|

|

|

|

|

Previous: GUEST SUPPLY INC, 8-K, EX-99, 2000-12-19 |

Next: SELIGMAN MUNICIPAL FUND SERIES INC, 24F-2NT, 2000-12-19 |

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant [x]

Filed by a party other than the registrant [ ]

Check the appropriate box:

| [ ] | Preliminary Proxy Statement | [ ] | Confidential, For Use of the |

| [x] | Definitive Proxy Statement | Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

| [ ] | Definitive Additional Materials | ||

| [ ] | Soliciting material pursuant to Rule 14a-11(c) or Rule 14a-12 |

| eLOT, Inc. |

| (Name of Registrant as Specified in Its Charter) |

| N/A |

| (Name of Person(s) Filing Proxy Statement) |

Payment of Filing Fee (Check the appropriate box):

X No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

_____________________________________________________________________________________________

(2) Aggregate number of securities to which transactions applies:

_____________________________________________________________________________________________

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11

(set forth the amount

on which the filing fee is calculated and state how it was determined):

_____________________________________________________________________________________________

(4) Proposed maximum aggregate value of transaction:

_____________________________________________________________________________________________

(5) Total fee paid:

_____________________________________________________________________________________________

[ ] Fee paid previously with preliminary materials:

_____________________________________________________________________________________________

[ ]Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for

which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the

form or schedule and the date of its filing.

(1) Amount previously paid:

_____________________________________________________________________________________________

(2) Form, Schedule or Registration Statement No.:

_____________________________________________________________________________________________

(3) Filing Party:

_____________________________________________________________________________________________

(4) Date Filed:

_____________________________________________________________________________________________

eLOT, INC.

301 Merritt 7 Corporate Park

Norwalk, CT 06851

December 13, 2000

Dear Shareholder:

You are cordially invited to attend the Annual Meeting of Shareholders of eLOT, Inc., to be held at The Norwalk Inn & Conference Center, 99 East Avenue, Norwalk, Connecticut 06851, on January 25, 2001, at 10:00 a.m.

At the meeting, you will be asked to elect six directors of eLOT to serve until the 2001 annual meeting.

The Board of Directors of eLOT has fixed the close of business on December 8, 2000, as the record date for the meeting. Only shareholders of record on that date are entitled to notice of, and to vote at, the meeting or any adjournments or postponements of the meeting.

Whether or not you plan to attend the meeting, we urge you to sign and return the enclosed proxy so that your shares will be represented at the meeting. If you so desire, you can withdraw your proxy and vote in person at the meeting.

| Sincerely, | |||

| Edwin J. McGuinn President and Chief Executive Officer |

eLOT, Inc.

301 Merritt 7 Corporate Park

Norwalk, Connecticut 06851

PROXY STATEMENT

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

JANUARY 25, 2001

To the Shareholders of

eLOT, Inc.:

Notice is hereby given that the Annual Meeting of Shareholders of eLOT, Inc. will be held at The Norwalk Inn & Conference Center, 99 East Avenue, Norwalk, Connecticut 06851, on January 25, 2001, at 10:00 a.m., for the following purposes:

1. To elect six directors of eLOT to serve until the next annual meeting of shareholders; and

2. To transact such other business as may properly come before the meeting or any adjournments or postponements of the meeting.

Only shareholders of record at the close of business on December 8, 2000, are entitled to notice of, and to vote at, the meeting or any adjournments or postponements of the meeting.

| Barbara C. Anderson Senior Vice President, Law and Administration, and Secretary |

Norwalk, Connecticut

December 13, 2000

Whether or not you plan to attend the meeting, please complete, date and sign the enclosed proxy, which is solicited by eLOT’s Board of Directors, and return it in the self-addressed envelope provided for this purpose. The proxy may be revoked at any time before it is exercised, by written notice received by eLOT, by submitting a subsequently-dated proxy or by attending the meeting and voting in person.

A WARNING ABOUT FORWARD–LOOKING INFORMATION

eLOT makes forward-looking statements in this proxy statement and in its public documents, that are subject to risks and uncertainties. These forward-looking statements include information about possible or assumed future results of operations or the performance of eLOT. Also, when eLOT uses any of the words “believes,” “expects,” “anticipates” or similar expressions, it is making forward-looking statements. Many possible events or factors could affect the future financial results and performance of eLOT. These risks could cause results or performance to differ materially from those expressed in the forward-looking statements.

THE MEETING

Time, Date and Place

The Annual Meeting of Shareholders of eLOT will be held at The Norwalk Inn & Conference Center, Norwalk, Connecticut 06851, on January 25, 2001, at 10:00 a.m.

Business to be Conducted

At the meeting, the shareholders of eLOT will be asked:

Proxies; Voting and Revocation

When a proxy is properly executed and returned, the common stock that it represents will be voted in accordance with the directions indicated on the proxy. If no directions are indicated on a proxy with respect to the proposal to elect six directors to serve until the next annual meeting of shareholders, the shares represented by the proxy will be counted as votes to elect the nominated directors.

ELOT’S SHAREHOLDERS ARE REQUESTED TO COMPLETE, DATE AND SIGN THE ACCOMPANYING PROXY AND RETURN IT PROMPTLY TO ELOT IN THE ENCLOSED POSTAGE-PAID ENVELOPE, EVEN IF THEY ARE PLANNING TO ATTEND THE MEETING.

A shareholder who has given a proxy may revoke it at any time prior to its exercise at the meeting by:

All revocations of proxies should be addressed to eLOT as follows: eLOT, Inc., 301 Merritt 7 Corporate Park, Norwalk, Connecticut 06851, Attention: Barbara C. Anderson, Senior Vice President, Law and Administration, and Secretary.

Vote Required and Record Date

A majority of the total number of shares of common stock entitled to vote as of December 8, 2000, the record date, or 33,348,022 shares, must be present at the meeting in person or by proxy in order to constitute a quorum, allowing eLOT to transact business at the meeting. Only holders of record of common stock as of the close of business on the record date will be entitled to vote at the meeting. eLOT shareholders are entitled to one vote per share on any matter that properly comes before the meeting. If a share is represented for any purpose at the meeting, it is also deemed to be present for quorum purposes for all other matters. Abstentions and shares held in street name that properly are voted on any matter are included in determining the number of votes present and represented at the meeting. Shares held in street name that are not voted on any matter will not be included in determining whether a quorum is present at the meeting. The election of each nominee for director requires the affirmative vote of the holders of a plurality of the outstanding shares of common stock, cast in the election of directors. Approval of any proposals other than the election of directors requires the affirmative vote of a majority of the votes cast at the

meeting. Abstentions and shares held in street name that are not voted on the proposals will not be included in determining the number of votes cast.

Other Matters

The management of eLOT does not currently expect any other business to be brought before the meeting. If any matters come before the meeting that are not directly referred to in this proxy statement, including matters incident to the conduct of the meeting, the proxy holders will vote the shares represented by the proxies in accordance with the recommendations of eLOT’s management.

PROPOSAL 1

ELECTION OF DIRECTORS

Each director to be elected at the meeting will serve until the next annual meeting of shareholders. eLOT’s Bylaws give the eLOT Board of Directors the flexibility to designate the size of the Board within a range of five to nine members and to appoint new directors should suitable candidates come to its attention before the next annual meeting of shareholders. Consequently, the eLOT Board of Directors has the ability to respond to changing requirements and to take timely advantage of the availability of especially well-qualified candidates. Any such appointees to the eLOT Board of Directors cannot serve past the next annual meeting without shareholder approval. The size of the Board is currently six directors.

The following persons have been nominated by the eLOT Board of Directors as candidates for election as directors, and proxies not marked to the contrary will be voted in favor of their election. In accordance with the Bylaws of eLOT, as amended by the Board effective November 15, 2000, the Board has determined that each of incumbent directors Fernandes, Hectus, Seslowe and Gunn is qualified to serve as an independent director pursuant to the Bylaws. Mr. Gunn served as interim president of eLottery, Inc., the company’s subsidiary, for approximately four months and his consulting company was paid for his services. In addition, Mr. Gunn as a trustee indirectly engaged in a stock transaction with the Company in January 2000. Both transactions are more fully described in the section of this Proxy Statement below entitled “Certain Relationships and Related Transactions”. As permitted by the Bylaws, the other independent directors, Messrs. Fernandes, Hectus and Seslowe, have determined that notwithstanding these transactions, Mr. Gunn should be deemed to be independent for purposes of the Bylaws since he is not a current employee or an immediate family member of a current employee of the Company and in their opinion his prior relationships with the Company would not interfere with his exercise of independent judgment in carrying out the responsibilities of an independent director. The reasons for the Board’s determination include the Board’s judgment that Mr. Gunn’s assistance as interim president of eLottery was limited in scope and duration and intended to be temporary, that the compensation he received from the interim assignment was indirect and financially not material to Mr. Gunn, and the value of the indirect stock transaction to Mr. Gunn was not sufficient in magnitude or relationship to current management as to influence his judgments as to current management of the Company.

The election of each nominee for director requires the affirmative vote of the holders of a plurality of shares of common stock cast in the election of directors. Votes that are withheld and shares held in street name that are not voted in the election of directors will not be included in determining the number of votes cast. Certain information regarding each nominee is set forth below, including each individual’s principal occupation and business experience during at least the last five years, and the year in which the individual was elected a director of eLOT or one of its predecessor companies.

| Name |

Age |

Principal Occupation |

Director Since |

|||

| Edwin J. McGuinn, Jr. | 49 | President and Chief Executive Officer of the Company since May 2000. Prior to joining eLOT, since 1998, Mr. McGuinn was President and CEO of Automated Trading Systems, Inc. and its subsidiary, LIMITrader

Securities, Inc., an Internet based securities firm operating one of the first proprietary web-based systems for trading corporate bonds, medium term notes and high-yield bonds. From 1996 to 1998, Mr. McGuinn was Executive Vice President and head of operations at InterVest Securities, Inc., an electronic bond-trading network where he was responsible for all sales, marketing and trading operations. Prior thereto, he held executive management positions at Rodman & Renshaw Capital Group, Inc. (from 1995 to 1996), Lehman Brothers, and Mabon Securities. He spent eleven years at Lehman Brothers as a Managing Director where he was a member of the firm’s fixed income operating committee responsible for international trading, sales and research in New York, London and Tokyo. Mr. McGuinn is a CPA and holds a bachelor’s degree in mathematics and economics from Colgate University, and a master’s degree in accounting from NYU. |

2000 | |||

| Stanley J. Kabala | 57 | Chairman of the Company since May 2000. Prior thereto, President, Chief Executive Officer and Chairman of the Company since June 1998. Prior thereto, Mr. Kabala was President and Chief Executive Officer of Rogers Cantel Mobile Communications, the largest wireless telephone company in Canada, and Chief Operating Officer of its parent Rogers Communications, Inc., from 1996 through 1997. During 1995, he was President and Chief Executive Officer of Unitel Communications, Inc., Canada’s largest alternative long distance provider. From 1968 through 1994, Mr. Kabala held various positions at AT&T Corporation. | 1998 | |||

| Richard J. Fernandes | 42 | Founder and Chief Executive Officer since 1999 of Webloyalty.com. From 1989 until 1998, Mr. Fernandes served in several executive positions at CUC International, Inc., including President of its subsidiary Plextel Telecommunications,, a database-driven classified business, from 1996 to 1998, and Executive Vice President, Interactive Services and Senior Vice President, Interactive Services from 1993 to 1996. | 2000 | |||

| Philip D. Gunn | 48 | Co-founder and President of Growth Capital Partners, LLC, a professional merchant banking and venture capital investment firm. Before establishing Growth Capital Partners in 1982, Mr. Gunn was a Vice President in the Manufacturers Hanover Merchant Banking Group with overall responsibility for merger and acquisition advisory services. During the past twenty years, he has been active in structuring, negotiating, and financing corporate acquisitions, management buyouts and venture capital investments. | 1999 |

| Name |

Age |

Principal Occupation |

Director Since |

|||

| John P. Hectus | 56 | Retired. Mr. Hectus was President, AT&T Canada Enterprises from March 1999 to December 1999; Vice President, Finance and Chief Financial Officer, AT&T Canada Enterprises, from June 1998 to March 31, 1999; Senior Vice President and Chief Financial Officer, AT&T Canada, Inc. from February 1996 through May 1998; and Vice President and Chief Financial Officer, AT&T Caribbean & Latin America from January 1995 through January 1996. Prior thereto, he held various executive positions within AT&T Corporation. | 1998 | |||

| Jerry M. Seslowe | 54 | Managing Director of Resource Holdings Ltd., an investment and financial consulting firm, since 1983. Prior to 1983, Mr. Seslowe was a partner at KPMG Peat Marwick, a provider of investment and financial services. Mr. Seslowe has served as a director of eLOT since February 1996 and prior to eLOT’s acquisition of eLottery was a director of eLottery. Mr. Seslowe is a certified public accountant and an attorney. | 1996 |

Director Compensation

Each director of eLOT other than Mr. McGuinn was granted upon his reelection to the Board on December 14, 1999, and any new director may be granted upon his or her initial election to the Board, an option to purchase 100,000 shares of eLOT’s common stock, at the market price on the date of election, under the terms of eLOT’s 1999 Stock Incentive Plan approved by the shareholders on December 14, 1999. Each director elected at the 1999 Annual Meeting was granted an option to purchase 100,000 eLOT shares at the market price at December 14, 1999 of $3.875 per share, and Mr. Fernandes was granted an option to purchase 100,000 shares at $7.375 per share, the market price on March 3, 2000, when he was elected to the Board. In addition, during 2000, each non-employee director was paid a fee of $500 per Board or Committee meeting attended and reimbursement of expenses incurred in attending Board and Committee meetings.

As of December 14, 1999, when the new Stock Incentive Plan was adopted, 127,800 shares had been issued upon exercise of options granted under the terms of the 1990 Directors’ Stock Option Plan, and options to purchase 115,100 shares of common stock were outstanding under the terms of that plan. An aggregate of up to 250,000 shares were issuable under the 1990 plan. During 1999, Mr. Philip Gunn received options to purchase 4,500 shares under the 1990 plan upon his initial election to the Board. No other grants were made to current directors under the prior Plan in 1999.

Prior to the 1999 Annual Meeting, the Company’s director compensation program provided that each director who did not receive other direct compensation from eLOT also received upon his or her initial election to the Board a warrant to purchase 25,000 shares of eLOT common stock at the market price at the date of grant. Each warrant has a term of five years. Under this program, the following warrants were granted to current directors upon their initial election to the Board:

| Name |

Date of Grant |

Warrant Price Per Share |

||

| Philip D. Gunn | May 21, 1999 | $5.31 | ||

| John J. Hectus | November 18, 1998 | $1.25 | ||

| Jerry M. Seslowe | February 1, 1996 | $2.63 |

eLOT also reimburses directors for the travel and accommodation expenses incurred in attending Board meetings.

Board and Committee Activities

During 1999, the Board of Directors met on nine occasions. All directors attended more than 75% of the total number of meetings of the Board and of all committees of which they were members during 1999. During 1999, the Board had two standing committees, an Audit Committee and a Compensation Committee.

The function of the Audit Committee is to recommend the selection of auditors and to review the audit report and the adequacy of internal controls. The Audit Committee met twice during 1999. The members of the Audit Committee during 1999 were Stanley M. Blau (until his resignation from the Board on September 30, 1999), Philip Gunn (following Mr. Blau’s resignation) and John Hectus. The current members of the Audit Committee are John Hectus (Chairman), Rick Fernandes and Philip Gunn. Effective January 1, 2001, the members of the Audit Committee shall be John Hectus (Chairman), Rick Fernandes and Jerry Seslowe.

The Compensation Committee recommends to the full Board the compensation arrangements, stock option grants and other benefits for executive management of Executone as well as the incentive plans to be adopted by Executone. The Compensation Committee met once during 1999. The members of the Compensation Committee until December 14, 1999 were Jerry Seslowe and Louis Adler. The members of the Compensation Committee are currently John Hectus and Jerry Seslowe.

Effective November 15, 2000, the Board amended the Bylaws of the Company to require a Lead Director of the independent directors, and a Nominating Committee and a Transaction Committee of the Board, all of the members of which shall be independent as defined in the Bylaws. The independent directors have selected John Hectus as the Lead Director in accordance with the Bylaws. The Nominating Committee shall be responsible for the evaluation and nomination of Board members. The Nominating Committee will consist of Rick Fernandes and John Hectus. The Transaction Committee shall be responsible for reviewing all related-party transactions involving the Corporation, and considering and making recommendations to the full Board with respect to all proposals involving (a) a change in control, or (b) the purchase or sale of assets constituting more than 10% of the Corporation’s total assets. The Transaction Committee will consist of Jerry Seslowe and Phil Gunn.

OWNERSHIP OF EQUITY SECURITIES

The following table lists any person (including any “group” as that term is used in Section 13(d)(3) of the Exchange Act) who, to the knowledge of eLOT, was the beneficial owner as of October 31, 2000, of more than 5% of the outstanding voting shares of the Company. Unless otherwise noted, the owner has sole voting and dispositive power with respect to the securities.

| Title of Class |

Name and Address of Beneficial Owner |

Amount and Nature of Beneficial Ownership |

Percent of Class (1) |

||||

| Common Stock | Heartland Advisors, Inc. 790 North Milwaukee Street Milwaukee, WI 53202 |

6,781,700 | 10.17% |

______________

(1) Percentages shown are based upon 66,696,043 shares of common stock actually outstanding as of October 31, 2000.

The following table sets forth, as of October 31, 2000 (except as otherwise indicated), the beneficial ownership of the Company’s voting shares by all current directors and nominees of the Company, the Chief Executive Officer, the former Chief Executive Officer, the four next most highly compensated executive officers in 1999, and all current directors and executive officers of the Company as a group. Unless otherwise indicated, each person listed below has sole voting and investment power over all shares beneficially owned by him.

| Title of Class |

Name of Beneficial Owner |

Amount and Nature of Beneficial Ownership |

Percentage of Class (1) |

||||

| Common Stock | James E. Cooke | 226,971 | (2) | * | |||

| Robert C. Daum | 1,000,000 | (3) | 1.48 | % | |||

| Richard J. Fernandes | 170,000 | (4) | * | ||||

| Philip D. Gunn | 334,500 | (5) | * | ||||

| John P. Hectus | 179,700 | (6) | * | ||||

| Robert W. Hopwood | 63,998 | (7) | * | ||||

| Stanley J. Kabala | 627,206 | (8) | * | ||||

| Edwin J. McGuinn, Jr. | 2,000,000 | (9) | 2.91 | % | |||

| Jerry M. Seslowe | 692,315 | (10) | * | ||||

| Edward R. Stone, Jr. | 250,161 | (11) | * | ||||

| Michael W. Yacenda | 1,092,883 | (12) | 1.68 | % | |||

| All Current Directors and | 6,818,290 | (13) | 9.41 | % | |||

| Officers as a Group | |||||||

| (10 Persons) |

______________

* Less than 1% of the class.

(1) Information is provided as reported to the Company as of October 31, 2000 for all owners except James E. Cooke, as to whom the information is provided as of December 31, 1999 when he ceased to be an officer of the Company in connection with the sale of the computer telephony business, and Edward R. Stone, as to whom the information is provided as of July 2000, when he ceased to be an officer of the Company in connection with the sale of the healthcare business. With respect to the Common Stock, percentages shown are based upon 66,696,043 shares of Common Stock actually outstanding as of October 31, 2000. In cases where the beneficial ownership of the individual or group includes options, warrants or convertible securities, the percentage is based on 66,696,043 shares actually outstanding, plus the number of shares issuable upon exercise or conversion of any such options, warrants or convertible securities held by the individual or group. The percentage does not reflect or assume the exercise or conversion of any options, warrants or convertible securities not owned by the individual or group in question.

(2) Includes 85,000 shares issuable upon exercise of options that were exercisable as of January 1, 2000.

(3) Includes 583,833 shares issuable upon exercise of options that are exercisable within 60 days of December 11, 2000, and 416,167 shares issuable upon exercise of options that are not exercisable within 60 days of December 11, 2000.

(4) Includes 50,000 shares issuable upon exercise of options that are exercisable within 60 days of December 11, 2000, and 50,000 shares subject to options that are not exercisable within 60 days of December 11, 2000.

(5) Includes 309,500 shares subject to options and 25,000 shares subject to warrants that are exercisable within 60 days of December 11, 2000.

(6) Includes 154,700 shares issuable upon exercise of options and 25,000 shares issuable upon exercise of warrants that are exercisable within 60 days of December 11, 2000.

(7) Includes 188,300 shares issuable upon exercise of options that are exercisable within 60 days of December 11, 2000, and 61,700 shares subject to options that are not exercisable within 60 days of December 11, 2000.

(8) Includes 340,000 shares issuable upon exercise of options that are exercisable within 60 days of December 11, 2000.

(9) Includes 600,000 shares issuable upon exercise of options that are exercisable within 60 days of December 11, 2000, and 1,400,000 shares issuable upon exercise of options that are not exercisable within 60 days of December 1, 2000.

(10) Includes 153,600 shares subject to options and 25,000 shares subject to warrants that are exercisable within 60 days of December 11, 2000. Also includes 25,467 shares of Common Stock owned and 125,000 shares of Common Stock subject to exercisable options and warrants held by Resource Holdings Associates, of which Mr. Seslowe is a managing director and in which he holds a greater than 10% ownership interest.

(11) Includes 250,000 shares subject to options that are exercisable within 60 days of December 11, 2000.

(12) Includes 1,600 shares issuable upon conversion of the Company’s Debentures, of which Mr. Yacenda beneficially owns $17,000 in principal amount or less than 1% of the outstanding principal amount. Includes 564,900 shares subject to options that are exercisable within 60 days of December 11, 2000, and 185,100 shares subject to options that are not exercisable within 60 days of December 11, 2000.

(13) Includes 3,223,200 shares issuable upon exercise of options that are exercisable within 60 days of December 11, 2000, 2,284,600 shares issuable upon exercise of options that are not exercisable within 60 days of December 11, 2000, 175,000 shares issuable upon exercise of warrants that are exercisable within 60 days of December 11, 2000, and 14,024 shares issuable upon conversion of the Company’s Debentures.

EXECUTIVE OFFICERS of ELOT

The executive officers of eLOT are as follows:

| Name |

Age |

Position with ELOT |

|||

| Edwin J. McGuinn, Jr. | 49 | President and Chief Executive Officer | |||

| Robert C. Daum | 48 | Executive Vice President, Finance and Development | |||

| Michael W. Yacenda | 49 | Executive Vice President and President, eLottery, Inc. | |||

| Barbara C. Anderson | 48 | Senior Vice President, Law and Administration and Secretary | |||

| David J. Parcells | 42 | Vice President and Chief Financial Officer |

Edwin J. McGuinn has been President and Chief Executive Officer of the Company since May 2000. Prior to joining eLOT, since 1998, Mr. McGuinn was President and CEO of Automated Trading Systems, Inc. and its subsidiary, LIMITrader Securities, Inc., an Internet based securities firm operating one of the first proprietary web-based systems for trading corporate bonds, medium term notes and high-yield bonds. From 1996 to 1998, Mr. McGuinn was Executive Vice President and head of operations at InterVest Securities, Inc., an electronic bond-trading network where he was responsible for all sales, marketing and trading operations. Prior thereto, he held executive management positions at Rodman & Renshaw Capital Group, Inc. (from 1995 to 1996), Lehman Brothers, and Mabon Securities. He spent eleven years at Lehman Brothers as a Managing Director where he was a member of the firm’s fixed income operating committee responsible for international trading, sales and research in New York, London and Tokyo. Mr. McGuinn is a CPA and holds a bachelor’s degree in mathematics and economics from Colgate University, and a master’s degree in accounting from NYU.

Robert C. Daum has been Executive Vice President, Finance and Development, since February 2000. From 1978 to 1999, Mr. Daum was employed in the investment banking industry, focused on corporate finance and mergers and acquisitions. Between 1994 and 1999 he was a Managing Director with Warburg Dillon Read and a predecessor, UBS securities. Prior to 1994, Mr. Daum was employed by Prudential Securities, Merrill Lynch & Co., and Dillon Read and Co., Inc. He holds a B.A. from Colgate University and an M.B.A. from Harvard University.

Michael W. Yacenda has served as Executive Vice President of eLOT since January 1990, and as President of eLottery and its subsidiary, UniStar Entertainment since 1996. Prior to that time, he was Vice President, Finance and Chief Financial Officer of eLOT from July 1988 to January 1990. He served as a Vice President of ISOETEC from 1983 to 1988. From 1974 to 1983, Mr. Yacenda was employed by the public accounting firm, Arthur Andersen & Co. Mr. Yacenda is a certified public accountant.

Barbara C. Anderson has been Senior Vice President, Law and Administration and Secretary of eLOT since January 2000. Prior to that time, she was Vice President, Law & Administration since October 1998, and Vice President, General Counsel and Secretary since 1990. From 1985 to 1989, she was Corporate Counsel of United States Surgical Corporation, a manufacturer of medical devices. She holds a B.A. from Middlebury College and a J.D. from New York University.

David J. Parcells has served as Vice President and Chief Financial Officer since January 2000. Prior to that he served as President and Chief Financial Officer of Sentinel Business Systems, Inc. from 1998-2000. From 1993 to 1998, Mr. Parcells served as Vice President, Operations for Swiss Army Brands, Inc. Prior thereto, he was Senior Manager for Arthur Andersen, LLP from 1985-1993. Mr. Parcells sits on the Board of St. Vincent’s Medical Center Foundation. He is a graduate from Providence College and a Certified Public Accountant.

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth the compensation by the Company of the former Chief Executive Officer, and the four most highly compensated other executive officers of the Company in 1999, for services in all capacities to the Company and its subsidiaries during the three fiscal years ended December 31,1999. The current President and Chief Executive Officer, Edwin J. McGuinn, received no compensation from the Company during the three years ended December 31, 1999.

| Annual Compensation | Long-Term Compensation | ||||||||||||||||||

| Name and Principal Position | Year | Salary ($) |

Bonus ($) |

Other Annual Compensation ($) |

Awards of Options/ SARs (#) |

All Other Compensation ($) (1) |

|||||||||||||

| Stanley J. Kabala (2) | 1999 | 300,000 | 633,833 | 0 | 50,000 | 6,493 | |||||||||||||

| Chairman of the Board, | 1998 | 144,231 | 151,562 | 91,936 | 400,000 | 6,072 | |||||||||||||

| President and Chief | — | — | — | — | — | — | |||||||||||||

| Executive Officer | |||||||||||||||||||

| Michael W. Yacenda | 1999 | 262,400 | 0 | 0 | 500,000 | 6,708 | |||||||||||||

| Executive Vice President | 1998 | 262,203 | 0 | 0 | 0 | 6,072 | |||||||||||||

| President, eLottery, Inc. | 1997 | 256,000 | 0 | 0 | 0 | 5,997 | |||||||||||||

| Edward W. Stone, Jr. | 1999 | 215,000 | 0 | 0 | 0 | 1,035 | |||||||||||||

| Senior Vice President, | 1998 | 32,250 | 0 | 0 | 0 | 129 | |||||||||||||

| Chief Financial Officer | — | — | — | — | — | — | |||||||||||||

| James E. Cooke III | 1999 | 215,000 | 0 | 15,542 | 0 | 2,332 | |||||||||||||

| Vice President, Sales, | 1998 | 163,942 | 19,250 | 18,475 | 100,000 | 3,510 | |||||||||||||

| Telephony Division | 1997 | 125,000 | 11,750 | 17,664 | 0 | 2,560 | |||||||||||||

| Robert W. Hopwood | 1999 | 150,000 | 26,250 | 0 | 250,000 | 1,603 | |||||||||||||

| Vice President, Operations, | 1998 | 139,460 | 16,000 | 0 | 0 | 1,902 | |||||||||||||

| eLottery, Inc. | 1997 | 130,000 | 10,000 | 0 | 0 | 2,707 | |||||||||||||

______________

(1) “All Other Compensation” includes for each individual a matching contribution by the Company under the Company’s 401(k) plan in the amount of $660 each for each year. This column also includes premiums paid by the Company for long-term disability and life insurance for the following individuals in the following amounts in 1999: Mr. Kabala, $5,833; Mr. Yacenda, $6,048; Mr. Stone, $375; Mr. Cooke, $1,662 and Mr. Hopwood, $943; in the following amounts in 1998: Mr. Kabala, $5,412; Mr. Yacenda, $5,412; Mr. Stone, $129; Mr. Cooke, $2,850, and Mr. Hopwood, $1,242; and in the following amounts in 1997: Mr. Yacenda, $5,337; Mr. Cooke, $2,560; and Mr. Hopwood, $2,047

(2) Mr. Kabala was elected Chairman, President and Chief Executive Officer effective June 28, 1998 and resigned as President and Chief Executive Officer in May 2000. See the discussion of his employment agreement below. The amounts shown as bonuses fro 1998 and 1999 represent the taxable value of stock granted pursuant to his employment agreement described below.

Employment Agreements

In June 1998, the Company entered into an employment agreement with Stanley J. Kabala, its Chairman of the Board, President and Chief Executive Officer, for an initial term of one year. The employment agreement provided for a minimum base salary of $300,000 per year, eligibility for a incentive bonus of 150,000 shares of Common Stock upon achievement of objective performance goals set by the Board of Directors, a signing bonus of 200,000 restricted shares of Common Stock vesting ratably over 12 months and an initial stock option covering 200,000 shares of Common Stock vesting ratably over 12 months. The agreement further provided that in the event of the termination of Mr. Kabala’s employment by the Company without cause or his voluntary termination of employment upon certain events, including diminution of his responsibilities or a change of control, the Company would pay Mr. Kabala his base salary for the remainder of the initial term, a prorated bonus and continuation of

medical insurance coverage, and his restricted stock and stock options would vest immediately. In August 1999, the Board of Directors approved the extension of Mr. Kabala’s employment on a month-to-month basis, to continue at least until the earlier of the closings of the sales of the computer telephony and healthcare communications businesses or March 31, 2000, at the same salary. The Board also granted 50,000 shares to Mr. Kabala as further compensation for his services during the prior year, and approved a contingent grant of 25,000 additional shares and an option to purchase 100,000 shares at $4.125 per share, contingent upon his employment throughout the sales of the telephone and healthcare businesses to buyers other than a management group in which he participates.

In May 2000, Mr. Kabala resigned as President and Chief Executive Officer. He retained his position as non-employee Chairman of the Board.

In May 2000, the Company entered into an employment agreement with Edwin J. McGuinn, its President and Chief Executive Officer, for an initial term of three years. The employment agreement provides for a minimum base salary of $325,000 per year, eligibility for a incentive bonus equal to 50% of salary upon achievement of objective performance goals set by the Board of Directors, and an initial stock option covering 2,000,000 shares of Common Stock vesting in quarterly increments over 36 months. The agreement further provides that in the event of the termination of Mr. McGuinn’s employment by the Company without cause or his voluntary termination of employment upon certain events, including diminution of his responsibilities or a change of control, the Company would pay Mr. McGuinn his base salary for the remainder of the initial term or one year, whichever is longer, and a prorated bonus for the year in which termination occurs, and his stock options would vest immediately and be exercisable for the balance of the option term or three years, whichever is shorter.

Option Grants in Last Fiscal Year

The following table sets forth individual grants of stock options and stock appreciation rights made during 1999 to each of the executive officers named in the Summary Compensation Table above. There were no grants of stock appreciation rights (SARs) to any officers in 1999.

OPTION GRANTS IN LAST FISCAL YEAR

| Individual Grants | |||||||||||||||||||

| Number of Securities Underlying Options |

% of Total Options Granted to Employees in Fiscal |

Exercise or Base Price |

Expiration | Potential Realizable Value At Assumed Annual Rates of Stock Price Appreciation For Option Term (1) |

|||||||||||||||

| Name | Granted (#) | Year | ($/sh) | Date | 5%($) | 10% ($) | |||||||||||||

| Stanley J. Kabala | 100,000 | 4.5 | % | 3.875 | 12/14/04 | 107,059 | 236,573 | ||||||||||||

| Michael W. Yacenda | 500,000 | 22.6 | % | 1.25 | 12/14/09 | 3,803,964 | 6,427,385 | ||||||||||||

| Edward W. Stone, Jr. | 0 | 0 | — | — | — | — | |||||||||||||

| James E. Cooke III | 0 | 0 | — | — | — | — | |||||||||||||

| Robert W. Hopwood | 250,000 | 11.3 | % | 1.25 | 12/14/09 | 1,901,982 | 3,213,693 | ||||||||||||

______________

(1) Based upon the last sale price on December 31, 1999 of $5.438 per share of Common Stock.

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

The following table sets forth each exercise of stock options made during the year ended December 31, 1999 by the current Chief Executive Officer, and the four most highly compensated other executive officers and the fiscal year-end value of unexercised options held by those individuals as of December 31, 1999. There were no exercises or holdings of stock appreciation rights by any officers during 1999, and there are no outstanding stock appreciation rights.

| Name | Shares Acquired on Exercise (#) |

Value Realized ($) |

Number of Unexercised Options at Fiscal Year-End(#) Exercisable/ Unexercisable |

Value of Unexercised In-the Money Options at Fiscal Year-End ($) (1) Exercisable/ Unexercisable |

|||||||||

| Stanley J. Kabala | 0 | 0 | 300,000/0 | 843,900/0 | |||||||||

| Michael W. Yacenda | 0 | 0 | 210,000/290,000 | 879,480/1,214,520 | |||||||||

| Edward W. Stone, Jr. | 0 | 0 | 250,000/0 | 1,078,250/0 | |||||||||

| James E. Cooke III | 0 | 0 | 85,000/0 | 346,605/0 | |||||||||

| Robert W. Hopwood | 0 | 0 | 250,000/145,000 | 439,740/607,260 | |||||||||

______________

(1) Based upon the last sale price on December 31, 1999 of $5.438 per share of Common Stock.

Compensation Committee Report on Executive Compensation

It is the responsibility of the Compensation Committee of the Board of Directors to administer the Company’s incentive plans, review the performance of management and approve the compensation of the Chief Executive Officer and other executive officers of the Company.

The Compensation Committee believes that the Company’s success depends on the coordinated efforts of individual employees working as a team toward defined common goals. The objectives of the Company’s compensation program are to align executive compensation with business objectives, to reward individual and team performance furthering the business objectives, and to attract, retain and reward employees who will contribute to the long-term success of the Company with competitive salary and incentive plans.

Specifically, executive compensation decisions are based on the following factors:

1. The total direct compensation package for the Company’s executives is made up of three elements: base salary, a short-term incentive program in the form of a performance-based bonus, and a long-term incentive program in the form of stock options and other inducements to own the Company’s stock.

2. The Committee believes that the total compensation of all executives should have a large incentive element that is dependent upon overall Company performance measured against objectives established at the beginning of the fiscal year. Bonus and stock opportunities represent a significant portion of the total compensation package, in an attempt to further the Company’s goal of linking compensation more closely to the Company’s performance. The percentage of direct compensation that is dependent upon the Company’s attainment of its objectives also generally increases as the responsibility of the officer in question for the overall corporate performance increases.

3. Total compensation levels, i.e., base salary, bonus potential, and number of stock options, are established by individual levels of responsibility and reference to competitive compensation levels for executives performing similar functions and having equivalent levels of responsibility. However, whether actual bonuses are paid to each executive depends upon the achievement of Company profitability goals.

4. Merit increases in base salary for executives other Mr. Kabala were reviewed on an individual basis by Mr. Kabala and increases were dependent upon a favorable evaluation by Mr. Kabala of individual executive performance relative to individual goals, the functioning of the executive’s team within the corporate structure, success in furthering the corporate strategy and goals, and individual management skills. Based upon his evaluation, Mr. Kabala recommended base salary increases to the Committee for its approval.

5. In addition to base salary and merit increases, the Compensation Committee considers cash incentive bonuses or stock awards for its executive officers, including the Chief Executive Officer, both prospectively based upon the attainment of specific performance goals, and retrospectively based upon the Committee’s discretionary

judgment as to the performance during the year of the Company and its executive officers or other considerations deemed appropriate at the time. There was no general bonus or incentive plan in effect for executive officers during 1999. In 1999, the Committee approved no bonus payments to Mr. Kabala or any of the four other highest paid executive officers for 1999, except a stock award of 50,000 shares of Common Stock to Mr. Kabala in connection with his individual performance through June 1999 and the extension of his employment through the sale of the telephony and healthcare businesses, and a cash bonus paid to one of the four other highest paid executive officers based on his individual performance.

The Committee reserves the right to make discretionary bonus awards in appropriate circumstances where an executive might merit a bonus based on other considerations.

6. In June 1998, the Company entered into an employment agreement with Stanley J. Kabala, its Chairman of the Board, President and Chief Executive Officer, as described above under “Executive Compensation.” In August 1999, the Committee and the Board approved the month-to-month extension of Mr. Kabala’s employment through the sale of the Company’s telephony healthcare businesses and the DCC investment or March 31, 2000, at the same salary and granted Mr. Kabala (i) a bonus stock award of 50,000 shares and (ii) the opportunity for Mr. Kabala to earn an additional stock bonus of 25,000 shares of Common Stock and an option to purchase 100,000 shares at $4.125 per share upon the closing of the sale of the telephony and healthcare businesses and the DCC investment. The contingent compensation described in (ii) was not earned due to Mr. Kabala’s resignation as an officer and employee prior to the sale of the healthcare business and DCC investment.

7. All executives, including the Chief Executive Officer, are eligible for stock option grants under the employee stock option plans applicable to employees generally, as approved by the Compensation Committee. The number of options granted to any individual depends on individual performance, salary level and competitive data. In addition, in determining the number of stock options granted to each senior executive, the Compensation Committee reviews the unvested options of each executive to determine the future benefits potentially available to the executive. The number of options granted will depend in part on the total number of unvested options deemed necessary to create a long-term incentive on the part of the executive to remain with the Company in order to realize future benefits.

In 1999, the Committee approved stock option grants for two of the four other highest paid executive officers named in the table, Mr. Yacenda and Mr. Hopwood, based upon their assuming the positions of President and Vice President, Operations, respectively, of eLottery, Inc. and its eLotteryFreeWay operations. The Board of Directors and the Compensation Committee believes that the option grants were necessary to retain the executives and for the successful development and operation of the eLotteryFreeWay and implementation of eLottery’s new business plan. The options are subject to a vesting schedule over three years in order to encourage the executives to continue their employment with the Company.

In conclusion, the Compensation Committee believes that the base salary, bonus and stock options of the Company’s Chief Executive Officer and other executives are appropriate in light of competitive pay practices and the Company’s performance against short and long-term performance goals.

| JOHN P. HECTUS JERRY M. SESLOWE |

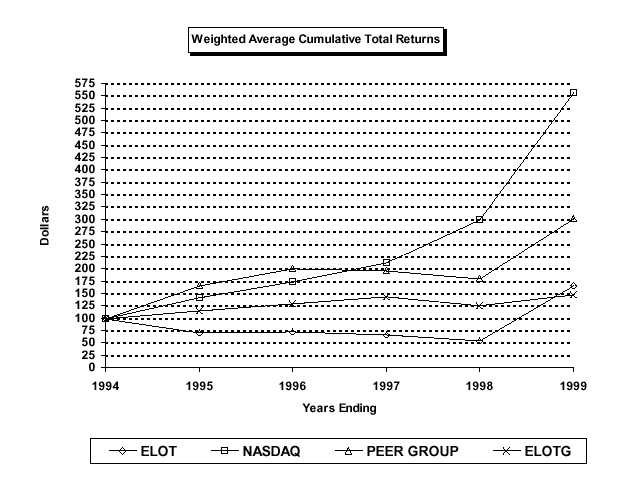

PERFORMANCE GRAPH

The graph below compares, for the last five fiscal years, the yearly percentage change in cumulative total returns (assuming reinvestment of dividends and interest) of (i) the Company’s Common Stock, (ii) the Company’s Debentures, (iii) the NASDAQ Stock Market and (iv) a peer group index constructed by the Company (the “Peer Group”).

FOR FUTURE YEARS, THE PEER GROUP WILL BE RECONFIGURED TO BE COMPOSED OF COMPANIES IN THE BUSINESSES IN WHICH ELOTTERY AND ELOT ARE ENGAGED AFTER THE SALE OF THE COMPUTER TELEPHONY AND HEALTHCARE COMMUNICATIONS BUSINESSES.

The Peer Group for 1999 for the telephony and healthcare businesses consisted of the following companies:

| Aspect Telecommunications Corp. | Inter-Tel, Incorporated. | |

| Centigram Communications Corp. | Microlog Corporation | |

| Comdial Corporation | Mitel Corporation | |

| Davox Corporation | Norstan, Inc. | |

| Electronic Information Systems, Inc. | Syntellect, Inc. | |

| InterVoice, Inc. | Teknekron Communications Systems, Inc.(TCSI) |

The Peer Group included companies that, until the sale of the computer telephony business to Inter-Tel, competed with the Company in the general voice communications equipment area as well as those active in several more specialized areas, such as ACD (automatic call distribution), voice mail, interactive voice response systems, and predictive dialing systems, as well as additional general voice communications companies. The Company believes that the mix of the companies in the Peer Group accurately reflected the mix of businesses in which the Company was engaged until the sale to Inter-Tel and the planned sale of the healthcare communications business.

The returns of each Peer Group issuer have been weighted in the graph below to reflect that issuer’s stock market capitalization at the beginning of each calendar year.

Comparison of Five-Year Cumulative Return

Among ELOT, including the Common

Stock (“ELOT”) and the Debentures (“ELOTG”),

the NASDAQ (US) Index and the Company’s

Peer Group

| Weighted Average Cumulative Total Returns | 1994 | 1995 | 1996 | 1997 | 1998 | 1999 | |||||||||||||

| ELOT | $ | 100 | $ | 71 | $ | 73 | $ | 67 | $ | 54 | $ | 167 | |||||||

| NASDAQ | $ | 100 | $ | 141 | $ | 174 | $ | 213 | $ | 300 | $ | 556 | |||||||

| PEER GROUP | $ | 100 | $ | 166 | $ | 200 | $ | 197 | $ | 180 | $ | 301 | |||||||

| ELOTG | $ | 100 | $ | 116 | $ | 129 | $ | 144 | $ | 126 | $ | 147 | |||||||

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The members of the Compensation Committee are Jerry Seslowe and John Hectus.

No member of the Committee is a former or current officer or employee of the Company or any subsidiary.

No executive officer of the Company served as a director or a member of the Compensation Committee or of the equivalent body of any entity, any one of whose executive officers serve on the Compensation Committee or the Board of Directors of the Company.

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires that eLOT’s directors and executive officers, and persons who own more than 10% of a registered class of eLOT’s equity securities, file with the Securities and Exchange Commission initial reports of ownership and reports of change in ownership of common stock and other equity securities of eLOT. Officers, directors and greater than 10% shareholders are required by SEC regulation to furnish eLOT with copies of all Section 16(a) forms that they file.

To eLOT’s knowledge, based solely on review of the copies of such reports furnished to eLOT, and written representations that no other reports were required, during the fiscal year ended December 31, 1999, all Section 16(a) filing requirements applicable to its officers, directors and greater than 10% beneficial owners were complied with.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

The 1994 Executive Stock Incentive Plan (the “Executive Plan”), approved by shareholders at the 1994 Annual Meeting, was implemented in October 1994 with 30 employees participating. Under the terms of the Executive Plan, eligible key employees were granted the right to purchase shares of the Company’s Common Stock at the market price, which was $3.1875 per share at the time of purchase. Participating employees financed the purchases of these shares through loans by the Company’s bank lender at the prime rate less 1/4%, payable over five years. The loans were fully-recourse to the participating employees but were guaranteed by letters of credit from the Company to the lending bank. The Company lent the employee 85% of the interest due to the bank. The Company held the purchased Common Stock as security for its guarantees of the repayment of the loans. Sales of the shares purchased under the Plan were subject to certain restrictions.

In December 1997, the Compensation Committee of the Board of Directors of the Company agreed, subject to the Company obtaining the agreement of the lending bank, that it would allow the participant loans to remain outstanding until December 2001 instead of requiring repayment in August 1999, and that it would defer collection from each participant of the 15% of the 1997 interest on the loans that would otherwise have been currently payable to the Company. The Committee also decided to waive certain restrictions in the Plan to allow participants to sell a portion or all of their Plan stock in 1998, subject to applicable legal requirements and to repayment of the loan with the proceeds of the shares sold.

In June 1998, the Board of Directors approved a Transition and Retention Plan (the “Transition Plan”) and offered it to certain participants in the Executive Plan including all of the executive officers as noted in the table below. The Transition Plan provided, in exchange for a release of all prior claims by the participant, defined retention and severance payments, option grants at current market value and deferral of all loan interest to the participant. A participant in the Transition Plan earned, through continued employment over a period of three years, a retention payment of up to 110% of any shortfall of the market value of the Common Stock purchased with the loan below the loan’s outstanding principal and interest. The amount of this retention payment would have been determined, and the payment become payable, only if and when the participant’s employment with the Company ended without a prior repayment of the loan. In the event the Company terminates the participant’s employment without cause, or a change of control of the Company occurs, the retention payment became fully vested and payable immediately. Under certain circumstances, such as termination by the Company of the participant’s employment following a change of control or otherwise without cause as defined in the Transition Plan, the participant is also entitled to continuation of salary and benefits for nine months.

The following table contains information about borrowings in excess of $60,000 by current executive officers and executive officers named in the Compensation Table that were outstanding during 1999 pursuant to the Executive Plan and that were or are guaranteed by the Company. The amounts listed below also include the interest paid by the Company to the bank, reimbursement of which was owed by the individual to the Company. No director, nominee, or beneficial owner of more than 5% of any class of voting securities was eligible for participation in the Executive Plan. All the persons listed below became fully vested in the retention payment under the Transition Plan as a result of the sale of the computer telephony business to Inter-Tel on January 1, 2000. Under the Transition Plan the individuals could have required the Company to repay the bank loan and retain the covered stock. However, during 2000, the individuals instead elected to sell the stock in the open market and repay the loan including accrued interest to the Company, except as indicated below.

| Name | Highest Amount of Indebtedness Between January 1, 1998 and October 31, 2000, Including Accrued Interest |

Unpaid Indebtedness at October 31, 2000, Including Accrued Interest |

|||||

| Barbara C. Anderson | $ | 257,621 | 0 | ||||

| James E. Cooke III | $ | 435,837 | 0 | ||||

| Robert W. Hopwood | $ | 435,216 | $ | 138,966 | |||

| Michael W. Yacenda | $ | 1,525,430 | 0 | ||||

Certain software development services have been provided to eLottery by Energenics, whose principal is Robert Hopwood Jr., and by The Winston Group, one of whose principals was Robert W. Hopwood, Jr., a son of an officer of eLottery, Inc., Robert W. Hopwood, and by Rosewood Computing, one of whose principals is Mark

Hopwood, another son of Mr. Hopwood. During 1999, eLottery incurred $335,864, $135,700, and $98,663, respectively, in fees from these firms. The contracts with these companies were entered into on terms eLottery believes are as favorable as would have been obtained through arm’s-length negotiations with an independent third party.

On August 2, 1999, the Board of Directors approved, with Mr. Seslowe abstaining, the issuance to Resource Holdings Associates, an investment banking firm in which Mr. Seslowe has more than a 10% interest, of a warrant to purchase 100,000 shares of common stock at a price of $3.00 per share, as compensation for certain investment banking services provided and to be provided to the company. Management believes the compensation paid for these services to be as least at favorable to the company as would have been obtained though arm’s-length negotiations with an independent third party.

From January 13, 2000 until May 22, 2000, Philip D. Gunn, a director of the Company, acted as interim Chief Executive Officer of eLottery, Inc. while the Board conducted the search for the new chief executive officer of the Company. The Company paid a consulting company owned by Mr. Gunn cash compensation of less than $60,000 for his services.

On January 13, 2000, the Company acquired from Twelve Oaks Liquidating Trust 254,686 shares (or approximately 4%) of the outstanding common stock of Dialogic Communications Corp. (“DCC”), of which the Company already owned approximately 47% of the issued and outstanding common stock. The purchase price for the DCC shares was 254, 656 shares of newly issued shares of the Company’s Common Stock. Twelve Oaks Liquidating Trust is a liquidating trust for Twelve Oaks Capital Limited Partners, of which Philip D. Gunn, a director of the Company and Interim CEO of eLottery, Inc., was the general partner and held a greater than 10% interest. Mr. Gunn is also the Liquidating Trustee for the Trust. The Company believes the acquisition of the DCC shares gave the Company over 51% of the voting stock of DCC and will make the sale of the DCC investment both easier to accomplish and more profitable to eLOT. Management believes the purchase price paid for the DCC shares to be as least at favorable to the Company as would have been obtained though arm’s-length negotiations with a third party not affiliated with the Company.

SHAREHOLDER PROPOSALS—2001 ANNUAL MEETING

Shareholders are entitled to present proposals for action at the 2001 Annual Meeting of Shareholders if they comply with the applicable requirements of eLOT’s Bylaws then in effect and with the requirements of the proxy rules as promulgated by the Securities and Exchange Commission. Any proposals intended to be presented at the 2001 Annual Meeting of Shareholders must be received at eLOT’s offices on or before August 11, 2001 in order to be considered for inclusion in eLOT’s proxy statement and form of proxy relating to such meeting.

OTHER MATTERS

The eLOT Board of Directors has designated Arthur Andersen LLP, independent accountants, as auditors for eLOT for the fiscal year ending December 31, 2000. Arthur Andersen LLP will be present at the annual meeting with an opportunity to make a statement and will be available to respond to appropriate questions relating to the audit of eLOT’s 1999 financial statements.

eLOT’s management knows of no other business which will be presented to the meeting. If other matters properly come before the meeting, the persons named as proxies will vote on them in accordance with their best judgment.

WHERE ELOT SHAREHOLDERS CAN FIND MORE INFORMATION

eLOT files annual, quarterly and special reports, proxy statements and other information with the Securities and Exchange Commission. eLOT shareholders may read and copy any reports, statements or other information that ELOT files with the Securities and Exchange Commission at the Securities and Exchange Commission’s public reference rooms in Washington, D.C., New York, New York and Chicago, Illinois. eLOT’s shareholders should call the Securities and Exchange Commission at 1-800-SEC-0330 for further information on the public reference rooms. These Securities and Exchange Commission filings are also available to the public from commercial document retrieval services and at the Internet world wide web site maintained by the Securities and Exchange Commission at

“http://www.sec.gov.” Reports, proxy statements and other information concerning eLOT may also be inspected at the offices of the National Association of Securities Dealers, Inc., at 1735 K Street, N.W., Washington, D.C. 20006.

| December 13, 2000 | By Order of the Board of Directors Barbara C. Anderson Senior Vice President, Law and Administration and Secretary |

PROXY CARD

ELOT, INC.

301 MERRITT 7 CORPORATE PARK

NORWALK, CONNECTICUT 06851

This Proxy is Solicited on Behalf of the eLOT Board of Directors.

The undersigned hereby appoints Edwin J. McGuinn, Robert C. Daum and Barbara C. Anderson, or any of them, with full power of substitution in each, Proxies, to vote all the shares of common stock of eLOT, Inc. held of record by the undersigned at the close of business on December 8, 2000, at the Annual Meeting of Shareholders to be held at The Norwalk Inn & Conference Center, 99 East Avenue, Norwalk, Connecticut 06851, on January 25, 2001, or at any adjournment or postponement of the meeting.

1. To elect Edwin J. McGuinn, Stanley J. Kabala, Richard J. Fernandes, Philip Gunn, Jerry M. Seslowe and John P. Hectus as directors of ELOT to serve until the next annual meeting of shareholders.

| FOR ALL | WITHHOLD ALL | FOR ALL EXCEPT | |

| ( ) | ( ) | ( ) |

INSTRUCTION: To withhold authority to vote for any such nominee(s), write the name(s) of the nominee(s) in the space provided below:

_____________________________________________________________________________________________

2. In their discretion, the Proxies are authorized to vote upon such other business as may properly come before the meeting.

PLEASE MARK, SIGN, DATE AND RETURN THIS PROXY CARD PROMPTLY USING THE ENCLOSED ENVELOPE.

THE PROXY, WHEN PROPERLY EXECUTED, WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED SHAREHOLDER. IF NO DIRECTION IS MADE, THIS PROXY WILL BE VOTED FOR PROPOSAL 1.

Signature: ______________________________ Date: ____________________________________

Signature if held jointly: ___________________ Date: ____________________________________

Note: Please sign exactly as the name appears hereon. When shares are held by joint tenants, both should sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. If a corporation, please sign in full corporate name by the President or other authorized officer. If a partnership, please sign in partnership name by authorized person.

|

|