||||||

| Paul Baszucki Chief Executive Officer, Chairman of the Board |

2000 1999 1998 |

363,262 325,000 308,700 |

— — 197,108 |

— — — |

100,050 60,000 25,000 |

50,000 — — |

13,941 20,858 14,232 |

|||||||

| David R. Richard President and Chief Executive Officer |

2000 1999 1998 |

253,387 350,000 275,000 |

— — 169,167 |

150,293 48,251 — |

— 75,000 80,000 |

— — 283,750 |

7,039 15,804 4,206 |

|||||||

| Michael E. Laughlin* Executive Vice President of Communication Services |

2000 | 154,519 | — | — | 40,050 | 10,000 | 5,549 | |||||||

| Peter E. Stilson** Executive Vice President of Communications Solutions |

2000 1999 |

174,615 139,230 |

— — |

— — |

45,050 17,500 |

10,000 4,000 |

5,635 3,393 |

|||||||

| Michael J. Theisen* Executive Vice President of Convergence Services |

2000 | 144,711 | 17,980 | — | 30,050 | 10,000 | 5,952 | |||||||

| Roger D. Van Beusekom Executive Vice President, Financial Services |

2000 1999 1998 |

156,869 150,000 136,515 |

49,549 — 99,826 |

— — — |

30,050 15,000 15,000 |

10,000 — — |

6,387 8,772 4,750 |

|||||||

9

| Name |

Restricted Shares |

Market Value |

|||

|---|---|---|---|---|---|

| Paul Baszucki | 50,000 | $ | 321,900 | ||

| Michael E. Laughlin | 10,000 | $ | 64,380 | ||

| Peter E. Stilson | 13,000 | $ | 83,694 | ||

| Michael J. Theisen | 10,000 | $ | 64,300 | ||

| Roger D. Van Buesekom | 10,000 | $ | 64,300 | ||

10

Stock Options

The following tables provide certain information with respect to stock options granted during fiscal 2000 to the named executive officers and the value of such officers' unexercised options at April 30, 2000. No stock options were exercised by the named executive officers during fiscal 2000.

| |

Individual Grants(1) |

Potential Realizable Value of Assumed Annual Rates of Stock Price Appreciation for Option Term(4) |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

Percentage of Total Options Granted to Employees in Fiscal Year |

|

|

||||||||

| |

Number of Securities Underlying Option Granted(2) |

|

|

|||||||||

| |

Exercise or Base Price ($/Share)(3) |

Expiration Date |

||||||||||

| Name |

5%($) |

10%($) |

||||||||||

| Paul Baszucki | 50 100,000 |

0 8.3 |

5.62 5.73 |

12-14-09 01-06-10 |

177 360,357 |

448 913,214 |

||||||

| Michael E. Laughlin | 20,000 50 20,000 |

1.7 0 1.7 |

11.44 5.62 5.73 |

6-09-09 12-14-09 1-06-10 |

143,891 177 72,071 |

364,648 448 182,643 |

||||||

| Peter E. Stilson | 25,000 50 20,000 |

2.1 0 1.7 |

11.44 5.62 5.73 |

06-09-09 12-14-09 01-06-10 |

179,864 177 72,071 |

455,810 448 182,643 |

||||||

| Michael J. Theisen | 10,000 50 20,000 |

.8 0 1.7 |

11.44 5.62 5.73 |

6-09-09 12-14-09 1-06-10 |

71,946 177 72,071 |

182,324 448 182,643 |

||||||

| Roger D. Van Beusekom | 10,000 50 20,000 |

.8 0 1.7 |

11.44 5.62 5.73 |

06-09-09 12-14-09 01-06-10 |

71,946 177 72,071 |

182,324 448 182,643 |

||||||

11

Aggregated Option Exercises in Last Fiscal Year

and FY-End Option Values

The following table summarizes information with respect to options held by the executive officers named in the Summary Compensation Table and the value of the options held by such persons as of the end of the last fiscal year.

| |

|

|

|

|

Value of Unexercised In-The Money Options at FY-End ($) |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

|

Number of Unexercised Options at FY-End (#) |

|||||||||

| |

Shares Acquired on Exercise(#) |

|

||||||||||

| |

Value Realized($) |

|||||||||||

| Name |

Exercisable |

Unexercisable |

Exercisable |

Unexercisable |

||||||||

| Paul Baszucki | — | — | 35,050 | 150,000 | 41 | 70,800 | ||||||

| David R. Richard | — | — | — | — | — | — | ||||||

| Michael E. Laughlin | — | — | 17,925 | 34,625 | 41 | 14,160 | ||||||

| Peter E. Stilson | — | — | 19,675 | 37,875 | 41 | 14,160 | ||||||

| Michael J. Theisen | — | — | 27,175 | 30,375 | 41 | 14,160 | ||||||

| Roger D. Van Beusekom | — | — | 27,300 | 37,750 | 41 | 14,160 | ||||||

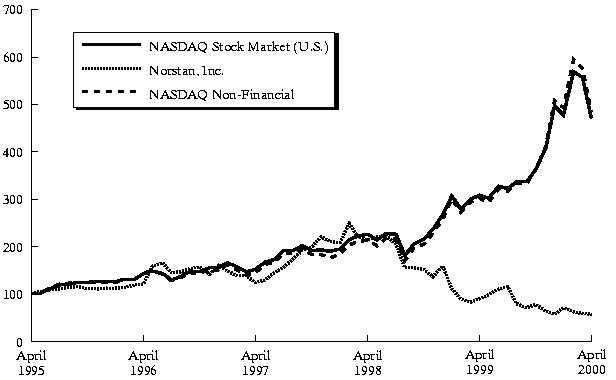

Performance Graph

The following performance graph compares cumulative total shareholder returns on the Company's common stock over the last five fiscal years, ended April 30, 2000, with The Nasdaq Stock Market (U.S. Companies) Index and the Nasdaq Non-Financial Stock Index, assuming an initial investment of $100 at the beginning of the period and the reinvestment of all dividends.

COMPARISON OF FIVE YEAR-CUMULATIVE TOTAL RETURNS*

PERFORMANCE GRAPH FOR

NORSTAN, INC.

Prepared by the Center for Research in Security Prices

*$100 INVESTED ON 4/30/95 IN STOCK OR INDEX—

INCLUDING REINVESTMENT OF DIVIDENDS.

FISCAL YEAR ENDING APRIL 30.

12

BENEFICIAL OWNERSHIP OF PRINCIPAL SHAREHOLDERS

AND MANAGEMENT

The following table sets forth information as of July 17, 2000 (except as otherwise noted), regarding the beneficial ownership of the common stock of the Company, its only class of equity security outstanding, by each director or nominee for director of the Company, by each current executive officer of the Company named in the Summary Compensation Table herein, by all directors, nominees and current executive officers as a group, and by each person (including any "group" as that term is used in section 13(d)(3) of the Securities Exchange Act of 1934, as amended) who is known by the Company to be the beneficial owner of more than five percent of the common stock of the Company:

| Name and Address of Beneficial Owner |

Amount and Nature of Beneficial Ownership(1) |

Percent of Outstanding(2) |

||

|---|---|---|---|---|

| Directors, nominees and executive officers: | ||||

| Paul Baszucki | 466,313 | (3) | 4.1 | |

| Richard W. Cohen | 540,933 | (4) | 4.8 | |

| Michael E. Laughlin | 28,230 | * | ||

| Barry R. Rubin | 10,000 | * | ||

| Peter E. Stilson | 35,175 | (6) | * | |

| Michael J. Theisen | 40,402 | * | ||

| Roger D. Van Beusekom | 110,792 | (8) | 1.0 | |

| Constance M. Levi | 32,670 | (9) | * | |

| Alan L. Mendelson | 1,000 | * | ||

| Dr. Jagdish N. Sheth | 31,270 | (10) | * | |

| Gerald D. Pint | 26,770 | (11) | * | |

| Herbert F. Trader | 36,270 | (12) | * | |

| Mercedes Walton | — | * | ||

| All directors, nominees and executive officers as a group (13 persons) | 1,329,520 | (13) | 11.6 | |

| Other beneficial owners: | ||||

| Heartland Advisors, Inc. 789 North Water Street Milwaukee, WI 53202 |

1,930,395 | (14) | 17.1 | |

| David L. Babson & Company, Incorporated One Memorial Drive Cambridge, MA 02142 |

566,200 | (15) | 5.0 | |

| Dimensional Fund Advisors, Inc. 1299 Ocean Avenue, 11th Floor Santa Monica, CA 90401 |

976,200 | (16) | 8.7 |

13

ownership of all such shares. Also includes 35,050 shares issuable to Mr. Baszucki upon exercise of options exercisable within 60 days.

14

PROPOSAL NO. 2

AMENDMENT OF 1995 LONG-TERM INCENTIVE PLAN

On September 20, 1995, the shareholders of the Company approved the Company's 1995 Long-Term Incentive Plan (the "Plan") covering up to 1,200,000 shares of common stock.

The brief summary of the Plan which follows is qualified in its entirety to the complete text of the Plan in its proposed amended form attached to this Proxy Statement as Exhibit B.

The Board of Directors believes that stock grants and awards have been, and will continue to be, an important compensation element in attracting and retaining key personnel. The objectives of the 1995 Plan are to aid the Company in maintaining and developing personnel capable of assuring the future success of the Company, to offer such personnel incentives to put forth maximum efforts for the success of the Company's business and to afford such personnel an opportunity to acquire a proprietary interest in the Company.

The 1995 Plan permits the granting of stock options, stock appreciation rights, restricted stock, performance awards and other stock-based awards to employees of the Company or its subsidiaries and to consultants or advisors providing bona fide services to the Company or its subsidiaries. Non-employee directors are not eligible for awards under the 1995 plan.

On September 24, 1998, the Company's shareholders approved an amendment to the Plan which increased the number of shares issuable thereunder to 2,400,000. In June 2000, the Company's Board of Directors approved, subject to shareholder ratification, a further amendment to the Plan increasing the number of shares issuable thereunder to 2,900,000.

The 1995 Plan is administered by the Compensation and Stock Option Committee of the Board of Directors of the Company (the "Committee") which has the authority and discretion to designate participants, determine the time at which awards shall be granted, set the period and terms and conditions under which each award becomes exercisable, and make any other determinations which are necessary or advisable for the administration of the 1995 Plan. The Committee consists of two non-employee directors, each of whom is a "disinterested person" within the meaning of Rule 16b-3 under the Securities Exchange Act of 1934, as amended. Participants may receive more than one award under the 1995 Plan.

Stock options granted under the 1995 Plan may be either incentive stock options ("Incentive Stock Options") subject to certain limitations and restrictions with the intent that such options will qualify under Section 422 of the Internal Revenue Code of 1986, as amended, or options that do not qualify as Incentive Stock Options under such statutory provisions ("Nonqualified Stock Options").

The exercise price per share under any stock option, the grant price of any stock appreciation right ("SAR"), and the purchase price of any security which may be purchased under any other stock-based award may not be less than 100 percent of the fair market value of the Company's common stock on the date of the grant of such option, SAR or right. Options may be exercised by payment in full of the exercise price in cash. Additionally, at the discretion of the Committee, options may be exercised, in whole or in part by the transfer of shares of the Company's common stock owned by the participant with a market value equal to the exercise price, or by withholding from the shares that would otherwise be issued upon exercise that number of shares having a fair market value equal to the exercise price, or by the assignment of the proceeds of a sale of some or all of the shares of common stock being acquired upon exercise of the option, or by any combination thereof.

The 1995 Plan provides for the issuance of SARs, which entitle the recipient to receive an amount equivalent to the difference between the fair market value of the Company's stock on the date of grant and the date of exercise. SARs may be granted in tandem with stock options or as a freestanding right not in tandem with an option. The exercise of SARs granted in tandem with options would require the

15

surrender of the related options. Any amount payable upon exercise of SARs may be paid in cash, in shares of common stock, or a combination of cash and shares, as determined by the Committee.

The 1995 Plan also provides for the issuance of restricted stock ("Restricted Stock") upon such terms and conditions as the Committee specifies. For participants it determines are eligible to receive Restricted Stock, the Committee specifies a restricted period and vesting schedule, according to which ownership of the Restricted Stock will vest in the recipient. Prior to the expiration of the restricted period, recipients of Restricted Stock have limits placed on their ownership and related rights in Restricted Stock which may include the deferral of dividends or other limitations. Unless otherwise agreed upon by the Committee and the recipient, holders of Restricted Stock have the right to vote the restricted shares prior to the expiration of the restricted period. Except to the extent otherwise provided by the Committee, if the recipient of Restricted Stock shall cease to be continuously employed by the Company during the restricted period, the recipient's rights to Restricted Stock not yet vested will be forfeited.

Performance awards made pursuant to the 1995 Plan entitle the recipient to receive future payments of cash or distributions of shares of common stock upon the achievement of pre-established performance goals. Performance goals are established by the Committee. Performance awards may be granted in conjunction with or separate from stock options granted under the 1995 Plan.

Awards may be granted for no cash consideration or for such minimal cash consideration as may be required by applicable law. Awards may provide that, upon the grant or exercise thereof, the holder will receive shares of common stock, cash, or any combination thereof, as the Committee shall determine.

No award granted under the 1995 Plan may be assigned or transferred by the individual to whom it is granted, otherwise than by will or by laws of descent and distribution. Each award is exercisable, during such individual's lifetime, only by such individual and during the term of his or her employment with the Company.

If any shares of common stock subject to any award or to which an award relates are not purchased or are forfeited, or if any such award terminates without the deliver of shares or other consideration, the shares previously used for such awards are available for future awards under the 1995 Plan. No person may be granted any award or awards, the value of which awards are based solely on an increase in the value of Company common stock after the date of grant of such awards, for more than 100,000 shares of Company common stock, in the aggregate, in any calendar year.

The 1995 Plan continues in effect through August 7, 2005, ten years from the effective date of the 1995 Plan, unless earlier terminated by the Board of Directors. The Board of Directors generally may amend, suspend or terminate the 1995 Plan or any portion thereof at any time. No amendment may be made without the consent of shareholders where such amendment would (i) increase the aggregate number of shares with respect to which awards may be made under the 1995 Plan; (ii) change the class of persons eligible to participate in the 1995 Plan; or (iii) materially increase the benefits accruing to participants under the 1995 Plan. In addition, shareholder approval must be obtained for any change that (i) requires the approval of the Company's shareholders under any rules or regulations of the National Association of Securities Dealers, Inc. or any other securities exchange applicable to the Company; or (ii) requires the approval of the Company's shareholders under the Internal Revenue Code in order to permit Incentive Stock options to be granted under the 1995 Plan. No amendment, suspension or termination of the 1995 Plan by the Board may have the effect of impairing any awards previously granted to a participant, unless the participant consents to such impairment.

16

Under the Internal Revenue Code, as presently in effect, the following principal federal tax consequences generally will result under the 1995 Plans:

1. The recipient of a stock option or SAR will not be deemed to receive any income for federal tax purposes at the time an option or SAR is granted, nor will the Company be entitled to a tax deduction at that time.

2. In the case of Incentive Stock Options, there is no tax liability to the recipient at time of exercise (excluding potential alternative minimum tax consequences). Generally, the recipient will at the time of sale be taxed on any gain, measured as the difference between the option price on the date of grant and the sale price. If the sale price is less than the option price, the difference will be treated as a capital loss.

3. In the case of an exercise of a Nonqualified Stock Option, recipients generally will be deemed to have received ordinary income in an amount equal to the difference between the option price and market price of the shares on the exercise date. Upon a sale of stock acquired pursuant to a Nonqualified Stock option, any difference between the sale price and the market value of the stock when the option was exercised will be treated as capital gain or capital loss.

4. In the case of an exercise of SARs, the recipient will be deemed to have received ordinary income on the exercise date in an amount equal to any cash and/or the market value of unrestricted shares received.

5. A recipient of Restricted Stock normally will not recognize taxable income at the time the stock is granted, unless the recipient's rights to part or all of the stock are immediately vested. Thereafter, the recipient will recognize ordinary income as the restrictions lapse. The amount of such ordinary income will be equal to the market value of the stock (in excess of any amount paid by the recipient) at the time of the lapse. However, the recipient may elect pursuant to section 83(b) of the Internal Revenue Code to recognize ordinary income in an amount equal to the market value of the Restricted Stock (in excess of any amount paid by the recipient) at the time the stock is granted. Any subsequent change in the value of the Restricted Stock would then be treated as capital gain or loss if and when the stock is sold. The Company will be allowed a deduction when and as the value of the Restricted Stock is treated as ordinary income to the recipient.

6. Upon the exercise of a Nonqualified Stock option or SAR or the vesting of Restricted Stock, the Company will generally be allowed an income tax deduction equal to the ordinary income recognized by the recipient. No income tax deduction will be allowed the Company as a result of the exercise of an Incentive Stock Option. However, if shares acquired pursuant to the exercise of an Incentive Stock Option are disposed of before the later of one year from the date of exercise and two years from the date of grant, the Company will be allowed an income tax deduction equal to the ordinary income recognized by the recipient as a result of the premature sale.

The income tax consequences set forth above are a summary only, and are based upon laws currently in effect. The tax consequences may be different in particular circumstances.

All shares represented by proxies that have been properly executed and returned will be voted in favor of the proposed amendment to the Norstan, Inc. 1995 Long-Term Incentive Plan, unless other instructions are indicated thereon. Approval of the proposed amendment to the Norstan, Inc. 1995 Long-Term Incentive Plan requires the affirmative vote of a majority of the shares of the Company's common stock present in person or by proxy at the 2000 Annual Meeting.

The Board of Directors recommends a vote in favor of the proposed amendment of the Norstan, Inc. 1995 Long-Term Incentive Plan.

17

PROPOSAL NO. 3

AMENDMENT OF RESTATED NON-EMPLOYEE DIRECTORS' PLAN

On September 20, 1995, the shareholders of the Company approved the Norstan, Inc. Restated Non-Employee Directors' Plan (the "Restated Plan") and the issuance of 150,000 shares of the Company's common stock thereunder. In June 2000, the Company's Board of Directors approved, subject to shareholder ratification, an amendment to the Restated Plan increasing the number of shares issuable thereunder to 250,000.

The following brief summary of the Restated Plan is qualified in its entirety to the complete text of the Restated Plan in its proposed amended form appearing as Exhibit C to this Proxy Statement.

The Restated Plan is intended to promote ownership by non-employee directors of a greater proprietary interest in the Company, thereby aligning such directors' interests more closely with the interests of stockholders of the Company, and to assist the Company in Attracting and retaining highly qualified persons to serve as non-employee directors.

The Restated Plan provides for a grant to each director who is not an employee of the Company or any subsidiary of a stock option to purchase 20,000 shares of common stock. Such grant will be made automatically to each new non-employee director on the day of such non-employee director's initial election or appointment to the Board. The Restated Plan also provides for additional, discretionary option and share grants. During fiscal 2000, grants covering 5,000 shares were made to each non-employee director.

The exercise price of each option granted under the Restated Plan is the fair market value of the common stock as of the date of grant, and each option is for a term of ten years. The options are Nonqualified stock options which are not intended to qualify as Incentive Stock Options under the provisions of section 422 of the Internal Revenue Code of 1986, as amended.

Options may be exercised by payment of cash or transfer of shares of the Company's common stock already owned by the non-employee director with a market value equal to the exercise price, or by delivering instructions to the Company to withhold from the shares that would otherwise be issued upon exercise that number of shares having a fair market value equal to the exercise price, or by the assignment of the proceeds of a sale of some or all of the shares of common stock being acquired upon exercise of the option, or by any combination thereof.

Options granted to the non-employee director vest and become exercisable in five equal installments of 20 percent six months after the date of grant and 20 percent on each of the first four anniversaries of the date of grant. A non-employee director whose service as a director terminates before the award is vested will forfeit any nonvested options upon termination of service unless such termination is a qualified termination. A qualified termination is termination of service due to the director's death or disability, retirement from the Board at or after age 65 or termination of service with the consent of a majority of the other directors of the Board. In the event of a director's qualified termination, any nonvested stock options granted to the director immediately vest and become exercisable. All options granted will immediately vest upon a "Change in Control" as that term is defined in Section 14 of the Restated Plan which is attached as Exhibit C to this Proxy Statement. See "Proposal to Approve the Norstan, Inc. 1995 Long-Term Incentive Plan". Options granted under the Restated Plan are exercisable only by the non-employee director or by his or her beneficiary in the event of the director's death during the option term. Options granted are not transferable or assignable except pursuant to the non-employee director's will or the laws of descent and distribution. In no event shall any option granted be exercisable at any time after ten years after the date the option is granted.

Under current federal income tax law, a non-employee director who is granted a nonqualified stock option does not have taxable income at the time of grant, but. does have taxable income at the

18

time of exercise equal to the excess of the fair market value of the shares on the exercise date over the option price. The Company is entitled to a deduction at the time the non-employee director recognizes income in an amount equal to such income. Upon disposition of shares acquired through exercise of an option, the non-employee director will recognize gain or loss measured by the difference between the amount received for the shares and their basis, which is generally the fair market value of the shares on the date of exercise.

The Board of Directors has set the current annual retainer for non-employee directors at $13,500 per annum, all of which is paid in common stock issued under the Restated Plan. During fiscal 2000, each non-employee director also received option grants covering 5,000 shares.

A non-employee director who becomes a member of the Board after the Annual Meeting of Shareholders in any year is awarded a prorated number of shares based on the number of full months of service for that year. For purposes of determining such number of shares, the fair market value of a share of common stock on the day of the director's election or appointment to the Board will be used.

The Restated Plan is administered by the Board of Directors. The Board of Directors may at any time amend or discontinue the Restated Plan, except that no such action shall adversely affect any rights as to any annual retainer shares theretofore received or stock options previously granted. If required to qualify the Restated Plan under Rule 16b-3 under the Securities Exchange Act of 1934, no amendment of the Restated Plan shall be made more than once every six months, except to comport to certain law changes, or, if required under Rule 16b-3 or by any rules or regulations of the National Association of Securities Dealers, Inc. or any other securities exchange applicable to the Company. No amendment shall be made without the approval of the Company's shareholders which would materially increase benefits under the Restated Plan, materially increase the number of shares that may be issued under the Restated Plan, materially modify the requirements for eligibility under the Restated Plan, or make any other change requiring shareholder approval.

All shares represented by proxies that have been properly executed and returned will be voted in favor of the proposal to amend the Norstan, Inc. Restated Non-Employee Directors' Plan, unless other instructions are indicated thereon. Approval of the proposed amendment to the Norstan, Inc. Restated Directors' Plan requires the affirmative vote of a majority of the shares of the Company's common stock present in person or by proxy at the 2000 Annual Meeting.

The Board of Directors recommends a vote for the approval of the Norstan, Inc. Restated Non-Employee Directors' Stock Plan.

PROPOSAL NO. 4

AMENDMENT OF 2000 EMPLOYEE STOCK PURCHASE PLAN

The Company's shareholders approved the 2000 Employee Stock Purchase Plan (the "Stock Purchase Plan") and the reservation of 400,000 shares of the Company's common stock for issuance thereunder at the Annual Meeting of Shareholders on September 21, 1999. In August 2000, the Company's Board of Directors approved, subject to shareholder ratification, an amendment to the Stock Purchase Plan to increase the number of shares issuable thereunder to 800,000.

The following brief summary of the Stock Purchase Plan is qualified in its entirety to the complete text of the Stock Purchase Plan in its proposed amended form appearing as Exhibit D to this Proxy Statement.

Each calendar quarter, the Company offers participants the option to purchase shares of common stock through voluntary payroll deductions for up to 10 percent of their base compensation. Substantially all of the employees and its subsidiaries are eligible to participate in the Stock Purchase Plan. Under the Stock Purchase Plan, the option exercise price for shares of common stock is

19

eighty-five percent of the closing price of the Company's common stock as reported on Nasdaq (or any other national securities exchange) on the first or the last day of each three month Offering Period (as defined in the Stock Purchase Plan), whichever is lower. Employees may acquire up to that number of shares purchasable at the option exercise price with ten percent of their compensation, subject to certain limitations. Shares of the Company's common stock are purchased for the account of each participant at the conclusion of the application Offering Period with funds deducted from the participant's payroll during such period.

Subject to certain limitations involving the magnitude of (i) existing beneficial ownership of the Company's common stock, and (ii) options to acquire the Company's common stock previously granted during the year under all benefit plans sponsored by the Company, all employees of the Company and its subsidiaries who have attained the age of 18 and completed one month of employment are eligible to participate in the Stock Purchase Plan.

The Stock Purchase plan is administered by the Company's Board of Directors. Expenses of administering the Stock Purchase Plan are borne by the Company.

In the event of any change in the Company's capitalization, including any merger, consolidation, acquisition or stock split, appropriate adjustments will be made to the number and class of shares available under the Stock Purchase Plan, the purchase price per share and the associated share purchase rights. The Board of Directors may terminate or amend the Stock Purchase Plan; provided, however, that in the absence of shareholder approval, the Board may not: (i) increase the maximum number of shares which may be issued under the Plan; or (ii) amend the requirements as to the class of employees eligible to purchase stock under the Stock Purchase Plan.

Participating employees do not recognize income for federal income tax purposes either upon enrollment of the Stock Purchase Plan or upon the purchase of shares. All tax consequences are deferred until a participating employee sells the shares, disposes of the shares by gift, or dies.

If shares are held for the greater of: (a) one year after the date of purchase; and (b) two years from the applicable date of grant, or if the participating employee dies while owning the shares, the participating employee realizes ordinary income on a sale (or a disposition by way of gift or upon death) equal to the excess of the fair market value of the shares on the date of purchase over the purchase price. All additional gain upon the sale of shares is treated as long-term capital gain. If the shares are sold and the sale price is less than the purchase price, there is no ordinary income and the participating employee has a long-term capital loss for the difference between the sale price and the purchase price.

If the shares are sold or are otherwise disposed of including by way of gift (but not death, bequest or inheritance) (in any case a "disqualifying disposition") prior to the expiration of holding period described above, the participating employee realizes ordinary income at the time of sale or other disposition, taxable to the extent that the fair market value of the shares at the date of purchase is greater than the purchase price. This excess constitutes ordinary income (currently subject to withholding) in the year of the sale or other disposition even if no gain is realized on the sale or if a gratuitous transfer is made. The difference, if any, between the proceeds of sale and the fair market value of the shares at the date of purchase is a capital gain or loss.

The Company is entitled to a deduction in connection with the disposition of shares acquired under the Stock Purchase Plan only to the extent that the participating employee recognizes ordinary income on a disqualifying disposition of the shares. The Company treats any transfer of record ownership of shares as a disposition, unless it is notified to the contrary. In order to enable the Company to learn of disqualifying dispositions and ascertain the amount of the deductions to which it is entitled, participating employees are required to notify the Company in writing of the date and terms of any disposition of shares purchased under the Stock Purchase Plan.

20

Approval of the proposed amendment to the 2000 Employee Stock Purchase Plan of Norstan, Inc. requires the affirmative vote of a majority of the shares of the Company's common stock present in person or by proxy at the 2000 Annual Meeting.

The Board of Directors recommends a vote in favor of the proposed amendment to the 2000 Employee Stock Purchase Plan of Norstan, Inc.

PROPOSAL NO. 5

RATIFICATION OF THE APPOINTMENT OF INDEPENDENT AUDITORS

The Board of Directors has appointed the firm of Arthur Andersen LLP as independent public accountants of the Company for the fiscal year ending April 30, 2001. Arthur Andersen LLP has served as the Company's independent public accountants since 1981.

Representatives of Arthur Andersen LLP will be present at the Annual Meeting, will have an opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions by shareholders.

Ratification of the appointment of the independent auditors requires the affirmative vote of a majority of the shares present in person or by proxy at the 2000 Annual Meeting.

The Board of Directors recommends a vote for the ratification of the appointment of Arthur Andersen LLP as independent auditors for the fiscal year ending April 30, 2001.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Prior to December 1999, when Richard Cohen was appointed Chief Financial Officer of the Company, Mr. Cohen provided consulting services to the Company pursuant to an agreement executed in September 1998. In December 1999, the consulting agreement was terminated. During the year ended April 30, 2000, Mr. Cohen received consulting fees of $87,500 from the Company.

Alan L. Mendelson, who was elected to the Board of Directors of the Company in May 2000, is Chief Executive Officer of The Phillips Group, a technology industry consulting firm. The Phillips Group has provided, and is expected to continue to provide, consulting services to the Company. During the year ended April 30, 2000, the Company paid The Phillips Group consulting fees aggregating $161,575.

Any proposal of a shareholder of the Company intended to be presented at the Annual Meeting of Shareholders in 2001 must be received at the Company's office on or before April 16, 2001 in order to be considered for inclusion in the Company's Proxy Statement and form of proxy relating to that meeting. If the Company is not provided notice of a shareholder proposal which the shareholder has not previously sought to include in the Company's proxy statement by June 30, 2001, the management proxies will be allowed to use their discretionary voting authority when the proposal is raised at the meeting.

The Company's directors, its executive officers, and any persons holding more than 10 percent of the Company's total issued and outstanding shares of common stock are required to file reports concerning their initial ownership of common stock and any subsequent changes in that ownership. The Company believes that the filing requirements for the last fiscal year were satisfied and that all required forms were timely filed. In making this disclosure, the Company has relied solely on written representations of its directors, executive officers and beneficial owners of more than 10 percent of

21

common stock and copies of the reports that they have filed with the Securities and Exchange Commission.

FINANCIAL AND OTHER INFORMATION

The Company's Annual Report for the fiscal year ended April 30, 2000, including financial statements, is being sent to shareholders of record as of the close of business on July 17, 2000 together with this Proxy Statement. The Annual Report is not a part of the proxy solicitation materials. The Company will furnish, without charge, a copy of its Annual Report on Form 10-K for the fiscal year ended April 30, 2000 as filed with the Commission to any shareholder who submits a written request to the Company's offices, Attention: Investor Relations, Norstan, Inc., 5101 Shady Oak Road, Minnetonka, MN 55343-4100. The Company's Annual Report is also available on the World Wide Web at the following address: www.norstan.com.

At the date of this Proxy Statement, management knows of no other matters which may come before the Annual Meeting. However, if any other matters properly come before the meeting, it is the intention of the persons named in the enclosed proxy form to vote such proxies received by the Company in accordance with their judgment on such matters.

By

Order of the Board of Directors

/s/ NEIL I. SELL, Secretary

August 14, 2000

22

EXHIBIT A

NORSTAN, INC.

AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

CHARTER

I. PURPOSE

The primary function of the Audit Committee is to assist the Board of Directors in fulfilling its oversight responsibilities by reviewing: the financial reports and other financial information provided by the Corporation to any governmental body or the public; the Corporation's systems of internal controls regarding finance, accounting, legal compliance and ethics that management and the Board have established; and the Corporation's auditing, accounting and financial reporting processes generally. Consistent with this function, the Audit Committee should encourage continuous improvement of, and should foster adherence to, the Corporation's policies, procedures and practices at all levels. The Audit Committee's primary duties and responsibilities are to:

The Audit Committee will primarily fulfill these responsibilities by carrying out the activities enumerated in Section IV of this Charter.

II. COMPOSITION

The Audit Committee shall be comprised of three or more directors as determined by the Board, each of whom shall be independent directors, and free from any relationship that, in the opinion of the Board, would interfere with the exercise of his or her independent judgment as a member of the Committee. All members of the Committee should have a working familiarity with basic finance and accounting practices, and at least one member of the Committee should have accounting or related financial management expertise. Committee members may enhance their familiarity with finance and accounting by participating in educational programs conducted by the Corporation or an outside consultant.

The members of the Committee shall be elected by the Board at the annual organizational meeting of the Board or until their successors shall be duly elected and qualified. Unless a Chair is elected by the full Board, the members of the Committee may designate a Chair by majority vote of the full Committee membership.

III. MEETINGS

The Committee shall meet at least four times annually, or more frequently as circumstances dictate. As part of its job to foster open communication, the Committee should meet at least annually with management, the manager of the business controls and the independent accountants in separate executive sessions to discuss any matters that the Committee or each of these groups believe should be discussed privately.

A-1

IV. RESPONSIBILITIES AND DUTIES

To fulfill its responsibilities and duties, the Audit Committee is expected to:

1. Provide an open avenue of communication between the business controls department, the independent accountants, and the Board of Directors.

2. Review annually and update, if necessary, the Committee's charter.

3. Recommend to the Board of Directors the independent accountants to be nominated, approve the compensation of the independent accountants, and review and approve the discharge of the independent accountants.

4. Confirm and assure the independence of the business control function and the independent accountants, including the prior review and approval of any management consulting services and related fees provided by the independent accountants.

5. Inquire of management and the independent accountants about significant risks or exposures and assess the steps management has taken to minimize such risk to the Corporation.

6. Consider, in consultation with the independent accountants, the audit scope and plan of the independent accountants.

7. Consider and review with the independent accountants and the manager of business controls:

(a) The adequacy of the Corporation's internal controls, including computerized information system controls and security.

(b) Any related significant findings and recommendations of the independent accountants together with management's responses thereto.

8. Review with management and the independent accountants at the completion of the annual examination:

(a) The Corporation's annual financial statements and related footnotes.

(b) The independent accountants' audit of the financial statements and their report thereon.

(c) Any significant changes required in the independent accountants' audit plan.

(d) Any serious difficulties or disputes with management encountered during the course of the audit.

(e) Other matters related to the conduct of the audit which are to be communicated to the Committee under generally accepted auditing standards.

9. Consider and review with management and the manager of business controls:

(a) Significant findings during the year and management's responses thereto.

(b) Any difficulties encountered in the course of their audits, including any restrictions on the scope of their work or access to required information.

(c) Any changes required in the planned scope of their audit plan.

(d) The business controls department charter.

10. Review with management and the independent accountants, the interim financial results that are filed with the SEC or other regulators.

A-2

11. Review with management legal and regulatory matters that may have a material effect on the financial statements, related Corporation compliance policies, and programs and reports received from regulators.

12. Meet with the manager of business controls, the independent accountants, and management in separate executive sessions to discuss any matters that the Committee or these groups believe should be discussed privately with the Audit Committee.

13. Report Committee actions to the Board of Directors with such recommendations as the Committee may deem appropriate.

14. The Audit Committee shall have the power to conduct or authorize investigations into any matters with the Committee's scope of responsibilities. The Committee shall be empowered to remain independent counsel, accountants, or others to assist it in the conduct of any investigation.

15. The Committee will perform such other functions as assigned by law, the Corporation's charter or bylaws, or the Board of Directors.

A-3

EXHIBIT B

NORSTAN, INC.

1995 LONG-TERM INCENTIVE PLAN

As Amended September 2000

Section 1. Purpose; Effect on Prior Plans.

(a) Purpose. The purpose of the Plan is to promote the interests of the Company and its stockholders by aiding the Company in attracting and retaining personnel capable of assuring the future success of the Company, to offer such personnel incentives to put forth maximum efforts for the success of the Company's business and to afford such personnel an opportunity to acquire a proprietary interest in the Company.

(b) Effect on Prior Plans. From and after the date on which the Company's stockholders approve this Plan, no stock options, restricted stock awards, stock appreciation rights, performance awards or other awards shall be granted or awarded under the Company's 1986 Long-Term Incentive Plan, as amended ("1986 Plan"). All outstanding stock options, restricted stock awards, stock appreciation rights and performance awards granted under the 1986 Plan prior to the date on which the Company's stockholders approve this Plan shall continue and remain outstanding in accordance with the terms thereof.

Section 2. Definitions.

As used in the Plan, the following terms shall have the meanings set forth below:

(a) "Affiliate" shall mean (i) any entity that, directly or indirectly through one or more intermediaries, is controlled by the Company and (ii) any entity in which the Company has a significant equity interest, in each case as determined by the Committee.

(b) "Award" shall mean any Option, Stock Appreciation Right, Restricted Stock, Performance Award, or Other Award granted under the Plan.

(c) "Award Agreement" shall mean any written agreement, contract or other instrument or document evidencing any Award granted under the Plan.

(d) "Code" shall mean the internal Revenue Code of 1986, as amended from time to time, and any regulations promulgated thereunder.

(e) "Committee" shall mean a committee of the Board of Directors of the Company designated by such Board to administer the Plan, which shall consist of members appointed from time to time by the Board of Directors and shall be comprised of not less than such number of directors as shall be required to permit the Plan to satisfy the requirements of Rule 16b-3. Each member of the Committee shall be a "non-employee director" within the meaning of Rule 16b-3.

(f) "Company" shall mean NORSTAN, INC., a Minnesota corporation, and any successor corporation.

(g) "Eligible Person" shall mean any employee, or any consultant or advisor providing bona fide services to the Company or any Affiliate who the Committee determines to be an Eligible Person. A director of the Company who is not also an employee of the Company or an Affiliate shall not be an Eligible Person.

(h) "Fair Market Value" shall mean, with respect to any property (including, without limitation, any Shares or other securities), the fair market value of such property determined by such methods or procedures as shall be established from time to time by the Committee.

B-1

(i) "Incentive Stock Option" shall mean an option granted under Section 6(a) of the Plan that is intended to meet the requirements of Section 422 of the Code or any successor provision.

(j) "Non-Qualified Stock Option" shall mean an option granted under Section 6(a) of the Plan that is not intended to be an Incentive Stock Option.