|

|

|

|

|

Previous: COAST DISTRIBUTION SYSTEM INC, SC 13D, 2001-01-12 |

Next: FIDELITY ADVISOR SERIES VIII, 497, 2001-01-12 |

Like securities of all mutual funds, these securities have not been approved or disapproved by the Securities and Exchange Commission, and the Securities and Exchange Commission has not determined if this prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

Fidelity® Advisor

Fund

Class A

(Fund 603, CUSIP 315920397)

Class T

(Fund 390, CUSIP 315920389)

Class B

(Fund 388, CUSIP 315920371)

Class C

(Fund 389, CUSIP 315920363)

Prospectus

December 29, 2000

<R>Revised January 16, 2001</R>

(fidelity_logo_graphic)

82 Devonshire Street, Boston, MA 02109

|

Fund Summary |

Investment Summary |

|

|

|

Performance |

|

|

|

Fee Table |

|

|

Fund Basics |

Investment Details |

|

|

|

Valuing Shares |

|

|

Shareholder Information |

Buying and Selling Shares |

|

|

|

Exchanging Shares |

|

|

|

Account Features and Policies |

|

|

|

Dividends and Capital Gain Distributions |

|

|

|

Tax Consequences |

|

|

Fund Services |

Fund Management |

|

|

|

Fund Distribution |

|

|

Appendix |

Financial Highlights |

Prospectus

Investment Objective

Advisor Korea Fund seeks long-term capital appreciation.

Principal Investment Strategies

Fidelity Management & Research Company (FMR)'s principal investment strategies include:

Principal Investment Risks

The fund is subject to the following principal investment risks:

Prospectus

Fund Summary - continued

In addition, the fund is considered non-diversified and can invest a greater portion of assets in securities of individual issuers than a diversified fund. As a result, changes in the market value of a single issuer could cause greater fluctuations in share price than would occur in a more diversified fund.

An investment in the fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

When you sell your shares of the fund, they could be worth more or less than what you paid for them.

Prior to July 1, 2000, the fund operated as Fidelity Advisor Korea Fund, Inc. (Closed-End Fund), a closed-end fund. The Closed-End Fund commenced operations on October 31, 1994 and had the same investment objective and substantially similar investment policies as the fund. On June 30, 2000, the Closed-End Fund was reorganized as an open-end fund through a transfer of all of its assets and liabilities to the fund. Shareholders of the Closed-End Fund received Class A shares of the fund in exchange for their shares of the Closed-End Fund. Class T, Class B, and Class C shares were not offered prior to July 3, 2000. The returns presented below for periods prior to July 1, 2000 do not reflect Class A's, Class T's, Class B's, or Class C's total expenses. If the effect of Class A's, Class T's, Class B's, and Class C's total expenses were reflected, returns may be lower than those shown because Class A, Class T, Class B, and Class C shares of the fund may have higher total expenses than the Closed-End Fund.

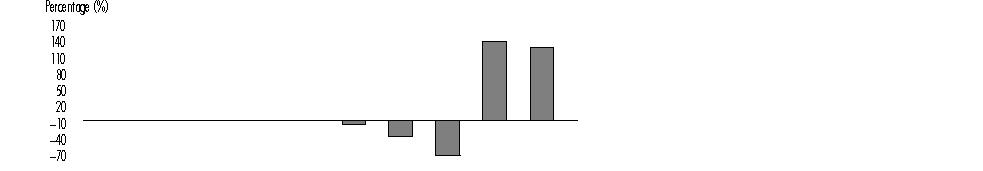

The following information illustrates the changes in the Closed-End Fund's performance from year to year and compares each class's performance to the performance of a market index and an average of the performance of similar funds over various periods of time. Returns are based on past results and are not an indication of future performance.

The returns in the chart do not include the effect of Class A's or Class T's front-end sales charge or Class B's or Class C's contingent deferred sales charge (CDSC). If the effect of the sales charge were reflected, returns would be lower than those shown.

Prospectus

Fund Summary - continued

|

The Closed-End Fund |

|

Calendar Year |

|

|

|

|

|

1995 |

1996 |

1997 |

1998 |

1999 |

|

|

|

|

|

|

|

-7.36% |

-29.25% |

-64.64% |

145.16% |

134.50% |

During the periods shown in the chart for the Closed-End Fund, the highest return for a quarter was 86.38% (quarter ended December 31, 1998) and the lowest return for a quarter was -61.57% (quarter ended December 31, 1997).

The year-to-date return as of September 30, 2000 for Class A of Advisor Korea was -43.95%. Returns prior to July 1, 2000 are those of the Closed-End Fund, which had no 12b-1 fee. If Class A's total expenses, including 12b-1 fee, had been reflected, returns may have been lower.

The returns in the following table include the effect of Class A's and Class T's maximum applicable front-end sales charge and Class B's and Class C's maximum applicable CDSC.

|

For the periods ended |

Past 1 |

Past 5 |

Life of classA,B |

|

Advisor Korea - Class A |

121.02% |

4.66% |

2.52% |

|

Advisor Korea - Class T |

126.30% |

5.16% |

2.99% |

|

Advisor Korea - Class B |

129.50% |

5.59% |

3.54% |

|

Advisor Korea - Class C |

133.50% |

5.91% |

3.71% |

|

Korea Composite Stock Price Index |

95.33% |

-5.72% |

-6.65% |

|

Lipper Pacific ex Japan Funds Average |

73.21% |

3.06% |

-- |

A Returns prior to July 1, 2000 are those of the Closed-End Fund, which had no 12b-1 fee. If Class A's, Class T's, Class B's, and Class C's total expenses, including 12b-1 fees, had been reflected, returns may have been lower.

B From October 31, 1994 (commencement of operations of the Closed-End Fund).

Korea Composite Stock Price Index (KOSPI) is a market capitalization-weighted index of all common stocks listed on the Korea Stock Exchange, except common stocks of newly listed companies that are excluded during their first 30 trading days after listing.

The Lipper Funds Average reflects the performance (excluding sales charges) of mutual funds with similar objectives.

Prospectus

Fund Summary - continued

The following table describes the fees and expenses that are incurred when you buy, hold, or sell Class A, Class T, Class B, and Class C shares of the fund. The annual class operating expenses provided below for each class are based on estimated expenses.

Shareholder fees (paid by the investor directly)

|

|

Class A |

|

Class T |

|

Class B |

|

Class C |

|

Maximum sales charge (load) on purchases (as a % of offering price) |

5.75%A |

|

3.50%B |

|

None |

|

None |

|

Maximum CDSC (as a % of the lesser of original purchase price |

NoneC |

|

NoneC |

|

5.00%D |

|

1.00%E |

|

Sales charge (load) on reinvested distributions |

None |

|

None |

|

None |

|

None |

|

<R>Redemption Fee |

None |

|

None |

|

None |

|

None</R> |

A Lower front-end sales charges for Class A may be available with purchase of $50,000 or more.

B Lower front-end sales charges for Class T may be available with purchase of $50,000 or more.

C A contingent deferred sales charge of 0.25% is assessed on certain redemptions of Class A and Class T shares on which a finder's fee was paid.

D Declines over 6 years from 5.00% to 0%.

E On Class C shares redeemed within one year of purchase.

<R>A</R>nnual class operating expenses (paid from class assets)

|

|

Class A |

|

Class T |

|

Class B |

|

Class C |

|

Management feeA |

0.83% |

|

0.83% |

|

0.83% |

|

0.83% |

|

Distribution and Service (12b-1) fee (including 0.25% Service fee only for Class B and Class C) |

0.25% |

|

0.50% |

|

1.00% |

|

1.00% |

|

Other expensesA |

1.06% |

|

1.15% |

|

1.19% |

|

1.10% |

|

Total annual class operating expensesB |

2.14% |

|

2.48% |

|

3.02% |

|

2.93% |

A Based on estimated expenses.

B FMR has agreed to reimburse Class A, Class T, Class B, and Class C of the fund to the extent that total operating expenses (excluding interest, taxes, certain securities lending costs, brokerage commissions, and extraordinary expenses), as a percentage of their respective average net assets, exceed the following rates:

Prospectus

Fund Summary - continued

|

|

Class A |

Effective |

Class T |

Effective |

Class B |

Effective |

Class C |

Effective |

|

Advisor Korea |

2.10% |

6/30/00 |

2.35% |

6/30/00 |

2.85% |

6/30/00 |

2.85% |

6/30/00 |

The arrangement for Class A will remain in effect until June 30, 2001. The arrangements for Class T, Class B, and Class C can be discontinued by FMR at any time.

This example helps you compare the cost of investing in the fund with the cost of investing in other mutual funds.

Let's say, hypothetically, that each class's annual return is 5% and that your shareholder fees and each class's annual operating expenses are exactly as described in the fee table. This example illustrates the effect of fees and expenses, but is not meant to suggest actual or expected fees and expenses or returns, all of which may vary. For every $10,000 you invested, here's how much you would pay in total expenses if you close your account at the end of each time period indicated and if you leave your account open:

|

|

Class A |

Class T |

Class B |

Class C |

||||

|

|

Account open |

Account closed |

Account open |

Account closed |

Account open |

Account closed |

Account open |

Account closed |

|

1 year |

$ 780 |

$ 780 |

$ 593 |

$ 593 |

$ 305 |

$ 805 |

$ 296 |

$ 396 |

|

3 years |

$ 1,206 |

$ 1,206 |

$ 1,097 |

$ 1,097 |

$ 933 |

$ 1,233 |

$ 907 |

$ 907 |

Prospectus

Investment Objective

Advisor Korea Fund seeks long-term capital appreciation.

Principal Investment Strategies

FMR normally invests at least 65% of the fund's total assets in equity and debt securities of Korean issuers. Korean issuers are those issuers (i) organized under the laws of Korea, (ii) that derive at least 50% of their revenues or profits from goods produced or sold, investments made, or services performed, in Korea, or have at least 50% of their assets located in Korea, (iii) that have the primary trading market for their securities in Korea, or (iv) that are the government, or its agencies or instrumentalities or other political subdivisions, of Korea. FMR intends to invest the fund's assets principally in equity securities of Korean issuers.

FMR may invest up to 35% of the fund's total assets in issuers (i) organized under the laws of Hong Kong, Japan, or Taiwan, (ii) that derive at least 50% of their revenues or profits from goods produced or sold, investments made, or services performed, in Hong Kong, Japan, or Taiwan, (iii) that have the primary trading market for their securities in Hong Kong, Japan, or Taiwan, or (iv) that are the governments, or their agencies or instrumentalities or other political subdivisions, of Hong Kong, Japan, or Taiwan.

FMR may invest up to 35% of the fund's total assets in any industry that accounts for more than 20% of the Korean market, as represented by an index determined by FMR to be an appropriate measure of the market. FMR intends to measure the percentage of the index represented by each industry no less frequently than once per month.

Because the fund is considered non-diversified, FMR may invest a significant percentage of the fund's assets in a single issuer.

In buying and selling securities for the fund, FMR relies on fundamental analysis of each issuer and its potential for success in light of its current financial condition, its industry position, and economic and market conditions. Factors considered include growth potential, earnings estimates, and management.

FMR may lend the fund's securities to broker-dealers or other institutions to earn income for the fund.

FMR may use various techniques, such as buying and selling futures contracts, to increase or decrease the fund's exposure to changing security prices or other factors that affect security values. If FMR's strategies do not work as intended, the fund may not achieve its objective.

Description of Principal Security Types

Equity securities represent an ownership interest, or the right to acquire an ownership interest, in an issuer. Different types of equity securities provide different voting and dividend rights and priority in the event of the bankruptcy of the issuer. Equity securities include common stocks, preferred stocks, convertible securities, and warrants.

Prospectus

Fund Basics - continued

Debt securities are used by issuers to borrow money. The issuer usually pays a fixed, variable, or floating rate of interest, and must repay the amount borrowed at the maturity of the security. Some debt securities, such as zero coupon bonds, do not pay current interest but are sold at a discount from their face values. Debt securities include corporate bonds, government securities, and mortgage and other asset-backed securities.

Principal Investment Risks

Many factors affect the fund's performance. The fund's share price changes daily based on changes in market conditions and interest rates and in response to other economic, political, or financial developments. The fund's reaction to these developments will be affected by the types of securities in which the fund invests, the financial condition, industry and economic sector, and geographic location of an issuer, and the fund's level of investment in the securities of that issuer. Because FMR concentrates the fund's investments in a particular country, the fund's performance is expected to be closely tied to economic and political conditions within that country and to be more volatile than the performance of more geographically diversified funds. Because FMR may invest a significant percentage of the fund's assets in certain industries, the fund's performance could be affected to the extent that the particular industry or industries in which the fund invests are sensitive to adverse changes in economic or political conditions. In addition, because FMR may invest a significant percentage of the fund's assets in a single issuer, the fund's performance could be closely tied to the market value of that one issuer and could be more volatile than the performance of more diversified funds. When you sell your shares of the fund, they could be worth more or less than what you paid for them.

The following factors can significantly affect the fund's performance:

Stock Market Volatility. The value of equity securities fluctuates in response to issuer, political, market, and economic developments. In the short term, equity prices can fluctuate dramatically in response to these developments. Different parts of the market and different types of equity securities can react differently to these developments. For example, large cap stocks can react differently from small cap stocks, and "growth" stocks can react differently from "value" stocks. Issuer, political, or economic developments can affect a single issuer, issuers within an industry or economic sector or geographic region, or the market as a whole.

Interest Rate Changes. Debt securities have varying levels of sensitivity to changes in interest rates. In general, the price of a debt security can fall when interest rates rise and can rise when interest rates fall. Securities with longer maturities and mortgage securities can be more sensitive to interest rate changes.

Foreign Exposure. Foreign securities, foreign currencies, and securities issued by U.S. entities with substantial foreign operations can involve additional risks relating to political, economic, or regulatory conditions in foreign countries. These risks include fluctuations in foreign currencies; withholding or other taxes; trading, settlement, custodial, and other operational risks; and the less stringent investor protection and disclosure standards of some foreign markets. All of these factors can make foreign investments, especially those in emerging markets, more volatile and potentially less liquid than U.S. investments. In addition, foreign markets can perform differently from the U.S. market.

Prospectus

Fund Basics - continued

Investing in emerging markets can involve risks in addition to and greater than those generally associated with investing in more developed foreign markets. The extent of economic development; political stability; market depth, infrastructure, and capitalization; and regulatory oversight can be less than in more developed markets. Emerging market economies can be subject to greater social, economic, regulatory, and political uncertainties. All of these factors can make emerging market securities more volatile and potentially less liquid than securities issued in more developed markets.

Geographic Concentration. Political and economic conditions and changes in regulatory, tax, or economic policy in a country could significantly affect the market in that country and in surrounding or related countries.

Korea. The Korean economy is currently recovering from a recession and can be significantly affected by continued capital outflows, currency fluctuations, and corporate bankruptcy. Korea's economy is dependent on international trade and the economies of other Asian countries. The United States is Korea's largest single trading partner, but much of Korea's trade is conducted with developing nations, almost all of which are in Southeast Asia. Korea is heavily dependent on imports of natural resources such as oil, forest products, and industrial metals. Accordingly, Korea's economy can also be significantly affected by fluctuations in international commodity prices and currency exchange rates. The Korean market tends to be relatively concentrated in certain issuers. For example, as of October 31, 2000, Samsung Electronics, SK Telecom, and Korea Telecom accounted for approximately 13%, 12%, and 12%, respectively, of the KOSPI.

Asia. Asia includes countries in all stages of economic development, from the highly developed economy of Japan to the emerging market economy of the People's Republic of China. Most Asian economies are characterized by over-extension of credit, currency devaluations and restrictions, rising unemployment, high inflation, decreased exports, and economic recessions. Currency devaluations in any one country can have a significant effect on the entire region. Recently, the markets in each Asian country have suffered significant downturns as well as significant volatility. Increased political and social unrest in some or all Asian countries could cause further economic and market uncertainty.

The Hong Kong economy is dependent on the economies of other Asian countries. The willingness and ability of the Chinese government to support the Hong Kong economy and market is uncertain. Changes in government policy could significantly affect the Hong Kong market.

Prospectus

Fund Basics - continued

The Japanese economy is currently in a recession. The economy is characterized by government intervention and protectionism, an unstable financial services sector, and relatively high unemployment. Economic growth is dependent on international trade, government support of the financial services sector and other troubled sectors, and consistent government policy.

The Taiwanese economy can be significantly affected by security threats from the People's Republic of China. In addition, the Taiwanese economy can be significantly affected by currency fluctuations and increasing competition from Asia's low-cost emerging economies.

Issuer-Specific Changes. Changes in the financial condition of an issuer, changes in specific economic or political conditions that affect a particular type of security or issuer, and changes in general economic or political conditions can affect the credit quality or value of an issuer's securities. The value of securities of smaller, less well-known issuers can be more volatile than that of larger issuers. Lower-quality debt securities (those of less than investment-grade quality) and certain types of other securities tend to be particularly sensitive to these changes.

Lower-quality debt securities and certain types of other securities involve greater risk of default or price changes due to changes in the credit quality of the issuer. The value of lower-quality debt securities and certain types of other securities often fluctuates in response to company, political, or economic developments and can decline significantly over short periods of time or during periods of general or regional economic difficulty.

In response to market, economic, political, or other conditions, FMR may temporarily use a different investment strategy for defensive purposes. If FMR does so, different factors could affect the fund's performance and the fund may not achieve its investment objective.

Fundamental Investment Policies

The policy discussed below is fundamental, that is, subject to change only by shareholder approval.

Advisor Korea Fund seeks long-term capital appreciation.

The fund is open for business each day the New York Stock Exchange (NYSE) is open.

A class's net asset value per share (NAV) is the value of a single share. Fidelity normally calculates each class's NAV as of the close of business of the NYSE, normally 4:00 p.m. Eastern time. However, NAV may be calculated earlier if trading on the NYSE is restricted or as permitted by the Securities and Exchange Commission (SEC). The fund's assets are valued as of this time for the purpose of computing each class's NAV.

To the extent that the fund's assets are traded in other markets on days when the NYSE is closed, the value of the fund's assets may be affected on days when the fund is not open for business. In addition, trading in some of the fund's assets may not occur on days when the fund is open for business.

Prospectus

Fund Basics - continued

The fund's assets are valued primarily on the basis of market quotations. Certain short-term securities are valued on the basis of amortized cost. If market quotations are not readily available or do not accurately reflect fair value for a security or if a security's value has been materially affected by events occurring after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), that security may be valued by another method that the Board of Trustees believes accurately reflects fair value. A security's valuation may differ depending on the method used for determining value.

Prospectus

For account, product, and service information, please use the following phone numbers:

Please use the following addresses:

Buying or Selling Shares

Fidelity Investments

P.O. Box 770002

Cincinnati, OH 45277-0081

Overnight Express

Fidelity Investments

2300 Litton Lane - KH2A

Hebron, KY 41048

You may buy or sell Class A, Class T, Class B, and Class C shares of the fund through a retirement account or an investment professional. When you invest through a retirement account or an investment professional, the procedures for buying, selling, and exchanging Class A, Class T, Class B, and Class C shares of the fund and the account features and policies may differ. Additional fees may also apply to your investment in Class A, Class T, Class B, and Class C shares of the fund, including a transaction fee if you buy or sell Class A, Class T, Class B, and Class C shares of the fund through a broker or other investment professional.

Certain methods of contacting Fidelity, such as by telephone, may be unavailable or delayed (for example, during periods of unusual market activity).

The different ways to set up (register) your account with Fidelity are listed in the following table.

|

Ways to Set Up Your Account |

|

Individual or Joint Tenant For your general investment needs |

|

Retirement For tax-advantaged retirement savings |

|

|

|

|

|

|

|

|

|

Gifts or Transfers to a Minor (UGMA, UTMA) To invest for a child's education or other future needs |

|

Trust For money being invested by a trust |

|

Business or Organization For investment needs of corporations, associations, partnerships, or other groups |

Prospectus

Shareholder Information - continued

The price to buy one share of Class A or Class T is the class's offering price or the class's NAV, depending on whether you pay a front-end sales charge.

For Class B or Class C, the price to buy one share is the class's NAV. Class B and Class C shares are sold without a front-end sales charge, but may be subject to a CDSC upon redemption.

If you pay a front-end sales charge, your price will be Class A's or Class T's offering price. When you buy Class A or Class T shares at the offering price, Fidelity deducts the appropriate sales charge and invests the rest in Class A or Class T shares of the fund. If you qualify for a front-end sales charge waiver, your price will be Class A's or Class T's NAV.

The offering price of Class A or Class T is its NAV divided by the difference between one and the applicable front-end sales charge percentage. Class A has a maximum front-end sales charge of 5.75% of the offering price. Class T has a maximum front-end sales charge of 3.50% of the offering price.

Your shares will be bought at the next offering price or NAV, as applicable, calculated after your order is received in proper form.

It is the responsibility of your investment professional to transmit your order to buy shares to Fidelity before the close of business on the day you place your order.

Short-term or excessive trading into and out of the fund may harm performance by disrupting portfolio management strategies and by increasing expenses. Accordingly, the fund may reject any purchase orders, including exchanges, particularly from market timers or investors who, in FMR's opinion, have a pattern of short-term or excessive trading or whose trading has been or may be disruptive to the fund. For these purposes, FMR may consider an investor's trading history in the fund or other Fidelity funds, and accounts under common ownership or control.

The fund may stop offering shares completely or may offer shares only on a limited basis, for a period of time or permanently.

When you place an order to buy shares, note the following:

Prospectus

Shareholder Information - continued

Class A, Class T, Class B, and Class C shares can be bought or sold through investment professionals using an automated order placement and settlement system that guarantees payment for orders on a specified date.

Certain financial institutions that meet creditworthiness criteria established by Fidelity Distributors Corporation (FDC) may enter confirmed purchase orders on behalf of customers by phone, with payment to follow no later than close of business on the next business day. If payment is not received by that time, the order will be canceled and the financial institution will be liable for any losses.

Minimums

|

To Open an Account |

$2,500 |

|

For certain Fidelity Advisor retirement |

|

|

accountsA |

$500 |

|

Through regular investment plansB |

$100 |

|

To Add to an Account |

$100 |

|

Minimum Balance |

$1,000 |

|

For certain Fidelity Advisor retirement |

|

|

accountsA |

None |

A Fidelity Advisor Traditional IRA, Roth IRA, Rollover IRA, SEP-IRA, and Keogh accounts.

B An account may be opened with a minimum of $100, provided that a regular investment plan is established at the time the account is opened.

There is no minimum account balance or initial or subsequent purchase minimum for certain Fidelity retirement accounts funded through salary deduction, or accounts opened with the proceeds of distributions from such retirement accounts. In addition, the fund may waive or lower purchase minimums in other circumstances.

Purchase and account minimums are waived for purchases of Class T shares with distributions from a Fidelity Defined Trust account.

Purchase amounts of more than $250,000 will not be accepted for Class B shares.

Purchase amounts of more than $1 million will not be accepted for Class C shares. This limit does not apply to purchases of Class C shares made by an employee benefit plan (as defined in the Employee Retirement Income Security Act), 403(b) program or plan covering a sole-proprietor (formerly Keogh/H.R. 10 plan).

Prospectus

Shareholder Information - continued

|

Key Information |

|

|

Phone |

To Open an Account

To Add to an Account

|

|

Mail |

To Open an Account

To Add to an Account

|

|

In Person |

To Open an Account

To Add to an Account

|

|

Wire |

To Open an Account

To Add to an Account

|

|

Automatically |

To Open an Account

To Add to an Account

|

The price to sell one share of Class A, Class T, Class B, or Class C is the class's NAV, minus<R> a</R>ny applicable CDSC.

<R>I</R>f appropriate to protect shareholders, the fund may impose a redemption fee <R>(trading fee) on </R>redemptions from the fund.

Prospectus

Shareholder Information - continued

Any applicable CDSC is calculated based on your original redemption amount.

Your shares will be sold at the next NAV calculated after your order is received in proper form, minus<R> a</R>ny applicable CDSC.

It is the responsibility of your investment professional to transmit your order to sell shares to Fidelity before the close of business on the day you place your order.

Certain requests must include a signature guarantee. It is designed to protect you and Fidelity from fraud. Your request must be made in writing and include a signature guarantee if any of the following situations apply:

You should be able to obtain a signature guarantee from a bank, broker, dealer, credit union (if authorized under state law), securities exchange or association, clearing agency, or savings association. A notary public cannot provide a signature guarantee.

When you place an order to sell shares, note the following:

Prospectus

Shareholder Information - continued

|

Key Information |

|

|

Phone |

|

|

Mail |

Individual, Joint Tenant, Sole Proprietorship, UGMA, UTMA

Retirement Account

Trust

Business or Organization

Executor, Administrator, Conservator, Guardian

|

|

In Person |

Individual, Joint Tenant, Sole Proprietorship, UGMA, UTMA

Retirement Account

Trust

Business or Organization

Executor, Administrator, Conservator, Guardian

|

|

Automatically |

|

Prospectus

Shareholder Information - continued

An exchange involves the redemption of all or a portion of the shares of one fund and the purchase of shares of another fund.

As a Class A shareholder, you have the privilege of exchanging Class A shares of the fund for the same class of shares of other Fidelity Advisor funds at NAV or for Daily Money Class shares of Treasury Fund, Prime Fund, or Tax-Exempt Fund.

As a Class T shareholder, you have the privilege of exchanging Class T shares of the fund for the same class of shares of other Fidelity Advisor funds at NAV or for Daily Money Class shares of Treasury Fund, Prime Fund, or Tax-Exempt Fund. If you purchased your Class T shares through certain investment professionals that have signed an agreement with FDC, you also have the privilege of exchanging your Class T shares for shares of Fidelity Capital Appreciation Fund.

As a Class B shareholder, you have the privilege of exchanging Class B shares of the fund for the same class of shares of other Fidelity Advisor funds or for Advisor B Class shares of Treasury Fund.

As a Class C shareholder, you have the privilege of exchanging Class C shares of the fund for the same class of shares of other Fidelity Advisor funds or for Advisor C Class shares of Treasury Fund.

However, you should note the following policies and restrictions governing exchanges:

The fund may terminate or modify the exchange privilege in the future.

Prospectus

Shareholder Information - continued

Other funds may have different exchange restrictions, and may impose trading fees of up to 1.00% of the amount exchanged. Check each fund's prospectus for details.

The following features are available to buy and sell shares of the fund.

Automatic Investment and Withdrawal Programs. Fidelity offers convenient services that let you automatically transfer money into your account, between accounts, or out of your account. While automatic investment programs do not guarantee a profit and will not protect you against loss in a declining market, they can be an excellent way to invest for retirement, a home, educational expenses, and other long-term financial goals. Automatic withdrawal or exchange programs can be a convenient way to provide a consistent income flow or to move money between your investments.

|

Fidelity Advisor Systematic Investment Program |

|||

|

Minimum Initial $100 |

Minimum Additional $100 |

Frequency Monthly, bimonthly, quarterly, |

Procedures

|

|

To direct distributions from a Fidelity Defined Trust to Class T of a Fidelity Advisor fund. |

|||

|

Minimum Initial Not Applicable |

Minimum Additional Not Applicable |

|

Procedures

|

|

Fidelity Advisor Systematic Exchange Program |

|||

|

Minimum $100 |

Frequency Monthly, quarterly, |

Procedures

|

|

|

Fidelity Advisor Systematic Withdrawal Program |

|

Minimum $100 |

Maximum $50,000 |

Frequency Class A and Class T: Monthly,

quarterly, or semi-annually |

Procedures

|

Prospectus

Shareholder Information - continued

Other Features. The following other feature is also available to buy and sell shares of the fund.

|

Wire |

|

The following policies apply to you as a shareholder.

Statements and reports that Fidelity sends to you include the following:

To reduce expenses, only one copy of most financial reports and prospectuses will be mailed, even if you have more than one account in the fund. Call Fidelity at 1-888-622-3175 if you need additional copies of financial reports or prospectuses.

You may initiate many transactions by telephone or electronically. Fidelity will not be responsible for any losses resulting from unauthorized transactions if it follows reasonable security procedures designed to verify the identity of the investor. Fidelity will request personalized security codes or other information, and may also record calls. For transactions conducted through the Internet, Fidelity recommends the use of an Internet browser with 128-bit encryption. You should verify the accuracy of your confirmation statements immediately after you receive them. If you do not want the ability to sell and exchange by telephone, call Fidelity for instructions. Additional documentation may be required from corporations, associations, and certain fiduciaries.

Prospectus

Shareholder Information - continued

When you sign your account application, you will be asked to certify that your social security or taxpayer identification number is correct and that you are not subject to 31% backup withholding for failing to report income to the IRS. If you violate IRS regulations, the IRS can require the fund to withhold 31% of your taxable distributions and redemptions.

If your account balance falls below $1,000 (except accounts not subject to account minimums), you will be given 30 days' notice to reestablish the minimum balance. If you do not increase your balance, Fidelity may close your account and send the proceeds to you. Your shares will be sold at the NAV, minus <R>any </R>applicable CDSC, on the day your account is closed.

Fidelity may charge a fee for certain services, such as providing historical account documents.

Dividends and Capital Gain Distributions

The fund earns dividends, interest, and other income from its investments, and distributes this income (less expenses) to shareholders as dividends. The fund also realizes capital gains from its investments, and distributes these gains (less any losses) to shareholders as capital gain distributions.

The fund normally pays dividends and capital gain distributions in December.

When you open an account, specify on your application how you want to receive your distributions. The following options may be available for each class's distributions:

1. Reinvestment Option. Your dividends and capital gain distributions will be automatically reinvested in additional shares of the same class of the fund. If you do not indicate a choice on your application, you will be assigned this option.

2. Income-Earned Option. Your capital gain distributions will be automatically reinvested in additional shares of the same class of the fund. Your dividends will be paid in cash.

3. Cash Option. Your dividends and capital gain distributions will be paid in cash.

4. Directed Dividends® Option. Your dividends will be automatically invested in the same class of shares of another identically registered Fidelity Advisor fund or shares of certain identically registered Fidelity funds. Your capital gain distributions will be automatically invested in the same class of shares of another identically registered Fidelity Advisor fund or shares of certain identically registered Fidelity funds, automatically reinvested in additional shares of the same class of the fund, or paid in cash.

Not all distribution options are available for every account. If the option you prefer is not listed on your account application, or if you want to change your current option, contact your investment professional directly or call Fidelity.

If you elect to receive distributions paid in cash by check and the U.S. Postal Service does not deliver your checks, your distribution option may be converted to the Reinvestment Option. You will not receive interest on amounts represented by uncashed distribution checks.

Prospectus

Shareholder Information - continued

As with any investment, your investment in the fund could have tax consequences for you. If you are not investing through a tax-advantaged retirement account, you should consider these tax consequences.

Taxes on distributions. Distributions you receive from the fund are subject to federal income tax, and may also be subject to state or local taxes.

For federal tax purposes, the fund's dividends and distributions of short-term capital gains are taxable to you as ordinary income, while the fund's distributions of long-term capital gains are taxable to you generally as capital gains.

If you buy shares when a fund has realized but not yet distributed income or capital gains, you will be "buying a dividend" by paying the full price for the shares and then receiving a portion of the price back in the form of a taxable distribution.

Any taxable distributions you receive from the fund will normally be taxable to you when you receive them, regardless of your distribution option.

Taxes on transactions. Your redemptions, including exchanges, may result in a capital gain or loss for federal tax purposes. A capital gain or loss on your investment in the fund generally is the difference between the cost of your shares and the price you receive when you sell them.

Prospectus

Advisor Korea is a mutual fund, an investment that pools shareholders' money and invests it toward a specified goal.

FMR is the fund's manager.

As of March 31, 2000, FMR had approximately $639.1 billion in discretionary assets under management.

As the manager, FMR is responsible for choosing the fund's investments and handling its business affairs.

Affiliates assist FMR with foreign investments:

Beginning January 1, 2001, FMR Co., Inc. (FMRC) will serve as a sub-adviser for the fund. FMRC may provide investment advisory services for the fund. FMRC is a wholly-owned subsidiary of FMR.

Hokeun Chung is a portfolio manager for Advisor Korea, which he has managed since December 1995. Prior to joining Fidelity, Mr. Chung was a senior analyst specializing in Korean equities for W.I. Carr in Seoul from 1991 to 1994. Born in 1967, he earned his Bachelor of Science degree in operations research from Columbia University in 1990.

Prospectus

Fund Services - continued

From time to time a manager, analyst, or other Fidelity employee may express views regarding a particular company, security, industry, or market sector. The views expressed by any such person are the views of only that individual as of the time expressed and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

The fund pays a management fee to FMR. The management fee is calculated and paid to FMR every month. The fee is calculated by adding a group fee rate to an individual fund fee rate, dividing by twelve, and multiplying the result by the fund's average net assets throughout the month.

The group fee rate is based on the average net assets of all the mutual funds advised by FMR. This rate cannot rise above 0.52%, and it drops as total assets under management increase.

For October 2000, the group fee rate was 0.2755%. The individual fund fee rate is 0.55%.

FMR pays FMR U.K., FMR Far East, and FIIA for providing sub-advisory services, and FIIA in turn pays FIIA(U.K.)L. FIIA or FMR Far East in turn pays FIJ for providing sub-advisory services.

FMR will pay FMRC for providing sub-advisory services.

FMR may, from time to time, agree to reimburse a class for management fees and other expenses above a specified limit. FMR retains the ability to be repaid by a class if expenses fall below the specified limit prior to the end of the fiscal year. Reimbursement arrangements, which, in the case of certain classes, may be discontinued by FMR at any time, can decrease a class's expenses and boost its performance.

The fund is composed of multiple classes of shares. All classes of the fund have a common investment objective and investment portfolio.

FDC distributes each class's shares.

You may pay a sales charge when you buy or sell your Class A, Class T, Class B, or Class C shares.

FDC collects the sales charge.

The front-end sales charge will be reduced for purchases of Class A and Class T shares according to the sales charge schedules below.

Prospectus

Fund Services - continued

Sales Charges and Concessions - Class A

|

|

Sales Charge |

|

|

|

|

As a % of |

As an |

Investment |

|

Up to $49,999 |

5.75% |

6.10% |

5.00% |

|

$50,000 to $99,999 |

4.50% |

4.71% |

3.75% |

|

$100,000 to $249,999 |

3.50% |

3.63% |

2.75% |

|

$250,000 to $499,999 |

2.50% |

2.56% |

2.00% |

|

$500,000 to $999,999 |

2.00% |

2.04% |

1.75% |

|

$1,000,000 to $24,999,999 |

1.00% |

1.01% |

0.75% |

|

$25,000,000 or more |

NoneA |

NoneA |

A |

A See "Finder's Fee" section on page 33.

Sales Charges and Concessions - Class T

|

|

Sales Charge |

|

|

|

|

As a % of |

As an |

Investment |

|

Up to $49,999 |

3.50% |

3.63% |

3.00% |

|

$50,000 to $99,999 |

3.00% |

3.09% |

2.50% |

|

$100,000 to $249,999 |

2.50% |

2.56% |

2.00% |

|

$250,000 to $499,999 |

1.50% |

1.52% |

1.25% |

|

$500,000 to $999,999 |

1.00% |

1.01% |

0.75% |

|

$1,000,000 or more |

NoneA |

NoneA |

A |

A See "Finder's Fee" section on page 33.

Class A or Class T shares purchased by an individual or company through the Combined Purchase, Rights of Accumulation, or Letter of Intent program may receive a reduced front-end sales charge according to the sales charge schedules above. To qualify for a Class A or Class T front-end sales charge reduction under one of these programs, you must notify Fidelity in advance of your purchase. More detailed information about these programs is contained in the statement of additional information (SAI).

Combined Purchase. To receive a Class A or Class T front-end sales charge reduction, if you are a new shareholder, you may combine your purchase of Class A or Class T shares with purchases of: (i) Class A, Class T, Class B, and Class C shares of any Fidelity Advisor fund and (ii) Advisor B Class shares and Advisor C Class shares of Treasury Fund.

Rights of Accumulation. To receive a Class A or Class T front-end sales charge reduction, if you are an existing shareholder, you may add to your purchase of Class A or Class T shares the current value of your holdings in: (i) Class A, Class T, Class B, and Class C shares of any Fidelity Advisor fund, (ii) Advisor B Class shares and Advisor C Class shares of Treasury Fund, and (iii) Daily Money Class shares of Treasury Fund, Prime Fund, or Tax-Exempt Fund acquired by exchange from any Fidelity Advisor fund.

Letter of Intent. You may receive a Class A or Class T front-end sales charge reduction on your purchases of Class A and Class T shares made during a 13-month period by signing a Letter of Intent (Letter). Each Class A or Class T purchase you make after you sign the Letter will be entitled to the reduced front-end sales charge applicable to the total investment indicated in the Letter. Purchases of the following may be aggregated for the purpose of completing your Letter: (i) Class A and Class T shares of any Fidelity Advisor fund (except those acquired by exchange from Daily Money Class shares of Treasury Fund, Prime Fund, or Tax-Exempt Fund that had been previously exchanged from a Fidelity Advisor fund), (ii) Class B and Class C shares of any Fidelity Advisor fund, and (iii) Advisor B Class shares and Advisor C Class shares of Treasury Fund. Reinvested income and capital gain distributions will not be considered purchases for the purpose of completing your Letter.

Prospectus

Fund Services - continued

Class B shares may, upon redemption, be assessed a CDSC based on the following schedule:

|

|

|

|

From Date |

Contingent Deferred |

|

Less than 1 year |

5% |

|

1 year to less than 2 years |

4% |

|

2 years to less than 3 years |

3% |

|

3 years to less than 4 years |

3% |

|

4 years to less than 5 years |

2% |

|

5 years to less than 6 years |

1% |

|

6 years to less than 7 yearsA |

0% |

A After a maximum of seven years, Class B shares will convert automatically to Class A shares of the fund.

When exchanging Class B shares of one fund for Class B shares of another Fidelity Advisor fund or Advisor B Class shares of Treasury Fund, your Class B shares retain the CDSC schedule in effect when they were originally bought.

Except as provided below, investment professionals receive as compensation from FDC, at the time of sale, a concession equal to 4.00% of your purchase of Class B shares. For purchases of Class B shares through reinvested dividends or capital gain distributions, investment professionals do not receive a concession at the time of sale.

Class C shares may, upon redemption within one year of purchase, be assessed a CDSC of 1.00%.

Except as provided below, investment professionals will receive as compensation from FDC, at the time of the sale, a concession equal to 1.00% of your purchase of Class C shares. For purchases of Class C shares made for an employee benefit plan, 403(b) program or plan covering a sole-proprietor (formerly Keogh/H.R. 10 plan) or through reinvested dividends or capital gain distributions, investment professionals do not receive a concession at the time of sale.

The CDSC for Class B and Class C shares will be calculated based on the lesser of the cost of the Class B or Class C shares, as applicable, at the initial date of purchase or the value of those Class B or Class C shares, as applicable, at redemption, not including any reinvested dividends or capital gains. Class B and Class C shares acquired through reinvestment of dividends or capital gain distributions will not be subject to a CDSC. In determining the applicability and rate of any CDSC at redemption, Class B or Class C shares representing reinvested dividends and capital gains will be redeemed first, followed by those Class B or Class C shares that have been held for the longest period of time.

Prospectus

Fund Services - continued

A front-end sales charge will not apply to the following Class A shares:

1. Purchased for an employee benefit plan (except a SIMPLE IRA, SEP, or SARSEP plan or a plan covering self-employed individuals and their employees (formerly Keogh/H.R. 10 plans)) or a 403(b) program with at least $25 million or more in plan assets;

2. Purchased for an employee benefit plan (except a SIMPLE IRA, SEP, or SARSEP plan or a plan covering self-employed individuals and their employees (formerly Keogh/H.R. 10 plans)) or a 403(b) program investing through an insurance company separate account used to fund annuity contracts;

3. Purchased for an employee benefit plan (except a SIMPLE IRA, SEP, or SARSEP plan or a plan covering self-employed individuals and their employees (formerly Keogh/H.R. 10 plans)) or a 403(b) program investing through a trust institution, bank trust department or insurance company, or any such institution's broker-dealer affiliate that is not part of an organization primarily engaged in the brokerage business. Employee benefit plans (except SIMPLE IRA, SEP, and SARSEP plans and plans covering self-employed individuals and their employees (formerly Keogh/H.R. 10 plans)) and 403(b) programs that participate in the Advisor Retirement Connection do not qualify for this waiver;

4. Purchased for an employee benefit plan (except a SIMPLE IRA, SEP, or SARSEP plan or a plan covering self-employed individuals and their employees (formerly Keogh/H.R. 10 plans)) or a 403(b) program investing through an investment professional sponsored program that requires the participating employee benefit plan to invest initially in Class C or Class B shares and, upon meeting certain criteria, subsequently requires the plan to invest in Class A shares;

5. Purchased by a trust institution or bank trust department for a managed account that is charged an asset-based fee. Employee benefit plans (except SIMPLE IRA, SEP, and SARSEP plans and plans covering self-employed individuals and their employees (formerly Keogh/H.R. 10 plans)), 403(b) programs, and accounts managed by third parties do not qualify for this waiver;

6. Purchased by a broker-dealer for a managed account that is charged an asset-based fee. Employee benefit plans (except SIMPLE IRA, SEP, and SARSEP plans and plans covering self-employed individuals and their employees (formerly Keogh/H.R. 10 plans)) and 403(b) programs do not qualify for this waiver;

7. Purchased by a registered investment adviser that is not part of an organization primarily engaged in the brokerage business for an account that is managed on a discretionary basis and is charged an asset-based fee. Employee benefit plans (except SIMPLE IRA, SEP, and SARSEP plans and plans covering self-employed individuals and their employees (formerly Keogh/H.R. 10 plans)) and 403(b) programs do not qualify for this waiver;

Prospectus

Fund Services - continued

8. Purchased with proceeds from the sale of front-end load shares of a non-Advisor mutual fund for an account participating in the FundSelect by Nationwide program;

9. Purchased by a bank trust officer, registered representative, or other employee (or a member of one of their immediate families) of investment professionals having agreements with FDC. A member of the immediate family of a bank trust officer, a registered representative, or other employee of investment professionals having agreements with FDC, is a spouse of one of those individuals, an account for which one of those individuals is acting as custodian for a minor child, and a trust account that is registered for the sole benefit of a minor child of one of those individuals; or

10. Purchased by the Fidelity Investments Charitable Gift Fund.

A front-end sales charge will not apply to the following Class T shares:

1. Purchased for an insurance company separate account used to fund annuity contracts for employee benefit plans (except SIMPLE IRA, SEP, and SARSEP plans and plans covering self-employed individuals and their employees (formerly Keogh/H.R. 10 plans)) or 403(b) programs;

2. Purchased by a trust institution or bank trust department for a managed account that is charged an asset-based fee. Accounts managed by third parties do not qualify for this waiver;

3. Purchased by a broker-dealer for a managed account that is charged an asset-based fee;

4. Purchased by a registered investment adviser that is not part of an organization primarily engaged in the brokerage business for an account that is managed on a discretionary basis and is charged an asset-based fee;

5. Purchased for an employee benefit plan (except a SIMPLE IRA, SEP, or SARSEP plan or a plan covering self-employed individuals and their employees (formerly Keogh/H.R. 10 plans)) or a 403(b) program;

6. Purchased for a Fidelity or Fidelity Advisor account with the proceeds of a distribution from (i) an insurance company separate account used to fund annuity contracts for employee benefit plans, 403(b) programs, or plans covering sole-proprietors (formerly Keogh/H.R. 10 plans) that are invested in Fidelity Advisor or Fidelity funds, or (ii) an employee benefit plan, 403(b) program, or plan covering a sole-proprietor (formerly Keogh/H.R. 10 plan) that is invested in Fidelity Advisor or Fidelity funds. (Distributions other than those transferred to an IRA account must be transferred directly into a Fidelity account.);

7. Purchased for any state, county, or city, or any governmental instrumentality, department, authority or agency;

8. Purchased with redemption proceeds from other mutual fund complexes on which you have previously paid a front-end sales charge or CDSC;

Prospectus

Fund Services - continued

9. Purchased by a current or former trustee or officer of a Fidelity fund or a current or retired officer, director or regular employee of FMR Corp. or Fidelity International Limited or their direct or indirect subsidiaries (a Fidelity trustee or employee), the spouse of a Fidelity trustee or employee, a Fidelity trustee or employee acting as custodian for a minor child, or a person acting as trustee of a trust for the sole benefit of the minor child of a Fidelity trustee or employee;

10. Purchased by a charitable organization (as defined for purposes of Section 501(c)(3) of the Internal Revenue Code, but excluding the Fidelity Investments Charitable Gift Fund) investing $100,000 or more;

11. Purchased by a bank trust officer, registered representative, or other employee (or a member of one of their immediate families) of investment professionals having agreements with FDC. A member of the immediate family of a bank trust officer, a registered representative, or other employee of investment professionals having agreements with FDC, is a spouse of one of those individuals, an account for which one of those individuals is acting as custodian for a minor child, and a trust account that is registered for the sole benefit of a minor child of one of those individuals;

12. Purchased for a charitable remainder trust or life income pool established for the benefit of a charitable organization (as defined for purposes of Section 501(c)(3) of the Internal Revenue Code);

13. Purchased with distributions of income, principal, and capital gains from Fidelity Defined Trusts; or

14. Purchased by the Fidelity Investments Charitable Gift Fund.

The Class B or Class C CDSC will not apply to the redemption of shares:

1. For disability or death, provided that the shares are sold within one year following the death or the initial determination of disability;

2. That are permitted without penalty at age 70 1/2 pursuant to the Internal Revenue Code from retirement plans or accounts (other than of shares purchased on or after February 11, 1999 for Traditional IRAs, Roth IRAs and Rollover IRAs);

3. For disability, payment of death benefits, or minimum required distributions starting at age 70 1/2 from Traditional IRAs, Roth IRAs and Rollover IRAs purchased on or after February 11, 1999;

4. Through the Fidelity Advisor Systematic Withdrawal Program; or

5. (Applicable to Class C only) From an employee benefit plan, 403(b) program, or plan covering a sole-proprietor (formerly Keogh/H.R. 10 plan).

To qualify for a Class A or Class T front-end sales charge reduction or waiver, you must notify Fidelity in advance of your purchase.

Prospectus

Fund Services - continued

To qualify for a Class B or Class C CDSC waiver, you must notify Fidelity in advance of your redemption.

Finder's Fee. On eligible purchases of (i) Class A shares in amounts of $1 million or more that qualify for a Class A load waiver, (ii) Class A shares in amounts of $25 million or more, and (iii) Class T shares in amounts of $1 million or more, investment professionals will be compensated with a fee at the rate of 0.25% of the purchase amount.

Shares held by an insurance company separate account will be aggregated at the client (e.g., the contract holder or plan sponsor) level, not at the separate account level. Upon request, anyone claiming eligibility for the 0.25% fee with respect to shares held by an insurance company separate account must provide Fidelity access to records detailing purchases at the client level.

Except as provided below, any assets on which a finder's fee has been paid will bear a contingent deferred sales charge (Class A or Class T CDSC) if they do not remain in Class A or Class T shares of the Fidelity Advisor funds, or Daily Money Class shares of Treasury Fund, Prime Fund, or Tax-Exempt Fund for a period of at least one uninterrupted year. The Class A or Class T CDSC will be 0.25% of the lesser of the cost of the Class A or Class T shares, as applicable, at the initial date of purchase or the value of those Class A or Class T shares, as applicable, at redemption, not including any reinvested dividends or capital gains. Class A and Class T shares acquired through reinvestment of dividends or capital gain distributions will not be subject to a Class A or Class T CDSC. In determining the applicability and rate of any Class A or Class T CDSC at redemption, Class A or Class T shares representing reinvested dividends and capital gains will be redeemed first, followed by those Class A or Class T CDSC shares that have been held for the longest period of time.

The Class A or Class T CDSC will not apply to the redemption of shares:

1. Held by insurance company separate accounts;

2. For plan loans or distributions or exchanges to non-Advisor fund investment options from employee benefit plans (except shares of SIMPLE IRA, SEP, and SARSEP plans and plans covering self-employed individuals and their employees (formerly Keogh/H.R. 10 plans) purchased on or after February 11, 1999) and 403(b) programs; or

3. For disability, payment of death benefits, or minimum required distributions starting at age 70 1/2 from Traditional IRAs, Roth IRAs, SIMPLE IRAs, SEPs, SARSEPs, and plans covering a sole-proprietor or self-employed individuals and their employees (formerly Keogh/H.R. 10 plans).

To qualify for a Class A or Class T finder's fee or CDSC waiver, you must notify Fidelity in advance of your purchase or redemption, respectively.

Reinstatement Privilege. If you have sold all or part of your Class A, Class T, Class B, or Class C shares of the fund, you may reinvest an amount equal to all or a portion of the redemption proceeds in the same class of the fund or another Fidelity Advisor fund, at the NAV next determined after receipt in proper form of your investment order, provided that such reinvestment is made within 90 days of redemption. Under these circumstances, the dollar amount of the CDSC you paid, if any, on shares will be reimbursed to you by reinvesting that amount in Class A, Class T, Class B, or Class C shares, as applicable. You must reinstate your Class A, Class T, Class B, or Class C shares into an account with the same registration. This privilege may be exercised only once by a shareholder with respect to the fund and certain restrictions may apply. For purposes of the CDSC schedule, the holding period will continue as if the Class A, Class T, Class B, or Class C shares had not been redeemed.

Prospectus

Fund Services - continued

To qualify for the reinstatement privilege, you must notify Fidelity in writing in advance of your reinvestment.

Conversion Feature. After a maximum of seven years from the initial date of purchase, Class B shares and any capital appreciation associated with those shares convert automatically to Class A shares of the fund. Conversion to Class A shares will be made at NAV. At the time of conversion, a portion of the Class B shares bought through the reinvestment of dividends or capital gains (Dividend Shares) will also convert to Class A shares. The portion of Dividend Shares that will convert is determined by the ratio of your converting Class B non-Dividend Shares to your total Class B non-Dividend Shares.

Class A has adopted a Distribution and Service Plan pursuant to Rule 12b-1 under the Investment Company Act of 1940. Under the plan, Class A of the fund is authorized to pay FDC a monthly 12b-1 fee as compensation for providing services intended to result in the sale of Class A shares and/or shareholder support services. Class A may pay FDC a 12b-1 fee at an annual rate of 0.75% of its average net assets, or such lesser amount as the Trustees may determine from time to time. Class A currently pays FDC a monthly 12b-1 fee at an annual rate of 0.25% of its average net assets throughout the month. Class A's 12b-1 fee rate may be increased only when the Trustees believe that it is in the best interests of Class A shareholders to do so.

Class T has adopted a Distribution and Service Plan pursuant to Rule 12b-1 under the Investment Company Act of 1940. Under the plan, Class T is authorized to pay FDC a monthly 12b-1 fee as compensation for providing services intended to result in the sale of Class T shares and/or shareholder support services. Class T may pay FDC a 12b-1 fee at an annual rate of 0.75% of its average net assets, or such lesser amount as the Trustees may determine from time to time. Class T currently pays FDC a monthly 12b-1 fee at an annual rate of 0.50% of its average net assets throughout the month. Class T's 12b-1 fee rate may be increased only when the Trustees believe that it is in the best interests of Class T shareholders to do so.

FDC may reallow to intermediaries (such as banks, broker-dealers, and other service-providers), including its affiliates, up to the full amount of the Class A and Class T 12b-1 fee, for providing services intended to result in the sale of Class A or Class T shares and/or shareholder support services.

Prospectus

Fund Services - continued

Class B has adopted a Distribution and Service Plan pursuant to Rule 12b-1 under the Investment Company Act of 1940. Under the plan, Class B of the fund is authorized to pay FDC a monthly 12b-1 (distribution) fee as compensation for providing services intended to result in the sale of Class B shares. Class B currently pays FDC a monthly 12b-1 (distribution) fee at an annual rate of 0.75% of its average net assets throughout the month.

In addition, pursuant to the Class B plan, Class B pays FDC a monthly 12b-1 (service) fee at an annual rate of 0.25% of Class B's average net assets throughout the month for providing shareholder support services.

FDC may reallow up to the full amount of the Class B 12b-1 (service) fee to intermediaries (such as banks, broker-dealers, and other service-providers), including its affiliates, for providing shareholder support services.

Class C has adopted a Distribution and Service Plan pursuant to Rule 12b-1 under the Investment Company Act of 1940. Under the plan, Class C is authorized to pay FDC a monthly 12b-1 (distribution) fee as compensation for providing services intended to result in the sale of Class C shares. Class C currently pays FDC a monthly 12b-1 (distribution) fee at an annual rate of 0.75% of its average net assets throughout the month.

In addition, pursuant to the Class C plan, Class C pays FDC a monthly 12b-1 (service) fee at an annual rate of 0.25% of Class C's average net assets throughout the month for providing shareholder support services.

Normally, after the first year of investment, FDC may reallow up to the full amount of the Class C 12b-1 (distribution) fees to intermediaries (such as banks, broker-dealers, and other service-providers), including its affiliates, for providing services intended to result in the sale of Class C shares and may reallow up to the full amount of the Class C 12b-1 (service) fee to intermediaries, including its affiliates, for providing shareholder support services.

For purchases of Class C shares made for an employee benefit plan, 403(b) program or plan covering a sole-proprietor (formerly Keogh/H.R. 10 plan) or through reinvestment of dividends or capital gain distributions, during the first year of investment and thereafter, FDC may reallow up to the full amount of the Class C 12b-1 (distribution) fee paid by such shares to intermediaries, including its affiliates, for providing services intended to result in the sale of Class C shares and may reallow up to the full amount of the Class C 12b-1 (service) fee paid by such shares to intermediaries, including its affiliates, for providing shareholder support services.

In addition, each plan specifically recognizes that FMR may make payments from its management fee revenue, past profits, or other resources to FDC for expenses incurred in connection with providing services intended to result in the sale of the applicable class's shares and/or shareholder support services, including payments of significant amounts made to intermediaries that provide those services. Currently, the Board of Trustees of the fund has authorized such payments for Class A, Class T, Class B, and Class C.

Prospectus

Fund Services - continued

Because 12b-1 fees are paid out of each class's assets on an ongoing basis, they will increase the cost of your investment and may cost you more than paying other types of sales charges.

To receive sales concessions, finder's fees, and payments made pursuant to a Distribution and Service Plan, intermediaries must sign the appropriate agreement with FDC in advance.

FMR may allocate brokerage transactions in a manner that takes into account the sale of shares of the Fidelity Advisor funds, provided that the fund receives brokerage services and commission rates comparable to those of other broker-dealers.

No dealer, sales representative, or any other person has been authorized to give any information or to make any representations, other than those contained in this prospectus and in the related SAI, in connection with the offer contained in this prospectus. If given or made, such other information or representations must not be relied upon as having been authorized by the fund or FDC. This prospectus and the related SAI do not constitute an offer by the fund or by FDC to sell shares of the fund to or to buy shares of the fund from any person to whom it is unlawful to make such offer.

Prospectus

The financial highlights tables are intended to help you understand each class's financial history for the past 5 years or, if shorter, the period of the class's operations. Certain information reflects financial results for a single class share. The total returns in the table represent the rate that an investor would have earned (or lost) on an investment in the class (assuming reinvestment of all dividends and distributions). This information has been audited by PricewaterhouseCoopers LLC, independent accountants, whose report, along with the fund's financial highlights and financial statements, are included in the fund's annual report. A free copy of the annual report is available upon request.

Prospectus

Appendix - continued

Advisor Korea Fund - Class A

|

|

2000K |

2000 H,L |

1999L |

1998L |

1997L |

1996L |

|

Selected Per-Share Data |

|

|

|

|

|

|

|

Net asset value, |

$ 8.99 |

$ 10.78 |

$ 3.67 |

$ 7.26 |

$ 10.71 |

$ 12.62 |

|

Income from Investment Operations |

|

|

|

|

|

|

|

Net investment income (loss) C |

(.01) |

(.09) |

(.04) G |

(.05) |

(.06) |

(.08) |

|

Net realized and unrealized |

(1.62) |

(1.97) |

7.15 |

(3.54) |

(3.14) |

(1.83) |

|

Total from investment |

(1.63) |

(2.06) |

7.11 |

(3.59) |

(3.20) |

(1.91) |

|

Dilution resulting from common stock issued through rights offering |

- |

- |

- |

- |

(.19) |

- |

|

Offering expenses |

- |

- |

- |

- |

(.06) |

- |

|

Redemption fees added to |

.02 |

.27 |

- |

- |

- |

- |

|

Net asset value, end of period |

$ 7.38 |

$ 8.99 |

$ 10.78 F |

$ 3.67 |

$ 7.26 |

$ 10.71 |

|

Total Return A, B |

(17.91)% |

(16.60)% |

193.73% |

(49.45)% |

(28.08)% I |

(15.13)% |

|

Ratios and Supplemental Data |

|

|

|

|

|

|

|

Net assets, end of period |

$ 19,279 |

$ 25,017 |

$ 60,601 |

$ 22,915 |

$ 45,312 |

$ 47,181 |

|

Ratio of expenses to average |

2.10% D, J |

1.91% D |

1.75% |

2.32% |

1.88% |

1.80% |

|

Ratio of expenses to average net assets after expense reductions |

2.10% J |

1.89% E |

1.61% E, G |

2.30% E |

1.88% |

1.79% E |

|

Ratio of net investment income |

(1.71)% J |

(.73)% |

(.42)% |

(1.22)% |

(.64)% |

(.68)% |

|

Portfolio turnover rate |

121% J |

39% |

58% |

65% |

51% |

28% |

A The total returns would have been lower had certain expenses not been reduced during the periods shown.

B Total returns do not include the one time sales charge and for periods of less than one year are not annualized.

C Net investment income (loss) per share has been calculated based on average shares outstanding during the period.

D FMR agreed to reimburse a portion of the class' expenses during the period. Without this reimbursement, the class' expense ratio would have been higher.

E FMR or the fund has entered into varying arrangements with third parties who either paid or reduced a portion of the class' expenses.

F The fund incurred expenses of $.01 per share in connection with its repurchase offer which were offset by redemption fees collected as part of the repurchase offer.

G Includes reimbursement of $.01 per share from the custodian for an adjustment to prior periods' fees.

H Prior to July 3, 2000, the fund operated as a closed-end management investment company. Shares of the fund existing at the time of its conversion to an open-ended management investment company were exchanged for Class A shares.

I The total return does not include the effect of dilution.

J Annualized

K One month ended October 31

L Years ended September 30

Prospectus

Appendix - continued

Advisor Korea Fund - Class T

|

|

2000H |

2000 E |

|

Selected Per-Share Data |

|

|

|

Net asset value, beginning of period |

$ 8.99 |

$ 12.58 |

|

Income from Investment Operations |

|

|

|

Net investment income (loss) D |

(.01) |

(.03) |

|

Net realized and unrealized gain (loss) |

(1.61) |

(3.56) |

|

Total from investment operations |

(1.62) |

(3.59) |

|

Net asset value, end of period |

$ 7.37 |

$ 8.99 |

|

Total Return B, C |

(18.02)% |

(28.54)% |

|

Ratios and Supplemental Data |

|

|

|

Net assets, end of period (000 omitted) |

$ 473 |

$ 108 |

|

Ratio of expenses to average net assets |

2.35% A, F |

2.35% A, F |

|

Ratio of expenses to average net assets after expense reductions |

2.35% A |

2.32% A, G |

|

Ratio of net investment income (loss) to average net assets |

(1.96)% A |

(1.16)% A |

|

Portfolio turnover rate |

121% A |

39% |

A Annualized

B The total returns would have been lower had certain expenses not been reduced during the periods shown.

C Total returns do not include the one time sales charge and for periods of less than one year are not annualized.

D Net investment income (loss) per share has been calculated based on average shares outstanding during the period.

E For the period July 3, 2000 (commencement of sale of Class T shares) to September 30, 2000.

F FMR agreed to reimburse a portion of the class' expenses during the period. Without this reimbursement, the class' expense ratio would have been higher.

G FMR or the fund has entered into varying arrangements with third parties who either paid or reduced a portion of the class' expenses.

H One month ended October 31

Prospectus

Appendix - continued

Advisor Korea Fund - Class B

|

|

2000H |

2000 E |

|

Selected Per-Share Data |

|

|

|

Net asset value, beginning of period |

$ 8.98 |

$ 12.58 |

|

Income from Investment Operations |

|

|

|

Net investment income (loss) D |

(.02) |

(.04) |

|

Net realized and unrealized gain (loss) |

(1.60) |

(3.56) |

|

Total from investment operations |

(1.62) |

(3.60) |

|

Net asset value, end of period |

$ 7.36 |

$ 8.98 |

|

Total Return B, C |

(18.04)% |

(28.62)% |

|

Ratios and Supplemental Data |

|

|

|

Net assets, end of period (000 omitted) |

$ 83 |

$ 80 |

|

Ratio of expenses to average net assets |

2.85% A, F |

2.85% A, F |

|

Ratio of expenses to average net assets after expense reductions |

2.85% A |

2.83% A, G |

|

Ratio of net investment income (loss) to average net assets |

(2.45)% A |

(1.67)% A |

|

Portfolio turnover rate |

121% A |

39% |

A Annualized

B The total returns would have been lower had certain expenses not been reduced during the periods shown.

C Total returns do not include the contingent deferred sales charge and for periods of less than one year are not annualized.

D Net investment income (loss) per share has been calculated based on average shares outstanding during the period.

E For the period July 3, 2000 (commencement of sale of Class B shares) to September 30, 2000.

F FMR agreed to reimburse a portion of the class' expenses during the period. Without this reimbursement, the class' expense ratio would have been higher.

G FMR or the fund has entered into varying arrangements with third parties who either paid or reduced a portion of the class' expenses.

H One month ended October 31

Prospectus

Appendix - continued

Advisor Korea Fund - Class C

|

|

2000 H |

2000 E |

|

Selected Per-Share Data |

|

|

|