|

|

|

|

|

Previous: DREYFUS NEW YORK TAX EXEMPT BOND FUND INC /NEW/, NSAR-B, EX-27, 2000-07-27 |

Next: CITY HOLDING CO, 8-K, 2000-07-27 |

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant /x/ |

||

| Filed by a Party other than the Registrant / / | ||

| Check the appropriate box: |

||

| / / | Preliminary Proxy Statement | |

| / / | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| /x/ | Definitive Proxy Statement | |

| / / | Definitive Additional Materials | |

| / / | Soliciting Material Under Rule 14a-12 |

|

| MINNTECH CORPORATION |

||||

(Name of Registrant as Specified In Its Charter) |

||||

| |

||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| /x/ | No fee required | |||

| / / | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

| / / | Fee paid previously with preliminary materials. | |||

| / / | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

Dear Shareholder:

You are cordially invited to attend the Annual Meeting of Shareholders to be held at the Lutheran Brotherhood Auditorium, 625 Fourth Avenue South, Minneapolis, Minnesota at 3:30 p.m., Central Daylight Time, on August 30, 2000.

The Notice of Annual Meeting of Shareholders and the Proxy Statement that follow describe the business to be conducted at the meeting. We will also report on matters of current interest to our shareholders.

Whether you own a few or many shares of stock, it is important that your shares be represented. If you cannot personally attend, we encourage you to make certain that you are represented at the meeting by signing the accompanying proxy and promptly returning it in the enclosed envelope. Alternatively, you may authorize the voting of your shares by proxy either through the Internet by visiting the web site shown on your proxy card or by telephone by using the toll-free telephone number shown on your proxy card. Your Internet or telephone authorization authorizes the named proxies to vote your shares in the same manner as if you marked, signed and returned your proxy card.

| Sincerely, | ||

| |

|

|

| William Hope Chairman and Chief Executive Officer |

July 27, 2000

The accompanying Proxy Statement describes important issues affecting Minntech Corporation. If you are a shareholder of record, you have the right to authorize the voting of your shares by proxy through the Internet, by telephone or by mail. Your Internet or telephone authorization authorizes the named proxies to vote your shares in the same manner as if you marked, signed and returned your proxy card. You may revoke your proxy any time before the Annual Meeting. Please help the Company save time and postage costs by voting through the Internet or by telephone. Each method is generally available 24 hours a day and will ensure that your vote is confirmed and posted immediately. To vote:

If your shares are held in the name of a bank, broker or other holder of record, you will receive instructions from the holder of record that you must follow in order for your shares to be voted.

Your vote is important. Thank you for voting.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

Wednesday, August 30, 2000

The Annual Meeting of Shareholders of Minntech Corporation will be held at the Lutheran Brotherhood Auditorium, 625 Fourth Avenue South, Minneapolis, Minnesota at 3:30 p.m., Central Daylight Time, on Wednesday, August 30, 2000, for the following purposes:

Pursuant to due action of the Board of Directors, shareholders of record on July 7, 2000 will be entitled to vote at the meeting or any adjournments thereof.

| By Order of the Board of Directors | ||||

| |

|

|

||

| Barbara A. Wrigley Secretary |

||||

July 27, 2000

TO ASSURE YOUR REPRESENTATION AT THE MEETING, PLEASE SIGN, DATE AND RETURN YOUR PROXY ON THE ENCLOSED PROXY CARD WHETHER OR NOT YOU EXPECT TO ATTEND IN PERSON. IF YOU ARE A REGISTERED SHAREHOLDER, YOU MAY ALSO AUTHORIZE THE VOTING OF YOUR SHARES EITHER THROUGH THE INTERNET OR BY TELEPHONE BY FOLLOWING THE INSTRUCTIONS ON THE INSIDE OF THE FRONT COVER OF THESE MATERIALS. YOUR INTERNET OR TELEPHONE AUTHORIZATION AUTHORIZES THE NAMED PROXIES TO VOTE YOUR SHARES IN THE SAME MANNER AS IF YOU MARKED, SIGNED AND RETURNED YOUR PROXY CARD. SHAREHOLDERS WHO ATTEND THE MEETING MAY REVOKE THEIR PROXIES AND VOTE IN PERSON IF THEY DESIRE.

Proxy Statement

of

MINNTECH CORPORATION

14605 28th Avenue North, Minneapolis, Minnesota 55447

Annual Meeting of Shareholders to be held

August 30, 2000

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Minntech Corporation (the "Company") to be used at the Annual Meeting of Shareholders of the Company to be held August 30, 2000, and at any adjournments thereof. The approximate date on which this Proxy Statement and accompanying proxy will be first sent or given to shareholders is July 27, 2000.

Proxies in the accompanying form which are properly signed, duly returned to the Company and not revoked will be voted in the manner specified. If no instructions are indicated, properly executed proxies will be voted for the proposals set forth in this Proxy Statement. A shareholder executing a proxy may revoke it at any time before it is exercised by notice in writing to an officer of the Company or by properly signing and duly returning a proxy bearing a later date. Unless so revoked, the shares represented by such proxy will be voted at the meeting and at any adjournments thereof. Presence at the meeting of a shareholder who has signed a proxy does not alone revoke the proxy. In addition, registered shareholders (those whose shares are owned in their name and not in "street name") may authorize the voting of their shares by proxy either through the Internet or by telephone by following the instructions on the inside front cover of these materials. Only shareholders of record at the close of business on July 7, 2000 will be entitled to vote at the meeting or any adjournments thereof.

Under Minnesota law, each item of business properly presented at a meeting of shareholders generally must be approved by the affirmative vote of the holders of a majority of the voting power of the shares present, in person or by proxy, and entitled to vote on that item of business. However, if the shares present and entitled to vote on that item of business would not constitute a quorum for the transaction of business at the meeting, then the item must be approved by a majority of the voting power of the minimum number of shares that would constitute such a quorum. Votes cast by proxy or in person at the Annual Meeting of Shareholders will be tabulated by the election inspector appointed for the meeting and such inspector will determine whether or not a quorum is present. The election inspector will treat abstentions as shares that are present and entitled to vote for purposes of determining the presence of a quorum and in tabulating votes cast on proposals presented to shareholders for a vote but as not being voted for the approval of the matter from which the shareholder abstains. Consequently, an abstention will have the same effect as a negative vote. If a broker indicates on the proxy that it does not have discretionary authority as to certain shares to vote on a particular matter, those shares will not be considered as present and entitled to vote with respect to that matter.

The Company has outstanding only one class of voting securities, common stock, $.05 par value. As of the close of business on the record date, July 7, 2000, 6,702,116 shares of common stock were outstanding. Each share of common stock is entitled to one vote. There is no cumulative voting for the election of directors.

1

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS, DIRECTORS AND MANAGEMENT

The following table sets forth certain information concerning the beneficial ownership of the common stock of the Company as of July 7, 2000 (except as otherwise noted) with respect to (i) all persons known by the Company to be the beneficial owners of more than 5% of the outstanding common stock of the Company, (ii) each director of the Company, (iii) each executive officer named in the Summary Compensation Table on page 6 and (iv) all directors and executive officers as a group.

| Beneficial Owner |

Shares Beneficially Owned(1) |

Percentage of Outstanding Shares |

|||

|---|---|---|---|---|---|

| Heartland Advisors, Inc.(2) 789 North Water Street Milwaukee, Wisconsin 53202 |

1,319,900 | 19.7 | % | ||

| AMVESCAP PLC(3) 11 Devonshire Square London EC2M 4YR England |

715,000 | 10.7 | |||

| T. Rowe Price Associates, Inc.(4) 100 East Pratt Street Baltimore, Maryland 21202 |

675,000 | 10.1 | |||

| Wellington Management Company, LLP(5) 75 State Street Boston, Massachusetts 02109 |

466,100 | 7.0 | |||

| Fleet Boston Corporation(6) One Federal Street Boston, Massachusetts 02110 |

389,350 | 5.8 | |||

| Putnam Investments, Inc.(7) One Post Office Square Boston, Massachusetts 02109 |

357,887 | 5.3 | |||

| Thomas J. McGoldrick | 275,372 | 4.0 | |||

| Fred L. Shapiro, M.D. | 166,264 | 2.5 | |||

| Daniel H. Schyma | 145,378 | 2.1 | |||

| Richard P. Goldhaber | 129,011 | 1.9 | |||

| George Heenan | 121,851 | 1.8 | |||

| Donald H. Soukup | 115,525 | 1.7 | |||

| Barbara A. Wrigley | 103,250 | 1.5 | |||

| Amos Heilicher | 73,265 | 1.1 | |||

| Paul E. Helms | 64,260 | 1.0 | |||

| Norman Dann | 28,308 | * | |||

| William Hope | 18,548 | * | |||

| Malcolm W. McDonald | 11,599 | * | |||

| All directors and executive officers as a group (14 persons) | 1,404,357 | 18.0 |

* Less than one percent.

(Footnotes continue on the following page)

2

(Footnotes continued from preceding page)

The Company's Restated Articles of Incorporation, as amended, provide that the number of directors constituting the Board of Directors shall be not more than eleven nor less than three persons and shall be determined from time to time by resolution of the Board. The Board of Directors has fixed the size of the Board at seven. The Restated Articles of Incorporation, as amended, also provide for the election of approximately one-third of the Board of Directors annually. Accordingly, two directors are to be elected at this year's annual meeting for terms expiring in the year 2003.

Each nominee named below has indicated a willingness to serve as a director if elected. Proxies solicited by the Board of Directors will, unless otherwise directed, be voted for the election of the two nominees. If a nominee should withdraw or otherwise become unavailable for reasons not presently

3

known, such shares may be voted for another person in the place of such nominee in accordance with the best judgment of the persons named in the proxy.

Set forth below is certain information as of July 7, 2000, with respect to each person nominated by the Board of Directors and each person whose term of office will continue after the meeting:

| Name and Age |

Principal Occupation and Other Information |

Director Since |

Present Term Expires |

|||

|---|---|---|---|---|---|---|

| NOMINEES: | ||||||

| George Heenan (61) |

|

Executive Fellow and Director of the Institute of Strategic Management from July 1999 to present and Executive Fellow and Director of the Institute of Venture Management at the University of St. Thomas from September 1994 to July 1999. President of Bissell Healthcare Corporation, North American Operations, a manufacturer and distributor of medical products, from February 1991 to August 1994. Chairman of Clarus Medical Systems, Inc., a manufacturer of diagnostic and interventional endoscopes, from May 1987 to February 1991. Mr. Heenan has also been a principal of Heenan Investments, Inc., a venture development and investment company, since January 1986. |

|

1982 |

|

2000 |

| Amos Heilicher (82) |

|

President of Advance-Carter, a venture capital company, and Advance Realty Co. for more than five years. Mr. Heilicher is the uncle by marriage of Dr. Fred L. Shapiro. |

|

1982 |

|

2000 |

| CONTINUING DIRECTORS: |

|

|

|

|

||

| Norman Dann (73) |

|

Independent business consultant concentrating in the areas of venture capital, strategic planning, marketing, and product development since 1992. Executive officer of and consultant to Pathfinder Ventures, Inc., a venture capital firm ("Pathfinder"), and general partner of three of Pathfinder's funds and partnerships, from 1980 to 1992. Vice President of Sales and Marketing and Senior Vice President of Development with Medtronic, Inc., a leading manufacturer of cardiac pacemakers and other medical products, from 1971 to 1977. Mr. Dann is also a director of Applied Biometrics, Inc., Medwave, Inc. and several private companies. |

|

1995 |

|

2001 |

| William Hope (66) |

|

Chairman of the Board and Chief Executive Officer of the Company since June 2000. President and Chief Executive Officer of G&K Services, Inc., a supplier of uniforms and specialty garments throughout North America, from 1997 to January 1999, and President from 1993 to 1997. Mr. Hope is also a director of G&K Services. |

|

1998 |

|

2001 |

| Malcolm W. McDonald (63) |

|

Director and Sr. Vice President of Space Center, Inc., an industrial real estate firm, since 1977. Mr. McDonald is also a director of several private companies and a director or trustee of several nonprofit organizations. |

|

1998 |

|

2001 |

| |

|

|

|

|

|

|

4

| Fred L. Shapiro, M.D. (65) | Consultant to Hennepin Faculty Associates, a nonprofit organization involved in medical education, research and patient care, from 1995 to 1999, and President of Hennepin Faculty Associates from 1984 to 1995. Medical Director of the Regional Kidney Disease Program from 1966 to 1984. Professor of Medicine at Hennepin County Medical Center and the University of Minnesota from 1976 to present. Dr. Shapiro is also a director of Medi-Ject Corporation. Dr. Shapiro is the nephew by marriage of Amos Heilicher. | 1982 | 2002 | |||

| Donald H. Soukup (60) |

|

Independent venture capitalist since 1984. Mr. Soukup is also a director of Ciprico, Inc. and several private companies. |

|

1980 |

|

2002 |

| |

|

|

|

|

|

|

Board Meetings During Fiscal 2000

The Board of Directors held 10 meetings during fiscal 2000. Each director participated in at least 75% of the aggregate total of meetings of the Board of Directors and Board Committees on which such director served during the last fiscal year.

Board Committees

The Board of Directors has established an Audit Committee, a Compensation Committee, an Acquisitions Committee and a Nominating Committee. The members of each of these committees are approved by the full Board. The members of such committees are noted below as of July 7, 2000.

The Audit Committee consists of three non-employee directors, Norman Dann, Malcolm W. McDonald and Donald H. Soukup, and is responsible for matters relating to accounting policies and practices, financial reporting and internal controls. To this end, it reviews and oversees the objectivity and independence of the independent auditors, reviews and discusses the Company's audited financial statements, recommends to the full Board the engagement of the independent auditors and annually reviews and reassesses the adequacy of the Audit Committee Charter. The Audit Committee held one meeting during fiscal 2000.

The Compensation Committee consists of four non-employee directors, George Heenan, Amos Heilicher, Malcolm McDonald and Fred L. Shapiro, M.D., and is responsible for making recommendations to the Board of Directors concerning the amount and form of compensation paid by the Company to its executive officers and members of the Board of Directors. The Compensation Committee held one meeting during fiscal 2000.

The Acquisitions Committee consists of William Hope and three non-employee directors, Norman Dann, Amos Heilicher and Donald H. Soukup, and is responsible for the review, evaluation and proposal to the Board of Directors of possible mergers, acquisitions and other business combinations on behalf of the Company. The Acquisitions Committee held one meeting during fiscal 2000.

The Nominating Committee consists of four non-employee directors, Norman Dann, Malcolm McDonald, Fred L. Shapiro, M.D. and Donald H. Soukup. The Nominating Committee was formed in May 2000 and consists entirely of independent directors not standing for re-election in the year of meetings. The Nominating Committee is responsible for considering the qualifications of and recommending each candidate and incumbent for election as a director of the Company and for nominating candidates to fill Board vacancies. It is also responsible for assessing the size, structure and composition of the Board and Board committees.

5

The Nominating Committee will consider nomination by a shareholder of a candidate for election as a director of the Company. Any shareholder who wishes the Nominating Committee to consider a candidate should submit a written request and related information to the Secretary of the Company on behalf of the Nominating Committee no later than March 31 of the calendar year of the Annual Meeting of Shareholders (currently held in August). See "Deadline For Submission of Shareholders' Proposals" below for information if a shareholder plans to nominate a person as a director at a meeting.

EXECUTIVE COMPENSATION AND OTHER INFORMATION

Summary of Cash and Certain Other Compensation

The following table shows, for the fiscal years ended March 31, 2000, 1999 and 1998, the cash compensation paid by the Company, as well as certain other compensation paid or accrued for those years, to Thomas J. McGoldrick, the Company's President and Chief Executive Officer during fiscal 2000, and to each of the other four most highly compensated executive officers of the Company during fiscal 2000 (together, the "Named Executives").

| |

|

|

|

Long-Term Compensation |

|

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Fiscal Year Ended March 31 |

|

|

|

||||||||||

| |

Annual Compensation |

|

||||||||||||

| |

Stock Options |

All Other Compensation |

||||||||||||

| Name and Position |

Salary |

Bonus |

||||||||||||

| Thomas J. McGoldrick(1) Former President and Chief Executive Officer |

2000 1999 1998 |

$ |

287,338 264,223 225,000 |

$ |

— 198,750 126,563 |

24,000 24,000 40,000 |

$ |

14,198 20,302 18,176 |

(2) |

|||||

| Richard P. Goldhaber(3) Former Vice President Research and Development |

|

2000 1999 1998 |

|

$ |

227,707 210,911 206,856 |

|

$ |

— 105,495 116,357 |

|

— 12,000 20,000 |

|

$ |

10,970 13,084 16,282 |

(4) |

| Barbara A. Wrigley Executive Vice President and Secretary |

|

2000 1999 1998 |

|

$ |

211,864 182,337 173,000 |

|

$ |

— 91,260 64,875 |

|

10,000 12,000 20,000 |

|

$ |

10,961 12,043 12,633 |

(5) |

| Paul E. Helms Sr. Vice President Operations |

|

2000 1999 1998 |

|

$ |

195,805 172,510 163,700 |

|

$ |

— 86,346 61,201 |

|

12,000 12,000 20,000 |

|

$ |

10,142 11,208 42,058 |

(6) (7) |

| Daniel H. Schyma(8) Former Vice President Sales and Marketing |

|

2000 1999 1998 |

|

$ |

185,619 170,930 158,000 |

|

$ |

— 128,388 88,875 |

|

10,550 12,000 20,000 |

|

$ |

9,986 13,209 13,496 |

(9) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6

continue to pay for his health insurance until July 7, 2001. Mr. McGoldrick has agreed to non-compete, non-solicitation and non-disclosure restrictions until July 7, 2003. The Company and Mr. McGoldrick also agreed that when the remaining balance of consulting fees due to Mr. McGoldrick equals approximately $64,000, he will be required to repay the outstanding loan balance on his promissory note with the Company (see "Certain Relationships and Related Transactions" below). If Mr. McGoldrick does not repay the balance of the loan at that time, then the Company has the right of offset against all remaining amounts owing to him under the terms of the agreement.

Stock Options

The following table contains information concerning the grant of stock options under the Company's 1998 Stock Option Plan during fiscal 2000 to the Named Executives identified in the Summary Compensation Table above.

7

Option Grants in Last Fiscal Year

| |

|

% of Total Options Granted to Employees in Fiscal Year Ended March 31, 2000 |

|

|

Potential Realizable Value at Assumed Rates of Stock Price Appreciation for Option Term(1) |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Number of Shares Granted |

|

|

||||||||||||

| |

Exercise Price |

Expiration Date |

|||||||||||||

| Name |

5% |

10% |

|||||||||||||

| Thomas J. McGoldrick | 24,000 | (2) | 12.0 | % | $ | 8.0625 | 3/30/10 | (2) | $ | 126,762 | $ | 308,388 | |||

| Richard P. Goldhaber | 0 | — | — | — | — | — | |||||||||

| Barbara A. Wrigley | 10,000 | (3) | 5.0 | 8.0625 | 3/30/10 | 50,705 | 128,495 | ||||||||

| Paul E. Helms | 12,000 | (3) | 6.0 | 8.0625 | 3/30/10 | 60,846 | 154,194 | ||||||||

| Daniel H. Schyma | 10,550 | (4) | 5.3 | 8.0625 | 3/30/10 | (4) | 53,494 | 135,562 | |||||||

Option Exercises and Holdings

The following table sets forth information with respect to the Named Executives concerning the exercise of options during the last fiscal year and unexercised options held as of the end of the fiscal year.

Aggregated Option Exercises In Last Fiscal Year

and Fiscal Year-End Option Values (1)

| |

Number of Unexercised Options at March 31, 2000 |

Value of Unexercised In-the-Money Options as of March 31, 2000(2) |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Name |

Exercisable |

Unexercisable |

Exercisable |

Unexercisable |

||||||

| Thomas J. McGoldrick | 217,000 | 41,000 | $ | — | $ | — | ||||

| Richard P. Goldhaber | 117,500 | 14,500 | — | — | ||||||

| Barbara A. Wrigley | 103,250 | 19,500 | — | — | ||||||

| Paul E. Helms | 58,500 | 25,500 | — | — | ||||||

| Daniel H. Schyma | 142,775 | 19,775 | — | — | ||||||

8

Employment Agreements

The Company has entered into agreements with its executive officers, including the Named Executives, that provide for a lump sum cash severance payment equal to an amount of one dollar less than three times the executive's average annual compensation for the preceding five year period or, if less, the period of the executive's employment with the Company, plus fringe benefits, in the event of a "change of control" of the Company. The maximum amounts currently payable to the Named Executives in the event of a change of control are as follows: Ms. Wrigley, $669,558 and Mr. Helms, $664,597. The agreements automatically renew year to year on September 1st until notice of termination of the agreement is given by either party within 60 days prior to the expiration of the annual renewal period then in effect. If a change in control of the Company occurs when the agreement is in effect, the severance payments are due to any executive who either is involuntarily terminated by the Company or voluntarily terminates his or her employment after a reduction in his or her duties, compensation or fringe benefits which occurs within the 36-month period following the change of control. Under the agreement, each executive agrees to remain with the Company for 90 days following a change of control to assist the transition, after which time the executive may, during the next 90 days, voluntarily terminate his or her employment and receive 50% of such severance payment.

Director Compensation

All non-employee directors received $15,000 as an annual fee and $1,000 for each full meeting attended in fiscal 2000. All non-employee directors also received $750 for each committee meeting attended. Directors and their spouses are reimbursed for all travel expenses incurred in connection with attendance at meetings of the Board of Directors. Effective July 1, 2000, the Board of Directors decreased the annual fee paid to non-employee directors to $12,000 annually. The amount of the fees paid to directors for attendance of full meetings and committee meetings remained unchanged. The Board of Directors also increased the number of scheduled full meetings from six to twelve.

Effective April 1, 1995, the Company adopted the Emeritus Director Consulting Plan (the "Plan"). The Plan has been adopted to enable the Company to continue to utilize the expertise of directors after retirement. Non-employee directors who have served on the Board of Directors for five full consecutive years are eligible for, and in the event of a change in control of the Company are, subject to certain exceptions, entitled to, participation in the Plan. An annual fee equal to the annual retainer in effect at the time of the director's retirement will be paid in consideration for consulting services to be provided to the Company following the director's retirement. Determination of eligibility and participation in the Plan will be made annually. The length of participation in the Plan will be limited to the number of years of service on the Board of Directors. There are presently no directors participating in the Plan.

The Company's 1998 Stock Plan (the "1998 Plan") provides for the annual, automatic granting of a defined number of options to non-employee directors at the last regularly scheduled meeting of the Board of Directors during the fiscal year. Such options are granted to each director who is not and has never been an employee of the Company and who (i) is serving an unexpired term as a director, as of the date of the last regularly scheduled meeting of the Board of Directors during any fiscal year of the Company, and (ii) at the time of any such meeting, has served as a director for at least six months of the year preceding the date of such meeting. The 1998 Plan provides that each such director shall, as of the date of the applicable meeting, automatically receive a non-qualified option to purchase 7,030 shares of the Company's common stock, with the option price equal to the fair market value of the Company's common stock on such date. The 1998 Plan was amended in September 1998 to provide that commencing April 1, 1998, no option may be granted under the 1998 Plan in any fiscal year if following such grant the number of shares purchasable pursuant to options granted under the 1998 Plan in such fiscal year would exceed 3% of the total number of outstanding shares of the Company as of the date of such grant. Because of this amendment, the Board unanimously agreed to reduce the number of shares to be granted to each non-employee director in fiscal 2000 to 4,218 shares. On March 30, 2000, each non-employee director was

9

granted an option under the 1998 Plan to purchase 4,218 shares of common stock at an exercise price of $8.0625 per share.

Report of the Compensation Committee

Overview

The Compensation Committee (the "Committee") of the Board of Directors is responsible for establishing compensation policies for all executive officers of the Company, including the Named Executives in the accompanying tables. The Committee establishes the total compensation for the executive officers in light of these policies. The Committee is composed entirely of non-employee directors.

The following report addresses the Company's executive compensation policies and discusses factors considered by the Committee in determining the compensation of the Company's President and Chief Executive Officer and other executive officers for its fiscal year ended March 31, 2000.

Compensation Policies for Executive Officers

The Committee's executive compensation policies are designed to provide competitive levels of compensation that integrate pay with the Company's annual and long-term performance goals, reward above-average corporate performance, recognize individual initiative and achievements, and assist the Company in attracting and retaining qualified executives. To that end, the Committee has established certain parameters of corporate performance that must be met before the discretionary features of its executive compensation plans apply. These discretionary features include stock option grants and performance bonuses, which are from 50% to 75% of an executive officer's base salary. Absent the discretionary features, the Company's executive officers are paid base salaries that are subject to annual merit increases. The Company's executive officers are also given the opportunity to participate in certain other broad-based employee benefit plans. As a result of the Company's increased emphasis on tying executive compensation to corporate performance, in any particular year the Company's executives may be paid more or less than the executives of other companies in the medical device industry. The Company's use of stock option grants as a key component of its executive compensation plans reflects the Committee's position that stock ownership by management and stock-based compensation arrangements are beneficial in aligning management's and shareholders' interests to enhance shareholder value.

Relationship of Performance under the Compensation Plans

Compensation paid to the Company's executive officers in fiscal 2000, as reflected in the Summary Compensation Table above as to the Named Executives, consisted of base salary and no bonuses. Pursuant to the Company's performance bonus plan, the Committee had established target performance levels and corresponding bonus amounts if those performance levels were met for fiscal 2000. The Named Executives did not receive bonuses for fiscal 2000 as the Company did not meet the established target performance levels.

The various performance-related aspects of the Company's executive compensation plans are set forth below:

Performance Bonus Awards. Performance bonus opportunities for the Company's executive officers, including the Named Executives and other key employees, are linked to a percentage of base salary, generally limited to 50% to 75% of an executive's base salary for fiscal 2000. Prior to the start of fiscal 2000, the Committee established a maximum bonus pool payable based on the Company reaching certain increases in pre-tax profits. The measures of performance utilized under the Company's performance bonus plan for fiscal 2000 were based on achieving pre-tax profits of varying levels, taking into account projected growth in earnings per share and return on shareholders' equity. The Company did not meet the

10

established target performance levels for fiscal 2000 so bonuses were not paid to executive officers. The Committee has once again established corporate target performance levels and corresponding bonus amounts if those performance levels are met for fiscal 2001 under the Company's bonus plan.

At the time it establishes the target profit levels, the Committee also sets out a list of the executives allowed to participate in the performance bonus plan for the coming fiscal year, along with maximum bonus amounts payable to each participant. The Company's Chief Executive Officer is then allowed to determine actual amounts payable to each participant, generally limited to such maximum amounts established by the Committee, based upon the Chief Executive Officer's evaluation of the individual's performance, subject to ratification by the Committee.

Stock Option Grants. For fiscal 2000, the Compensation Committee granted stock options to various executives, including the options granted to the Named Executives as reflected in the table above. Stock options are intended to focus the Company's key employees, including the Named Executives, on long-term Company performance which results in improvement in shareholder value and provides significant earnings potential to the executives.

Other Compensation Plans. The executive officers are able to defer a portion of their income to future years under the Company's Supplemental Executive Retirement Plan. In addition, at various times in the past the Company has adopted certain broad-based employee benefit plans in which the Company's executive officers, including the Named Executives, have been permitted to participate. The incremental cost to the Company of the Named Executives' benefits provided under these plans (which is not set forth in any of the tables above) equaled approximately 1% of their base salaries for fiscal 2000.

Other than with respect to the Company's Profit Sharing and Retirement Plan and its 1990 Employee Stock Purchase Plan, benefits under these plans are not directly or indirectly tied to Company performance.

Mr. McGoldrick's Fiscal 2000 Compensation

Mr. McGoldrick's compensation for fiscal 2000, as reflected in the Summary Compensation Table above, consisted of base compensation and a grant of an option to purchase 24,000 shares of the Company's common stock. Mr. McGoldrick's base salary for fiscal 2000 was increased 4.72% over his base salary paid for fiscal 1999. Mr. McGoldrick was not paid a performance bonus for fiscal year 2000, because the Company did not meet the target performance bonus standards set by the Committee.

SUBMITTED BY THE COMPENSATION COMMITTEE OF THE COMPANY'S BOARD OF DIRECTORS:

| George Heenan | Amos Heilicher | Malcolm McDonald | Fred L. Shapiro, M.D. |

11

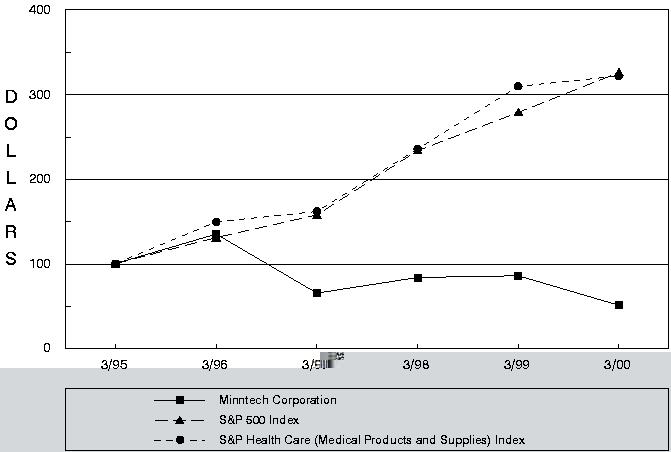

Performance Graph

The following graph compares the cumulative total shareholder return on the common stock of the Company for the last five fiscal years with the cumulative total return of the Standard & Poor's 500 Stock Index and the Standard & Poor's Health Care (Medical Products and Supplies) Index over the same period (assuming the investment of $100 in each on March 31, 1995, and the reinvestment of all dividends).

Comparison of Five-Year Cumulative Total Return Among Minntech Corporation,

the S&P 500 Stock Index and the S&P Health Care (Medical Products and Supplies) Index

| |

Year Ended March 31, |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

1995 |

1996 |

1997 |

1998 |

1999 |

2000 |

||||||

| Minntech Corporation | 100 | 135 | 66 | 84 | 86 | 51 | ||||||

| S&P 500 Index | 100 | 132 | 158 | 234 | 278 | 327 | ||||||

| S&P Health Care (Medical Product and Supplies) Index | 100 | 149 | 163 | 236 | 310 | 323 | ||||||

12

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

During the fiscal year ended March 31, 2000, the Company had a loan outstanding to Mr. McGoldrick, its President and Chief Executive Officer during that time period. The purpose of the loan was for the payment of taxes related to the exercise of options by Mr. McGoldrick in 1997. The highest amount outstanding of the loan during fiscal 2000 was $61,035. As of June 30, 2000, the outstanding balance of the loan was $62,838. During fiscal 2000, the loan bore interest at the rate of 5.91% per annum, compounded semi-annually. On March 29, 2000, the Compensation Committee adjusted the interest rate to 6.49% per annum, compounded semi-annually, and extended the loan period for another three years so that payment of principal and interest on the loan would be due on April 13, 2003. In connection with Mr. McGoldrick's separation from the Company effective July 7, 2000, however, the Company entered into an agreement with Mr. McGoldrick that accelerated the repayment terms of his loan (see "Summary Compensation Table," footnote (1), above).

DEADLINE FOR SUBMISSION OF SHAREHOLDERS' PROPOSALS

Proposals of shareholders prepared in accordance with the proxy rules and intended to be presented at the 2001 Annual Meeting of Shareholders and desired to be included in the Company's Proxy Statement and form of proxy for such meeting must be received by the Secretary of the Company, 14605 28th Avenue North, Minneapolis, Minnesota 55447, no later than March 29, 2001 for inclusion in the Proxy Statement for that meeting. Notice of shareholder proposals or nominations of directors intended to be presented at the 2001 Annual Meeting of Shareholders but not intended to be included in the Company's Proxy Statement and form of proxy for such meeting must be received by the Secretary of the Company, 14605 28th Avenue North, Minneapolis, Minnesota 55447, by June 1, 2001. If, however, the date of the 2001 Annual Meeting of Shareholders is more than 30 days before or after the first anniversary of the date of the 2000 Annual Meeting of Shareholders (i.e. August 30, 2001), notice of such proposal must be received by the Company at least 90 days before such meeting or, if later, within 10 days after the first public announcement of the date of the 2001 Annual Meeting of Shareholders. The proposals and nominations must also comply with all applicable statutes and regulations and the provisions of the Company's By-laws, as amended. The Company suggests that all such proposals be sent to the Company by certified mail, return receipt requested.

APPOINTMENT OF INDEPENDENT PUBLIC ACCOUNTANTS

At the meeting, a vote will be taken on a proposal to ratify the appointment of PricewaterhouseCoopers LLP by the Board of Directors to act as independent accountants of the Company for the year ending March 31, 2001. PricewaterhouseCoopers LLP, independent certified public accountants, have audited the Company's financial statements since 1995. A representative of PricewaterhouseCoopers LLP is expected to be present at the Annual Meeting to make a statement if such representative so desires and to respond to appropriate questions.

Solicitation

The Company will bear the cost of preparing, assembling and mailing the proxy, Proxy Statement, Annual Report to Shareholders and other material that may be sent to the shareholders in connection with this solicitation. Brokerage houses and other custodians, nominees and fiduciaries may be requested to forward soliciting material to the beneficial owners of stock, in which case they will be reimbursed by the Company for their expenses in doing so. Proxies are being solicited primarily by mail but, in addition, officers, employees and agents of the Company may solicit proxies personally by telephone or special letter without remuneration other than regular compensation.

13

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the Company's directors and executive officers, and persons who own more than 10% of a registered class of the Company's equity securities, to file with the Securities and Exchange Commission initial reports of ownership and reports of changes in ownership of common stock and other equity securities of the Company. These insiders are required by Securities and Exchange Commission regulations to furnish the Company with copies of all Section 16(a) forms they file, including Forms 3, 4 and 5.

To the Company's knowledge, based solely on a review of copies of such reports furnished to the Company and written representations that no other reports were required during and with respect to the fiscal year ended March 31, 2000, there were no failures in such fiscal year to file on a timely basis a report required under Section 16(a).

Other Matters

The Board of Directors does not intend to present to the meeting any matter not referred to above and does not presently know of any matters that may be presented to the meeting by others. However, if other matters come before the meeting, it is the intention of the persons named in the enclosed form of proxy to vote the proxy in accordance with their best judgment.

The Company is including with this Proxy Statement its Annual Report to Shareholders for the year ended March 31, 2000, which includes an audited balance sheet as of that date and the related statements of earnings, cash flows and stockholders' equity, as well as other financial information relating to the Company, including Management's Discussion and Analysis of Financial Condition and Results of Operations. Shareholders may receive, without charge, a copy of the Company's Annual Report on Form 10-K for the year ended March 31, 2000, as filed with the Securities and Exchange Commission, upon written request to Minntech Corporation, 14605 28th Avenue North, Minneapolis, Minnesota 55447, Attention: Chief Financial Officer, or through the Company's web site at www.minntech.com.

| By Order of the Board of Directors | ||||

| |

|

|

||

| Barbara A. Wrigley Secretary |

||||

July 27, 2000

14

| MINNTECH CORPORATION |

||

| ANNUAL MEETING OF SHAREHOLDERS |

||

| Wednesday, August 30, 2000 3:30 p.m. Central Daylight Time |

||

| Lutheran Brotherhood Auditorium 625 Fourth Avenue South Minneapolis, Minnesota |

||

| |

|

|

| MINNTECH CORPORATION 14605 28th Avenue North, Minneapolis, Minnesota 55447 |

Proxy | |||

This Proxy is solicited on behalf of the Board of Directors.

By signing this Proxy, you revoke all prior Proxies and appoint William Hope and Barbara A. Wrigley, or either one of them, as Proxies, each with the power to appoint his or her substitute and to act without the other, and authorize each of them to represent and to vote, as designated herein, all shares of common stock of MINNTECH CORPORATION (the "Company") held of record by the undersigned on July 7, 2000, at the Annual Meeting of Shareholders of the Company to be held on August 30, 2000 or at any adjournments thereof.

If no choice is specified, the proxy will be voted "FOR" Items 1 and 2.

See reverse for voting instructions.

| |

|

COMPANY # CONTROL # |

| There are three ways to authorize the voting of your shares by Proxy. | ||

Your Internet or telephone authorization authorizes the Named Proxies to vote your shares in the same manner as if you marked, signed and returned your proxy card.

VOTE BY INTERNET — http://www.eproxy.com/mntx/ — QUICK *** EASY *** IMMEDIATE

VOTE BY TELEPHONE — TOLL FREE — 1-800-240-6326 — QUICK *** EASY *** IMMEDIATE

VOTE BY MAIL

Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Minntech Corporation, c/o Shareowner ServicesSM, P.O. Box 64873, St. Paul, MN 55164-0873.

If you authorize the voting of your shares by Internet or telephone, please do not mail your proxy card.

Please detach here

The Board of Directors Recommends a Vote FOR Items 1 and 2.

| 1. | Election of directors: | 01 George Heenan | 02 Amos Heilicher | / / | Vote FOR all nominees (except as marked to the contrary below) |

/ / | Vote WITHHELD from all nominees |

|||||||

| (Instructions: To withhold authority to vote for any indicated nominee, write the number(s) of the nominee(s) in the box provided to the right.) |

|

|

||||||||||||

| 2. | Ratification of the appointment of PricewaterhouseCoopers LLP as the independent accountants of the Company for the fiscal year ending March 31, 2001. |

/ / | For | / / | Against | / / | Abstain |

THIS PROXY, WHEN PROPERLY EXECUTED, WILL BE VOTED AS DIRECTED. IF NO DIRECTION IS GIVEN, THIS PROXY WILL BE VOTED FOR EACH ITEM. THE PROXIES ARE AUTHORIZED TO VOTE IN THEIR DISCRETION WITH RESPECT TO OTHER MATTERS WHICH MAY PROPERLY COME BEFORE THE MEETING.

Address Change? Mark Box / /

Indicate changes below:

| Date | |||

| |

|

|

|

| Signature(s) in Box | |||

| Please sign exactly as your name(s) appear(s) on the Proxy. If held in joint tenancy, all persons must sign. Trustees, administrators, etc. should include title and authority. Corporations should provide the full name of corporation and title of authorized officer signing the Proxy. | |||

|

|