PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant

to §240.14a-11(c) or §240.14a-12

MICROSOFT CORPORATION

(Name of Registrant as Specified in Its Charter)

MICROSOFT CORPORATION

(Name of Person(s) Filing Proxy Statement)

Payment of Filing Fee (Check the appropriate box):

¨

|

$125 per Exchange Act Rules 0-11(c)(1)(ii), 14a-6(i)(1), or 14a-6(i)(2).

|

¨

|

$500 per each party to the controversy pursuant to Exchange Act Rule 14a-6(i)(3).

|

¨

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11:

1

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the

offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

(1)

|

Amount Previously Paid:

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

1

|

Set forth the amount on which the filing fee is calculated and state how it was determined.

|

September 28, 2000

Dear Shareholder:

You are cordially invited to attend the annual meeting of shareholders of Microsoft Corporation which will be held at the

Washington State Convention and Trade Center, 800 Convention Place, Seattle, Washington, on November 9, 2000, at 8:00 a.m. I look forward to greeting as many of our shareholders as possible. Please note that parking is limited, so please plan ahead if you

are driving to the meeting.

Details of the business to be conducted at the annual meeting are given in the attached Notice of Annual Meeting and Proxy

Statement.

You will notice in reading the Proxy Statement that Richard Hackborn, a director of the Company since 1994, is not standing

for re-election. In addition, Paul Allen, a co-founder of the Company and a long-time director, is not standing for re-election but will continue to serve as a senior strategy advisor to the Company. Bill Gates, Microsoft’s co-founder and currently

the Company’s Chief Software Architect and Chairman of the Board of Directors, has noted that “Paul was instrumental in the creation of Microsoft and has played an important role in the success and direction of our Company throughout the years.

I will continue to value his friendship and counsel in the years ahead.” We want to express our appreciation to Paul and Dick for their valuable contributions to the Company during their service on the Board.

Whether or not you attend the annual meeting it is important that your shares be represented and voted at the meeting.

Therefore, I urge you to sign, date, and promptly return the enclosed proxy in the enclosed postage-paid envelope. If you decide to attend the annual meeting, you will of course be able to vote in person, even if you have previously submitted your proxy.

On behalf of the Board of Directors, I would like to express our appreciation for your continued interest in the affairs of

the Company.

|

Executive Vice President and Chief Operating Officer

|

MICROSOFT CORPORATION

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

November 9, 2000

To the Shareholders:

The annual meeting of the shareholders of Microsoft Corporation will be held at the Washington State Convention and Trade

Center, 800 Convention Place, Seattle, Washington, on November 9, 2000, at 8:00 a.m. for the following purposes:

|

2. To approve the adoption of the 2001 Stock Plan.

|

|

3. To consider two shareholder proposals described in the

accompanying Proxy Statement.

|

|

4. To transact such other business as may properly come

before the meeting.

|

Only shareholders of record at the close of business on September 8, 2000, are entitled to notice of, and to vote at, this

meeting.

|

BY ORDER OF THE BOARD OF DIRECTORS

|

|

William H. Neukom, Secretary

|

Redmond, Washington

September 28, 2000

IMPORTANT

|

Whether or not you expect to attend in person, we urge you to sign, date, and return the enclosed Proxy at your earliest

convenience. This will ensure the presence of a quorum at the meeting. Promptly signing, dating, and returning the Proxy will save the Company the expenses and extra work of additional solicitation. An addressed envelope for which no postage is required if mailed in the United States is enclosed for that purpose.

Sending in your Proxy will not prevent you from voting your stock at the meeting if you desire to do so, as your Proxy is revocable at your option.

|

MICROSOFT CORPORATION

One Microsoft Way

Redmond, Washington 98052

PROXY STATEMENT FOR ANNUAL MEETING

OF SHAREHOLDERS

To Be Held November 9, 2000

This Proxy Statement, which was first mailed to shareholders on or about September 28, 2000, is furnished in connection with

the solicitation of proxies by the Board of Directors of Microsoft Corporation (the “Company” or “Microsoft”), to be voted at the annual meeting of the shareholders of the Company, which will be held at 8:00 a.m. on November 9, 2000,

at the Washington State Convention and Trade Center, 800 Convention Place, Seattle, Washington, for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders. Shareholders who execute proxies retain the right to revoke them at

any time before the shares are voted by proxy at the meeting. A shareholder may revoke a proxy by delivering a signed statement to the Secretary of the Company at or prior to the annual meeting or by executing another proxy dated as of a later date. The

Company will pay the cost of solicitation of proxies.

Shareholders of record at the close of business on September 8, 2000 will be entitled to vote at the meeting on the basis of

one vote for each share held. On September 8, 2000, there were 5,355,376,816 shares of common stock outstanding, held of record by 107,812 shareholders.

1. ELECTION OF DIRECTORS AND MANAGEMENT INFORMATION

The Company’s Board of Directors currently consists of eight members. Paul G. Allen, a long-time director of the

Company, and Richard A. Hackborn, a director of the Company since 1994, are leaving the Board effective as of the date of the annual meeting. In connection with the retirement of Messrs. Allen and Hackborn, the Board of Directors will, at its meeting on

November 9, 2000, decrease the size of the Board to six members, as authorized under the Company’s Bylaws.

Six directors are to be elected at the annual meeting to hold office until the next annual meeting of shareholders and until

their successors are elected and qualified. It is intended that the accompanying proxy will be voted in favor of the following persons to serve as directors unless the shareholder indicates to the contrary on the proxy. The election of the Company’s

Directors requires a plurality of the votes cast in person or by proxy at the meeting. Management expects that each of the nominees will be available for election, but if any of them is not a candidate at the time the election occurs, it is intended that

such proxy will be voted for the election of another nominee to be designated by the Board of Directors to fill any such vacancy.

Nominees

William H. Gates, 44, was a founder of the Company and served as its Chief Executive Officer from 1981 until January 2000,

when he resigned as Chief Executive Officer and took on the position of Chief Software Architect. Mr. Gates has served as Chairman of the Board of the Company since the Company’s incorporation. Mr. Gates is also a director of ICOS Corporation.

Steven A. Ballmer, 44, has been a director of the Company since January 2000, at which time he was also named Chief Executive

Officer of the Company. Mr. Ballmer had been President since July 1998, and prior to that, had served as Executive Vice President, Sales and Support since February 1992. He joined Microsoft in 1980.

David F. Marquardt, 51, has served as a director of the Company since 1981. Mr. Marquardt is a founding general partner of

August Capital, formed in 1995, and has been a general partner of various Technology Venture Investors entities, which are private venture capital limited partnerships, since August 1980. He is a director of Cobalt Networks, Netopia, Inc., Tumbleweed

Communications, Inc., and various privately held companies.

Ann McLaughlin, 58, has been a director of the Company since January 2000. Ms. McLaughlin is Chairman Emeritus of The Aspen

Institute, an international non-profit educational institution. Before taking the position of Chairman Emeritus in August 2000, she had served as Chairman of the Aspen Institute since 1996. From 1993 to 1996, she served as Vice Chairman of The Aspen

Institute. Ms. McLaughlin also serves as Senior Advisor with Benedetto Gartland & Company, Inc., a private investment banking company. Ms. McLaughlin served as President of the Federal City Council, a non-profit, non-partisan organization comprised of

approximately 150 top business and civic leaders dedicated to improving the nation’s capital, from 1990 until 1995. Ms. McLaughlin served as the United States Secretary of Labor from 1987 to 1989. She currently serves as a member of the Board of

Directors of AMR Corporation (and its subsidiary, American Airlines), Fannie Mae, Harman International Industries, Inc., Kellogg Company, Nordstrom, Donna Karan International, Vulcan Materials, and Host Marriott Corporation.

W. G. Reed, Jr., 61, has been a director of the Company since 1987. Mr. Reed served as Chairman of Simpson Timber Company, a

forest products company, from 1971 to 1986, and as Chairman of Simpson Investment Company, from 1986 to 1996. In addition to serving on the Board of the privately-held Simpson Investment Company, he is a director of PACCAR, Inc., SAFECO Corporation, the

Seattle Times Company, and Washington Mutual Savings Bank.

Jon A. Shirley, 62, served as President and Chief Operating Officer of Microsoft from 1983 to 1990. He has been a director of

the Company since 1983.

Information Regarding the Board and its Committees

The Company’s Board of Directors has an Audit Committee, a Compensation Committee, and a Finance Committee. There is no

nominating committee. Messrs. Reed, Marquardt and Shirley serve on the Audit Committee, which meets with financial management, the internal auditors, and the independent auditors to review internal accounting controls and accounting, auditing, and

financial reporting matters. Messrs. Hackborn and Reed and Ms. McLaughlin serve on the Compensation Committee, which reviews the compensation of the Chief Executive Officer and other officers of the Company, reviews executive bonus plan allocations, and

grants stock options to officers and employees of the Company under its stock option plan. Messrs. Hackborn, Marquardt, and Shirley serve on the Finance Committee, which reviews and provides guidance to the Board of Directors and management with respect

to major financial policies of the Company.

The Audit Committee, Compensation Committee, and Finance Committee each met four times during fiscal 2000. The entire Board

of Directors met five times during the last fiscal year. All directors attended 75% or more of the aggregate number of Board meetings and meetings of the committees on which they served.

Messrs. Gates, Allen, and Ballmer receive no cash compensation for serving on the Board except for reimbursement of

reasonable expenses incurred in attending meetings. Pursuant to agreements with the Company, the other directors are each paid $8,000 per year plus $1,000 for each Board meeting and $500 for each committee meeting they attend. During fiscal 2000, Messrs.

Allen, Hackborn, Marquardt, Reed, and Shirley each received an option to purchase 5,000 shares of the Company’s common stock, and Ms. McLaughlin received an option to purchase 10,000 shares upon her appointment to the Board. The exercise price of

each option was the market price of Microsoft common stock on the date of grant.

Information Regarding Beneficial Ownership of Principal Shareholders, Directors, and Management

The following table sets forth information regarding the beneficial ownership of the Company’s common shares by the

nominees for directors, the Company’s Chief Executive Officer and the four other highest paid executive officers (the “Named Executive Officers”), and the directors and executive officers as a group.

Names

|

|

Amount and Nature of

Beneficial Ownership

of Common Shares as

of 9/8/00(1)

|

|

Percent of Class

|

| William H. Gates |

|

731,749,668 |

(2)(3) |

|

13.7 |

% |

| Steven A. Ballmer |

|

239,626,832 |

|

|

4.5 |

% |

| David F. Marquardt |

|

1,873,810 |

(4) |

|

* |

|

| Ann McLaughlin |

|

1,000 |

|

|

* |

|

| W. G. Reed, Jr. |

|

611,872 |

(5) |

|

* |

|

| Jon A. Shirley |

|

9,184,971 |

(6) |

|

* |

|

| Robert J. Herbold |

|

985,246 |

(7) |

|

* |

|

| James E. Allchin |

|

1,015,327 |

(8) |

|

* |

|

| Jeffrey S. Raikes |

|

7,527,175 |

(9) |

|

* |

|

| Executive Officers and Directors as a group (31 persons) |

|

1,011,455,169 |

(10) |

|

18.8 |

% |

(1)

|

Beneficial ownership represents sole voting and investment power. To the Company’s knowledge, the only shareholder who

beneficially owned more than 5% of the outstanding common shares as of September 8, 2000, was Mr. Gates.

|

(2)

|

The business address for Mr. Gates is: Microsoft Corporation, One Microsoft Way, Redmond, Washington 98052.

|

(3)

|

Does not include 214,460 shares owned by Mr. Gates’ wife, as to which he disclaims beneficial ownership.

|

(4)

|

Includes 930,000 shares that may be purchased within 60 days of September 8, 2000, pursuant to outstanding stock options (“

Vested Options”).

|

(5)

|

Includes 521,000 Vested Options.

|

(6)

|

Includes 1,323,670 shares held by the Shirley Family Limited Partnership, a limited partnership of which Mr. Shirley is the

president of the sole general partner, 50,000 shares held by the Shirley Investment Company, and 930,000 Vested Options.

|

(7)

|

Includes 975,000 Vested Options.

|

(8)

|

Includes 990,000 Vested Options.

|

(9)

|

Includes 1,110,000 Vested Options.

|

(10)

|

Includes 17,860,533 Vested Options.

|

Information Regarding Executive Officer Compensation

Cash Compensation

The following table discloses compensation received for the three fiscal years ended June 30, 2000, by the Named Executive

Officers.

SUMMARY COMPENSATION TABLE

Name and Principal Position

|

|

Year

|

|

Annual Compensation

|

|

Long-Term

Compensation

Awards

|

|

|

Salary

|

|

Bonus(1)

|

|

Securities

Underlying

Options(#)

|

|

All Other

Compensation(2)

|

| Steven A. Ballmer |

|

2000 |

|

$428,414 |

|

$200,000 |

|

0 |

|

$5,100 |

| President and |

|

1999 |

|

388,392 |

|

272,181 |

|

0 |

|

4,800 |

| Chief Executive Officer; Director |

|

1998 |

|

337,429 |

|

205,598 |

|

0 |

|

4,800 |

|

| William H. Gates |

|

2000 |

|

439,401 |

|

200,000 |

|

0 |

|

0 |

| Chairman of the Board; |

|

1999 |

|

400,213 |

|

223,160 |

|

0 |

|

0 |

| Chief Software Architect; Director |

|

1998 |

|

368,874 |

|

173,423 |

|

0 |

|

0 |

|

| Robert J. Herbold |

|

2000 |

|

585,802 |

|

425,000 |

|

2,900,000 |

|

57,512 |

| Executive Vice President; |

|

1999 |

|

562,465 |

|

363,693 |

|

0 |

|

50,997 |

| Chief Operating Officer |

|

1998 |

|

535,773 |

|

572,317 |

|

0 |

|

76,833 |

|

| James E. Allchin |

|

2000 |

|

355,263 |

|

275,000 |

|

3,000,000 |

|

3,925 |

| Group Vice President, |

|

1999 |

|

288,364 |

|

217,785 |

|

0 |

|

3,415 |

| Platforms |

|

1998 |

|

264,900 |

|

184,019 |

|

0 |

|

3,460 |

|

| Jeffrey S. Raikes |

|

2000 |

|

370,991 |

|

258,500 |

|

3,000,000 |

|

5,250 |

| Group Vice President, |

|

1999 |

|

309,629 |

|

211,820 |

|

0 |

|

5,119 |

| Productivity and Business Services |

|

1998 |

|

288,930 |

|

197,447 |

|

0 |

|

4,956 |

(1)

|

The amounts disclosed in the Bonus column were all awarded under the Company’s Executive Bonus Plan, except the amounts

disclosed for Mr. Herbold include payments of $250,000 in 1998 pursuant to a signing bonus.

|

(2)

|

The amounts disclosed in this column only include Company contributions under the Company’s 401(k) plan, except that the

amounts for Mr. Herbold also includes $72,033, $46,197, and $46,197 in 1998, 1999, and 2000, respectively, for life insurance premiums, and $6,215 in 2000 for disability premiums.

|

Compensation Pursuant to Stock Options

The following table sets forth information on option grants in fiscal 2000 to the Named Executive Officers.

OPTION GRANTS IN LAST FISCAL YEAR

| |

|

Individual Grants

|

|

Potential Realized Value at Assumed

Annual Rates of Stock Price

Appreciation for Option Term(2)

|

| |

|

Number of

Securities

Underlying

Options

Granted(#)(1)

|

|

Percent of Total

Options Granted

to Employees in

Fiscal Year

|

|

($/Share)

|

|

Expiration

Date

|

Name

|

|

|

|

|

|

0%($)

|

|

5%($)

|

|

10%($)

|

| Steven A. Ballmer |

|

0 |

|

0 |

|

|

0 |

|

N/A |

|

0 |

|

0 |

|

0 |

| |

| William H. Gates |

|

0 |

|

0 |

|

|

0 |

|

N/A |

|

0 |

|

0 |

|

0 |

| |

| Robert J. Herbold |

|

600,000 |

|

|

|

|

$90.63 |

|

March, 2010 |

|

0 |

|

$ 88,571,145 |

|

$141,034,746 |

| |

|

300,000 |

|

|

|

|

66.63 |

|

April, 2010 |

|

0 |

|

32,557,531 |

|

51,842,427 |

| |

|

2,000,000 |

|

|

|

|

69.38 |

|

May, 2010 |

|

0 |

|

226,009,129 |

|

359,881,766 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

2,900,000 |

|

0.95 |

% |

|

|

|

|

|

0 |

|

347,137,805 |

|

552,758,939 |

| |

| James E. Allchin |

|

2,000,000 |

|

|

|

|

90.63 |

|

March, 2010 |

|

0 |

|

295,237,151 |

|

470,115,821 |

| |

|

1,000,000 |

|

|

|

|

66.63 |

|

April, 2010 |

|

0 |

|

108,525,105 |

|

172,808,091 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

3,000,000 |

|

0.99 |

% |

|

|

|

|

|

0 |

|

403,762,256 |

|

642,923,912 |

| |

| Jeffrey S. Raikes |

|

2,000,000 |

|

|

|

|

90.63 |

|

March, 2010 |

|

0 |

|

295,237,151 |

|

470,115,821 |

| |

|

1,000,000 |

|

|

|

|

66.63 |

|

April, 2010 |

|

0 |

|

108,525,105 |

|

172,808,091 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

3,000,000 |

|

0.99 |

% |

|

|

|

|

|

0 |

|

403,762,256 |

|

642,923,912 |

(1)

|

All options listed were granted pursuant to the 1991 Stock Option Plan. Option exercise prices were at the market price when

granted. The options have a term of 10 years and vest over 5 years. The exercise price and federal tax withholding may be paid in cash or with shares of Microsoft stock already owned.

|

(2)

|

Potential realizable values are based on assumed annual rates of return specified by the Securities and Exchange Commission.

Microsoft management has consistently cautioned shareholders and option holders that such increases in values are based on speculative assumptions and should not inflate expectations of the future value of their holdings.

|

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR-END OPTION VALUES

The following table provides information on option exercises in fiscal 2000 by the Named Executive Officers and the value of

such officers’ unexercised options at June 30, 2000.

Name

|

|

Shares

Acquired

on Exercise

(#)

|

|

Value

Realized

($)

|

|

Number of Securities

Underlying Unexercised

Options at Fiscal

Year-End(#)

|

|

Value of Unexercised

In-the-Money Options

at Fiscal Year-End($)

|

|

|

|

Exercisable

|

|

Unexercisable

|

|

Exercisable

|

|

Unexercisable

|

| Steven A. Ballmer |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

| William H. Gates |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

| Robert J. Herbold |

|

625,000 |

|

$56,799,919 |

|

975,000 |

|

3,650,000 |

|

$70,413,281 |

|

$79,426,563 |

| James E. Allchin |

|

550,000 |

|

51,639,375 |

|

950,000 |

|

3,190,000 |

|

64,872,780 |

|

27,440,938 |

| Jeffrey S. Raikes |

|

1,560,000 |

|

144,827,175 |

|

1,110,000 |

|

4,080,000 |

|

79,885,067 |

|

70,448,170 |

Robert J. Herbold Employment Agreement

Mr. Herbold joined Microsoft in November 1994, and pursuant to his employment agreement, he receives enhanced health and

disability benefits during and after his employment. Microsoft also maintains two life insurance policies of $650,000 and $1.35 million, respectively, to replace policies he had from his previous employer.

If Mr. Herbold’s employment is terminated for any reason other than Misconduct or voluntary resignation, Microsoft and

Mr. Herbold will negotiate in good faith a reasonable severance package with a minimum of 18 months’ base salary. For severance purposes, Misconduct is limited to the commission of a felony or any other intentional misconduct that has a material

adverse effect upon the business or reputation of Microsoft.

REPORT OF THE MICROSOFT CORPORATION BOARD

OF DIRECTORS COMPENSATION COMMITTEE

Microsoft’s employee compensation policy is to offer a package including a competitive salary, an incentive bonus based

upon individual performance goals, competitive benefits, and an efficient workplace environment. The Company also encourages broad-based employee ownership of Microsoft stock through a stock option program in which most employees are eligible to participate

.

The Company’s compensation policy for officers is similar to that for other employees, and is designed to promote

excellent performance and attainment of corporate and personal goals.

The Compensation Committee of the Board of Directors (comprised entirely of non-employee directors) reviews and approves

individual officer salaries, bonuses, and stock option grants. The Committee also reviews guidelines for compensation, bonus, and stock option grants for non-officer employees.

Officers of the Company are paid salaries in line with their responsibilities. These salaries are structured so the midpoint

salary range is at the 65th percentile of salaries paid by competitors in the computer and other relevant industries. Competitors selected for salary comparison purposes differ from the companies included in the Nasdaq Computer Index, which is used in the

Performance Graph that follows this report. Officers also participate in an Executive Bonus Plan. Each officer is eligible to receive a discretionary bonus of up to 100% of base salary based upon individually established performance goals. Officers (and

other employees) are also eligible to receive stock option grants, which are intended to promote success by aligning employee financial interests with long-term shareholder value. Stock option grants are based on various subjective factors primarily

relating to the responsibilities of the individual officers, and also to their expected future contributions and prior option grants.

As noted above, the Company’s compensation policy is primarily based upon the practice of pay-for-performance. Section

162(m) of the Internal Revenue Code imposes a limitation on the deductibility of nonperformance-based compensation in excess of $1 million paid to Named Executive Officers. The Committee currently believes that the Company should be able to continue to

manage its executive compensation program for Named Executive Officers so as to preserve the related federal income tax deductions, although individual exceptions may occur.

The Compensation Committee annually reviews and approves the compensation of Steven A. Ballmer, President and Chief Executive

Officer, and William H. Gates, the Chairman of the Board and Chief Software Architect. Messrs. Ballmer and Gates participate in an Executive Bonus Plan in which they are eligible to receive up to 100% of their base salary. Their bonuses are tied to

corporate revenue and profit goals established by the Compensation Committee as an incentive for superior corporate performance. In addition, Messrs. Ballmer and Gates are significant shareholders in the Company, and to the extent their performance

translates into an increase in the value of the Company’s stock, all shareholders, including Messrs. Ballmer and Gates, share the benefits.

COMPENSATION COMMITTEE

Richard A. Hackborn

Ann McLaughlin

Wm. G. Reed, Jr.

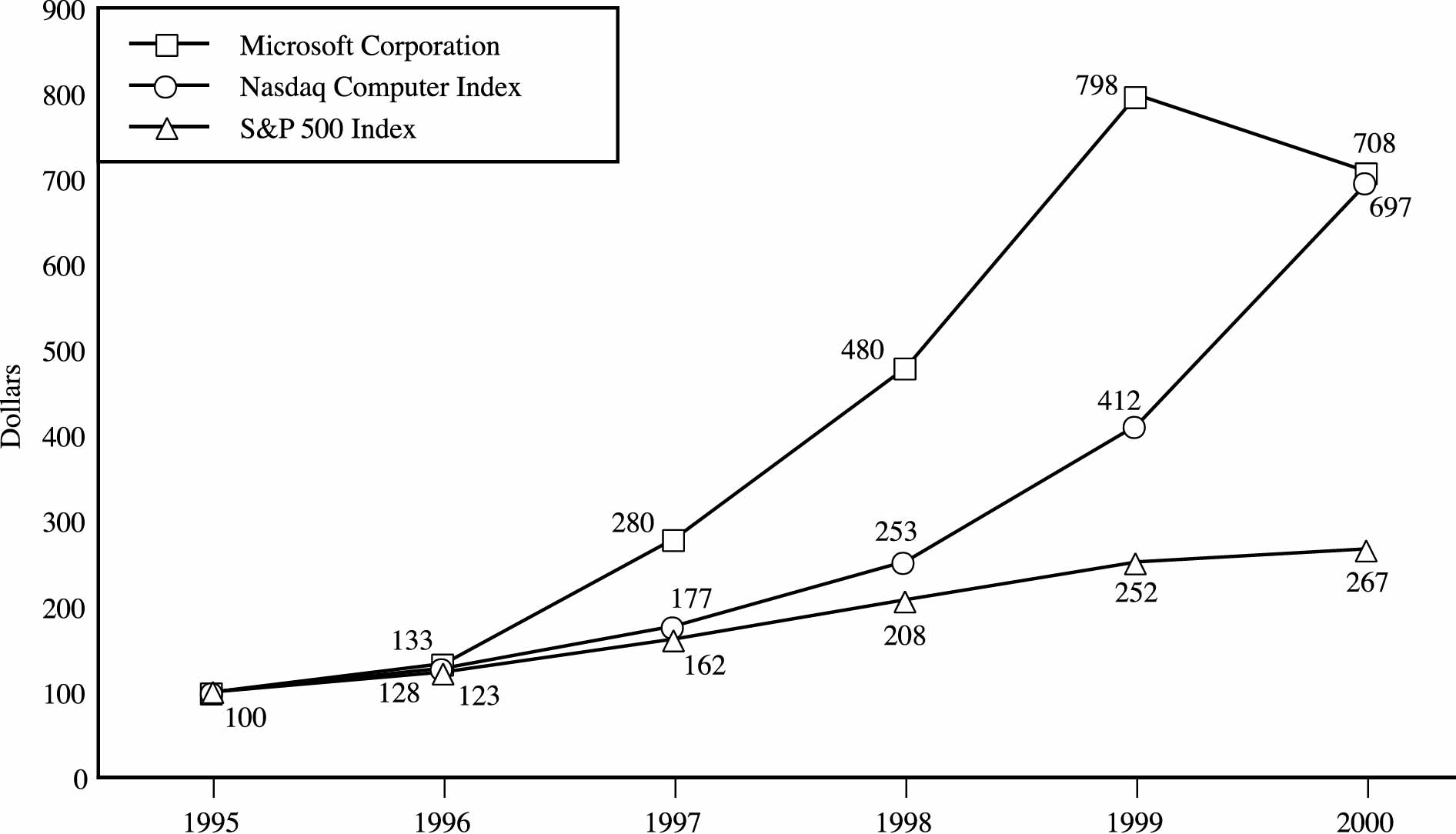

PERFORMANCE GRAPH

Note: Microsoft management consistently cautions that the stock price performance shown in the graph below should not be

considered indicative of potential future stock price performance.

Fiscal Year Ended June 30

Certain Relationships and Related Transactions

Mr. Gates is the sole shareholder of Corbis Corporation, a company that provides digitized images and production services.

The Company paid Corbis Corporation approximately $61,000 in fiscal 2000 as licensing fees for digital images.

In July 1999, the Company agreed to lease approximately 565,000 square feet of space in three buildings located in Issaquah,

Washington. The lessor of the properties is Sammamish Park L.L.C., a limited liability company owned by Paul G. Allen. These leases run for approximately 7 years, and the total amount of rent payable over the term of the leases is approximately $143

million, which the Company believes is consistent with the fair market value for such leases. In fiscal 2000, Microsoft paid Sammamish Park L.L.C. approximately $3.11 million in lease and operating expense payments.

Section 16(a) Beneficial Ownership Reporting Compliance

Each of John G. Connors, Richard F. Rashid, Robert J. Bach, and Jean-Philippe Courtois were late in filing their initial Form

3 stating their beneficial ownership of equity securities of the Company. Gregory B. Maffei was late in filing a Form 4 that disclosed three transactions in which Mr. Maffei exercised Company stock options and simultaneously sold the Company common stock

underlying such options.

2. PROPOSAL FOR APPROVAL OF THE 2001 STOCK PLAN

At the meeting, the shareholders will be requested to approve the Microsoft Corporation 2001 Stock Plan (the “Stock

Plan”). The Company’s 1991 Stock Option Plan expires in 2001, and the Board of Directors

(“Board”) recommends approval of the new Stock Plan to allow the Company to continue to attract and retain the best available employees and provide an incentive for employees to use their best efforts on the Company’s behalf. For these

reasons, the Board has unanimously adopted resolutions approving, and recommending to the shareholders for their approval, the Stock Plan. A copy of the Stock Plan may be obtained upon written request to the Company’s Investor Relations Department at

the address listed on page 17.

Description of the Plan

General. The purposes of this Stock Plan are to attract and retain the best available

individuals for positions of substantial responsibility, to provide additional incentive to such individuals, and to promote the success of Microsoft’s business by aligning the financial interests of employees and consultants providing personal

services to the Company or its affiliates with long-term shareholder value. Stock options, stock awards and stock appreciation rights may be granted under the Stock Plan. Options granted under the Stock Plan may be either “incentive stock

options,” as defined in Section 422 of the Internal Revenue Code (“Code”), or non-statutory stock options.

Administration. The Stock Plan will be administered by the Board or the Compensation Committee

of the Board (hereafter, the “Committee”).

New Plan Benefits. Because benefits under the Stock Plan will depend on the Committee’s

actions and the fair market value of common stock at various future dates, it is not possible to determine the benefits that will be received by officers and other employees if the Stock Plan is approved by the shareholders.

Eligibility. Incentive stock options may be granted only to employees of the Company or its

subsidiaries. Non-statutory stock options, stock awards and stock appreciation rights awards may be granted under the Stock Plan to employees and consultants of the Company, its affiliates and subsidiaries, as well as to persons to whom offers of

employment as employees have been granted. The Committee, in its discretion, will select the individuals to whom options, stock awards and stock appreciation rights will be granted, the time or times at which such awards are granted, and the number of

shares subject to each grant.

Shares Subject to the Stock Plan. Shares of Company common stock which may be awarded and

delivered under the Stock Plan are those which remain available for future awards under the Company’s 1991 Stock Option Plan as of January 1, 2001, the effective date of the Stock Plan, and any shares represented by awards under the 1991 Stock Option

Plan which are forfeited, expire, cancelled without delivery of shares, or otherwise result in the return of shares to the Company. The shares may be authorized, but unissued, or reacquired common shares. The Company expects there to be approximately 730

million shares remaining available for future awards under the 1991 Stock Option Plan as of the effective date of the Stock Plan.

Limitations. The Stock Plan provides that the maximum aggregate number of Company common shares

underlying all awards to be granted to any person in any single fiscal year of the Company is 10,000,000 shares of common stock. In addition, the aggregate number of shares underlying all stock awards to be granted under the Stock Plan may not exceed

25,000,000, and the aggregate number of shares underlying all non-statutory stock options and all stock appreciation rights that may be granted under the Stock Plan at exercise prices which are less than fair market value at the dates of such grants may

not exceed 25,000,000.

Terms and Conditions of Awards. Each award is to be evidenced by an award agreement between the

Company and the individual awardee and is subject to the following additional terms and conditions:

Exercise Price. The

Committee will determine the exercise price for the shares of common stock underlying each award at the time the award is granted. The exercise price for shares under an incentive stock option may not be less than 100% of the fair market value of the

common stock on the date such option is granted. The exercise price for shares subject to a non-statutory stock option or stock appreciation right may not be less than 75% of the fair market value of the common stock on the date such award is granted,

except that

certain replacement (conversion) options with lower exercise prices for the underlying shares may be granted, in connection with acquisitions, to employees, consultants and advisors of entities to be acquired by the Company. The fair market value price

for a share of Company common stock underlying each award is the closing price per share on the Nasdaq Stock Market on the date the award is granted. As of September 15, 2000 the closing price for one share of Microsoft common stock was $64.1875. No award

may be repriced, replaced, regranted through cancellation, or modified without shareholder approval (except in connection with a change in the Company’s capitalization), if the effect would be to reduce the exercise price for the shares underlying

such award.

Exercise of Award; Form of Consideration.

The Committee will determine when awards become exercisable. The means of payment for shares issued upon exercise of an award will be specified in each award agreement. The Stock Plan permits payment to be made by cash, check, broker

assisted same day sales, and, in the case of certain executive officers, by delivery of other shares of Company stock which they have owned for six (6) months or more as of the exercise date. For non-statutory stock options, stock grants, and stock

received upon the exercise of stock appreciation rights, the option holder or stock recipient must also pay the Company, at the time of purchase, the amount of federal, state, and local withholding taxes required to be withheld by the Company.

Term of Award. The term

of an award may be no more than ten (10) years from the date of grant. No award may be exercised after the expiration of its term.

Death or Disability. If

an awardee’s employment or consulting relationship terminates as a result of his or her death, then all awards he or she could have exercised at the date of death, or would have been able to exercise within the following twelve (12) months if the

employment or consulting relationship had continued, may be exercised within the twelve (12) month period following the awardee’s death by his or her estate or by the person who acquires the exercise right by bequest or inheritance. In addition, if

an awardee’s employment or consulting relationship terminates as a result of the awardee’s total and permanent disability, then the awardee may, within eighteen (18) months after the termination, exercise all awards he or she could have

exercised at the termination date, or would have been able to exercise within the twelve (12) month period following the termination if the employment or consulting relationship had continued, provided that no such award may be exercised after expiration

of the term specified in the award agreement.

Nontransferability of Awards.

Unless otherwise determined by the Committee, awards granted under the Stock Plan are not transferable other than by will or the laws of descent and distribution and may be exercised during the awardee’s lifetime only by the awardee.

Other Provisions. An

award agreement may contain other terms, provisions, and conditions not inconsistent with the Stock Plan, as may be determined by the Committee.

Stock Awards. Stock awards may be granted alone, in addition to, or in tandem with other awards

under the Stock Plan. Unless the Committee determines otherwise, the stock award agreement will provide that any non-vested stock is forfeited back to the Company upon the awardee’s termination of employment for any reason. The forfeiture provisions

for the non-vested stock will lapse at a rate determined by the Committee.

Stock Appreciation Rights. Stock appreciation rights (SARs) may be granted alone (Stand-Alone

SARs), in addition to, or in tandem (Tandem SARs) with other awards under the Stock Plan. Upon exercise of a Stand-Alone SAR, the awardee will be entitled to receive the excess of the fair market value on the exercise date of the Company common shares

underlying the SAR over the aggregate base price applicable to such shares; provided that the base price per share may not be less than the fair market value of such shares on the grant date. An awardee granted a Tandem SAR will be required to elect

between exercising the underlying option and surrendering the option in exchange for a distribution from the Company equal to the excess of the fair market value on the surrender date of the shares that could have been acquired under the option over the

aggregate exercise price payable for such shares. Any such surrender must be first approved by the Committee.

Distributions to the awardee may be made in common stock, in cash, or in a combination of stock and cash, as determined by the Committee.

Adjustments upon Changes in Capitalization, Merger or Sale of Assets. In the event that the

Company’s stock changes by reason of any stock split, dividend, combination, reclassification or other similar change in the Company’s capital structure effected without the receipt of consideration, appropriate adjustments shall be made in the

number and class of shares of stock subject to the Stock Plan, the number and class of shares of stock subject to any award outstanding under the Stock Plan, and the exercise price for shares subject to any such outstanding award.

In the event of a liquidation or dissolution, any unexercised awards will terminate. In the event of a change of control of

the Company, as determined by the Board, the Board, in its discretion, may provide for the assumption, substitution or adjustment of each outstanding award.

Amendment and Termination of the Stock Plan. The Board may amend, alter, suspend or terminate

the Stock Plan, or any part thereof, at any time and for any reason. However, the Company shall obtain shareholder approval for any amendment to the Stock Plan to the extent necessary and desirable to comply with applicable laws. No such action by the

Board or shareholders may alter or impair any award previously granted under the Stock Plan without the written consent of the awardee. The Stock Plan shall remain in effect until terminated by action of the Board or operation of law.

Federal Income Tax Consequences Relating to the 2001 Stock Plan

The federal income tax consequences to the Company and its employees of awards under the Stock Plan are complex and subject

to change. The following discussion, which has been prepared by the law firm of Preston Gates & Ellis, counsel to the Company, is only a summary of the general rules applicable to the Stock Plan. Recipients of awards under the Stock Plan should

consult their own tax advisors since a taxpayer’s particular situation may be such that some variation of the rules described below will apply.

As discussed above, several different types of instruments may be issued under the Stock Plan. The tax consequences related

to the issuance of each is discussed separately below.

Options

As noted above, options granted under the Stock Plan may be either incentive stock options or non-qualified stock options.

Incentive stock options are options which are designated as such by the Company and which meet certain requirements under Section 422 of the Code and the regulations thereunder. Any option which does not satisfy these requirements will be treated as a

non-qualified stock option.

Incentive Stock Options

If an option granted under the Stock Plan is treated as an incentive stock option, the optionee will not recognize any income

upon either the grant or the exercise of the option, and the Company will not be allowed a deduction for federal tax purposes. Upon a sale of the shares, the tax treatment to the optionee and the Company will depend primarily upon whether the optionee has

met certain holding period requirements at the time he or she sells the shares. In addition, as discussed below, the exercise of an incentive stock option may subject the optionee to alternative minimum tax liability.

If an optionee exercises an incentive stock option and does not dispose of the shares received within two years after the

date such option was granted or within one year after the transfer of the shares to him or her, any gain realized upon the disposition will be characterized as long-term capital gain and, in such case, the Company will not be entitled to a federal tax

deduction.

If the optionee disposes of the shares either within two years after the date the option is granted or within one year after

the transfer of the shares to him or her, such disposition will be treated as a disqualifying

disposition and an amount equal to the lesser of (1) the fair market value of the shares on the date of exercise minus the exercise price, or (2) the amount realized on the disposition minus the exercise price, will be taxed as ordinary income to the

optionee in the taxable year in which the disposition occurs. (However, in the case of gifts, sales to related parties, and certain other transactions, the full difference between the fair market value of the stock and the purchase price will be treated

as compensation income). The excess, if any, of the amount realized upon disposition over the fair market value at the time of the exercise of the option will be treated as long-term capital gain if the shares have been held for more than one year

following the exercise of the option. In the event of a disqualifying disposition, the Company may withhold income taxes from the optionee’s compensation with respect to the ordinary income realized by the optionee as a result of the disqualifying

disposition.

The exercise of an incentive stock option may subject an optionee to alternative minimum tax liability. The excess of the

fair market value of the shares at the time an incentive stock option is exercised over the purchase price of the shares is included in income for purposes of the alternative minimum tax even though it is not included in taxable income for purposes of

determining the regular tax liability of an employee. Consequently, an optionee may be obligated to pay alternative minimum tax in the year he or she exercises an incentive stock option.

In general, there will be no federal income tax deductions allowed to the Company upon the grant, exercise, or termination of

an incentive stock option. However, in the event an optionee sells or otherwise disposes of stock received on the exercise of an incentive stock option in a disqualifying disposition, the Company will be entitled to a deduction for federal income tax

purposes in an amount equal to the ordinary income, if any, recognized by the optionee upon disposition of the shares, provided that the deduction is not otherwise disallowed under the Code.

Nonqualified Stock Options

Nonqualified stock options granted under the Stock Plan do not qualify as “incentive stock options” and will not

qualify for any special tax benefits to the optionee. An optionee generally will not recognize any taxable income at the time he or she is granted a nonqualified option. However, upon its exercise, the optionee will recognize ordinary income for federal

tax purposes measured by the excess of the then fair market value of the shares over the exercise price. The income realized by the optionee will be subject to income and other employee withholding taxes.

The optionee’s basis for determination of gain or loss upon the subsequent disposition of shares acquired upon the

exercise of a nonqualified stock option will be the amount paid for such shares plus any ordinary income recognized as a result of the exercise of such option. Upon disposition of any shares acquired pursuant to the exercise of a nonqualified stock

option, the difference between the sale price and the optionee’s basis in the shares will be treated as a capital gain or loss and generally will be characterized as long-term capital gain or loss if the shares have been held for more than one year

at their disposition.

In general, there will be no federal income tax deduction allowed to the Company upon the grant or termination of a

nonqualified stock option or a sale or disposition of the shares acquired upon the exercise of a nonqualified stock option. However, upon the exercise of a nonqualified stock option, the Company will be entitled to a deduction for federal income tax

purposes equal to the amount of ordinary income that an optionee is required to recognize as a result of the exercise, provided that the deduction is not otherwise disallowed under the Code.

Stock Awards

Generally, the recipient of a stock award will recognize ordinary compensation income at the time the stock is received equal

to the excess, if any, of the fair market value of the stock received over any amount paid by the recipient in exchange for the stock. If, however, the stock is non-vested when it is received under the Stock Plan

(e.g., if the employee is required to work for a period of time in order to have the right to sell the stock), the recipient generally will not recognize income until the stock becomes vested, at which time the recipient will recognize ordinary

compensation income equal to the excess, if any, of the fair market value of the stock on the date it becomes vested over any amount paid by the recipient in exchange for the stock.

The recipient’s basis for determination of gain or loss upon the subsequent disposition of shares acquired as stock

awards will be the amount paid for such shares plus any ordinary income recognized either when the stock is received or when the stock becomes vested. Upon the disposition of any stock received as a stock award under the Stock Plan, the difference between

the sale price and the recipient’s basis in the shares will be treated as a capital gain or loss and generally will be characterized as long-term capital gain or loss if the shares have been held from more than one year at the time of their disposition

.

In the year that the recipient of a stock award recognizes ordinary taxable income in respect of such award, the Company will

be entitled to a deduction for federal income tax purposes equal to the amount of ordinary income that the recipient is required to recognize, provided that the deduction is not otherwise disallowed under the Code.

Stock Appreciation Rights

As discussed above, the Company may grant either Stand-Alone SARs or Tandem SARs under the Stock Plan. Generally, the

recipient of a Stand-Alone SAR will not recognize any taxable income at the time the Stand-Alone SAR is granted.

With respect to Stand-Alone SARs, if the employee receives the appreciation inherent in the SARs in cash, the cash will be

taxable as ordinary compensation income to the employee at the time that it is received. If the employee receives the appreciation inherent in the Stand-Alone SARs in stock, the employee will recognize ordinary compensation income equal to the excess of

the fair market value of the stock on the day it is received over any amounts paid by the employee for the stock.

With respect to Tandem SARs, if a holder elects to surrender the underlying option in exchange for cash or stock equal to the

appreciation inherent in the underlying option, the tax consequences to the employee will be the same as discussed above relating to Stand-Alone SARs. If the employee elects to exercise the underlying the option, the holder will be taxed at the time of

exercise as if he or she had exercised a nonqualified stock option (discussed above), i.e., the employee will recognize ordinary income for federal tax purposes measured by the excess of the then fair market value of the shares over the exercise price.

In general, there will be no federal income tax deduction allowed to the Company upon the grant or termination of Stand-Alone

SARs or Tandem SARs. However, upon the exercise of either a Stand-Alone SAR or a Tandem SAR, the Company will be entitled to a deduction for federal income tax purposes equal to the amount of ordinary income that the employee is required to recognize as a

result of the exercise, provided that the deduction is not otherwise disallowed under the Code.

Vote Required and Board Recommendation

The affirmative vote of holders of a majority of the shares of common stock cast in person or by proxy at the meeting is

required for approval of the Stock Plan. THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE ADOPTION OF THE STOCK PLAN.

3. SHAREHOLDER PROPOSAL NO. 1

Rosemary Faulkner, 1120 Park Avenue, Apt. 20B, New York, NY 10128, along with three other shareholders, have notified the

Company that they intend to submit the following proposal at this year’s annual meeting:

|

WHEREAS, corporate campaign contributions and lobbying expenses have reached record levels;

|

|

WHEREAS, public opinion polls demonstrate widespread support for campaign finance reforms limiting the political influence of

large-money contributors, including corporations;

|

|

WHEREAS, corporations spent a record $1.42 billion on lobbying in 1998, up 13% from the previous year, according to the

non-partisan Center for Responsive Politics. The number of registered Washington-based lobbyists rose to 20,512 in 1998, up from the previous year and representing 38 lobbyists for each member of Congress;

|

|

WHEREAS, Microsoft is the nation’s fourth largest corporate soft-money contributed (exceeded only by AT&T, United Parcel

Service and Philip Morris) during the current 1999-2000 federal campaign cycle (source: Center for Responsive Politics; www.opensecrets.org);

|

|

WHEREAS, several large companies, including General Motors, Time Warner and Ameritech, have adopted policies prohibiting

unregulated “soft money” political contributions;

|

|

RESOLVED, that Microsoft publishes a report to shareholders outlining its policies and use of shareholder funds for political

purposes. The report shall: a) summarize Microsoft’s federal, state and local campaign finance contributions (including soft money contributions) and lobbying expenses; b) summarize the company’s policies applied in allocating shareholder funds

for political purposes; and c) summarize the corporation’s lobbying position on campaign finance reform. This report shall be prepared at reasonable cost, and may omit confidential information. The report shall be made available to shareholders, no

later than April 30, 2001.

|

|

“I see in the near future a crisis approaching that unnerves me and causes me

to tremble for the safety of my country...corporations have been enthroned and an era of corruption in high places will follow, and the money power of the country will endeavor to prolong its reign by working upon the prejudices of the people until all

wealth is aggregated in a few hands and the Republic destroyed.”—Abraham Lincoln, 1864

|

|

In the midst of the Civil War, President Abraham Lincoln warned of the dangers to

a democracy when political power is concentrated. Lincoln’s words ring as true today as they did seven score years ago. A growing number of Americans are worried about special interests taking over our political process.

|

|

As shareholders we should be concerned that our company is winning in the

marketplace because it delivers superior products and services to its customers, not because it has superior access to political leaders who make the rules. Political control is fleeting, leaving companies relying on this strategy vulnerable to public

backlash.

|

|

As shareholders and citizens we bear a responsibility for the political

investments of our corporation. It is our responsibility to assure that our company is using its political influence prudently and in a fashion that doesn’t trample upon the interests of others in our democracy. Please vote YES.

|

Vote Required and Board Recommendation

The affirmative vote of holders of a majority of the shares of common stock cast in person or by proxy at the meeting is

required for approval of the proposal.

THE BOARD RECOMMENDS A VOTE AGAINST THIS PROPOSAL. The Company believes that it is in the best interests of the

shareholders for the Company to support the electoral process by contributing prudently to federal, state and local candidates and political organizations when such contributions are permitted by federal, state and local laws. The Company is fully

committed to complying with campaign finance and lobbying laws, and changes in such laws that may be enacted in the future, including the laws requiring public disclosure of political contributions and lobbying expenses. Because the Company is committed

to complying with applicable campaign finance and lobbying laws, and because all of its political contributions and all federal

and virtually all state lobbying costs are required to be publicly disclosed, the Board does not believe that the report requested in this proposal is necessary and recommends a vote against the proposal.

4. SHAREHOLDER PROPOSAL NO. 2

John C. Harrington, P.O. Box 6108, Napa, California 94981, has notified the Company that he intends to submit the following

proposal at this year’s annual meeting:

|

WHEREAS: our company’s business practices in China respect human and labor

rights of workers. The eleven principles below were designed to commit a company to a widely accepted and thorough set of human and labor rights standards for China. They were defined by the International Labor Organization, the United Nations Covenants

on Economic, Social and Cultural Rights, and Civil, and Political Rights. They have been signed by the Chinese government and China’s national laws.

|

|

(1) No goods or products produced within our company’s facilities

or those of suppliers shall be manufactured by bonded labor, forced labor, within prison camps or as part of reform-through-labor or reeducation-through-labor programs.

|

|

(2) Our facilities and suppliers shall adhere to wages that meet

workers’ basic needs, fair and decent working hours, and at a minimum, to the wage and hour guidelines provided by China’s national labor laws.

|

|

(3) Our facilities and suppliers shall prohibit the use of corporal

punishment, any physical, sexual or verbal abuse or harassment of workers.

|

|

(4) Our facilities and suppliers shall use production methods that do

not negatively affect the worker’s occupational safety and health.

|

|

(5) Our facilities and suppliers shall prohibit any police or military

presence designed to prevent workers from exercising their rights.

|

|

(6) We shall undertake to promote the following freedoms among our

employees and the employees of our suppliers: freedom of association and assembly, including the rights to form unions and bargain collectively; freedom of expression, and freedom from arbitrary arrest or detention.

|

|

(7) Company employees and those of our suppliers shall not face

discrimination in hiring, remuneration or promotion based on age, gender, marital status, pregnancy, ethnicity or region of origin.

|

|

(8) Company employees and those of our suppliers shall not face

discrimination in hiring, remuneration or promotion based on labor, political or religious activity, or on involvement in demonstrations, past records of arrests or internal exile for peaceful protest, or membership in organizations committed to

non-violent social or political change.

|

|

(9) Our facilities and suppliers shall use environmentally responsible

methods of production that have minimum adverse impact on land, air and water quality.

|

|

(10) Our facilities and suppliers shall prohibit child labor, at a

minimum comply with guidelines on minimum age for employment within China’s national labor laws.

|

|

(11) We will issue annual statements to the Human Rights for Workers in

China Working Group detailing our efforts to uphold these principles and to promote these basic freedoms.

|

|

RESOLVED: Shareholders request the Board to make all possible lawful efforts to

implement and/or increase activity on each of the principles named above in the People’s Republic of China.

|

|

SUPPORTING STATEMENT: As U.S. companies import more goods, consumer and

shareholder concern is growing about working conditions in China that fall below basic standards of fair and humane treatment. We hope that our company can prove to be a leader in its industry and embrace these principles.

|

Vote Required and Board Recommendation

The affirmative vote of holders of a majority of the shares of common stock cast in person or by proxy at the meeting is

required for approval of the proposal.

THE BOARD RECOMMENDS A VOTE AGAINST THIS PROPOSAL. The Company is committed to operating in full compliance with

applicable laws in every country where it does business, including China. In 1991, the Company adopted the Microsoft Corporation Business Practice Standards and Compliance Policies to ensure compliance with the laws of the numerous countries in which the

Company operates. These policies have proven effective and provide uniformity for the Company’s worldwide operations, including its China operations. In addition, Microsoft already maintains strong policies designed to promote a healthy environment,

prohibit harassment, and prohibit discrimination on the basis of race, age, gender, or national origin. The Board therefore believes that adoption of the shareholder proposal is unnecessary.

Certain provisions of the proposal are vague and overbroad. If adopted, the Company would be unable to determine readily,

without additional time or expense, what action is required, and in some instances, would be required to take action that is beyond the Company’s ability to effectuate.

The Board therefore does not believe that adoption of the Proposal is necessary or in the best interests of the Company and

recommends a vote against the Proposal.

PROPOSALS OF SHAREHOLDERS FOR 2001 ANNUAL MEETING

To be considered for inclusion in next year’s Proxy Statement, shareholder proposals must be received at Microsoft’

s principal executive offices no later than the close of business on May 25, 2001.

For any proposal that is not submitted for inclusion in next year’s proxy statement (as described in the preceding

paragraph) but is instead sought to be presented directly at next year’s annual meeting, Securities and Exchange Commission rules permit management to vote proxies in its discretion if (a) the Company receives notice of the proposal before the close

of business on August 13, 200l and advises stockholders in next year’s proxy statement about the nature of the matter and how management intends to vote on such matter, or (b) does not receive notice of the proposal prior to the close of business on

August 13, 2001.

Notices of intention to present proposals at the 2001 Annual Meeting should be addressed to Deputy General Counsel, Finance

and Operations, Microsoft Corporation, One Microsoft Way Redmond, Washington 98052. The Company reserves the right to reject, rule out of order, or take other appropriate action with respect to any proposal that does not comply with these and other

applicable requirements.

SOLICITATION OF PROXIES

The proxy accompanying this Proxy Statement is solicited by the Board of Directors of the Company. Proxies may be solicited

by officers, directors, and regular supervisory and executive employees of the Company, none of whom will receive any additional compensation for their services. Also, W.F. Doring & Co. may solicit proxies at an approximate cost of $12,500 plus

reasonable expenses. Such solicitations may be made personally or by mail, facsimile, telephone, telegraph, messenger, or via the Internet. The Company will pay persons holding shares of common stock in their names or in the names of nominees, but not

owning such shares beneficially, such as brokerage houses, banks, and other fiduciaries, for the expense of forwarding solicitation materials to their principals. All of the costs of solicitation of proxies will be paid by the Company.

VOTING PROCEDURES

Tabulation of Votes: Votes cast by proxy or in person at the meeting will be tabulated by

ChaseMellon Shareholder Services, LLC.

Effect of an Abstention and Broker Non-Votes: A shareholder who abstains from voting on any or

all proposals will be included in the number of shareholders present at the meeting for the purpose of determining the presence of a quorum. Abstentions and broker non-votes will not be counted either in favor of or against the election of the nominees or

other proposals. Under the rules of the National Association of Securities Dealers, brokers holding stock for the accounts of their clients who have not been given specific voting instructions as to a matter by their clients may vote their clients’

proxies in their own discretion.

AUDITORS

Representatives of Deloitte & Touche LLP, independent public auditors for the Company for fiscal 2000 and the current

fiscal year, will be present at the Annual Meeting, will have an opportunity to make a statement, and will be available to respond to appropriate questions.

OTHER MATTERS

The Board of Directors does not intend to bring any other business before the meeting, and so far as is known to the Board,

no matters are to be brought before the meeting except as specified in the notice of the meeting. In addition to the scheduled items of business, the meeting may consider shareholder proposals (including proposals omitted from the Proxy Statement and form

of proxy pursuant to the Proxy Rules of the Securities and Exchange Commission) and matters relating to the conduct of the meeting. As to any other business that may properly come before the meeting, it is intended that proxies, in the form enclosed, will

be voted in respect thereof in accordance with the judgment of the persons voting such proxies.

|

DATED: Redmond, Washington, September 28, 2000.

|

|

A COPY OF THE COMPANY’S FORM 10-K REPORT FOR FISCAL YEAR 2000, CONTAINING INFORMATION ON OPERATIONS, FILED WITH THE

SECURITIES AND EXCHANGE COMMISSION, IS HEREBY INCORPORATED INTO THIS PROXY STATEMENT BY REFERENCE AND IS AVAILABLE UPON REQUEST. PLEASE CONTACT:

|

INVESTOR RELATIONS DEPARTMENT

MICROSOFT CORPORATION

ONE MICROSOFT WAY

REDMOND, WASHINGTON 98052

1-800-285-7772

| [LOGO OF MSFT] |

[LOGO OF MICROSOFT]

|

| Microsoft Investor Relations | www.microsoft/com/msft/ |

www.microsoft.com |

VOTE YOUR PROXY OVER THE INTERNET OR BY TELEPHONE!

YOUR VOTE IS IMPORTANT!

> It's fast, convenient, and your vote is immediately confirmed and tabulated. Most important, by using the Internet or telephone, you help Microsoft reduce postage and proxy tabulation

costs.

WHY USE THE INTERNET? Using the Internet or telephone, you can vote anytime, 24 hours a day. Or if you prefer, you can return the enclosed paper ballot in the envelope provided. Please do not return the

enclosed paper ballot if you are voting over the Internet or by telephone.

VOTING OPTIONS

1

|

VOTE OVER THE INTERNET:

|

OR

|

2

|

VOTE BY TELEPHONE:

|

| |

— |

Read the accompanying Proxy Statement. |

|

|

— |

Read the accompanying Proxy Statement. |

| |

— |

Have your 12-digit control number located on your voting ballot available. |

|

|

— |

Have your 12-digit control number located on your voting ballot available. |

| |

— |

Point your browser to http://www.proxyvote.com/ |

|

|

— |

Using a touch-tone phone, call the following toll-free number: (800) 454-8683 |

| |

— |

Follow the instructions. |

|

|

— |

Following the recorded instructions. |

| |

— |

you can simply cast your vote, |

|

|

|

|

| |

|

or |

|

|

|

|

| |

— |

you can cast your vote and register to receive all future shareholder communications electronically, instead of in print. This means that the annual report, proxy, and other correspondence will be

delivered to you electronically via e-mail. |

|

|

|

|

This proxy when properly signed will be voted in the manner directed herein by the undersigned shareholder.

IF NO DIRECTION IS PROVIDED, THIS PROXY WILL BE VOTED FOR PROPOSALS 1 AND 2, AND AGAINST PROPOSALS 3 AND 4.

Please mark you votes as indicated [X]

| |

|

FOR election of

all nominees

|

WITHHOLD vote

from all nominees

|

|

| 1. |

Election of directors: 01William H. Gates,

02 Steven A. Ballmer, 03 David F. Marquardt,

04 Ann McLaughlin, 05 W. G. Reed, Jr., and

06 Jon A. Shirley |

[_]

|

[_]

|

|

| |

|

|

|

|

| |

Except for nominee(s) listed below

from whom vote is withheld: |

|

|

|

| |

|

|

|

|

| |

_________________________________________ |

|

|

|

| |

|

|

|

|

| |

|

FOR

|

AGAINST

|

ABSTAIN

|

| 2. |

Proposal to approve the 2001 Stock Plan. |

[_]

|

[_]

|

[_]

|

| |

|

|

|

|

| 3. |

Shareholder Proposal No. 1 |

[_]

|

[_]

|

[_]

|

| |

|

|

|

|

| 4. |

Shareholder Proposal No. 2 |

[_]

|

[_]

|

[_]

|

| |

|

|

|

|

| 5. |

In their discretion, the proxies are authorized to vote upon such other business as may properly come before the meeting. |

IMPORTANT - PLEASE SIGN AND RETURN PROMPTLY. When shares are held by joint tenants, both should sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. If a corporation, please sign in

full corporate name by President or other authorized officer. If a partnership, please sign in partnership name by an authorized person.

| Signature_______________ |

Signature if held jointly_______________ |

Dated:______________, 2000 |

MICROSOFT CORPORATION

P R O X Y

FOR ANNUAL MEETING OF THE SHAREHOLDERS OF MICROSOFT CORPORATION

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned hereby appoints WILLIAM H. GATES and ROBERT J. HERBOLD, and each of them, with full power of substitution, as proxies to vote the shares which the undersigned is entitled to vote at the Annual

Meeting of the Company to be held at the Washington State Convention and Trade Center, 800 Convention Place, Seattle, Washington, on November 9, 2000 at 8:00 a.m. and at any adjournments thereof.

(Continued and to be signed on the reverse side)

FOLD AND DETACH HERE

This proxy when properly signed will be voted in the manner directed herein by the undersigned shareholder.

IF NO DIRECTION IS PROVIDED, THIS PROXY WILL BE VOTED FOR PROPOSALS 1 AND 2, AND AGAINST PROPOSALS 3 AND 4.

Please mark you votes as indicated [X]

| |

|

FOR election of

all nominees

|

WITHHOLD vote

from all nominees

|

|

| 1. |

Election of directors: 01 William H. Gates,

02 Steven A. Ballmer, 03 David F. Marquardt,

04 Ann McLaughlin, 05 W. G. Reed, Jr., and

06 Jon A. Shirley |

[_]

|

[_]

|

|

| |

|

|

|

|

| |

Except for nominee(s) listed below

from whom vote is withheld: |

|

|

|

| |

|

|

|

|

| |

_________________________________________ |

|

|

|

| |

|

|

|

|

| |

|

FOR

|

AGAINST

|

ABSTAIN

|

| 2. |

Proposal to approve the 2001 Stock Plan. |

[_]

|

[_]

|

[_]

|

| |

|

|

|

|

| 3. |

Shareholder Proposal No. 1 |

[_]

|

[_]

|

[_]

|

| |

|

|

|

|

| 4. |

Shareholder Proposal No. 2 |

[_]

|

[_]

|

[_]

|

| |

|

|

|

|

| 5. |

In their discretion, the proxies are authorized to vote upon such other business as may properly come before the meeting. |

IMPORTANT - PLEASE SIGN AND RETURN PROMPTLY. When shares are held by joint tenants, both should sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. If a corporation, please sign in

full corporate name by President or other authorized officer. If a partnership, please sign in partnership name by an authorized person.

| Signature_______________ |

Signature if held jointly_______________ |

Dated:______________, 2000 |

|

| FOLD AND DETACH HERE AND READ THE REVERSE SIDE

|

| |

YOUR VOTE IS IMPORTANT!

|

|

| [GRAPHIC OF

TELEPHONE]

|

|

[GRAPHIC OF

COMPUTER]

|

|

|

YOU CAN VOTE IN ONE OF THREE WAYS:

|

|

VOTE BY INTERNET

24 hours a day, 7 days a week.

Follow the instructions at our Internet Address: http://www.eproxy.com/msft

VOTE BY PHONE

HAVE YOUR PROXY CARD IN HAND

Call toll-free 1-800-840-1208 on a touch tone telephone 24 hours a day, 7 days a week.

There is NO CHARGE to you for this call.

You will be asked to enter your 11-digit Control Number, which is located in the box in the lower right hand corner of this form. Follow the recorded instructions

| VOTE BY PROXY CARD

|

| Mark, sign and date your proxy card and return it promptly in the enclosed envelope.

|

|

NOTE: If you voted by internet or telephone, THERE IS NO NEED TO MAIL BACK your proxy card.

THANK YOU FOR

VOTING.

MICROSOFT CORPORATION

P R O X Y

FOR ANNUAL MEETING OF THE SHAREHOLDERS OF MICROSOFT CORPORATION

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned hereby appoints WILLIAM H. GATES and ROBERT J. HERBOLD, and each of them, with full power of substitution, as proxies to vote the shares which the undersigned is entitled to vote at the Annual

Meeting of the Company to be held at the Washington State Convention and Trade Center, 800 Convention Place, Seattle, Washington, on November 9, 2000 at 8:00 a.m. and at any adjournments thereof.

(Continued and to be signed on the reverse side)

FOLD AND DETACH HERE