|

|

|

|

|

Previous: WHITE MOUNTAINS INSURANCE GROUP LTD, 10-Q, EX-27.1, 2000-08-11 |

Next: BEAR STEARNS COMPANIES INC, 424B5, 2000-08-11 |

Filed

Pursuant to Rule 424(b)(5)

Registration No. 333-31980

PROSPECTUS SUPPLEMENT

(To Prospectus Dated August 8, 2000)

US$500,000,000

The Bear Stearns Companies Inc.

The Bear Stearns Companies Inc.

% Global Notes due 2007

Offered through DAiSSSM, a proprietary system of Bear, Stearns & Co. Inc.

Set forth below is a summary of the terms of the Notes offered by this prospectus supplement and the accompanying prospectus. For more detail, see "Description of the Notes."

| • | Global Offering We are offering the Notes in the United States and in parts of Europe and Asia where it is legal to offer the Notes. |

| • | Allocation of Notes The Underwriters intend to sell the amount of Notes to the bidders who participate in the DAiSSSM (Dutch Auction internet Syndication SystemSM) auction in accordance with the DAiSSSM auction allocation rules. See Appendix A for the DAiSSSM auction rules. |

| • | Interest and Pricing The interest rate for the Notes will be established through the DAiSSSM auction bidding procedure. The interest rate for the Notes will be rounded up or down to the nearest .05 of 1%. The purchase price for the Notes will be set at a premium or discount to par so as to adjust for such rounding. Interest will be paid every six months on February 15 and August 15. |

| • | Maturity The Notes will mature on August 15, 2007. |

| • | Ranking The Notes will be our unsecured senior debt and will rank equally with all of our other unsecured and unsubordinated debt. |

| • | Redemption The Notes are only redeemable prior to maturity if certain events involving US taxation occur. |

| • | No Sinking Fund The Notes will not be subject to any sinking fund. |

| • | Book-Entry Notes The Notes will be represented by one or more global securities registered in the name of Cede & Co., as nominee of The Depository Trust Company. |

| • | Listing We will make application to the Financial Services Authority in its capacity as competent authority under the Financial Services Act 1986 for the Notes to be admitted to the official list of the UK Listing Authority and to the London Stock Exchange Limited for such Notes to be admitted to trading on the London Stock Exchange's market for listed securities. |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

| |

Per Note |

Total |

|||

|---|---|---|---|---|---|

| Initial public offering price | % | $ | |||

| Underwriting discount | % | $ | |||

| Proceeds, before expenses, to us | % | $ | |||

Bear, Stearns & Co. Inc. is the Global Coordinator for the offering of the Notes. Bear, Stearns International Limited is the International Coordinator for all Notes to be sold to purchasers in Europe. The Underwriters expect to deliver the Notes in book-entry form only through the facilities of The Depository Trust Company, Clearstream Banking, Société anonyme and Morgan Guaranty Trust Company of New York, Brussels office, as operator of the Euroclear system against payment on or about August 17, 2000.

After this offering is complete, the Underwriters may use this prospectus supplement and the accompanying prospectus in connection with market-making transactions at negotiated prices related to the prevailing market prices at the time of sale. The Underwriters may act as principal or agent in these transactions.

Bear, Stearns & Co. Inc.

Bear, Stearns International Limited

The date of this prospectus supplement is August 10, 2000

Pricing and allocation of the Notes will be established through DAiSSSM (Dutch Auction internet Syndication SystemSM). DAiSSSM is a rules-based, proprietary, single-priced, modified Dutch Auction syndication system, developed by Bear Stearns for the pricing and allocation of securities. DAiSSSM allows bidders to directly participate in the pricing of the Notes, through Internet access to an auction site, by submitting conditional offers to buy that are subject to acceptance by the Underwriters and us. These bids may directly affect the price at which the Notes are sold by the Underwriters to the bidders. The final offering price at which the Notes will be sold and the allocation of the Notes by the Underwriters among bidders will be based on the results of the DAiSSSM auction. The DAiSSSM auction rules are contained in Appendix A and should be carefully reviewed by each bidder participating in the DAiSSSM auction. We will file a prospectus supplement setting forth the final price of the Notes and other information regarding the underwriting arrangements with the Securities and Exchange Commission promptly after the DAiSSSM auction is completed.

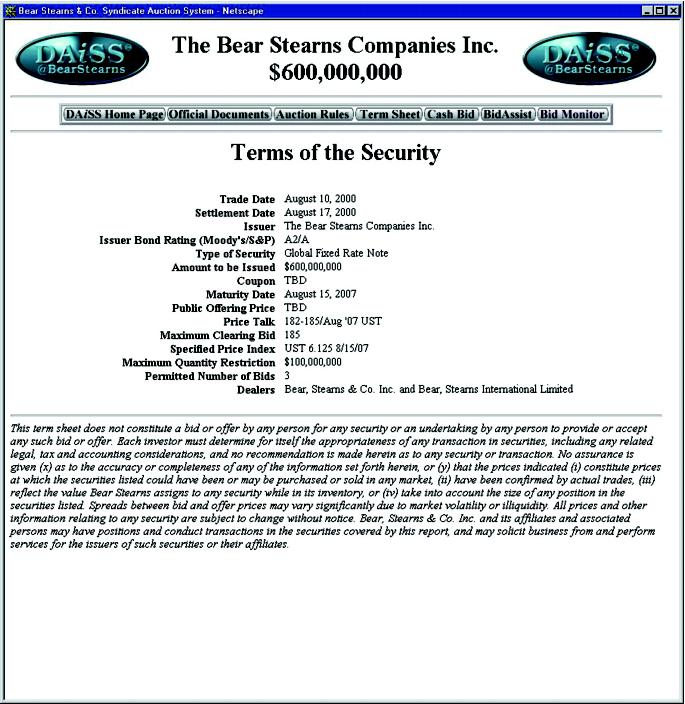

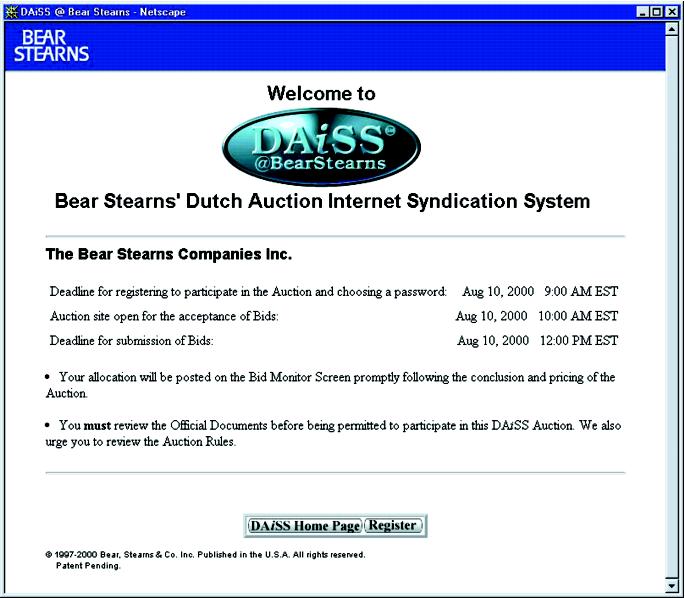

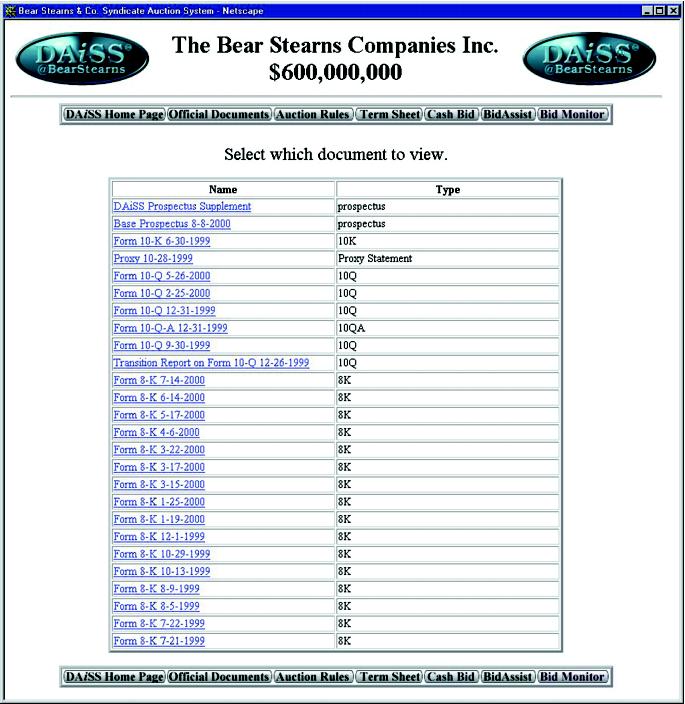

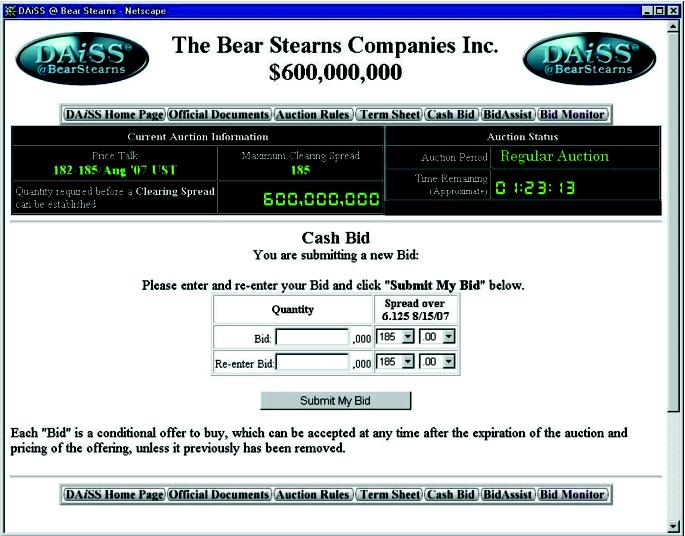

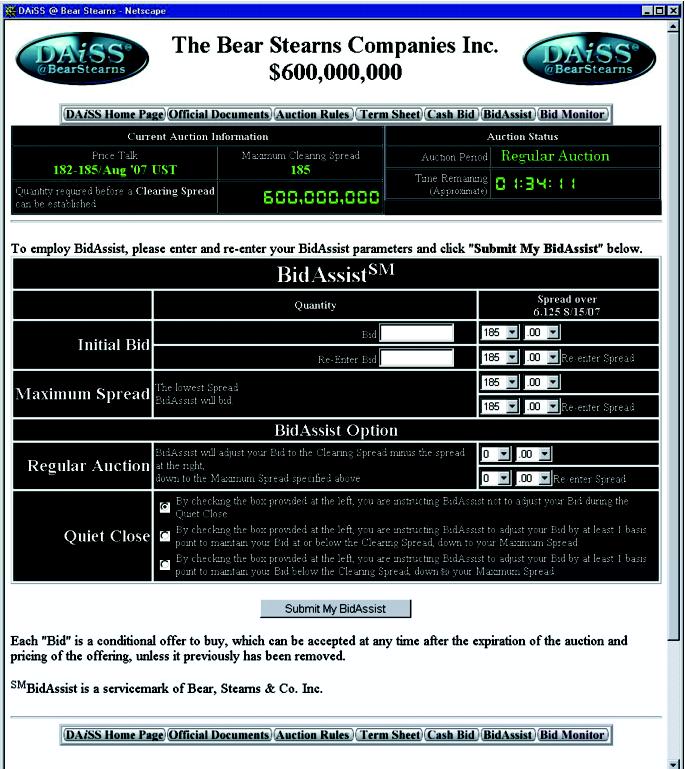

Information regarding the anticipated range of the public offering price of the Notes, minimum admissible bids, maximum clearing bid, maximum quantity restrictions and other specific rules governing the auction process will be contained in the term sheet and the auction rules made available to participating bidders in the offering cul-de-sac on the DAiSSSM auction site. In order to participate in the DAiSSSM auction, each bidder must complete certain jurisdictional eligibility certifications and comply with specified auction registration and document review procedures. Upon approval of a particular bidder's registration, the bidder will be permitted access to various screens on the DAiSSSM auction site in order to participate in the DAiSSSM auction. Copies of each of the term sheet and the forms of DAiSSSM home page, official documents screen and cash bid, bid assist and bid monitor screens are attached to this prospectus supplement as Appendices B, C, D, E, F and G respectively.

Offers and sales of the Notes are subject to restrictions in certain jurisdictions. In particular, there are restrictions on the distribution of this prospectus supplement and the accompanying prospectus and the offer or sale of the Notes in the United Kingdom, and details of these restrictions are set out in "Underwriting" in this prospectus supplement. The distribution of this prospectus supplement and the accompanying prospectus and the offer or sale of the Notes in certain other jurisdictions may be restricted by law. Persons who come into possession of this prospectus supplement and the accompanying prospectus or any Notes must inform themselves about and observe any applicable restrictions on the distribution of this prospectus supplement and the accompanying prospectus and the offer and sale of the Notes.

We accept responsibility for the information contained in this prospectus supplement and the accompanying prospectus. To the best of our knowledge and belief (having taken all reasonable care to ensure that such is the case) the information contained in this prospectus supplement and the accompanying prospectus is in accordance with the facts and does not omit anything likely to affect the import of the information.

You must read this prospectus supplement and the accompanying prospectus as one along with all the documents which are deemed to be incorporated in this prospectus supplement and the accompanying prospectus by reference (see "Where You Can Find More Information"). This prospectus supplement and the accompanying prospectus must be read and construed on the basis that the incorporated documents are so incorporated and form part of this document, except as specified in this document.

We have not authorized any person to give any information or represent anything not contained in this prospectus supplement and the accompanying prospectus. You must not rely on any unauthorized information.

In order to facilitate the offering of the Notes, Bear Stearns, in its capacity as Global Coordinator of the offering of the Notes, may over-allot or effect transactions which stabilize or maintain the

S-2

market price of the Notes at a level which might not otherwise prevail in the open market. Specifically, Bear Stearns, on behalf of the Underwriters, may over-allot or otherwise create a short position in the Notes for the account of the Underwriters by selling more Notes than have been sold to them by us. Bear Stearns, on behalf of the Underwriters, may elect to cover any such short position by purchasing Notes in the open market. In addition, Bear Stearns, on behalf of the Underwriters, may stabilize or maintain the price of the Notes by bidding for or purchasing Notes in the open market and may impose penalty bids, under which selling concessions allowed to syndicate members or other broker-dealers participating in the offering are reclaimed if Notes previously distributed in the offering are repurchased in connection with stabilization transactions or otherwise. The effect of these transactions may be to stabilize or maintain the market price of the Notes at a level above that which might otherwise prevail in the open market. The imposition of a penalty bid may also affect the price of the Notes to the extent that it discourages resales of Notes. No representation is made as to the magnitude or effect of any such stabilization or other transactions. Such transactions, if commenced, may be discontinued at any time.

S-3

This prospectus supplement and the accompanying prospectus include and incorporate by reference "forward-looking statements" within the meaning of the securities laws. All statements regarding our expected financial position, business and financing plans are forward-looking statements. Forward-looking statements also include representations of our expectations or beliefs concerning future events that involve risks and uncertainties, including those associated with the effect of international, national and regional economic conditions and the performance of Bear Stearns' and BSSC's products within the prevailing economic environment. Although we believe that the expectations reflected in those forward-looking statements are reasonable, those expectations may prove to be incorrect. Cautionary statements describing important factors that could cause actual results to differ materially from our expectations are disclosed in this prospectus supplement along with the forward-looking statements included or incorporated by reference in this prospectus supplement and the accompanying prospectus. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by such cautionary statements. These forward-looking statements speak only as of the date of the document in which they are made. We disclaim any obligation or undertaking to provide any updates or revisions to any forward-looking statement to reflect any change in our expectations or any change in events, conditions or circumstances on which the forward-looking statement is based.

Unless otherwise stated in this prospectus supplement:

Other capitalized terms that are used but not defined in this prospectus supplement have the meanings given to them in the accompanying prospectus.

Bear Stearns, BSSC and BSIL are subsidiaries of The Bear Stearns Companies Inc.

S-4

WHERE YOU CAN FIND MORE INFORMATION

We file annual and quarterly reports, proxy statements and other information required by the Securities Exchange Act of 1934, as amended (the "Exchange Act"), with the Securities and Exchange Commission (the "SEC"). You may read and copy any document we file at the SEC's public reference rooms located at 450 Fifth Street, N.W., Washington, D.C. 20549, at Seven World Trade Center, 13th Floor, New York, New York 10048, U.S.A. and at Northwest Atrium Center, 5000 West Madison Street, Suite 1400, Chicago, Illinois 60661-2511, U.S.A. Please call the SEC at 1-800-SEC-0330 for further information on the public reference rooms. Our SEC filings are also available to the public from the SEC's web site at http://www.sec.gov. Copies of these reports, proxy statements and other information can also be inspected at the offices of the New York Stock Exchange, 20 Broad Street, New York, New York 10005, U.S.A.

The SEC allows us to "incorporate by reference" the information that we file with them, which means that we can disclose important information to you by referring you to the other information we have filed with the SEC. The information that we incorporate by reference is considered to be part of this prospectus supplement, and information that we file later with the SEC will automatically update and supersede this information.

The following documents filed by us with the SEC pursuant to Section 13 of the Exchange Act (File No. 1-8989) and any future filings under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act made before the termination of the offering of the Notes are incorporated by reference:

We will provide to you without charge, a copy of any or all documents incorporated by reference into this prospectus supplement except the exhibits to such documents (unless such exhibits are specifically incorporated by reference in such documents). You may request copies by writing or telephoning us at the Corporate Communications Department, The Bear Stearns Companies Inc., 245 Park Avenue, New York, New York 10167, U.S.A.; telephone number (212) 272-2000. In addition, once the Notes are admitted to the Official List of the UK Listing Authority (as defined below), these documents will be available from BSIL in its capacity as listing agent for the Notes at its principal office at One Canada Square, London E14 5AD, England.

S-5

| Issuer | The Bear Stearns Companies Inc. | |

| Securities Offered | US $500,000,000 aggregate principal amount of fixed rate Global Notes due 2007. The interest rate for the Notes will be established through DAiSSSM (Dutch Auction internet Syndication SystemSM). | |

| Specified Currency | The Notes will be denominated in US dollars and all payments on the Notes will be made in US dollars. | |

| Establishment of Offering Price Through DAiSSSM | Pricing and allocation of the Notes will be established through DAiSSSM. DAiSSSM is a rules-based, proprietary, single-priced, modified Dutch Auction syndication system designed to facilitate the direct participation of the ultimate purchasers of the Notes from the Underwriters in the pricing and allocation of securities. DAiSSSM allows bidders to directly participate in the pricing of the Notes, through Internet access to an auction site, by submitting conditional offers to buy that are subject to acceptance by the Underwriters and us. These bids may directly affect the price at which the Notes are sold. The final offering price at which the Notes will be sold and the allocation of the Notes by the Underwriters among participating bidders will be based on the results of the DAiSSSM auction. | |

| It is anticipated that the public offering price for the Notes will be based on the rate reported at the close of the DAiSSSM auction for 61/8% U.S. Treasury Notes due August 15, 2007, as reported on page BSET 6 (Bear Stearns Electronic Trading) on Bloomberg L.P. The interest rate determined through the DAiSSSM auction bidding procedure will be rounded up or down to the nearest .05% of 1%. The purchase price of the Notes will be set at a premium or discount to par so as to adjust for such rounding. Additional information regarding pricing of the Notes, including minimum admissible bids and maximum quantity restrictions, is contained in the term sheet. The term sheet is available to participating bidders in the offering cul-de-sac on the DAiSSSM auction site and is attached to this prospectus supplement as Appendix B. | ||

| If bids in an amount equal to the aggregate amount of Notes offered have not been received at the close of the regular auction period in the DAiSSSM auction, Bear Stearns will consult with us and may submit a bid at the maximum clearing spread in an amount that will bring the total amount bid to the aggregate amount of the offering. See "Underwriting" below. |

S-6

| Participation in the DAiSSSM auction is subject to specific rules and procedures. These procedures, including how to bid, how to change a bid, how the offering will be allocated and other mechanical and legal aspects of participating in the DAiSSSM auction, are contained in the auction rules. The DAiSSSM auction rules are available to participating bidders in the offering cul-de-sac on the DAiSSSM auction site and are attached to this prospectus supplement as Appendix A. You should review the auction rules for a more detailed description of the offering procedures. | ||

| Date of Original Issuance (Settlement Date) | August 17, 2000. | |

| Maturity Date | August 15, 2007. | |

| Interest Payment Dates | February 15 and August 15 in each year, beginning February 15, 2001. | |

| Ranking | The Notes will be unsecured and will rank equally with all our other unsecured and unsubordinated debt. Because we are a holding company, the Notes will be effectively subordinated to the claims of creditors of our subsidiaries with respect to their assets. At June 30, 2000: | |

| • we had outstanding (on an unconsolidated basis) approximately $41.3 billion of debt and other obligations, including approximately $40.2 billion of senior debt, none of which is secured; and |

||

| • our subsidiaries had outstanding (after consolidation and eliminations) approximately $146.2 billion of debt and other obligations (including $77.9 billion related to securities sold under repurchase agreements, $40.5 billion related to payables to customers, $19.9 billion related to financial instruments sold, but not yet purchased, and $7.9 billion of other liabilities, including $4.1 billion of debt). |

||

| Mandatory Redemption or Sinking Fund | None. | |

| Optional Redemption | The Notes may only be redeemed prior to maturity if certain events involving US taxation occur. See "Redemption Upon Certain Tax Events" below. |

S-7

| Payment of Additional Amounts | Subject to the various exceptions and limitations set forth in this prospectus supplement, we will pay as additional interest or, as the case may be, principal on the Notes all such additional amounts that are necessary in order that the net payment by us or a paying agent of the principal of and interest on the Notes to a person that is not a US Holder (as defined under "Certain US Federal Income Tax Considerations"), after deduction for any present or future tax, assessment or governmental charge of the United States or a political subdivision or taxing authority of the United States or in the United States, imposed by withholding with respect to the payment, will not be less than the amount provided in the Notes to be then due and payable. See "Description of the Notes—Payment of Additional Amounts" below. | |

| Redemption Upon Certain Tax Events | If (a) as a result of any change in, or amendment to, the laws (or any regulations or rulings promulgated under those laws) of the United States (or any political subdivision or taxing authority of the United States or in the United States), or any change in, or amendments to, the official position regarding the application or interpretation of these laws, regulations or rulings, which is announced or becomes effective on or after the date of this prospectus supplement, we become or will become obligated to pay additional amounts as described in this prospectus supplement under the heading "Description of the Notes—Payment of Additional Amounts" below or (b) any act is taken by a taxing authority of the United States on or after the date of this prospectus supplement, whether that act is taken with respect to us or any affiliate, that results in a substantial probability that we will or may be required to pay such additional amounts, then we may, at our option, redeem, in whole but not in part, the Notes on any interest payment date on not less than 30 nor more than 60 days' prior notice, at a redemption price equal to 100% of their principal amount, together with interest accrued on the Notes to the date fixed for redemption; provided that we determine, in our business judgment, that the obligation to pay such additional amounts cannot be avoided by the use of reasonable measures available to us, not including substitution of the obligor under the Notes. See "Description of the Notes—Redemption Upon Certain Tax Events" below. | |

| Use of Proceeds | We will use the net proceeds before expenses from the sale of the Notes of approximately $ million for general corporate purposes. These purposes may include additions to working capital, the repayment of short-term and long-term debt and making investments in or extending credit to our subsidiaries. |

S-8

| Book-Entry Form | The Notes will be issued only in book-entry form. This means that we will not issue certificates to you. Instead, the Notes will be issued in the form of one or more fully registered global securities, which will be deposited with a custodian. The Notes will be registered in the name of Cede & Co., as the nominee for The Depository Trust Company. You will not receive a definitive note representing your interest. This form will be referred to as "book-entry only." You may elect to hold your interests in the global securities through either The Depository Trust Company ("DTC") (in the United States) or Clearstream Banking, Société anonyme ("Clearstream Luxembourg") or Morgan Guaranty Trust Company of New York, Brussels office, as operator of the Euroclear system ("Euroclear") (in Europe). Interests will be held on behalf of the participants of Clearstream Luxembourg and Euroclear on the books of their respective depositaries. See "Description of Debt Securities—Global Securities" in the accompanying prospectus and "Description of the Notes—Book-Entry, Delivery and Form—Global Clearance and Settlement Procedures" below. | |

| Events of Default | See "Description of Debt Securities—Events of Default" in the accompanying prospectus. | |

| Limitation on Liens | See "Description of Debt Securities—Limitation on Liens" in the accompanying prospectus. | |

| Listing | We will make application to the Financial Services Authority in its capacity as competent authority under the Financial Services Act 1986 (the "UK Listing Authority") for the Notes to be admitted to the official list of the UK Listing Authority (the "Official List") and to the London Stock Exchange Limited (the "London Stock Exchange") for such Notes to be admitted to trading on the London Stock Exchange's market for listed securities. We cannot guarantee that our application will be approved, and settlement of the Notes is not conditioned on obtaining the listing. | |

| Governing Law | New York. | |

| Selling Restrictions | There are selling restrictions for certain jurisdictions, including the United Kingdom. See "Underwriting" below. |

S-9

RATIO OF EARNINGS TO FIXED CHARGES

Our ratio of earnings to fixed charges was 1.3 for the six months ended May 26, 2000 and for the fiscal year ended June 30, 1999. The ratio was calculated by dividing the sum of the fixed charges into the sum of the earnings before taxes and fixed charges. Fixed charges for purposes of the ratio consist of interest expense and certain other immaterial expenses.

THE BEAR STEARNS COMPANIES INC.

The Bear Stearns Companies Inc. is a holding company that, through its principal subsidiaries, Bear Stearns, BSSC and BSIL, is a leading investment banking, securities trading and brokerage firm serving corporations, governments and institutional and individual investors worldwide. Our business includes:

We are incorporated in the State of Delaware. Our principal executive office is located at 245 Park Avenue, New York, New York 10167, USA, and our telephone number is (212) 272-2000. Our Internet address is http://www.bearstearns.com.

S-10

Directors of the Company

The following table sets forth certain information (unless otherwise noted, as of September 8, 1999) concerning the directors of the Company.

| Name |

Age (as of May 26, 2000) |

Principal Occupation and Directorships Held |

Year First Elected to Serve as Director of the Company |

||||

|---|---|---|---|---|---|---|---|

| James E. Cayne | 66 | President and Chief Executive Officer of the Company and Bear Stearns and member of the Executive Committee | 1985 | ||||

| Carl D. Glickman | 73 | Private Investor; In the United States, Director, Lexington Capital Properties Trust and Office Max Inc.; In Israel, Director, Alliance Tire and Rubber Company (1992) Ltd. and The Jerusalem Economic Corporation Ltd.; Trustee, Cleveland State University | 1985 | ||||

| Alan C. Greenberg | 72 | Chairman of the Board of the Company and Bear Stearns and Chairman of the Executive Committee | 1985 | ||||

| Donald J. Harrington | 54 | President, St. John's University; Director, The Reserve Fund, Reserve Institutional Trust, Reserve Tax-Exempt Trust, Reserve New York Tax-Exempt Trust and Reserve Special Portfolios Trust | 1993 | ||||

| William L. Mack | 60 | President and Senior Managing Partner, The Mack Organization; Founder and Managing Partner, The Apollo Real Estate Investment Funds; Chairman of the Board of Metropolis Realty Trust, Inc.; Director, Mack-Cali Realty Corporation, Koger Equity, Inc. and Vail Resorts, Inc. | 1997 | ||||

| Frank T. Nickell | 52 | President and Chief Executive Officer of Kelso & Company; Director, Earle M. Jorgensen Company and Peebles Inc. | 1993 | ||||

| Frederic V. Salerno | 56 | Senior Executive Vice President and CFO/Strategy and Business Development and Director of Bell Atlantic Corporation; Director, Avnet, Inc., KeySpan Energy Corp., The Hartford and Viacom, Inc. | 1992 | ||||

| Alan D. Schwartz | 50 | Executive Vice President and Head of the Investment Banking Group of Bear Stearns; Director, Unique Casual Restaurants, Inc., Young & Rubicam, Inc. | 1987 | (1) | |||

| Warren J. Spector | 42 | Executive Vice President and Head of the Fixed Income Group of Bear Stearns | 1990 | (1) |

S-11

| Vincent Tese | 57 | Chairman and Director of Wireless Cable International Inc.; Director, Allied Waste Industries Inc., Angram, Inc., Bowne & Co., Inc., Cablevision International, Custodial Trust Co., Mack-Cali Realty Corp. and KeySpan Energy Corp. | 1994 | ||||

| Fred Wilpon | 63 | Chairman of the Board of Directors of Sterling Equities, Inc.; Chairman of Executive Committee and Director of Pathogenesis Corporation; President and Chief Executive Officer of the New York Mets | 1993 |

Mr. Cayne has been Chief Executive Officer of the Company and Bear Stearns since July 1993. Mr. Cayne has been President of the Company for more than the past five years.

Mr. Glickman has been a private investor for more than the past five years. Mr. Glickman is also currently Chairman of the Compensation Committee of the Board of Directors of the Company.

Mr. Greenberg has been Chairman of the Board of the Company for more than the past five years.

Father Harrington has been the President of St. John's University for more than the past five years.

Mr. Mack has been President and Senior Managing Partner of The Mack Organization (a national owner, developer and investor in office and industrial buildings and other real estate) and a founder and Managing Partner of the Apollo Real Estate Investment Funds for more than the past five years. In 1997, Mr. Mack was appointed Chairman of the Executive Committee and Director of Mack-Cali Realty Corporation (a publicly traded real estate investment trust). Mr. Mack is Chairman of the Board of Metropolis Realty Trust, Inc. (the owner of high rise office buildings).

Mr. Nickell has been President of Kelso & Company, a privately held merchant banking firm, for more than the past five years. Mr. Nickell was appointed Chief Executive Officer of Kelso & Company in 1998.

Mr. Salerno is the Senior Executive Vice President and CFO/Strategy and Business Development of Bell Atlantic Corporation ("Bell Atlantic"). Prior to the merger of NYNEX Corp. ("NYNEX") and Bell Atlantic, Mr. Salerno was the Vice Chairman of the Board of NYNEX for more than the past five years. Mr. Salerno served as Chairman of the Board of the State University of New York from 1990 to 1996.

Mr. Schwartz has been an Executive Vice President of Bear Stearns for more than the past five years. Prior to June 30, 1999, Mr. Schwartz was an Executive Vice President of the Company and a member of the Executive Committee for more than the past five years. Mr. Schwartz is responsible for all of the investment banking activities of Bear Stearns.

Mr. Spector has been an Executive Vice President of Bear Stearns for more than the past five years. Prior to June 30, 1999, Mr. Spector was an Executive Vice President of the Company and a

S-12

member of the Executive Committee for more than the past five years. Mr. Spector is responsible for all of the fixed income activities of Bear Stearns.

Mr. Tese has been Chairman of Wireless Cable International Inc. since April 1995. Mr. Tese was Chairman of Cross Country Wireless Inc. from October 1994 to July 1995 and was a corporate officer and a general partner of Cross Country Wireless Inc.'s predecessors, Cross Country Wireless Cable—I, L.P. and Cross Country Wireless Cable West, L.P., from 1990 until October 1994. Mr. Tese was the Director of Economic Development for the State of New York from June 1987 to December 1994. Mr. Tese is currently Chairman of the Audit Committee of the Board of Directors of the Company.

Mr. Wilpon has been Chairman of the Board of Directors of Sterling Equities, Inc., a privately held entity, and certain affiliates thereof, which are primarily real estate development/owner management companies, for more than the past five years. Mr. Wilpon has also been President and Chief Executive Officer of the New York Mets baseball team for more than the past five years. Mr. Wilpon has been a Director of Pathogenesis Corporation, a publicly held bio-pharmaceutical company, for more than the past five years and currently serves as Chairman of its Executive Committee.

There is no family relationship among any of the directors or executive officers.

All directors hold office until our next Annual Meeting of Stockholders or until their successors have been duly elected and qualified. Officers serve at the discretion of the Board of Directors.

The business address for each director is 245 Park Avenue, New York, New York 10167, USA.

We will use the net proceeds before expenses from the sale of the Notes of approximately $ million for general corporate purposes. These purposes may include additions to working capital, the repayment of short-term and long-term debt and making investments in or extending credit to our subsidiaries.

S-13

The following table sets forth our consolidated capitalization as of May 26, 2000 and as adjusted to give effect to the offering of the Notes. It is important that you read the following information along with the consolidated financial statements and notes thereto incorporated by reference in this prospectus supplement and the accompanying prospectus. See "Where You Can Find More Information" and "General Information."

| |

May 26, 2000 |

||||||||

|---|---|---|---|---|---|---|---|---|---|

| |

Actual |

As Adjusted |

|||||||

| |

(unaudited, in thousands, except share data) |

||||||||

| Short-Term Borrowings(1)(3): | |||||||||

| Bank Borrowings | $ | 1,980,588 | $ | 1,980,588 | |||||

| Commercial Paper | 9,660,220 | 9,660,220 | |||||||

| Medium-Term Notes | 6,300,584 | 6,300,584 | |||||||

| Total Short-Term Borrowings | $ | 17,941,392 | $ | 17,941,392 | |||||

| Long-Term Borrowings(2)(3): | |||||||||

| Floating Rate Notes due 2001 to 2005 | $ | 3,584,169 | $ | 4,182,279 | |||||

| Fixed Rate Senior Notes due 2000 to 2009; interest rates ranging from 5.75% to 9.375% | 8,090,177 | 8,590,177 | |||||||

| Medium-Term Notes | 7,574,837 | 7,574,837 | |||||||

| Total Long-Term Borrowings | 19,249,183 | 19,749,183 | |||||||

| Guaranteed Preferred Beneficial Interests in Company Subordinated Debt Securities(4) | 500,000 | 500,000 | |||||||

| Stockholders' Equity: | |||||||||

| Preferred Stock, $1.00 par value, Series A, E, F and G, 10,000,000 shares authorized, 6,250,000 shares issued | 800,000 | 800,000 | |||||||

| Common Stock, $1.00 par value; 200,000,000 shares authorized; 184,805,848 shares issued | 184,806 | 184,806 | |||||||

| Paid-in Capital | 2,519,402 | 2,519,402 | |||||||

| Retained Earnings | 2,275,183 | 2,275,183 | |||||||

| Capital Accumulation Plan | 1,140,407 | 1,140,407 | |||||||

| Treasury Stock: | |||||||||

| Adjustable Rate Cumulative Preferred Stock, Series A—2,520,750 shares | (103,421 | ) | (103,421 | ) | |||||

| Common Stock—75,638,357 shares | (1,951,095 | ) | (1,951,095 | ) | |||||

| Total Stockholders' Equity | 4,865,282 | 4,865,282 | |||||||

| Total Long-Term Borrowings, Guaranteed Preferred Beneficial Interests in Company Subordinated Debt Securities and Stockholders' Equity | $ | 24,614,465 | $ | 25,114,465 | |||||

S-14

SELECTED CONSOLIDATED FINANCIAL DATA

The financial data in the following table for the six months ended May 26, 2000 and May 28, 1999 and the five month periods ended November 26, 1999 and November 27, 1998 has been derived from our unaudited consolidated financial statements for those periods. The financial data in the following table for the fiscal years ended June 30, 1999, 1998, 1997, 1996 and 1995 has been derived from our audited consolidated financial statements for those years. See "Where You Can Find More Information" and "General Information."

| |

Six Months Ended |

Five Months Ended* |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

May 26, 2000 |

May 28, 1999 |

November 26, 1999 |

November 27, 1998 |

||||||||||

| |

(unaudited) (in thousands, except share data) |

|||||||||||||

| Operating Results: | ||||||||||||||

| Revenues | $ | 5,191,717 | $ | 4,209,503 | $ | 3,470,290 | $ | 2,975,181 | ||||||

| Interest expense | 2,364,345 | 1,569,843 | 1,531,787 | 1,650,885 | ||||||||||

| Revenues, net of interest expense | 2,827,372 | 2,639,660 | 1,938,503 | 1,324,296 | ||||||||||

| Non-interest expenses | ||||||||||||||

| Employee compensation and benefits | 1,423,183 | 1,303,747 | 973,990 | 732,884 | ||||||||||

| Other | 784,567 | 643,399 | 510,921 | 401,684 | ||||||||||

| Total non-interest expenses | 2,207,750 | 1,947,146 | 1,484,911 | 1,134,568 | ||||||||||

| Income before provision for income taxes | 619,622 | 692,514 | 453,592 | 189,728 | ||||||||||

| Provision for income taxes | 223,064 | 263,748 | 167,778 | 59,460 | ||||||||||

| Net income | $ | 396,558 | $ | 428,766 | $ | 285,814 | $ | 130,268 | ||||||

| Net income applicable to common shares | $ | 377,002 | $ | 409,210 | $ | 269,517 | $ | 113,654 | ||||||

| Financial Position: | ||||||||||||||

| Total assets | $ | 172,150,657 | $ | 162,037,962 | ||||||||||

| Long-term borrowings | $ | 19,249,183 | $ | 15,911,392 | ||||||||||

| Stockholders' equity(1) | $ | 5,365,282 | $ | 5,441,947 | ||||||||||

| Common shares and common share equivalents outstanding(2) | 160,568,727 | 165,956,810 | ||||||||||||

| Per Share Data: | ||||||||||||||

| Earnings per share(2) | $ | 2.67 | $ | 2.83 | $ | 1.78 | $ | 0.73 | ||||||

| Cash dividends declared per common share(2) | $ | 0.25 | $ | 0.28 | $ | 0.29 | $ | 0.27 | ||||||

| Book value per common share(2) | $ | 28.74 | $ | 26.93 | ||||||||||

| Other Data: | ||||||||||||||

| Return on average common equity | 19.5 | % | ||||||||||||

| Profit margin(3) | 21.9 | % | 26.2 | % | 23.4 | % | 14.3 | % | ||||||

| Employees | 10,373 | 9,722 | 10,081 | 9,416 | ||||||||||

S-15

| |

Fiscal Year Ended June 30, |

||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

1999 |

1998 |

1997 |

1996 |

1995 |

||||||||||||

| |

(in thousands, except share data) |

||||||||||||||||

| Operating Results: | |||||||||||||||||

| Revenues | $ | 7,882,038 | $ | 7,979,936 | $ | 6,077,278 | $ | 4,963,863 | $ | 3,753,572 | |||||||

| Interest expense | 3,379,914 | 3,638,513 | 2,551,364 | 1,981,171 | 1,678,515 | ||||||||||||

| Revenues, net of interest expense | 4,502,124 | 4,341,423 | 3,525,914 | 2,982,692 | 2,075,057 | ||||||||||||

| Non-interest expenses | |||||||||||||||||

| Employee compensation and benefits | 2,285,594 | 2,111,741 | 1,726,931 | 1,469,448 | 1,080,487 | ||||||||||||

| Other | 1,152,422 | 1,166,190 | 785,293 | 678,318 | 606,488 | ||||||||||||

| Total non-interest expenses | 3,438,016 | 3,277,931 | 2,512,224 | 2,147,766 | 1,686,975 | ||||||||||||

| Income before provision for income taxes | 1,064,108 | 1,063,492 | 1,013,690 | 834,926 | 388,082 | ||||||||||||

| Provision for income taxes | 391,060 | 403,063 | 400,360 | 344,288 | 147,471 | ||||||||||||

| Net income | $ | 673,048 | $ | 660,429 | $ | 613,330 | $ | 490,638 | $ | 240,611 | |||||||

| Net income applicable to common shares | $ | 633,618 | $ | 629,417 | $ | 589,497 | $ | 466,145 | $ | 215,474 | |||||||

| Financial Position: | |||||||||||||||||

| Total assets | $ | 153,894,340 | $ | 154,495,895 | $ | 121,433,535 | $ | 92,085,157 | $ | 74,597,160 | |||||||

| Long-term borrowings | $ | 14,647,092 | $ | 13,295,952 | $ | 8,120,328 | $ | 6,043,614 | $ | 4,059,944 | |||||||

| Stockholders' equity(1) | $ | 5,455,509 | $ | 4,641,533 | $ | 3,626,371 | $ | 2,895,414 | $ | 2,502,461 | |||||||

| Common shares and common share equivalents outstanding(2) | 167,265,996 | 167,173,826 | 167,096,515 | 166,780,371 | 166,991,227 | ||||||||||||

| Per Share Data: | |||||||||||||||||

| Earnings per share(2) | $ | 4.26 | $ | 4.17 | $ | 3.81 | $ | 2.96 | $ | 1.40 | |||||||

| Cash dividends declared per common share(2) | $ | 0.56 | $ | 0.54 | $ | 0.52 | $ | 0.50 | $ | 0.47 | |||||||

| Book value per common share(2) | $ | 25.60 | $ | 21.64 | $ | 17.74 | $ | 14.54 | $ | 12.10 | |||||||

| Other Data: | |||||||||||||||||

| Return on average common equity | 18.8 | % | 21.7 | % | 27.9 | % | 25.6 | % | 13.5 | % | |||||||

| Profit margin(3) | 23.6 | % | 24.5 | % | 28.7 | % | 28.0 | % | 18.7 | % | |||||||

| Employees | 9,808 | 9,180 | 8,309 | 7,749 | 7,481 | ||||||||||||

S-16

The following discussion of the terms of the Notes and the Indenture supplements the general terms and provisions of the debt securities contained in the accompanying prospectus under the heading "Description of Debt Securities" and identifies any general terms and provisions described in the accompanying prospectus that will not apply to the Notes.

You can find the definitions of certain capitalized terms used in this section under "Description of Debt Securities" in the accompanying prospectus. For purposes of this section only, references to "we," "us" and "our" include only The Bear Stearns Companies Inc. and not its subsidiaries. We will issue the Notes under the Indenture, dated as of May 31, 1991, as supplemented by the First Supplemental Indenture, dated January 29, 1998 (as supplemented, the "Indenture"), between us and The Chase Manhattan Bank (formerly known as Chemical Bank and successor by merger to Manufacturers Hanover Trust Company), as trustee (the "Trustee").

The terms of the Notes include those stated in the Indenture and those made part of the Indenture by reference to the Trust Indenture Act of 1939, as amended. A copy of the Indenture has been filed as an exhibit to the Registration Statement and is available as set forth under "Where You Can Find More Information" and "General Information."

The following description along with the description in the accompanying prospectus is a summary of the material provisions of the Indenture. It does not restate the Indenture in its entirety. We urge you to read the Indenture because it, and not these descriptions, defines your rights as a holder of the Notes (a "Holder").

Brief Description of the Notes

The Notes will:

Because we are a holding company, the Notes will be effectively subordinated to the claims of creditors of our subsidiaries with respect to their assets. At June 30, 2000:

S-17

Principal, Maturity and Interest

Notes in the aggregate principal amount of $500,000,000 will be issued in this offering and will mature on August 15, 2007. We may, without your consent, issue additional notes having the same ranking and the same interest rate, maturity and other terms as the Notes. Any of these additional notes, together with the Notes, will constitute a single series of debt securities under the Indenture. However, no additional notes may be issued if an Event of Default has occurred and is continuing with respect to the Notes.

Interest on the Notes will accrue at a fixed rate to be established through the DAiSSSM auction (and rounded up or down to the nearest .05 of 1%) February 15 and August 15, beginning February 15, 2001 (which first payment includes interest from the date of issuance), to the persons who are registered Holders at the close of business on the February 1 and August 1 immediately before the applicable interest payment date. The purchase price of the Notes will be set at a premium or discount to par so as to adjust for the rounding of the interest rate established by the DAiSSSM auction bidding procedure. If an interest payment date is not a business day, the interest payment will be made on the next business day, and the Holder is not entitled to any additional interest for the delay.

Interest on the Notes will accrue from the most recent date to which interest has been paid, or if no interest has been paid, from and including August 17, 2000. Interest will be computed on the basis of a 360-day year of twelve 30-day months. The Notes will not be entitled to the benefit of any mandatory sinking fund.

Principal Paying Agent, Paying Agents, Registrar and Transfer Agent

The Chase Manhattan Bank, the Trustee under the Indenture, will initially act as the principal office or agency where Notes may be presented for payment (the "Principal Paying Agent"). We have also agreed that as long as the Notes are admitted to the Official List of the UK Listing Authority and its rules require, we will appoint and maintain a transfer agent and paying agent in London. We have appointed The Chase Manhattan Bank to serve as registrar (the "Registrar") under the Indenture. The terms "paying agent" and "transfer agent" include the Principal Paying Agent and the Registrar and any additional or successor agents appointed by us. The names of the initial Paying Agents and Transfer Agents and their initial specified offices are set out below.

Methods of Receiving Payments on the Notes

The Principal Paying Agent will pay interest to DTC, or its nominee, by wire transfer of same day funds for credit to the accounts of DTC's participants and subsequent distribution to the beneficial owners of the Notes, or, if the Notes are issued in certificated form under the circumstances described below in "—Book-Entry, Delivery and Form—Definitive Notes," the Principal Paying Agent will pay the registered Holder of the Notes against presentation and surrender by such Holder of its Note to any paying agent, by US dollar check drawn on a bank in New York City and mailed on the business day immediately before the interest due date.

Payment of Additional Amounts

Subject to the various exceptions and limitations set forth below, we will pay as additional interest or principal, as the case may be, on the Notes, all such additional amounts that are necessary in order that the net payment by us or a paying agent of the principal of and interest on the Notes to a person that is not a US Holder (as defined under "Certain US Federal Income Tax Considerations," below), after deduction for any present or future tax, assessment or governmental charge of the United States or a political subdivision or taxing authority thereof or therein, imposed by withholding with respect to

S-18

the payment, will not be less than the amount provided in the Notes to be then due and payable. However, the obligation to pay additional amounts shall not apply:

(1) to a tax, assessment or governmental charge that is imposed or withheld solely by reason of the Holder, or a fiduciary, settlor, beneficiary, member or shareholder of the Holder, if the Holder is an estate, trust, partnership or corporation for federal income tax purposes, or a person holding a power over such an estate, trust, partnership or corporation, or a person holding a power over such an estate or trust administered by a fiduciary holder, being considered as:

(a) being or having been present or engaged in a trade or business in the United States or having or having had a permanent establishment in the United States;

(b) having a current or former connection with the United States, including a connection as a citizen or resident thereof;

(c) being or having been a foreign or domestic personal holding company, a passive foreign investment company or a controlled foreign corporation with respect to the United States or a corporation that has accumulated earnings to avoid United States federal income tax;

(d) being or having been a private foundation or other tax-exempt organization;

(e) being or having been a "10-percent shareholder" of the Company as defined in Section 871(h)(3) of the United States Internal Revenue Code or any successor provision; or

(f) being a bank receiving payments on an extension of credit made pursuant to a loan agreement entered into in the ordinary course of its trade or business;

(2) to any Holder that is not the sole beneficial owner of the Notes, or a portion thereof, or that is a fiduciary or partnership, but only to the extent that a beneficiary or settlor with respect to the fiduciary, a beneficial owner or member of the partnership would not have been entitled to the payment of an additional amount had the beneficiary, settlor, beneficial owner or member received directly its beneficial or distributive share of the payment;

(3) to a tax, assessment or governmental charge that is imposed or withheld solely by reason of the failure of the Holder or any other person to comply with certification, identification or information reporting requirements concerning the nationality, residence, identity or connection with the United States of the Holder or beneficial owner of such Note, if compliance is required by statute or regulation of the United States or of any political subdivision or taxing authority thereof or therein, or by an applicable income tax treaty to which the United States is a party as a precondition to exemption from such tax, assessment or other governmental charge;

(4) to a tax, assessment or governmental charge that is imposed otherwise than by withholding by the Company or a paying agent from payments on or in respect of a Note;

(5) to a tax, assessment or governmental charge that is imposed or withheld by reason of the presentation by or on behalf of the beneficial owner of any Note for payment on a date more than 15 days after the payment becomes due or is duly provided for, whichever occurs later;

(6) to an estate, inheritance, gift, sales, excise, transfer, wealth or personal property tax or a similar tax, assessment or governmental charge;

(7) to any tax, assessment or other governmental charge required to be withheld by any paying agent from any payment of principal of or interest on any Note, if such payment can be made without such withholding by any other paying agent; or

(8) in the case of any combination of any of the above items;

S-19

nor shall additional amounts be paid with respect to any payment on a Note to a Holder who is a fiduciary or partnership or other than the sole beneficial owner of such payment to the extent such payment would be required by the laws of the United States (or any political subdivision thereof) to be included in the income, for tax purposes, of a beneficiary or settlor with respect to such fiduciary or a member of such partnership or a beneficial owner who would not have been entitled to the additional amounts had such beneficiary, settlor, member or beneficial owner held its interest in the Note directly.

The Notes are subject in all cases to any tax, fiscal or other law or regulation or administrative or judicial interpretation that is applicable to them. Except as specifically provided under this heading "—Payment of Additional Amounts" and under the heading "—Redemption Upon Certain Tax Events," we are not required to make any payments with respect to any tax, assessment or governmental charge imposed by any government or a political subdivision or taxing authority thereof or therein.

Redemption Upon Certain Tax Events

If,

(a) as a result of any change in, or amendment to, the laws (or any regulations or rulings promulgated thereunder) of the United States (or any political subdivision or taxing authority thereof or therein), or any change in, or amendment to, the official position regarding the application or interpretation of such laws, regulations or rulings, which is announced or becomes effective on or after the date of this prospectus supplement, we determine that we will be or will become obligated to pay additional amounts as described in this prospectus supplement under the heading "—Payment of Additional Amounts"; or

(b) any act is taken by a taxing authority of the United States on or after the date of this prospectus supplement, whether such act is taken with respect to us or any affiliate, that results in a substantial probability that we will or may be required to pay such additional amounts;

then we may, at our option, redeem, as a whole, but not in part, the Notes on any interest payment date on not less than 30 nor more than 60 days' prior notice, at a redemption price equal to 100% of their principal amount, together with interest accrued thereon to the date fixed for redemption; provided that we determine, in our business judgement, that the obligation to pay such additional amounts cannot be avoided by the use of reasonable measures available to us, not including substitution of the obligor under the Notes. No redemption pursuant to clause (b) above may be made unless we have delivered to the Trustee a written opinion of independent legal counsel of recognized legal standing to the effect that an act taken by a taxing authority of the United States has resulted or will result in a substantial probability that it will or may be required to pay the additional amounts described herein under the heading "—Payment of Additional Amounts" and that we are therefore entitled to redeem the Notes pursuant to their terms.

Unclaimed Amounts

The Indenture provides that any payments in respect of principal and any interest remaining that are unclaimed for two years after their due date will be paid to us, and the Holder of the Note will after that time look, as an unsecured creditor, only to us for payment of those amounts.

Notices

All notices regarding the Notes will be valid if published (i) in a leading English language daily newspaper of general circulation in London, and (ii) in a leading English language daily newspaper of general circulation in New York. However, it is expected that that publication will be made in (i) the Financial Times or another daily newspaper in London approved by the Trustee or, if this is not

S-20

possible, in one other English language daily newspaper approved by the Trustee with general circulation in Europe, and (ii) The Wall Street Journal (Eastern Edition) in New York. Any notice will be deemed to have been given on the date of the first publication in all the relevant newspapers.

Until the time any definitive Notes are issued under the circumstances described below in "—Book-Entry, Delivery and Form—Definitive Notes," and as long as the Global Securities are held in their entirety on behalf of Euroclear and/or Clearstream Luxembourg and DTC, publication in the specified newspapers may be replaced with the delivery of the relevant notice to Euroclear and/or Clearstream Luxembourg and DTC for communication by them to the Holders of the Notes. Any notice shall be deemed to have been given to the Holders of the Notes on the seventh day after the day on which the notice was given to Euroclear and/or Clearstream Luxembourg or DTC.

Book-Entry, Delivery and Form

The Notes will be issued only in book-entry form. This means that we will not issue certificates to you. Instead, the Notes will be issued in the form of one or more fully registered global notes (the "Global Securities"), which will be deposited with a custodian. The Notes will be registered in the name of Cede & Co., as the nominee for DTC. You will not receive a definitive note representing your interest. This form will be referred to as "book-entry only."

You may elect to hold your interests in the Global Securities either through DTC (in the United States) or through Clearstream Luxembourg or Euroclear (in Europe). Interests will be held on behalf of Clearstream Luxembourg and Euroclear participants on the books of their respective depositaries.

Denominations

Beneficial interests in the Global Securities will be held in denominations of $1,000 increased in multiples of $1,000. Except as set forth below, the Global Securities may be transferred, in whole and not in part, only to another nominee of DTC or to a successor of DTC or its nominee.

DTC Services

DTC has informed us that DTC is:

DTC holds securities that its participants ("DTC Participants") deposit with DTC. DTC Participants include securities brokers and dealers, banks, trust companies, clearing corporations and certain other organizations. DTC also facilitates the settlement among these DTC Participants of securities transactions, such as transfers and pledges, in deposited securities through electronic computerized book-entry changes in Participants' accounts, which eliminates the need for the physical movement of securities certificates.

DTC's book-entry system is also available for use by other organizations such as securities brokers and dealers, banks and trust companies that work through a DTC Participant, either directly or indirectly. The rules applicable to DTC and the DTC Participants are on file with the SEC.

S-21

DTC is owned by a number of DTC Participants and by the New York Stock Exchange, Inc., the American Stock Exchange, Inc. and the National Association of Securities Dealers, Inc.

A further description of DTC's procedures with respect to the Global Securities is set forth in the accompanying prospectus under "Description of Debt Securities—Global Securities."

Clearstream Luxembourg and Euroclear Services

Clearstream Luxembourg is incorporated under the laws of Luxembourg as a professional depositary. Clearstream Luxembourg holds securities for its participating organizations ("Clearstream Luxembourg Participants") and facilitates the clearance and settlement of securities transactions between Clearstream Luxembourg Participants through electronic book-entry charges in accounts of Clearstream Luxembourg Participants, which eliminates the need for physical movement of certificates. Clearstream Luxembourg provides to Clearstream Luxembourg Participants, among other things, services for safekeeping, administration, clearance and settlement of internationally traded securities and securities lending and borrowing.

Conducting business in the domestic markets of several countries as a professional depositary, Clearstream Luxembourg is regulated by the Luxembourg Monetary Institute. Clearstream Luxembourg Participants are recognized financial institutions around the world, including underwriters, securities brokers and dealers, banks, trust companies, clearing corporations and certain other organizations and may include some of the Underwriters. Indirect access to Clearstream Luxembourg is also available to others, such as banks, brokers, dealers and trust companies that clear through or maintain a custodial relationship with a Clearstream Luxembourg Participant either directly or indirectly.

Distributions with respect to the Notes that are held beneficially through Clearstream Luxembourg will be credited to cash accounts of Clearstream Luxembourg Participants in accordance with its rules and procedures, and to the extent received by the US depositary for Clearstream Luxembourg.

Euroclear was created in 1968 to hold securities for participants of Euroclear ("Euroclear Participants") and to clear and settle transactions between Euroclear Participants through simultaneous electronic book-entry delivery against payment. Euroclear includes various other services, including securities lending and borrowing and interfaces with domestic markets in several countries.

Euroclear is operated by the Brussels, Belgium office of Morgan Guaranty Trust Company of New York (the "Euroclear Operator"), under contract with Euroclear Clearance Systems S.C., a Belgian cooperative corporation (the "Cooperative"). All operations are conducted by the Euroclear Operator, and all Euroclear securities clearance accounts and Euroclear cash accounts are accounts with the Euroclear Operator, not the Cooperative. The Cooperative establishes policy for Euroclear on behalf of Euroclear Participants. Euroclear Participants include banks (including central banks), securities brokers and dealers and other professional financial intermediaries and may include some of the Underwriters.

Indirect access to Euroclear is also available to other firms that clear through or maintain a custodial relationship with a Euroclear Participant, either directly or indirectly.

The Euroclear Operator is the Belgian Branch of a New York banking corporation which is a member bank of the Federal Reserve System and is regulated and examined by the Board of Governors of the Federal Reserve System and the New York State Banking Department, as well as the Belgian Banking Commission. The Terms and Conditions Governing Use of Euroclear and the related Operating Procedures of the Euroclear System, and applicable Belgian law (collectively, the "Euroclear Terms and Conditions") govern securities clearance accounts and cash accounts with the Euroclear Operator. The Euroclear Terms and Conditions govern transfers of securities and cash within Euroclear, withdrawals of securities and cash from Euroclear, and receipts of payments with respect to securities in Euroclear.

S-22

All securities in Euroclear are held on a fungible basis and no certificates are apportioned to specific securities clearance accounts. The Euroclear Operator acts under the Euroclear Terms and Conditions only on behalf of Euroclear Participants, and has no record of or relationship with persons holding through Euroclear Participants.

Distributions with respect to Notes held beneficially through Euroclear will be credited to the cash accounts of Euroclear Participants in accordance with the Euroclear Terms and Conditions, to the extent received by the US depositary for Euroclear.

Definitive Notes

Definitive Notes may be issued upon:

(i) Euroclear and/or Clearstream Luxembourg being closed for a continuous period of 14 days (other than by reason of public holidays); and/or

(ii) in the limited circumstances set forth in "Description of the Debt Securities—Global Securities" in the accompanying prospectus.

If definitive Notes are issued, payment of principal of and interest on the Notes will be made as set forth under "—Methods of Receiving Payments on the Notes" above. Definitive Notes can be transferred by presentation for registration to the Registrar or other transfer agent at any of their specified offices and must be duly endorsed by the holder or his attorney duly authorized in writing, or accompanied by a written instrument or instruments of transfer in form satisfactory to us or the Trustee duly executed by the holder or his attorney duly authorized in writing. We may require payment of a sum sufficient to cover any tax or other governmental charge that may be imposed in connection with any exchange or registration of transfer of definitive Notes.

For the purposes of this description, "business day" means any day, other than a Saturday or Sunday, that is not a day on which banks are authorized or required by law or regulation to close in New York and, where definitive Notes have been issued, the relevant place of presentation.

Global Clearance and Settlement Procedures

Initial settlement for the Notes will be made in same day funds. Secondary market trading and transfers within DTC, Clearstream Luxembourg or Euroclear, as the case may be, will be made in accordance with the usual rules and operating procedures of those systems. Secondary market trading between DTC Participants will occur in the ordinary way in accordance with DTC rules and will be settled in same day funds using DTC's Same-Day Funds Settlement System. Secondary market trading between Clearstream Luxembourg Participants and/or Euroclear Participants will occur in the ordinary way in accordance with the applicable rules and operating procedures of Clearstream Luxembourg and Euroclear and will be settled using the procedures applicable to conventional eurobonds in registered form in same day funds.

Since the purchaser determines the place of delivery, it is important to establish at the time of the trade where both the purchaser's and seller's accounts are located to ensure that settlement can be made on the desired value date.

Trading between DTC Purchasers and Sellers. Secondary market trading between DTC Participants will be settled using the procedures applicable to global bonds in same-day funds.

Trading between Euroclear and/or Clearstream Luxembourg Participants. Secondary market trading between Euroclear Participants and/or Clearstream Luxembourg Participants will be settled using the procedures applicable to conventional eurobonds in same-day funds.

S-23

Trading between DTC Seller and Euroclear or Clearstream Luxembourg Purchaser. When Notes are to be transferred from the account of a DTC Participant to the account of a Euroclear or Clearstream Luxembourg Participant, the purchaser will send instructions to Euroclear or Clearstream Luxembourg through a Euroclear or Clearstream Luxembourg Participant, as the case may be, at least one business day before settlement. Euroclear or Clearstream Luxembourg will instruct its respective depositary to receive those Notes against payment. Payment for the Notes will then be made by the depositary to the DTC Participant's account against delivery of the Notes. After settlement has been completed, the Notes will be credited to the respective clearing systems, and by the clearing system, in accordance with its usual procedures, to the Euroclear or Clearstream Luxembourg Participant's account. The securities credit will appear the next day (European time) and the cash debit will be back-valued to the value date, which would be the preceding day when settlement occurred in New York. If settlement is not completed on the intended value date and the trade fails, the Euroclear or Clearstream Luxembourg cash debit will be valued as of the actual settlement date.

Euroclear and Clearstream Luxembourg Participants will need to make available to the respective clearing systems the funds necessary to process same-day funds settlement. The most direct means of doing so is to preposition funds for settlement, either from cash on hand or existing lines of credit. However, under this approach, DTC Participants may take on credit exposure to Euroclear and Clearstream Luxembourg until the interests in the Global Security are credited to their accounts one day later.

As an alternative, if Euroclear or Clearstream Luxembourg has extended a line of credit to a Euroclear or Clearstream Luxembourg Participant, as the case may be, that Participant may elect not to preposition funds and allow that credit line to be drawn upon to finance settlement. Under this procedure, Euroclear or Clearstream Luxembourg Participants purchasing Notes would incur overdraft charges for one day, assuming they cleared the overdraft when the Notes were credited to their accounts. However, interest on the Notes would accrue from the value date. Therefore, in many cases the investment income on Notes earned during that one-day period may substantially reduce or offset the amount of such overdraft charges, although this result will depend on each Participant's particular cost of funds.

Since the settlement occurs during New York business hours, DTC Participants can employ their usual procedures for transferring global bonds to the respective depositaries of Euroclear or Clearstream Luxembourg for the benefit of Euroclear or Clearstream Luxembourg Participants. The sale proceeds will be available to the DTC seller on the settlement date. Thus, to the DTC seller, a cross-market sale transaction will settle no differently than a trade between two DTC Participants.

Trading between Euroclear or Clearstream Luxembourg Seller and DTC Purchaser. Because the time zone difference operates in their favor, Euroclear and Clearstream Luxembourg Participants may employ their customary procedures for transactions in which Notes are to be transferred by the respective clearing system, through its respective depositary, to a DTC Participant. The seller will send instructions to Euroclear or Clearstream Luxembourg through a Euroclear or Clearstream Luxembourg Participant at least one business day before settlement. In these cases, Euroclear or Clearstream Luxembourg will instruct its respective depositary to credit the Notes to the DTC Participant's account against payment. The payment will then be reflected in the account of the Euroclear or Clearstream Luxembourg Participant on the following day, and receipt of the cash proceeds in the Euroclear or Clearstream Luxembourg Participant's account would be back-valued to the value date (which would be the preceding day, when settlement occurred in New York).

If the Euroclear or Clearstream Luxembourg Participant has a line of credit in its respective clearing system and elects to be in a debt position in anticipation of receipt of the sale proceeds in its account, the back-valuation may substantially reduce or offset any overdraft charges incurred over that one-day period. If settlement is not completed on the intended value date (that is, the trade fails),

S-24

receipt of the cash proceeds in the Euroclear or Clearstream Luxembourg Participant's account would instead be valued as of the actual settlement date.

Finally, day traders that use Euroclear or Clearstream Luxembourg to purchase Notes from DTC Participants for delivery to Euroclear or Clearstream Luxembourg Participants should note that these trades automatically fail on the sale side unless some form of affirmative action is taken. At least three techniques should be readily available to eliminate this potential problem:

(i) borrowing through Euroclear or Clearstream Luxembourg for one day (until the purchase side of the day trade is reflected in their Euroclear or Clearstream Luxembourg accounts) in accordance with the clearing system's customary procedures;

(ii) borrowing the Notes in the United States from a DTC Participant no later than one day before settlement, which would give the Notes sufficient time to be reflected in their Euroclear or Clearstream Luxembourg account in order to settle the sale side of the trade; or

(iii) staggering the value date for the buy and sell sides of the trade so that the value date for the purchase from the DTC Participant is at least one day before the value date for the sale to the Euroclear or Clearstream Luxembourg Participant.

Although DTC, Clearstream Luxembourg and Euroclear have agreed to the foregoing procedures in order to facilitate transfers of Notes among participants of DTC, Clearstream Luxembourg and Euroclear, they are not obligated to perform or continue to perform these procedures. As a result, these procedures may be discontinued at any time.

The information in this section concerning DTC, Clearstream Luxembourg, Euroclear and their book-entry systems has been obtained from sources that we believe to be accurate, but we assume no responsibility for the accuracy of this information. We are not responsible for DTC's, Clearstream Luxembourg's, Euroclear's or their participants' performance of their respective obligations, as they are described above or under the rules and procedures governing their respective operations.

S-25

General Development of the Business

The Bear Stearns Companies Inc. was incorporated under the laws of the State of Delaware on August 21, 1985. We are a holding company that through our subsidiaries, principally Bear Stearns, BSSC and BSIL is a leading investment banking, securities trading and brokerage firm serving corporations, governments, institutional and individual investors worldwide. BSSC, a subsidiary of Bear Stearns, provides professional and correspondent clearing services, in addition to clearing and settling our proprietary and customer transactions. We succeeded on October 29, 1985, to the business of Bear, Stearns & Co., a New York limited partnership (the "Partnership"). As used in this section, "we," "us" or "our" refer (unless the context requires otherwise) to The Bear Stearns Companies Inc., its subsidiaries and the prior business activities of the Partnership.

Financial Information About Industry Segments

We are primarily engaged in business as a securities broker and dealer operating in three principal segments: Capital Markets, Execution Services and Wealth Management. These segments are strategic business units analyzed separately due to the distinct nature of the products they provide and the clients they serve. Certain Capital Markets products are distributed by the Wealth Management and Execution Services distribution network with related revenue of such intersegment services allocated to the respective segments through transfer pricing policies.

The Capital Markets segment is comprised of the Equities, Fixed Income and Investment Banking areas with over 2,600 directly attributable employees. Equities combines the efforts of sales, trading and research professionals to offer in-depth expertise in areas such as block trading, convertible bonds, over-the-counter ("OTC") equities, equity derivatives and risk arbitrage. Fixed Income includes the efforts of sales, trading and research for institutional clients in a variety of products such as mortgage-backed and asset-backed securities, corporate and government bonds, municipal and high yield securities, foreign exchange and derivatives. Investment Banking provides a variety of services to our clients, including capital raising, strategic advisory, mergers and acquisitions and merchant banking capabilities. Capital raising encompasses our underwriting of equity, investment grade debt and high yield debt securities.

The Execution Services segment is comprised of clearance and predominately commission-related areas, including institutional equity sales, institutional futures sales and specialists activities. At June 30, 1999, approximately 2,700 dedicated employees serve these business areas.

Institutional equity sales involves the execution of transactions in US equity securities for domestic and foreign institutional customers and providing these customers with liquidity, trading expertise, trade execution, research and investment advice. We provide transaction services for institutional customers who trade in futures and futures-related instruments. We are also involved in specialist activities on both the New York Stock Exchange ("NYSE") and the American Stock Exchange ("AMEX").

As of May 26, 2000 the Company provided clearing, margin lending and securities borrowing to facilitate customer short sales to over 2,900 clearing clients worldwide. Such clients include approximately 2,500 prime brokerage clients including hedge fund managers, money managers, short sellers, arbitrageurs and other professional investors and approximately 400 fully disclosed introducing brokers, who engage in either the retail or institutional brokerage business. We processed trades in over 70 countries and accounted for approximately 10% of the average daily NYSE volume in fiscal 1999. The Company processed an average of in excess of 265,000 trades per day during the quarter ended May 26, 2000.

Wealth Management provides fee-based products and services through the Private Client Services ("PCS") and Asset Management areas to both individual and institutional investors.

S-26

PCS provides high-net-worth individuals with an institutional level of service, including access to our resources and professionals. PCS maintains a select team of approximately 500 account executives in seven regional offices. These account executives averaged approximately $1.0 million in production in fiscal 1999. PCS had approximately $40.5 billion in client assets at May 26, 2000.

The Asset Management area, through Bear Stearns Asset Management Inc., had $14.6 billion in assets under management at May 26, 2000 which reflected a 23% increase over the prior year. The largest component of the increase was attributable to mutual funds and alternative investments. Asset Management serves the diverse investment needs of corporations, municipal governments, multi-employer plans, foundations, endowments, family groups and high-net-worth individuals. Innovation in products and services enables Asset Management to serve clients in an increasingly competitive financial marketplace.

Financial information regarding our industry segments and foreign operations for the three successive fiscal years ended June 30, 1999 is set forth under the Notes to the Consolidated Financial Statements in Footnote 13, entitled "Segment and Geographic Area Data," in our Annual Report on Form 10-K for the fiscal year ended June 30, 1999. See "Where You Can Find More Information" and "General Information."

Narrative Description of Business

We are a holding company which through our principal subsidiaries, Bear Stearns, BSSC and BSIL, is a leading investment banking, securities trading and brokerage firm serving corporations, governments, institutional and individual investors worldwide. Our business includes:

Our business is conducted:

S-27

Our international offices provide services and engage in investment activities involving foreign clients and international transactions. Additionally, certain of these foreign offices provide services to US clients. We provide trust company services through our subsidiary, Custodial Trust Company ("CTC"), located in Princeton, New Jersey.

Bear Stearns and BSSC are broker-dealers registered with the SEC. Additionally, Bear Stearns is registered as an investment adviser with the SEC. Bear Stearns and BSSC are also members of the NYSE, all other principal US securities and futures exchanges, the National Association of Securities Dealers ("NASD"), the Commodity Futures Trading Commission ("CFTC") and the National Futures Association ("NFA"). Bear Stearns is a "primary dealer" in US government securities as designated by the Federal Reserve Bank of New York.

BSIL is a full service broker-dealer based in London and is a member of Eurex (formerly the Deutsche Terminborse), the International Petroleum Exchange ("IPE"), the London Commodity Exchange ("LCE"), the London International Financial Futures and Options Exchange ("LIFFE"), The London Securities & Derivatives Exchange ("OMLX"), Marche à Terme International de France, SA ("MATIF") and the London Clearing House ("LCH"). BSIL is supervised by and regulated in accordance with the rules of the Securities and Futures Authority ("SFA").

As of May 26, 2000, we had 10,373 employees.

Institutional Equities

General. We provide customers with liquidity, trading expertise, equity research and extensive expertise in products such as domestic and international equities and convertible securities.

Option and Index Products. We provide an array of equity and index option-related execution services to institutional and individual clients. We utilize sophisticated research and computer modeling to formulate for clients specific recommendations relating to options and index trading.

Arbitrage. We engage for our own account in both "classic" and "risk" securities-arbitrage. Our risk arbitrage activities generally involve the purchase of securities at a discount from a value that is expected to be realized if a proposed or anticipated merger, recapitalization, tender or exchange offer is consummated. In classic arbitrage, we seek to profit from temporary discrepancies (i) between the price of a security in two or more markets, (ii) between the price of a convertible security and its underlying security, (iii) between securities that are, or will be, exchangeable at a later date, and (iv) between the prices of securities with contracts settling on differing dates.

Strategic Structuring and Transactions (SST). We target mispriced assets using sophisticated models and proprietary quantitative methods. We maintain substantial proprietary trading and investment positions in domestic and foreign markets traversing a wide spectrum of equity and futures products including listed and OTC options and swaps.