|

|

|

|

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed

by the Registrant /x/

Filed by a party other than the Registrant / /

| Check the appropriate box: | ||

| / / | Preliminary Proxy Statement | |

| / / | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| /x/ | Definitive Proxy Statement | |

| / / | Definitive Additional Materials | |

| / / | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12 |

|

PEOPLES ENERGY CORPORATION (Name of Registrant as Specified In Its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

||

| /x/ | No fee required | |

| / / | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

|

| / / | Fee paid previously with preliminary materials. |

/ / |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

Notice of Annual Meeting of Shareholders

and Proxy Statement

February 23,

2001 at 11:00 a.m.

Harris Trust and Savings Bank

Eighth Floor - Auditorium

115 S. LaSalle Street

Chicago, Illinois

PEOPLES ENERGY CORPORATION • 130 East Randolph Drive • Chicago, Illinois 60601

RICHARD

E. TERRY

Chairman of the Board

December 28, 2000

Dear Shareholder:

You are cordially invited to attend the Annual Meeting of Shareholders of Peoples Energy Corporation, to be held on Friday, February 23, 2001. The meeting will begin at 11:00 a.m. in the auditorium on the eighth floor of Harris Trust and Savings Bank, located at 115 S. LaSalle Street, Chicago, Illinois.

It is important that your shares be represented at this meeting. Therefore, whether or not you plan to attend, please sign the enclosed proxy and return it promptly in the envelope provided. If you attend the meeting, you may, at your discretion, withdraw your proxy and vote in person.

If you plan to attend the meeting, please save the admission ticket that is attached to your proxy and present it at the door.

Let me again urge you to return your proxy at your earliest convenience.

Sincerely,

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

February 23, 2001

The regular Annual Meeting of Shareholders of PEOPLES ENERGY CORPORATION will be held in the auditorium on the eighth floor of Harris Trust and Savings Bank, located at 115 S. LaSalle Street, Chicago, Illinois, at 11:00 a.m. on Friday, February 23, 2001, for the following purposes:

All shareholders, whether or not they expect to be present at the meeting, are requested to sign, date, and mail the accompanying proxy in the envelope enclosed with this Notice. Shareholders who are present at the meeting may withdraw their proxies and vote in person.

If you plan to attend the meeting, please save the admission ticket that is attached to your proxy and present it at the door. Attendance at the meeting will be limited to shareholders of record as of the record date and their guests or their authorized representatives, not to exceed two per shareholder, and to guests of the Company.

Shareholders of record as of December 25, 2000, will be entitled to vote at the meeting and at any adjournment thereof.

PETER

KAUFFMAN

Secretary

Chicago,

Illinois

December 28, 2000

PEOPLES ENERGY CORPORATION • 130 East Randolph Drive • Chicago, Illinois 60601

December 28, 2000

This Proxy Statement is being mailed to shareholders on or about December 28, 2000, in connection with the solicitation of proxies on behalf of the Board of Directors of Peoples Energy Corporation (the Company), to be voted at the Annual Meeting of Shareholders of the Company. The meeting will be held at 11:00 a.m. on Friday, February 23, 2001, in the auditorium on the eighth floor of Harris Trust and Savings Bank, located at 115 S. LaSalle Street, Chicago, Illinois. The shares represented by the proxies received are to be voted in accordance with the specifications contained in the proxy. Proxies are revocable at any time prior to use.

The Company has borne the cost of preparing, assembling, and mailing this proxy soliciting material. In addition to solicitation by mail, there may be incidental personal solicitations made by directors, officers, and regular employees of the Company. The cost of solicitation, including payments to brokers, nominees, or fiduciaries who mail such material to their clients, will be borne by the Company.

The Company has retained Corporate Investor Communications, Inc., 111 Commerce Road, Carlstadt, New Jersey, to assist with the solicitation of proxies from certain shareholders, for which services Corporate Investor Communications will receive a fee that is expected to be about $6,500, plus reimbursement for certain expenses.

Only holders of common shares of record as of December 25, 2000, are entitled to vote at the meeting or any adjournment thereof. As of December 25, 2000, there were outstanding 35,375,094 shares of common stock of the Company.

The Annual Report of the Company for the fiscal year ended September 30, 2000, including financial statements, is being mailed on or about December 28, 2000, together with this Proxy Statement, to all shareholders of record as of December 25, 2000.

In the election of directors, shareholders have cumulative voting rights. Cumulative voting rights consist of the right to vote, in person or by proxy, the number of shares owned by the shareholder for as many persons as there are directors to be elected, or to cumulate said shares and give one candidate as many votes as the number of directors multiplied by the number of his or her shares shall equal, or to distribute such number of votes among the candidates as he or she shall think fit.

All directors are to hold office for a term of one year or until their respective successors shall be duly elected. The affirmative vote of a plurality of the votes cast at the Annual Meeting by holders of common stock entitled to vote is required for the election of each nominee as a director. Unless otherwise specified, votes represented by the proxies will be cast equally for the election of the below-named nominees to the office of director; however, the votes may be cast cumulatively for less than the entire number of nominees if any situation arises that, in the opinion of the proxy holders, makes such action necessary or desirable. If any of the nominees should be unable to serve or will not serve, which is not anticipated, management reserves discretionary authority to vote for a substitute.

1

Information Concerning Nominees for Election as Directors

|

James R. Boris, 56. Director since 1999. Chairman of JB Capital Management, LLC. Former Chairman and Chief Executive Officer of EVEREN Capital Corporation (1995-1999) and EVEREN Securities, Inc., a wholly owned subsidiary (1990-1999). Mr. Boris was concurrently an Executive Vice President of Kemper Corporation (1994-1995) and a director of Kemper Financial Companies, Inc. and its major subsidiaries (1990-1995). Mr. Boris is also a director of CORE, Inc. |

|

|

William J. Brodsky, 56. Director since 1997. Chairman and Chief Executive Officer (1997) of The Chicago Board Options Exchange. Prior to that, Mr. Brodsky was President and CEO of The Chicago Mercantile Exchange (1985-1997). |

|

|

Pastora San Juan Cafferty, 60. Director since 1988. Professor, since 1985, at the University of Chicago, Chicago, Illinois, where she has been on the faculty since 1971. Mrs. Cafferty is also a director of Bankmont Financial Corp. and its subsidiaries, Harris Bankcorp, Inc., and Harris Trust and Savings Bank, Kimberly-Clark Corporation, and Waste Management, Inc. |

|

|

Homer J. Livingston, Jr., 65. Director since 1989. Chairman of the Board of Evanston Northwestern Healthcare. President and Chief Executive Officer (1993-1995), until his retirement in 1995, of the Chicago Stock Exchange, Chicago, Illinois. |

2

|

Lester H. McKeever, 66. Director since 1999. Managing Principal of Washington, Pittman & McKeever, LLC, certified public accountants and management consultants. Mr. McKeever is also a member of the Board of the Federal Reserve Bank of Chicago. Mr. McKeever is also President of Associates Racing Association, Secretary of Maywood Park Trotting, and Chairman of Advanced Data Concepts, LLC. Mr. McKeever is also a director of Photogen Technologies, Inc. and The Lou Holland Trust-Growth Fund. |

|

|

Thomas M. Patrick, 54. Director since 1998. President and Chief Operating Officer (1998) and Director (1998) of the Company. Prior to becoming President, Mr. Patrick was Executive Vice President (1997-1998) of the Company and its subsidiaries and Vice President (1989-1996) of both the Company's utility subsidiaries. Mr. Patrick has been an employee of the Company and/or its subsidiaries since 1976. |

|

|

Richard E. Terry, 63. Director since 1984. Chairman of the Board and Chief Executive Officer (1990) of the Company. Prior to becoming Chairman, Mr. Terry was President and Chief Operating Officer (1987-1990), Executive Vice President (1984-1987), and Vice President and General Counsel (1981-1984) of the Company and its subsidiaries. Mr. Terry has been an employee of the Company and/or its subsidiaries since 1972. Mr. Terry is also a director of Amsted Industries, Bankmont Financial Corp. and its subsidiaries, Harris Bankcorp, Inc., and Harris Trust and Savings Bank. |

|

|

Richard P. Toft, 64. Director since 1988. Non-executive Chairman of Alleghany Asset Management, Inc. (2000). Former Chairman of the Board and Chief Executive Officer of Alleghany Asset Management, Inc., Chicago, Illinois, an investment management and advisory service subsidiary of Alleghany Corp. (1995-2000). Mr. Toft is also Chairman of the Board of Chicago Title Corporation and was Chairman and CEO of its predecessor company, Chicago Title & Trust Co. (1982-93). Mr. Toft is also a director of Fidelity National Financial, Inc. He was also a director of The Cologne Life Reinsurance Company (1994-1999). |

|

|

Arthur R. Velasquez, 62. Director since 1985. Chairman, President and Chief Executive Officer, since 1989, of Azteca Foods, Inc., Chicago, Illinois, a Mexican food products company. Prior to that, Mr. Velasquez was President and Chief Executive Officer (1971-1987) of Azteca Corn Products Corporation. Mr. Velasquez is also a director of LaSalle Bank National Association. |

3

Meetings and Fees of the Board of Directors

The Board of Directors held nine meetings during fiscal 2000. All incumbent directors attended at least 93.33% or more of the aggregate number of meetings of the Board and of those committees on which such directors served.

Directors who are not employees receive an annual retainer of $25,000 and a meeting fee of $1,000 for each Board and each committee meeting attended. In addition, any non-employee director who serves as chairman of a committee of the Board receives a $3,000 annual retainer. Officers of the Company who serve on the Board receive no compensation as directors.

Non-employee directors also participate in the Company's Directors Stock and Option Plan ("DSOP"). The purpose of the DSOP is to provide non-employee directors with a proprietary interest in the Company to improve the Company's ability to attract and retain highly qualified individuals to serve as directors of the Company. Under the DSOP, on May 1 of each year that the DSOP is in effect, each non-employee director of the Company holding that position will receive, as part of his or her annual retainer, a stock payment of 300 shares of common stock and options to purchase 3,000 shares of common stock. The exercise price for each option will equal one hundred percent (100%) of the mean between the highest and lowest quoted selling price for the Company's common stock in the New York Stock Exchange Composite Transactions on the last day in April for which the New York Stock Exchange is open for trading in the year of the grant. Options granted under the plan are not exercisable until six months after the date of the grant and have a ten-year term.

The Company offers non-employee directors an opportunity to defer their compensation, except for options and stock received upon the exercise thereof. Under the Directors Deferred Compensation Plan, a director may elect to defer the receipt of compensation earned as a director until a future date. Cash compensation may be deferred in the form of cash, Company common stock, or a combination of both; stock compensation may be deferred only in the form of Company common stock. An election to defer, or to cease to defer, compensation earned as a director of the Company is effective only with respect to compensation earned in the calendar year following the year in which the election is made, but in no event with respect to compensation earned within six months after the date on which the election is made.

A bookkeeping account is maintained for each participant. The account reflects the amount of cash and/or the number of share equivalents to which the participant is entitled under the terms of the plan.

The account of a participant who elects to defer compensation in the form of cash is credited with the dollar amount of compensation so deferred on each date that the participant is entitled to payment for services as a director. Interest on the cash balance of the account is computed and credited quarterly as of March 31, June 30, September 30, and December 31 of each year at the prime commercial rate in effect at Harris Trust and Savings Bank, Chicago, Illinois.

The account of a participant who elects to defer compensation in the form of stock is credited with share equivalents on each date that the participant is entitled to payment for services as a director. The number of share equivalents so credited is determined by dividing the compensation so deferred by the mean price of a share of Company common stock on the New York Stock Exchange on such date. Additional share equivalents are credited to the director's account on each date that the Company pays a dividend on the common stock. During the fiscal year ended September 30, 2000, plan participants as a group were credited with 5,592.294 share equivalents for compensation deferred in the form of stock, with an average per-share base price of $31.78. During the same period, such participants were credited with $40,735.87 for compensation deferred in the form of cash.

4

Committees of the Board of Directors

The standing committees of the Board of Directors of the Company during fiscal 2000 were the Audit, Compensation-Nominating, Public Policy, and Executive Committees.

The Audit Committee makes recommendations to the Board concerning the appointment of the Company's independent public accountants and reviews with the accountants the scope and nature of the audit engagement, the fees for services performed by the firm, and the results of the completed audit. The Committee also reviews and discusses with the internal audit department, management, and the Board, such matters as accounting policies, internal controls, and procedures for preparation of financial statements. In addition, the Committee oversees the selection of independent public accountants to perform audits of certain Company-sponsored employee benefit plans and reviews reports regarding the results of such audits. The members of the Audit Committee are Messrs. Brodsky (Chairman), Boris, Velasquez, McKeever, Mitchell, and Mrs. Cafferty. Due to mandatory retirement at age 70, Mr. Mitchell will not be standing for re-election. The Committee held two meetings in fiscal 2000.

The Compensation-Nominating Committee considers and makes recommendations to the Board concerning salary compensation for elected officers of the Company and its subsidiaries. The Committee also considers, reviews and grants awards under the Company's Long-Term Incentive Compensation Plan (LTIC Plan) and Short-Term Incentive Compensation Plan (STIC Plan) to officers (and, with respect to the LTIC Plan, other key employees) of the Company and its subsidiaries other than the Chief Executive Officer. With respect to the Chief Executive Officer, the Committee considers, reviews and makes awards under the LTIC Plan and the STIC Plan subject to the approval of the non-employee directors of the Board.

The Committee also makes recommendations to the Board regarding nominees for election as members of the Board of the Company. The Committee will consider written recommendations from shareholders of the Company regarding potential nominees for election as directors. To be considered for inclusion in the slate of nominees proposed by the Board at the next Annual Meeting of Shareholders of the Company, such recommendations should be received in writing by the Secretary of the Company no later than December 24, 2001. In addition, the Committee maintains, with the approval of the Board, formal criteria for selecting directors and also considers other matters, such as the size and composition of the Board, directors' compensation, benefits, and other forms of remuneration. The members of the Compensation-Nominating Committee are Messrs. Livingston (Chairman), Boris, Brodsky, Mitchell, and Toft. The Committee held four meetings in fiscal 2000.

The Public Policy Committee prepares reports to the Board and provides advice to management on major public issues affecting the Company or the gas industry in general. The Committee also considers and makes recommendations to the Board regarding the Company's Contributions Program and Budget and reviews and monitors corporate policy with respect to charitable and philanthropic giving. Members of the Public Policy Committee are Mrs. Cafferty (Chairman), Messrs. Livingston, McKeever, Toft, and Velasquez. The Committee held two meetings in fiscal 2000.

The Executive Committee, in the recess of the Board, has the authority to act upon most corporate matters that require Board approval. The members of the Executive Committee are Messrs. Terry (Chairman), Mitchell (Vice Chairman), Boris, Brodsky, Livingston, McKeever, Toft, Velasquez, and Mrs. Cafferty. The Committee held no meetings in fiscal 2000.

5

The Audit Committee is comprised of Messrs. Brodsky, Boris, Velasquez, McKeever, Mitchell and Mrs. Cafferty, each of whom is independent (as that term is defined in Sections 303.01(B)(2)(a) and (3) of the New York Stock Exchange's listing standards). The Board of Directors has adopted a written charter for the Audit Committee. The Audit Committee's charter is attached as Exhibit A to this proxy statement

The Audit Committee has reviewed and discussed the Company's audited financial statements with management. The Audit Committee has discussed with the Company's independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61 (Codification of Statements on Auditing Standards AU 380), as modified and supplemented. The Audit Committee has received and reviewed the written disclosures and the letter from the independent auditors required by Independence Standards Board Standard No. 1 (Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees), as modified or supplemented, and has discussed the independent accountant's independence with the independent accountant.

The Audit Committee, based upon its reviews and discussions described in the immediately preceding paragraph, has recommended to the Board of Directors that the audited financial statements be included in the Company's Annual Report on Form 10-K for the fiscal year ended September 30, 2000.

Submitted by:

THE AUDIT COMMITTEE

William

J. Brodsky (Chairman)

James R. Boris

Pastora San Juan Cafferty

Lester H. McKeever

William G. Mitchell

Arthur R. Velasquez

6

Share Ownership of Directors

and Executive Officers

The following table sets forth certain information regarding the beneficial ownership, as of November 30, 2000, of the Company's Common Stock by (a) each director, the Chief Executive Officer and the four most highly paid executive officers of the Company and (b) all directors and executive officers as a group.

| Directors & Officers |

Shares Beneficially Owned as of November 30, 2000(1) |

Percent of Class |

||

|---|---|---|---|---|

| James R. Boris | 5,552 | (2)(4) | * | |

| William J. Brodsky | 9,494 | (2)(4) | * | |

| Pastora San Juan Cafferty | 6,100 | (4) | * | |

| Donald M. Field | 36,426 | (3)(4) | * | |

| James Hinchliff | 47,259 | (3)(4) | * | |

| Homer J. Livingston, Jr. | 13,106 | (2)(4) | * | |

| James M. Luebbers | 22,417 | (3)(4) | * | |

| Lester H. McKeever | 5,502 | (2)(4) | * | |

| William G. Mitchell | 25,812 | (2)(4) | * | |

| Thomas M. Patrick | 62,136 | (3)(4) | * | |

| Richard E. Terry | 141,308 | (3)(4) | * | |

| Richard P. Toft | 12,375 | (2)(4) | * | |

| Arthur R. Velasquez | 13,145 | (2)(4) | * | |

| Directors and executive officers as a group | 461,403 | (3)(4) | 1.31 |

* Percentage of shares beneficially owned does not exceed one percent.

7

The following tables set forth information concerning annual and long-term compensation and grants of stock options, stock appreciation rights (SARs) and restricted stock awards under the Company's Long-Term Incentive Compensation Plan. All compensation was paid by the Company and its subsidiaries for services in all capacities during the three fiscal years set forth below, to (i) the Chief Executive Officer and (ii) the four most highly compensated executive officers of the Company other than the Chief Executive Officer.

| |

|

Annual Compensation |

Long Term Compensation Awards |

|

||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name and Principal Position |

Year |

Salary ($) |

Bonus ($) |

Restricted Stock Awards(1)(2) ($) |

Options/SARs (#) |

All Other Compensation (3)($) |

||||||

| Richard E. Terry Chairman and Chief Executive Officer |

2000 1999 1998 |

650,000 618,000 600,000 |

392,000 328,200 245,000 |

326,625 204,309 192,828 |

73,200 30,000 20,600 |

23,400 21,321 18,000 |

||||||

| Thomas M. Patrick President and Chief Operating Officer |

2000 1999 1998 |

400,000 319,150 254,800 |

249,300 171,400 75,300 |

209,625 105,836 55,497 |

46,400 11,600 6,000 |

14,400 11,037 7,644 |

||||||

| James Hinchliff Senior Vice President and General Counsel |

2000 1999 1998 |

290,400 279,200 271,100 |

131,600 100,900 75,300 |

99,938 57,980 55,497 |

20,000 6,400 6,000 |

10,454 9,632 8,133 |

||||||

| Donald M. Field Executive Vice President |

2000 1999 1998 |

245,300 217,117 156,800 |

131,600 97,700 67,900 |

99,938 57,980 27,278 |

20,000 6,400 3,000 |

8,831 7,515 4,704 |

||||||

| James M. Luebbers Chief Financial Officer and Controller |

2000 1999 1998 |

215,000 185,067 133,000 |

116,900 74,700 30,200 |

83,688 46,936 0 |

14,200 5,200 4,600 |

7,740 6,932 3,990 |

||||||

8

stock awarded to the named individuals for 2000 constitutes 25,225 shares, of which 5,045 shares will vest in 2001; 5,045 shares will vest in 2002; 5,045 shares will vest in 2003; 5,045 shares will vest in 2004; and the remaining 5,045 shares will vest in 2005.

OPTIONS/SAR GRANTS IN FISCAL 2000

| |

Individual Grants |

|

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name and Principal Position |

Options/SARs Granted (#)(1) |

% of Total Options/SARs Granted to Employees in Fiscal Year(2) |

Exercise or Base Price ($/Sh) |

Expiration Date |

Grant Date Present Value ($)(3) |

|||||||

| Richard E. Terry Chairman and Chief Executive Officer |

73,200 | 19.4 | % | $ | 35.56 | 06-Oct-09 | $ | 300,852 | ||||

| Thomas M. Patrick President and Chief Operating Officer |

46,400 | 12.3 | 35.56 | 06-Oct-09 | 190,704 | |||||||

| James Hinchliff Senior Vice President and General Counsel |

20,000 | 5.3 | 35.56 | 06-Oct-09 | 82,200 | |||||||

| Donald M. Field Executive Vice President |

20,000 | 5.3 | 35.56 | 06-Oct-09 | 82,200 | |||||||

| James M. Luebbers Chief Financial Officer and Controller |

14,200 | 3.8 | 35.56 | 06-Oct-09 | 58,362 | |||||||

9

AGGREGATED OPTION/SAR EXERCISES IN FISCAL 2000

AND FISCAL YEAR-END OPTION/SAR VALUES

| |

|

|

Number of Unexercised Options/SARs at Fiscal Year-End(#) |

Value of Unexercised In-the-Money Options/SARs at Fiscal Year-End($) |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Shares Acquired on (Option/SAR) Exercise(#) |

|

|||||||||||||

| Name and Principal Position |

Value Realized($) |

||||||||||||||

| Exercisable |

Unexercisable |

Exercisable |

Unexercisable |

||||||||||||

| Richard E. Terry Chairman and Chief Executive Officer |

0 | $ | 0 | 97,400 | 73,200 | $ | 150,090 | $ | 0 | ||||||

| Thomas M. Patrick President and Chief Operating Officer |

0 | 0 | 24,000 | 46,400 | 6,400 | 0 | |||||||||

| James Hinchliff Senior Vice President and General Counsel |

0 | 0 | 18,800 | 20,000 | 6,400 | 0 | |||||||||

| Donald M. Field Executive Vice President |

0 | 0 | 25,000 | 20,000 | 72,562 | 0 | |||||||||

| James M. Luebbers Chief Financial Officer and Controller |

0 | 0 | 12,400 | 14,200 | 2,600 | 0 | |||||||||

10

The following table illustrates various annual straight-life benefits at normal retirement (age 65) for the indicated levels of average annual compensation and various periods of service, assuming no future changes in the Company's pension benefits. The compensation used in the computation of annual retirement benefits is substantially equivalent to the salary and bonus reported in the Summary Compensation Table. The benefit amounts shown reflect reduction for applicable Social Security benefits.

| |

Years of Service |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Average Annual Compensation |

||||||||||

| 20 |

25 |

30 |

35 |

40 |

||||||

| $ 200,000 | 73,944 | 92,430 | 110,916 | 123,416 | 135,916 | |||||

| 250,000 | 93,944 | 117,430 | 140,916 | 156,541 | 172,166 | |||||

| 300,000 | 113,944 | 142,430 | 170,916 | 189,666 | 208,416 | |||||

| 350,000 | 133,944 | 167,430 | 200,916 | 222,791 | 244,666 | |||||

| 400,000 | 153,944 | 192,430 | 230,916 | 255,916 | 280,916 | |||||

| 450,000 | 173,944 | 217,430 | 260,916 | 289,041 | 317,166 | |||||

| 500,000 | 193,944 | 242,430 | 290,916 | 322,166 | 353,416 | |||||

| 550,000 | 213,944 | 267,430 | 320,916 | 355,291 | 389,666 | |||||

| 600,000 | 233,944 | 292,430 | 350,916 | 388,416 | 425,916 | |||||

| 650,000 | 253,944 | 317,430 | 380,916 | 421,541 | 462,166 | |||||

| 700,000 | 273,944 | 342,430 | 410,916 | 454,666 | 498,416 | |||||

| 750,000 | 293,944 | 367,430 | 440,916 | 487,791 | 534,666 | |||||

| 800,000 | 313,944 | 392,430 | 470,916 | 520,916 | 570,916 | |||||

| 850,000 | 333,944 | 417,430 | 500,916 | 554,041 | 607,166 | |||||

| 900,000 | 353,944 | 442,430 | 530,916 | 587,166 | 643,416 | |||||

| 950,000 | 373,944 | 467,430 | 560,916 | 620,291 | 679,666 | |||||

| 1,000,000 | 393,944 | 492,430 | 590,916 | 653,416 | 715,916 | |||||

| 1,050,000 | 413,944 | 517,430 | 620,916 | 686,541 | 752,166 | |||||

| 1,100,000 | 433,944 | 542,430 | 650,916 | 719,666 | 788,416 | |||||

Average annual compensation is the average 12-month compensation for the highest 60 consecutive months of the last 120 months of service prior to retirement. Compensation is total salary paid to an employee by the Company and/or its affiliates, including bonuses under the Company's Short-Term Incentive Compensation Plan, pre-tax contributions under the Company's Capital Accumulation Plan, pre-tax contributions under the Company's Health and Dependent Care Spending Accounts Plan, and pre-tax contributions for life and health care insurance, but excluding moving allowances, exercise of stock options and SARs, and other compensation that has been deferred.

At September 30, 2000, the credited years of retirement benefit service for the individuals listed in the Summary Compensation Table were as follows: Mr. Terry, 36 years; Mr. Patrick, 24 years; Mr. Hinchliff, 28 years; Mr. Field, 29 years; and Mr. Luebbers, 31 years. The benefits shown in the foregoing table are subject to maximum limitations under the Employee Retirement Income Security Act of 1974, as amended, and the Internal Revenue Code of 1986, as amended. Should these benefits at the time of retirement exceed the then-permissible limits of the applicable Act, the excess would be paid by the Company as supplemental pensions pursuant to the Company's Supplemental Retirement Benefit Plan. The benefits shown give effect to these supplemental pension benefits.

The Company has entered into separate severance agreements with certain key executives, including each of the executives named in the Summary Compensation Table. The intent of the severance agreements is to assure the continuity of the Company's administration and operations in the event of a Change in Control of the Company (as described below). The severance agreements were developed in accordance with the advice of outside consultants.

11

The term of each severance agreement is for the longer of 36 months after the date in which a Change in Control of the Company occurs or 24 months after the completion of the transaction approved by shareholders described in (iii) below of the description of a Change in Control. A Change in Control is defined as occurring when (i) the Company receives a report on Schedule 13D filed with the Securities and Exchange Commission pursuant to Section 13(d) of the Securities Exchange Act of 1934, as amended, disclosing that any person, group, corporation, or other entity is the beneficial owner, directly or indirectly, of 20% or more of the common stock of the Company; (ii) any person, group, corporation, or other entity (except the Company or a wholly-owned subsidiary), after purchasing common stock of the Company in a tender offer or exchange offer, becomes the beneficial owner, directly or indirectly, of 20% or more of such common stock; (iii) the shareholders of the Company approve (a) any consolidation or merger of the Company in which the Company is not the continuing or surviving corporation, other than a consolidation or merger in which holders of the Company's common stock prior to the consolidation or merger have substantially the same proportionate ownership of common stock of the surviving corporation immediately after the consolidation or merger as immediately before; (b) any consolidation or merger in which the Company is the continuing or surviving corporation, but in which the common shareholders of the Company immediately prior to the consolidation or merger do not hold at least 90% of the outstanding common stock of the Company; (c) any sale, lease, exchange or other transfer of all or substantially all of the assets of the Company, except where the Company owns all of the outstanding stock of the transferee entity or the Company's common shareholders immediately prior to such transaction own at least 90% of the transferee entity or group of transferee entities immediately after such transaction; or (d) any consolidation or merger of the Company where, after the consolidation or merger, one entity or group of entities owns 100% of the shares of the Company, except where the Company's common shareholders immediately prior to such merger or consolation own at least 90% of the outstanding stock of such entity or group of entities immediately after such consolidation or merger; or (iv) a change in the majority of the members of the Company's Board of Directors within a 24-month period, unless approved by two-thirds of the directors then still in office who were in office at the beginning of the 24-month period.

Each severance agreement provides for payment of severance benefits to the executive in the event that, during the term of the severance agreement, (i) the executive's employment is terminated by the Company, except for "cause" as defined therein; or (ii) the executive's employment is terminated due to a constructive discharge, which includes (a) a material change in the executive's responsibilities, which change would cause the executive's position with the Company to become of less dignity, responsibility, prestige or scope; (b) reduction, which is more than de minimis, in total compensation; (c) assignment without the executive's consent to a location more than 50 miles from the current place of employment; or (d) liquidation, dissolution, consolidation, merger, or sale of all or substantially all of the assets of the Company, unless the successor corporation has a net worth at least equal to that of the Company and expressly assumes the obligations of the Company under the executive's severance agreement.

The principal severance benefits payable under each severance agreement consist of the following: (i) the executive's base salary and accrued benefits through the date of termination, including a pro rata portion of awards under the Company's STIC Plan; (ii) three times the sum of the individual's base salary, the average of the STIC Plan awards for the prior three years and the value of the LTIC Plan awards in the prior calendar year; and (iii) the present value of the executive's accrued benefits under the Company's Supplemental Retirement Benefits Plan (SRBP) that would be payable upon retirement at normal retirement age, computed as if the executive had completed three years of additional service. In addition, the executive will be entitled to continuation of life insurance and medical benefits for the longer of (a) a period of three years after termination or (b) a period commencing after termination and ending when the executive may receive pension benefits without actuarial reduction, provided that the Company's obligation for such benefits under the severance agreement shall cease upon the executive's employment with another employer that provides life insurance and medical benefits. Each severance agreement also provides that the executive's Options and SARs shall become exercisable upon a Change in Control and that all Options and SARs shall remain exercisable for the shorter of (a) three years after termination or

12

(b) the term of such Options and SARs. Any restricted stock previously awarded to the executive under the LTIC Plan would vest upon a Change in Control if such vesting does not occur due to a Change in Control under the terms of the LTIC Plan. The Company is also obligated under each severance agreement to pay an additional amount to the executive sufficient on an after-tax basis to satisfy any excise tax liability imposed by Section 4999 of the Internal Revenue Code of 1986, as amended. The benefits received by the executive under each agreement are in lieu of benefits under the Company's termination allowance plan and the executive's benefits under the SRBP. Each executive would be required to waive certain claims prior to receiving any severance benefits.

REPORT ON EXECUTIVE COMPENSATION

Composition of Committee

The Compensation-Nominating Committee (Committee) is appointed by the Board from the membership of the Outside Directors. The Outside Directors are all of the directors who are not officers or employees of the Company or its subsidiaries.

Officer Compensation Generally

The Board has established a comprehensive officer compensation program designed to provide equitable and generally competitive cash compensation and incentives to its officers so as to attract and retain skilled and experienced officers. Officer compensation is comprised of cash compensation, consisting of base salary and bonus, and long-term compensation, consisting of non-qualified stock options (Options), stock appreciation rights (SARs) and restricted stock awards. The Board annually reviews the competitiveness of each component of compensation and total compensation with the assistance of the Committee and a nationally recognized compensation firm (Independent Consultant).

The Committee believes that ownership of Company stock by the Company's management aligns more closely the interests of management and shareholders. To encourage appropriate levels of executive stock ownership, the Committee has adopted ownership guidelines for its officers. The levels of stock ownership specified by the guidelines range from three times the officer's annual base salary to one times annual base salary, depending on the officer's position.

Salaries for elected officers are established by the Board based on recommendations of the Committee. The Committee's recommendations are based on advice and information from the Independent Consultant, a compensation report prepared by the Human Resources Division of the Company's wholly-owned utility subsidiary, The Peoples Gas Light and Coke Company, and, for officers other than the Chairman of the Board and Chief Executive Officer (CEO), the recommendations of the CEO.

The Committee evaluates the competitiveness of the Company's elected officer salaries in light of competitive market data for comparable companies, primarily energy utility companies having revenues of similar size to those of the Company. The Committee believes that the Company's competition for executive talent includes a broader range of companies than the peer group established to compare shareholder returns and, therefore, the group of companies used for compensation purposes is not the same as the peer group used in the performance graph contained in this Proxy Statement. Officer salaries are established by reference to salary range midpoints that are set at the average for the comparison companies. Actual salaries may be above or below the midpoint, depending upon the length of incumbency, the performance of job responsibilities and other factors. The information used by the Committee is derived from market data collected and surveys prepared by the Independent Consultant. The Committee considers the recommendations of the CEO (for officers other than the CEO), as well as market data, in

13

making its recommendations. The Committee's recommendations consider not only the general competitiveness of the elected officers' salary ranges and proposed salaries, but also take into account each individual officer's performance of his or her job responsibilities.

For fiscal 2000, the Board accepted the Committee's recommendation and approved a base salary increase for Mr. Terry of $32,000. The Committee's recommendation was based on the need to maintain the market competitiveness of Mr. Terry's base salary.

Short-Term Incentive Compensation Plan

The Short-Term Incentive Compensation Plan (STIC Plan) makes a portion of executive cash compensation directly related to the Company's short-term performance.

The STIC Plan provides that cash bonuses may be awarded to officers of the Company and its subsidiaries based on levels of achievement under performance measures established at the beginning of each fiscal year. The purposes of the STIC Plan are: (i) to provide meaningful incentives to participants that will benefit shareholders and customers through performance improvements in areas of strategic concern to the Company; (ii) to provide competitive levels of compensation to enable the Company to attract and retain people who are able to make a significant contribution to the Company's success; and (iii) to encourage teamwork and cooperation in the achievement of Company goals. Each year the Independent Consultant reviews the STIC Plan and evaluates the continued use of the STIC Plan and its guidelines in light of competitive practice.

The STIC Plan is administered by the Committee. At the beginning of each fiscal year, the Committee identifies the officers who will be participants for the year and establishes award opportunities for each participant based on the participant's salary range midpoint. The Committee also establishes performance measures and aligns the measures with award opportunities for each participant. Awards are computed at the end of each year on the basis of achievement of the performance measures. The final awards are based on these computed amounts, adjusted at the Committee's discretion for all participants other than the CEO, and, with respect to the CEO, at the Committee's discretion subject to the approval of the Outside Directors. The Committee decided that for fiscal 2000, awards would be paid under the STIC Plan only if the Company achieved dividend coverage on a weather normalized basis for the year and did not reduce its common stock dividend during the year.

For fiscal year 2000, awards for certain participants, including Mr. Terry, were based entirely on corporate performance measures. Other participants' awards were based partly on corporate performance measures and partly on individual or divisional performance measures. For Mr. Terry, the STIC Plan award opportunities were weighted among six corporate measures-20 percent of the award based on earnings per share, 20 percent based on utility return on equity, 20 percent based on utility operating costs, 25 percent based on operating income from diversified energy businesses, 10 percent based on customer satisfaction, and 5 percent based on vendor diversity. The award for the measures was determined by comparing the Company's performance to the respective internally established goal for each measure. The Committee decided that the corporate performance measures should not reflect a one-time charge for the actual and accrued costs for the mercury investigation and remediation program of the Company's utilities. The utilities' program was a response to public perceptions associated with mercury-containing equipment that was in broad use decades ago. The Committee believes that the STIC Plan award for Mr. Terry should reflect his leadership in handling the mercury problem. Under Mr. Terry's leadership, the Company acted decisively in the face of adverse publicity and successfully handled the mercury problem in all respects. The Committee is of the opinion that Mr. Terry's leadership and decisions regarding this matter protected shareholder value and the Company's reputation for reliability and safety.

The award percentages determined under the corporate performance measures were added together, resulting in a composite award percentage of 60.3 percent of the maximum award opportunity for Mr. Terry and other participants whose award opportunity was based solely on corporate performance

14

measures. Based on these results, the Committee decided upon, and the Outside Directors approved, an award to Mr. Terry of $392,000.

Long-Term Incentive Compensation Plan

The Long-Term Incentive Compensation Plan (LTIC Plan) is administered by the Committee for employees other than the CEO and, with respect to the CEO, by the Committee subject to the approval of the Outside Directors. The Committee has the duty to select the individuals to whom Options, SARs and restricted stock awards, or combinations thereof, will be granted, determine the amount and the extent of such individuals' participation, interpret provisions of the plan, and promulgate, amend and rescind rules for its administration. With respect to the CEO, the Committee prescribes the form and content of Options, SARs and restricted stock granted and is authorized to interpret the plan, to prescribe, amend or rescind rules relating to it, and to make all other determinations necessary or advisable for the plan's administration, subject to the approval of the Outside Directors.

The purpose of the LTIC Plan is to align the interests of key employees with those of shareholders, thereby increasing those employees' interest in the financial success and growth of the Company. In selecting employees who receive awards under the LTIC Plan, the Committee considers the individual's position and responsibilities, nature of service to the Company, and past, present and potential contributions to the success of the Company.

The grant of an Option enables the recipient to purchase Company common stock at a purchase price equal to the fair market value of the shares on the date the Option was granted. The grant of an SAR entitles the recipient to receive, for each SAR granted, cash in an amount equal to the excess of the fair market value of one share of Company common stock on the date the SAR is exercised over the fair market value of such common stock on the date the SAR was granted. Before an Option or SAR may be exercised, the recipient must complete 12 months of continuous employment subsequent to the grant of the Option or SAR. Options and SARs may be exercised within 10 years from the date of grant, subject to earlier termination in case of death, retirement, or termination of employment for other reasons.

The grant of a restricted stock award entitles the recipient to vote the shares of Company common stock covered by such award and to receive dividends thereon. The recipient may not transfer or otherwise dispose of such shares until the restrictions thereon lapse. Restricted stock awards granted to date vest in equal annual increments over a five-year period from the date of grant. If a recipient's employment with the Company terminates, other than by reason of death, disability or retirement after attaining age 65, the recipient forfeits all rights to the unvested portion of the restricted stock award. In addition, the Committee (and, with respect to the CEO, the Committee subject to the approval of the Outside Directors) may, in its discretion, accelerate the vesting of any restricted stock awards granted under the LTIC Plan.

Grants of Options, SARs and restricted stock are made by the Committee by general application of the LTIC Plan guidelines. The Committee also considers the recommendations of the CEO for recipients other than the CEO. Under the guidelines, the number of Options, SARs and shares of restricted stock is determined for recipients by applying percentages of salary range midpoints (this percentage varies with the recipient's position in the Company), and dividing that amount by the Company's common stock price on or shortly before the date on which Options, SARs and restricted stock will be granted. All awards under the LTIC Plan (except for the CEO) are subject to the discretion and approval of the Committee. With respect to the CEO, the Committee awards under the LTIC Plan are subject to the discretion and approval of the Outside Directors. Each year, prior to Committee approval, the Independent Consultant reviews the LTIC Plan and evaluates the appropriateness of the continued use of the plan, its guidelines and the value of the grants to be made thereunder.

15

Based on the application of the guideline formula and the recommendation of the Independent Consultant, the Committee granted, and the Outside Directors approved, awards to Mr. Terry of 36,600 Options, 36,600 SARs, and 10,050 shares of restricted stock.

Section 162(m) of the Internal Revenue Code of 1986, as amended, places a limit of $1 million on the amount of certain compensation that may be deducted by the Company in any year with respect to the executive officers named in the Summary Compensation Table of the proxy statement. Mr. Terry's compensation for fiscal 2000 exceeded this limit by $287,836.

The Committee will continue to monitor the impact of Section 162(m) on the Company's compensation programs. The Committee believes it is in the best interest of the Company's shareholders to retain broader discretion in determination of performance criteria with respect to certain compensation programs of the Company than that contemplated by regulations of the Internal Revenue Service.

Submitted by:

THE COMPENSATION-NOMINATING COMMITTEE

Homer

J. Livingston, Jr. (Chairman)

James R. Boris

William J. Brodsky

William G. Mitchell

Richard P. Toft

16

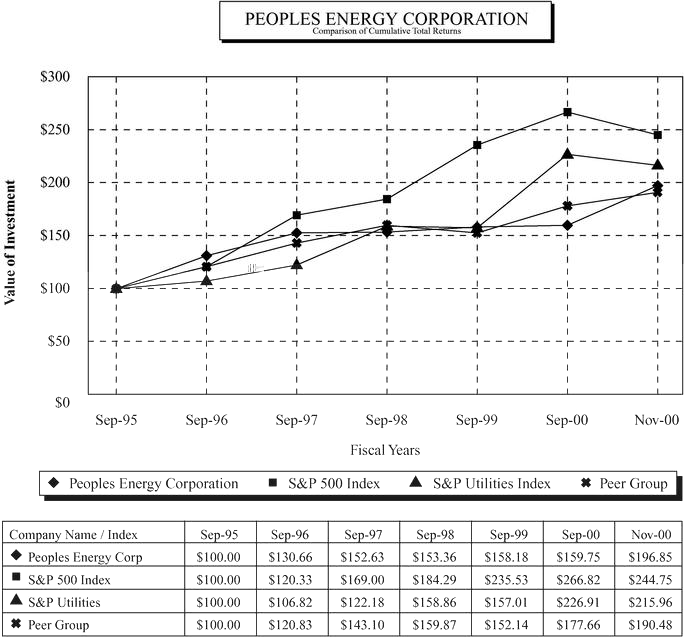

The following graph compares the cumulative total shareholder return on Company common stock to the cumulative total return of the S&P 500 Index, the S&P Utility Index, and a peer group selected by the Company comprised of energy companies with substantial gas distribution operations, weighted by market capitalization, over a period commencing September 30, 1995 and ending November 30, 2000. The graph assumes that the value of investment in Company common stock and each index was $100 on September 30, 1995, and that all dividends were reinvested.

The peer group is comprised of the following companies: AGL Resources Inc.; Keyspan Corporation; Laclede Gas Company; New Jersey Resources Corp.; Nicor, Inc.; Northwest Natural Gas Company; Piedmont Natural Gas Company; Sempra Energy; Vectren Corporation and WGL Holdings, Inc. The Company believes that the peer group companies are more similar to the Company for purposes of comparing total returns on an investment than are the companies in the S&P Utility Index, which include electric utilities and many companies with much larger market capitalizations than that of the Company.

17

ITEM 2. APPOINTMENT OF AUDITORS

Shareholders will be asked to ratify the recommendation of the Audit Committee and the appointment by the Board of Directors of Arthur Andersen LLP as the independent public accountants for the Company and its subsidiaries for the fiscal year ending September 30, 2001.

A representative of Arthur Andersen LLP is expected to be present at the meeting and will be available to respond to appropriate questions or to make a statement if said representative so desires.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR SUCH APPOINTMENT.

Management does not know of any matters to be presented at the meeting other than those mentioned in the Notice of Annual Meeting of Shareholders. However, if other matters come before the meeting, it is the intention of the persons named in the accompanying proxy to vote said proxy in accordance with their judgment on such matters.

Any proposals by shareholders that are intended to be presented for action at the 2002 Annual Meeting of Shareholders of the Company must be received by the Company by August 31, 2001, to be considered for inclusion in the proxy statement and form of proxy relating to such meeting.

PETER

KAUFFMAN

Secretary

December 28, 2000

18

P E O P L E S E N E R G Y C O R P O R A T I O N

CHARTER

OF THE AUDIT COMMITTEE

OF THE BOARD OF DIRECTORS

Effective: May 18, 2000

Superseding: November 6, 1996

CHARTER OF THE AUDIT COMMITTEE

OF THE BOARD OF DIRECTORS

OF PEOPLES ENERGY CORPORATION

The Audit Committee shall provide assistance to the Board by providing oversight of the quality and integrity of the Company's financial reporting, accounting, internal controls, auditing and such other matters as the Chairman of the Audit Committee deems appropriate as well as compliance with the Company's codes of conduct.

The Audit Committee shall be comprised of a minimum of three directors. Members of the Committee shall meet the independence, financial literacy and experience requirements of the New York Stock Exchange and any other relevant listing authority ("Membership Requirements"). Each member shall be chosen by the Board to serve for a term of three years or such other term as determined by the Board. If any regular member is unable to act or complete his or her term for any reason, any other member of the Board who meets the Membership Requirements may be chosen by the Board to serve as an alternate member.

III. Chairman of the Audit Committee

The Board shall choose a chairman of the Audit Committee to serve for a term of three years or such other term as may be determined by the Board. The chairman may convene a meeting of the Audit Committee at his or her discretion in addition to regularly scheduled meetings of the Audit Committee.

The Audit Committee shall have the following responsibilities:

1 of 4

2 of 4

the Audit Committee shall inform the Securities and Exchange Commission ("SEC") of the Independent Auditor's conclusion within one business day after receipt of the report, and furnish the Independent Auditor with a copy of the notice given to the SEC.

3 of 4

Effective: May 18, 2000

Superseding: November 6, 1996

4 of 4

PEOPLES ENERGY CORPORATION

PLEASE MARK VOTE IN OVAL IN THE FOLLOWING MANNER USING DARK INK ONLY. /*/

[ |

] |

1. |

Election of Directors: 01-J.R. Boris, 02-W.J. Brodsky, 03-P. Cafferty, 04-H.J. Livingston, Jr., 05-L.H. McKeever, 06-T.M. Patrick, 07-R.E. Terry, 08-R.P. Toft and 09-A.R. Velasquez. |

For All / / |

Withhold All / / |

For All Except / / |

||||

(Except Nominee(s) written above) |

||||||||

2. |

Ratify the appointment of Arthur Andersen LLP as independent public accountants. |

For / / |

Against / / |

Abstain / / |

The Board of Directors recommends a vote FOR all proposals.

| THIS PROXY WILL BE VOTED IN ACCORDANCE WITH THE SPECIFICATION MADE. IF NO CHOICES ARE INDICATED, THIS PROXY WILL BE VOTED FOR ALL PROPOSALS. | ||

| Dated: , 2001 | ||

| Signature(s) | ||

| NOTE: Please sign exactly as your name(s) appears. For joint accounts, each owner should sign. When signing as executor, administrator, attorney, trustee or guardian, etc., please give your full title. |

Your

vote is important. Please complete, date, sign and detach the above proxy card and promptly

return it in the enclosed envelope.

Admission Ticket

Peoples Energy Corporation

Annual Meeting of Shareholders

Friday, February 23, 2001

11:00 a.m.

Harris Trust and Savings Bank

8th Floor Auditorium

115 South LaSalle Street

Chicago, Illinois

ENTER AT THE SOUTHEAST CORNER OF

MONROE AND LASALLE STREETS

PEOPLES ENERGY CORPORATION

ANNUAL MEETING OF SHAREHOLDERS—FEBRUARY 23, 2001

The undersigned hereby appoints Homer J. Livingston, Jr., Arthur R. Velasquez and Richard E. Terry, and each of them, with power of substitution in each, as proxies, with the powers the undersigned would possess if personally present, to vote all of the undersigned's shares of stock in the Company at the Annual Meeting of Shareholders of the Company to be held at Harris Trust and Savings Bank, 115 South LaSalle Street, Chicago, Illinois, on February 23, 2001, at 11:00 A.M., and at any adjournment thereof, upon all matters that may properly come before the meeting, including the matters described in the Company's Notice of Annual Meeting of Shareholders and Proxy Statement dated December 28, 2000, subject to any directions indicated on the reverse side of this card. If any of the nominees should be unable to serve or for good cause will not serve, which is not anticipated, management reserves discretionary authority to vote for a substitute.

This Proxy is Solicited on Behalf of the Board of Directors of the Company.

IMPORTANT— To be signed and dated on the reverse side.

|

|