|

|

|

|

|

Previous: HEALTHCARE SERVICES GROUP INC, 10-Q, 2000-07-31 |

Next: FLIGHT INTERNATIONAL GROUP INC, NT 10-K, NTN 10K, 2000-07-31 |

VICOM

INCORPORATED

9449 Science Center Drive

New Hope, Minnesota 55428

NOTICE OF 2000 ANNUAL MEETING OF SHAREHOLDERS

To be held August 10, 2000

The Annual Meeting of the Shareholders of VICOM, INCORPORATED will be Held at The Minneapolis Club, 729 2nd Avenue South, Minneapolis, Minnesota Thursday, August 10, 2000 at 3:00 p.m., Minneapolis time, for the following purpose, as more fully described in the accompanying Proxy Statement.

Only Shareholders of record at the close of business June 14, 2000 will be entitled to receive notice of and vote at the meeting. The Company's Board of Directors recommends a vote in favor of all the proposals, which will be submitted at the meeting.

Shareholders are urged to fill in and sign the enclosed proxy and mail it promptly in the accompanying envelope to which no postage need be affixed if mailed in the United States. Shareholders who are present at the meeting may revoke their proxies and vote in person.

If you cannot attend this meeting, please mark, sign, date and mail the enclosed proxy.

By Order of the Board of Directors

Pierce

McNally

Secretary

1

VICOM, INCORPORATED

9449 Science Center Drive

New Hope, Minnesota 55428

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

AUGUST 10, 2000

SOLICITATION, EXECUTION AND REVOCATION OF PROXIES

The mailing address of the principal corporate office of the Company is 9449 Science Center Drive, New Hope, MN 55428. This Proxy Statement and the form of proxy, which is enclosed, are being mailed to the Company's shareholders commencing on or about July 28, 2000.

Proxies in the accompanying form are solicited on behalf, and at the direction, of the Board of Directors of the Company. All shares of Common Stock represented by properly executed proxies, unless such proxies have previously been revoked, will be voted in accordance with the direction of the proxies. If no direction is indicated, the shares will be voted in accordance with the direction of the proxies. If any others matters are properly presented at the meeting for action, including a question of adjourning the meeting from time to time, the persons named in the proxies and acting thereunder will have discretion to vote on such matters in accordance with their best judgement.

When stock is in the name of more than one person, each such person should sign the proxy. If the shareholder is a corporation, the proxy should be signed in the name of such corporation by an executive or other authorized officer. If signed as attorney, executor, administrator, trustee, guardian or in any other representative capacity, the signer's full-title should be given and, if not previously furnished, a certificate or other evidence of appointment should be furnished.

A shareholder executing and returning a proxy has the power to revoke it at any time before it is voted. A shareholder who wishes to revoke a proxy can do so by executing a late dated proxy relating to the same shares and delivering it to the Secretary of the Company prior to the vote at the Annual Meeting, by written notice of revocation received by the Secretary prior to the vote at the Annual Meeting, or by appearing in person at the Annual Meeting, filing a written notice or revocation and voting in person the shares to which the proxy relates.

In addition to the use of the mails, proxies may be solicited by personal interview, telephone and telegram by the directors, officers and regular employees of the Company. Such persons will receive no additional compensation for such services. Arrangements will also be made with certain brokerage firms and certain other custodians, nominees and fiduciaries for the forwarding of solicitation materials to the beneficial owners of Common Stock held of record by such persons, and such brokers, custodians, nominees and fiduciaries will be reimbursed for their reasonable out-of-pocket expenses incurred by them in connection therewith will be borne by the Company. All expenses incurred in connection with this solicitation will be borne by the Company.

The Company is including with this Proxy Statement its Annual Report to shareholders for the year ended December 31, 1999, which includes a copy of the Company's Form 10 registration as filed with the Securities and Exchange Commission. Shareholders may receive, without charge, additional copies of the Form 10 registration, by writing to Vicom, Inc. at its principal corporate office.

2

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

Only shareholders of record at the close of business on June 14, 2000 (the "Record Date") will be entitled to vote at this meeting. On the Record Date, there were 7,558,269 shares of Common Stock issued and outstanding. Each holder of Common Stock is entitled to one vote, exercisable in person or by proxy, for each share of common stock held of record on the Record Date. The affirmative vote of holders of a majority of shares of Common Stock outstanding on the Record Date is required for approval of the proposals to be voted upon at the Annual Meeting.

The following table sets forth certain information as of June 14, 2000 with respect to each person known by the Company to be the beneficial owner of more than 5 percent of its Common Stock, each director of the Company, and all officers and directors of the Company as a group. Except as indicated, each of the persons listed in the following table has sole voting and investment power with respect to the shares set forth opposite his name.

| Name and Address Of Beneficial Owners |

Number of Shares Beneficially Owned(1) |

Percent of Common Shares Outstanding |

|||

|---|---|---|---|---|---|

| Americable, Inc. 7450 Flying Cloud Drive Eden Prairie, MN 55344 |

2,800,000 | (2) | 23.6 | % | |

| Steven Bell 9449 Science Center Drive New Hope, MN 55428 |

1,071,347 | (3) | 9.0 | % | |

| David Ekman 1402 42nd Street SW Fargo, ND 58103 |

3,200,000 | (4) | 27.0 | % | |

| Marvin Frieman 9449 Science Center Drive New Hope, MN 55428 |

969,714 | (5) | 8.2 | % | |

| James L. Mandel 9449 Science Center Drive New Hope, MN 55428 |

280,800 | (6) | 2.4 | % | |

| Pierce McNally 14853 DeVeau Place Minnetonka, MN 55345 |

108,272 | (7) | Less than 1 | % | |

| Paul Knapp 2501 Cleveland Avenue North Roseville, MN 55113-2717 |

101,300 | (8) | Less than 1 | % | |

| Jonathan Dodge 715 Florida Avenue South—Suite 402 Golden Valley, Minnesota 55426 |

0 | 0 | |||

| Mark Mekler 800 Nicollet Mall Minneapolis, Minnesota 55402 |

0 | 0 | |||

| Jeff Michael 7450 Flying Cloud Drive Eden Prairie, Minnesota 55344 |

0 | 0 | |||

| Manuel A. Villafana 3905 Annapolis Lane—Suite 105 Plymouth, Minnesota 55447 |

0 | 0 | |||

| All Directors and executive officers as a group (nine persons) | 8,531,433 | 72 | % |

3

determining the number of shares owned by each person and the group and the percent of the class owned by each individual and the group. Unless otherwise indicated, each person named or included in the group has sole vesting and investment power with respect to the shares of Common Stock set forth opposite his or her name. Unless otherwise indicated, the information in the table does not include any effects for stock options and warrants outstanding, yet be issued or yet to be exercised.

4

1. ELECTION OF DIRECTORS

Nine persons have been nominated for election at the 2000 Annual Meeting as directors for a one-year term expiring at the 2001 Annual Meeting. The directors will hold office for the term for which elected and will serve until their successors have been duly elected and qualified.

It is intended that votes will be case pursuant to the enclosed proxy for the election of the nominees in the table below, except for those proxies which withhold such authority. In the event that the proxy will be voted for the election of such other person or persons as the management may recommend in the place of such nominee. The management has no reason to believe that any of the nominees will not be candidates or will be unable to serve.

Information About Nominees

The following information has been furnished to the Company by the respective nominees for director.

| Name |

Age |

Position |

Director Since |

|||

|---|---|---|---|---|---|---|

| Steven Bell | 41 | President, Vicom Incorporated | 1994 | |||

| Jonathan Dodge | 49 | Partner, Dodge & Fox C.P.A. Firm | 1997 | |||

| David Ekman | 39 | President, Corporate Technologies, USA, Inc. | 1999 | |||

| Marvin Frieman | 68 | Chairman of the Board, Vicom | 1983 | |||

| Paul Knapp | 40 | President and Chief Executive Officer, Space Center Ventures, Inc. | 2000 | |||

| James L. Mandel | 44 | Chief Executive Officer, Vicom, Inc. | 1998 | |||

| Pierce McNally | 51 | Chairman of the Board, Lockermate Corporation | 1999 | |||

| Mark Mekler | 46 | Regional Director, U.S. Bancorp Piper Jaffray | 1999 | |||

| Manuel A. Villafana | 59 | Chairman and Chief Executive Officer ATS Medical | 2000 |

The Board of Directors recommends a vote for the election each of the nominees named above.

Steven Bell was general counsel and Vice President of the Company from June 1985 through October 1994, at which time he became Chief Financial Officer. He was also named President in July 1997. He is a graduate of the William Mitchell College of Law.

Jonathan Dodge has been the Senior Partner of the C.P.A. firm of Dodge & Fox since its inception in March 1997. Prior to that, he was a partner in the CPA firm of Misukanis and Dodge from 1992 to March 1997. Mr. Dodge is a member of both the AICPA and the Minnesota Society of CPA's.

David Ekman is President of Corporate Technologies, USA, Inc. He has worked continuously in the computer business since 1981, initially as a franchisee of Computerland, a personal computer dealer and subsequently from 1996 to December 1999 as President of Ekman, Inc., a value-added computer reseller and the predecessor company to Corporate Technologies, USA, Inc

Marvin Frieman was Vice President and Sales Manager of the Company since its inception in 1975 until October 1994. He was named Chief Executive Officer of the Company in November 1994 and served in that position until he became Chairman in October 1998. He has been a director since September 1983.

Paul Knapp has been President and CEO of Space Center Ventures, Inc. since April 1998. He is Sr. Vice President of Space Center, Inc. From February, 1993 to March, 1998, he was Vice President

5

and Director of Operations for Space Center Ventures, Inc. Mr. Knapp also serves on the Board of Directors for Devnet, LLC; Atrix International, Inc.; Viamedics and Square Roots.

James Mandel has been the Chief Executive Officer and the Director of the Company since October 1, 1998. He was co-founder of Call 4 Wireless, LLC, a telecommunications company specializing in wireless communications, and served as its Chairman and a member of the Board of Directors from December 1996 until October 1998 and as its interim Chief Executive Officer from December 1996 until December 1997. From October 1991 to October 1996, he was Vice President of Systems for Grand Casinos, Inc., where his duties included managing the design, development, installation and on-going maintenance for the 2,000 room, $507 million Stratosphere Hotel, Casino and Tower in Las Vegas. Mr. Mandel also managed the systems development of Grand Casino Mille Lacs, in Onamia, Minnesota, Grand Casino Hinckley in Hinckley, Minnesota and six other casinos nationwide. He also serves on the board of CorVu Corporation and is a trustee of the Boys and Girls Club of Minneapolis.

Pierce McNally currently serves as Chairman, Secretary and Director of Lockermate Corporation of Minnetonka, Minnesota, a company that provides locker systems to schools. He served as Minnesota American's Chairman of the Board, Chief Executive Officer and Secretary from October 1994 until January 2000 when Minnesota American merged with CorVu Corporation. He practiced corporate law at Oppenheimer, Wolff & Donnelly, LLP from 1979 to 1985. He served as Chairman and Director of Corporate Development of Nicollet Process Engineering, Inc. from May 1995 until April 1999, when he retired from the board.

Mark K. Mekler, a registered representative, is a Regional Director of U.S. Bancorp Piper Jaffray responsible for overseeing branch officers in Minnesota. He has nineteen years experience in the financial services industry. He is also a member of the Board of Directors of the Business Education and Economics Foundation (BEEF).

Manuel A. Villafana currently serves as Chairman and Chief Executive Officer of ATS Medical, which he has headed since 1987. Prior to his current position, Mr. Villafana was Chairman of GV Medical, Inc. from 1983 to 1987. Mr. Villafana also served as President and Chairman of St. Jude Medical, Inc. from 1976 to 1982 where he co-developed the St. Jude heart valve.

Board of Directors and its Committees

The Board of Directors met five times on a regular basis in 1999. As permitted by Minnesota Law, the Board of Directors also acted from time to time during 1999 by unanimous written consent in lieu of conducting formal meetings. Last year, there were five such actions and accompanying Board Resolutions passed. The Board has designated an audit committee consisting in 1999 of Peter Flynn and Jon Dodge. The Board also designated a compensation committee consisting in 1999 of Pierce McNally and Mark Mekler.

Our audit committee,

6

Our compensation committee,

Executive Compensation

The following table sets forth certain information relating to the remuneration paid by the Company to its executive officers whose aggregate cash and cash-equivalent remuneration approximated or exceeded $100,000 during the Company's last three fiscal years ending December 31, 1999.

SUMMARY COMPENSATION TABLE

| |

|

|

|

|

Long Term Compensation |

|

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

Annual Compensation |

|

Awards |

Payouts |

|

|||||||||||

| Name And Principal Position |

Year |

Salary ($) |

Bonus ($) |

Other Annual Compensation ($) |

Restricted Stock Award(s) ($) |

Securities Underlying Options/ SARs(#) |

LTIP Payouts ($) |

All Other Compensation ($) |

|||||||||

| (a) |

(b) |

(c) |

(d) |

(e) |

(f) |

(g) |

(h) |

(i) |

|||||||||

| James L. Mandel Chief Executive Officer |

1999 1998 1997 |

$ $ |

133,117 36,114 -0- |

* |

-0- -0- -0- |

-0- -0- -0- |

-0- -0- -0- |

-0- 225,000 -0- |

-0- -0- -0- |

-0- -0- -0- |

|||||||

| Steven Bell President |

1999 1998 1997 |

$ $ $ |

108,392 101,076 102,337 |

-0- -0- -0- |

-0- -0- -0- |

-0- -0- -0- |

-0- -0- 87,500 |

-0- -0- -0- |

-0- -0- -0- |

||||||||

| Marvin Frieman Chairman of the Board |

1999 1998 1997 |

$ $ $ |

98,582 103,095 101,269 |

-0- -0- -0- |

-0- -0- -0- |

-0- -0- -0- |

-0- -0- 87,500 |

-0- -0- -0- |

-0- -0- -0- |

||||||||

Directors Fees

No fees have been paid to Directors to date.

7

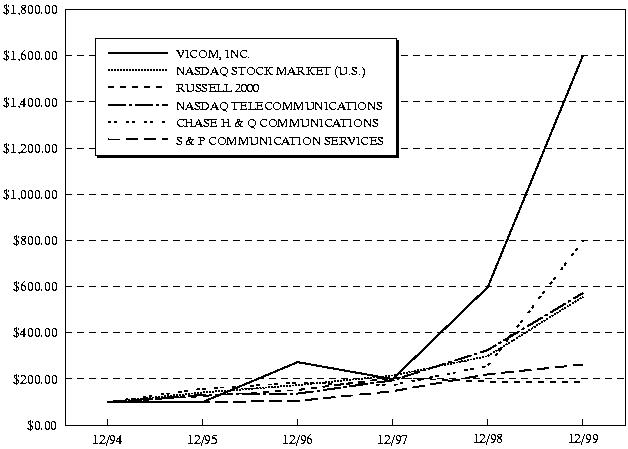

Performance Graph

The following performance graph compares cumulative total shareholder returns on the Company's common stock over the last five fiscal years, ended December 31, 1999, with The Nasdaq Stock Market (U.S. Companies) Index and other leading industry indices, assuming initial investment of $100 at the beginning of the period and the reinvestment of all dividends.

COMPARISON OF FIVE YEAR—CUMULATIVE TOTAL RETURNS

PERFORMANCE GRAPH FOR VICOM, INC.

PREPARE BY THE RESEARCH DATAGROUP, INC.

| |

Cumulative Total Return |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| VICOM, INC. |

12/94 |

12/95 |

12/96 |

12/97 |

12/98 |

12/99 |

||||||

| VICOM, INC. | 100.00 | 100.00 | 275.00 | 200.00 | 600.00 | 1,600.00 | ||||||

| NASDAQ STOCK MARKET (U.S.) | 100.00 | 141.33 | 173.90 | 213.07 | 300.43 | 557.58 | ||||||

| RUSSELL 2000 | 100.00 | 127.49 | 154.73 | 203.91 | 190.76 | 187.92 | ||||||

| NASDAQ TELECOMMUNICATIONS | 100.00 | 130.91 | 133.86 | 195.40 | 323.51 | 573.43 | ||||||

| CHASE H & Q COMMUNICATIONS | 100.00 | 159.36 | 182.84 | 173.10 | 255.56 | 799.78 | ||||||

| S & P COMMUNICATION SERVICES | 100.00 | 100.00 | 102.34 | 144.52 | 220.16 | 262.27 | ||||||

2. INDEPENDENT PUBLIC ACCOUNTANTS

It is proposed that Lurie, Besikof, Lapidus & Co., L.L.P. Independent Public Accountants, be ratified as auditors for the Company for the prior year.

It is expected that a representative of Lurie, Besikof, Lapidus & Co., L.L.P. will be present at this meeting. The representative will have an opportunity to make a statement and will be available to respond to appropriate questions.

8

3. AMENDMENT TO 1999 STOCK COMPENSATION PLAN

The Company's Board of Directors is recommending and seeking shareholder approval of an amendment to its 1999 Stock Compensation Plan. The total number of shares of stock reserved for awards under the plan is 1,500,000 shares. This includes the 700,000 authorized under the Company's 1997 Stock Option Plan. The Company's seeking to amend the plan to change the total number of stock shares reserved for awards under the plan to 2,500,000 shares.

The purpose of the plan is to promote the interest of the Company and its shareholders and by providing employees of the company with an opportunity to be given a proprietary interest in the Company, and thereby develop a stronger incentive to contribute to the Company's continued success and growth. Awards pursuant to the proposed 1999 plan may be in the form of either a restricted stock grant, which means a three year vesting period, or stock options.

The exercise price of the options granted under the Plan is required to be not less than the fair market value of the Common Stock on the date of grant, and in the case of any shareholder owning 10 percent or more of the Common Stock to whom an incentive stock option has been granted under the Plan, the exercise price thereof is required to be not less than 110 percent of the fair market value of the Common Stock on the date the option is granted. Options are not transferrable. An optionee, or his or her personal representative, may exercise his or her option for a period of ninety (90) days following termination of employment, disability, or death. The term of each option, which is fixed by the Committee, may not exceed 10 years from the date the option is granted, or 5 years in the case of incentive stock options grated to shareholders owning 10 percent or more of the Common Stock to whom options have been granted. Options may be made exercisable in whole or in installments as determined by the Committee or Board. The Committee or Board may cancel an option of an employee who has terminated for cause or takes employment with a competitor.

Stock Option Grants During 1999

The following table provides information regarding stock options granted during fiscal 1999 to the named executive officers in the Summary Compensation Table.

| Name |

Number of Shares Underlying Options Granted |

Percent of Total Options Granted to Employees in Fiscal Year |

Exercise or Base Price Per Share |

Expiration Date |

||||

|---|---|---|---|---|---|---|---|---|

| James L. Mandel | -0- | -0- | — | — | ||||

| Steven M. Bell | -0- | -0- | — | — | ||||

| Marvin Frieman | -0- | -0- | — | — |

9

Aggregated Option Exercises in 1999 and Year End Option Values

The following table provides information as to options exercised by the named executive officers in the Summary Compensation Table during fiscal 1999 and the number and value of options at December 31, 1999.

| |

|

|

Number of Unexercised Options at December 31, 1999 |

|

|

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

|

Value of Unexercised In-The-Money Options at December 31, 1999 |

|||||||||||

| |

Shares Acquired On Exercise |

|

||||||||||||

| |

Value Realized |

|||||||||||||

| Name |

Exercisable/Unexercisable |

Exercisable/Unexcersiable |

||||||||||||

| James L. Mandel | -0- | -0- | 75,000 | 150,000 | $ | 225,000 | $ | 510,000 | ||||||

| Steven M. Bell | -0- | -0- | 58,333 | 29,167 | $ | 184,582 | $ | 92,241 | ||||||

| Marvin Frieman | -0- | -0- | 58,333 | 29,167 | $ | 184,582 | $ | 92,241 | ||||||

Other Compensation and Long-Term Incentive Plans

The Company has no long-term incentive plans and issued no long-term incentive awards during 1999.

The Company has employment agreements with Mr. Marvin Frieman, Chairman of the Board, and Mr. Steven Bell, President, for the term beginning October 1996 and expiring October 2001. Messrs. Frieman's and Bell's compensation is not directly tied to the Company's performance. Their agreements call for special compensation payable to each of them in an amount equal to two and one-half times his annual salary upon his termination if other than for cause and a change in control in the Company. The agreements state that annual base salary for Messrs. Frieman and Bell will be $95,000 per year. This base salary is set and subject to approval by the Company's entire Board of Directors. Thus, the aforementioned lump sum compensation could equal $237,500 for Mr. Frieman if such special compensation is triggered. Other key provisions of the contracts include an agreement by Mr. Frieman and Mr. Bell to keep confidential information secret both during and after employment by the Company and covenants not to compete with the Company for one year from the date of termination of employment. A change in control in the agreements is defined as the acquisition by any corporation or group of more than 20 percent of the outstanding shares of voting stock of Vicom coupled with or followed by the election as Directors of Vicom of persons who were not directors at the time of such acquisition, if such persons shall become a majority of the Board of Directors of Vicom.

The Company maintains key man life insurance policies in the amount of $1,000,000 each on the lives of Steven Bell and Marvin Frieman. The Company is the beneficiary of these policies and has adopted a plan to pay fifty percent of all life insurance proceeds to the spouse or surviving children of each such officer.

The Company also has a three year employment agreement, from October 1998 to September 2001, with James L. Mandel, Chief Executive Officer, the terms of which involve an annual base salary of $132,000 and a stock option of 225,000 shares at $0.60 cents per share, vested over a three year period. Mr. Mandel's job responsibilities involve developing company business plans, developing expansion and growth opportunities and directing other executive officers.

The Company has a three-year employment agreement, from December 1999 to November 2002, with David Ekman as President of CTU. The terms of the agreement pay Mr. Ekman an annual salary $110,000 per year. Mr. Ekman also has a warrant to purchase 100,000 shares of Vicom Common Stock

10

at a price of $2.00 per share and a stock option for 150,000 shares, vested over a three-year period at a price of $2.00 per share. Mr. Ekman's job responsibilities involve direct supervision of CTUs daily operations.

Preferred Stock

In December 1998, the Company issued 8% Class A Convertible Preferred Stock in the amount of $23,638 and Class B Convertible Preferred Stock in the amount of $359,893. Dividends on Class A Preferred are payable quarterly at 8% per annum. Dividends on Class B Preferred are payable monthly at 10% per annum. The Class B Preferred was offered to certain notes payable holders at a conversion of $10.00 per Class B share. Each share of Class A Preferred and Class B Preferred is nonvoting and convertible into five shares of common stock. Each holder of a share of Preferred Stock has a five-year warrant to purchase one share of common stock at $3.00 per share, subject to adjustment.

In June 2000 the Company issued 10% Class C Convertible Preferred Stock in the amount of $805,000. Dividends on Class C Preferred are payable monthly at 10% per annum. The Class C Preferred was offered to certain note holders at $10.00 per share. Each share of Class C Preferred is non-voting and convertible into two shares of Vicom Common Stock.

The shares of Classes A, B and C of Preferred Stock (collectively "Preferred Stock") are non-voting, except as may otherwise be required by law. The holders of the Preferred Stock are entitled to receive, as and when declared by the Board, out of the assets of the Company legally available for payment thereof, cumulative cash dividends calculated based on the $10.00 per share stated value of the Preferred Stock. The per annum dividend rate is eight percent (8%) for the Class A Preferred and ten percent (10%) for the Classes B and C Preferred. Dividends on the Class A Preferred are payable quarterly on March 31, June 30, September 30, and December 31 of each year. Dividends on the Classes B and C Preferred are payable monthly on the first day of each calendar month. Dividends on the Preferred Stock accrue cumulatively on a daily basis until the Preferred Stock is redeemed or converted.

In the event of any liquidation, dissolution or winding up of the Company, the holders of Preferred Stock will be entitled to receive a liquidation preference of $10.50 per share, subject to adjustment, which shall be payable out of any net assets of the Company remaining after payment or provision for payment of the debts and other liabilities of the Company.

The Company may redeem the Preferred Stock, in whole or in part, at a redemption price of $10.50 per share (subject to adjustment, plus any earned and unpaid dividends) on not less than thirty days' notice to the holders of the Preferred Stock, provided that the closing bid price of the Common Stock exceeds $4.00 per share (subject to adjustment) for any ten consecutive trading days prior to such notice. Upon the Company's call for redemption, the holders of the Preferred Stock called for redemption will have the option to convert each share of Preferred Stock into five shares of Common Stock until the close of business on the date fixed for redemption, unless extended by the Company in its sole discretion. Preferred Stock not so converted will be redeemed. No holder of Preferred Stock can require the Company to redeem his or her shares.

Related Party Transactions

The following is a summary of all significant related party transactions for the three years ended December 31, 1999.

The Company leases facility space in Minneapolis from Marbell Realty, a limited liability corporation owned in equal shares by Steven Bell and Marvin Frieman, Executive Officers and Directors of Vicom pursuant to a lease, expiring in 2006. Total facilities rent expense paid under said lease was approximately $136,533 in 1999. The Company believes that the rental amounts being paid

11

under the lease are equal to or less than the Company would be paying to another landlord. See Item 3: Properties.

The Company leases its space in Fargo, North Dakota from David Ekman, an Executive Officer of CTU and Director of Vicom, pursuant to a lease expiring in 2001. Rent paid in November and December 1999 totaled $45,000. See Item 3: Properties.

In December 1999, James Mandel and Pierce McNally, directors of Vicom, and Enstar, Inc., a Vicom shareholder, guaranteed a note payable by Vicom to David Ekman in the amount of $1,250,000 pursuant to the purchase of Ekman, Inc. They were given warrants to purchase Vicom's stock at $2.00 per share in exchange for the guarantee.

The number of warrants issued were Enstar, Inc. 50,000 shares, Messrs. Mandel and McNally, 25,000 shares each.

Interest expense paid by Vicom to related parties was approximately $142,000 in 1999, $47,000 in 1998 and $38,000 in 1997. Related parties include the Company's Chairman, Chief Executive Officer, President, and the President's mother.

Subsequently, in April 2000, Vicom advanced loans to the following Directors in the amounts stated by their names: David Ekman, $200,000; James Mandel, $132,000; Paul Knapp, $68,750; Pierce McNally, $57,500. All loans are due to Vicom on October 15, 2001 and bear an annual interest rate of 8%, evidenced by Promissory Notes. All loans were incurred for the purpose of purchasing Vicom stock and the loans are collateralized by the Director/Borrower granting Vicom a security interest in said stock.

4. 2000 NON-EMPLOYEE DIRECTOR STOCK COMPENSATION PLAN

Background

Shareholders will be asked to approve the Company's 2000 Non-Employee Directors' Stock Compensation Plan (the "2000 Directors' Plan"). A complete copy of The Plan is attached hereto as Exhibit A. The 2000 Directors' Plan was approved by the Company's Board of Directors in July 2000 and is being submitted to the shareholders of the Company for their approval at the Meeting.

The purpose of the 2000 Directors' Plan is to enable the Company, through the grant of stock options to non-employee ("outside") directors of the Company, to attract and retain highly-qualified outside directors and, by providing them with such a stock-based incentive, to motivate them to promote the best interests of the Company and its shareholders. For the purposes of the Plan, outside directors are directors who, at the time of granting of options under the Plan, are not and for the prior twelve months have not been employees of the Company or any of its subsidiaries.

Summary of 2000 Directors' Plan

The text of the 2000 Directors' Plan is attached as an Appendix to this proxy statement. The following description of the Plan is intended merely as a summary of the principal features of the Plan and is qualified in its entirety by reference to the provisions of the Plan itself.

The 2000 Directors' Plan is to be administered by the Board of Directors and authorizes up to an aggregate of 300,000 shares of Common Stock ("Shares") for the granting of qualified and/or nonqualified stock options ("Options"). Generally, Shares subject to Options that remain unexercised upon expiration or earlier termination of such Options will once again become available for the granting of additional Options under the 2000 Directors' Plan.

The 2000 Directors' Plan provides for an initial automatic grant to each outside director of an option for 30,000 Shares. The initial grant will be made shortly after the 2000 Annual Meeting to all

12

non-employee directors re-elected or serving in the following year. At the first Directors meeting following January 1, 2001, each non-employee director will be granted an option to purchase an additional 3,000 shares. Thereafter, beginning in 2002, each non-employee director will be granted an option to purchase another 2,000 shares annually following the Annual Meeting. Beginning after the 2001 Annual Meeting, newly elected directors will initially be granted an option to purchase 30,000 shares, and each year following the initial grant they will be granted an option to purchase an additional 2,000 shares. All grants will provide for an exercise price equal to 100% of the fair market value of a Share at the date of the grant. Options will become exercisable approximately one year after date of grant and will expire ten years after date of grant, subject to earlier exercise and termination in certain circumstances. If an outside director ceases to be a director due to death, any of his outstanding Options which have not yet become exercisable will accelerate, and all of his outstanding Options will remain exercisable for various specified periods of time up to a maximum of approximately 1 year. If an outside director ceases to be a director due to disability, all of his or her outstanding Options not fully vested will immediately terminate, and those that are fully vested will remain exercisable for various specified periods of time up to a maximum of approximately 1 year. If an outside director ceases to be a director for any other reason, all of his or her outstanding Options not fully vested will immediately terminate, and those that are fully vested will remain exercisable for 90 days.

The number of Shares authorized for issuance under the 2000 Directors' Plan, the number of Shares with respect to which Options automatically will be granted, and the number of Shares issuable under (and the exercise price of) outstanding Options are subject to adjustment in the event of a stock split, stock dividend or similar change in the capitalization of the Company. The 2000 Directors' Plan further provides that, in the event of a merger, consolidation or other specified corporate transactions, the Board of Directors, in its discretion, may terminate the outstanding Options, in which case the exercise date of Options to be so terminated will be accelerated automatically.

The Board of Directors, at any time, may suspend or discontinue the 2000 Directors' Plan and, subject to certain limitations (as set forth in Section 9 of the Plan), may amend the Plan and any outstanding Options in any respect.

The 2000 Directors' Plan will become effective upon its approval by the Company's shareholders and is scheduled to expire on December 31, 2009, unless earlier terminated or extended by the Board of Directors.

A total of 150,000 Options have been granted under the 2000 Directors' Plan, contingent upon shareholder approval. These options have been granted to the five non-employee directors (Messrs. Dodge, Knapp, Mcnally, Mekler, and Villafana).

Following subsequent Annual Meetings during the term of the 2000 Directors' Plan, the number of automatic 30,000 share Option grants under the Plan will depend upon the number of outside directors who are newly elected at such meetings and the number of automatic 2,000 share options grants under the Plan will depend on the number of outside directors who return to the Board. The exercise price of the Options granted this year and of future Option grants under the 2000 Directors' Plan will be equal to 100% of the fair market value of the Common Stock on the date of grant.

None of the six above-named outside directors who would be granted Options under the 2000 Directors' Plan currently holds or is eligible to receive options under any other option plan of the Company. (See Item 1. "Election of Directors—Compensation of Directors" and "Additional Information—Beneficial Ownership of Principal Shareholders and Management" for further information concerning compensation paid to and shareholdings of outside directors of the Company.)

13

5. 2000 EMPLOYEE STOCK PURCHASE PLAN (THE PLAN)

The Plan was adopted by the Vicom Board of Directors in July 2000 and is being submitted to Company shareholders for their approval at the Annual Meeting. A complete copy of The Plan is attached hereto as Exhibit B. The purpose of the Plan is to provide Eligible Employees with an opportunity to increase their proprietary interest in the success of the Company by purchasing Stock from the Company on favorable terms and to pay for such purchase through payroll deductions. The Plan is intended to qualify under section 423 of the Code. The provisions of the Plan shall be construed so as to extend and limit participation in a manner consistent with the requirements of that section of the Code.

The Plan shall be administered by the Committee. The Committee shall consist exclusively of one or more directors of the Company, who shall be appointed by the Board. The Committee shall interpret the Plan and make all other policy decisions relating to the operation of the Plan. The Committee may adopt such rules, guidelines and forms as it deems appropriate to implement the Plan. The Committee's determinations under the Plan shall be final and binding on all persons.

The Plan Year shall consist of a twelve month period commencing on January 1 and ending on December 31. Notwithstanding the foregoing, the first Plan Year shall be a short Plan Year commencing on the effective date of the Plan and ending on December 31, 2000.

6. OTHER MATTERS

The management of the Company is unaware of any other matters that are to be presented for action at the meeting. Should any other matter come before the meeting, however, the persons named in the enclosed proxy will have discretionary authority to vote all proxies with respect to such matter in accordance with their judgement.

Shareholders Proposals

Proposals submitted to be presented at the 2001 annual meeting of shareholders must be received by the Company by December 30, 2000 to be considered for inclusion in the Company proxy materials relating to that meeting.

Vicom, Incorporated

by

Pierce McNally

Secretary

14

Exhibit A

Vicom, Inc.

2000 Non-Employee Directors Stock Compensation Plan

1. PURPOSE

This VICOM, Inc. 2000 NON-EMPLOYEE DIRECTORS' STOCK COMPENSATION PLAN (the "Plan") is intended to provide a means whereby VICOM, Inc. (the "Company") may, through the grant of qualified or non-qualified stock options ("Options") to purchase common stock of the Company ("Common Stock") to Non-Employee Directors (as defined in Section 4 hereof), attract and retain capable outside directors and motivate such outside directors to promote the best interests of the Company, its related corporations and shareholders.

2. DEFINITIONS

Wherever used in the Plan, the following terms shall have the meanings set forth below:

2.01 "Award" means any Option granted under the Plan.

2.02 "Award Agreement" means any written agreement, contract or other instrument or document evidencing any Award granted under the Plan.

2.03 "Board" means the Board of Directors of the Company.

2.04 "Code" means the Internal Revenue Service Code of 1954, as amended, and the rules and regulations promulgated thereunder.

2.05 "Committee" means the committee which may be designated from time to time by the Board to administer the Plan. If so designated, the Committee shall be composed of not less that three persons (who need not be members of the Board) who are appointed from time to time to serve on the Committee by the Board and who qualify as "disinterested persons" within the meaning of Rule 16b-3 of the Securities and Exchange Act of 1934.

2.06 "Company" means Vicom, Inc. and any successor corporation.

2.07 "Fair Market Value" means the value to be determined in good faith at the time of the grant of an Award as by decision of the Board, or, if the stock is publicly traded, Fair Market Value shall equal the average of the highest and lowest sales prices of the Stock on the date of an Award, as reported by such responsible reporting services as the Board may select.

2.08 "Incentive Stock Option" or "ISO" means a stock option which is intended to meet and comply with the terms and conditions for an incentive stock options as set forth in Section 422A of the Code.

2.09 "Non-Employee Director" means a member of the Board of Directors as defined in Section 4.

2.10 "Non-Incentive Stock Option" or "NQSO" means a stock option to purchase stock which does not meet or comply with the requirements for an incentive stock option as set forth in section 422A of the Code. Included in this definition are any other form or forms of tax-qualified discriminatory stock options which may be incorporated within the Code as it may from time to time be amended.

2.11 "Option" means, where required by the context of the Plan, an ISO and/or NQSQ granted pursuant to the Plan.

15

2.12 "Participant" means a Non-Employee Director as defined in Section 4 that has been granted one or more Options pursuant to the Plan.

2.13 "Related Corporation" means a corporate subsidiary of the Company, as defined in section 424(f) of the Internal Revenue Code of 1986, as amended ("Code").

2.14 "Stock" means the Common Stock of the Company.

3. ADMINISTRATION

The Plan shall be administered by the Company's Board of Directors (the "Board"). The Board shall have all the powers vested in it by the terms of the Plan, such powers to include authority (within any limitations described herein) to prescribe the form of the agreement embodying awards of Options. The Board shall, subject to the provisions of the Plan, implement the grant of Options under the Plan and shall have the power to construe the Plan, to determine all questions arising thereunder and to adopt and amend such rules and regulations for the administration of the Plan as it may deem desirable. Any decisions of the Board in the administration of the Plan, as described herein, shall be final and conclusive. The Board may authorize any one or more of its number or the Secretary or any other officer of the Company to execute and deliver documents on behalf of the Board. No member of the Board shall be liable for anything done or omitted to be done by him or by any other member of the Board in connection with the Plan, except for his own willful misconduct or as expressly provided by statute.

4. ELIGIBILITY

The persons who shall be eligible to receive Options under the Plan ("Non-Employee Directors") shall be those directors of the Company who:

5. AUTHORIZED SHARES

Options may be granted under the Plan to purchase up to a maximum of three hundred thousand (300,000) shares of Common Stock, par value $.01 per share, subject to adjustment as hereinafter provided. Shares issuable under the Plan shall be treasury shares, and the Company may purchase shares of Common Stock against which Options may be granted hereunder, from time to time, if it deems such purchases to be advisable.

If any Option granted under the Plan expires or otherwise terminates, in whole or in part, for any reason whatever (including, without limitation, a Non-Employee Director's surrender thereof) without having been exercised, the shares subject to the unexercised portion of such Option shall continue to be available for the granting of Options under the Plan as fully as if such shares had never been subject to an Option.

6. GRANTING OF OPTIONS

Non-Employee Directors that are serving on the Board of Directors on the third business day following the Company's 2000 Annual Meeting of Stockholders shall be granted an Option to purchase thirty thousand (30,000) shares of Common Stock at price equal to the closing price on July 11, 2000, subject to the terms of the Plan, and contingent on shareholder approval of the Plan. Directors that are serving on the Board on the first Board meeting date after January 1, 2001 will be granted an additional Option to purchase three thousand (3,000) shares on that date. Thereafter, upon initial

16

election to the Board of Directors, each person newly elected as a Non-Employee Director automatically shall be granted an Option to purchase thirty thousand (30,000) shares of Common Stock, subject to the terms of the Plan. Each year thereafter, commencing in 2002, on the third business day following the date of the Company's Annual Meeting, each person reelected or continuing as a Non-Employee Director automatically shall be granted an Option to purchase two thousand (2,000) shares of Common Stock, subject to the terms of the Plan.

7. TERMS AND CONDITIONS OF OPTIONS

Options granted pursuant to the Plan shall include expressly or by reference the following terms and conditions:

7.01 Number of Shares: A statement of the number of shares to which the Option pertains.

7.02 Price: A statement of the Option exercise price (the "Option Price"). The Option Price shall be one hundred percent (100%) of the Fair Market Value of the Common Stock.

7.03 Term: Subject to earlier termination as provided in Sections 7.05, 7.06, and 7.07 and in Section 8 hereof, the term of each Option shall be ten (10) years from the date of grant.

7.04 Exercise: Options shall be exercisable commencing one (1) year after the date of grant, except that, if the date of the next succeeding annual meeting of shareholders is less than one (1) year from the date of grant of the Options, then such Options shall be exercisable, commencing on the day preceding the date of the annual meeting of shareholders next succeeding the date of grant of such Options. Except as otherwise provided in Sections 7.05, 7.06 and 7.07 hereof, Options shall only be exercisable while a Non-Employee Director remains a director of the Company. Any Option shares, the right to the purchase of which has accrued, may be purchased at any time up to the expiration or termination of the Option. Exercisable Options may be exercised, in whole or in part, from time to time by giving written notice of exercise to the Company at its principal office, specifying the number of shares to be purchased and accompanied by payment in full of the aggregate price for such shares. Only full shares shall be issued under the Plan, and any fractional share which might otherwise be issuable upon exercise of an Option granted hereunder shall be forfeited.

The Option Price shall be payable:

7.05 Termination of Service as a Director: If a Non-Employee Director's service as a director of the Company terminates prior to the expiration date of his or her Options for any reason (such as, without limitation, failure to be re-elected by the shareholders or resignation) other than those set forth in Sections 7.06 and 7.07 below, all such Non-Employee Director's outstanding options not fully vested shall immediately terminate. Fully vested options may be exercised by the former Non-Employee Director, at any time prior to the earlier of:

7.06 Disability of Non-Employee Director: If a Non-Employee Director shall become disabled (within the meaning of section 22 (e) (3) of the Code) during the period in which he or she is a director of the Company and, prior to the expiration date fixed for his or her Options, his or her

17

service as a director with the Company is terminated as a consequence of such disability, all such Non-Employee Director's outstanding options not fully vested shall immediately terminate. Fully vested options may be exercised by the former Non-Employee Director, at any time prior to the earlier of:

In the event of a Non-Employee Director's legal disability, such Options may be so exercised by the Non-Employee Director's legal representative.

7.07 Death of Non-Employee Director: If a Non-Employee Director ceases to be a director of the Company by reason of his or her death prior to the expiration date fixed for his or her Options, all of such Non-Employee Director's outstanding Options immediately shall become fully exercisable, and such Options may be exercised at any time prior to the earlier of:

If a Non-Employee Director who ceases to be a director for reasons described in Sections 7.06 and 7.07 hereof shall die following his or her ceasing to be a director but prior to the earlier of the expiration date fixed for his or her Options, or the expiration of the period determined under Sections 7.06 and 7.07 hereof, as the case may be, such Options may be exercised, to the extent of the number of shares with respect to which the Non-Employee Director could have exercised it on the date of his or her death, at any time prior to the earlier of:

In the event of a Non-Employee Director's death, such Options may be so exercised by the Non-Employee Director's estate, personal representative or beneficiary who acquired the right to exercise such Option by bequest or inheritance or by reason of the death of the Non-Employee Director.

7.08 Non-Transferability: Except as otherwise provided in any Option Agreement (as defined in Section 8 hereof), no Option shall be assignable or transferable by the Non-Employee Director otherwise than by will or by the laws of descent and distribution, and during the lifetime of the Non-Employee Director, the Option shall be exercisable only by him or by his or her guardian or legal representative. If the Non-Employee Director is married at the time of exercise and if the Non-Employee Director so requests at the time of exercise, the share certificate or certificates shall be registered in the name of the Non-Employee Director and the Non-Employee Director's spouse, jointly, with right of survivor-ship.

7.09 Rights as a Shareholder: An Participant under the Plan shall have no rights as a shareholder with respect to any shares covered by his or her Option until the issuance of a stock certificate to him or her for such shares.

7.10 Listing and Registration of Shares: Each Option shall be subject to the requirement that, if at any time the Board shall determine, in its discretion, that the listing, registration or qualification of the shares covered thereby upon any securities exchange or under any state or federal law, or the consent or approval of any governmental regulatory body, is necessary or desirable as a condition of, or in connection with, the granting of such Option or the purchase of shares thereunder, or that action by the Company or by a Non-Employee Director should be taken in order to obtain an exemption from any such requirement, no such Option may be granted or be exercised, in whole or in part, unless and

18

until such listing, registration, qualification, consent, approval, or action shall have been effected, obtained, or taken under conditions acceptable to the Board. Without limiting the generality of the foregoing, each Non-Employee Director or his or her legal representative or beneficiary may also be required to give satisfactory assurance that shares purchased upon exercise of an Option are being purchased for investment and not with a view to distribution, and certificates representing such shares may be legended accordingly.

8. OPTION AGREEMENTS—OTHER PROVISIONS

Options granted under the Plan shall be evidenced by written documents ("Option Agreements") in such form as the Board shall from time to time, approve, which Option Agreements shall contain such provisions, not inconsistent with the provisions of the Plan as the Board shall deem advisable. Each Non-Employee Director shall enter into, and be bound by, such Option Agreements.

9. CAPITAL ADJUSTMENTS

The number of shares of Common Stock which may be issued under the Plan, as stated in Section 6 hereof, the number of shares covered by future Option grants, as stated in Section 5 hereof, and the number of shares issuable upon exercise of outstanding Options under the Plan (as well as the Option price per share under such outstanding Options) shall be adjusted proportionately to reflect any stock dividend, stock split, share combination, or similar change in the capitalization of the Company.

In the event of a corporate transaction (as that term is described in section 424(a) of the Code and the Treasury Regulations issued thereunder as, for example, a merger, consolidation, acquisition of property or stock, separation, reorganization, or liquidation) and provision is not made for the continuance and assumption of Options under the Plan, or the substitution for such Options of new Options to acquire securities or other property to be delivered in connection with the transaction, the Board shall, by written notice to the holders of Options, provide that all unexercised Options will terminate immediately prior to the consummation of such merger, consolidation, acquisition, reorganization, liquidation, sale or transfer unless exercised by the holder within a specified number of days (which shall not be less than fourteen (14) days) following the date of such notice. On the date of such notice, all such unexercised Options automatically shall become fully exercisable.

10. AMENDMENT, SUSPENSION AND DISCONTINUANCE OF THE PLAN

The Board, from time to time, may suspend or discontinue the Plan or amend the Plan or any Option outstanding under it in any respect whatsoever, provided, however, that:

19

11. TERMINATION OF PLAN

Unless earlier terminated or extended as provided in the Plan, the Plan and all authority granted hereunder shall terminate absolutely at 12:00 midnight on December 31, 2009, and no Options hereunder shall be granted thereafter. Nothing contained in this Section 11, however, shall terminate or affect the continued existence in accordance with their terms of Options outstanding on the date of termination of the Plan.

12. MISCELLANEOUS PROVISIONS

12.01 Additional Compensation: Nothing contained in the Plan shall prevent the Board from adopting other or additional compensation arrangements for directors (subject to shareholder approval if such approval is required); and such arrangements may be either generally applicable or applicable only in specific cases.

12.02 Right to Continued Service: The adoption of the Plan and the receipt of grants hereunder shall not confer upon any person any right to continue service as a Non-Employee Director of the Company.

12.03 Withhold Taxes: In the event of exercise of an Option, the Participant shall pay to the Company, upon its demand, such amount as may be requested by the Company for the purpose of satisfying any liability to withhold Federal, state, local, or foreign income or other taxes (which payment may be made in any manner prescribed in Section 6(d) hereof). The obligations of the Company under the Plan shall be conditioned on such payment, and the Company shall have the right to withhold the issuance of shares to the Participant and, to the extent permitted by law, shall have the right to deduct any such taxes from any payment of any kind otherwise due to the Non-Employee Director.

12.04 Indemnification and Hold Harmless: Each person who is or shall have been a member of the Board shall be indemnified and held harmless by the Company, to the fullest extent permissible by Minnesota Law, against and from any loss, cost, liability, or expense that may be imposed upon or reasonably incurred by such person in connection with or resulting from any claim, action, suit, or proceeding to which such person may be made a party or in which such person may be involved by reason of any action taken or failure to act under or with respect to the Plan and against and from any and all amounts paid by such person in settlement thereof, with the Company's approval, or paid by such person in satisfaction of any judgement in any such action, suit, or proceeding against such person, provided such person shall give the Company an opportunity, at the Company's expense, to handle and defend the same before such person undertakes to handle and defend it on such person's own behalf. The foregoing right of indemnification shall not be exclusive and shall be independent of any other rights of indemnification to which such persons may be entitled under the Company's Certificate of Incorporation or By-laws, by contract, as a matter of law, or otherwise.

12.05 Governing Law: The Plan and all awards made and actions taken thereunder shall be governed by and construed in accordance with laws of the State of Minnesota.

13. EFFECTIVE DATE

The Plan shall become effective when the Plan is approved and adopted by the Company's shareholders.

20

Exhibit B

VICOM, INC.

2000 EMPLOYEE STOCK PURCHASE PLAN

1. PURPOSE.

The Plan was adopted by the Board on July 2000 effective as defined in Subsection 2.09. The purpose of the Plan is to provide Eligible Employees with an opportunity to increase their proprietary interest in the success of the Company by purchasing Stock from the Company on favorable terms and to pay for such purchases through payroll deductions. The Plan is intended to qualify under section 423 of the Code. The provisions of the Plan shall be construed so as to extend and limit participation in a manner consistent with the requirements of that section of the Code.

2. DEFINITIONS.

2.01 "ACCUMULATION PERIOD" means a three-month period during which contributions may be made toward the purchase of Stock under the Plan, as determined pursuant to Subsection 4.02.

2.02 "BOARD" means the Board of Directors of the Company, as constituted from time to time.

2.03 "CHANGE IN CONTROL" means:

A transaction shall not constitute a Change in Control if its sole purpose is to change the state of the Company's incorporation or to create a holding company that will be owned in substantially the same proportions by the persons who held the Company's securities immediately before such transaction.

2.04 "CODE" means the Internal Revenue Code of 1986, as amended.

21

2.05 "COMMITTEE" means a committee of the Board, as described in Section 3.

2.06 "COMPANY" means Vicom, Inc., a Minnesota corporation.

2.07 "COMPENSATION" means (i) the total taxable compensation paid to a Participant by a Participating Company during a calendar year as reported on the Participant's form W-2, including salaries, wages, bonuses, incentive compensation, commissions, overtime pay and shift premiums, plus (ii) any pre-tax contributions made by the Participant under sections 401(k) or 125 of the Code. Notwithstanding the foregoing, "Compensation" shall exclude all non-cash items, moving or relocation allowances, cost-of-living equalization payments, car allowances, tuition reimbursements, imputed income attributable to cars or life insurance, severance pay, fringe benefits, contributions or benefits received under employee benefit plans, income attributable to the exercise of stock options, and similar items. The Committee shall determine whether a particular item is included in Compensation.

2.08 "ELIGIBLE EMPLOYEE" means any employee of a Participating Company whose customary employment is for more than five months per calendar year and for more than 20 hours per week. The foregoing notwithstanding, an individual shall not be considered an Eligible Employee if he or she works in a job classification covered by a collective bargaining agreement and the parties to that agreement have bargained in good faith about stock purchase benefits and the bargaining agreement does not provide for participation in this Plan.

2.09 "EFFECTIVE DATE" means the date on which both:

2.10 "EXCHANGE ACT" means the Securities Exchange Act of 1934, as amended.

2.11 "FAIR MARKET VALUE" means the market price of Stock, determined by the Committee as follows:

Whenever possible, the determination of Fair Market Value by the Committee shall be based on the prices reported in THE WALL STREET JOURNAL or as reported directly to the Company by Nasdaq or a comparable exchange. Such determination shall be conclusive and binding on all persons.

2.12 "OFFERING PERIOD" means a 3-month period with respect to which the right to purchase Stock may be granted under the Plan, as determined pursuant to Subsection 4.01.

22

2.13 "PARTICIPANT" means an Eligible Employee who elects to participate in the Plan, as provided in Subsection 4.03.

2.14 "PARTICIPATING COMPANY" means (i) the Company and (ii) each present or future Subsidiary designated by the Committee as a Participating Company.

2.15 "PLAN" means this Vicom, Inc. 2000 Employee Stock Purchase Plan, as it may be amended from time to time.

2.16 "PLAN ACCOUNT" means the account established for each Participant pursuant to Subsection 8.01.

2.17 "PURCHASE PRICE" means the price at which Participants may purchase Stock under the Plan, as determined pursuant to Subsection 8.02.

2.18 "STOCK" means the Common Stock of the Company.

2.19 "SUBSIDIARY" means any corporation (other than the Company) in an unbroken chain of corporations beginning with the Company, if each of the corporations other than the last corporation in the unbroken chain owns stock possessing 50% or more of the total combined voting power of all classes of stock in one of the other corporations in such chain.

3. ADMINISTRATION.

3.01 COMMITTEE COMPOSITION. The Plan shall be administered by the Committee. The Committee shall consist exclusively of one or more directors of the Company, who shall be appointed by the Board.

3.02 COMMITTEE RESPONSIBILITIES. The Committee shall interpret the Plan and make all other policy decisions relating to the operation of the Plan. The Committee may adopt such rules, guidelines and forms as it deems appropriate to implement the Plan. The Committee's determinations under the Plan shall be final and binding on all persons.

3.03 PLAN YEAR. The Plan Year shall consist of a twelve month period commencing on January 1 and ending on December 31. Notwithstanding the foregoing, the first Plan Year shall be a short Plan Year commencing on the Effective Date of the Plan and ending on December 31, 2000.

4. ENROLLMENT AND PARTICIPATION.

4.01 OFFERING PERIODS. While the Plan is in effect, Offering Periods will be consecutive quarterly periods commencing on the first trading day on or after January 1, April 1, July 1, and October 1 each year and ending on the following March 31, June 30, September 30, or December 31 of each year, except that the first Offering Period shall commence on the first Trading Day on or after the Effective Date as defined in Subsection2.09 and ending on the last Trading Day before the next March 31, June 30, September 30, or December 31, whichever is first. The Committee shall have the power to change the duration of offering periods (including the commencement dates hereof) with respect to future offerings without shareholder approval if each such change is announced at least five (5) days prior to the scheduled beginning of the first Offering Period to be affected thereafter.

4.02 ACCUMULATION PERIODS. While the Plan is in effect, four (4) Accumulation periods shall commence in each calendar year. The Accumulation Periods shall consist of the three-month periods commencing on each January 1, April 1, July 1, and October 1, except that the first Accumulation Period shall commence on the Effective Date as defined in Subsection 2.09 and end on the next March 31, June 30, September 30, or December 31, whichever is first.

4.03 ENROLLMENT. Any individual who, on the day preceding the first day of an Offering Period, qualifies as an Eligible Employee may elect to become a Participant in the Plan for such

23

Offering Period by executing the enrollment form prescribed for this purpose by the Committee. The enrollment form shall be filed with the Company at the prescribed location not later than 10 days prior to the commencement of such Offering Period. Notwithstanding the foregoing, the Committee may designate a date that is fewer than 10 days prior to the commencement of the first Offering Period under the Plan as the date by which enrollment forms must be filed with respect to the first Offering Period; in no event, however, shall the Committee designate a date that is subsequent to the date on which the Company's Registration Statement currently pending becomes effective with the Securities and Exchange Commission.

4.04 DURATION OF PARTICIPATION. Once enrolled in the Plan, a Participant shall continue to participate in the Plan until he or she ceases to be an Eligible Employee, withdraws from the Plan under Subsection 6.01 or reaches the end of the Accumulation Period in which his or her employee contributions were discontinued under Subsection 5.04 or 9.02. A Participant who discontinued employee contributions under Subsection 5.04 or withdrew from the Plan under Subsection 6.01 may again become a Participant, if he or she then is an Eligible Employee, by following the procedure described in Subsection 6.01 above. A Participant whose employee contributions were discontinued automatically under Subsection 9.02 must re-enroll by following the procedure described in Subsection 6.01 above, if he or she then is an Eligible Employee.

5. EMPLOYEE CONTRIBUTIONS.

5.01 FREQUENCY OF PAYROLL DEDUCTIONS. A Participant may purchase shares of Stock under the Plan solely by means of payroll deductions. Payroll deductions shall occur on each payday during participation in the Plan and shall be determined based upon the Payroll Withholding Rate designated by the Participant pursuant to Subsection 5.02 below.

5.02 PAYROLL WITHHOLDING RATE. An Eligible Employee shall designate on the enrollment form the portion of his or her Compensation that he or she elects to have withheld during a calendar year for the purchase of Stock (the "Payroll Withholding Rate"). Such portion shall be a whole percentage of the Eligible Employee's Compensation, but not less than 1% nor more than 15% of Compensation. In no event may an Eligible Employee contribute more than 15% of his or her Compensation during a calendar year for the purchase of shares of Stock under the Plan.

5.03 CHANGING WITHHOLDING RATE. If a Participant wishes to change his or her Payroll Withholding Rate, he or she may do so by filing a new enrollment form with the Company at the prescribed location at any time. The new Payroll Withholding Rate shall be effective as soon as reasonably practicable after such form has been received by the Company. The new Payroll Withholding Rate shall be a whole percentage of the Eligible Employee's Compensation, but not less than 1% nor more than 15% of Compensation.

5.04 DISCONTINUING PAYROLL DEDUCTIONS. If a Participant wishes to discontinue employee contributions entirely, he or she may do so by filing a new enrollment form with the Company at the prescribed location at any time. Payroll withholding shall cease as soon as reasonably practicable after such form has been received by the Company. (In addition, employee contributions may be discontinued automatically pursuant to Subsection 9.02. A Participant who has discontinued employee contributions may resume such contributions by filing a new enrollment form with the Company at the prescribed location. Payroll withholding shall resume as soon as reasonably practicable after such form has been received by the Company.

5.05 LIMIT ON NUMBER OF ELECTIONS. No Participant shall make more than two elections under Subsection 5.03 or 5.04 above during any Accumulation Period.

24

6. WITHDRAWAL FROM THE PLAN.

6.01 WITHDRAWAL. A Participant may elect to withdraw from the Plan by filing the prescribed form with the Company at the prescribed location at any time before the last day of an Accumulation Period. As soon as reasonably practicable thereafter, payroll deductions shall cease and the entire amount credited to the Participant's Plan Account shall be refunded to him or her in cash, without interest. No partial withdrawals shall be permitted.

6.02 RE-ENROLLMENT AFTER WITHDRAWAL. A former Participant who has withdrawn from the Plan shall not be a Participant until he or she re-enrolls in the Plan under Subsection 4.03. Re-enrollment may be effective only at the commencement of an Offering Period.

7. CHANGE IN EMPLOYMENT STATUS.

7.01 TERMINATION OF EMPLOYMENT. Termination of employment as an Eligible Employee for any reason, including death, shall be treated as an automatic withdrawal from the Plan under Subsection 6.01. (A transfer from one Participating Company to another shall not be treated as a termination of employment.)

7.02 LEAVE OF ABSENCE. For purposes of the Plan, employment shall not be deemed to terminate when the Participant goes on a military leave, a sick leave or another BONA FIDE leave of absence, if the leave was approved by the Company in writing. Employment, however, shall be deemed to terminate 90 days after the Participant goes on a leave, unless a contract or statute guarantees his or her right to return to work. Employment shall be deemed to terminate in any event when the approved leave ends, unless the Participant immediately returns to work.

7.03 DEATH. In the event of the Participant's death, the amount credited to his or her Plan Account shall be paid to a beneficiary designated by him or her for this purpose on the prescribed form or, if none, to the Participant's estate. Such form shall be valid only if it was filed with the Company at the prescribed location before the Participant's death.

8. PLAN ACCOUNTS AND PURCHASE OF SHARES.

8.01 PLAN ACCOUNTS. The Company shall maintain a Plan Account on its books in the name of each Participant. Whenever an amount is deducted from the Participant's Compensation under the Plan, such amount shall be credited to the Participant's Plan Account. Amounts credited to Plan Accounts shall not be trust funds and may be commingled with the Company's general assets and applied to general corporate purposes. No interest shall be credited to Plan Accounts.

8.02 PURCHASE PRICE. The Purchase Price for each share of Stock purchased after the close of an Accumulation Period shall be the lower of:

8.03 NUMBER OF SHARES PURCHASED. As of the last day of each Accumulation Period, each Participant shall be deemed to have elected to purchase the number of shares of Stock calculated in accordance with this Subsection 8.03, unless the Participant has previously elected to withdraw from the Plan in accordance with Subsection 6.01. The amount then in the Participant's Plan Account shall be divided by the Purchase Price, and the number of shares that results shall be purchased from the Company with the funds in the Participant's Plan Account. The foregoing notwithstanding, no Participant shall purchase more than 1,000 shares of Stock with respect to any Accumulation Period nor more than the amounts of Stock set forth in Subsections 9.02 and 14.01. The Committee may

25

determine with respect to all Participants that any fractional share, as calculated under this Subsection 8.03, shall be (i) rounded down to the next lower whole share or (ii) credited as a fractional share.

8.04 AVAILABLE SHARES INSUFFICIENT. In the event that the aggregate number of shares that all Participants elect to purchase during an Accumulation Period exceeds the maximum number of shares remaining available for issuance under Subsection 14.01, then the number of shares to which each Participant is entitled shall be determined by multiplying the number of shares available for issuance by a fraction, the numerator of which is the number of shares that such Participant has elected to purchase and the denominator of which is the number of shares that all Participants have elected to purchase.

8.05 ISSUANCE OF STOCK. Certificates representing the shares of Stock purchased by a Participant under the Plan shall be issued to him or her as soon as reasonably practicable after the close of the applicable Accumulation Period, except that a certificate will not be issued for fewer than 100 shares. The Committee may determine that such shares shall be held for each Participant's benefit by a broker designated by the Committee (unless the Participant has elected that certificates be issued to him or her). Shares may be registered in the names of the Participant or jointly in the name of the Participant and his or her spouse as joint tenants with right of survivorship or as community property.

8.06 UNUSED CASH BALANCES. An amount remaining in the Participant's Plan Account that represents the Purchase Price for any fractional share shall be carried over in the Participant's Plan Account to the next Accumulation Period. Any amount remaining in the Participant's Plan Account that represents the Purchase Price for whole shares that could not be purchased by reason of Subsection 8.03, Subsection 9.02, or Subsection 14.01 shall be refunded to the Participant in cash, without interest.

8.07 STOCKHOLDER APPROVAL. Any other provision of the Plan notwithstanding, no shares of Stock shall be purchased under the Plan unless and until the Company's stockholders have approved the adoption of the Plan.

9. LIMITATIONS ON STOCK OWNERSHIP.

9.01 FIVE PERCENT LIMIT. Any other provision of the Plan notwithstanding, no Participant shall be granted a right to purchase Stock under the Plan if such Participant, immediately after his or her election to purchase such Stock, would own stock possessing more than 5% of the total combined voting power or value of all classes of stock of the Company or any parent or Subsidiary of the Company. For purposes of this Subsection 9.01, the following rules shall apply:

9.02 DOLLAR LIMIT. Any other provision of the Plan notwithstanding, no Participant shall purchase Stock under the Plan if the Fair Market Value of all stock purchased under all employee stock purchase plans is in excess of $25,000 for each calendar year in which in which such option is outstanding at any time.

10. RIGHTS NOT TRANSFERABLE.

The rights of any Participant under the Plan, or any Participant's interest in any Stock or moneys to which he or she may be entitled under the Plan, shall not be transferable by voluntary or involuntary

26

assignment or by operation of law, or in any other manner other than by beneficiary designation or the laws of descent and distribution. If a Participant in any manner attempts to transfer, assign or otherwise encumber his or her rights or interest under the Plan, other than by beneficiary designation or the laws of descent and distribution, then such act shall be treated as an election by the Participant to withdraw from the Plan under Subsection 6.01.

11. NO RIGHTS AS AN EMPLOYEE.

Nothing in the Plan or in any right granted under the Plan shall confer upon the Participant any right to continue in the employ of a Participating Company for any period of specific duration or interfere with or otherwise restrict in any way the rights of the Participating Companies or of the Participant, which rights are hereby expressly reserved by each, to terminate his or her employment at any time and for any reason, with or without cause.

12. NO RIGHTS AS A STOCKHOLDER.

A Participant shall have no rights as a stockholder with respect to any shares of Stock that he or she may have a right to purchase under the Plan until such shares have been purchased.

13. SECURITIES LAW REQUIREMENTS.

Shares of Stock shall not be issued under the Plan unless the issuance and delivery of such shares comply with (or are exempt from) all applicable requirements of law, including (without limitation) the Securities Act of 1933, as amended, the rules and regulations promulgated thereunder, state securities laws and regulations, and the regulations of any stock exchange or other securities market on which the Company's securities may then be traded.

14. STOCK OFFERED UNDER THE PLAN.

14.01 AUTHORIZED SHARES. The aggregate number of shares of Stock available for purchase under the Plan shall be 400,000, subject to adjustment pursuant to this Section 13.

14.02 ANTI-DILUTION ADJUSTMENTS. The aggregate number of shares of Stock offered under the Plan, the 1,000-share limitation described in Subsection 8.03 and the price of shares that any Participant has elected to purchase shall be adjusted proportionately by the Committee for any increase or decrease in the number of outstanding shares of Stock resulting from a subdivision or consolidation of shares or the payment of a stock dividend, any other increase or decrease in such shares effected without receipt or payment of consideration by the Company, the distribution of the shares of a Subsidiary to the Company's stockholders or a similar event.

14.03 REORGANIZATIONS. Any other provision of the Plan notwithstanding, immediately prior to the effective time of a Change in Control, the Offering Period and Accumulation Period then in progress shall terminate and shares shall be purchased pursuant to Section 8. In the event of a merger or consolidation to which the Company is a constituent corporation and which does not constitute a Change in Control, the Plan shall continue unless the plan of merger or consolidation provides otherwise. The Plan shall in no event be construed to restrict in any way the Company's right to undertake a dissolution, liquidation, merger, consolidation or other reorganization.

15. TERM OF PLAN

The Plan shall be effective as of the Effective Date as defined in Subsection 2.09 and end on December 31, 2009, except an earlier termination is permissible as provided in Section 16.

27

16. AMENDMENT OR DISCONTINUANCE.

The Board shall have the right to amend, suspend or terminate the Plan at any time and without notice. Except as provided in Section 14, any increase in the aggregate number of shares of Stock to be issued under the Plan shall be subject to approval by a vote of the stockholders of the Company. In addition, any other amendment of the Plan shall be subject to approval by a vote of the stockholders of the Company to the extent required by an applicable law or regulation. The right to purchase Stock granted herein is granted voluntarily by the Company and can be revoked at any time.

17. GOVERNING LAW.

The Plan shall be construed consistent with and governed by the laws of the State of Minnesota and the laws of the United States.

18. EXECUTION.

To record the adoption of the Plan as of July 21, 2000, the Company has caused its authorized officer to execute the same.

28

VICOM, INC.

PROXY FOR ANNUAL MEETING OF SHAREHOLDERS, AUGUST 10, 2000

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS. It will be voted on the matters set forth on this form as directed by the shareholder, but if no direction is made in the space provided, it will be voted FOR the election of all nominees to the Board of Directors, and FOR the ratification of all proposals submitted herewith to Vicom shareholders.