|

|

|

|

|

Previous: PARKER & PARSLEY 84-A LTD, 10-Q, EX-27, 2000-08-11 |

Next: GREAT PLAINS SOFTWARE INC, DEFA14A, 2000-08-11 |

SCHEDULE 14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant /x/ |

||

| Filed by a Party other than the Registrant / / | ||

| Check the appropriate box: |

||

| / / | Preliminary Proxy Statement | |

| / / | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| /x/ | Definitive Proxy Statement | |

| / / | Definitive Additional Materials | |

| / / | Soliciting Material Pursuant to §240.14a-11 or §240.14a-12 |

|

| GREAT PLAINS SOFTWARE |

||||

(Name of Registrant as Specified In Its Charter) |

||||

| |

||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| /x/ | No fee required | |||

| / / | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

| / / | Fee paid previously with preliminary materials. | |||

| / / | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

GREAT PLAINS SOFTWARE, INC.

1701 S.W. 38TH STREET

FARGO, NORTH DAKOTA 58103

PROXY STATEMENT FOR

ANNUAL MEETING OF SHAREHOLDERS

SEPTEMBER 13, 2000

This Proxy Statement is furnished in connection with the solicitation of the enclosed proxy by the Board of Directors of Great Plains Software, Inc. (the "Company") for use at the Annual Meeting of Shareholders (the "Annual Meeting") to be held on Wednesday, September 13, 2000, at 9:00 a.m., central time, at the Ramada Plaza Suites, 1635 42nd Street S.W., Fargo, North Dakota, and at any adjournment thereof, for the purposes set forth in the Notice of Annual Meeting of Shareholders. This Proxy Statement and the form of proxy enclosed are being mailed to shareholders with the Company's Annual Report to shareholders commencing on or about August 7, 2000.

SOLICITATION OF PROXIES

The Company is paying the costs of solicitation, including the cost of preparing and mailing this Proxy Statement. Proxies are being solicited primarily by mail, but in addition, the solicitation by mail may be followed by solicitation in person, or by Internet, telephone or facsimile, by regular employees of the Company without additional compensation. The Company will reimburse brokers, banks and other custodians and nominees for their reasonable out-of-pocket expenses incurred in sending proxy materials to the Company's shareholders.

VOTING RIGHTS AND PROCEDURES

Only shareholders of record of the Common Stock of the Company at the close of business on July 26, 2000 will be entitled to vote at the Annual Meeting. As of that date, a total of 19,906,692 shares of Common Stock were outstanding, each share being entitled to one vote. There is no cumulative voting.

The presence at the Annual Meeting, in person or by proxy, of the holders of a majority of the shares of Common Stock will constitute a quorum for the transaction of business at the Annual Meeting. If a shareholder returns a proxy withholding authority to vote the proxy with respect to a nominee for director, then the shares of the Common Stock covered by such proxy shall be deemed present at the Annual Meeting for purposes of determining a quorum and for purposes of calculating the vote with respect to such nominee, but shall not be deemed to have been voted for such nominee. If a shareholder abstains from voting as to any matter, then the shares held by such shareholder shall be deemed present at the meeting for purposes of determining a quorum and for purposes of calculating the vote with respect to such matter, but shall not be deemed to have been voted in favor of such matter. If a broker returns a "non-vote" proxy, indicating a lack of authority to vote on such matter, then the shares covered by such non-vote shall be deemed present at the Annual Meeting for purposes of determining a quorum but shall not be deemed to be present and entitled to vote at the Annual Meeting for purposes of calculating the vote with respect to such matter.

Shares of the Company's Common Stock represented by proxies in the accompanying form will be voted in the manner directed by a shareholder. If no direction is given, the proxy will be voted for the election of the nominees for director named in this Proxy Statement, for approval of the appointment of PricewaterhouseCoopers LLP as the Company's independent auditors, and for an increase of shares authorized under the Employee Stock Purchase Plan. A shareholder may revoke a proxy at any time prior to its exercise by giving to an officer of the Company a written notice of revocation of the proxy's authority, by submitting a duly elected proxy bearing a later date or by delivering a written revocation at the Annual Meeting.

1

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding beneficial ownership of the Company's Common Stock as of July 26, 2000 by (i) each person who is known by the Company to own beneficially more than 5% of the Common Stock, (ii) each director, (iii) each executive officer of the Company named in the Summary Compensation Table under the heading "Executive Compensation" below and (iv) all directors and executive officers of the Company as a group. Beneficial ownership is determined in accordance with rules of the Securities and Exchange Commission (the "Commission"), and includes generally voting or investment power with respect to securities. Shares of Common Stock subject to options currently exercisable or exercisable within 60 days of July 26, 2000 are deemed outstanding for purposes of computing the percentage beneficially owned by the person holding such options but are not deemed outstanding for purposes of computing the percentage beneficially owned by any other person. Except as otherwise noted, the persons or entities named have sole voting and investment power with respect to all shares shown as beneficially owned by them.

Beneficial Ownership Table

As of July 26, 2000

| |

Number of Shares Beneficially Owned |

Percentage of Outstanding Shares |

||

|---|---|---|---|---|

| Frederick W. Burgum (1) | 2,450,915 | 12.3% | ||

| Douglas J. Burgum (2) | 1,613,069 | 8.1% | ||

| Bradley J. Burgum (3) | 507,325 | 2.5% | ||

| Jodi A. Uecker-Rust (4) | 57,350 | * | ||

| Darren C. Laybourn (5) | 36,844 | * | ||

| J.A. Heidi Roizen (6) | 29,000 | * | ||

| Tami L. Reller (7) | 21,791 | * | ||

| Joseph S. Tibbetts, Jr. (8) | 15,250 | * | ||

| Jeffrey A. Young (9) | 10,847 | * | ||

| James Leland Strange (10) | 5,259 | * | ||

| David M. O'Hara (11) | 1,972 | * | ||

| All directors and executive officers as a group (11 persons) (12) | 4,749,622 | 23.7% |

* Less than 1%

2

ELECTION OF DIRECTORS

The Board of Directors of the Company is composed of six members divided into three classes. The members of each class are elected to serve three-year terms with the term of office of each class ending in successive years. J.A. Heidi Roizen and Joseph S. Tibbetts, Jr. are the directors in the class whose term expires at the Annual Meeting. The Board of Directors has nominated J. A. Heidi Roizen and Joseph S. Tibbetts, Jr. for election to the Board of Directors at the Annual Meeting for terms of three years, and each has indicated a willingness to serve. William V. Campbell resigned from the Board of Directors effective July 20, 2000. Effective July 21, 2000, the Board appointed James Leland Strange to serve on the Board; however, as required by the by-laws, James Leland Strange will stand for election at the Annual Meeting to a term expiring in 2001. The other directors of the Company will continue in office for their existing terms. Bradley J. Burgum serves in the class whose term expires in 2001 and Douglas J. Burgum and Frederick W. Burgum serve in the class whose term expires in 2002. Upon the expiration of the term of a class of directors, directors in such class will be elected for three-year terms at the annual meeting of shareholders in the year in which such term expires. The affirmative vote of a majority of the shares of Common Stock present and entitled to vote at the Annual Meeting is necessary to elect the nominees for director.

The persons named as proxies in the enclosed form of proxy will vote the proxies received by them for the election of Ms. J. A. Heidi Roizen and Messrs. Joseph S. Tibbetts, Jr. and James Leland Strange, unless otherwise directed. In the event that any nominee becomes unavailable for election at the Annual Meeting, the persons named as proxies in the enclosed form of proxy may vote for a substitute nominee in their discretion as recommended by the Board of Directors.

Information concerning the incumbent directors is set forth below.

| Bradley J. Burgum (Term expiring in 2001) |

Mr. Burgum, 48 years of age, has served as a director of Great Plains since 1984 and as Secretary since January 1996. Mr. Burgum has practiced law in Casselton, North Dakota for 23 years and is currently a shareholder and President of the Burgum & Irby Law Firm, P.C. He has served on the Board of Directors for the Arthur Companies, Inc., a privately-held diversified agribusiness corporation, since 1974. Mr. Burgum holds a B.S. in Business Economics from North Dakota State University and a J.D. from the University of North Dakota School of Law. Mr. Burgum is a Certified Public Accountant. | |

| Douglas J. Burgum (Term expiring in 2002) |

Mr. Burgum, 44 years of age, has served as President since March 1984, Chief Executive Officer since September 1991 and Chairman of the Board since January 1996. Mr. Burgum was an early investor in Great Plains, and he initially served as Vice President and a director from March 1983 to March 1984. Before joining Great Plains, Mr. Burgum was a management consultant in the Chicago office of McKinsey & Company, Inc. Mr. Burgum holds a B.U.S. from North Dakota State University and an M.B.A. from the Stanford University Graduate School of Business. |

3

| Frederick W. Burgum (Term expires in 2002) |

Mr. Burgum, 54 years of age, has served as a director of Great Plains since 1988. Mr. Burgum has been Chairman of the Board of the Arthur Companies, Inc. since 1984 and has served as its Chief Executive Officer since June 1992. He has served as Senior Vice President and a director of the First State Bank of North Dakota since 1972. Mr. Burgum is a veteran of the United States Army and holds a B.Ph. from the University of North Dakota. | |

| J. A. Heidi Roizen (Nominee for term expiring in 2003) |

Ms. Roizen, 42 years of age, has served as a director of Great Plains since February 1997. Ms. Roizen's career has included roles as an entrepreneur, CEO, large corporation executive, and most recently as a corporate director and venture capitalist to leading technology companies. Today, Ms. Roizen is a Managing Director of SOFTBANK Venture Capital, a $600 million venture fund focused in early stage Internet companies. She serves on the Boards of Directors of Bayla, DoDots Inc., DrDrew.com, iPrint.com, Preview Systems, Reelplay.com, and the Software Development Forum. She is an advisory board member of Time Domain Corporation and Garage.com. She is also a member of the Stanford Board of Trustees Nominating Committee. Prior to this, Ms. Roizen was VP of Worldwide Developer Relations for Apple Computer. Before joining Apple, she served for 13 years as CEO of T/Maker Company, a successful software developer and publisher. Ms. Roizen is a past president of the Software Publisher's Association and has served as a Public Governor of the Pacific Stock Exchange. She has been recognized as one of the 100 most influential people in the microcomputer industry by MicroTimes, Personal Computing Magazine, and Upside Magazine. Ms. Roizen holds a B.A. and an M.B.A. from Stanford University. | |

| Joseph S. Tibbetts, Jr. (Nominee for term expiring in 2003) |

Mr. Tibbetts, 47 years of age, has served as a director of Great Plains since October 1996. He has served as a partner of Charles River Ventures, based in Waltham, Massachusetts, since March 2000. He served as Senior Vice President, Finance and Administration and Chief Financial Officer of Lightbridge, Inc., a publicly-held company based in Burlington, MA from May 1998 to February 2000. He served as Vice President, Finance and Administration, Chief Financial Officer and Treasurer of SeaChange International, Inc., a publicly-held company based in Maynard, Massachusetts, from June 1996 to March 1998. From November 1976 to June 1996, Mr. Tibbetts was employed as a Certified Public Accountant by Price Waterhouse LLP. He became a partner of the firm in 1986 and the National Director of its Software Services Group in 1991. Mr. Tibbetts holds a B.S. in Business Administration from the University of New Hampshire and is a graduate of the Stanford Business School Executive Program for Growing Companies. |

4

| James Leland Strange (Nominee for term expiring in 2001) |

Mr. Strange, 58 years of age, currently serves as Chairman, President and CEO of Intelligent Systems Corporation. He has served as a director of Great Plains since July 21, 2000. Prior to the merger with Great Plains Mr. Strange served as a director of Solomon Software, Inc. He has served as an advisor to incubator companies as well as to other emerging companies in which ISC has investments. Mr. Strange serves on the boards of several private technology companies and non-profit organizations. Mr. Strange served on the faculty of Mercer University as a marketing professor. He was inducted into the Georgia Technology Hall of Fame in 1995. Mr. Strange holds a B.S. in Industrial Management from the Georgia Institute of Technology and an M.B.A. from Georgia State University. | |

| Information concerning a director who resigned this year is set forth below. |

||

| William V. Campbell (Resigned as of July 20, 2000) |

Mr. Campbell, 59 years of age, served as a director of the Company from March 1997 until July 2000. Mr. Campbell is Chairman of the Board of Intuit, Inc., a publicly-held company based in Palo Alto, California. Mr. Campbell served as both President and Chief Executive Officer of Intuit Inc. from April 1994 to June, 1998. Prior to joining Intuit Inc., Mr. Campbell was President and Chief Executive Officer of GO Corporation, a pen-based computing software company, from January 1991 to December 1993. He was the founder, President and Chief Executive Officer of Claris Corporation, a software subsidiary of Apple Computer, Inc., from 1987 to January 1991. Mr. Campbell has also held senior executive positions at Apple Computer, Inc. and senior management positions at Kodak and J. Walter Thompson, an advertising agency in New York. Mr. Campbell has also recently joined the Board of Directors of Apple Computer, Inc. Mr. Campbell also serves on the Board of Directors of SanDisk, Inc. Mr. Campbell holds both a B.S. and a M.S. in Economics from Columbia University. He is presently a director of the National Football Foundation and Hall of Fame. | |

Douglas J. Burgum and Bradley J. Burgum are brothers, and Frederick W. Burgum is their cousin.

5

The Board of Directors recommends that you vote FOR the election of Ms. J.A. Heidi Roizen and Messrs. Joseph S. Tibbetts, Jr. and James Leland Strange as directors of the Company.

Meetings and Committees of the Board of Directors.

During the 2000 fiscal year, the Board of Directors held eight meetings. During the fiscal year, each director holding office during the fiscal year attended at least 75% of the total number of meetings of the Board of Directors and committees of the Board on which he or she served. The Board of Directors has an Audit Committee and a Compensation Committee, which are described below.

Messrs. Bradley Burgum and Tibbetts are members of the Audit Committee. The Audit Committee is responsible for nominating the Company's independent accountants for approval by the Board of Directors, reviewing the scope, results and costs of the audit with the Company's independent accountants and reviewing the financial statements of the Company. The Audit Committee held six meetings during the 2000 fiscal year.

Frederick Burgum and Ms. Roizen are members of the Compensation Committee. The Compensation Committee is responsible for determining the compensation and benefits for the executive officers of the Company and for administering the Company's stock plans. The Compensation Committee held two meetings during the 2000 fiscal year.

Compensation of Directors

Each non-employee director of the Company receives $1,000 for each meeting of the Board of Directors and $500 for each committee meeting attended, and an annual retainer of $6,000 paid in quarterly installments. The Company also reimburses non-employee directors for expenses incurred in attending Board meetings. Non-employee directors of the Company also receive stock options under the Company's Outside Directors' Stock Option Plan (the "Directors' Plan"). On June 18, 1997, each non-employee director was granted a non-qualified stock option under the Director's Plan to purchase 3,000 shares at an exercise price of $16.00 per share (vesting immediately). In addition, an option to purchase 4,000 shares of Common Stock will be granted under the Director's Plan to each incumbent non-employee director on the date of each annual meeting of shareholders beginning with the Annual Meeting (vesting immediately). The Directors' Plan also provides that each non-employee director initially elected to the Board after June 19, 1997 will receive a non-qualified stock option to purchase 15,000 shares of Common Stock upon such initial election (vesting in three equal installments on each of the first three 12-month anniversaries following the date of grant). Options granted under the Directors' Plan have an exercise price equal to the fair market value of the Common Stock as of the date of grant, and such options expire five years from the date of grant.

Directors who are also employees of the Company are not separately compensated for any services provided as a director.

6

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

Overview

The Compensation Committee of the Board of Directors (the "Committee") is currently composed of two outside directors and is responsible for developing and approving the Company's compensation program for the Chief Executive Officer and the other executive officers of the Company. In addition, the Committee administers the Company's 1997 Stock Incentive Plan and annual cash incentive compensation program. The overall objective of the Company's executive compensation program is to provide total compensation that will attract and retain highly qualified executives.

Compensation Philosophy

The philosophy of the Committee regarding the compensation of the executive officers consists of the following premises:

Executive Officer Compensation Program

Base Salary and Benefits

In order to attract and retain executives, the Company strives to offer competitive salaries and employee benefits, including its 1997 Employee Stock Purchase Plan, health care plans, Section 401(k) Profit Sharing Plan and other employee benefit programs. The Committee sets base salary levels for executives by comparison to industry compensation data for other software and technology companies with revenues in the same range as those of the Company. The Committee generally sets base salaries between the 25th percentile and 75th percentile, taking into account the executive's experience and level of responsibility.

ANNUAL INCENTIVE COMPENSATION

The Company's annual incentive program allows an executive officer (other than the Chief Executive Officer) to earn additional cash compensation in an amount up to 40% to 60% of base salary (depending upon the specific plan approved for each executive officer) if target level performance goals are met. The Chief Executive Officer may earn an additional amount up to 60% of base salary if target level performance goals are met, 20% of which is discretionary. The total incentive compensation payable for other executive officers is based 90% on objective performance criteria and 10% on discretionary performance criteria, as determined by the Committee. Threshold, target and maximum goals are set by the Committee for each of the following objective performance criteria: pro-forma operating income, revenue, and revenue per team member and customer satisfaction. Incentive compensation is paid only if the threshold level of profitability is attained, which reflects the Committee's philosophy that incentive compensation payments are merited only if the Company meets base level profitability goals. Once the threshold level of operating income is reached, incentive compensation is paid based on actual operating income, revenue, revenue per team member and customer satisfaction as measured against the threshold, target and maximum goals for each of such performance criteria. Threshold performance results in payment of 25% of the target level bonus. A maximum incentive bonus equal to 150% of the target level

7

bonus can be earned if performance meets or exceeds the maximum goal for each performance criterion used under the plan. The operating income and revenue goals are based on quarterly performance. Customer satisfaction and revenue per team member are measured semi-annually. The discretionary criteria for the executive officers (other than the Chief Executive Officer) are measured annually and are established by the Committee in conjunction with the Chief Executive Officer. The discretionary criteria for the Chief Executive Officer is established by the Committee. In fiscal 2000, the total incentive compensation which was capable of being earned by the executive officers as a percentage of base salary was between 40% and 60%. The incentive compensation actually earned ranged from $800 to $20,648 which represented from 2% to 30% of target bonuses.

Stock Option Program

Stock options are awarded in the Committee's discretion to executive officers based upon historical and potential contributions to the success of the Company, an evaluation of market survey data with respect to grants of stock options by comparable companies and consideration of the number of stock options already held by each executive officer. Generally, stock options have an exercise price equal to the fair market value of the Common Stock on the date of grant.

Chief Executive Officer Compensation

In fiscal 2000, Douglas J. Burgum received a base salary of $336,000, an amount representing approximately the 60th percentile of base salaries for chief executive officers of other software and technology companies with revenues comparable to those of the Company. Mr. Burgum was paid $2,272 of incentive compensation under the Company's annual incentive compensation program, which represented less than 2% of his target bonus for the fiscal year.

Tax Deductibility of Executive Compensation

The Company's 1997 Stock Incentive Plan complies with Section 162(m) of the Internal Revenue Code of 1986, as amended, in order that compensation resulting from stock options and certain other awards under such plan will not be counted toward the $1,000,000 limit on the deductibility of compensation under Section 162(m). Section 162(m) should not affect the deductibility of compensation paid to the Company's executive officers for the foreseeable future.

Frederick

W. Burgum

J. A. Heidi Roizen

Members of the Compensation Committee

8

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth all compensation awarded to, earned by or paid for services rendered to the Company in all capacities during each of the fiscal years ended May 31, 2000, 1999 and 1998, by the Company's Chief Executive Officer and the four other most highly compensated executive officers.

| |

|

|

|

|

Long Term Compensation Awards |

|

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

Annual Compensation |

|

|||||||||||||

| Name and Principal Position |

|

Shares Underlying Options |

All Other Compensation (3) |

|||||||||||||

| Year |

Salary |

Bonus (1) |

Other (2) |

|||||||||||||

| Douglas J. Burgum Chairman of the Board, President, and Chief Executive Officer |

2000 1999 1998 |

$ $ $ |

336,000 306,000 265,000 |

$ $ $ |

2,272 116,283 154,625 |

$ $ $ |

— — — |

— — 50,000 |

$ $ $ |

2,500 2,500 2,920 |

||||||

| Jodi A. Uecker-Rust Chief Operating Officer |

2000 1999 1998 |

$ $ $ |

184,333 153,750 132,000 |

$ $ $ |

700 27,429 48,960 |

$ $ $ |

— — — |

10,000 — 10,000 |

$ $ $ |

— 3,053 2,529 |

||||||

| Tami L. Reller (4) Chief Financial Officer |

2000 | $ | 171,375 | $ | 800 | $ | — | — | $ | 3,112 | ||||||

| Darren C. Laybourn (5) Executive Vice President, Products and Services |

2000 1999 |

$ $ |

209,667 180,000 |

$ $ |

975 39,238 |

$ $ |

— — |

10,000 — |

$ $ |

— 2,555 |

||||||

| Jeffrey A. Young (6) Executive Vice President, Global Operations |

2000 | $ | 186,667 | $ | 20,648 | (7) | $ | — | — | $ | — | |||||

9

Stock Options

The following table summarizes stock options granted to the executive officers named in the Summary Compensation Table above during the Company's fiscal year ended May 31, 2000.

| |

|

Granted to Employees in Fiscal Year (1) |

|

|

Annual Rates of Stock Price Appreciation for Option Term (3) |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Securities Underlying Options Granted |

|

|

||||||||||||

| |

Exercise Price Per Share (2) |

Expiration Date |

|||||||||||||

| Name |

5% |

10% |

|||||||||||||

| Douglas J. Burgum | — | 0.0% | $ | 0.00 | — | $ | — | $ | — | ||||||

| Jodi A. Uecker-Rust | 10,000 | 1.6% | $ | 42.75 | 7/30/09 | $ | 268,852 | $ | 681,325 | ||||||

| Tami L. Reller | — | 0.0% | $ | 0.00 | — | $ | — | $ | — | ||||||

| Darren C. Laybourn | 10,000 | 1.6% | $ | 42.75 | 7/30/09 | $ | 268,852 | $ | 681,325 | ||||||

| Jeffrey A. Young | — | 0.0% | $ | 0.00 | — | $ | — | $ | — | ||||||

Year-End Option Table

The following table sets forth certain information concerning options to purchase Common Stock exercised by the executive officers named in the Summary Compensation Table above during fiscal year 2000 and the number and value of unexercised stock options held by such officers as of May 31, 2000.

| |

|

|

Underlying Unexercised Options at Fiscal Year-end |

Value of Unexercised In-the-Money Options at Fiscal Year-end (1) |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Shares Acquired on Exercise |

|

|||||||||||||

| |

Value Realized (1) |

||||||||||||||

| Name |

Exercisable |

Unexercisable |

Exercisable |

Unexercisable |

|||||||||||

| Douglas J. Burgum | 62,599 | $ | 1,813,929 | — | 40,734 | $ | — | $ | 1,169,092 | ||||||

| Jodi A. Uecker-Rust | 4,000 | $ | 174,880 | 7,999 | 18,668 | $ | 219,315 | $ | 212,113 | ||||||

| Tami L. Reller | 8,000 | $ | 355,550 | 4,800 | 3,200 | $ | 168,420 | $ | 112,280 | ||||||

| Darren C. Laybourn | — | — | 21,133 | 21,700 | $ | 707,491 | $ | 341,505 | |||||||

| Jeffrey A. Young | 6,934 | $ | 298,548 | 4,000 | 22,800 | $ | 36,500 | $ | 292,570 | ||||||

RELATED TRANSACTIONS

On January 8, 2000, the Company purchased 33 acres of land immediately west of its Fargo headquarters from a partnership controlled by its director, Frederick W. Burgum, for expansion purposes.

10

The purchase price of $969,000 (based upon $.67 per square foot) was determined by an independent third-party appraisal.

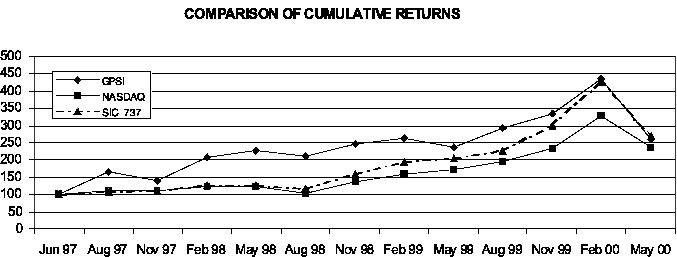

STOCK PERFORMANCE GRAPH

The following chart compares the cumulative total stockholder return on the Company's Common Stock for the period of June 19, 1997 through May 31, 2000 with cumulative total return on the Nasdaq National Market (U.S. Companies) Index and the cumulative total return for the Nasdaq Computer & Data Processing Services Index, SIC 737. The comparison assumes that $100 was invested on June 19, 1997 in the Company's Common Stock and in both of the comparison indices, and assumes reinvestment of dividends, if any. The Company has historically reinvested earnings in the growth of its business and has not paid cash dividends on its Common Stock.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires the Company's executive officers and directors and persons who beneficially own more than 10% of the Company's Common Stock to file initial reports of ownership and reports of changes in ownership with the Commission. Such executive officers, directors and greater than 10% beneficial owners are required by the regulations of the Commission to furnish the Company with copies of all Section 16(a) reports they file.

Based solely on a review of the copies of such reports furnished to the Company and written representations from the executive officers and directors, the Company believes that all Section 16(a) filing requirements applicable to its executive officers and directors and greater than 10% beneficial owners were met. All filings are current as of August 7, 2000.

APPOINTMENT OF INDEPENDENT AUDITORS

The Board of Directors has appointed PricewaterhouseCoopers LLP as independent auditors for the Company for the fiscal year ending May 31, 2001. A proposal to approve the appointment of PricewaterhouseCoopers LLP will be presented at the Annual Meeting. Representatives of PricewaterhouseCoopers LLP are expected to be present at the Annual Meeting, will have an opportunity to make a statement if they desire to do so, and will be available to answer appropriate questions from shareholders. If the appointment of PricewaterhouseCoopers LLP is not approved by the shareholders, the Board of Directors is not obligated to appoint a different firm as independent auditors, but the Board of Directors will give consideration to such unfavorable vote.

The Board of Directors recommends that you vote FOR approval of the appointment of PricewaterhouseCoopers LLP as the Company's independent auditors.

11

PROPOSAL TO INCREASE SHARES AUTHORIZED UNDER

1997 EMPLOYEE STOCK PURCHASE PLAN

The Compensation Committee of the Board of Directors has adopted, subject to shareholder approval, an amendment to the 1997 Employee Stock Purchase Plan (the "Stock Purchase Plan") to increase the number of shares of Common Stock available for issuance pursuant to the Stock Purchase Plan by 875,000 shares. The Board believes that the Stock Purchase Plan has been, and will continue to be, a critical compensation element in attracting and retaining employees.

In 1997 it was anticipated that the original allocation of 400,000 shares for the Stock Purchase Plan would be sufficient to last 3 or 4 years. The popularity of the plan among employees, coupled with growth in the employee base from 800 to 2000, has depleted the original allocation to less than 93,000 shares available for issuance. Based upon current estimates of biennial purchase rates, the suggested 875,000 share increase should meet employee demand through fiscal 2003.

The market value of Common Stock on July 26, 2000 was $18.4219 per share.

Summary of the Employee Stock Purchase Plan

The Stock Purchase Plan is intended to be an "employee stock purchase plan" as defined in Section 423(b) of the Internal Revenue Code of 1986, as amended (the "Code"), and Treasury Regulations promulgated thereunder, and is interpreted and administered in a manner consistent therewith.

Participation in the Stock Purchase Plan is voluntary All permanent full-time employees are eligible to participate in the Stock Purchase Plan beginning on the first day of the first purchase period to commence after such person becomes a permanent full-time employee. Any employee who possesses 5% or more of the total combined voting power or value of all the classes of the Company capital stock is not eligible to participate in the Stock Purchase Plan.

To participate in the Stock Purchase Plan, eligible employees must file an enrollment form with the Company in advance of a purchase period. Purchase periods begin and end on a semi-annual basis beginning January 1 and July 1, and ending June 30 and December 31. The enrollment form permits employees to elect payroll deductions in any multiple of 1% but not less than 1% or more than 10% the employee's compensation for each pay period. The Company may from time to time contribute to each participant's stock purchase account an amount equal to up to 50% of each payroll deduction credited to such account.

Following the last business day of a purchase period, the entire credit balance in each participant's stock purchase account is used to purchase the largest number of whole shares of Common Stock purchasable with such amount, unless the participant has filed with the Company, in advance of that date, a form provided by the Company that requests the distribution of the entire credit balance in cash. The purchase price for any purchase period is the lesser of (a) 85% of the fair market value of the Common Stock on the first business day of that purchase period or (b) 85% of the fair market value of the Common Stock on the last business day of that purchase period. A participant may purchase no more than 5,000 shares of Common Stock under the Stock Purchase Plan for a given purchase period and no more than an aggregate of $25,000 in fair market value of shares of Common Stock under the Plan and all other employee stock purchase plans (if any) of the Company and its affiliates in any calendar year. A participant may withdraw from the Stock Purchase Plan and cease making payroll deductions at any time. Upon withdrawal, the entire amount credited to the participant's stock purchase account is paid to the participant, without interest, in cash within 30 days. A participant who withdraws from the Stock Purchase Plan is not eligible to reenter the Stock Purchase Plan until the beginning of the next purchase period.

The Stock Purchase Plan is administered by a committee (the "Committee") of two or more directors of the Company, none of whom are officers or employees of the Company and all of whom are

12

"disinterested persons" with respect to the Stock Purchase Plan. The members of the Committee are appointed by and serve at the pleasure of the Board of Directors.

The Board may at any time amend the Stock Purchase Plan in any manner which does not adversely affect the rights of participants pursuant to shares previously acquired under the Stock Purchase Plan, except that, without stockholder approval on the same basis as required to originally approve the Stock Purchase Plan, no amendment will be made (i) to increase the number of shares to be reserved under the Stock Purchase Plan, (ii) to decrease the minimum purchase price, (iii) to withdraw the administration of the Stock Purchase Plan from the Committee, or (iv) to change the definition of employees eligible to participate in the Stock Purchase Plan. All rights of participants under the Stock Purchase Plan will terminate at the earlier of (i) December 31, 2004, (ii) the last day that Participants become entitled to purchase a number of shares of Common Stock equal to or greater than the number of shares remaining available for purchase; or (iii) at any time, at the discretion of the Board, after 30 days' notice has been given to all participants.

Tax Considerations

Payroll deductions under the Stock Purchase Plan are made on an after-tax basis. Participants are not be taxed as a result of participation in the Stock Purchase Plan until the time of disposition of shares acquired under the Stock Purchase Plan or the death of the participant. Participants have a basis in their shares equal to the purchase price of their shares plus any amount that must be treated as ordinary income at the time of disposition of the shares, as described below. Additional gain or loss is capital gain or loss.

If a participant holds shares for less than two years after the first day of the relevant purchase period or one year after the last day of such purchase period, then the excess of the fair market value of the shares on the date of purchase by the participant over the purchase price paid by the participant will be taxed as ordinary income. In this circumstance, the Company generally would be entitled to a deduction in the amount taxed as ordinary income.

If a participant holds shares for longer than the periods described in the preceding paragraph or dies while holding the shares, then only a portion of the gain realized upon the sale of other disposition of the shares will be taxed as ordinary income, and the remainder will be taxed as capital gain. The portion to be taxed as ordinary income would be equal to the lesser of (i) the excess of the fair market value of the shares on the date of disposition or death over the purchase paid by the participant or (ii) the excess of the fair market value of the shares on the first day of the purchase period over the purchase price paid by the participant. In this circumstance, the Company would not be entitled to a deduction for any amount taxed as ordinary income.

Certain Laws and Regulations

The Stock Purchase Plan is not subject to the Employee Retirement Income Security Act of 1974, as amended, and is not a qualified plan under Section 401(a) of the Code. Rights to purchase Common Stock granted under the Stock Purchase Plan shall be construed and shall take effect in accordance with the laws of the State of Minnesota. The affirmative vote of the holders of a majority of the shares of Common Stock represented at the meeting and entitled to vote on this matter is necessary for approval of the amendment to the Stock Purchase Plan.

The Board of Directors recommends that you vote FOR approval of the proposal to increase the number of shares authorized under the Stock Purchase Plan.

PROPOSALS FOR THE 2001 ANNUAL MEETING

Any proposal by a shareholder to be considered for inclusion in the Company's proxy materials for the 2001 Annual Meeting of Shareholders must have been received at the Company's executive offices,

13

1701 S.W. 38th Street, Fargo, North Dakota 58103, no later than the close of business on April 9, 2001. Proposals should be sent to the attention of the Secretary. In connection with any matter to be proposed by a shareholder at the 2001 Annual Meeting of Shareholders, but not proposed for inclusion in the Company's proxy materials, the proxy holders designated by the Company for that meeting may exercise their discretionary voting authority with respect to that shareholder proposal if appropriate notice of that proposal is not received by the Company at its principal executive office by April 9, 2001.

OTHER MATTERS

The Company is not aware of any other matters which may come before the Annual Meeting. If other matters are properly presented at the Annual Meeting, it is the intention of the persons named as proxies in the enclosed proxy to vote in accordance with their judgment as to the best interests of the Company.

August 7, 2000

By Order of the Board of Directors

Bradley

J. Burgum

Secretary

14

| GREAT PLAINS SOFTWARE, INC. |

| 2000 ANNUAL MEETING OF SHAREHOLDERS |

| Wednesday, September 13, 2000 9:00 a.m. Central Time |

| RAMADA PLAZA SUITES 1635 42nd Street S.W. Fargo, ND 58103 |

| |

| [LOGO] | Great Plains Software, Inc. 1701 38th Street S.W. Fargo, ND 58103 |

proxy | ||

This proxy is solicited by the Board of Directors for use at the Annual Meeting on September 13, 2000.

The undersigned hereby appoints Douglas J. Burgum and Tami L. Reller proxies (each with the power to act alone and with the power of substitution), to vote, as designated below, all shares of Common Stock of Great Plains Software, Inc. which the undersigned is entitled to vote at the 2000 Annual Meeting of Shareholders of Great Plains Software, Inc. to be held on Wednesday, September 13, 2000 at 9:00 a.m. central time at the Ramada Plaza Suites, 1635 42nd Street S.W., Fargo, North Dakota 58103, and any adjournment thereof, and hereby revokes all former proxies.

PLEASE MARK, SIGN, DATE AND RETURN THIS PROXY IN THE ENCLOSED ADDRESSED ENVELOPE, WHICH REQUIRES NO POSTAGE IF MAILED IN THE UNITED STATES.

See reverse for voting instructions.

| There are three ways to vote your Proxy |

|

Company # Control # |

Your telephone or Internet vote authorizes the Named Proxies to vote your shares in the same manner as if you marked, signed and returned your proxy card.

VOTE BY PHONE — TOLL FREE — 1-800-240-6326 — QUICK *** EASY *** IMMEDIATE

VOTE BY INTERNET — www.eproxy.com/gpsl/ — QUICK *** EASY *** IMMEDIATE

VOTE BY MAIL

Mark, sign and date your proxy card and return it in the postage-paid envelope we've provided or return it to Great Plains Software, Inc., c/o Shareowner ServicesSM, P.O. Box 64873, St. Paul, MN 55164-0873.

If you vote by phone or Internet, please do not mail your Proxy Card

Please detach here

The Board of Directors Recommends a Vote FOR Items 1, 2 and 3.

| 1. | Election of Directors: | 01 J.A. Heidi Roizen 02 Joseph S. Tibbetts, Jr. |

03 James Leland Strange | / / | Vote FOR all nominees (except as marked) |

/ / | VOTE WITHHELD from all nominees |

|||||||

| (Instructions: To withhold authority to vote for any indicated nominee, write the number(s) of the nominee(s) in the box provided to the right.) |

|

|

||||||||||||

| 2. | Proposal to approve the appointment of PricewaterhouseCoopers LLP as independent auditors of the Company. | / / | For | / / | Against | / / | Abstain | |||||||

| 3. | Proposal to approve an increase of 875,000 shares in the number of shares authorized under the Employee Stock Purchase Plan. | / / | For | / / | Against | / / | Abstain | |||||||

| 4. | In their discretion, the proxies are authorized to vote upon such other matters that may properly come before the Annual Meeting or any adjournment or adjournments thereof. |

|||||||||||||

THIS PROXY, WHEN PROPERLY EXECUTED, WILL BE VOTED AS DIRECTED HEREIN BY THE UNDERSIGNED SHAREHOLDER. IF NO DIRECTION IS MADE, THIS PROXY WILL BE VOTED FOR THE ELECTION OF DIRECTORS AND FOR PROPOSALS 2 AND 3.

| Address Change? Mark Box / / | Date | ||||

| Indicate changes below: | |||||

| |

|

|

|||

| |

|

|

|||

| |

|

Signature(s) in Box |

|||

| Please sign exactly as your name appears hereon. Jointly owned shares will be voted as directed if one owner signs unless another owner instructs to the contrary, in which case the shares will not be voted. If

signing in a representative capacity, please indicate title and authority. |

|||||

|

|