|

|

|

|

|

Previous: CANTERBURY INFORMATION TECHNOLOGY INC, 424B1, 2000-12-22 |

Next: GABELLI WESTWOOD FUNDS, 24F-2NT, 2000-12-22 |

Fidelity® Advisor

Annual Report

October 31, 2000

(2_fidelity_logos)

|

President's Message |

3 |

Ned Johnson on investing strategies. |

|

Performance |

4 |

How the fund has done over time. |

|

Fund Talk |

7 |

The manager's review of fund performance, strategy and outlook. |

|

Investment Changes |

10 |

A summary of major shifts in the fund's investments over the past six months. |

|

Investments |

11 |

A complete list of the fund's investments with their market values. |

|

Financial Statements |

15 |

Statements of assets and liabilities,

operations, and changes in net assets, |

|

Notes |

24 |

Notes to financial statements. |

|

Report of Independent Accountants |

31 |

The auditors' opinion. |

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

(Recycle graphic) This report is printed on recycled paper using soy-based inks.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

Mutual fund shares are not deposits or obligations of, or guaranteed by, any depository institution. Shares are not insured by the FDIC, Federal Reserve Board or any other agency, and are subject to investment risks, including possible loss of principal amount invested.

Neither the fund nor Fidelity Distributors Corporation is a bank.

For more information on any Fidelity Advisor fund, including charges and expenses, contact your investment professional for a free prospectus. Read it carefully before you invest or send money.

Annual Report

(photo_of_Edward_C_Johnson_3d)

Dear Shareholder:

A sixth-straight year of double-digit positive returns for the Dow Jones Industrial Average, NASDAQ and S&P 500® could be in jeopardy unless the U.S. stock market shows marked improvement in the final two months of 2000. Through October, all three indexes had negative year-to-date returns. On the other hand, most fixed-income sectors were solidly in the black. Treasuries and other long-term government securities led the way, returning nearly 14%.

While it's impossible to predict the future direction of the markets with any degree of certainty, there are certain basic principles that can help investors plan for their future needs.

The longer your investment time frame, the less likely it is that you will be affected by short-term market volatility. A 10-year investment horizon appropriate for saving for a college education, for example, enables you to weather market cycles in a long-term fund, which may have a higher risk potential, but also has a higher potential rate of return.

An intermediate-length fund could make sense if your investment horizon is two to four years, while a short-term bond fund could be the right choice if you need your money in one or two years.

If your time horizon is less than a year, you might want to consider moving some of your bond investment into a money market fund. These funds seek income and a stable share price by investing in high-quality, short-term investments. Of course, it's important to remember that an investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although money market funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in these types of funds.

Finally, no matter what your time horizon or portfolio diversity, it makes good sense to follow a regular investment plan, investing a certain amount of money in a fund at the same time each month or quarter and periodically reviewing your overall portfolio. By doing so, you won't get caught up in the excitement of a rapidly rising market, nor will you buy all your shares at market highs. While this strategy - known as dollar cost averaging - won't assure a profit or protect you from a loss in a declining market, it should help you lower the average cost of your purchases. Of course, you should consider your financial ability to continue your purchases through periods of low price levels before undertaking such a strategy.

Remember to contact your investment professional if you need help with your investments.

Best regards,

/s/Edward C. Johnson 3d

Edward C. Johnson 3d

Annual Report

There are several ways to evaluate historical performance. You can look at the total percentage change in value, the average annual percentage change or the growth of a hypothetical $10,000 investment. Total return reflects the change in the value of an investment, assuming reinvestment of the class' dividend income and capital gains (the profits earned upon the sale of securities that have grown in value). You can also look at the class' income, as reflected in its yield, to measure performance. The initial offering of Institutional Class shares took place on March 3, 1997. Returns prior to March 3, 1997 are those of Initial Class, the original class of the fund. If Fidelity had not reimbursed certain class expenses, the past five year, and past 10 year total returns would have been lower.

Cumulative Total Returns

|

Periods ended October 31, 2000 |

|

Past 1 |

Past 5 |

Past 10 |

|

Fidelity Adv Mortgage Securities - Inst CL |

|

7.64% |

36.36% |

111.49% |

|

LB Mortgage |

|

7.57% |

38.70% |

113.69% |

|

US Mortgage Funds Average |

|

6.73% |

32.12% |

98.71% |

Cumulative total returns show Institutional Class' performance in percentage terms over a set period - in this case, one year, five years or 10 years. For example, if you had invested $1,000 in a fund that had a 5% return over the past year, the value of your investment would be $1,050. You can compare Institutional Class' returns to the performance of the Lehman Brothers Mortgage-Backed Securities Index - a market value-weighted index of fixed-rate securities that represent interests in pools of mortgage loans with original terms of 15 and 30 years that are issued by the Government National Mortgage Association (GNMA), the Federal National Mortgage Association (FNMA), and the Federal Home Loan Mortgage Corp. (FHLMC), and balloon mortgages with fixed-rate coupons. To measure how Institutional Class' performance stacked up against its peers, you can compare it to the U.S. mortgage funds average, which reflects the performance of mutual funds with similar objectives tracked by Lipper Inc. The past one year average represents a peer group of 64 mutual funds. These benchmarks reflect reinvestment of dividends and capital gains, if any, and exclude the effect of sales charges.

Average Annual Total Returns

|

Periods ended October 31, 2000 |

Past 1 |

Past 5 |

Past 10 |

|

Fidelity Adv Mortgage Securities - Inst CL |

7.64% |

6.40% |

7.78% |

|

LB Mortgage |

7.57% |

6.76% |

7.89% |

|

US Mortgage Funds Average |

6.73% |

5.72% |

7.10% |

Average annual total returns take Institutional Class' cumulative return and show you what would have happened if Institutional Class had performed at a constant rate each year.

Annual Report

Performance - continued

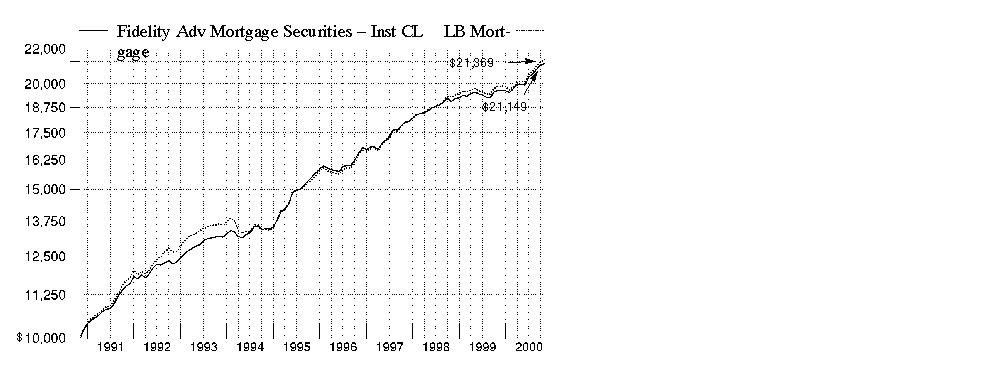

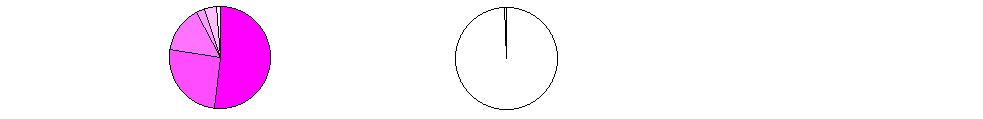

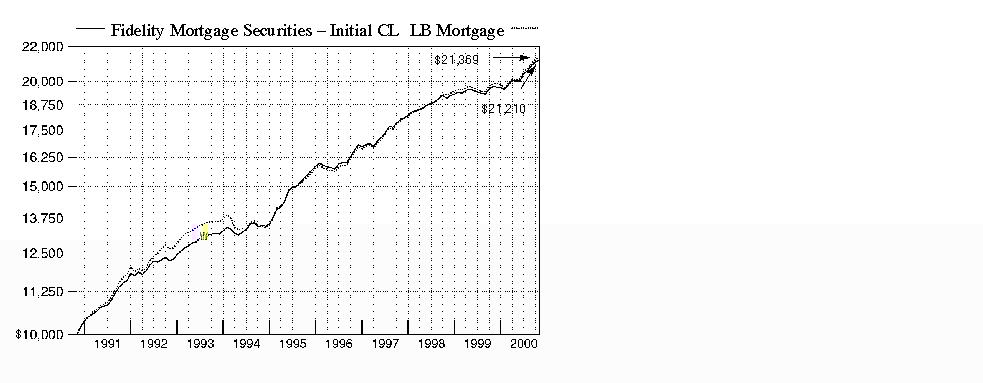

$10,000 Over 10 Years

$10,000 Over 10 years: Let's say hypothetically that $10,000 was invested in Fidelity Advisor Mortgage Securities Fund - Institutional Class on October 31, 1990. As the chart shows, by October 31, 2000, the value of the investment would have grown to $21,149 - a 111.49% increase on the initial investment. For comparison, look at how the Lehman Brothers Mortgage-Backed Securities Index did over the same period. With dividends and capital gains, if any, reinvested, the same $10,000 would have grown to $21,369 - a 113.69% increase.

Understanding

Performance

How a fund did yesterday is no guarantee of how it will do tomorrow. Bond prices, for example, generally move in the opposite direction of interest rates. In turn, the share price, return and yield of a fund that invests in bonds will vary. That means if you sell your shares during a market downturn, you might lose money. But if you can ride out the market's ups and downs, you may have a gain.

3Annual Report

Performance - continued

Total Return Components

|

|

Years ended October 31, |

March 3, 1997 (commencement of sale of Institutional Class shares) to October 31, |

|||

|

|

2000 |

1999 |

1998 |

1997 |

|

|

Dividend returns |

7.16% |

6.14% |

6.13% |

4.30% |

|

|

Capital returns |

0.48% |

-3.05% |

-0.27% |

2.43% |

|

|

Total returns |

7.64% |

3.09% |

5.86% |

6.73% |

|

Total return components include both dividend returns and capital returns. A dividend return reflects the actual dividends paid by the class. A capital return reflects both the amount paid by the class to shareholders as capital gain distributions and changes in the class' share price. Both returns assume the dividends or capital gains paid by the class are reinvested, if any.

Dividends and Yield

|

Periods ended October 31, 2000 |

Past 1 |

Past 6 |

Past 1 |

|

Dividends per share |

5.80¢ |

34.50¢ |

71.45¢ |

|

Annualized dividend rate |

6.49% |

6.59% |

6.90% |

|

30-day annualized yield |

6.71% |

- |

- |

Dividends per share show the income paid by the class for a set period. If you annualize this number, based on an average share price of $10.52 over the past one month, $10.38 over the past six months, and $10.35 over the past one year, you can compare the class' income over these three periods. The 30-day annualized yield is a standard formula for all bond funds based on the yields of the bonds in the fund, averaged over the past 30 days. This figure shows you the yield characteristics of the fund's investments at the end of the period. It also helps you compare funds from different companies on an equal basis.

Annual Report

Market Recap

Strong technical factors in the market helped most investment-grade bonds overcome sharply rising interest rates and volatile market conditions, enabling them to outperform a number of major U.S. equity indexes during the 12-month period that ended October 31, 2000. The Lehman Brothers Aggregate Bond Index - a popular measure of taxable-bond performance - returned 7.30% during this time frame. Following a bullish fourth quarter of 1999 for the spread sectors - namely corporate bonds, mortgage and agency securities - Treasuries usurped market leadership not long after the millennium changeover. A growing federal surplus spurred the U.S. government in January to begin buying back outstanding debt and reducing future issuance. The scarcity premium created by a shrinking supply of long-dated Treasuries sent prices soaring and yields plummeting, thereby inducing an inverted yield curve - which occurs when short-term bonds outyield longer-dated securities. Anticipation that the Fed was finished raising interest rates entering the summer, combined with persistent flights-to-safety from risk-averse investors concerned about volatility in equity markets, further bolstered the long bond, helping the Lehman Brothers Treasury Index return 8.22% during the period. Mortgages made up some ground late in the period behind strong housing turnover. Agencies, too, staged a late rally in response to reduced political risk surrounding government-sponsored enterprises. However, corporates had little to celebrate, plagued by deteriorating credit conditions and growing supply pressures. For the overall period, the Lehman Brothers Mortgage-Backed Securities, U.S. Agency and Credit Bond indexes returned 7.57%, 7.30% and 5.48%, respectively.

(Portfolio Manager photograph)

An interview with Tom Silvia, Portfolio Manager of Fidelity Advisor Mortgage Securities Fund

Q. How did the fund perform, Tom?

A. For the 12 months ending October 31, 2000, the fund's Institutional Class shares returned 7.64%. To get a sense of how the fund did relative to its competitors, the U.S. mortgage funds average returned 6.73% for the same period, according to Lipper Inc. Meanwhile, the Lehman Brothers Mortgage-Backed Securities Index - which tracks the types of securities in which the fund invests - returned 7.57%.

Q. What factors influenced the fund's performance?

A. In the plus column was the fund's relatively large weighting in commercial mortgage-backed securities (CMBS) - which accounted for about 15% of the fund's net assets at the end of the period. CMBS are bonds that are collateralized by mortgage loans on commercial real estate - such as office buildings, shopping malls, hotels and apartment buildings. They seemingly had the wind at their backs during the past year. Rising interest rates, which hurt many other fixed-income securities, boosted outstanding CMBS by limiting issuance of new securities. Second, there was overall improvement in the credit quality of the sector thanks to the strong economy and better commercial real estate fundamentals as rents and occupancies increased. Finally, the Labor Department proposed allowing private pension funds to buy some mortgage securities that had been off-limits.

Annual Report

Fund Talk: The Manager's Overview - continued

Q. How did mortgage securities made up of home loans - those issued by Fannie Mae, Freddie Mac and Ginnie Mae - perform during the year?

A. Generally speaking, they performed poorly early on but improved quite a bit in the second half of the year. At first, rising interest rates were a drag on the performance of these mortgage securities, pushing their yields higher and their prices lower. At the same time, good economic conditions translated into a strong housing market, prompting more mortgage prepayment. More recently, mortgage security prices firmed as it became evident that previous interest-rate hikes had helped slow the economy. In response, mortgage prepayments fell and the outstanding supply was reduced. Against that backdrop, various types of mortgage securities fell in and out of favor during the year. For instance, Ginnie Mae securities - which accounted for a smaller portion of the fund than of the Lehman Brothers index - outpaced Fannie Mae and Freddie Mac securities during much of the year. That was due to a very small supply of Ginnie Mae securities. Some legislators floated the idea of even cutting off their longstanding but never-used lines of credit. Having a relatively small weighting in Ginnie Mae securities probably was the biggest disappointment for the year.

Q. What helped Fannie Mae and Freddie Mac securities regain their footing?

A. The yield advantage offered by Fannie Mae and Freddie Mac securities - as much as 10 basis points (0.10 percentage points) - over Ginnie Maes was one factor that helped them rebound. Also, the legislative pressure on the agencies eased when Fannie Mae and Freddie Mac made some concessions to legislators, adopting measures to improve their capital structure and allow more scrutiny of their books. In response, demand for their securities improved as more investors became attracted to their relatively high yields and cheap prices.

Q. Interest rates have been relatively volatile over the past year. How did you manage the fund's sensitivity to interest-rate changes?

A. I kept the fund's duration - a gauge of its interest-rate sensitivity - in line with the mortgage securities market as a whole as measured by the Lehman Brothers Mortgage-Backed Securities Index. That meant I avoided positioning the fund with more or less sensitivity based on my view of where interest rates were headed.

Q. What's your outlook?

A. I'm optimistic about the prospects for mortgage securities. Even though there's the possibility that interest rates will move lower, I don't see a large wave of mortgage prepayment in the future. By my calculations, mortgage rates would have to decline at least one full percentage point from current levels in order for prepayments to accelerate at a meaningful level. Given that, I think that mortgage securities offer very attractive values at current levels, offering yields that are well in excess of U.S. Treasury securities.

Annual Report

Fund Talk: The Manager's Overview - continued

The views expressed in this report reflect those of the portfolio manager only through the end of the period of the report as stated on the cover and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Fund Facts

Goal: seeks a high level of current income, consistent with prudent investment risk; the fund may also consider the potential for capital gain

Start date: December 31, 1984

Size: as of October 31, 2000, more than $466 million

Manager: Tom Silvia, since 1997; joined Fidelity in 1993

3Tom Silvia on the strength of the housing market and its effect on mortgage securities:

"Sometimes, significant interest-rate volatility - such as we've seen during the past year - can lead to an increase in the rate of mortgage prepayments, which can have negative implications for the mortgage market. This past year, however, that was not the case. The strong housing market, fueled by the robust economy, favorable employment growth and rising personal incomes, benefited the mortgage market during the past year. Thanks to a significant wave of refinancing activity in 1998 and early 1999, the vast majority of mortgages outstanding 12 months ago carried interest rates of 6.5% to 7.0%. As interest rates climbed throughout the past year, these bonds started to trade below their par value of $100. Essentially, investors weren't willing to pay full price - or par - for a bond that paid less income when they could buy a newly issued bond with a higher income. As a result, 6.5% to 7.0% mortgage securities began to trade at discount prices ranging from $92 to $96. But given the fact that the housing market was strong and many homeowners decided to move into other homes, many of those mortgage securities were paid off at par, resulting in fairly good performance for the mortgage market as a whole."

Annual Report

|

Coupon Distribution as of October 31, 2000 |

||

|

|

% of fund's investments |

% of fund's investments |

|

Less than 6% |

0.4 |

0.5 |

|

6 - 6.99% |

32.6 |

45.0 |

|

7 - 7.99% |

43.7 |

38.4 |

|

8 - 8.99% |

14.0 |

9.9 |

|

9% and over |

2.8 |

4.2 |

|

Coupon distribution shows the range of stated interest rates on the fund's investments, excluding short-term investments. |

|

Average Years to Maturity as of October 31, 2000 |

||

|

|

|

6 months ago |

|

Years |

7.1 |

8.0 |

|

Average years to maturity is based on the average time remaining until principal payments are expected from each of the fund's bonds, weighted by dollar amount. |

|

Duration as of October 31, 2000 |

||

|

|

|

6 months ago |

|

Years |

3.7 |

4.7 |

|

Duration shows how much a bond fund's price fluctuates with changes in comparable interest rates. If rates rise 1%, for example, a fund with a five-year duration is likely to lose about 5% of its value. Other factors also can influence a bond fund's performance and share price. Accordingly, a bond fund's actual performance may differ from this example. |

|

Asset Allocation (% of fund's net assets) |

|||||||

|

As of October 31, 2000 |

As of April 30, 2000 |

||||||

|

Mortgage |

|

|

Mortgage |

|

||

|

CMOs and Other Mortgage Related Securities 19.3% |

|

|

CMOs and Other Mortgage Related Securities 21.8% |

|

||

|

U.S. Government |

|

|

U.S. Government |

|

||

|

Short-Term |

|

|

Short-Term |

|

||

* Short-term investments and net other assets are not included in the pie chart.

Annual Report

Showing Percentage of Net Assets

|

U.S. Government and Government Agency Obligations - 3.1% |

||||

|

|

Principal Amount |

Value |

||

|

U.S. Government Agency Obligations - 3.1% |

||||

|

Fannie Mae 6.5% 4/29/09 |

|

$ 15,440,000 |

$ 14,701,814 |

|

|

U.S. Government Agency - Mortgage Securities - 77.3% |

||||

|

|

||||

|

Fannie Mae - 48.5% |

||||

|

6% 2/1/14 to 6/1/29 |

|

17,285,396 |

16,223,096 |

|

|

6.5% 9/1/10 to 2/1/30 |

|

66,387,810 |

63,905,089 |

|

|

7% 3/1/19 to 10/1/30 |

|

71,013,814 |

69,662,626 |

|

|

7% 11/1/30 (b) |

|

15,000,000 |

14,695,313 |

|

|

7.5% 3/1/22 to 11/1/30 |

|

40,259,542 |

40,213,187 |

|

|

8% 1/1/07 to 7/1/30 |

|

13,049,020 |

13,209,123 |

|

|

8.25% 1/1/13 |

|

54,630 |

55,566 |

|

|

8.5% 6/1/16 to 11/1/23 |

|

2,946,350 |

3,021,512 |

|

|

8.75% 11/1/08 to 7/1/09 |

|

122,645 |

125,817 |

|

|

9% 1/1/08 to 2/1/13 |

|

497,626 |

512,597 |

|

|

9.5% 5/1/03 to 8/1/22 |

|

2,747,955 |

2,835,347 |

|

|

11% 12/1/02 to 8/1/10 |

|

834,963 |

905,168 |

|

|

12.25% 5/1/13 to 6/1/15 |

|

146,833 |

164,723 |

|

|

12.5% 11/1/14 to 3/1/16 |

|

279,804 |

316,089 |

|

|

12.75% 2/1/14 to 6/1/15 |

|

44,209 |

49,029 |

|

|

13.5% 9/1/13 to 12/1/14 |

|

129,910 |

149,843 |

|

|

14% 11/1/14 |

|

40,901 |

47,586 |

|

|

|

226,091,711 |

|||

|

Freddie Mac - 12.1% |

||||

|

5% 7/1/10 |

|

2,010,726 |

1,866,834 |

|

|

6% 2/1/29 to 7/1/29 |

|

4,606,402 |

4,321,358 |

|

|

6.5% 1/1/24 to 9/1/24 |

|

20,168,922 |

19,511,494 |

|

|

7% 7/1/29 to 9/1/29 |

|

7,508,084 |

7,360,249 |

|

|

7.5% 6/1/26 to 11/1/30 |

|

6,307,591 |

6,309,623 |

|

|

7.5% 11/1/30 (b) |

|

7,275,000 |

7,270,453 |

|

|

8% 10/1/07 to 4/1/21 |

|

487,909 |

493,337 |

|

|

8.5% 11/1/03 to 5/1/30 |

|

2,741,499 |

2,801,348 |

|

|

9% 9/1/08 to 5/1/21 |

|

3,334,308 |

3,434,549 |

|

|

10% 1/1/09 to 5/1/19 |

|

930,499 |

974,266 |

|

|

10.5% 8/1/10 to 2/1/16 |

|

83,810 |

88,684 |

|

|

11.5% 4/1/12 |

|

54,722 |

59,735 |

|

|

12.25% 6/1/14 to 7/1/15 |

|

106,234 |

119,159 |

|

|

12.5% 5/1/12 to 12/1/14 |

|

521,724 |

580,346 |

|

|

U.S. Government Agency - Mortgage Securities - continued |

||||

|

|

Principal Amount |

Value |

||

|

Freddie Mac - continued |

||||

|

12.75% 6/1/05 to 3/1/15 |

|

$ 55,553 |

$ 60,251 |

|

|

13% 1/1/11 to 6/1/15 |

|

865,615 |

995,218 |

|

|

|

56,246,904 |

|||

|

Government National Mortgage Association - 16.7% |

||||

|

6.5% 5/15/28 to 1/15/29 |

|

4,059,163 |

3,918,350 |

|

|

7% 1/15/26 to 6/15/29 (d) |

|

16,431,436 |

16,196,453 |

|

|

7.5% 7/15/05 to 9/15/27 |

|

12,034,063 |

12,123,749 |

|

|

8% 4/15/02 to 12/15/25 |

|

7,861,876 |

8,003,375 |

|

|

8.5% 7/15/16 to 10/15/30 |

|

35,803,208 |

36,731,278 |

|

|

9% 9/20/16 to 4/20/18 |

|

60,050 |

61,959 |

|

|

9.5% 8/15/09 to 12/15/24 |

|

72,451 |

76,491 |

|

|

10.5% 1/15/01 to 2/20/18 |

|

487,533 |

519,050 |

|

|

13% 10/15/13 |

|

43,913 |

50,431 |

|

|

13.5% 7/15/11 to 10/15/14 |

|

56,959 |

65,227 |

|

|

|

77,746,363 |

|||

|

TOTAL U.S. GOVERNMENT AGENCY - MORTGAGE SECURITIES (Cost $362,314,237) |

360,084,978 |

|||

|

Collateralized Mortgage Obligations - 4.3% |

||||

|

|

||||

|

U.S. Government Agency - 4.3% |

||||

|

Fannie Mae REMIC planned amortization class: |

|

|

|

|

|

Series 1999-1 Class PJ, 6.5% 2/25/29 |

|

10,049,260 |

9,369,247 |

|

|

Series 1999-51 Class LK, 6.5% 8/25/29 |

|

10,000,000 |

9,128,100 |

|

|

Freddie Mac REMIC planned amortization class |

|

1,404,060 |

1,445,298 |

|

|

TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS (Cost $19,677,765) |

19,942,645 |

|||

|

Commercial Mortgage Securities - 15.0% |

||||

|

|

||||

|

Bankers Trust II Series 1999-S1A Class D, 8.81% 2/28/14 (a)(c) |

|

5,000,000 |

5,010,938 |

|

|

CBM Funding Corp. sequential pay Series 1996-1 |

|

2,300,000 |

2,296,586 |

|

|

CS First Boston Mortgage Securities Corp. |

|

2,000,000 |

1,902,938 |

|

|

Deutsche Mortgage & Asset Receiving Corp. |

|

10,200,000 |

9,431,813 |

|

|

Federal Deposit Insurance Corp. REMIC Trust sequential pay Series 1996-C1 Class 1A, 6.75% 7/25/26 |

|

2,242,680 |

2,220,078 |

|

|

Commercial Mortgage Securities - continued |

||||

|

|

Principal Amount |

Value |

||

|

GS Mortgage Securities Corp. II Series 1998-GLII |

|

$ 1,600,000 |

$ 1,450,500 |

|

|

Nomura Asset Securities Corp. weighted average coupon Series 1998-D6 Class A4, 7.3619% 3/17/28 (c) |

|

15,000,000 |

14,067,188 |

|

|

Nomura Depositor Trust floater Series 1998-ST1A: |

|

|

|

|

|

Class A4, 7.5213% 2/15/34 (a)(c) |

|

7,900,000 |

7,755,579 |

|

|

Class A5, 7.8713% 2/15/34 (a)(c) |

|

5,278,196 |

5,156,138 |

|

|

Structured Asset Securities Corp. Series 1992-M1 |

|

3,192,522 |

3,097,744 |

|

|

Thirteen Affiliates of General Growth Properties, Inc. Series 1 Class D1, 6.917% 12/15/07 (a) |

|

18,200,000 |

17,531,720 |

|

|

TOTAL COMMERCIAL MORTGAGE SECURITIES (Cost $72,038,810) |

69,921,222 |

|||

|

Cash Equivalents - 7.0% |

|||

|

Maturity Amount |

|

||

|

Investments in repurchase agreements (U.S. Government Obligations), in a joint trading account at 6.62%, dated 10/31/00 due

11/1/00 |

$ 32,828,035 |

32,822,000 |

|

|

TOTAL INVESTMENT PORTFOLIO - 106.7% (Cost $501,145,620) |

497,472,659 |

||

|

NET OTHER ASSETS - (6.7)% |

(31,448,023) |

||

|

NET ASSETS - 100% |

$ 466,024,636 |

||

|

Legend |

|

(a) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the period end, the value of these securities amounted to $36,904,875 or 7.9% of net assets. |

|

(b) Security purchased on a delayed delivery or when-issued basis. |

|

(c) The coupon rate shown on floating or adjustable rate securities represents the rate at period end. |

|

(d) A portion of this security is subject to a forward commitment to sell. |

|

Income Tax Information |

|

At October 31, 2000, the aggregate cost of investment securities for income tax purposes was $501,225,418. Net unrealized depreciation aggregated $3,752,759, of which $3,729,911 related to appreciated investment securities and $7,482,670 related to depreciated investment securities. |

|

At October 31, 2000, the fund had a capital loss carryforward of approximately $8,706,000 of which $5,050,000 and $3,656,000 will expire on October 31, 2007 and 2008, respectively. |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Assets and Liabilities

|

|

October 31, 2000 |

|

|

Assets |

|

|

|

Investment in securities, at value (including repurchase agreements of $32,822,000) (cost $501,145,620) - See accompanying schedule |

|

$ 497,472,659 |

|

Commitment to sell securities on a delayed delivery basis |

$ (14,775,000) |

|

|

Receivable for securities sold on a delayed delivery basis |

14,906,250 |

131,250 |

|

Receivable for investments sold, regular delivery |

|

113,202 |

|

Cash |

|

485 |

|

Receivable for fund shares sold |

|

182,244 |

|

Interest receivable |

|

2,409,643 |

|

Total assets |

|

500,309,483 |

|

Liabilities |

|

|

|

Payable for investments purchased |

8,232,107 |

|

|

Delayed delivery |

22,113,125 |

|

|

Payable for fund shares redeemed |

3,103,942 |

|

|

Distributions payable |

505,453 |

|

|

Accrued management fee |

168,882 |

|

|

Distribution fees payable |

27,900 |

|

|

Other payables and accrued expenses |

133,438 |

|

|

Total liabilities |

|

34,284,847 |

|

Net Assets |

|

$ 466,024,636 |

|

Net Assets consist of: |

|

|

|

Paid in capital |

|

$ 477,537,240 |

|

Undistributed net investment income |

|

813,267 |

|

Accumulated undistributed net realized |

|

(8,784,160) |

|

Net unrealized appreciation (depreciation) on investments |

|

(3,541,711) |

|

Net Assets |

|

$ 466,024,636 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Statements - continued

Statement of Assets and Liabilities - continued

|

|

October 31, 2000 |

|

|

Calculation of Maximum Offering Price |

|

$10.53 |

|

Maximum offering price per share (100/95.25 of $10.53) |

|

$11.06 |

|

Class T: |

|

$10.54 |

|

Maximum offering price per share (100/96.50 of $10.54) |

|

$10.92 |

|

Class B: |

|

$10.53 |

|

Initial Class: |

|

$10.54 |

|

Institutional Class: |

|

$10.52 |

A Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Statements - continued

Statement of Operations

|

|

Year ended October 31, 2000 |

|

|

Investment Income Interest |

|

$ 32,656,104 |

|

Expenses |

|

|

|

Management fee |

$ 1,899,545 |

|

|

Transfer agent fees |

759,081 |

|

|

Distribution fees |

261,047 |

|

|

Accounting fees and expenses |

143,998 |

|

|

Non-interested trustees' compensation |

1,585 |

|

|

Custodian fees and expenses |

69,446 |

|

|

Registration fees |

93,364 |

|

|

Audit |

54,560 |

|

|

Legal |

7,135 |

|

|

Miscellaneous |

2,586 |

|

|

Total expenses before reductions |

3,292,347 |

|

|

Expense reductions |

(12,991) |

3,279,356 |

|

Net investment income |

|

29,376,748 |

|

Realized and Unrealized Gain (Loss) Net realized gain (loss) on investment securities |

|

(3,442,334) |

|

Change in net unrealized appreciation (depreciation) on: |

|

|

|

Investment securities |

6,356,250 |

|

|

Delayed delivery commitments |

131,250 |

6,487,500 |

|

Net gain (loss) |

|

3,045,166 |

|

Net increase (decrease) in net assets resulting |

|

$ 32,421,914 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Statements - continued

Statement of Changes in Net Assets

|

|

Year ended

October 31, |

Year ended

October 31, |

|

Increase (Decrease) in Net Assets |

|

|

|

Operations |

$ 29,376,748 |

$ 30,638,885 |

|

Net realized gain (loss) |

(3,442,334) |

(5,620,586) |

|

Change in net unrealized appreciation (depreciation) |

6,487,500 |

(10,190,965) |

|

Net increase (decrease) in net assets resulting |

32,421,914 |

14,827,334 |

|

Distributions to shareholders |

(30,637,049) |

(30,183,549) |

|

From net realized gain |

- |

(6,924,572) |

|

Total distributions |

(30,637,049) |

(37,108,121) |

|

Share transactions - net increase (decrease) |

(9,263,825) |

(14,273,306) |

|

Total increase (decrease) in net assets |

(7,478,960) |

(36,554,093) |

|

Net Assets |

|

|

|

Beginning of period |

473,503,596 |

510,057,689 |

|

End of period (including undistributed net investment income of $813,267 and $1,901,973, respectively) |

$ 466,024,636 |

$ 473,503,596 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Class A

|

Years ended October 31, |

2000 |

1999 |

1998 |

1997 G |

1997 F |

|

Selected Per-Share Data |

|

|

|

|

|

|

Net asset value, beginning of period |

$ 10.480 |

$ 10.960 |

$ 11.020 |

$ 11.050 |

$ 10.830 |

|

Income from Investment Operations |

|

|

|

|

|

|

Net investment income D |

.665 |

.646 |

.669 |

.170 |

.268 |

|

Net realized and unrealized gain (loss) |

.086 |

(.336) |

(.061) |

.048 |

.224 |

|

Total from investment |

.751 |

.310 |

.608 |

.218 |

.492 |

|

Less Distributions |

|

|

|

|

|

|

From net investment |

(.701) |

(.640) |

(.638) |

(.168) |

(.272) |

|

From net realized gain |

- |

(.150) |

(.030) |

(.080) |

- |

|

Total distributions |

(.701) |

(.790) |

(.668) |

(.248) |

(.272) |

|

Net asset value, end |

$ 10.530 |

$ 10.480 |

$ 10.960 |

$ 11.020 |

$ 11.050 |

|

Total Return B, C |

7.49% |

2.93% |

5.65% |

2.00% |

4.61% |

|

Ratios and Supplemental Data |

|

|

|

|

|

|

Net assets, end of period (000 omitted) |

$ 4,610 |

$ 3,090 |

$ 1,865 |

$ 1,648 |

$ 1,586 |

|

Ratio of expenses to average net assets |

.88% |

.90% E |

.90% E |

.90% A, E |

.90% A, E |

|

Ratio of net investment income to average |

6.44% |

6.09% |

6.01% |

6.18% A |

6.09% A |

|

Portfolio turnover rate |

99% |

183% |

262% |

125% A |

149% |

A Annualized

B The total returns would have been lower had certain expenses not been reduced during the periods shown.

C Total returns do not include the one time sales charge and for periods of less than one year are not annualized.

D Net investment income per share has been calculated based on average shares outstanding during the period.

E FMR agreed to reimburse a portion of the class' expenses during the period. Without this reimbursement, the class' expense ratio would have been higher.

F For the period March 3, 1997 (commencement of sale of Class A shares) to July 31, 1997.

G Three months ended October 31

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Class T

|

Years ended October 31, |

2000 |

1999 |

1998 |

1997 G |

1997 F |

|

Selected Per-Share Data |

|

|

|

|

|

|

Net asset value, beginning |

$ 10.480 |

$ 10.960 |

$ 11.020 |

$ 11.050 |

$ 10.830 |

|

Income from Investment Operations |

|

|

|

|

|

|

Net investment income D |

.653 |

.637 |

.665 |

.167 |

.255 |

|

Net realized and unrealized gain (loss) |

.092 |

(.338) |

(.063) |

.048 |

.233 |

|

Total from investment |

.745 |

.299 |

.602 |

.215 |

.488 |

|

Less Distributions |

|

|

|

|

|

|

From net investment income |

(.685) |

(.629) |

(.632) |

(.165) |

(.268) |

|

From net realized gain |

- |

(.150) |

(.030) |

(.080) |

- |

|

Total distributions |

(.685) |

(.779) |

(.662) |

(.245) |

(.268) |

|

Net asset value, end of period |

$ 10.540 |

$ 10.480 |

$ 10.960 |

$ 11.020 |

$ 11.050 |

|

Total Return B, C |

7.42% |

2.82% |

5.60% |

1.98% |

4.57% |

|

Ratios and Supplemental Data |

|

|

|

|

|

|

Net assets, end of period |

$ 61,359 |

$ 29,052 |

$ 19,103 |

$ 14,649 |

$ 12,193 |

|

Ratio of expenses to average net assets |

1.00% |

1.00% E |

1.00% E |

1.00% A, E |

1.00% A, E |

|

Ratio of net investment income to average net assets |

6.33% |

5.99% |

6.05% |

6.10% A |

5.99% A |

|

Portfolio turnover rate |

99% |

183% |

262% |

125% A |

149% |

A Annualized

B The total returns would have been lower had certain expenses not been reduced during the periods shown.

C Total returns do not include the one time sales charge and for periods of less than one year are not annualized.

D Net investment income per share has been calculated based on average shares outstanding during the period.

E FMR agreed to reimburse a portion of the class' expenses during the period. Without this reimbursement, the class' expense ratio would have been higher.

F For the period March 3, 1997 (commencement of sale of Class T shares) to July 31, 1997.

G Three months ended October 31

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Class B

|

Years ended October 31, |

2000 |

1999 |

1998 |

1997 G |

1997 F |

|

Selected Per-Share Data |

|

|

|

|

|

|

Net asset value, beginning |

$ 10.480 |

$ 10.950 |

$ 11.020 |

$ 11.040 |

$ 10.830 |

|

Income from Investment Operations |

|

|

|

|

|

|

Net investment income D |

.593 |

.567 |

.584 |

.142 |

.234 |

|

Net realized and unrealized gain (loss) |

.081 |

(.324) |

(.064) |

.065 |

.214 |

|

Total from investment |

.674 |

.243 |

.520 |

.207 |

.448 |

|

Less Distributions |

|

|

|

|

|

|

From net investment income |

(.624) |

(.563) |

(.560) |

(.147) |

(.238) |

|

From net realized gain |

- |

(.150) |

(.030) |

(.080) |

- |

|

Total distributions |

(.624) |

(.713) |

(.590) |

(.227) |

(.238) |

|

Net asset value, end of period |

$ 10.530 |

$ 10.480 |

$ 10.950 |

$ 11.020 |

$ 11.040 |

|

Total Return B, C |

6.70% |

2.29% |

4.82% |

1.90% |

4.20% |

|

Ratios and Supplemental Data |

|

|

|

|

|

|

Net assets, end of period |

$ 19,911 |

$ 19,101 |

$ 7,840 |

$ 1,587 |

$ 823 |

|

Ratio of expenses to average |

1.60% |

1.62% |

1.65% E |

1.65% A, E |

1.65% A, E |

|

Ratio of net investment income to average net assets |

5.73% |

5.37% |

5.37% |

5.32% A |

5.34% A |

|

Portfolio turnover rate |

99% |

183% |

262% |

125% A |

149% |

A Annualized

B The total returns would have been lower had certain expenses not been reduced during the periods shown.

C Total returns do not include the contingent deferred sales charge and for periods of less than one year are not annualized.

D Net investment income per share has been calculated based on average shares outstanding during the period.

E FMR agreed to reimburse a portion of the class' expenses during the period. Without this reimbursement, the class' expense ratio would have been higher.

F For the period March 3, 1997 (commencement of sale of Class B shares) to July 31, 1997.

G Three months ended October 31

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Initial Class

|

Years ended October 31, |

2000 |

1999 |

1998 |

1997 F |

1997 G |

1996 G |

|

Selected Per-Share Data |

|

|

|

|

|

|

|

Net asset value, beginning of period |

$ 10.490 |

$ 10.970 |

$ 11.020 |

$ 11.050 |

$ 10.780 |

$ 10.890 |

|

Income from Investment Operations |

|

|

|

|

|

|

|

Net investment income |

.690 D |

.674 D |

.700 D |

.176 D |

.678 D |

.729 |

|

Net realized and unrealized gain (loss) |

.078 |

(.342) |

(.056) |

.047 |

.391 |

(.015) |

|

Total from investment operations |

.768 |

.332 |

.644 |

.223 |

1.069 |

.714 |

|

Less Distributions |

|

|

|

|

|

|

|

From net investment |

(.718) |

(.662) |

(.664) |

(.173) |

(.689) |

(.724) |

|

From net realized gain |

- |

(.150) |

(.030) |

(.080) |

(.110) |

(.100) |

|

Total distributions |

(.718) |

(.812) |

(.694) |

(.253) |

(.799) |

(.824) |

|

Net asset value, end |

$ 10.540 |

$ 10.490 |

$ 10.970 |

$ 11.020 |

$ 11.050 |

$ 10.780 |

|

Total Return B, C |

7.66% |

3.14% |

5.99% |

2.05% |

10.34% |

6.72% |

|

Ratios and Supplemental Data |

|

|

|

|

|

|

|

Net assets, end of period |

$ 371,107 |

$ 406,839 |

$ 459,212 |

$ 494,304 |

$ 506,113 |

$ 488,162 |

|

Ratio of expenses to average net assets |

.67% |

.70% |

.71% |

.72% A |

.73% |

.74% |

|

Ratio of expenses to average net assets after expense reductions |

.67% |

.70% |

.71% |

.72% A |

.73% |

.73% E |

|

Ratio of net investment

income to average |

6.65% |

6.29% |

6.34% |

6.36% A |

6.26% |

6.75% |

|

Portfolio turnover rate |

99% |

183% |

262% |

125% A |

149% |

221% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C The total returns would have been lower had certain expenses not been reduced during the periods shown.

D Net investment income per share has been calculated based on average shares outstanding during the period.

E FMR or the fund has entered into varying arrangements with third parties who either paid or reduced a portion of the class' expenses.

F Three months ended October 31

G Year ended July 31

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Institutional Class

|

Years ended October 31, |

2000 |

1999 |

1998 |

1997 H |

1997 G |

|

Selected Per-Share Data |

|

|

|

|

|

|

Net asset value, beginning |

$ 10.470 |

$ 10.950 |

$ 11.010 |

$ 11.040 |

$ 10.830 |

|

Income from Investment Operations |

|

|

|

|

|

|

Net investment income D |

.684 |

.669 |

.693 |

.172 |

.263 |

|

Net realized and unrealized gain (loss) |

.080 |

(.343) |

(.063) |

.050 |

.226 |

|

Total from investment |

.764 |

.326 |

.630 |

.222 |

.489 |

|

Less Distributions |

|

|

|

|

|

|

From net investment income |

(.714) |

(.656) |

(.660) |

(.172) |

(.279) |

|

From net realized gain |

- |

(.150) |

(.030) |

(.080) |

- |

|

Total distributions |

(.714) |

(.806) |

(.690) |

(.252) |

(.279) |

|

Net asset value, end of period |

$ 10.520 |

$ 10.470 |

$ 10.950 |

$ 11.010 |

$ 11.040 |

|

Total Return B, C |

7.64% |

3.09% |

5.86% |

2.05% |

4.59% |

|

Ratios and Supplemental Data |

|

|

|

|

|

|

Net assets, end of period |

$ 9,038 |

$ 15,422 |

$ 22,038 |

$ 19,718 |

$ 13,177 |

|

Ratio of expenses to average net assets |

.73% |

.75% E |

.75% E |

.75% A, E |

.75% A, E |

|

Ratio of expenses to average net assets after expense reductions |

.72% F |

.75% |

.75% |

.75% A |

.70% A, F |

|

Ratio of net investment income to average net assets |

6.60% |

6.24% |

6.30% |

6.35% A |

6.29% A |

|

Portfolio turnover rate |

99% |

183% |

262% |

125% A |

149% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C The total returns would have been lower had certain expenses not been reduced during the periods shown.

D Net investment income per share has been calculated based on average shares outstanding during the period.

E FMR agreed to reimburse a portion of the class' expenses during the period. Without this reimbursement, the class' expense ratio would have been higher.

F FMR or the fund has entered into varying arrangements with third parties who either paid or reduced a portion of the class' expenses.

G For the period March 3, 1997 (commencement of sale of Institutional Class shares) to July 31, 1997.

H Three months ended October 31

See accompanying notes which are an integral part of the financial statements.

Annual Report

For the period ended October 31, 2000

1. Significant Accounting Policies.

Fidelity Advisor Mortgage Securities Fund (the fund) is a fund of Fidelity Advisor Series II (the trust) and is authorized to issue an unlimited number of shares. Effective the close of business on February 28,1997, the fund's Initial Class was closed to new accounts. The trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust.

The fund offers Class A, Class T, Class B, Initial Class, and Institutional Class shares, each of which has equal rights as to assets and voting privileges. Each class has exclusive voting rights with respect to matters that affect that class. Class B shares will automatically convert to Class A shares after a holding period of seven years from the initial date of purchase. Investment income, realized and unrealized capital gains and losses, the common expenses of the fund, and certain fund-level expense reductions, if any, are allocated on a pro rata basis to each class based on the relative net assets of each class to the total net assets of the fund. Each class of shares differs in its respective distribution, transfer agent, and certain other class-specific fees, expenses, and expense reductions.

The financial statements have been prepared in conformity with generally accepted accounting principles which require management to make certain estimates and assumptions at the date of the financial statements. The following summarizes the significant accounting policies of the fund:

Security Valuation. Securities are valued based upon a computerized matrix system and/or appraisals by a pricing service, both of which consider market transactions and dealer-supplied valuations. Securities (including restricted securities) for which market quotations are not readily available are valued at their fair value as determined in good faith under consistently applied procedures under the general supervision of the Board of Trustees. Short-term securities with remaining maturities of sixty days or less for which quotations are not readily available are valued at amortized cost or original cost plus accrued interest, both of which approximate current value. Investments in open-end investment companies are valued at their net asset value each business day.

Income Taxes. As a qualified regulated investment company under Subchapter M of the Internal Revenue Code, the fund is not subject to income taxes to the extent that it distributes substantially all of its taxable income for its fiscal year. The schedule of investments includes information regarding income taxes under the caption "Income Tax Information."

Investment Income. Interest income, which includes accretion of original issue discount, is accrued as earned.

Expenses. Most expenses of the trust can be directly attributed to a fund. Expenses which cannot be directly attributed are apportioned among the funds in the trust.

Annual Report

Notes to Financial Statements - continued

1. Significant Accounting Policies - continued

Distributions to Shareholders. Distributions are declared daily and paid monthly from net investment income. Distributions from realized gains, if any, are recorded on the ex-dividend date. Income dividends and capital gain distributions are declared separately for each class.

Income and capital gain distributions are determined in accordance with income tax regulations which may differ from generally accepted accounting principles. These differences, which may result in distribution reclassifications, are primarily due to differing treatments for paydown gains/losses on certain securities, market discount, capital loss carryforwards and losses deferred due to wash sales.

Permanent book and tax basis differences relating to shareholder distributions will result in reclassifications to paid in capital. Undistributed net investment income and accumulated undistributed net realized gain (loss) on investments may include temporary book and tax basis differences which will reverse in a subsequent period. Any taxable income or gain remaining at fiscal year end is distributed in the following year.

Security Transactions. Security transactions are accounted for as of trade date. Gains and losses on securities sold are determined on the basis of identified cost.

2. Operating Policies.

Joint Trading Account. Pursuant to an Exemptive Order issued by the Securities and Exchange Commission, the fund, along with other affiliated entities of Fidelity Management & Research Company (FMR), may transfer uninvested cash balances into one or more joint trading accounts. These balances are invested in one or more repurchase agreements for U.S. Treasury or Federal Agency obligations.

Repurchase Agreements. The underlying U.S. Treasury, Federal Agency, or other obligations found to be satisfactory by FMR are transferred to an account of the fund, or to the Joint Trading Account, at a custodian bank. The securities are marked-to-market daily and maintained at a value at least equal to the principal amount of the repurchase agreement (including accrued interest). FMR, the fund's investment adviser, is responsible for determining that the value of the underlying securities remains in accordance with the market value requirements stated above.

Delayed Delivery Transactions. The fund may purchase or sell securities on a delayed delivery basis. Payment and delivery may take place after the customary settlement period for that security. The price of the underlying securities and the date when the securities will be delivered and paid for are fixed at the time the transaction is negotiated. The market values of the securities purchased on a delayed delivery basis are identified as such in the fund's schedule of investments. The fund may receive compensation for interest forgone in the purchase of a delayed delivery security. With respect to

Annual Report

Notes to Financial Statements - continued

2. Operating Policies - continued

Delayed Delivery Transactions - continued

purchase commitments, the fund identifies securities as segregated in its records with a value at least equal to the amount of the commitment. Losses may arise due to changes in the market value of the underlying securities or if the counterparty does not perform under the contract.

Restricted Securities. The fund is permitted to invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. At the end of the period, the fund had no investments in restricted securities (excluding 144A issues).

3. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities, aggregated $455,603,228 and $472,388,211, respectively, of which U.S. government and government agency obligations aggregated $439,935,274 and $444,362,092, respectively.

4. Fees and Other Transactions with Affiliates.

Management Fee. As the fund's investment adviser, FMR receives a monthly fee that is calculated on the basis of a group fee rate plus a fixed individual fund fee rate applied to the average net assets of the fund. The group fee rate is the weighted average of a series of rates and is based on the monthly average net assets of all the mutual funds advised by FMR. The rates ranged from .0920% to .3700% for the period. The annual individual fund fee rate is .30%. In the event that these rates were lower than the contractual rates in effect during the period, FMR voluntarily implemented the above rates, as they resulted in the same or a lower management fee. For the period, the management fee was equivalent to an annual rate of .43% of average net assets.

Sub-Adviser Fee. FMR, on behalf of the fund, has entered into a sub-advisory agreement with Fidelity Investments Money Management, Inc. (FIMM), a wholly owned subsidiary of FMR. For its services, FIMM receives a fee from FMR of 50% of the management fee payable to FMR. The fee is paid prior to any voluntary expense reimbursements which may be in effect.

Distribution and Service Plan. In accordance with Rule 12b-1 of the 1940 Act, the Board of Trustees has adopted separate Distribution and Service Plans with respect to each class of shares (collectively referred to as "the Plans"). Under certain of the Plans, the class pays Fidelity Distributors Corporation (FDC), an affiliate of FMR, a 12b-1 fee. A portion of this fee may be reallowed to securities dealers, banks and other financial institutions for the distribution of each class of shares and providing shareholder support

Annual Report

Notes to Financial Statements - continued

4. Fees and Other Transactions with Affiliates - continued

Distribution and Service Plan - continued

services. For the period, this fee was based on the following annual rates of the average net assets of each applicable class:

|

Class A |

.15% |

|

Class T |

.25% |

|

Class B |

.90%* |

* .65% represents a distribution fee and .25% represents a shareholder service fee.

For the period, each class paid FDC the following amounts, a portion of which was retained by FDC:

|

|

Paid to |

Retained |

|

Class A |

$ 5,801 |

$ 9 |

|

Class T |

82,308 |

1,661 |

|

Class B |

172,938 |

124,900 |

|

|

$ 261,047 |

$ 126,570 |

Sales Load. FDC receives a front-end sales charge of up to 4.75% for selling Class A shares, and 3.50% for selling Class T shares of the fund. FDC receives the proceeds of contingent deferred sales charges levied on Class B share redemptions occurring within six years of purchase. The Class B charge is based on declining rates ranging from 5% to 1% of the lesser of the cost of shares at the initial date of purchase or the net asset value of the redeemed shares, excluding any reinvested dividends and capital gains. In addition, purchases of Class A and Class T shares that were subject to a finder's fee bear a contingent deferred sales charge on assets that do not remain in the fund for at least one year. The Class A and Class T contingent deferred sales charge is based on 0.25% of the lesser of the cost of shares at the initial date of purchase or the net asset value of the redeemed shares, excluding any reinvested dividends and capital gains. A portion of the sales charges paid to FDC is paid to securities dealers, banks and other financial institutions.

For the period, sales charge amounts paid to and retained by FDC were as follows:

|

|

Paid to |

Retained |

|

Class A |

$ 19,275 |

$ 5,275 |

|

Class T |

45,570 |

13,922 |

|

Class B |

104,949 |

104,949* |

|

|

$ 169,794 |

$ 124,146 |

* When Class B shares are initially sold, FDC pays commissions from its own resources to securities dealers,

banks, and other financial institutions through which the sales are made.

Annual Report

Notes to Financial Statements - continued

4. Fees and Other Transactions with Affiliates - continued

Transfer Agent Fees. Fidelity Investments Institutional Operations Company, Inc., (FIIOC), an affiliate of FMR, is the transfer, dividend disbursing and shareholder servicing agent (collectively referred to as the transfer agent) for the fund's Class A, Class T, Class B, and Institutional Class Shares. Fidelity Service Company, Inc. (FSC), an affiliate of FMR, is the transfer agent for the Initial Class Shares. FIIOC and FSC receive account fees and asset-based fees that vary according to the account size and type of account of the shareholders of the respective classes of the fund. FIIOC and FSC pay for typesetting, printing and mailing of all shareholder reports, except proxy statements. For the period, the following amounts were paid to FIIOC or FSC:

|

|

Amount |

% of |

|

Class A |

$ 8,617 |

.22 |

|

Class T |

78,644 |

.24 |

|

Class B |

36,267 |

.19 |

|

Initial Class |

607,430 |

.16 |

|

Institutional Class |

28,123 |

.22 |

|

|

$ 759,081 |

|

Accounting Fees. FSC maintains the fund's accounting records. The fee is based on the level of average net assets for the month plus out-of-pocket expenses.

5. Expense Reductions.

Through arrangements with the fund's custodian and each class' transfer agent, credits realized as a result of uninvested cash balances were used to reduce a portion of expenses. During the period, the fund's custodian fees were reduced by $12,619 under the custodian arrangement, and Initial Class' transfer agent expenses were reduced by $372 under the transfer agent arrangement.

Annual Report

Notes to Financial Statements - continued

6. Distributions to Shareholders.

Distributions to shareholders of each class were as follows:

|

|

Years ended October 31, |

|

|

|

2000 |

1999 |

|

From net investment income |

|

|

|

Class A |

$ 259,663 |

$ 153,223 |

|

Class T |

2,169,235 |

1,450,107 |

|

Class B |

1,158,837 |

724,614 |

|

Initial Class |

26,148,441 |

26,727,640 |

|

Institutional Class |

900,873 |

1,127,965 |

|

Total |

$ 30,637,049 |

$ 30,183,549 |

|

From net realized gain |

|

|

|

Class A |

$ - |

$ 26,293 |

|

Class T |

- |

278,709 |

|

Class B |

- |

132,050 |

|

Initial Class |

- |

6,182,269 |

|

Institutional Class |

- |

305,251 |

|

Total |

$ - |

$ 6,924,572 |

7. Share Transactions.

Transactions for each class of shares were as follows:

|

|

Shares |

Dollars |

||

|

|

Year ended October 31, |

Year ended October 31, |

Year ended October 31, |

Year ended October 31, |

|

|

2000 |

1999 |

2000 |

1999 |

|

Class A |

215,111 |

233,326 |

$ 2,232,936 |

$ 2,488,784 |

|

Reinvestment of distributions |

18,825 |

11,952 |

195,149 |

127,329 |

|

Shares redeemed |

(90,958) |

(120,472) |

(941,418) |

(1,280,382) |

|

Net increase (decrease) |

142,978 |

124,806 |

$ 1,486,667 |

$ 1,335,731 |

|

Class T |

4,402,524 |

2,003,369 |

$ 45,948,619 |

$ 21,386,352 |

|

Reinvestment of distributions |

163,509 |

148,336 |

1,696,640 |

1,582,559 |

|

Shares redeemed |

(1,514,665) |

(1,122,570) |

(15,663,958) |

(11,947,707) |

|

Net increase (decrease) |

3,051,368 |

1,029,135 |

$ 31,981,301 |

$ 11,021,204 |

Annual Report

Notes to Financial Statements - continued

7. Share Transactions - continued

|

|

Shares |

Dollars |

||

|

|

Year ended October 31, |

Year ended October 31, |

Year ended October 31, |

Year ended October 31, |

|

|

2000 |

1999 |

2000 |

1999 |

|

Class B |

652,666 |

1,505,268 |

$ 6,775,572 |

$ 16,049,817 |

|

Reinvestment of distributions |

85,020 |

63,855 |

880,755 |

679,689 |

|

Shares redeemed |

(669,424) |

(461,420) |

(6,925,550) |

(4,891,488) |

|

Net increase (decrease) |

68,262 |

1,107,703 |

$ 730,777 |

$ 11,838,018 |

|

Initial Class |

3,201,394 |

3,914,002 |

$ 33,214,158 |

$ 41,964,545 |

|

Reinvestment of distributions |

2,034,985 |

2,515,203 |

21,102,123 |

26,913,754 |

|

Shares redeemed |

(8,824,923) |

(9,502,966) |

(91,371,208) |

(101,601,425) |

|

Net increase (decrease) |

(3,588,544) |

(3,073,761) |

$ (37,054,927) |

$ (32,723,126) |

|

Institutional Class |

827,963 |

667,600 |

$ 8,501,722 |

$ 7,141,162 |

|

Reinvestment of distributions |

43,983 |

70,535 |

454,723 |

754,625 |

|

Shares redeemed |

(1,486,148) |

(1,277,677) |

(15,364,088) |

(13,640,920) |

|

Net increase (decrease) |

(614,202) |

(539,542) |

$ (6,407,643) |

$ (5,745,133) |

Annual Report

To the Trustees of Fidelity Advisor Series II and the Shareholders of Fidelity Advisor Mortgage Securities Fund:

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Fidelity Advisor Mortgage Securities Fund (a fund of Fidelity Advisor Series II) at October 31, 2000, and the results of its operations, the changes in its net assets and the financial highlights for the periods indicated, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as "financial statements") are the responsibility of the Fidelity Advisor Mortgage Securities Fund's management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with auditing standards generally accepted in the United States of America which require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at October 31, 2000 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

/s/PricewaterhouseCoopers LLP

PricewaterhouseCoopers LLP

Boston, Massachusetts

December 11, 2000

Annual Report

Investment Adviser

Fidelity Management & Research Company

Boston, MA

Investment Sub-Advisers

Fidelity Investment Money

Management Inc.

Fidelity Management & Research

(U.K.) Inc.

Fidelity Management & Research

(Far East) Inc.

Fidelity Investment Japan Limited

Officers

Edward C. Johnson 3d, President

Robert C. Pozen, Senior Vice President

Dwight D. Churchill, Vice President

David L. Murphy, Vice President

Thomas J. Silvia, Vice President

Stanley N. Griffith, Assistant Vice President

Eric D. Roiter, Secretary

Robert A. Dwight, Treasurer

Maria F. Dwyer, Deputy Treasurer

John H. Costello, Assistant Treasurer

Thomas J. Simpson, Assistant Treasurer

Board of Trustees

Ralph F. Cox *

Phyllis Burke Davis *

Robert M. Gates *

Edward C. Johnson 3d

Donald J. Kirk *

Ned C. Lautenbach *

Peter S. Lynch

Marvin L. Mann *

William O. McCoy *

Gerald C. McDonough *

Robert C. Pozen

Thomas R. Williams *

* Independent trustees

Advisory Board

J. Michael Cook

Abigail P. Johnson

Marie L. Knowles

General Distributor

Fidelity Distributors Corporation

Boston, MA

Transfer and Shareholder

Servicing Agent

Fidelity Investments Institutional Operations Company, Inc.

Boston, MA

Custodian

The Bank of New York

New York, NY

|

AMORI-ANN-1200 |

119005 |

|

1.538544.103 |

|

(Fidelity Investment logo)(registered trademark)

Fidelity® Advisor

Annual Report

October 31, 2000

(2_fidelity_logos)

|

President's Message |

3 |

Ned Johnson on investing strategies. |

|

Performance |

4 |

How the fund has done over time. |

|

Fund Talk |

15 |

The manager's review of fund performance, strategy and outlook. |

|

Investment Changes |

18 |

A summary of major shifts in the fund's investments over the past six months. |

|

Investments |

19 |

A complete list of the fund's investments with their market values. |

|

Financial Statements |

23 |

Statements of assets and liabilities,

operations, and changes in net assets, |

|

Notes |

32 |

Notes to the financial statements. |

|

Report of Independent Accountants |

39 |

The auditors' opinion. |

|

|

|

|

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

(Recycle graphic) This report is printed on recycled paper using soy-based inks.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

Mutual fund shares are not deposits or obligations of, or guaranteed by, any depository institution. Shares are not insured by the FDIC, Federal Reserve Board or any other agency, and are subject to investment risks, including possible loss of principal amount invested.

Neither the fund nor Fidelity Distributors Corporation is a bank.

For more information on any Fidelity Advisor fund, including charges and expenses, contact

your investment professional for a free prospectus. Read it carefully before you invest or

send money.

Annual Report

(photo_of_Edward_C_Johnson_3d)

Dear Shareholder:

A sixth-straight year of double-digit positive returns for the Dow Jones Industrial Average, NASDAQ and S&P 500® could be in jeopardy unless the U.S. stock market shows marked improvement in the final two months of 2000. Through October, all three indexes had negative year-to-date returns. On the other hand, most fixed-income sectors were solidly in the black. Treasuries and other long-term government securities led the way, returning nearly 14%.

While it's impossible to predict the future direction of the markets with any degree of certainty, there are certain basic principles that can help investors plan for their future needs.

The longer your investment time frame, the less likely it is that you will be affected by short-term market volatility. A 10-year investment horizon appropriate for saving for a college education, for example, enables you to weather market cycles in a long-term fund, which may have a higher risk potential, but also has a higher potential rate of return.

An intermediate-length fund could make sense if your investment horizon is two to four years, while a short-term bond fund could be the right choice if you need your money in one or two years.

If your time horizon is less than a year, you might want to consider moving some of your bond investment into a money market fund. These funds seek income and a stable share price by investing in high-quality, short-term investments. Of course, it's important to remember that an investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although money market funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in these types of funds.

Finally, no matter what your time horizon or portfolio diversity, it makes good sense to follow a regular investment plan, investing a certain amount of money in a fund at the same time each month or quarter and periodically reviewing your overall portfolio. By doing so, you won't get caught up in the excitement of a rapidly rising market, nor will you buy all your shares at market highs. While this strategy - known as dollar cost averaging - won't assure a profit or protect you from a loss in a declining market, it should help you lower the average cost of your purchases. Of course, you should consider your financial ability to continue your purchases through periods of low price levels before undertaking such a strategy.

Remember to contact your investment professional if you need help with your investments.

Best regards,

/s/Edward C. Johnson 3d

Edward C. Johnson 3d

Annual Report

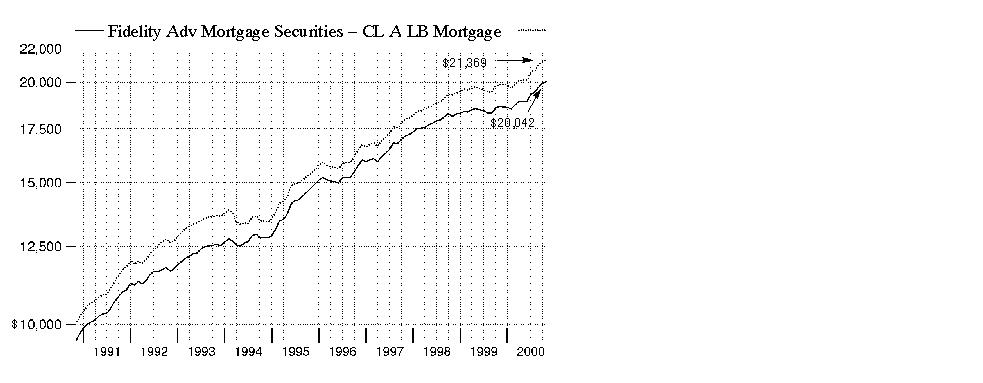

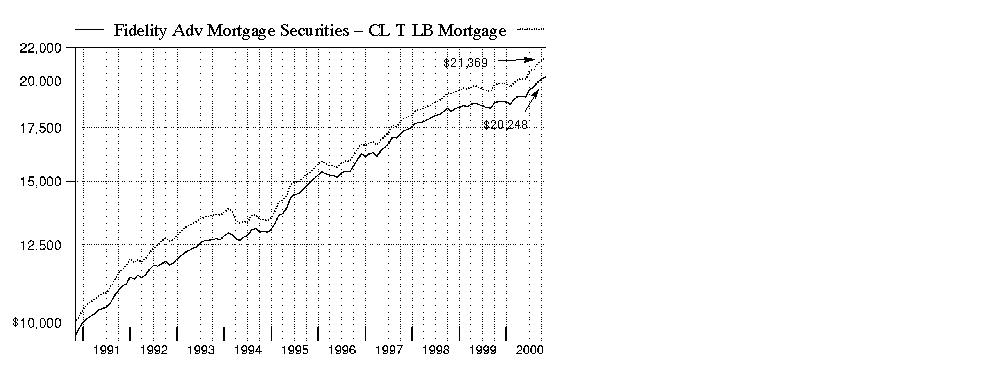

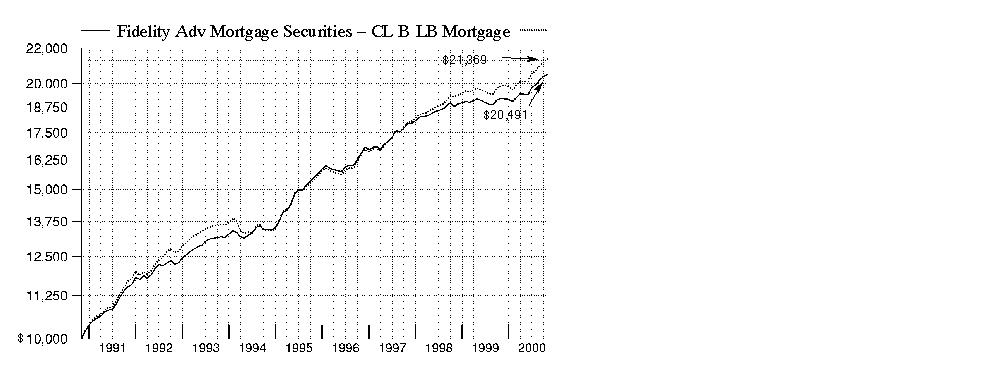

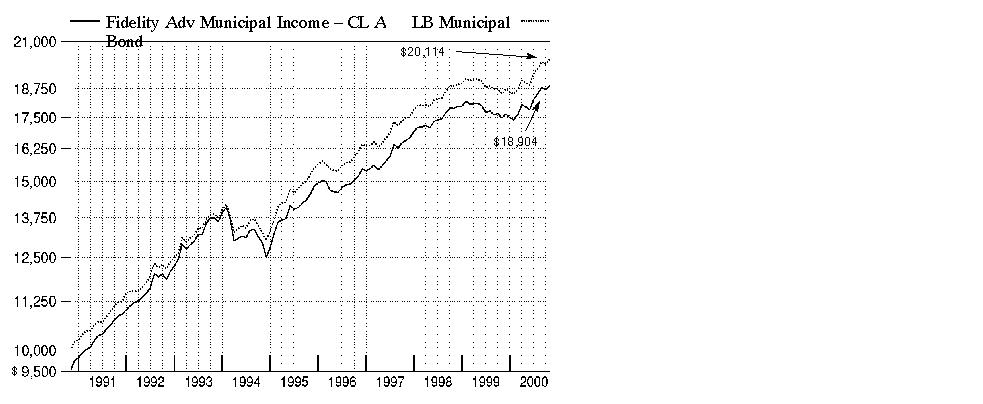

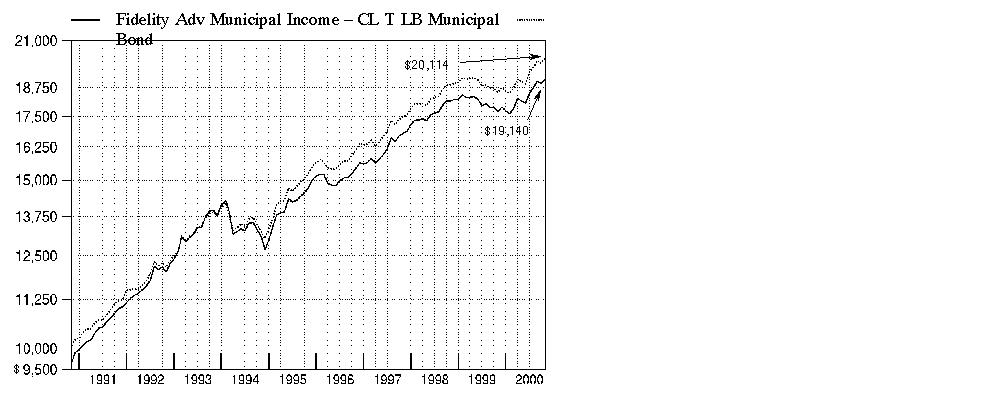

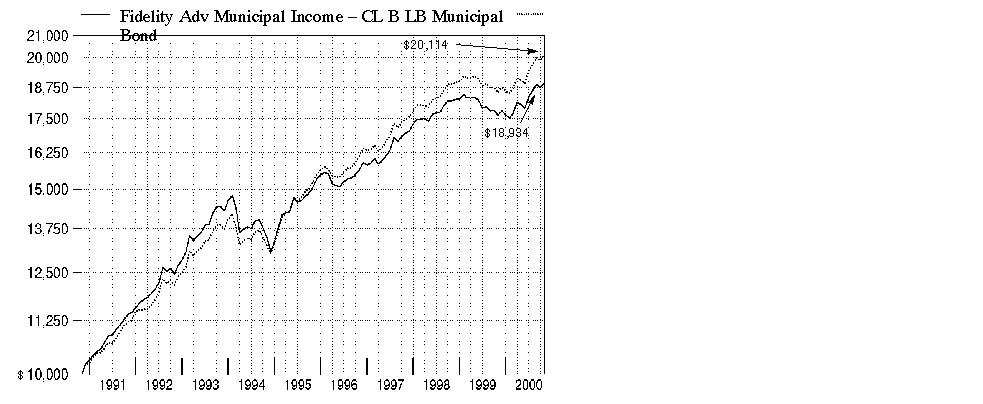

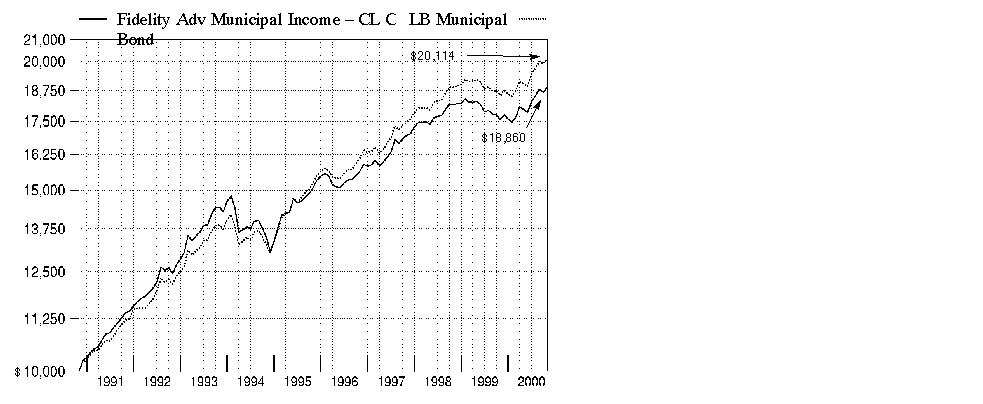

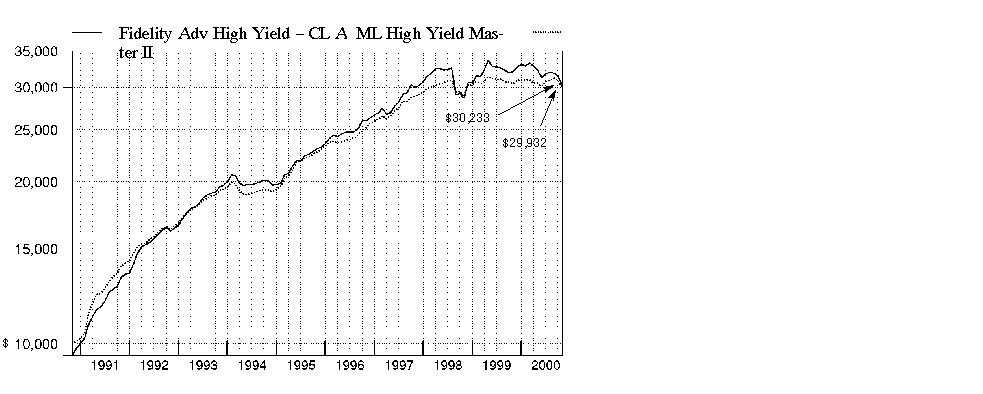

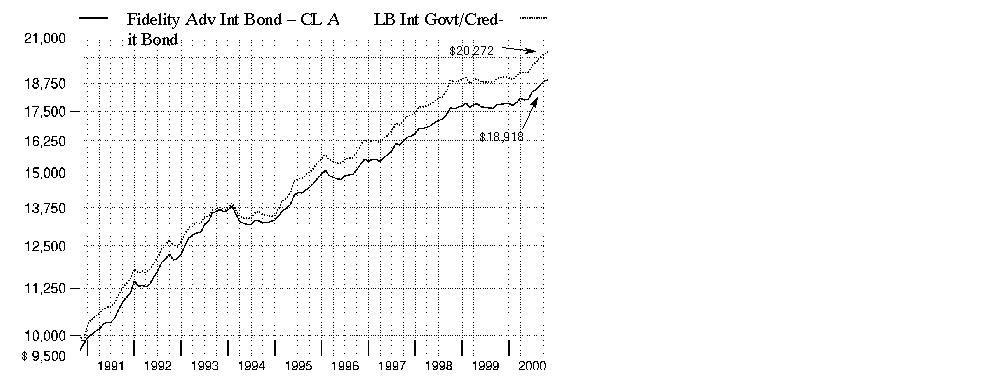

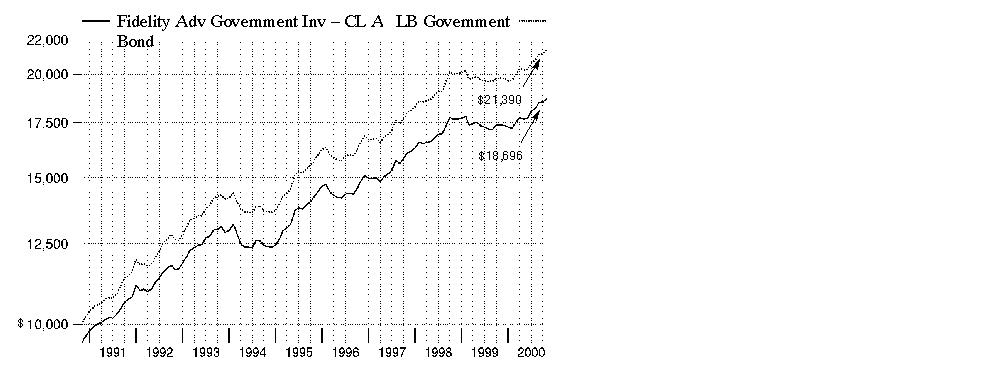

There are several ways to evaluate historical performance. You can look at the total percentage change in value, the average annual percentage change or the growth of a hypothetical $10,000 investment. Total return reflects the change in the value of an investment, assuming reinvestment of the class' dividend income and capital gains (the profits earned upon the sale of securities that have grown in value). You can also look at the class' income, as reflected in its yield, to measure performance. The initial offering of Class A shares took place on March 3, 1997. Class A shares bear a 0.15% 12b-1 fee. Returns prior to March 3, 1997 are those of Initial Class, the original class of the fund, which does not bear a 12b-1 fee. Had Class A shares' 12b-1 fee been reflected, returns prior to March 3, 1997 would have been lower. If Fidelity had not reimbursed certain class expenses, the past five year and past 10 year total returns would have been lower.

Cumulative Total Returns

|

Periods ended October 31, 2000 |

|

Past 1 |