|

|

|

|

|

Previous: SEPRAGEN CORP, SB-2, EX-5, 2000-08-21 |

Next: FRONTIER INSURANCE GROUP INC, 10-Q, 2000-08-21 |

(Fidelity Investment logo)(registered trademark)

(2_fidelity_logos)Fidelity Advisor

Semiannual Report

June 30, 2000

|

President's Message |

3 |

Ned Johnson on investing strategies. |

|

Performance |

4 |

How the fund has done over time. |

|

Fund Talk |

21 |

The managers' review of fund performance, strategy and outlook. |

|

Investment Changes |

25 |

A summary of major shifts in the fund's investments over the past six months. |

|

Investments |

26 |

A complete list of the fund's investments with their market values. |

|

Financial Statements |

45 |

Statements of assets and liabilities,

operations, and changes in net assets, |

|

Notes |

54 |

Notes to the financial statements. |

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

(Recycle graphic) This report is printed on recycled paper using soy-based inks.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

Mutual fund shares are not deposits or obligations of, or guaranteed by, any depository institution. Shares are not insured by the FDIC, Federal Reserve Board or any other agency, and are subject to investment risks, including possible loss of principal amount invested.

Neither the fund nor Fidelity Distributors Corporation is a bank.

For more information on any Fidelity Advisor fund, including charges and expenses, contact your investment professional for a free prospectus. Read it carefully before you invest or send money.

Semiannual Report

(photo_of_Edward_C_Johnson_3d)Dear Shareholder:

In stark contrast to the final six months of 1999, most major equity market indexes posted negative returns for the first half of 2000, due mainly to a correction in the technology sector during the second quarter. The majority of bond markets - with the notable exception of high yield - fared better, as Treasuries and non-Treasuries alike benefited as a haven from the volatility of stocks and riskier investment alternatives.

While it's impossible to predict the future direction of the markets with any degree of certainty, there are certain basic principles that can help investors plan for their future needs.

The longer your investment time frame, the less likely it is that you will be affected by short-term market volatility. A 10-year investment horizon appropriate for saving for a college education, for example, enables you to weather market cycles in a long-term fund, which may have a higher risk potential, but also has a higher potential rate of return.

An intermediate-length fund could make sense if your investment horizon is two to four years, while a short-term bond fund could be the right choice if you need your money in one or two years.

If your time horizon is less than a year, you might want to consider moving some of your bond investment into a money market fund. These funds seek income and a stable share price by investing in high-quality, short-term investments. Of course, it's important to remember that an investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although money market funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in these types of funds.

Finally, no matter what your time horizon or portfolio diversity, it makes good sense to follow a regular investment plan, investing a certain amount of money in a fund at the same time each month or quarter and periodically reviewing your overall portfolio. By doing so, you won't get caught up in the excitement of a rapidly rising market, nor will you buy all your shares at market highs. While this strategy - known as dollar cost averaging - won't assure a profit or protect you from a loss in a declining market, it should help you lower the average cost of your purchases. Of course, you should consider your financial ability to continue your purchases through periods of low price levels before undertaking such a strategy.

Remember to contact your investment professional if you need help with your investments.

Best regards,

/s/Edward C. Johnson 3d

Edward C. Johnson 3d

Semiannual Report

Fidelity Advisor Strategic Income Fund - Class A

There are several ways to evaluate historical performance. You can look at the total percentage change in value, the average annual percentage change or the growth of a hypothetical $10,000 investment. Total return reflects the change in the value of an investment, assuming reinvestment of the class' dividend income and capital gains (the profits earned upon the sale of securities that have grown in value). You can also look at the class' income to measure performance. The initial offering of Class A shares took place on September 3, 1996. Class A shares bear a 0.15% 12b-1 fee that is reflected in returns after September 3, 1996. Returns prior to that date are those of Class T, and reflect Class T shares' 0.25% 12b-1 fee. If Fidelity had not reimbursed certain class expenses, the past five year and life of fund total returns would have been lower.

Semiannual Report

Fidelity Advisor Strategic Income Fund - Class A

Cumulative Total Returns

|

Periods ended June 30, 2000 |

Past 6 |

Past 1 |

Past 5 |

Life of |

|

Fidelity Adv Strategic Income - CL A |

1.90% |

5.41% |

46.61% |

66.88% |

|

Fidelity Adv Strategic Income - CL A |

-2.94% |

0.40% |

39.65% |

58.95% |

|

Fidelity Strategic Income Composite |

1.85% |

4.47% |

43.72% |

60.78% |

|

JP EMBI Global |

6.95% |

20.74% |

107.11% |

111.56% |

|

LB Government Bond |

4.97% |

5.01% |

35.12% |

50.89% |

|

ML High Yield Master II |

-1.00% |

-0.97% |

40.48% |

58.92% |

|

SB Non-US Dollar |

-1.95% |

2.41% |

8.81% |

28.05% |

|

Multi-Sector Income Funds Average |

0.43% |

2.09% |

35.58% |

n/a * |

Cumulative total returns show Class A's performance in percentage terms over a set period - in this case, six months, one year, five years or since the fund started on October 31, 1994. For example, if you had invested $1,000 in a fund that had a 5% return over the past year, the value of your investment would be $1,050. You can compare Class A's returns to those of the Merrill Lynch High Yield Master II Index - a market value-weighted index of all domestic and yankee high-yield bonds, including deferred interest bonds and payment-in-kind securities. Issues included in the index have maturities of one year or more and have a credit rating lower than BBB-/Baa3, but are not in default. Additionally you can also compare Class A's returns to those of the Fidelity Strategic Income Composite Index - a hypothetical combination of unmanaged indices. The composite index combines the total returns of the J.P. Morgan Emerging Markets Bond Index Global, the Lehman Brothers Government Bond Index, the Merrill Lynch High Yield Master II Index and the Salomon Brothers Non-U.S. Dollar World Government Bond Index weighted according to the fund's neutral mix. To measure how Class A's performance stacked up against its peers, you can compare it to the multi-sector income funds average, which reflects the performance of mutual funds with similar objectives tracked by Lipper Inc. The past six months average represents a peer group of 124 mutual funds. The benchmarks listed in the table above include reinvested dividends and capital gains, if any, and exclude the effect of sales charges.

* Not available

Semiannual Report

Fidelity Advisor Strategic Income Fund - Class A

Average Annual Total Returns

|

Periods ended June 30, 2000 |

Past 1 |

Past 5 |

Life of |

|

Fidelity Adv Strategic Income - CL A |

5.41% |

7.95% |

9.46% |

|

Fidelity Adv Strategic Income - CL A |

0.40% |

6.91% |

8.52% |

|

Fidelity Strategic Income Composite |

4.47% |

7.52% |

8.74% |

Average annual total returns take Class A's cumulative return and show you what would have happened if Class A had performed at a constant rate each year.3

Understanding

Performance

How a fund did yesterday is no guarantee of how it will do tomorrow. If you sell your shares during a market downturn, you might lose money. But if you can ride out the market's ups and downs, you may have a gain.

Semiannual Report

Fidelity Advisor Strategic Income Fund - Class A

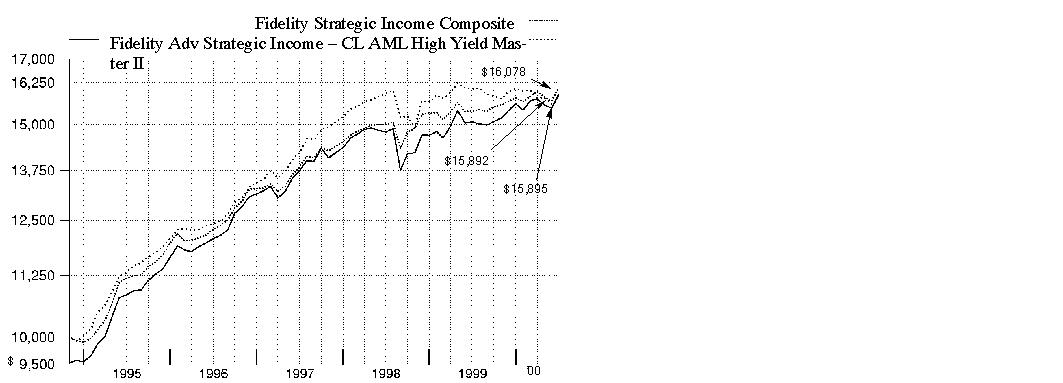

$10,000 Over Life of Fund

$10,000 Over Life of Fund: Let's say hypothetically that $10,000 was invested in Fidelity Advisor Strategic Income Fund - Class A on October 31, 1994, when the fund started, and the current 4.75% sales charge was paid. As the chart shows, by June 30, 2000, the value of the investment would have grown to $15,895 - a 58.95% increase on the initial investment. For comparison, look at how the Merrill Lynch High Yield Master II Index - a market value-weighted index of all domestic and yankee high-yield bonds, including deferred interest bonds and payment-in-kind securities - did over the same period. Issues included in the index have maturities of one year or more and have a credit rating lower than BBB-/Baa3, but are not in default. With dividends and capital gains, if any, reinvested, the same $10,000 investment would have grown to $15,892 - a 58.92% increase. You can also look at how the Fidelity Strategic Income Composite Index - a hypothetical combination of unmanaged indices that is more representative of the fund's investable universe - did over the same period. This index combines returns from the J.P. Morgan Emerging Markets Bond Index Global, Lehman Brothers Government Bond Index, Merrill Lynch High Yield Master II Index, and the Salomon Brothers Non-U.S. Dollar World Government Bond Index, according to the fund's neutral mix .** With dividends and capital gains, if any, reinvested, the same $10,000 investment would have grown to $16,078 - a 60.78% increase.

** 40% high yield, 30% U.S. government and investment-grade,

15% emerging markets, and 15% foreign developed markets.

Semiannual Report

Fidelity Advisor Strategic Income Fund - Class A

Total Return Components

|

|

Six months

ended |

Years ended December 31, |

September 3, 1996 |

||

|

|

2000 |

1999 |

1998 |

1997 |

1996 |

|

Dividend returns |

3.33% |

6.97% |

6.59% |

7.20% |

2.56% |

|

Capital returns |

-1.43% |

-0.85% |

-4.21% |

2.04% |

4.39% |

|

Total returns |

1.90% |

6.12% |

2.38% |

9.24% |

6.95% |

Total return components include both dividend returns and capital returns. A dividend return reflects the actual dividends paid by the class. A capital return reflects both the amount paid by the class to shareholders as capital gain distributions and changes in the class' share price. Both returns assume the dividends or capital gains, if any, paid by the class are reinvested, and exclude the effect of sales charges.

Dividends and Yield

|

Periods ended June 30, 2000 |

Past 1 |

Past 6 |

Past 1 |

|

Dividends per share |

5.79 ¢ |

34.33 ¢ |

70.52 ¢ |

|

Annualized dividend rate |

6.85% |

6.67% |

6.82% |

|

30-day annualized yield |

n/a |

- |

- |

Dividends per share show the income paid by the class for a set period. If you annualize this number, based on an average share price of $10.28 over the past one month, $10.32 over the past six months and $10.34 over the past one year, you can compare the class' income over these three periods. The 30-day annualized yield is a standard formula for all bond funds based on the yields of the bonds in the fund, averaged over the past 30 days. This figure shows you the yield characteristics of the fund's investments at the end of the period. It also helps you to compare funds from different companies on an equal basis. Yield information will be reported once Class A has a longer, more stable, operating history.

Semiannual Report

Fidelity Advisor Strategic Income Fund - Class T

There are several ways to evaluate historical performance. You can look at the total percentage change in value, the average annual percentage change or the growth of a hypothetical $10,000 investment. Total return reflects the change in the value of an investment, assuming reinvestment of the class' dividend income and capital gains (the profits earned upon the sale of securities that have grown in value). You can also look at the class' income, as reflected in its yield, to measure performance. If Fidelity had not reimbursed certain class expenses, the past five year and life of fund total returns would have been lower.

Cumulative Total Returns

|

Periods ended June 30, 2000 |

Past 6 |

Past 1 |

Past 5 |

Life of |

|

Fidelity Adv Strategic Income - CL T |

1.77% |

5.34% |

46.43% |

66.67% |

|

Fidelity Adv Strategic Income - CL T (incl. 3.50% sales charge) |

-1.79% |

1.65% |

41.30% |

60.83% |

|

Fidelity Strategic Income Composite |

1.85% |

4.47% |

43.72% |

60.78% |

|

JP EMBI Global |

6.95% |

20.74% |

107.11% |

111.56% |

|

LB Government Bond |

4.97% |

5.01% |

35.12% |

50.89% |

|

ML High Yield Master II |

-1.00% |

-0.97% |

40.48% |

58.92% |

|

SB Non-US Dollar |

-1.95% |

2.41% |

8.81% |

28.05% |

|

Multi-Sector Income Funds Average |

0.43% |

2.09% |

35.58% |

n/a* |

Cumulative total returns show Class T's performance in percentage terms over a set period - in this case, six months, one year, five years or since the fund started on October 31, 1994. For example, if you had invested $1,000 in a fund that had a 5% return over the past year, the value of your investment would be $1,050. You can compare Class T's returns to those of the Merrill Lynch High Yield Master II Index - a market value-weighted index of all domestic and yankee high-yield bonds, including deferred interest bonds and payment-in-kind securities. Issues included in the index have maturities of one year or more and have a credit rating lower than BBB-/Baa3, but are not in default. Additionally you can also compare Class T's returns to those of the Fidelity Strategic Income Composite Index - a hypothetical combination of unmanaged indices. The composite index combines the total returns of the J.P. Morgan Emerging Markets Bond Index Global, the Lehman Brothers Government Bond Index, the Merrill Lynch High Yield Master II Index and the Salomon Brothers Non-U.S. Dollar World Government Bond Index weighted according to the fund's neutral mix. To measure how Class T's performance stacked up against its peers, you can compare it to the multi-sector income funds average, which reflects the performance of mutual funds with similar objectives tracked by Lipper Inc. The past six months average represents a peer group of 124 mutual funds. The benchmarks listed in the table above include reinvested dividends and capital gains, if any, and exclude the effect of sales charges.

* Not available

Semiannual Report

Fidelity Advisor Strategic Income Fund - Class T

Average Annual Total Returns

|

Periods ended June 30, 2000 |

Past 1 |

Past 5 |

Life of |

|

Fidelity Adv Strategic Income - CL T |

5.34% |

7.93% |

9.43% |

|

Fidelity Adv Strategic Income - CL T |

1.65% |

7.16% |

8.75% |

|

Fidelity Strategic Income Composite |

4.47% |

7.52% |

8.74% |

Average annual total returns take Class T's cumulative return and show you what would have happened if Class T had performed at a constant rate each year.3

Understanding

Performance

How a fund did yesterday is no guarantee of how it will do tomorrow. If you sell your shares during a market downturn, you might lose money. But if you can ride out the market's ups and downs, you may have a gain.

Semiannual Report

Fidelity Advisor Strategic Income Fund - Class T

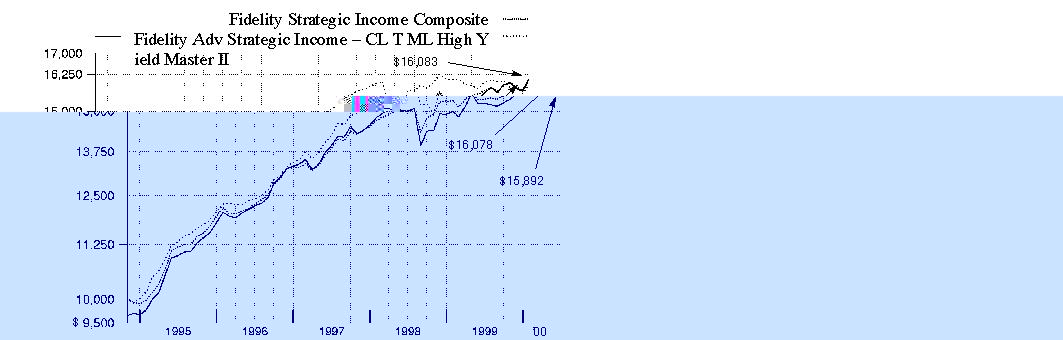

$10,000 Over Life of Fund

$10,000 Over Life of Fund: Let's say hypothetically that $10,000 was invested in Fidelity Advisor Strategic Income Fund - Class T on October 31, 1994, when the fund started, and the current 3.50% sales charge was paid. As the chart shows, by June 30, 2000, the value of the investment would have grown to $16,083 - a 60.83% increase on the initial investment. For comparison, look at how the Merrill Lynch High Yield Master II Index - a market value- weighted index of all domestic and yankee high-yield bonds, including deferred interest bonds and payment-in-kind securities - did over the same period. Issues included in the index have maturities of one year or more, and have a credit rating lower than BBB-/Baa3, but are not in default. With dividends and capital gains, if any, reinvested, the same $10,000 investment would have grown to $15,892 - a 58.92% increase. You can also look at how the Fidelity Strategic Income Composite Index - a hypothetical combination of unmanaged indices that is more representative of the fund's investable universe - did over the same period. This index combines returns from the J.P. Morgan Emerging Markets Bond Index Global, Lehman Brothers Government Bond Index, Merrill Lynch High Yield Master II Index, and the Salomon Brothers Non-U.S. Dollar World Government Bond Index, according to the fund's neutral mix .** With dividends and capital gains, if any, reinvested, the same $10,000 investment would have grown to $16,078 - a 60.78% increase.

** 40% high yield, 30% U.S. government and investment-grade,

15% emerging markets, and 15% foreign developed markets.

Semiannual Report

Fidelity Advisor Strategic Income Fund - Class T

Total Return Components

|

|

Six months

ended |

Years ended December 31, |

||||

|

|

2000 |

1999 |

1998 |

1997 |

1996 |

1995 |

|

Dividend returns |

3.30% |

6.91% |

6.56% |

7.29% |

7.73% |

8.65% |

|

Capital returns |

-1.53% |

-0.76% |

-4.30% |

2.04% |

5.16% |

13.37% |

|

Total returns |

1.77% |

6.15% |

2.26% |

9.33% |

12.89% |

22.02% |

Total return components include both dividend returns and capital returns. A dividend return reflects the actual dividends paid by the class. A capital return reflects both the amount paid by the class to shareholders as capital gain distributions and changes in the class' share price. Both returns assume the dividends or capital gains, if any, paid by the class are reinvested, and exclude the effect of sales charges.

Dividends and Yield

|

Periods ended June 30, 2000 |

Past 1 |

Past 6 |

Past 1 |

|

Dividends per share |

5.74 ¢ |

34.03 ¢ |

69.79 ¢ |

|

Annualized dividend rate |

6.79% |

6.62% |

6.75% |

|

30-day annualized yield |

7.51% |

- |

- |

Dividends per share show the income paid by the class for a set period. If you annualize this number, based on an average share price of $10.28 over the past one month, $10.31 over the past six months, and $10.34 over the past one year, you can compare the class' income over these three periods. The 30-day annualized yield is a standard formula for all bond funds based on the yields of the bonds in the fund, averaged over the past 30 days. This figure shows you the yield characteristics of the fund's investments at the end of the period. It also helps you to compare funds from different companies on an equal basis. The offering share price used in the calculation of the yield includes the effect of Class T's 3.50% sales charge.

Semiannual Report

Fidelity Advisor Strategic Income Fund - Class B

There are several ways to evaluate historical performance. You can look at the total percentage change in value, the average annual percentage change or the growth of a hypothetical $10,000 investment. Total return reflects the change in the value of an investment, assuming reinvestment of the class' dividend income and capital gains (the profits earned upon the sale of securities that have grown in value). You can also look at the class' income, as reflected in its yield to measure performance. Class B shares' contingent deferred sales charge included in the past six month, one year, five year and life of fund total return figures are 5%, 5%, 2% and 1%, respectively. If Fidelity had not reimbursed certain class expenses, the past five year and life of fund total returns would have been lower.

Cumulative Total Returns

|

Periods ended June 30, 2000 |

Past 6 |

Past 1 |

Past 5 |

Life of |

|

Fidelity Adv Strategic Income - CL B |

1.44% |

4.65% |

41.84% |

60.66% |

|

Fidelity Adv Strategic Income - CL B |

-3.49% |

-0.28% |

39.94% |

59.66% |

|

Fidelity Strategic Income Composite |

1.85% |

4.47% |

43.72% |

60.78% |

|

JP EMBI Global |

6.95% |

20.74% |

107.11% |

111.56% |

|

LB Government Bond |

4.97% |

5.01% |

35.12% |

50.89% |

|

ML High Yield Master II |

-1.00% |

-0.97% |

40.48% |

58.92% |

|

SB Non-US Dollar |

-1.95% |

2.41% |

8.81% |

28.05% |

|

Multi-Sector Income Funds Average |

0.43% |

2.09% |

35.58% |

n/a* |

Cumulative total returns show Class B's performance in percentage terms over a set period - in this case, six months, one year, five years or since the fund started on October 31, 1994. For example, if you had invested $1,000 in a fund that had a 5% return over the past year, the value of your investment would be $1,050. You can compare Class B's returns to those of the Merrill Lynch High Yield Master II Index - a market value-weighted index of all domestic and yankee high-yield bonds, including deferred interest bonds and payment-in-kind securities. Issues included in the index have maturities of one year or more and have a credit rating lower than BBB-/Baa3, but are not in default. Additionally you can also compare Class B's returns to those of the Fidelity Strategic Income Composite Index - a hypothetical combination of unmanaged indices. The composite index combines the total returns of the J.P. Morgan Emerging Markets Bond Index Global, the Lehman Brothers Government Bond Index, the Merrill Lynch High Yield Master II Index and the Salomon Brothers Non-U.S. Dollar World Government Bond Index weighted according to the fund's neutral mix. To measure how Class B's performance stacked up against its peers, you can compare it to the multi-sector income funds average, which reflects the performance of mutual funds with similar objectives tracked by Lipper Inc. The past six months average represents a peer group of 124 mutual funds. The benchmarks listed in the table above include reinvested dividends and capital gains, if any, and exclude the effect of sales charges.

* Not available

Semiannual Report

Fidelity Advisor Strategic Income Fund - Class B

Average Annual Total Returns

|

Periods ended June 30, 2000 |

Past 1 |

Past 5 |

Life of |

|

Fidelity Adv Strategic Income - CL B |

4.65% |

7.24% |

8.73% |

|

Fidelity Adv Strategic Income - CL B |

-0.28% |

6.95% |

8.61% |

|

Fidelity Strategic Income Composite |

4.47% |

7.52% |

8.74% |

Average annual total returns take Class B's cumulative return and show you what would have happened if Class B had performed at a constant rate each year. 3

Understanding

Performance

How a fund did yesterday is no guarantee of how it will do tomorrow. If you sell your shares during a market downturn, you might lose money. But if you can ride out the market's ups and downs, you may have a gain.

Semiannual Report

Fidelity Advisor Strategic Income Fund - Class B

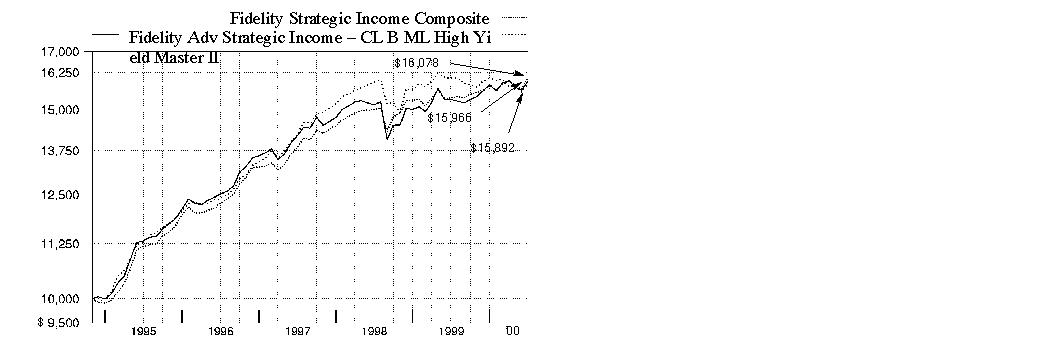

$10,000 Over Life of Fund

$10,000 Over Life of Fund: Let's say hypothetically that $10,000 was invested in Fidelity Advisor Strategic Income Fund - Class B on October 31, 1994, when the fund started. As the chart shows, by June 30, 2000, the value of the investment, including the effect of the contingent deferred sales charge, would have grown to $15,966 - a 59.66% increase on the initial investment. For comparison, look at how the Merrill Lynch High Yield Master II Index - a market value-weighted index of all domestic and yankee high-yield bonds, including deferred interest bonds and payment-in-kind securities - did over the same period. Issues included in the index have maturities of one year or more and have a credit rating lower than BBB-/Baa3, but are not in default. With dividends and capital gains, if any, reinvested, the same $10,000 investment would have grown to $15,892 - a 58.92% increase. You can also look at how the Fidelity Strategic Income Composite Index - a hypothetical combination of unmanaged indices that is more representative of the fund's investable universe - did over the same period. This index combines returns from the J.P. Morgan Emerging Markets Bond Index Global, Lehman Brothers Government Bond Index, Merrill Lynch High Yield Master II Index, and the Salomon Brothers Non-U.S. Dollar World Government Bond Index, according to the fund's neutral mix. ** With dividends and capital gains, if any, reinvested, the same $10,000 investment would have grown to $16,078 - a 60.78% increase.

** 40% high yield, 30% U.S. government and investment-grade,

15% emerging markets, and 15% foreign developed markets.

Semiannual Report

Fidelity Advisor Strategic Income Fund - Class B

Total Return Components

|

|

Six months

ended |

Years ended December 31, |

||||

|

|

1999 |

1999 |

1998 |

1997 |

1996 |

1995 |

|

Dividend returns |

2.96% |

6.21% |

5.89% |

6.58% |

7.00% |

7.78% |

|

Capital returns |

-1.52% |

-0.76% |

-4.20% |

2.02% |

5.14% |

13.57% |

|

Total returns |

1.44% |

5.45% |

1.69% |

8.60% |

12.14% |

21.35% |

Total return components include both dividend returns and capital returns. A dividend return reflects the actual dividends paid by the class. A capital return reflects both the amount paid by the class to shareholders as capital gain distributions and changes in the class' share price. Both returns assume the dividends or capital gains, if any, paid by the class are reinvested, and exclude the effect of sales charges.

Dividends and Yield

|

Periods ended June 30, 2000 |

Past 1 |

Past 6 |

Past 1 |

|

Dividends per share |

5.17 ¢ |

30.62 ¢ |

63.04 ¢ |

|

Annualized dividend rate |

6.11% |

5.94% |

6.08% |

|

30-day annualized yield |

7.08% |

- |

- |

Dividends per share show the income paid by the class for a set period. If you annualize this number based on an average share price of $10.29 over the past one month, $10.33 over the past six months, and $10.36 over the past one year, you can compare the class' income over these three periods. The 30-day annualized yield is a standard formula for all bond funds based on the yields of the bonds in the fund, averaged over the past 30 days. This figure shows you the yield characteristics of the fund's investments at the end of the period. It also helps you to compare funds from different companies on an equal basis. The offering share price used in the calculation of the yield excludes the effect of Class B's contingent deferred sales charge.

Semiannual Report

Fidelity Advisor Strategic Income Fund - Class C

There are several ways to evaluate historical performance. You can look at the total percentage change in value, the average annual percentage change or the growth of a hypothetical $10,000 investment. Total return reflects the change in the value of an investment, assuming reinvestment of the class' dividend income and capital gains (the profits earned upon the sale of securities that have grown in value). You can also look at the class' income, as reflected in its yield, to measure performance. The initial offering of Class C shares took place on November 3, 1997. Class C shares bear a 1.00% 12b-1 fee that is reflected in returns after November 3, 1997. Returns prior to November 3, 1997 are those of Class B shares and reflect Class B shares' 0.90% 12b-1 fee (1.00% prior to January 1, 1996). If Class C shares 12b-1 fee had been reflected, returns between January 1, 1996 and November 3, 1997 would have been lower. Class C shares' contingent deferred sales charge included in the past six month, one year, five year, and life of fund total return figures are 1%, 1%, 0% and 0%, respectively. If Fidelity had not reimbursed certain class expenses, the past five year and life of fund total returns and dividends would have been lower.

Cumulative Total Returns

|

Periods ended June 30, 2000 |

Past 6 |

Past 1 |

Past 5 |

Life of |

|

Fidelity Adv Strategic Income - CL C |

1.39% |

4.45% |

41.04% |

59.75% |

|

Fidelity Adv Strategic Income - CL C |

0.40% |

3.46% |

41.04% |

59.75% |

|

Fidelity Strategic Income Composite |

1.85% |

4.47% |

43.72% |

60.78% |

|

JP EMBI Global |

6.95% |

20.74% |

107.11% |

111.56% |

|

LB Government Bond |

4.97% |

5.01% |

35.12% |

50.89% |

|

ML High Yield Master II |

-1.00% |

-0.97% |

40.48% |

58.92% |

|

SB Non-US Dollar |

-1.95% |

2.41% |

8.81% |

28.05% |

|

Multi-Sector Income Funds Average |

0.43% |

2.09% |

35.58% |

n/a * |

Cumulative total returns show Class C's performance in percentage terms over a set period - in this case, six months, one year, five years or since the fund started on October 31, 1994. For example, if you had invested $1,000 in a fund that had a 5% return over the past year, the value of your investment would be $1,050. You can compare Class C's returns to those of the Merrill Lynch High Yield Master II Index - a market value-weighted index of all domestic and yankee high-yield bonds, including deferred interest bonds and payment-in-kind securities. Issues included in the index have maturities of one year or more and have a credit rating lower than BBB-/Baa3, but are not in default. Additionally you can also compare Class C's returns to those of the Fidelity Strategic Income Composite Index - a hypothetical combination of unmanaged indices. The composite index combines the total returns of the J.P. Morgan Emerging Markets Bond Index Global, the Lehman Brothers Government Bond Index, the Merrill Lynch High Yield Master II Index and the Salomon Brothers Non-U.S. Dollar World Government Bond Index weighted according to the fund's neutral mix. To measure how Class C's performance stacked up against its peers, you can compare it to the multi-sector income funds average, which reflects the performance of mutual funds with similar objectives tracked by Lipper Inc. The past six months average represents a peer group of 124 mutual funds. The benchmarks listed in the table above include reinvested dividends and capital gains, if any, and exclude the effect of sales charges.

* Not available

Semiannual Report

Fidelity Advisor Strategic Income Fund - Class C

Average Annual Total Returns

|

Periods ended June 30, 2000 |

Past 1 |

Past 5 |

Life of |

|

Fidelity Adv Strategic Income - CL C |

4.45% |

7.12% |

8.62% |

|

Fidelity Adv Strategic Income - CL C |

3.46% |

7.12% |

8.62% |

|

Fidelity Strategic Income Composite |

4.47% |

7.52% |

8.74% |

Average annual total returns take Class C's cumulative return and show you what would have happened if Class C had performed at a constant rate each year. 3

Understanding

Performance

How a fund did yesterday is no guarantee of how it will do tomorrow. If you sell your shares during a market downturn, you might lose money. But if you can ride out the market's ups and downs, you may have a gain.

Semiannual Report

Fidelity Advisor Strategic Income Fund - Class C

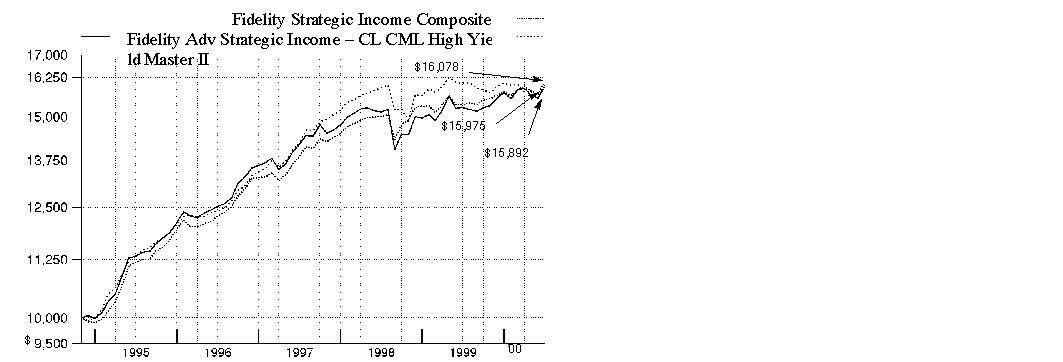

$10,000 Over Life of Fund

$10,000 Over Life of Fund: Let's say hypothetically that $10,000 was invested in Fidelity Advisor Strategic Income Fund - Class C on October 31, 1994, when the fund started. As the chart shows, by June 30, 2000, the value of the investment, would have grown to $15,975 - a 59.75% increase on the initial investment. For comparison, look at how the Merrill Lynch High Yield Master II Index - a market value-weighted index of all domestic and yankee high-yield bonds, including deferred interest bonds and payment-in-kind securities - did over the same period. Issues included in the index have maturities of one year or more and have a credit rating lower than BBB-/Baa3, but are not in default. With dividends and capital gains, if any, reinvested, the same $10,000 investment would have grown to $15,892 - a 58.92% increase. You can also look at how the Fidelity Strategic Income Composite Index - a hypothetical combination of unmanaged indices that is more representative of the fund's investable universe - did over the same period. This index combines returns from the J.P. Morgan Emerging Markets Bond Index Global, Lehman Brothers Government Bond Index, Merrill Lynch High Yield Master II Index, and the Salomon Brothers Non-U.S. Dollar World Government Bond Index, according to the fund's neutral mix. ** With dividends and capital gains, if any, reinvested, the same $10,000 investment would have grown to $16,078 - a 60.78% increase.

** 40% high yield, 30% U.S. government and investment-grade,

15% emerging markets, and 15% foreign developed markets.

Semiannual Report

Fidelity Advisor Strategic Income Fund - Class C

Total Return Components

|

|

Six months

ended |

Years ended December 31, |

November 3, 1997 |

|

|

|

2000 |

1999 |

1998 |

1997 |

|

Dividend returns |

2.91% |

6.10% |

5.63% |

1.36% |

|

Capital returns |

-1.52% |

-0.85% |

-4.21% |

-0.09% |

|

Total returns |

1.39% |

5.25% |

1.42% |

1.27% |

Total return components include both dividend returns and capital returns. A dividend return reflects the actual dividends paid by the class. A capital return reflects both the amount paid by the class to shareholders as capital gain distributions and changes in the class' share price. Both returns assume the dividends or capital gains, if any, paid by the class are reinvested, and exclude the effect of sales charges.

Dividends and Yield

|

Periods ended June 30, 2000 |

Past 1 |

Past 6 |

Past 1 |

|

Dividends per share |

5.09 ¢ |

30.06 ¢ |

61.94 ¢ |

|

Annualized dividend rate |

6.03% |

5.85% |

6.00% |

|

30-day annualized yield |

7.00% |

- |

- |

Dividends per share show the income paid by the class for a set period. If you annualize this number based on an average share price of $10.27 over the past one month, $10.31 over the past six months, and $10.33 over the past one year, you can compare the class' income over these three periods. The 30-day annualized yield is a standard formula for all bond funds based on the yields of the bonds in the fund, averaged over the past 30 days. This figure shows you the yield characteristics of the fund's investments at the end of the period. It also helps you to compare funds from different companies on an equal basis. The offering share price used in the calculation of the yield excludes the effect of Class C's contingent deferred sales charge.

Semiannual Report

Market Recap

International bond investors faced a myriad of negative factors throughout the majority of the six-month period ending June 30, 2000. Strong global economic growth and the threat of rising interest rates, currency fluctuations, and a weakening euro continued to plague global debt issues. Additionally, poor liquidity hampered bond prices in non-U.S. developed markets, particularly in the high-yield bond area, which historically is less sensitive to interest rates and driven more by credit fundamentals. High-yield bonds suffered as a result of declining demand and an increase in the default rate - except for telecommunications issues, which got a boost from the sector's global appeal for wireless communications. Those factors helped drag down the Salomon Brothers Non-U.S. World Government Bond Index, which returned -1.95%. On the bright side, a number of favorable factors propelled demand for emerging-market bonds, which was reflected in the 6.95% return of the J.P. Morgan Emerging Markets Bond Index Global - a popular benchmark of emerging market debt. Credit momentum, which was driven by improving fundamentals - such as the Russian government's Soviet-era debt restructuring and new political leadership - fostered the rally in emerging-market bonds. Elsewhere, Brazil's better-than-expected economic growth fueled a sharp increase in foreign direct investment. Often large commodity suppliers, emerging-market countries also benefited from a sharp increase in oil prices.

(Portfolio Manager photograph)

The following is an interview with John Carlson (top left), Lead Portfolio Manager of Fidelity Advisor Strategic Income Fund, with additional

comments from Kevin Grant (top right), on U.S. government and investment-grade securities; Mark Notkin (lower left) on high-yield securities; and

Ian Spreadbury (lower right) on foreign developed-market securities. John Carlson also manages the emerging-markets portion of the fund.

Q. How did the fund perform, John?

J.C. For the six months ending June 30, 2000, the fund's Class A, Class T, Class B and Class C shares returned 1.90%, 1.77%, 1.44% and 1.39%, respectively. The multi-sector income funds average, as tracked by Lipper Inc., returned 0.43%. Meanwhile, the Merrill Lynch High Yield Master II Index returned -1.00%. For the 12 months ending June 30, 2000, the fund's Class A, Class T, Class B and Class C shares returned 5.41%, 5.34%, 4.65% and 4.45%, respectively, while the Lipper average returned 2.09% and the Merrill Lynch index returned -0.97%.

Semiannual Report

Fund Talk: The Managers' Overview - continued

Q. What helped the fund outperform its benchmarks?

J.C. Three of the four subportfolios that make up the fund - high yield, non-U.S. developed markets and emerging markets - outperformed their respective benchmarks. The subportfolio managers will discuss this in more detail below.

Q. Kevin, what was your strategy for the U.S. government sector?

K.G. The subportfolio is designed to be the low risk portion of the fund. Most of the subportfolio's holdings are in U.S. Treasuries and agency issues, which are high-quality, liquid instruments. While the subportfolio did not outperform its benchmark, it did meet its objective of providing liquidity and security for the other subportfolios that make up the fund.

Q. Mark, how did the high-yield subportfolio achieve its outperformance?

M.N. Despite the high-yield market being negatively affected by rising interest rates, wider credit spreads, volatile equity markets and fears of an economic slowdown,

the subportfolio was able to outperform its benchmark. This was a result primarily of industry selection and, to a lesser extent, security selection. The portfolio's

underweighted position relative to its benchmark in the steel, automotive and entertainment sectors more than offset the negative performance of our overweighted

position in cable and underweighting in energy. The steel and

automotive sectors were negatively impacted by fears of an economic slowdown, while poor fundamentals in the movie theater industry drove the entertainment arena

downward. Energy benefited from robust oil and gas prices, and the cable industry was hurt by too much competition and a disappointing rollout of new services.

Q. Which securities helped and which hampered performance?

M.N. Positive contributions were made by Winstar, a wireless CLEC (competitive local exchange carrier); Laboratory Corp., one of the few large players left in the consolidating clinical laboratory testing business; and Voicestream Wireless, the owner and operator of one of the few national wireless platforms in the U.S. Unfortunately, these gains were somewhat offset by the poor stock performance of Signature Resorts, Kitty Hawk and GST Telecom, which are no longer in the fund.

Q. John, what events affected the emerging-market debt sector?

J.C. The year started off with one of the most important events - the resignation of Russian President Boris Yeltsin on New Year's Eve. Vladimir Putin, who acted as president until he was formally elected in March, enacted a number of reforms to enhance governability and the rule of law, which increased local and foreign investor confidence and drove asset prices upward. The Russian government also completed a restructuring of Soviet-era debt with private investors. Russia's performance was helped by the continued firmness in oil prices, providing an enormous boost to the country's external accounts. Mexico's story in the first half of this year is also noteworthy. Recognizing Mexico's strong fiscal discipline, reduced risk from the banking sector and increasing integration into the world economy, Moody's Credit Investor Services raised the country's rating to investment-grade level. In addition, with elections slated for the first week in July, President Ernesto Zedillo has been working diligently to avoid the election-related problems of the past. Finally, with respect to the overall market, many countries took advantage of ongoing strength in commodity prices, particularly oil, and continued growth in the U.S.

Semiannual Report

Fund Talk: The Managers' Overview - continued

Q. Ian, what were the factors that

influenced the non-U.S. developed

country subportfolio and what was

your strategy?

I.S. The subportfolio surpassed its benchmark by utilizing active security selection. The key factor was monetary tightening in both the United Kingdom and Euroland - the euro market countries. The Bank of England and the European Central Bank increased interest rates in an effort to slow their respective economies. Credit markets continued to underperform, driven by a number of factors including an increased level of corporate supply, reduced levels of government supply and equity volatility. In response, I reduced the subportfolio's credit exposure and increased holdings in government issues, since the outlook for the credit sector remained uncertain. In the euro market, I added value by utilizing a barbell approach, meaning the subportfolio's holdings were underweighted at the shorter durations, while overweighted in cash and 10-year duration bonds - in anticipation of an inversion in the yield curve and rising rates. In Japan, the economy showed some signs of recovery, as the government maintained its zero percent interest-rate policy in an attempt to encourage growth. As a result, the subportfolio maintained a short-duration position relative to the benchmark since interest rates remained very low both at the short and long-end of the yield curve.

Q. John, as lead portfolio manager, what's your outlook?

J.C. I see continued demand for credit product given current low yields and lack of supply at the long-end of the U.S. yield curve. Since I expect that fundamentals will drive the performance of credits in high-yield and emerging markets, we'll continue to focus Fidelity's research strength on selecting debt and securities that can enable the fund to continue outperforming.

The views expressed in this report reflect those of the portfolio managers only through the end of the period of the report as stated on the cover and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous

Semiannual Report

Fund Talk: The Managers' Overview - continued

factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Fund Facts

Goal: a high level of current income by investing primarily in debt securities; as a secondary objective, the fund may seek capital appreciation

Start date: October 31, 1994

Size: as of June 30, 2000, more than $321 million

Manager: John Carlson, lead and emerging-markets manager, since 1995 and 1999, respectively; Kevin Grant, U.S. government investments, since 1998; Mark Notkin, high-yield investments, since 1999; and Ian Spreadbury, foreign developed-market securities, since 1998

3John Carlson discusses emerging markets - five years later:

"This year marks my fifth anniversary managing Fidelity's emerging-market debt funds and funds holding positions in emerging markets. Over the past five years, the emerging-market debt marketplace has evolved positively, becoming more efficient, deeper and broader.

"When I began managing these funds, the benchmark index used was the J.P. Morgan Emerging Markets Bond Index, which included nine countries, was 88% invested in Latin America and contained no investment-grade securities. The current index used as the benchmark is the J.P. Morgan Emerging Markets Bond Index Global. As the marketplace has evolved, the index also changed to reflect greater diversification and today includes 27 countries, only 65% exposure to Latin America and now 30% in investment-grade securities. In addition, the new index holds a greater number of securities and has a much larger market capitalization - $190 billion as of June 30, 2000, compared to $66 billion as of June 30, 1995.

"The changes in the marketplace and the index complement our portfolio management style. We have always looked for undervalued, out-of-index countries and securities in an effort to enhance performance and achieve better diversification for the portfolios we manage. I remain optimistic about emerging-market debt and look forward to continued growth and development in this marketplace."

Semiannual Report

|

Top Five Holdings as of June 30, 2000 |

||

|

(by issuer, excluding cash equivalents) |

% of fund's |

% of fund's net assets |

|

U.S. Treasury Obligations |

16.9 |

15.5 |

|

Germany Federal Republic |

5.2 |

1.8 |

|

Fannie Mae |

4.9 |

5.3 |

|

Brazilian Federative Rep. |

2.8 |

2.7 |

|

Canadian Government |

2.5 |

3.0 |

|

|

32.3 |

28.3 |

|

Top Five Market Sectors as of June 30, 2000 |

||

|

|

% of fund's |

% of fund's net assets |

|

Media & Leisure |

16.8 |

16.7 |

|

Utilities |

9.6 |

10.0 |

|

Basic Industries |

3.1 |

3.9 |

|

Finance |

3.0 |

2.0 |

|

Technology |

2.2 |

2.1 |

|

Quality Diversification as of June 30, 2000 |

||

|

(Moody's Ratings) |

% of fund's investments |

% of fund's investments |

|

Aaa, Aa, A |

43.3 |

42.4 |

|

Baa |

3.2 |

1.2 |

|

Ba |

3.2 |

4.8 |

|

B |

34.4 |

34.4 |

|

Caa, Ca, C |

4.3 |

5.7 |

|

Not Rated |

2.7 |

2.2 |

|

Table excludes short-term investments. Where Moody's ratings are not available, we have used |

|

Asset Allocation (% of fund's net assets) |

|||||||

|

As of June 30, 2000 * |

As of December 31, 1999 ** |

||||||

|

Corporate Bonds 35.8% |

|

|

Corporate Bonds 35.6% |

|

||

|

U.S. Government and Government Agency Obligations 29.2% |

|

|

U.S. Government and Government Agency Obligations 29.0% |

|

||

|

Foreign Government & Government Agency Obligations 23.5% |

|

|

Foreign Government & Government Agency Obligations 23.0% |

|

||

|

Stocks 4.9% |

|

|

Stocks 6.6% |

|

||

|

Other Investments 1.9% |

|

|

Other Investments 1.5% |

|

||

|

Short-Term |

|

|

Short-Term |

|

||

|

* Foreign investments |

31.5% |

|

** Foreign investments |

31.8% |

|

||

Semiannual Report

(Unaudited)

Showing Percentage of Net Assets

|

Corporate Bonds - 35.8% |

|||||

|

Moody's Ratings (unaudited) (b) |

Principal Amount (d) |

Value |

|||

|

Convertible Bonds - 0.6% |

|||||

|

HEALTH - 0.2% |

|||||

|

Medical Facilities Management - 0.2% |

|||||

|

Total Renal Care Holdings, Inc. 7% 5/15/09 |

B1 |

|

$ 860,000 |

$ 571,900 |

|

|

MEDIA & LEISURE - 0.3% |

|||||

|

Broadcasting - 0.3% |

|||||

|

EchoStar Communications Corp. 4.875% 1/1/07 (g) |

- |

|

600,000 |

570,750 |

|

|

NTL, Inc. 5.75% 12/15/09 (g) |

CCC+ |

|

344,000 |

271,760 |

|

|

|

842,510 |

||||

|

RETAIL & WHOLESALE - 0.1% |

|||||

|

Retail & Wholesale, Miscellaneous - 0.1% |

|||||

|

Sunglass Hut International, Inc. 5.25% 6/15/03 |

B3 |

|

660,000 |

476,025 |

|

|

TOTAL CONVERTIBLE BONDS |

1,890,435 |

||||

|

Nonconvertible Bonds - 35.2% |

|||||

|

BASIC INDUSTRIES - 3.1% |

|||||

|

Chemicals & Plastics - 1.9% |

|||||

|

Avecia Group PLC 11% 7/1/09 |

B2 |

|

840,000 |

823,200 |

|

|

Berry Plastics Corp. 11% 7/15/07 |

B3 |

|

590,000 |

528,050 |

|

|

Huntsman Corp. 9.5% 7/1/07 (g) |

B2 |

|

940,000 |

857,750 |

|

|

Huntsman ICI Chemicals LLC 10.125% 7/1/09 |

B2 |

|

1,200,000 |

1,200,000 |

|

|

Lyondell Chemical Co.: |

|

|

|

|

|

|

9.625% 5/1/07 |

Ba3 |

|

750,000 |

742,500 |

|

|

9.875% 5/1/07 |

Ba3 |

|

1,230,000 |

1,217,700 |

|

|

Sovereign Specialty Chemicals, Inc. 11.875% 3/15/10 |

B3 |

|

795,000 |

817,856 |

|

|

|

6,187,056 |

||||

|

Metals & Mining - 0.3% |

|||||

|

Better Minerals & Aggregates Co. 13% 9/15/09 |

B3 |

|

280,000 |

271,600 |

|

|

Kaiser Aluminum & Chemical Corp. 12.75% 2/1/03 |

B3 |

|

780,000 |

709,800 |

|

|

|

981,400 |

||||

|

Corporate Bonds - continued |

|||||

|

Moody's Ratings (unaudited) (b) |

Principal Amount (d) |

Value |

|||

|

Nonconvertible Bonds - continued |

|||||

|

BASIC INDUSTRIES - continued |

|||||

|

Packaging & Containers - 0.4% |

|||||

|

Gaylord Container Corp.: |

|

|

|

|

|

|

9.375% 6/15/07 |

Caa1 |

|

$ 520,000 |

$ 400,400 |

|

|

9.75% 6/15/07 |

Caa1 |

|

1,125,000 |

877,500 |

|

|

|

1,277,900 |

||||

|

Paper & Forest Products - 0.5% |

|||||

|

Container Corp. of America: |

|

|

|

|

|

|

gtd.: |

|

|

|

|

|

|

9.75% 4/1/03 |

B2 |

|

210,000 |

208,950 |

|

|

11.25% 5/1/04 |

B2 |

|

50,000 |

50,750 |

|

|

10.75% 5/1/02 |

B2 |

|

70,000 |

71,225 |

|

|

Repap New Brunswick, Inc. yankee 10.625% 4/15/05 |

Caa1 |

|

470,000 |

413,600 |

|

|

Stone Container Corp. 12.58% 8/1/16 (h) |

B2 |

|

560,000 |

576,800 |

|

|

Tjiwi Kimia International Finance Co. 13.25% 8/1/01 |

Caa1 |

|

270,000 |

237,600 |

|

|

|

1,558,925 |

||||

|

TOTAL BASIC INDUSTRIES |

10,005,281 |

||||

|

CONSTRUCTION & REAL ESTATE - 0.6% |

|||||

|

Construction - 0.1% |

|||||

|

Blount, Inc. 13% 8/1/09 |

B3 |

|

490,000 |

498,575 |

|

|

Engineering - 0.2% |

|||||

|

360networks, Inc. 13% 5/1/08 (g) |

B3 |

|

635,000 |

628,650 |

|

|

Real Estate Investment Trusts - 0.3% |

|||||

|

Pinnacle Holdings, Inc. 0% 3/15/08 (e) |

B3 |

|

1,235,000 |

858,325 |

|

|

TOTAL CONSTRUCTION & REAL ESTATE |

1,985,550 |

||||

|

DURABLES - 0.4% |

|||||

|

Home Furnishings - 0.4% |

|||||

|

Omega Cabinets Ltd. 10.5% 6/15/07 |

B3 |

|

720,000 |

648,000 |

|

|

Sealy Corp., Inc. 10% 12/18/08 pay-in-kind (k) |

- |

|

676,406 |

581,709 |

|

|

Sealy Mattress Co. 9.875% 12/15/07 |

B3 |

|

170,000 |

163,200 |

|

|

|

1,392,909 |

||||

|

Corporate Bonds - continued |

|||||

|

Moody's Ratings (unaudited) (b) |

Principal Amount (d) |

Value |

|||

|

Nonconvertible Bonds - continued |

|||||

|

DURABLES - continued |

|||||

|

Textiles & Apparel - 0.0% |

|||||

|

St. John Knits International, Inc. 12.5% 7/1/09 |

B3 |

|

$ 75,000 |

$ 71,250 |

|

|

TOTAL DURABLES |

1,464,159 |

||||

|

ENERGY - 0.4% |

|||||

|

Energy Services - 0.3% |

|||||

|

Petroliam Nasional BHD (Petronas): |

|

|

|

|

|

|

7.125% 10/18/06 (Reg. S) |

Baa3 |

|

355,000 |

335,919 |

|

|

7.625% 10/15/26 (Reg. S) |

Baa3 |

|

250,000 |

214,063 |

|

|

yankee 7.625% 10/15/26 (g) |

Baa3 |

|

570,000 |

488,063 |

|

|

|

1,038,045 |

||||

|

Oil & Gas - 0.1% |

|||||

|

Petroleos Mexicanos 9.4367% 7/15/05 |

Baa3 |

|

235,000 |

235,588 |

|

|

TOTAL ENERGY |

1,273,633 |

||||

|

FINANCE - 2.9% |

|||||

|

Banks - 1.0% |

|||||

|

Banco Nacional de Comercio Exterior SNC 11.25% 5/30/06 |

Baa3 |

|

525,000 |

560,438 |

|

|

Banco Nacional de Desenvolvimento Economico e Social: |

|

|

|

|

|

|

12.554% 6/16/08 (h) |

B2 |

|

2,130,000 |

1,994,213 |

|

|

12.554% 6/16/08 (g)(h) |

B2 |

|

500,000 |

468,125 |

|

|

|

3,022,776 |

||||

|

Credit & Other Finance - 1.9% |

|||||

|

Ahold Finance USA, Inc. euro 6.375% 6/8/05 |

A3 |

EUR |

1,000,000 |

962,168 |

|

|

AMRESCO, Inc. 9.875% 3/15/05 |

Caa3 |

|

351,000 |

163,215 |

|

|

APP International Finance (Mauritius) Ltd. 0% 7/5/01 (g) |

B3 |

|

520,000 |

410,800 |

|

|

APP International Finance Co. 11.75% 10/1/05 |

Caa1 |

|

170,000 |

119,000 |

|

|

Astra Overseas Finance BV: |

|

|

|

|

|

|

6.7775% 6/30/05 (Reg.S) (h) |

- |

|

103,062 |

62,353 |

|

|

6.7775% 6/30/05 (g)(h) |

- |

|

92,755 |

56,117 |

|

|

Dobson/Sygnet Communications Co. 12.25% 12/15/08 |

- |

|

625,000 |

660,938 |

|

|

Ford Motor Credit Co. euro 1.2% 2/7/05 |

A1 |

JPY |

300,000,000 |

2,806,107 |

|

|

Kappa Beheer BV 10.625% 7/15/09 |

B2 |

|

715,000 |

715,000 |

|

|

Corporate Bonds - continued |

|||||

|

Moody's Ratings (unaudited) (b) |

Principal Amount (d) |

Value |

|||

|

Nonconvertible Bonds - continued |

|||||

|

FINANCE - continued |

|||||

|

Credit & Other Finance - continued |

|||||

|

Netia Holdings II BV euro 13.5% 6/15/09 |

B3 |

EUR |

230,000 |

$ 221,603 |

|

|

Stone Container Finance Co. 11.5% 8/15/06 (g) |

B2 |

|

120,000 |

124,200 |

|

|

|

6,301,501 |

||||

|

TOTAL FINANCE |

9,324,277 |

||||

|

HEALTH - 1.3% |

|||||

|

Medical Facilities Management - 1.3% |

|||||

|

Everest Healthcare Services, Inc. 9.75% 5/1/08 |

B3 |

|

740,000 |

621,600 |

|

|

Express Scripts, Inc. 9.625% 6/15/09 |

Ba2 |

|

630,000 |

614,250 |

|

|

Fountain View, Inc. 11.25% 4/15/08 |

Caa1 |

|

200,000 |

49,000 |

|

|

Hanger Orthopedic Group, Inc. 11.25% 6/15/09 |

B3 |

|

490,000 |

441,000 |

|

|

Mariner Post-Acute Network, Inc. 9.5% 11/1/07 (c) |

C |

|

1,136,000 |

114 |

|

|

Oxford Health Plans, Inc. 11% 5/15/05 |

B2 |

|

930,000 |

960,225 |

|

|

Unilab Corp. 12.75% 10/1/09 |

B3 |

|

1,330,000 |

1,369,900 |

|

|

|

4,056,089 |

||||

|

INDUSTRIAL MACHINERY & EQUIPMENT - 1.5% |

|||||

|

Electrical Equipment - 0.2% |

|||||

|

Motors & Gears, Inc. 10.75% 11/15/06 |

B3 |

|

570,000 |

547,200 |

|

|

Industrial Machinery & Equipment - 0.4% |

|||||

|

Applied Power, Inc. 8.75% 4/1/09 |

B1 |

|

810,000 |

838,350 |

|

|

Dunlop Standard Aero Holdings PLC 11.875% 5/15/09 |

B3 |

|

480,000 |

475,200 |

|

|

|

1,313,550 |

||||

|

Corporate Bonds - continued |

|||||

|

Moody's Ratings (unaudited) (b) |

Principal Amount (d) |

Value |

|||

|

Nonconvertible Bonds - continued |

|||||

|

INDUSTRIAL MACHINERY & EQUIPMENT - continued |

|||||

|

Pollution Control - 0.9% |

|||||

|

Allied Waste North America, Inc. 7.875% 1/1/09 |

Ba2 |

|

$ 2,145,000 |

$ 1,823,250 |

|

|

Browning-Ferris Industries, Inc. 7.4% 9/15/35 |

Ba3 |

|

1,640,000 |

1,131,600 |

|

|

|

2,954,850 |

||||

|

TOTAL INDUSTRIAL MACHINERY & EQUIPMENT |

4,815,600 |

||||

|

MEDIA & LEISURE - 14.7% |

|||||

|

Broadcasting - 12.8% |

|||||

|

ACME Television LLC/ACME Financial Corp. |

B3 |

|

1,020,000 |

974,100 |

|

|

Adelphia Communications Corp.: |

|

|

|

|

|

|

8.375% 2/1/08 |

B1 |

|

370,000 |

326,525 |

|

|

9.25% 10/1/02 |

B1 |

|

280,000 |

275,100 |

|

|

Ascent Entertainment Group, Inc. 0% 12/15/04 (e) |

Ba1 |

|

380,000 |

307,800 |

|

|

Callahan Nordrhein Westfalen 14% 7/15/10 (g) |

B3 |

|

1,260,000 |

1,261,576 |

|

|

CapStar Broadcasting Partners, Inc.: |

|

|

|

|

|

|

0% 2/1/09 (e) |

B2 |

|

315,000 |

287,438 |

|

|

9.25% 7/1/07 |

B1 |

|

1,010,000 |

1,016,313 |

|

|

Century Communications Corp.: |

|

|

|

|

|

|

Series B, 0% 1/15/08 |

B1 |

|

3,330,000 |

1,365,300 |

|

|

8.375% 12/15/07 |

B1 |

|

20,000 |

17,450 |

|

|

8.75% 10/1/07 |

B1 |

|

90,000 |

81,000 |

|

|

9.5% 3/1/05 |

B1 |

|

60,000 |

57,750 |

|

|

Chancellor Media Corp.: |

|

|

|

|

|

|

8.125% 12/15/07 |

B1 |

|

250,000 |

251,563 |

|

|

9% 10/1/08 |

B1 |

|

2,720,000 |

2,774,400 |

|

|

Charter Communications Holdings LLC/Charter Communications Holdings Capital Corp.: |

|

|

|

|

|

|

0% 1/15/10 (e) |

B2 |

|

1,770,000 |

1,004,475 |

|

|

0% 4/1/11 (e) |

B2 |

|

2,600,000 |

1,475,500 |

|

|

Citadel Broadcasting Co.: |

|

|

|

|

|

|

9.25% 11/15/08 |

B3 |

|

1,320,000 |

1,280,400 |

|

|

10.25% 7/1/07 |

B3 |

|

2,030,000 |

2,057,913 |

|

|

Comcast UK Cable Partners Ltd. 0% 11/15/07 (e) |

B2 |

|

220,000 |

204,600 |

|

|

Diamond Cable Communications PLC yankee |

B3 |

|

696,000 |

650,760 |

|

|

Corporate Bonds - continued |

|||||

|

Moody's Ratings (unaudited) (b) |

Principal Amount (d) |

Value |

|||

|

Nonconvertible Bonds - continued |

|||||

|

MEDIA & LEISURE - continued |

|||||

|

Broadcasting - continued |

|||||

|

Earthwatch, Inc. 0% 7/15/07 unit (e)(g) |

- |

|

$ 700,000 |

$ 448,000 |

|

|

EchoStar DBS Corp. 9.375% 2/1/09 |

B2 |

|

1,800,000 |

1,737,000 |

|

|

Fox Family Worldwide, Inc. 0% 11/1/07 (e) |

B1 |

|

1,920,000 |

1,190,400 |

|

|

FrontierVision Holdings LP/FrontierVision Holdings Capital Corp. 0% 9/15/07 (e) |

B1 |

|

901,000 |

777,113 |

|

|

Golden Sky DBS, Inc. 0% 3/1/07 (e) |

Caa1 |

|

2,505,000 |

1,684,613 |

|

|

Golden Sky Systems, Inc. 12.375% 8/1/06 |

B3 |

|

300,000 |

327,000 |

|

|

LIN Holdings Corp. 0% 3/1/08 (e) |

B3 |

|

1,240,000 |

815,300 |

|

|

NorthPoint Communication Holdings, Inc. 12.875% 2/15/10 |

Caa1 |

|

520,000 |

358,800 |

|

|

NTL Communications Corp.: |

|

|

|

|

|

|

0% 10/1/08 (e) |

B3 |

|

6,975,000 |

4,481,438 |

|

|

11.5% 10/1/08 |

B3 |

|

1,080,000 |

1,088,100 |

|

|

NTL, Inc. 0% 4/1/08 (e) |

B3 |

|

890,000 |

551,800 |

|

|

Olympus Communications LP/Olympus Capital Corp. 10.625% 11/15/06 |

B1 |

|

90,000 |

88,200 |

|

|

Pegasus Communications Corp. 12.5% 8/1/17 |

B3 |

|

1,010,000 |

1,070,600 |

|

|

Satelites Mexicanos SA de CV 10.125% 11/1/04 |

B3 |

|

580,000 |

391,500 |

|

|

Susquehanna Media Co. 8.5% 5/15/09 |

B1 |

|

90,000 |

85,500 |

|

|

Telemundo Holdings, Inc. 0% 8/15/08 (e) |

Caa1 |

|

3,405,000 |

2,366,475 |

|

|

Telewest Communications PLC: |

|

|

|

|

|

|

0% 4/15/09 (e) |

B1 |

|

2,030,000 |

1,116,500 |

|

|

0% 2/1/10 (e)(g) |

B1 |

|

2,970,000 |

1,574,100 |

|

|

9.875% 2/1/10 (g) |

B1 |

|

350,000 |

325,500 |

|

|

11.25% 11/1/08 |

B1 |

|

170,000 |

170,000 |

|

|

Telewest PLC yankee 9.625% 10/1/06 |

B1 |

|

625,000 |

587,500 |

|

|

United Pan-Europe Communications NV: |

|

|

|

|

|

|

0% 8/1/09 (e) |

B2 |

|

1,160,000 |

580,000 |

|

|

10.875% 8/1/09 |

B2 |

|

3,690,000 |

3,247,200 |

|

|

11.5% 2/1/10 |

B2 |

|

300,000 |

268,500 |

|

|

|

41,001,102 |

||||

|

Entertainment - 0.5% |

|||||

|

Bally Total Fitness Holding Corp. 9.875% 10/15/07 |

B3 |

|

455,000 |

414,050 |

|

|

Livent, Inc. 9.375% 10/15/04 (c) |

- |

|

300,000 |

60,000 |

|

|

Corporate Bonds - continued |

|||||

|

Moody's Ratings (unaudited) (b) |

Principal Amount (d) |

Value |

|||

|

Nonconvertible Bonds - continued |

|||||

|

MEDIA & LEISURE - continued |

|||||

|

Entertainment - continued |

|||||

|

Premier Parks, Inc.: |

|

|

|

|

|

|

0% 4/1/08 (e) |

B3 |

|

$ 1,170,000 |

$ 794,138 |

|

|

9.25% 4/1/06 |

B3 |

|

480,000 |

453,600 |

|

|

|

1,721,788 |

||||

|

Lodging & Gaming - 1.4% |

|||||

|

Florida Panthers Holdings, Inc. 9.875% 4/15/09 |

B2 |

|

930,000 |

869,550 |

|

|

HMH Properties, Inc. 7.875% 8/1/05 |

Ba2 |

|

700,000 |

644,000 |

|

|

Horseshoe Gaming LLC: |

|

|

|

|

|

|

8.625% 5/15/09 |

B2 |

|

480,000 |

451,200 |

|

|

9.375% 6/15/07 |

B+ |

|

890,000 |

883,325 |

|

|

ITT Corp. 7.375% 11/15/15 |

Ba1 |

|

720,000 |

603,000 |

|

|

KSL Recreation Group, Inc. 10.25% 5/1/07 |

B2 |

|

320,000 |

304,000 |

|

|

Station Casinos, Inc. 8.875% 12/1/08 |

B1 |

|

745,000 |

709,613 |

|

|

|

4,464,688 |

||||

|

TOTAL MEDIA & LEISURE |

47,187,578 |

||||

|

NONDURABLES - 0.4% |

|||||

|

Foods - 0.4% |

|||||

|

Del Monte Corp. 12.25% 4/15/07 |

B3 |

|

252,000 |

267,120 |

|

|

Del Monte Foods Co. 0% 12/15/07 (e) |

Caa1 |

|

1,564,000 |

1,173,000 |

|

|

|

1,440,120 |

||||

|

RETAIL & WHOLESALE - 0.2% |

|||||

|

Grocery Stores - 0.2% |

|||||

|

Pathmark Stores, Inc. 9.625% 5/1/03 (c) |

Caa3 |

|

910,000 |

627,900 |

|

|

SERVICES - 0.5% |

|||||

|

Printing - 0.4% |

|||||

|

Sullivan Graphics, Inc. 12.75% 8/1/05 |

Caa1 |

|

720,000 |

723,600 |

|

|

Von Hoffman Corp. 13.5% 5/15/09 pay-in-kind (g) |

- |

|

740,131 |

666,118 |

|

|

|

1,389,718 |

||||

|

Services - 0.1% |

|||||

|

Medaphis Corp. 9.5% 2/15/05 |

Caa1 |

|

190,000 |

142,500 |

|

|

TOTAL SERVICES |

1,532,218 |

||||

|

Corporate Bonds - continued |

|||||

|

Moody's Ratings (unaudited) (b) |

Principal Amount (d) |

Value |

|||

|

Nonconvertible Bonds - continued |

|||||

|

TECHNOLOGY - 2.1% |

|||||

|

Computer Services & Software - 1.2% |

|||||

|

Covad Communications Group, Inc.: |

|

|

|

|

|

|

0% 3/15/08 (e) |

B3 |

|

$ 510,000 |

$ 249,900 |

|

|

12% 2/15/10 |

B3 |

|

510,000 |

395,250 |

|

|

12.5% 2/15/09 |

B3 |

|

784,000 |

623,280 |

|

|

Federal Data Corp. 10.125% 8/1/05 |

B3 |

|

760,000 |

494,000 |

|

|

PSINet, Inc. 11% 8/1/09 |

B3 |

|

1,460,000 |

1,350,500 |

|

|

Verio, Inc. 11.25% 12/1/08 |

B3 |

|

705,000 |

775,500 |

|

|

|

3,888,430 |

||||

|

Computers & Office Equipment - 0.1% |

|||||

|

Globix Corp. 12.5% 2/1/10 |

B- |

|

580,000 |

478,500 |

|

|

Electronic Instruments - 0.2% |

|||||

|

Telecommunications Techniques Co. LLC 9.75% 5/15/08 |

B3 |

|

624,000 |

574,080 |

|

|

Electronics - 0.6% |

|||||

|

ChipPAC International Ltd. 12.75% 8/1/09 |

B3 |

|

385,000 |

413,875 |

|

|

Details, Inc. 10% 11/15/05 |

B3 |

|

65,000 |

61,750 |

|

|

Fairchild Semiconductor Corp. 10.125% 3/15/07 |

B2 |

|

595,000 |

600,950 |

|

|

Flextronics International Ltd. 9.875% 7/1/10 (g) |

Ba3 |

|

365,000 |

370,475 |

|

|

Intersil Corp. 13.25% 8/15/09 |

B3 |

|

294,000 |

335,160 |

|

|

|

1,782,210 |

||||

|

TOTAL TECHNOLOGY |

6,723,220 |

||||

|

UTILITIES - 7.1% |

|||||

|

Cellular - 4.8% |

|||||

|

Comunicacion Celular SA 0% 3/1/05 (e)(g) |

B3 |

|

310,000 |

229,400 |

|

|

Crown Castle International Corp. 0% 5/15/11 (e) |

B3 |

|

1,970,000 |

1,201,700 |

|

|

Leap Wireless International, Inc.: |

|

|

|

|

|

|

0% 4/15/10 (e)(g) |

- |

|

450,000 |

189,000 |

|

|

12.5% 4/15/10 (g) |

Caa2 |

|

775,000 |

682,000 |

|

|

McCaw International Ltd. 0% 4/15/07 (e) |

Caa1 |

|

930,000 |

706,800 |

|

|

Millicom International Cellular SA 0% 6/1/06 (e) |

Caa1 |

|

1,610,000 |

1,368,500 |

|

|

Nextel Communications, Inc.: |

|

|

|

|

|

|

0% 9/15/07 (e) |

B1 |

|

703,000 |

551,855 |

|

|

0% 10/31/07 (e) |

B1 |

|

850,000 |

633,250 |

|

|

0% 2/15/08 (e) |

B1 |

|

2,220,000 |

1,626,150 |

|

|

Corporate Bonds - continued |

|||||

|

Moody's Ratings (unaudited) (b) |

Principal Amount (d) |

Value |

|||

|

Nonconvertible Bonds - continued |

|||||

|

UTILITIES - continued |

|||||

|

Cellular - continued |

|||||

|

Nextel Communications, Inc.: - continued |

|

|

|

|

|

|

12% 11/1/08 |

B1 |

|

$ 460,000 |

$ 491,050 |

|

|

Occidente Y Caribe Celular SA 0% 3/15/04 (e) |

B3 |

|

200,000 |

140,000 |

|

|

Rogers Communications, Inc. 8.875% 7/15/07 |

Ba3 |

|

625,000 |

612,500 |

|

|

Tritel PCS, Inc. 0% 5/15/09 (e) |

B3 |

|

1,790,000 |

1,181,400 |

|

|

Triton PCS, Inc. 0% 5/1/08 (e) |

B3 |

|

1,810,000 |

1,307,725 |

|

|

VoiceStream Wireless Corp.: |

|

|

|

|

|

|

0% 11/15/09 (e) |

B2 |

|

5,200,000 |

3,484,000 |

|

|

10.375% 11/15/09 |

B2 |

|

990,000 |

1,029,600 |

|

|

|

15,434,930 |

||||

|

Telephone Services - 2.3% |

|||||

|

Allegiance Telecom, Inc. 0% 2/15/08 (e) |

B3 |

|

862,000 |

627,105 |

|

|

Esat Telecom Group PLC 11.875% 12/1/08 |

Caa1 |

|

60,000 |

69,600 |

|

|

Intermedia Communications, Inc. 8.5% 1/15/08 |

B2 |

|

445,000 |

409,400 |

|

|

NEXTLINK Communications, Inc.: |

|

|

|

|

|

|

0% 6/1/09 (e) |

B2 |

|

1,050,000 |

645,750 |

|

|

10.5% 12/1/09 |

B2 |

|

620,000 |

607,600 |

|

|

Rhythms NetConnections, Inc. 12.75% 4/15/09 |

B3 |

|

690,000 |

469,200 |

|

|

WinStar Communications, Inc.: |

|

|

|

|

|

|

0% 4/15/10 (e)(g) |

B3 |

|

6,271,000 |

2,916,015 |

|

|

12.75% 4/15/10 (g) |

B3 |

|

1,724,000 |

1,663,660 |

|

|

|

7,408,330 |

||||

|

TOTAL UTILITIES |

22,843,260 |

||||

|

TOTAL NONCONVERTIBLE BONDS |

113,278,885 |

||||

|

TOTAL CORPORATE BONDS (Cost $120,672,477) |

115,169,320 |

||||

|

U.S. Government and Government Agency Obligations - 25.9% |

|||||

|

|

|||||

|

U.S. Government Agency Obligations - 9.0% |

|||||

|

Fannie Mae: |

|

|

|

|

|

|

5.25% 1/15/09 |

Aaa |

|

6,500,000 |

5,729,165 |

|

|

6.5% 4/29/09 |

Aaa |

|

5,500,000 |

5,138,210 |

|

|

Federal Farm Credit Bank 6.66% 12/26/06 |

Aaa |

|