|

|

|

|

|

Previous: HARBOR FUND, NSAR-B, EX-99.2, 2000-12-21 |

Next: NEWS COMMUNICATIONS INC, SC 13D/A, 2000-12-21 |

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities and Exchange Act of 1934

(Amendment No. )

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e) (2))

[X] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i) (4) and 0-11.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of this filing.

Our annual shareholders’ meeting will be held at 3:00 p.m. on January 23, 2001 at The Phoenix, 812 Race Street, Cincinnati, Ohio. We hope you will attend. At the meeting, you will hear a report on our operations and have a chance to meet your directors and executives.

This booklet includes the formal notice of the meeting and the proxy statement. The proxy statement tells you more about the agenda and procedures for the meeting. It also describes how the Board operates and gives personal information about our director candidates.

We want your shares to be represented at the meeting. I urge you to complete, sign, date, and return your proxy card promptly in the enclosed envelope.

Sincerely yours,Only shareholders of record on December 1, 2000 may vote at the meeting. The approximate mailing date of this Proxy Statement and accompanying Proxy Card is December 20, 2000.

Your vote is important. Please complete, sign, date, and return your proxy card promptly in the enclosed envelope.

/s/ Melissa LuekeShareholders of Meridian, as recorded in our stock register on December 1, 2000, may vote at the meeting. As of that date, Meridian had 14,597,614 shares of Common Stock outstanding.

How to voteYou may vote in person at the meeting or by proxy. We recommend you vote by proxy even if you plan to attend the meeting. You can always change your vote at the meeting. >

How proxies workMeridian’s Board of Directors is asking for your proxy. Giving us your proxy means you authorize us to vote your shares at the meeting in the manner you direct. You may vote for all, some, or none of our director candidates. You may also vote for or against the other proposals or abstain from voting. >

If you sign and return the enclosed proxy card but do not specify how to vote, we will vote your shares in favor of our director candidates, in favor of the company name change, in favor of amending the 1996 Stock Option Plan and in favor of the ratification of Arthur Andersen LLP as the Company’s independent public accountants for fiscal year 2001.

If any other matters come before the meeting or any adjournment, each proxy will be voted in the discretion of the individuals named as proxies on the card.

You may receive more than one proxy or voting card depending on how you hold your shares. Shares registered in your name are covered by one card. If you hold shares through someone else, such as a stockbroker, you may get material from them asking how you want to vote.

Revoking a proxyYou may revoke your proxy before it is voted by submitting a new proxy with a later date, by voting in person at the meeting, or by notifying Meridian’s Secretary in writing at the address under “Questions?” on page 12.

QuorumIn order to carry on the business of the meeting, we must have a quorum. This means at least a majority of the outstanding shares eligible to vote must be represented at the meeting, either by proxy or in person.

Votes neededThe six director candidates receiving the most votes will be elected to fill the seats on the Board.

Approval of the company name change requires the affirmative vote of the holders of two-thirds of the issued and outstanding common shares. Accordingly, abstentions from voting and broker non-votes will have the effect of a vote against this proposal. Approval of the amendment to the 1996 Stock Option Plan to increase the authorized number of shares for issuance and ratification of appointment of accountants requires the favorable vote of a majority of the votes cast. Only votes for or against these proposals count.

Other MattersAny other matters considered at the meeting, including adjournment, will require the affirmative vote of a majority of shares voting.

The Board has nominated the director candidates named below.

The Board of Directors oversees the management of the Company on your behalf. The Board reviews Meridian’s long-term strategic plans and exercises direct decision-making authority in key areas, such as choosing the Chief Executive Officer, setting the scope of his authority to manage the Company’s business day to day, and evaluating management’s performance.

The Board is nominating for election all of the following current directors: James A. Buzard, John A. Kraeutler, Gary P. Kreider, William J. Motto, David C. Phillips, and Robert J. Ready. Mr. Phillips was appointed to the Board in October 2000.Proxies solicited by the Board will be voted for the election of these nominees. All directors elected at the Annual Meeting will be elected to hold office until the next annual meeting. In voting to elect directors, shareholders are entitled to cumulate their votes and to give one candidate a number of votes equal to the number of directors to be elected multiplied by the number of shares held by the shareholder, or to distribute their votes on the same principle among as many candidates as the shareholder sees fit. In order to invoke cumulative voting, notice of cumulative voting must be given in writing by a shareholder to the President, a Vice President or the Secretary of Meridian not less than 48 hours prior to the Annual Meeting. The proxies solicited include discretionary authority to cumulate their votes.

Four of our six nominees are not Meridian employees. Only non-employee directors serve on Meridian’s Audit and Compensation committees. All Meridian directors are elected for one-year terms. Personal information on each of our nominees is given below.

Board meetings last year: 5If a director nominee becomes unavailable before the election, your proxy card authorizes us to vote for a replacement nominee if the Board names one.

Nominees receiving the highest number of votes cast for the positions to be filled will be elected.

The Board recommends you vote FOR each of the following candidates:

James A. Buzard, Ph.D. James A. Buzard, Ph.D. serves as Chairman of the

Age 73 Compensation Committee. From March 1981 until

Director since 1990 December 1989, he was Executive Vice President of

Merrell Dow Pharmaceuticals Inc. From December

1989 until his retirement in February 1990, he was

Vice President of Marion Merrell Dow, Inc. He

has been a business consultant since February 1990.

----------------------------- --------------------------------------------------

John A. Kraeutler John A. Kraeutler has more than 20 years of

Age 52 experience in the medical diagnostics industry and

Director since 1997 joined the Company as Executive Vice President

and Chief Operating Officer in January 1992.

In July 1992, Mr. Kraeutler was named President of

the Company. Before joining Meridian, Mr.

Kraeutler served as Vice President, General

Manager for a division of Carter-Wallace, Inc.

Prior to that, he held key marketing and technical

positions with Becton, Dickinson and Company and

Organon, Inc.

----------------------------- --------------------------------------------------

Gary P. Kreider, Esq. Gary P. Kreider has been a Senior Partner of the

Age 62 Cincinnati law firm of Keating, Muething &

Director since 1991 Klekamp, P.L.L., counsel to the Company, since

1975. He is also an Adjunct Professor of Law in

securities at the University of Cincinnati College

of Law.

----------------------------- --------------------------------------------------

William J. Motto William J. Motto has more than 25 years of

Age 59 experience in the pharmaceutical and diagnostics

Director since 1977 products industries, is a founder of the Company

and has been Chairman of the Board since 1977.

Before forming the Company, Mr. Motto served in

various capacities for Wampole Laboratories, Inc.,

Marion Laboratories, Inc. and Analytab Products,

Inc., a division of American Home Products Corp.

----------------------------- --------------------------------------------------

David C. Phillips David C. Phillips spent 32 years with Arthur

Age 62 Andersen LLP. His service with this firm included

Director since October 2000 several managing partner leadership positions.

After retiring from Arthur Andersen in 1994,

Mr. Phillips became Chief Executive Officer of

Downtown Cincinnati, Inc., which is responsible

for economic revitalization of Downtown

Cincinnati. Mr. Phillips retired from DCI in 1999

to devote full time to Cincinnati Works, Inc., an

organization dedicated to reducing the number of

people living below the poverty level by assisting

them to strive towards self-sufficiency through

work.

----------------------------- --------------------------------------------------

Robert J. Ready Robert J. Ready serves as Chairman of the Audit

Age 60 Committee. In 1976, Mr. Ready founded LSI

Director since 1986 Industries, Inc., Cincinnati, Ohio, which

engineers, manufactures and markets commercial/

industrial lighting and graphics products, and has

served as its President and Chairman of its Board

of Directors since that time.

--------------------------------------------------------------------------------

You are being asked to approve an amendment to The Company’s Articles of Incorporation that will change the Company’s official name to Meridian Bioscience, Inc. from Meridian Diagnostics, Inc. To accomplish this name change, the Board proposes to amend the first Article of the Articles of Incorporation to read as follows:

FIRST: The name of the Corporation is Meridian Bioscience, Inc.

The Board believes that the corporate name Meridian Bioscience, Inc. better reflects the Company’s expanding capabilities in bioscience, research reagent development and other services that will enable the discovery and realization of new pharmaceuticals, vaccines and diagnostics. In addition, the Company’s Nasdaq trading symbol will be changed from KITS to VIVO in the near future. The symbol KITS has served well, however, it is now far too limiting in suggesting Meridian is only a diagnostic test kit company. VIVO suggests life and indeed Meridian will be engaged in a broad range of life science business opportunities in the future, including diagnostics.

It will not be necessary for you to surrender your share certificates upon approval of the proposed name change. Rather, when share certificates are presented for transfer, new share certificates bearing the name Meridian Bioscience, Inc. will be issued.

Adoption of the proposed amendment to the Articles of Incorporation requires the affirmative vote of the holders of two-thirds of the issued and outstanding common shares. Accordingly, abstentions from voting and broker non-votes will have the effect of a vote against the proposed amendment. The Board recommends a vote FOR the proposed amendment.

The Board is recommending that the Company’s 1996 Amended and Restated Stock Option Plan be amended to provide 500,000 additional shares available for issuance. This plan was adopted at the 1997 Annual Shareholder’s Meeting. It was amended and restated at the 1999 Annual Shareholders Meeting to, among other things, increase the number of shares available for issuance from 200,000 to 700,000. With the continued growth of the Company and the passage of time, nearly all of the 700,000 shares provided by the Plan have been subjected to options. The Board considers it advisable to have an additional 500,000 shares available for issuance in order to provide awards that are designed to attract and retain key employees. If approved, this amendment would increase the maximum available shares from 700,000 to 1,200,000. The closing sale price for Meridian on Nasdaq on December 8, 2000 was $5.56 per share.

A committee established by the Board administers the Plan. The Committee evaluates the duties of employees and their present and potential contributions to the Company and such other factors as it deems relevant in determining key persons to whom options will be granted and the number of shares covered by such grants. All employees of the Company are eligible to be considered by the Committee for the grant of options.

The Plan provides that all options are to be granted with exercise prices of not less than 95% of the last closing sale price of the Common Stock reported prior to the date of grant. Options may be granted for varying periods of up to ten years. Options may be granted either as Incentive Stock Options designed to provide certain tax benefits under the Internal Revenue Code or as Non-Qualified Options without such benefits. However, persons who beneficially own 10% or more of the Company’s outstanding Common Stock may not be granted incentive options for terms exceeding five years and the exercise prices of such options must be at least 110% of market value at the time of grant.

The right to exercise options vests according to a schedule determined at the time of grant which generally is at the rate of 25% per year commencing on the first anniversary of the date of grant, with this right to exercise cumulative to the extent not utilized in prior periods. Options granted under the Plan will not become exercisable until one year from the date of grant. The committee is empowered to grant options with different vesting provisions. Options may be exercised for cash or for the Company common stock at its fair market value. If the employment of a person holding an option is terminated for any reason other than death, total permanent disability or retirement, the option terminates.

Persons who receive options incur no federal income tax liability at the time of grant.

Persons exercising Non-Qualified Options recognize taxable income and the Company has a tax deduction at the time of exercise to extent of the difference between market price on the day of exercise and the exercise price.

Persons exercising Incentive Stock Options do not recognize taxable income until they sell the stock. Sales within two years of the date of grant or one year of the date of exercise result in taxable income to the holder and a deduction for the Company, both measured by the difference between the market price at the time of sale and the exercise price. Sales after such period are treated as capital transactions to the holder and the Company receives no deduction.

The affirmative vote of a majority of votes cast at the meeting also is required to approve the adoption of this proposal.

Although not required, the Board is seeking shareholder ratification of its selection of Arthur Andersen LLP as the Company’s independent public accountants for fiscal 2001. The affirmative vote of a majority of shares voting at the meeting is required for ratification. If ratification is not obtained, the Board intends to continue the employment of Arthur Andersen LLP at least through fiscal 2001. Representatives of Arthur Andersen LLP are expected to be present at the Shareholders’ Meeting and will be given an opportunity to make a statement, if they so desire, and to respond to appropriate questions that may be asked by shareholders.

Non-employee directors of Meridian receive $12,000 per year for serving as a director and as members of committees of the Board. They also receive $1,000 for each director or committee meeting attended, except if a committee meeting occurs on the same day as a directors’ meeting and then the committee meeting fee is $800. They receive $500 for each director or committee meeting held by telephone. Committee chairmen receive an additional $500 for each committee meeting held. Each non-employee director is also granted a non-qualified option to purchase 2,317 shares of Common Stock at the time of election or re-election to the Board of Directors, with the exercise price being the closing sale price on Nasdaq reported immediately prior to the date of grant. Directors who are employees of Meridian are not separately compensated for serving as directors.

The Board appoints committees to help carry out its duties. In particular, Board committees work on key issues in greater detail than would be possible at full Board meetings. Each committee reviews the results of its meetings with the full Board. The Board of Directors does not have a nominating committee or executive committee.

The Audit Committee is responsible for reviewing the Company’s internal accounting operations. It also recommends the employment of independent accountants and reviews the relationship between the Company and its outside accountants. The Audit Committee’s charter is included in this Proxy Statement as Appendix I.

Meetings last year: 5Meridian's Audit Committee is composed of Messrs. Ready (Chairman), Buzard and Kreider. All of the members of the Committee meet the NASD standards for independence and financial literacy.

In November 1999, the Committee adopted the Audit Committee Charter, which is attached to this Proxy Statement as Appendix I. The Charter outlines the activities and responsibilities of the Committee. In November 1999, the Committee reviewed with representatives of Arthur Andersen LLP the results of the audit of the Company’s financial statements that had been completed by the independent public accountants for fiscal 1999. The Arthur Andersen representatives presented a report to the Committee in compliance with Statement on Auditing Standards No. 61, as amended. At that meeting, Arthur Andersen presented a letter affirming its independent status as accountants as required by Independence Standards Board Standard No. 1. The Committee discussed this information with Arthur Andersen. The Committee recommended that the Company retain Arthur Andersen as the Company’s independent public accountants for fiscal 2000.

In August 2000, the Committee met with representatives of Arthur Andersen and the Company’s internal accountants and reviewed with them the outline of the audit for fiscal 2000. The Committee also discussed the fee arrangements with Arthur Andersen and areas that warranted particular concentration on the audit. At that meeting, the Committee also discussed its Charter and its implementation and reviewed its requirements with the representatives of Arthur Andersen and Meridian’s internal accounting staff. In addition, the Committee recommended the engagement of Arthur Andersen as the Company’s independent public accountants for fiscal 2001. They also discussed with the Arthur Andersen representatives, without the presence of the Company’s accountants or other members of management, the adequacy of the Company’s accounting functions, personnel and other matters related to the Company’s financial reporting procedures.

At its meeting in November 2000, the Committee reviewed with management, Arthur Andersen and the Company’s accounting officers the results of the audit for fiscal 2000, including the audited financial statements. The Committee reviewed the requirements of its Charter previously adopted and the reports that were required to be disclosed by the Committee in this Proxy Statement. The Arthur Andersen representatives reviewed with the Committee written disclosures required by the Independence Standards Board Standard No. 1 regarding independence of the public accountants and presented a letter regarding that matter to the Committee.

Relying upon the discussions and reviews described above, the Committee recommended to the Board of Directors that the audited financial statements of Meridian be included in its Annual Report on Form 10-K for the year ended September 30, 2000 for filing with the Securities and Exchange Commission.

Respectfully submitted,

Audit Committee

Robert J. Ready (Chairman)

James A. Buzard

Gary P. Kreider

The Compensation Committee is responsible for establishing compensation for management and administering the Company’s stock option plans.

Meetings last year: 4Report of the Compensation Committee

Meridian’s Compensation Committee is composed of Messrs. Buzard (Chairman), Kreider and Ready. The Compensation Committee is responsible for establishing compensation for executive officers, establishing salary levels and bonus plans, making bonus awards and otherwise dealing in all matters concerning compensation of the executive officers and awarding stock options for all employees.

At its meeting in August 1999, the Committee set the salaries for the executive officers for fiscal 2000 as shown in the Summary Compensation Table. The Committee had available to it in establishing executive salaries the recommendations of management with respect to overall staff level compensation for the coming fiscal year for the Company, as well as a summary of studies supplied to the Committee by Meridian personnel and members of the Committee. The Committee took into account these considerations plus the financial performance of the Company during fiscal 1999 in establishing salary levels. It determined the compensation for the Chief Executive Officer in the same manner it did for its other executive officers. The Committee also recommended that Meridian’s bonus plan covering fiscal 2000 be amended by adding an additional earnings target level, which would provide for additional bonus compensation should those target levels be met. The Committee met without the Company’s management in making its decisions. At its meeting in November 1999, the Committee awarded stock options pursuant to the Company’s Stock Option Plan to various employees including the stock options to executive officers listed elsewhere in this Proxy Statement.

At its meeting in November 2000, the Committee reviewed Meridian’s financial results against the terms of the bonus plan established for fiscal 2000 and confirmed management’s recommendations as to the earnings targets reached as set forth in the plan. The Committee also approved a personal achievement rating schedule for the participants in the bonus plan. These awards are reflected in the Summary Compensation Table.

Respectfully submitted,

Compensation CommitteeThe following person is the only shareholder known by the Company to own beneficially 5% or more of its outstanding Common Stock as of December 1, 2000:

Amount and Nature of Percent

Name of Beneficial Owner Beneficial Ownership of Class

------------------------ -------------------- --------

William J. Motto 4,619,261 31.6%

The business address of Mr. Motto is 3471 River Hills Drive, Cincinnati, Ohio 45244.

The shares of Common Stock reported as beneficially owned by Mr. Motto include 613,117 shares held by his three children as trustees of various trusts, 51,646 shares held by the William J. Motto Family Charitable Remainder Unitrust and 15,000 shares subject to options exercisable within 60 days.

This table lists the executive officers and directors of Meridian and shows how much common stock each owned on December 1, 2000.

Common Stock

Beneficially Owned

------------------------

Name and Age Position Amount(1) Percentage

------------------------ ---------------------------- ----------- ----------

William J. Motto Chairman of the Board of 4,619,261(2) 31.6%

59 Directors, Chief Executive

Officer

John A. Kraeutler President, Chief Operating

52 Officer and Director 212,467 1.4%

Antonio A. Interno(3) Senior Vice President 372,585 2.5%

50

Richard L. Eberly(4) Executive Vice President,

39 Sales, Marketing and

Operations 22,125 *

Kenneth J. Kozak(5) Vice President, Research

46 and Development 3,659 *

James A. Buzard, Ph.D.(6)

73 Director 24,076 *

Gary P. Kreider(6)

62 Director 39,901(7) *

Robert J. Ready(6)

60 Director 26,781 *

David C. Phillips

62 Director 1,000(8) *

--------- -----

All Executive Officers 5,321,855 35.6%

and Directors as a Group

* Less than one percent.

Section 16 of the Securities Exchange Act of 1934 requires the Company's executive officers, directors and persons who own more than ten percent of a registered class of the Company's equity securities to file reports of ownership and changes in ownership. Mr. Motto filed his Form 5 with the Securities and Exchange Commission one day past due its November 14, 2000 filing deadline. In addition, Mr. Kozak was late in filing his December 1999 Form 4. Such Form 4 will be filed with the SEC in December 2000. Based on a review of the copies of such other forms received by it, the Company believes that during the last fiscal year, all of its executive officers, directors and ten percent stockholders complied with the Section 16 reporting requirements except as noted above.

Gary P. Kreider, who is a member of the Compensation Committee, is a senior partner of Keating, Muething & Klekamp, P.L.L., Cincinnati, Ohio, a law firm that provided legal services to Meridian in fiscal 2000.

SUMMARY COMPENSATION TABLE

Annual Compensation

---------------------------------------------------

Securities All Other

Name and Underlying Compensation

Principal Position Year Salary Bonus Options (1)

--------------------------- ---- ------ -------- ------- ------------

William J. Motto 2000 $371,000 $104,344 20,000 $43,908

Chairman of the Board of 1999 355,000 144,813 - 41,139

Directors, Chief Executive 1998 338,000 - - 29,312

Officer

John A. Kraeutler 2000 $280,400 $ 75,544 50,000 $31,401

President, Chief Operating 1999 267,900 111,738 50,000 25,121

Officer 1998 255,100 - 50,000 15,635

Antonio A. Interno 2000 $200,000 $ 32,837 15,000 $16,200

Senior Vice President, 1999 210,000 59,527 - -

Managing Director MDE 1998 200,000 - 7,000 -

Richard L. Eberly 2000 $170,000 $ 43,594 10,000 $35,813

Executive Vice President, 1999 116,000 64,150 7,500 26,028

Sales, Marketing and 1998 110,000 9,400 10,500 9,719

Operations

Kenneth J. Kozak 2000 $109,700 $ 30,853 - $23,589

Vice President, Research

and Development

(1) Amounts accrued under the Company's Savings and Investment Plan. Also

includes certain education related expenses, professional fees and car

allowances, as well as premiums paid under the Company's Split-Dollar

Insurance Program. Under this Program, the Company has purchased insurance

policies on the lives of Mr. Motto, Mr. Kraeutler, Mr. Eberly and Mr.

Kozak. These individuals are responsible for a portion of the premiums and

the Company pays the remainder. Upon the death of any of these individuals,

the Company will receive that portion of the benefits paid that equals the

premiums paid by the Company on the respective policy. The beneficiary

named by the decedent will receive the remainder of the death benefits. The

premiums paid to the insurer under these policies for the fiscal years

ended September 2000, 1999 and 1998 were $11,182, $10,411, and $15,033,

respectively, for Mr. Motto; $7,422, $7,058, and $5,791, respectively, for

Mr. Kraeutler; $2,487, $755, and $596, respectively, for Mr. Eberly; and

$13,211 for Mr. Kozak for the fiscal year ended September 30, 2000.

Todd Motto, the adult son of William J. Motto, is Director International

Marketing - MDE at Meridian. Todd Motto received $83,196 in compensation

for fiscal 2000.

OPTION GRANTS IN LAST FISCAL YEAR

---------------------------------

% of Total

Number of Options Potential Realized Value

Securities Granted to at Assumed Annual

Underlying Employees Rates of Price

Options in Fiscal Exercise Price Expiration Appreciation

Names Granted 2000 ($/Per Share) Date for Option Term

----------------- ----------- ---------- ------------- ---------- ------------------------

5% 10%

--------- ----------

Willam J. Motto 20,000 12.5% $8.663 11/18/04 $ 282,206 $ 449,366

John A. Kraeutler 50,000 31.3% 7.875 11/18/09 641,377 1,021,286

Antonio A. Interno 15,000 9.4% 7.875 11/18/09 192,413 306,386

Kenneth J. Kozak - - - - - -

Richard L. Eberly 10,000 6.3% 7.875 11/18/09 128,275 204,257

FISCAL 2000 OPTION EXERCISES AND FISCAL YEAR-END OPTION VALUES

--------------------------------------------------------------

Number of Securities Value of Unexercised

Underlying Unexercised In-the-Money Options at

Shares Acquired Options at FY-End FY-End

Name on Exercise Value Realized Exercisable/Unexercisale Exercisable/Unexercisable

-------------------- --------------- -------------- ------------------------ -------------------------

William J. Motto - - 15,000 / 15,000 $ - / $ -

John A. Kraeutler - - 210,273 / 91,800 331,700 / 28,125

Antonio A. Interno 154,702 $ 1,027,253 58,616 / 13,500 75,914 / -

Richard L. Eberly - - 22,025 / 16,500 4,519 / 8,072

Kenneth J. Kozak 309 $ 640 3,350 / 7,000 718 / 2,153

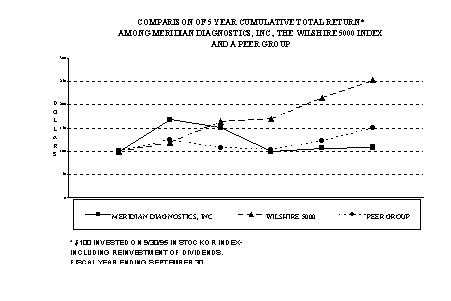

The following graph shows the yearly percentage change in Meridian's cumulative total shareholder return on its Common Stock as measured by dividing the sum of (A) the cumulative amount of dividends, assuming dividend reinvestment during the periods presented and (B) the difference between Meridian's share price at the end and the beginning of the periods presented; by the share price at the beginning of the periods presented with the Wilshire 5000 Equity Index and a Peer Group Index. The Peer Group consists of Biomerica, Inc., Biosite Diagnostics, Inc., Diagnostic Products Corp., Hemagen Diagnostics, Inc., Hycor Biomedical, Inc., Idexx Laboratories Corp., Neogen Corp., Quidel Corp., Sybron International and Trinity Biotech Plc.

The deadline for shareholder proposals to be included in the Proxy Statement for next year’s meeting is August 19, 2001.

The form of Proxy for this meeting grants authority to the designated proxies to vote in their discretion on any matters that come before the meeting except those set forth in the Company’s Proxy Statement and except for matters as to which adequate notice is received. In order for a notice to be deemed adequate for the 2002 Annual Shareholders’ Meeting, it must be received prior to November 3, 2001. If there is a change in the anticipated date of next year’s annual meeting or these deadlines by more than 30 days, we will notify you of this change through our Form 10-Q filings.

Meridian’s Code of Regulations provides that only persons nominated by an officer, director or in writing by a shareholder at least five days prior to the meeting at which directors are to be selected shall be eligible for election.

If you have questions or need more information about the annual meeting, write to:

Melissa Lueke, Acting SecretaryFor information about your record holdings call the Fifth Third Bank Shareholder Services at 1-800-837-2755.

TABLE OF CONTENTS

Page

GENERAL INFORMATION.......................................................... 1

ELECTION OF DIRECTORS........................................................ 1

COMPANY NAME CHANGE.......................................................... 3

APPROVAL OF AMENDING AND RESTATING THE COMPANY'S 1996 STOCK OPTION PLAN...... 3

RATIFICATION OF APPOINTMENT OF ACCOUNTANTS................................... 4

DIRECTOR COMPENSATION........................................................ 4

BOARD COMMITTEES............................................................. 4

AUDIT COMMITTEE REPORT....................................................... 4

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION...................... 5

PRINCIPAL SHAREHOLDER........................................................ 7

DIRECTORS AND EXECUTIVE OFFICERS ............................................ 8

SECTION 16 BENEFICIAL OWNERSHIP REPORTING COMPLIANCE......................... 9

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION.................. 9

SUMMARY COMPENSATION TABLE................................................... 9

OPTION GRANTS IN LAST FISCAL YEAR............................................10

FISCAL 2000 OPTION EXERCISES AND FISCAL YEAR-END OPTION VALUES...............10

PERFORMANCE GRAPH............................................................11

SHAREHOLDER PROPOSALS FOR NEXT YEAR..........................................12

QUESTIONS?...................................................................12

AUDIT COMMITTEE CHARTER..............................................APPENDIX I

The primary function of the Audit Committee is to assist the Board of Directors in fulfilling its oversight responsibilities by reviewing: the financial reports and other financial information provided by the Corporation to any governmental body or the public; the Corporation’s systems of internal controls regarding finance, accounting, legal compliance and ethics that management and the Board have established; and the Corporation’s auditing, accounting and financial reporting processes generally. Consistent with this function, the Audit Committee should encourage continuous improvement of, and should foster adherence to, the company’s policies, procedures and practices at all levels. The Audit Committee shall:

Serve as an independent and objective party to monitor the corporation’s financial reporting process and internal control system.

Review and appraise the audit efforts of the Corporation's independent public accountants and any internal auditing efforts.

Provide an open avenue of communication among the independent public accountants, financial and senior management, any internal auditing efforts, and the Board of Directors.

The Audit Committee will primarily fulfill these responsibilities by carrying out the activities enumerated in Section IV of this Charter.

II COMPOSITIONThe Audit Committee shall be comprised of three or more directors as determined by the Board, each of whom shall be independent directors. All members of the Committee shall have a working familiarity with basic finance and accounting practices. At least one member of the Committee shall have had past employment experience in finance or accounting or a professional certification in accounting or comparable experience or background which results in that individual possessing financial sophistication.

The members of the Committee shall be elected by the Board at the annual organizational meeting of the Board and serve until their successors shall be duly elected and qualified. Unless a Chair is elected by the Board, the members of the Committee shall designate a Chair.

III MEETINGSThe Committee shall meet at least four times annually, and more frequently as circumstances dictate. As part of its job to foster open communication, the Committee should meet at least annually with management, the director or coordinator of any internal auditing efforts, if applicable, or the chief financial officer and the independent public accountants in separate executive sessions to discuss any matters that the Committee or any of these groups believe should be discussed independently. In addition, the Committee or at least its Chair should meet with the independent accountants and management quarterly to review the Corporation’s financials. The Committee shall maintain minutes of its meetings and activities.

To fulfill its responsibilities and duties the Audit Committee shall:

Documents/Reports ReviewThe following items are not included above which the Committee may want to consider:

(1) Review policies and procedures with respect to officers’ expense accounts and perquisites, including their use of corporate assets, and consider the results of any review of these areas by the internal auditor or the independent public accountant.

(2) Prepare a letter for inclusion in the annual report that describes the Committee’s composition and responsibilities, and how they were discharged.

The undersigned hereby appoints WILLIAM J. MOTTO and MELISSA LUEKE, or either of them, proxies of the undersigned, each with the power of substitution, to vote cumulatively or otherwise all shares of Common Stock which the undersigned would be entitled to vote on the matters specified below and in their discretion with respect to such other business as may properly come before the Annual Meeting of Shareholders of Meridian Diagnostics, Inc. to be held on January 23, 2001 at 3:00 P.M. Eastern Time at The Phoenix, 812 Race Street, Cincinnati, Ohio or any adjournment of such Annual Meeting.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" THE FOLLOWING PROPOSALS:

1. Authority to elect as directors the six nominees listed below.

FOR _______ WITHHOLD AUTHORITY _______

JAMES A. BUZARD, JOHN A. KRAEUTLER, GARY P. KREIDER, WILLIAM J. MOTTO, DAVID C. PHILLIPS, AND ROBERT J. READY

WRITE THE NAME OF ANY NOMINEE(S) FOR WHOM AUTHORITY TO VOTE IS WITHHELD

----------------------------------------------------------------------

2. To amend the Articles of Incorporation to change the Company's name to Meridian Bioscience, Inc.

FOR _______ AGAINST _______ ABSTAIN _________

3. To amend the 1996 Stock Option Plan .

FOR _______ AGAINST _______ ABSTAIN _________

4. To ratify the appointment of Arthur Andersen LLP as independent public accountants for fiscal 2001.

FOR _______ AGAINST _______ ABSTAIN _________

THIS PROXY WILL BE VOTED AS RECOMMENDED BY THE BOARD OF DIRECTORS UNLESS A CONTRARY CHOICE IS SPECIFIED.

(This proxy is continued and is to be signed on the reverse side)

Date

______________________________________________, ________

______________________________________________________________

______________________________________________________________

Important: Please sign exactly as name appears hereon indicating, where proper, official position or representative capacity. In

the case of joint holders, all should sign.)

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

|

|